7a05a61dbf596ab0650216c57f313c6f.ppt

- Количество слайдов: 72

Dean’s Seminar Ned C. Hill Dean, Marriott School of Management Minneapolis, MN April 15, 2004

Dean’s Seminar Ned C. Hill Dean, Marriott School of Management Minneapolis, MN April 15, 2004

Marriott School What’s happening with: n Rankings n Student Achievements n Alumni Portals n Management Society

Marriott School What’s happening with: n Rankings n Student Achievements n Alumni Portals n Management Society

Who Beat Stanford & USC? (not to mention UCLA, Notre Dame & Virginia)

Who Beat Stanford & USC? (not to mention UCLA, Notre Dame & Virginia)

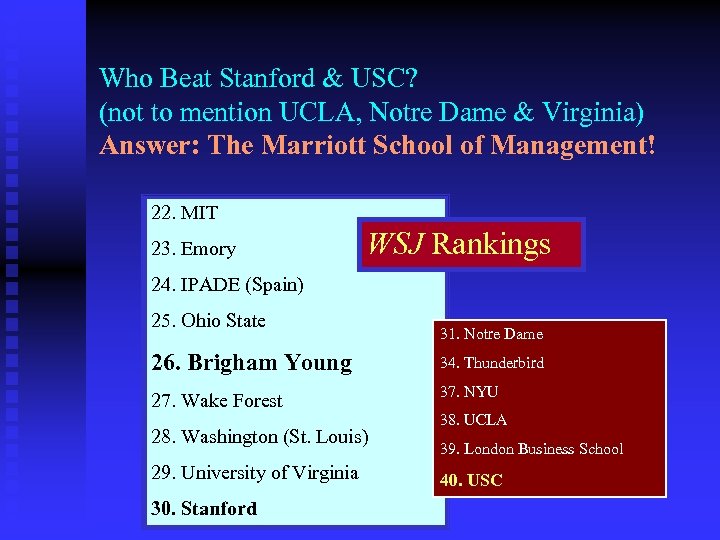

Who Beat Stanford & USC? (not to mention UCLA, Notre Dame & Virginia) Answer: The Marriott School of Management! 22. MIT 23. Emory WSJ Rankings 24. IPADE (Spain) 25. Ohio State 31. Notre Dame 26. Brigham Young 34. Thunderbird 27. Wake Forest 37. NYU 28. Washington (St. Louis) 29. University of Virginia 30. Stanford 38. UCLA 39. London Business School 40. USC

Who Beat Stanford & USC? (not to mention UCLA, Notre Dame & Virginia) Answer: The Marriott School of Management! 22. MIT 23. Emory WSJ Rankings 24. IPADE (Spain) 25. Ohio State 31. Notre Dame 26. Brigham Young 34. Thunderbird 27. Wake Forest 37. NYU 28. Washington (St. Louis) 29. University of Virginia 30. Stanford 38. UCLA 39. London Business School 40. USC

What the Wall Street Journal Said n n “Schools making the biggest advances in the ranking: Brigham Young University…” (12) “Brigham Young’s Marriott School of Management stood out for its students’ integrity in this era of corporate scandals. ‘Our recruiters return to Brigham Young year in and year out because of the school’s high ethical standards, ’ says Roger Mc. Carty, corporate strategy development leader for Dow Chemical Co. ”

What the Wall Street Journal Said n n “Schools making the biggest advances in the ranking: Brigham Young University…” (12) “Brigham Young’s Marriott School of Management stood out for its students’ integrity in this era of corporate scandals. ‘Our recruiters return to Brigham Young year in and year out because of the school’s high ethical standards, ’ says Roger Mc. Carty, corporate strategy development leader for Dow Chemical Co. ”

…continued n n n “Recruiters find that Brigham Young produces a particularly valuable type of graduate these days…the ethical accountant. ” “Brigham Young, which is sponsored by the Church of Jesus Christ of Latter-day Saints, is considered one of the best schools for hiring students with high ethical standards. ” “In addition to ethics and integrity, recruiters gave students very high marks for analytical and problem solving abilities, communication and interpersonal skills, fit with the corporate culture and team orientation. ”

