00276bd69f6ffdb6993bd5cfd661ebea.ppt

- Количество слайдов: 58

Death & Dying What an Agent Can Do to Help with the “Process” Presented by Jeffrey F. Bigler, CLU, Ch. FC

Death & Dying What an Agent Can Do to Help with the “Process” Presented by Jeffrey F. Bigler, CLU, Ch. FC

Jeffrey F. Bigler l l l l l 1986 - Started in financial services industry-obtained insurance license. 1988 - Obtained Series 7 and 63 securities licenses. 1989 - Luther College graduate with Economics & Management majors. 1989 - Life Investors Home Office in Marketing Department. 1993 – Moved to Rochester, MN as a field manager. 1997 – Appointed Executive General Agent with Life Investors managing representatives in MN, WI, AZ & IA. Business focus on comprehensive individual financial planning & business succession planning. Over $150 million assets under management. MDRT Qualifier since 1997 – Court of the Table since 2004, TOT 2007

Jeffrey F. Bigler l l l l l 1986 - Started in financial services industry-obtained insurance license. 1988 - Obtained Series 7 and 63 securities licenses. 1989 - Luther College graduate with Economics & Management majors. 1989 - Life Investors Home Office in Marketing Department. 1993 – Moved to Rochester, MN as a field manager. 1997 – Appointed Executive General Agent with Life Investors managing representatives in MN, WI, AZ & IA. Business focus on comprehensive individual financial planning & business succession planning. Over $150 million assets under management. MDRT Qualifier since 1997 – Court of the Table since 2004, TOT 2007

Jeffrey F. Bigler l l l Married 25 years 2 boys 2 girls 3 dogs, 1 cat 1 chainsaw & a baseball bat

Jeffrey F. Bigler l l l Married 25 years 2 boys 2 girls 3 dogs, 1 cat 1 chainsaw & a baseball bat

WHY NAIFA? Why are you here? • Camaraderie? • Association? • Education? • Part of something Good? • Give Back?

WHY NAIFA? Why are you here? • Camaraderie? • Association? • Education? • Part of something Good? • Give Back?

Death Claims How many of you have had training on this topic? How about education? Training does not get you to the top of your plateau, education does. Training teaches you how, Education teaches you why.

Death Claims How many of you have had training on this topic? How about education? Training does not get you to the top of your plateau, education does. Training teaches you how, Education teaches you why.

A Death Claim Properly Handled… Creates a desire or want l Creates a need or demand l Proves the need, fills the demand l Does not sell product. In short, done right, a death claim creates a demand for your “SERVICE” that converts your process FROM YOU SELLING, TO THE CLIENT BUYING.

A Death Claim Properly Handled… Creates a desire or want l Creates a need or demand l Proves the need, fills the demand l Does not sell product. In short, done right, a death claim creates a demand for your “SERVICE” that converts your process FROM YOU SELLING, TO THE CLIENT BUYING.

Understanding the Role of an Agent Few truly understand the difficulties and challenges faced by a life insurance agent.

Understanding the Role of an Agent Few truly understand the difficulties and challenges faced by a life insurance agent.

Understanding the Role of an Agent Actual wording on life application: “Patient has chest pains if she lies on her left side for over a year. ”

Understanding the Role of an Agent Actual wording on life application: “Patient has chest pains if she lies on her left side for over a year. ”

Understanding the Role of an Agent Actual wording on life application: “On the second day, the knee was better and on the third day, it had completely disappeared. ”

Understanding the Role of an Agent Actual wording on life application: “On the second day, the knee was better and on the third day, it had completely disappeared. ”

Understanding the Role of an Agent Actual wording on life application: “His past medical history has been remarkably insignificant with only a 40 pound weight gain in the past three days. ”

Understanding the Role of an Agent Actual wording on life application: “His past medical history has been remarkably insignificant with only a 40 pound weight gain in the past three days. ”

Understanding the Role of an Agent Actual wording on life application: “She had some problems but had her armpits removed and looks much better. ”

Understanding the Role of an Agent Actual wording on life application: “She had some problems but had her armpits removed and looks much better. ”

Understanding the Role of an Agent Actual wording on APS: “Patient left his white blood cells at another hospital. ”

Understanding the Role of an Agent Actual wording on APS: “Patient left his white blood cells at another hospital. ”

