f643a6e2ecd1357c78b5a3bddfd1a7be.ppt

- Количество слайдов: 27

DECEMBER 10, 2013 Qianwen Wu, Wenqiang Xu, Yi Liu and Zuowei Xu

Agenda Introduction Macroeconomic Outlook Industry Overview Company Overview Financial Analysis Valuation Recommendation

Introduction q q Started as a health food store in 1935 A leading global specialty retailer of health and wellness products: vitamins, minerals and sports nutrition products. 8100 locations in the United States and 54 international countries Listed on April 1 st, 2011 and has already returned far more cash to shareholders than it raised in IPO Industry: Nutritional Supplements Industry Source: Company overview, GNC website

Macroeconomic Outlook Population over 50 and older Nutrition Supplement Disposable income q CCI Consumer Confidence Index is a good indicator for the future consumption of nutrition supplement. The index soars above expectations came in at 82. 5, beating the forecast of 76. 0 in December.

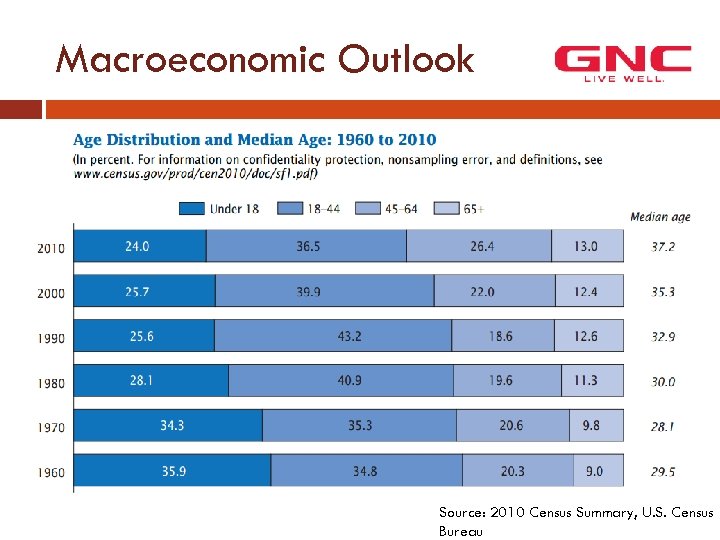

Macroeconomic Outlook Source: 2010 Census Summary, U. S. Census Bureau

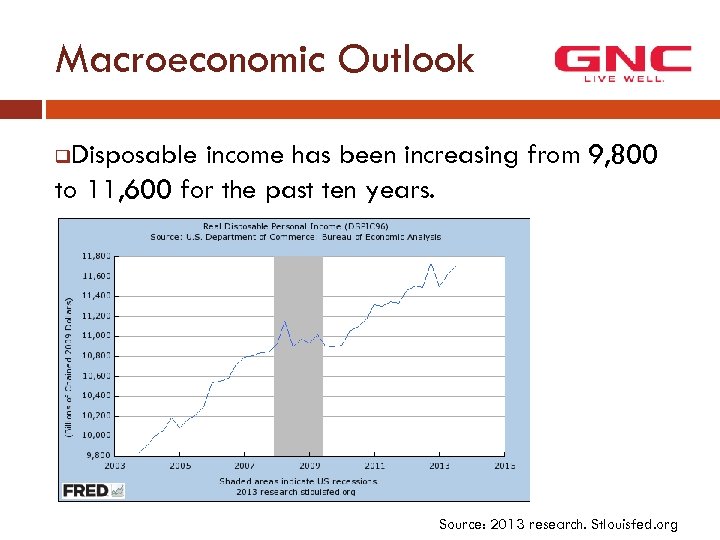

Macroeconomic Outlook Disposable income has been increasing from 9, 800 to 11, 600 for the past ten years. q q a Source: 2013 research. Stlouisfed. org

