56df164eae0864ab25a374880baada35.ppt

- Количество слайдов: 22

Dental, Vision & Hearing Expense Insurance Plan Mindy Van Order, Manager of Agent Services DVH WEB 0512 For agent use only. 1

Dental, Vision & Hearing Expense Insurance Plan Mindy Van Order, Manager of Agent Services DVH WEB 0512 For agent use only. 1

DVH presentation overview Topics we’ll cover: – – Quick overview of UCT DVH Plan overview Useful tools for agents Questions & follow up For agent use only. 2

DVH presentation overview Topics we’ll cover: – – Quick overview of UCT DVH Plan overview Useful tools for agents Questions & follow up For agent use only. 2

About UCT: Who We Are The Order of United Commercial Travelers of America (UCT) is a fraternal benefit society. UCT is a non-profit, member-benefit organization founded more than 124 years ago. International in scope, we are guided by our mission of: Uniting people with a common passion for good citizenship and volunteerism to improve their local communities. For agent use only. 3

About UCT: Who We Are The Order of United Commercial Travelers of America (UCT) is a fraternal benefit society. UCT is a non-profit, member-benefit organization founded more than 124 years ago. International in scope, we are guided by our mission of: Uniting people with a common passion for good citizenship and volunteerism to improve their local communities. For agent use only. 3

About UCT: Who We Are continued UCT is a membership organization open to anyone over age 18. We provide benefits, financial services and insurance products that are of value to our members and prospective members. We are a different kind of financial services organization - we reinvest our earnings to support the needs of local communities and the causes our members care about. For agent use only. 4

About UCT: Who We Are continued UCT is a membership organization open to anyone over age 18. We provide benefits, financial services and insurance products that are of value to our members and prospective members. We are a different kind of financial services organization - we reinvest our earnings to support the needs of local communities and the causes our members care about. For agent use only. 4

Dental, Vision & Hearing Expense Insurance Issued and underwritten by The Order of United Commercial Travelers of America Rates may vary by state . t use only For agen 5

Dental, Vision & Hearing Expense Insurance Issued and underwritten by The Order of United Commercial Travelers of America Rates may vary by state . t use only For agen 5

UCT DVH Product State Availability As of April 2012, this product is offered in the following states: Alabama Arizona Arkansas Colorado Georgia Idaho Indiana Iowa Kansas Kentucky Louisiana Michigan Mississippi Missouri Montana Nebraska North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania South Carolina South Dakota Tennessee Texas Utah Virginia West Virginia Wisconsin Wyoming For agent use only. 6

UCT DVH Product State Availability As of April 2012, this product is offered in the following states: Alabama Arizona Arkansas Colorado Georgia Idaho Indiana Iowa Kansas Kentucky Louisiana Michigan Mississippi Missouri Montana Nebraska North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania South Carolina South Dakota Tennessee Texas Utah Virginia West Virginia Wisconsin Wyoming For agent use only. 6

DVH Policy Benefits Deductible - $0 or $100 policy year deductible Maximum Benefit – Applicants can choose between a $750, $1, 000, $1, 500 or $2, 000 policy year maximum at the time of application. Benefits – After the Policy Year Deductible is satisfied the policy pays the following percentages of reasonable and customary charges for covered expenses up to the policy year maximum*: – 60% - First Policy Year – 70% - Second Policy Year – 80% - Third Policy Year – 90% - Fourth Policy Year and thereafter * Ohio only – 65% - First Policy Year – 75% - Second Policy Year and thereafter For agent use only. 7

DVH Policy Benefits Deductible - $0 or $100 policy year deductible Maximum Benefit – Applicants can choose between a $750, $1, 000, $1, 500 or $2, 000 policy year maximum at the time of application. Benefits – After the Policy Year Deductible is satisfied the policy pays the following percentages of reasonable and customary charges for covered expenses up to the policy year maximum*: – 60% - First Policy Year – 70% - Second Policy Year – 80% - Third Policy Year – 90% - Fourth Policy Year and thereafter * Ohio only – 65% - First Policy Year – 75% - Second Policy Year and thereafter For agent use only. 7

