405f9f2f6c876e411f182acf3b163bb3.ppt

- Количество слайдов: 40

Decentralization: Responsibility Accounting, Performance Evaluation, and Transfer Pricing Prepared by Douglas Cloud Pepperdine University 10 -1

Objectives 1. Define responsibility accounting and describe After studying this the four types of responsibility centers. chapter, you should 2. Explain why firms chose to decentralize. be able to: 3. Compute and explain return on investment (ROI), residual income (RI), and economic value added (EVA). 4. Discuss the methods of evaluating and rewarding managerial performance. Continued 10 -2

Objectives 5. Explain the role of transfer pricing in a decentralized firm. 6. Discuss the methods of setting transfer pricing. 10 -3

Responsibility Accounting Responsibility accounting is a system that measures the results of each responsibility center and compares those results with some measure of expected or budgeted outcome. There are four major types of responsibility centers: ü Cost center ü Revenue center ü Profit center ü Investment center 10 -4

Reasons for Decentralization 1. Better access to local information 2. Cognitive limitations 3. More timely response 4. Focusing of central management 5. Training and evaluation 6. Motivation 7. Enhanced competition 10 -5

Measuring the Performance of Investment Centers Return on Investment (ROI) Residual Income (RI) Economic Value Added (EVA) 10 -6

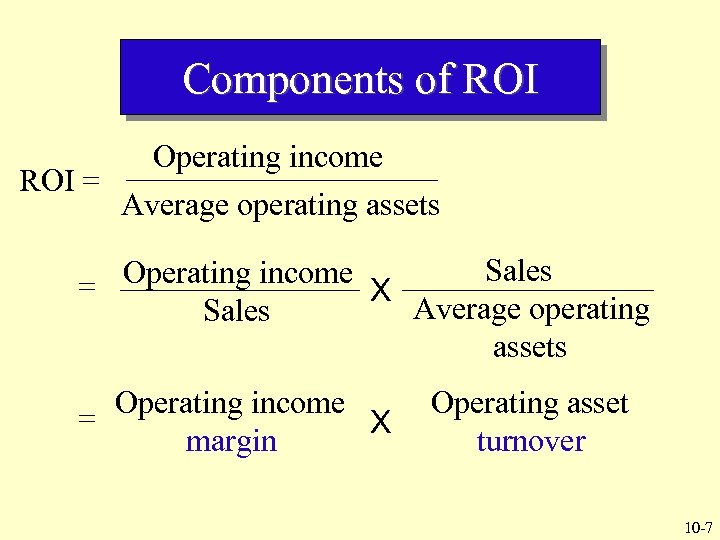

Components of ROI Operating income ROI = Average operating assets Sales Operating income = X Average operating Sales assets Operating income = X margin Operating asset turnover 10 -7

Components of ROI Margin expresses the portion of sales that is available for interest, income taxes, and profit. Turnover shows how productively assets are being used to generate sales. 10 -8

Advantages of the ROI Measure q It encourages managers to pay careful attention to the relationships among sales, expenses, and investments, as should be the case for a manager of an investment center. q It encourages cost efficiency. q It discourages excessive investment in operating assets. 10 -9

