99c7c19478848b93b0fecf54485a4286.ppt

- Количество слайдов: 36

Decision-making by borrowers and lenders ahead of the financial crisis Lessons from data on indebted UK households Peter Welch December 2009

Contents 1. 2. 3. 4. 5. 6. 7. 8. 9. Context and overview Growth in UK household borrowing Helping people with financial problems Consumer Credit Counselling Service (CCCS) CCCS database Research possibilities Sources and further reading Peter Welch: background and contact details Appendix: UK debt advice 2

1. Context and overview 3

Context • United Kingdom (UK) and United States (US) among the economies most damaged by the financial crisis • In both countries, the rapid growth and high level of household borrowing before the crisis was a major factor • Raises important questions about decision-making by borrowers and lenders • Why did households borrow so much? – Poor financial capability / lack of financial education? • And why did banks and finance companies lend so much? – Why did the sophisticated infrastructures for assessing consumer loans (including advanced credit scoring systems and credit bureaux) not lead to better decisions? 4

Overview of presentation • Focus on the UK • Uses data from the Consumer Credit Counselling Service (CCCS), the largest debt advice charity in the UK • CCCS a world leader in information systems and use of the internet • Through its management of repayment plans for 100. 000 indebted UK consumers, CCCS now has the largest database of its kind in the world • CCCS data illustrates the extent of over-borrowing and over-lending in the UK in the years before the financial crisis 5

2. Growth in UK household borrowing 6

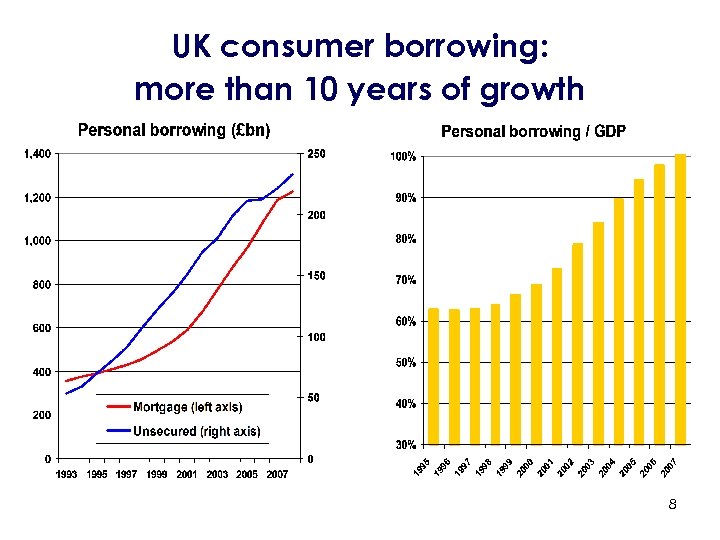

Growth in UK consumer borrowing • UK consumer borrowing the highest in Europe • In the decade before the crisis, consumer borrowing grew at approximately double rate of growth in national income (PIL) & personal incomes (stipendi, ecc) • At end 1999, outstanding mortgage (mutui) borrowing in the UK just under £ 500 bn while outstanding unsecured borrowing (credito al consumo: carte di credito, prestiti personali, prestiti per macchine, mobili, ecc) approximately £ 120 bn • During 2008, outstanding mortgage borrowing passed £ 1. 2 trillion while outstanding unsecured borrowing passed £ 230 bn • Year-end mortgage and unsecured consumer borrowing rose from approximately 66% of UK GDP (PIL) in 1999 to just over 100% by 2007 • On some measures, household borrowing higher in the UK than in the United States 7