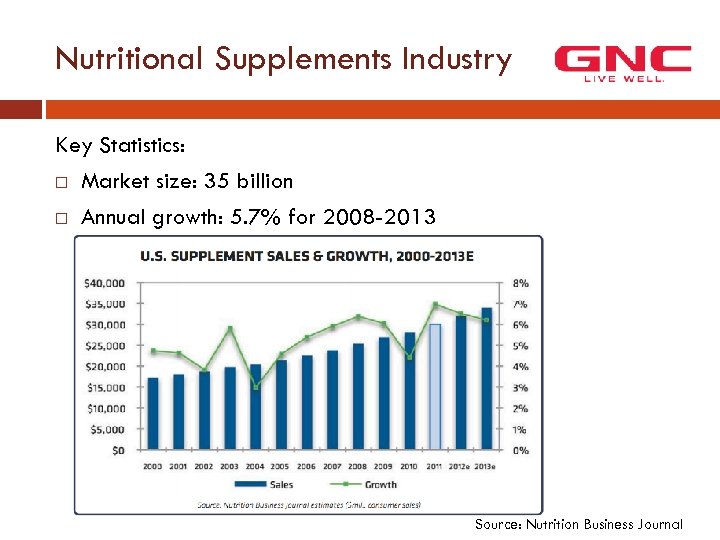

Nutritional Supplements Industry Key Statistics: Market size: 35 billion Annual growth: 5. 7% for 2008 -2013 Source: Nutrition Business Journal

Nutritional Supplements Industry Target Consumers: q According to the National Health and Nutrition Examination Survey, more than 50% of adults are taking a dietary supplement and 35% use a multivitamin product q According to the IBIS World, older white women with higher education levels, lower BMIs, and higher physical activity levels are the most likely consumer to using a supplement. Source: Nutrition Business Journal

Nutritional Supplements Industry Key to Success: Stock New Products Brand Availability

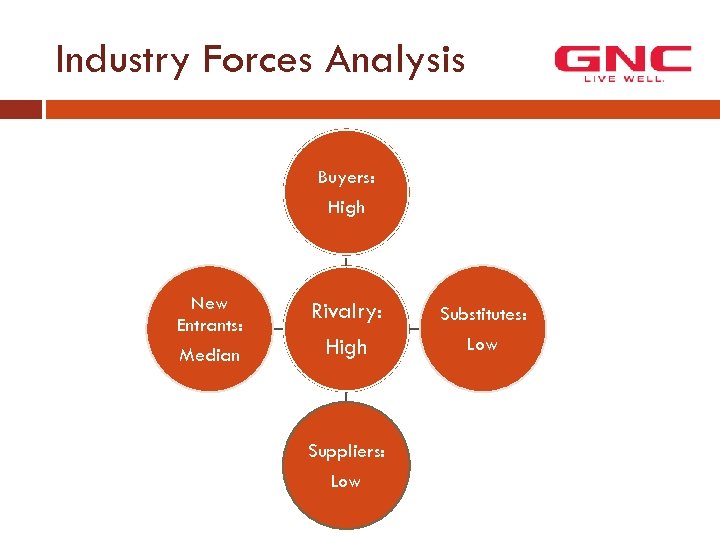

Industry Forces Analysis Buyers: High New Entrants: Median Rivalry: High Suppliers: Low Substitutes: Low

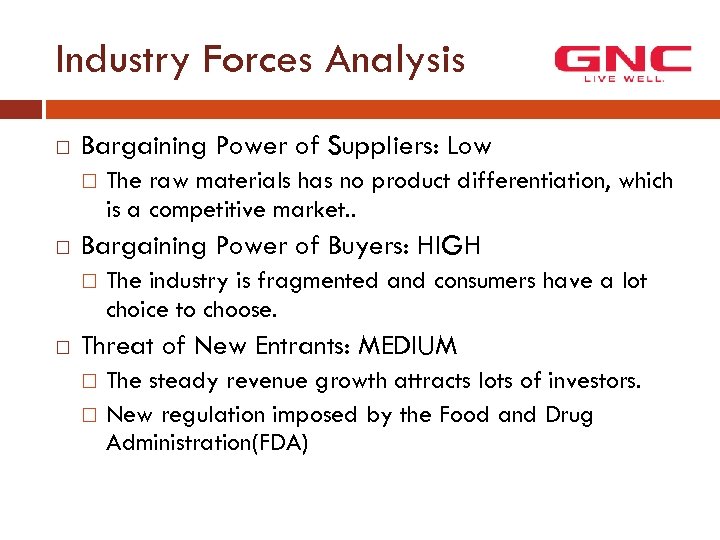

Industry Forces Analysis Bargaining Power of Suppliers: Low Bargaining Power of Buyers: HIGH The raw materials has no product differentiation, which is a competitive market. . The industry is fragmented and consumers have a lot choice to choose. Threat of New Entrants: MEDIUM The steady revenue growth attracts lots of investors. New regulation imposed by the Food and Drug Administration(FDA)

