Decision tree

Decision tree

A decision tree is a graphical method that shows the sequence of strategic decisions and proposed sequence in every possible unit of circumstances 2

A decision tree is a graphical method that shows the sequence of strategic decisions and proposed sequence in every possible unit of circumstances 2

Building the decision tree begins with the earliest decisions and moves forward in time through the successive events and decisions 3

Building the decision tree begins with the earliest decisions and moves forward in time through the successive events and decisions 3

4 Because of every decision depends on the assessment of the events that will occur later, the tree decision analysis begins at the end of the sequence and moves back

4 Because of every decision depends on the assessment of the events that will occur later, the tree decision analysis begins at the end of the sequence and moves back

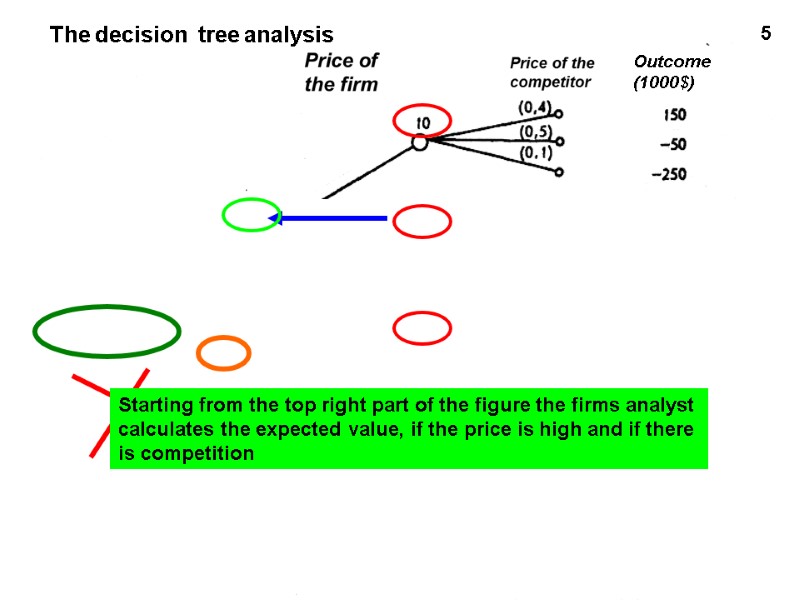

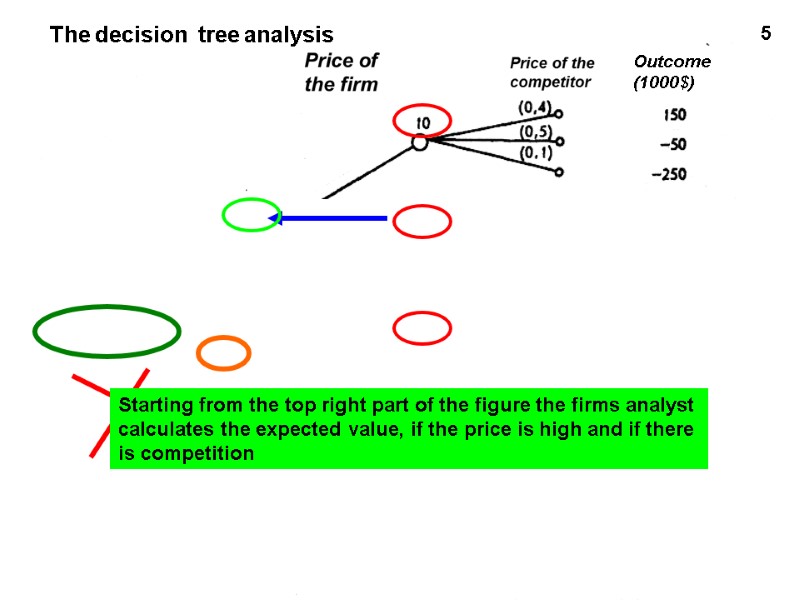

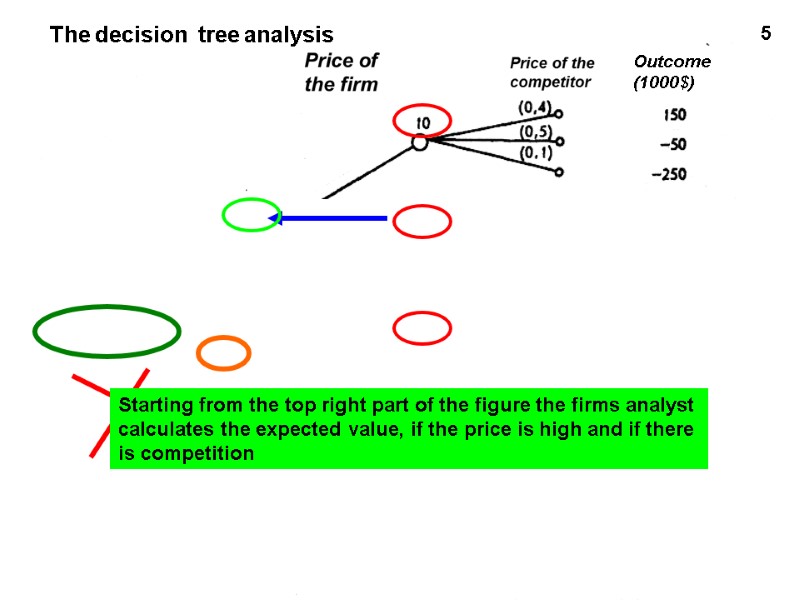

The decision tree analysis 5 Starting from the top right part of the figure the firms analyst calculates the expected value, if the price is high and if there is competition

The decision tree analysis 5 Starting from the top right part of the figure the firms analyst calculates the expected value, if the price is high and if there is competition

Risk planning and price of risk

Risk planning and price of risk

For the risk it is characteristic that the probability of outcomes can be evaluated statistically Potential profit and loss can be included in the cost structure of the firm 9

For the risk it is characteristic that the probability of outcomes can be evaluated statistically Potential profit and loss can be included in the cost structure of the firm 9

In-house risk Concerns possible losses that firms prefer to include in the cost structure in advance instead of buying insurance against such losses 10

In-house risk Concerns possible losses that firms prefer to include in the cost structure in advance instead of buying insurance against such losses 10

If the number of accidents within the firm is large enough so that they can be predicted, the management may determine the probability of loss and add it to the other costs Ех: If the average estimated losses of the company can be predicted for the current period, then they can be insured in the company, regarding them as the cost of doing business 11

