8915da8e44d38a0e6304d7d0cfdea8b1.ppt

- Количество слайдов: 56

Debunking Some Common Myths About Brazil Alexandre Schwartsman April 2005 1

Commonly held myths I. Growth in 2004 resulted from unexpected export performance II. Reduction of monetary impulse condemns economy to stagnation III. Inflation results from prices beyond the reach of monetary policy IV. The debt-to-GDP ratio resulted from the stronger BRL V. Improvements in the balance of payments were mainly exogenous 2

Debunking some common myths about Brazil I. Growth in 2004 resulted from unexpected export performance 3

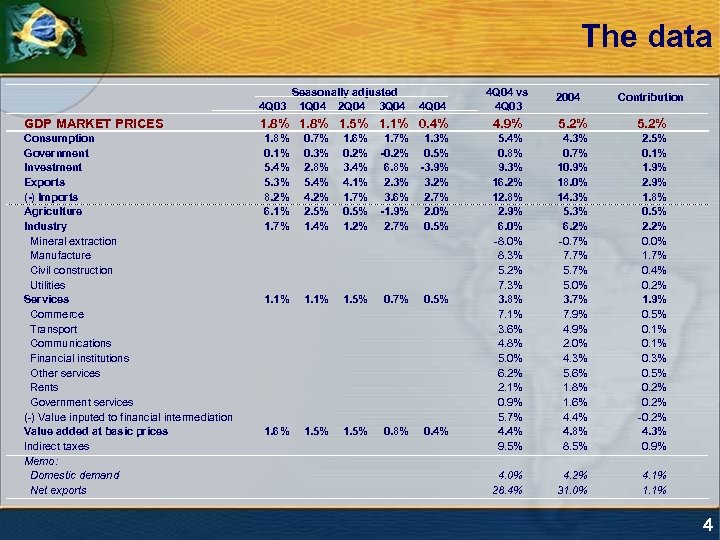

The data Seasonally adjusted 4 Q 03 1 Q 04 2 Q 04 3 Q 04 GDP MARKET PRICES Consumption Government Investment Exports (-) Imports Agriculture Industry Mineral extraction Manufacture Civil construction Utilities Services Commerce Transport Communications Financial institutions Other services Rents Government services (-) Value inputed to financial intermediation Value added at basic prices Indirect taxes Memo: Domestic demand Net exports 4 Q 04 1. 8% 1. 5% 1. 1% 0. 4% 1. 8% 0. 1% 5. 4% 5. 3% 8. 2% 6. 1% 1. 7% 0. 3% 2. 8% 5. 4% 4. 2% 2. 5% 1. 4% 1. 6% 0. 2% 3. 4% 4. 1% 1. 7% 0. 5% 1. 2% 1. 7% -0. 2% 6. 8% 2. 3% 3. 6% -1. 9% 2. 7% 1. 3% 0. 5% -3. 9% 3. 2% 2. 7% 2. 0% 0. 5% 1. 1% 1. 5% 0. 7% 0. 5% 1. 6% 1. 5% 0. 8% 0. 4% 4 Q 04 vs 4 Q 03 2004 Contribution 4. 9% 5. 2% 5. 4% 0. 8% 9. 3% 16. 2% 12. 8% 2. 9% 6. 0% -8. 0% 8. 3% 5. 2% 7. 3% 3. 8% 7. 1% 3. 6% 4. 8% 5. 0% 6. 2% 2. 1% 0. 9% 5. 7% 4. 4% 9. 5% 4. 3% 0. 7% 10. 9% 18. 0% 14. 3% 5. 3% 6. 2% -0. 7% 7. 7% 5. 0% 3. 7% 7. 9% 4. 9% 2. 0% 4. 3% 5. 6% 1. 8% 1. 6% 4. 4% 4. 8% 8. 5% 2. 5% 0. 1% 1. 9% 2. 9% 1. 8% 0. 5% 2. 2% 0. 0% 1. 7% 0. 4% 0. 2% 1. 9% 0. 5% 0. 1% 0. 3% 0. 5% 0. 2% -0. 2% 4. 3% 0. 9% 4. 0% 28. 4% 4. 2% 31. 0% 4. 1% 1. 1% 4

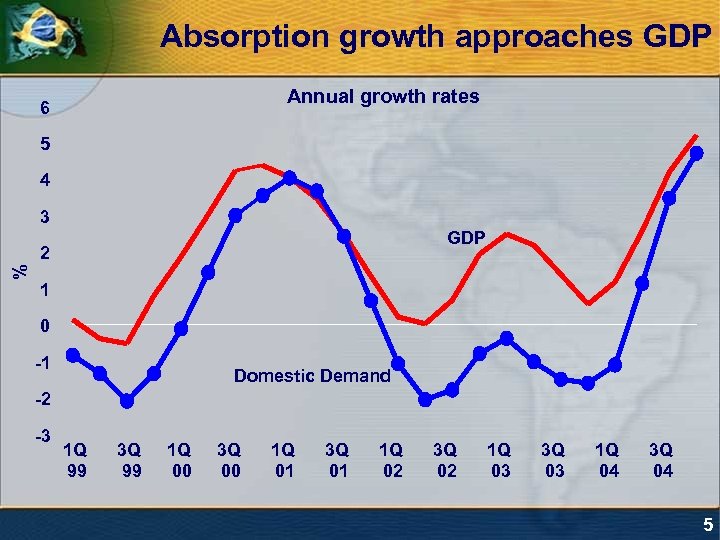

Absorption growth approaches GDP Annual growth rates 6 5 4 3 GDP % 2 1 0 -1 Domestic Demand -2 -3 1 Q 99 3 Q 99 1 Q 00 3 Q 00 1 Q 01 3 Q 01 1 Q 02 3 Q 02 1 Q 03 3 Q 03 1 Q 04 3 Q 04 5

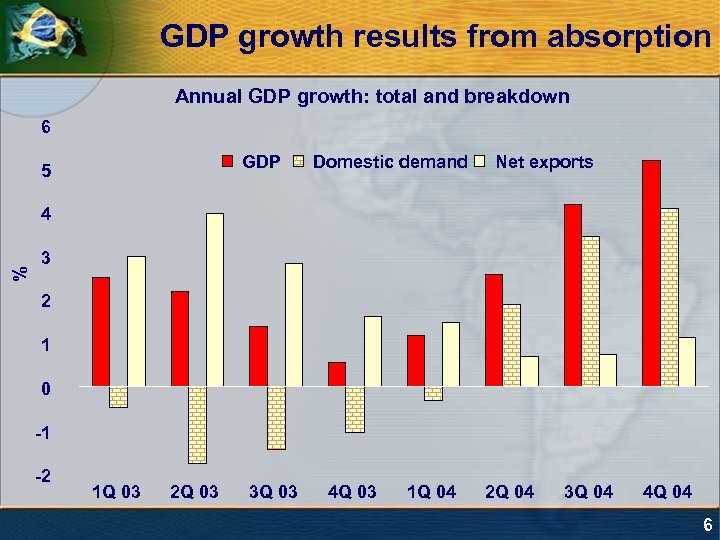

GDP growth results from absorption Annual GDP growth: total and breakdown 6 GDP 5 Domestic demand Net exports % 4 3 2 1 0 -1 -2 1 Q 03 2 Q 03 3 Q 03 4 Q 03 1 Q 04 2 Q 04 3 Q 04 4 Q 04 6

Could it be the indirect impact ? Retail sales 114 112 2000 = 100 110 108 106 104 102 100 98 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Jan 05 7

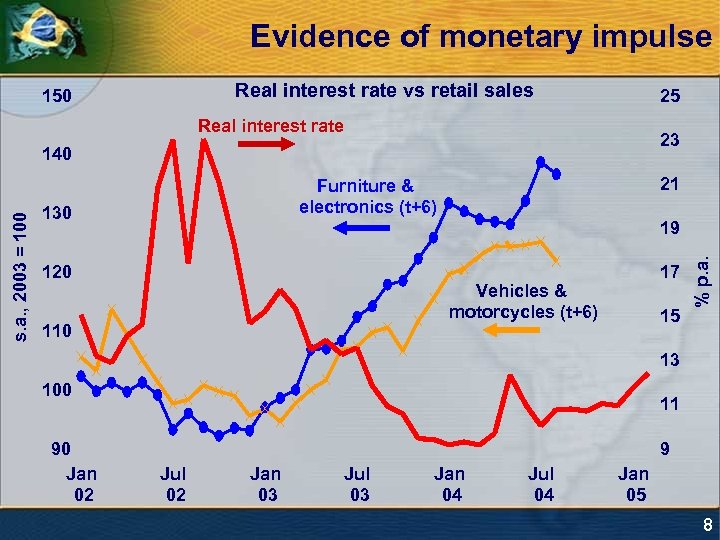

Evidence of monetary impulse Real interest rate vs retail sales 150 25 Real interest rate 23 21 Furniture & electronics (t+6) 130 19 120 17 Vehicles & motorcycles (t+6) 110 15 % p. a. s. a. , 2003 = 100 140 13 100 90 Jan 02 11 9 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Jan 05 8