DVH Policy Benefits continued Covered expenses, subject to the exceptions and limitations, are: Dental: – – Day One: X-Rays, fillings, and outpatient dental surgery prescribed as Medically Necessary. After a three month waiting period – One annual cleaning up to $75. After a six month waiting period – Root canals After a one year waiting period – Bridges, crowns, dentures, work relating to replacement of natural teeth missing on the Policy Effective Date, full mouth extractions and fluoride treatments. For agent use only. 8

DVH Policy Benefits continued Covered expenses, subject to the exceptions and limitations, are: Dental: – – Day One: X-Rays, fillings, and outpatient dental surgery prescribed as Medically Necessary. After a three month waiting period – One annual cleaning up to $75. After a six month waiting period – Root canals After a one year waiting period – Bridges, crowns, dentures, work relating to replacement of natural teeth missing on the Policy Effective Date, full mouth extractions and fluoride treatments. For agent use only. 8

DVH Policy Benefits Con’t. Vision: – – Day One – One annual basic eye examination or eye refraction, including the cost of first time eyeglasses or prescribed contact lenses After a six month waiting period – Repair or replacement of existing eyeglasses or contact lens (including the renewal or changing prescriptions) Hearing: – – Day One – Hearing examinations, including the cost of first time hearing aids and any necessary repairs. After a one year waiting period – Repair or replacement of existing hearing aids Exceptions & Limitations apply. See policy for full details. For agent use only. 9

DVH Policy Benefits Con’t. Vision: – – Day One – One annual basic eye examination or eye refraction, including the cost of first time eyeglasses or prescribed contact lenses After a six month waiting period – Repair or replacement of existing eyeglasses or contact lens (including the renewal or changing prescriptions) Hearing: – – Day One – Hearing examinations, including the cost of first time hearing aids and any necessary repairs. After a one year waiting period – Repair or replacement of existing hearing aids Exceptions & Limitations apply. See policy for full details. For agent use only. 9

Underwriting Process The underwriting process for the DVH policy is simple and straightforward: – The information that is captured at the time of application is used to determine how claims will be paid – Some benefits are excluded for the first 6 months – Some benefits are excluded for the first 12 months There is no personal health interview with the applicant Policy delivery receipts must be signed, dated and returned to the Home Office by the insured in the following states: Florida, Louisiana, North Carolina, Nebraska, and South Dakota. For agent use only. 10

Underwriting Process The underwriting process for the DVH policy is simple and straightforward: – The information that is captured at the time of application is used to determine how claims will be paid – Some benefits are excluded for the first 6 months – Some benefits are excluded for the first 12 months There is no personal health interview with the applicant Policy delivery receipts must be signed, dated and returned to the Home Office by the insured in the following states: Florida, Louisiana, North Carolina, Nebraska, and South Dakota. For agent use only. 10

Underwriting and EMSI We allow voice signatures to make the application process as easy as possible. You and your client may call EMSI at 1 -866 -685 -6602 to go through the voice signature process for the DVH application. – You’ll still need to send in a paper copy of the application with the agent signature, but we will accept a voice signature from the client. Note the EMSI case number on the application/application cover sheet so we know not to ask for the wet signature. EMSI will also get the bank information* so we can draft initial premium. No check copy will be required. * If the account holder is different than the applicant, he/she may need to complete the bank account piece of the interview or send the EFT authorization with a wet signature from the account holder. For agent use only. 11

Underwriting and EMSI We allow voice signatures to make the application process as easy as possible. You and your client may call EMSI at 1 -866 -685 -6602 to go through the voice signature process for the DVH application. – You’ll still need to send in a paper copy of the application with the agent signature, but we will accept a voice signature from the client. Note the EMSI case number on the application/application cover sheet so we know not to ask for the wet signature. EMSI will also get the bank information* so we can draft initial premium. No check copy will be required. * If the account holder is different than the applicant, he/she may need to complete the bank account piece of the interview or send the EFT authorization with a wet signature from the account holder. For agent use only. 11

Additional Information & Features Premium Rates Based on State of Issue – Premium rates are based on required state-by-state loss ratios. Most of the country will have the same rates; however, some states require higher loss ratios, which make lower premiums (and lower commissions) necessary. Policy Effective Date – The policy is not effective until it is approved by the Home Office. – However, upon approval by the Underwriting Department, the policy will become effective on the day of the fax or postmark date, unless a special effective date is requested by the applicant. Coordination of Benefits – This policy does not coordinate benefits with other policies. For agent use only. 12

