c8d24b5505cbfab7782fe56af887e6c4.ppt

- Количество слайдов: 69

Decision-making context Karl M. Rich, Lab 863 s. r. o. & Norwegian University of Life Sciences Jarkko K. Niemi, Natural Resources Institute Finland (Luke) This presentation was developed within the frame of the NEAT project, funded with support from the European Commission under the Lifelong Learning Programme (Grant no. 527 855). Please attribute the NEAT network with a link to www. neat-network. eu. Except where otherwise noted, this presentation is licensed under a Creative Commons Attribution-Non. Commercial-Share. Alike 4. 0 International License.

Chapter 4 Leaning objectives for this module § To understand the decision-making context § How is decision-making described in economics? § Which factors determine decisions by different stakeholders? § How do interactions between stakeholders influence decisions? § To be able to identify how economics analyses decisions 2

1. Introduction Economics focuses on people and their decision-making 3

Chapter 4 Introduction § Economics is the study of how scarce resources are or should be allocated (Black 1997, A dictionary of economics) Decisions are needed to allocate resources Economics highlights how and why people make choices under conditions of scarcity and the results of such choices on society. Economics is about TRADEOFFS: Our needs are endless, but decisions to satisfy these needs are constrained by resource availability Economics is about behavior and incentives, and how those influence choice 4

Chapter 4 There are different economic actors (see lesson 1) § How do we study “how resources should be allocated”? § Who are the actors – who make the decisions? § What do these actors care about – i. e. how/why do they value (see previous lectures) different things? § Which options are there? § Which constraints are there? § How do we do that in the context of animal health? § Who are the actors, what are their values and goals, what can or cannot be chosen by them and why? 5

Chapter 4 An example § Your car needs to be taken for service. Spend a few minutes by discussing in groups § Which actors are there in the process of getting the service? § From which options (services, service providers) can you choose? § How do you value different characteristics of service? § When you make your choice, which factors constrain your choice? § Next, think of yourself as a service provider (i. e. garage owner) § What kind of goals could you have as an entrepreneur? § Which factors affect what you can or cannot offer to a customer coming to your garage? 6

Chapter 4 Scarcity, the basic economic problem § People have endless needs but only limited (scarce) resources § Because of scarcity, decisions must be made to allocate resources efficiently § How does a person determine efficiency? Focus on consuming goods which can provide the highest value per resource (e. g. value for money) 7

Chapter 4 Some key concepts – review from the previous lessons § Utility refers to how much happiness or satisfaction a person gets from consuming a set of goods § It is an abstract concept: there are no ”utility meters”! § Utility is a way of representing preferences and tradeoffs § It allows us to combine the happiness obtained by consuming different goods such as apples and bananas § To fulfill our needs, we make decisions on which needs are satisified and which are not ( tradeoffs). § Opportunity cost is the value of the second-best alternative that has to be given up to choose the first-best alternative 8

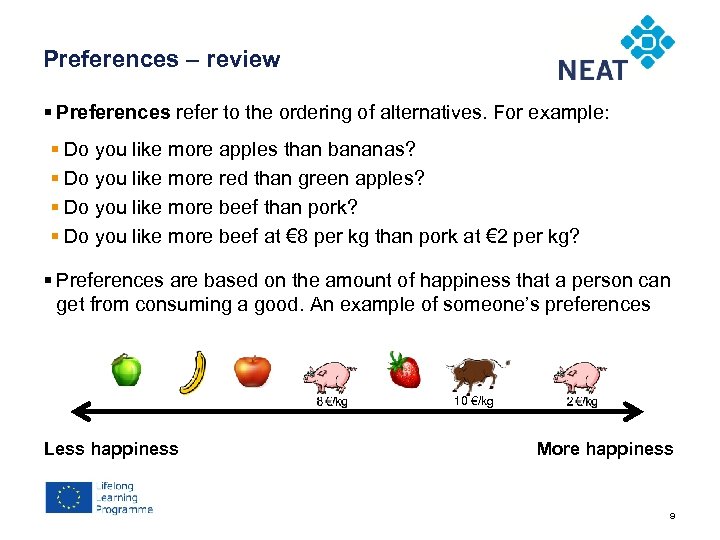

Chapter 4 Preferences – review § Preferences refer to the ordering of alternatives. For example: § Do you like more apples than bananas? § Do you like more red than green apples? § Do you like more beef than pork? § Do you like more beef at € 8 per kg than pork at € 2 per kg? § Preferences are based on the amount of happiness that a person can get from consuming a good. An example of someone’s preferences 10 €/kg Less happiness More happiness 9

Chapter 4 Factors affecting preferences - review § Tastes § Cultural factors, religion, norms, habits (e. g. seasonal demand for certain goods) § Biological factors: e. g. age, gender, physical characteristics § Social factors: e. g. education, occupation, marital status (e. g. singles and married persons have different needs) § Other factors 10

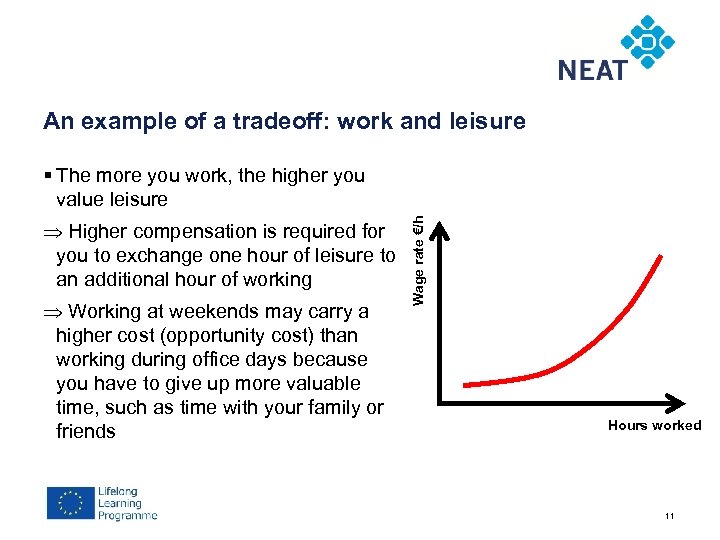

Chapter 4 An example of a tradeoff: work and leisure Higher compensation is required for you to exchange one hour of leisure to an additional hour of working Working at weekends may carry a higher cost (opportunity cost) than working during office days because you have to give up more valuable time, such as time with your family or friends Wage rate €/h § The more you work, the higher you value leisure Hours worked 11

2. The maximisation problem Economic actors strive for a goal Profit maximisation In sections 2 and 3 we will consider two groups (producers and consumers) which have different decision-making contexts 12

Chapter 4 Economic actors can have different objectives § Important: your client may have different goals than you! § Maximise health § Minimise costs, e. g. if only a limited quantity can be produced § Maximise profit (=revenues minus costs) § Maximising production or health may not maximise profit! § Maximise utility, i. e. happiness that one can get by consuming goods, given their resources (e. g. income) available to get the goods § To maximise utility, one makes tradeoffs between goods (e. g. give up a holiday in Spain to be able to spend a holiday in Italy) § Tradeoffs are made because resources are scarce 13