…continued n n n “Recruiters find that Brigham Young produces a particularly valuable type of graduate these days…the ethical accountant. ” “Brigham Young, which is sponsored by the Church of Jesus Christ of Latter-day Saints, is considered one of the best schools for hiring students with high ethical standards. ” “In addition to ethics and integrity, recruiters gave students very high marks for analytical and problem solving abilities, communication and interpersonal skills, fit with the corporate culture and team orientation. ”

MBA Rankings n We advanced or maintained standing in ever 22 nd worldwide in Forbes (17 th in U. S. ) u 26 th worldwide in The Wall Street Journal u 29 th in U. S. News & World Report u 1 st bang for the buck in Business Week u 2 nd for Ethics in The Wall Street Journal u

MBA Rankings n We advanced or maintained standing in ever 22 nd worldwide in Forbes (17 th in U. S. ) u 26 th worldwide in The Wall Street Journal u 29 th in U. S. News & World Report u 1 st bang for the buck in Business Week u 2 nd for Ethics in The Wall Street Journal u

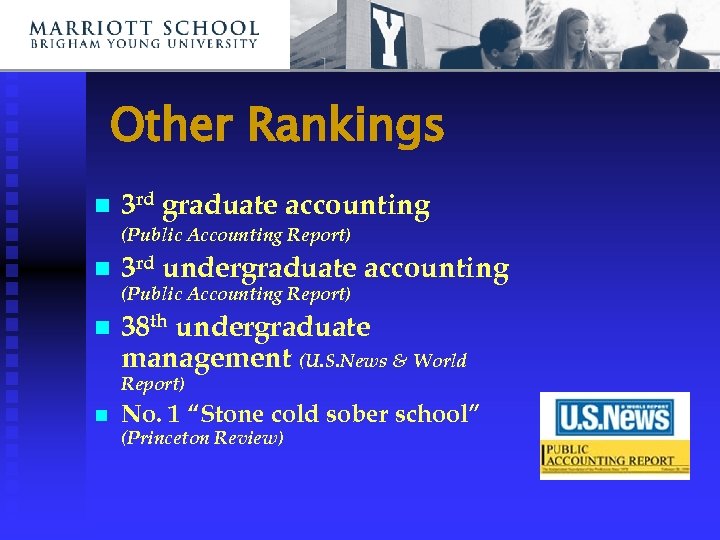

Other Rankings n 3 rd graduate accounting (Public Accounting Report) n 3 rd undergraduate accounting (Public Accounting Report) n 38 th undergraduate management (U. S. News & World Report) n No. 1 “Stone cold sober school” (Princeton Review)

Other Rankings n 3 rd graduate accounting (Public Accounting Report) n 3 rd undergraduate accounting (Public Accounting Report) n 38 th undergraduate management (U. S. News & World Report) n No. 1 “Stone cold sober school” (Princeton Review)

Student Achievements Undergraduates beat out MBA students nationwide to win Fortune Small Business Magazine’s first business plan competition. MBA team wins 2003 Thunderbird Innovation Challenge, beating 154 other teams.

Student Achievements Undergraduates beat out MBA students nationwide to win Fortune Small Business Magazine’s first business plan competition. MBA team wins 2003 Thunderbird Innovation Challenge, beating 154 other teams.

Student Achievements MBA students win the D. A. Davidson & Co. investment competition— earning a 32 percent return on their investment. Three students placed second at the Net Impact 2003 International Case Competition.

Student Achievements MBA students win the D. A. Davidson & Co. investment competition— earning a 32 percent return on their investment. Three students placed second at the Net Impact 2003 International Case Competition.

Student Achievements An information systems student placed first and another student placed third in the school’s first appearance at the National Collegiate Conference. An MPA student was the first in Utah to win an American College of Healthcare Executives Scholarship.

Student Achievements An information systems student placed first and another student placed third in the school’s first appearance at the National Collegiate Conference. An MPA student was the first in Utah to win an American College of Healthcare Executives Scholarship.

Student Achievements Marriott School MAcc team wins first place in Deloitte national auditing case competition in March against all top Accounting programs. Marriott School MBA team wins first place in U of Denver National Ethics Case competition—with invited schools known for their ethics programs.

Student Achievements Marriott School MAcc team wins first place in Deloitte national auditing case competition in March against all top Accounting programs. Marriott School MBA team wins first place in U of Denver National Ethics Case competition—with invited schools known for their ethics programs.

Student Achievements Undergraduate accounting students took first place and the graduates took second place at the Deloitte Tax Case Study Competition. This is the seventh time in the twelve-year history of the competition that both BYU teams placed among the top three —an unparalleled accomplishment.

Student Achievements Undergraduate accounting students took first place and the graduates took second place at the Deloitte Tax Case Study Competition. This is the seventh time in the twelve-year history of the competition that both BYU teams placed among the top three —an unparalleled accomplishment.

Alumni Portals • New portal service unveiled in September 2003 • Portals are customized by program and year (i. e. MBA 1996, MAcc 2001) • Alumni portals are a powerful tool to renew connections and establish new relationships

Alumni Portals • New portal service unveiled in September 2003 • Portals are customized by program and year (i. e. MBA 1996, MAcc 2001) • Alumni portals are a powerful tool to renew connections and establish new relationships

Alumni Portals Visit your alumni portal to: • • • Update your profile Access a class directory Participate in online forums Connect to the Management Society Search 40, 000 Marriott School and nearly half a million BYU alumni records Web: marriottschool. byu. edu • Click “Alumni Portals” “I believe this new tool will help our graduates really leverage their Marriott School degree. One of the benefits of going to this school is the strength of the alumni network you’re tied into. ” — Dean Ned C. Hill

Alumni Portals Visit your alumni portal to: • • • Update your profile Access a class directory Participate in online forums Connect to the Management Society Search 40, 000 Marriott School and nearly half a million BYU alumni records Web: marriottschool. byu. edu • Click “Alumni Portals” “I believe this new tool will help our graduates really leverage their Marriott School degree. One of the benefits of going to this school is the strength of the alumni network you’re tied into. ” — Dean Ned C. Hill

Management Society • Now a global organization • 40 Chapters in the U. S. • 17 International chapters • Developed central membership database • • Membership records Online dues/events payment Online calendar Communication tools • Formalized 5 -year strategic plan

Management Society • Now a global organization • 40 Chapters in the U. S. • 17 International chapters • Developed central membership database • • Membership records Online dues/events payment Online calendar Communication tools • Formalized 5 -year strategic plan

Management Society “We need the members of the BYU Management Society to help build the moral base of our communities. You have standards, ideals, and values that will not only lead you to success, but will bless and strengthen this nation and all the world. ” — Elder David B. Haight

Management Society “We need the members of the BYU Management Society to help build the moral base of our communities. You have standards, ideals, and values that will not only lead you to success, but will bless and strengthen this nation and all the world. ” — Elder David B. Haight

Questions?

Questions?

Putting Our Financial Houses in Order Ned C. Hill Dean, Marriott School of Management President, BYU 5 th Stake

Putting Our Financial Houses in Order Ned C. Hill Dean, Marriott School of Management President, BYU 5 th Stake

President Gordon B. Hinckley Priesthood Meeting, October 3 rd, 1998 n n n Story of Pharaoh’s dream of the seven fat cattle and the seven lean cattle “…I want to make it very clear that I am not prophesying, that I am not predicting years of famine in the future. But I am suggesting that the time has come to get our houses in order. There is a portent of stormy weather ahead to which we had better give heed. ” “So many of our people are living on the very edge of their incomes. In fact, some are living on borrowings. ”

President Gordon B. Hinckley Priesthood Meeting, October 3 rd, 1998 n n n Story of Pharaoh’s dream of the seven fat cattle and the seven lean cattle “…I want to make it very clear that I am not prophesying, that I am not predicting years of famine in the future. But I am suggesting that the time has come to get our houses in order. There is a portent of stormy weather ahead to which we had better give heed. ” “So many of our people are living on the very edge of their incomes. In fact, some are living on borrowings. ”

President Gordon B. Hinckley (cont. ) n n “I urge you, brethren, to look to the condition of your finances. ” “I urge you to be modest in your expenditures; discipline yourselves in your purchases to avoid debt to the extent possible. ” “Pay off debt as quickly as you can, and free yourselves from bondage. ” “That’s all I have to say about it, but I wish to say it with all the emphasis of which I am capable. ”

President Gordon B. Hinckley (cont. ) n n “I urge you, brethren, to look to the condition of your finances. ” “I urge you to be modest in your expenditures; discipline yourselves in your purchases to avoid debt to the extent possible. ” “Pay off debt as quickly as you can, and free yourselves from bondage. ” “That’s all I have to say about it, but I wish to say it with all the emphasis of which I am capable. ”

