47e1d583f2bc70ece168b00f033ff904.ppt

- Количество слайдов: 70

DERIVATIVES IN BANKRUPTCY Shmuel Vasser Dechert LLP 1095 Avenue of the Americas New York, New York 10036 +1 212 698 3500 This presentation is provided by Dechert LLP for educational and informational purposes only and is not intended and should not be construed as legal advice. This presentation is considered attorney advertising in some jurisdictions. © 2008 All Rights Reserved © 2008 Dechert LLP

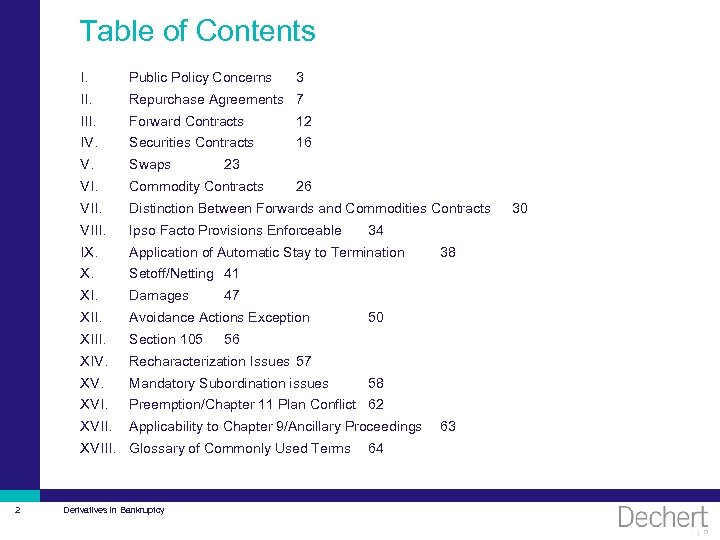

Table of Contents I. Public Policy Concerns II. Repurchase Agreements 7 III. Forward Contracts 12 IV. Securities Contracts 16 V. Swaps VI. Commodity Contracts VII. Distinction Between Forwards and Commodities Contracts VIII. Ipso Facto Provisions Enforceable IX. Application of Automatic Stay to Termination X. Setoff/Netting 41 XI. Damages XII. Avoidance Actions Exception XIII. Section 105 XIV. Recharacterization Issues 57 XV. Mandatory Subordination issues XVI. Preemption/Chapter 11 Plan Conflict 62 XVII. Applicability to Chapter 9/Ancillary Proceedings 3 23 26 Derivatives in Bankruptcy 38 47 50 56 XVIII. Glossary of Commonly Used Terms 2 34 58 64 63 30

I. Public Policy Concerns • The legislative history to the Safe Harbor Provisions indicates strong Congressional policy to protect American financial markets and institutions from the ripple effects resulting from a bankruptcy filing by a major player in the financial markets. These provisions are designed to protect the financial markets from systemic risks. – It is essential that stockbrokers and securities clearing agencies be protected from the issuance of a court or administrative agency order which would stay the prompt liquidation of an insolvent's positions, because market fluctuations in the securities markets create an inordinate risk that the insolvency of one party could trigger a chain reaction of insolvencies of the others who carry accounts for that party and undermine the integrity of those markets. See Statement of Senator Dole, 128 Cong. Rec. S 8, 132 -33 (daily ed. July 13, 1982). – The legislative history to the Act to Amend Title 11 of the United States Code Regarding Swap Agreements and Forward Contracts, Pub. L. 101 -311, 104 Stat. 268, is similarly a testament to the public policy behind the safe harbor provisions. See Statement of Senator De. Concini, 135 Cong. Rec. S 1414 (daily ed. Feb. 9, 1989). 3 Derivatives in Bankruptcy

Public Policy Concerns (cont’d) • The legislation is supported by the Federal Reserve Board, Securities Industry Association, Public Securities Association, New York Clearinghouse Association, International Swap Dealers Association, and others. I am not aware of any opposition to the legislation. Id. at S 1415. • As new financial instruments have been developed, Congress has recognized the need to amend certain aspects of the Bankruptcy Code in order to continue to provide the necessary speed and certainty in complex financial transactions. In 1982 and again in 1984 Congress amended section 362 to exempt the termination and setoff of mutual debts and claims arising under securities contracts, forward contracts, commodity contracts and repurchase agreements. The 1982 amendments were "intended to minimize the displacement caused in the commodities and securities markets in the event of a bankruptcy affecting these industries, " recognizing the "potential volatile nature of the markets. " 128 Cong. Rec. H 261 (daily ed. Feb. 9, 1982). The same rationale supported the 1984 amendments. These protections should be extended to the swap and forward foreign exchange agreements for the same reasons. Id. at S 1416. 4 Derivatives in Bankruptcy

Public Policy Concerns (cont’d) • As Congress recognized at the time of the 1982 and 1984 amendments, counterparties could be faced with substantial losses if forced to await bankruptcy court decision on assumption or rejection of financial transaction agreements. Unlike ordinary leases or executory contracts, where the markets change gradually, the financial markets can move significantly in a manner of minutes. The markets will not wait for a court decision. . There is a clear need for Congress to assure counterparties that they will be able to terminate these agreements and exercise contractual liquidation and netting rights if a party to the agreement files for bankruptcy relief. Id. at S 1417. – “The commodities and securities markets operate through a complex system of accounts and guarantees. Because of the structure of the clearing systems in these industries and the sometimes volatile nature of the markets, certain protections are necessary to prevent the insolvency of one commodity or security firm from spreading to other firms and possibly threatening the collapse of the affected market. ” H. R. Rep. No. 97 -420, at 1 (1982). – 5 S. Rep. No. 98 -65, at 44 -49 (1983) contains a description of importance of repo markets “to the health of the country’s financial system” – including importance to state and local governments – and uncertainty as to coverage of securities contract provisions. Derivatives in Bankruptcy

Public Policy Concerns (cont’d) – – The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 , Pub. L. 109 -8, signed into law on April 20, 2005, amends the Bankruptcy Code effective October 17, 2005, and contains provisions expanding the protections for derivative and financial contract transactions. – 6 H. R. Rep. No. 101 -484, at 1 -4 (1990) contains description of importance and vulnerability of swap and forward contract markets. The Financial Netting Improvements Act of 2006 , Pub. L. 109 -390, signed into law on December 12, 2006, makes certain technical amendments and clarifications to the various provisions dealing with derivative and financial contract transactions. Derivatives in Bankruptcy

II. Repurchase Agreements • Defined in § 101(47): – an agreement, including related terms • provides for a transfer; • of certificates of deposit, mortgage related securities (as defined in Section 3 of the Securities Exchange Act of 1934), mortgage loans, interests in mortgage related securities or mortgage loans; • eligible bankers’ acceptances, qualified foreign government securities (representing a direct obligation of, or that is fully guaranteed by, the central government of a member of the organization for Economic Cooperation and Development); • securities that are direct obligations of, or are fully guaranteed by the U. S. or U. S. agency; • against transfer of funds by the transferee; • with simultaneous agreement by transferee to transfer the instruments back; • at a date certain not later than one year after the transfer, or on demand, against transfer of fund. – – an option to enter into an agreement or transaction described in (i) or (ii); – 7 any combination of agreements or transactions described in (i) and (iii); a master agreement that provides for an agreement or transaction referred to above, together with all supplements to any such master agreement, without regard to whether such master agreement provides for an agreement or transaction that is not a repurchase agreement under this paragraph, except that such master agreement shall be considered to be a repurchase agreement under this paragraph only with respect to each agreement or transaction under the master agreement that is referred to above; or Derivatives in Bankruptcy

Repurchase Agreements (cont’d) – any security agreement or arrangement or other credit enhancement related to any agreement or transaction referred to in clause (i), (iii), or (iv), including any guarantee or reimbursement obligation by or to a repo participant or financial participant in connection with any agreement or transaction referred to in any such clause, but not to exceed the damages in connection with any such agreement or transaction, measured in accordance with section 562; • Does not include a repurchase obligation under a participation in a commercial mortgage loan. • • 8 Applies to reverse repos: A Repo in which the broker-dealer rather than being the initial seller, is the initial buyer. Mortgage related securities: A security that is rated in one of the two highest rating categories by at least one nationally recognized statistical rating agency. American Home Mortgage v. Lehman Brothers, 388 B. R. 69 (Bankr. D. Del. 2008) (notes secured by mortgages rated BBB by S&P and Baa 2 by Moody’s, do not meet the definition). Derivatives in Bankruptcy

Repurchase Agreements (cont’d) • Interest in mortgage loans: Notes secured by mortgage loans qualify. American Home Mortgage v. Lehman, supra. • Eligible bankers’ acceptances: Probably refers to bankers’ acceptances authorized under § 13(7) of the Federal Reserve Act. Bankers’ acceptances are essentially thirdparty obligations which the bank committed to honor. • What is a U. S. Agency? – – 9 Legislative History: Intended to cover entities whose obligations are eligible for purchase by federal reserve banks, pursuant to resolutions of the Board of Governors of the Federal Reserve System. The legislative history to the 2005 amendments states that the intent is to cover obligations issued or guaranteed by Fannie Mae and Freddie Mac as well as all obligations eligible for purchase by Federal Reserve banks under the similar language of § 14(b) of the Federal Reserve Act. Board of Governors’ interpretation FRRS 2 -040, codified at 12 C. F. R. § 201. 108 (2005), lists 20 principal type obligations that qualify. Derivatives in Bankruptcy