If the number of accidents within the firm is large enough so that they can be predicted, the management may determine the probability of loss and add it to the other costs Ех: If the average estimated losses of the company can be predicted for the current period, then they can be insured in the company, regarding them as the cost of doing business 11

Determination of the possibility of such damages can be part of the planning of the company under condition of allocation of reserve in case of damage or unforeseen circumstances

Determination of the possibility of such damages can be part of the planning of the company under condition of allocation of reserve in case of damage or unforeseen circumstances

Therefore, banks regularly write off bad loans, and the usual practice in accounting is unpaid invoices for any business that has a receivables

Therefore, banks regularly write off bad loans, and the usual practice in accounting is unpaid invoices for any business that has a receivables

Occurs if the number of observations within one company is not large enough so that the management can predict the damages with reasonable accuracy Intercompany risk

Occurs if the number of observations within one company is not large enough so that the management can predict the damages with reasonable accuracy Intercompany risk

When considering a lot of firms, the number of observations becomes large enough to be able to demonstrate the necessary stability of predictions

When considering a lot of firms, the number of observations becomes large enough to be able to demonstrate the necessary stability of predictions

Examples of such risks are fire,

Examples of such risks are fire,

floods,

floods,

storms and other natural disasters

storms and other natural disasters

The burden of forecasting passed on insurance companies The insurance companies have large base of certain cases Since the heads of companies are not able to predict such damage to their firms

The burden of forecasting passed on insurance companies The insurance companies have large base of certain cases Since the heads of companies are not able to predict such damage to their firms