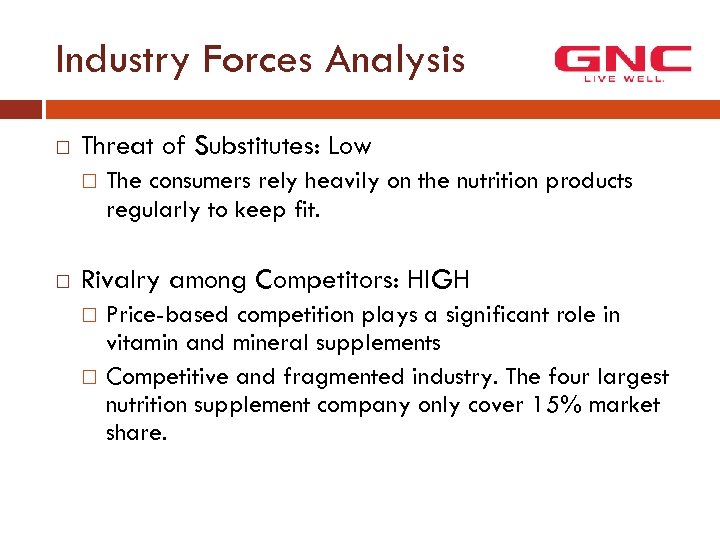

Industry Forces Analysis Threat of Substitutes: Low The consumers rely heavily on the nutrition products regularly to keep fit. Rivalry among Competitors: HIGH Price-based competition plays a significant role in vitamin and mineral supplements Competitive and fragmented industry. The four largest nutrition supplement company only cover 15% market share.

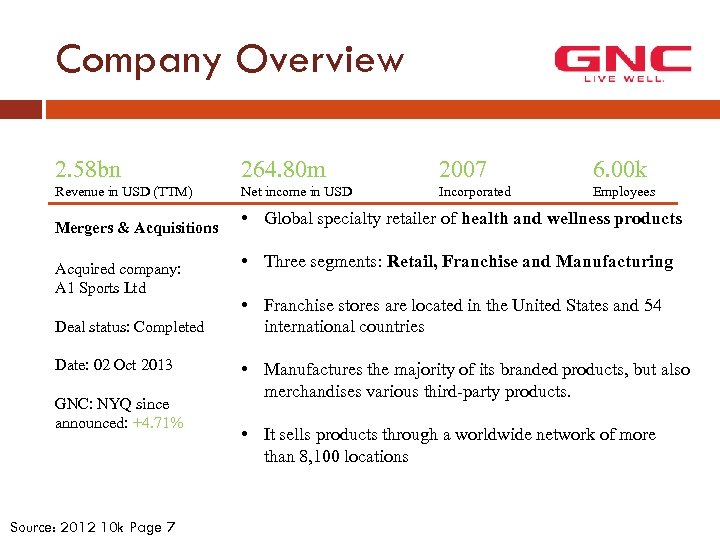

Company Overview 2. 58 bn 264. 80 m 2007 6. 00 k Revenue in USD (TTM) Net income in USD Incorporated Employees Mergers & Acquisitions Acquired company: A 1 Sports Ltd Deal status: Completed Date: 02 Oct 2013 GNC: NYQ since announced: +4. 71% Source: 2012 10 k Page 7 • Global specialty retailer of health and wellness products • Three segments: Retail, Franchise and Manufacturing • Franchise stores are located in the United States and 54 international countries • Manufactures the majority of its branded products, but also merchandises various third-party products. • It sells products through a worldwide network of more than 8, 100 locations

