29f236912091f7eb5bdcd4c2ccf277f8.ppt

- Количество слайдов: 53

Decision: Should I keep my group health plan or take Medicare? A look at what to do and why

Decision: Should I keep my group health plan or take Medicare? A look at what to do and why

Overview Why was this course developed? Demographics – an aging workforce TEFRA – rules to govern who pays first Health and Drug Plan Options Case Studies Q&A

Overview Why was this course developed? Demographics – an aging workforce TEFRA – rules to govern who pays first Health and Drug Plan Options Case Studies Q&A

Why was this course developed? Because even the best agents do not understand Medicare Secondary payer rules.

Why was this course developed? Because even the best agents do not understand Medicare Secondary payer rules.

Recent scenario (BM) “… there was a discussion about an active employee dropping their employer based health plan and having just Medicare. When the active employee had a huge claim and CMS audited the claim, CMS went after the employer for what the employer would have paid had the employee remained on the employer’s health plan. At the time, I called CMS and asked if this was accurate and was told it was very much accurate. The question has come up again and out of curiosity, I called Medicare and asked them the question, “If I’m working for a company subject to TEFRA where the employer plan is primary and Medicare is secondary, can I drop the employer plan and have Medicare be my primary coverage. ” I was assured I could. So, two calls to Medicare; two different answers. Anyone else remember the situation some years ago or have any input that can help me make since of this? ”

Recent scenario (BM) “… there was a discussion about an active employee dropping their employer based health plan and having just Medicare. When the active employee had a huge claim and CMS audited the claim, CMS went after the employer for what the employer would have paid had the employee remained on the employer’s health plan. At the time, I called CMS and asked if this was accurate and was told it was very much accurate. The question has come up again and out of curiosity, I called Medicare and asked them the question, “If I’m working for a company subject to TEFRA where the employer plan is primary and Medicare is secondary, can I drop the employer plan and have Medicare be my primary coverage. ” I was assured I could. So, two calls to Medicare; two different answers. Anyone else remember the situation some years ago or have any input that can help me make since of this? ”

First reply (MS) See pages 5 -12 to get your answer; more details after that. Valuable chart to print on pages 6 -7: https: //www. medicare. gov/Publications/Pubs/pdf/02179. pdf

First reply (MS) See pages 5 -12 to get your answer; more details after that. Valuable chart to print on pages 6 -7: https: //www. medicare. gov/Publications/Pubs/pdf/02179. pdf

Second reply (LN) “I believe what BM is asking is…will CMS sue the employer if the employee drops his employer sponsored health insurance that would have been primary thus making Medicare primary, not who pays first. BM asked his question to CMS without asking and can the employer be sued if it is dropped. Therefore, was given the correct but perhaps not complete answer. I don’t know the answer to this and I may have misread BM’s question and if so I apologize. However, on a different note I did hear of an agent becoming embroiled in a potential legal action because it was not explained to the employee (of an employer under 20 thus making Medicare primary) that the carrier they were with will pay as IF the employee was enrolled in Part B regardless if they were or not. Carriers when primary pay claims differently. Some automatically pay as primary and some will pay assuming and expecting the employee to have Part B. ”

Second reply (LN) “I believe what BM is asking is…will CMS sue the employer if the employee drops his employer sponsored health insurance that would have been primary thus making Medicare primary, not who pays first. BM asked his question to CMS without asking and can the employer be sued if it is dropped. Therefore, was given the correct but perhaps not complete answer. I don’t know the answer to this and I may have misread BM’s question and if so I apologize. However, on a different note I did hear of an agent becoming embroiled in a potential legal action because it was not explained to the employee (of an employer under 20 thus making Medicare primary) that the carrier they were with will pay as IF the employee was enrolled in Part B regardless if they were or not. Carriers when primary pay claims differently. Some automatically pay as primary and some will pay assuming and expecting the employee to have Part B. ”

Fourth reply (MB) “I'd like to further add to this: Employer group of about 15 employees. Employer only contributes 50%. When you have employees over age 65 whose premium is $1000+ a month - and their share is $500 - it is cheaper for the employee to choose Medicare w/ supplement. Shouldn't matter to CMS since Medicare is primary either way. However, What IF this was a 20+ person group? Does the fact that an employee chooses Medicare instead of the Employer's plan BECAUSE it is CHEAPER for EE to do so - cause CMS to go after the ER? ? ? ”

Fourth reply (MB) “I'd like to further add to this: Employer group of about 15 employees. Employer only contributes 50%. When you have employees over age 65 whose premium is $1000+ a month - and their share is $500 - it is cheaper for the employee to choose Medicare w/ supplement. Shouldn't matter to CMS since Medicare is primary either way. However, What IF this was a 20+ person group? Does the fact that an employee chooses Medicare instead of the Employer's plan BECAUSE it is CHEAPER for EE to do so - cause CMS to go after the ER? ? ? ”

Fifth reply (BM) “This is the crux of the question. From CMS, I’ve received two answers. That said, everything I’ve read of new, the employee has the right to reject the TEFRA group coverage in favor of Medicare is they so choose. ”

Fifth reply (BM) “This is the crux of the question. From CMS, I’ve received two answers. That said, everything I’ve read of new, the employee has the right to reject the TEFRA group coverage in favor of Medicare is they so choose. ”

Sixth reply (JB) “That’s the way I am reading it. We have a group that is about to VOLUNTARYILY move a couple of Medicare employees off of the group plan. So if anyone has info/opinion that we shouldn’t, please advise. ”

Sixth reply (JB) “That’s the way I am reading it. We have a group that is about to VOLUNTARYILY move a couple of Medicare employees off of the group plan. So if anyone has info/opinion that we shouldn’t, please advise. ”

Seventh reply (DK) “I have helped scores of people make this choice. We give them all the facts and costs. Employee makes the choice. It is their right to choose. No one forces them to stay on the group plan. ”