Chapter 4 Veterinarians and clients affect each other’s business § Recall lesson 3: A vet’s effort to improve animal health can be regarded as an input It is a cost to the client It can cause changes in the client’s outputs and revenues § Hence the question: Is the vet able to increase a client’s revenues by more than the costs of the vet’s activity? § Note that the vet’s fee and prescribed medicine can be only a part of the cost. The advice of a vet can affect the consumption of other inputs as well! § Think how much value-added your advice can provide to the client? 14

Chapter 4 Firms operate in the market § Most people enter business to make profit § To make profit, a firm must be able to sell its products, while the costs (monetary + non-monetary) of producing the good must be less than the sale price § Usually we assume that markets are perfectly competitive § There are many buyers and sellers which sell standardized products § Buyers and sellers know which opportunities there are § Firms are typically price takers, i. e. the price offered in the market is “take it or leave it”. If the price is too high, the buyer can go to another seller. No one firm in the market can influence the price of goods sold in the market. 15

Chapter 4 Profit § Profit = revenue – cost § The farmer’s revenue is determined by the market prices (p) of inputs and output(s) and his/her production technology: f(x 1, x 2, x 3, …), where § x 1, x 2, x 3, … are different inputs into production (labor, feed, capital, etc. ) § f(x 1, x 2, x 3, …) describes how much output (e. g. milk) farmer can produce with certain amount of inputs § Each of these inputs has a cost associated with them i. e. x 1 costs w 1, x 2 costs w 2, etc. 16

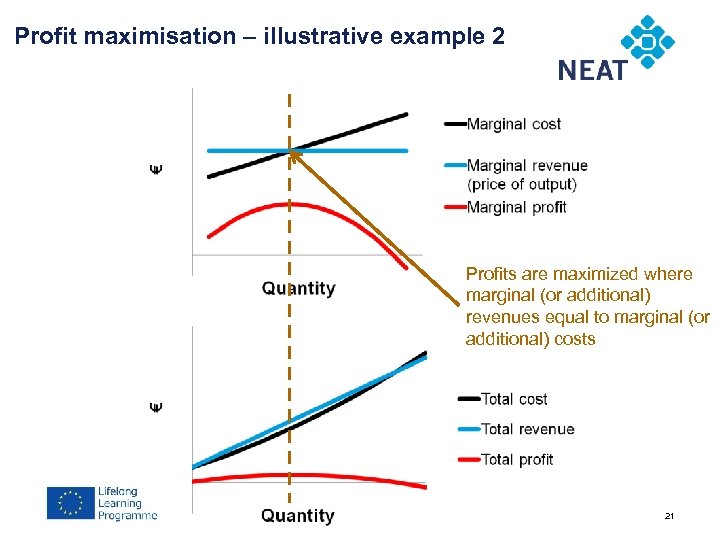

Chapter 4 Profit maximisation § Total profit (π) for the farmer is π= maximise(Poutput* f(x 1, x 2, x 3, …) – w 1 x 1 -w 2 x 2 – w 3 x 3 ) x 1, x 2, x 3 § The costs and the revenues of production increase when production is increased, but in the relevant range the costs per unit of output usually increase more than the revenues per unit of output. The law of diminishing returns: if the amount of one input is increased (while other inputs are held constant), amount of output added per unit of variable input will decrease § The profits are maximized where marginal (or additional) revenues equal to marginal (or additional) costs 17

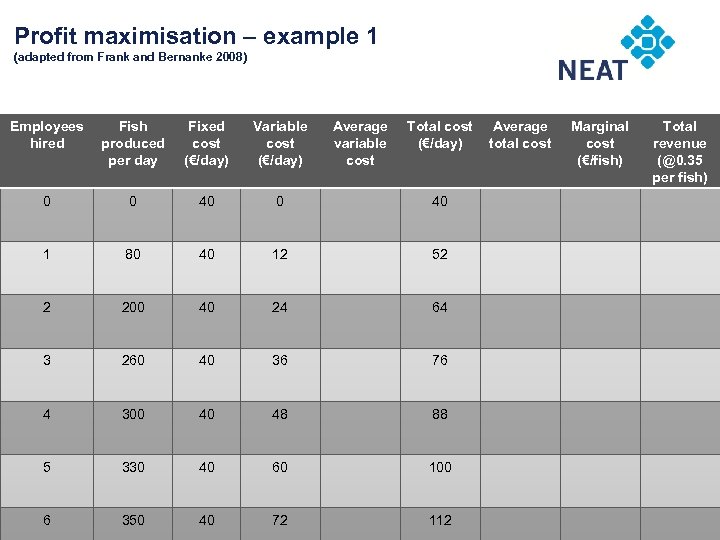

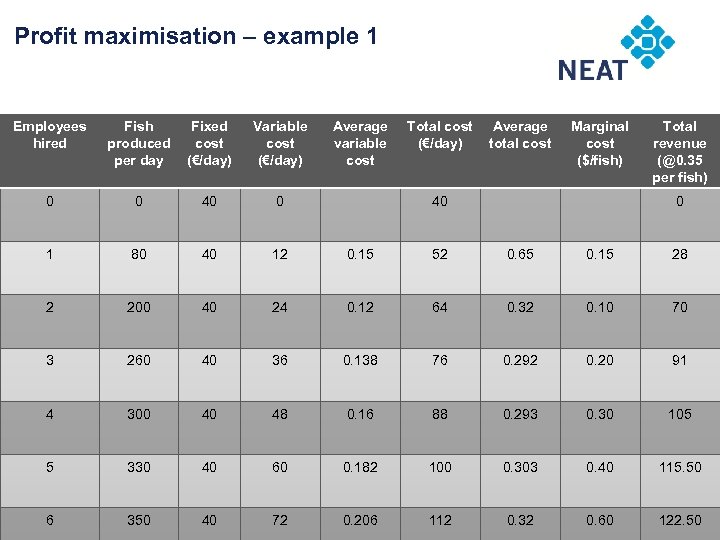

Profit maximisation – example 1 Chapter 4 (adapted from Frank and Bernanke 2008) Employees hired Fish produced per day Fixed cost (€/day) Variable cost (€/day) Average variable cost Total cost (€/day) 0 0 40 1 80 40 12 52 2 200 40 24 64 3 260 40 36 76 4 300 40 48 88 5 330 40 60 100 6 350 40 72 112 Average total cost Marginal cost (€/fish) Total revenue (@0. 35 per fish)

Profit maximisation – example 1 Chapter 4 Economics and decision-making: different actors Employees hired Fish produced per day Fixed cost (€/day) Variable cost (€/day) Average variable cost Total cost (€/day) Average total cost Marginal cost ($/fish) 0 0 40 0 1 80 40 12 0. 15 52 0. 65 0. 15 28 2 200 40 24 0. 12 64 0. 32 0. 10 70 3 260 40 36 0. 138 76 0. 292 0. 20 91 4 300 40 48 0. 16 88 0. 293 0. 30 105 5 330 40 60 0. 182 100 0. 303 0. 40 115. 50 6 350 40 72 0. 206 112 0. 32 0. 60 122. 50 40 Total revenue (@0. 35 per fish) 0

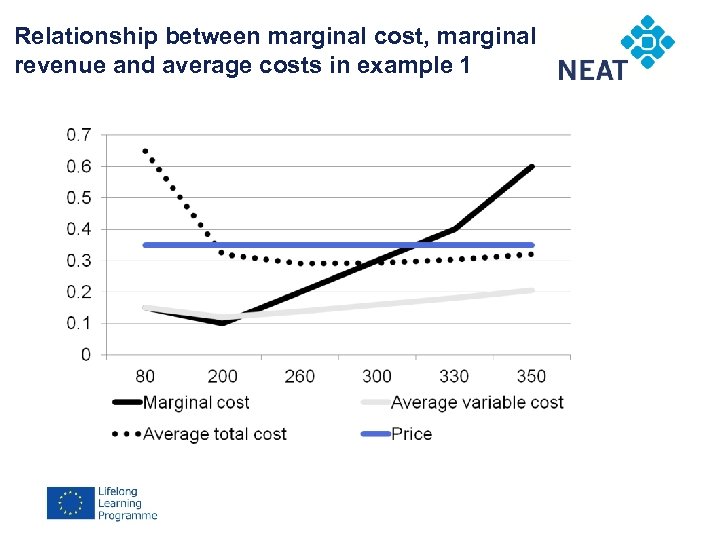

Relationship between marginal cost, marginal Chapter 4 revenue and average costs in example 1

Profit maximisation – illustrative example 2 Chapter 4 Profits are maximized where marginal (or additional) revenues equal to marginal (or additional) costs 21

Low-hanging fruit § “Low-hanging fruit”: in expanding production, first use those resources with the lowest cost before using those with higher costs First focus on business activities where you are able to get the highest reward (e. g. the highest return (%) on the capital invested) 22

Constraints can prevent your client from acting § Vet’s clients make decisions under constraints § They have limited resources: money, time, skills etc. § Even if clients would like to take actions for the benefit of their animals’ health, they may not have enough resources to do it! Potential for a conflict between vet’s view and clients’ view 23

3. The consumer Utility maximisation 24

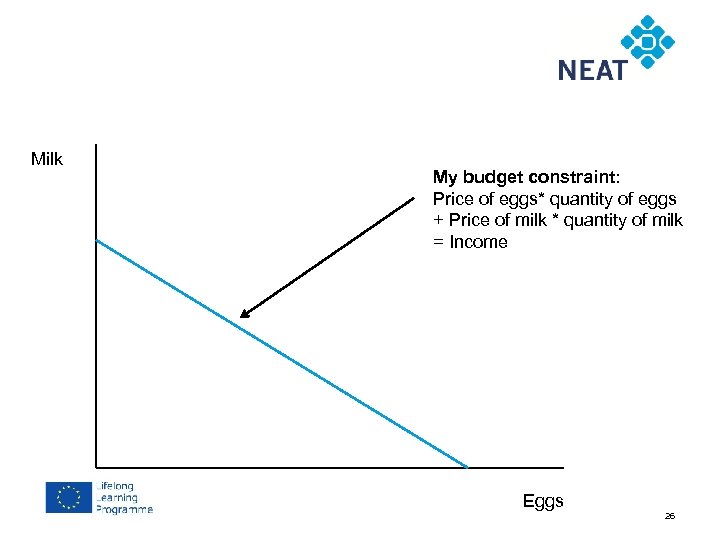

Chapter 4 Consumer’s perspective § Consumers consume to get more utility § Consumption decisions are constrained by the scarcity of resources (e. g. income the budget constraint) § Consumption should be increased until the marginal benefit is smaller than the marginal cost § Diminishing marginal utility means that the extra utility from consuming something falls after a certain point § Consider an example where you spend all you income on two goods: milk and eggs 25

Chapter 4 Milk My budget constraint: Price of eggs* quantity of eggs + Price of milk * quantity of milk = Income Eggs 26

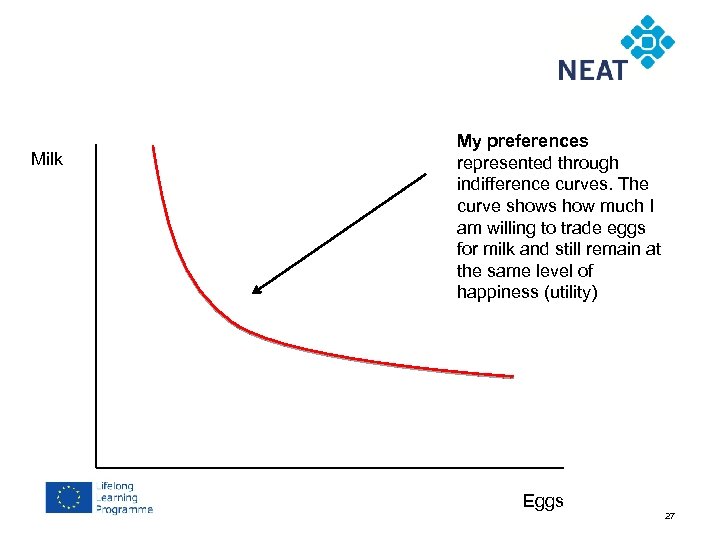

Chapter 4 Milk My preferences represented through indifference curves. The curve shows how much I am willing to trade eggs for milk and still remain at the same level of happiness (utility) Eggs 27

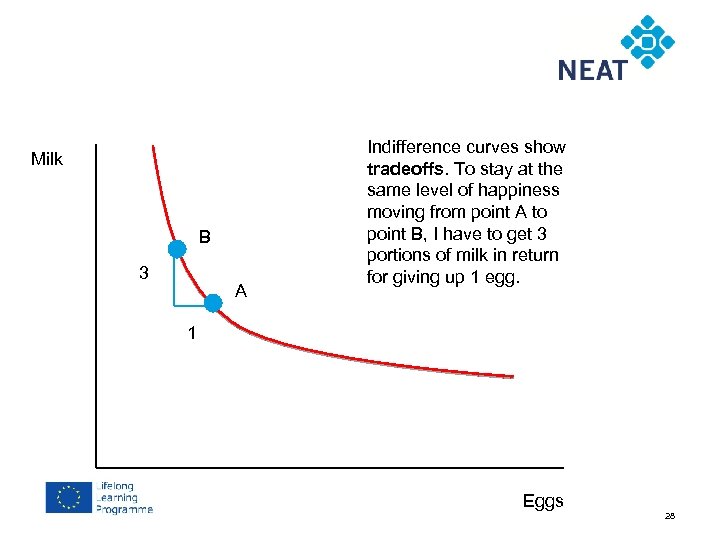

Chapter 4 Milk B 3 A Indifference curves show tradeoffs. To stay at the same level of happiness moving from point A to point B, I have to get 3 portions of milk in return for giving up 1 egg. 1 Eggs 28

