173b27531314b59dedf9f23035b46c49.ppt

- Количество слайдов: 26

Demand Supply Analysis

Demand Supply Analysis

Headlines: • On August 2, 1990, when Iraq invaded Kuwait, market price of crude petroleum jumped from $21. 54 to $30. 50 per barrel (almost 42% increase) before any physical reduction in the current amount of oil available for sale. One year later, the price of oil was $21. 32 per barrel. • In August 1987, a 386 PC sold at $6, 995. In March 1992, the same computer sold at $1, 495. Today Pentiums are cheaper then original 386 PCs.

Headlines: • On August 2, 1990, when Iraq invaded Kuwait, market price of crude petroleum jumped from $21. 54 to $30. 50 per barrel (almost 42% increase) before any physical reduction in the current amount of oil available for sale. One year later, the price of oil was $21. 32 per barrel. • In August 1987, a 386 PC sold at $6, 995. In March 1992, the same computer sold at $1, 495. Today Pentiums are cheaper then original 386 PCs.

Market Demand Curve • Amounts of a good purchased at alternative prices. • Inverse demand shows the maximum price paid for given quantity of a good. • Law of Demand (ceteris paribus) • Downward demand due to income and wealth effects. • Downward inverse demand diminishing marginal utility. • Giffen's Paradox Quantity Price D ID Price Quantity

Market Demand Curve • Amounts of a good purchased at alternative prices. • Inverse demand shows the maximum price paid for given quantity of a good. • Law of Demand (ceteris paribus) • Downward demand due to income and wealth effects. • Downward inverse demand diminishing marginal utility. • Giffen's Paradox Quantity Price D ID Price Quantity

The Demand Function • An equation representing the demand curve Qxd = f(Px , PY , I, N, A, Z) Qxd = a 0+a 1 Px+a 2 Py+a 3 I+a 4 N+a 5 A+a 6 Z • • Qxd = quantity demand of good X. Px = price of good X. PY = price of a substitute good Y. I = income. N = population A = advertisement Z = any other variable affecting demand (expectations, credit conditions)

The Demand Function • An equation representing the demand curve Qxd = f(Px , PY , I, N, A, Z) Qxd = a 0+a 1 Px+a 2 Py+a 3 I+a 4 N+a 5 A+a 6 Z • • Qxd = quantity demand of good X. Px = price of good X. PY = price of a substitute good Y. I = income. N = population A = advertisement Z = any other variable affecting demand (expectations, credit conditions)

Change in Quantity Demanded Price A to B: Increase in quantity demanded (due to change in the price of the good) A 10 B 6 D 0 4 7 Quantity

Change in Quantity Demanded Price A to B: Increase in quantity demanded (due to change in the price of the good) A 10 B 6 D 0 4 7 Quantity

Change in Demand Price D 0 to D 1: Increase in Demand (due to change in demand determinants) 6 D 1 D 0 7 13 Quantity

Change in Demand Price D 0 to D 1: Increase in Demand (due to change in demand determinants) 6 D 1 D 0 7 13 Quantity

Market Supply Curve • Amounts of a good produced at alternative prices. • Inverse supply shows the minimum price required to produce given quantity of a good. • Law of Supply (ceteris paribus) • The supply curve is upward sloping Quantity S Price IS Quantity

Market Supply Curve • Amounts of a good produced at alternative prices. • Inverse supply shows the minimum price required to produce given quantity of a good. • Law of Supply (ceteris paribus) • The supply curve is upward sloping Quantity S Price IS Quantity

The Supply Function • An equation representing the supply curve: Qx. S = f(Px , PR , PVI, PFI, Z) Qxs = a 0+a 1 Px+a 2 PR+a 3 PVI+a 4 PFI+a 5 Z • • • Qx. S = quantity supplied of good X. Px = price of good X. PR = price of a related good (substitutes in production) PVI = price of variable inputs (labor, material, utilities) PFI = price of fixed inputs (land, buildings, machines) Z = other variable affecting supply (technology, government, number of firms, expectations)

The Supply Function • An equation representing the supply curve: Qx. S = f(Px , PR , PVI, PFI, Z) Qxs = a 0+a 1 Px+a 2 PR+a 3 PVI+a 4 PFI+a 5 Z • • • Qx. S = quantity supplied of good X. Px = price of good X. PR = price of a related good (substitutes in production) PVI = price of variable inputs (labor, material, utilities) PFI = price of fixed inputs (land, buildings, machines) Z = other variable affecting supply (technology, government, number of firms, expectations)