Seventh reply (DK) “I have helped scores of people make this choice. We give them all the facts and costs. Employee makes the choice. It is their right to choose. No one forces them to stay on the group plan. ”

Eighth reply (LN) “Not a force. However, if the employee does and now Medicare is primary when they would have been secondary does that make the employer at all responsible for the difference in claims? I would not think so as I think this would be clearly written in the documents. ”

Eighth reply (LN) “Not a force. However, if the employee does and now Medicare is primary when they would have been secondary does that make the employer at all responsible for the difference in claims? I would not think so as I think this would be clearly written in the documents. ”

Ninth reply (DK) “No, and in most cases if that employee leaves a group plan to enroll in Medicare with a Medigap plan, he will have less out of pocket than if he had stayed on a group plan. I have never seen an instance where an employee in this circumstance would have any cause to ask an employer for help with claims. The only thing an agent needs to worry about is that they can’t “encourage” the employee to leave the group. Present facts only and let the employee decide. If it is more cost effective for the employee to remain on a group plan, then the numbers will show them that, and in my own practice, I point it out to them and explain WHY moving to Medicare primary at this time is actually not in their best interest. First do no harm. What goes around comes around. That employee will come back to you down the road when it’s time for them to retire and leave the group insurance because he will remember that you gave him honest advice the first time around. ”

Ninth reply (DK) “No, and in most cases if that employee leaves a group plan to enroll in Medicare with a Medigap plan, he will have less out of pocket than if he had stayed on a group plan. I have never seen an instance where an employee in this circumstance would have any cause to ask an employer for help with claims. The only thing an agent needs to worry about is that they can’t “encourage” the employee to leave the group. Present facts only and let the employee decide. If it is more cost effective for the employee to remain on a group plan, then the numbers will show them that, and in my own practice, I point it out to them and explain WHY moving to Medicare primary at this time is actually not in their best interest. First do no harm. What goes around comes around. That employee will come back to you down the road when it’s time for them to retire and leave the group insurance because he will remember that you gave him honest advice the first time around. ”

10 th reply (AH) “Same here. Because of the much lower co-pays on the group plan for RX, any savings on the Med Supp would be wiped out. I’ve advised two clients who are taking a long list of drugs to stay with the group plan for that reason. ”

10 th reply (AH) “Same here. Because of the much lower co-pays on the group plan for RX, any savings on the Med Supp would be wiped out. I’ve advised two clients who are taking a long list of drugs to stay with the group plan for that reason. ”

Why sell Medicare related products? Because there is a huge market out there!

Why sell Medicare related products? Because there is a huge market out there!

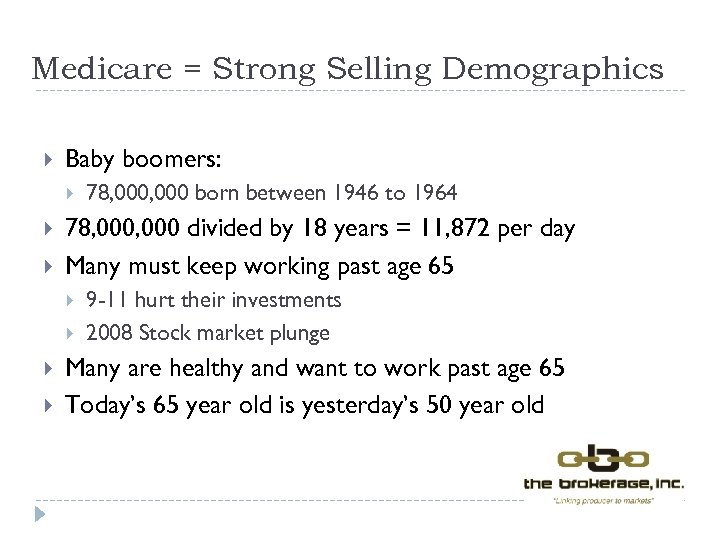

Medicare = Strong Selling Demographics Baby boomers: 78, 000 divided by 18 years = 11, 872 per day Many must keep working past age 65 78, 000 born between 1946 to 1964 9 -11 hurt their investments 2008 Stock market plunge Many are healthy and want to work past age 65 Today’s 65 year old is yesterday’s 50 year old

Medicare = Strong Selling Demographics Baby boomers: 78, 000 divided by 18 years = 11, 872 per day Many must keep working past age 65 78, 000 born between 1946 to 1964 9 -11 hurt their investments 2008 Stock market plunge Many are healthy and want to work past age 65 Today’s 65 year old is yesterday’s 50 year old

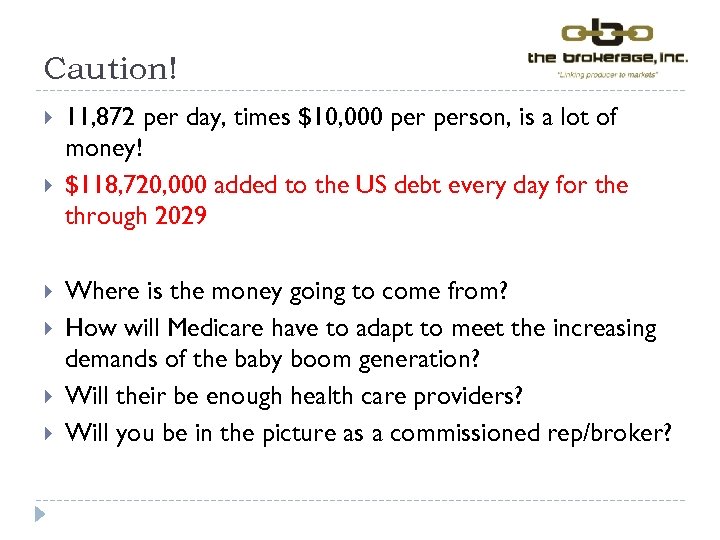

Caution! 11, 872 per day, times $10, 000 person, is a lot of money! $118, 720, 000 added to the US debt every day for the through 2029 Where is the money going to come from? How will Medicare have to adapt to meet the increasing demands of the baby boom generation? Will their be enough health care providers? Will you be in the picture as a commissioned rep/broker?

