6225cfd6584242054418f3c7684f0d24.ppt

- Количество слайдов: 24

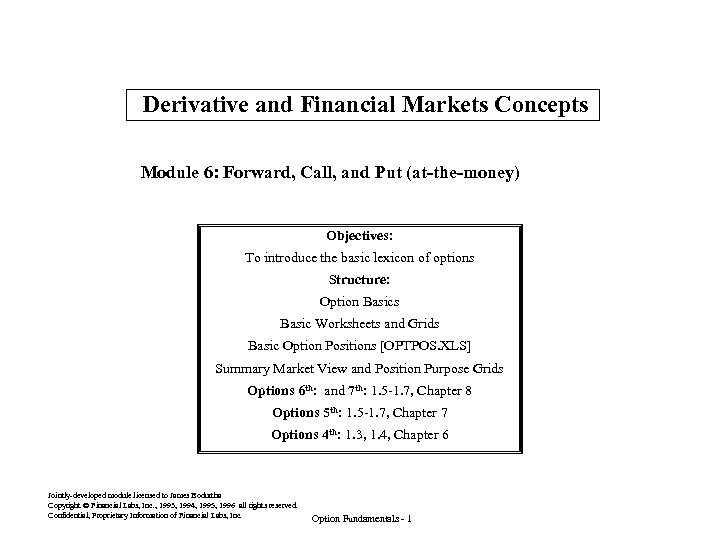

Derivative and Financial Markets Concepts Module 6: Forward, Call, and Put (at-the-money) Objectives: To introduce the basic lexicon of options Structure: Option Basics Basic Worksheets and Grids Basic Option Positions [OPTPOS. XLS] Summary Market View and Position Purpose Grids Options 6 th: and 7 th: 1. 5 -1. 7, Chapter 8 Options 5 th: 1. 5 -1. 7, Chapter 7 Options 4 th: 1. 3, 1. 4, Chapter 6 Jointly-developed module licensed to James Bodurtha Copyright Ó Financial Labs, Inc. , 1993, 1994, 1995, 1996 all rights reserved. Confidential, Proprietary Information of Financial Labs, Inc. Option Fundamentals - 1

Derivative and Financial Markets Concepts Module 6: Forward, Call, and Put (at-the-money) Objectives: To introduce the basic lexicon of options Structure: Option Basics Basic Worksheets and Grids Basic Option Positions [OPTPOS. XLS] Summary Market View and Position Purpose Grids Options 6 th: and 7 th: 1. 5 -1. 7, Chapter 8 Options 5 th: 1. 5 -1. 7, Chapter 7 Options 4 th: 1. 3, 1. 4, Chapter 6 Jointly-developed module licensed to James Bodurtha Copyright Ó Financial Labs, Inc. , 1993, 1994, 1995, 1996 all rights reserved. Confidential, Proprietary Information of Financial Labs, Inc. Option Fundamentals - 1

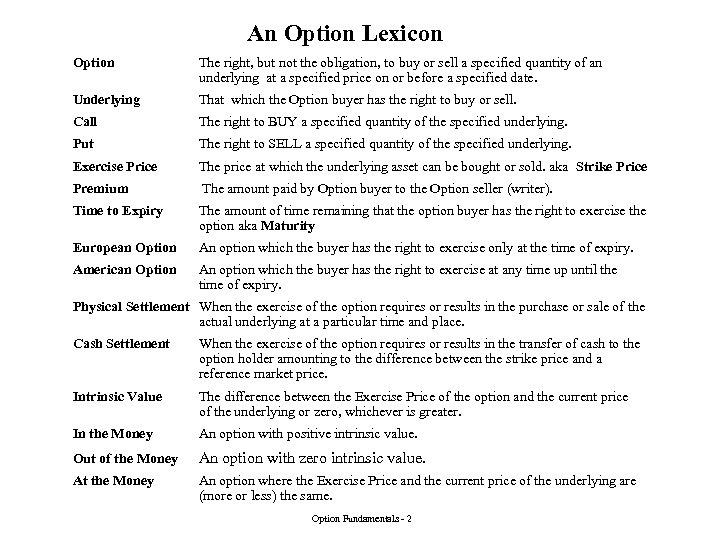

An Option Lexicon Option The right, but not the obligation, to buy or sell a specified quantity of an underlying at a specified price on or before a specified date. Underlying That which the Option buyer has the right to buy or sell. Call The right to BUY a specified quantity of the specified underlying. Put The right to SELL a specified quantity of the specified underlying. Exercise Price The price at which the underlying asset can be bought or sold. aka Strike Price Premium The amount paid by Option buyer to the Option seller (writer). Time to Expiry The amount of time remaining that the option buyer has the right to exercise the option aka Maturity European Option An option which the buyer has the right to exercise only at the time of expiry. American Option An option which the buyer has the right to exercise at any time up until the time of expiry. Physical Settlement When the exercise of the option requires or results in the purchase or sale of the actual underlying at a particular time and place. Cash Settlement When the exercise of the option requires or results in the transfer of cash to the option holder amounting to the difference between the strike price and a reference market price. Intrinsic Value The difference between the Exercise Price of the option and the current price of the underlying or zero, whichever is greater. In the Money An option with positive intrinsic value. Out of the Money An option with zero intrinsic value. At the Money An option where the Exercise Price and the current price of the underlying are (more or less) the same. Option Fundamentals - 2