President Gordon B. Hinckley n n n General Conference, October 7 th, 2001 “The economy is particularly vulnerable. We have been counseled again and again concerning selfreliance, concerning debt, concerning thrift. So many of our people are heavily in debt for things that are not entirely necessary. ” “I urge you as members of this Church to get free of debt where possible and to have a little laid aside against a rainy day. ” “But there is no need to fear. We can have peace in our hearts and peace in our homes. ”

President Gordon B. Hinckley n n n General Conference, October 7 th, 2001 “The economy is particularly vulnerable. We have been counseled again and again concerning selfreliance, concerning debt, concerning thrift. So many of our people are heavily in debt for things that are not entirely necessary. ” “I urge you as members of this Church to get free of debt where possible and to have a little laid aside against a rainy day. ” “But there is no need to fear. We can have peace in our hearts and peace in our homes. ”

Elder Joseph B. Wirthlin April Conference, 2004 n n “Remember this: debt is a form of bondage. It is a financial termite. When we make purchases on credit, they give us only an illusion of prosperity. We think we own things, but the reality is, our things own us. ” “Some debt—such as for a modest home, expenses for education, perhaps for a needed first car—may be necessary. But never should we enter into financial bondage through consumer debt without carefully weighing the costs. ”

Elder Joseph B. Wirthlin April Conference, 2004 n n “Remember this: debt is a form of bondage. It is a financial termite. When we make purchases on credit, they give us only an illusion of prosperity. We think we own things, but the reality is, our things own us. ” “Some debt—such as for a modest home, expenses for education, perhaps for a needed first car—may be necessary. But never should we enter into financial bondage through consumer debt without carefully weighing the costs. ”

Other Counsel on Debt n n Revelation to Martin Harris: “Pay the debt thou hast contracted with the printer. Release thyself from bondage. ” (D&C 19: 35) Heber J. Grant: “If there is any one thing that will bring peace and contentment into the human heart, and into the family, it is to live within our means. And if there is any one thing that is grinding and discouraging and disheartening, it is to have debts and obligations that one cannot meet. ”

Other Counsel on Debt n n Revelation to Martin Harris: “Pay the debt thou hast contracted with the printer. Release thyself from bondage. ” (D&C 19: 35) Heber J. Grant: “If there is any one thing that will bring peace and contentment into the human heart, and into the family, it is to live within our means. And if there is any one thing that is grinding and discouraging and disheartening, it is to have debts and obligations that one cannot meet. ”

Some Facts about Credit Cards Average household has 8 credit cards n 65% of card holders do not pay off total balance each month n Why so much credit card debt? n u Good times = confidence = overspending u Lots of money and it needs a place to go

Some Facts about Credit Cards Average household has 8 credit cards n 65% of card holders do not pay off total balance each month n Why so much credit card debt? n u Good times = confidence = overspending u Lots of money and it needs a place to go

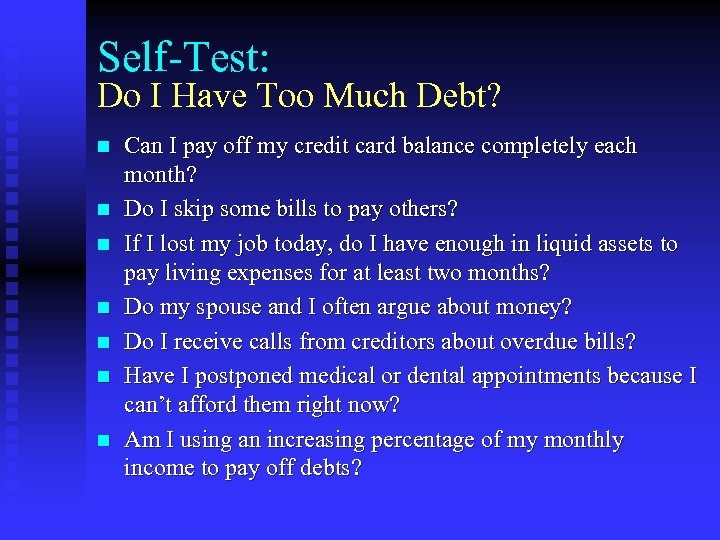

Self-Test: Do I Have Too Much Debt? n n n n Can I pay off my credit card balance completely each month? Do I skip some bills to pay others? If I lost my job today, do I have enough in liquid assets to pay living expenses for at least two months? Do my spouse and I often argue about money? Do I receive calls from creditors about overdue bills? Have I postponed medical or dental appointments because I can’t afford them right now? Am I using an increasing percentage of my monthly income to pay off debts?

