4c6a13d3b4c8a11531a91b3b7172b3e7.ppt

- Количество слайдов: 20

Derivatives Introduction Forward contracts Futures contracts Call and put option contracts Notation Definitions Graphical representations Bond prices and interest rates notation and definitions Finance 70523 Spring 2000 Assistant Professor Steven C. Mann The Neeley School of Business at TCU

Derivatives Introduction Forward contracts Futures contracts Call and put option contracts Notation Definitions Graphical representations Bond prices and interest rates notation and definitions Finance 70523 Spring 2000 Assistant Professor Steven C. Mann The Neeley School of Business at TCU

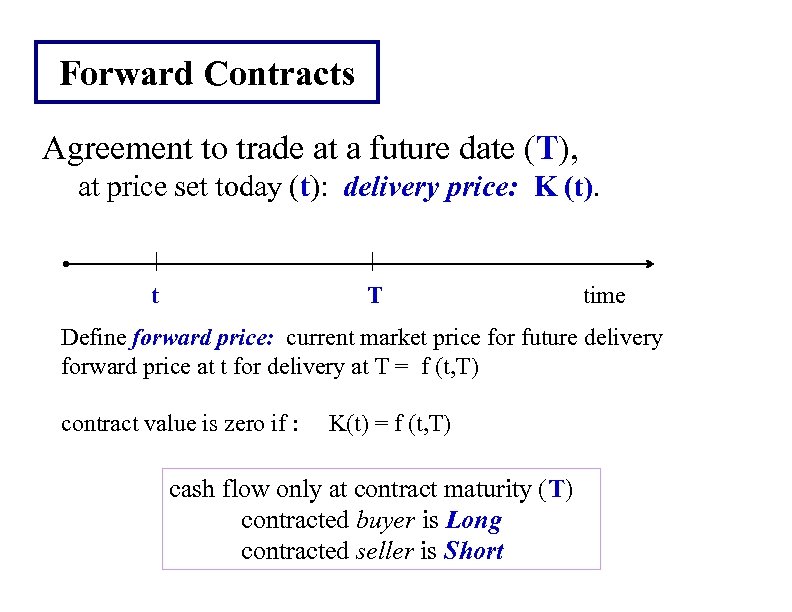

Forward Contracts Agreement to trade at a future date (T), at price set today (t): delivery price: K (t). t T time Define forward price: current market price for future delivery forward price at t for delivery at T = f (t, T) contract value is zero if : K(t) = f (t, T) cash flow only at contract maturity (T) contracted buyer is Long contracted seller is Short

Forward Contracts Agreement to trade at a future date (T), at price set today (t): delivery price: K (t). t T time Define forward price: current market price for future delivery forward price at t for delivery at T = f (t, T) contract value is zero if : K(t) = f (t, T) cash flow only at contract maturity (T) contracted buyer is Long contracted seller is Short

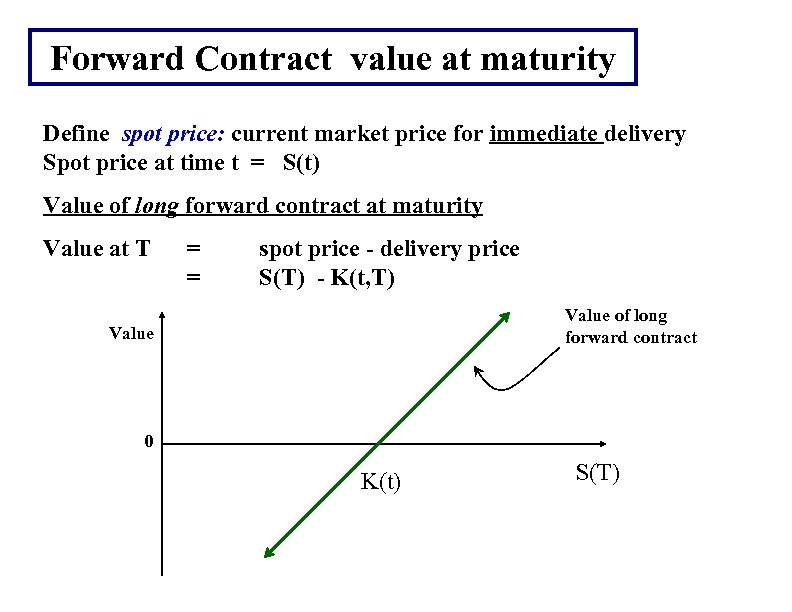

Forward Contract value at maturity Define spot price: current market price for immediate delivery Spot price at time t = S(t) Value of long forward contract at maturity Value at T = = spot price - delivery price S(T) - K(t, T) Value of long forward contract Value 0 K(t) S(T)

Forward Contract value at maturity Define spot price: current market price for immediate delivery Spot price at time t = S(t) Value of long forward contract at maturity Value at T = = spot price - delivery price S(T) - K(t, T) Value of long forward contract Value 0 K(t) S(T)