An Option Lexicon Option The right, but not the obligation, to buy or sell a specified quantity of an underlying at a specified price on or before a specified date. Underlying That which the Option buyer has the right to buy or sell. Call The right to BUY a specified quantity of the specified underlying. Put The right to SELL a specified quantity of the specified underlying. Exercise Price The price at which the underlying asset can be bought or sold. aka Strike Price Premium The amount paid by Option buyer to the Option seller (writer). Time to Expiry The amount of time remaining that the option buyer has the right to exercise the option aka Maturity European Option An option which the buyer has the right to exercise only at the time of expiry. American Option An option which the buyer has the right to exercise at any time up until the time of expiry. Physical Settlement When the exercise of the option requires or results in the purchase or sale of the actual underlying at a particular time and place. Cash Settlement When the exercise of the option requires or results in the transfer of cash to the option holder amounting to the difference between the strike price and a reference market price. Intrinsic Value The difference between the Exercise Price of the option and the current price of the underlying or zero, whichever is greater. In the Money An option with positive intrinsic value. Out of the Money An option with zero intrinsic value. At the Money An option where the Exercise Price and the current price of the underlying are (more or less) the same. Option Fundamentals - 2

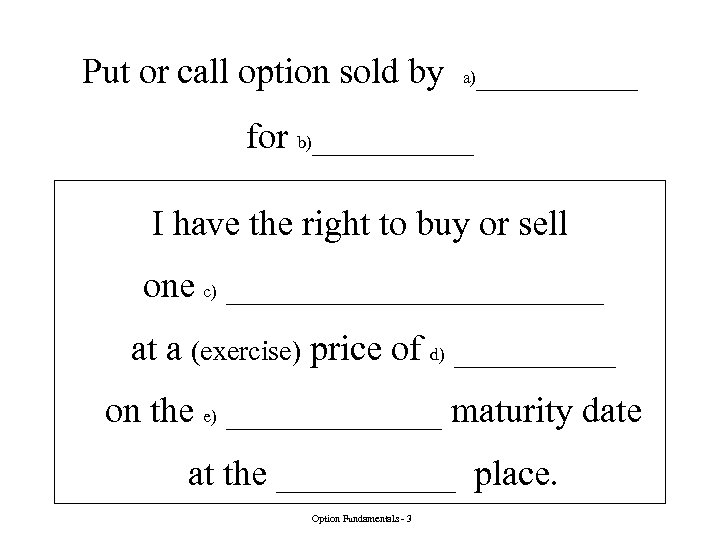

Put or call option sold by a)_____ for b)_____ I have the right to buy or sell one c) ___________ at a (exercise) price of d) _____ on the e) ______ maturity date at the _____ place. Option Fundamentals - 3

Put or call option sold by a)_____ for b)_____ I have the right to buy or sell one c) ___________ at a (exercise) price of d) _____ on the e) ______ maturity date at the _____ place. Option Fundamentals - 3

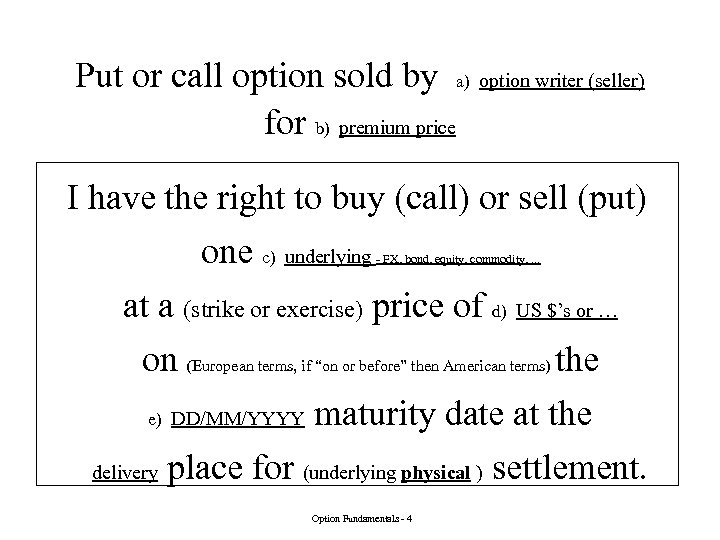

Put or call option sold by a) option writer (seller) for b) premium price I have the right to buy (call) or sell (put) one c) underlying - FX, bond, equity, commodity, . . . at a (strike or exercise) price of d) US $’s or … on (European terms, if “on or before” then American terms) the maturity date at the delivery place for (underlying physical ) settlement. e) DD/MM/YYYY Option Fundamentals - 4

Put or call option sold by a) option writer (seller) for b) premium price I have the right to buy (call) or sell (put) one c) underlying - FX, bond, equity, commodity, . . . at a (strike or exercise) price of d) US $’s or … on (European terms, if “on or before” then American terms) the maturity date at the delivery place for (underlying physical ) settlement. e) DD/MM/YYYY Option Fundamentals - 4

