f744884694b1ac56b5af4cc77aa02b4f.ppt

- Количество слайдов: 23

Dell and HP’s Value Chain MBA 290 G 2007 Erik Hebert Cristian Marcu Marshal Miller Anna Tsai Kai Xia Joseph Zakzeski 26 September 2007

Table of Contents Executive Summary Brief History of the PC Industry Value Chain Introduction Porter’s 5 Forces Analysis Value Chain In Detail Comparable Companies Analysis

Executive Summary • PC industry value chain very different from Mobile Handset industry…why? • Wintel standard: basic PC largely commoditized with little opportunities for differentiation • Mature: growth has slowed as new markets have been penetrated and existing markets saturated • Oligopoly: need for economies of scale and scope drove massive consolidation leaving only the strongest handful of competitors remaining • Margin compression: maintain/gain market share largely through price competition • Results on the PC industry value chain? • Completely fragmented: links separated to take advantage of absolute cost advantages and core competencies, both country and firm-specific • Economies of scale the rule: with thin industry profit margins, scale is a requirement just to compete • Wintel stranglehold: Microsoft and Intel able to leverage control over core IP and standards development enabling them to extract enormous economic rents

Personal Computer Industry History Computers Military Research during WWII Hobbyists and Educational Institutions Increased popularity 1945 1975 Large mainframe computers IBM DEC 1981 Integrated, preassembled PC’s IBM launches first PC Apple Computers MITS Where a calculator on the ENIAC is equipped with 18, 000 vacuum tubes and weighs 30 tons, computers in the future may have only 1, 000 vacuum tubes and weigh only 1 1/2 tons. ---Popular Mechanics, March 1949 Rivkin. , J. W. , Porter, M. E. , Matching Dell. Harvard Business School, 1999

Historical Growth of the Value Chain 1981 IBM mainframe and standard Components commissioned Intel microprocessor Sears and Computerland Value-added Resellers Sales Force Microsoftware Large corporations -Bulk Discounts Individuals & small business IBM opening up its standard is an industry turning point enabled the PC to proliferate very rapidly to a 95% market share in 10 years Rivkin. , J. W. , Porter, M. E. , Matching Dell. Harvard Business School, 1999

The IBM Clone Wars IBM declines to adopt 386 Low-priced clones enter market -Compaq -Dell -Hewlett-Packard 1982 Use Retailers and Resellers IBM holds 42% of market 1983 Compaq adopts 386 and leads clone makers to affirm existing industry standards Recession 1986 1990 IBM market share falls from 37% to 16. 9% Dell/Compaq Price war Rivkin. , J. W. , Porter, M. E. , Matching Dell. Harvard Business School, 1999

1998 -Present • Hardware components – Highly competitive global markets • Microprocessors – Supplied by very few companies • Intel dominated the market (80 -90%) • Operating System – Microsoft also dominated this market • Hardware and software in PC’s sold as integrated bundle by a few major players Rivkin. , J. W. , Porter, M. E. , Matching Dell. Harvard Business School, 1999