UK consumer borrowing: more than 10 years of growth 8

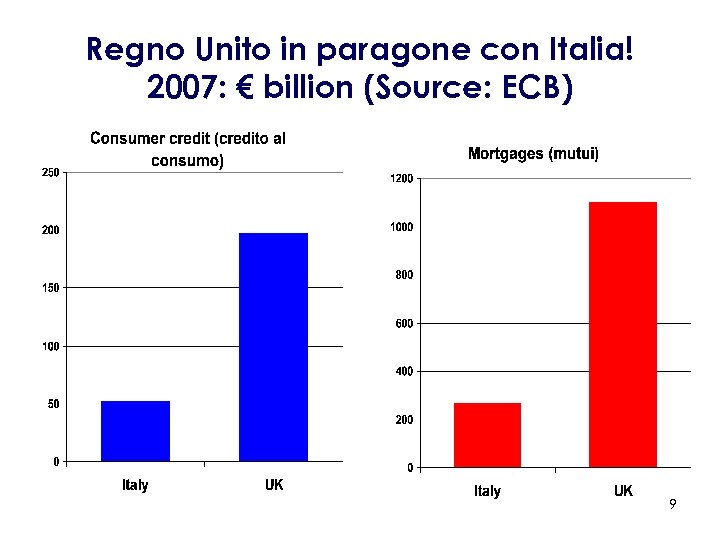

Regno Unito in paragone con Italia! 2007: € billion (Source: ECB) 9

Indebted population • Outcome – a large indebted population in the UK with many people unable to repay their loans • Problems evident before the financial crisis • Arrears and defaults on credit cards and other unsecured loans first rose sharply during 2005 • Bank write-offs on consumer credit rose from £ 3, 9 billion in 2004 to almost £ 5, 8 billion in 2005 • Evidence that financial problems caused by over-borrowing, not just a change in circumstances (unemployment or divorce) • Second phase of problems directly linked to financial crisis and recession • Rise in unemployment and reduced income (loss of overtime, short-time working) • Sharp rise in problems with mortgages, and further problems with unsecured borrowing 10

3. Helping people with financial problems 11

The need for debt advice • Many people in the UK need help with their personal finances • Often owe money to several different lenders • Unable to meet contractual loan repayments • Facing actions from lenders to recover loans • Need for professional help covering: – Budgeting – Restructuring of loan repayments – Negotiations with creditors – Pastoral care 12

UK debt advice process • Two-stage process. . . • First stage – counselling: – Gathering data on the client’s financial circumstances (income, outgoings, loans, etc) – Recommendation based on analysis of the data • With some clients (those with less severe problems and/or seek advice early), sufficient to provide them with the tools and information to help themselves • But if structured debt arrangement needed (involving some measure of debt relief), second stage in the process: – Organising the appropriate debt arrangement (negotiation with creditors, setting up arrangement, etc) – Ongoing monitoring and support (which may last for several years) • At both stages, accompanying pastoral care may be needed • And at both stages, specialist counselling and support may be needed (eg self-employed clients / small business owners, those with 13 specialist housing and benefits issues)

Overview of debt advice process 14

4. Consumer Credit Counselling Service (CCCS) 15

CCCS overview • The largest UK debt advice charity • Founded in the UK in 1993 in response to growing need for professional debt advice • Based on a proven debt management system operated in the USA over many years • Offers free, confidential and impartial debt advice based on a repayment ethic • 10 centres and 1 partnership covering the UK • 0800 free phone helpline, available 8 am to 8 pm • Web based 24 hour ‘virtual’ counselling through “Debt Remedy” (a world first) • Specialist advice services for self-employed (lavoro autonomo), mortgages, bankruptcy, welfare benefits • Recently launched an online money management service “Money Matters” for all people, not just those in debt 16