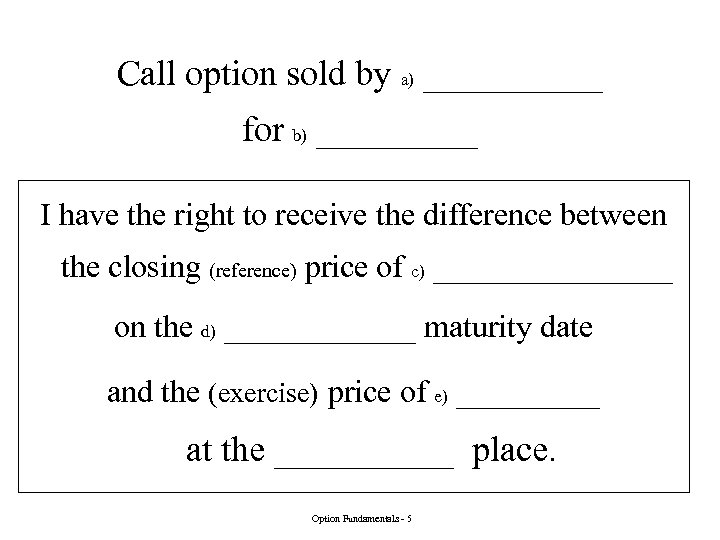

Call option sold by a) _____ for b) _____ I have the right to receive the difference between the closing (reference) price of c) ________ on the d) ______ maturity date and the (exercise) price of e) _____ at the _____ place. Option Fundamentals - 5

Call option sold by a) _____ for b) _____ I have the right to receive the difference between the closing (reference) price of c) ________ on the d) ______ maturity date and the (exercise) price of e) _____ at the _____ place. Option Fundamentals - 5

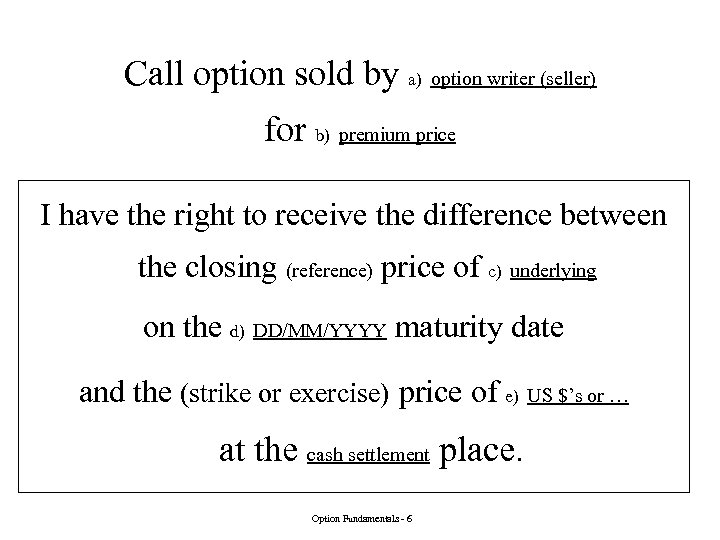

Call option sold by a) option writer (seller) for b) premium price I have the right to receive the difference between the closing (reference) price of c) underlying on the d) DD/MM/YYYY maturity date and the (strike or exercise) price of e) US $’s or … at the cash settlement place. Option Fundamentals - 6

Call option sold by a) option writer (seller) for b) premium price I have the right to receive the difference between the closing (reference) price of c) underlying on the d) DD/MM/YYYY maturity date and the (strike or exercise) price of e) US $’s or … at the cash settlement place. Option Fundamentals - 6

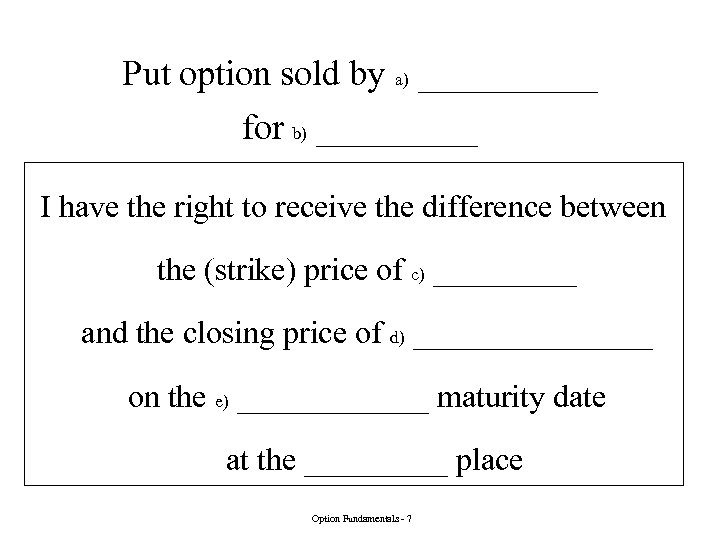

Put option sold by a) _____ for b) _____ I have the right to receive the difference between the (strike) price of c) _____ and the closing price of d) ________ on the e) ______ maturity date at the _____ place Option Fundamentals - 7

Put option sold by a) _____ for b) _____ I have the right to receive the difference between the (strike) price of c) _____ and the closing price of d) ________ on the e) ______ maturity date at the _____ place Option Fundamentals - 7