Understanding the Role of an Agent Actual wording on APS: “The patient is tearful, cries constantly, and appears depressed. She has no past history of suicide. ”

Understanding the Role of an Agent Actual wording on APS: “The patient is tearful, cries constantly, and appears depressed. She has no past history of suicide. ”

Understanding the Role of an Agent Actual wording on life application: “…herni; hernea; herrneea; herneo; herrnneia, hurneyia, whatever it was – you know what I mean and it’s okay now. ”

Understanding the Role of an Agent Actual wording on life application: “…herni; hernea; herrneea; herneo; herrnneia, hurneyia, whatever it was – you know what I mean and it’s okay now. ”

It’s All About The Experiences… Understanding the Role of an Agent

It’s All About The Experiences… Understanding the Role of an Agent

Why is Death & Dying such a key topic? At some point in your career, it will happen. Very few agents have ever been educated in handling these situations. Are you prepared?

Why is Death & Dying such a key topic? At some point in your career, it will happen. Very few agents have ever been educated in handling these situations. Are you prepared?

Today’s Agenda Offering Support (Moral, Relational & Organizational) l Filing a Claim l Getting Organized l Asset Transfer Details l Service, Service l Case Studies l Questions l

Today’s Agenda Offering Support (Moral, Relational & Organizational) l Filing a Claim l Getting Organized l Asset Transfer Details l Service, Service l Case Studies l Questions l

STEP ONE OFFERING MORAL SUPPORT – l l l l Listen with your heart Be compassionate Avoid clichés Make contact – attend the funeral Don’t disappear – contact them after a few days just to offer support. Write a personal note Be aware of holidays and anniversaries

STEP ONE OFFERING MORAL SUPPORT – l l l l Listen with your heart Be compassionate Avoid clichés Make contact – attend the funeral Don’t disappear – contact them after a few days just to offer support. Write a personal note Be aware of holidays and anniversaries

STEP TWO OFFERING A RELATIONSHIP – l l l Give value first. Be known as a resource. Dig in. Be committed or it won’t work. Be consistent. Once you get involved, seek a leadership role. Get to know people on a friendly basis. Go slow. Relationships are not built

STEP TWO OFFERING A RELATIONSHIP – l l l Give value first. Be known as a resource. Dig in. Be committed or it won’t work. Be consistent. Once you get involved, seek a leadership role. Get to know people on a friendly basis. Go slow. Relationships are not built

STEP THREE OFFERING ORGANIZATION SUPPORT l Social Security – Provide them with the phone number & contact name – Call with them to set appointment – Offer to go with them to appointment l Workman’s Comp – Provide them with the phone number & contact name – Call with them to set appointment – Offer to go with them to appointment l Employer Benefits – Offer to call employer’s office

STEP THREE OFFERING ORGANIZATION SUPPORT l Social Security – Provide them with the phone number & contact name – Call with them to set appointment – Offer to go with them to appointment l Workman’s Comp – Provide them with the phone number & contact name – Call with them to set appointment – Offer to go with them to appointment l Employer Benefits – Offer to call employer’s office

STEP FOUR OFFERING “EXTRA” SERVICES - Notary services - Claim paperwork processing - File clean up & organization - Tax or attorney referrals - Cost basis research This leads to “TESTIMONIAL WORD” (i. e. referrals, recommendations)

STEP FOUR OFFERING “EXTRA” SERVICES - Notary services - Claim paperwork processing - File clean up & organization - Tax or attorney referrals - Cost basis research This leads to “TESTIMONIAL WORD” (i. e. referrals, recommendations)

STEP FIVE LISTEN - Listen without distractions. - Focus eye contact on the communicator. - Write the communication down. - Repeat it back or ask about it. - Deliver what you promised.

STEP FIVE LISTEN - Listen without distractions. - Focus eye contact on the communicator. - Write the communication down. - Repeat it back or ask about it. - Deliver what you promised.

