27c9ffef08d2d317fd54a019a5d930b4.ppt

- Количество слайдов: 52

Derivatives Markets Chapter 9

Derivatives Markets Chapter 9

Introduction n Futures, options, and swaps are complicated instruments However, they have found their way into the risk management options of just about every major financial institution Derivatives—A financial instrument/contract that derives its value from some other underlying asset

Introduction n Futures, options, and swaps are complicated instruments However, they have found their way into the risk management options of just about every major financial institution Derivatives—A financial instrument/contract that derives its value from some other underlying asset

Futures Markets n n Market in standardized contracts for future delivery of various goods. Arose in the mid-1800 s in Chicago and institutionalized an ancient form of contracting called forward contracting. 1842, Chicago Board of Trade 1871, Fire destroyed all records.

Futures Markets n n Market in standardized contracts for future delivery of various goods. Arose in the mid-1800 s in Chicago and institutionalized an ancient form of contracting called forward contracting. 1842, Chicago Board of Trade 1871, Fire destroyed all records.

Futures Contracts vs. Forward Contracts n Futures Contract n n trade in an organized exchange. standardized contract terms. contract guaranteed by exchange (clearing corporation) Forward Contract n n transaction in which two parties agree in advance on the terms of a trade to be executed later. Non standardized contract terms. More flexibility. Difficult to find a trading partner.

Futures Contracts vs. Forward Contracts n Futures Contract n n trade in an organized exchange. standardized contract terms. contract guaranteed by exchange (clearing corporation) Forward Contract n n transaction in which two parties agree in advance on the terms of a trade to be executed later. Non standardized contract terms. More flexibility. Difficult to find a trading partner.

An Overview of Financial Futures n n Future Contract is a contractual agreement that calls for delivery of a specific underlying commodity or security at some future date at a currently agreed-upon price There are contracts on interest-bearing securities (Treasury bonds, notes, etc), on stock indices (Standard & Poors’ and Japan’s Nikkei index), and on foreign currencies

An Overview of Financial Futures n n Future Contract is a contractual agreement that calls for delivery of a specific underlying commodity or security at some future date at a currently agreed-upon price There are contracts on interest-bearing securities (Treasury bonds, notes, etc), on stock indices (Standard & Poors’ and Japan’s Nikkei index), and on foreign currencies

An Overview of Financial Futures n n Trading in these contracts is conducted on the various commodity exchanges Financial futures were introduced about 30 years ago and volume now exceeds the more traditional agricultural commodities

An Overview of Financial Futures n n Trading in these contracts is conducted on the various commodity exchanges Financial futures were introduced about 30 years ago and volume now exceeds the more traditional agricultural commodities

Characteristics of Financial Futures n n Standardized agreement to buy/sell a particular asset or commodity at a future date and a current agreedupon price Designed to promote liquidity—the ability to buy and sell quickly with low transactions costs Promotes large trading volume which narrows the bid -asked spreads Allows many individuals to trade the identical commodity

Characteristics of Financial Futures n n Standardized agreement to buy/sell a particular asset or commodity at a future date and a current agreedupon price Designed to promote liquidity—the ability to buy and sell quickly with low transactions costs Promotes large trading volume which narrows the bid -asked spreads Allows many individuals to trade the identical commodity

Characteristics of Financial Futures n Terms specify the amount and type of asset as well as the location and delivery period n n Financial futures—underlying asset is either a specific security or cash value of a group of securities Stock index futures—contract calls for the delivery of the cash value of a particular stock index

Characteristics of Financial Futures n Terms specify the amount and type of asset as well as the location and delivery period n n Financial futures—underlying asset is either a specific security or cash value of a group of securities Stock index futures—contract calls for the delivery of the cash value of a particular stock index

Characteristics of Financial Futures n n n Precise terms of each contract are established by the exchange that sponsors trading in the contracts Seller of the contract has the obligation to deliver the securities at a specified time In futures markets, the buyer of the contract is called long and the seller is called short

Characteristics of Financial Futures n n n Precise terms of each contract are established by the exchange that sponsors trading in the contracts Seller of the contract has the obligation to deliver the securities at a specified time In futures markets, the buyer of the contract is called long and the seller is called short

Price of the Contract n n The price is determined by bidding and offering that occurs at the location (pit) of the exchange sponsoring the auction The auction process insures that all orders are exposed to highest bid and lowest offer, guaranteeing execution at the best possible price

Price of the Contract n n The price is determined by bidding and offering that occurs at the location (pit) of the exchange sponsoring the auction The auction process insures that all orders are exposed to highest bid and lowest offer, guaranteeing execution at the best possible price

Market Structure n Open outcry n n n Traders call out offers to buy or sell. Gives appearance of chaos. Gives all traders in the pit the opportunity to accept the offer. Seat on the exchange Floor Traders

Market Structure n Open outcry n n n Traders call out offers to buy or sell. Gives appearance of chaos. Gives all traders in the pit the opportunity to accept the offer. Seat on the exchange Floor Traders

Clearing Corporation n The clearing corporation associated with the exchange acts as a middleman in the transaction n n Reduce the credit risk exposure associated with future deliveries Longs and shorts do not have to worry that the other party will not perform their contractual obligations Requires the short and long to place a deposit (Margin) which is a performance bond for both the seller and buyer Requires that gains and losses be settled each day in the mark-to-market operation

