166c2e85cea02d12911d91e1898041c6.ppt

- Количество слайдов: 87

Definitions • Supply and Demand: the name of the most important model in all economics • Price: the amount of money that must be paid for a unit of output • Market: any mechanism by which buyers and sellers negotiate price • Output: the good or service and/or the amount of it sold

Definitions • Supply and Demand: the name of the most important model in all economics • Price: the amount of money that must be paid for a unit of output • Market: any mechanism by which buyers and sellers negotiate price • Output: the good or service and/or the amount of it sold

Definitions (continued) • Consumers: those people in a market who are wanting to exchange money for goods or services • Producers: those people in a market who are wanting to exchange goods or services for money • Equilibrium Price: the price at which no consumers wish they could have purchased more goods at that price; no producers wish that they could have sold more • Equilibrium Quantity: the amount of output exchanged at the equilibrium price

Definitions (continued) • Consumers: those people in a market who are wanting to exchange money for goods or services • Producers: those people in a market who are wanting to exchange goods or services for money • Equilibrium Price: the price at which no consumers wish they could have purchased more goods at that price; no producers wish that they could have sold more • Equilibrium Quantity: the amount of output exchanged at the equilibrium price

Quantity Demanded and Quantity Supplied • Quantity demanded: how much consumers are willing and able to buy at a particular price during a particular period of time • Quantity supplied: how much firms are willing and able to sell at a particular price during a particular period of time

Quantity Demanded and Quantity Supplied • Quantity demanded: how much consumers are willing and able to buy at a particular price during a particular period of time • Quantity supplied: how much firms are willing and able to sell at a particular price during a particular period of time

Markets • Capitalism – free markets in financial capital as well as goods and services – freedom to borrow or lend – profits go to the owners of capital • Communism – capital and the profit that it generates is controlled by a government authority. – a government authority decides how the money is used. • Socialism – a significant part of the profit generated by financial capital goes to government in the form of taxes. – a government uses the tax money to counter the wealth impacts of the distribution of profit.

Markets • Capitalism – free markets in financial capital as well as goods and services – freedom to borrow or lend – profits go to the owners of capital • Communism – capital and the profit that it generates is controlled by a government authority. – a government authority decides how the money is used. • Socialism – a significant part of the profit generated by financial capital goes to government in the form of taxes. – a government uses the tax money to counter the wealth impacts of the distribution of profit.

![Heritage Foundation Index of Economic Freedom (Most Free) Hong Kong 1 [90. 3] Singapore Heritage Foundation Index of Economic Freedom (Most Free) Hong Kong 1 [90. 3] Singapore](https://present5.com/presentation/166c2e85cea02d12911d91e1898041c6/image-5.jpg) Heritage Foundation Index of Economic Freedom (Most Free) Hong Kong 1 [90. 3] Singapore 2 [87. 4] Ireland 3 [82. 4] Australia 4 [82. 0] United States 5 [80. 6] New Zealand 6 [80. 2] Canada 7 [80. 2] Chile 8 [79. 8] Switzerland 9 [79. 7] United Kingdom 10 [79. 5] Denmark 11 [79. 2] Estonia 12 [77. 8] Netherlands 13 [76. 8] Iceland 14 [76. 5] Luxembourg 15 [75. 2] Finland 16 [74. 8] Japan 17 [72. 5] Mauritius 18 [72. 3] Bahrain 19 [72. 2] Belgium 20 [71. 5] 5

Heritage Foundation Index of Economic Freedom (Most Free) Hong Kong 1 [90. 3] Singapore 2 [87. 4] Ireland 3 [82. 4] Australia 4 [82. 0] United States 5 [80. 6] New Zealand 6 [80. 2] Canada 7 [80. 2] Chile 8 [79. 8] Switzerland 9 [79. 7] United Kingdom 10 [79. 5] Denmark 11 [79. 2] Estonia 12 [77. 8] Netherlands 13 [76. 8] Iceland 14 [76. 5] Luxembourg 15 [75. 2] Finland 16 [74. 8] Japan 17 [72. 5] Mauritius 18 [72. 3] Bahrain 19 [72. 2] Belgium 20 [71. 5] 5

![Heritage Foundation Index of Economic Freedom (Most Oppressed) Haiti 138 [48. 9] Sierra Leone Heritage Foundation Index of Economic Freedom (Most Oppressed) Haiti 138 [48. 9] Sierra Leone](https://present5.com/presentation/166c2e85cea02d12911d91e1898041c6/image-6.jpg) Heritage Foundation Index of Economic Freedom (Most Oppressed) Haiti 138 [48. 9] Sierra Leone 139 [48. 9] Togo 140 [48. 8] Central African Republic 141 [48. 2] Chad 142 [47. 7] Angola 143 [47. 1] Syria 144 [46. 6] Burundi 145 [46. 3] Congo, Republic of 146 [45. 2] Guinea Bissau 147 [45. 1] Venezuela 148 [45. 0] Bangladesh 149 [44. 9] Belarus 150 [44. 7] Iran 151 [44. 0] Turkmenistan 152 [43. 4] Burma 153 [39. 5] Libya 154 [38. 7] Zimbabwe 155 [29. 8] Cuba 156 [27. 5] Korea, North 157 [3. 0] 6

Heritage Foundation Index of Economic Freedom (Most Oppressed) Haiti 138 [48. 9] Sierra Leone 139 [48. 9] Togo 140 [48. 8] Central African Republic 141 [48. 2] Chad 142 [47. 7] Angola 143 [47. 1] Syria 144 [46. 6] Burundi 145 [46. 3] Congo, Republic of 146 [45. 2] Guinea Bissau 147 [45. 1] Venezuela 148 [45. 0] Bangladesh 149 [44. 9] Belarus 150 [44. 7] Iran 151 [44. 0] Turkmenistan 152 [43. 4] Burma 153 [39. 5] Libya 154 [38. 7] Zimbabwe 155 [29. 8] Cuba 156 [27. 5] Korea, North 157 [3. 0] 6

The Scientific Method and Ceteris Paribus • Scientists – conduct experiments in laboratories. – use replication and verification to ensure the accuracy of their conclusions. • Social Scientists – cannot experiment on their subjects. – must use models and look at the effects of individual variables within those models. • Economists – hold variables constant within models to examine the effect of other variables. – use the Latin phrase ceteris paribus which means “holding other things equal” to identify this is the case.

The Scientific Method and Ceteris Paribus • Scientists – conduct experiments in laboratories. – use replication and verification to ensure the accuracy of their conclusions. • Social Scientists – cannot experiment on their subjects. – must use models and look at the effects of individual variables within those models. • Economists – hold variables constant within models to examine the effect of other variables. – use the Latin phrase ceteris paribus which means “holding other things equal” to identify this is the case.

Demand Supply • Demand is the relationship between price and quantity demanded, ceteris paribus. • Supply is the relationship between price and quantity supplied, ceteris paribus.

Demand Supply • Demand is the relationship between price and quantity demanded, ceteris paribus. • Supply is the relationship between price and quantity supplied, ceteris paribus.

The Supply and Demand Model 9

The Supply and Demand Model 9

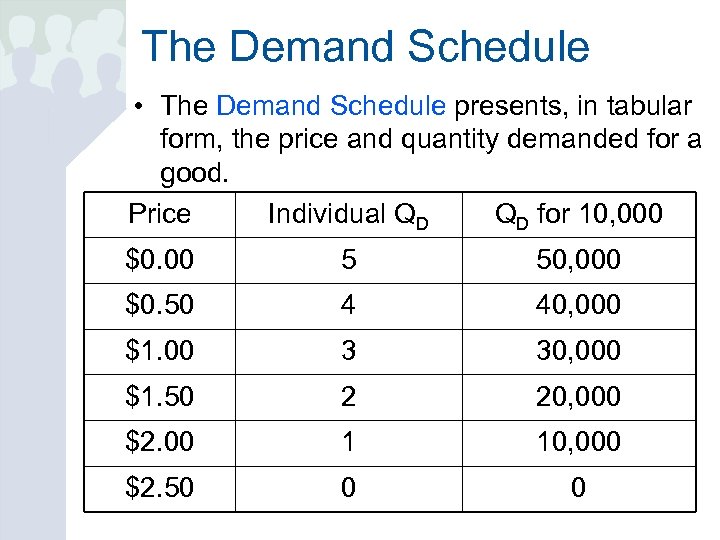

The Demand Schedule • The Demand Schedule presents, in tabular form, the price and quantity demanded for a good. Price Individual QD QD for 10, 000 $0. 00 5 50, 000 $0. 50 4 40, 000 $1. 00 3 30, 000 $1. 50 2 20, 000 $2. 00 1 10, 000 $2. 50 0 0

The Demand Schedule • The Demand Schedule presents, in tabular form, the price and quantity demanded for a good. Price Individual QD QD for 10, 000 $0. 00 5 50, 000 $0. 50 4 40, 000 $1. 00 3 30, 000 $1. 50 2 20, 000 $2. 00 1 10, 000 $2. 50 0 0

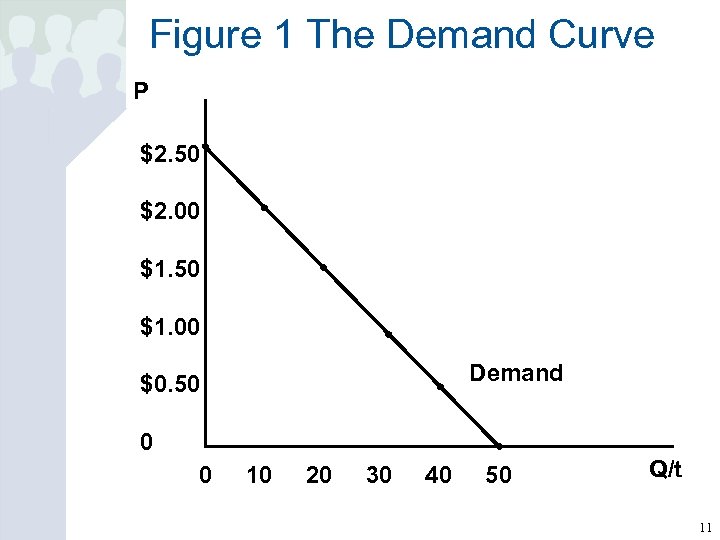

Figure 1 The Demand Curve P $2. 50 $2. 00 $1. 50 $1. 00 Demand $0. 50 0 0 10 20 30 40 50 Q/t 11

Figure 1 The Demand Curve P $2. 50 $2. 00 $1. 50 $1. 00 Demand $0. 50 0 0 10 20 30 40 50 Q/t 11

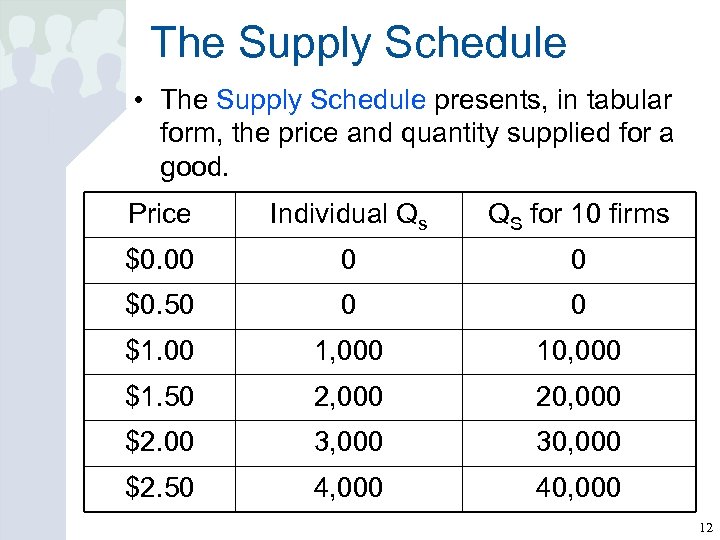

The Supply Schedule • The Supply Schedule presents, in tabular form, the price and quantity supplied for a good. Price Individual Qs QS for 10 firms $0. 00 0 0 $0. 50 0 0 $1. 00 1, 000 10, 000 $1. 50 2, 000 20, 000 $2. 00 3, 000 30, 000 $2. 50 4, 000 40, 000 12

The Supply Schedule • The Supply Schedule presents, in tabular form, the price and quantity supplied for a good. Price Individual Qs QS for 10 firms $0. 00 0 0 $0. 50 0 0 $1. 00 1, 000 10, 000 $1. 50 2, 000 20, 000 $2. 00 3, 000 30, 000 $2. 50 4, 000 40, 000 12

