344795c20d82cf64969fd6b9e140a456.ppt

- Количество слайдов: 31

Debt Instruments: Qualitative Aspects Chapter 8 Sources of Risk Non Marketable vs. Marketable Short-Term, Long-Term Instruments Mortgage Backed Securities Bankruptcy 1

Sources of Risk • Default; probability of not getting all of the promised interest and principal. • Price; changes in prices as interest rates change over time. • Purchasing Power; effects on inflation on buying power of coupon income. • Liquidity: inability to buy or sell at intrinsic value due to inactive market or small float. 2

Non-Marketable Debt • Certificates of Deposit (Depos. Inst. ) – 3 months to 2 years (may carry special terms) – Decision Criterion: Expectations for rates – May be Brokered • Money Market Fund Balances – Invested in S-T instruments – Many have check writing priviledges • Savings Bonds (U. S. Treasury) – EE S. B. (“zero-coupon bond”) – I-Bonds (rates reset 2 x a year) – Low denominations available 3

Marketable Debt • Key Attribute: LIQUIDITY – Ability to convert securities to cash at a price similar to price of previous trade in security – Assumes no significant new information has arrived since previous trade – Also ability to sell an asset quickly without having to make substantial price concession: narrow bidask spread • Dealer Spread = Ask – Bid 4

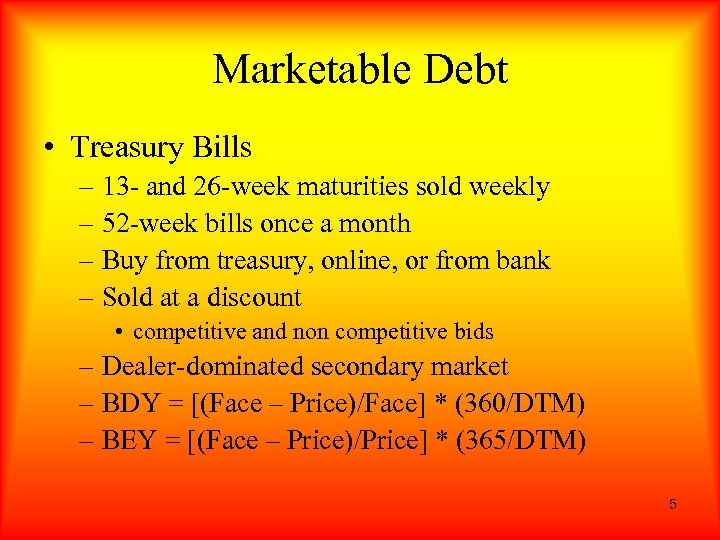

Marketable Debt • Treasury Bills – 13 - and 26 -week maturities sold weekly – 52 -week bills once a month – Buy from treasury, online, or from bank – Sold at a discount • competitive and non competitive bids – Dealer-dominated secondary market – BDY = [(Face – Price)/Face] * (360/DTM) – BEY = [(Face – Price)/Price] * (365/DTM) 5