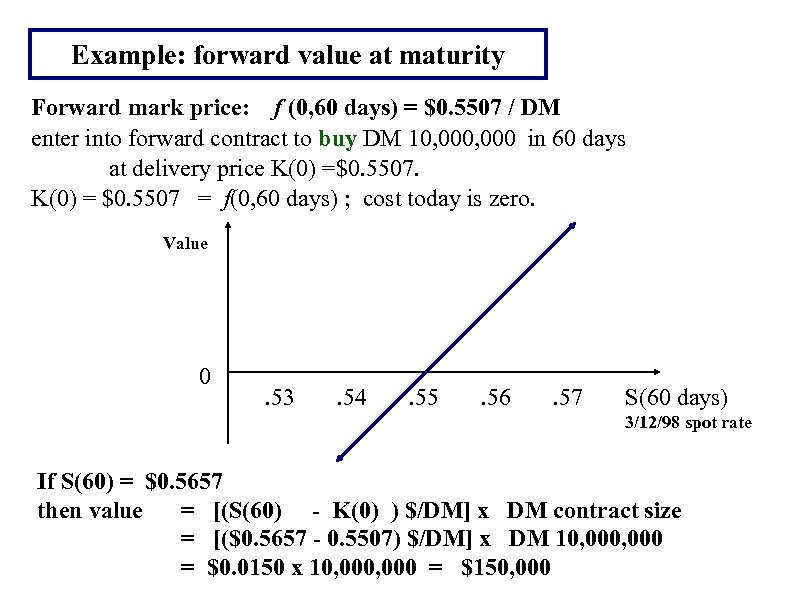

Example: forward value at maturity Forward mark price: f (0, 60 days) = $0. 5507 / DM enter into forward contract to buy DM 10, 000 in 60 days at delivery price K(0) =$0. 5507. K(0) = $0. 5507 = f(0, 60 days) ; cost today is zero. Value 0 . 53 . 54 . 55 . 56 . 57 S(60 days) 3/12/98 spot rate If S(60) = $0. 5657 then value = [(S(60) - K(0) ) $/DM] x DM contract size = [($0. 5657 - 0. 5507) $/DM] x DM 10, 000 = $0. 0150 x 10, 000 = $150, 000

Example: forward value at maturity Forward mark price: f (0, 60 days) = $0. 5507 / DM enter into forward contract to buy DM 10, 000 in 60 days at delivery price K(0) =$0. 5507. K(0) = $0. 5507 = f(0, 60 days) ; cost today is zero. Value 0 . 53 . 54 . 55 . 56 . 57 S(60 days) 3/12/98 spot rate If S(60) = $0. 5657 then value = [(S(60) - K(0) ) $/DM] x DM contract size = [($0. 5657 - 0. 5507) $/DM] x DM 10, 000 = $0. 0150 x 10, 000 = $150, 000

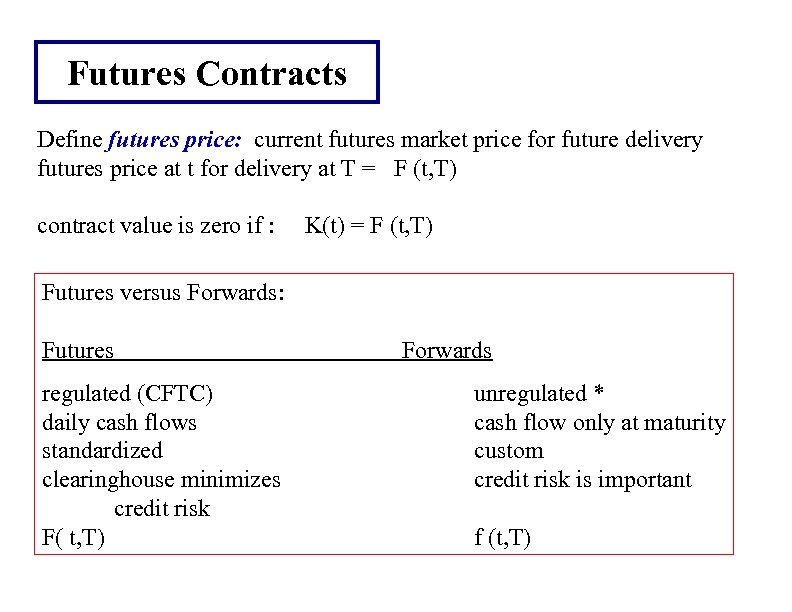

Futures Contracts Define futures price: current futures market price for future delivery futures price at t for delivery at T = F (t, T) contract value is zero if : K(t) = F (t, T) Futures versus Forwards: Futures regulated (CFTC) daily cash flows standardized clearinghouse minimizes credit risk F( t, T) Forwards unregulated * cash flow only at maturity custom credit risk is important f (t, T)

Futures Contracts Define futures price: current futures market price for future delivery futures price at t for delivery at T = F (t, T) contract value is zero if : K(t) = F (t, T) Futures versus Forwards: Futures regulated (CFTC) daily cash flows standardized clearinghouse minimizes credit risk F( t, T) Forwards unregulated * cash flow only at maturity custom credit risk is important f (t, T)