Caution! 11, 872 per day, times $10, 000 person, is a lot of money! $118, 720, 000 added to the US debt every day for the through 2029 Where is the money going to come from? How will Medicare have to adapt to meet the increasing demands of the baby boom generation? Will their be enough health care providers? Will you be in the picture as a commissioned rep/broker?

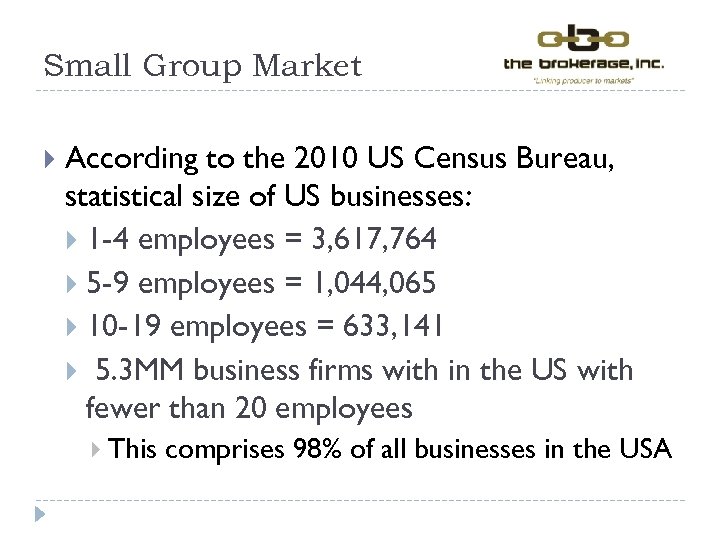

Small Group Market According to the 2010 US Census Bureau, statistical size of US businesses: 1 -4 employees = 3, 617, 764 5 -9 employees = 1, 044, 065 10 -19 employees = 633, 141 5. 3 MM business firms with in the US with fewer than 20 employees This comprises 98% of all businesses in the USA

Small Group Market According to the 2010 US Census Bureau, statistical size of US businesses: 1 -4 employees = 3, 617, 764 5 -9 employees = 1, 044, 065 10 -19 employees = 633, 141 5. 3 MM business firms with in the US with fewer than 20 employees This comprises 98% of all businesses in the USA

So how do you determine if a person should keep their group health plan option or take Medicare? Simple: it’s all in the math!

So how do you determine if a person should keep their group health plan option or take Medicare? Simple: it’s all in the math!

Group health plan or Medicare? Advantages Disadvantages It’s all in the math Use the worksheet we developed to help you advise

Group health plan or Medicare? Advantages Disadvantages It’s all in the math Use the worksheet we developed to help you advise

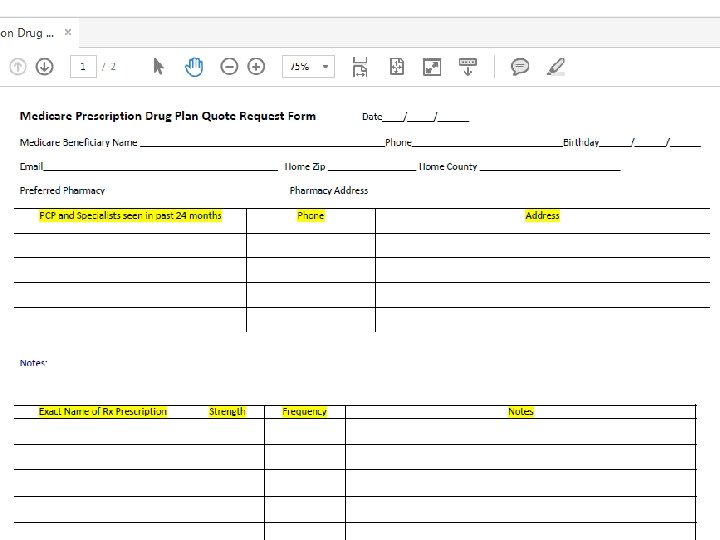

Use www. Medicare. gov for your Part D quotes

Use www. Medicare. gov for your Part D quotes

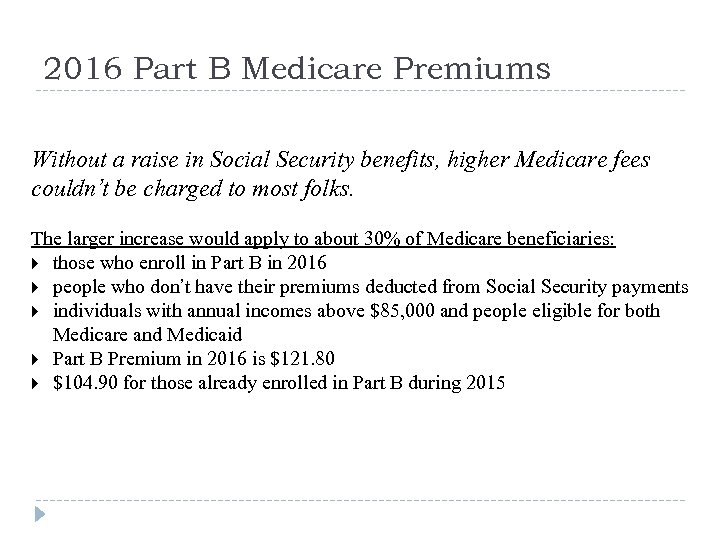

2016 Part B Medicare Premiums Without a raise in Social Security benefits, higher Medicare fees couldn’t be charged to most folks. The larger increase would apply to about 30% of Medicare beneficiaries: those who enroll in Part B in 2016 people who don’t have their premiums deducted from Social Security payments individuals with annual incomes above $85, 000 and people eligible for both Medicare and Medicaid Part B Premium in 2016 is $121. 80 $104. 90 for those already enrolled in Part B during 2015