Repurchase Agreements (cont’d) – Protected Party – repo participant (§ 101(46)): • • at any time before bankruptcy • – any entity has outstanding repo with the debtor Financial Participant (§ 101(22 A)) • • • 10 an entity that, at the time it enters into a securities contract, commodity contract, swap agreement, repurchase agreement, or forward contract, or at the time of the date of the filing of the petition, has one or more securities contracts, commodities contracts, forward contracts, repos, swaps or master netting agreements with the debtor or any other entity (other than an affiliate) of a total gross dollar value of not less than $1, 000, 000 in notional or actual principal amount outstanding on any day during the 15 month period prior to the petition date, or has gross mark-to-market positions of not less than $100, 000 (aggregated across counterparties) in one or more such agreements or transactions with the debtor or any other entity (other than an affiliate) on any day during the 15 -month period prior to the petition date; or a clearing organization (as defined in section 402 of the Federal Deposit Insurance Corporation Improvement Act of 1991). A repo is essentially a current sale and a forward contract. Derivatives in Bankruptcy

Repurchase Agreements (cont’d) • Economically it is hard to distinguish a repo from a secured loan (underlying securities serve as collateral) since the repurchase price includes interest on the imputed loan created by the repo. Comark, 124 B. R. 806, 809 n. 4 (Bankr. C. D. Cal. 1991), aff’d, 145 B. R. 47 (B. A. P. 9 th Cir. 1992), but under the plain meaning cannon of interpretation a contract that meets the statutory definition will be treated is such. Caylon NY Branch v. American Home Mortgage Corp. , 379 B. R. 503 (Bankr. D. Del. 2008). – Courts are split on whether non-qualified repos are sales or loans. – Loans: • – RTC v. Aetna, 25 F. 3 d 570, 578 -80 (7 th Cir. 1994) (loans for insurance law purposes); Nebraska Dep’t of Revenue v. Lowenstein, 513 U. S. 123, 134 (1994) (loans for state tax law purposes); Lombard-Wall, 23 B. R. 165 (Bankr. S. D. N. Y. 1982). Sales: • Granite Partners v. Bear Stearns, 17 F. Supp. 2 d 275, 300 -04 (S. D. N. Y. 1998); SEC v. Drysdale Securities, 785 F. 2 d 38, 41 (2 d Cir. 1986); Bevill, Bressler, 67 B. R. 557, 596 -98 (D. N. J. 1986). – – 11 Undecided: CRIIMI MAE, 251 B. R. 796, 802 -05 (Bankr. D. Md. 2000) (whether a repo is a sale or a loan is a factual question; finding the standard repo form to be ambiguous on this point). Servicing Rights: Not protected and not subject to the safe harbor provisions even if included in the repo agreement. Caylon NY Branch v. American Home Mortgage Corp. , 379 B. R. 503 (Bankr. D. Del. , 2008). Derivatives in Bankruptcy

III. Forward Contracts • Defined in § 101(25): – – for purchase, sale or transfer; – of a commodity, including any similar good, article, service or interest which is presently or in the future becomes the subject of dealing with in the forward contract trade, or product or by product thereof; – maturity date of more than 2 days after the contract is entered into ( Mirant, 310 B. R. 548, 565 n. 26 (Bankr. N. D. Tex. 2004); maturity means the due date for commencement of performance; Borden Chemicals, 336 B. R. 214, 219 (Bankr. D. Del. 2006), monthly nomination of quantities to be delivered six days before delivery date satisfies this requirement)); – including, but not limited to: repos, reverse repos, consignment, lease, swap, hedge, deposit, loan, option, allocated or unallocated transaction, or any other similar agreement. – 12 a contract (not a commodity contract); Similar to the repo definition, including any combination of agreements or transactions, any option to enter into these agreements or transactions, master agreements, and security and credit enhancement agreements, with damages subject to § 562. Derivatives in Bankruptcy

Forward Contracts (cont’d) • Protected Party – forward contract merchant (§ 101(26)): – Federal Reserve Bank, – Entity whose business consists in whole or in part of entering into forward contracts, • as a merchant or with merchants, • in commodities or other similar good, service or interests, • Which presently or in the future becomes part of the forward contract trade – – • Appears to overrule Mirant, 303 B. R. 319, 326 -27 (Bankr. N. D. Tex. 2003) (holding that governmental entities are not protected; old definition used “person” which excludes governmental entities). Financial participant (§ 101 (22 A)). Note: – – “repurchase transaction” and “reverse repurchase transaction” are included, not “repurchase agreement”; The 2006 amendments made clear that these terms do not refer to the defined term “repurchase agreement” – 13 “swap” is mentioned as included, not a “swap agreement” The 2006 amendments made clear that the commodity contract carve-out specifically refer to commodity contract as defined in § 761(4). Derivatives in Bankruptcy

Forward Contracts (cont’d) • Query: What about a “mixed” contract – Party A purchase gas from Party B, processes it and sells the processed product to Party B – is it a forward or a service contract? • What is a forward contract merchant? – – Mirant, 310 B. R. 548, 568 (Bankr. N. D. Tex. 2004): a person that, in order to profit, engages in forward contract trade as a, or with, merchants. Merchant is not one acting as the end-user or producer; it buys, sell or trades in the market; Borden Chemicals, 336 B. R. 214, 225 (Bankr. D. Del. 2006): a party who buys and sells gas using forward contracts qualifies as a merchant. – Aurora Natural Gas, 316 B. R. 481 (Bankr. N. D. Tex. 2004); a forward contract merchant engaging in collection activities for gas it sold may not qualify as a forward contract merchant for settlement payment protections. – 14 Definition is descriptive Legislative history suggests that it is a commercial trading firm that offers producers, users of commodities and other traders opportunity to buy and sell commodities on a forward basis. See 124 Cong. Rec. 14724 -6 (daily ed. Sept. 7, 1978) (comment of Senator Mathias) (“Forward contract merchants are commercial trading firms which offer to commercial customers the ability to buy or sell commodities in the physical market on a forward basis. ”) Derivatives in Bankruptcy

Forward Contracts (cont’d) • Query: – – A person that has only one forward contract but is otherwise a very large business; qualifies? Mirant, 310 B. R. 548 – probably not. – • A person having only one asset/contract, which is a forward; qualifies as forward contract merchant? Mirant, 310 B. R. 548 – probably not. But – entities that do not qualify as forward contract merchants could still qualify as financial participants. What is “forward contract trade”? – Type of forward contracts that are traded? – Type of goods or services that are commonly the subject of forward contracts? • • 15 There is an active forward contract market in electricity. Duke Energy Trading & Marketing, L. L. C. v. Davies, 267 F. 3 d 1042 (9 th Cir. 2001); California Power Exchange Corp. v. FERC, 245 F. 3 d 1110 (9 th Cir. 2001). And in Natural Gas. Mirant, 310 B. R. 548 (Bankr. N. D. Tex. 2004); Borden Chemicals, 336 B. R. 214, 21819 (Bankr. D. Del. 2006). Derivatives in Bankruptcy

IV. Securities Contracts • Defined in § 741(7) (not part of the regular chapter 7; but the sub-chapter applicable to stockbroker liquidation): – Contract; – for purchase, sale or loan • (query-is redemption/prepayment in full of debt instruments qualifies as a purchase? Not clear. Enron, 325 B. R. 671, 686 (Bankr. S. D. N. Y. 2005); – – option entered on a national securities exchange relating to foreign securities; – 16 of a security, certificate of deposit, mortgage loan or any interest in a mortgage loan, group or index of securities, certificates of deposit, or mortgage loans, or interest therein (including any interest therein or based on value thereof), or any option to purchase or sell any of the foregoing and any repo or reverse repo on the foregoing (whether or not the repo or reversed repo comes within the definition of a “repurchase agreement”); the guarantee, including by novation, by or to a securities clearing agency of a settlement of cash, securities, certificates of deposit, mortgage loans or interests therein, group or index of securities, or mortgage loans or interests therein (including any interest therein or based on the value thereof), or option on any of the foregoing, including an option to purchase or sell any such security, certificate of deposit, mortgage loan, interest, group or index, or option (whether or not such settlement is in connection with any agreement or transaction referred to in the definition of a”securities contract”); Derivatives in Bankruptcy

Securities Contracts (cont’d) – – Extension of credit for the clearance or settlement of securities transactions; – Loan transaction coupled with securities collar transaction, any prepaid forward securities transaction, or any total return swap transaction coupled with securities sale transaction; – any other agreement or transaction that is similar to an agreement or transaction referred to in the section; – Similarly to forwards and repos, the definition includes any combination of agreements or transactions, option to enter into these agreements or transactions, master agreements with all supplements and security and credit enhancement agreements, with damages subject to § 562. – 17 any margin loan; does not include purchase, sale or repurchase obligation under a participation in a commercial mortgage loan. Derivatives in Bankruptcy

Securities Contracts (cont’d) Security defined in § 101(49) to include (not inclusive): • • treasury stock, • Note, • bond, • debenture, • collateral trust certificate, • pre-organization certificate or subscription, • transferable share, • voting trust certificate, • certificate of deposit, • 18 stock, certificate of deposit of a security, Derivatives in Bankruptcy • investment contract or certificate of interest or participation in a profit- sharing agreement or in oil, gas or mineral royalty or lease, it if is required to be registered under the Securities Act of 1933 or is exempt from registration under § 3(b) of the 33 Act, • interest in a limited partnership, • other claim or interest commonly known as a security, • certificate of interest of participation in, temporary or interim certificate for, receipt for, or warrant or right to subscribe to or purchase or sell, a security.