Additional Information & Features Premium Rates Based on State of Issue – Premium rates are based on required state-by-state loss ratios. Most of the country will have the same rates; however, some states require higher loss ratios, which make lower premiums (and lower commissions) necessary. Policy Effective Date – The policy is not effective until it is approved by the Home Office. – However, upon approval by the Underwriting Department, the policy will become effective on the day of the fax or postmark date, unless a special effective date is requested by the applicant. Coordination of Benefits – This policy does not coordinate benefits with other policies. For agent use only. 12

Additional Information & Features continued Other features include: Guaranteed Renewable - Issue Ages: 18 - 84 Individually Issued - Policy Fee: No Optional Benefit Riders: None Premiums – Issue Age Rates with Household Discount (in most states) Premium Modes: • Automatic Bank Withdrawal - Monthly • Direct Bill – Annual, Semi-Annual, Quarterly, List Bill for Work Site • We do not accept credit cards or debit cards – Initial Premium – The initial premium can be drafted from the insured’s checking account. – Rate Guarantee – This policy does not have a rate guarantee. If an increase is necessary, we can change the premium only if we do the same to all policies of this form issued to persons of the same class. Class means the factors of age, gender, underwriting class and geographic area in the state of residence that determined the premium rate when coverage was issued. – – – For agent use only. 13

Additional Information & Features continued Other features include: Guaranteed Renewable - Issue Ages: 18 - 84 Individually Issued - Policy Fee: No Optional Benefit Riders: None Premiums – Issue Age Rates with Household Discount (in most states) Premium Modes: • Automatic Bank Withdrawal - Monthly • Direct Bill – Annual, Semi-Annual, Quarterly, List Bill for Work Site • We do not accept credit cards or debit cards – Initial Premium – The initial premium can be drafted from the insured’s checking account. – Rate Guarantee – This policy does not have a rate guarantee. If an increase is necessary, we can change the premium only if we do the same to all policies of this form issued to persons of the same class. Class means the factors of age, gender, underwriting class and geographic area in the state of residence that determined the premium rate when coverage was issued. – – – For agent use only. 13

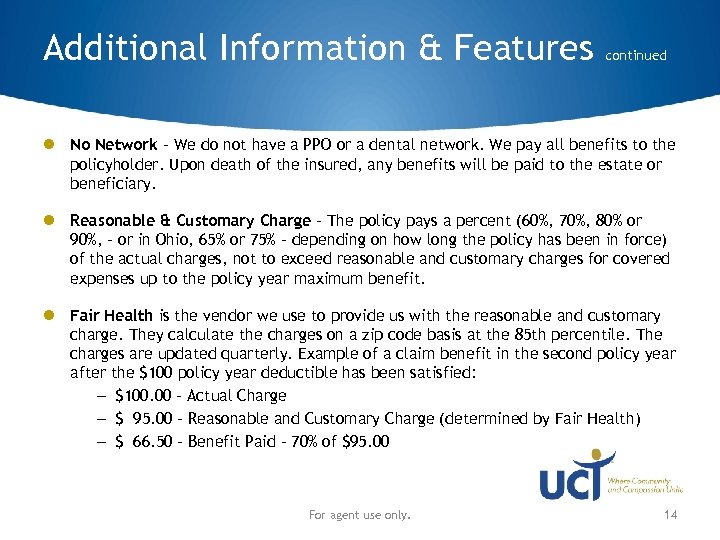

Additional Information & Features continued No Network – We do not have a PPO or a dental network. We pay all benefits to the policyholder. Upon death of the insured, any benefits will be paid to the estate or beneficiary. Reasonable & Customary Charge – The policy pays a percent (60%, 70%, 80% or 90%, - or in Ohio, 65% or 75% - depending on how long the policy has been in force) of the actual charges, not to exceed reasonable and customary charges for covered expenses up to the policy year maximum benefit. Fair Health is the vendor we use to provide us with the reasonable and customary charge. They calculate the charges on a zip code basis at the 85 th percentile. The charges are updated quarterly. Example of a claim benefit in the second policy year after the $100 policy year deductible has been satisfied: – $100. 00 – Actual Charge – $ 95. 00 – Reasonable and Customary Charge (determined by Fair Health) – $ 66. 50 – Benefit Paid – 70% of $95. 00 For agent use only. 14