2016 Part B Medicare Premiums Without a raise in Social Security benefits, higher Medicare fees couldn’t be charged to most folks. The larger increase would apply to about 30% of Medicare beneficiaries: those who enroll in Part B in 2016 people who don’t have their premiums deducted from Social Security payments individuals with annual incomes above $85, 000 and people eligible for both Medicare and Medicaid Part B Premium in 2016 is $121. 80 $104. 90 for those already enrolled in Part B during 2015

IRMAA Part B IRMAA – Income Related Monthly Adjustment Amount Implemented by MIPPA Medicare Improvements for Patients & Providers Act Part D Started in 2011

IRMAA Part B IRMAA – Income Related Monthly Adjustment Amount Implemented by MIPPA Medicare Improvements for Patients & Providers Act Part D Started in 2011

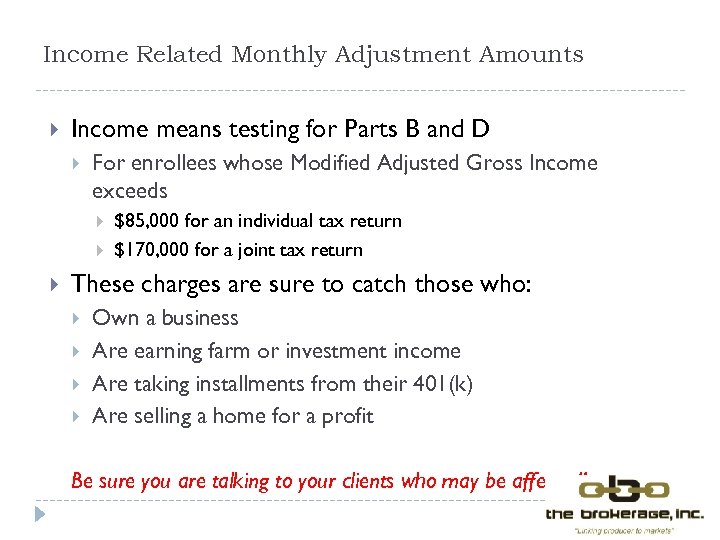

Income Related Monthly Adjustment Amounts Income means testing for Parts B and D For enrollees whose Modified Adjusted Gross Income exceeds $85, 000 for an individual tax return $170, 000 for a joint tax return These charges are sure to catch those who: Own a business Are earning farm or investment income Are taking installments from their 401(k) Are selling a home for a profit Be sure you are talking to your clients who may be affected!

Income Related Monthly Adjustment Amounts Income means testing for Parts B and D For enrollees whose Modified Adjusted Gross Income exceeds $85, 000 for an individual tax return $170, 000 for a joint tax return These charges are sure to catch those who: Own a business Are earning farm or investment income Are taking installments from their 401(k) Are selling a home for a profit Be sure you are talking to your clients who may be affected!

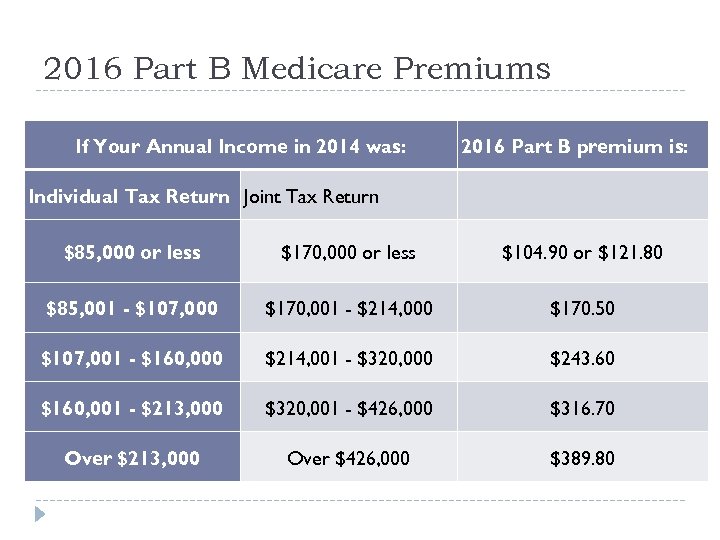

2016 Part B Medicare Premiums If Your Annual Income in 2014 was: Individual Tax Return Joint Tax Return 2016 Part B premium is: $85, 000 or less $170, 000 or less $104. 90 or $121. 80 $85, 001 - $107, 000 $170, 001 - $214, 000 $170. 50 $107, 001 - $160, 000 $214, 001 - $320, 000 $243. 60 $160, 001 - $213, 000 $320, 001 - $426, 000 $316. 70 Over $213, 000 Over $426, 000 $389. 80

2016 Part B Medicare Premiums If Your Annual Income in 2014 was: Individual Tax Return Joint Tax Return 2016 Part B premium is: $85, 000 or less $170, 000 or less $104. 90 or $121. 80 $85, 001 - $107, 000 $170, 001 - $214, 000 $170. 50 $107, 001 - $160, 000 $214, 001 - $320, 000 $243. 60 $160, 001 - $213, 000 $320, 001 - $426, 000 $316. 70 Over $213, 000 Over $426, 000 $389. 80