Securities Contracts (cont’d) • Excluded: • currency, check, draft, bill of exchange or bank letter of credit. • leverage transaction (§ 761) • commodity futures contract • forward contracts • option, warrant or right to subscribe or purchase/sell a commodity futures contract • debt or evidence of indebtedness for goods sold or services rendered. • • Short term commercial paper – should be; but the court left it open. Enron, 325 B. R. 671, 686 (Bankr. S. D. N. Y. 2005). • 19 Limited liability company interests – constitute a security of the debtor. Iridium Africa, 197 F. Supp. 2 d 120, 133 (D. Del. 2002) (Mag. J. ), adopted in part, rejected in part on other grounds, 2004 WL 323178 (D. Del. Feb. 13, 2004) (D. J. ), and adopted in part, rejected in part on other grounds, 307 F. Supp. 2 d 608 (D. Del. 2004). CLO notes (notes issued in connection with a collateralized loan obligation structure), are securities. Enron Corp. v. Int’l Finance Corp. , 341 B. R. 451 (Bankr. S. D. N. Y. 2006). Derivatives in Bankruptcy

Securities Contracts (cont’d) • • Securities exempt from registration under any exemption other than § 3(b) of the 1933 Act are not securities within the Bankruptcy Code’s definition. Basin Resources, 182 B. R. 489, 491 (Bankr. N. D. Tex. 1995) (case involved investment contracts and should probably be applied only to these instruments, not to other items listed in the definition). • Margin contract where stockbroker advances loans against pledged securities in a margin account qualifies as securities contract. Weisberg, 136 F. 3 d 655 , 658 -59 (9 th Cir. 1998). The 2005 amendments specifically list margin loans as a securities contract. § 741(7)(A)(iv). • 20 Employee stock options are securities. Enron, 341 B. R. 141, 150 (Bankr. S. D. N. Y. 2006). Legislative history to the 2005 amendments states the intent to cover any loans known in the securities industry as margin loans, such as credit permitted under Regulation T of the Federal Reserve or where a protected party extends credit in connection with the purchase, sale, carrying or trading of securities; loans merely secured by securities are not included. Derivatives in Bankruptcy

Securities Contracts (cont’d) • Non qualified repos for securities, qualify as securities contracts. Hamilton Taft, 114 F. 3 d 991 (9 th Cir. 1997); Residential Resources, 98 B. R. 2, 23 (Bankr. D. Ariz. 1989). The legislative history to the 2005 amendments also states the same intent, and the 2006 amendments amended section 741(7)(A) to so provide. • Repos for notes secured by mortgage loans qualify both as repurchase agreement and a securities contract. American Home Mortgage v. Lehman Brothers, 388 B. R. 69 (Bankr. D. Del. 2008) • Protected Parties: – – Stockbrokers (§ 101(53 A)): has a customer as defined in § 741 and is engaged in effecting securities transactions for the account of others or with the general public, from of for such person’s account. Stewart Finance Co. , 2007 WL 1032263 (Bankr. M. D. Ga. 2007) (Morgan Stanley is protected for a challenged payment although the debtor transferor directed the margin payment be made to an account of a third party (insider)); American Home Mortgage v. Lehman Brothers, supra (Lehman Brothers is a stockbroker; relying on its 10 -Q); Slatkin, 525 F. 3 d 805, 816 -19 (9 th Cir. 2008) (analyzing “customer” and “stockbroker”). – 21 Financial participant (§ 101(22 A)) Securities clearing agencies (§ 101(48)) Derivatives in Bankruptcy

Securities Contracts (cont’d) – Financial institutions (§ 101(22)) • • While customer is not defined, the 2006 amendments made clear that the definition of customer in § 741(2) is inapplicable • § 741(2) defines a customer essentially as a person with whom the stockbroker acts as principal or agent, and the person has a claim against the broker for security received, held or acquired by the broker in its ordinary course of business as a broker from or for the account of the customer for safekeeping, with a view to sale, pursuant to a purchase, or as collateral. • 22 when a bank acts as agent for a “customer” in connection with a securities contract, such customer • • mainly banks Investment companies registered under the Investment Companies Act of 1940. Query: Is a private securities transaction subject to the safe-harbor provisions merely because a financial institution is inserted to act as an agent? Munford, 98 F. 3 d 604, 610 (11 th Cir. 1996) (No; LBO transaction, acknowledging the involvement of a financial institution, but noting that it acted as a mere intermediary or conduit); Quality Stores, 355 B. R. 629 (Bankr. W. D. Mich. 2006), aff’d, W. D. Mich. Dec. 21, 2007 (Yes; Private LBO transaction). Derivatives in Bankruptcy

V. Swaps • Swap agreement is defined in § 101(53 B): – – an interest rate swap, option, future, or forward agreement (is the term different from the defined term forward contract? Nat’l Gas, 369 B. R. at 895), including a rate floor, rate cap, rate collar, cross-currency rate swap, and basis swap; – a spot, same day-tomorrow, tomorrow-next, forward, or other foreign exchange, precious metals or other commodity agreement; – a currency swap, option, future, or forward agreement; – an equity index or equity swap, option, future, or forward agreement; – a debt index or debt swap, option, future, or forward agreement; – a total return, credit spread or credit swap, option, future, or forward agreement; – a commodity index or a commodity swap, option, future, or forward agreement; – a weather swap, weather derivative, or weather options; – Emissions swap, option future, or forward agreement; or – 23 Any agreement (including terms and conditions incorporated by reference in such agreement); Inflation swap, option, or future agreement. Derivatives in Bankruptcy

Swaps (cont’d) – any agreement or transaction that is similar to any other agreement or transaction referred to in this paragraph and that • • Similar to the other financial contracts, the definition includes any combination of these agreements or transactions, any option thereon, any master agreement and the supplements and any security or credit enhancement agreement, with damages subject to § 562. • 24 is a forward, swap, future, option or spot transaction on one or more rates, currencies, commodities, equity securities, or other equity instruments, debt securities or other debt instruments, quantitative measures associated with an occurrence, extent of an occurrence, or contingency associated with a financial, commercial, or economic consequence, or economic or financial indices or measures of economic or financial risk or value. • • is of a type that has been, is presently, or in the future becomes, the subject of recurrent dealings in the swap markets (including terms and conditions incorporated by reference therein); and The definition applies only for Bankruptcy Code purposes and shall not be applied to challenge or affect the characterization or treatment of swaps under any other statute, regulation or rule. The 2005 amendments significantly expanded the definition to specifically cover, among other things, equity and credit derivatives. The legislative history notes that the original definition, which included “any other similar agreements, ” was intended to provide sufficient flexibility to avoid the need to amend the definition as the nature and uses of swaps mature. The amended definition is designed to clarify such intent. Derivatives in Bankruptcy

Swaps (cont’d) • Protected Parties – “Swap participants” (§ 101(53 C)): An entity that, at any time before the bankruptcy filing, has an outstanding swap agreement with the debtor (no timing limitations). – Financial Participant. (§ 101(22 A)) • • 25 Legislative history to the 2005 amendments states that agreements are not protected just because they are documented as swaps. National Gas Distributors, LLC, 369 B. R. 884, 898 (Bankr. E. D. N. C. 2007) (refusing to treat a forward gas supply agreement as a swap agreement because it was a private supply agreement with no impact on financial markets). Legislative history also states that a forward transaction could qualify as a swap even if not qualified as a forward. Derivatives in Bankruptcy

VI. Commodity Contracts • Defined in § 761(4), contained in the sub-chapter dealing with commodity broker liquidation. Commodity Broker is defined in CFTC’s Rule 190. 01(f) as any person registered or required to be registered as a futures commission merchant under the CEA, as well as other specified entities, including clearing organizations, as to which there is a customer. • Definitions are limited only to this sub-chapter; are they applicable when the term is used in other chapters without cross-reference? Olympic Natural Gas, 294 F. 3 d 737, 741 (5 th Cir. 2002) (term has the same meaning in § 101(25) (forward contract exclusion)). This drafting glitch was corrected in the 2006 amendments to section 101(25). • Commodity is defined in § 761(8) through cross-reference to the Commodity Exchange Act (“CEA”). – – 26 CEA § 1 a(4) defines “commodity” to include a list of agricultural products “and all other goods and articles, except onions as provided in section 13 -1 of this title, and all services, rights, and interests in which contracts for future delivery are presently or in the future dealt in. ” The quoted phrase above was added to CEA in 1974 and was intended by Congress to expand “the definition of commodity to encompass virtually anything that is or becomes the subject of futures trading, intangible as well as tangible, ” except for onions. 1 Phillip Mc. Bride Johnson & Thomas Lee Hagen, Derivatives Regulation § 1. 02[1], at 9 (1 st. ed. 2004). Derivatives in Bankruptcy