www. cccs. co. uk 17

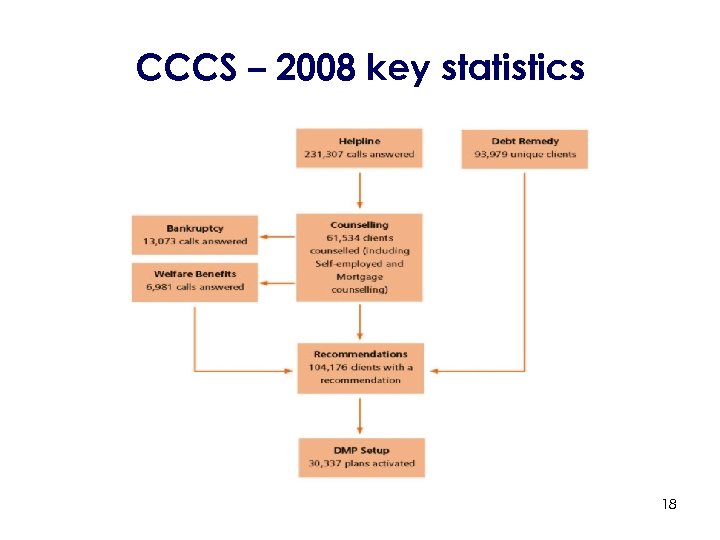

CCCS – 2008 key statistics 18

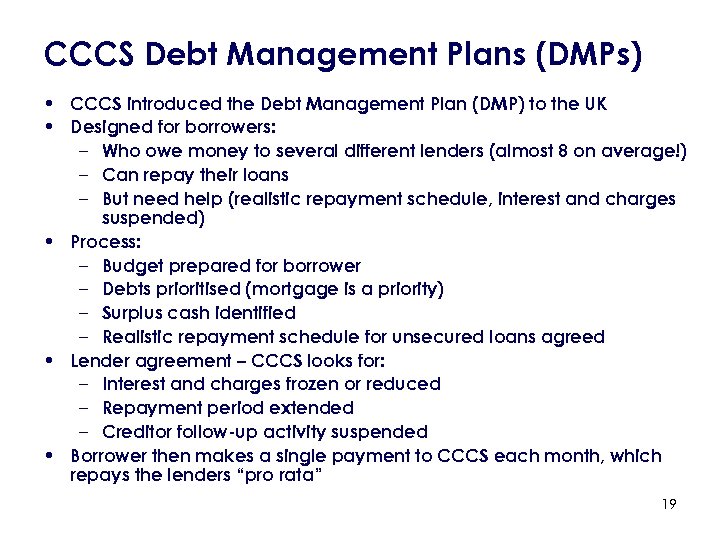

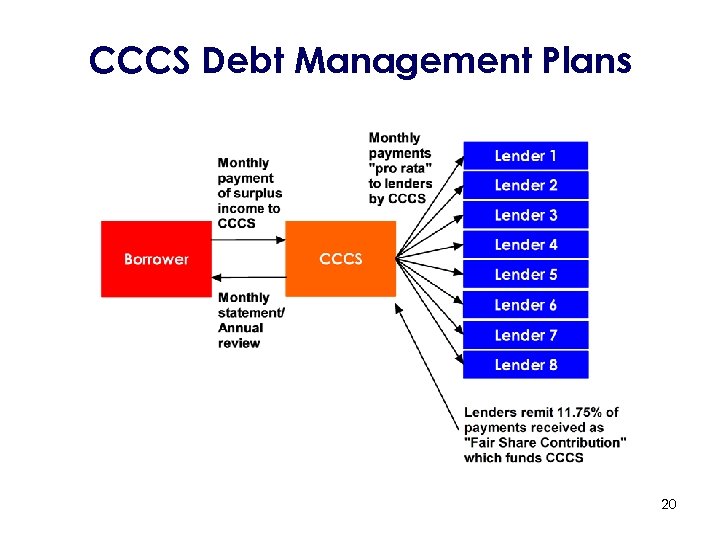

CCCS Debt Management Plans (DMPs) • CCCS introduced the Debt Management Plan (DMP) to the UK • Designed for borrowers: – Who owe money to several different lenders (almost 8 on average!) – Can repay their loans – But need help (realistic repayment schedule, interest and charges suspended) • Process: – Budget prepared for borrower – Debts prioritised (mortgage is a priority) – Surplus cash identified – Realistic repayment schedule for unsecured loans agreed • Lender agreement – CCCS looks for: – Interest and charges frozen or reduced – Repayment period extended – Creditor follow-up activity suspended • Borrower then makes a single payment to CCCS each month, which repays the lenders “pro rata” 19

CCCS Debt Management Plans 20

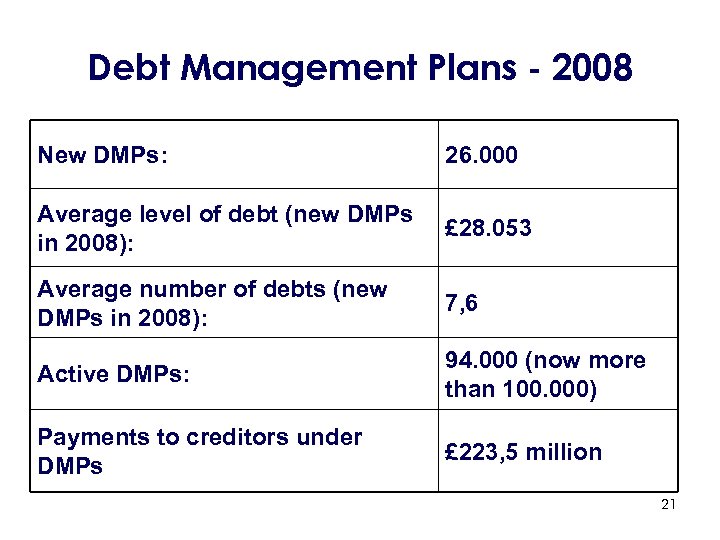

Debt Management Plans - 2008 New DMPs: 26. 000 Average level of debt (new DMPs in 2008): £ 28. 053 Average number of debts (new DMPs in 2008): 7, 6 Active DMPs: 94. 000 (now more than 100. 000) Payments to creditors under DMPs £ 223, 5 million 21

5. CCCS Data Warehouse 22

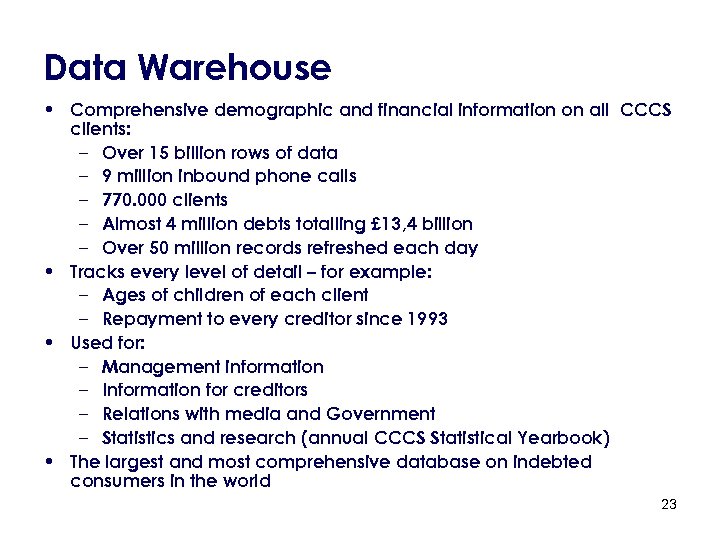

Data Warehouse • Comprehensive demographic and financial information on all CCCS clients: – Over 15 billion rows of data – 9 million inbound phone calls – 770. 000 clients – Almost 4 million debts totalling £ 13, 4 billion – Over 50 million records refreshed each day • Tracks every level of detail – for example: – Ages of children of each client – Repayment to every creditor since 1993 • Used for: – Management information – Information for creditors – Relations with media and Government – Statistics and research (annual CCCS Statistical Yearbook) • The largest and most comprehensive database on indebted consumers in the world 23