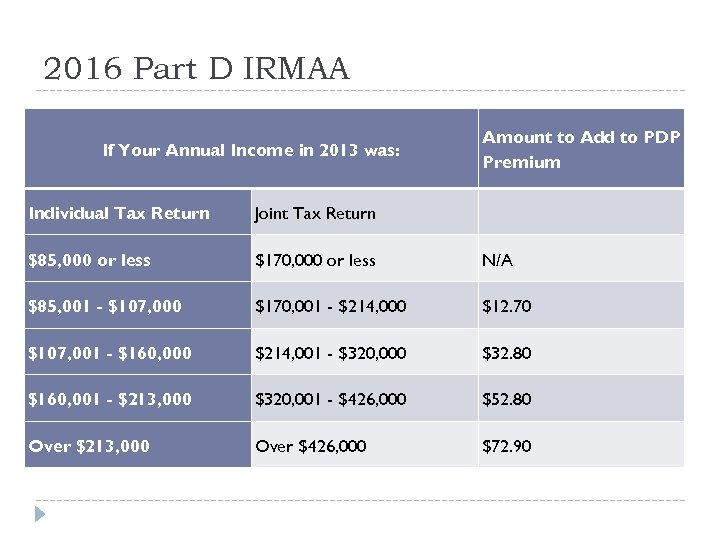

2016 Part D IRMAA If Your Annual Income in 2013 was: Amount to Add to PDP Premium Individual Tax Return Joint Tax Return $85, 000 or less $170, 000 or less N/A $85, 001 - $107, 000 $170, 001 - $214, 000 $12. 70 $107, 001 - $160, 000 $214, 001 - $320, 000 $32. 80 $160, 001 - $213, 000 $320, 001 - $426, 000 $52. 80 Over $213, 000 Over $426, 000 $72. 90

2016 Part D IRMAA If Your Annual Income in 2013 was: Amount to Add to PDP Premium Individual Tax Return Joint Tax Return $85, 000 or less $170, 000 or less N/A $85, 001 - $107, 000 $170, 001 - $214, 000 $12. 70 $107, 001 - $160, 000 $214, 001 - $320, 000 $32. 80 $160, 001 - $213, 000 $320, 001 - $426, 000 $52. 80 Over $213, 000 Over $426, 000 $72. 90

How about those penalties! For not having “other creditable coverage” Part B 10% for each year in which you were eligible for but did not have a creditable health plan in place Part D 1% per month for each month in which you were eligible for but did not have a creditable drug plan in place

How about those penalties! For not having “other creditable coverage” Part B 10% for each year in which you were eligible for but did not have a creditable health plan in place Part D 1% per month for each month in which you were eligible for but did not have a creditable drug plan in place

What are the health plan options for your clients? Health Plans Group health insurance Medicare Supplement (Medigap) Medicare Advantage Plan (Part C of Medicare) VA Retiree plan Example: “Seniors Choice” program

What are the health plan options for your clients? Health Plans Group health insurance Medicare Supplement (Medigap) Medicare Advantage Plan (Part C of Medicare) VA Retiree plan Example: “Seniors Choice” program

What are the drug plan options for your clients? Drug Plans Group health Medicare Advantage Plan with Rx Drug Coverage Part D of Medicare plan Beware of the HDHP may NOT be creditable for Rx! PDP – Prescription Drug Plan VA Retiree Drug plan

What are the drug plan options for your clients? Drug Plans Group health Medicare Advantage Plan with Rx Drug Coverage Part D of Medicare plan Beware of the HDHP may NOT be creditable for Rx! PDP – Prescription Drug Plan VA Retiree Drug plan

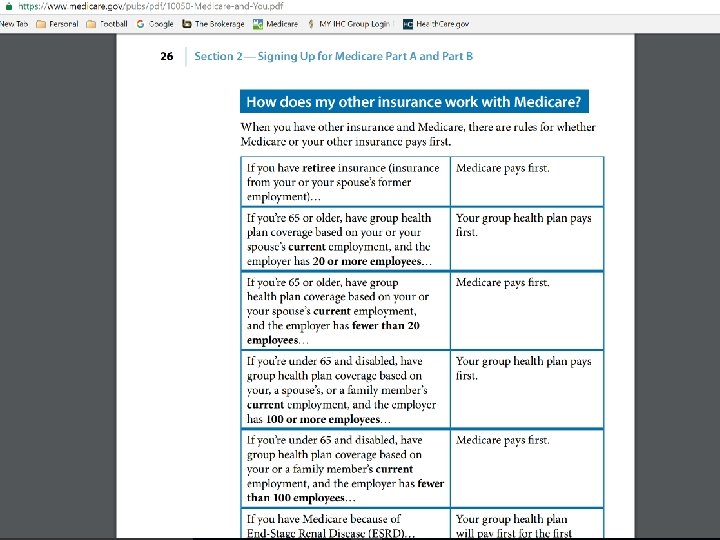

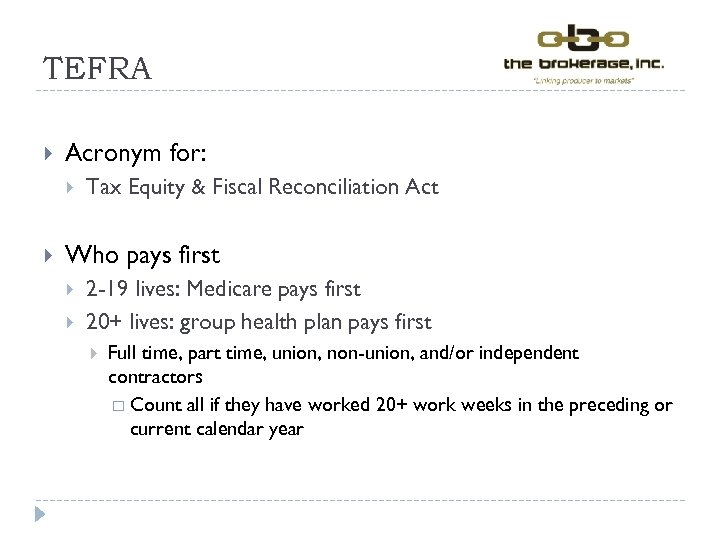

TEFRA Acronym for: Tax Equity & Fiscal Reconciliation Act Who pays first 2 -19 lives: Medicare pays first 20+ lives: group health plan pays first Full time, part time, union, non-union, and/or independent contractors Count all if they have worked 20+ work weeks in the preceding or current calendar year