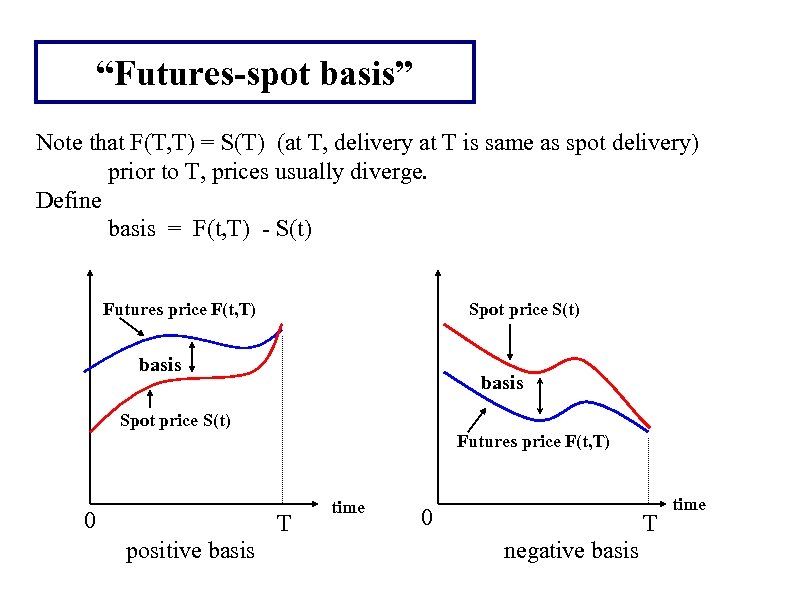

“Futures-spot basis” Note that F(T, T) = S(T) (at T, delivery at T is same as spot delivery) prior to T, prices usually diverge. Define basis = F(t, T) - S(t) Futures price F(t, T) Spot price S(t) basis Spot price S(t) Futures price F(t, T) 0 T positive basis time 0 T negative basis time

“Futures-spot basis” Note that F(T, T) = S(T) (at T, delivery at T is same as spot delivery) prior to T, prices usually diverge. Define basis = F(t, T) - S(t) Futures price F(t, T) Spot price S(t) basis Spot price S(t) Futures price F(t, T) 0 T positive basis time 0 T negative basis time

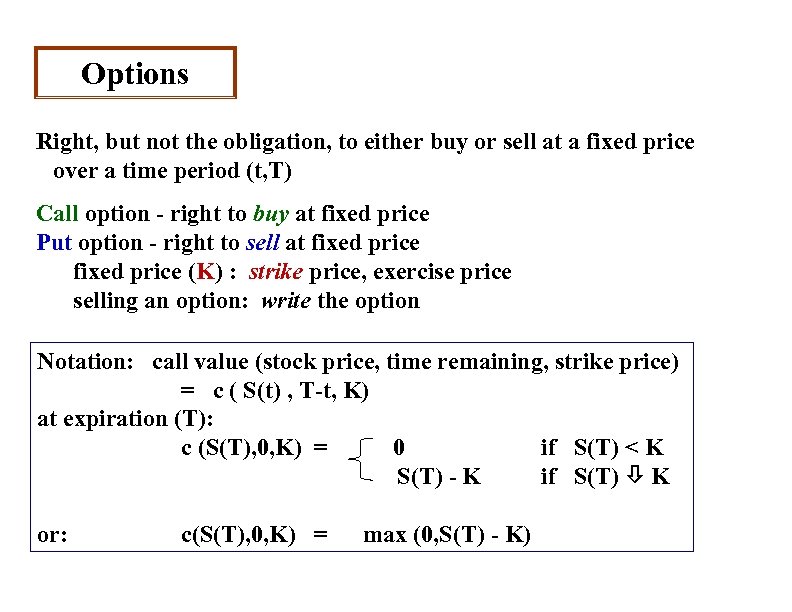

Options Right, but not the obligation, to either buy or sell at a fixed price over a time period (t, T) Call option - right to buy at fixed price Put option - right to sell at fixed price (K) : strike price, exercise price selling an option: write the option Notation: call value (stock price, time remaining, strike price) = c ( S(t) , T-t, K) at expiration (T): c (S(T), 0, K) = 0 if S(T) < K S(T) - K if S(T) K or: c(S(T), 0, K) = max (0, S(T) - K)

Options Right, but not the obligation, to either buy or sell at a fixed price over a time period (t, T) Call option - right to buy at fixed price Put option - right to sell at fixed price (K) : strike price, exercise price selling an option: write the option Notation: call value (stock price, time remaining, strike price) = c ( S(t) , T-t, K) at expiration (T): c (S(T), 0, K) = 0 if S(T) < K S(T) - K if S(T) K or: c(S(T), 0, K) = max (0, S(T) - K)