Commodity Contracts (cont’d) • Section 761(4) of the Bankruptcy Code defines a commodity contract as: – (A) with respect to a futures commission merchant, contract for the purchase or sale of a commodity for future delivery on, or subject to the rules of, a contract market or board of trade; • – "Futures commission merchant" is defined in CEA § 1 a(20), which definition is incorporated by section 761(8) of the Bankruptcy Code, as "an individual, association, partnership, corporation, or trust that – (A) is engaged in soliciting or in accepting orders for the purchase or sale of any commodity for future delivery on or subject to the rules of any contract market or derivatives transaction execution facility; and (B) in or in connection with such solicitation or acceptance of orders, accepts any money, securities, or property (or extends credit in lieu thereof) to margin, guarantee, or secure any trades or contracts that result or may result therefrom. " (B) with respect to a foreign futures commission merchant, foreign future; • • 27 "Foreign futures commission merchant" is defined in section 761(12) of the Bankruptcy Code as an "entity engaged in soliciting or accepting orders for the purchase or sale of a foreign future or that, in connection with such a solicitation or acceptance, accepts cash, a security, or other property, or extends credit to margin, guarantee, or secure any trade or contract that results from such a solicitation or acceptance. " "Foreign future" is defined in section 761(11) of the Bankruptcy Code as a "contract for the purchase or sale of a commodity for future delivery on, or subject to the rules of, a board of trade outside the United States. " Derivatives in Bankruptcy

Commodity Contracts (cont’d) – (C) with respect to a leverage transaction merchant, leverage transaction; • • – "Leverage transaction merchant" is defined in section 761(14) of the Bankruptcy Code as a "person in the business of engaging in leverage transactions. " "Leverage transaction" is defined in section 761(13) of the Bankruptcy Code as an "agreement that is subject to regulation under section 19 of the [CEA, codified as 7 U. S. C. § 23], and that is commonly known to the commodities trade as a margin account, margin contract, leverage account, or leverage contract. " The CFTC's regulations under CEA § 19 describe a leverage transaction as “the purchase or sale of any leverage contract, the repurchase or resale of any leverage contract, the delivery of the leverage commodity, or the liquidation or rescission of any such leverage contract by or to the leverage transaction merchant. " 17 C. F. R. § 31. 4(x) (2004). The CFTC's regulations define a leverage contract as a "contract, standardized as to terms and conditions, for the long-term (ten years or longer) purchase ('long leverage contract') or sale ('short leverage contract'). " 17 C. F. R. § 31. 4(w) (2004). (D) with respect to a clearing organization, contract for the purchase or sale of a commodity for future delivery on, or subject to the rules of, a contract market or board of trade that is cleared by such clearing organization, or commodity option traded on, or subject to the rules of, a contract market or board of trade that is cleared by such clearing organization; • 28 "Clearing organization" is defined in section 761(2) of the Bankruptcy Code as "a derivatives clearing organization registered under the [CEA]. " Derivatives in Bankruptcy

Commodity Contracts (cont’d) – (E) with respect to a commodity options dealer, commodity option. " • • – 29 "Commodity options dealer" is defined in section 761(6) of the Bankruptcy Code as a "person that extends credit to, or that accepts cash, a security, or other property from, a customer of such person for the purchase or sale of an interest in a commodity option. " "Commodity option" is defined in section 761(5) of the Bankruptcy Code as an "agreement or transaction subject to regulation under section 4 c(b) of the [CEA, codified as 7 U. S. C. § 6 c(b)]. " Section 4 c(b) of the CEA regulates option trading: "No person shall offer to enter into, enter into or confirm the execution of, any transaction involving any commodity regulated under this chapter which is of the character of, or is commonly known to the trade as, an 'option, ' 'privilege, ' 'indemnity, ' 'bid, ' 'offer, ' 'put, ' 'call, ' 'advance guaranty, ' or 'decline guaranty, ' contrary to any rule, regulation or order of the [CFTC]. . “ The 2005 amendments expanded the definition to cover combinations of agreements and transactions, options, master agreements and security and credit enhancement agreements, with damages subject to § 562. Derivatives in Bankruptcy

VII. Distinction Between Forwards and Commodities Contracts • The terms forward contracts and commodity contracts, taken together, cover the entirety of transactions in the commodity and forward contract markets. Olympic Natural Gas, 294 F. 3 d 737, 740 -41 (5 th Cir. 2002) • The distinction is essentially between forwards, which are private, non-regulated contracts, and futures (or “commodity” contracts), which are regulated by the Commodity Futures Trading Commission (“CFTC”) – 30 Olympic Natural Gas, 294 F. 3 d at 741 (“The term ‘commodity contract’ ‘encompasses purchases and sales of commodities for future delivery on, or subject to the rules of, a contract market or board of trade. . ’ In contrast, ‘forward contracts’ are ‘contracts for the future purchase or sale of commodities that are not subject to the rules of a contract market or board of trade. ’”) (citations omitted), aff’g Olympic Gas, 258 B. R. at 163 (referring to “on- exchange transactions” as futures and to “off-exchange transactions” as forwards), 165 (“[C]ontracts for the purchase and sale of a certain, specified quantity of natural gas to be delivered at some certain, specified future date. . . are indeed forward contracts. ”). Derivatives in Bankruptcy

Forwards and Commodities Contracts (cont’d) • The jurisdictional focus of the CEA is not on what is a commodity, almost everything is a commodity, but on whether the contract is a futures contract. – CEA § 2 grants to the CFTC exclusive jurisdiction over, among other things, “transactions involving contracts of sale of a commodity for future delivery. ” The term “contract of sale” is defined to include “sales, agreements of sale, and agreements to sell. ” CEA § 1 a(7). The “future delivery” component, however, is defined in the CEA only by way of exclusion: “the term ‘future delivery’ does not include any sale of any cash commodity for deferred shipment or delivery. ” CEA § 1 a(19). As a leading commentator notes: • [T]he phrase future delivery eliminates transactions where an immediate sale occurs but where, for the convenience of the parties or otherwise, the actual transfer of the commodity is deferred. The primary focus of this exclusion, in historical context, was on a common practice in agricultural trade of making binding sales with postponed delivery; these arrangements frequently are referred to as forward contracts. • Derivatives Regulation § 1. 02[3], at 23 -24. – – 31 There is no fixed definition for a futures contract. CFTC v. Co Petro Marketing Group, 680 F. 2 d 573, 581 (9 th Cir. 1982) (“[N]o bright-line definition or list of characterizing elements is determinative. The transaction must be viewed as a whole with a critical eye toward its underlying purpose. ”); MG Refining & Marketing, Inc. v. Knight Enters. , Inc. , 25 F. Supp. 2 d 175, 182 (S. D. N. Y. 1998) (same). When the contract contemplates actual delivery, but the obligation is deferred the forward contract exception applies. In re Bybee, 945 F. 2 d 309, 315 (9 th Cir. 1991); CFTC v. Noble Metals Int’l, Inc. , 67 F. 3 d 766, 772 (9 th Cir. 1995) (forward contract exception did not apply because actual delivery was not contemplated). Derivatives in Bankruptcy

Forwards and Commodities Contracts (cont’d) • The differences and similarities between forwards and futures were explained in Abrams, 737 F. 2 d 582, 590 -92 (7 th Cir. 1984): – – both are designed to shift risks, – both in theory require actual delivery, but futures generally are not used to obtain actual delivery and are discharged by entering into offsetting transactions while forwards often contemplate actual delivery, – the only open term to be negotiated in a futures is the price, in a forward all of the sale terms are negotiated including price, quantity, quality and date of delivery, and – • forwards are privately negotiated transactions while futures are traded on an exchange, in futures a clearing house is required to effect the sale, in forwards the terms are negotiated directly among the parties. The ultimate determination of whether a contract is a futures contract is highly factual. The CFTC and the courts have developed certain criteria relevant to the determination: – the designation of the contract as a futures or forward is not controlling, – the use of standardized forms is significant in finding a futures contract to exist, – in a futures contract actual delivery of the commodity is not expected to occur, and – the customer generally has no business use for the commodity. Commodities Regulation § 1. 02[5], at 32 -33. 32 Derivatives in Bankruptcy

Forwards and Commodities Contracts (cont’d) • The lack of expectation of delivery is the most significant factor. Commodities Regulation § 1. 02[5], at 33 -34 & n. 139 (citing Petro Marketing, 680 F. 2 d at 581 ("The contracts here represent speculative ventures in commodity futures which were marketed to those for whom delivery was not an expectation. "); Bybee, 945 F. 2 d at 313 -15; Andersons, Inc. v. Horton Farms, Inc. , 166 F. 3 d 308 (6 th Cir. 1998); Noble Metals, 67 F. 3 d at 772 -73); Olympic Gas, 294 F. 3 d at 741; CFTC v. Midland Rare Coin Exchange, Inc. , 71 F. Supp. 2 d 1257, 1263 (S. D. Fla. 1999). • In reviewing the expectation of delivery element, courts examine the parties' objective ability to actually take delivery. Salomon Forex, Inc. v. Tauber, 8 F. 3 d 966, 971 (4 th Cir. 1993); CFTC v. IBS, Inc. , 113 F. Supp. 2 d 830, 846 (W. D. N. C. 2000), aff’d, 276 F. 3 d 187 (4 th Cir. 2002); Midland, 71 F. Supp. 2 d at 1263. • The Seventh Circuit has refined the multi-factor test and held that if the following three factors exist, the contract is a forward contract not subject to CFTC's regulation: – it has idiosyncratic terms regarding place of delivery, quantity or other terms, and is not fungible with other contracts for the sale of the commodity, – the contract is among industry participants, not the general public, and – delivery cannot be deferred forever. Nagel v. ADM Inv. Servs. , Inc. , 217 F. 3 d 436, 441 (7 th Cir. 2000). 33 Derivatives in Bankruptcy