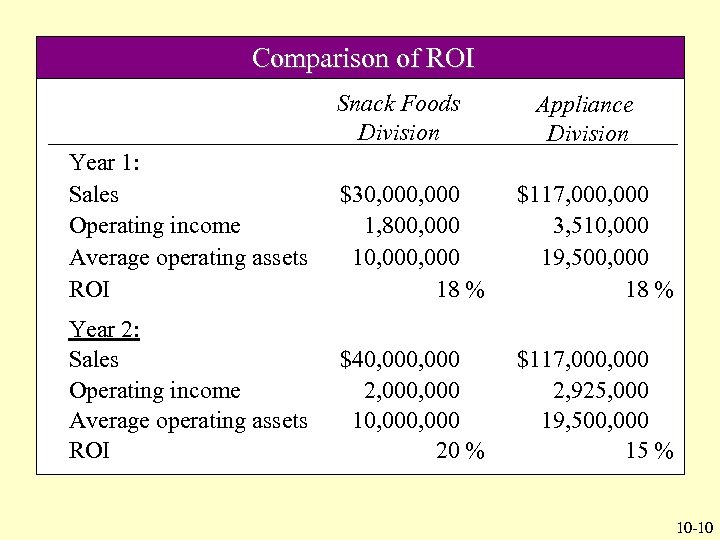

Comparison of ROI Snack Foods Division Appliance Division Year 1: Sales Operating income Average operating assets ROI $30, 000 1, 800, 000 10, 000 18 % $117, 000 3, 510, 000 19, 500, 000 18 % Year 2: Sales Operating income Average operating assets ROI $40, 000 2, 000 10, 000 20 % $117, 000 2, 925, 000 19, 500, 000 15 % 10 -10

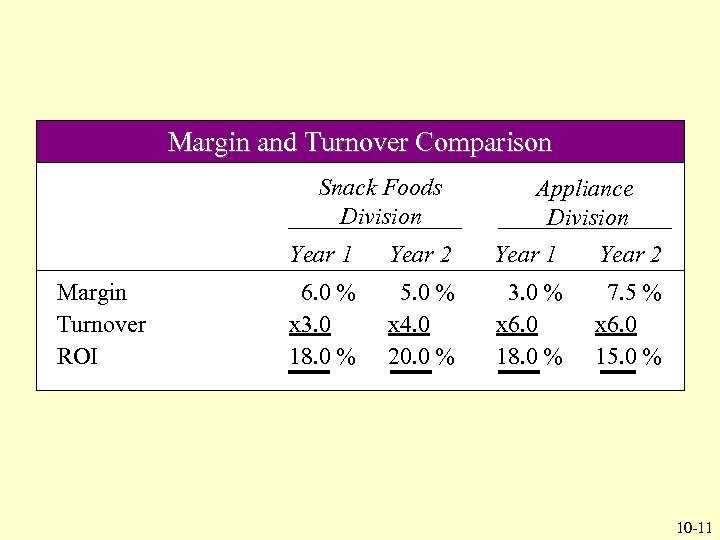

Margin and Turnover Comparison Snack Foods Division Appliance Division Year 1 Margin Turnover ROI Year 2 Year 1 Year 2 6. 0 % x 3. 0 18. 0 % 5. 0 % x 4. 0 20. 0 % 3. 0 % x 6. 0 18. 0 % 7. 5 % x 6. 0 15. 0 % 10 -11

Disadvantages of the ROI Measure q It discourages managers from investing in projects that would decrease the divisional ROI but would increase the profitability of the company as a whole. q It can encourage myopic behavior, in that managers may focus on the short run at the expense of the long run. 10 -12

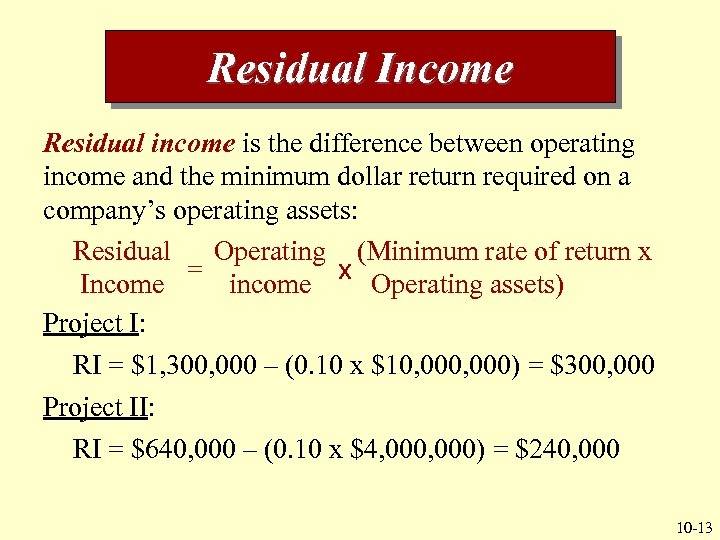

Residual Income Residual income is the difference between operating income and the minimum dollar return required on a company’s operating assets: Residual Operating (Minimum rate of return x = x Income income Operating assets) Project I: RI = $1, 300, 000 – (0. 10 x $10, 000) = $300, 000 Project II: RI = $640, 000 – (0. 10 x $4, 000) = $240, 000 10 -13

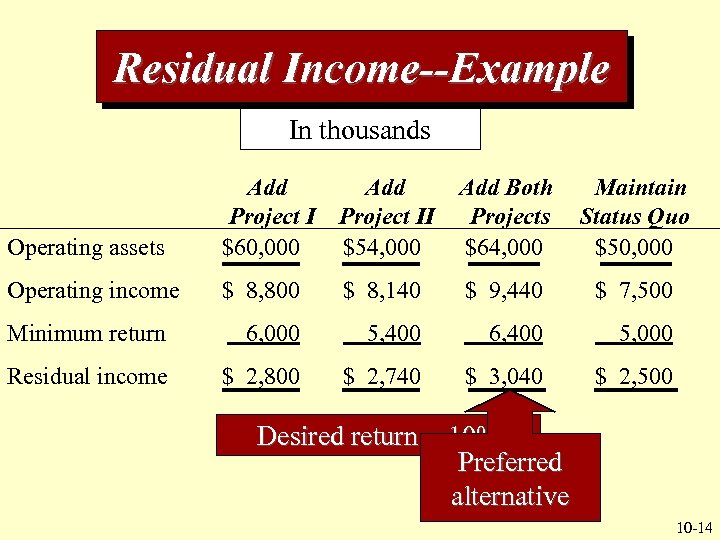

Residual Income--Example In thousands Operating assets Add Project I $60, 000 Add Project II $54, 000 Add Both Projects $64, 000 Maintain Status Quo $50, 000 Operating income $ 8, 800 $ 8, 140 $ 9, 440 $ 7, 500 Minimum return 6, 000 5, 400 6, 400 5, 000 Residual income $ 2, 800 $ 2, 740 $ 3, 040 $ 2, 500 Desired return = 10% Preferred alternative 10 -14

Disadvantages of Residual Income 1. It is an absolute measure of return which make it difficult to directly compare the performance of divisions. 2. It does not discourage myopic behavior. 10 -15

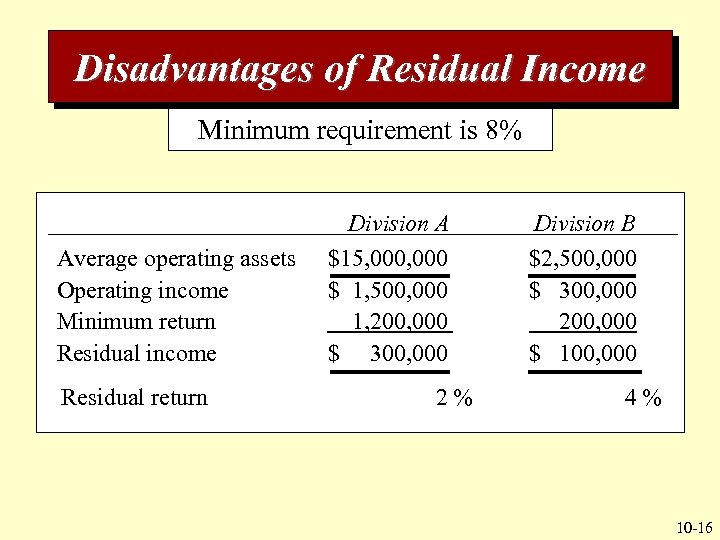

Disadvantages of Residual Income Minimum requirement is 8% Average operating assets Operating income Minimum return Residual income Residual return Division A $15, 000 $ 1, 500, 000 1, 200, 000 $ 300, 000 2% Division B $2, 500, 000 $ 300, 000 200, 000 $ 100, 000 4% 10 -16

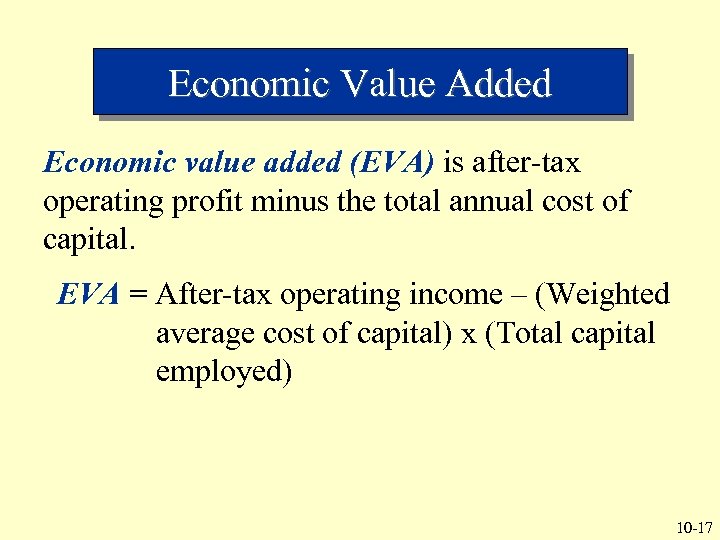

Economic Value Added Economic value added (EVA) is after-tax operating profit minus the total annual cost of capital. EVA = After-tax operating income – (Weighted average cost of capital) x (Total capital employed) 10 -17

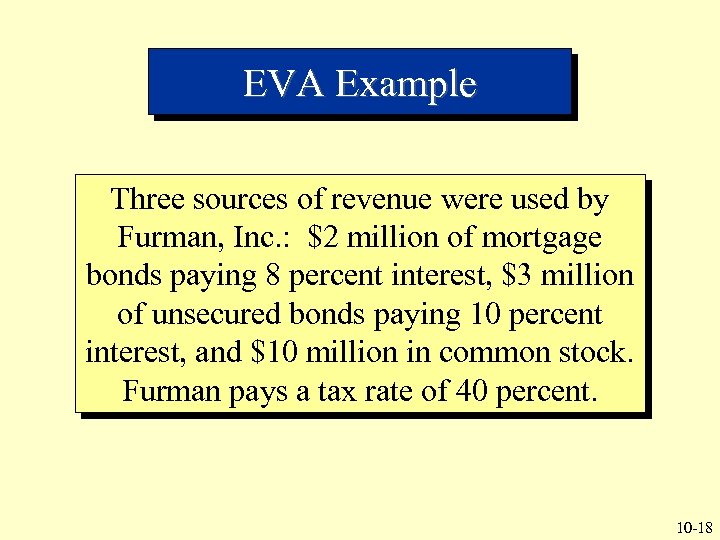

EVA Example Three sources of revenue were used by Furman, Inc. : $2 million of mortgage bonds paying 8 percent interest, $3 million of unsecured bonds paying 10 percent interest, and $10 million in common stock. Furman pays a tax rate of 40 percent. 10 -18

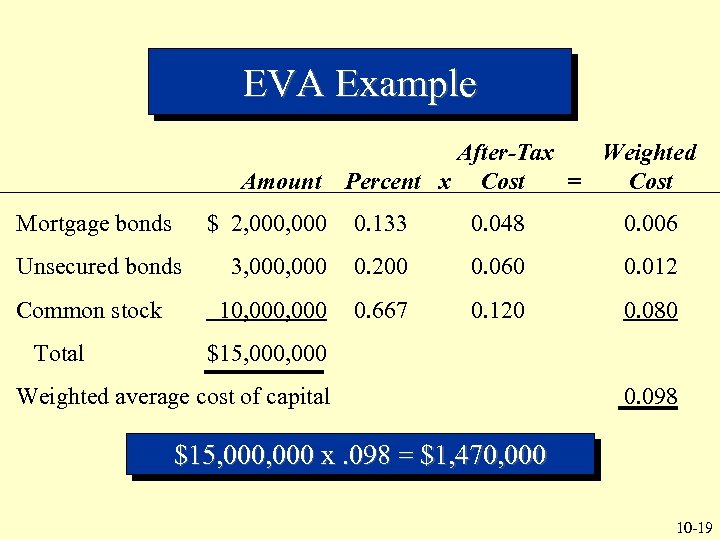

EVA Example After-Tax Weighted Amount Percent x Cost = Cost Mortgage bonds $ 2, 000 Common stock Total 0. 048 0. 006 3, 000 0. 200 0. 060 0. 012 10, 000 Unsecured bonds 0. 133 0. 667 0. 120 0. 080 $15, 000 Weighted average cost of capital 0. 098 $15, 000 x. 098 = $1, 470, 000 10 -19

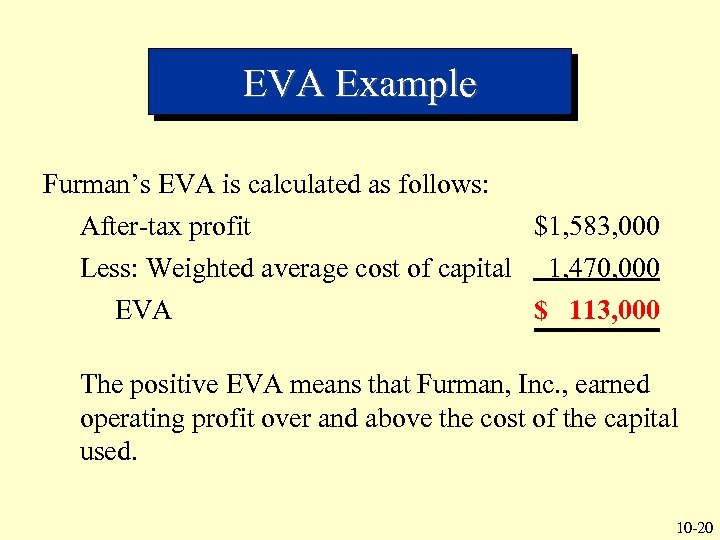

EVA Example Furman’s EVA is calculated as follows: After-tax profit Less: Weighted average cost of capital EVA $1, 583, 000 1, 470, 000 $ 113, 000 The positive EVA means that Furman, Inc. , earned operating profit over and above the cost of the capital used. 10 -20

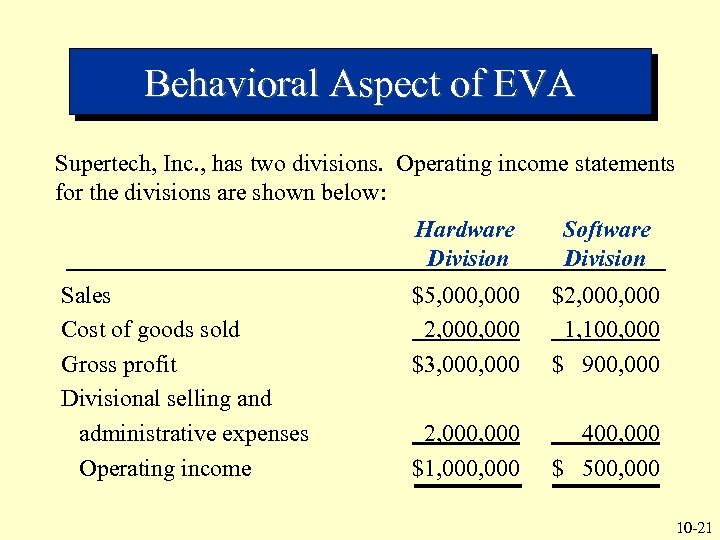

Behavioral Aspect of EVA Supertech, Inc. , has two divisions. Operating income statements for the divisions are shown below: Hardware Division Sales Cost of goods sold Gross profit Divisional selling and administrative expenses Operating income Software Division $5, 000 2, 000 $3, 000 $2, 000 1, 100, 000 $ 900, 000 2, 000 $1, 000 400, 000 $ 500, 000 10 -21

