4287c5c4a5c803050b5bac9647984b2d.ppt

- Количество слайдов: 19

Department of Treasury & Administration

Department of Treasury & Administration

Introductions 1. 2. 3. Division of Personnel, Labor & Manpower Development Division of Revenue & Taxation Division of Finance & Property Accountability The Department is responsible for the effective administration of the Financial Management Act (1 L-203 -87) as amended; Public Service Act (2 L-57 -81) as amended; Comprehensive Taxation Reform Act (4 L-35 -97) as amended.

Introductions 1. 2. 3. Division of Personnel, Labor & Manpower Development Division of Revenue & Taxation Division of Finance & Property Accountability The Department is responsible for the effective administration of the Financial Management Act (1 L-203 -87) as amended; Public Service Act (2 L-57 -81) as amended; Comprehensive Taxation Reform Act (4 L-35 -97) as amended.

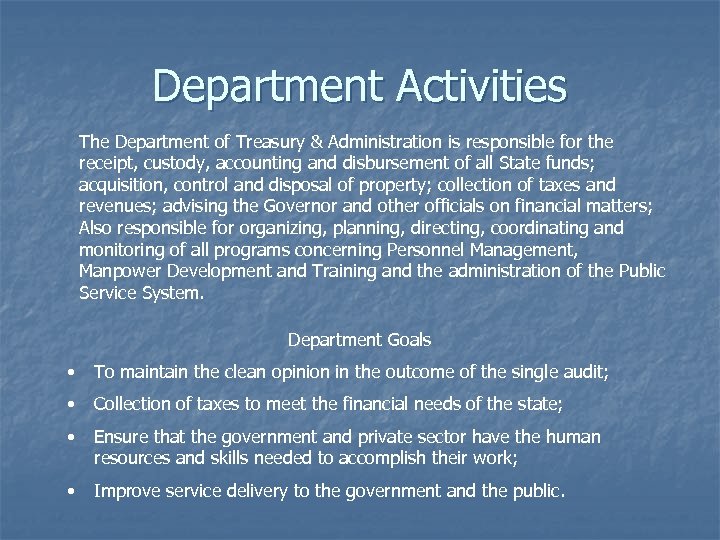

Department Activities The Department of Treasury & Administration is responsible for the receipt, custody, accounting and disbursement of all State funds; acquisition, control and disposal of property; collection of taxes and revenues; advising the Governor and other officials on financial matters; Also responsible for organizing, planning, directing, coordinating and monitoring of all programs concerning Personnel Management, Manpower Development and Training and the administration of the Public Service System. Department Goals • To maintain the clean opinion in the outcome of the single audit; • Collection of taxes to meet the financial needs of the state; • Ensure that the government and private sector have the human resources and skills needed to accomplish their work; • Improve service delivery to the government and the public.

Department Activities The Department of Treasury & Administration is responsible for the receipt, custody, accounting and disbursement of all State funds; acquisition, control and disposal of property; collection of taxes and revenues; advising the Governor and other officials on financial matters; Also responsible for organizing, planning, directing, coordinating and monitoring of all programs concerning Personnel Management, Manpower Development and Training and the administration of the Public Service System. Department Goals • To maintain the clean opinion in the outcome of the single audit; • Collection of taxes to meet the financial needs of the state; • Ensure that the government and private sector have the human resources and skills needed to accomplish their work; • Improve service delivery to the government and the public.

