7d963f8674e638b972450c3215d58212.ppt

- Количество слайдов: 52

Den Danske Finansanalytikerforening Dalhoff Larsen & Horneman A/S 3. juni 2008 Jørgen Møller-Rasmussen, CEO Claus Mejlby Nielsen, Vice President Treasury & IR

Den Danske Finansanalytikerforening Dalhoff Larsen & Horneman A/S 3. juni 2008 Jørgen Møller-Rasmussen, CEO Claus Mejlby Nielsen, Vice President Treasury & IR

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 2

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 2

CONTENTS • General presentation • Q 1 2008, Group 3 12 • Outlook 200818 • Renewed strategy 22 • Renewed financial goals • M&A activities 27 30 3

CONTENTS • General presentation • Q 1 2008, Group 3 12 • Outlook 200818 • Renewed strategy 22 • Renewed financial goals • M&A activities 27 30 3

IN SHORT One of the world’s major timber wholesalers • Forecast group revenues of DKK 5. 7 billion in 2008 • Largest producer of sustainable tropical hardwood in Africa • Sales and procurement offices, warehouses and processing facilities in 31 countries on 5 continents • Approx. 3, 600 employees • >85% of DLH’s revenues are • Listed in Copenhagen generated outside Denmark since 1986 • Strategic focus on international B 2 B timber trade after • Market cap DKK 1. 4 billion (EUR 175 million) divestiture of building- materials-chain in DK to Saint -Gobain 4

IN SHORT One of the world’s major timber wholesalers • Forecast group revenues of DKK 5. 7 billion in 2008 • Largest producer of sustainable tropical hardwood in Africa • Sales and procurement offices, warehouses and processing facilities in 31 countries on 5 continents • Approx. 3, 600 employees • >85% of DLH’s revenues are • Listed in Copenhagen generated outside Denmark since 1986 • Strategic focus on international B 2 B timber trade after • Market cap DKK 1. 4 billion (EUR 175 million) divestiture of building- materials-chain in DK to Saint -Gobain 4

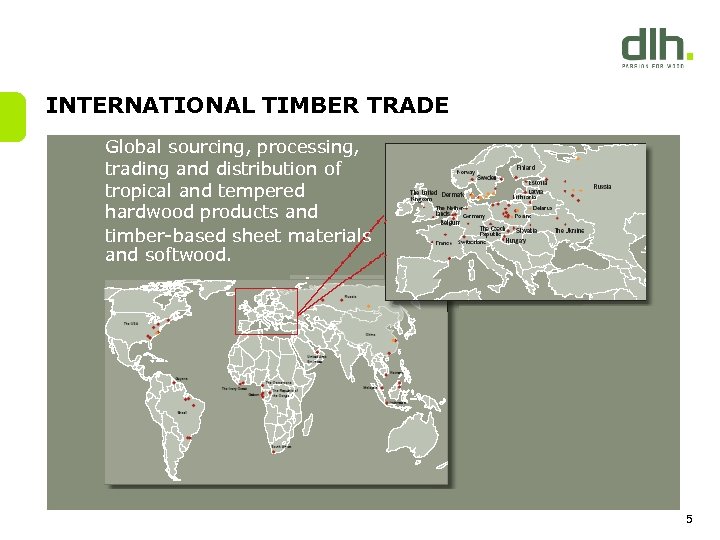

INTERNATIONAL TIMBER TRADE Global sourcing, processing, trading and distribution of tropical and tempered hardwood products and timber-based sheet materials and softwood. 5

INTERNATIONAL TIMBER TRADE Global sourcing, processing, trading and distribution of tropical and tempered hardwood products and timber-based sheet materials and softwood. 5

FROM THE FOREST TO THE END-USER X 6

FROM THE FOREST TO THE END-USER X 6

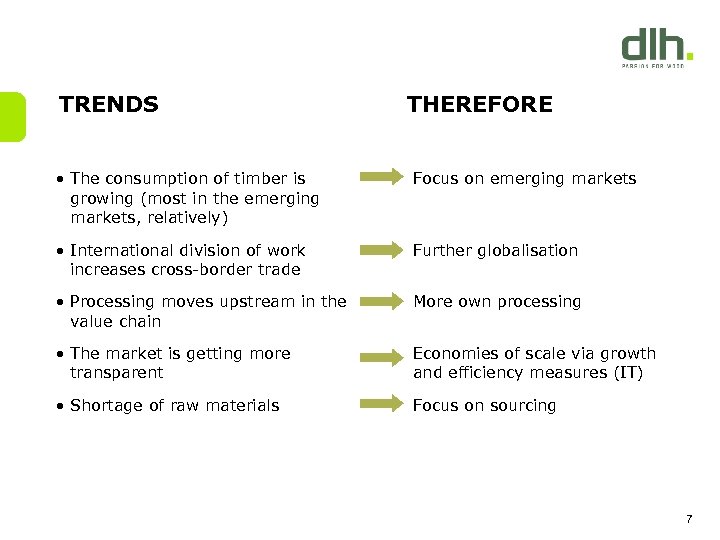

TRENDS THEREFORE • The consumption of timber is growing (most in the emerging markets, relatively) Focus on emerging markets • International division of work increases cross-border trade Further globalisation • Processing moves upstream in the value chain More own processing • The market is getting more transparent Economies of scale via growth and efficiency measures (IT) • Shortage of raw materials Focus on sourcing 7

TRENDS THEREFORE • The consumption of timber is growing (most in the emerging markets, relatively) Focus on emerging markets • International division of work increases cross-border trade Further globalisation • Processing moves upstream in the value chain More own processing • The market is getting more transparent Economies of scale via growth and efficiency measures (IT) • Shortage of raw materials Focus on sourcing 7