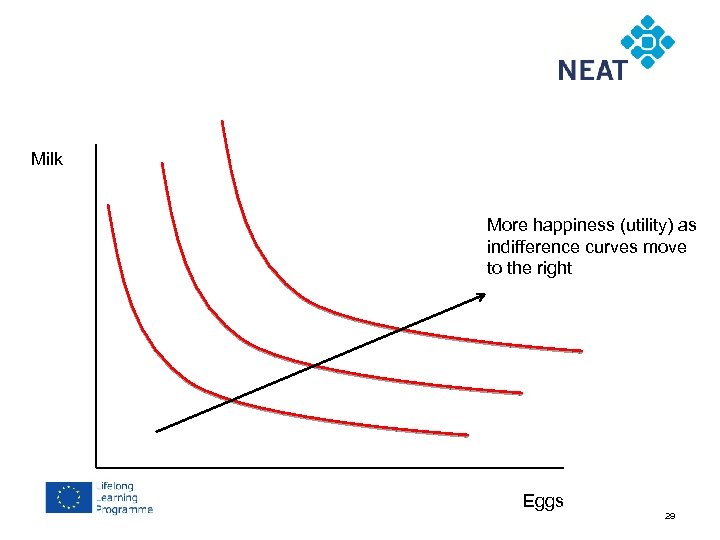

Chapter 4 Milk More happiness (utility) as indifference curves move to the right Eggs 29

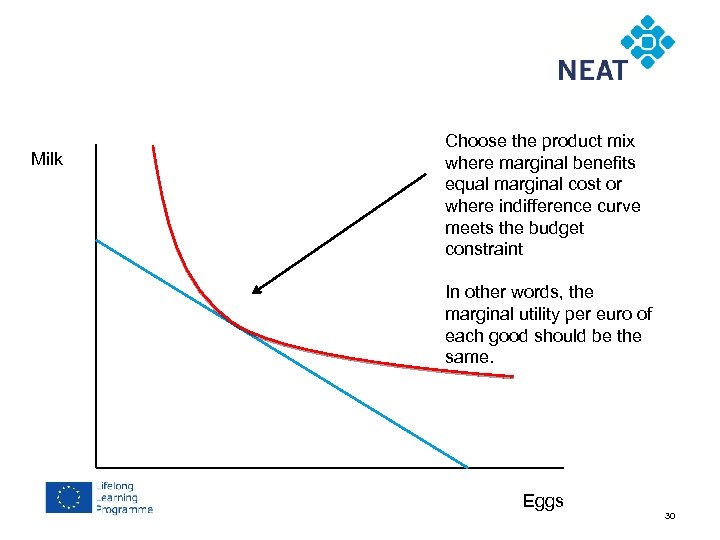

Chapter 4 Milk Choose the product mix where marginal benefits equal marginal cost or where indifference curve meets the budget constraint In other words, the marginal utility per euro of each good should be the same. Eggs 30

4. A group of actors is analysed differently from an individual actor Markets can play an important role in animal health issues 31

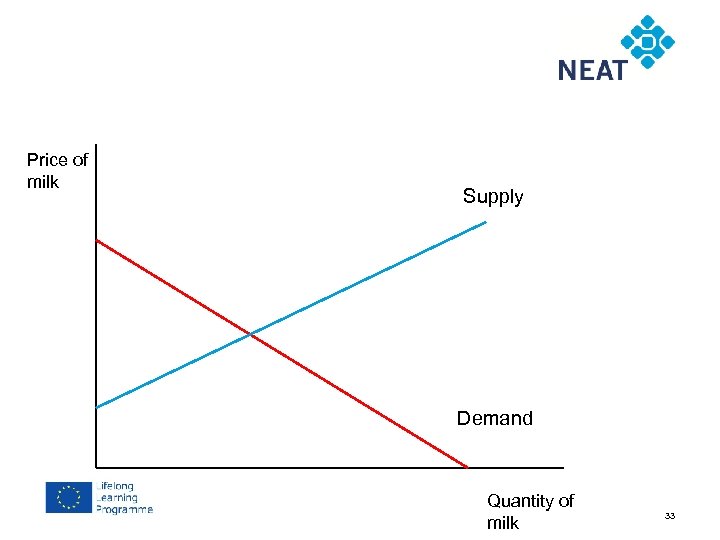

Chapter 4 Market prices transmit information § If we take all farmers and consumers in the economy together, we get supply and demand curves. § Supply curves show the opportunity cost of supplying to the market § At higher prices, more people are willing to forgo other activities to supply a good to the market § Supply is determined by production technology, prices etc. § Demand curves show the willingness to pay for a good § At higher prices, only those with a high willingness to pay will buy § Demand is determined by income, prices etc. 32

Chapter 4 Price of milk Supply Demand Quantity of milk 33

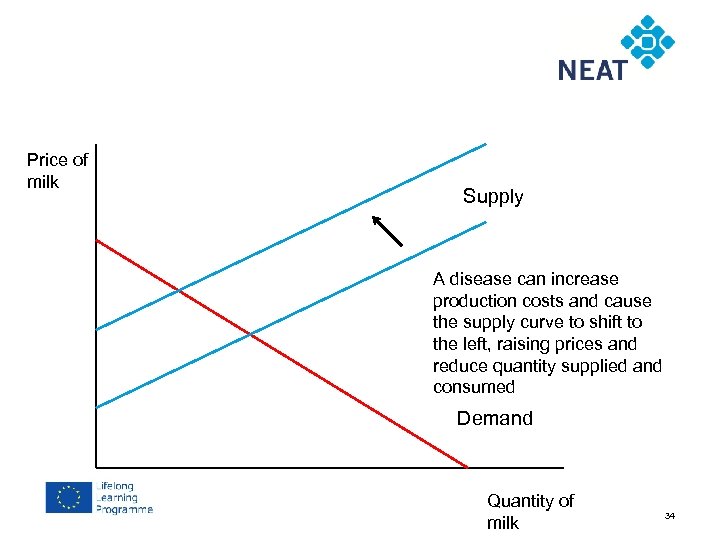

Chapter 4 Price of milk Supply A disease can increase production costs and cause the supply curve to shift to the left, raising prices and reduce quantity supplied and consumed Demand Quantity of milk 34