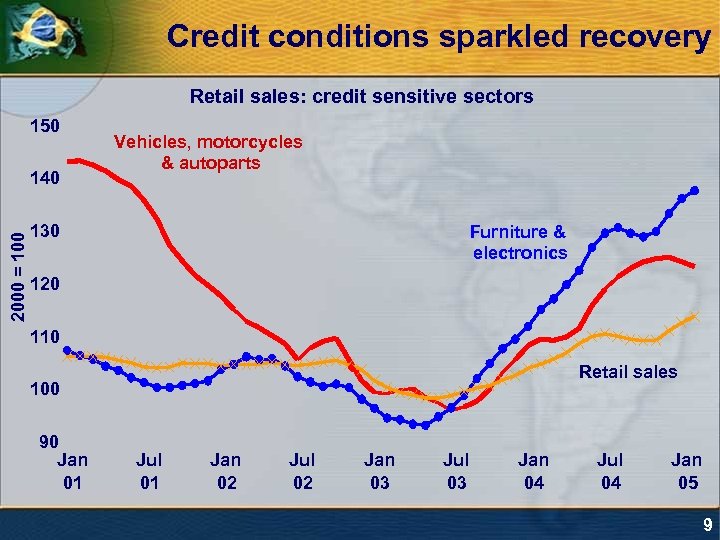

Credit conditions sparkled recovery Retail sales: credit sensitive sectors 150 2000 = 100 140 Vehicles, motorcycles & autoparts 130 Furniture & electronics 120 110 Retail sales 100 90 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Jan 05 9

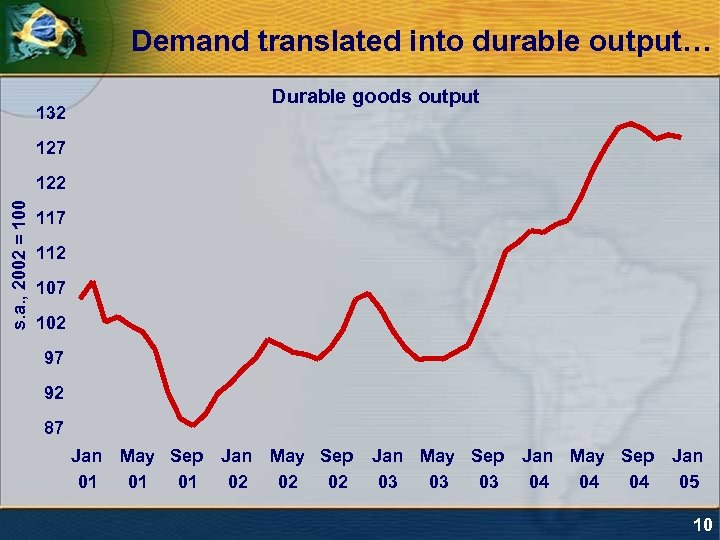

Demand translated into durable output… Durable goods output 132 127 s. a. , 2002 = 100 122 117 112 107 102 97 92 87 Jan May Sep 01 01 01 Jan May Sep 02 02 02 Jan May Sep 03 03 03 Jan May Sep Jan 04 04 04 05 10

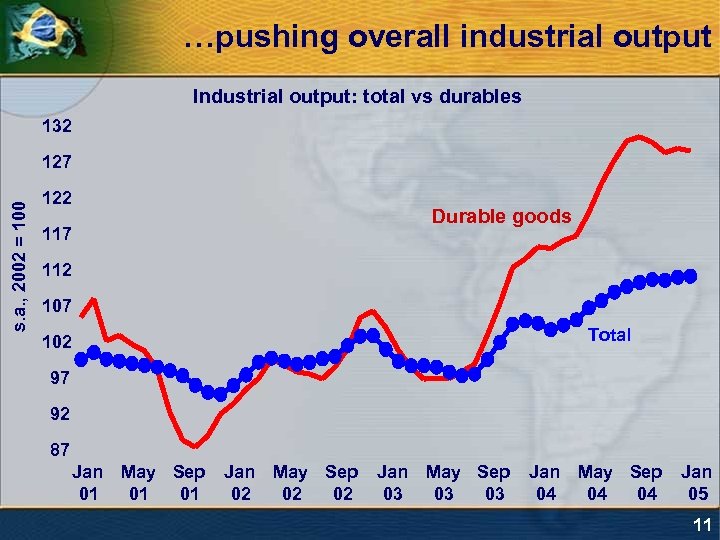

…pushing overall industrial output Industrial output: total vs durables 132 s. a. , 2002 = 100 127 122 Durable goods 117 112 107 Total 102 97 92 87 Jan 01 May Sep 01 01 Jan 02 May Sep 02 02 Jan 03 May Sep 03 03 Jan 04 May Sep 04 04 Jan 05 11

Trickling down Industrial sales, output, hours and employment 125 s. a. , 2002 = 100 120 115 110 105 100 95 90 Jan 01 Jul 01 Jan 02 Output Jul 02 Sales Jan Jul 03 03 Employment Jan 04 Hours Jul 04 Jan 05 12

So much for Myth I ØThere are indications that net exports played a much lesser role in the recovery than usually assumed, despite their importance in preventing a deeper decline in 2003 ØDomestic demand played the major part in 2004 recovery ØPattern of sales/output recovery along the year suggests that monetary impulse lies behind domestic absorption pick-up 13

Debunking some common myths about Brazil II. Reduction of monetary impulse condemns economy to stagnation 14

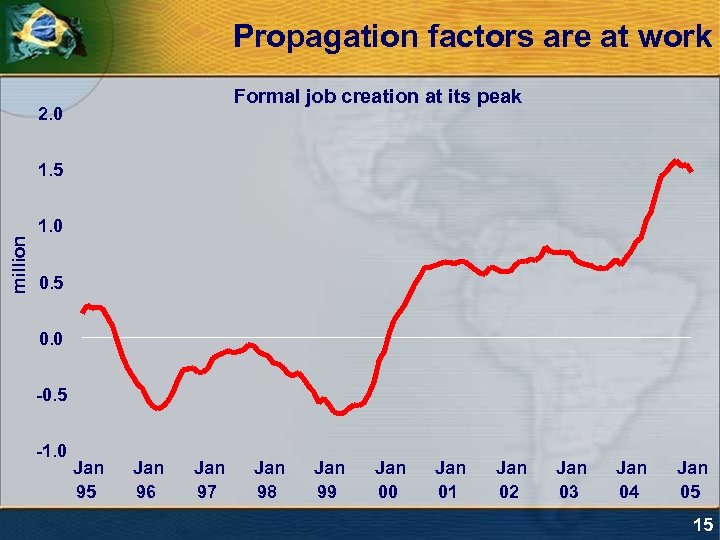

Propagation factors are at work Formal job creation at its peak 2. 0 1. 5 million 1. 0 0. 5 0. 0 -0. 5 -1. 0 Jan 95 Jan 96 Jan 97 Jan 98 Jan 99 Jan 00 Jan 01 Jan 02 Jan 03 Jan 04 Jan 05 15

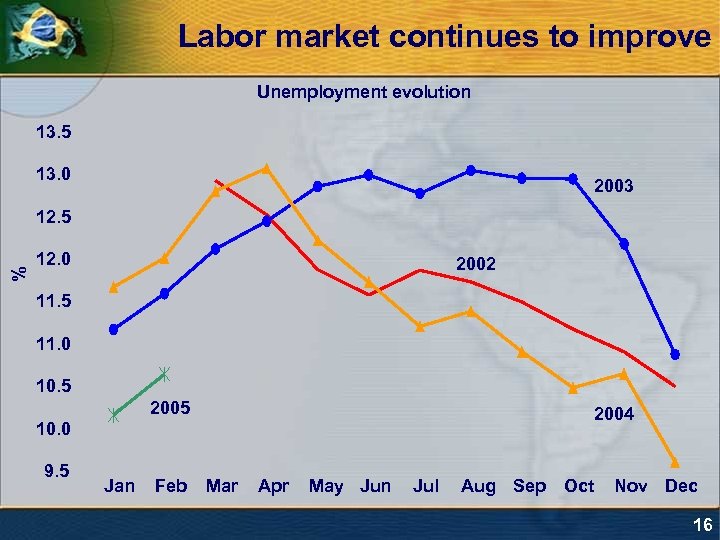

Labor market continues to improve Unemployment evolution 13. 5 13. 0 2003 % 12. 5 12. 0 2002 11. 5 11. 0 10. 5 2004 10. 0 9. 5 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 16

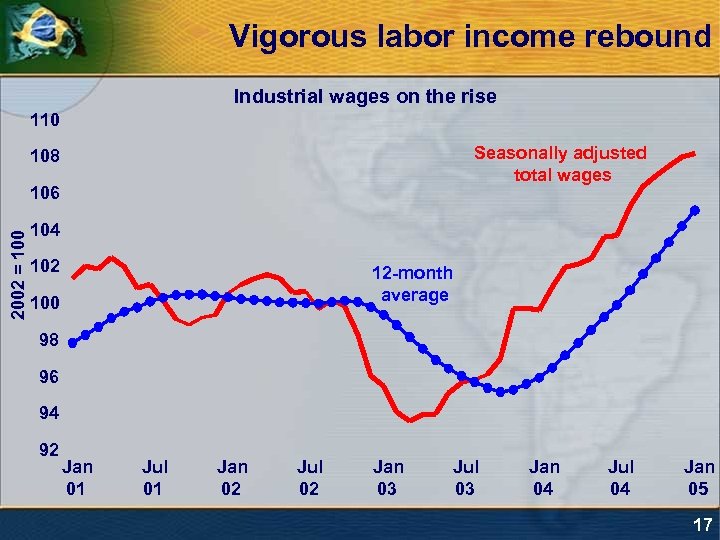

Vigorous labor income rebound Industrial wages on the rise 110 Seasonally adjusted total wages 108 2002 = 100 106 104 102 12 -month average 100 98 96 94 92 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Jan 05 17