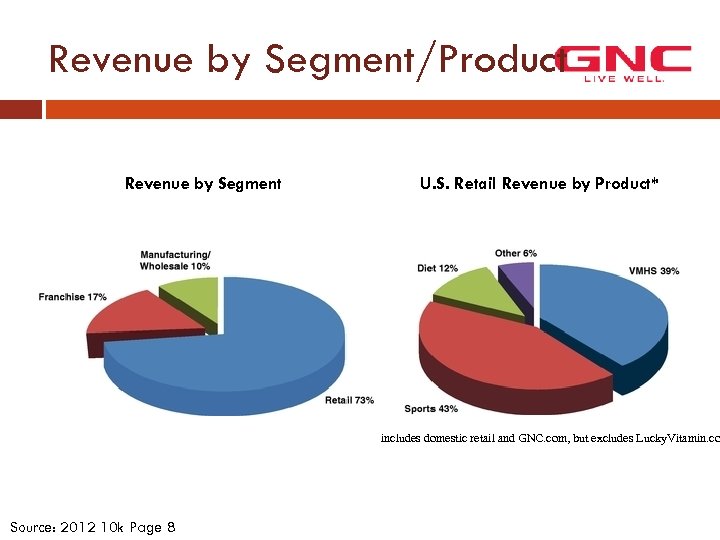

Revenue by Segment/Product Revenue by Segment U. S. Retail Revenue by Product* includes domestic retail and GNC. com, but excludes Lucky. Vitamin. co Source: 2012 10 k Page 8

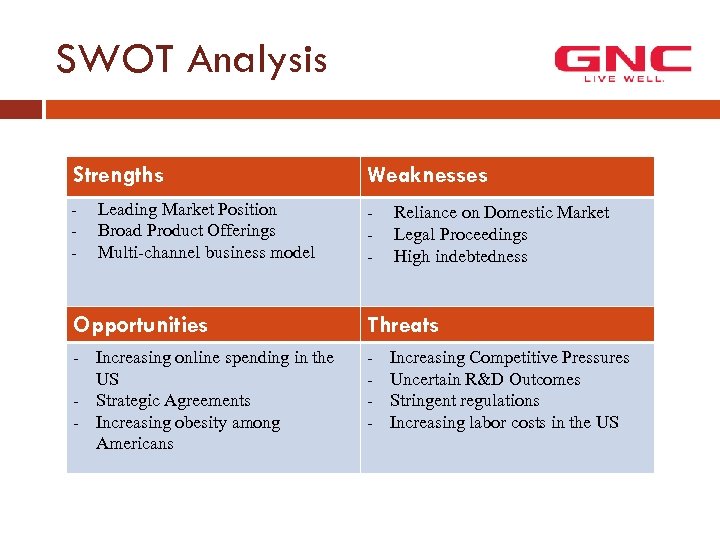

SWOT Analysis Strengths Weaknesses - - Leading Market Position Broad Product Offerings Multi-channel business model Reliance on Domestic Market Legal Proceedings High indebtedness Opportunities Threats - Increasing online spending in the US - Strategic Agreements - Increasing obesity among Americans - Increasing Competitive Pressures Uncertain R&D Outcomes Stringent regulations Increasing labor costs in the US