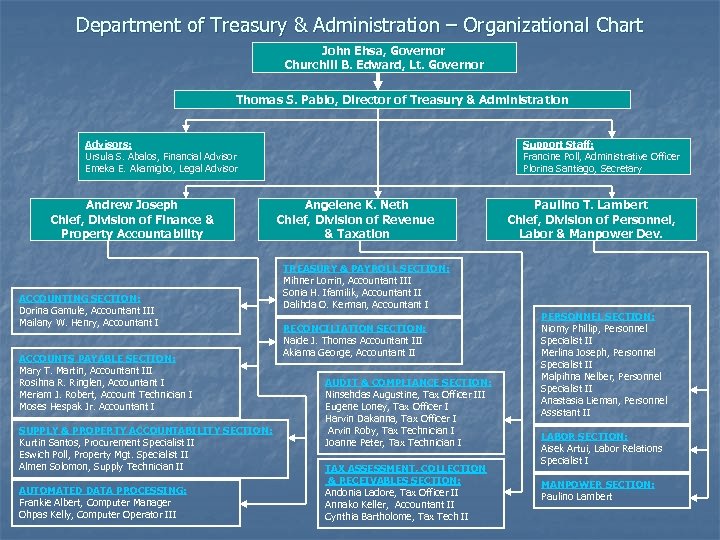

Department of Treasury & Administration – Organizational Chart John Ehsa, Governor Churchill B. Edward, Lt. Governor Thomas S. Pablo, Director of Treasury & Administration Advisors: Ursula S. Abalos, Financial Advisor Emeka E. Akamigbo, Legal Advisor Andrew Joseph Chief, Division of Finance & Property Accountability ACCOUNTING SECTION: Dorina Gamule, Accountant III Mailany W. Henry, Accountant I ACCOUNTS PAYABLE SECTION: Mary T. Martin, Accountant III Rosihna R. Ringlen, Accountant I Meriam J. Robert, Account Technician I Moses Hespak Jr. Accountant I SUPPLY & PROPERTY ACCOUNTABILITY SECTION: Kurtin Santos, Procurement Specialist II Eswich Poll, Property Mgt. Specialist II Almen Solomon, Supply Technician II AUTOMATED DATA PROCESSING: Frankie Albert, Computer Manager Ohpas Kelly, Computer Operator III Support Staff: Francine Poll, Administrative Officer Plorina Santiago, Secretary Angelene K. Neth Chief, Division of Revenue & Taxation TREASURY & PAYROLL SECTION: Mihner Lorrin, Accountant III Sonia H. Ifamilik, Accountant II Dalihda O. Kerman, Accountant I RECONCILIATION SECTION: Naide J. Thomas Accountant III Akiama George, Accountant II AUDIT & COMPLIANCE SECTION: Ninsehdas Augustine, Tax Officer III Eugene Loney, Tax Officer I Harvin Dakanna, Tax Officer I Arvin Roby, Tax Technician I Joanne Peter, Tax Technician I TAX ASSESSMENT, COLLECTION & RECEIVABLES SECTION: Andonia Ladore, Tax Officer II Annako Keller, Accountant II Cynthia Bartholome, Tax Tech II Paulino T. Lambert Chief, Division of Personnel, Labor & Manpower Dev. PERSONNEL SECTION: Niomy Phillip, Personnel Specialist II Merlina Joseph, Personnel Specialist II Malpihna Nelber, Personnel Specialist II Anastasia Lieman, Personnel Assistant II LABOR SECTION: Aisek Artui, Labor Relations Specialist I MANPOWER SECTION: Paulino Lambert