TEFRA Acronym for: Tax Equity & Fiscal Reconciliation Act Who pays first 2 -19 lives: Medicare pays first 20+ lives: group health plan pays first Full time, part time, union, non-union, and/or independent contractors Count all if they have worked 20+ work weeks in the preceding or current calendar year

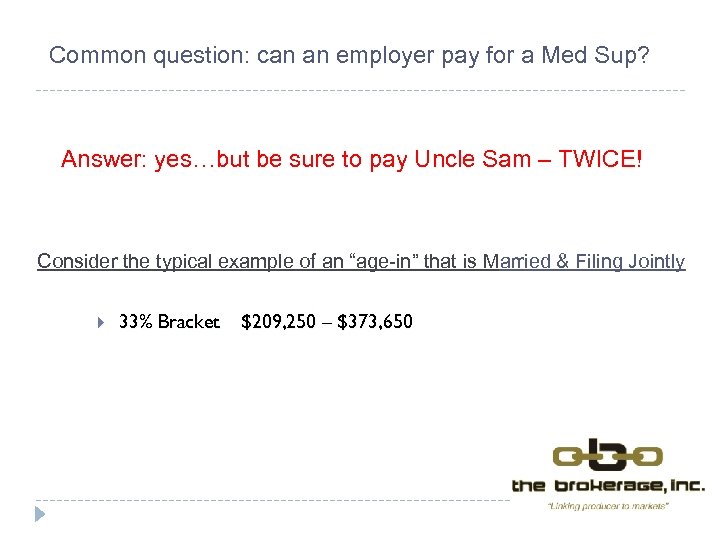

Common question: can an employer pay for a Med Sup? Answer: yes…but be sure to pay Uncle Sam – TWICE! Consider the typical example of an “age-in” that is Married & Filing Jointly 33% Bracket $209, 250 – $373, 650

Common question: can an employer pay for a Med Sup? Answer: yes…but be sure to pay Uncle Sam – TWICE! Consider the typical example of an “age-in” that is Married & Filing Jointly 33% Bracket $209, 250 – $373, 650

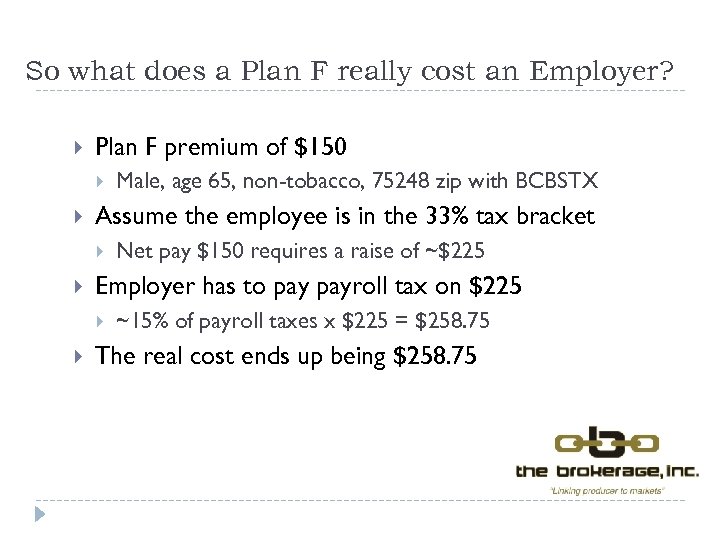

So what does a Plan F really cost an Employer? Plan F premium of $150 Assume the employee is in the 33% tax bracket Net pay $150 requires a raise of ~$225 Employer has to payroll tax on $225 Male, age 65, non-tobacco, 75248 zip with BCBSTX ~15% of payroll taxes x $225 = $258. 75 The real cost ends up being $258. 75

So what does a Plan F really cost an Employer? Plan F premium of $150 Assume the employee is in the 33% tax bracket Net pay $150 requires a raise of ~$225 Employer has to payroll tax on $225 Male, age 65, non-tobacco, 75248 zip with BCBSTX ~15% of payroll taxes x $225 = $258. 75 The real cost ends up being $258. 75

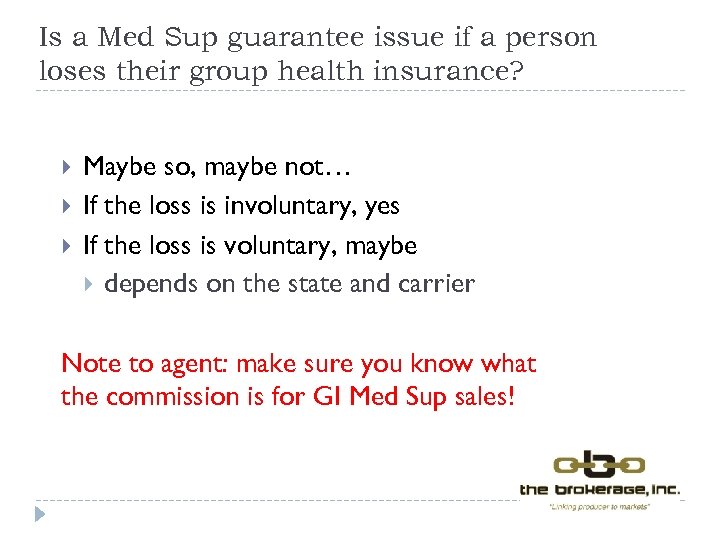

Is a Med Sup guarantee issue if a person loses their group health insurance? Maybe so, maybe not… If the loss is involuntary, yes If the loss is voluntary, maybe depends on the state and carrier Note to agent: make sure you know what the commission is for GI Med Sup sales!