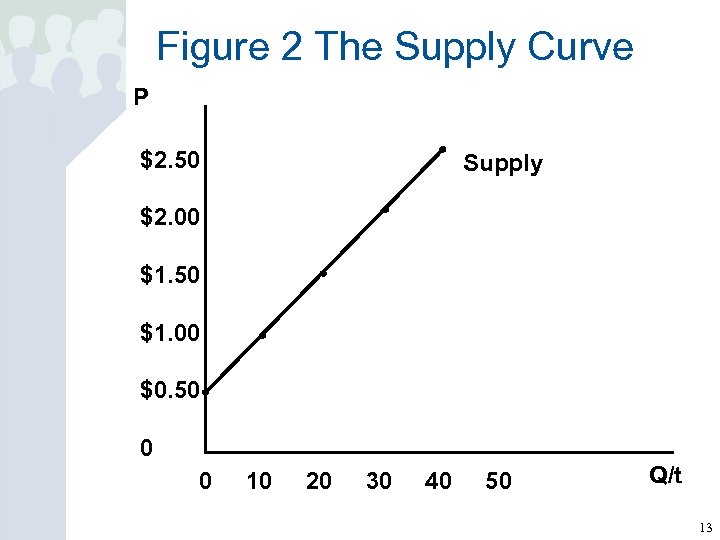

Figure 2 The Supply Curve P $2. 50 Supply $2. 00 $1. 50 $1. 00 $0. 50 0 0 10 20 30 40 50 Q/t 13

Figure 2 The Supply Curve P $2. 50 Supply $2. 00 $1. 50 $1. 00 $0. 50 0 0 10 20 30 40 50 Q/t 13

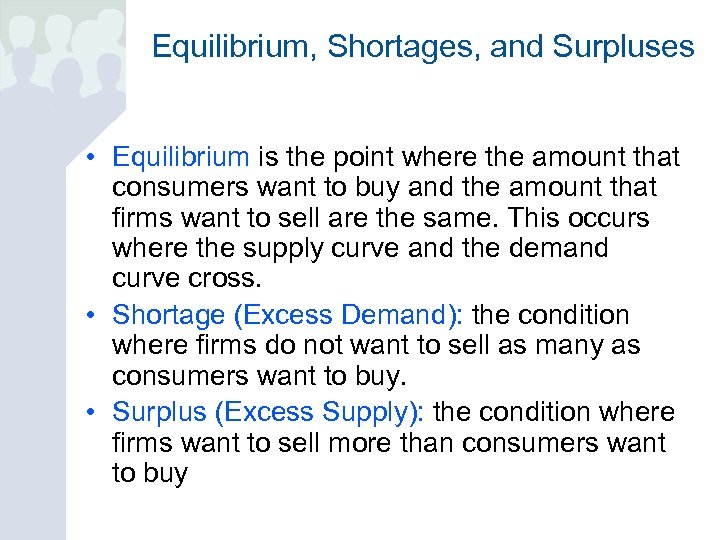

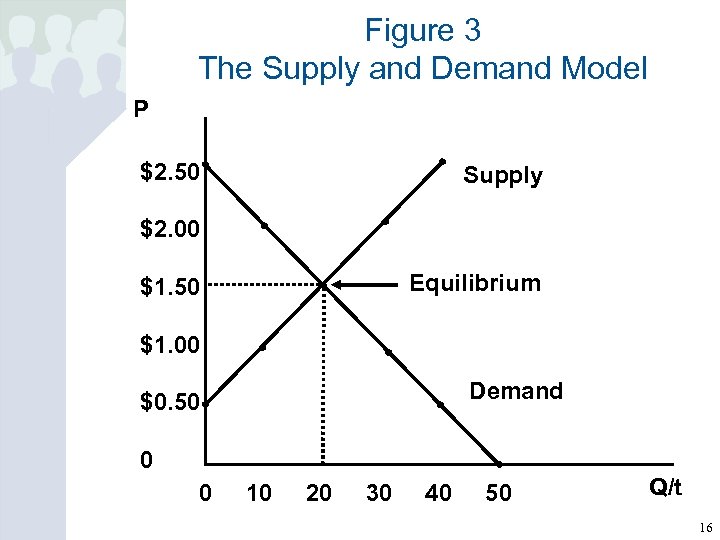

Equilibrium, Shortages, and Surpluses • Equilibrium is the point where the amount that consumers want to buy and the amount that firms want to sell are the same. This occurs where the supply curve and the demand curve cross. • Shortage (Excess Demand): the condition where firms do not want to sell as many as consumers want to buy. • Surplus (Excess Supply): the condition where firms want to sell more than consumers want to buy

Equilibrium, Shortages, and Surpluses • Equilibrium is the point where the amount that consumers want to buy and the amount that firms want to sell are the same. This occurs where the supply curve and the demand curve cross. • Shortage (Excess Demand): the condition where firms do not want to sell as many as consumers want to buy. • Surplus (Excess Supply): the condition where firms want to sell more than consumers want to buy

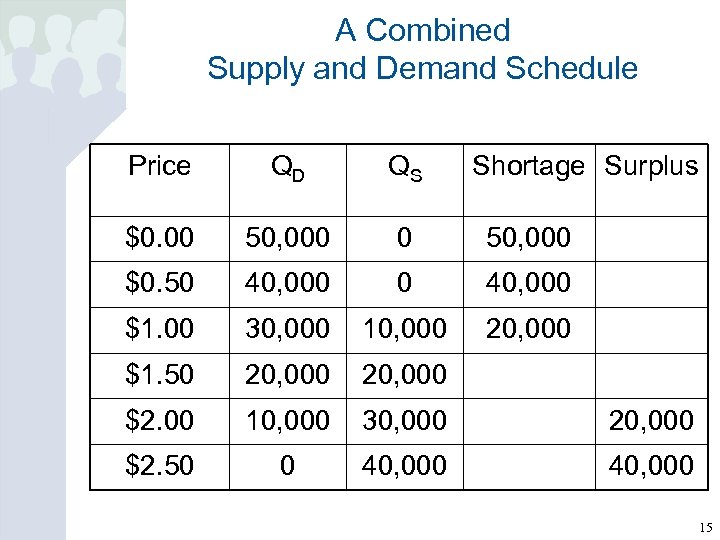

A Combined Supply and Demand Schedule Price QD QS Shortage Surplus $0. 00 50, 000 $0. 50 40, 000 $1. 00 30, 000 10, 000 20, 000 $1. 50 20, 000 $2. 00 10, 000 30, 000 20, 000 $2. 50 0 40, 000 15

A Combined Supply and Demand Schedule Price QD QS Shortage Surplus $0. 00 50, 000 $0. 50 40, 000 $1. 00 30, 000 10, 000 20, 000 $1. 50 20, 000 $2. 00 10, 000 30, 000 20, 000 $2. 50 0 40, 000 15

Figure 3 The Supply and Demand Model P $2. 50 Supply $2. 00 Equilibrium $1. 50 $1. 00 Demand $0. 50 0 0 10 20 30 40 50 Q/t 16

Figure 3 The Supply and Demand Model P $2. 50 Supply $2. 00 Equilibrium $1. 50 $1. 00 Demand $0. 50 0 0 10 20 30 40 50 Q/t 16

All About Demand • The Law of Demand – The relationship between price and quantity demanded is a negative or inverse one.

All About Demand • The Law of Demand – The relationship between price and quantity demanded is a negative or inverse one.

Why Does the Law of Demand Make Sense? • The Substitution Effect – moves people toward the good that is now cheaper or away from the good that is now more expensive • The Real Balances Effect – When a price increases it decreases your buying power causing you to buy less. • The Law of Diminishing Marginal Utility – The amount of additional happiness that you get from an additional unit of consumption falls with each additional unit.

Why Does the Law of Demand Make Sense? • The Substitution Effect – moves people toward the good that is now cheaper or away from the good that is now more expensive • The Real Balances Effect – When a price increases it decreases your buying power causing you to buy less. • The Law of Diminishing Marginal Utility – The amount of additional happiness that you get from an additional unit of consumption falls with each additional unit.

The Law of Supply • The Law of Supply is the statement that there is a positive relationship between price and quantity supplied.

The Law of Supply • The Law of Supply is the statement that there is a positive relationship between price and quantity supplied.

Why Does the Law of Supply Make Sense? • Because of Increasing Marginal Costs firms require higher prices to produce more output.

Why Does the Law of Supply Make Sense? • Because of Increasing Marginal Costs firms require higher prices to produce more output.

Determinants of Demand • Taste • Income – Normal Goods – Inferior Goods • Price of Other Goods – Complement – Substitute • Population of Potential Buyers • Expected Price

Determinants of Demand • Taste • Income – Normal Goods – Inferior Goods • Price of Other Goods – Complement – Substitute • Population of Potential Buyers • Expected Price

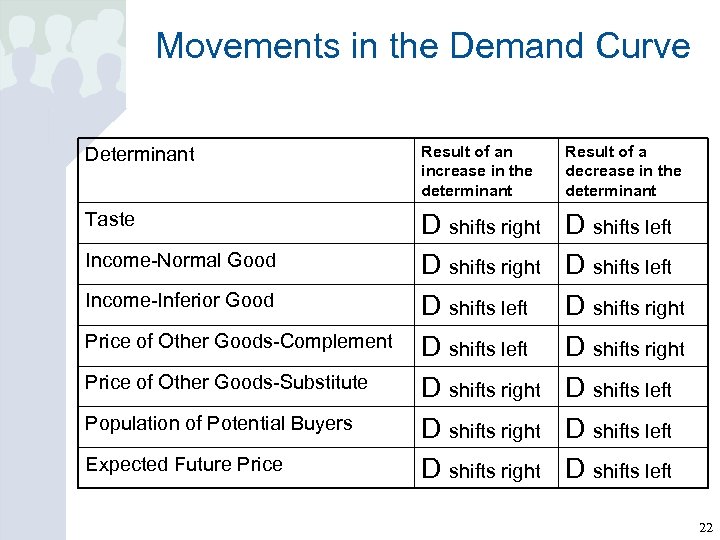

Movements in the Demand Curve Determinant Result of an increase in the determinant Result of a decrease in the determinant Taste D shifts right D shifts right D shifts left D shifts left Income-Normal Good Income-Inferior Good Price of Other Goods-Complement Price of Other Goods-Substitute Population of Potential Buyers Expected Future Price 22

Movements in the Demand Curve Determinant Result of an increase in the determinant Result of a decrease in the determinant Taste D shifts right D shifts right D shifts left D shifts left Income-Normal Good Income-Inferior Good Price of Other Goods-Complement Price of Other Goods-Substitute Population of Potential Buyers Expected Future Price 22

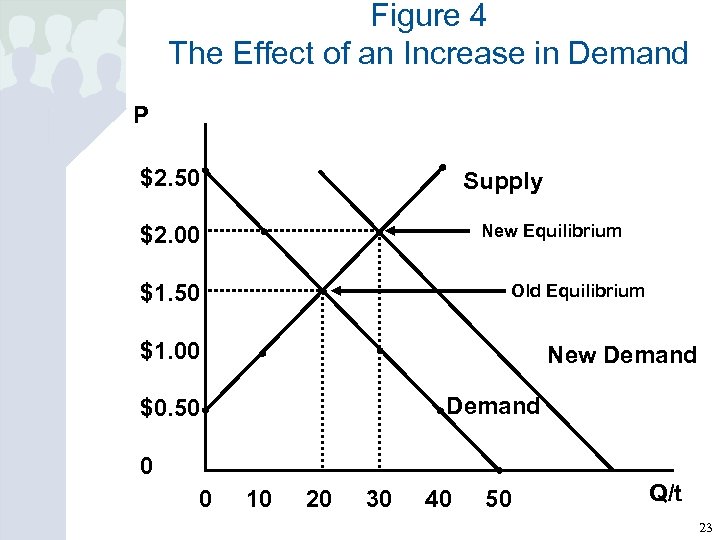

Figure 4 The Effect of an Increase in Demand P $2. 50 Supply New Equilibrium $2. 00 $1. 50 Old Equilibrium $1. 00 New Demand $0. 50 0 0 10 20 30 40 50 Q/t 23

Figure 4 The Effect of an Increase in Demand P $2. 50 Supply New Equilibrium $2. 00 $1. 50 Old Equilibrium $1. 00 New Demand $0. 50 0 0 10 20 30 40 50 Q/t 23

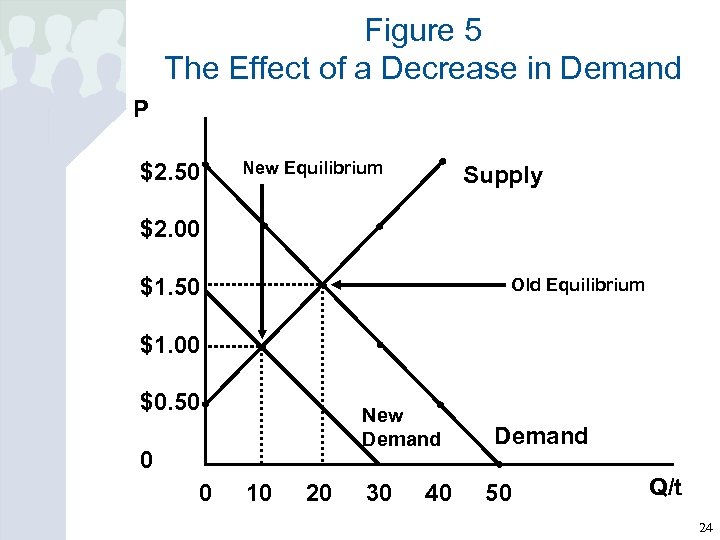

Figure 5 The Effect of a Decrease in Demand P $2. 50 New Equilibrium Supply $2. 00 $1. 50 Old Equilibrium $1. 00 $0. 50 New Demand 0 0 10 20 30 40 Demand 50 Q/t 24

Figure 5 The Effect of a Decrease in Demand P $2. 50 New Equilibrium Supply $2. 00 $1. 50 Old Equilibrium $1. 00 $0. 50 New Demand 0 0 10 20 30 40 Demand 50 Q/t 24

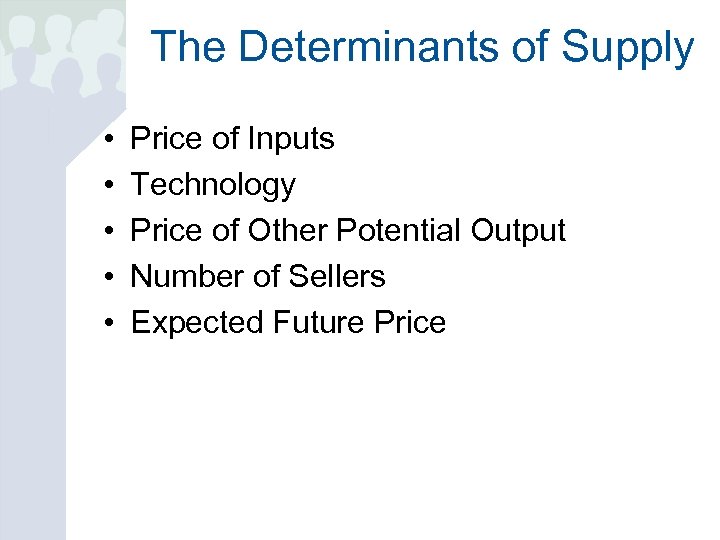

The Determinants of Supply • • • Price of Inputs Technology Price of Other Potential Output Number of Sellers Expected Future Price

The Determinants of Supply • • • Price of Inputs Technology Price of Other Potential Output Number of Sellers Expected Future Price

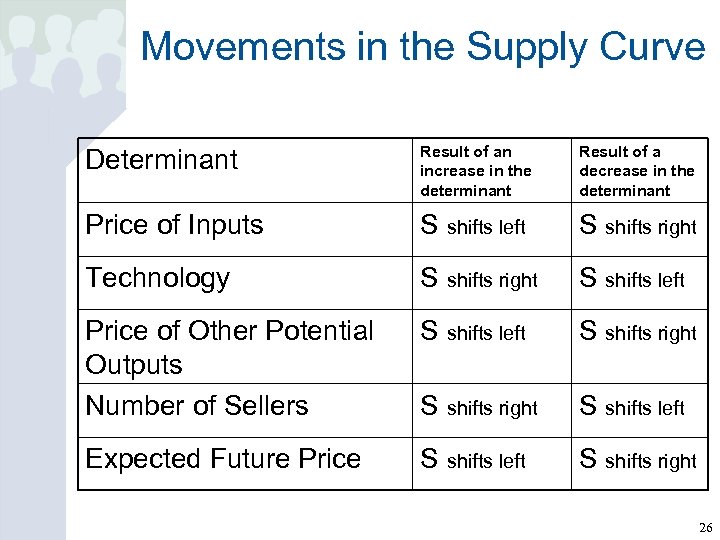

Movements in the Supply Curve Determinant Result of an increase in the determinant Result of a decrease in the determinant Price of Inputs S shifts left S shifts right Technology S shifts right S shifts left Price of Other Potential Outputs Number of Sellers S shifts left S shifts right S shifts left Expected Future Price S shifts left S shifts right 26

Movements in the Supply Curve Determinant Result of an increase in the determinant Result of a decrease in the determinant Price of Inputs S shifts left S shifts right Technology S shifts right S shifts left Price of Other Potential Outputs Number of Sellers S shifts left S shifts right S shifts left Expected Future Price S shifts left S shifts right 26

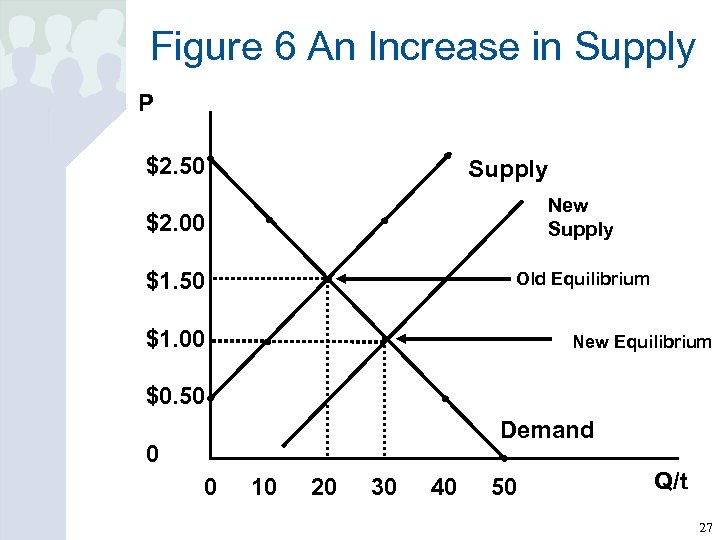

Figure 6 An Increase in Supply P $2. 50 Supply $2. 00 New Supply $1. 50 Old Equilibrium $1. 00 New Equilibrium $0. 50 Demand 0 0 10 20 30 40 50 Q/t 27

Figure 6 An Increase in Supply P $2. 50 Supply $2. 00 New Supply $1. 50 Old Equilibrium $1. 00 New Equilibrium $0. 50 Demand 0 0 10 20 30 40 50 Q/t 27

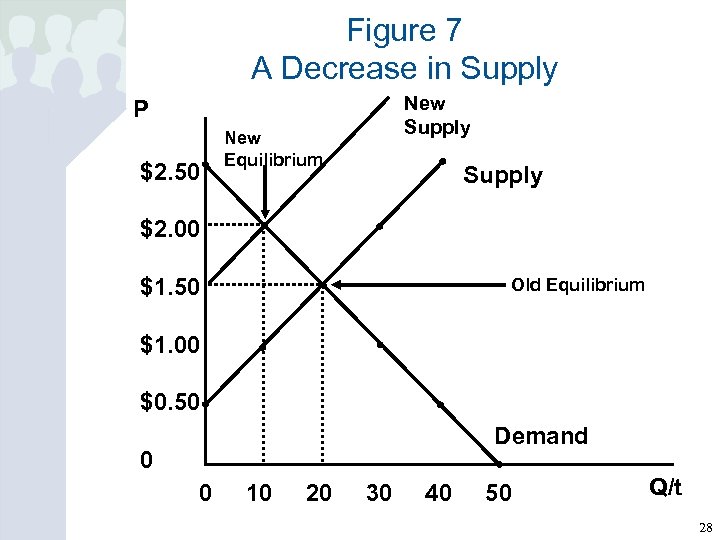

Figure 7 A Decrease in Supply New Supply P $2. 50 New Equilibrium Supply $2. 00 $1. 50 Old Equilibrium $1. 00 $0. 50 Demand 0 0 10 20 30 40 50 Q/t 28

Figure 7 A Decrease in Supply New Supply P $2. 50 New Equilibrium Supply $2. 00 $1. 50 Old Equilibrium $1. 00 $0. 50 Demand 0 0 10 20 30 40 50 Q/t 28

Elasticity • Elasticity: the responsiveness of quantity to a change in another variable • Price Elasticity of Demand: the responsiveness of quantity demanded to a change in price • Price Elasticity of Supply: the responsiveness of quantity supplied to a change in price • Income Elasticity of Demand: the responsiveness of quantity demanded to a change in income • Cross Price Elasticity of Demand: the responsiveness of quantity demanded of one good to a change in the price of another good

Elasticity • Elasticity: the responsiveness of quantity to a change in another variable • Price Elasticity of Demand: the responsiveness of quantity demanded to a change in price • Price Elasticity of Supply: the responsiveness of quantity supplied to a change in price • Income Elasticity of Demand: the responsiveness of quantity demanded to a change in income • Cross Price Elasticity of Demand: the responsiveness of quantity demanded of one good to a change in the price of another good

The Mathematical Representation of Elasticity ΔQ %ΔQ Q Elasticity = = %ΔP ΔP P Because the demand curve is downward sloping and the supply curve is upward sloping the elasticity of demand is negative and the elasticity of supply is positive. Often these signs are implicit and ignored. 30

The Mathematical Representation of Elasticity ΔQ %ΔQ Q Elasticity = = %ΔP ΔP P Because the demand curve is downward sloping and the supply curve is upward sloping the elasticity of demand is negative and the elasticity of supply is positive. Often these signs are implicit and ignored. 30

Elasticity Labels • Elastic : the condition of demand when the percentage change in quantity is larger than the percentage change in price • Inelastic: the condition of demand when the percentage change in quantity is smaller than the percentage change in price • Unitary Elastic: the condition of demand when the percentage change in quantity is equal to the percentage change in price

Elasticity Labels • Elastic : the condition of demand when the percentage change in quantity is larger than the percentage change in price • Inelastic: the condition of demand when the percentage change in quantity is smaller than the percentage change in price • Unitary Elastic: the condition of demand when the percentage change in quantity is equal to the percentage change in price

Alternative Ways to Understand Elasticity The Graphical Explanation 32

Alternative Ways to Understand Elasticity The Graphical Explanation 32

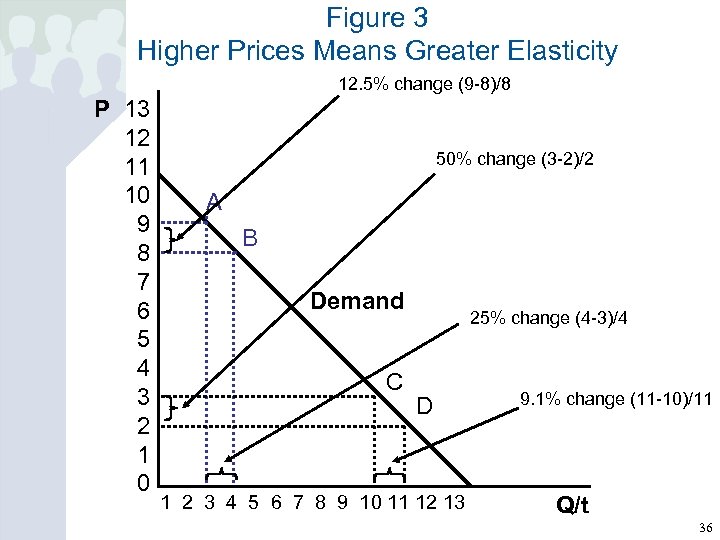

The Relationship Between Slope and Elasticity • Elasticity and the slope of the demand curve are not the same but they are related. • At a given price level, elasticity is greater with a flatter demand curve. • With a linear demand curve (meaning a demand curve that has a single value for the slope) elasticity is greater at higher prices

The Relationship Between Slope and Elasticity • Elasticity and the slope of the demand curve are not the same but they are related. • At a given price level, elasticity is greater with a flatter demand curve. • With a linear demand curve (meaning a demand curve that has a single value for the slope) elasticity is greater at higher prices

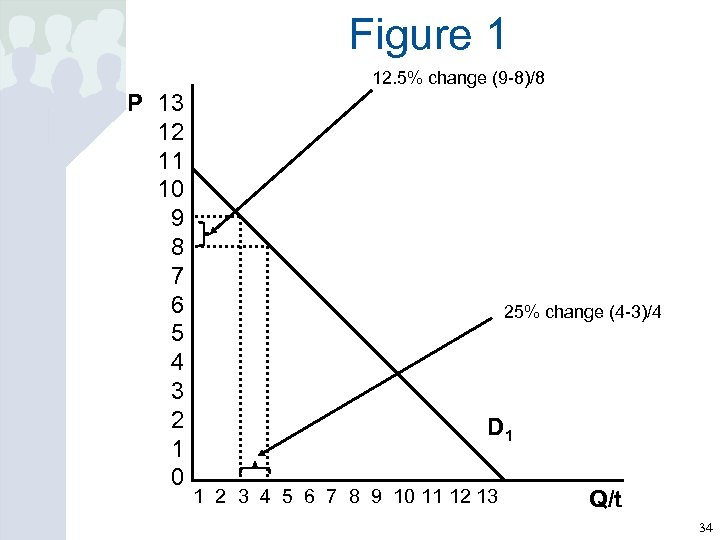

Figure 1 12. 5% change (9 -8)/8 P 13 12 11 10 9 8 7 6 5 4 3 2 1 0 25% change (4 -3)/4 D 1 1 2 3 4 5 6 7 8 9 10 11 12 13 Q/t 34

Figure 1 12. 5% change (9 -8)/8 P 13 12 11 10 9 8 7 6 5 4 3 2 1 0 25% change (4 -3)/4 D 1 1 2 3 4 5 6 7 8 9 10 11 12 13 Q/t 34

