Ринок фин.п..ppt

- Количество слайдов: 16

Depository Institution Ivanas A. N. Lyalina V. V.

Depository Institution Ivanas A. N. Lyalina V. V.

Depository Institutions • Depository Institutions – businesses which offer multiple services in banking and finance – These institutions include: • Banks • Savings and Loans • Credit Unions

Depository Institutions • Depository Institutions – businesses which offer multiple services in banking and finance – These institutions include: • Banks • Savings and Loans • Credit Unions

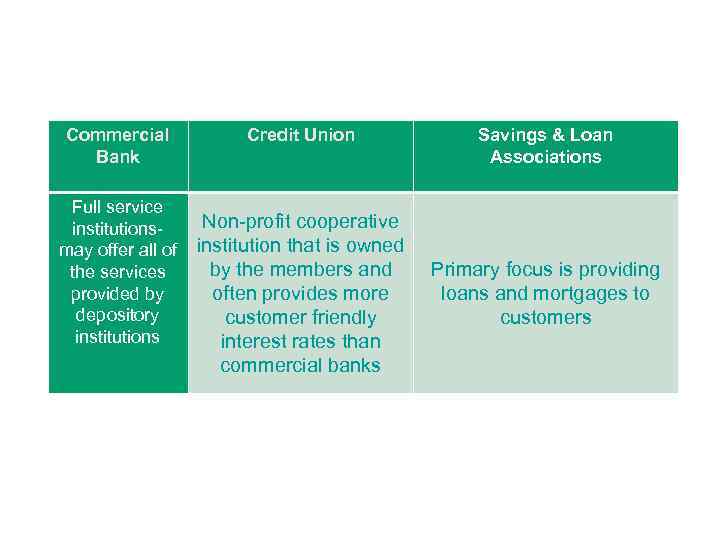

Commercial Bank Full service institutionsmay offer all of the services provided by depository institutions Credit Union Non-profit cooperative institution that is owned by the members and often provides more customer friendly interest rates than commercial banks Savings & Loan Associations Primary focus is providing loans and mortgages to customers

Commercial Bank Full service institutionsmay offer all of the services provided by depository institutions Credit Union Non-profit cooperative institution that is owned by the members and often provides more customer friendly interest rates than commercial banks Savings & Loan Associations Primary focus is providing loans and mortgages to customers

Commercial Bank • Commercial Banks – Usually the largest depository institutions – Considered full-service depository institutions – Available to a variety of consumers

Commercial Bank • Commercial Banks – Usually the largest depository institutions – Considered full-service depository institutions – Available to a variety of consumers

Credit Union • Credit Unions – Non-profit cooperative depository institution • Owned by members who share a common bond

Credit Union • Credit Unions – Non-profit cooperative depository institution • Owned by members who share a common bond

Savings and Loan Association (S&Ls) • Savings and Loan Association – Focus on providing loans and mortgages • Customers must have a savings account with them

Savings and Loan Association (S&Ls) • Savings and Loan Association – Focus on providing loans and mortgages • Customers must have a savings account with them

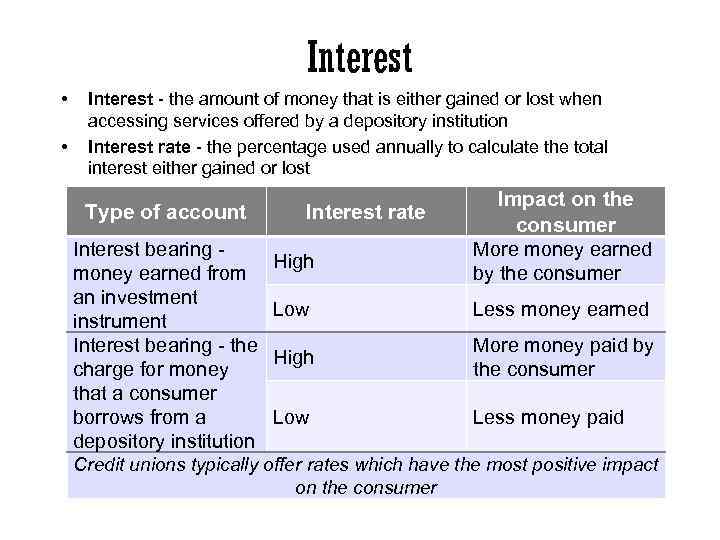

Interest • • Interest - the amount of money that is either gained or lost when accessing services offered by a depository institution Interest rate - the percentage used annually to calculate the total interest either gained or lost Type of account Interest bearing money earned from an investment instrument Interest bearing - the charge for money that a consumer borrows from a depository institution Interest rate High Impact on the consumer More money earned by the consumer Low Less money earned High More money paid by the consumer Low Less money paid Credit unions typically offer rates which have the most positive impact on the consumer

Interest • • Interest - the amount of money that is either gained or lost when accessing services offered by a depository institution Interest rate - the percentage used annually to calculate the total interest either gained or lost Type of account Interest bearing money earned from an investment instrument Interest bearing - the charge for money that a consumer borrows from a depository institution Interest rate High Impact on the consumer More money earned by the consumer Low Less money earned High More money paid by the consumer Low Less money paid Credit unions typically offer rates which have the most positive impact on the consumer

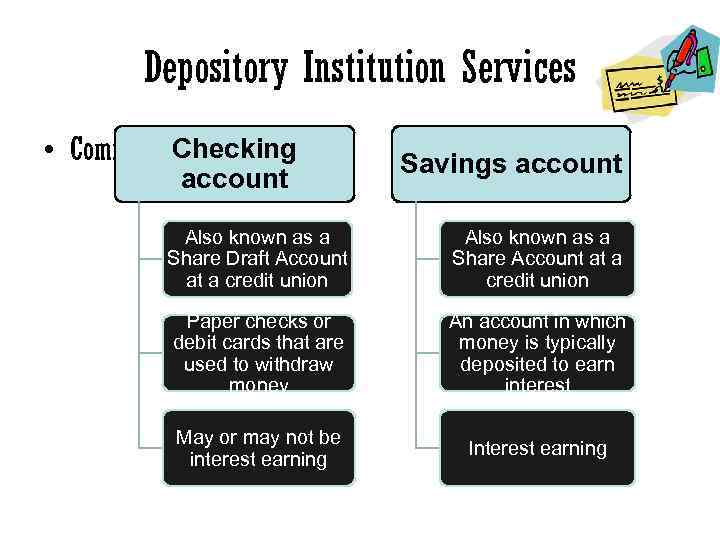

Depository Institution Services Checking • Common Services Offered account Savings account Also known as a Share Draft Account at a credit union Also known as a Share Account at a credit union Paper checks or debit cards that are used to withdraw money An account in which money is typically deposited to earn interest May or may not be interest earning Interest earning

Depository Institution Services Checking • Common Services Offered account Savings account Also known as a Share Draft Account at a credit union Also known as a Share Account at a credit union Paper checks or debit cards that are used to withdraw money An account in which money is typically deposited to earn interest May or may not be interest earning Interest earning

Interest Bearing Accounts Stock • Ownership, represented by shares in a corporation Certificate of Deposit • Share certificate account at a credit union • An insured interest – earning savings instrument with restricted access to the funds Money Market Account • An account which offers higher interest rates than a savings account and may offer limited check writing privileges Bond • A debt instrument issued by an organization such as a business or the government • Designed as an investment for the purchasers to earn interest

Interest Bearing Accounts Stock • Ownership, represented by shares in a corporation Certificate of Deposit • Share certificate account at a credit union • An insured interest – earning savings instrument with restricted access to the funds Money Market Account • An account which offers higher interest rates than a savings account and may offer limited check writing privileges Bond • A debt instrument issued by an organization such as a business or the government • Designed as an investment for the purchasers to earn interest

Interest Bearing Accounts • Credit Card – A card used to make a purchase now and repay later • If the balance is paid before the grace period ends, interest is not added • If the balance is paid after the grace period, the payment of interest is required • Loan – Money borrowed and paid back with interest • Mortgage – loan for a home • Personal – interest rates vary depending upon type of loan – Loan types can include vehicle, school, etc.

Interest Bearing Accounts • Credit Card – A card used to make a purchase now and repay later • If the balance is paid before the grace period ends, interest is not added • If the balance is paid after the grace period, the payment of interest is required • Loan – Money borrowed and paid back with interest • Mortgage – loan for a home • Personal – interest rates vary depending upon type of loan – Loan types can include vehicle, school, etc.

Additional Services Which May Be Offered • Safe-Deposit Box – A secured box in a bank to be used for valuable and important personal items. • Financial Counseling – Information and advice is given to customers to help make financial decisions.

Additional Services Which May Be Offered • Safe-Deposit Box – A secured box in a bank to be used for valuable and important personal items. • Financial Counseling – Information and advice is given to customers to help make financial decisions.

The National Depository of Ukraine • • According to the Law of Ukraine “On the National Depository System and Peculiarities of Electronic Circulation of Securities in Ukraine”, the NDU shall exercise the following activities: safekeeping and servicing of securities circulation; servicing of issuers’ operations as to the outstanding securities; clearing and settlement of securities transactions; keeping of the registries of registered securities owners.

The National Depository of Ukraine • • According to the Law of Ukraine “On the National Depository System and Peculiarities of Electronic Circulation of Securities in Ukraine”, the NDU shall exercise the following activities: safekeeping and servicing of securities circulation; servicing of issuers’ operations as to the outstanding securities; clearing and settlement of securities transactions; keeping of the registries of registered securities owners.

Within exclusive competence of the National Depository shall fall the following activities: • standardization of depository accounting and documents management on securities operations; • according to international standards, numbering (codification) of securities issued in Ukraine; • establishment of relations and ongoing cooperation with depository institutions in other countries, conclusion of bilateral and multilateral agreements on direct partnership or correspondent relations aimed at servicing international securities transactions by participants of the National Depository System and supervision of their correspondent relations with depository institutions in other countries.

Within exclusive competence of the National Depository shall fall the following activities: • standardization of depository accounting and documents management on securities operations; • according to international standards, numbering (codification) of securities issued in Ukraine; • establishment of relations and ongoing cooperation with depository institutions in other countries, conclusion of bilateral and multilateral agreements on direct partnership or correspondent relations aimed at servicing international securities transactions by participants of the National Depository System and supervision of their correspondent relations with depository institutions in other countries.

Сonclusion • Depository Institution - an organization, which may be either for-profit or non-profit, that takes money from clients and places it in any of a variety of investment vehicles for the benefit of both the client and the organization.

Сonclusion • Depository Institution - an organization, which may be either for-profit or non-profit, that takes money from clients and places it in any of a variety of investment vehicles for the benefit of both the client and the organization.

Thank you for your attention!

Thank you for your attention!