Which one are you? “If you walk in with information about you, they consider you a salesman. If you walk in with ideas and answers, they consider you a resource. Which one are you? ” - Jeffrey Gitomer

Which one are you? “If you walk in with information about you, they consider you a salesman. If you walk in with ideas and answers, they consider you a resource. Which one are you? ” - Jeffrey Gitomer

FILING A CLAIM Gather as many pertinent facts before you meet. - Review all notes. - Double check ownership and beneficiary designations. - Have lists made for surviving family. -

FILING A CLAIM Gather as many pertinent facts before you meet. - Review all notes. - Double check ownership and beneficiary designations. - Have lists made for surviving family. -

Filing a Claim l Preparing to meet with the surviving spouse/family l Forms needed

Filing a Claim l Preparing to meet with the surviving spouse/family l Forms needed

Forms Needed Filing a Claim TYPICAL REQUIRED FORMS INCLUDE: l l l Claim Paperwork from each company Policies Copies of statements Certified Death Certificate Copy of Will Certified Copy of Letters of Testamentary – Court document stating official appointment of executor l Affidavit of Domicile – Verification of the state where client lived prior to death

Forms Needed Filing a Claim TYPICAL REQUIRED FORMS INCLUDE: l l l Claim Paperwork from each company Policies Copies of statements Certified Death Certificate Copy of Will Certified Copy of Letters of Testamentary – Court document stating official appointment of executor l Affidavit of Domicile – Verification of the state where client lived prior to death

Filing a Claim l Preparing to meet with the surviving spouse/family l Forms needed l Meeting with the client – Allow time to build trust and confidence. – Follow their lead.

Filing a Claim l Preparing to meet with the surviving spouse/family l Forms needed l Meeting with the client – Allow time to build trust and confidence. – Follow their lead.

Filing a Claim l Preparing to meet with the surviving spouse/family l Forms needed l Meeting with the client l Other advisor involvement – Attorney, accountant, HR dept. , Union, other investment or insurance advisors.

Filing a Claim l Preparing to meet with the surviving spouse/family l Forms needed l Meeting with the client l Other advisor involvement – Attorney, accountant, HR dept. , Union, other investment or insurance advisors.

Filing a Claim l Preparing to meet with the surviving spouse/family l Forms needed l Meeting with the client l Other advisor involvement l Deliver the proceeds

Filing a Claim l Preparing to meet with the surviving spouse/family l Forms needed l Meeting with the client l Other advisor involvement l Deliver the proceeds

Delivering the proceeds Deliver in person if at all possible! 1. 2. 3. 4. 5. 6. Rapport – put yourself in their seat, find something in common Need – determine factors that influence motivation to listen Importance – find weight they assign to benefits, time frame, etc. Confidence – ability to gain credibility, remove doubt, comfort Value Transferred – ability to communicate value Enthusiasm – your belief, your attitude, your passion contagious

Delivering the proceeds Deliver in person if at all possible! 1. 2. 3. 4. 5. 6. Rapport – put yourself in their seat, find something in common Need – determine factors that influence motivation to listen Importance – find weight they assign to benefits, time frame, etc. Confidence – ability to gain credibility, remove doubt, comfort Value Transferred – ability to communicate value Enthusiasm – your belief, your attitude, your passion contagious

Getting Organized l Helping survivors cope with new responsibilities – Was survivor the decision-maker? Organizer? Passive participant? – What will their role be now?

Getting Organized l Helping survivors cope with new responsibilities – Was survivor the decision-maker? Organizer? Passive participant? – What will their role be now?

Getting Organized l Helping survivors cope with new responsibilities l Offering Personal Financial Inventory

Getting Organized l Helping survivors cope with new responsibilities l Offering Personal Financial Inventory

Getting Organized l Helping survivors cope with new responsibilities l Offering Personal Financial Inventory binders l Helping family determine what they want to do with the estate.

Getting Organized l Helping survivors cope with new responsibilities l Offering Personal Financial Inventory binders l Helping family determine what they want to do with the estate.