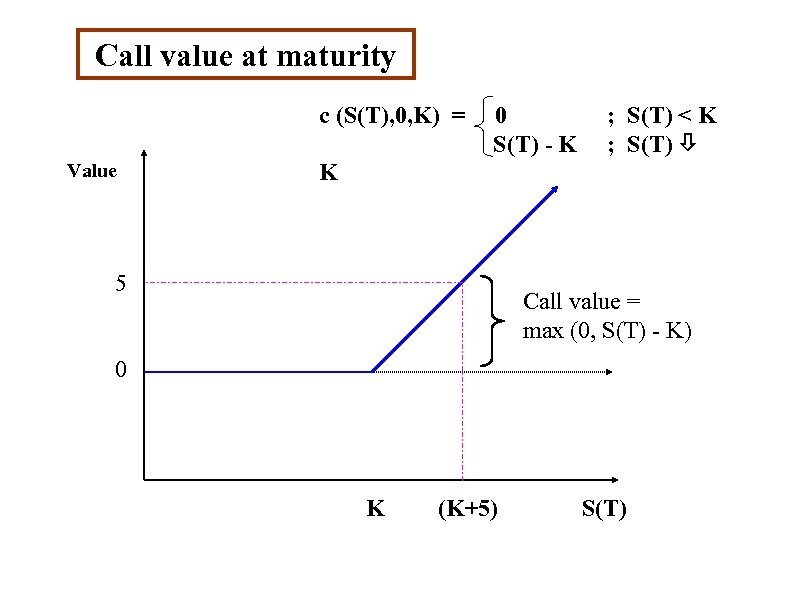

Call value at maturity c (S(T), 0, K) = Value 0 S(T) - K ; S(T) < K ; S(T) K 5 Call value = max (0, S(T) - K) 0 K (K+5) S(T)

Call value at maturity c (S(T), 0, K) = Value 0 S(T) - K ; S(T) < K ; S(T) K 5 Call value = max (0, S(T) - K) 0 K (K+5) S(T)

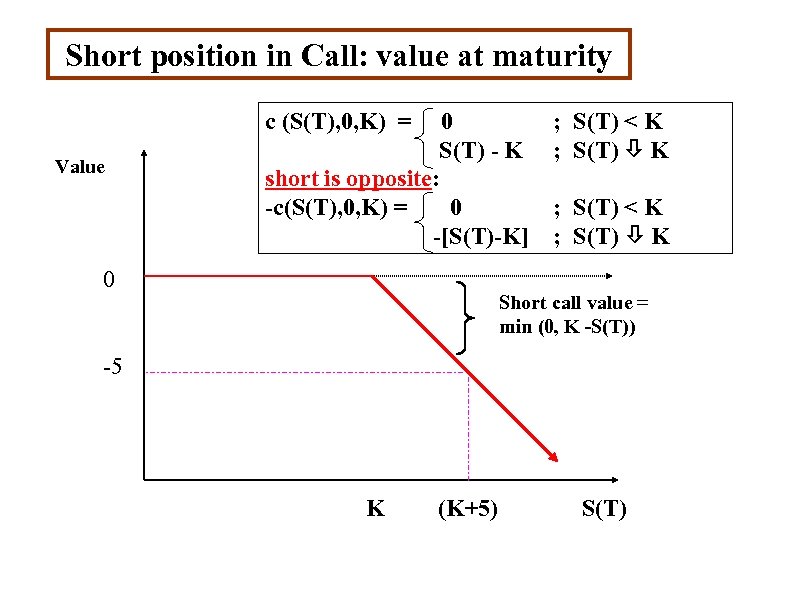

Short position in Call: value at maturity c (S(T), 0, K) = Value 0 S(T) - K short is opposite: -c(S(T), 0, K) = 0 -[S(T)-K] 0 ; S(T) < K ; S(T) K Short call value = min (0, K -S(T)) -5 K (K+5) S(T)

Short position in Call: value at maturity c (S(T), 0, K) = Value 0 S(T) - K short is opposite: -c(S(T), 0, K) = 0 -[S(T)-K] 0 ; S(T) < K ; S(T) K Short call value = min (0, K -S(T)) -5 K (K+5) S(T)

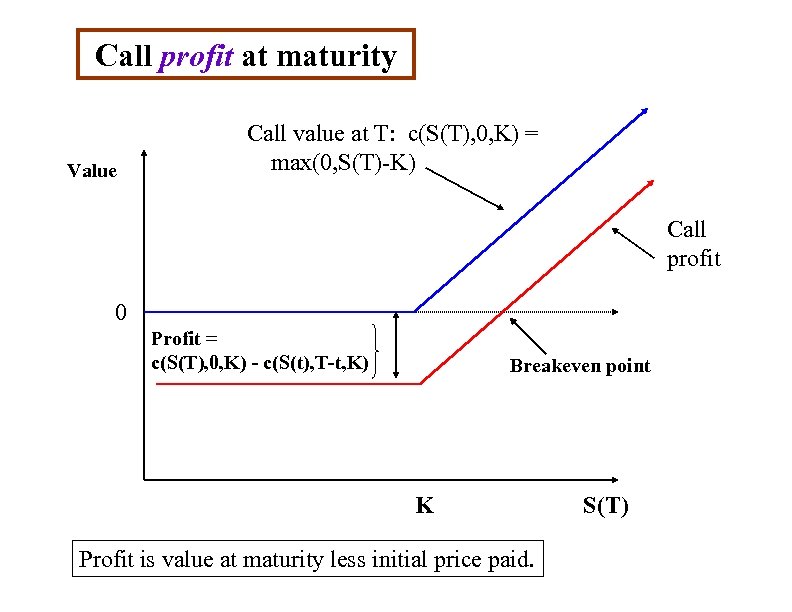

Call profit at maturity Value Call value at T: c(S(T), 0, K) = max(0, S(T)-K) Call profit 0 Profit = c(S(T), 0, K) - c(S(t), T-t, K) Breakeven point K Profit is value at maturity less initial price paid. S(T)