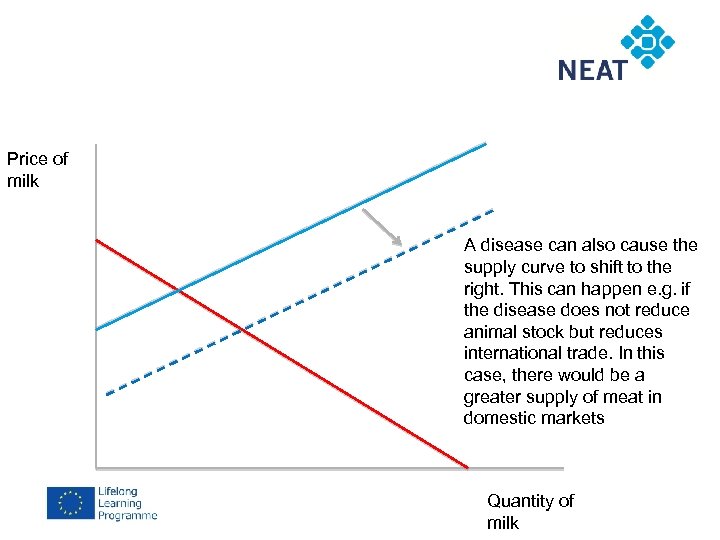

Price of milk A disease can also cause the supply curve to shift to the right. This can happen e. g. if the disease does not reduce animal stock but reduces international trade. In this case, there would be a greater supply of meat in domestic markets Quantity of milk

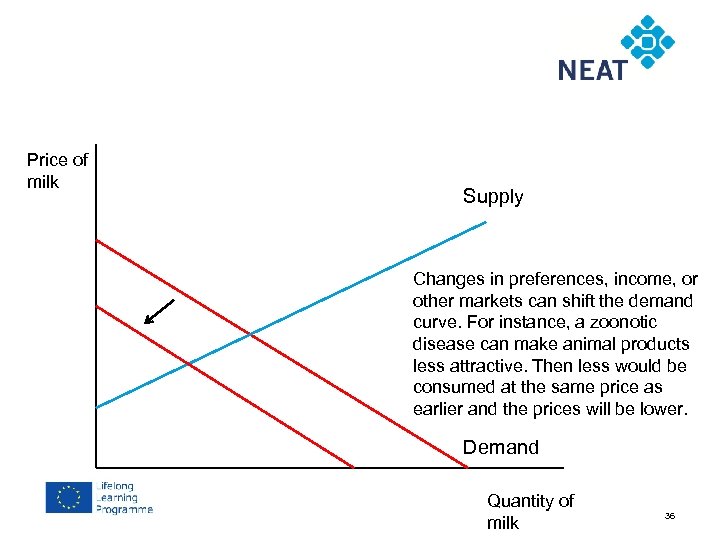

Chapter 4 Price of milk Supply Changes in preferences, income, or other markets can shift the demand curve. For instance, a zoonotic disease can make animal products less attractive. Then less would be consumed at the same price as earlier and the prices will be lower. Demand Quantity of milk 36

5. Additional topics Things that influence decisions: Framing Incentives (information, risk) 37

Things that influence decision-making, … …. but not necessarily at all levels § Risk and uncertainty: Most people are risk-averse. Whenever there is decreasing marginal utility, there is also risk aversion § Asymmetric information: Actors are not equally informed about the situation § Strategic behavior § Externalities: Individual vs. collective benefits and costs. What is best for you may not be the best for your neighbour. § Market failures: Public goods, externalities § Ways to overcome these issues include contracts, insurance, taxes, property rights, etc. 38

The framing of situations matters § Consider the following two scenarios (from Kahneman and Tversky 1979) 1) Imagine your country is preparing for the outbreak of a disease expected to kill 600 people. There are two alternatives to act: a) If program A is adopted, exactly 400 people will die. b) If program B is adopted there is a 1/3 probability that no one will die and a 2/3 probability that 600 people will die. § Which program would you choose? 39

The framing of situations matters 2) Imagine your country is preparing for the outbreak of a disease expected to kill 600 people. There are two alternatives to act: a) If program A is adopted, exactly 200 people will be saved. b) If program B is adopted there is a 1/3 probability that 600 people will be saved and a 2/3 probability that no people will be saved. § Which program would you choose? 40

The framing of situation matters § On average, both programs results in exactly the same outcome. § Yet people often make different choices depending on how the risk is framed § Most choose B for scenario 1 (they choose to avoid the possibility of 600 deaths) § Most choose A for scenario 2 (they choose to save 200 lives with certainty) 41

Incentives to maintain biosecurity and report disease § Standard economic analysis assumes perfect information. But what if somebody has more information than another? § Adverse selection (hidden information): one party in a transaction uses information that is disadvantageous the party without the information § Example: a person insures a pet which he/she knows is sick § Moral hazard (hidden action): one party in a transaction takes advantage of asymmetric information and acts in a risky way after the transaction § Example: Not maintaining good biosecurity after having been insured Solution: an incentive program that encourages both to maintain good biosecurity and to report the disease quickly 42

6. Concluding remarks 43

Summary § People have endless needs but only limited resources. Hence, decisions must be made to allocate resources efficiently ( tradeoffs) § Vets and their clients can have different goals and these differences can result in different decisions § Vet’s efforts can be regarded as an input which carries a cost (monetary and non-monetary) and contributes to outputs and revenues. How much value-added does a vet provide to the client? § Low-hanging fruit: first focus on business activities where you are able to get the highest reward. § Profits are maximized when marginal revenues equal to marginal costs. It is uneconomic to use more inputs than at this point. 44

Selected readings § Rushton, J. 2009. The Economics of Animal Health and Production. CABI, Wallingford, UK. § Bernanke, B. & Frank, R. H. (2008). Principles of microeconomics, 4 th edition. Mc. Graw Hill/Irwin, New York. § Rich, K. M. , & Perry, B. D. (2011). The economic and poverty impacts of animal diseases in developing countries: new roles, new demands for economics and epidemiology. Preventive veterinary medicine, 101(3), 133 -147. § Rich, K. M. , Miller, G. Y. , & Winter-Nelson, A. (2005). A review of economic tools for the assessment of animal disease outbreaks. Revue scientifique et technique (International Office of Epizootics), 24(3), 833 -845. § Kahneman, D. , & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica: Journal of the Econometric Society, 263 -291. 45

Exercises 1. Stakeholder role play 2. Farm-level decision making: Production costs of disease prevention 3. Farm-level decision making: Poultry production example 46

Exercise 1. Stakeholder role play 47

Exercise 1 – Stakeholder role play § Divide into six groups corresponding to 1. 2. 3. 4. 5. 6. Farmers Industry Government Media general public environmental groups § Describe 1. 2. 3. 4. The ways in which your group interacts with the others The ways in which your group can affect an animal disease outbreak The reasons your group behaves as it does Represent your findings to other groups & contrast with their findings 48