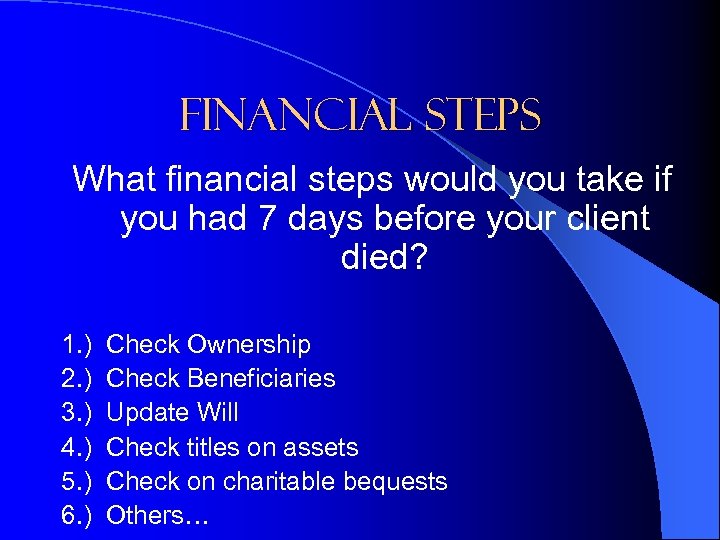

Financial Steps What financial steps would you take if you had 7 days before your client died? 1. ) 2. ) 3. ) 4. ) 5. ) 6. ) Check Ownership Check Beneficiaries Update Will Check titles on assets Check on charitable bequests Others…

Financial Steps What financial steps would you take if you had 7 days before your client died? 1. ) 2. ) 3. ) 4. ) 5. ) 6. ) Check Ownership Check Beneficiaries Update Will Check titles on assets Check on charitable bequests Others…

3 Ways Assets Pass to Heirs

3 Ways Assets Pass to Heirs

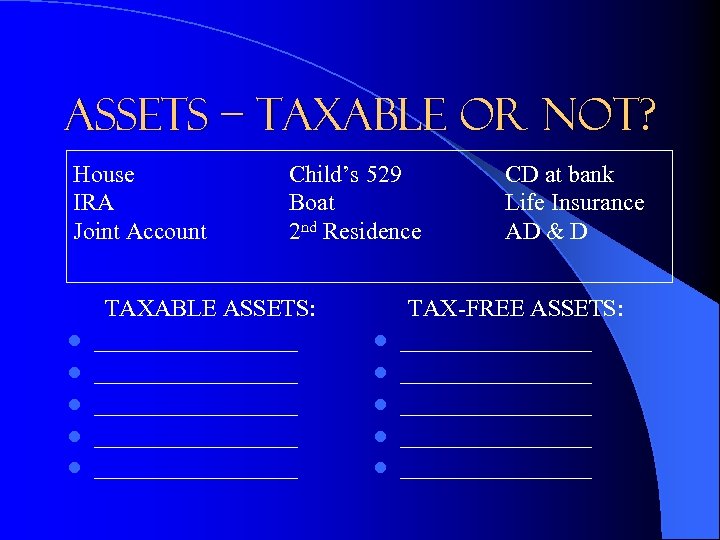

Assets – Taxable or Not? House IRA Joint Account l l l Child’s 529 Boat 2 nd Residence TAXABLE ASSETS: _________________ _________ l l l CD at bank Life Insurance AD & D TAX-FREE ASSETS: ________________ ________

Assets – Taxable or Not? House IRA Joint Account l l l Child’s 529 Boat 2 nd Residence TAXABLE ASSETS: _________________ _________ l l l CD at bank Life Insurance AD & D TAX-FREE ASSETS: ________________ ________

What’s the Cost Basis? STEPPED UP BASIS: STEPPED DOWN BASIS:

What’s the Cost Basis? STEPPED UP BASIS: STEPPED DOWN BASIS:

OWNERSHIP ISSUES: FEE SIMPLE JOINT TENANTS WITH RIGHTS OF SURVIVORSHIP TOD (Transfer On Death) JOINT TENANTS IN COMMON

OWNERSHIP ISSUES: FEE SIMPLE JOINT TENANTS WITH RIGHTS OF SURVIVORSHIP TOD (Transfer On Death) JOINT TENANTS IN COMMON

WHAT’S STRETCHING? “The term ‘stretch’ refers to a method for extending the duration of traditional and Roth IRA beneficiary distributions to certain successor beneficiaries, beyond the death of an original designated beneficiary—a method especially valuable to a nonspouse beneficiary. ” Bankers Systems Retirement Plan Services January 2004

WHAT’S STRETCHING? “The term ‘stretch’ refers to a method for extending the duration of traditional and Roth IRA beneficiary distributions to certain successor beneficiaries, beyond the death of an original designated beneficiary—a method especially valuable to a nonspouse beneficiary. ” Bankers Systems Retirement Plan Services January 2004

Common Family Goals for Proceeds l Creating an Income Stream l Leaving a Legacy

Common Family Goals for Proceeds l Creating an Income Stream l Leaving a Legacy

SERVICE, SERVICE l Remember the state of mind the survivors were in during the process. l Reviewing the process and goals may be needed frequently to continue to keep everyone on same page. l Continue to provide extraordinary service until family is comfortable with new responsibilities. l Don’t forget to make sure client updates wills, trusts, titles, beneficiaries, etc.