Clearing Corporation n The clearing corporation associated with the exchange acts as a middleman in the transaction n n Reduce the credit risk exposure associated with future deliveries Longs and shorts do not have to worry that the other party will not perform their contractual obligations Requires the short and long to place a deposit (Margin) which is a performance bond for both the seller and buyer Requires that gains and losses be settled each day in the mark-to-market operation

Settlement by Offset n To insure the obligations are met at the delivery date, most trades in futures market choose settlement by offset rather than delivery n n Both parties make offsetting sales/purchases to cover the contract Permits hedgers, speculators, and arbitrageurs to make legitimate use of the futures market without getting into technical details of making or taking delivery of assets

Settlement by Offset n To insure the obligations are met at the delivery date, most trades in futures market choose settlement by offset rather than delivery n n Both parties make offsetting sales/purchases to cover the contract Permits hedgers, speculators, and arbitrageurs to make legitimate use of the futures market without getting into technical details of making or taking delivery of assets

Using Financial Futures Contracts n n n Provides the opportunity to hedge legitimate commercial activities Allows participants to alter their risk exposure Hedgers—buy and sell futures contracts to reduce their exposure to the risk of future price movement Permits dealers to cover both the short and long position of a contract Reduces risk since future prices move almost in lockstep with the price of the underlying asset

Using Financial Futures Contracts n n n Provides the opportunity to hedge legitimate commercial activities Allows participants to alter their risk exposure Hedgers—buy and sell futures contracts to reduce their exposure to the risk of future price movement Permits dealers to cover both the short and long position of a contract Reduces risk since future prices move almost in lockstep with the price of the underlying asset

Hedging Vs. Speculating n n “Short hedgers” offset inventory risk by selling futures while “long hedgers” offset anticipated purchases of securities by buying futures Speculators n n Purposely take on risk of price movement Expect to make a profit on the risky transaction

Hedging Vs. Speculating n n “Short hedgers” offset inventory risk by selling futures while “long hedgers” offset anticipated purchases of securities by buying futures Speculators n n Purposely take on risk of price movement Expect to make a profit on the risky transaction

Arbitrageurs n n Determine the relationship between the price in the “cash market” and the price in the futures market During the delivery period of a futures contract, the rights and obligations of the contract force the price of the futures contract and the price of the underlying security to be identical

Arbitrageurs n n Determine the relationship between the price in the “cash market” and the price in the futures market During the delivery period of a futures contract, the rights and obligations of the contract force the price of the futures contract and the price of the underlying security to be identical

Arbitrageurs n n If the arbitrageur senses the price relationship between the futures contract and the underlying asset is not correct, take actions in the market (buy or sell) to make a profit which forces the prices into proper relationship The activities of arbitrageurs cause the prices to converge on the delivery date or be in proper alignment during periods prior to final delivery date

Arbitrageurs n n If the arbitrageur senses the price relationship between the futures contract and the underlying asset is not correct, take actions in the market (buy or sell) to make a profit which forces the prices into proper relationship The activities of arbitrageurs cause the prices to converge on the delivery date or be in proper alignment during periods prior to final delivery date

Liquidating a Position n n n Settlement dates Nearby contract Distant contract Cash settlement contracts Settlement by offset Open interest n n number of contracts obligated for delivery. Each open transaction has a buyer and a seller, but for calculation only one side of the contract is counted.

Liquidating a Position n n n Settlement dates Nearby contract Distant contract Cash settlement contracts Settlement by offset Open interest n n number of contracts obligated for delivery. Each open transaction has a buyer and a seller, but for calculation only one side of the contract is counted.

Futures Data n n n Wall Street Journal Chicago Board of Trade Chicago Mercantile Exchange

Futures Data n n n Wall Street Journal Chicago Board of Trade Chicago Mercantile Exchange

An Overview of Options Contracts n n Options on individual stocks have been traded in over-the-counter market since nineteenth century Increased visibility in 1972 when the Chicago Board Options Exchange (CBOE) standardized terms of contracts and introduced futurestype pit trading

An Overview of Options Contracts n n Options on individual stocks have been traded in over-the-counter market since nineteenth century Increased visibility in 1972 when the Chicago Board Options Exchange (CBOE) standardized terms of contracts and introduced futurestype pit trading

Stock Options n Prior to 1973, over-the-counter market n n CBOE established April 26, 1973 and begin trading options on 16 stocks n n n fragmented high transaction costs no liquidity creation of central market place introduction of a clearing corporation standardization secondary market June 1, 1977, SEC allowed trading in puts

Stock Options n Prior to 1973, over-the-counter market n n CBOE established April 26, 1973 and begin trading options on 16 stocks n n n fragmented high transaction costs no liquidity creation of central market place introduction of a clearing corporation standardization secondary market June 1, 1977, SEC allowed trading in puts

Options n n Contractual Obligations Derive their value from some underlying asset n n n A specified number of shares of a particular stock Stock Index Option—Basket of equities represented by some overall stock index such as S&P 500 In options on future contracts, the contractual obligations call for delivery of one futures contract

Options n n Contractual Obligations Derive their value from some underlying asset n n n A specified number of shares of a particular stock Stock Index Option—Basket of equities represented by some overall stock index such as S&P 500 In options on future contracts, the contractual obligations call for delivery of one futures contract