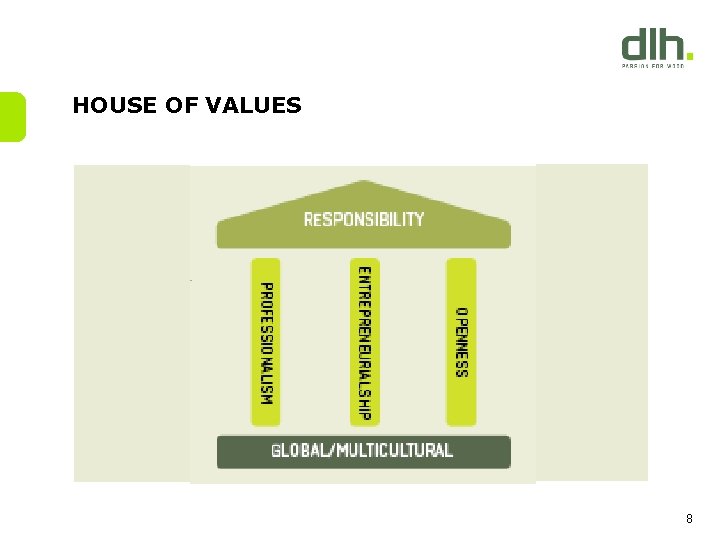

HOUSE OF VALUES 8

HOUSE OF VALUES 8

CORPORATE SOCIAL RESPONSIBILITY (CSR) Environment ∙ Human rights ∙ Social responsibility • Good Supplier Program • Enhanced efforts to introduce sustainability in the DLH Group’s businesses • Now the worlds largest supplier of certified tropical hardwood • Dialogue and cooperation for human rights 9

CORPORATE SOCIAL RESPONSIBILITY (CSR) Environment ∙ Human rights ∙ Social responsibility • Good Supplier Program • Enhanced efforts to introduce sustainability in the DLH Group’s businesses • Now the worlds largest supplier of certified tropical hardwood • Dialogue and cooperation for human rights 9

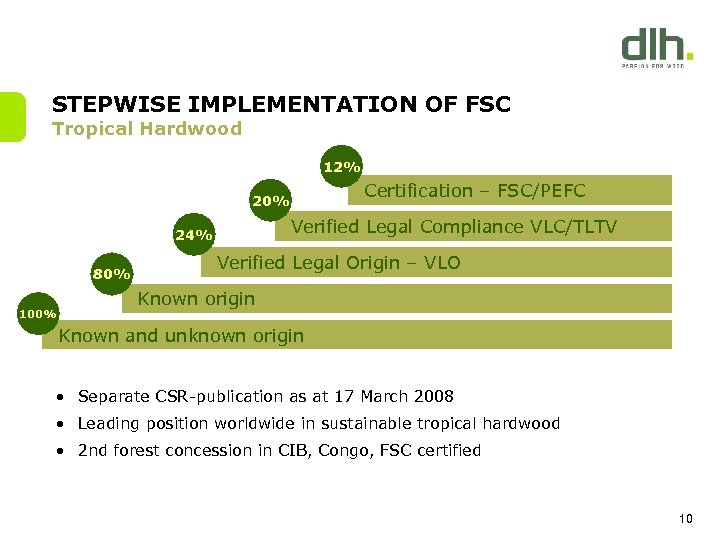

STEPWISE IMPLEMENTATION OF FSC Tropical Hardwood 12% Certification – FSC/PEFC 20% Verified Legal Compliance VLC/TLTV 24% 80% 100% Verified Legal Origin – VLO Known origin Known and unknown origin • Separate CSR-publication as at 17 March 2008 • Leading position worldwide in sustainable tropical hardwood • 2 nd forest concession in CIB, Congo, FSC certified 10

STEPWISE IMPLEMENTATION OF FSC Tropical Hardwood 12% Certification – FSC/PEFC 20% Verified Legal Compliance VLC/TLTV 24% 80% 100% Verified Legal Origin – VLO Known origin Known and unknown origin • Separate CSR-publication as at 17 March 2008 • Leading position worldwide in sustainable tropical hardwood • 2 nd forest concession in CIB, Congo, FSC certified 10

DIVIDEND AND SHARE BUY-BACK DKK/share of DKK 10 Share buy-back programme • Launched 26 May 2008 • Up to DKK 100 million (7% of B-cap. ) • ”Safe-harbour”-method • Ends 1 March 2009 • At a later stage DLH can issue new shares in connection with major acquisitions Financial year 11

DIVIDEND AND SHARE BUY-BACK DKK/share of DKK 10 Share buy-back programme • Launched 26 May 2008 • Up to DKK 100 million (7% of B-cap. ) • ”Safe-harbour”-method • Ends 1 March 2009 • At a later stage DLH can issue new shares in connection with major acquisitions Financial year 11

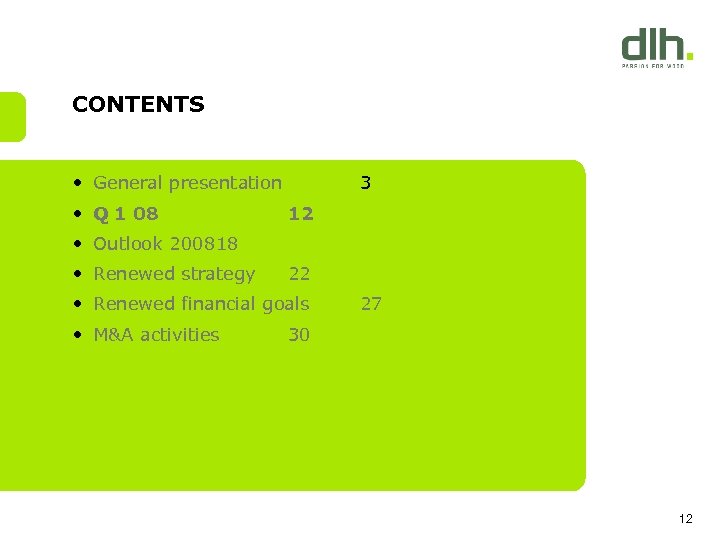

CONTENTS • General presentation • Q 1 08 3 12 • Outlook 200818 • Renewed strategy 22 • Renewed financial goals • M&A activities 27 30 12

CONTENTS • General presentation • Q 1 08 3 12 • Outlook 200818 • Renewed strategy 22 • Renewed financial goals • M&A activities 27 30 12

GROUP INCOME STATEMENT DKK million Revenue (continuing operations) Gross profit Gross margin Costs EBIT Q 1 2008 Q 1 2007 1, 361 1, 443 223 262 16. 4% 18. 1% 195 194 28 68 2. 1% 4. 7% Profit before tax 3 46 Profit after tax (continuing operations) 2 31 Profit after tax of discontinued operations 580 7 Profit after tax 582 38 EBIT margin 13