SERVICE, SERVICE l Remember the state of mind the survivors were in during the process. l Reviewing the process and goals may be needed frequently to continue to keep everyone on same page. l Continue to provide extraordinary service until family is comfortable with new responsibilities. l Don’t forget to make sure client updates wills, trusts, titles, beneficiaries, etc.

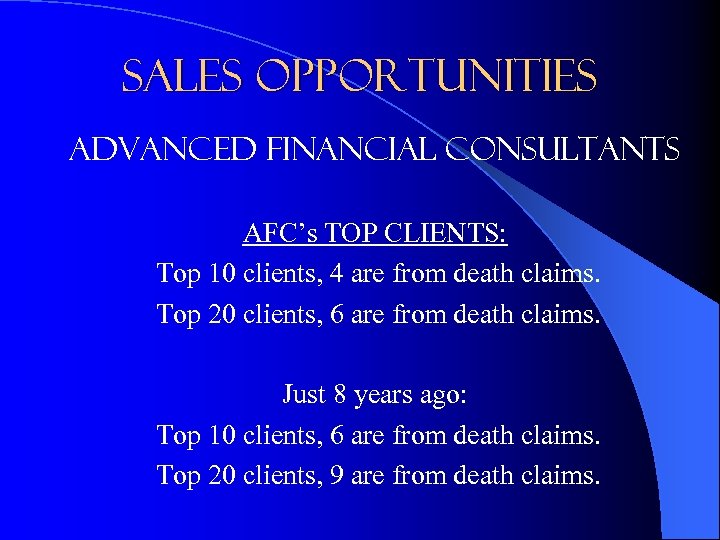

SALES OPPORTUNITIES Advanced Financial Consultants AFC’s TOP CLIENTS: Top 10 clients, 4 are from death claims. Top 20 clients, 6 are from death claims. Just 8 years ago: Top 10 clients, 6 are from death claims. Top 20 clients, 9 are from death claims.

SALES OPPORTUNITIES Advanced Financial Consultants AFC’s TOP CLIENTS: Top 10 clients, 4 are from death claims. Top 20 clients, 6 are from death claims. Just 8 years ago: Top 10 clients, 6 are from death claims. Top 20 clients, 9 are from death claims.

CASE STUDY The Facts Pete & Patty – – – – Referred friends (apprx 45 yrs old) Husband cancer with < 1 month to live 3 Joint accounts 2 Retirement accounts 2 529 accounts 2 UTMA accounts 2 Work retirement accounts Work life insurance plan

CASE STUDY The Facts Pete & Patty – – – – Referred friends (apprx 45 yrs old) Husband cancer with < 1 month to live 3 Joint accounts 2 Retirement accounts 2 529 accounts 2 UTMA accounts 2 Work retirement accounts Work life insurance plan

CASE STUDY STEPS Gather as many pertinent facts as possible - Check ownership - - Joint accounts to Individual TOD accounts Check beneficiaries - Start lists -

CASE STUDY STEPS Gather as many pertinent facts as possible - Check ownership - - Joint accounts to Individual TOD accounts Check beneficiaries - Start lists -