Call Options n Buyer of a call option (long) has the right (not obligation) to buy a given quantity of the underlying asset at a predetermined price (exercise or strike) at any time prior to the expiration date

Call Options n Buyer of a call option (long) has the right (not obligation) to buy a given quantity of the underlying asset at a predetermined price (exercise or strike) at any time prior to the expiration date

Call Options n n n Seller of the call option (short) has the obligation to deliver the asset at the agreed price Therefore, rights and obligations of option buyers and sellers are not symmetrical Buyer of the call option pays a price to the seller for the rights acquired (option premium)

Call Options n n n Seller of the call option (short) has the obligation to deliver the asset at the agreed price Therefore, rights and obligations of option buyers and sellers are not symmetrical Buyer of the call option pays a price to the seller for the rights acquired (option premium)

Put Options n n n Buyer of a put option has the right (not obligation) to sell a given quantity of the underlying asset at a predetermined price before the expiration date Seller of the option (short) has the obligation to buy the asset at the agreed price The buyer of the put option pays a premium to the seller

Put Options n n n Buyer of a put option has the right (not obligation) to sell a given quantity of the underlying asset at a predetermined price before the expiration date Seller of the option (short) has the obligation to buy the asset at the agreed price The buyer of the put option pays a premium to the seller

Summary n n Option buyers have rights; option sellers have obligations Call buyers have the right to buy the underlying asset Put buyers have the right to sell the asset In both puts and calls the option buyer pays a premium to the option seller

Summary n n Option buyers have rights; option sellers have obligations Call buyers have the right to buy the underlying asset Put buyers have the right to sell the asset In both puts and calls the option buyer pays a premium to the option seller

Clearing Corporation n The exchange sponsoring the options trading established rules for trading Standardization is designed to generate interest by potential traders, thereby contract liquidity Clearing Corporation n Guarantees the performance of contractual obligations Buyers and sellers do not have to be concerned with creditworthiness of their trading partners Only matter up for negotiation is option premium—price buyer pays to seller for rights

Clearing Corporation n The exchange sponsoring the options trading established rules for trading Standardization is designed to generate interest by potential traders, thereby contract liquidity Clearing Corporation n Guarantees the performance of contractual obligations Buyers and sellers do not have to be concerned with creditworthiness of their trading partners Only matter up for negotiation is option premium—price buyer pays to seller for rights

Using and Valuing Options n n n Investors who buy options (puts or calls) have rights, but no obligations Therefore, option buyers will do whatever is in their best interest on expiration date On expiration date, payoff on expiration of a long call position is either zero (price below exercise price) or stock price minus exercise price (intrinsic value) (price above the exercise price)

Using and Valuing Options n n n Investors who buy options (puts or calls) have rights, but no obligations Therefore, option buyers will do whatever is in their best interest on expiration date On expiration date, payoff on expiration of a long call position is either zero (price below exercise price) or stock price minus exercise price (intrinsic value) (price above the exercise price)

Using and Valuing Options n n A long put position on expiration date has a value of zero if price is above the exercise price or a value equal to the exercise price minus the stock price if price is below the exercise price Option Premium—The asymmetry payoff has the characteristic of insurance which is why the premium is charged on the transaction

Using and Valuing Options n n A long put position on expiration date has a value of zero if price is above the exercise price or a value equal to the exercise price minus the stock price if price is below the exercise price Option Premium—The asymmetry payoff has the characteristic of insurance which is why the premium is charged on the transaction

Option Premiums - Calls n n Option premiums are determined by supply and demand Call options are worth more (higher premiums) the higher the price and the greater the volatility of the underlying asset, and the longer the time to expiration of the option

Option Premiums - Calls n n Option premiums are determined by supply and demand Call options are worth more (higher premiums) the higher the price and the greater the volatility of the underlying asset, and the longer the time to expiration of the option

Option Premiums - Puts n n Premiums on put options will be higher the lower the price of the underlying asset, greater volatility of asset and longer time to expiration Options are an expensive way to hedge portfolio risks if those risks are substantial

Option Premiums - Puts n n Premiums on put options will be higher the lower the price of the underlying asset, greater volatility of asset and longer time to expiration Options are an expensive way to hedge portfolio risks if those risks are substantial

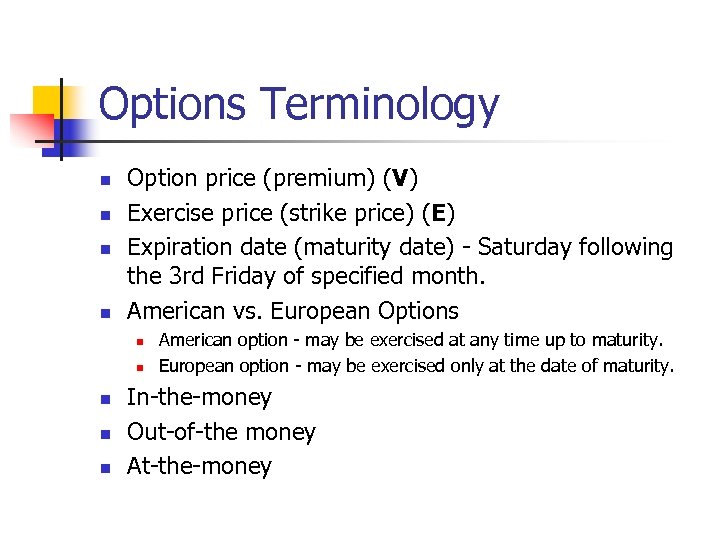

Options Terminology n n Option price (premium) (V) Exercise price (strike price) (E) Expiration date (maturity date) - Saturday following the 3 rd Friday of specified month. American vs. European Options n n n American option - may be exercised at any time up to maturity. European option - may be exercised only at the date of maturity. In-the-money Out-of-the money At-the-money