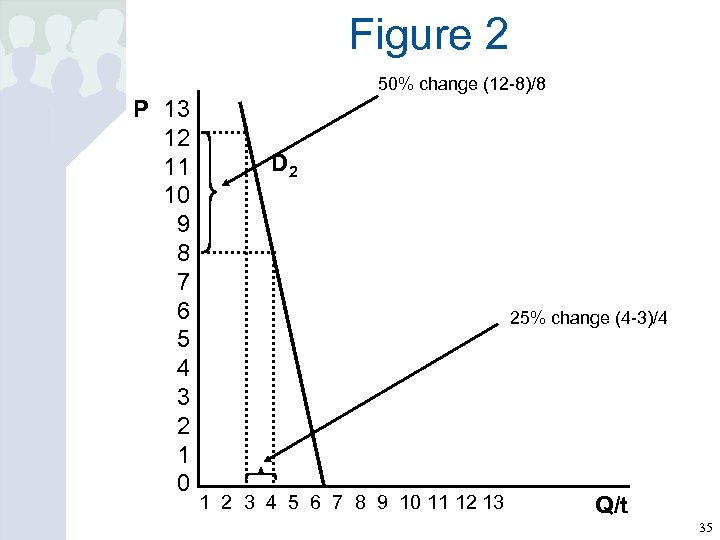

Figure 2 50% change (12 -8)/8 P 13 12 11 10 9 8 7 6 5 4 3 2 1 0 D 2 25% change (4 -3)/4 1 2 3 4 5 6 7 8 9 10 11 12 13 Q/t 35

Figure 2 50% change (12 -8)/8 P 13 12 11 10 9 8 7 6 5 4 3 2 1 0 D 2 25% change (4 -3)/4 1 2 3 4 5 6 7 8 9 10 11 12 13 Q/t 35

Figure 3 Higher Prices Means Greater Elasticity 12. 5% change (9 -8)/8 P 13 12 11 10 9 8 7 6 5 4 3 2 1 0 50% change (3 -2)/2 A B Demand C 25% change (4 -3)/4 D 1 2 3 4 5 6 7 8 9 10 11 12 13 9. 1% change (11 -10)/11 Q/t 36

Figure 3 Higher Prices Means Greater Elasticity 12. 5% change (9 -8)/8 P 13 12 11 10 9 8 7 6 5 4 3 2 1 0 50% change (3 -2)/2 A B Demand C 25% change (4 -3)/4 D 1 2 3 4 5 6 7 8 9 10 11 12 13 9. 1% change (11 -10)/11 Q/t 36

Alternative Ways to Understand Elasticity The Verbal Explanation • A good for which there are no good substitutes is likely to be one for which you must pay whatever price is charged. It is also likely to be one for which a lower price will not induce substantially greater consumption. Thus, as price changes there is very little change in consumption, i. e. demand is inelastic and the demand curve is steep. • Inexpensive goods that take up little of your income can change in price and your consumption will not change dramatically. Thus, at low prices, demand is inelastic.

Alternative Ways to Understand Elasticity The Verbal Explanation • A good for which there are no good substitutes is likely to be one for which you must pay whatever price is charged. It is also likely to be one for which a lower price will not induce substantially greater consumption. Thus, as price changes there is very little change in consumption, i. e. demand is inelastic and the demand curve is steep. • Inexpensive goods that take up little of your income can change in price and your consumption will not change dramatically. Thus, at low prices, demand is inelastic.

Seeing Elasticity Through Total Expenditures • Total Expenditure Rule: if the price and the amount you spend both go in the same direction then demand is inelastic while if they go in opposite directions demand is elastic.

Seeing Elasticity Through Total Expenditures • Total Expenditure Rule: if the price and the amount you spend both go in the same direction then demand is inelastic while if they go in opposite directions demand is elastic.

Determinants of Elasticity • Number of and Closeness of Substitutes – The more alternatives you have the less likely you are to pay high prices for a good and the more likely you are to settle for something that will do. • Time – The longer you have to come up with alternatives to paying high prices the more likely it is you will shift to those alternatives.

Determinants of Elasticity • Number of and Closeness of Substitutes – The more alternatives you have the less likely you are to pay high prices for a good and the more likely you are to settle for something that will do. • Time – The longer you have to come up with alternatives to paying high prices the more likely it is you will shift to those alternatives.

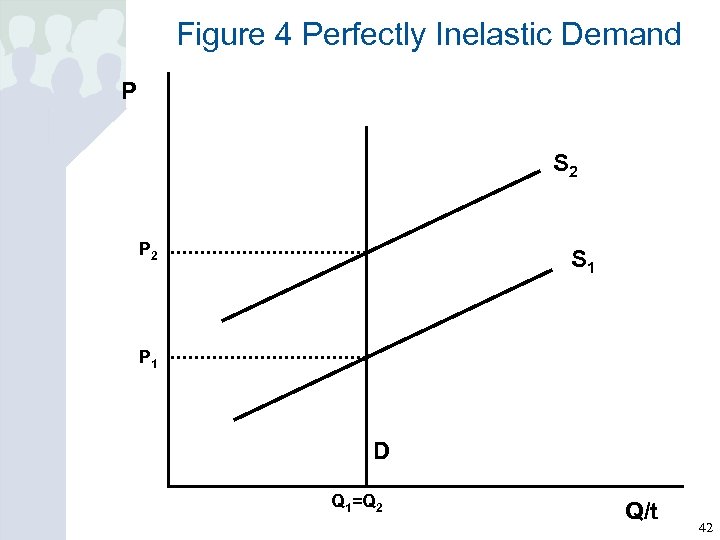

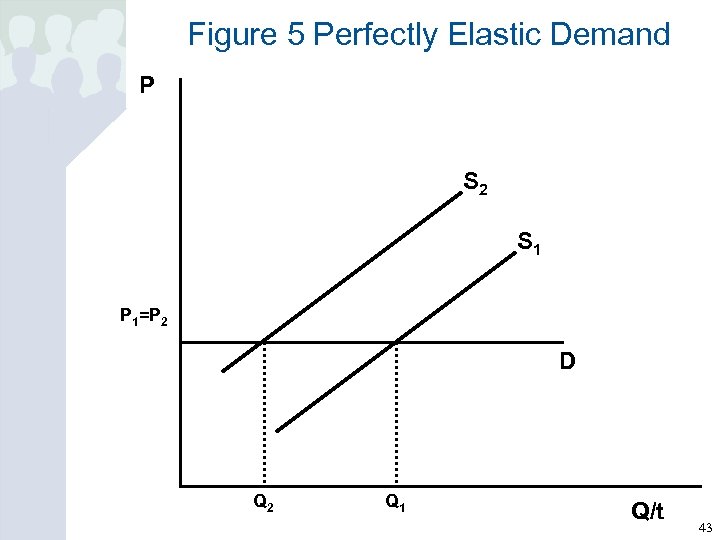

Extremes of Elasticity • Perfectly Inelastic: the condition of demand when price changes have no effect on quantity • Perfectly Elastic: the condition of demand when price cannot change

Extremes of Elasticity • Perfectly Inelastic: the condition of demand when price changes have no effect on quantity • Perfectly Elastic: the condition of demand when price cannot change

Elasticity and the Demand Curve How the Elasticity of Demand Affects Reactions to Price Changes 41

Elasticity and the Demand Curve How the Elasticity of Demand Affects Reactions to Price Changes 41

Figure 4 Perfectly Inelastic Demand P S 2 P 2 S 1 P 1 D Q 1=Q 2 Q/t 42

Figure 4 Perfectly Inelastic Demand P S 2 P 2 S 1 P 1 D Q 1=Q 2 Q/t 42

Figure 5 Perfectly Elastic Demand P S 2 S 1 P 1=P 2 D Q 2 Q 1 Q/t 43

Figure 5 Perfectly Elastic Demand P S 2 S 1 P 1=P 2 D Q 2 Q 1 Q/t 43

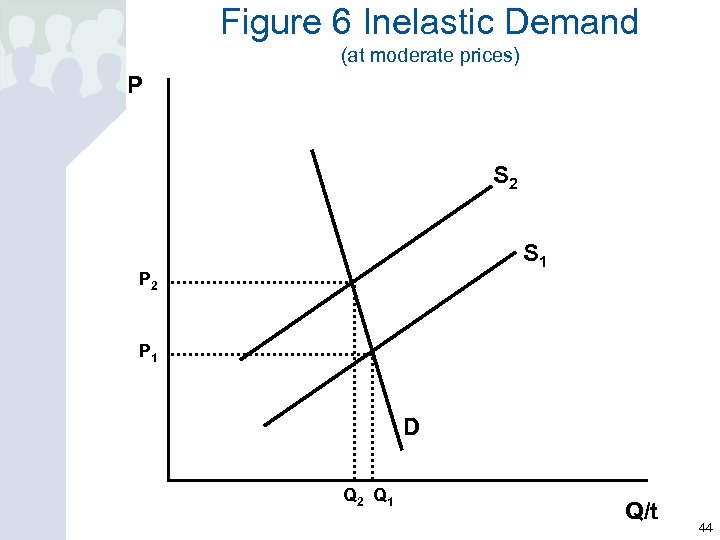

Figure 6 Inelastic Demand (at moderate prices) P S 2 S 1 P 2 P 1 D Q 2 Q 1 Q/t 44

Figure 6 Inelastic Demand (at moderate prices) P S 2 S 1 P 2 P 1 D Q 2 Q 1 Q/t 44

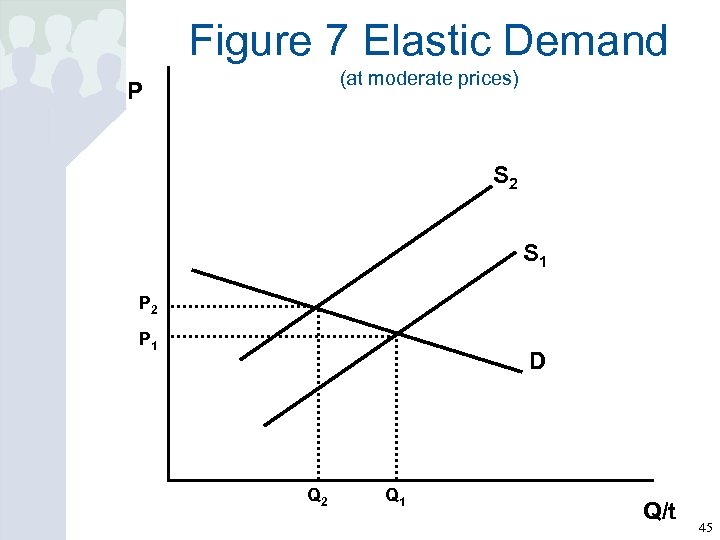

Figure 7 Elastic Demand (at moderate prices) P S 2 S 1 P 2 P 1 D Q 2 Q 1 Q/t 45

Figure 7 Elastic Demand (at moderate prices) P S 2 S 1 P 2 P 1 D Q 2 Q 1 Q/t 45

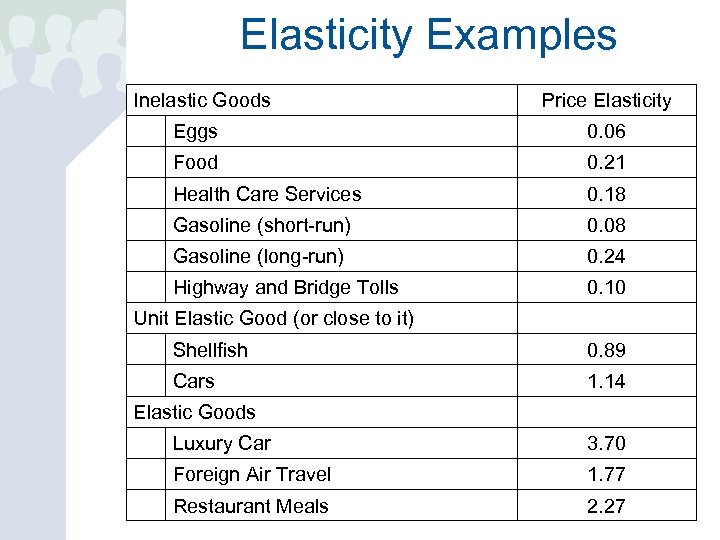

Elasticity Examples Inelastic Goods Price Elasticity Eggs 0. 06 Food 0. 21 Health Care Services 0. 18 Gasoline (short-run) 0. 08 Gasoline (long-run) 0. 24 Highway and Bridge Tolls 0. 10 Unit Elastic Good (or close to it) Shellfish 0. 89 Cars 1. 14 Elastic Goods Luxury Car 3. 70 Foreign Air Travel 1. 77 Restaurant Meals 2. 27

Elasticity Examples Inelastic Goods Price Elasticity Eggs 0. 06 Food 0. 21 Health Care Services 0. 18 Gasoline (short-run) 0. 08 Gasoline (long-run) 0. 24 Highway and Bridge Tolls 0. 10 Unit Elastic Good (or close to it) Shellfish 0. 89 Cars 1. 14 Elastic Goods Luxury Car 3. 70 Foreign Air Travel 1. 77 Restaurant Meals 2. 27