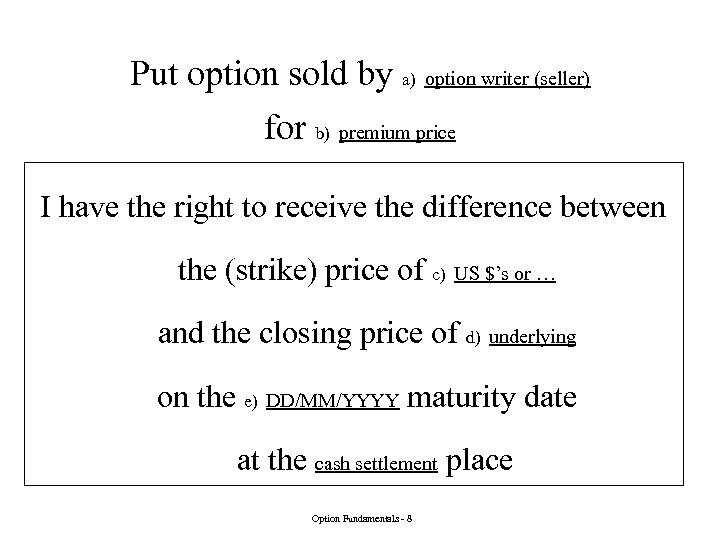

Put option sold by a) option writer (seller) for b) premium price I have the right to receive the difference between the (strike) price of c) US $’s or … and the closing price of d) underlying on the e) DD/MM/YYYY maturity date at the cash settlement place Option Fundamentals - 8

Put option sold by a) option writer (seller) for b) premium price I have the right to receive the difference between the (strike) price of c) US $’s or … and the closing price of d) underlying on the e) DD/MM/YYYY maturity date at the cash settlement place Option Fundamentals - 8

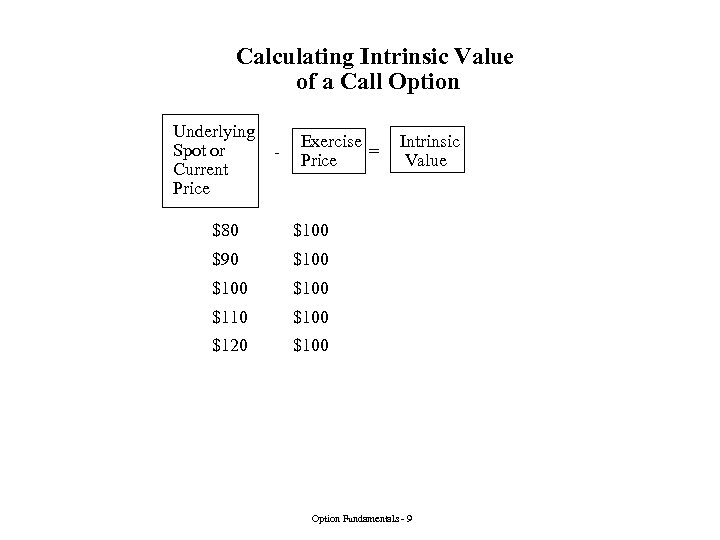

Calculating Intrinsic Value of a Call Option Underlying Spot or Current Price - Exercise = Price $80 $100 $90 $100 $110 $100 $120 Intrinsic Value $100 Option Fundamentals - 9

Calculating Intrinsic Value of a Call Option Underlying Spot or Current Price - Exercise = Price $80 $100 $90 $100 $110 $100 $120 Intrinsic Value $100 Option Fundamentals - 9

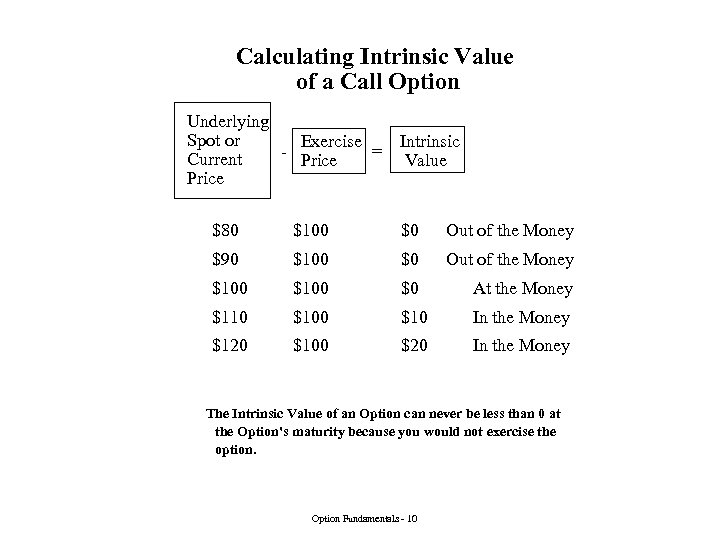

Calculating Intrinsic Value of a Call Option Underlying Spot or Exercise Intrinsic = Current Price Value Price $80 $100 $0 Out of the Money $90 $100 $0 Out of the Money $100 $0 At the Money $110 $10 In the Money $120 $100 $20 In the Money The Intrinsic Value of an Option can never be less than 0 at the Option's maturity because you would not exercise the option. Option Fundamentals - 10