Call profit at maturity Value Call value at T: c(S(T), 0, K) = max(0, S(T)-K) Call profit 0 Profit = c(S(T), 0, K) - c(S(t), T-t, K) Breakeven point K Profit is value at maturity less initial price paid. S(T)

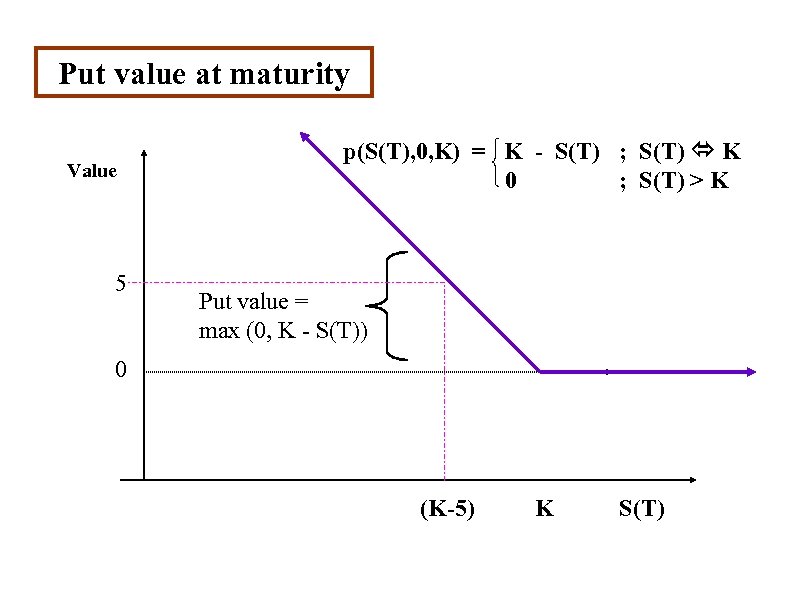

Put value at maturity Value 5 p(S(T), 0, K) = K - S(T) ; S(T) K 0 ; S(T) > K Put value = max (0, K - S(T)) 0 (K-5) K S(T)

Put value at maturity Value 5 p(S(T), 0, K) = K - S(T) ; S(T) K 0 ; S(T) > K Put value = max (0, K - S(T)) 0 (K-5) K S(T)

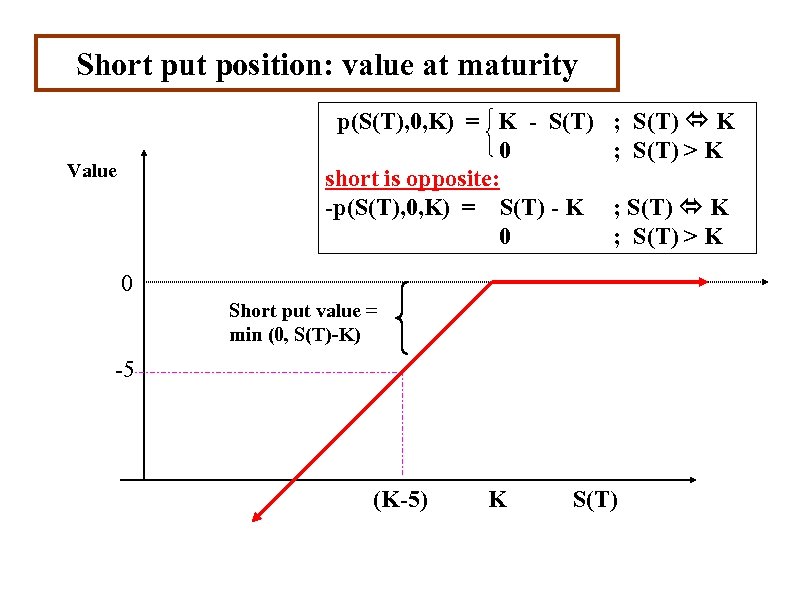

Short put position: value at maturity p(S(T), 0, K) = K - S(T) 0 short is opposite: -p(S(T), 0, K) = S(T) - K 0 Value ; S(T) K ; S(T) > K 0 Short put value = min (0, S(T)-K) -5 (K-5) K S(T)

Short put position: value at maturity p(S(T), 0, K) = K - S(T) 0 short is opposite: -p(S(T), 0, K) = S(T) - K 0 Value ; S(T) K ; S(T) > K 0 Short put value = min (0, S(T)-K) -5 (K-5) K S(T)