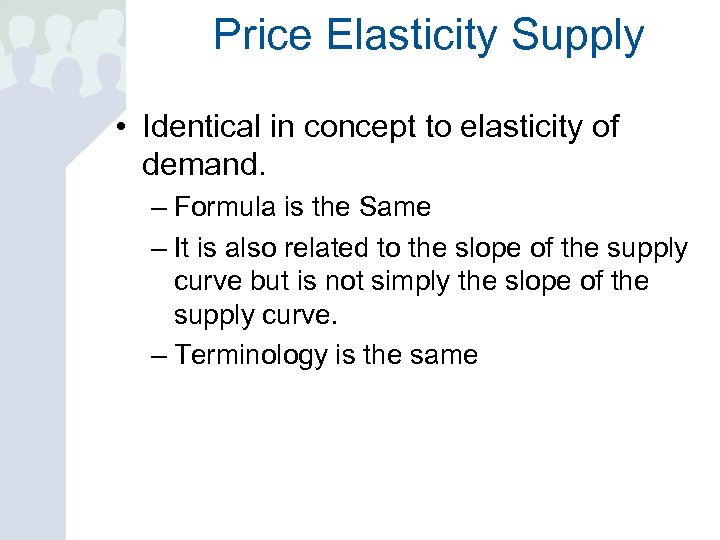

Price Elasticity Supply • Identical in concept to elasticity of demand. – Formula is the Same – It is also related to the slope of the supply curve but is not simply the slope of the supply curve. – Terminology is the same

Price Elasticity Supply • Identical in concept to elasticity of demand. – Formula is the Same – It is also related to the slope of the supply curve but is not simply the slope of the supply curve. – Terminology is the same

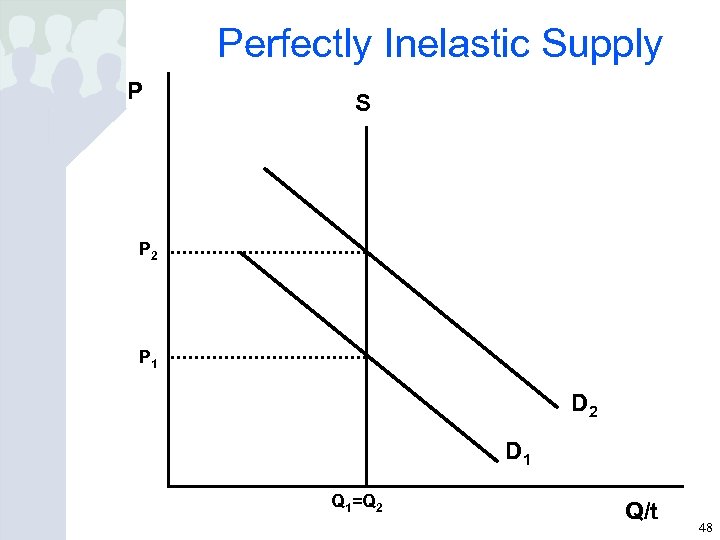

Perfectly Inelastic Supply P S P 2 P 1 D 2 D 1 Q 1=Q 2 Q/t 48

Perfectly Inelastic Supply P S P 2 P 1 D 2 D 1 Q 1=Q 2 Q/t 48

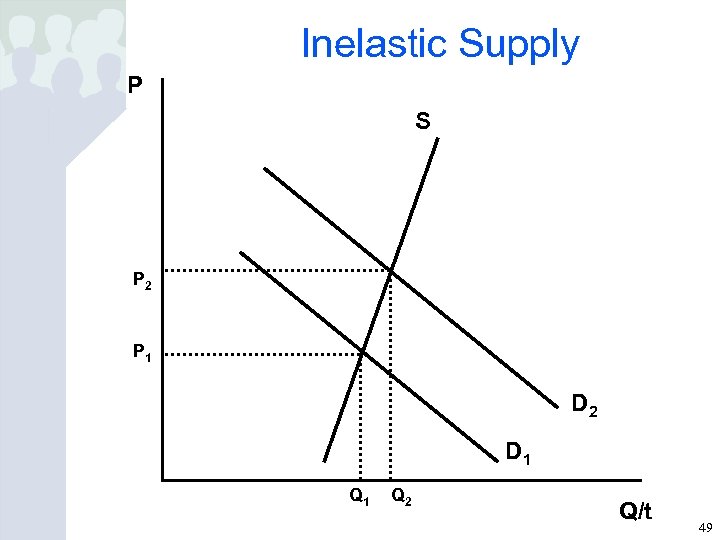

Inelastic Supply P S P 2 P 1 D 2 D 1 Q 2 Q/t 49

Inelastic Supply P S P 2 P 1 D 2 D 1 Q 2 Q/t 49

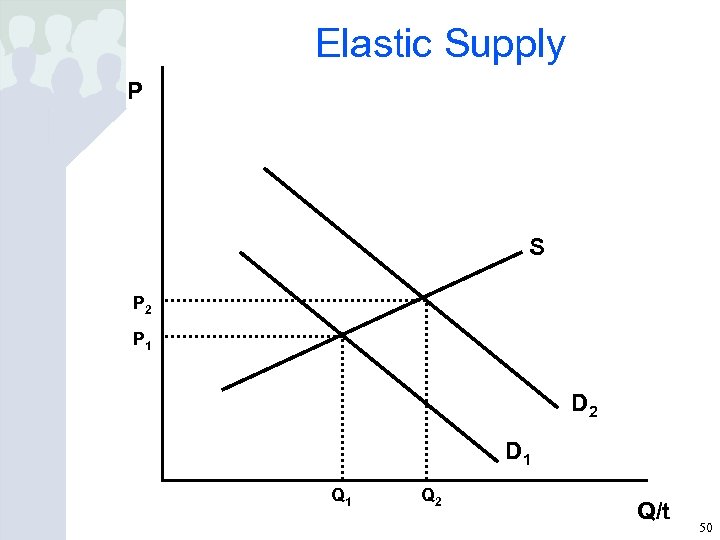

Elastic Supply P S P 2 P 1 D 2 D 1 Q 2 Q/t 50

Elastic Supply P S P 2 P 1 D 2 D 1 Q 2 Q/t 50

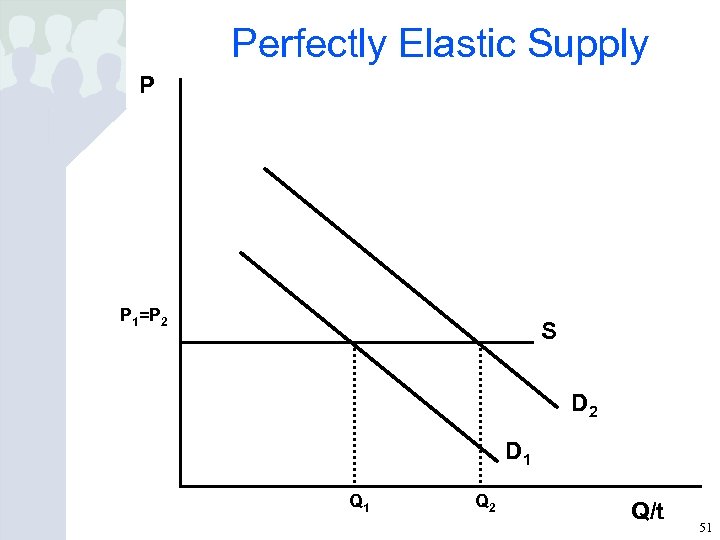

Perfectly Elastic Supply P P 1=P 2 S D 2 D 1 Q 2 Q/t 51

Perfectly Elastic Supply P P 1=P 2 S D 2 D 1 Q 2 Q/t 51

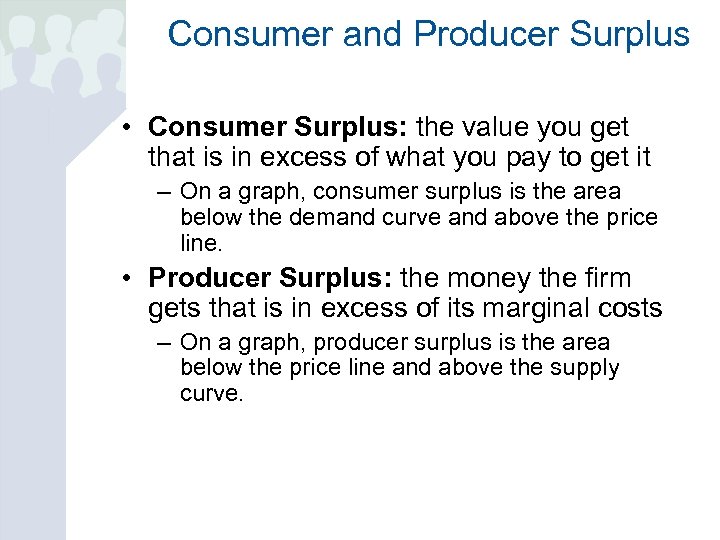

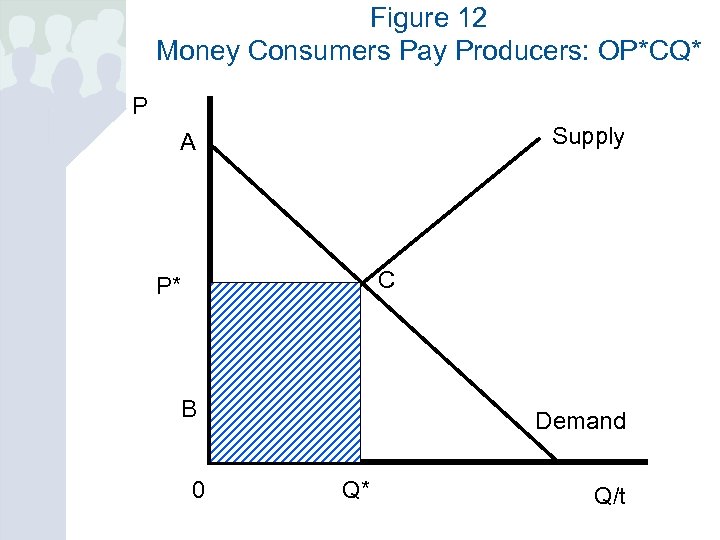

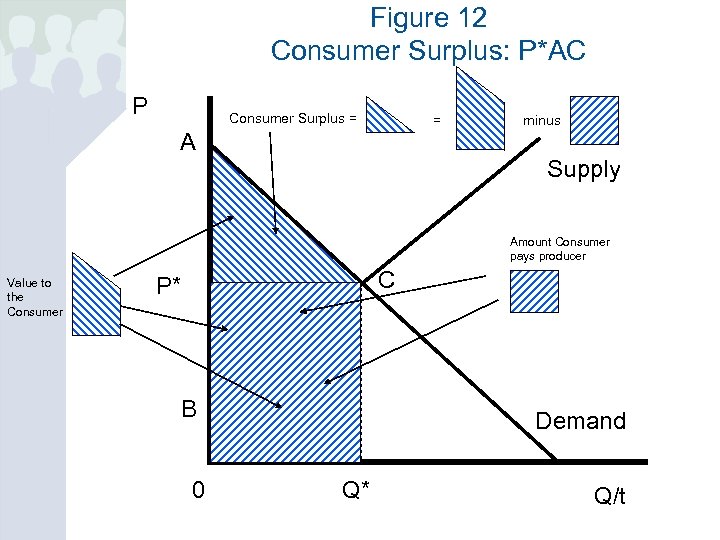

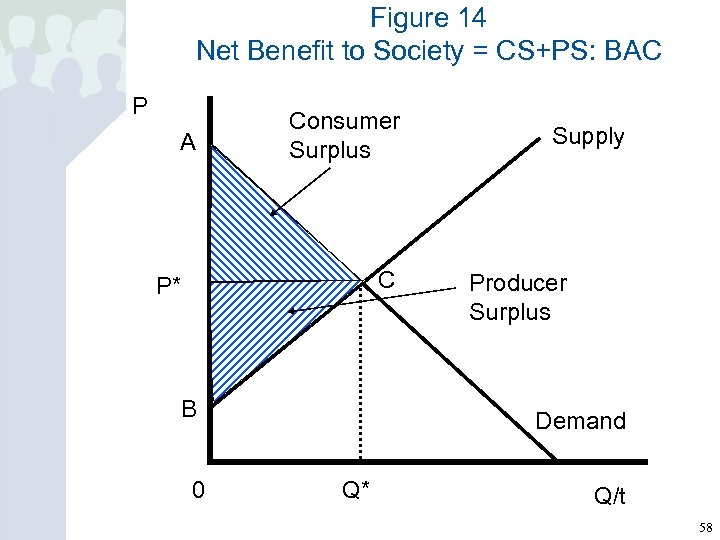

Consumer and Producer Surplus • Consumer Surplus: the value you get that is in excess of what you pay to get it – On a graph, consumer surplus is the area below the demand curve and above the price line. • Producer Surplus: the money the firm gets that is in excess of its marginal costs – On a graph, producer surplus is the area below the price line and above the supply curve.