Additional Information & Features continued No Network – We do not have a PPO or a dental network. We pay all benefits to the policyholder. Upon death of the insured, any benefits will be paid to the estate or beneficiary. Reasonable & Customary Charge – The policy pays a percent (60%, 70%, 80% or 90%, - or in Ohio, 65% or 75% - depending on how long the policy has been in force) of the actual charges, not to exceed reasonable and customary charges for covered expenses up to the policy year maximum benefit. Fair Health is the vendor we use to provide us with the reasonable and customary charge. They calculate the charges on a zip code basis at the 85 th percentile. The charges are updated quarterly. Example of a claim benefit in the second policy year after the $100 policy year deductible has been satisfied: – $100. 00 – Actual Charge – $ 95. 00 – Reasonable and Customary Charge (determined by Fair Health) – $ 66. 50 – Benefit Paid – 70% of $95. 00 For agent use only. 14

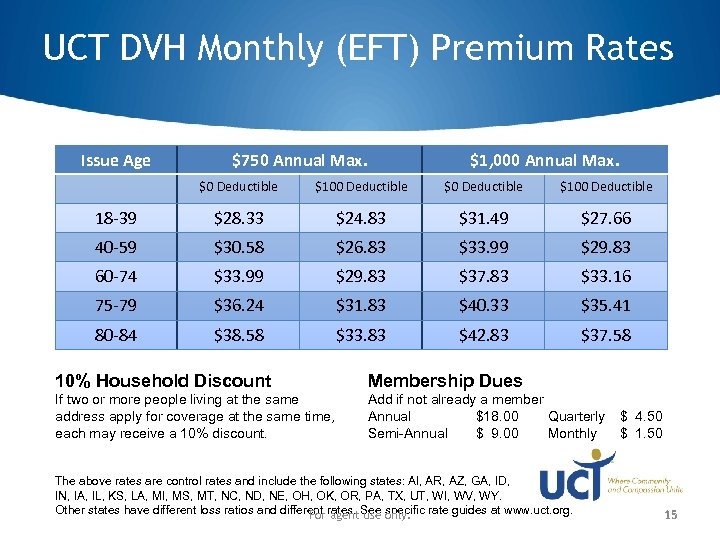

UCT DVH Monthly (EFT) Premium Rates Issue Age $750 Annual Max. $1, 000 Annual Max. $0 Deductible $100 Deductible 18 -39 $28. 33 $24. 83 $31. 49 $27. 66 40 -59 $30. 58 $26. 83 $33. 99 $29. 83 60 -74 $33. 99 $29. 83 $37. 83 $33. 16 75 -79 $36. 24 $31. 83 $40. 33 $35. 41 80 -84 $38. 58 $33. 83 $42. 83 $37. 58 10% Household Discount Membership Dues If two or more people living at the same address apply for coverage at the same time, each may receive a 10% discount. Add if not already a member Annual $18. 00 Quarterly Semi-Annual $ 9. 00 Monthly The above rates are control rates and include the following states: Al, AR, AZ, GA, ID, IN, IA, IL, KS, LA, MI, MS, MT, NC, ND, NE, OH, OK, OR, PA, TX, UT, WI, WV, WY. Other states have different loss ratios and different rates. See only. rate guides at www. uct. org. For agent use specific $ 4. 50 $ 1. 50 15

UCT DVH Monthly (EFT) Premium Rates Issue Age $750 Annual Max. $1, 000 Annual Max. $0 Deductible $100 Deductible 18 -39 $28. 33 $24. 83 $31. 49 $27. 66 40 -59 $30. 58 $26. 83 $33. 99 $29. 83 60 -74 $33. 99 $29. 83 $37. 83 $33. 16 75 -79 $36. 24 $31. 83 $40. 33 $35. 41 80 -84 $38. 58 $33. 83 $42. 83 $37. 58 10% Household Discount Membership Dues If two or more people living at the same address apply for coverage at the same time, each may receive a 10% discount. Add if not already a member Annual $18. 00 Quarterly Semi-Annual $ 9. 00 Monthly The above rates are control rates and include the following states: Al, AR, AZ, GA, ID, IN, IA, IL, KS, LA, MI, MS, MT, NC, ND, NE, OH, OK, OR, PA, TX, UT, WI, WV, WY. Other states have different loss ratios and different rates. See only. rate guides at www. uct. org. For agent use specific $ 4. 50 $ 1. 50 15