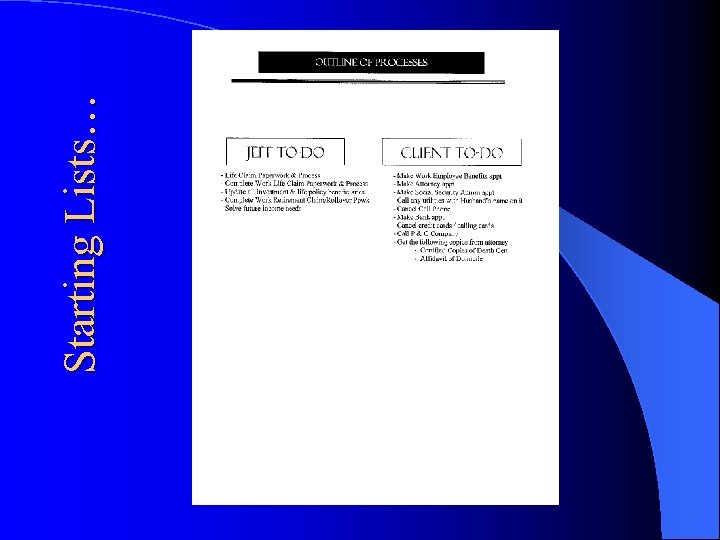

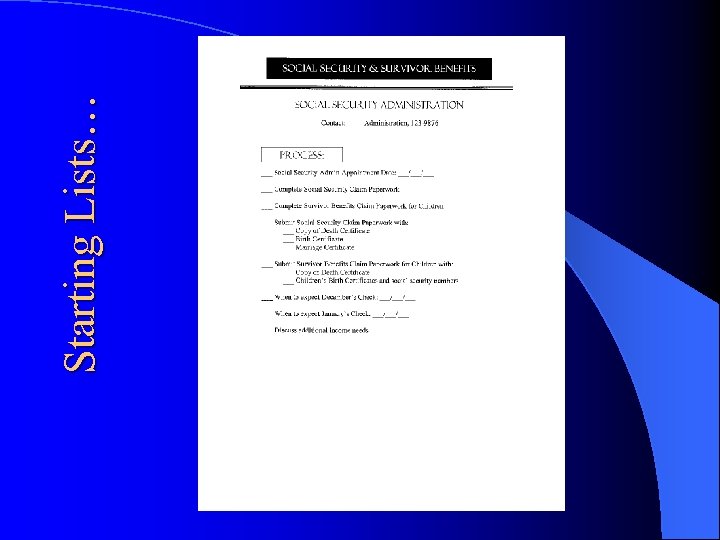

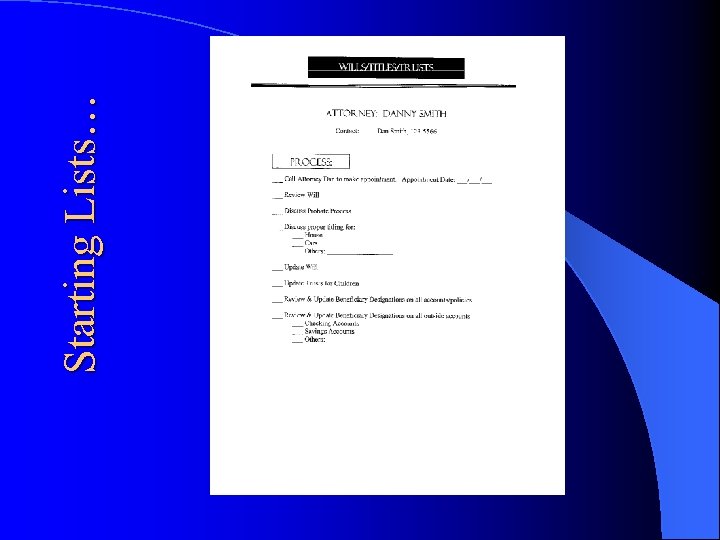

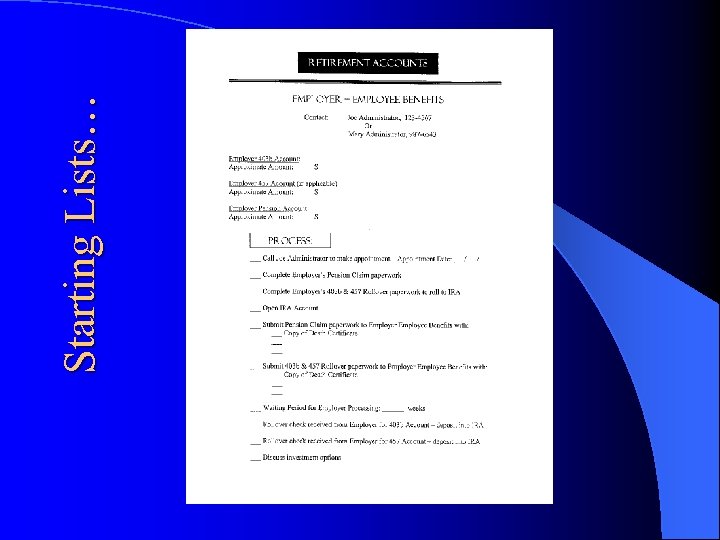

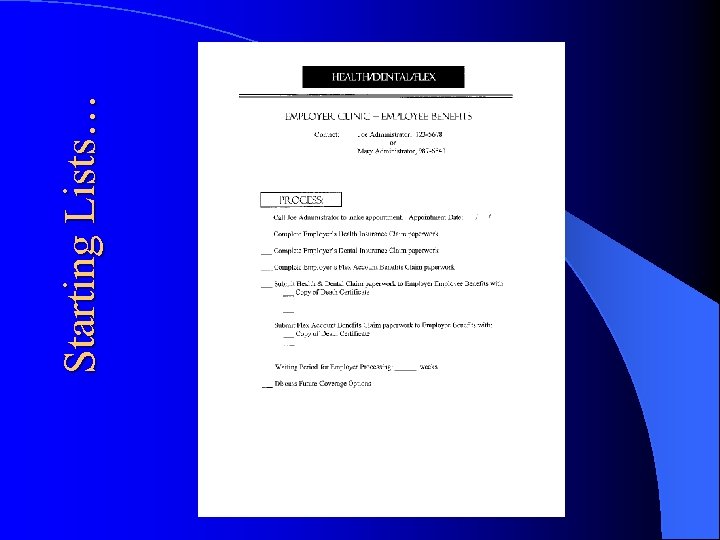

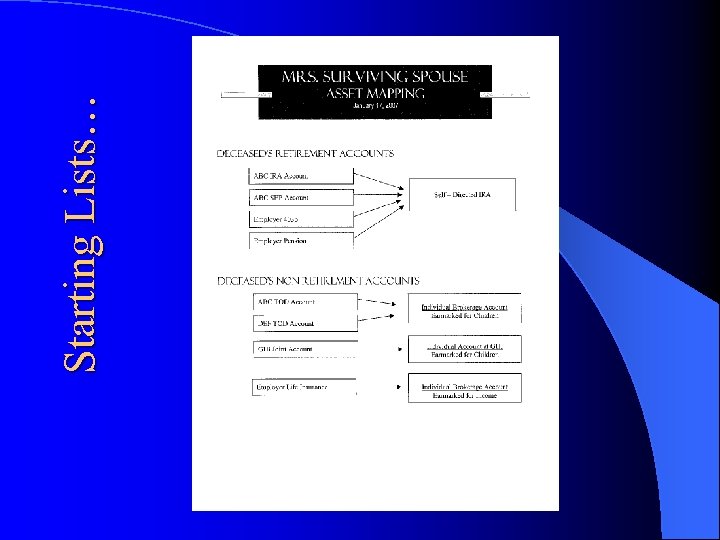

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

Starting Lists…

CASE STUDY Benefits to Client Patty - Individual TOD Accounts: Stepped up basis on 2 Joint Accounts = $ 18, 601. 23 or $2, 790 tax savings - Change Title on House

CASE STUDY Benefits to Client Patty - Individual TOD Accounts: Stepped up basis on 2 Joint Accounts = $ 18, 601. 23 or $2, 790 tax savings - Change Title on House

CASE STUDIES Opportunities Patty - Individual Account IRA Rollover Account Life Insurance on Survivor 529 Accounts $ 1, 499, 000 Assets Gathered, 1 life app

CASE STUDIES Opportunities Patty - Individual Account IRA Rollover Account Life Insurance on Survivor 529 Accounts $ 1, 499, 000 Assets Gathered, 1 life app

The more you believe, the more you will sell.

The more you believe, the more you will sell.

The more value you provide to others, the more people will come to know and respect you.

The more value you provide to others, the more people will come to know and respect you.

Most people are looking for some secret formula for success – you already have the secret within you.

Most people are looking for some secret formula for success – you already have the secret within you.

Being a person of principle means that you are self guided. And in that self guiding way you will come to inspire yourself and achieve by your own inspiration.

Being a person of principle means that you are self guided. And in that self guiding way you will come to inspire yourself and achieve by your own inspiration.

Questions Personal case studies, experiences, etc.

Questions Personal case studies, experiences, etc.

Thank you! Please call if you have any questions. Jeff Bigler, CLU, Ch. FC Advanced Financial Consultants 507 -288 -4248

Thank you! Please call if you have any questions. Jeff Bigler, CLU, Ch. FC Advanced Financial Consultants 507 -288 -4248