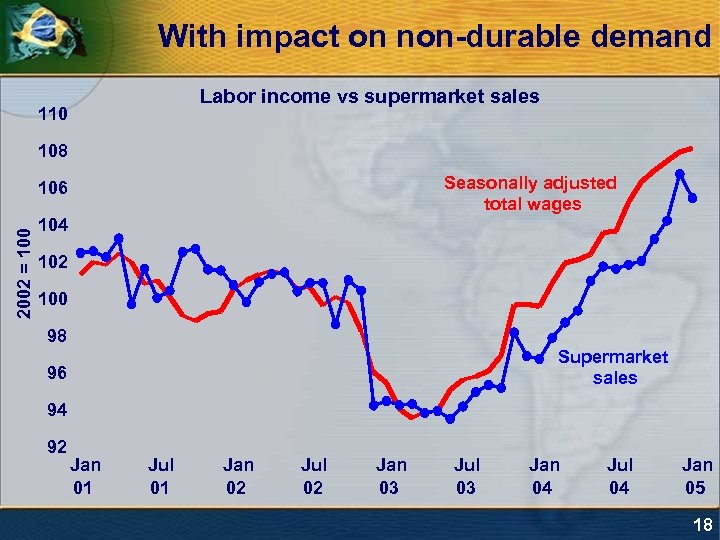

With impact on non-durable demand Labor income vs supermarket sales 110 108 Seasonally adjusted total wages 2002 = 100 106 104 102 100 98 Supermarket sales 96 94 92 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Jan 05 18

Self-propagating impacts Retail sales vs supermarket sales 110 108 Retail sales 2002 = 100 106 104 102 100 98 Supermarket sales 96 94 92 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Jan 05 19

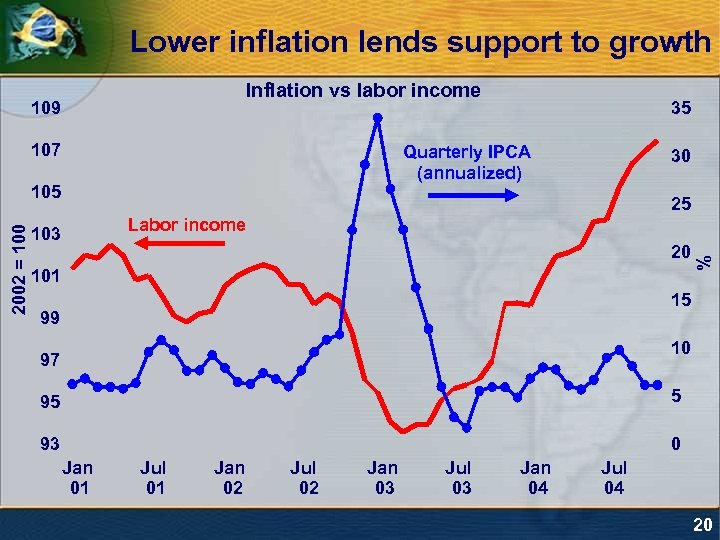

Lower inflation lends support to growth Inflation vs labor income 109 107 Quarterly IPCA (annualized) 105 30 25 Labor income 103 20 101 % 2002 = 100 35 15 99 10 97 95 5 93 0 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 20

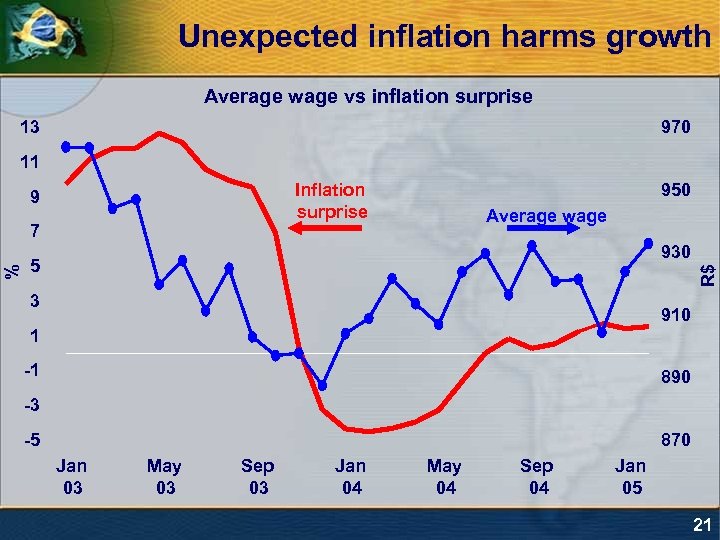

Unexpected inflation harms growth Average wage vs inflation surprise 13 970 11 7 Average wage 930 5 R$ % 950 Inflation surprise 9 3 910 1 -1 890 -3 -5 870 Jan 03 May 03 Sep 03 Jan 04 May 04 Sep 04 Jan 05 21

What about Myth II? Ø Pattern of demand growth indicates shift from credit sensitive sectors towards income sensitive sectors Ø Self-propagating forces are already at work Ø Low and predictable inflation is key to assure that labor income continues to rise and to support growth 22

Debunking some common myths about Brazil III. Inflation results from prices beyond the reach of monetary policy 23

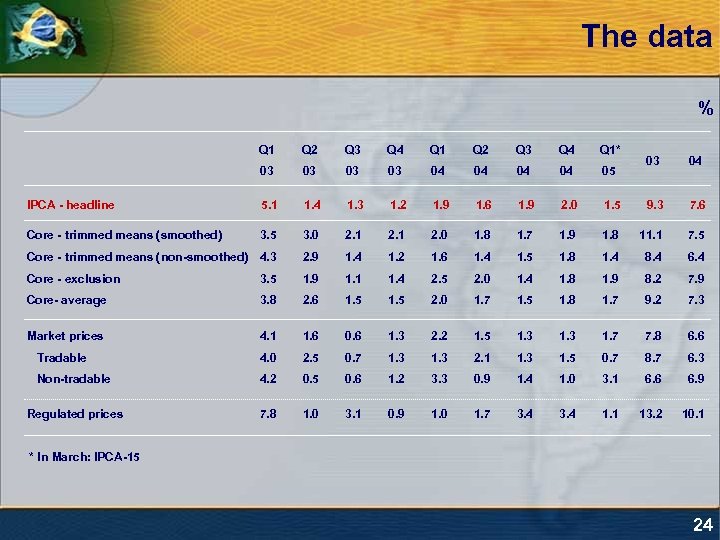

The data % Q 1 Q 2 Q 3 Q 4 Q 1* 03 03 04 04 05 IPCA - headline 5. 1 1. 4 1. 3 1. 2 1. 9 1. 6 1. 9 2. 0 Core - trimmed means (smoothed) 3. 5 3. 0 2. 1 2. 0 1. 8 1. 7 Core - trimmed means (non-smoothed) 4. 3 2. 9 1. 4 1. 2 1. 6 1. 4 Core - exclusion 3. 5 1. 9 1. 1 1. 4 2. 5 Core- average 3. 8 2. 6 1. 5 Market prices 4. 1 1. 6 0. 6 Tradable 4. 0 2. 5 Non-tradable 4. 2 Regulated prices 7. 8 03 04 1. 5 9. 3 7. 6 1. 9 1. 8 11. 1 7. 5 1. 8 1. 4 8. 4 6. 4 2. 0 1. 4 1. 8 1. 9 8. 2 7. 9 2. 0 1. 7 1. 5 1. 8 1. 7 9. 2 7. 3 1. 3 2. 2 1. 5 1. 3 1. 7 7. 8 6. 6 0. 7 1. 3 2. 1 1. 3 1. 5 0. 7 8. 7 6. 3 0. 5 0. 6 1. 2 3. 3 0. 9 1. 4 1. 0 3. 1 6. 6 6. 9 1. 0 3. 1 0. 9 1. 0 1. 7 3. 4 1. 1 13. 2 10. 1 * In March: IPCA-15 24

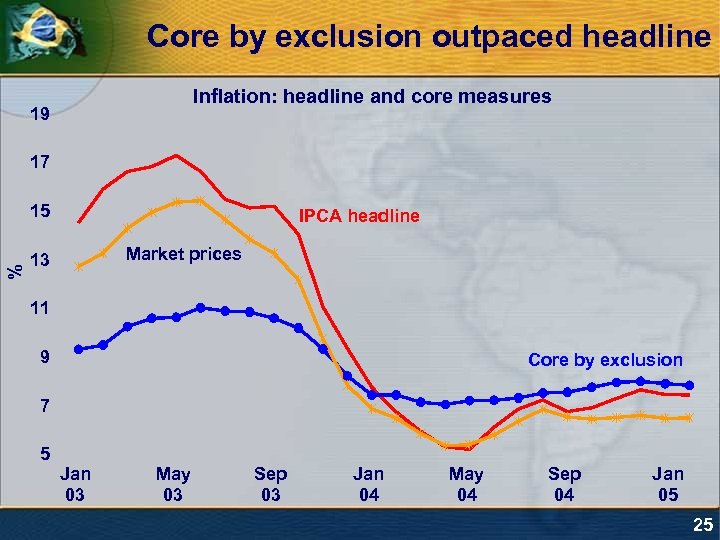

Core by exclusion outpaced headline Inflation: headline and core measures 19 17 % 15 IPCA headline Market prices 13 11 9 Core by exclusion 7 5 Jan 03 May 03 Sep 03 Jan 04 May 04 Sep 04 Jan 05 25

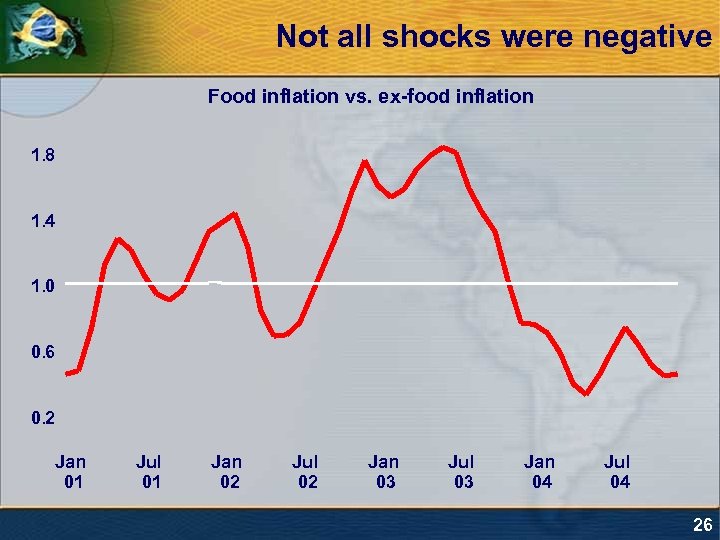

Not all shocks were negative Food inflation vs. ex-food inflation 1. 8 1. 4 1. 0 0. 6 0. 2 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 26