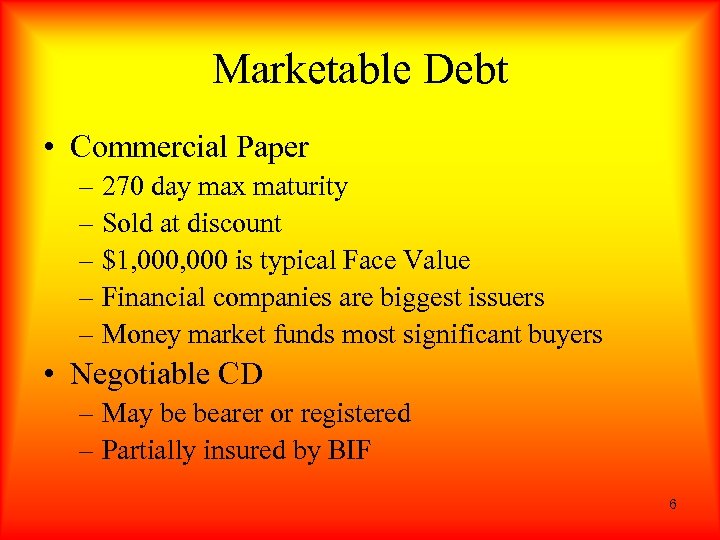

Marketable Debt • Commercial Paper – 270 day max maturity – Sold at discount – $1, 000 is typical Face Value – Financial companies are biggest issuers – Money market funds most significant buyers • Negotiable CD – May be bearer or registered – Partially insured by BIF 6

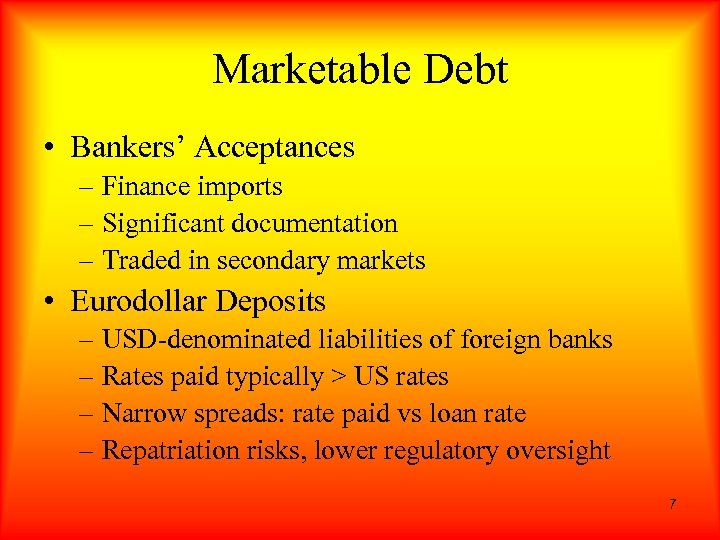

Marketable Debt • Bankers’ Acceptances – Finance imports – Significant documentation – Traded in secondary markets • Eurodollar Deposits – USD-denominated liabilities of foreign banks – Rates paid typically > US rates – Narrow spreads: rate paid vs loan rate – Repatriation risks, lower regulatory oversight 7

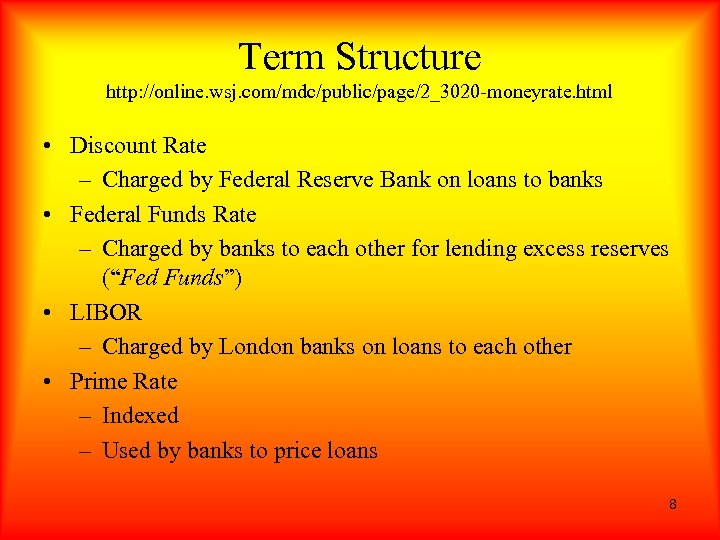

Term Structure http: //online. wsj. com/mdc/public/page/2_3020 -moneyrate. html • Discount Rate – Charged by Federal Reserve Bank on loans to banks • Federal Funds Rate – Charged by banks to each other for lending excess reserves (“Fed Funds”) • LIBOR – Charged by London banks on loans to each other • Prime Rate – Indexed – Used by banks to price loans 8