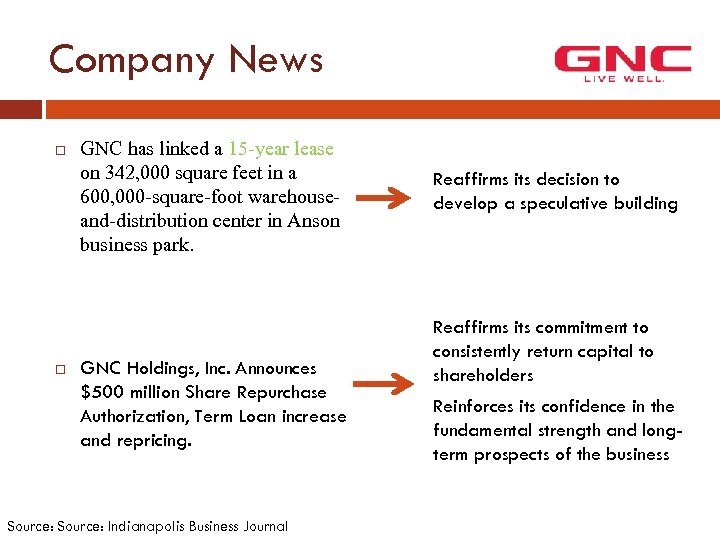

Company News GNC has linked a 15 -year lease on 342, 000 square feet in a 600, 000 -square-foot warehouseand-distribution center in Anson business park. GNC Holdings, Inc. Announces $500 million Share Repurchase Authorization, Term Loan increase and repricing. Source: Indianapolis Business Journal Reaffirms its decision to develop a speculative building Reaffirms its commitment to consistently return capital to shareholders Reinforces its confidence in the fundamental strength and longterm prospects of the business

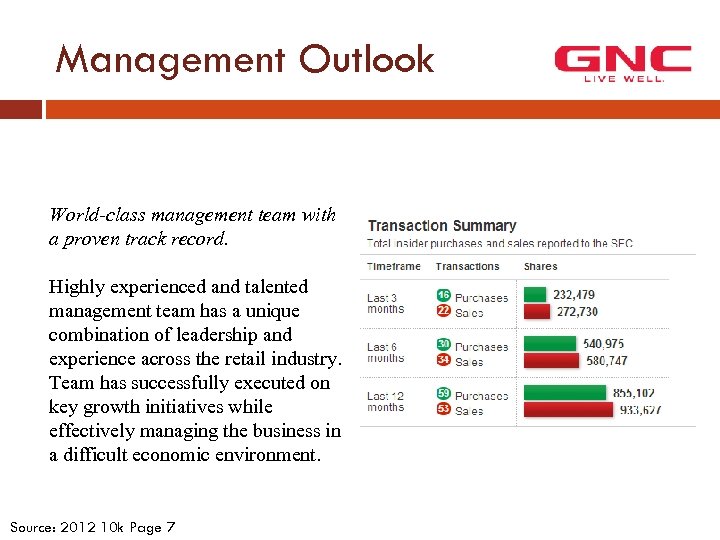

Management Outlook World-class management team with a proven track record. Highly experienced and talented management team has a unique combination of leadership and experience across the retail industry. Team has successfully executed on key growth initiatives while effectively managing the business in a difficult economic environment. Source: 2012 10 k Page 7