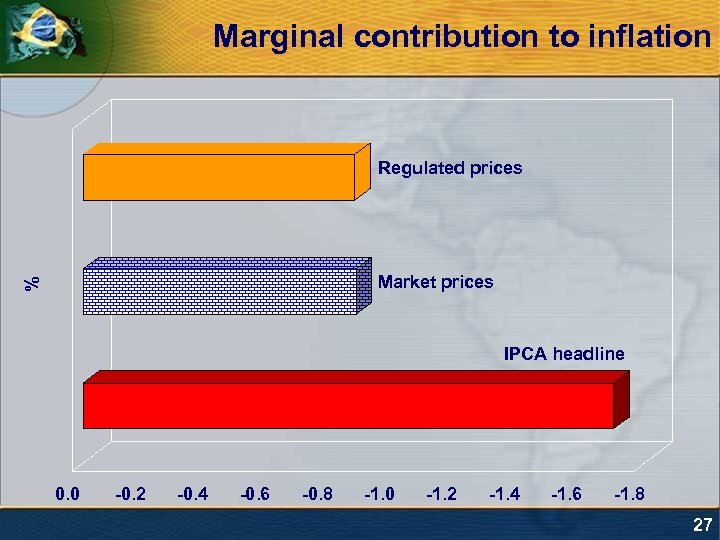

Marginal contribution to inflation Regulated prices % Market prices IPCA headline 0. 0 -0. 2 -0. 4 -0. 6 -0. 8 -1. 0 -1. 2 -1. 4 -1. 6 -1. 8 27

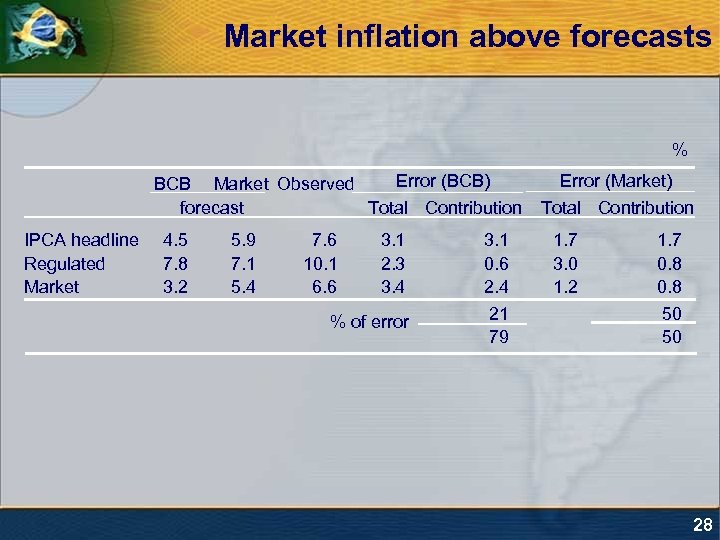

Market inflation above forecasts % Error (BCB) BCB Market Observed forecast Total Contribution IPCA headline Regulated Market 4. 5 7. 8 3. 2 5. 9 7. 1 5. 4 7. 6 10. 1 6. 6 3. 1 2. 3 3. 4 % of error 3. 1 0. 6 2. 4 21 79 Error (Market) Total Contribution 1. 7 3. 0 1. 2 1. 7 0. 8 50 50 28

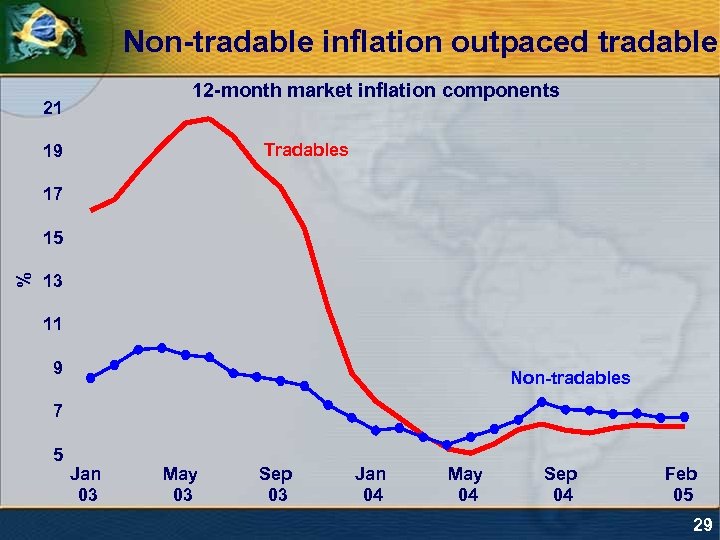

Non-tradable inflation outpaced tradable 12 -month market inflation components 21 Tradables 19 17 % 15 13 11 9 Non-tradables 7 5 Jan 03 May 03 Sep 03 Jan 04 May 04 Sep 04 Feb 05 29

Only 5 countries showed higher inflation Latin America Country Argentina Bolivia Chile Colombia Ecuador Mexico (core) Peru Venezuela (core) Asia % 6. 1 4. 9 2. 4 5. 5 2. 0 5. 2 3. 8 2. 8 19. 2 21. 2 Eastern Europe/Other Country % China South Korea Philippines Hong Kong India Indonesia Malaysia Singapore Thailand Taiwan 2. 8 3. 0 7. 9 0. 2 4. 2 6. 4 2. 2 1. 7 2. 9 1. 6 Poland 2. 8 Turkey 9. 3 Hungary 4. 4 Russia 11. 7 Czech Republic 2. 9 South Africa 3. 7 Israel 0. 9 Egypt 11. 9 30

Summing up on Myth III Ø Core inflation measures were close to headline and, in the case of the core by exclusion, even above it Ø Higher core shows that regulated prices (which are absent in this measure) played no role in maintaining inflation at the levels observed in 2004 Ø Market inflation marginal contribution to lower headline inflation was equivalent to the impact of lower regulated prices inflation Ø Market prices below headline inflation, but largely due to favorable supply shock (food inflation less than ½ ex-food inflation) Ø Behavior of market prices was a negative surprise both to the Central Bank and to market forecasters Ø Factors paraded as supply shocks (commodity prices) did not have the same effect on inflation rates for most emerging economies 31

Debunking some common myths about Brazil IV. The debt-to-GDP ratio resulted from the stronger BRL 32

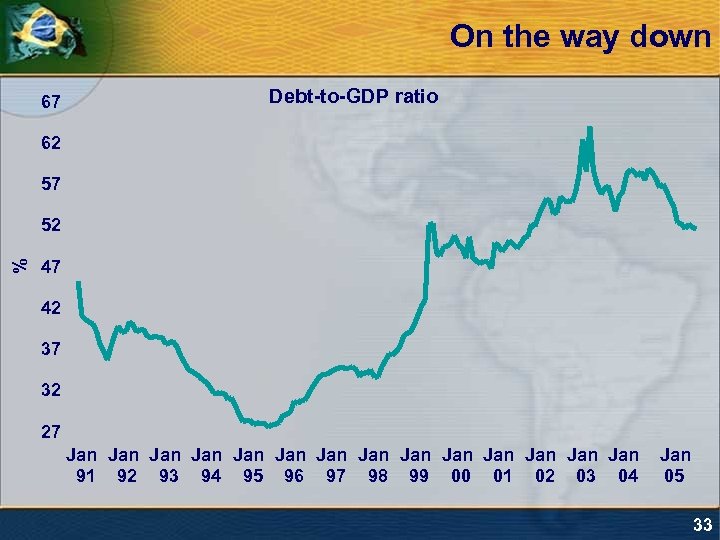

On the way down 67 Debt-to-GDP ratio 62 57 % 52 47 42 37 32 27 Jan Jan Jan Jan 91 92 93 94 95 96 97 98 99 00 01 02 03 04 Jan 05 33

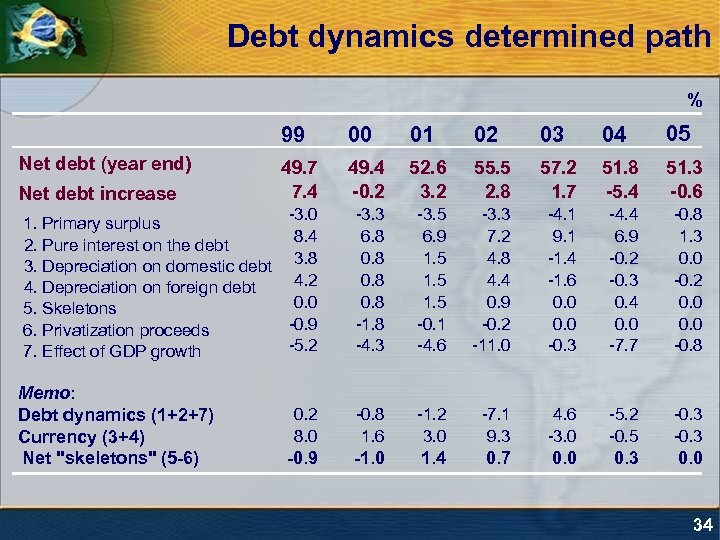

Debt dynamics determined path % 99 00 01 02 03 04 05 49. 7 7. 4 49. 4 -0. 2 52. 6 3. 2 55. 5 2. 8 57. 2 1. 7 51. 8 -5. 4 51. 3 -0. 6 -3. 0 1. Primary surplus 8. 4 2. Pure interest on the debt 3. Depreciation on domestic debt 3. 8 4. 2 4. Depreciation on foreign debt 0. 0 5. Skeletons -0. 9 6. Privatization proceeds -5. 2 7. Effect of GDP growth -3. 3 6. 8 0. 8 -1. 8 -4. 3 -3. 5 6. 9 1. 5 -0. 1 -4. 6 -3. 3 7. 2 4. 8 4. 4 0. 9 -0. 2 -11. 0 -4. 1 9. 1 -1. 4 -1. 6 0. 0 -0. 3 -4. 4 6. 9 -0. 2 -0. 3 0. 4 0. 0 -7. 7 -0. 8 1. 3 0. 0 -0. 2 0. 0 -0. 8 0. 2 8. 0 -0. 8 1. 6 -1. 2 3. 0 -7. 1 9. 3 4. 6 -3. 0 -5. 2 -0. 5 -0. 3 -0. 9 -1. 0 1. 4 0. 7 0. 0 0. 3 0. 0 Net debt (year end) Net debt increase Memo: Debt dynamics (1+2+7) Currency (3+4) Net "skeletons" (5 -6) 34

The lowest deficit ever % Jan-Feb 98 Nominal deficit Primary deficit 99 00 01 02 03 04 05 change 7. 5 5. 8 3. 6 4. 6 5. 1 2. 7 2. 5 4. 2 2. 9 -1. 3 0. 0 -3. 2 -3. 5 -3. 6 -3. 9 -4. 3 -4. 6 -4. 8 -3. 9 -5. 2 -1. 3 Central Government -0. 5 -2. 3 -1. 9 -1. 8 -2. 4 -2. 5 -3. 0 -2. 8 -4. 6 -3. 6 1. 0 Subnational governments 0. 2 -0. 5 -0. 9 -0. 8 -0. 9 -1. 0 -1. 1 -1. 3 -1. 9 -0. 6 States 0. 3 -0. 2 -0. 4 -0. 6 -0. 8 -0. 9 -1. 1 -1. 2 -0. 1 Municipalities Public companies Federal Local -0. 1 -0. 3 -0. 2 0. 4 -0. 6 -1. 1 -0. 9 -0. 7 0. 2 -0. 7 -0. 9 -0. 6 -0. 5 0. 1 0. 0 -0. 1 -0. 3 Nominal interest on debt 7. 5 9. 0 7. 1 -0. 9 -0. 6 -0. 3 -0. 1 -0. 6 -0. 5 -0. 1 7. 2 8. 5 9. 3 7. 3 -0. 2 -0. 7 -0. 5 -0. 9 2. 0 0. 3 -1. 7 -0. 7 2. 4 0. 8 -1. 6 -0. 1 -0. 4 -0. 5 0. 0 7. 3 8. 1 -0. 1 35

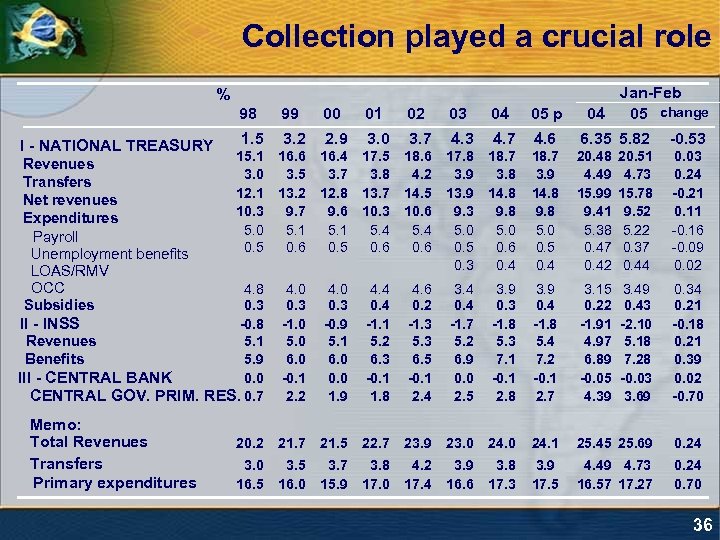

Collection played a crucial role % Jan-Feb 04 05 change 98 99 00 01 02 03 04 05 p 1. 5 3. 2 2. 9 3. 0 3. 7 4. 3 4. 7 4. 6 6. 35 5. 82 -0. 53 15. 1 3. 0 12. 1 10. 3 5. 0 0. 5 16. 6 3. 5 13. 2 9. 7 5. 1 0. 6 16. 4 3. 7 12. 8 9. 6 5. 1 0. 5 17. 5 3. 8 13. 7 10. 3 5. 4 0. 6 18. 6 4. 2 14. 5 10. 6 5. 4 0. 6 17. 8 3. 9 13. 9 9. 3 5. 0 0. 5 0. 3 18. 7 3. 8 14. 8 9. 8 5. 0 0. 6 0. 4 18. 7 3. 9 14. 8 9. 8 5. 0 0. 5 0. 4 20. 48 4. 49 15. 99 9. 41 5. 38 0. 47 0. 42 20. 51 4. 73 15. 78 9. 52 5. 22 0. 37 0. 44 0. 03 0. 24 -0. 21 0. 11 -0. 16 -0. 09 0. 02 4. 8 0. 3 II - INSS -0. 8 Revenues 5. 1 Benefits 5. 9 III - CENTRAL BANK 0. 0 CENTRAL GOV. PRIM. RES. 0. 7 4. 0 0. 3 -1. 0 5. 0 6. 0 -0. 1 2. 2 4. 0 0. 3 -0. 9 5. 1 6. 0 0. 0 1. 9 4. 4 0. 4 -1. 1 5. 2 6. 3 -0. 1 1. 8 4. 6 0. 2 -1. 3 5. 3 6. 5 -0. 1 2. 4 3. 4 0. 4 -1. 7 5. 2 6. 9 0. 0 2. 5 3. 9 0. 3 -1. 8 5. 3 7. 1 -0. 1 2. 8 3. 9 0. 4 -1. 8 5. 4 7. 2 -0. 1 2. 7 3. 15 0. 22 -1. 91 4. 97 6. 89 -0. 05 4. 39 3. 49 0. 43 -2. 10 5. 18 7. 28 -0. 03 3. 69 0. 34 0. 21 -0. 18 0. 21 0. 39 0. 02 -0. 70 20. 2 21. 7 21. 5 22. 7 23. 9 23. 0 24. 1 25. 45 25. 69 0. 24 3. 0 16. 5 3. 5 16. 0 3. 7 15. 9 3. 8 17. 0 4. 2 17. 4 3. 9 16. 6 3. 8 17. 3 3. 9 17. 5 4. 49 4. 73 16. 57 17. 27 0. 24 0. 70 I - NATIONAL TREASURY Revenues Transfers Net revenues Expenditures Payroll Unemployment benefits LOAS/RMV OCC Subsidies Memo: Total Revenues Transfers Primary expenditures 36

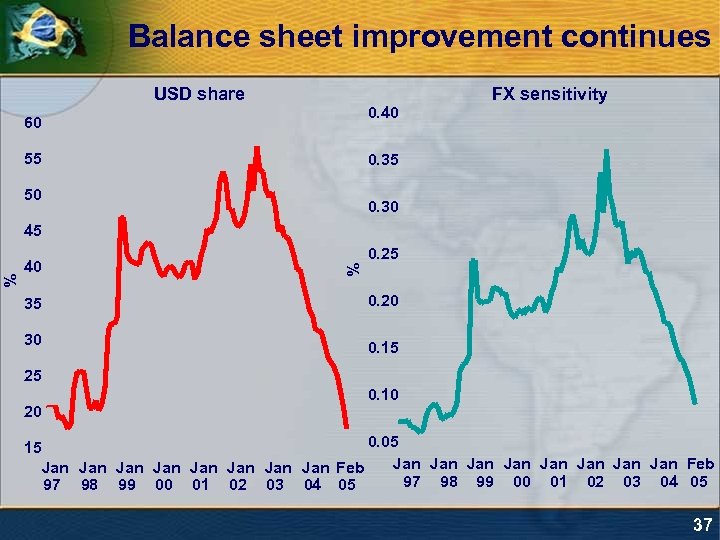

Balance sheet improvement continues USD share 0. 40 60 55 FX sensitivity 0. 35 50 0. 30 40 35 30 0. 25 % % 45 0. 20 0. 15 25 20 0. 10 0. 05 15 Jan Jan Jan Jan Feb 97 98 99 00 01 02 03 04 05 37

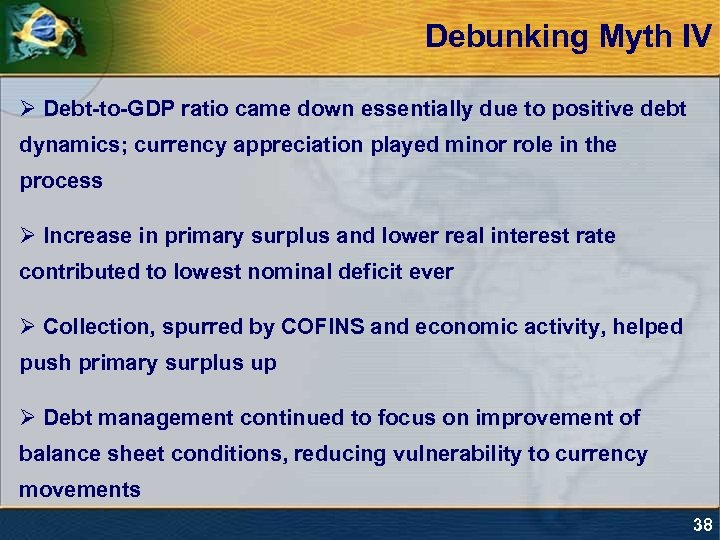

Debunking Myth IV Ø Debt-to-GDP ratio came down essentially due to positive debt dynamics; currency appreciation played minor role in the process Ø Increase in primary surplus and lower real interest rate contributed to lowest nominal deficit ever Ø Collection, spurred by COFINS and economic activity, helped push primary surplus up Ø Debt management continued to focus on improvement of balance sheet conditions, reducing vulnerability to currency movements 38

Debunking some common myths about Brazil V. Improvements in the balance of payments were mainly exogenous 39

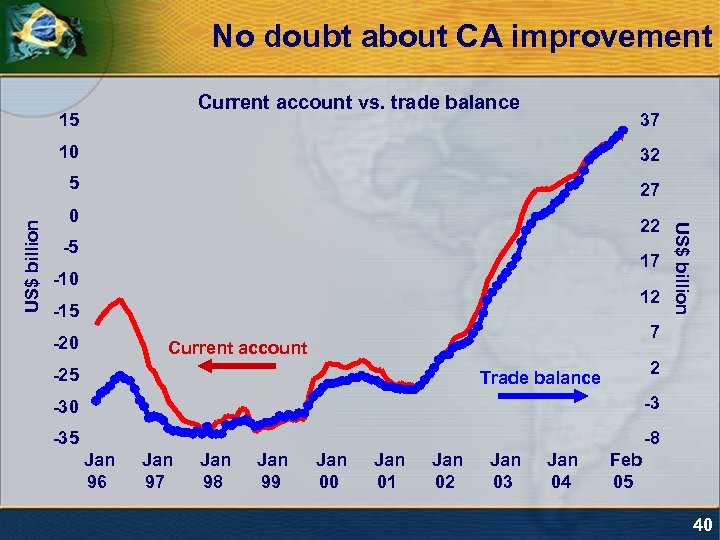

No doubt about CA improvement Current account vs. trade balance 15 37 32 5 27 0 22 -5 17 -10 12 -15 -20 US$ billion 10 7 Current account -25 2 Trade balance -30 -3 -35 -8 Jan 96 Jan 97 Jan 98 Jan 99 Jan 00 Jan 01 Jan 02 Jan 03 Jan 04 Feb 05 40

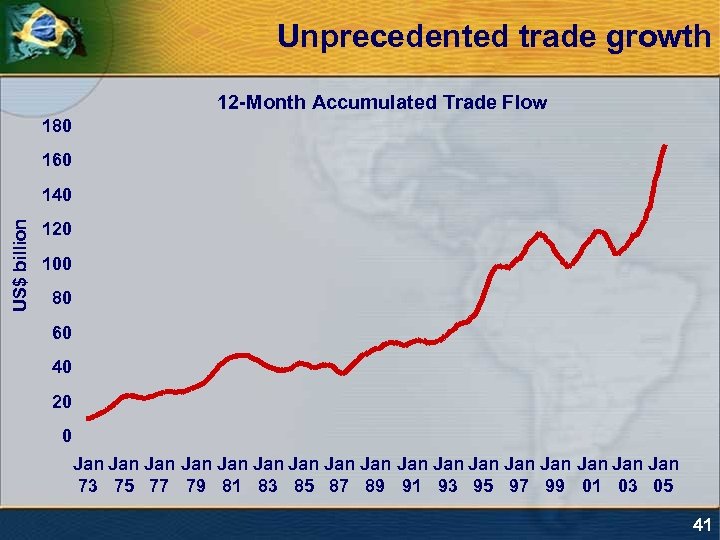

Unprecedented trade growth 12 -Month Accumulated Trade Flow 180 160 US$ billion 140 120 100 80 60 40 20 0 Jan Jan Jan Jan Jan 73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 41

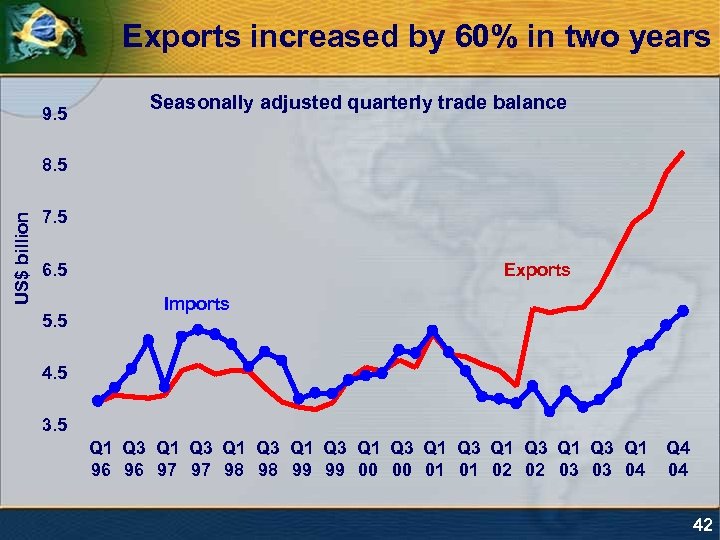

Exports increased by 60% in two years 9. 5 Seasonally adjusted quarterly trade balance US$ billion 8. 5 7. 5 6. 5 5. 5 Exports Imports 4. 5 3. 5 Q 1 Q 3 Q 1 Q 3 Q 1 96 96 97 97 98 98 99 99 00 00 01 01 02 02 03 03 04 Q 4 04 42

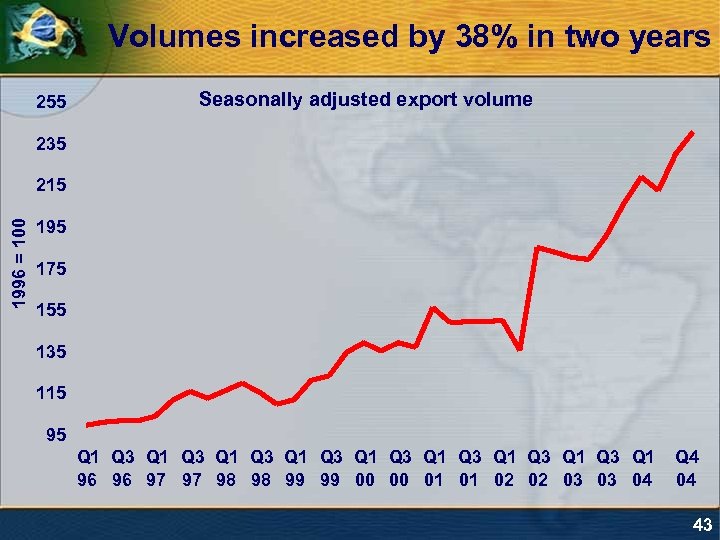

Volumes increased by 38% in two years 255 Seasonally adjusted export volume 235 1996 = 100 215 195 175 155 135 115 95 Q 1 Q 3 Q 1 Q 3 Q 1 96 96 97 97 98 98 99 99 00 00 01 01 02 02 03 03 04 Q 4 04 43

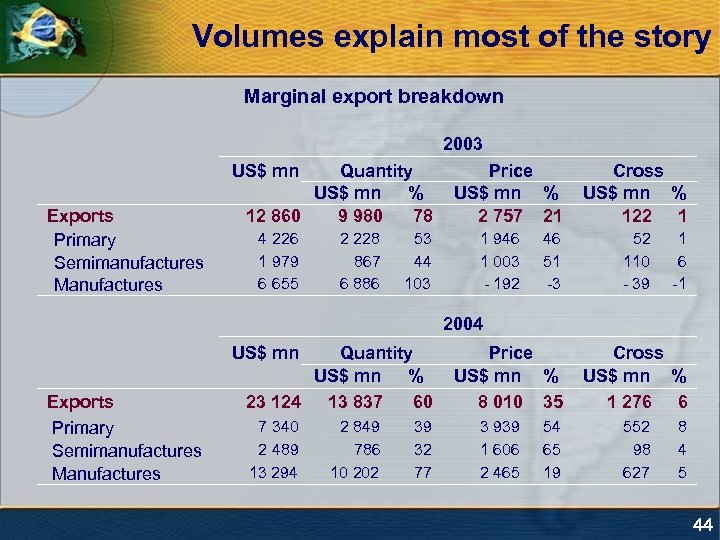

Volumes explain most of the story Marginal export breakdown 2003 US$ mn Exports Primary Semimanufactures Manufactures Quantity US$ mn % 12 860 9 980 78 4 226 1 979 6 655 2 228 867 6 886 53 44 103 Price US$ mn % 2 757 21 1 946 1 003 - 192 46 51 -3 Cross US$ mn % 122 1 52 110 - 39 1 6 -1 2004 US$ mn Exports Primary Semimanufactures Manufactures Quantity US$ mn % 23 124 13 837 60 7 340 2 489 13 294 2 849 786 10 202 39 32 77 Price US$ mn % 8 010 35 3 939 1 606 2 465 54 65 19 Cross US$ mn % 1 276 6 552 98 627 8 4 5 44