Options Terminology n n Option price (premium) (V) Exercise price (strike price) (E) Expiration date (maturity date) - Saturday following the 3 rd Friday of specified month. American vs. European Options n n n American option - may be exercised at any time up to maturity. European option - may be exercised only at the date of maturity. In-the-money Out-of-the money At-the-money

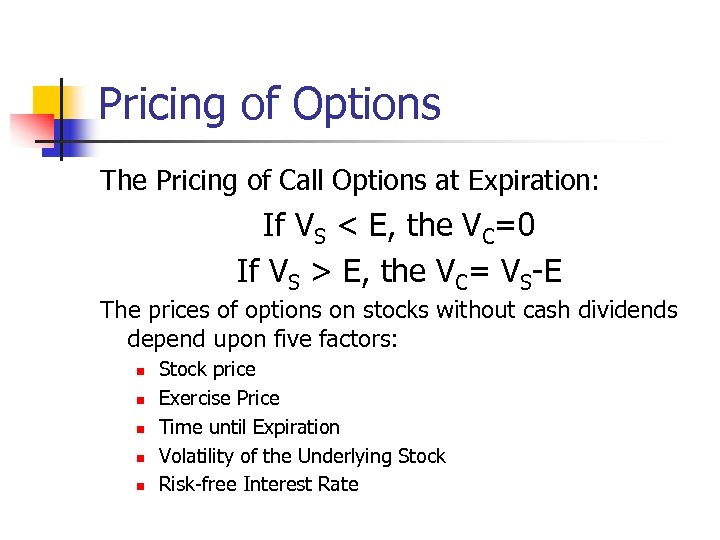

Pricing of Options The Pricing of Call Options at Expiration: If VS < E, the VC=0 If VS > E, the VC= VS-E The prices of options on stocks without cash dividends depend upon five factors: n n n Stock price Exercise Price Time until Expiration Volatility of the Underlying Stock Risk-free Interest Rate

Pricing of Options The Pricing of Call Options at Expiration: If VS < E, the VC=0 If VS > E, the VC= VS-E The prices of options on stocks without cash dividends depend upon five factors: n n n Stock price Exercise Price Time until Expiration Volatility of the Underlying Stock Risk-free Interest Rate

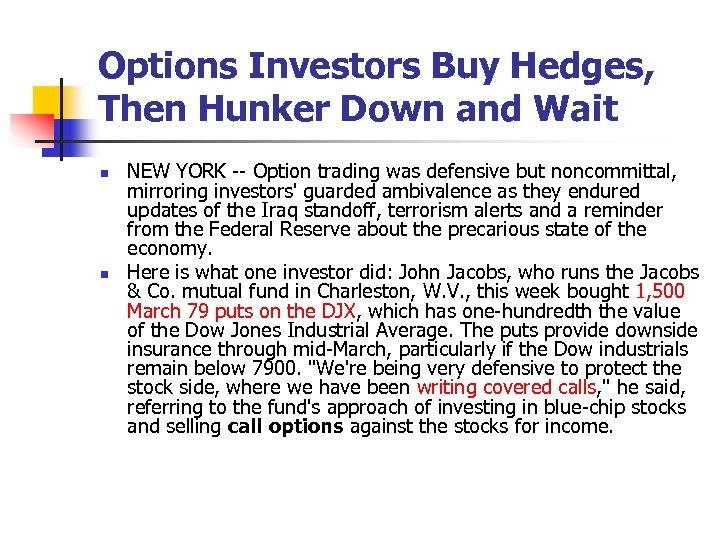

Options Investors Buy Hedges, Then Hunker Down and Wait n n NEW YORK -- Option trading was defensive but noncommittal, mirroring investors' guarded ambivalence as they endured updates of the Iraq standoff, terrorism alerts and a reminder from the Federal Reserve about the precarious state of the economy. Here is what one investor did: John Jacobs, who runs the Jacobs & Co. mutual fund in Charleston, W. V. , this week bought 1, 500 March 79 puts on the DJX, which has one-hundredth the value of the Dow Jones Industrial Average. The puts provide downside insurance through mid-March, particularly if the Dow industrials remain below 7900. "We're being very defensive to protect the stock side, where we have been writing covered calls, " he said, referring to the fund's approach of investing in blue-chip stocks and selling call options against the stocks for income.

Options Investors Buy Hedges, Then Hunker Down and Wait n n NEW YORK -- Option trading was defensive but noncommittal, mirroring investors' guarded ambivalence as they endured updates of the Iraq standoff, terrorism alerts and a reminder from the Federal Reserve about the precarious state of the economy. Here is what one investor did: John Jacobs, who runs the Jacobs & Co. mutual fund in Charleston, W. V. , this week bought 1, 500 March 79 puts on the DJX, which has one-hundredth the value of the Dow Jones Industrial Average. The puts provide downside insurance through mid-March, particularly if the Dow industrials remain below 7900. "We're being very defensive to protect the stock side, where we have been writing covered calls, " he said, referring to the fund's approach of investing in blue-chip stocks and selling call options against the stocks for income.