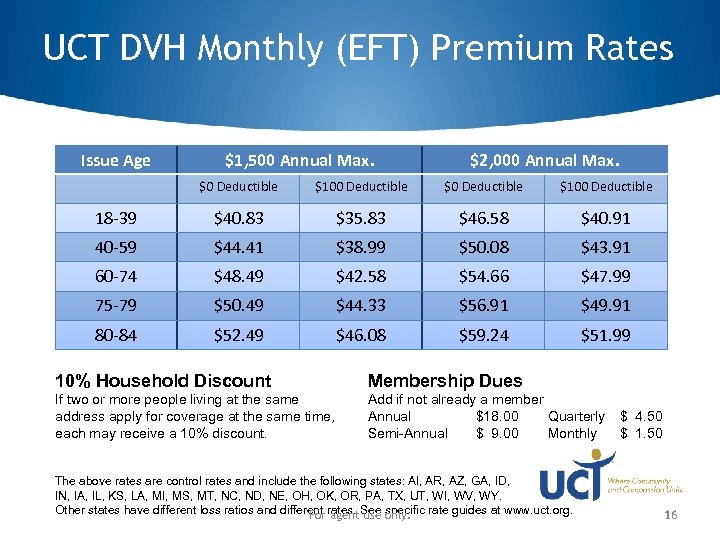

UCT DVH Monthly (EFT) Premium Rates Issue Age $1, 500 Annual Max. $2, 000 Annual Max. $0 Deductible $100 Deductible 18 -39 $40. 83 $35. 83 $46. 58 $40. 91 40 -59 $44. 41 $38. 99 $50. 08 $43. 91 60 -74 $48. 49 $42. 58 $54. 66 $47. 99 75 -79 $50. 49 $44. 33 $56. 91 $49. 91 80 -84 $52. 49 $46. 08 $59. 24 $51. 99 10% Household Discount Membership Dues If two or more people living at the same address apply for coverage at the same time, each may receive a 10% discount. Add if not already a member Annual $18. 00 Quarterly Semi-Annual $ 9. 00 Monthly The above rates are control rates and include the following states: Al, AR, AZ, GA, ID, IN, IA, IL, KS, LA, MI, MS, MT, NC, ND, NE, OH, OK, OR, PA, TX, UT, WI, WV, WY. Other states have different loss ratios and different rates. See only. rate guides at www. uct. org. For agent use specific $ 4. 50 $ 1. 50 16

UCT DVH Monthly (EFT) Premium Rates Issue Age $1, 500 Annual Max. $2, 000 Annual Max. $0 Deductible $100 Deductible 18 -39 $40. 83 $35. 83 $46. 58 $40. 91 40 -59 $44. 41 $38. 99 $50. 08 $43. 91 60 -74 $48. 49 $42. 58 $54. 66 $47. 99 75 -79 $50. 49 $44. 33 $56. 91 $49. 91 80 -84 $52. 49 $46. 08 $59. 24 $51. 99 10% Household Discount Membership Dues If two or more people living at the same address apply for coverage at the same time, each may receive a 10% discount. Add if not already a member Annual $18. 00 Quarterly Semi-Annual $ 9. 00 Monthly The above rates are control rates and include the following states: Al, AR, AZ, GA, ID, IN, IA, IL, KS, LA, MI, MS, MT, NC, ND, NE, OH, OK, OR, PA, TX, UT, WI, WV, WY. Other states have different loss ratios and different rates. See only. rate guides at www. uct. org. For agent use specific $ 4. 50 $ 1. 50 16

Submitting New Business Several options are available: – UPLOAD: Upload an application (PDF): • • Log on to the Agents area of UCT’s website (www. uct. org) Click on “On-line application submission” Click on “Application Upload” Browse files, select correct file, hit “Upload the File” to the site – FAX: • Toll Free: 1 -800 -948 -1039 – MAIL TO: UCT 1801 Watermark Drive, Suite 100 Columbus, OH 43215 Note: An application cover sheet should be included with all applications. For agent use only. 17