Department of Treasury & Administration – Organizational Chart John Ehsa, Governor Churchill B. Edward, Lt. Governor Thomas S. Pablo, Director of Treasury & Administration Advisors: Ursula S. Abalos, Financial Advisor Emeka E. Akamigbo, Legal Advisor Andrew Joseph Chief, Division of Finance & Property Accountability ACCOUNTING SECTION: Dorina Gamule, Accountant III Mailany W. Henry, Accountant I ACCOUNTS PAYABLE SECTION: Mary T. Martin, Accountant III Rosihna R. Ringlen, Accountant I Meriam J. Robert, Account Technician I Moses Hespak Jr. Accountant I SUPPLY & PROPERTY ACCOUNTABILITY SECTION: Kurtin Santos, Procurement Specialist II Eswich Poll, Property Mgt. Specialist II Almen Solomon, Supply Technician II AUTOMATED DATA PROCESSING: Frankie Albert, Computer Manager Ohpas Kelly, Computer Operator III Support Staff: Francine Poll, Administrative Officer Plorina Santiago, Secretary Angelene K. Neth Chief, Division of Revenue & Taxation TREASURY & PAYROLL SECTION: Mihner Lorrin, Accountant III Sonia H. Ifamilik, Accountant II Dalihda O. Kerman, Accountant I RECONCILIATION SECTION: Naide J. Thomas Accountant III Akiama George, Accountant II AUDIT & COMPLIANCE SECTION: Ninsehdas Augustine, Tax Officer III Eugene Loney, Tax Officer I Harvin Dakanna, Tax Officer I Arvin Roby, Tax Technician I Joanne Peter, Tax Technician I TAX ASSESSMENT, COLLECTION & RECEIVABLES SECTION: Andonia Ladore, Tax Officer II Annako Keller, Accountant II Cynthia Bartholome, Tax Tech II Paulino T. Lambert Chief, Division of Personnel, Labor & Manpower Dev. PERSONNEL SECTION: Niomy Phillip, Personnel Specialist II Merlina Joseph, Personnel Specialist II Malpihna Nelber, Personnel Specialist II Anastasia Lieman, Personnel Assistant II LABOR SECTION: Aisek Artui, Labor Relations Specialist I MANPOWER SECTION: Paulino Lambert

Division of Personnel Labor and Manpower Development

Division of Personnel Labor and Manpower Development

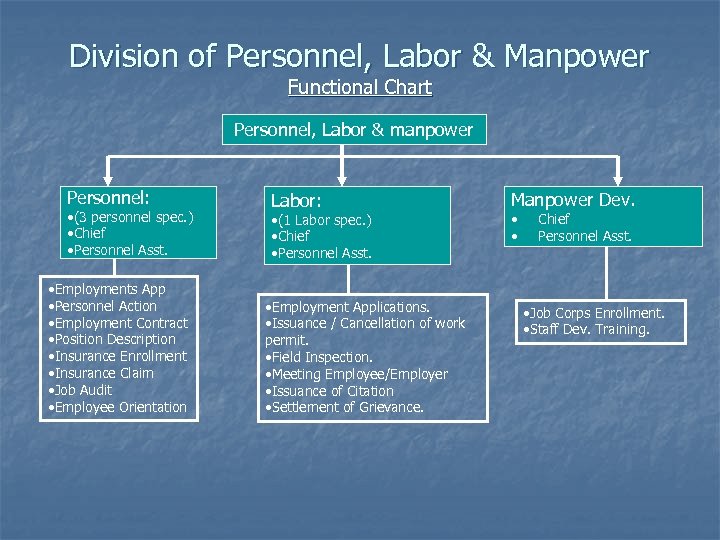

Division of Personnel, Labor & Manpower Functional Chart Personnel, Labor & manpower Personnel: • (3 personnel spec. ) • Chief • Personnel Asst. • Employments App • Personnel Action • Employment Contract • Position Description • Insurance Enrollment • Insurance Claim • Job Audit • Employee Orientation Labor: • (1 Labor spec. ) • Chief • Personnel Asst. • Employment Applications. • Issuance / Cancellation of work permit. • Field Inspection. • Meeting Employee/Employer • Issuance of Citation • Settlement of Grievance. Manpower Dev. • • Chief Personnel Asst. • Job Corps Enrollment. • Staff Dev. Training.

Division of Personnel, Labor & Manpower Functional Chart Personnel, Labor & manpower Personnel: • (3 personnel spec. ) • Chief • Personnel Asst. • Employments App • Personnel Action • Employment Contract • Position Description • Insurance Enrollment • Insurance Claim • Job Audit • Employee Orientation Labor: • (1 Labor spec. ) • Chief • Personnel Asst. • Employment Applications. • Issuance / Cancellation of work permit. • Field Inspection. • Meeting Employee/Employer • Issuance of Citation • Settlement of Grievance. Manpower Dev. • • Chief Personnel Asst. • Job Corps Enrollment. • Staff Dev. Training.

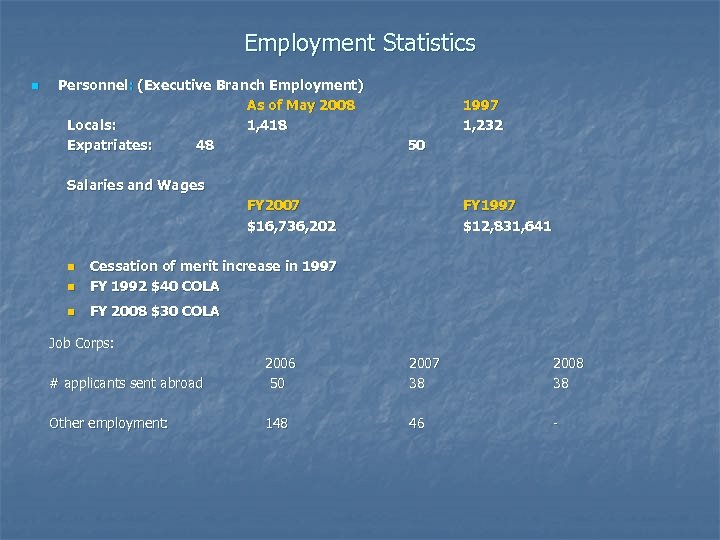

Employment Statistics n Personnel: (Executive Branch Employment) As of May 2008 Locals: 1, 418 Expatriates: 48 1997 1, 232 50 Salaries and Wages FY 2007 $16, 736, 202 n Cessation of merit increase in 1997 FY 1992 $40 COLA n FY 1997 $12, 831, 641 FY 2008 $30 COLA n Job Corps: # applicants sent abroad 2006 50 2007 38 2008 38 Other employment: 148 46 -

Employment Statistics n Personnel: (Executive Branch Employment) As of May 2008 Locals: 1, 418 Expatriates: 48 1997 1, 232 50 Salaries and Wages FY 2007 $16, 736, 202 n Cessation of merit increase in 1997 FY 1992 $40 COLA n FY 1997 $12, 831, 641 FY 2008 $30 COLA n Job Corps: # applicants sent abroad 2006 50 2007 38 2008 38 Other employment: 148 46 -

Division of Revenue & Taxation

Division of Revenue & Taxation

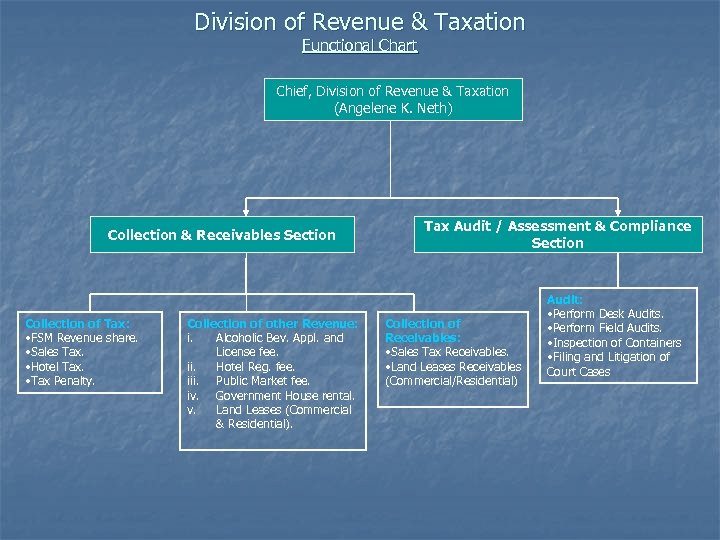

Division of Revenue & Taxation Functional Chart Chief, Division of Revenue & Taxation (Angelene K. Neth) Collection & Receivables Section Collection of Tax: • FSM Revenue share. • Sales Tax. • Hotel Tax. • Tax Penalty. Collection of other Revenue: i. Alcoholic Bev. Appl. and License fee. ii. Hotel Reg. fee. iii. Public Market fee. iv. Government House rental. v. Land Leases (Commercial & Residential). Tax Audit / Assessment & Compliance Section Collection of Receivables: • Sales Tax Receivables. • Land Leases Receivables (Commercial/Residential) Audit: • Perform Desk Audits. • Perform Field Audits. • Inspection of Containers • Filing and Litigation of Court Cases

Division of Revenue & Taxation Functional Chart Chief, Division of Revenue & Taxation (Angelene K. Neth) Collection & Receivables Section Collection of Tax: • FSM Revenue share. • Sales Tax. • Hotel Tax. • Tax Penalty. Collection of other Revenue: i. Alcoholic Bev. Appl. and License fee. ii. Hotel Reg. fee. iii. Public Market fee. iv. Government House rental. v. Land Leases (Commercial & Residential). Tax Audit / Assessment & Compliance Section Collection of Receivables: • Sales Tax Receivables. • Land Leases Receivables (Commercial/Residential) Audit: • Perform Desk Audits. • Perform Field Audits. • Inspection of Containers • Filing and Litigation of Court Cases

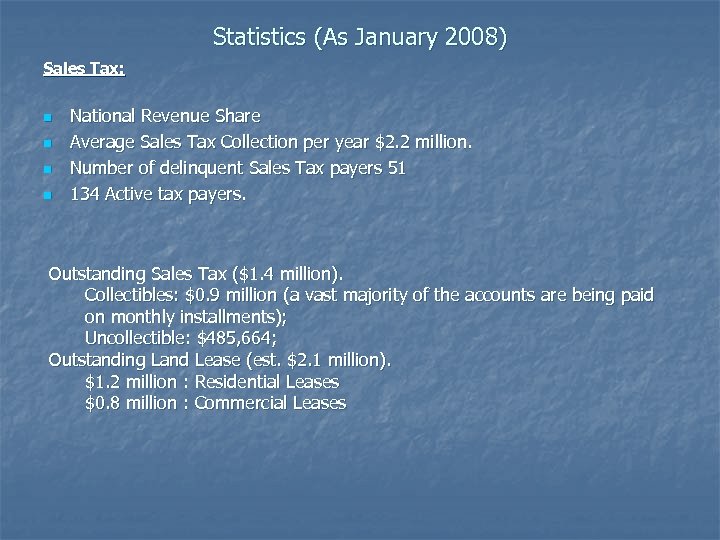

Statistics (As January 2008) Sales Tax: n n National Revenue Share Average Sales Tax Collection per year $2. 2 million. Number of delinquent Sales Tax payers 51 134 Active tax payers. Outstanding Sales Tax ($1. 4 million). Collectibles: $0. 9 million (a vast majority of the accounts are being paid on monthly installments); Uncollectible: $485, 664; Outstanding Land Lease (est. $2. 1 million). $1. 2 million : Residential Leases $0. 8 million : Commercial Leases

Statistics (As January 2008) Sales Tax: n n National Revenue Share Average Sales Tax Collection per year $2. 2 million. Number of delinquent Sales Tax payers 51 134 Active tax payers. Outstanding Sales Tax ($1. 4 million). Collectibles: $0. 9 million (a vast majority of the accounts are being paid on monthly installments); Uncollectible: $485, 664; Outstanding Land Lease (est. $2. 1 million). $1. 2 million : Residential Leases $0. 8 million : Commercial Leases

Division of Finance & Property Accountability

Division of Finance & Property Accountability

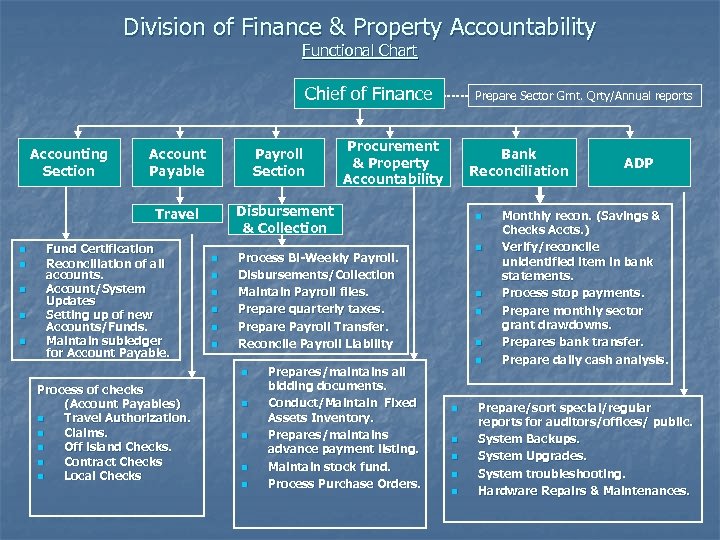

Division of Finance & Property Accountability Functional Chart Chief of Finance Accounting Section Account Payable Payroll Section n n Fund Certification Reconciliation of all accounts. Account/System Updates Setting up of new Accounts/Funds. Maintain subledger for Account Payable. n Bank Reconciliation n n n Process Bi-Weekly Payroll. Disbursements/Collection Maintain Payroll files. Prepare quarterly taxes. Prepare Payroll Transfer. Reconcile Payroll Liability n Process of checks (Account Payables) n Travel Authorization. n Claims. n Off island Checks. n Contract Checks n Local Checks Procurement & Property Accountability Disbursement & Collection Travel n Prepare Sector Grnt. Qrty/Annual reports n n Prepares/maintains all bidding documents. Conduct/Maintain Fixed Assets Inventory. Prepares/maintains advance payment listing. Maintain stock fund. Process Purchase Orders. n n n n n ADP Monthly recon. (Savings & Checks Accts. ) Verify/reconcile unidentified item in bank statements. Process stop payments. Prepare monthly sector grant drawdowns. Prepares bank transfer. Prepare daily cash analysis. Prepare/sort special/regular reports for auditors/offices/ public. System Backups. System Upgrades. System troubleshooting. Hardware Repairs & Maintenances.

Division of Finance & Property Accountability Functional Chart Chief of Finance Accounting Section Account Payable Payroll Section n n Fund Certification Reconciliation of all accounts. Account/System Updates Setting up of new Accounts/Funds. Maintain subledger for Account Payable. n Bank Reconciliation n n n Process Bi-Weekly Payroll. Disbursements/Collection Maintain Payroll files. Prepare quarterly taxes. Prepare Payroll Transfer. Reconcile Payroll Liability n Process of checks (Account Payables) n Travel Authorization. n Claims. n Off island Checks. n Contract Checks n Local Checks Procurement & Property Accountability Disbursement & Collection Travel n Prepare Sector Grnt. Qrty/Annual reports n n Prepares/maintains all bidding documents. Conduct/Maintain Fixed Assets Inventory. Prepares/maintains advance payment listing. Maintain stock fund. Process Purchase Orders. n n n n n ADP Monthly recon. (Savings & Checks Accts. ) Verify/reconcile unidentified item in bank statements. Process stop payments. Prepare monthly sector grant drawdowns. Prepares bank transfer. Prepare daily cash analysis. Prepare/sort special/regular reports for auditors/offices/ public. System Backups. System Upgrades. System troubleshooting. Hardware Repairs & Maintenances.

Reporting Requirements Monthly Financial Reports (Legislature & Departments): n 131 p – Detail Allotment, Expenditure, Revenue & Encumbrances for the month. n 132 p – Cumulative summary Allotments, Expenditures, Revenue, Encumbrances and fund balance for the year. n 135 p – Cumulative detail of Allotments, Revenue, Encumbrances and fund balance for the year. 121 p – Report of Unliquidated Encumbrances. In addition to the above, legislature receive the following reports … n n 101 p – Balance Status of state’s Assets, Liabilities and Capital at any given time. 134 p – Cumulative total of state’s Revenue & Expenditures. Sector Grants Reporting Requirements (Quarterly & Annual)… n SF 269: Reports on cumulative Revenue, Expenditures and Encumbrances. SF 272: Reports Cash Account Status (actual cash received less disbursement).