GROUP INCOME STATEMENT DKK million Revenue (continuing operations) Gross profit Gross margin Costs EBIT Q 1 2008 Q 1 2007 1, 361 1, 443 223 262 16. 4% 18. 1% 195 194 28 68 2. 1% 4. 7% Profit before tax 3 46 Profit after tax (continuing operations) 2 31 Profit after tax of discontinued operations 580 7 Profit after tax 582 38 EBIT margin 13

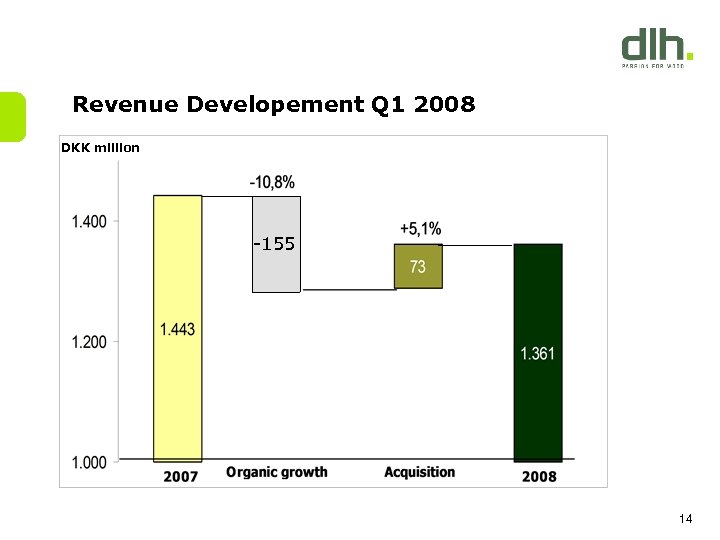

Revenue Developement Q 1 2008 DKK million -155 14

Revenue Developement Q 1 2008 DKK million -155 14

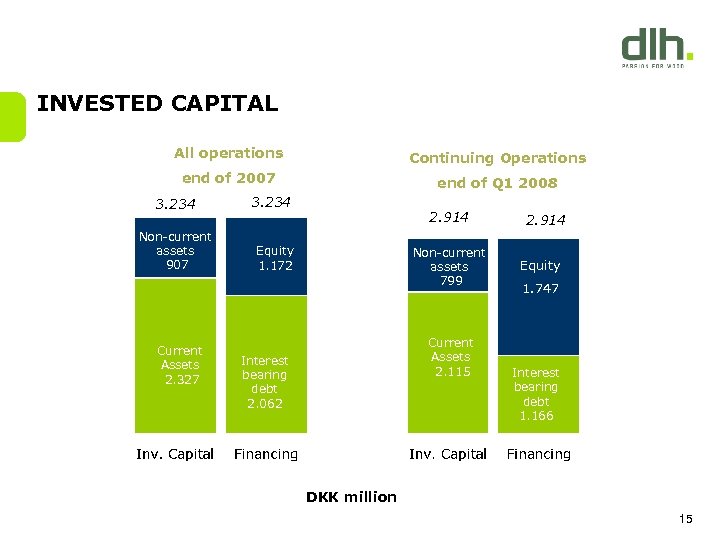

INVESTED CAPITAL All operations Continuing Operations end of 2007 end of Q 1 2008 3. 234 2. 914 Anlægsaktiver Non-current assets 907 729 Egenkapital Equity 1. 172 Non-current assets 799 1. 068 Equity Nettoomsætnings. Current Interest Assets aktiver bearing 2. 327 2. 914 1. 747 Current Assets 2. 115 Interest bearing debt 1. 166 debt 2. 143 2. 062 DKK million 15

INVESTED CAPITAL All operations Continuing Operations end of 2007 end of Q 1 2008 3. 234 2. 914 Anlægsaktiver Non-current assets 907 729 Egenkapital Equity 1. 172 Non-current assets 799 1. 068 Equity Nettoomsætnings. Current Interest Assets aktiver bearing 2. 327 2. 914 1. 747 Current Assets 2. 115 Interest bearing debt 1. 166 debt 2. 143 2. 062 DKK million 15

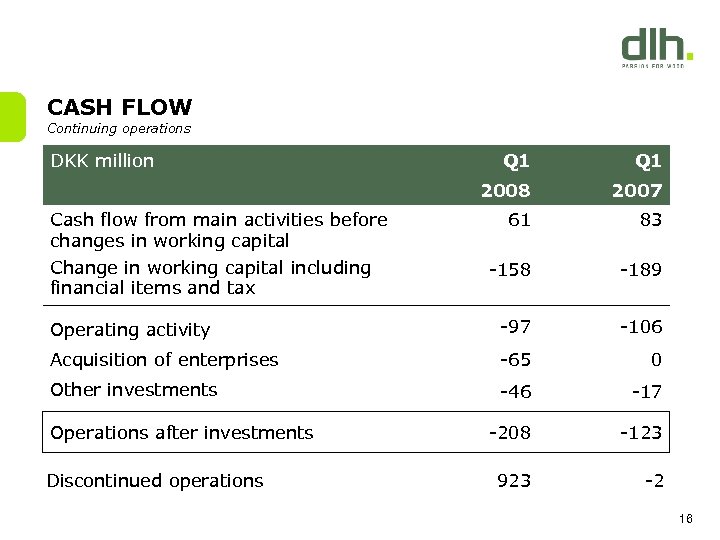

CASH FLOW Continuing operations DKK million Q 1 2008 2007 61 83 -158 -189 Operating activity -97 -106 Acquisition of enterprises -65 0 Other investments -46 -17 -208 -123 923 -2 Cash flow from main activities before changes in working capital Change in working capital including financial items and tax Operations after investments Discontinued operations 16

CASH FLOW Continuing operations DKK million Q 1 2008 2007 61 83 -158 -189 Operating activity -97 -106 Acquisition of enterprises -65 0 Other investments -46 -17 -208 -123 923 -2 Cash flow from main activities before changes in working capital Change in working capital including financial items and tax Operations after investments Discontinued operations 16