VIII. Ipso Facto Provisions Enforceable • Generally, bankruptcy termination, also known as ipso facto clauses are unenforceable in bankruptcy. 11 U. S. C. §§ 365(e)(1); 541(c)(1). • An exception to this general rule is provided for – – Forward and commodities contracts (§ 556) – Repos (§ 559) – • Securities contracts (§ 555) Swaps (§ 560) The exception applies to a “contractual right, ” which includes rights provided for in a rule or by law of a clearing organization (derivative clearing organization as defined in the CEA; multilateral clearing organization as defined in the FDIC Improvement Act of 1991; securities clearing agency), a national securities exchange, a national securities association, or contract market designated under the CEA, a derivative transaction execution facility designated under the CEA, or a board of trade as defined in the CEA, or resolution of their board, arising under common law, law of merchant or by reason of usual business practice. – • 34 Mirant, 310 B. R. 548 (Bankr. N. D. Tex. 2004) – parties assumed that Southern California Gas Company is a clearing organization. The exception requires a qualified protected counter-party. Derivatives in Bankruptcy

Ipso Facto Provisions Enforceable (cont’d) • Courts may interfere with enforcement of ipso facto clauses in securities contracts and repos, if authorized by the Securities Investor Protection Act of 1970, administered by SIPC, or by any statute administered by the SEC (§§ 555, 559) – – By letter dated August 29, 1988, Deputy General Counsel of SIPC advised counsel to The Public Securities Associations (now known as The Bond Market Association, “BMA”) that SIPC would modify its standard from of order, while still barring the immediate close-out of securities lending transactions which would otherwise by protected under Section 555 upon written consent of SIPC and the trustee appointed in the case (thus eliminating the need for court relief). The letter indicates that it is expected that SIPC would consent (and would urge the trustee to consent) if it received an affidavit of the counterparty attesting that it has no knowledge of fraud in the transaction and, if it is the lender, that it has a perfected security interest in the collateral; that SIPC would act promptly to determine whether the subject securities are necessary to satisfy the claims of customers (stating 4 to 5 days after the initiation of the proceeding as a hoped-for time frame); and thereafter would lift the stay or perform the debtor’s obligations under the transaction. – A similar letter addressing repos was issued on February 4, 1986, and was made applicable to reverse repos by a letter dated June 5, 2002. – 35 At the commencement of SIPA proceeding, SIPC generally seeks and obtains an order staying the close-out of at least some securities contracts, including securities loans and repurchases agreements. In two major stockbroker failures, Drexel Burnham and Thomson Mc. Kinnon, the stockbroker entities filed chapter 11 petitions and did not become subject to SIPA proceedings, by transferring their customer accounts and giving up their broker/dealer licenses prepetition (thus ceasing to be stockbrokers). Derivatives in Bankruptcy

Ipso Facto Provisions Enforceable (cont’d) – • The 2005 amendments amend Section 5(b)(2) of SIPA to block SIPC from seeking a stay of the exercise of contractual rights with respect to the various protected contracts, except that it may seek to stay the foreclosure on or disposal of securities collateral pledged by the debtor, securities sold by the debtor under a repurchase agreement, and securities lent under a securities lending agreement. Thus, a counterparty would be able to terminate/accelerate a securities contract (and reduce its exposure to market movements), but might be stayed from foreclosing on the related securities collateral. Prior to the 2005 amendments, these sections exempt from the ipso-facto prohibition the right “to cause the liquidation of” the securities contracts, forwards, commodities contracts and repos. As to swaps the exception applied to the right “to cause the termination” of the swap. – – 36 The “liquidation” term used is understood to mean, at a minimum, the termination of the contract. In re R. M. Cordova Int’l, 77 B. R. 441, 448 (Bankr. D. N. J. 1987) (“As the legislative history makes clear, the right to liquidate a commodity contract pursuant to Section 556, is ‘the right to close out an open position. ’”). But, "the right to liquidate does not constitute the right to transfer cash, securities, or property held with respect to such contracts, except to the extent otherwise provided in this title. " H. R. Rep. No. 420, 97 th Cong. , 2 d Sess. 4 (1982). The 2005 amendments to the Bankruptcy Code, modified sections 555, 556, 559 and 560 by allowing not only the liquidation, but also the “termination, or acceleration” of these contracts. Derivatives in Bankruptcy

Ipso Facto Provisions Enforceable (cont’d) • • Courts may refuse to allow termination of safe harbor contracts, for reasons wholly unrelated to the counter-party's bankruptcy. Enron Corp. , 306 B. R. 465 (Bankr. S. D. N. Y. 2004) (city transit authority sought to terminate cash settled swap for natural gas based on unenforceability of the agreement); In re Amcor Funding Corp. , 117 B. R. 549, 553 (D. Az. 1990) (Drexel prohibited from terminating its securities contract under section 555, a year after Amcor's filing, due to Drexel's bankruptcy rather than due to Amcor's bankruptcy); but see, Mirant, 314 B. R. 347 (Bankr. N. D. Tex. 2004) (late termination due to reliance on being protected by bankruptcy court’s orders allowed). • 37 Unless a protected party exercises its right as soon as possible after the counter-party's bankruptcy, preferably on the first day it learns of the bankruptcy, courts may refuse to apply the safe harbors, thus, prohibiting termination. Courts may rely on the doctrine of waiver, finding that the forward contract merchant's continuing post-petition performance and failure to enforce the event of default constitute waiver. See e. g. , Nat'l Westminster Bank, U. S. A. v. Ross, 130 B. R. 656, 675 (S. D. N. Y. 1991), aff'd sub nom. Yaeger v. Nat’l Westminster, 962 F. 2 d 1 (2 d Cir. 1992). Practical advice to reduce termination risks: Obtain court approval for counter-party assurance programs designed to encourage counter-parties not to terminate. Programs may contain variety of features: Collateral, (super) administrative expense priority, guaranties, letters of credit; could provide that any participating waives termination right based on bankruptcy filing. Mirant, Case No. 03 -46590 (Bankr. N. D. Tex. ) Derivatives in Bankruptcy

IX. Application of Automatic Stay to Termination • Few courts have addressed whether the automatic stay applies to a nondebtor party's right to exercise its right to terminate a contact exempt from the ipso facto prohibition. Those that have are split. – The only court to address safe harbor transactions, held the automatic stay not to stay termination. Mirant, 314 B. R. 347 (Bankr. N. D. Tex. 2004) (swap); Mirant, 310 B. R. 548, 564 (Bankr. N. D. Tex. 2004) (forward contract), explaining its seemingly contrary decision, Mirant, 303 B. R. 319, 327 -28 (Bankr. N. D. Tex. 2003) – The Courts of Appeals for the Fifth and Ninth Circuits held that to effectuate a termination clause that is enforceable under section 365(e)(2), which exempts ipso facto clauses in certain types of contracts from the general unenforceability of such clauses, the nondebtor party to the executory contract must first seek relief from the automatic stay of section 362. Mirant, 440 F. 3 d 238 (5 th Cir. 2006); Computer Communications, Inc. , 824 F. 2 d 725, 730 (9 th Cir. 1987) (held, "even if § 365(e)(2) allowed [the nondebtor party] to terminate the contract, § 362 automatically stayed termination. ”) • 38 Accord: Calvin v. Siegal (In re Siegal), 190 B. R. 639, 640 n. 1 (Bankr. D. Ariz. 1996); In re Cardinal Indus. , Inc. , 116 B. R. 964, 971 (Bankr. S. D. Ohio 1990); Wegner Farms Co. v. Merchants Bonding Co. (In re Wegner Farms Co. ), 49 B. R. 440, 445 (Bankr. N. D. Iowa 1985); Gov't Nat'l Mortgage Corp. v. Adana Mortgage Bankers, Inc. (In re Adana Mortgage Bankers, Inc. ), 12 B. R. 977, 983 (Bankr. N. D. Ga. 1980). Derivatives in Bankruptcy