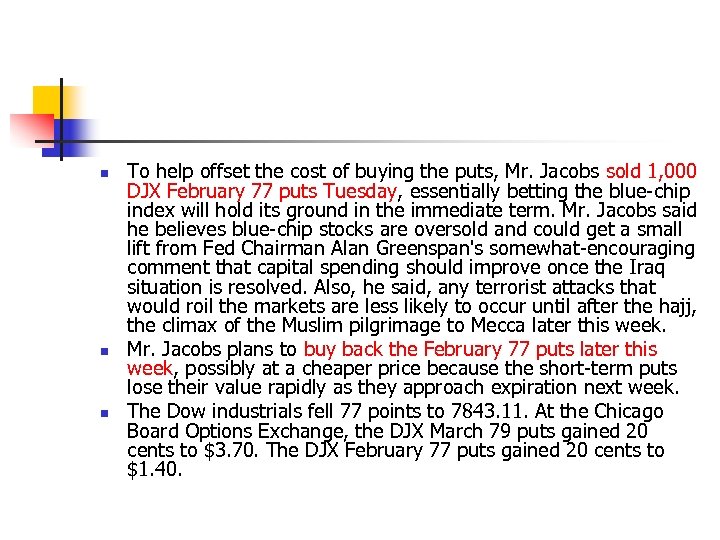

n n n To help offset the cost of buying the puts, Mr. Jacobs sold 1, 000 DJX February 77 puts Tuesday, essentially betting the blue-chip index will hold its ground in the immediate term. Mr. Jacobs said he believes blue-chip stocks are oversold and could get a small lift from Fed Chairman Alan Greenspan's somewhat-encouraging comment that capital spending should improve once the Iraq situation is resolved. Also, he said, any terrorist attacks that would roil the markets are less likely to occur until after the hajj, the climax of the Muslim pilgrimage to Mecca later this week. Mr. Jacobs plans to buy back the February 77 puts later this week, possibly at a cheaper price because the short-term puts lose their value rapidly as they approach expiration next week. The Dow industrials fell 77 points to 7843. 11. At the Chicago Board Options Exchange, the DJX March 79 puts gained 20 cents to $3. 70. The DJX February 77 puts gained 20 cents to $1. 40.

n n n To help offset the cost of buying the puts, Mr. Jacobs sold 1, 000 DJX February 77 puts Tuesday, essentially betting the blue-chip index will hold its ground in the immediate term. Mr. Jacobs said he believes blue-chip stocks are oversold and could get a small lift from Fed Chairman Alan Greenspan's somewhat-encouraging comment that capital spending should improve once the Iraq situation is resolved. Also, he said, any terrorist attacks that would roil the markets are less likely to occur until after the hajj, the climax of the Muslim pilgrimage to Mecca later this week. Mr. Jacobs plans to buy back the February 77 puts later this week, possibly at a cheaper price because the short-term puts lose their value rapidly as they approach expiration next week. The Dow industrials fell 77 points to 7843. 11. At the Chicago Board Options Exchange, the DJX March 79 puts gained 20 cents to $3. 70. The DJX February 77 puts gained 20 cents to $1. 40.

n n Caution remains the watchword. "In this market, you should be more concerned about protecting profits than giving up upside, " says Elliot Spar, Ryan Beck & Co. option strategist. One way investors protect profits, Mr. Spar said, is with so-called collars, where an investor sells a call to define a target price at which he is willing to sell stock while using the proceeds to buy a put for downside protection. "This puts a floor under the stock and caps the upside" at the strike price of the call, he said.

n n Caution remains the watchword. "In this market, you should be more concerned about protecting profits than giving up upside, " says Elliot Spar, Ryan Beck & Co. option strategist. One way investors protect profits, Mr. Spar said, is with so-called collars, where an investor sells a call to define a target price at which he is willing to sell stock while using the proceeds to buy a put for downside protection. "This puts a floor under the stock and caps the upside" at the strike price of the call, he said.

Options Data n n Wall Street Journal Chicago Board Options Exchange

Options Data n n Wall Street Journal Chicago Board Options Exchange

Swaps n The 1 st major swap occurred in August of 1981. The World Bank issued $290 million in eurobonds and swapped the interest and principal on these bonds with IBM for Swiss francs and German marks.

Swaps n The 1 st major swap occurred in August of 1981. The World Bank issued $290 million in eurobonds and swapped the interest and principal on these bonds with IBM for Swiss francs and German marks.

An Overview of Swaps n n Two broad varieties—Interest rate swaps and currency swaps Swaps are contractual agreement between two parties (counterparties) and customized to meet the requirements of both parties

An Overview of Swaps n n Two broad varieties—Interest rate swaps and currency swaps Swaps are contractual agreement between two parties (counterparties) and customized to meet the requirements of both parties

Counter parties n Fixed-rate payer n n Party to a swap that makes fixed-rate payments in exchange for floating-rate payments. Floating-rate payer n Party to a swap that makes floating-rate payments in exchange for fixed-rate payments.

Counter parties n Fixed-rate payer n n Party to a swap that makes fixed-rate payments in exchange for floating-rate payments. Floating-rate payer n Party to a swap that makes floating-rate payments in exchange for fixed-rate payments.