Self-Test: Do I Have Too Much Debt? n n n n Can I pay off my credit card balance completely each month? Do I skip some bills to pay others? If I lost my job today, do I have enough in liquid assets to pay living expenses for at least two months? Do my spouse and I often argue about money? Do I receive calls from creditors about overdue bills? Have I postponed medical or dental appointments because I can’t afford them right now? Am I using an increasing percentage of my monthly income to pay off debts?

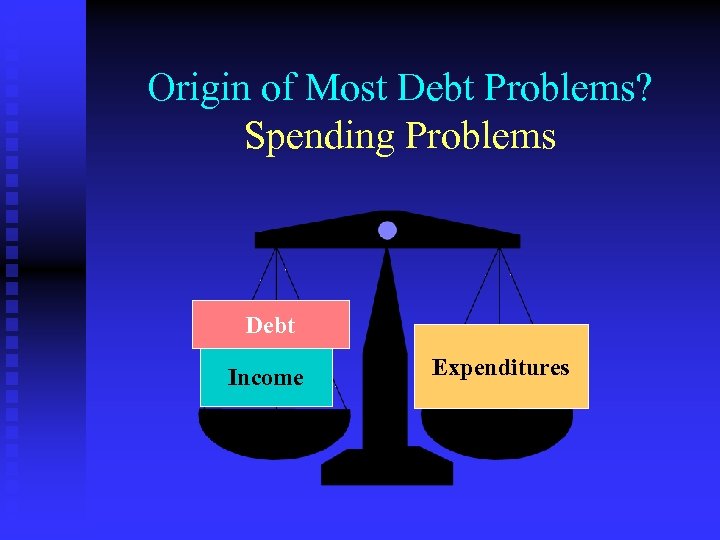

Origin of Most Debt Problems? Spending Problems Debt Income Expenditures

Origin of Most Debt Problems? Spending Problems Debt Income Expenditures

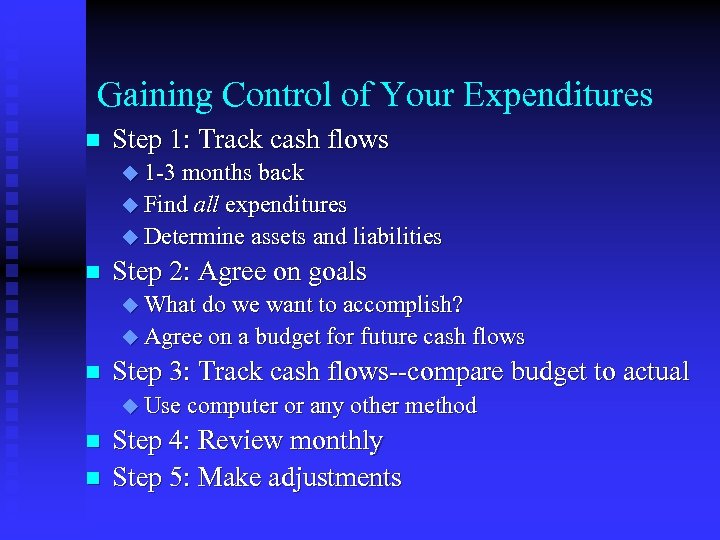

Gaining Control of Your Expenditures n Step 1: Track cash flows u 1 -3 months back u Find all expenditures u Determine assets and liabilities n Step 2: Agree on goals u What do we want to accomplish? u Agree on a budget for future cash flows n Step 3: Track cash flows--compare budget to actual u Use computer or any other method n n Step 4: Review monthly Step 5: Make adjustments

Gaining Control of Your Expenditures n Step 1: Track cash flows u 1 -3 months back u Find all expenditures u Determine assets and liabilities n Step 2: Agree on goals u What do we want to accomplish? u Agree on a budget for future cash flows n Step 3: Track cash flows--compare budget to actual u Use computer or any other method n n Step 4: Review monthly Step 5: Make adjustments