Consumer and Producer Surplus • Consumer Surplus: the value you get that is in excess of what you pay to get it – On a graph, consumer surplus is the area below the demand curve and above the price line. • Producer Surplus: the money the firm gets that is in excess of its marginal costs – On a graph, producer surplus is the area below the price line and above the supply curve.

Figure 12 Value to the Consumer: OACQ* P Supply A C P* B 0 Demand Q* Q/t 53

Figure 12 Value to the Consumer: OACQ* P Supply A C P* B 0 Demand Q* Q/t 53

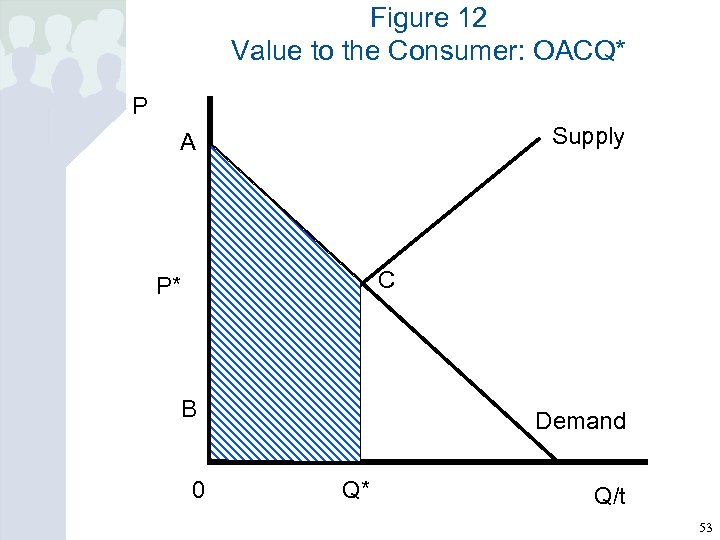

Figure 12 Money Consumers Pay Producers: OP*CQ* P Supply A C P* B 0 Demand Q* Q/t

Figure 12 Money Consumers Pay Producers: OP*CQ* P Supply A C P* B 0 Demand Q* Q/t

Figure 12 Consumer Surplus: P*AC P Consumer Surplus = = minus A Supply Amount Consumer pays producer Value to the Consumer C P* B 0 Demand Q* Q/t

Figure 12 Consumer Surplus: P*AC P Consumer Surplus = = minus A Supply Amount Consumer pays producer Value to the Consumer C P* B 0 Demand Q* Q/t

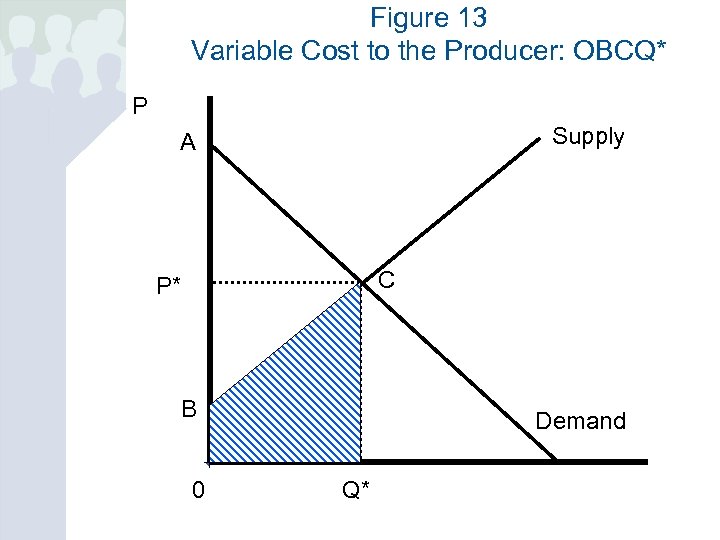

Figure 13 Variable Cost to the Producer: OBCQ* P Supply A C P* B 0 Demand Q*

Figure 13 Variable Cost to the Producer: OBCQ* P Supply A C P* B 0 Demand Q*

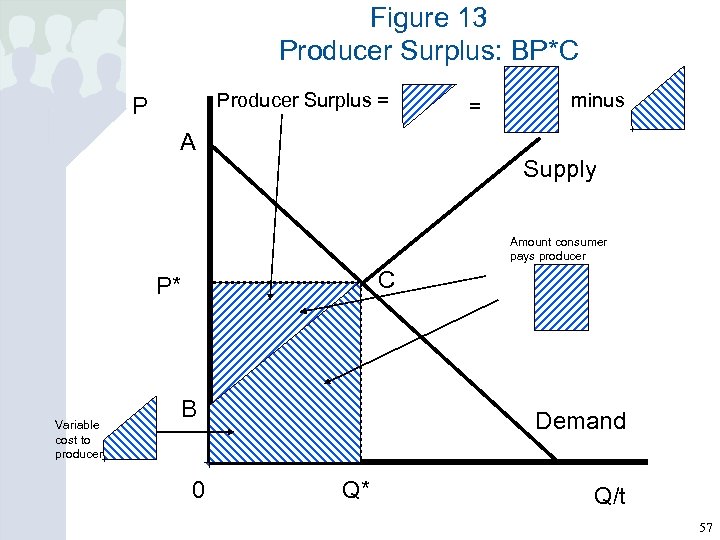

Figure 13 Producer Surplus: BP*C Producer Surplus = P = minus A Supply Amount consumer pays producer C P* Variable cost to producer B 0 Demand Q* Q/t 57

Figure 13 Producer Surplus: BP*C Producer Surplus = P = minus A Supply Amount consumer pays producer C P* Variable cost to producer B 0 Demand Q* Q/t 57

Figure 14 Net Benefit to Society = CS+PS: BAC P A Consumer Surplus C P* B 0 Supply Producer Surplus Demand Q* Q/t 58

Figure 14 Net Benefit to Society = CS+PS: BAC P A Consumer Surplus C P* B 0 Supply Producer Surplus Demand Q* Q/t 58

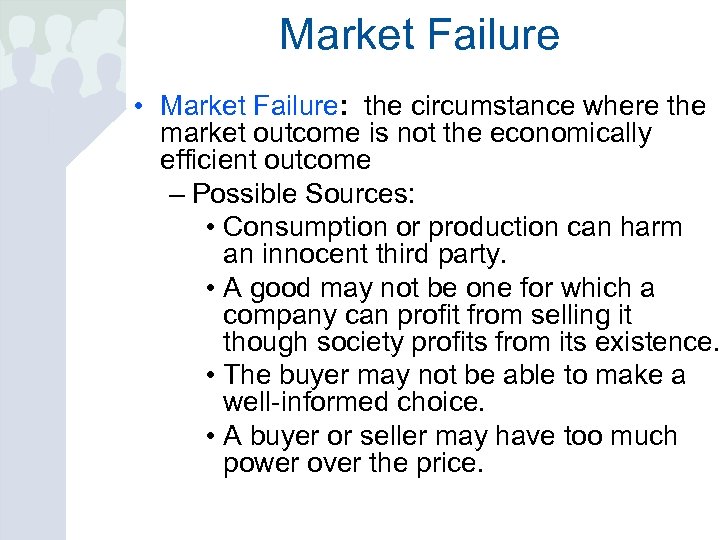

Market Failure • Market Failure: the circumstance where the market outcome is not the economically efficient outcome – Possible Sources: • Consumption or production can harm an innocent third party. • A good may not be one for which a company can profit from selling it though society profits from its existence. • The buyer may not be able to make a well-informed choice. • A buyer or seller may have too much power over the price.

Market Failure • Market Failure: the circumstance where the market outcome is not the economically efficient outcome – Possible Sources: • Consumption or production can harm an innocent third party. • A good may not be one for which a company can profit from selling it though society profits from its existence. • The buyer may not be able to make a well-informed choice. • A buyer or seller may have too much power over the price.

Exclusivity and Rivalry • Exclusivity: the degree to which the consumption of the good can be restricted by a seller to only those who pay for it • Rivalry: the degree to which one person’s consumption reduces the value of the good for the next consumer

Exclusivity and Rivalry • Exclusivity: the degree to which the consumption of the good can be restricted by a seller to only those who pay for it • Rivalry: the degree to which one person’s consumption reduces the value of the good for the next consumer

Private and Public Goods • Purely private good: a good with the characteristics of both exclusivity and rivalry • Purely public good: a good with the neither of the characteristics exclusivity and rivalry • Excludable public good: a good with the characteristic of exclusivity but not of rivalry • Congestible public good: a good with the characteristic of rivalry but not of exclusivity

Private and Public Goods • Purely private good: a good with the characteristics of both exclusivity and rivalry • Purely public good: a good with the neither of the characteristics exclusivity and rivalry • Excludable public good: a good with the characteristic of exclusivity but not of rivalry • Congestible public good: a good with the characteristic of rivalry but not of exclusivity

Kick it Up a Notch Consumer and Producer Surplus in a Supply and Demand Model 62

Kick it Up a Notch Consumer and Producer Surplus in a Supply and Demand Model 62

The Optimality of Equilibrium and Dead Weight Loss • At equilibrium the sum of producer and consumer surplus is as big as it can be (ABC). • Away from equilibrium the sum of producer and consumer surplus is smaller. The degree to which it is smaller is called the dead weight loss. That is, it is the loss in societal welfare associated with production being too little or too great.

The Optimality of Equilibrium and Dead Weight Loss • At equilibrium the sum of producer and consumer surplus is as big as it can be (ABC). • Away from equilibrium the sum of producer and consumer surplus is smaller. The degree to which it is smaller is called the dead weight loss. That is, it is the loss in societal welfare associated with production being too little or too great.

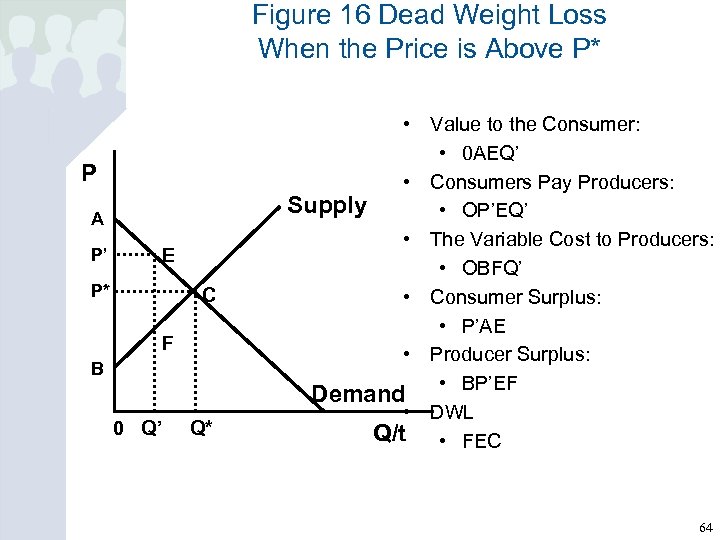

Figure 16 Dead Weight Loss When the Price is Above P* P A P’ E P* C F B 0 Q’ Q* • Value to the Consumer: • 0 AEQ’ • Consumers Pay Producers: Supply • OP’EQ’ • The Variable Cost to Producers: • OBFQ’ • Consumer Surplus: • P’AE • Producer Surplus: • BP’EF Demand • DWL Q/t • FEC 64

Figure 16 Dead Weight Loss When the Price is Above P* P A P’ E P* C F B 0 Q’ Q* • Value to the Consumer: • 0 AEQ’ • Consumers Pay Producers: Supply • OP’EQ’ • The Variable Cost to Producers: • OBFQ’ • Consumer Surplus: • P’AE • Producer Surplus: • BP’EF Demand • DWL Q/t • FEC 64

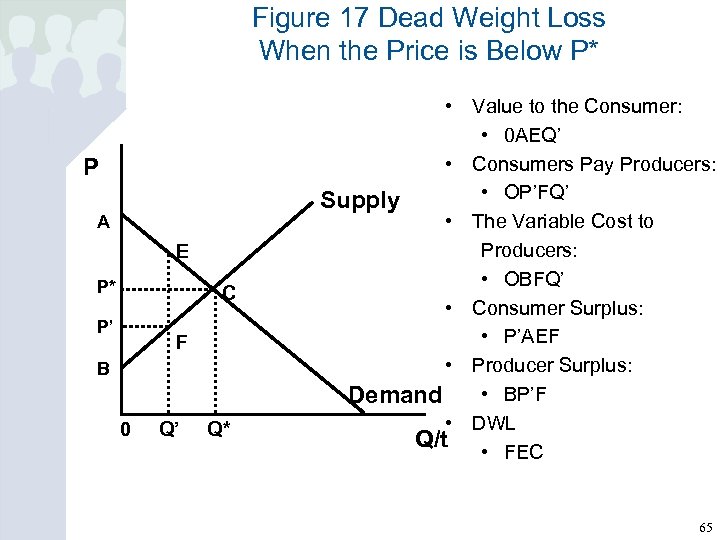

Figure 17 Dead Weight Loss When the Price is Below P* P A E P* C P’ F B 0 Q’ Q* • Value to the Consumer: • 0 AEQ’ • Consumers Pay Producers: • OP’FQ’ Supply • The Variable Cost to Producers: • OBFQ’ • Consumer Surplus: • P’AEF • Producer Surplus: • BP’F Demand • DWL Q/t • FEC 65