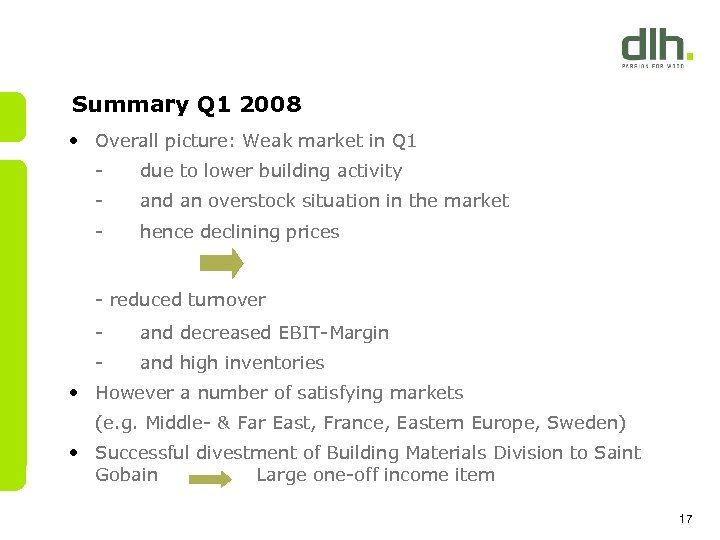

Summary Q 1 2008 • Overall picture: Weak market in Q 1 - due to lower building activity - and an overstock situation in the market - hence declining prices - reduced turnover - and decreased EBIT-Margin - and high inventories • However a number of satisfying markets (e. g. Middle- & Far East, France, Eastern Europe, Sweden) • Successful divestment of Building Materials Division to Saint Gobain Large one-off income item 17

Summary Q 1 2008 • Overall picture: Weak market in Q 1 - due to lower building activity - and an overstock situation in the market - hence declining prices - reduced turnover - and decreased EBIT-Margin - and high inventories • However a number of satisfying markets (e. g. Middle- & Far East, France, Eastern Europe, Sweden) • Successful divestment of Building Materials Division to Saint Gobain Large one-off income item 17

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 18

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 18

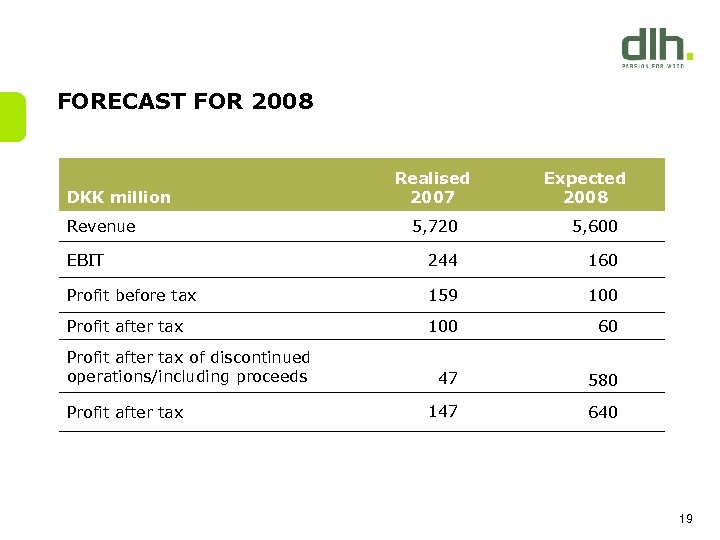

FORECAST FOR 2008 Realised 2007 DKK million Revenue Expected 2008 5, 720 5, 600 EBIT 244 160 Profit before tax 159 100 Profit after tax 100 60 47 580 147 640 Profit after tax of discontinued operations/including proceeds Profit after tax 19

FORECAST FOR 2008 Realised 2007 DKK million Revenue Expected 2008 5, 720 5, 600 EBIT 244 160 Profit before tax 159 100 Profit after tax 100 60 47 580 147 640 Profit after tax of discontinued operations/including proceeds Profit after tax 19

PROFIT BEFORE TAX DKK million 580 20

PROFIT BEFORE TAX DKK million 580 20

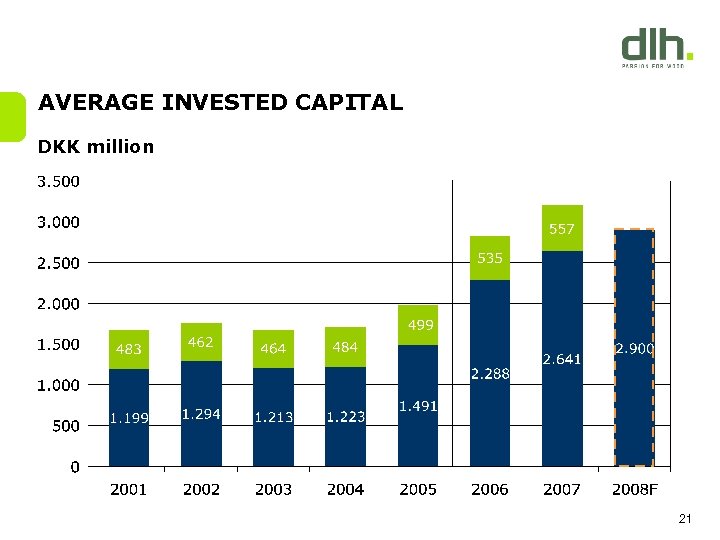

AVERAGE INVESTED CAPITAL DKK million 21

AVERAGE INVESTED CAPITAL DKK million 21

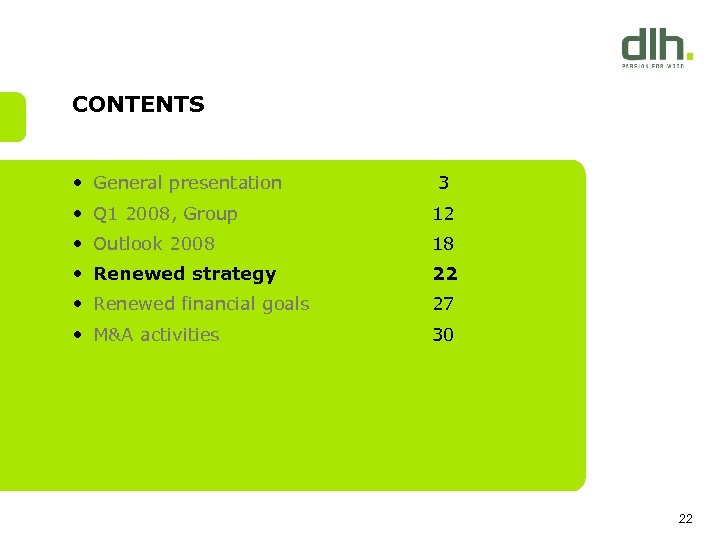

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 22

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 22

EQUITY STORY • Industry with growth potential • Strong business concept • Strong environmental profile • Considerable economies of scale • Structural opportunities 23