Application of Automatic Stay to Termination (cont’d) – The Court of Appeals for the Third Circuit, which covers Delaware, disagrees. In Watts v. Pa. Hous. Fin. Co. , 876 F. 2 d 1090, 1096 (3 d Cir. 1989), a state agency that had agreed to lend debtor money to avert foreclosure ceased advances upon commencement of case. The court held that the termination of advances did not violate stay: "Section 365(e)(2)(B), unequivocally and without qualification, provides for the termination of a contract to make a loan after the commencement of a bankruptcy case. To hold that such termination is, at the same time, stayed under section 362 would be at worst anomalous, and at best an imposition of a pro forma requirement that the creditor must ask for what the Code plainly grants him. ” – Accord In re New Town Mall, 17 B. R. 326, 329 (Bankr. D. S. D. 1982) (automatic stay did not prevent ipso facto termination of contract to make loan; "'where one section of the Bankruptcy Code explicitly governs an issue, another section should not be interpreted to cause an irreconcilable conflict'"). – The law in the other circuits is not clear. For example, courts within the Second Circuit refer to both Computer Communications and Watts, but they have yet to address this specific issue. Courts in the Sixth Circuit seem to prefer the approach of Computer Communications. • • 39 2 nd Circuit: Shimer v. Fugazy (In re Fugazy Express, Inc. ), 982 F. 2 d 769, 776 (2 d Cir. 1992); Slater v. Smith (In re Albion Disposal, Inc. ), 152 B. R. 794, 806 -07 (Bankr. W. D. N. Y. 1993); Alert Holdings, Inc. v. Interstate Protective Servs. , Inc. (In re Alert Holdings, Inc. ), 148 B. R. 194, 202 (Bankr. S. D. N. Y. 1992). 6 th Circuit: Elder-Beerman Stores Corp. v. Thomasville Furniture Indus. Inc. (In re Elder-Beerman Stores, Inc. ), 206 B. R. 142, 154 (Bankr. S. D. Ohio 1997), aff'd in part, rev'd in part, 250 B. R. 609 (S. D. Ohio 1998). Derivatives in Bankruptcy

Application of Automatic Stay to Termination (cont’d) • • The 2005 amendments supplemented the protections by also amending section 362 accordingly (§ 362(o)) • 40 Prior to the 2005 amendments, it was not entirely clear whether the Fifth and Ninth Circuits’ rationale should apply to safe harbor contracts. Section 365(e)(2), which was the subject of the decisions, provides for the enforceability of an ipso facto clause but does not specifically mention the term "stay. " The post-2005 amendments safe harbor provisions of the Bankruptcy Code, dealing with the enforceability of ipso facto clauses, specifically provides that the contractual right to liquidate, terminate or accelerate a safe harbor contract "shall not be stayed, avoided, or otherwise limited by operation of any provision of this title or by order of the court. ” Accord Mirant, 310 B. R. 548, 554 (Bankr. N. D. Tex. 2004). Query: Should Computer Communications be extended to contracts that require an advance termination notice? Derivatives in Bankruptcy

![X. Setoff/Netting • Legislative Intent: Focus is on stability of financial markets: – "[T]he X. Setoff/Netting • Legislative Intent: Focus is on stability of financial markets: – "[T]he](https://present5.com/presentation/47e1d583f2bc70ece168b00f033ff904/image-41.jpg)

X. Setoff/Netting • Legislative Intent: Focus is on stability of financial markets: – "[T]he stay provisions of the Code are not construed to prevent brokers from closing out the open accounts of insolvent customers or brokers. The prompt closing out or liquidation of such open accounts freezes the status quo and minimizes the potentially massive losses and chain reactions that could occur if the market were to move sharply in the wrong direction. " H. R. Rep. No. 97 -420, at 2 (1982), reprinted in 1982 U. S. C. C. A. N. 583, 584; see also id. at 585 (specifically referring to forward contract merchants). • Exercise of setoff rights and other secured creditor’s remedies are generally subject to the automatic stay. §§ 362(a)(4), (6), (7); 553 • Recoupment is generally held to be exempt from the stay. Holyoke Nursing, 372 F. 3 d 1, 3 (1 st Cir. 2004). – – 41 Setoff allows parties to setoff obligations arising from various transactions among them; recoupment is limited to the same transaction. Recoupment does not apply to claims arising from post rejection/termination of the contracts. Mirant, 310 B. R. 548, 560 (Bankr. N. D. Tex. 2004). Derivatives in Bankruptcy

Setoff/Netting (cont’d) • Query: Do various confirmations under a single master deemed one transaction or several transactions? – – • In Mirant, the parties assumed they were. Mirant, 310 B. R. at 560. The 2005 amendments specifically include in the definitions of the various financial contracts, master agreements with all supplements thereto. The safe harbor provisions and certain sub-sections of § 362 exempt certain setoffs from the automatic stay: – Securities contracts, forwards and commodity contracts: § 362(b)(6) exempt the exercise of contractual right to setoff or net termination values, payment amounts, or other transfer obligation arising under, or in connection with these contracts, including any security agreement or arrangement, credit enhancement and any master agreement. – Forwards and commodity contracts are also subject to the exemption of § 556 -- protected parties’ right to variation or maintenance margin payment received from a trustee under those contracts shall not be stayed, avoided or limited. – Repos: § 362(b)(7), similar to § 362(b)(6). – Swaps: § 362(b)(17) Similar to § 362(b)(6). • 42 Supplemented by § 560: contractual right to offset or net-out any termination values or payment amounts shall not be stayed, avoided or limited. Derivatives in Bankruptcy

Setoff/Netting (cont’d) • • Section 362(o): Supplements the protections by prohibiting any court or administrative agency from staying the exercise of rights exempt from the stay with respect of protected transactions. • Query: What is the scope of payments due “in connection with” a safe harbor contract? • 43 Master Netting Agreements: § 362(b)(27) allows setoffs and netting under masternetting agreements. Setoff is allowed regardless of whether the post-petition termination of a safe harbor contract is deemed to give rise to a post-petition, or pre-petition claim, notwithstanding § 553 requiring both claims to arise pre-petition. Weisberg, 136 F. 3 d 655, 657 -59 (9 th Cir. 1998) (affirming application of § 362(b)(6) to liquidation of collateral posted prepetition as margin to cover unanswered post-petition margin calls). Derivatives in Bankruptcy

Setoff/Netting (cont’d) • Cross Product Netting – prior to the 2005 amendments did not appear to be covered by the safe harbor provisions. – – • New section 561(a) specifically allows cross product netting. Section 561(a) provides that the right to terminate, accelerate or liquidate, or to offset, or net termination values, payment amounts or other transfer obligations arising under or in connection with one or more securities contracts, commodity contracts, forward contracts, repurchase agreements, swap agreements or master netting agreements, shall not be stayed, avoided or limited by operation of the bankruptcy code or by order of a court or administrative agency. Master netting agreement is defined as – – 44 An agreement providing for the exercise of rights, including rights of netting, setoff, liquidation, termination, acceleration, or close out, under or in connection with one or more securities contracts, commodities contracts, forwards, repos or swaps, or any security agreement or arrangement or other credit enhancement related to one or more of the foregoing, including any guarantee or reimbursement obligation related to one or more of the foregoing; If the agreement contains provisions relating to agreements or transactions that are not securities contracts, commodities contracts, forwards, repos or swaps, it shall be deemed to be a master netting agreement only with respect to those agreements or transactions that qualify as such. Derivatives in Bankruptcy

Setoff/Netting (cont’d) • The legislative history is clear: “The definition of ‘Master Netting Agreement’ is designed to protect the termination and closeout netting provisions of cross-product master agreements between parties. ” • Foreclosure – Prior to the 2005 amendments, § 362(b)(6), (7), (17) were drafted in terms of setoff, but it was not clear whether realization on collateral was exempt from the stay. – • 45 Weisberg, 136 F. 3 d 655, 657 -59 (9 th Cir. 1998) (§ 362(b)(6) applies to liquidation of collateral posted pre-petition as margin to cover unanswered post-petition margin calls); but see Mirant, 310 B. R. 548, 559 -60 (Bankr. N. D. Tex. 2004) (reversal of a wire, after the amount was deposited into the debtors’ account, violated the stay. ) The 2005 amendments specifically allow realization against pledged collateral. The legislative history is also crystal clear on this point: Derivatives in Bankruptcy

Setoff/Netting (cont’d) – – 46 “Subsection (d) amends section 362(b) of the Bankruptcy Code to protect enforcement, free from the automatic stay, of setoff or netting provisions in swap agreements and in master netting agreements and security agreements or arrangements related to one or more swap agreements or master netting agreements. This provision parallels the other provisions of the Bankruptcy Code that protect netting provisions of securities contracts, commodity contracts, forward contracts, and repurchase agreements. Because the relevant definitions include related security agreements, the references to ‘setoff’ in these provisions, as well as in section 362(b)(6) and (7) of the Bankruptcy Code, are intended to refer also to rights to foreclose on, and to set off against obligations to return, collateral securing swap agreements, master netting agreements, repurchase agreements, securities contracts, commodity contracts, or forward contracts. Collateral may be pledged to cover the cost of replacing the defaulted transactions in the relevant market, as well as other costs and expenses incurred or estimated to be incurred for the purpose of hedging or reducing the risks arising out of such termination. Enforcement of these agreements and arrangements free from the automatic stay is consistent with the policy goal of minimizing systemic risk. Subsection (d) also clarifies that the provisions protecting setoff and foreclosure in relation to securities contracts, commodity contracts, forward contracts, repurchase agreements, swap agreements, and master netting agreements free from the automatic stay apply to collateral pledged by the debtor but that cannot technically be ‘held by’ the creditor, such as receivables and book-entry securities, and to collateral that has been repledged by the creditor and securities re-sold pursuant to repurchase agreements. ” Derivatives in Bankruptcy