Change in Quantity Supplied A to B: Increase in quantity supplied (due to change in the price of the good) Price S 0 B 20 A 10 5 10 Quantity

Change in Quantity Supplied A to B: Increase in quantity supplied (due to change in the price of the good) Price S 0 B 20 A 10 5 10 Quantity

Change in Supply S 0 to S 1: Increase in supply (due to change in supply determinants) S 0 Price S 1 8 6 5 7 Quantity

Change in Supply S 0 to S 1: Increase in supply (due to change in supply determinants) S 0 Price S 1 8 6 5 7 Quantity

Mathematics of Equilibrium Demand curve: Qd = 400 - ½P, Supply curve: Qs = 200 + P Price (P) a=800 Market equilibrium P = d. Qs - c = Qs - 200 Supply Slope is d = 1 P* = 133. 33 Slope is -b = -2 Demand P = a - b. Qd = 800 - 2 Qd 0 c=-200 Q* = 333. 33 Quantity supplied (Q ) and s Quantity demanded (Qd)

Mathematics of Equilibrium Demand curve: Qd = 400 - ½P, Supply curve: Qs = 200 + P Price (P) a=800 Market equilibrium P = d. Qs - c = Qs - 200 Supply Slope is d = 1 P* = 133. 33 Slope is -b = -2 Demand P = a - b. Qd = 800 - 2 Qd 0 c=-200 Q* = 333. 33 Quantity supplied (Q ) and s Quantity demanded (Qd)

Consumer Surplus: The Continuous Case Price $ 10 8 6 4 2 Consumer Surplus Value of 4 units Total Cost of 4 units 1 2 3 D 4 5 Quantity

Consumer Surplus: The Continuous Case Price $ 10 8 6 4 2 Consumer Surplus Value of 4 units Total Cost of 4 units 1 2 3 D 4 5 Quantity

Producer Surplus • The amount producers receive in excess of the amount necessary to induce them to produce the good. Price S 0 P* Producer Surplus Cost of Production Q* Quantity

Producer Surplus • The amount producers receive in excess of the amount necessary to induce them to produce the good. Price S 0 P* Producer Surplus Cost of Production Q* Quantity

If price is too low… Price S 7 6 5 D Shortage 12 - 6 = 6 6 12 Quantity

If price is too low… Price S 7 6 5 D Shortage 12 - 6 = 6 6 12 Quantity

If price is too high… Surplus 14 - 6 = 8 Price S 9 8 7 D 6 8 14 Quantity

If price is too high… Surplus 14 - 6 = 8 Price S 9 8 7 D 6 8 14 Quantity

Comparative Statics: Effects of Changes in Demand and/or Supply Increase in D increases both Q and P. Increase in S increases Q and decreases P. Increase in D and S increases Q and P = ? . Decrease in D and increase in S decreases P and Q = ? .

Comparative Statics: Effects of Changes in Demand and/or Supply Increase in D increases both Q and P. Increase in S increases Q and decreases P. Increase in D and S increases Q and P = ? . Decrease in D and increase in S decreases P and Q = ? .

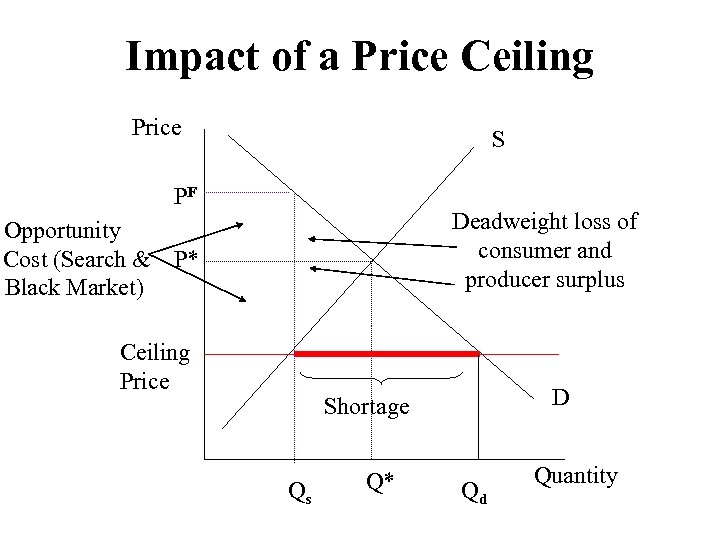

Price Restrictions • Price Ceilings • The maximum legal price that can be charged • Examples: • Gasoline prices in the 1970 s • Housing in New York City • Proposed restrictions on ATM fees • Price Floors • The minimum legal price that can be charged. • Examples: • Minimum wage • Agricultural price supports

Price Restrictions • Price Ceilings • The maximum legal price that can be charged • Examples: • Gasoline prices in the 1970 s • Housing in New York City • Proposed restrictions on ATM fees • Price Floors • The minimum legal price that can be charged. • Examples: • Minimum wage • Agricultural price supports

Impact of a Price Ceiling Price S PF Deadweight loss of consumer and producer surplus Opportunity Cost (Search & P* Black Market) Ceiling Price D Shortage Qs Q* Qd Quantity

Impact of a Price Ceiling Price S PF Deadweight loss of consumer and producer surplus Opportunity Cost (Search & P* Black Market) Ceiling Price D Shortage Qs Q* Qd Quantity

Full Economic Price • The dollar amount paid to a firm under a price ceiling, plus the nonpecuniary price: PF = PC + (PF - PC) • PF = full economic price • PC = price ceiling • PF - PC = nonpecuniary price • In 1970 s ceiling price of gasoline = $1 • 3 hours in line to buy 15 gallons of gasoline • Opportunity cost: $5/hr • Total value of time spent in line: 3 $5 = $15 • Non-pecuniary price per gallon: $15/15 = $1 • Full economic price of a gallon of gasoline: $1 + $1 = $2

Full Economic Price • The dollar amount paid to a firm under a price ceiling, plus the nonpecuniary price: PF = PC + (PF - PC) • PF = full economic price • PC = price ceiling • PF - PC = nonpecuniary price • In 1970 s ceiling price of gasoline = $1 • 3 hours in line to buy 15 gallons of gasoline • Opportunity cost: $5/hr • Total value of time spent in line: 3 $5 = $15 • Non-pecuniary price per gallon: $15/15 = $1 • Full economic price of a gallon of gasoline: $1 + $1 = $2

Impact of a Price Floor Price Surplus S PF Cost of purchasing excess supply P* Decreased Demand Qd D Increased Supply Q* Qs Quantity

Impact of a Price Floor Price Surplus S PF Cost of purchasing excess supply P* Decreased Demand Qd D Increased Supply Q* Qs Quantity

The Excise Tax (Fixed per Unit) Price ($/CD player) 130 Buyer pays (with tax) Consumer surplus S + tax S $10 tax P =105 Tax Revenue Price before 2 P 1=100 tax P 2 - P 1 Buyer tax burden Deadweight loss P 2 -T=95 P 1 - (P 2 - T) Seller tax burden Seller receives (without tax) 75 0 D Producer surplus 1 2 3 4 5 6 7 8 9 10 Quantity (thousands of CD players per week)

The Excise Tax (Fixed per Unit) Price ($/CD player) 130 Buyer pays (with tax) Consumer surplus S + tax S $10 tax P =105 Tax Revenue Price before 2 P 1=100 tax P 2 - P 1 Buyer tax burden Deadweight loss P 2 -T=95 P 1 - (P 2 - T) Seller tax burden Seller receives (without tax) 75 0 D Producer surplus 1 2 3 4 5 6 7 8 9 10 Quantity (thousands of CD players per week)

Excise Tax and the Demand Price P Inelastic D Buyer pays entire tax P 2=P 1+T=2. 20 S + tax Price Seller pays entire tax P 1=P 2=1. 00 S + tax S Elastic D S P 2 -T=0. 90 P 1 = 2. 00 100 Thousands of insulin doses The more inelastic D, the more buyer pays: P 2 = P 1 + T Buyer burden: P 2 - P 1 = (P 1 + T) - P 1 = T Seller burden: P 1 - (P 2 - T) = P 1 - (P 1 + T - T) = 0 1 4 Thousands of pencils The more elastic D, the more seller pays: P 2 = P 1 Buyer burden: P 2 - P 1 = P 1 - P 1 = 0 Seller burden: P 1 - (P 2 - T) = P 1 - (P 1 - T) = T

Excise Tax and the Demand Price P Inelastic D Buyer pays entire tax P 2=P 1+T=2. 20 S + tax Price Seller pays entire tax P 1=P 2=1. 00 S + tax S Elastic D S P 2 -T=0. 90 P 1 = 2. 00 100 Thousands of insulin doses The more inelastic D, the more buyer pays: P 2 = P 1 + T Buyer burden: P 2 - P 1 = (P 1 + T) - P 1 = T Seller burden: P 1 - (P 2 - T) = P 1 - (P 1 + T - T) = 0 1 4 Thousands of pencils The more elastic D, the more seller pays: P 2 = P 1 Buyer burden: P 2 - P 1 = P 1 - P 1 = 0 Seller burden: P 1 - (P 2 - T) = P 1 - (P 1 - T) = T

Excise Tax and the Supply Price P 1=P 2=50 Inelastic S Seller pays entire tax Price S + tax P 2=P 1+T=11 P 1=10 P 2 -T=45 100 Bottles of spring water The more inelastic S, the more seller pays: P 2 = P 1 Buyer pays entire tax D Elastic S 3 5 Thousands of pounds of send for computer chips The more elastic S, the more buyer pays: P 2 = P 1 + T D

Excise Tax and the Supply Price P 1=P 2=50 Inelastic S Seller pays entire tax Price S + tax P 2=P 1+T=11 P 1=10 P 2 -T=45 100 Bottles of spring water The more inelastic S, the more seller pays: P 2 = P 1 Buyer pays entire tax D Elastic S 3 5 Thousands of pounds of send for computer chips The more elastic S, the more buyer pays: P 2 = P 1 + T D

The Ad Valorem Tax (% of Value) Price ($/CD player) 130 Buyer pays (with tax) Consumer surplus S(1 + tax) S $10 tax P =105 Tax Revenue Price before 2 P 1=100 tax P 2 - P 1 Buyer tax burden Deadweight loss P 2 -T=95 P 1 - (P 2 - T) Seller tax burden Seller receives (without tax) 75 0 D Producer surplus 1 2 3 4 5 6 7 8 9 10 Quantity (thousands of CD players per week)

The Ad Valorem Tax (% of Value) Price ($/CD player) 130 Buyer pays (with tax) Consumer surplus S(1 + tax) S $10 tax P =105 Tax Revenue Price before 2 P 1=100 tax P 2 - P 1 Buyer tax burden Deadweight loss P 2 -T=95 P 1 - (P 2 - T) Seller tax burden Seller receives (without tax) 75 0 D Producer surplus 1 2 3 4 5 6 7 8 9 10 Quantity (thousands of CD players per week)

Static Effects of a Tariff Sus P Pt PW Tt PIt QSW G Mt MW CIt Dus QDt QDW Loss of Consumer Surplus = Tt + PIt + G + CIt Transfer to Producer Surplus = Tt Government Revenues from Tariff = G Dead Weight Loss due to Tariff = PIt + CIt Production Inefficiencies = PIt Consumption Inefficiencies = CIt

Static Effects of a Tariff Sus P Pt PW Tt PIt QSW G Mt MW CIt Dus QDt QDW Loss of Consumer Surplus = Tt + PIt + G + CIt Transfer to Producer Surplus = Tt Government Revenues from Tariff = G Dead Weight Loss due to Tariff = PIt + CIt Production Inefficiencies = PIt Consumption Inefficiencies = CIt

Static Effects of a Quota Sus P 0 PQ PW Sus + Quota Tq PIq W CIq Dus QSq QSW Quota QDq MW QDW Loss of Consumer Surplus = Tq + PIq + W + CIq Transfer to Producer Surplus = Tq Windfall to Importer =W Dead Weight Loss due to Quota = PIq + CIq Production Inefficiencies = PIq Consumption Inefficiencies = CIq

Static Effects of a Quota Sus P 0 PQ PW Sus + Quota Tq PIq W CIq Dus QSq QSW Quota QDq MW QDW Loss of Consumer Surplus = Tq + PIq + W + CIq Transfer to Producer Surplus = Tq Windfall to Importer =W Dead Weight Loss due to Quota = PIq + CIq Production Inefficiencies = PIq Consumption Inefficiencies = CIq