Other MM Arrangements • Repurchase Agreements (Repos) and Reverse Repos – Repo effectively a short term loan – Reverse Repo – buy for resale contract • Short-term Municipals • Money Market Mutual Funds • Short-Term Unit Investment Trusts 9

US Government Debt Securities • Notes – Max maturities = 10 years • Bonds – Max maturities = 30 years • General Features – Very liquid – Registered – Semi-annual interest payments 10

US Government Debt Securities • STRIPS – Separate Trading of Registered Interest & Principal Securities – Sell semi-annual coupons as one security and sell maturity value as separate security. – Prices set by YTM • TIPS – Treasury Inflation-Protected Securities – Lower coupon rates - $ coupon fixed – Par values adjusted – vary yields 11

Off Balance Sheet Debt • GSE Issuers (largest) – FNMA (fannie mae) – FHLMC (freddie mac) • Federal Agencies (Guaranteed by US) – EXIM Bank – GNMA – TVA 12

Municipal Debt • Issued by State, County, or City Gov’t – General Obligation Bonds – Revenue Bonds – Tax preferences (interest exempt from Fed taxes) 13

Corporate Debt • Indenture Agreement – Agreement between lender and borrower • Specifies and Restrictive Covenants • May require sinking funds or serial redemption • Grace period specified (curing a default) – Appoints the trustee; a fiduciary responsible for guarding the lenders' interests. – Provides for legal remedies if terms & conditions of indenture are not met. – Sets timing and rate of interest payments 14

Corporate Debt • Market Trading – OTC dominates – Quotes include: • • • Coupon rate Maturity Current Yield Volume Last price (change) 15

Corporate Debt • Collateralized Debt – Mortgage Bonds – Equipment Trust Certificates • Un-Collateralized Debt – Debentures • Senior • Subordinated – Notes (promissory) • Fixed or floating rate 16

Corporate Debt Issues • Other Important Features – Callable bonds • Call price includes premium • Yield-to-First-Call – impact of call premium – Convertible bonds • Convertible to common stock • C-bond is may be characterized as an interest-paying call option on the underlying stock • Conversions may be forced – Trading Flat: price does not include accrued interest – Zero Coupon Bonds (pure discount bonds) 17

Corporate Debt Issues • Other Important Features (continued) – Original-issue discount bonds • “Zero” + coupon rate below market – Split coupon bonds: from Zero to “regular” – Floating rate securities (notes, bonds) – Step-up notes: scheduled changes in rate paid – Sinking Funds: Indenture requires issuer to set aside funds each year – assures payoff funds available at maturity. 18

Credit Ratings • Several Companies specialize in rating debt issues • Ratings (S&P schema) – Prime or High Quality (AAA) – Investment Grade (meets legal list requirements) • AA, A, & BBB – Speculative Grade • BB, B – High Risk • CCC, C – Default • DDD, etc. 19

Corporate Bankruptcy • Definitions of Failure – Economic Failure; revenues do not cover expenses – Business Failure; termination resulting in loss to creditors – Technical Insolvency: firm cannot meet maturing obligations – Technical Bankruptcy: Value of assets < value of liabilities, • Legal Bankruptcy: Acts of Bankruptcy – Firm admits inability to pay (voluntary). – Composition of creditors petitions court (involuntary). – Concealment or improper transfer of assets to avoid attachment or repossession. 20

Corporate Bankruptcy • Out-of-Court Remedies – Extension; postpone due date. – Composition; creditors agree to take less. – Necessary conditions; • Debtor is good moral risk. • Debtor must show ability to make a recovery. • General business conditions must be favorable. – Creditor committees; lenders assume management. – Assignment; Requires agreement as to liquidation values, and priority. 21