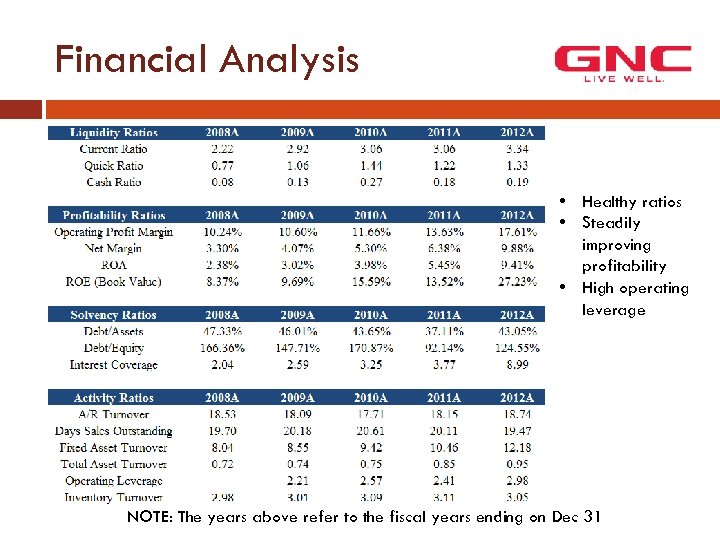

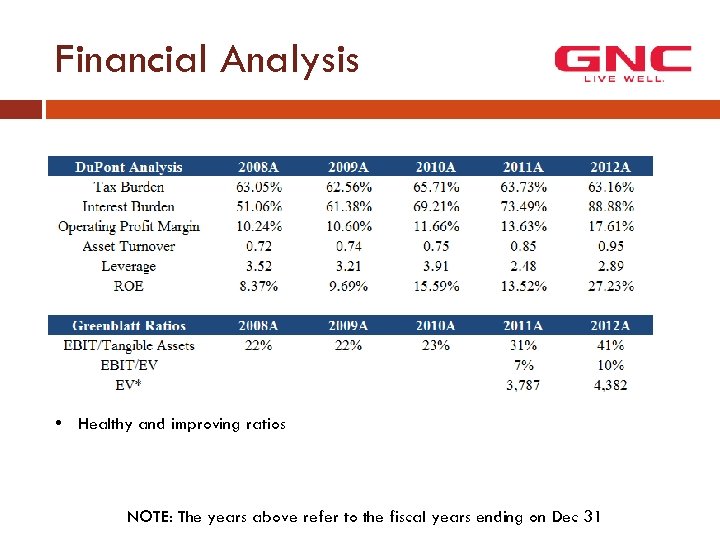

Financial Analysis • Healthy ratios • Steadily improving profitability • High operating leverage NOTE: The years above refer to the fiscal years ending on Dec 31

Financial Analysis • Healthy and improving ratios NOTE: The years above refer to the fiscal years ending on Dec 31