Exercise 2. Farm-level decision making: The cost of disease prevention 49

Exercise 2 – The cost of disease prevention § Mr. farmer is running a beef cattle farm which is experiencing continuous problems with an animal disease. Currently half of animals are sick. Mr. Farmer estimates that each sick animal is causing him a loss of € 200. § The animals are divided into four groups. Each group can be treated separately with a new medicine to reduce the disease. Each group contains 50 animals and the medicine costs € 12 per treated animal. § Mr. Veterinarian estimates that each additional group that is treated will reduce the number of sick animals by 20%. § Develop a table which indicates disease prevalence, treatment costs, disease losses and net costs of disease by the number of treated groups (0, 1, 2, 3, or 4). How many groups should be treated? 50

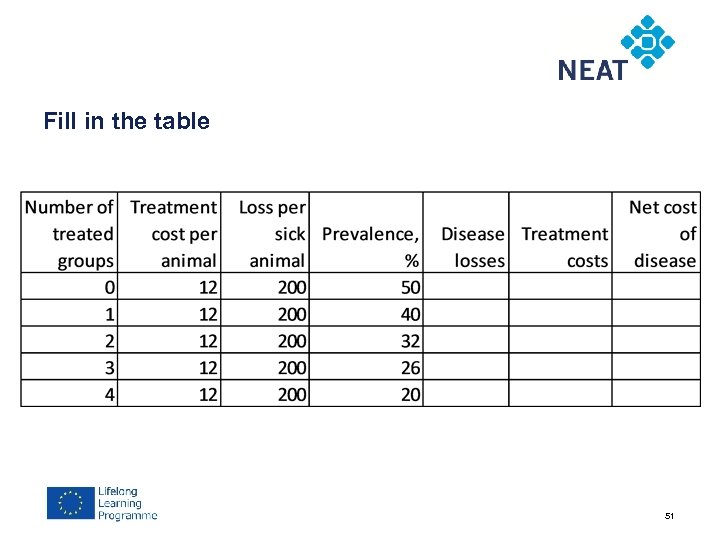

Fill in the table 51

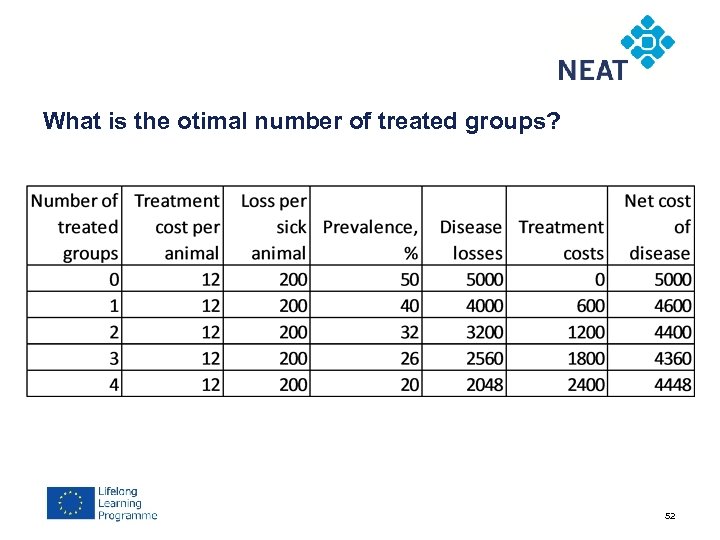

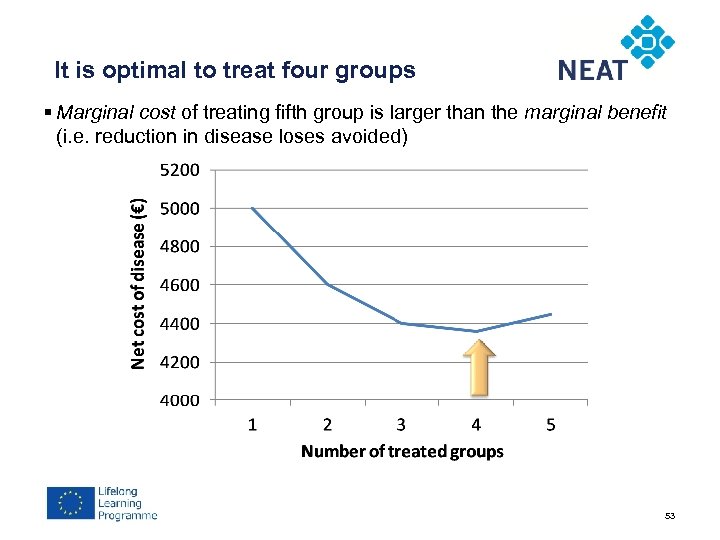

What is the otimal number of treated groups? 52

It is optimal to treat four groups § Marginal cost of treating fifth group is larger than the marginal benefit (i. e. reduction in disease loses avoided) 53

Exercise 3. Farm-level decision making: Poultry production example 54

Exercise 3 – Poultry house capacity § A livestock producer has a poultry house where he can accommodate a maximum of 75 000 broilers. One-day old chicks are sold in batches of 8000 birds. The producer wonders how many poults he/she should purchase in order to maximise the gross margin of the poultry house. The producer asks for your advice. You study the literature and find that increasing stocking density is likely to decrease average daily weight gain for chicks, and to increase feed consumption and mortality of birds. You estimate that the productivity will change as represented in the next slide. 55