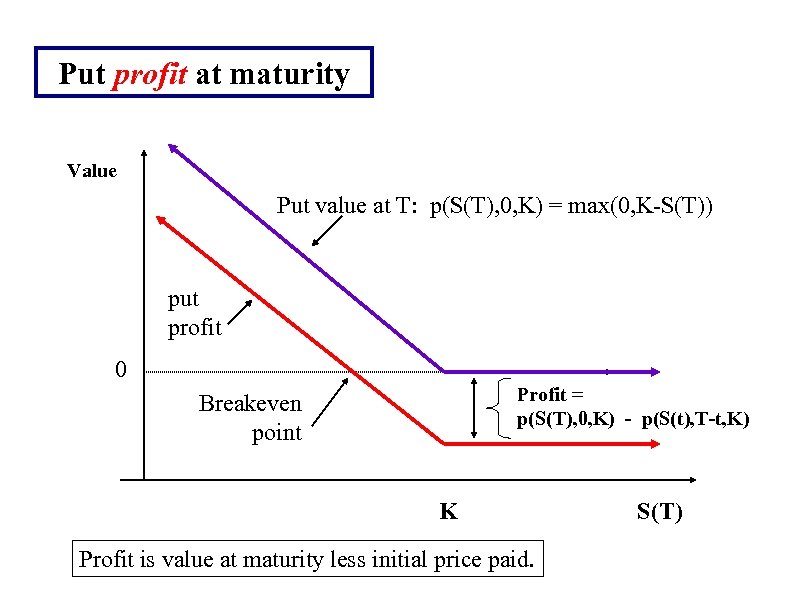

Put profit at maturity Value Put value at T: p(S(T), 0, K) = max(0, K-S(T)) put profit 0 Profit = p(S(T), 0, K) - p(S(t), T-t, K) Breakeven point K Profit is value at maturity less initial price paid. S(T)

Put profit at maturity Value Put value at T: p(S(T), 0, K) = max(0, K-S(T)) put profit 0 Profit = p(S(T), 0, K) - p(S(t), T-t, K) Breakeven point K Profit is value at maturity less initial price paid. S(T)

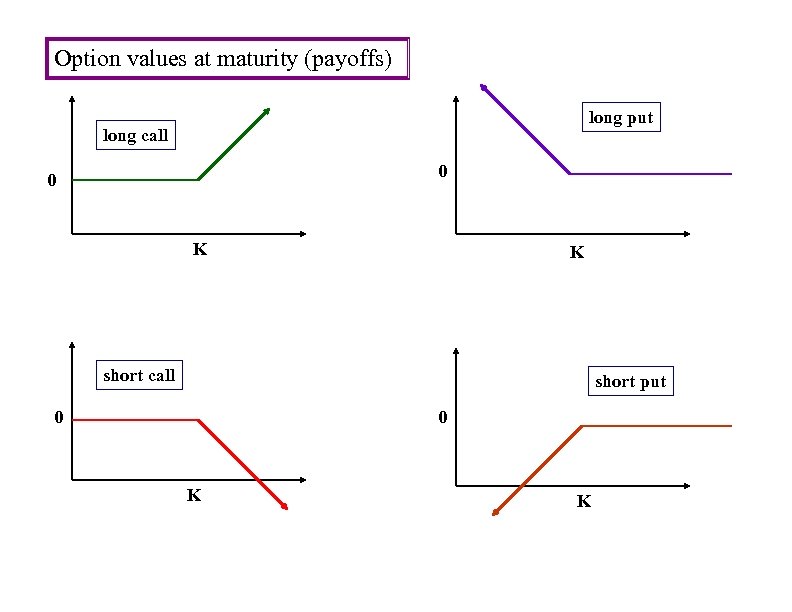

Option values at maturity (payoffs) long put long call 0 0 K K short call short put 0 0 K K

Option values at maturity (payoffs) long put long call 0 0 K K short call short put 0 0 K K

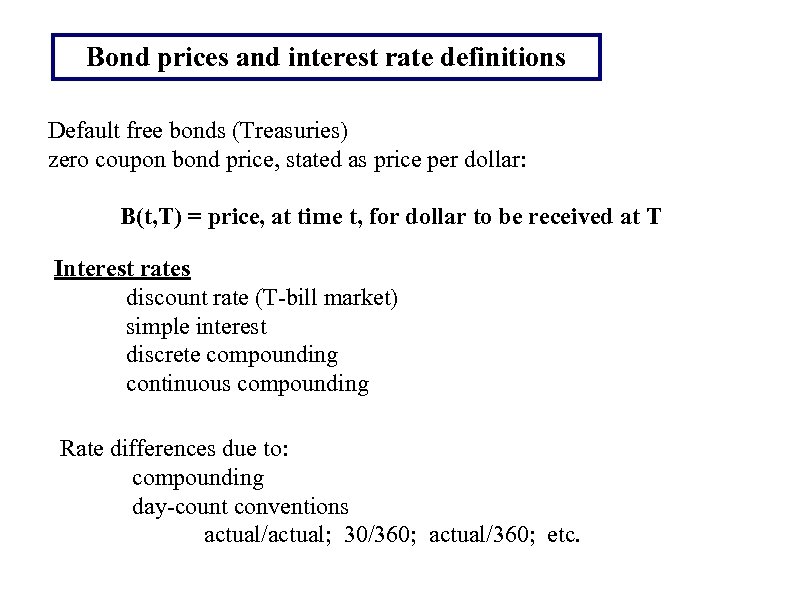

Bond prices and interest rate definitions Default free bonds (Treasuries) zero coupon bond price, stated as price per dollar: B(t, T) = price, at time t, for dollar to be received at T Interest rates discount rate (T-bill market) simple interest discrete compounding continuous compounding Rate differences due to: compounding day-count conventions actual/actual; 30/360; actual/360; etc.