6. Research possibilities 24

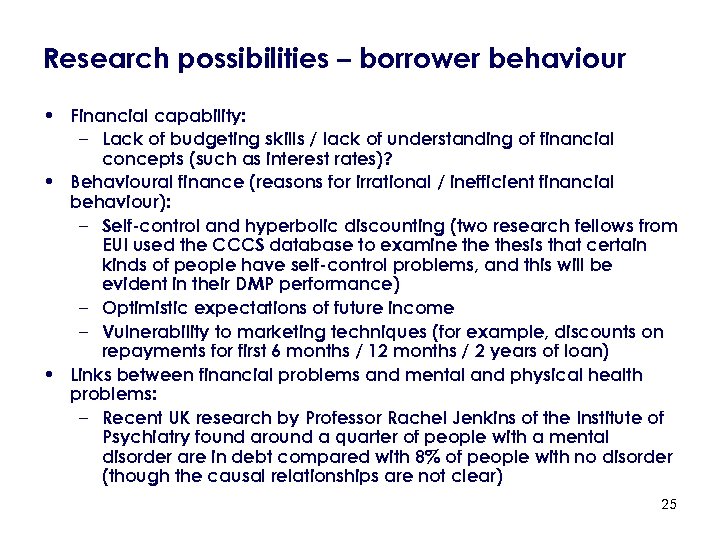

Research possibilities – borrower behaviour • Financial capability: – Lack of budgeting skills / lack of understanding of financial concepts (such as interest rates)? • Behavioural finance (reasons for irrational / inefficient financial behaviour): – Self-control and hyperbolic discounting (two research fellows from EUI used the CCCS database to examine thesis that certain kinds of people have self-control problems, and this will be evident in their DMP performance) – Optimistic expectations of future income – Vulnerability to marketing techniques (for example, discounts on repayments for first 6 months / 12 months / 2 years of loan) • Links between financial problems and mental and physical health problems: – Recent UK research by Professor Rachel Jenkins of the Institute of Psychiatry found around a quarter of people with a mental disorder are in debt compared with 8% of people with no disorder (though the causal relationships are not clear) 25

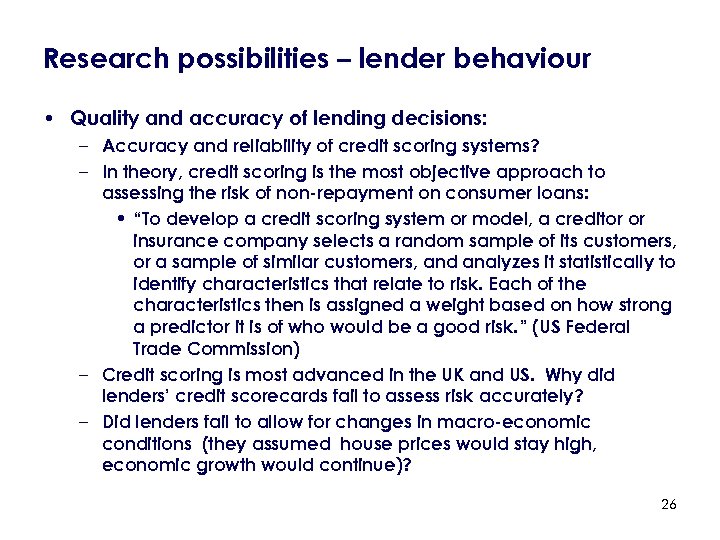

Research possibilities – lender behaviour • Quality and accuracy of lending decisions: – Accuracy and reliability of credit scoring systems? – In theory, credit scoring is the most objective approach to assessing the risk of non-repayment on consumer loans: • “To develop a credit scoring system or model, a creditor or insurance company selects a random sample of its customers, or a sample of similar customers, and analyzes it statistically to identify characteristics that relate to risk. Each of the characteristics then is assigned a weight based on how strong a predictor it is of who would be a good risk. ” (US Federal Trade Commission) – Credit scoring is most advanced in the UK and US. Why did lenders’ credit scorecards fail to assess risk accurately? – Did lenders fail to allow for changes in macro-economic conditions (they assumed house prices would stay high, economic growth would continue)? 26

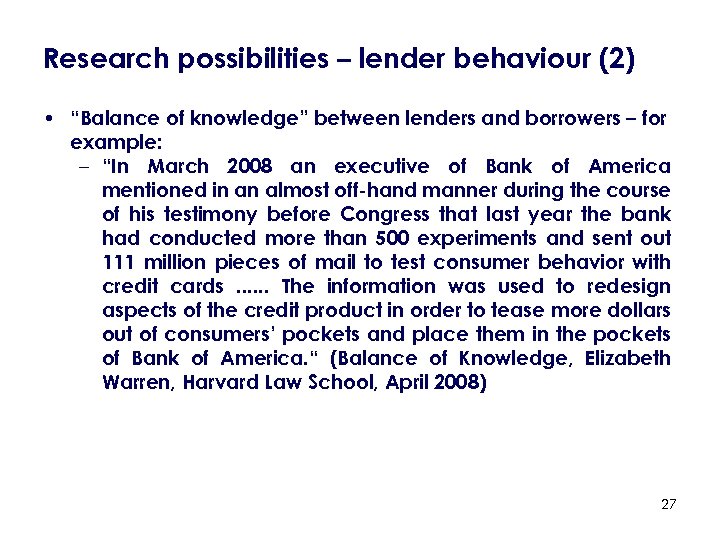

Research possibilities – lender behaviour (2) • “Balance of knowledge” between lenders and borrowers – for example: – “In March 2008 an executive of Bank of America mentioned in an almost off-hand manner during the course of his testimony before Congress that last year the bank had conducted more than 500 experiments and sent out 111 million pieces of mail to test consumer behavior with credit cards. . . The information was used to redesign aspects of the credit product in order to tease more dollars out of consumers’ pockets and place them in the pockets of Bank of America. “ (Balance of Knowledge, Elizabeth Warren, Harvard Law School, April 2008) 27