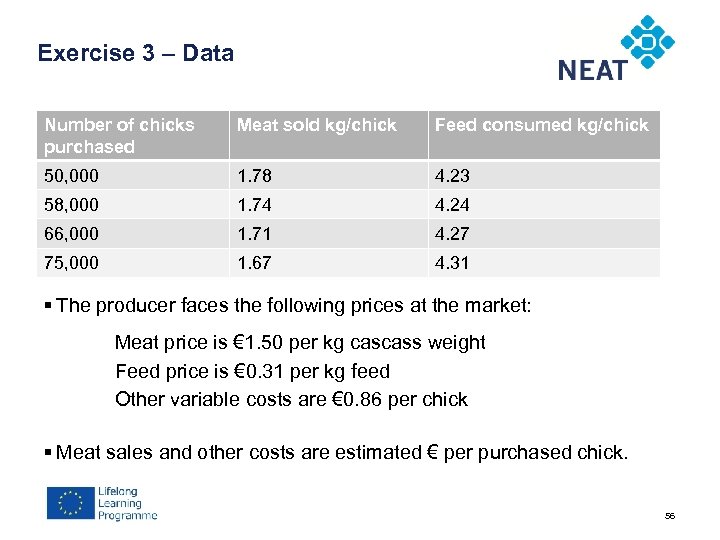

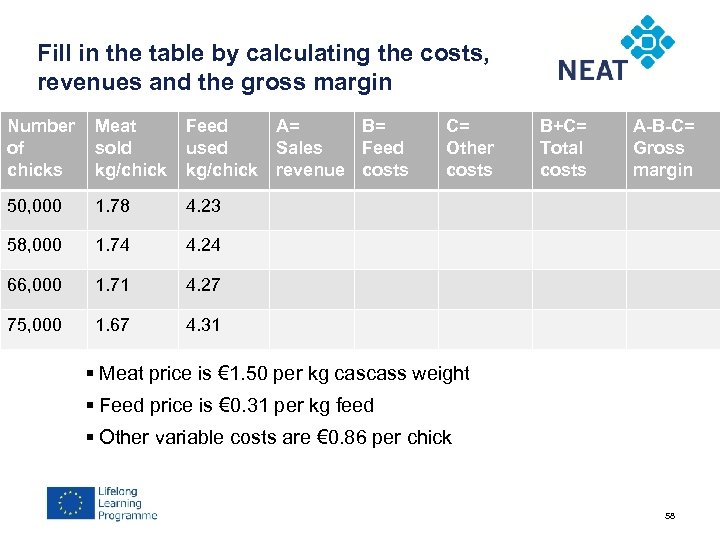

Exercise 3 – Data Number of chicks purchased Meat sold kg/chick Feed consumed kg/chick 50, 000 1. 78 4. 23 58, 000 1. 74 4. 24 66, 000 1. 71 4. 27 75, 000 1. 67 4. 31 § The producer faces the following prices at the market: Meat price is € 1. 50 per kg cascass weight Feed price is € 0. 31 per kg feed Other variable costs are € 0. 86 per chick § Meat sales and other costs are estimated € per purchased chick. 56

Exercise 3 – Cost curves and marginal effects § Based on these presented data: 1. 2. 3. 4. 5. Calculate the costs of each alternative Calculate the gross margin of each alternative Represent costs and profits graphically as a function of input Which option would you choose? For some reason, suppose that the cost of feed increases by 10% or decreases by 10%. How does that affect your choice? 57

Fill in the table by calculating the costs, revenues and the gross margin Number of chicks Meat sold kg/chick Feed used kg/chick 50, 000 1. 78 4. 23 58, 000 1. 74 4. 24 66, 000 1. 71 4. 27 75, 000 1. 67 A= B= Sales Feed revenue costs C= Other costs B+C= Total costs A-B-C= Gross margin 4. 31 § Meat price is € 1. 50 per kg cascass weight § Feed price is € 0. 31 per kg feed § Other variable costs are € 0. 86 per chick 58

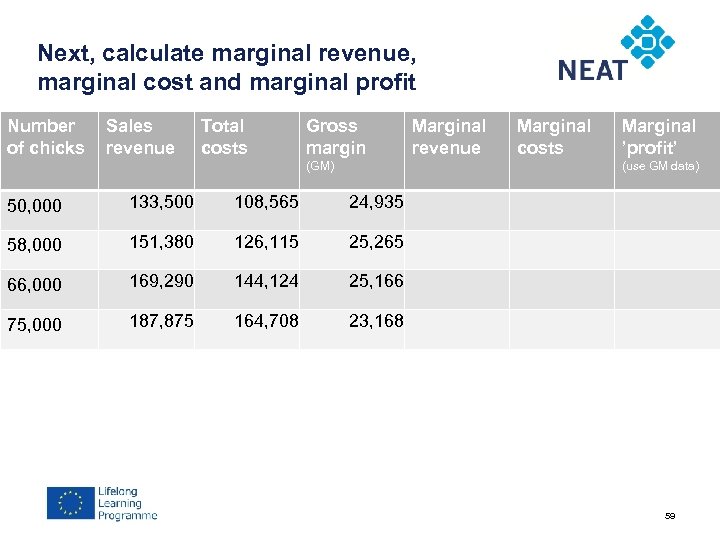

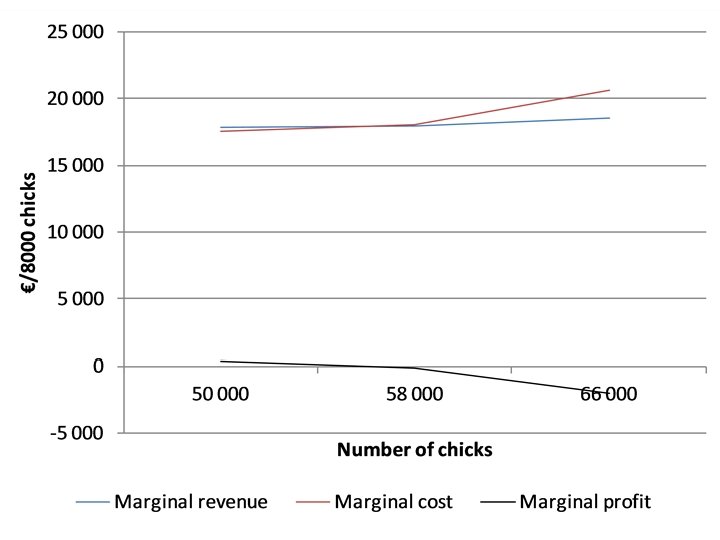

Next, calculate marginal revenue, marginal cost and marginal profit Number of chicks Sales revenue Total costs Gross margin (GM) Marginal revenue Marginal costs Marginal ’profit’ (use GM data) 50, 000 133, 500 108, 565 24, 935 58, 000 151, 380 126, 115 25, 265 66, 000 169, 290 144, 124 25, 166 75, 000 187, 875 164, 708 23, 168 59