Reporting Requirements Monthly Financial Reports (Legislature & Departments): n 131 p – Detail Allotment, Expenditure, Revenue & Encumbrances for the month. n 132 p – Cumulative summary Allotments, Expenditures, Revenue, Encumbrances and fund balance for the year. n 135 p – Cumulative detail of Allotments, Revenue, Encumbrances and fund balance for the year. 121 p – Report of Unliquidated Encumbrances. In addition to the above, legislature receive the following reports … n n 101 p – Balance Status of state’s Assets, Liabilities and Capital at any given time. 134 p – Cumulative total of state’s Revenue & Expenditures. Sector Grants Reporting Requirements (Quarterly & Annual)… n SF 269: Reports on cumulative Revenue, Expenditures and Encumbrances. SF 272: Reports Cash Account Status (actual cash received less disbursement).

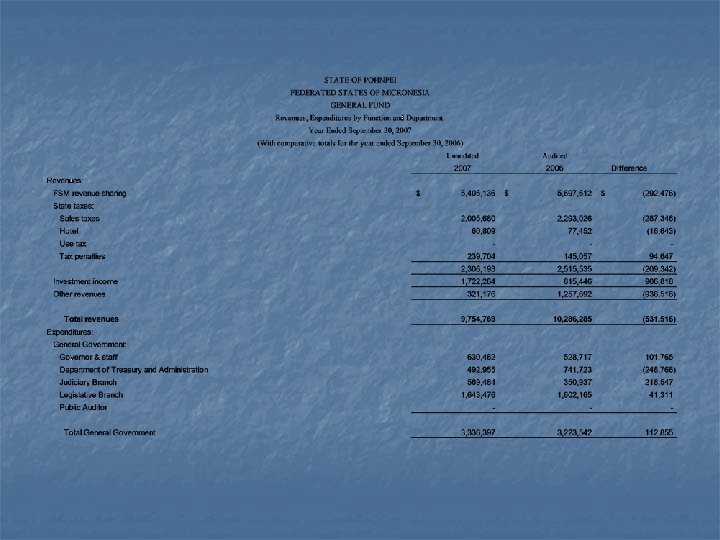

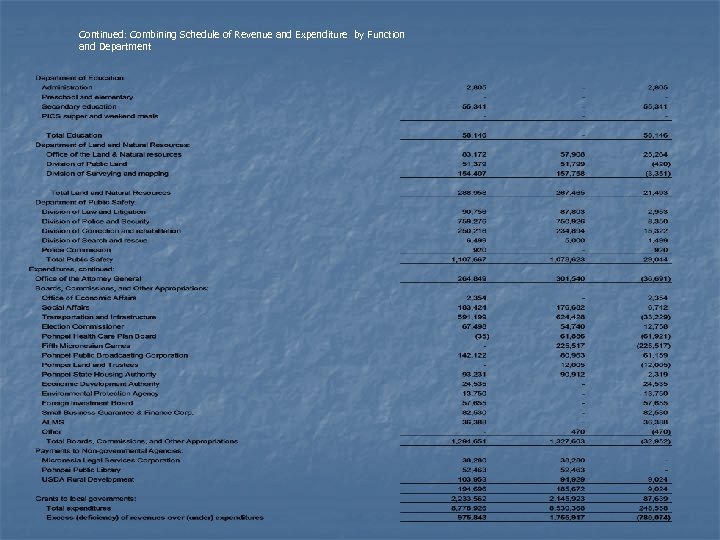

Continued: Combining Schedule of Revenue and Expenditure by Function and Department

Continued: Combining Schedule of Revenue and Expenditure by Function and Department

CONCLUSION The Department will continue in its efforts towards improving its service delivery by encouraging cooperation and effective teamwork among departments and Offices.

CONCLUSION The Department will continue in its efforts towards improving its service delivery by encouraging cooperation and effective teamwork among departments and Offices.