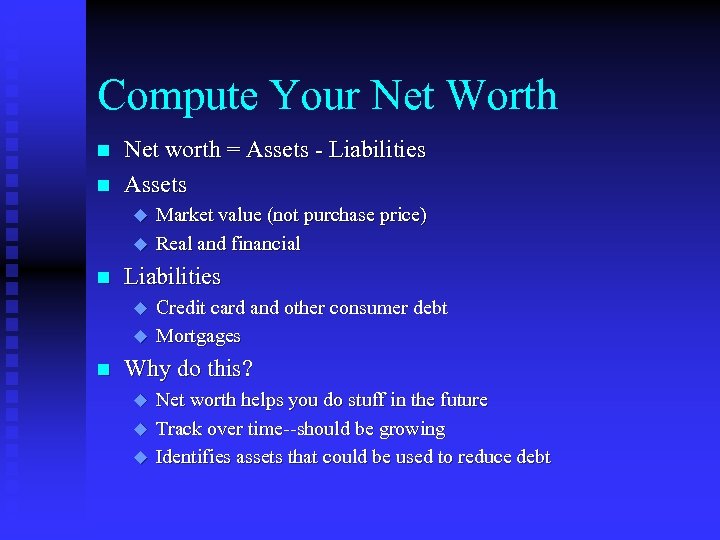

Compute Your Net Worth n n Net worth = Assets - Liabilities Assets u u n Liabilities u u n Market value (not purchase price) Real and financial Credit card and other consumer debt Mortgages Why do this? u u u Net worth helps you do stuff in the future Track over time--should be growing Identifies assets that could be used to reduce debt

Compute Your Net Worth n n Net worth = Assets - Liabilities Assets u u n Liabilities u u n Market value (not purchase price) Real and financial Credit card and other consumer debt Mortgages Why do this? u u u Net worth helps you do stuff in the future Track over time--should be growing Identifies assets that could be used to reduce debt

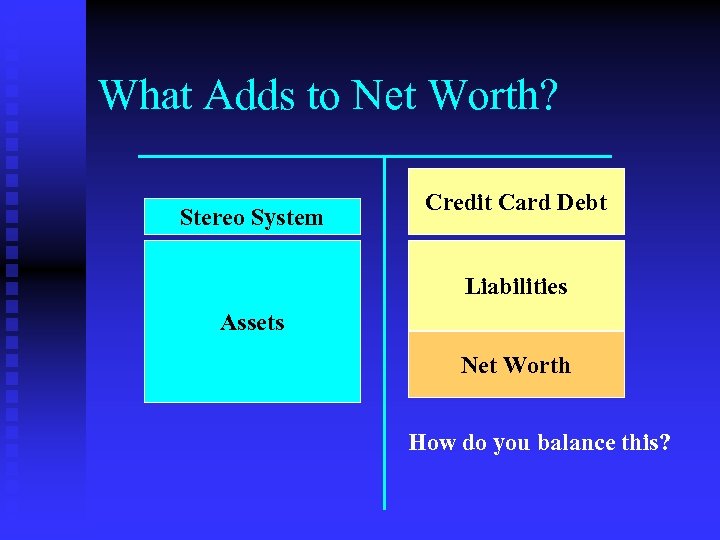

What Adds to Net Worth? Stereo System Credit Card Debt Liabilities Assets Net Worth How do you balance this?

What Adds to Net Worth? Stereo System Credit Card Debt Liabilities Assets Net Worth How do you balance this?

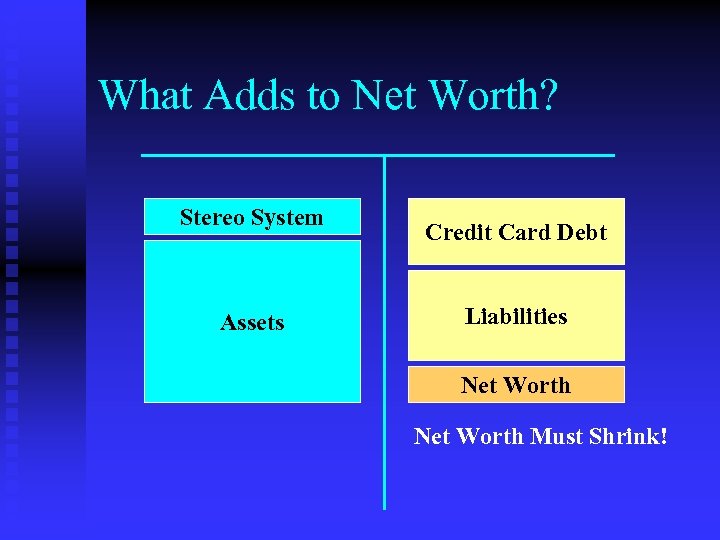

What Adds to Net Worth? Stereo System Assets Credit Card Debt Liabilities Net Worth Must Shrink!