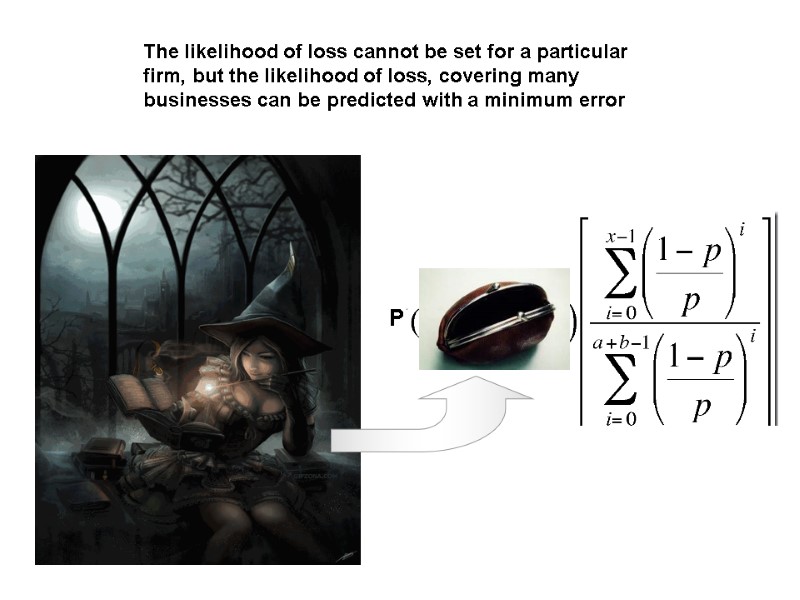

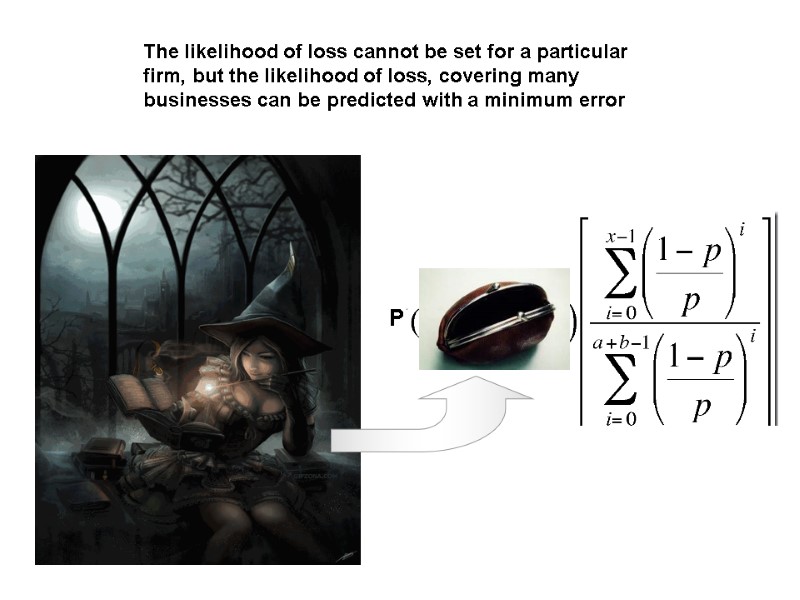

The likelihood of loss cannot be set for a particular firm, but the likelihood of loss, covering many businesses can be predicted with a minimum error Р

The likelihood of loss cannot be set for a particular firm, but the likelihood of loss, covering many businesses can be predicted with a minimum error Р

Insurance company predicts cumulative risk of all firms that she secures and distributes the total cost of the anticipated losses by charging each firm fee, called a premium

Insurance company predicts cumulative risk of all firms that she secures and distributes the total cost of the anticipated losses by charging each firm fee, called a premium

Insurance premium becomes part of the cost structure of the insured company

Insurance premium becomes part of the cost structure of the insured company

The insurance company must decide what premium to charge based on estimated losses + administrative costs and profit

The insurance company must decide what premium to charge based on estimated losses + administrative costs and profit

The manager, trying to avoid risk, should decide whether to buy or not to buy insurance, based on the estimated cost of operations of the company and its utility functions

The manager, trying to avoid risk, should decide whether to buy or not to buy insurance, based on the estimated cost of operations of the company and its utility functions

Функция полезности Ех:

Функция полезности Ех: