117496e9ba3a167d4570b50165230c14.ppt

- Количество слайдов: 30

Debt –Understanding the Challenge n n n The Injustice of the debt burden Background to the Debt Crisis Structure of Debt Campaign Achievements Challenge ahead JDC Web Group - Debt Slides 1

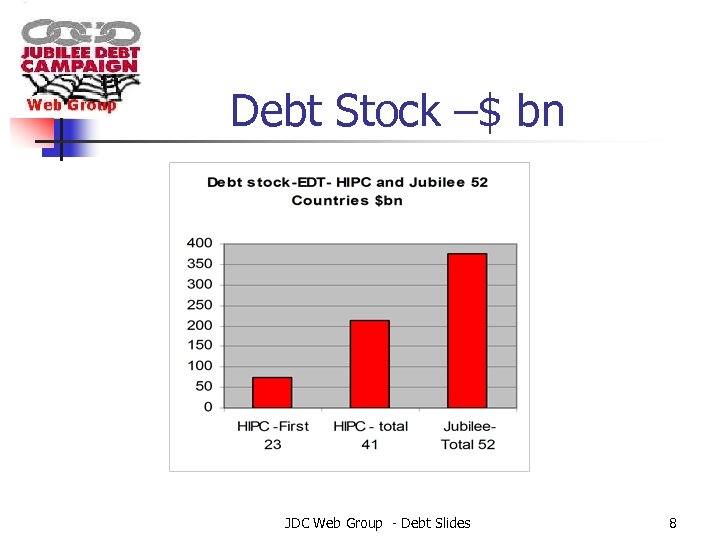

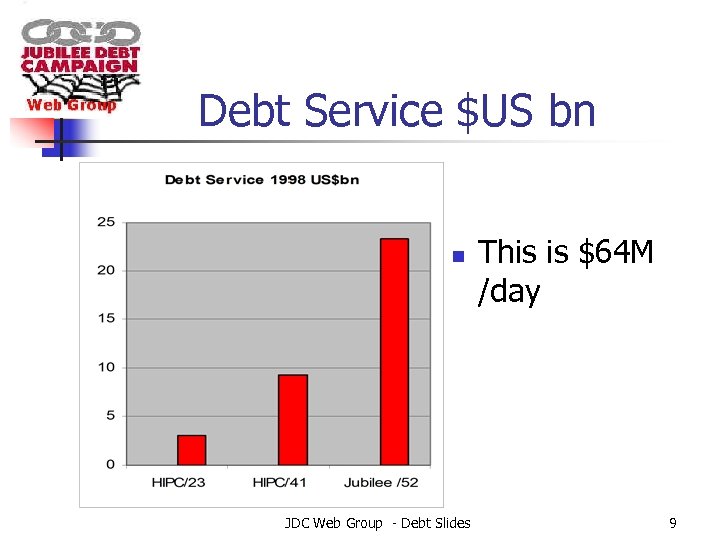

The Debt burden Debt Service: n $64, 000 every day n $23, 000, 000 every year Debt stock n $375, 000, 000 n n 52 counties identified by Jubilee Over 1 billion people live on less than $1/day JDC Web Group - Debt Slides 2

Debt = death n n n 19, 000 die every day from poverty 1 in 5 babies die before the age of 5 Average is falling! n n n 2 -3 Million AIDS 3. 5 Million from Pneumonia 2 million TB 1 million Malaria Because there is no money in drugs for the poor countries, less than 1 % of health research is in tropical disease JDC Web Group - Debt Slides 3

Debt = lost opportunity n n n Education has to be paid for 125 million children get no education Sometimes the state pays just the teachers salary n n Pay for books, paper, buildings, school clothes Education is a route to empowerment JDC Web Group - Debt Slides 4

Origins of Debt n n Vast petroleum dollar liquidity after the oil price rise in the 1960's Cold war politics to 'buy' influence – Much of it military contracts n Conversion of commercial debt into public debt What does the 'G' stand for? . . why, GREEDY ! JDC Web Group - Debt Slides 5

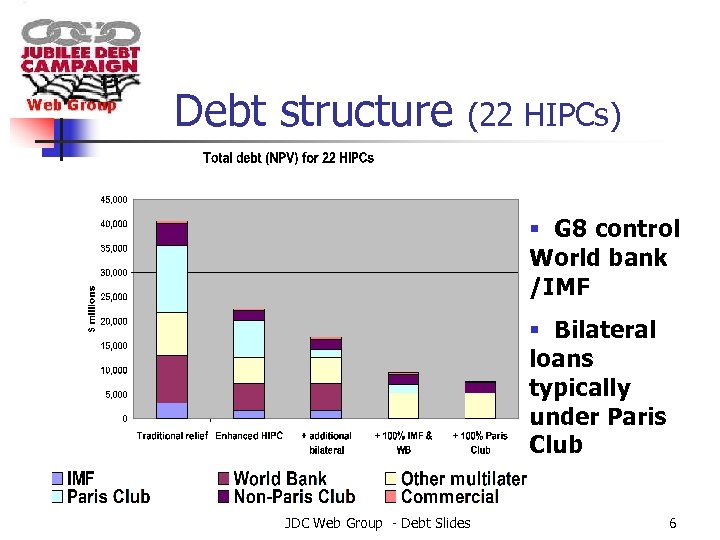

Debt structure (22 HIPCs) § G 8 control World bank /IMF § Bilateral loans typically under Paris Club JDC Web Group - Debt Slides 6

HIPC (Enhanced) Heavily Indebted Poor Countries n HIPC covers 41 countries n Only 23 have reached agreement n So poor even the banks know they couldn’t pay n Conditions of sustainability set by IMF/WB – HIPC doesn’t cancel all debt; it reduces it to a ‘sustainable’ level Debt: exports>150%; Debt : Government revenue 250% JDC Web Group - Debt Slides 7

Debt Stock –$ bn JDC Web Group - Debt Slides 8

Debt Service $US bn n JDC Web Group - Debt Slides This is $64 M /day 9

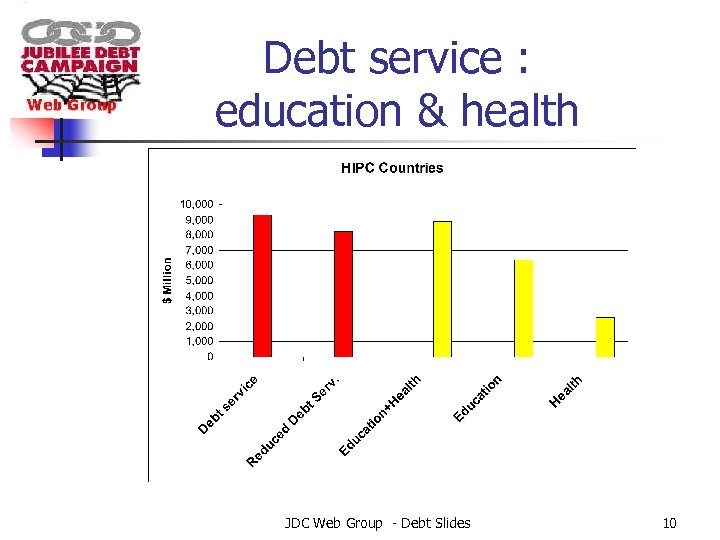

Debt service : education & health JDC Web Group - Debt Slides 10

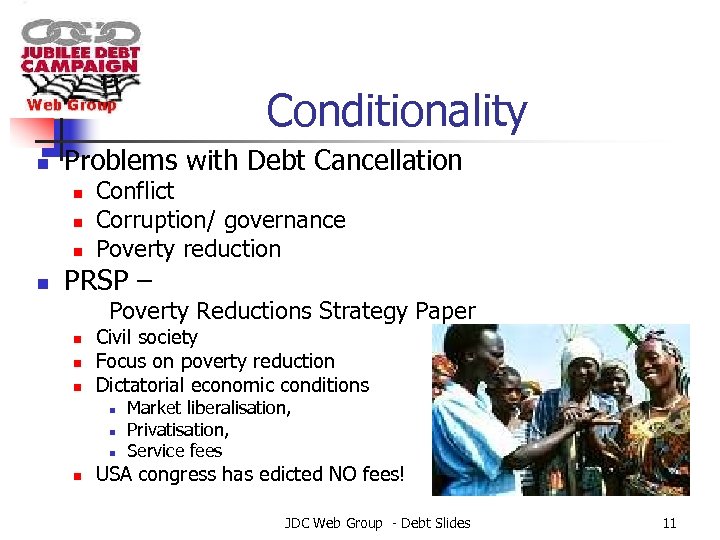

Conditionality n Problems with Debt Cancellation n n Conflict Corruption/ governance Poverty reduction PRSP – Poverty Reductions Strategy Paper n n n Civil society Focus on poverty reduction Dictatorial economic conditions n n Market liberalisation, Privatisation, Service fees USA congress has edicted NO fees! JDC Web Group - Debt Slides 11

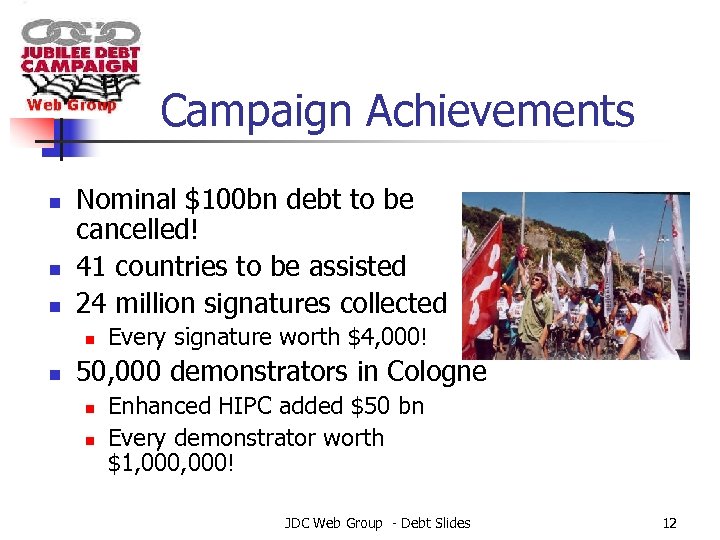

Campaign Achievements n n n Nominal $100 bn debt to be cancelled! 41 countries to be assisted 24 million signatures collected n n Every signature worth $4, 000! 50, 000 demonstrators in Cologne n n Enhanced HIPC added $50 bn Every demonstrator worth $1, 000! JDC Web Group - Debt Slides 12

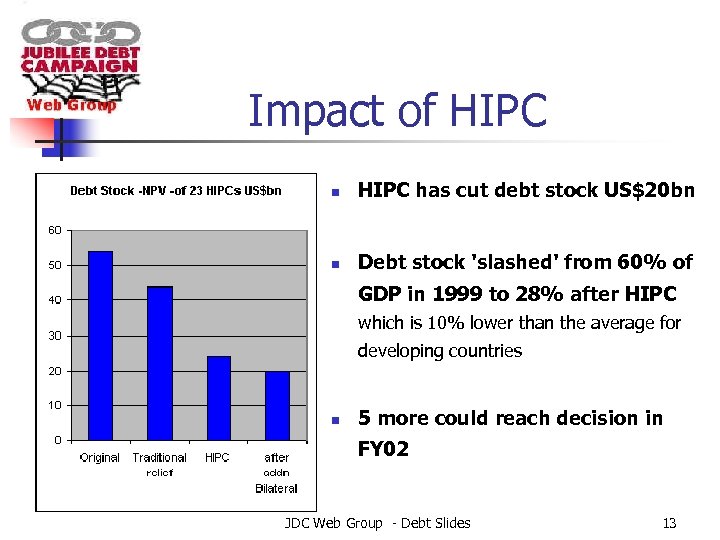

Impact of HIPC n HIPC has cut debt stock US$20 bn n Debt stock 'slashed' from 60% of GDP in 1999 to 28% after HIPC which is 10% lower than the average for developing countries n 5 more could reach decision in FY 02 JDC Web Group - Debt Slides 13

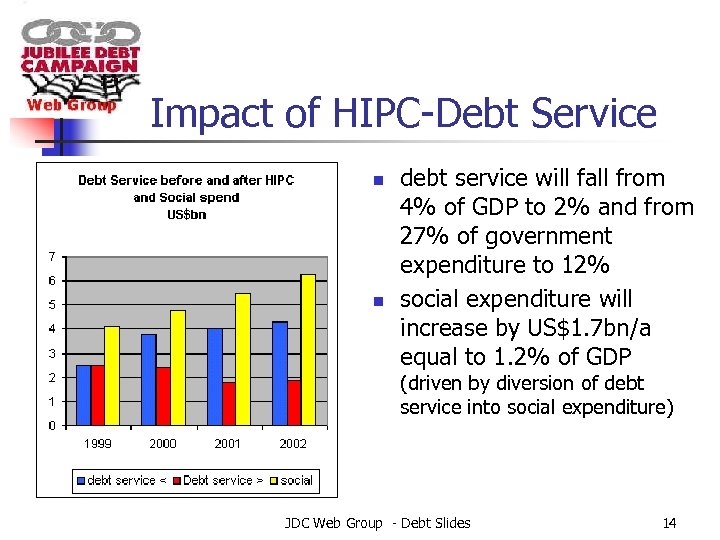

Impact of HIPC-Debt Service n n debt service will fall from 4% of GDP to 2% and from 27% of government expenditure to 12% social expenditure will increase by US$1. 7 bn/a equal to 1. 2% of GDP (driven by diversion of debt service into social expenditure) JDC Web Group - Debt Slides 14

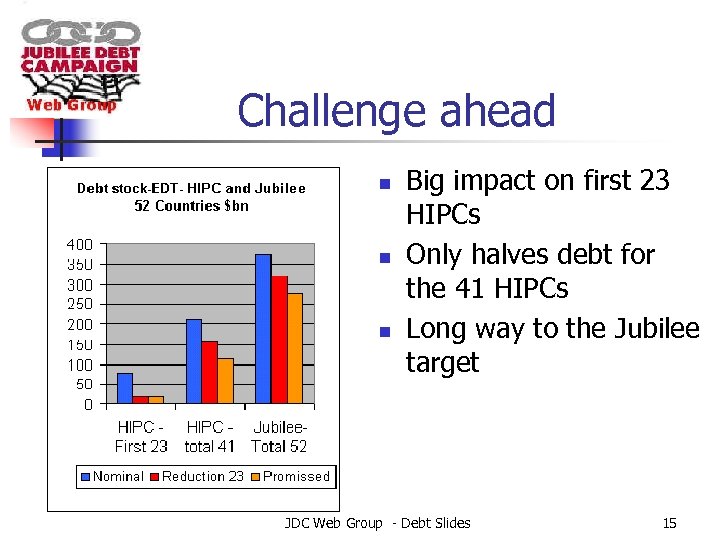

Challenge ahead n n n Big impact on first 23 HIPCs Only halves debt for the 41 HIPCs Long way to the Jubilee target JDC Web Group - Debt Slides 15

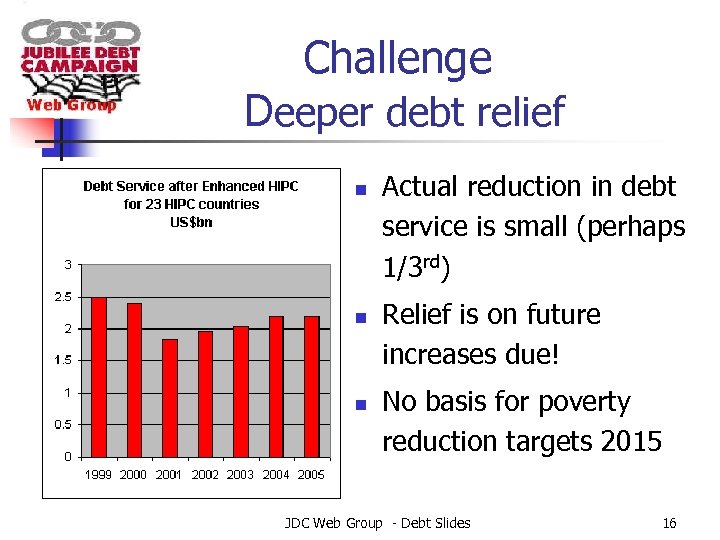

Challenge Deeper debt relief n n n Actual reduction in debt service is small (perhaps 1/3 rd) Relief is on future increases due! No basis for poverty reduction targets 2015 JDC Web Group - Debt Slides 16

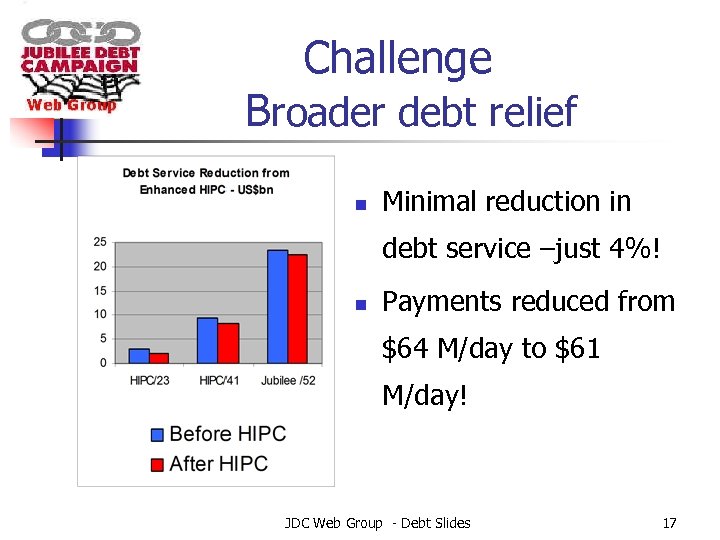

Challenge Broader debt relief n Minimal reduction in debt service –just 4%! n Payments reduced from $64 M/day to $61 M/day! JDC Web Group - Debt Slides 17

Challenge – WB/IMF rejection of 100% cancellation n n Claim – debt service now sustainable for 23 HIPCs Unfair on other countries who need WB/IMF loans Write off reduces loan capability by 5 times Deplete asset reserves would reduce credit rating and hence increase cost of loans JDC Web Group - Debt Slides 18

Challenge 2015 Poverty Reduction Targets n Free primary education for all n Halve the number below poverty level ($1/day) n Halve infant mortality (from 1: 5 to 1: 10) JDC Web Group - Debt Slides 19

Challenge n Debt sustainability measured against social spending n Grants/aid not loans n Independent arbitration of debt, not just WB/IMF –include UN/WHO JDC Web Group - Debt Slides 20

Cancel the Debt n Faster n Broader n Deeper n Fairer JDC Web Group - Debt Slides 21

Campaign arguments n n Focus on poorest countries (say HIPC) or broader base? What criteria for sustainability Corruption/conflict Move on to fairer trade rules JDC Web Group - Debt Slides Discussion 22

Motivation issues What will win wider public support? n Demonstrations? n Images of poverty n Health? Education? n Individuals/families/human interest stories JDC Web Group - Debt Slides Discussion 23

How should we campaign? n n n How do we move the political process? Letters/lobbying/vigils – as before? Alternatives to G 8/IMF venues? It’s the media that set the agenda! Post terrorism focus on poverty is the breeding ground? JDC Web Group - Debt Slides Discussion 24

Origins of Debt –(2) n n Vast petroleum dollar liquidity after the oil price rise in the 1960's Cold war politics to 'buy' influence Conversion of commercial debt into public debt * Commodity prices crash n n (IMF/WB had insisted countries focused on these cash commodities) Little of the money was spent on poverty alleviation n n It was known that much of the money was being spent on arms and corruption. Large proportion for ‘Arms’ and western prestige projects JDC Web Group - Debt Slides Discussion 25

Structure of Debt Burden n Multilateral banks – controlled by G 8 n World bank – primary responsibility loans for development n n n IMF –International Monetary Fund –primary responsibility global financial stability Many regional development banks (IDB, Af. DB, As. DB etc) Bilateral loans –individual countries n n ODA -Overseas development aid –low interest/high risk countries IDA International Development Association –loans, zero interest IBRD: The International Bank for Reconstruction and Development Paris club Commercial Banks –now negligible JDC Web Group - Debt Slides Discussion 26

Structure of Debt Burden n Multilateral banks – controlled by G 8 n n IMF –International Monetary Fund –primary responsibility global financial stability Many regional development banks (IDB, Af. DB, As. DB etc) Bilateral loans –individual countries n n World bank – primary responsibility loans for development Paris club Commercial Banks –now negligible JDC Web Group - Debt Slides Discussion 27

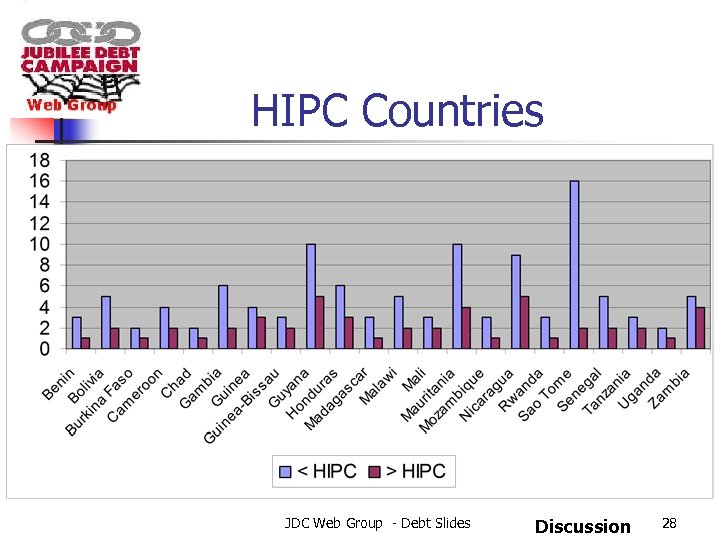

HIPC Countries JDC Web Group - Debt Slides Discussion 28

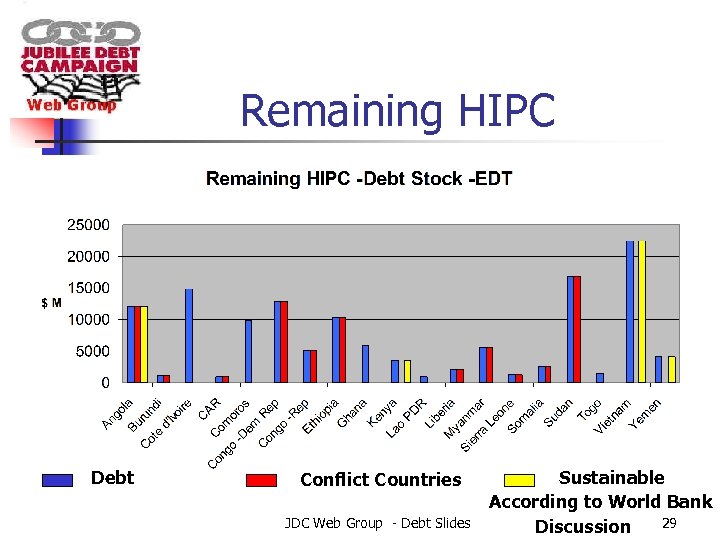

Remaining HIPC Debt Conflict Countries JDC Web Group - Debt Slides Sustainable According to World Bank 29 Discussion

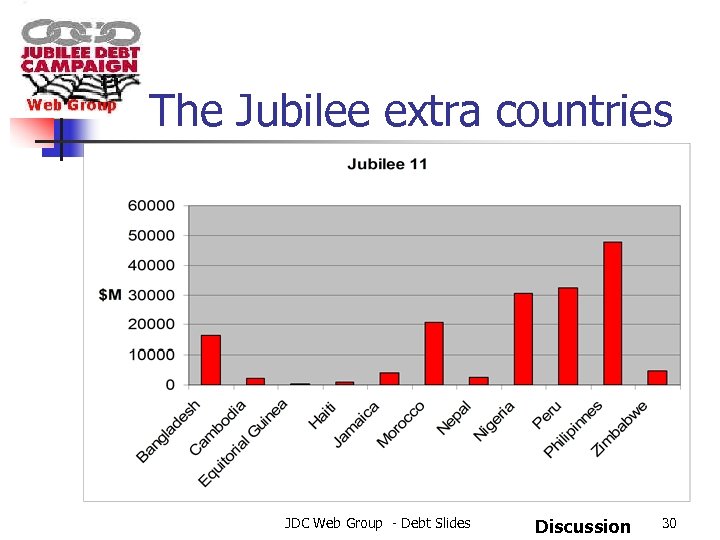

The Jubilee extra countries JDC Web Group - Debt Slides Discussion 30

117496e9ba3a167d4570b50165230c14.ppt