What Adds to Net Worth? Stereo System Assets Credit Card Debt Liabilities Net Worth Must Shrink!

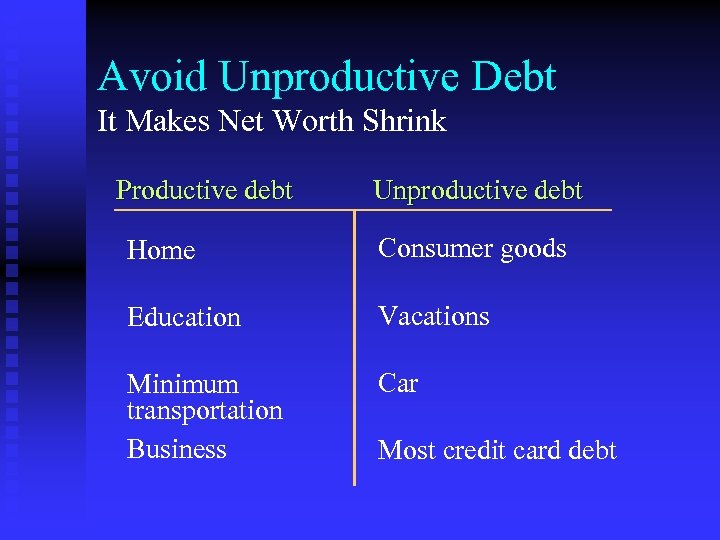

Avoid Unproductive Debt It Makes Net Worth Shrink Productive debt Unproductive debt Home Consumer goods Education Vacations Minimum transportation Business Car Most credit card debt

Avoid Unproductive Debt It Makes Net Worth Shrink Productive debt Unproductive debt Home Consumer goods Education Vacations Minimum transportation Business Car Most credit card debt

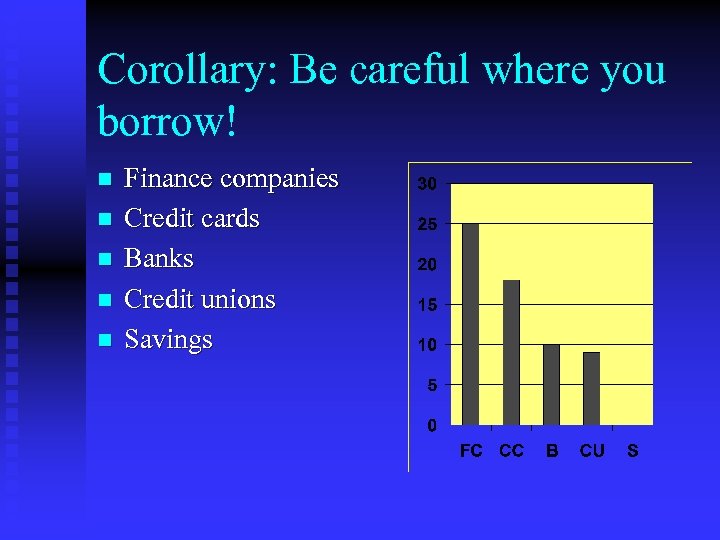

Corollary: Be careful where you borrow! n n n Finance companies Credit cards Banks Credit unions Savings

Corollary: Be careful where you borrow! n n n Finance companies Credit cards Banks Credit unions Savings

Reducing Unproductive Debt Plastic surgery n Reduce spending n Use assets to pay off debt n Reduce interest rate n u Consider a home equity loan u Use another lower cost source of borrowing Make a plan -- stick to it n Talk to a credit counselor if needed n

Reducing Unproductive Debt Plastic surgery n Reduce spending n Use assets to pay off debt n Reduce interest rate n u Consider a home equity loan u Use another lower cost source of borrowing Make a plan -- stick to it n Talk to a credit counselor if needed n