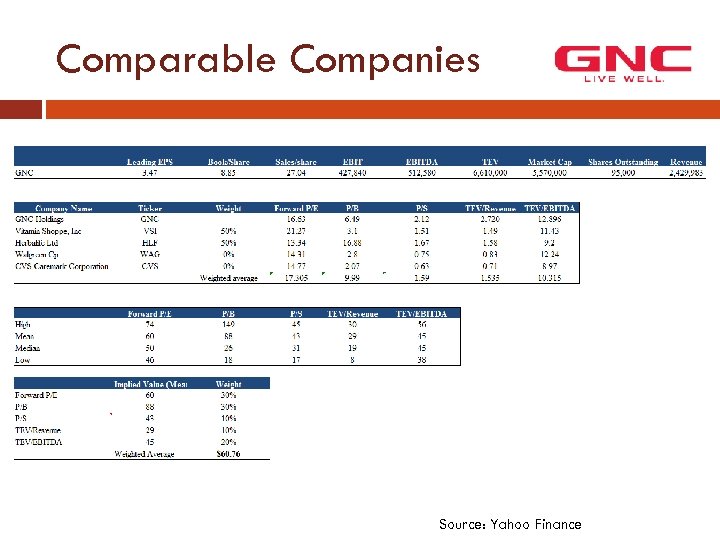

Comparable Companies Source: Yahoo Finance

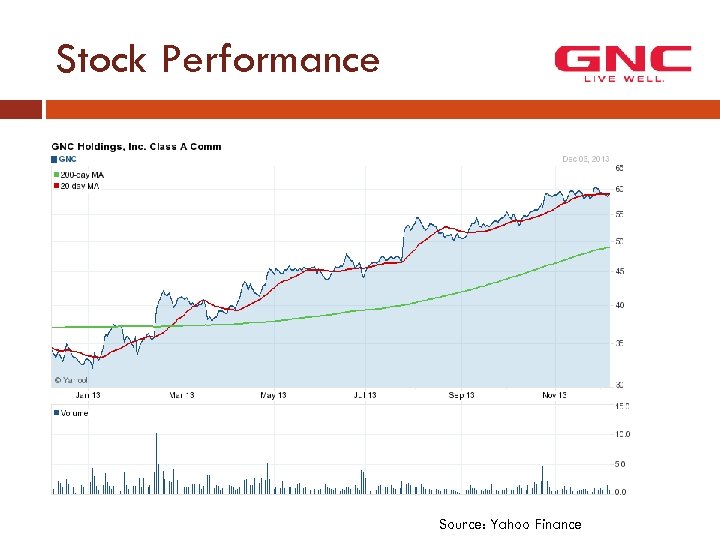

Stock Performance Source: Yahoo Finance

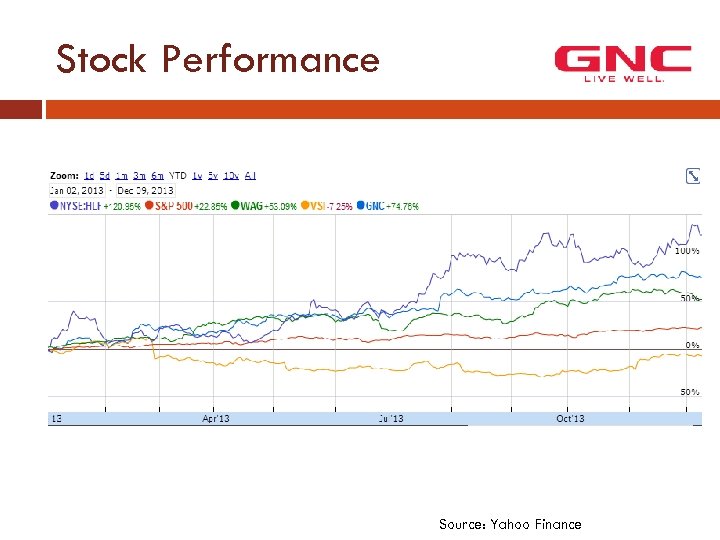

Stock Performance Source: Yahoo Finance

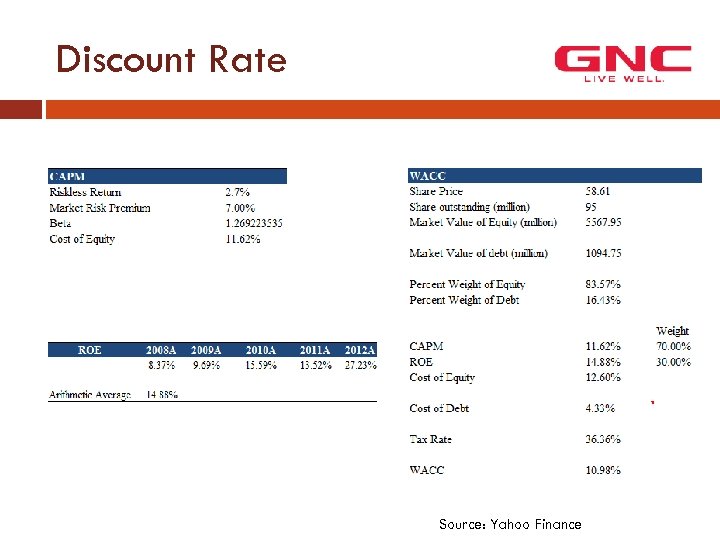

Discount Rate Source: Yahoo Finance

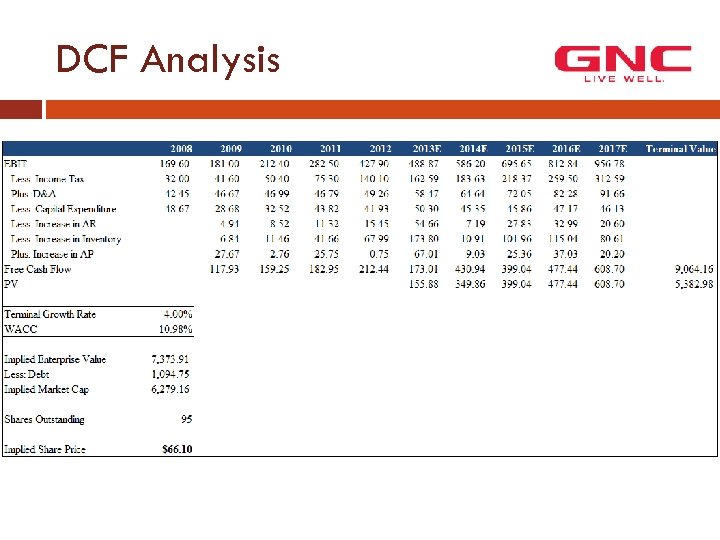

DCF Analysis

Decision Drivers Strengths Leading market position (10 times larger store base than 2 nd player) New product line potential (sports nutrition, pet, etc. ) High operating leverage with certain top line growth International expansion potential Concerns Stringent regulation Price competition Quickly changing consumer behavior

Recommendation Valuation Summary Current price: $58. 16 DCF result: $66. 10 Comps result: $60. 76 Recommendation: Buy 100 shares at market, with an estimated total cost of $5816

Questions?

f643a6e2ecd1357c78b5a3bddfd1a7be.ppt