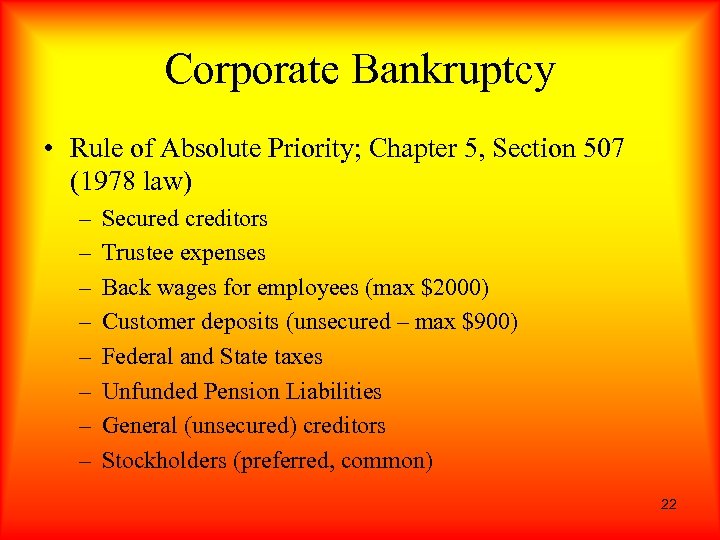

Corporate Bankruptcy • Rule of Absolute Priority; Chapter 5, Section 507 (1978 law) – – – – Secured creditors Trustee expenses Back wages for employees (max $2000) Customer deposits (unsecured – max $900) Federal and State taxes Unfunded Pension Liabilities General (unsecured) creditors Stockholders (preferred, common) 22

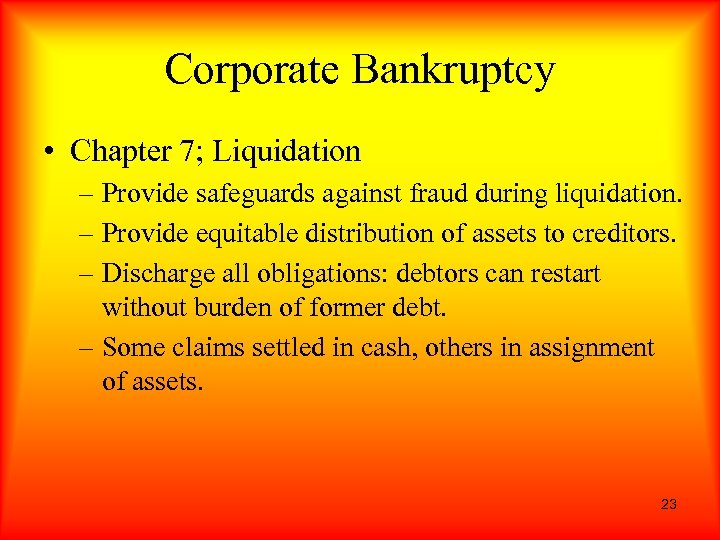

Corporate Bankruptcy • Chapter 7; Liquidation – Provide safeguards against fraud during liquidation. – Provide equitable distribution of assets to creditors. – Discharge all obligations: debtors can restart without burden of former debt. – Some claims settled in cash, others in assignment of assets. 23