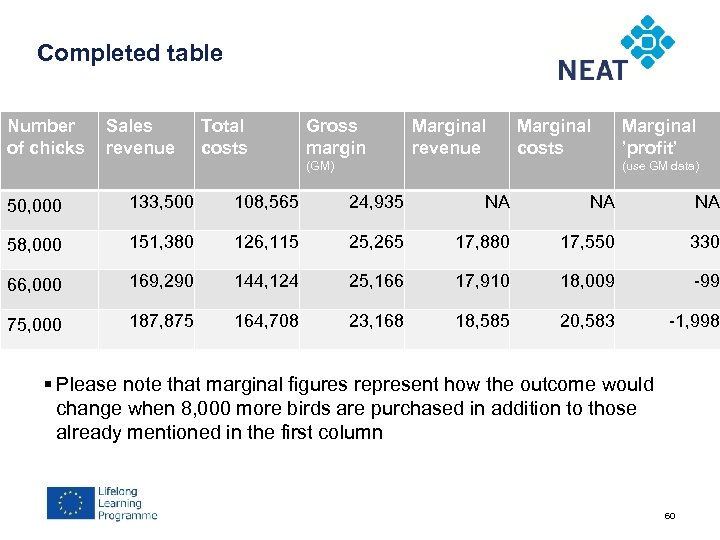

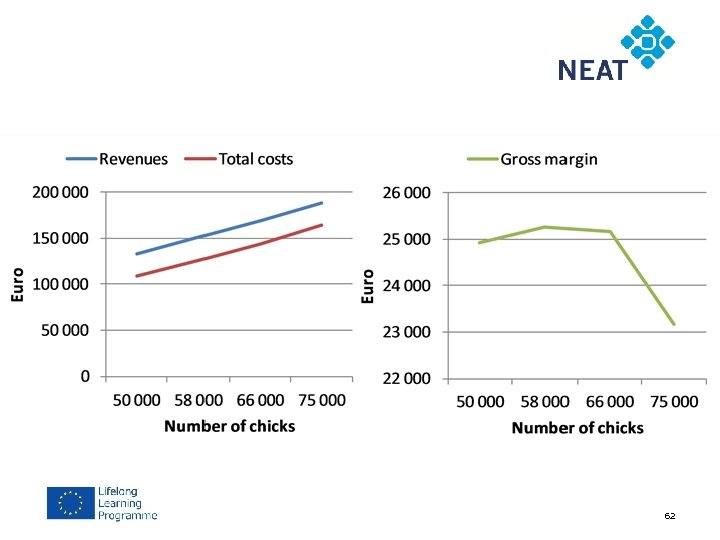

Completed table Number of chicks Sales revenue Total costs Gross margin Marginal revenue Marginal costs (GM) Marginal ’profit’ (use GM data) 50, 000 133, 500 108, 565 24, 935 NA NA NA 58, 000 151, 380 126, 115 25, 265 17, 880 17, 550 330 66, 000 169, 290 144, 124 25, 166 17, 910 18, 009 -99 75, 000 187, 875 164, 708 23, 168 18, 585 20, 583 -1, 998 § Please note that marginal figures represent how the outcome would change when 8, 000 more birds are purchased in addition to those already mentioned in the first column 60

Next, represent your results (costs and profits) in a graph § Represent the number of chicks in the horizontal axis § Represent monetary results in the vertical axis. 61

62

63

Questions § Provide some advice for the producer. According to your analysis, how many poults should the producer buy and why? § Examine the costs and profits. When does the marginal profit curve become negative? How does that coincide with gross margin? 64

Sensitivity analysis 1. The cost of feed increases by 10% 2. The cost of feed decreases by 10% => Calculate gross margins with the new prices. § If one of these changes is realised, does it affect the results? § Does it affect your advice? 65

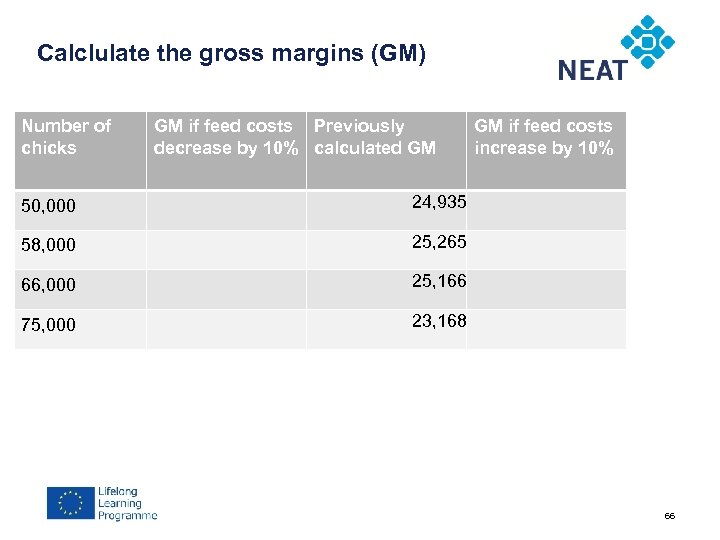

Calclulate the gross margins (GM) Number of chicks GM if feed costs Previously decrease by 10% calculated GM 50, 000 24, 935 58, 000 25, 265 66, 000 25, 166 75, 000 GM if feed costs increase by 10% 23, 168 66

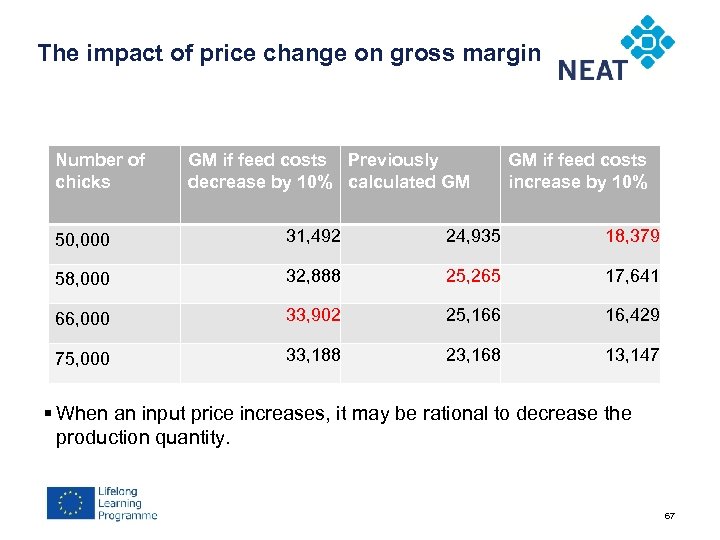

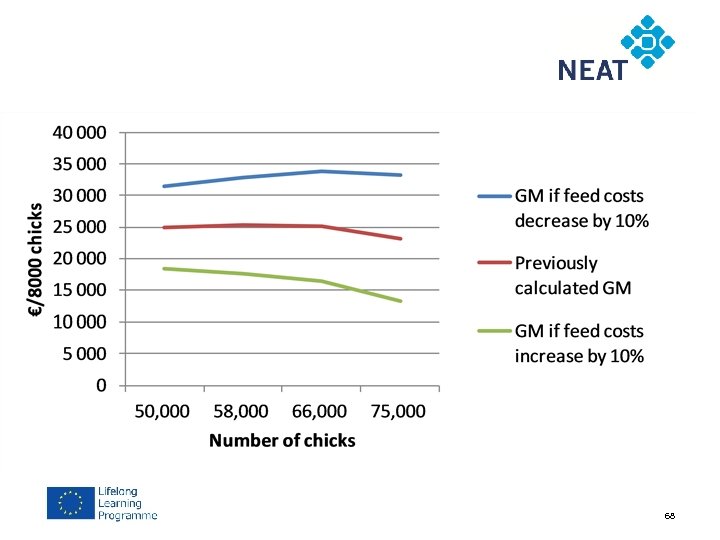

The impact of price change on gross margin Number of chicks GM if feed costs Previously decrease by 10% calculated GM GM if feed costs increase by 10% 50, 000 31, 492 24, 935 18, 379 58, 000 32, 888 25, 265 17, 641 66, 000 33, 902 25, 166 16, 429 75, 000 33, 188 23, 168 13, 147 § When an input price increases, it may be rational to decrease the production quantity. 67

68

Contact Karl M. Rich Lab 863 s. r. o. & Norwegian University of Life Sciences Jarkko K. Niemi Natural Resources Institute Finland (Luke) karl@lab 863. com http: //www. neat-network. eu jarkko. niemi@luke. fi http: //www. neat-network. eu 69

c8d24b5505cbfab7782fe56af887e6c4.ppt