Calculating Intrinsic Value of a Call Option Underlying Spot or Exercise Intrinsic = Current Price Value Price $80 $100 $0 Out of the Money $90 $100 $0 Out of the Money $100 $0 At the Money $110 $10 In the Money $120 $100 $20 In the Money The Intrinsic Value of an Option can never be less than 0 at the Option's maturity because you would not exercise the option. Option Fundamentals - 10

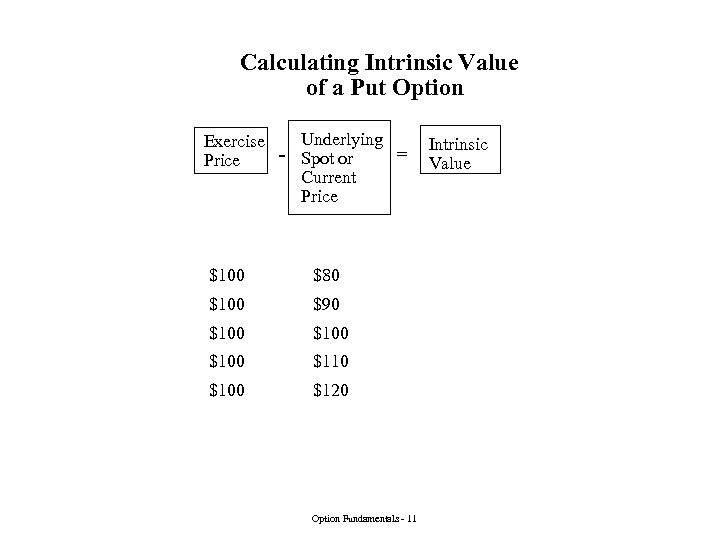

Calculating Intrinsic Value of a Put Option Underlying Exercise - Spot or = Price Current Price $100 $80 $100 $90 $100 $110 $100 $120 Option Fundamentals - 11 Intrinsic Value

Calculating Intrinsic Value of a Put Option Underlying Exercise - Spot or = Price Current Price $100 $80 $100 $90 $100 $110 $100 $120 Option Fundamentals - 11 Intrinsic Value

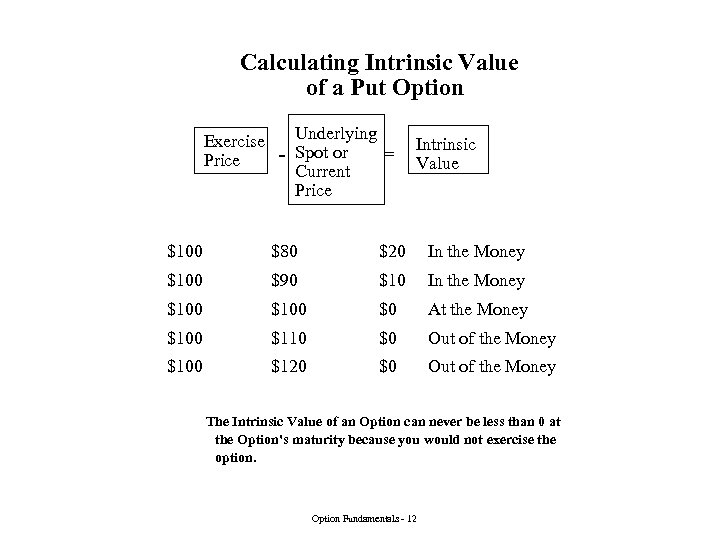

Calculating Intrinsic Value of a Put Option Underlying Exercise - Spot or = Price Current Price Intrinsic Value $100 $80 $20 In the Money $100 $90 $10 In the Money $100 $0 At the Money $100 $110 $0 Out of the Money $100 $120 $0 Out of the Money The Intrinsic Value of an Option can never be less than 0 at the Option's maturity because you would not exercise the option. Option Fundamentals - 12

Calculating Intrinsic Value of a Put Option Underlying Exercise - Spot or = Price Current Price Intrinsic Value $100 $80 $20 In the Money $100 $90 $10 In the Money $100 $0 At the Money $100 $110 $0 Out of the Money $100 $120 $0 Out of the Money The Intrinsic Value of an Option can never be less than 0 at the Option's maturity because you would not exercise the option. Option Fundamentals - 12