7. Sources and further reading 28

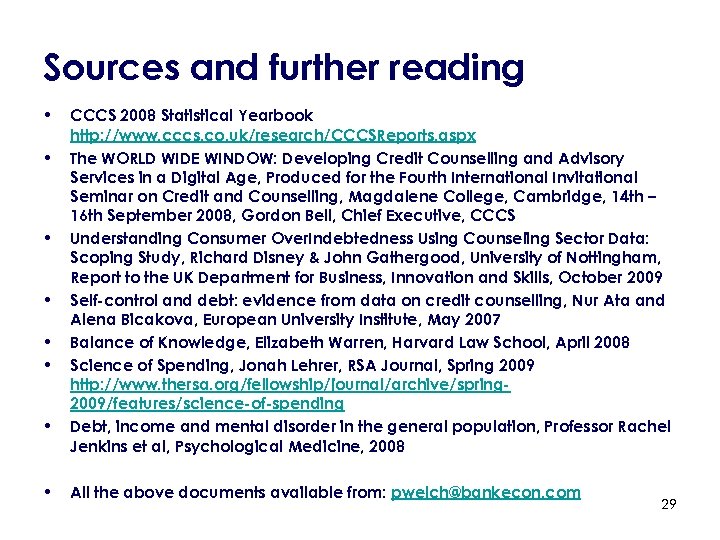

Sources and further reading • • CCCS 2008 Statistical Yearbook http: //www. cccs. co. uk/research/CCCSReports. aspx The WORLD WIDE WINDOW: Developing Credit Counselling and Advisory Services in a Digital Age, Produced for the Fourth International Invitational Seminar on Credit and Counselling, Magdalene College, Cambridge, 14 th – 16 th September 2008, Gordon Bell, Chief Executive, CCCS Understanding Consumer Over. Indebtedness Using Counseling Sector Data: Scoping Study, Richard Disney & John Gathergood, University of Nottingham, Report to the UK Department for Business, Innovation and Skills, October 2009 Self-control and debt: evidence from data on credit counselling, Nur Ata and Alena Bicakova, European University Institute, May 2007 Balance of Knowledge, Elizabeth Warren, Harvard Law School, April 2008 Science of Spending, Jonah Lehrer, RSA Journal, Spring 2009 http: //www. thersa. org/fellowship/journal/archive/spring 2009/features/science-of-spending Debt, income and mental disorder in the general population, Professor Rachel Jenkins et al, Psychological Medicine, 2008 All the above documents available from: pwelch@bankecon. com 29