Submitting New Business Several options are available: – UPLOAD: Upload an application (PDF): • • Log on to the Agents area of UCT’s website (www. uct. org) Click on “On-line application submission” Click on “Application Upload” Browse files, select correct file, hit “Upload the File” to the site – FAX: • Toll Free: 1 -800 -948 -1039 – MAIL TO: UCT 1801 Watermark Drive, Suite 100 Columbus, OH 43215 Note: An application cover sheet should be included with all applications. For agent use only. 17

Marketing Supplies & Support Application Kit: The application kit includes all forms necessary to write and submit an application, except the replacement form. The replacement form is available on our website or through the Supply Department if needed. PDF forms are available for download on the Agents area of our website. Applications, rate sheets, brochures and additional materials can also be ordered online or by calling 1 -800 -848 -1124, ext. 147. Advertising materials: Camera-ready artwork for postcards, flyers, direct mail pieces and newspaper ads that have been approved for use in the states in which we do business are available. Contact the Public Relations Department at lfisher@uct. org or at 1 -800848 -1124, ext. 130 for information. For agent use only. 18

Marketing Supplies & Support Application Kit: The application kit includes all forms necessary to write and submit an application, except the replacement form. The replacement form is available on our website or through the Supply Department if needed. PDF forms are available for download on the Agents area of our website. Applications, rate sheets, brochures and additional materials can also be ordered online or by calling 1 -800 -848 -1124, ext. 147. Advertising materials: Camera-ready artwork for postcards, flyers, direct mail pieces and newspaper ads that have been approved for use in the states in which we do business are available. Contact the Public Relations Department at lfisher@uct. org or at 1 -800848 -1124, ext. 130 for information. For agent use only. 18

Customer/Client Services Our Customer Service Department provides exceptional and professional service: – Dedicated numbers • Policyholders: • Providers: • FAX number to Submit claims: 1 -800 -848 -0123, Ext. 300 1 -800 -848 -0123, Ext. 302 1 -614 -487 -9603 – Dedicated customer service email addresses: customerservice@uct. org or claimservices@uct. org Claims mailing address: 1801 Watermark Drive, Suite 100 P. O. Box 159019 Columbus, OH 43215 For agent use only. 19

Customer/Client Services Our Customer Service Department provides exceptional and professional service: – Dedicated numbers • Policyholders: • Providers: • FAX number to Submit claims: 1 -800 -848 -0123, Ext. 300 1 -800 -848 -0123, Ext. 302 1 -614 -487 -9603 – Dedicated customer service email addresses: customerservice@uct. org or claimservices@uct. org Claims mailing address: 1801 Watermark Drive, Suite 100 P. O. Box 159019 Columbus, OH 43215 For agent use only. 19

We’re here to help you! Useful tools for Agents Dedicated website for Agents – Newly revised for easier access to forms, applications and other documents – – – Agent newsletter New product updates State specific forms Agent Field Guide Calculators Useful phone numbers and contact information For agent use only. 20

We’re here to help you! Useful tools for Agents Dedicated website for Agents – Newly revised for easier access to forms, applications and other documents – – – Agent newsletter New product updates State specific forms Agent Field Guide Calculators Useful phone numbers and contact information For agent use only. 20

We’re here to help you! Useful tools for Agents Agent Services Department – available to answer your questions, – 8 a. m. – 5 p. m. , Monday-Friday (EST). CONTACT INFORMATION Phone: 1 -800 -848 -1124, Ext. 304 Fax: 614 -487 -9664 Email: agentservices@uct. org For agent use only. 21

We’re here to help you! Useful tools for Agents Agent Services Department – available to answer your questions, – 8 a. m. – 5 p. m. , Monday-Friday (EST). CONTACT INFORMATION Phone: 1 -800 -848 -1124, Ext. 304 Fax: 614 -487 -9664 Email: agentservices@uct. org For agent use only. 21

Thank you for your attention For more information, contact Questions? Agent Services Department Phone: 1 -800 -848 -1124, Ext. 304 Email: agentservices@uct. org. www. uct. org For agent use only. 22

Thank you for your attention For more information, contact Questions? Agent Services Department Phone: 1 -800 -848 -1124, Ext. 304 Email: agentservices@uct. org. www. uct. org For agent use only. 22