Figure 17 Dead Weight Loss When the Price is Below P* P A E P* C P’ F B 0 Q’ Q* • Value to the Consumer: • 0 AEQ’ • Consumers Pay Producers: • OP’FQ’ Supply • The Variable Cost to Producers: • OBFQ’ • Consumer Surplus: • P’AEF • Producer Surplus: • BP’F Demand • DWL Q/t • FEC 65

Basic Definitions • Profit: The money that business makes: Revenue minus Cost • Cost: the expense that must be incurred in order to produce goods for sale • Revenue : the money that comes into the firm from the sale of their goods

Basic Definitions • Profit: The money that business makes: Revenue minus Cost • Cost: the expense that must be incurred in order to produce goods for sale • Revenue : the money that comes into the firm from the sale of their goods

Economic vs. Accounting Cost • Economic Cost: All costs, both those that must be paid as well as those incurred in the form of forgone opportunities, of a business • Accounting Cost: Only those costs that must be explicitly paid by the owner of a business

Economic vs. Accounting Cost • Economic Cost: All costs, both those that must be paid as well as those incurred in the form of forgone opportunities, of a business • Accounting Cost: Only those costs that must be explicitly paid by the owner of a business

Production • Production Function: a graph which shows how many resources we need to produce various amounts of output • Cost Function: a graph which shows how much various amounts of production cost

Production • Production Function: a graph which shows how many resources we need to produce various amounts of output • Cost Function: a graph which shows how much various amounts of production cost

Inputs to Production • Fixed Inputs: resources that you cannot change • Variable Inputs : resources that can be easily changed

Inputs to Production • Fixed Inputs: resources that you cannot change • Variable Inputs : resources that can be easily changed

Concepts in Production • Division of Labor: workers divide up the tasks in such a way that each can build up a momentum and not have to switch jobs • Diminishing Returns: the notion that there exists a point where the addition of resources increases production but does so at a decreasing rate

Concepts in Production • Division of Labor: workers divide up the tasks in such a way that each can build up a momentum and not have to switch jobs • Diminishing Returns: the notion that there exists a point where the addition of resources increases production but does so at a decreasing rate

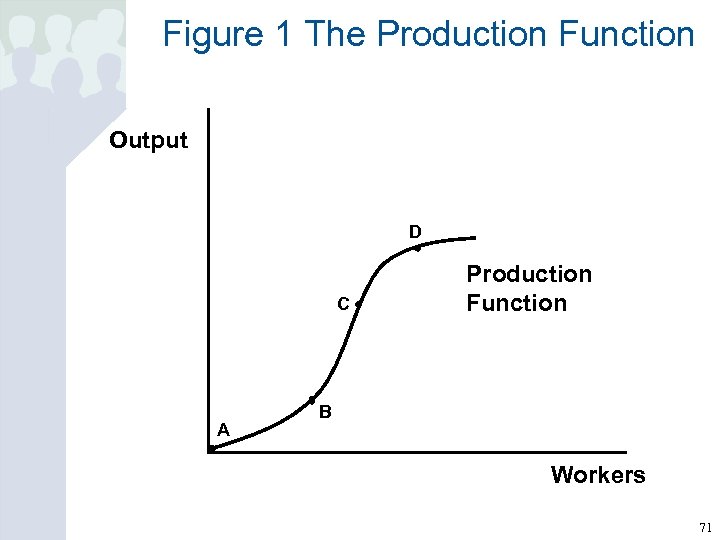

Figure 1 The Production Function Output D C A Production Function B Workers 71

Figure 1 The Production Function Output D C A Production Function B Workers 71

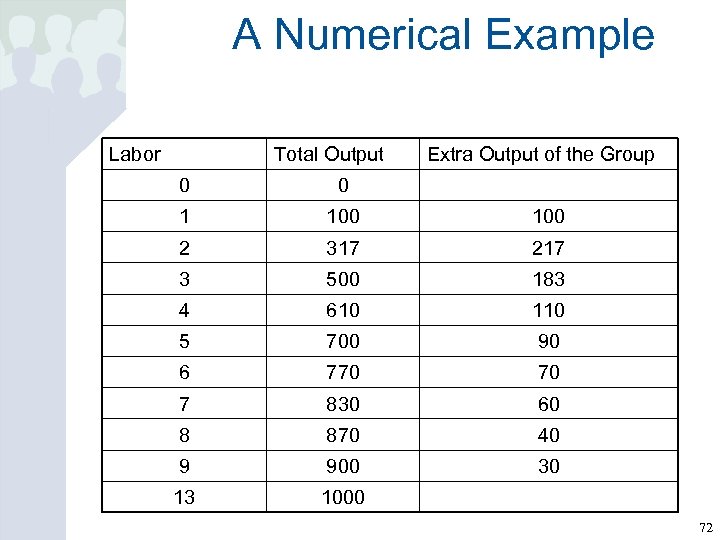

A Numerical Example Labor Total Output Extra Output of the Group 0 0 1 100 2 317 217 3 500 183 4 610 110 5 700 90 6 770 70 7 830 60 8 870 40 9 900 30 13 1000 72

A Numerical Example Labor Total Output Extra Output of the Group 0 0 1 100 2 317 217 3 500 183 4 610 110 5 700 90 6 770 70 7 830 60 8 870 40 9 900 30 13 1000 72

Costs • Fixed Costs: costs of production that we cannot change • Variable Costs: costs of production that we can change

Costs • Fixed Costs: costs of production that we cannot change • Variable Costs: costs of production that we can change

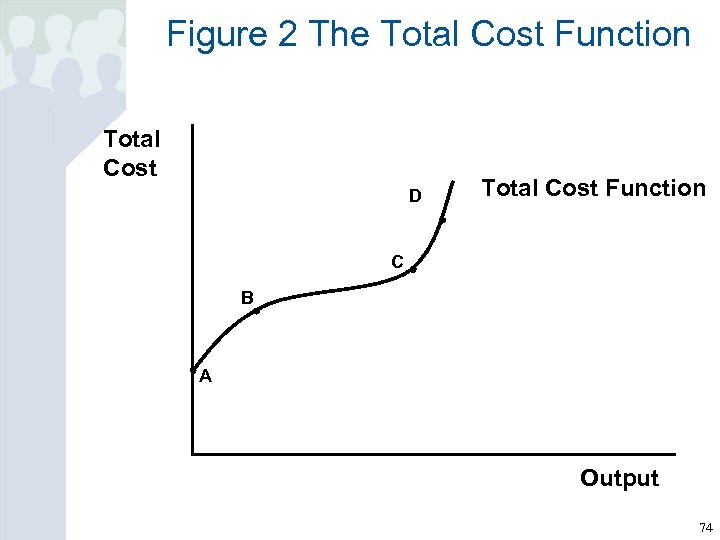

Figure 2 The Total Cost Function Total Cost D Total Cost Function C B A Output 74

Figure 2 The Total Cost Function Total Cost D Total Cost Function C B A Output 74

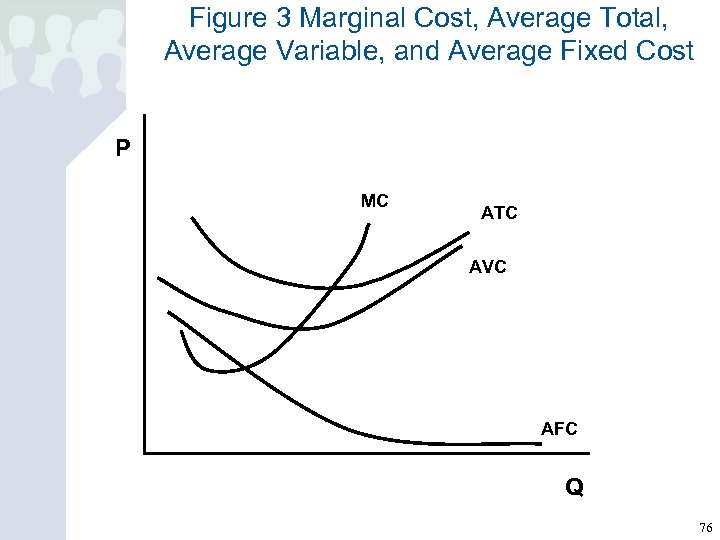

Cost Concepts • Marginal Cost: the addition to cost associated with one additional unit of output • Average Total Cost: Total Cost/Output, the cost per unit of production • Average Variable Cost: Total Variable Cost/Output, the average variable cost per unit of production • Average Fixed Cost: Total Fixed Cost/Output, the average fixed cost per unit of production

Cost Concepts • Marginal Cost: the addition to cost associated with one additional unit of output • Average Total Cost: Total Cost/Output, the cost per unit of production • Average Variable Cost: Total Variable Cost/Output, the average variable cost per unit of production • Average Fixed Cost: Total Fixed Cost/Output, the average fixed cost per unit of production

Figure 3 Marginal Cost, Average Total, Average Variable, and Average Fixed Cost P MC ATC AVC AFC Q 76

Figure 3 Marginal Cost, Average Total, Average Variable, and Average Fixed Cost P MC ATC AVC AFC Q 76

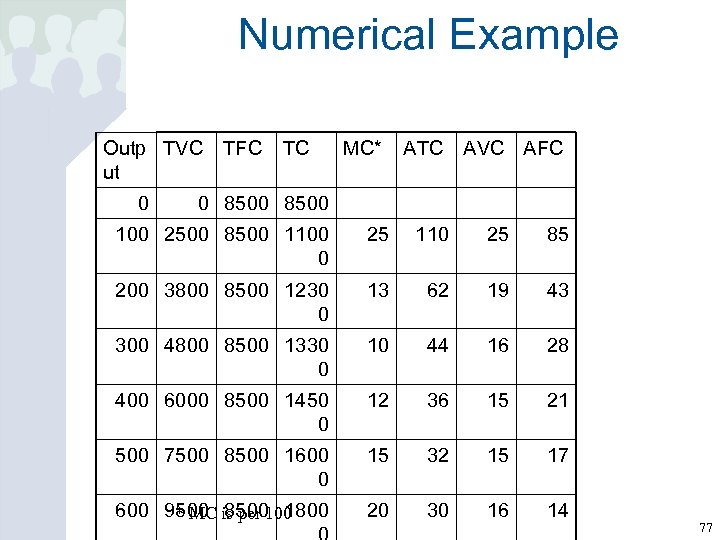

Numerical Example Outp TVC ut 0 TFC TC MC* ATC AVC AFC 0 8500 100 2500 8500 1100 0 25 110 25 85 200 3800 8500 1230 0 13 62 19 43 300 4800 8500 1330 0 10 44 16 28 400 6000 8500 1450 0 12 36 15 21 500 7500 8500 1600 0 15 32 15 17 600 9500 is per 100 * MC 8500 1800 20 30 16 14 77

Numerical Example Outp TVC ut 0 TFC TC MC* ATC AVC AFC 0 8500 100 2500 8500 1100 0 25 110 25 85 200 3800 8500 1230 0 13 62 19 43 300 4800 8500 1330 0 10 44 16 28 400 6000 8500 1450 0 12 36 15 21 500 7500 8500 1600 0 15 32 15 17 600 9500 is per 100 * MC 8500 1800 20 30 16 14 77

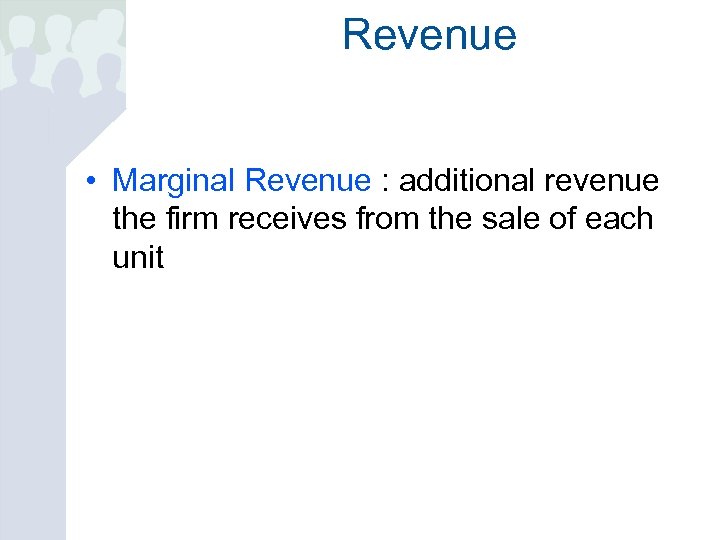

Revenue • Marginal Revenue : additional revenue the firm receives from the sale of each unit

Revenue • Marginal Revenue : additional revenue the firm receives from the sale of each unit