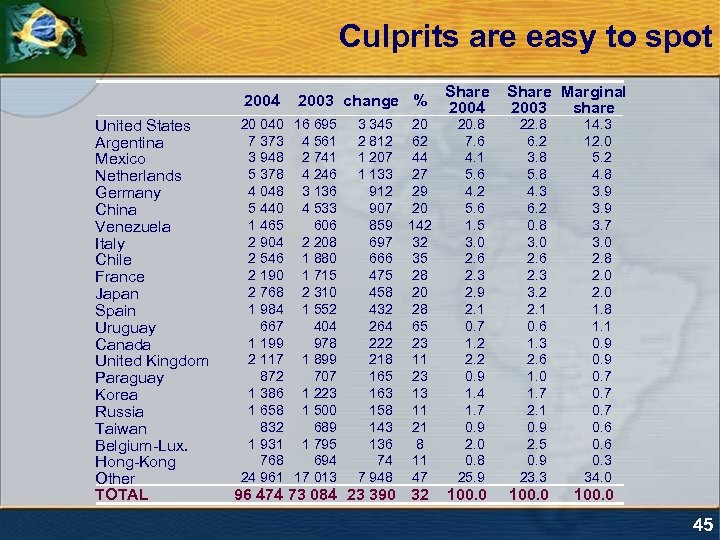

Culprits are easy to spot 2004 United States Argentina Mexico Netherlands Germany China Venezuela Italy Chile France Japan Spain Uruguay Canada United Kingdom Paraguay Korea Russia Taiwan Belgium-Lux. Hong-Kong Other TOTAL 2003 change % 20 040 16 695 7 373 4 561 3 948 2 741 5 378 4 246 4 048 3 136 5 440 4 533 1 465 606 2 904 2 208 2 546 1 880 2 190 1 715 2 768 2 310 1 984 1 552 667 404 1 199 978 2 117 1 899 872 707 1 386 1 223 1 658 1 500 832 689 1 931 1 795 768 694 24 961 17 013 3 345 2 812 1 207 1 133 912 907 859 697 666 475 458 432 264 222 218 165 163 158 143 136 74 7 948 20 62 44 27 29 20 142 32 35 28 20 28 65 23 11 23 13 11 21 8 11 47 96 474 73 084 23 390 32 Share 2004 Share Marginal 2003 share 22. 8 6. 2 3. 8 5. 8 4. 3 6. 2 0. 8 3. 0 2. 6 2. 3 3. 2 2. 1 0. 6 1. 3 2. 6 1. 0 1. 7 2. 1 0. 9 2. 5 0. 9 23. 3 14. 3 12. 0 5. 2 4. 8 3. 9 3. 7 3. 0 2. 8 2. 0 1. 8 1. 1 0. 9 0. 7 0. 6 0. 3 34. 0 100. 0 20. 8 7. 6 4. 1 5. 6 4. 2 5. 6 1. 5 3. 0 2. 6 2. 3 2. 9 2. 1 0. 7 1. 2 2. 2 0. 9 1. 4 1. 7 0. 9 2. 0 0. 8 25. 9 45

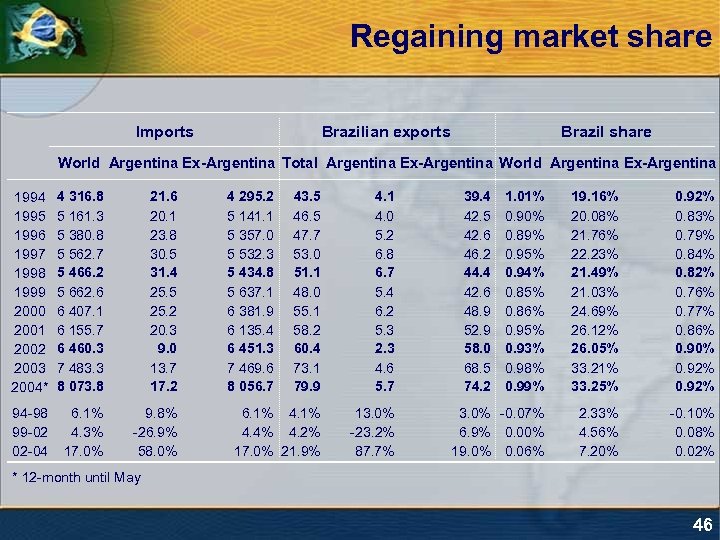

Regaining market share Imports Brazilian exports Brazil share World Argentina Ex-Argentina Total Argentina Ex-Argentina World Argentina Ex-Argentina 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004* 4 316. 8 5 161. 3 5 380. 8 5 562. 7 5 466. 2 5 662. 6 6 407. 1 6 155. 7 6 460. 3 7 483. 3 8 073. 8 21. 6 20. 1 23. 8 30. 5 31. 4 25. 5 25. 2 20. 3 9. 0 13. 7 17. 2 94 -98 99 -02 02 -04 6. 1% 4. 3% 17. 0% 9. 8% -26. 9% 58. 0% 4 295. 2 5 141. 1 5 357. 0 5 532. 3 5 434. 8 5 637. 1 6 381. 9 6 135. 4 6 451. 3 7 469. 6 8 056. 7 43. 5 46. 5 47. 7 53. 0 51. 1 48. 0 55. 1 58. 2 60. 4 73. 1 79. 9 4. 1 4. 0 5. 2 6. 8 6. 7 5. 4 6. 2 5. 3 2. 3 4. 6 5. 7 6. 1% 4. 4% 4. 2% 17. 0% 21. 9% 13. 0% -23. 2% 87. 7% 39. 4 42. 5 42. 6 46. 2 44. 4 42. 6 48. 9 52. 9 58. 0 68. 5 74. 2 1. 01% 0. 90% 0. 89% 0. 95% 0. 94% 0. 85% 0. 86% 0. 95% 0. 93% 0. 98% 0. 99% 19. 16% 20. 08% 21. 76% 22. 23% 21. 49% 21. 03% 24. 69% 26. 12% 26. 05% 33. 21% 33. 25% 0. 92% 0. 83% 0. 79% 0. 84% 0. 82% 0. 76% 0. 77% 0. 86% 0. 90% 0. 92% 3. 0% -0. 07% 6. 9% 0. 00% 19. 0% 0. 06% 2. 33% 4. 56% 7. 20% -0. 10% 0. 08% 0. 02% * 12 -month until May 46

Regaining market share in the US US imports and Brazilian market share 1. 5 1. 40 Brazilian market share 1. 35 1. 3 1. 25 1. 2 1. 1 1. 0 0. 9 1. 20 % US$ billion 1. 30 1. 15 US 12 -month imports 1. 10 1. 05 1. 00 Jan Jul Jan Jul Nov 99 99 00 00 01 01 02 02 03 03 04 04 04 47

Diversification Total exports Marginal exports US$ mn % % change Transport equipment Metals Soy Meats Chemicals Oil & derivatives Mechanical Ore Shoes & leather Electronics Wood Paper & pulp Sugar Textiles Coffee Tobacco Orange juice Other Total 16 090 10 335 10 071 6 176 6 032 5 753 5 627 5 254 3 352 3 133 3 054 2 919 2 649 2 087 2 033 1 428 791 9 692 17 11 10 6 6 5 3 3 3 2 2 1 1 10 96 474 100 US$ mn % % change 52 42 24 51 25 18 46 44 20 5 47 3 24 26 34 31 -13 25 Transport equipment Metals Meats Soy Mechanical Ore Chemicals Wood Oil & derivatives Shoes & leather Coffee Sugar Textiles Tobacco Electronics Paper & pulp Orange juice Other 32 Total 5 478 3 039 2 089 1 944 1 777 1 616 1 207 978 866 554 519 509 434 340 138 80 - 119 1 939 23 13 9 8 8 7 5 4 4 2 2 1 1 0 -1 8 52 42 51 24 46 44 25 47 18 20 34 24 26 31 5 3 -13 25 23 390 100 32 48

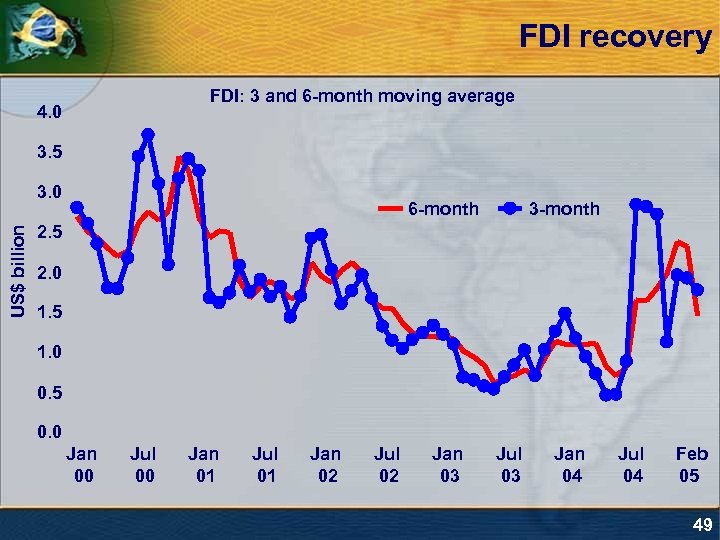

FDI recovery FDI: 3 and 6 -month moving average 4. 0 3. 5 US$ billion 3. 0 6 -month 3 -month 2. 5 2. 0 1. 5 1. 0 0. 5 0. 0 Jan 00 Jul 00 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Feb 05 49

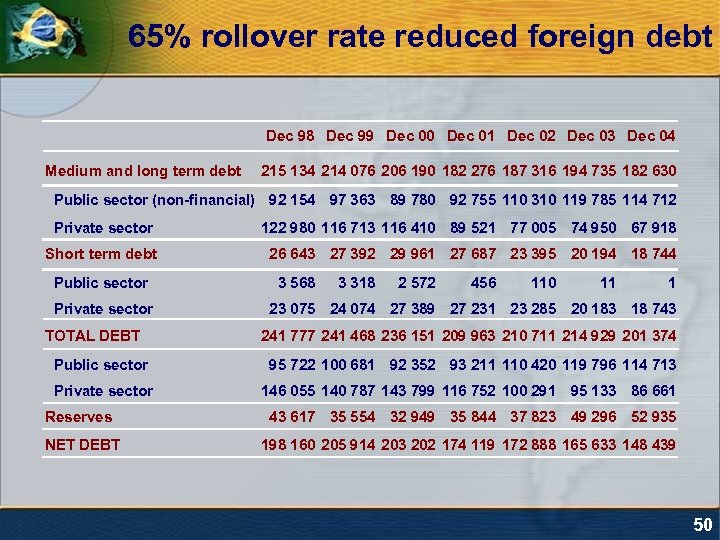

65% rollover rate reduced foreign debt Dec 98 Dec 99 Dec 00 Dec 01 Dec 02 Dec 03 Dec 04 Medium and long term debt 215 134 214 076 206 190 182 276 187 316 194 735 182 630 Public sector (non-financial) 92 154 97 363 89 780 92 755 110 310 119 785 114 712 Private sector 122 980 116 713 116 410 89 521 77 005 74 950 67 918 Short term debt 26 643 27 392 29 961 27 687 23 395 20 194 18 744 Public sector Private sector TOTAL DEBT 3 568 3 318 2 572 456 110 11 1 23 075 24 074 27 389 27 231 23 285 20 183 18 743 241 777 241 468 236 151 209 963 210 711 214 929 201 374 Public sector 95 722 100 681 92 352 93 211 110 420 119 796 114 713 Private sector 146 055 140 787 143 799 116 752 100 291 95 133 86 661 Reserves 43 617 35 554 32 949 35 844 37 823 49 296 52 935 NET DEBT 198 160 205 914 203 202 174 119 172 888 165 633 148 439 50