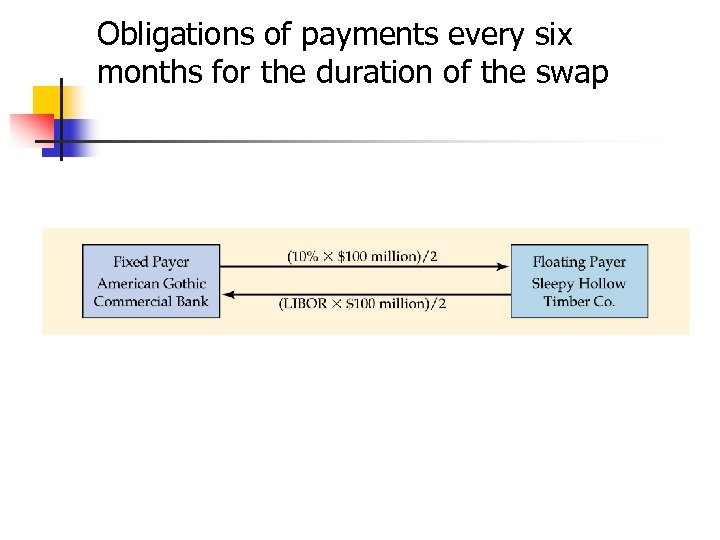

Obligations of payments every six months for the duration of the swap

Obligations of payments every six months for the duration of the swap

Interest Rate Swap n n The fixed-rate payer always pays the same amount while payments by the floating-rate payer varies according to the reference rate The dollar amount of the payments is determined by multiplying the interest rate by an agreed-upon principal (notional principal amount)

Interest Rate Swap n n The fixed-rate payer always pays the same amount while payments by the floating-rate payer varies according to the reference rate The dollar amount of the payments is determined by multiplying the interest rate by an agreed-upon principal (notional principal amount)

What determines the rates paid by both parties? n n n Shape of the yield curve—expected rates in the future Risk of default—possibility that counterparties might default on scheduled interest payments Financial institutions facilitate swaps n n n Act as the Swap Dealer Bring the counterparties together Impose their own credit between the counterparties

What determines the rates paid by both parties? n n n Shape of the yield curve—expected rates in the future Risk of default—possibility that counterparties might default on scheduled interest payments Financial institutions facilitate swaps n n n Act as the Swap Dealer Bring the counterparties together Impose their own credit between the counterparties

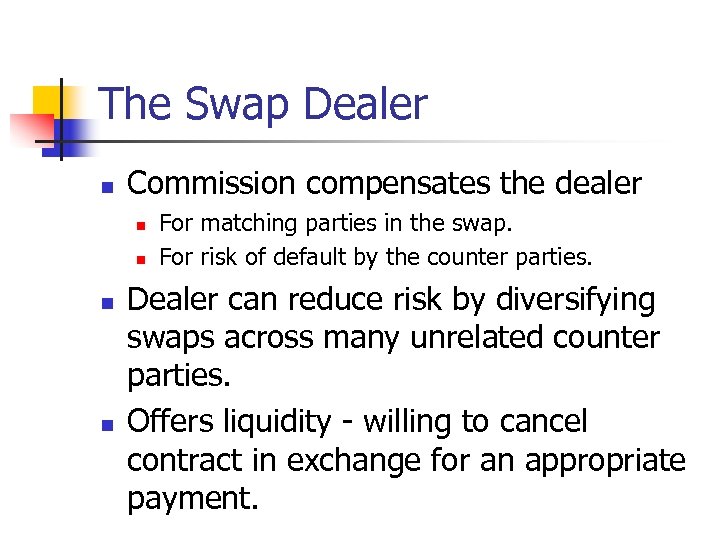

The Swap Dealer n Commission compensates the dealer n n For matching parties in the swap. For risk of default by the counter parties. Dealer can reduce risk by diversifying swaps across many unrelated counter parties. Offers liquidity - willing to cancel contract in exchange for an appropriate payment.

The Swap Dealer n Commission compensates the dealer n n For matching parties in the swap. For risk of default by the counter parties. Dealer can reduce risk by diversifying swaps across many unrelated counter parties. Offers liquidity - willing to cancel contract in exchange for an appropriate payment.

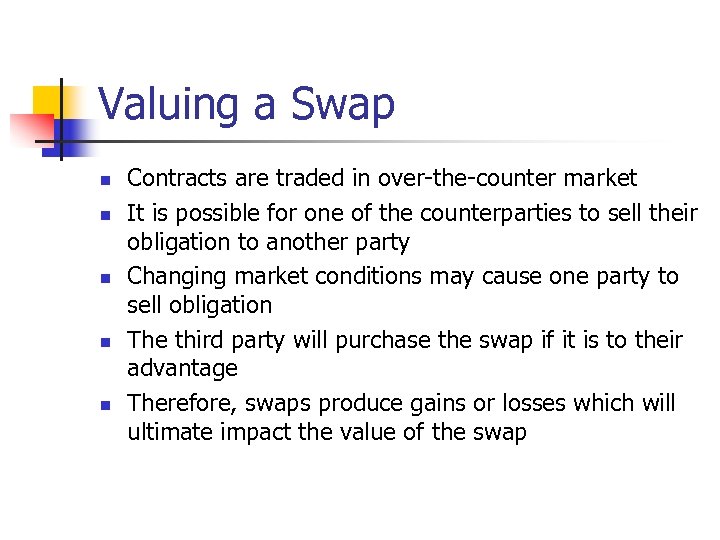

Valuing a Swap n n n Contracts are traded in over-the-counter market It is possible for one of the counterparties to sell their obligation to another party Changing market conditions may cause one party to sell obligation The third party will purchase the swap if it is to their advantage Therefore, swaps produce gains or losses which will ultimate impact the value of the swap