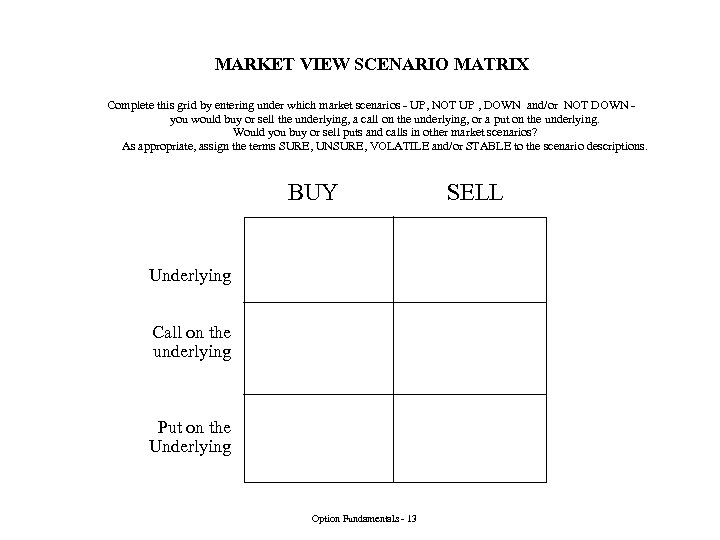

MARKET VIEW SCENARIO MATRIX Complete this grid by entering under which market scenarios - UP, NOT UP , DOWN and/or NOT DOWN you would buy or sell the underlying, a call on the underlying, or a put on the underlying. Would you buy or sell puts and calls in other market scenarios? As appropriate, assign the terms SURE, UNSURE, VOLATILE and/or STABLE to the scenario descriptions. BUY Underlying Call on the underlying Put on the Underlying Option Fundamentals - 13 SELL

MARKET VIEW SCENARIO MATRIX Complete this grid by entering under which market scenarios - UP, NOT UP , DOWN and/or NOT DOWN you would buy or sell the underlying, a call on the underlying, or a put on the underlying. Would you buy or sell puts and calls in other market scenarios? As appropriate, assign the terms SURE, UNSURE, VOLATILE and/or STABLE to the scenario descriptions. BUY Underlying Call on the underlying Put on the Underlying Option Fundamentals - 13 SELL

Derivative Concepts Option Positions have three major purposes: 1. Insurance (buying options) Options are purchased to protect against adverse changes in the value of an underlying position, while retaining profit opportunity. Usually, limited downside. 2. Yield (Income) Enhancement - Shifting (selling options) Options are sold to yield income in order to increase returns or lower costs. The income is shifted in time and/or eventuality. Often, yield is generated from unlimited downside. 3. Trading Positions (have price risk at all) Options are purchased and sold to take positions to profit on expected market direction and/or volatility. Option Fundamentals - 14

Derivative Concepts Option Positions have three major purposes: 1. Insurance (buying options) Options are purchased to protect against adverse changes in the value of an underlying position, while retaining profit opportunity. Usually, limited downside. 2. Yield (Income) Enhancement - Shifting (selling options) Options are sold to yield income in order to increase returns or lower costs. The income is shifted in time and/or eventuality. Often, yield is generated from unlimited downside. 3. Trading Positions (have price risk at all) Options are purchased and sold to take positions to profit on expected market direction and/or volatility. Option Fundamentals - 14

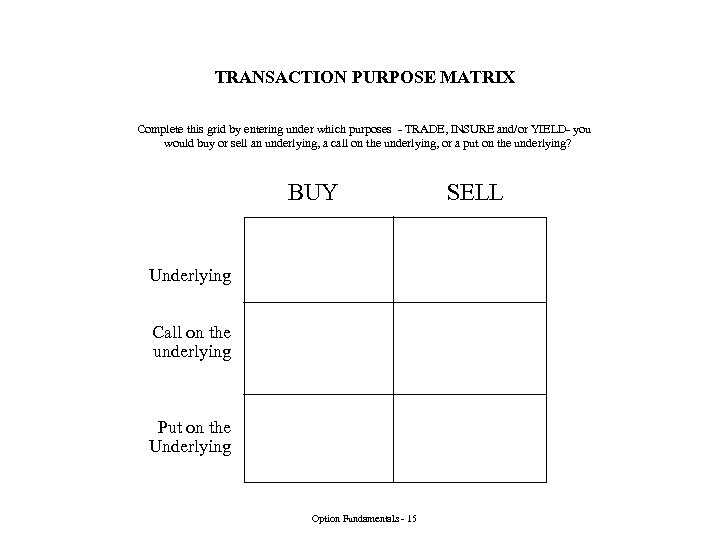

TRANSACTION PURPOSE MATRIX Complete this grid by entering under which purposes - TRADE, INSURE and/or YIELD- you would buy or sell an underlying, a call on the underlying, or a put on the underlying? BUY Underlying Call on the underlying Put on the Underlying Option Fundamentals - 15 SELL

TRANSACTION PURPOSE MATRIX Complete this grid by entering under which purposes - TRADE, INSURE and/or YIELD- you would buy or sell an underlying, a call on the underlying, or a put on the underlying? BUY Underlying Call on the underlying Put on the Underlying Option Fundamentals - 15 SELL