8. Peter Welch: background and contact details 30

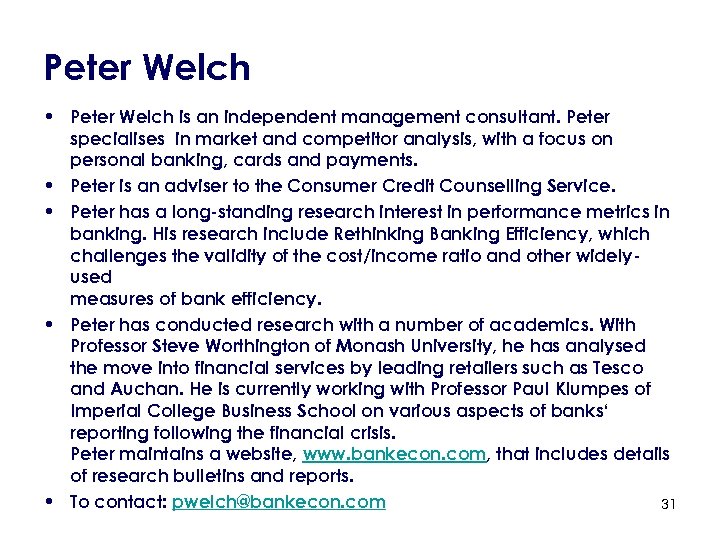

Peter Welch • Peter Welch is an independent management consultant. Peter specialises in market and competitor analysis, with a focus on personal banking, cards and payments. • Peter is an adviser to the Consumer Credit Counselling Service. • Peter has a long-standing research interest in performance metrics in banking. His research include Rethinking Banking Efficiency, which challenges the validity of the cost/income ratio and other widelyused measures of bank efficiency. • Peter has conducted research with a number of academics. With Professor Steve Worthington of Monash University, he has analysed the move into financial services by leading retailers such as Tesco and Auchan. He is currently working with Professor Paul Klumpes of Imperial College Business School on various aspects of banks‘ reporting following the financial crisis. Peter maintains a website, www. bankecon. com, that includes details of research bulletins and reports. • To contact: pwelch@bankecon. com 31

9. Appendix: UK debt advice 32

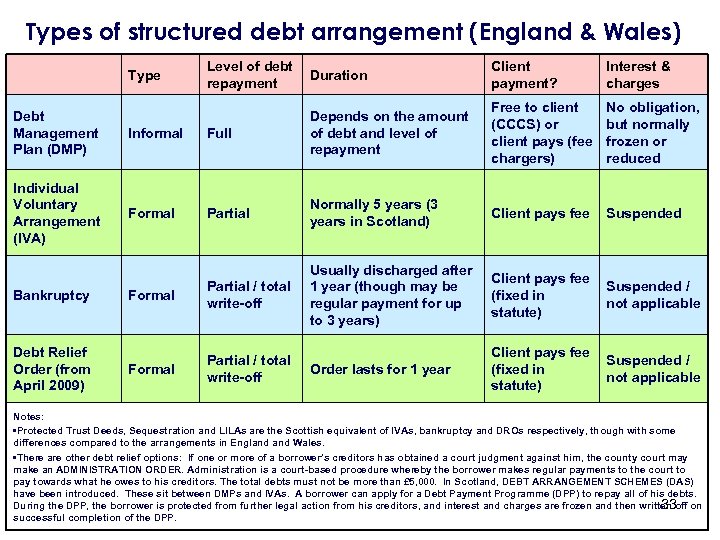

Types of structured debt arrangement (England & Wales) Type Level of debt repayment Duration Client payment? Interest & charges Free to client (CCCS) or client pays (fee chargers) No obligation, but normally frozen or reduced Debt Management Plan (DMP) Informal Full Depends on the amount of debt and level of repayment Individual Voluntary Arrangement (IVA) Formal Partial Normally 5 years (3 years in Scotland) Client pays fee Suspended Formal Partial / total write-off Usually discharged after 1 year (though may be regular payment for up to 3 years) Client pays fee (fixed in statute) Suspended / not applicable Formal Partial / total write-off Order lasts for 1 year Client pays fee (fixed in statute) Suspended / not applicable Bankruptcy Debt Relief Order (from April 2009) Notes: • Protected Trust Deeds, Sequestration and LILAs are the Scottish equivalent of IVAs, bankruptcy and DROs respectively, though with some differences compared to the arrangements in England Wales. • There are other debt relief options: If one or more of a borrower’s creditors has obtained a court judgment against him, the county court may make an ADMINISTRATION ORDER. Administration is a court-based procedure whereby the borrower makes regular payments to the court to pay towards what he owes to his creditors. The total debts must not be more than £ 5, 000. In Scotland, DEBT ARRANGEMENT SCHEMES (DAS) have been introduced. These sit between DMPs and IVAs. A borrower can apply for a Debt Payment Programme (DPP) to repay all of his debts. During the DPP, the borrower is protected from further legal action from his creditors, and interest and charges are frozen and then written off on 33 successful completion of the DPP.