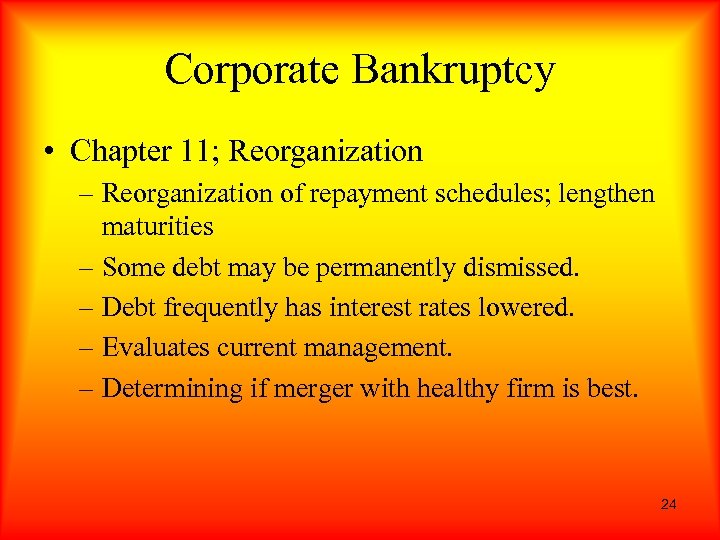

Corporate Bankruptcy • Chapter 11; Reorganization – Reorganization of repayment schedules; lengthen maturities – Some debt may be permanently dismissed. – Debt frequently has interest rates lowered. – Evaluates current management. – Determining if merger with healthy firm is best. 24

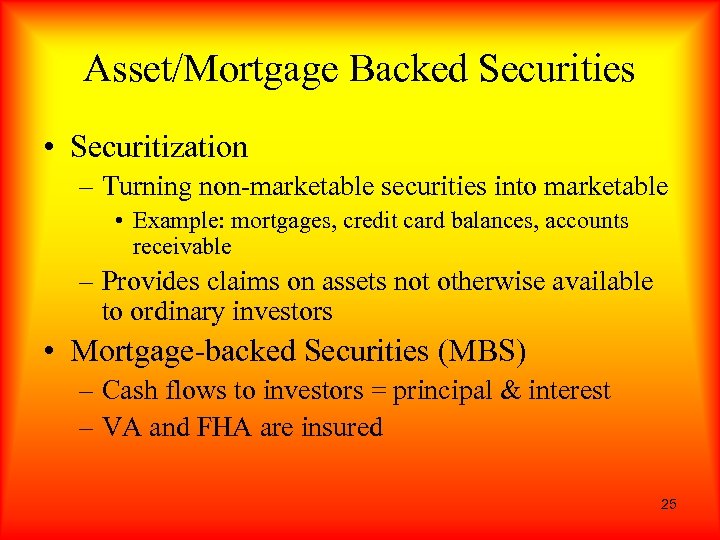

Asset/Mortgage Backed Securities • Securitization – Turning non-marketable securities into marketable • Example: mortgages, credit card balances, accounts receivable – Provides claims on assets not otherwise available to ordinary investors • Mortgage-backed Securities (MBS) – Cash flows to investors = principal & interest – VA and FHA are insured 25

Mortgage Backed Securities • Pass-Throughs – P&I less fee sent to investor – Many issuers: Fannie, Freddie, Ginnie • Collateralized Mortgage Obligations – Cash flows are sequenced (Tranches) – More risk for buyers of later tranches 26

Other Debt Securities • Foreign Bonds – State-issued – Corporate issues – Forex and Political risk important factors • Insurance Investments – Guaranteed Investment Contracts – Annuities • Single-premium deferred • Flexible-premium deferred 27

Guaranteed Investment Contracts • Stable value contract • Available in 401(k) retirement plans, profit-sharing plans, IRAs, and mutual funds • Investment choice provided by plan sponsor, but contract between insurance company and employee • Specified maturity date and rate of return guaranteed through maturity by insurance company • Not insured 28

Annuities • Qualified Annuity is purchased through a tax sheltered program • Non-qualified annuity is purchased outside a tax-sheltered program • Accumulation value is the annuity value before any surrender charges have been deducted • Surrender value is the account value after surrender charges have been deducted 29

Types of Annuities • • Single premium deferred annuities (SPDAs) Flexible premium deferred annuities (FPDAs) CD-type annuities Single premium immediate annuities (SPIAs) 30

Annuity Payout Options • • • Straight life annuity Life income with period certain annuity Life with cash or installment refund annuity Joint and survivor life annuity Fixed period annuity Fixed amount annuity 31

344795c20d82cf64969fd6b9e140a456.ppt