Valuing a Swap n n n Contracts are traded in over-the-counter market It is possible for one of the counterparties to sell their obligation to another party Changing market conditions may cause one party to sell obligation The third party will purchase the swap if it is to their advantage Therefore, swaps produce gains or losses which will ultimate impact the value of the swap

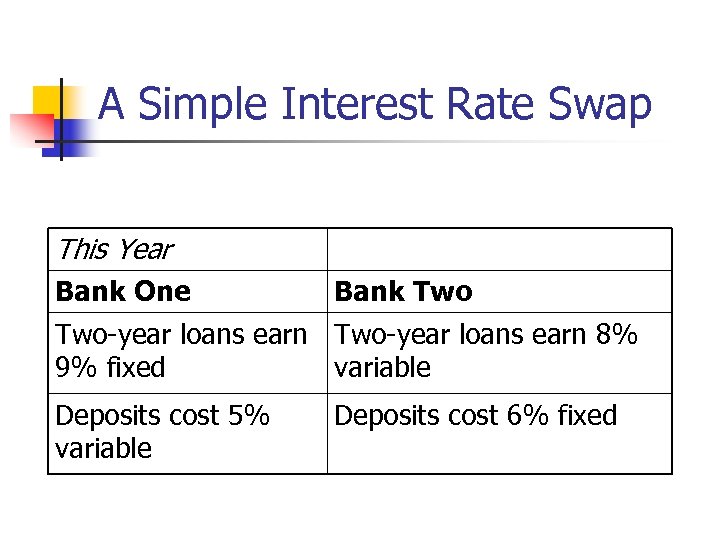

A Simple Interest Rate Swap This Year Bank One Bank Two-year loans earn 8% 9% fixed variable Deposits cost 5% variable Deposits cost 6% fixed

A Simple Interest Rate Swap This Year Bank One Bank Two-year loans earn 8% 9% fixed variable Deposits cost 5% variable Deposits cost 6% fixed

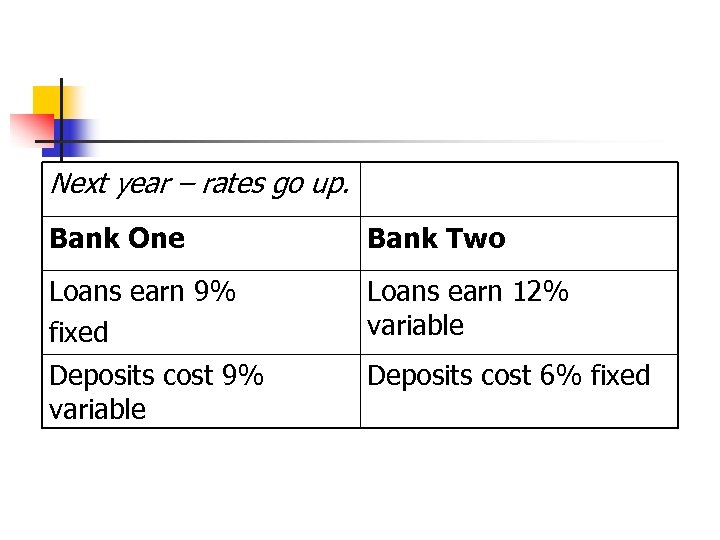

Next year – rates go up. Bank One Bank Two Loans earn 9% fixed Loans earn 12% variable Deposits cost 9% variable Deposits cost 6% fixed

Next year – rates go up. Bank One Bank Two Loans earn 9% fixed Loans earn 12% variable Deposits cost 9% variable Deposits cost 6% fixed

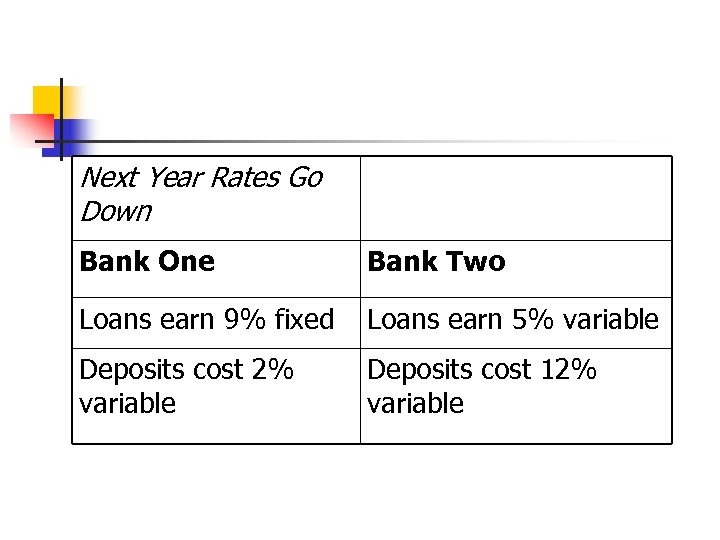

Next Year Rates Go Down Bank One Bank Two Loans earn 9% fixed Loans earn 5% variable Deposits cost 2% variable Deposits cost 12% variable