Is a Med Sup guarantee issue if a person loses their group health insurance? Maybe so, maybe not… If the loss is involuntary, yes If the loss is voluntary, maybe depends on the state and carrier Note to agent: make sure you know what the commission is for GI Med Sup sales!

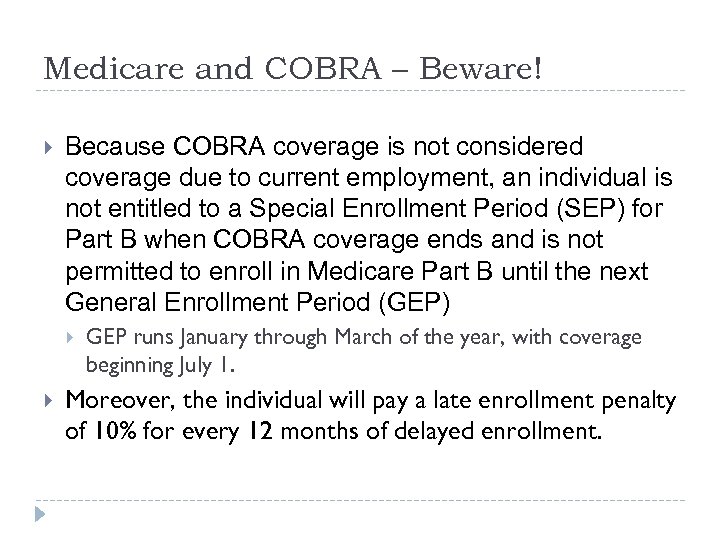

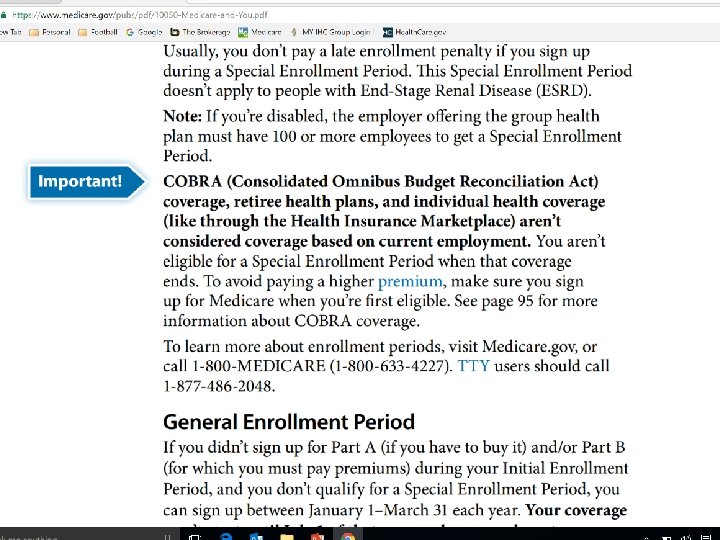

Medicare and COBRA – Beware! Because COBRA coverage is not considered coverage due to current employment, an individual is not entitled to a Special Enrollment Period (SEP) for Part B when COBRA coverage ends and is not permitted to enroll in Medicare Part B until the next General Enrollment Period (GEP) GEP runs January through March of the year, with coverage beginning July 1. Moreover, the individual will pay a late enrollment penalty of 10% for every 12 months of delayed enrollment.

Medicare and COBRA – Beware! Because COBRA coverage is not considered coverage due to current employment, an individual is not entitled to a Special Enrollment Period (SEP) for Part B when COBRA coverage ends and is not permitted to enroll in Medicare Part B until the next General Enrollment Period (GEP) GEP runs January through March of the year, with coverage beginning July 1. Moreover, the individual will pay a late enrollment penalty of 10% for every 12 months of delayed enrollment.

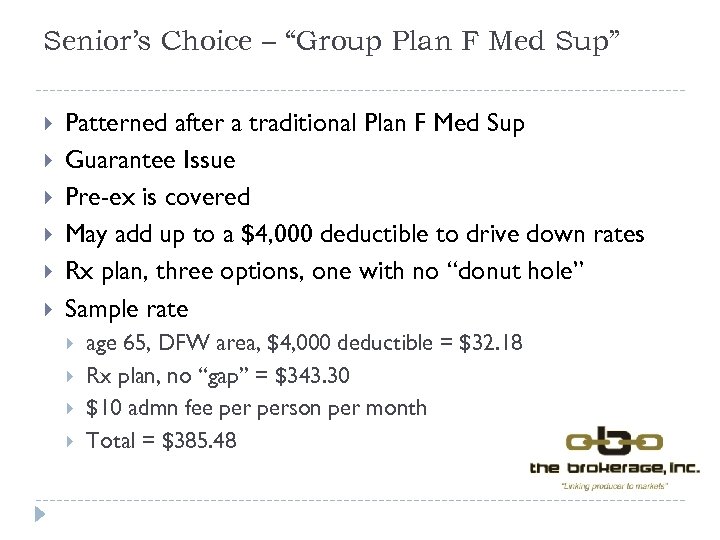

Senior’s Choice – “Group Plan F Med Sup” Patterned after a traditional Plan F Med Sup Guarantee Issue Pre-ex is covered May add up to a $4, 000 deductible to drive down rates Rx plan, three options, one with no “donut hole” Sample rate age 65, DFW area, $4, 000 deductible = $32. 18 Rx plan, no “gap” = $343. 30 $10 admn fee person per month Total = $385. 48

Senior’s Choice – “Group Plan F Med Sup” Patterned after a traditional Plan F Med Sup Guarantee Issue Pre-ex is covered May add up to a $4, 000 deductible to drive down rates Rx plan, three options, one with no “donut hole” Sample rate age 65, DFW area, $4, 000 deductible = $32. 18 Rx plan, no “gap” = $343. 30 $10 admn fee person per month Total = $385. 48

Case Examples A peek at what to do and perhaps why…

Case Examples A peek at what to do and perhaps why…

Case Example #1 Employee approaching age 65 has a group health plan Group size is less than 20 lives Employee waives the group health plan and opts for Medicare Spouse is age 63 What are the options for the spouse?