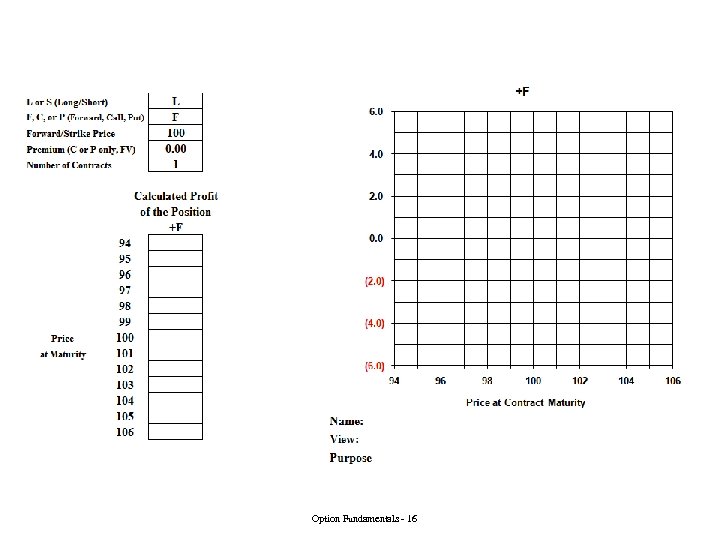

Option Fundamentals - 16

Option Fundamentals - 16

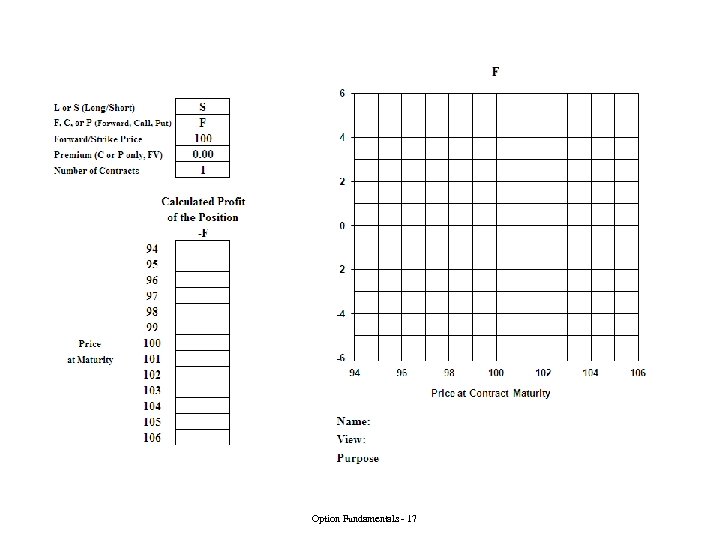

Option Fundamentals - 17

Option Fundamentals - 17

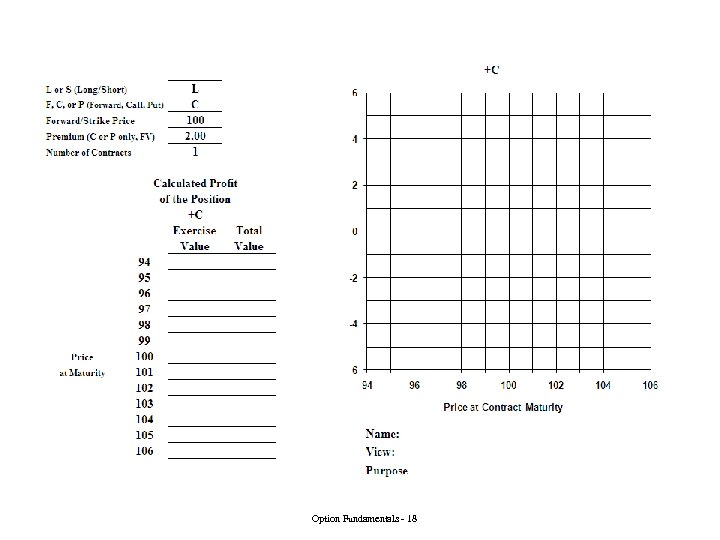

Option Fundamentals - 18

Option Fundamentals - 18

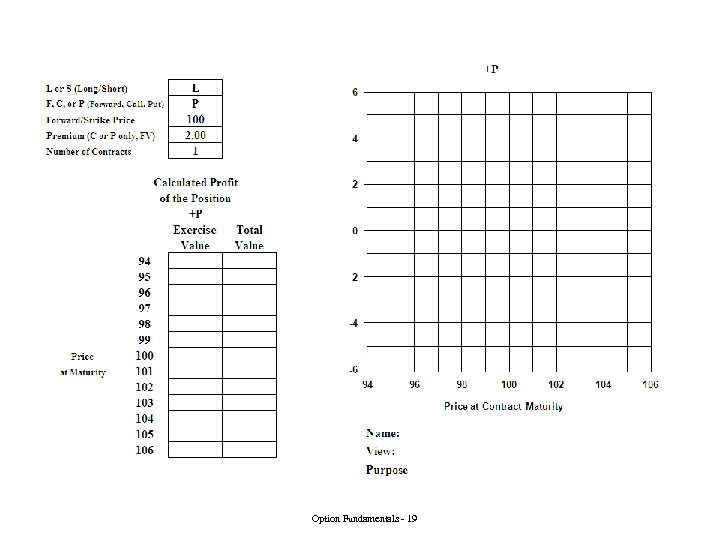

Option Fundamentals - 19

Option Fundamentals - 19

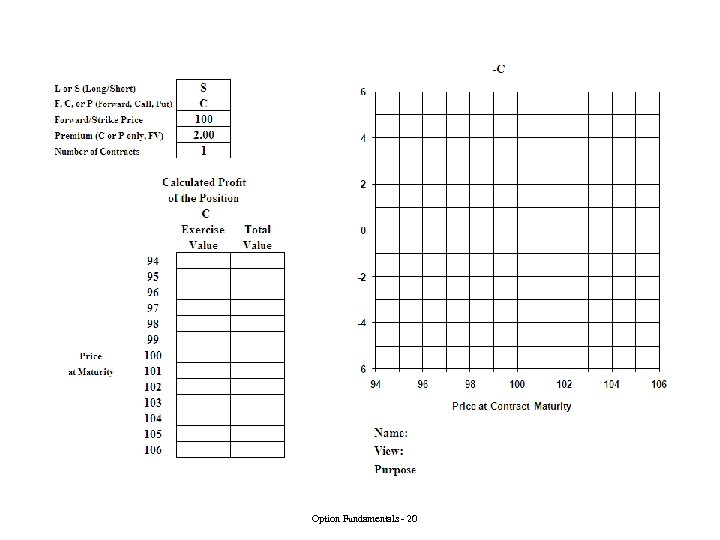

Option Fundamentals - 20

Option Fundamentals - 20

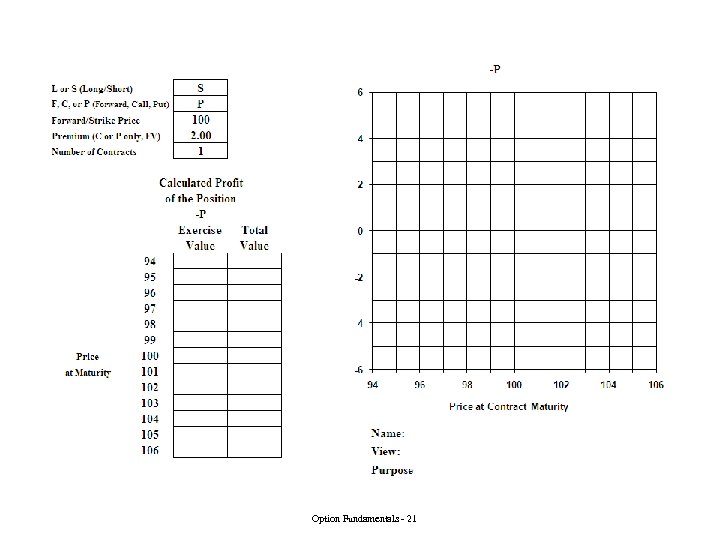

Option Fundamentals - 21

Option Fundamentals - 21

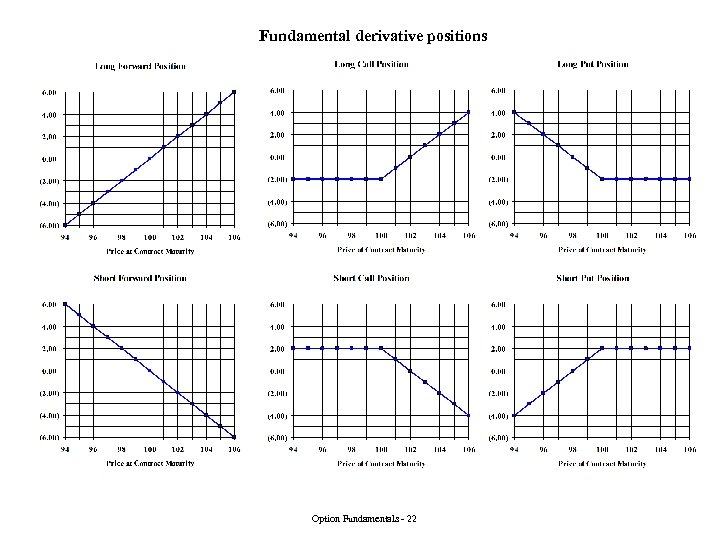

Fundamental derivative positions Option Fundamentals - 22

Fundamental derivative positions Option Fundamentals - 22

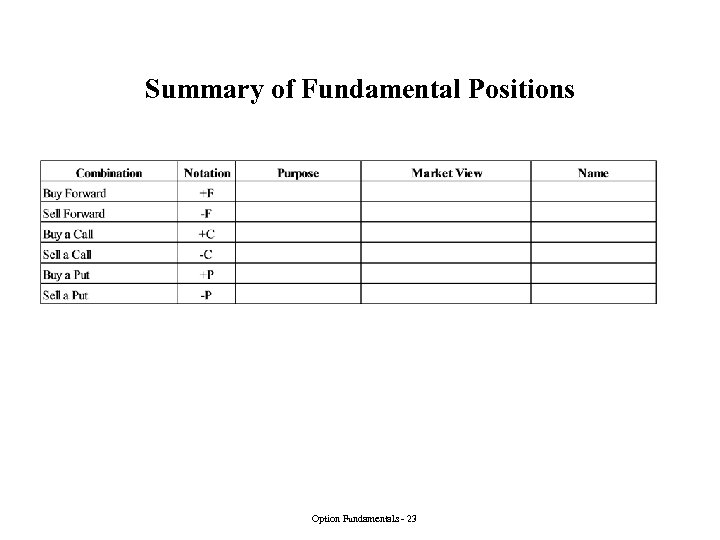

Summary of Fundamental Positions Option Fundamentals - 23

Summary of Fundamental Positions Option Fundamentals - 23

This page is intentionally left blank Option Fundamentals - 24

This page is intentionally left blank Option Fundamentals - 24