Bond prices and interest rate definitions Default free bonds (Treasuries) zero coupon bond price, stated as price per dollar: B(t, T) = price, at time t, for dollar to be received at T Interest rates discount rate (T-bill market) simple interest discrete compounding continuous compounding Rate differences due to: compounding day-count conventions actual/actual; 30/360; actual/360; etc.

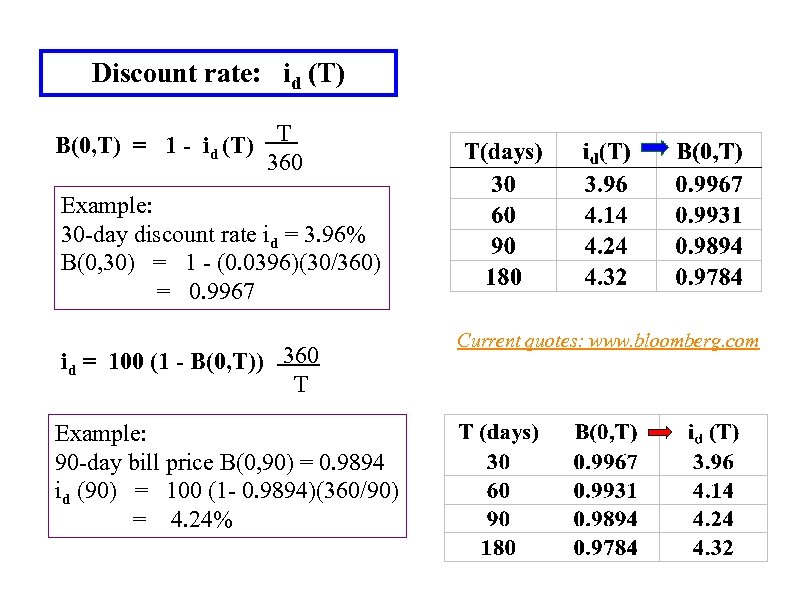

Discount rate: id (T) B(0, T) = 1 - id (T) T 360 Example: 30 -day discount rate id = 3. 96% B(0, 30) = 1 - (0. 0396)(30/360) = 0. 9967 id = 100 (1 - B(0, T)) 360 T Example: 90 -day bill price B(0, 90) = 0. 9894 id (90) = 100 (1 - 0. 9894)(360/90) = 4. 24% Current quotes: www. bloomberg. com

Discount rate: id (T) B(0, T) = 1 - id (T) T 360 Example: 30 -day discount rate id = 3. 96% B(0, 30) = 1 - (0. 0396)(30/360) = 0. 9967 id = 100 (1 - B(0, T)) 360 T Example: 90 -day bill price B(0, 90) = 0. 9894 id (90) = 100 (1 - 0. 9894)(360/90) = 4. 24% Current quotes: www. bloomberg. com

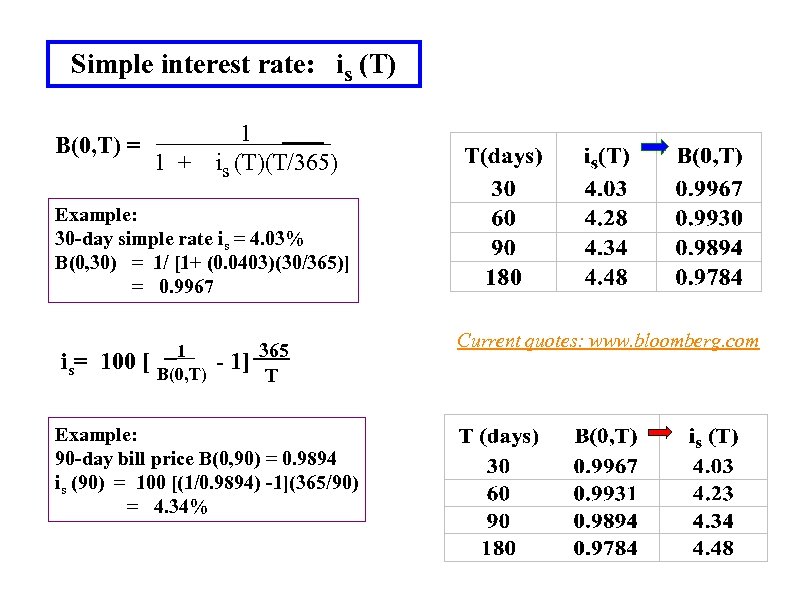

Simple interest rate: is (T) B(0, T) = 1 + 1 is (T)(T/365) Example: 30 -day simple rate is = 4. 03% B(0, 30) = 1/ [1+ (0. 0403)(30/365)] = 0. 9967 is= 100 [ 1 B(0, T) - 1] 365 T Example: 90 -day bill price B(0, 90) = 0. 9894 is (90) = 100 [(1/0. 9894) -1](365/90) = 4. 34% Current quotes: www. bloomberg. com

Simple interest rate: is (T) B(0, T) = 1 + 1 is (T)(T/365) Example: 30 -day simple rate is = 4. 03% B(0, 30) = 1/ [1+ (0. 0403)(30/365)] = 0. 9967 is= 100 [ 1 B(0, T) - 1] 365 T Example: 90 -day bill price B(0, 90) = 0. 9894 is (90) = 100 [(1/0. 9894) -1](365/90) = 4. 34% Current quotes: www. bloomberg. com

