7dda4734fdabce65854646fe6336e670.ppt

- Количество слайдов: 24

Department Revenue of Exemptions from Sales Tax

Department Revenue of Exemptions from Sales Tax

What Who Why Documentation

What Who Why Documentation

Examples of Exempt Products or Services • • Agricultural products Agricultural services Warranty Goods Food Stamps (SNAP) Water Supply System Trucking Services Trade-in Allowance Mini-Storage • Prescription drugs for humans • Prescribed medical devices • Healthcare Services • Financial Services • Social Services • Travel Agent Services • Advertising Services

Examples of Exempt Products or Services • • Agricultural products Agricultural services Warranty Goods Food Stamps (SNAP) Water Supply System Trucking Services Trade-in Allowance Mini-Storage • Prescription drugs for humans • Prescribed medical devices • Healthcare Services • Financial Services • Social Services • Travel Agent Services • Advertising Services

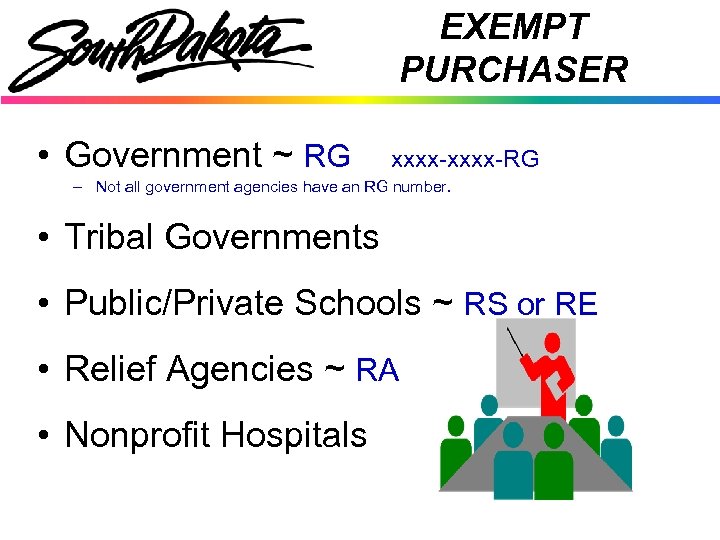

EXEMPT PURCHASER • Government ~ RG xxxx-RG – Not all government agencies have an RG number. • Tribal Governments • Public/Private Schools ~ RS or RE • Relief Agencies ~ RA • Nonprofit Hospitals

EXEMPT PURCHASER • Government ~ RG xxxx-RG – Not all government agencies have an RG number. • Tribal Governments • Public/Private Schools ~ RS or RE • Relief Agencies ~ RA • Nonprofit Hospitals

TAXABLE PURCHASER • Purchasers that are NOT exempt: • Churches – Purchases by churches are subject to sales tax. • Non-profit civic organizations – Such as PTA, Service Clubs (Rotary), Veterans clubs etc. Their purchases are subject to sales tax. – Their dues are exempt from sales tax as are services provided by them.

TAXABLE PURCHASER • Purchasers that are NOT exempt: • Churches – Purchases by churches are subject to sales tax. • Non-profit civic organizations – Such as PTA, Service Clubs (Rotary), Veterans clubs etc. Their purchases are subject to sales tax. – Their dues are exempt from sales tax as are services provided by them.

WHY IS IT EXEMPT • Sales for Resale • Goods sold are shipped outside the state – Documentation is shipping address • Goods are leased outside the state • Services are received by customer outside the state Examples of where tax is sourced (or due): v Repair Service – keep documentation where customer takes receipt of the repaired item v Consulting service – keep documentation where report is sent v Online service – documentation is customer’s address Use Tax is due where the service is used. This may differ from where the receipt is.

WHY IS IT EXEMPT • Sales for Resale • Goods sold are shipped outside the state – Documentation is shipping address • Goods are leased outside the state • Services are received by customer outside the state Examples of where tax is sourced (or due): v Repair Service – keep documentation where customer takes receipt of the repaired item v Consulting service – keep documentation where report is sent v Online service – documentation is customer’s address Use Tax is due where the service is used. This may differ from where the receipt is.

RESALE PURCHASES OF PRODUCTS • Tangible personal property purchased to be resold • Tangible personal property purchased to be leased Note: Tangible personal property used by service providers cannot be purchased exempt for resale unless there is a specific exemption. Example: Chemicals used by lawn care providers can be purchased for resale.

RESALE PURCHASES OF PRODUCTS • Tangible personal property purchased to be resold • Tangible personal property purchased to be leased Note: Tangible personal property used by service providers cannot be purchased exempt for resale unless there is a specific exemption. Example: Chemicals used by lawn care providers can be purchased for resale.

DOCUMENTATION FOR EXEMPT SALES IS REQUIRED Using the Exemption Certificate

DOCUMENTATION FOR EXEMPT SALES IS REQUIRED Using the Exemption Certificate

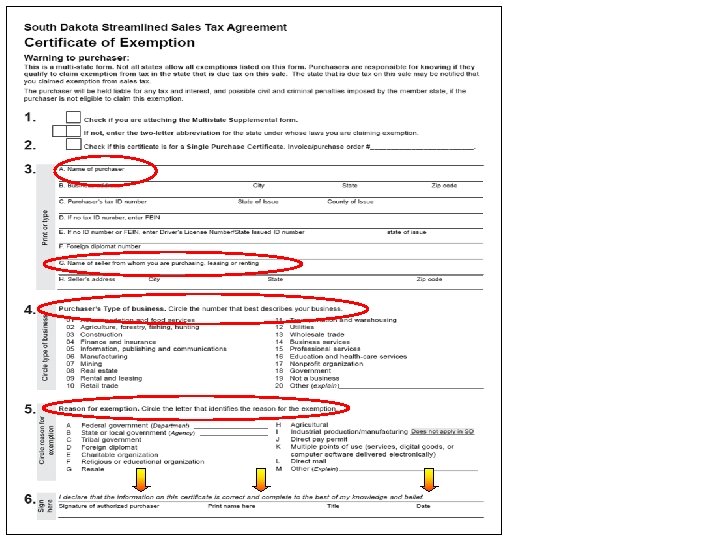

• Purchaser must provide to Seller • Good for only ST, WT, MT licenses • No requirement to update, but DOR advises to updated every 3 years • Invalid Certificates - Issuer may be held responsible for tax plus up to 50% penalty, and may be guilty of Class 1 Misdemeanor.

• Purchaser must provide to Seller • Good for only ST, WT, MT licenses • No requirement to update, but DOR advises to updated every 3 years • Invalid Certificates - Issuer may be held responsible for tax plus up to 50% penalty, and may be guilty of Class 1 Misdemeanor.

REASON FOR EXEMPTION • • • Federal government State or local government (see next slide for out-of-state governments) Tribal government Foreign diplomat Charitable organization - SD Relief Agency permit required Religious or private educational organization - SD permit required (only SD religious or private schools are exempt) Resale Agricultural (item or service must be specifically exempt) Direct pay permit Direct Mail

REASON FOR EXEMPTION • • • Federal government State or local government (see next slide for out-of-state governments) Tribal government Foreign diplomat Charitable organization - SD Relief Agency permit required Religious or private educational organization - SD permit required (only SD religious or private schools are exempt) Resale Agricultural (item or service must be specifically exempt) Direct pay permit Direct Mail

EXEMPT GOVERNMENTS • The governments from other states or the District of Columbia are exempt from SD sales tax if the law in that state provides a similar exemption for SD governments. • Governments providing a similar exemption: Colorado, Indiana, Iowa (lodging is not exempt), Minnesota (lodging and meals are not exempt), North Dakota, Ohio, and West Virginia. • The governments from states without a sales tax are exempt from South Dakota sales tax. These states are Alaska, Delaware, Montana, New Hampshire, and Oregon.

EXEMPT GOVERNMENTS • The governments from other states or the District of Columbia are exempt from SD sales tax if the law in that state provides a similar exemption for SD governments. • Governments providing a similar exemption: Colorado, Indiana, Iowa (lodging is not exempt), Minnesota (lodging and meals are not exempt), North Dakota, Ohio, and West Virginia. • The governments from states without a sales tax are exempt from South Dakota sales tax. These states are Alaska, Delaware, Montana, New Hampshire, and Oregon.

EXEMPT SERVICES ADVERTISING SERVCIES If ad is prepared and placed in the media by the service provider the service is exempt. Media: Newspaper, radio, TV, Internet, magazine etc. If prepared by service provider and given to the customer it is taxable.

EXEMPT SERVICES ADVERTISING SERVCIES If ad is prepared and placed in the media by the service provider the service is exempt. Media: Newspaper, radio, TV, Internet, magazine etc. If prepared by service provider and given to the customer it is taxable.

MANUFACTURERS Tangible personal property can be purchased for resale if it becomes part of the final product Examples of purchases for resale by manufacturer: v Steel v Screws v Tires v Engine v Glass v Shipping container

MANUFACTURERS Tangible personal property can be purchased for resale if it becomes part of the final product Examples of purchases for resale by manufacturer: v Steel v Screws v Tires v Engine v Glass v Shipping container

MANUFACTURERS COMPONENT PARTS - CONTAINERS • Raw materials sold to manufacturers, processors or fabricators are exempt from sales tax as a sale for resale. Raw materials include: containers labels packing cases wrapping paper twine bags bottles tape casings and similar articles and receptacles if they become part of other tangible personal property to be sold ultimately at retail.

MANUFACTURERS COMPONENT PARTS - CONTAINERS • Raw materials sold to manufacturers, processors or fabricators are exempt from sales tax as a sale for resale. Raw materials include: containers labels packing cases wrapping paper twine bags bottles tape casings and similar articles and receptacles if they become part of other tangible personal property to be sold ultimately at retail.

PACKAGING AND CONTAINERS Retailers can purchase certain containers exempt from sales tax as a sale for resale even if the retailer – Furnishes the container free of charge to a customer, as long as the container hold products the retailer sold to the customer • Containers include: bags, boxes, wrapping paper, twine, tape, cups, food wrappers, and similar articles. Containers the retailer reuses cannot be purchased for resale.

PACKAGING AND CONTAINERS Retailers can purchase certain containers exempt from sales tax as a sale for resale even if the retailer – Furnishes the container free of charge to a customer, as long as the container hold products the retailer sold to the customer • Containers include: bags, boxes, wrapping paper, twine, tape, cups, food wrappers, and similar articles. Containers the retailer reuses cannot be purchased for resale.

SERVICES FOR RESALE Services as a component part of a manufactured product Example of services that might qualify for resale for manufacturer, fabricator or processor: v Welding v Painting ü Design service does not qualify as a service for resale Two criteria must be met for service to be purchased for resale: 1. Service is not used in any manner by the seller and 2. Service is delivered or resold to the ultimate customer without any alteration or change.

SERVICES FOR RESALE Services as a component part of a manufactured product Example of services that might qualify for resale for manufacturer, fabricator or processor: v Welding v Painting ü Design service does not qualify as a service for resale Two criteria must be met for service to be purchased for resale: 1. Service is not used in any manner by the seller and 2. Service is delivered or resold to the ultimate customer without any alteration or change.

SERVICES FOR RESALE Is the service used to develop a product or does it become an actual physical part of the product? Attaching components becomes part of the product. Resale allowed. Designing - does not become actual part of product. Resale not allowed.

SERVICES FOR RESALE Is the service used to develop a product or does it become an actual physical part of the product? Attaching components becomes part of the product. Resale allowed. Designing - does not become actual part of product. Resale not allowed.

SERVICES TO OTHER SERVICE PROVIDERS A service provider can purchase another service for resale if the service is delivered to a specific customer in conjunction with the services contracted to be provided to the customer. 3 criteria must be met in order to purchase the service for resale: 1. Purchased for or on behalf of a current customer; 2. Purchaser of the service does not use the service in any manner; and 3. Service is delivered or resold without any alteration or change

SERVICES TO OTHER SERVICE PROVIDERS A service provider can purchase another service for resale if the service is delivered to a specific customer in conjunction with the services contracted to be provided to the customer. 3 criteria must be met in order to purchase the service for resale: 1. Purchased for or on behalf of a current customer; 2. Purchaser of the service does not use the service in any manner; and 3. Service is delivered or resold without any alteration or change

RESALE EXAMPLES Veterinarian Services: • Laboratory services for a specific customer can be purchased for resale • The veterinarian’s service is subject to sales tax, but they can purchase medications as a sale for resale • Products placed in or on the animal can be purchased by the veterinarian for resale

RESALE EXAMPLES Veterinarian Services: • Laboratory services for a specific customer can be purchased for resale • The veterinarian’s service is subject to sales tax, but they can purchase medications as a sale for resale • Products placed in or on the animal can be purchased by the veterinarian for resale

RESALE EXAMPLES #1 - A computer software company hires a programmer to develop customized software for a specific client. Is this resale? Yes, it meets all 3 criteria. #2 - The software company hires a programmer to develop a new app to scan products and compare prices. The software company then copies and markets this plan to the public. Is this resale? No, not developed for specific client.

RESALE EXAMPLES #1 - A computer software company hires a programmer to develop customized software for a specific client. Is this resale? Yes, it meets all 3 criteria. #2 - The software company hires a programmer to develop a new app to scan products and compare prices. The software company then copies and markets this plan to the public. Is this resale? No, not developed for specific client.

ARCHITECTS, ENGINEERS, SURVEYORS Exception to the rule that it “must meet the 3 criteria” Any service purchased by an architect, engineer or surveyor on behalf of a client in performance of a contract for that client may be purchased for resale.

ARCHITECTS, ENGINEERS, SURVEYORS Exception to the rule that it “must meet the 3 criteria” Any service purchased by an architect, engineer or surveyor on behalf of a client in performance of a contract for that client may be purchased for resale.

Sources • Internet Publications – Exempt Entities – Exemption Certificate • Statistics – List of Relief Agencies • Coming January 2012 You can request a tax seminar for your specific business or industry.

Sources • Internet Publications – Exempt Entities – Exemption Certificate • Statistics – List of Relief Agencies • Coming January 2012 You can request a tax seminar for your specific business or industry.

Questions? Need Information? Visit our Website §www. state. sd. us/drr 2 Toll Free Number: 1 -800 -829 -9188 Visit our Geographic Information Systems (GIS) §http: //www. state. sd. us/drr 2/GIS/index. htm Email the Business Tax Division §bustax@state. sd. us Check out our Quest Program (E-file)

Questions? Need Information? Visit our Website §www. state. sd. us/drr 2 Toll Free Number: 1 -800 -829 -9188 Visit our Geographic Information Systems (GIS) §http: //www. state. sd. us/drr 2/GIS/index. htm Email the Business Tax Division §bustax@state. sd. us Check out our Quest Program (E-file)