Case Example #1 Employee approaching age 65 has a group health plan Group size is less than 20 lives Employee waives the group health plan and opts for Medicare Spouse is age 63 What are the options for the spouse?

Case Example #2 Husband & Wife had income in 2014 in excess of $500 k Filed jointly in 2014 He is a dependent under her group health plan He turns 65 in June 2016 She is age 63 Should he enroll in Part B and D? What would it cost? Use the Group health vs. Medicare worksheet!

Case Example #2 Husband & Wife had income in 2014 in excess of $500 k Filed jointly in 2014 He is a dependent under her group health plan He turns 65 in June 2016 She is age 63 Should he enroll in Part B and D? What would it cost? Use the Group health vs. Medicare worksheet!

Case example #3 CEO age 75, delayed Part B Company has 51+ full time employees Carrier wants the 75 year old off the group health plan If the CEO stays on the plan, the renewal rates will be $50, 000 higher for the next 12 months What options do they have? Can this legally be done? Is there an E&O claim looming?

Case example #3 CEO age 75, delayed Part B Company has 51+ full time employees Carrier wants the 75 year old off the group health plan If the CEO stays on the plan, the renewal rates will be $50, 000 higher for the next 12 months What options do they have? Can this legally be done? Is there an E&O claim looming?

Case example #4 Employer with 200+ workers Many are seasonal more than 6 months out of the year Employer does not want to allow the seasonal workers age 65+ on the group health plan Employer wants the broker to write a letter telling the seasonal workers they are not eligible for the group health plan Should the broker write the letter? What options do they have?

Case example #4 Employer with 200+ workers Many are seasonal more than 6 months out of the year Employer does not want to allow the seasonal workers age 65+ on the group health plan Employer wants the broker to write a letter telling the seasonal workers they are not eligible for the group health plan Should the broker write the letter? What options do they have?

Case example #5 Group health HDHP Executives have a MERP (Section 105) Company max funds the HSA Executive age 70 has not enrolled in a Part D plan because he does not take any maintenance Rx Should the Executive be penalized if/when he eventually enrolls in a “creditable” drug plan?

Case example #5 Group health HDHP Executives have a MERP (Section 105) Company max funds the HSA Executive age 70 has not enrolled in a Part D plan because he does not take any maintenance Rx Should the Executive be penalized if/when he eventually enrolls in a “creditable” drug plan?

Case Example #6 Husband & Wife on a group retiree plan A mid-year formulary change has motivated the couple to explore their options to find a new drug plan Can they get off of the retiree plan mid-year? In other words, are they “locked in”? What options do they have?

Case Example #6 Husband & Wife on a group retiree plan A mid-year formulary change has motivated the couple to explore their options to find a new drug plan Can they get off of the retiree plan mid-year? In other words, are they “locked in”? What options do they have?

Case example #7 Group of 25 people A person age 64 ½ retires in January 2015 and elects COBRA After 18 months of COBRA, tries to enroll in Medicare Part B Now at age 66 it is July 2016 Person is denied Part B due to not enrolling in the AEP or OEP (Jan-March) Why was Part B denied and when can the person get it?

Case example #7 Group of 25 people A person age 64 ½ retires in January 2015 and elects COBRA After 18 months of COBRA, tries to enroll in Medicare Part B Now at age 66 it is July 2016 Person is denied Part B due to not enrolling in the AEP or OEP (Jan-March) Why was Part B denied and when can the person get it?

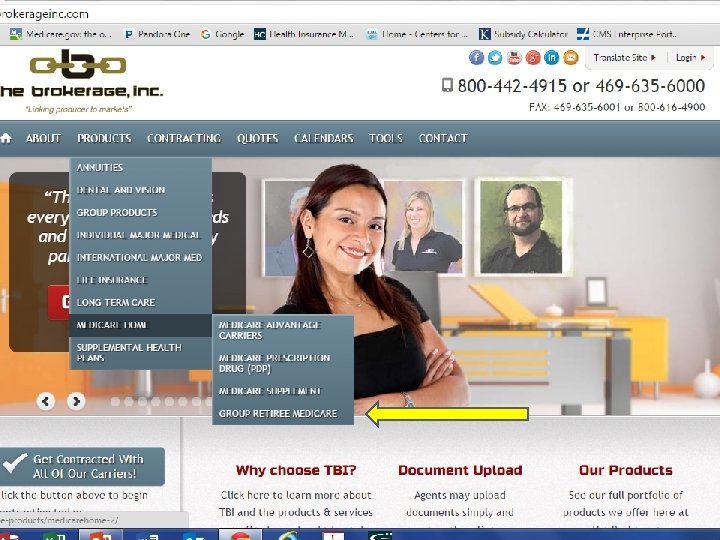

Wrap up American workers need agents to educate them regarding all health and drug plan options Medicare beneficiaries are still confused There are many excellent options! You should be their advisor! The opportunities to help are bountiful Become proficient and grab your market share Visit www. The. Brokerage. Inc. com for resources you may use to support these ideas

Wrap up American workers need agents to educate them regarding all health and drug plan options Medicare beneficiaries are still confused There are many excellent options! You should be their advisor! The opportunities to help are bountiful Become proficient and grab your market share Visit www. The. Brokerage. Inc. com for resources you may use to support these ideas

Questions? Turn in your evaluation form to receive your CE Certificate…

Questions? Turn in your evaluation form to receive your CE Certificate…