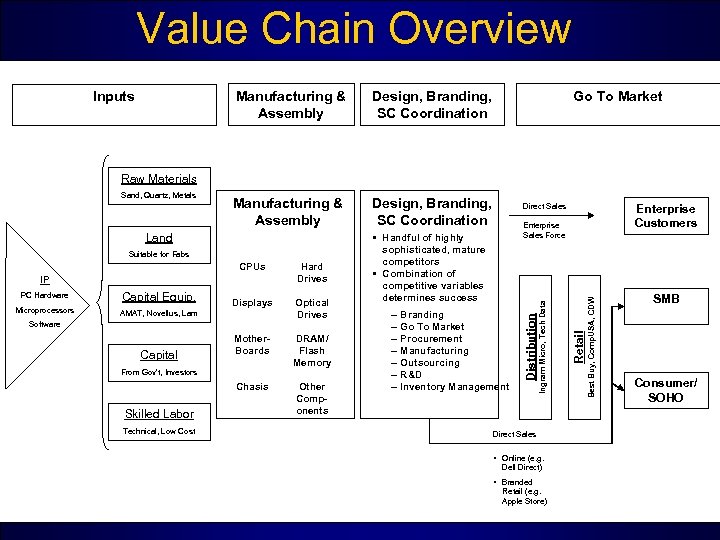

Value Chain Overview Manufacturing & Assembly Inputs Design, Branding, SC Coordination Manufacturing & Assembly Go To Market Design, Branding, SC Coordination Raw Materials Hard Drives PC Hardware Capital Equip. Microprocessors Displays Optical Drives AMAT, Novellus, Lam Software DRAM/ Flash Memory Chasis Capital Mother. Boards Other Components From Gov’t, Investors Skilled Labor Technical, Low Cost – – – – Branding Go To Market Procurement Manufacturing Outsourcing R&D Inventory Management Direct Sales • Online (e. g. Dell Direct) • Branded Retail (e. g. Apple Store) Retail CPUs IP Best Buy, Comp. USA, CDW Suitable for Fabs Enterprise Customers Enterprise Sales Force • Handful of highly sophisticated, mature competitors • Combination of competitive variables determines success Distribution Land Direct Sales Ingram Micro, Tech Data Sand, Quartz, Metals SMB Consumer/ SOHO

Value Chain Feedback and Feedforward

Applying Porter’s Five Forces Threat of New Entrants • Moderately high • Asian competitors, especially China, using learning curve and local market expertise to move up the value chain Bargaining Power of Suppliers • Extremely high with respect to Wintel! • Wintel dominance enables them to extract enormous rents from PC value chain • Customers demand compatibility, enabling Wintel standard to remain entrenched • Other suppliers of commoditized components and services have little power • Few opportunities for product differentiation or absolute cost advantage Intensity of Rivalry • Extremely high! • Wintel standard removes opportunities for product differentiation • Excess capacity leads to severe price competition • Economies of scale are key • Operational efficiency, supply chain coordination, Q/A and service key determinants of competitive advantage Threat of Substitutes • Currently low but growing • PDAs/smartphones increasing functionality • Proprietary/alternative platforms (e. g. Apple, thin computing) Bargaining Power of Buyers • Extremely high in enterprise market, moderately high though increasing in SMB and Consumer/SOHO markets • Low switching costs • Role of distribution and inventory management (e. g. Ingram, Tech Data) and retail shelf space (e. g. Best Buy, Comp. USA) very important in certain segments

Key Themes and their Roles in the PC Industry Theme Role in the PC Industry Outsourcing • Labor-intensive links in the value chain (e. g. assembly, packaging) • Outsource activities to locations with absolute cost advantages • Risky to outsource links that transfer IP Economies of Scale • Critical for high-volume enterprise segment • Enables buyer/supplier power within the value chain in consolidated procurement and volume purchasing • Complicated by customization and need for flexibility, particularly in consumer segment Economies of Scope • Enables product bundling and family branding • Leverages strengths in distribution and retail presence to sell more products • Halo effect (i. e. i. Pods driving sales of Macs, Apple software, accessories) Ecosystem Development • Growing and controlling the ecosystem can help competitors extract rents (e. g. software and applications developed on the Wintel standard) • Extremely complex and diverse value chain; no single firm can dominate every link

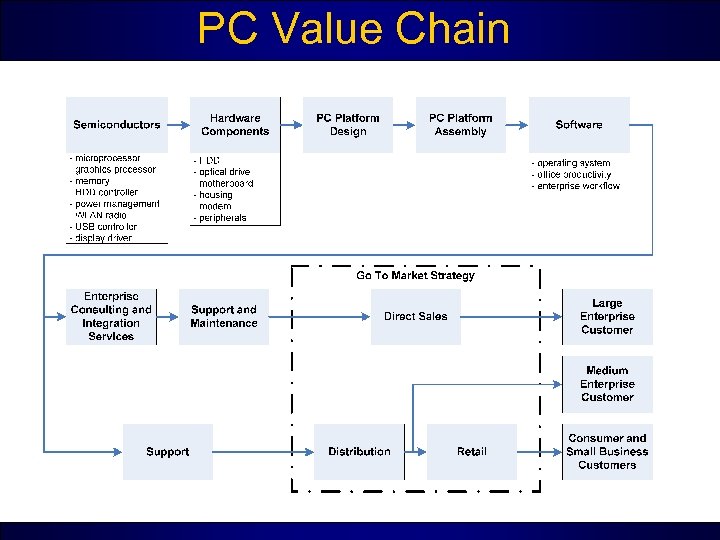

PC Value Chain

Companies in the PC Value Chain

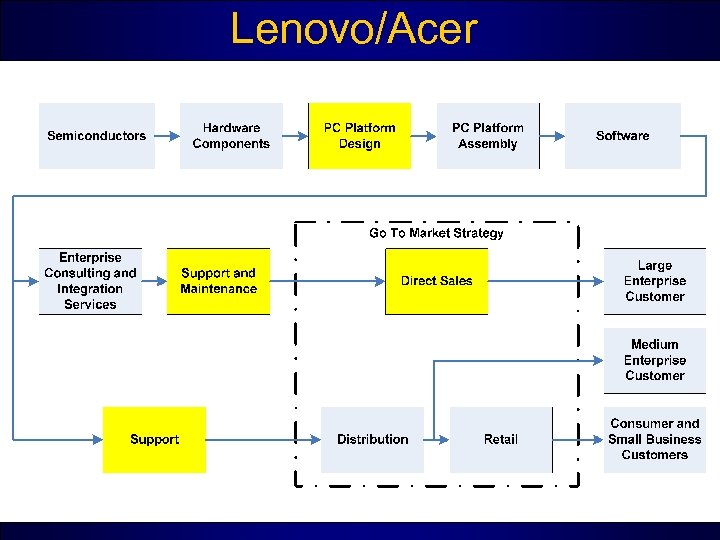

Lenovo/Acer

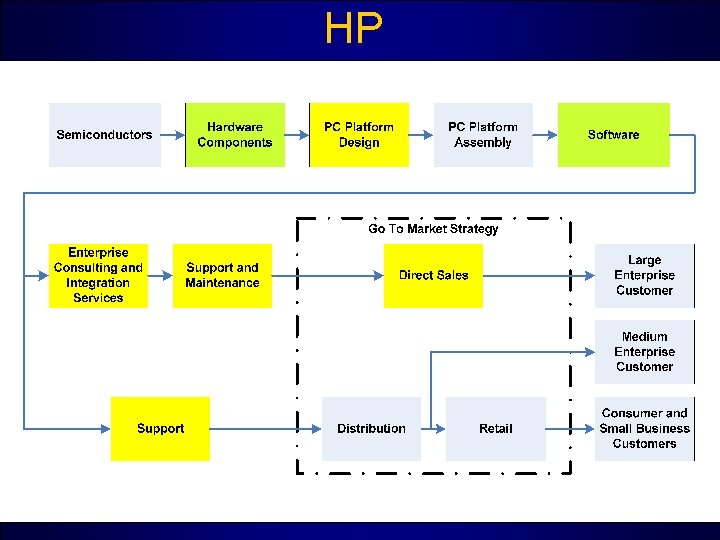

HP

Dell

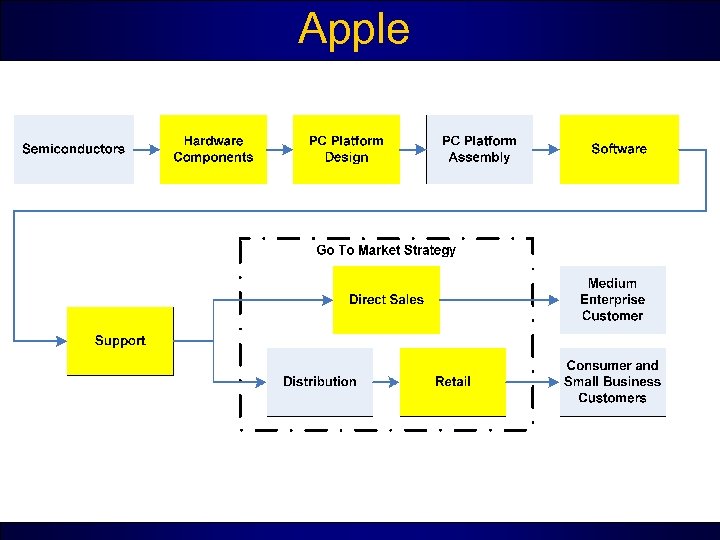

Apple

Value Chain Economics • Illustrative Division of $2, 000 Notebook Economics • Microsoft is a monopolist so no opportunity to get share of pie from them • Intel/AMD lately have had to compete more on price though Intel still very powerful • Retailers and distributors very large and powerful in their own right • Leaves very little in the value chain for PC makers to work with!!! Source: Based on Merrill Lynch estimates as of May 2007

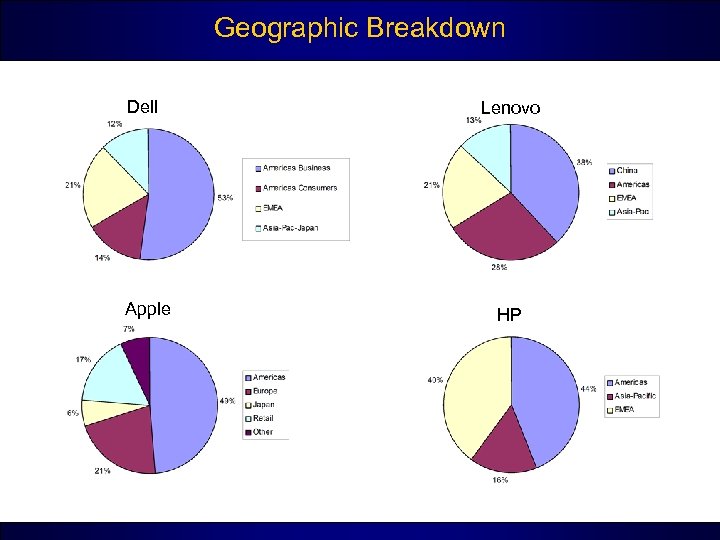

Geographic Breakdown Dell Lenovo Apple HP

YOY Growth per Geographic Region • HP is a mature company with large revenues and slow growth across all segments • Lenovo is “new” and is showing good growth everywhere but in the Americas • Growth in Asia-Pacific region and China among the highest for all companies – Apple’s “Other” column may be hiding growth in China

Comparable Companies Analysis – Trading Metrics • Comparable companies analysis reveals the enormous rents Microsoft and Intel are able to extract from the value chain as shown by huge profit margins (i. e. EBITDA Margin) • Apple, through tremendous growth prospects and innovation (outside the Wintel standard) enabling it to maintain relatively high margins, is rewarded with a higher valuation • The PC clone makers struggle with relatively thin profit margins and their valuations are much more modest (compare EV/Revenue multiples)

Comps Analysis for PC Industry • Effects of value chain on financial ratios • Financial ratios indicate: Margins, Debt, Capital Intensity, Power

Highlights • • Apple higher margins International lower margins In general very capital intensive industry Dell high ROA and low inventory turnover days • Apple high A/P days, low A/R days

f744884694b1ac56b5af4cc77aa02b4f.ppt