Behavioral Aspect of EVA ü Supertech’s weighted average cost of capital is 11 percent. ü Hardware, a buildup of inventories, use of warehouses, etc. uses capital amounting to $10 million. ü The cost of capital is $1, 100, 000 (0. 11 x $10, 000). ü The dollar cost of capital for the Software Division is $220, 000 (0. 11 x $2, 000). 10 -22

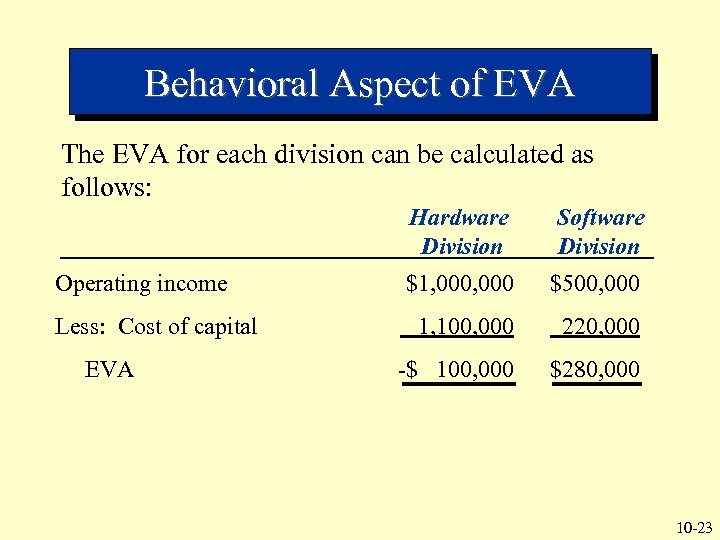

Behavioral Aspect of EVA The EVA for each division can be calculated as follows: Hardware Division Operating income Less: Cost of capital EVA Software Division $1, 000 $500, 000 1, 100, 000 220, 000 -$ 100, 000 $280, 000 10 -23

Multiple Performance Measurements Tends to focus on long-run § Discourages myopic behavior § 10 -24

Incentive Pay for Managers Why would managers not provide good service? There are three reasons: Ø They may have low ability. Ø They may prefer not to work hard. Ø They may prefer to spend company resources on perquisites. 10 -25

Managerial Rewards • Frequently managerial rewards include incentives tied to performance. • The objective of managerial awards is to encourage goal congruence, so that managers will act in the best interests of the firm. • Managerial rewards include salary increases, bonuses based on reported income, stock options, and noncash compensations. 10 -26

Cash Compensation v Good management performance may be rewarded by granting periodic raises. v Unlike periodic raises, bonuses are more flexible. v Many companies use a combination of salary and bonus to reward performance by keeping salaries fairly level and allow bonuses to fluctuate with reported income. 10 -27

Stock-Based Compensation Stock options frequently are offered to manager to make A owners of them part stock option is is the right to buy a certain number of company—thus encourage The price of shares of the company’s the stock is goal congruence. stock, at a usually setprice particular approximately at market of time. and after a set lengthprice at the time of issue. Then, if the stock price rises in the future, the manager may exercise the option. 10 -28

Transfer Pricing The transferred good is revenue to the selling division and cost to the buying division. This value is called transfer pricing. 10 -29

Transfer Pricing Some Major Issues ü Impact on divisional performance measures ü Impact on firm wide profits ü Impact on divisional autonomy 10 -30

Transfer Pricing § Market price § Negotiated transfer prices § Cost-based transfer prices ü Variable cost ü Full (absorption cost) 10 -31