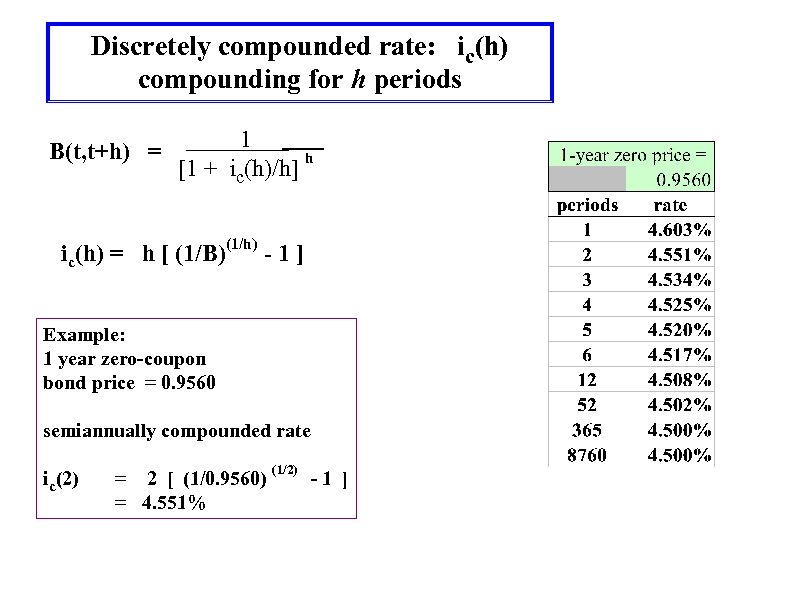

Discretely compounded rate: ic(h) compounding for h periods B(t, t+h) = 1 h [1 + ic(h)/h] ic(h) = h [ (1/B)(1/h) - 1 ] Example: 1 year zero-coupon bond price = 0. 9560 semiannually compounded rate ic(2) = 2 [ (1/0. 9560) = 4. 551% (1/2) -1 ]

Discretely compounded rate: ic(h) compounding for h periods B(t, t+h) = 1 h [1 + ic(h)/h] ic(h) = h [ (1/B)(1/h) - 1 ] Example: 1 year zero-coupon bond price = 0. 9560 semiannually compounded rate ic(2) = 2 [ (1/0. 9560) = 4. 551% (1/2) -1 ]

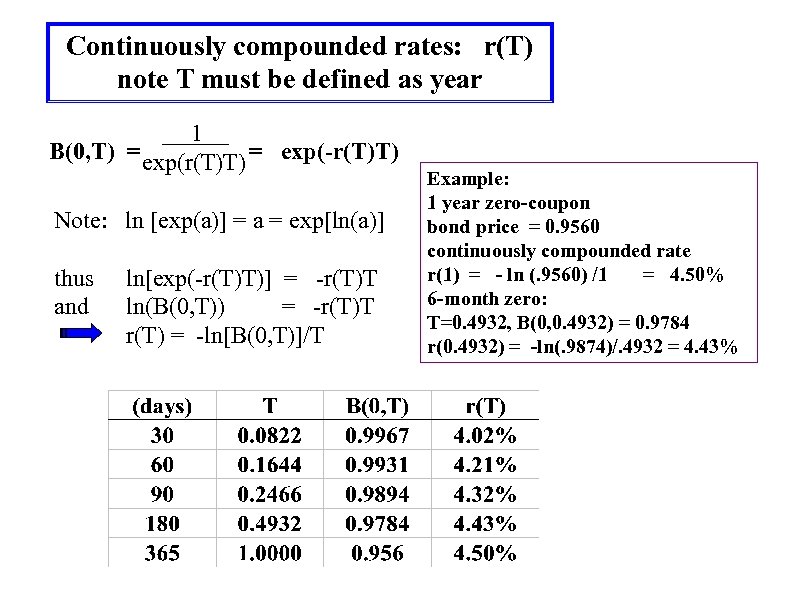

Continuously compounded rates: r(T) note T must be defined as year 1 B(0, T) = exp(r(T)T) = exp(-r(T)T) Note: ln [exp(a)] = a = exp[ln(a)] thus and ln[exp(-r(T)T)] = -r(T)T ln(B(0, T)) = -r(T)T r(T) = -ln[B(0, T)]/T Example: 1 year zero-coupon bond price = 0. 9560 continuously compounded rate r(1) = - ln (. 9560) /1 = 4. 50% 6 -month zero: T=0. 4932, B(0, 0. 4932) = 0. 9784 r(0. 4932) = -ln(. 9874)/. 4932 = 4. 43%

Continuously compounded rates: r(T) note T must be defined as year 1 B(0, T) = exp(r(T)T) = exp(-r(T)T) Note: ln [exp(a)] = a = exp[ln(a)] thus and ln[exp(-r(T)T)] = -r(T)T ln(B(0, T)) = -r(T)T r(T) = -ln[B(0, T)]/T Example: 1 year zero-coupon bond price = 0. 9560 continuously compounded rate r(1) = - ln (. 9560) /1 = 4. 50% 6 -month zero: T=0. 4932, B(0, 0. 4932) = 0. 9784 r(0. 4932) = -ln(. 9874)/. 4932 = 4. 43%