EQUITY STORY • Industry with growth potential • Strong business concept • Strong environmental profile • Considerable economies of scale • Structural opportunities 23

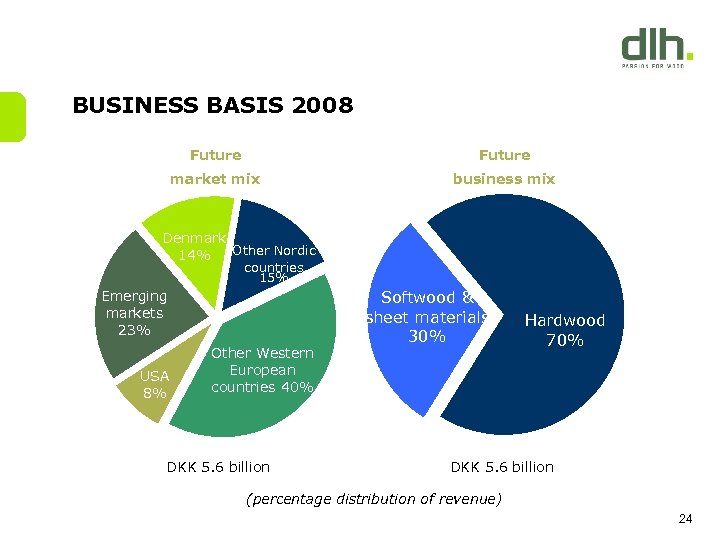

BUSINESS BASIS 2008 Future market mix business mix Denmark Other Nordic 14% countries 15% Emerging Byggemarkets materialer 23% Other Western USA 8% Softwood & Byggesheet materials materialer Hardwood 30% 70% 23% European countries 40% Træ & plade 18% DKK 5. 6 billion (percentage distribution of revenue) 24

BUSINESS BASIS 2008 Future market mix business mix Denmark Other Nordic 14% countries 15% Emerging Byggemarkets materialer 23% Other Western USA 8% Softwood & Byggesheet materials materialer Hardwood 30% 70% 23% European countries 40% Træ & plade 18% DKK 5. 6 billion (percentage distribution of revenue) 24

RENEWED STRATEGY The new DLH – one of the world’s leading timber wholesalers • Full focus on the international B 2 B trade with timber and timber products • Strengthened efforts to implement sustainability in DLH group units • Rapidly proceeding towards a market position as the world’s leading supplier of certified tropical hardwood • Strategic extension of the value chain: ”From forest to end user” • Enlarged security of supply in the long term 25

RENEWED STRATEGY The new DLH – one of the world’s leading timber wholesalers • Full focus on the international B 2 B trade with timber and timber products • Strengthened efforts to implement sustainability in DLH group units • Rapidly proceeding towards a market position as the world’s leading supplier of certified tropical hardwood • Strategic extension of the value chain: ”From forest to end user” • Enlarged security of supply in the long term 25

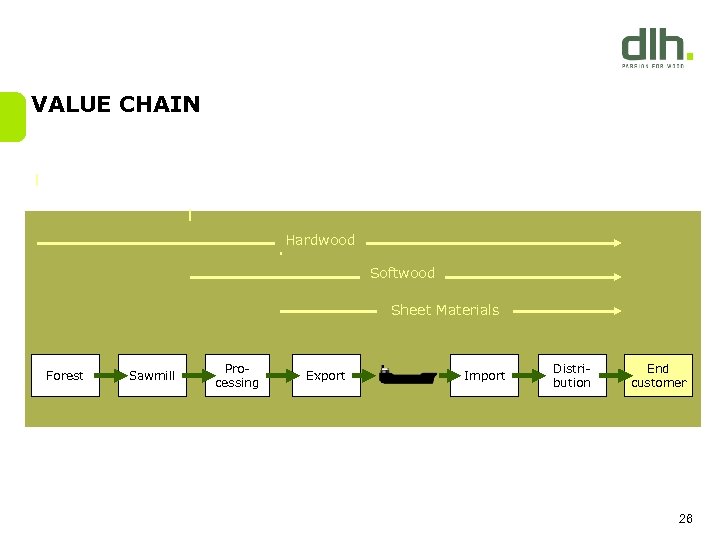

VALUE CHAIN Hardwood Softwood Sheet Materials Forest Sawmill Processing Export Import Distribution End customer 26

VALUE CHAIN Hardwood Softwood Sheet Materials Forest Sawmill Processing Export Import Distribution End customer 26

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 27

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 27

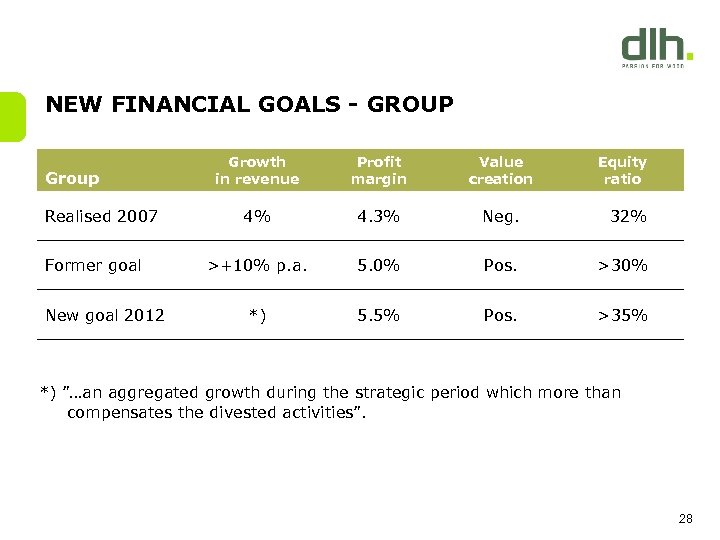

NEW FINANCIAL GOALS - GROUP Group Realised 2007 Former goal New goal 2012 Growth in revenue Profit margin Value creation Equity ratio 4% 4. 3% Neg. 32% >+10% p. a. 5. 0% Pos. >30% *) 5. 5% Pos. >35% *) ”…an aggregated growth during the strategic period which more than compensates the divested activities”. 28