Next Year Rates Go Down Bank One Bank Two Loans earn 9% fixed Loans earn 5% variable Deposits cost 2% variable Deposits cost 12% variable

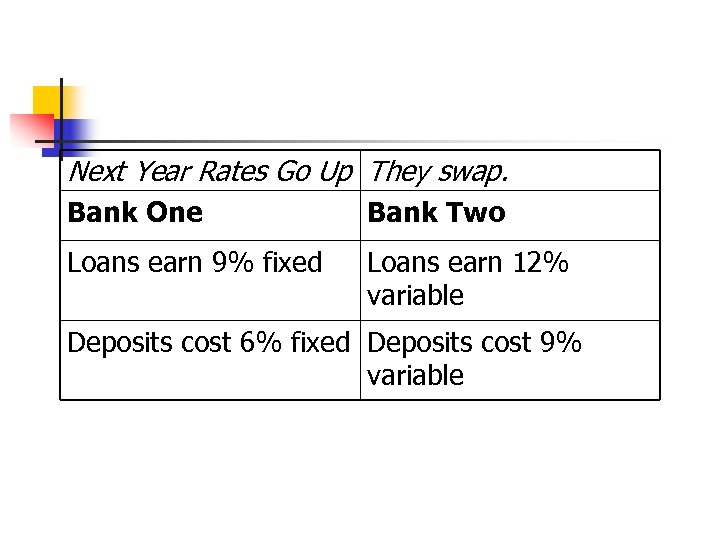

Next Year Rates Go Up They swap. Bank One Bank Two Loans earn 9% fixed Loans earn 12% variable Deposits cost 6% fixed Deposits cost 9% variable

Next Year Rates Go Up They swap. Bank One Bank Two Loans earn 9% fixed Loans earn 12% variable Deposits cost 6% fixed Deposits cost 9% variable

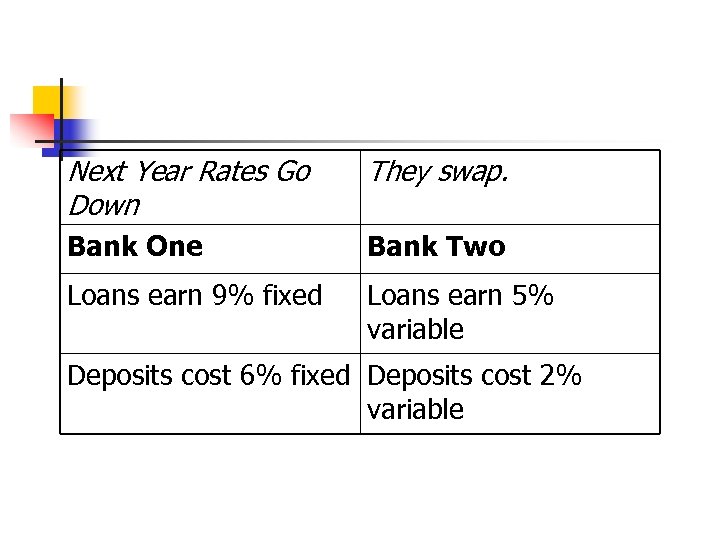

Next Year Rates Go Down They swap. Bank One Bank Two Loans earn 9% fixed Loans earn 5% variable Deposits cost 6% fixed Deposits cost 2% variable

Next Year Rates Go Down They swap. Bank One Bank Two Loans earn 9% fixed Loans earn 5% variable Deposits cost 6% fixed Deposits cost 2% variable

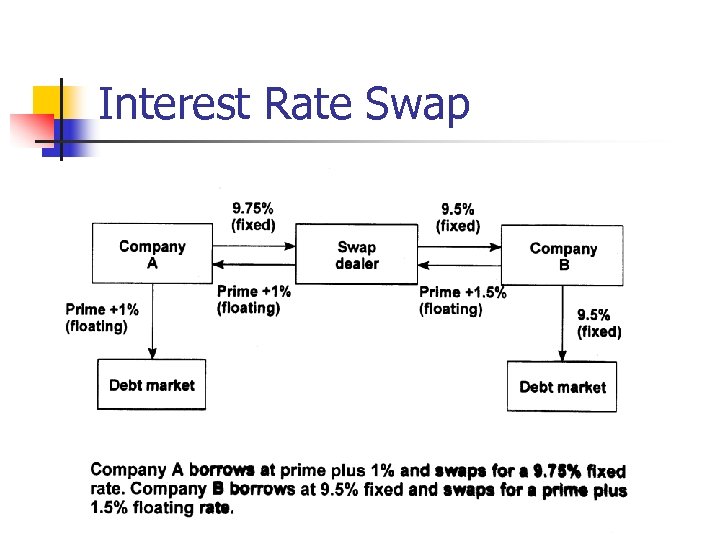

Interest Rate Swap

Interest Rate Swap

Currency Swaps n Two companies agree to exchange a specific amount of one currency for a specific amount of another at specific dates in the future.

Currency Swaps n Two companies agree to exchange a specific amount of one currency for a specific amount of another at specific dates in the future.