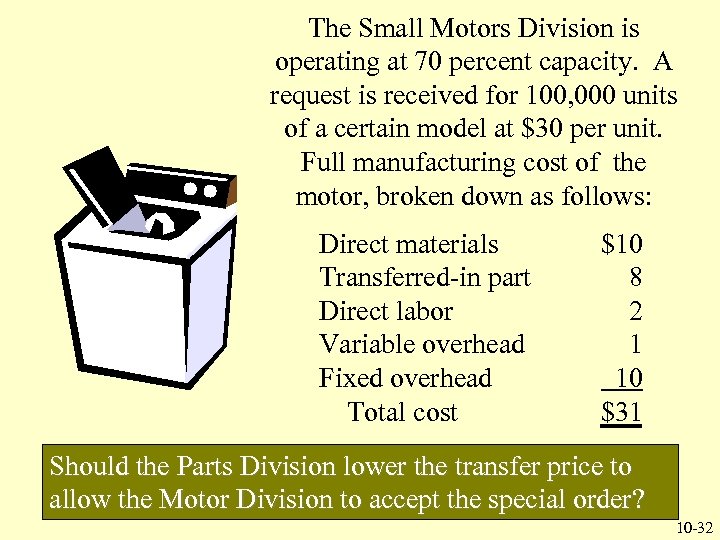

The Small Motors Division is operating at 70 percent capacity. A request is received for 100, 000 units of a certain model at $30 per unit. Full manufacturing cost of the motor, broken down as follows: Direct materials Transferred-in part Direct labor Variable overhead Fixed overhead Total cost $10 8 2 1 10 $31 Should the Parts Division lower the transfer price to allow the Motor Division to accept the special order? 10 -32

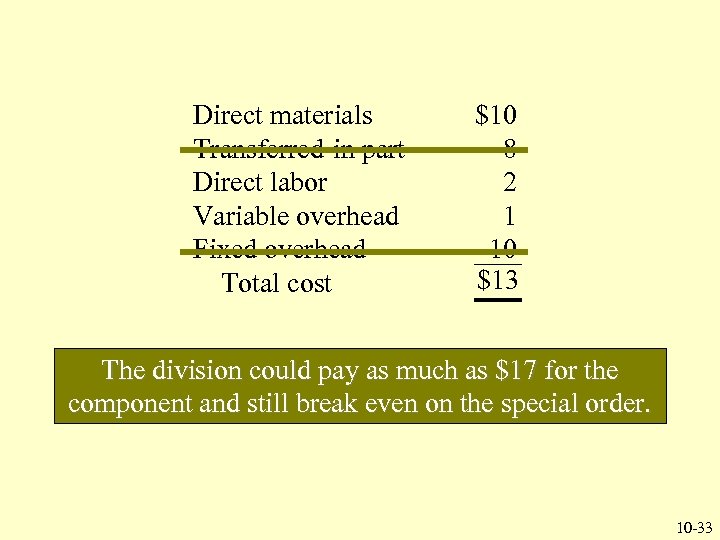

Direct materials Transferred-in part Direct labor Variable overhead Fixed overhead Total cost $10 8 2 1 10 $13 $31 The division could pay as much as $17 for the component and still break even on the special order. 10 -33

Negotiated Transfer Prices When imperfection exists in competitive markets for the intermediate product, market price may no longer be suitable. 10 -34

Negotiated Transfer Prices In this case, negotiated transfer prices may be a practical alternative. Opportunity costs can be used to define the boundaries of the negotiation set. 10 -35

Disadvantages of Negotiated Transfer Prices 1. One division manager, possessing private information, may take advantage of another divisional manager. 2. Performance measures may be distorted by the negotiating skills of managers. 3. Negotiation can consume considerable time and resources. 10 -36

Despite the disadvantages, negotiated price transfer prices offer some hope of complying with the three criteria of goal congruence, autonomy, and accurate performance evaluation. 10 -37

Cost-Based Transfer Pricing § Full-cost transfer pricing § Full cost plus markup § Variable cost per fixed fee 10 -38

End of Chapter 10 -39

10 -40

405f9f2f6c876e411f182acf3b163bb3.ppt