NEW FINANCIAL GOALS - GROUP Group Realised 2007 Former goal New goal 2012 Growth in revenue Profit margin Value creation Equity ratio 4% 4. 3% Neg. 32% >+10% p. a. 5. 0% Pos. >30% *) 5. 5% Pos. >35% *) ”…an aggregated growth during the strategic period which more than compensates the divested activities”. 28

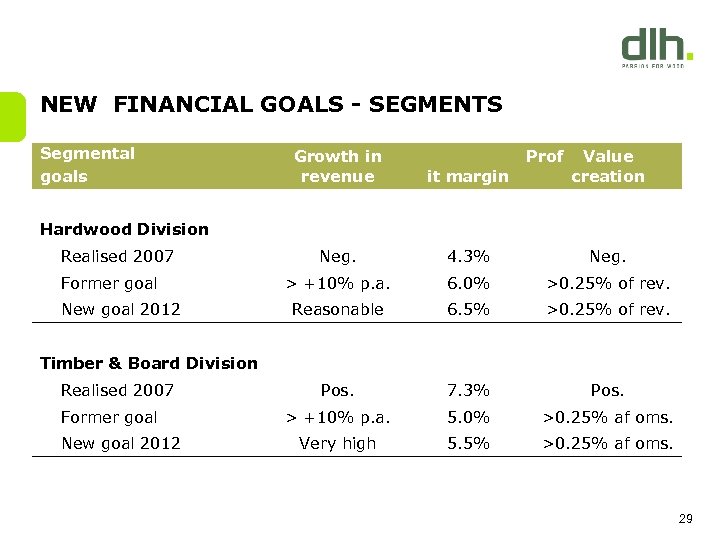

NEW FINANCIAL GOALS - SEGMENTS Segmental goals Growth in revenue Prof Value creation it margin Neg. 4. 3% Neg. > +10% p. a. 6. 0% >0. 25% of rev. Reasonable 6. 5% >0. 25% of rev. Pos. 7. 3% Pos. > +10% p. a. 5. 0% >0. 25% af oms. Very high 5. 5% >0. 25% af oms. Hardwood Division Realised 2007 Former goal New goal 2012 Timber & Board Division Realised 2007 Former goal New goal 2012 29

NEW FINANCIAL GOALS - SEGMENTS Segmental goals Growth in revenue Prof Value creation it margin Neg. 4. 3% Neg. > +10% p. a. 6. 0% >0. 25% of rev. Reasonable 6. 5% >0. 25% of rev. Pos. 7. 3% Pos. > +10% p. a. 5. 0% >0. 25% af oms. Very high 5. 5% >0. 25% af oms. Hardwood Division Realised 2007 Former goal New goal 2012 Timber & Board Division Realised 2007 Former goal New goal 2012 29

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 30

CONTENTS • General presentation 3 • Q 1 2008, Group 12 • Outlook 2008 18 • Renewed strategy 22 • Renewed financial goals 27 • M&A activities 30 30

M&A • Acquisition candidates in a fragmented market • Multiples based on EVA approach • New share capital will only be issued to finance specific acquisitions 31

M&A • Acquisition candidates in a fragmented market • Multiples based on EVA approach • New share capital will only be issued to finance specific acquisitions 31

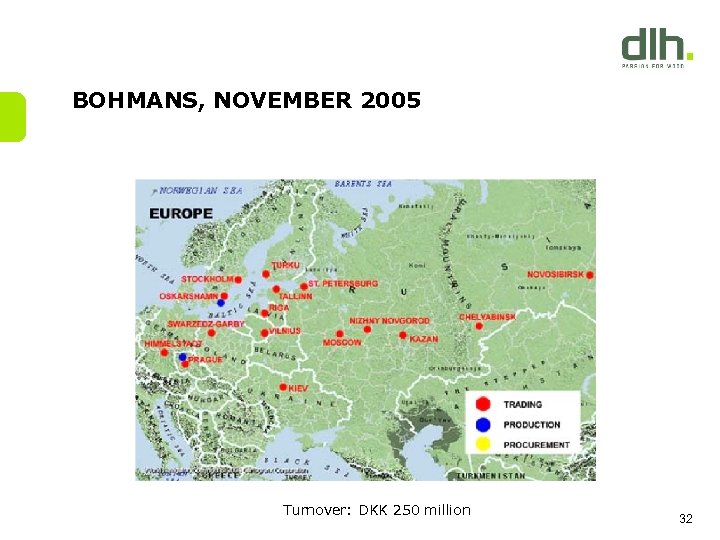

BOHMANS, NOVEMBER 2005 Turnover: DKK 250 million 32

BOHMANS, NOVEMBER 2005 Turnover: DKK 250 million 32

TT TIMBER GROUP, JANUARY 2006 Turnover: DKK 1. 300 million 33

TT TIMBER GROUP, JANUARY 2006 Turnover: DKK 1. 300 million 33

LJUNGBERGS, SEPTEMBER 2006 Turnover: DKK 300 million 34

LJUNGBERGS, SEPTEMBER 2006 Turnover: DKK 300 million 34

OLLE ZETTERGREN, JULY 2007 Turnover: DKK 80 million 35

OLLE ZETTERGREN, JULY 2007 Turnover: DKK 80 million 35

HUSTVEDT-GRUPPEN, AUGUST 2007 Turnover: DKK 140 million 36

HUSTVEDT-GRUPPEN, AUGUST 2007 Turnover: DKK 140 million 36

PALMA, FEBRUARY 2008 Turnover: DKK 100 million 37

PALMA, FEBRUARY 2008 Turnover: DKK 100 million 37

PUUKESKUS OY, May 2008 Hardwood activities only 38

PUUKESKUS OY, May 2008 Hardwood activities only 38

FURTHER INFORMATION • Stock Brokers monitoring DLH • Danske Equities, Copenhagen • Nordea, Copenhagen • Kaupthing Bank, Copenhagen • Website (incl. investor presentations): www. dlh-group. com • IR-contact: cmn@dlh-group. com 39