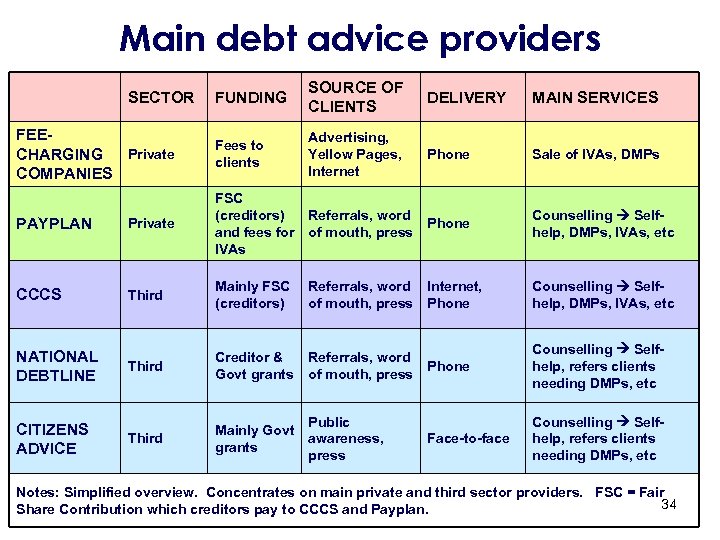

Main debt advice providers FUNDING SOURCE OF CLIENTS DELIVERY MAIN SERVICES FEEPrivate CHARGING COMPANIES Fees to clients Advertising, Yellow Pages, Internet Phone Sale of IVAs, DMPs PAYPLAN Private FSC (creditors) Referrals, word Phone and fees for of mouth, press IVAs Counselling Selfhelp, DMPs, IVAs, etc CCCS Third Mainly FSC (creditors) Referrals, word Internet, of mouth, press Phone Counselling Selfhelp, DMPs, IVAs, etc Third Creditor & Govt grants Referrals, word Phone of mouth, press Counselling Selfhelp, refers clients needing DMPs, etc Third Public Mainly Govt awareness, grants press SECTOR NATIONAL DEBTLINE CITIZENS ADVICE Face-to-face Counselling Selfhelp, refers clients needing DMPs, etc Notes: Simplified overview. Concentrates on main private and third sector providers. FSC = Fair 34 Share Contribution which creditors pay to CCCS and Payplan.

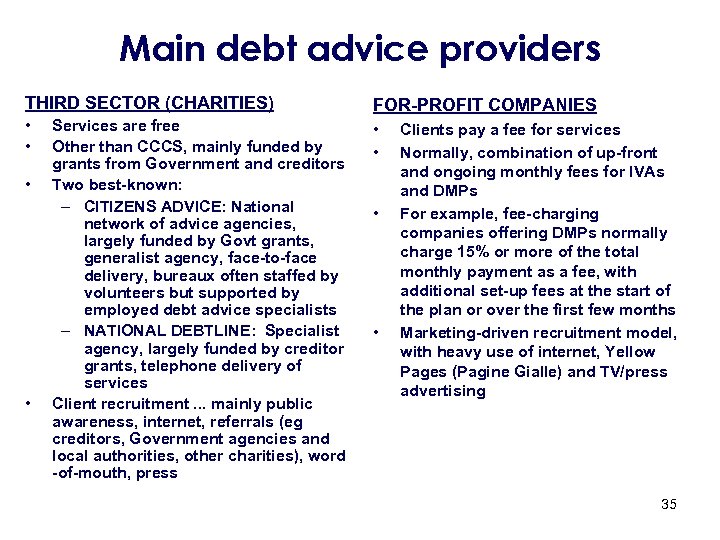

Main debt advice providers THIRD SECTOR (CHARITIES) FOR-PROFIT COMPANIES • • • Services are free Other than CCCS, mainly funded by grants from Government and creditors Two best-known: – CITIZENS ADVICE: National network of advice agencies, largely funded by Govt grants, generalist agency, face-to-face delivery, bureaux often staffed by volunteers but supported by employed debt advice specialists – NATIONAL DEBTLINE: Specialist agency, largely funded by creditor grants, telephone delivery of services Client recruitment. . . mainly public awareness, internet, referrals (eg creditors, Government agencies and local authorities, other charities), word -of-mouth, press • • Clients pay a fee for services Normally, combination of up-front and ongoing monthly fees for IVAs and DMPs For example, fee-charging companies offering DMPs normally charge 15% or more of the total monthly payment as a fee, with additional set-up fees at the start of the plan or over the first few months Marketing-driven recruitment model, with heavy use of internet, Yellow Pages (Pagine Gialle) and TV/press advertising 35

Fee-charging companies – example of advertising 36

99c7c19478848b93b0fecf54485a4286.ppt