XI. Damages • Relevant Date – Prior to the 2005 amendments was not clear whether it is the petition date or termination date. – – The 2005 amendments to Bankruptcy Code provide that the measure of damages is determined on the earlier of rejection of the agreement or the liquidation, termination or acceleration date. (§ 562(a)); the claim is a pre petition claim. (§ 502(g)(2)) – Not clear which date controls (liquidation, termination or acceleration) if values shifted in between these dates. – • Bank of Montreal v. American Homepatient, Inc. , 309 B. R. 738, 740 -41 (M. D. Tenn. 2004) (Damages for rejection of a warrant agreement to purchase debtor’s common stock will be based on the value of the shares on the petition date, not rejection date). If there is no way to determine the values involved in a commercially reasonable manner, damages will be measured at the earliest subsequent date or dates on which values can be determined in a commercially reasonable manner. (§ 562 (b)). In any objection to timing, the objecting party carries the burden of proof. (§ 562 (c)) Measure of Damages: – – 47 could be costs to replace the derivative, or difference between derivative price and market value of the underlying security, index or other property. Derivatives in Bankruptcy

Damages (cont’d) • Swaps: – – The commonly used “Market Quotation” measure of damages under the 1992 ISDA Master Agreement (Multicurrency-Cross Border) does not use the lowest bid, but uses either (i) the average of the two middle bids obtained from four reference market makers or (ii) the middle bid of three bids so obtained. Drexel Burnham Lambert Products Corp. v. Mcorp, 1989 WL 16981, at *6 -*7 (Del. Super. Ct. Feb. 23, 1989) (Market Quotation method is a reasonable method of determining damages even though claimant did not actually enter into a replacement agreement). – 48 The practice (no longer common) of denying a defaulting swap counterparty the termination value of a swap transaction (known as the “first method”) was held enforceable in Drexel Burnham Lambert products Corp. v. Midland Bank PLC, 1992 U. S. Dist. LEXIS 21223 (S. D. N. Y. Nov. 10, 1992). First method was eliminated in the 2002 ISDA Master. The other commonly used measure of damages under the ISDA Master Agreement – “Loss” (essentially losses, costs and loss of the bargain incurred by a counterparty) – expressly includes the cost of unwinding hedges related to the terminated swap agreement. Derivatives in Bankruptcy

Damages (cont’d) – – The 2002 ISDA Master adopts a single measure of damages—the “closed out amount. ” It involves a determination as to losses and costs incurred and gains realized in replacing the terminated transactions or providing the economic equivalent of the material terms of these transactions. – What if the non-defaulting party under a swap in which the parties chose not to declare automatic termination upon bankruptcy event, refuses to designate an early termination event because it is “out of the money” at the time of bankruptcy (which prevents the bankrupt from getting the termination payment it would have been entitled to)? The New South Wales Supreme Court in Enron Australia v. TXU Electricity, [2003] NSWSC 1169, held the contract provisions enforceable, refused to compel TXU to designate an early termination date and refused to allow Enron to “disclaim” the swap because the effect of which would be to re-write the terms of the swap. – 49 Damages under interest rate swap agreements are not subject to disallowance as unmatured interest under § 502(b)(2). Thrifty Oil Co. , 249 B. R. 537, 543 -51 (S. D. Cal. 2000), aff’d, 322 F. 3 d 1039 (9 th Cir. 2003). UCC Article 9 Inapplicable: Article 9 requirement that the secured creditor liquidate collateral in a commercially reasonable manner inapplicable to protected repos. American Home Mortgage v. Lehman Brothers, 388 B. R. 69 (Bankr. D. Del. 2008). Derivatives in Bankruptcy

XII. Avoidance Actions Exception • Except for actual fraudulent transfers, § 546(e), (f), (g), protect from avoidance transfers that constitutes margin or settlement payments made by, to, or for the benefit of a protected party, or transfers made in connection with qualified contracts. – – The 2006 amendments to § 546(f) dealing with repos, deleted the reference to margin and settlement payment and apply to any transfer made “in connection with a repurchase agreement. ” – Note that § 546(g) dealing with swaps, exempt a transfer under, or in connection with a swap agreement but does not reference margin or settlement payments. – 50 While the 2006 amendments provide that § 546(e), dealing with margin or settlement payments to a commodity broker, forward contract merchant, stockbroker, financial institutions, financial participant or securities clearing agencies, apply to transfers made under qualified contracts, it is not clear that it requires that the margin or settlement payments referred to be made under a qualified contract. The 2005 amendments added § 546(j) protecting from avoidance a transfer made by, to or for the benefit of a master netting agreement participant (defined in § 101(38 B) as an entity that any time before the petition is a party to an outstanding master netting agreement with the debtor), in connection with a master-netting agreement, except if such transfer is avoidable under a contract covered by the master netting agreement. Derivatives in Bankruptcy

Avoidance Actions Exception (cont’d) • Protection is supplemented by § 548(d)(2)(B), (C), (D) providing that protected parties that receive margin or settlement payments are deemed to have provided value. – • Legislative History: “[T]his provision exempts these types of customary setoff payments in the forward contract trade from scrutiny as to whether they are actually fair value for the amount used. ” H. R. Rep. No. 101 -484, at 7 (1990), reprinted in 1990 U. S. C. C. A. N. 223, 229. Margin Payments – Margin payment forward contract purposes is defined in section 101(38) of the Bankruptcy Code as a "payment or deposit of cash, a security or other property, that is commonly known in the forward contract trade as original margin, initial margin, maintenance margin, or variation margin, including mark-to-market payments, or variation payments. " • – 51 Sections 741(5) and 761(15) of the Bankruptcy Code contain similar definitions of margin payment for the securities trade and commodities trade, respectively. In re Stewart Finance Co. , 367 B. R. 909 (Bankr. M. D. Ga. 2007) at *5 (“Margin payment is a broadly construed term and includes any payment by a debtor to pay for the purchase of securities or to reduce a deficiency in a margin account. ”) At least two courts suggested that an initial payment made to open a margin account, at a time when no trades took place and no deficiency exists, is not a margin payment. Seitter v. Farmer's Commodities Corp. (In re Yeagley), 220 B. R. 402, 405 (Bankr. D. Kan. 1998) ("The term 'margin payment' is not broad enough, however, to encompass payment made to open a margin account before any trading is conducted or any deficiency incurred. "); Biggs v. Smith Barney, Inc. (In re David), 193 B. R. 935, 940 (Bankr. C. D. Cal. 1996) ("[T]he terms 'margin payments and 'settlement payment' do not include all payments into a margin account. For example, the court would be hard-pressed to find that a payment made to open an account with a stockbroker, prior to any trading, constituted a margin payment. "). Derivatives in Bankruptcy

Avoidance Actions Exception (cont’d) • Settlement Payments – – 52 Settlement payment is defined in § 101(51 A) forward contract purposes as "a preliminary settlement payment, a partial settlement payment, an interim settlement payment, a settlement payment on account, a final settlement payment, a net settlement payment, or any other similar payment commonly used in the forward contract trade. " Section 741(8) of the Bankruptcy Code contains a substantially similar definition of settlement payment for the securities trade. Although the statutory definition is circular and not particularly illuminating, courts, in the securities context, have held that at a minimum the payment must involve the system of intermediaries and guarantees typical of the securities industry. Munford, 98 F. 3 d 604, 609 -10 (11 th Cir. 1996) (LBO is essentially a private transaction; no protection from avoidance); Norstan Apparel Shops, Inc. , 367 B. R. 68 (Bankr. E. D. N. Y. 2007) (LBO of a private company); Grafton, 321 B. R. 527 (Bankr. 9 th Cir. 2005) (redemption of equity in an LLC run as a ponzi scheme; not protected-not involving public markets and involving illegally unregistered securities); Zahn v. Yucaipa Capital Fund, 218 B. R. 656, 675 -76 (D. R. I. 1998) (court held that, even if interpreted broadly, to qualify as settlement payment for purposes of statute, payment must implicate the "system of intermediaries and guarantees" of the securities industry "wherein parties use intermediaries to make trades of public stock which are instantaneously credited, but in which the actual exchange of stock and consideration therefor take place at a later date"); Jewel Recovery, L. P. v. Gordon, 196 B. R. 348, 353 (N. D. Tex. 1996) (held, private stock sale not protected by the Bankruptcy Code because it "lack[s] the impact on the public market trading systems that Congress intended to protect"); Grand Eagle, 288 B. R. 484, 491 -95 (Bankr. N. D. Ohio 2003) (private sale through financial intermediary); Integra Realty, 198 B. R. 352, 356 -60 (Bankr. D. Colo. 1996) (spin-off); Healthco, 195 B. R. 971, 983 (Bankr. D. Mass. 1996) (LBO); Wieboldt Stores, 131 B. R. 655, 664 -65 (N. D. Ill. 1991) (LBO). Derivatives in Bankruptcy