FURTHER INFORMATION • Stock Brokers monitoring DLH • Danske Equities, Copenhagen • Nordea, Copenhagen • Kaupthing Bank, Copenhagen • Website (incl. investor presentations): www. dlh-group. com • IR-contact: cmn@dlh-group. com 39

www. dlh-group. com 40

www. dlh-group. com 40

COMPETITION • No similar worldwide competitors • Regional players e. g. • Tradelink (Brazil Europe, US) • Denker (SEA NL, Germany) • Rougier (Africa France) • Danzer (Africa Germany etc. ) • Large customers having own procurement organisation • Large producers having own sales agents. 41

COMPETITION • No similar worldwide competitors • Regional players e. g. • Tradelink (Brazil Europe, US) • Denker (SEA NL, Germany) • Rougier (Africa France) • Danzer (Africa Germany etc. ) • Large customers having own procurement organisation • Large producers having own sales agents. 41

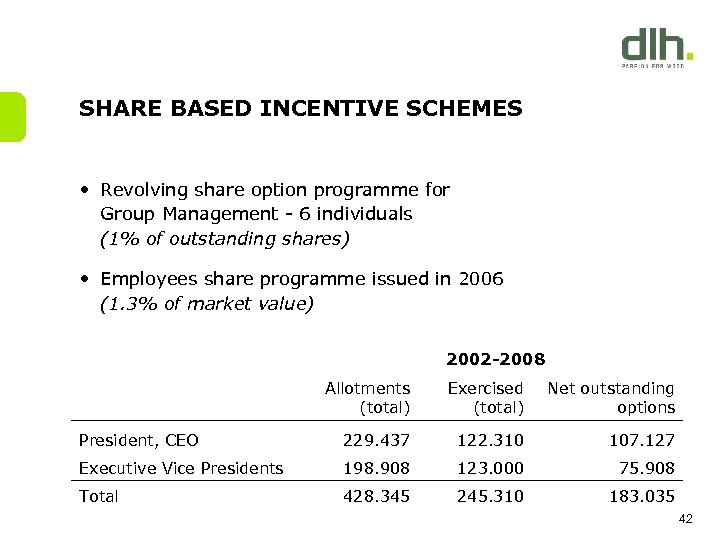

SHARE BASED INCENTIVE SCHEMES • Revolving share option programme for Group Management - 6 individuals (1% of outstanding shares) • Employees share programme issued in 2006 (1. 3% of market value) 2002 -2008 Allotments (total) Exercised (total) Net outstanding options President, CEO 229. 437 122. 310 107. 127 Executive Vice Presidents 198. 908 123. 000 75. 908 Total 428. 345 245. 310 183. 035 42

SHARE BASED INCENTIVE SCHEMES • Revolving share option programme for Group Management - 6 individuals (1% of outstanding shares) • Employees share programme issued in 2006 (1. 3% of market value) 2002 -2008 Allotments (total) Exercised (total) Net outstanding options President, CEO 229. 437 122. 310 107. 127 Executive Vice Presidents 198. 908 123. 000 75. 908 Total 428. 345 245. 310 183. 035 42

SEGMENTATION 2007 OLD S Building materials 23% Revenue 2007 DKK 7, 4 b F 2008 DKK 5, 6 b EBIT margin 2007 4, 3% F 2008 2, 9% Hardwood 55% Timber & Board 22% (% of revenue) 43

SEGMENTATION 2007 OLD S Building materials 23% Revenue 2007 DKK 7, 4 b F 2008 DKK 5, 6 b EBIT margin 2007 4, 3% F 2008 2, 9% Hardwood 55% Timber & Board 22% (% of revenue) 43

RISKS • Commercial risks • Market and customer risks (Cyclical business) • Political risks and other supply risks (3 rd world countries) • Financial risks • Foreign exchange rates (USD vs. EUR) • Interest rates and funding • Balance sheet risks • Inventories (Market prices) • Trade receivables • Prepayments to suppliers • Environmental and human rights matters (Compliance and reputation) 44

RISKS • Commercial risks • Market and customer risks (Cyclical business) • Political risks and other supply risks (3 rd world countries) • Financial risks • Foreign exchange rates (USD vs. EUR) • Interest rates and funding • Balance sheet risks • Inventories (Market prices) • Trade receivables • Prepayments to suppliers • Environmental and human rights matters (Compliance and reputation) 44

Renewed strategy: FORESTRY • New investments in forests - Normally concessions and sawmills, exceptionally ownership of land - Cooperation with investors about investments in plantation, will become an important parameter in the CO 2/climate solutions • Strategic necessity in certain tropical areas • Only in the Hardwood Division and presently only in Congo and Gabon • Supports the commercial interest regarding: - Supply security - Environment/sustainability (certification) - Test of new species 45

Renewed strategy: FORESTRY • New investments in forests - Normally concessions and sawmills, exceptionally ownership of land - Cooperation with investors about investments in plantation, will become an important parameter in the CO 2/climate solutions • Strategic necessity in certain tropical areas • Only in the Hardwood Division and presently only in Congo and Gabon • Supports the commercial interest regarding: - Supply security - Environment/sustainability (certification) - Test of new species 45