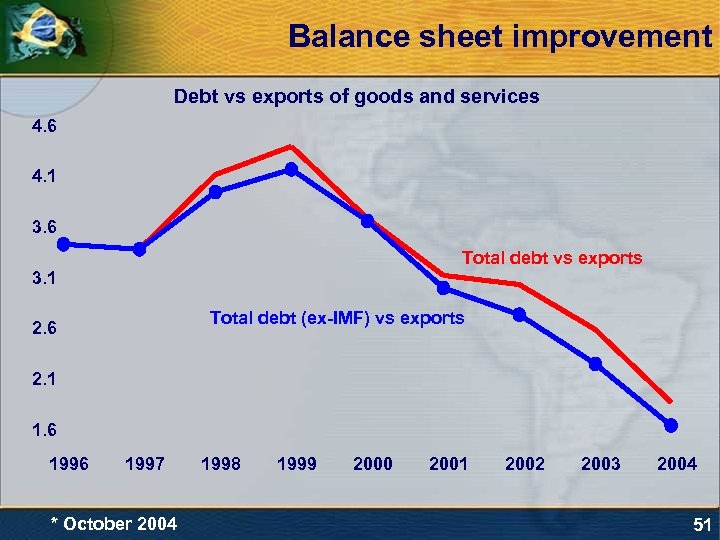

Balance sheet improvement Debt vs exports of goods and services 4. 6 4. 1 3. 6 Total debt vs exports 3. 1 Total debt (ex-IMF) vs exports 2. 6 2. 1 1. 6 1997 * October 2004 1998 1999 2000 2001 2002 2003 2004 51

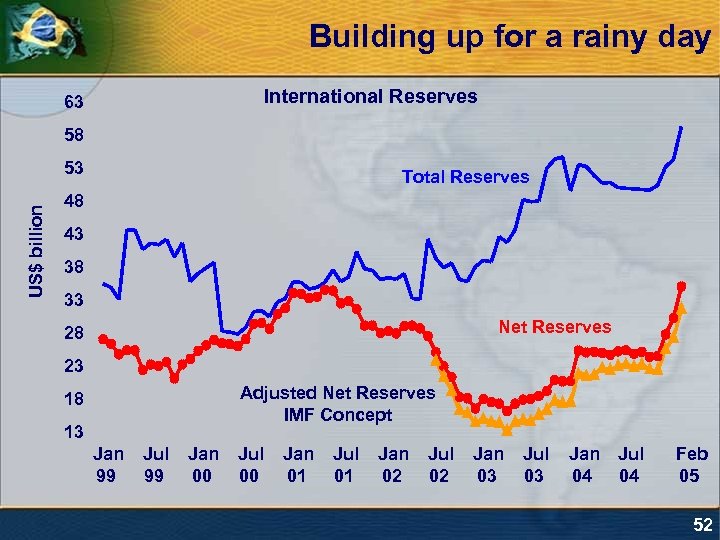

Building up for a rainy day International Reserves 63 58 US$ billion 53 Total Reserves 48 43 38 33 Net Reserves 28 23 Adjusted Net Reserves IMF Concept 18 13 Jan 99 Jul 99 Jan 00 Jul 00 Jan 01 Jul 01 Jan 02 Jul 02 Jan 03 Jul 03 Jan 04 Jul 04 Feb 05 52

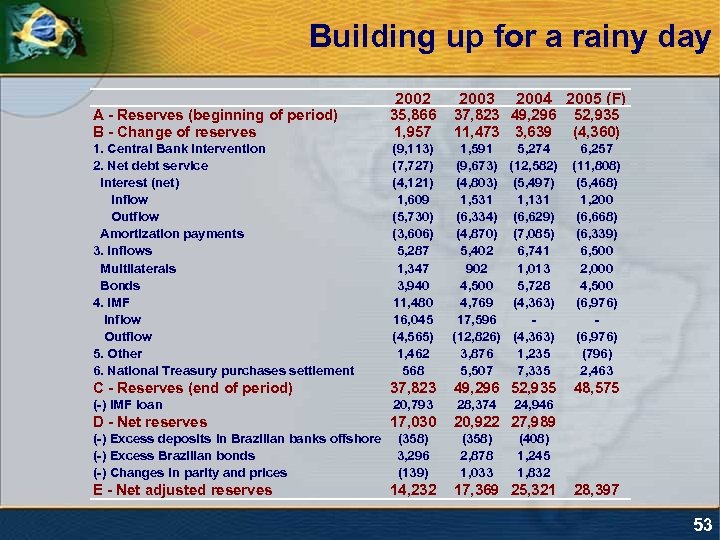

Building up for a rainy day 2002 2003 2004 2005 (F) A - Reserves (beginning of period) B - Change of reserves 35, 866 1, 957 37, 823 49, 296 11, 473 3, 639 52, 935 (4, 360) 1. Central Bank intervention 2. Net debt service Interest (net) Inflow Outflow Amortization payments 3. Inflows Multilaterals Bonds 4. IMF Inflow Outflow 5. Other 6. National Treasury purchases settlement (9, 113) (7, 727) (4, 121) 1, 609 (5, 730) (3, 606) 5, 287 1, 347 3, 940 11, 480 16, 045 (4, 565) 1, 462 568 1, 591 (9, 673) (4, 803) 1, 531 (6, 334) (4, 870) 5, 402 902 4, 500 4, 769 17, 596 (12, 826) 3, 876 5, 507 5, 274 (12, 582) (5, 497) 1, 131 (6, 629) (7, 085) 6, 741 1, 013 5, 728 (4, 363) 1, 235 7, 335 6, 257 (11, 808) (5, 468) 1, 200 (6, 668) (6, 339) 6, 500 2, 000 4, 500 (6, 976) (796) 2, 463 C - Reserves (end of period) 37, 823 49, 296 52, 935 48, 575 (-) IMF loan 20, 793 28, 374 D - Net reserves 17, 030 20, 922 27, 989 (-) Excess deposits in Brazilian banks offshore (-) Excess Brazilian bonds (-) Changes in parity and prices E - Net adjusted reserves (358) 3, 296 (139) 14, 232 (358) 2, 878 1, 033 24, 946 (408) 1, 245 1, 832 17, 369 25, 321 28, 397 53

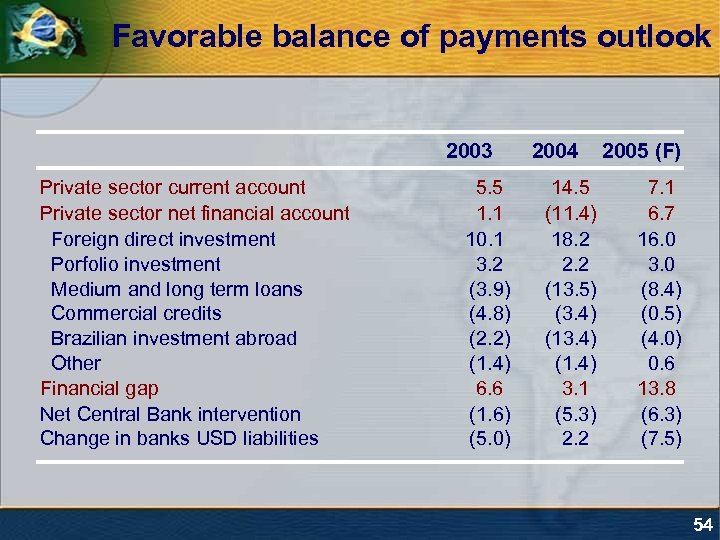

Favorable balance of payments outlook 2003 Private sector current account Private sector net financial account Foreign direct investment Porfolio investment Medium and long term loans Commercial credits Brazilian investment abroad Other Financial gap Net Central Bank intervention Change in banks USD liabilities 5. 5 1. 1 10. 1 3. 2 (3. 9) (4. 8) (2. 2) (1. 4) 6. 6 (1. 6) (5. 0) 2004 14. 5 (11. 4) 18. 2 2. 2 (13. 5) (3. 4) (1. 4) 3. 1 (5. 3) 2. 2 2005 (F) 7. 1 6. 7 16. 0 3. 0 (8. 4) (0. 5) (4. 0) 0. 6 13. 8 (6. 3) (7. 5) 54

A final look at Myth V Ø While international conditions were favorable, Brazil did its homework to take advantage of friendly environment Ø Brazilian exports outpaced international trade growth Ø Effect of higher commodity prices on Brazilian exports remains overstated; volume growth still explains bulk of favorable performance ØExport growth remains strong and diversified Ø FDI has rebounded, allowing further improvement in debt reduction ØCentral Bank seized the opportunity to rebuild international reserves 55

Debunking Some Common Myths About Brazil Alexandre Schwartsman April 2005 56

8915da8e44d38a0e6304d7d0cfdea8b1.ppt