Avoidance Actions Exception (cont’d) – – Applies to “private” stock redemption. Loranger Mfg. Corp. , 324 B. R. 575, 583 -86 (Bankr. W. D. Pa. 2005). – A CLO’s sponsor’s purchase of CLO notes to provide credit support and to prevent investors’ losses through financial institutions and stockbrokers, qualifies as a settlement payment. Enron Corp. v. Int'l Finance Corp. , 341 B. R. 451 (Bankr. S. D. N. Y. 2006). – 53 Other cases refuse to deny protection simply because the transaction does not impact the public markets or involve illegal securities law transactions. Resorts Int’l, 181 F. 3 d 505, 514 -16 (3 d Cir. 1999) (LBO); Kaiser Steel, 952 F. 2 d 1230, 1236 -37 (10 th Cir. 1991) (LBO); Bevill, Bresler, 878 F. 2 d 742, 750 -53 (3 d Cir. 1989) (Repo); Hechinger, 274 B. R. 71, 83 -89 (D. Del. 2002) (LBO); QSI Holdings, 2007 WL 4557855 (W. D. Mich. 2007) (private LBO); Plassein Int’l Corp. , 366 B. R. 318 (Bankr. D. Del. 2007), aff’d 388 B. R. 46 (D. Del. 2008) (LBOs of privately held companies); Quality Stores, 355 B. R. 629 (Bankr. W. D. Mich. 2006), aff’d, W. D. Mich. Dec. 21, 2007 (private LBO); IT Group, 359 B. R. 97 2006 (Bankr. D. Del. 2006) (private stock sale transaction). Payment made contrary to the applicable contractual terms, does not qualify. Enron, 325 B. R. 671, 685 -86 (Bankr. S. D. N. Y. 2005) (Prepayments made to retire short terms CP notes, where the notes were not redeemable or prepayable pursuant to their terms and the offering document (and also at significantly above market value) are not common and thus do not qualify). Derivatives in Bankruptcy

Avoidance Actions Exception (cont’d) • These authorities are probably inapplicable to forwards and swaps as these transactions are typically private. But see National Gas Distrib. , 369 B. R. at 898 (refusing to treat a forward gas supply agreement as a swap agreement because it was a private supply agreement with no impact on financial markets). – The Fifth Circuit expressed its agreement with precedents outside the securities area that the term should be interpreted broadly, and in the context of forward contracts does not require the payment to be made on a financial derivative, under on-market transaction or to be cleared or settled through a centralized system. Olympic Gas, 294 F. 3 d at 742, aff'g 258 B. R. at 165 -66 (payments made under forward contracts were settlement payments forward contract purposes although their avoidance "would have no impact on the securities system"); Borden Chemicals, 336 B. R. 214, 229 (Bankr. D. Del. 2006) (payments made under the contract following delivery of gas are settlement payments); Mirant, 310 B. R. 548, 563 (Bankr. N. D. Tex. 2004) (setoff of claims arising from termination of forward contract is a settlement payment). • 54 The legislative history to section 101(51 A) as well as the section itself state that, as to forward contracts, a settlement payment includes a "similar payment commonly used in the forward contract trade. " Olympic Gas, 258 B. R. at 166 (net payments exchanged monthly among the parties on account of forward contracts for natural gas, qualified as settlement payments under section 101(51 A) as "a similar payment commonly used in the forward contract trade"), aff'd, 294 F. 3 d at 742. Derivatives in Bankruptcy

Avoidance Actions Exception (cont’d) • • Payment obtained through attachment did not qualify as a protected payment under a swap under the pre-2005 amendments version of section 546(g), Interbulk, 240 B. R. 195, 201 n. 8 (Bankr. S. D. N. Y. 1999), but does qualify post 2005 amendments. Casa de Cambio, 390 B. R. 595 (Bankr. N. D. Ill. 2008). • Exercise of setoff to recover erroneous payments, may not qualify. GPR Holdings, 316 B. R. 477 (Bankr. N. D. Tex. 2004) (forward). • 55 Courts applied this definition to repos. Hamilton Taft, 114 F. 3 d 991, 993 (9 th Cir. 1997) (reverse repo); Jonas v. Resolution Trust Corp. (In re Comark), 971 F. 2 d 322, 326 (9 th Cir. 1992) (party's withdrawal from a repurchase transaction, and the return of additional margin posted in connection with the repo, is a settlement payment); Bevill, Bresler & Schulman Asset Management Corp. v. Spencer Sav. & Loan Ass'n, 878 F. 2 d 742, 751 -53 (3 d Cir. 1989) (interpreting the term settlement payment to fit the settlement process applicable to repurchase agreements). Payment for gas purchased after initial failure to pay and collection activities by the seller, may not qualify. Aurora Natural Gas, 316 B. R. 481 (Bankr. N. D. Tex. 2004) (forward). Derivatives in Bankruptcy

XIII. Section 105 • • 56 Allows courts to issue any order to carry out the provisions of Bankruptcy Code. It would appear that § 105 should not be used to override the specific provisions protecting safe harbor transactions; except that courts may temporarily enforce the stay or prevent close-outs of protected transactions to enable the courts to decide whether all of the necessary elements are satisfied. See Thomson Mc. Kinnon Sec. , Inc. v. Residential Resources Mortgage Invs. , 98 B. R. 2, 20 -24 (Bankr. D. Ariz. 1989) (staying broker-dealer from liquidating repurchase agreement to enable the court to first determine whether the contract was in fact a repo). Derivatives in Bankruptcy

XIV. Recharacterization Issues • • Repos have the economics of a secured loan and carry a significant recharacterization risks. Granite Partners, L. P. v. Bear, Stearns & Co. , 17 F. Supp. 2 d 275, 298 -99 (S. D. N. Y. 1998) (question of fact whether a repo is "true" repo or disguised financing); In re CRIIMI MAE, Inc. , 251 B. R. 796, 800 -05 (Bankr. D. Md. 2000) (same). • 57 Bankruptcy courts generally have the power to recharacterize transactions based on their economic substance, rather than based on their form. Courts seem less than willing to recharacterize sophisticated financial products, based on a counter-party's post-hoc view as to their alleged economic substance. Courts in the Ninth Circuit refused to recharacterize a swap and floating rate loan as one transaction representing in substance a fixed rate loan. In re Thrifty Oil Co. , 212 B. R. 147, 150 -53 (Bankr S. D. Cal. 1997), aff'd, 249 B. R. 537 (S. D. Cal. 2000), aff'd, 322 F. 3 d 1039 (9 th Cir. 2003). Derivatives in Bankruptcy

XV. Mandatory Subordination Issues • Section 510(b) of the Bankruptcy Code requires mandatory subordination of damage claims arising from purchase of sale of a security of the debtor or its affiliates. • This section may subordinate claims under forwards, swap, repos or securities contracts where the underlying security is a security of the debtor or its affiliates. • Purchase includes claims for the failure to issue securities or options under employment agreements or termination agreements. Med Diversified, 461 F. 3 d 251, 256 (2 d Cir. 2006); U. S. Wireless, 384 B. R. 713, 718 -18 (Bankr. D. Del. 2008); Enron, 341 B. R. at 151. • Damages: It is not entirely clear what the term means. – – 58 Technically, the rejection of any agreement is a breach of the contract which gives rise to damages. If that what it means, then any holder of a note issued by the debtor or an affiliate may be subordinated, a result that makes no sense as held by Blondheim, 91 B. R. 639, 642 (Bankr. D. N. H. 1988). But, in that case, the investors filed claims based on the unpaid amounts outstanding on the debtor's notes. Id. at 640; see also Nations. Rent, 2008 WL 114864 (Bankr. D. Del. 2008) (make whole claims not subordinated; such claims represent the bargained for sales price, not damages); Montgomery Ward, 272 B. R. 836, 844 -45 (Bankr. D. Del. 2001) (absent an allegation of fraud in the purchase, sale or issuance of the debt instrument, § 510(b) does not apply to a claim seeking recovery of an unpaid debt due upon a promissory note. ”); Wyeth, 134 B. R. 920, 921 (Bankr. W. D. Mo. 1991) (“[T]he term 'damages' implies more than a simple debt. . "); Washington Bancorporation, 1996 WL 148533, at *20 (D. D. C. , Mar. 19, 1996). Derivatives in Bankruptcy

Mandatory Subordination Issues (cont’d) – • In other contexts, courts did apply the more comprehensive meaning of damages. Response USA, 288 B. R. 88 (D. N. J. 2003) (claimant who sold shares in a third company to the debtor in exchange for debtor's cash and stock was subordinated; the investment was an equity investment and the damages resulted from the debtor's failure to pay under the stock purchase agreement); Vista Eyecare, 283 B. R. 613, 627 -28 (Bankr. N. D. Ga. 2002) (debtor's refusal to repurchase shares; damages equal the repurchase price minus shares' value); NAL, 237 B. R. 225, 231 -32 (Bankr. S. D. Fla. 1999) (breach of best efforts to register securities; breach of contract yields claim for damages). Breach. – – 59 Section 510(b) does not mention the term "breach, " but generally, damages can result either from tort type claim or from a breach of contract. Enron, 341 B. R. 141 (Bankr. S. D. N. Y. 2006) (claims of employees on account of their stock options subordinated whether framed in terms of fraudulent inducement, fraudulent retention or breach of contract). A related question may be whether a claim resulting from the acceleration of a safe harbor contract upon bankruptcy filing, constitutes a claim for damages resulting from a breach of the safe harbor contract. If the contract by its terms refers to it as a credit event type default, the argument for it constituting a breach and damages is straightforward; question is whether a change in the formulation would make a difference. Derivatives in Bankruptcy