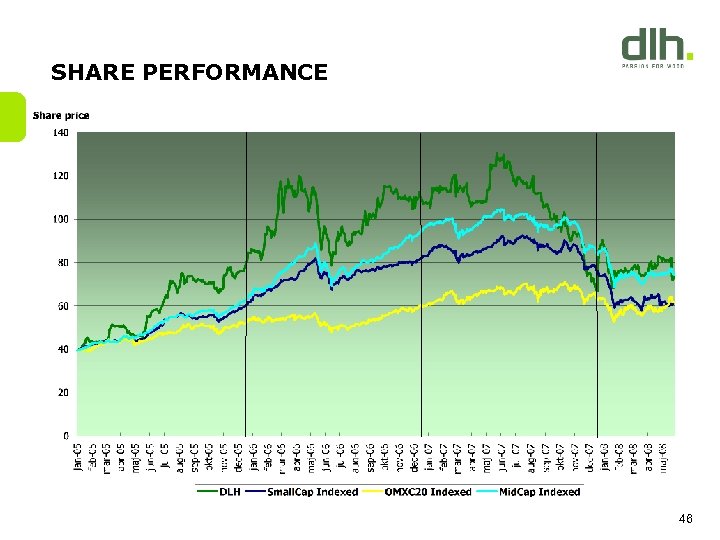

SHARE PERFORMANCE 46

SHARE PERFORMANCE 46

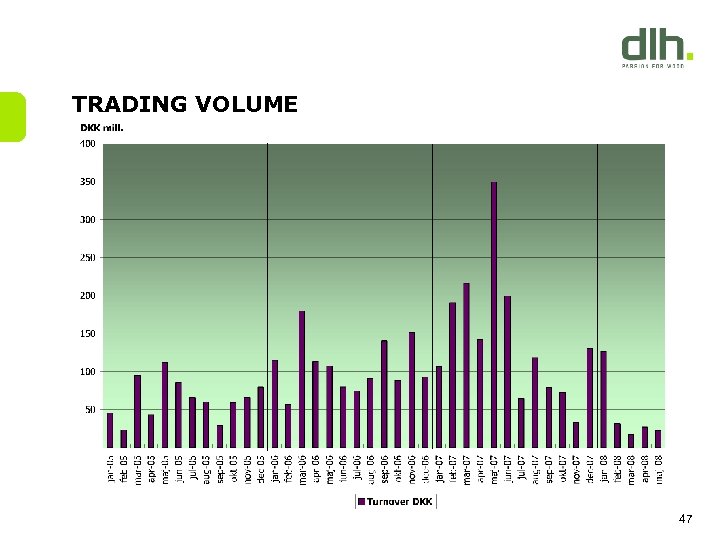

TRADING VOLUME 47

TRADING VOLUME 47

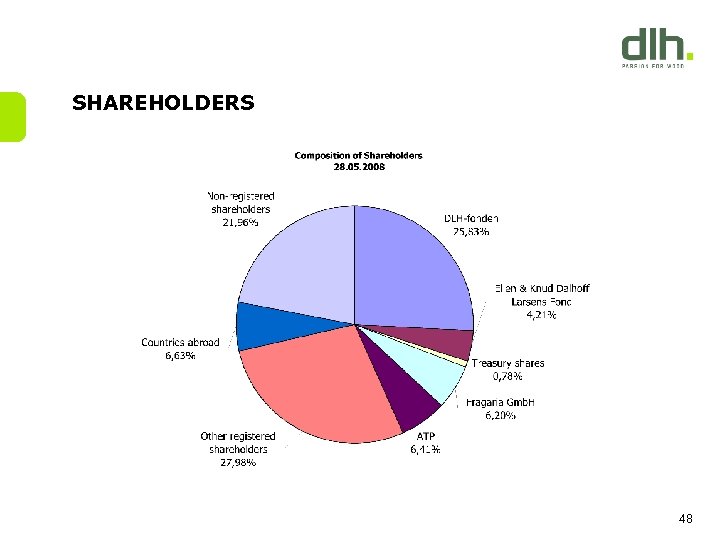

SHAREHOLDERS 48

SHAREHOLDERS 48

Renewed strategy: PROCESSING • New investments in processing • Often required precondition for own forest concessions • Only in Hardwood Division, predominantly in (7) supply countries • Typically kiln-drying and production of semi-finished goods, including a few finished products (f. inst. decking and flooring) • Supports commercial interests: - Environment and sustainability - ”Market leadership” in the supply part - Completes the supply chain - Able to buy ”mill-run” from external sawmills 49

Renewed strategy: PROCESSING • New investments in processing • Often required precondition for own forest concessions • Only in Hardwood Division, predominantly in (7) supply countries • Typically kiln-drying and production of semi-finished goods, including a few finished products (f. inst. decking and flooring) • Supports commercial interests: - Environment and sustainability - ”Market leadership” in the supply part - Completes the supply chain - Able to buy ”mill-run” from external sawmills 49

Renewed strategy: TRADING • Organic growth without capital investments • Innovated focus in both divisions • Back to back businesses with limited tied up capital • Supports the commercial interests regarding: - Markets without DLH distribution activity - Introduction to new markets - Utilization of imbalances in international trade - Sales channel for surplus of own production 50

Renewed strategy: TRADING • Organic growth without capital investments • Innovated focus in both divisions • Back to back businesses with limited tied up capital • Supports the commercial interests regarding: - Markets without DLH distribution activity - Introduction to new markets - Utilization of imbalances in international trade - Sales channel for surplus of own production 50

Renewed strategy: DISTRIBUTION • The major part of the investments will be within distribution • Both strategic acquisitions and minor add-on purchases • Acquisition of sales units with own inventory in both divisions • Also in new countries - In Hardwood Division global perspective - In Timber & Board Division in geographic connection to existing areas • Focus areas - Nordic countries - Western Europe - USA - Emerging markets 51

Renewed strategy: DISTRIBUTION • The major part of the investments will be within distribution • Both strategic acquisitions and minor add-on purchases • Acquisition of sales units with own inventory in both divisions • Also in new countries - In Hardwood Division global perspective - In Timber & Board Division in geographic connection to existing areas • Focus areas - Nordic countries - Western Europe - USA - Emerging markets 51

Renewed organisation: ORGANISATION • Continuously two divisions • New regionalized geographical structure • To support the integrated business model, strengthening of crossgroup coordination: International relations HR Environment/CSR Marketing Logistic Shipping Production • Search for new member of Group Executive Board • Focus on implementation of new IT system (GTS) and the relating organisational adjustments 52

Renewed organisation: ORGANISATION • Continuously two divisions • New regionalized geographical structure • To support the integrated business model, strengthening of crossgroup coordination: International relations HR Environment/CSR Marketing Logistic Shipping Production • Search for new member of Group Executive Board • Focus on implementation of new IT system (GTS) and the relating organisational adjustments 52