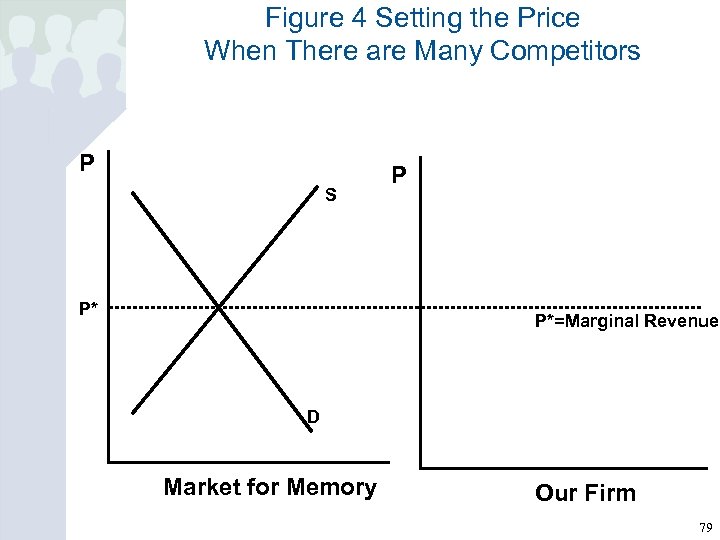

Figure 4 Setting the Price When There are Many Competitors P S P* P P*=Marginal Revenue D Market for Memory Our Firm 79

Figure 4 Setting the Price When There are Many Competitors P S P* P P*=Marginal Revenue D Market for Memory Our Firm 79

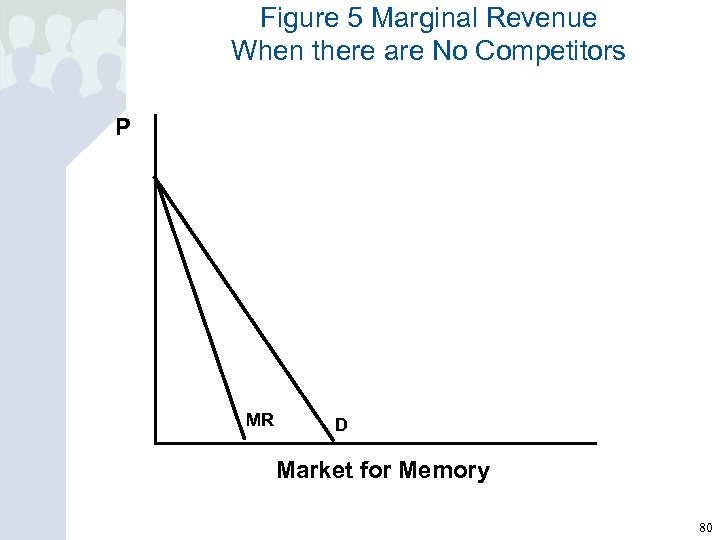

Figure 5 Marginal Revenue When there are No Competitors P MR D Market for Memory 80

Figure 5 Marginal Revenue When there are No Competitors P MR D Market for Memory 80

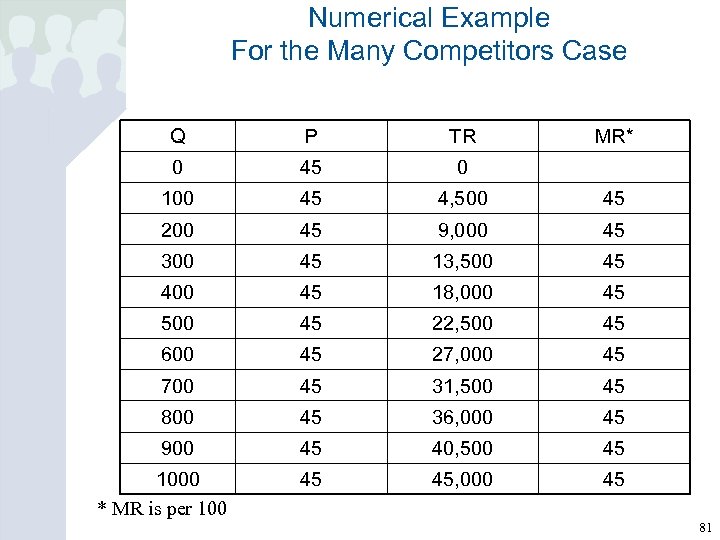

Numerical Example For the Many Competitors Case Q P TR 0 45 0 100 45 4, 500 45 200 45 9, 000 45 300 45 13, 500 45 400 45 18, 000 45 500 45 22, 500 45 600 45 27, 000 45 700 45 31, 500 45 800 45 36, 000 45 900 45 40, 500 45 45 45, 000 45 1000 * MR is per 100 MR* 81

Numerical Example For the Many Competitors Case Q P TR 0 45 0 100 45 4, 500 45 200 45 9, 000 45 300 45 13, 500 45 400 45 18, 000 45 500 45 22, 500 45 600 45 27, 000 45 700 45 31, 500 45 800 45 36, 000 45 900 45 40, 500 45 45 45, 000 45 1000 * MR is per 100 MR* 81

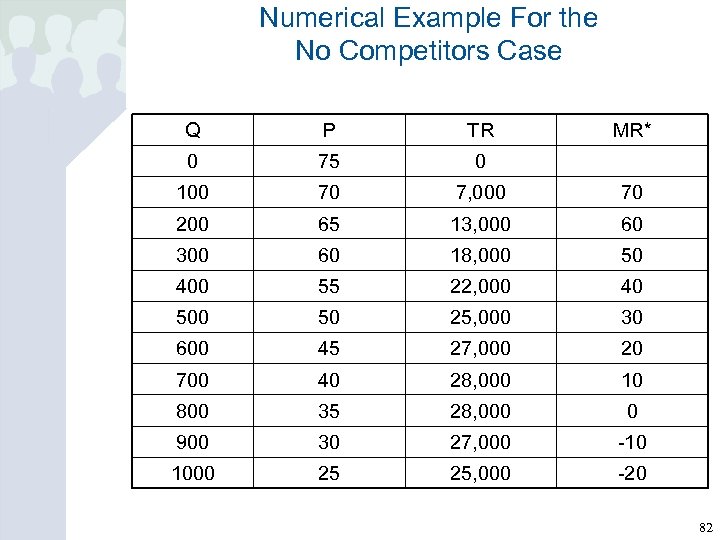

Numerical Example For the No Competitors Case Q P TR MR* 0 75 0 100 70 7, 000 70 200 65 13, 000 60 300 60 18, 000 50 400 55 22, 000 40 50 25, 000 30 600 45 27, 000 20 700 40 28, 000 10 800 35 28, 000 0 900 30 27, 000 -10 1000 25 25, 000 -20 82

Numerical Example For the No Competitors Case Q P TR MR* 0 75 0 100 70 7, 000 70 200 65 13, 000 60 300 60 18, 000 50 400 55 22, 000 40 50 25, 000 30 600 45 27, 000 20 700 40 28, 000 10 800 35 28, 000 0 900 30 27, 000 -10 1000 25 25, 000 -20 82

Maximizing Profit • We assume that firms wish to maximize profits

Maximizing Profit • We assume that firms wish to maximize profits

Market Forms • Perfect Competition: a situation in a market where there are many firms producing the same good • Monopoly: a situation in a market where there is only one firm producing the good

Market Forms • Perfect Competition: a situation in a market where there are many firms producing the same good • Monopoly: a situation in a market where there is only one firm producing the good

Rules of Production • A firm should a) produce an amount such that Marginal Revenue equals Marginal Cost (MR=MC), unless b) the price is less than the average variable cost (P

Rules of Production • A firm should a) produce an amount such that Marginal Revenue equals Marginal Cost (MR=MC), unless b) the price is less than the average variable cost (P

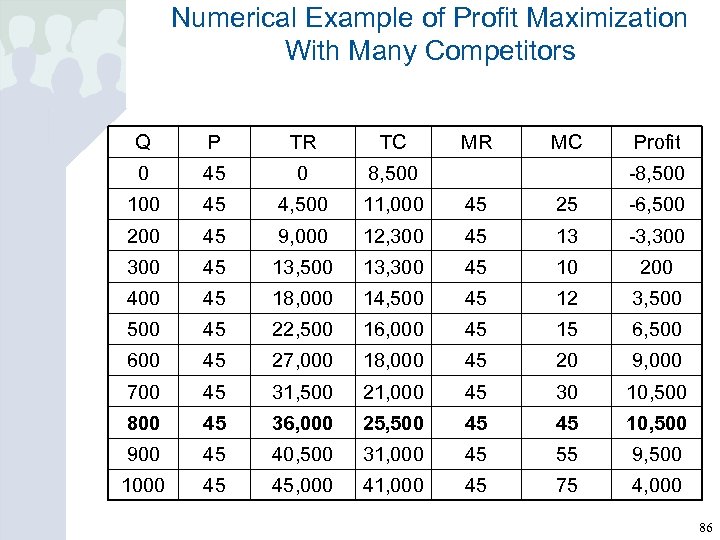

Numerical Example of Profit Maximization With Many Competitors Q P TR TC MR MC Profit 0 45 0 8, 500 100 45 4, 500 11, 000 45 25 -6, 500 200 45 9, 000 12, 300 45 13 -3, 300 45 13, 500 13, 300 45 10 200 45 18, 000 14, 500 45 12 3, 500 45 22, 500 16, 000 45 15 6, 500 600 45 27, 000 18, 000 45 20 9, 000 700 45 31, 500 21, 000 45 30 10, 500 800 45 36, 000 25, 500 45 45 10, 500 900 45 40, 500 31, 000 45 55 9, 500 1000 45 45, 000 41, 000 45 75 4, 000 -8, 500 86

Numerical Example of Profit Maximization With Many Competitors Q P TR TC MR MC Profit 0 45 0 8, 500 100 45 4, 500 11, 000 45 25 -6, 500 200 45 9, 000 12, 300 45 13 -3, 300 45 13, 500 13, 300 45 10 200 45 18, 000 14, 500 45 12 3, 500 45 22, 500 16, 000 45 15 6, 500 600 45 27, 000 18, 000 45 20 9, 000 700 45 31, 500 21, 000 45 30 10, 500 800 45 36, 000 25, 500 45 45 10, 500 900 45 40, 500 31, 000 45 55 9, 500 1000 45 45, 000 41, 000 45 75 4, 000 -8, 500 86

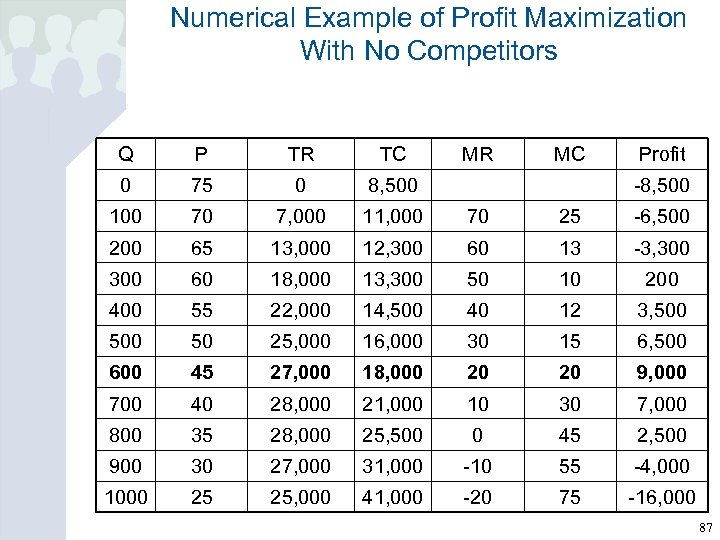

Numerical Example of Profit Maximization With No Competitors Q P TR TC MR MC Profit 0 75 0 8, 500 100 70 7, 000 11, 000 70 25 -6, 500 200 65 13, 000 12, 300 60 13 -3, 300 60 18, 000 13, 300 50 10 200 400 55 22, 000 14, 500 40 12 3, 500 50 25, 000 16, 000 30 15 6, 500 600 45 27, 000 18, 000 20 20 9, 000 700 40 28, 000 21, 000 10 30 7, 000 800 35 28, 000 25, 500 0 45 2, 500 900 30 27, 000 31, 000 -10 55 -4, 000 1000 25 25, 000 41, 000 -20 75 -16, 000 -8, 500 87

Numerical Example of Profit Maximization With No Competitors Q P TR TC MR MC Profit 0 75 0 8, 500 100 70 7, 000 11, 000 70 25 -6, 500 200 65 13, 000 12, 300 60 13 -3, 300 60 18, 000 13, 300 50 10 200 400 55 22, 000 14, 500 40 12 3, 500 50 25, 000 16, 000 30 15 6, 500 600 45 27, 000 18, 000 20 20 9, 000 700 40 28, 000 21, 000 10 30 7, 000 800 35 28, 000 25, 500 0 45 2, 500 900 30 27, 000 31, 000 -10 55 -4, 000 1000 25 25, 000 41, 000 -20 75 -16, 000 -8, 500 87