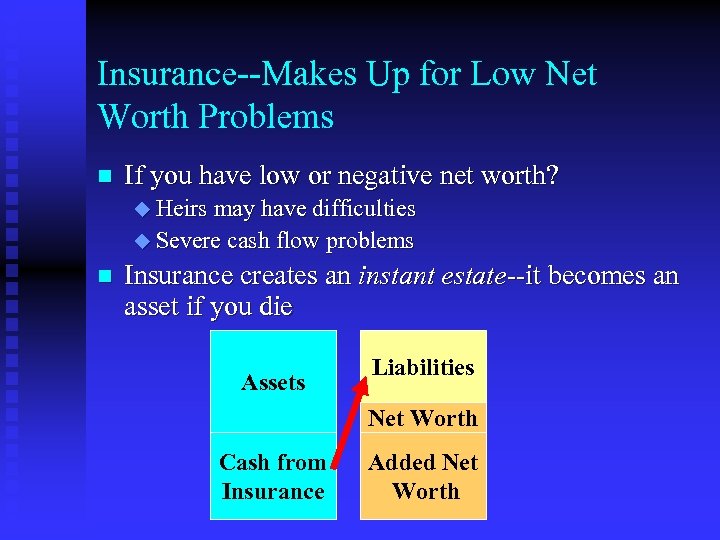

Insurance--Makes Up for Low Net Worth Problems n If you have low or negative net worth? u Heirs may have difficulties u Severe cash flow problems n Insurance creates an instant estate--it becomes an asset if you die Assets Liabilities Net Worth Cash from Insurance Added Net Worth

Insurance--Makes Up for Low Net Worth Problems n If you have low or negative net worth? u Heirs may have difficulties u Severe cash flow problems n Insurance creates an instant estate--it becomes an asset if you die Assets Liabilities Net Worth Cash from Insurance Added Net Worth

Goals of Estate Planning 1. Live life fully u Provide for self & spouse u Provide for others without spoiling them u Provide for own possible incompetence 2. Pass property according to desires u Provide for administration (who does the work) u Provide dispositive scheme (who gets what)

Goals of Estate Planning 1. Live life fully u Provide for self & spouse u Provide for others without spoiling them u Provide for own possible incompetence 2. Pass property according to desires u Provide for administration (who does the work) u Provide dispositive scheme (who gets what)

Goals of Estate Planning, Cont. 3. Provide for guardianship & conservatorship of minor children 4. Avoid probate if desired or use probate strategically 5. Decrease or eliminate taxes u Income tax (capital gains basis problems) u Gift & estate tax

Goals of Estate Planning, Cont. 3. Provide for guardianship & conservatorship of minor children 4. Avoid probate if desired or use probate strategically 5. Decrease or eliminate taxes u Income tax (capital gains basis problems) u Gift & estate tax

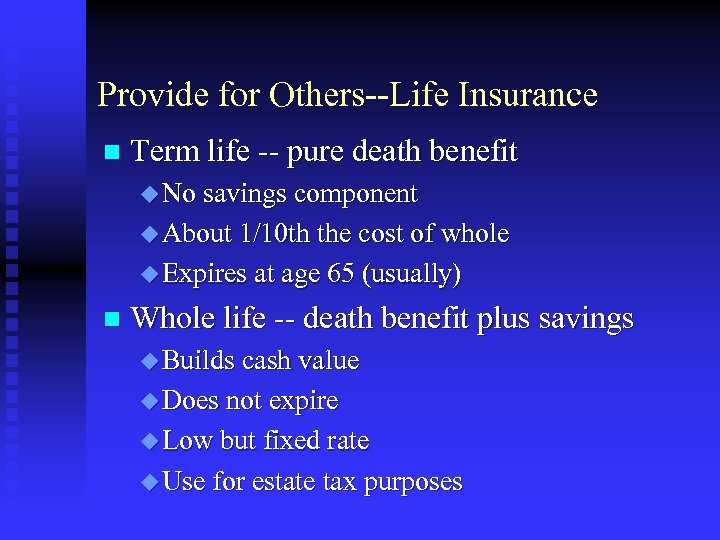

Provide for Others--Life Insurance n Term life -- pure death benefit u No savings component u About 1/10 th the cost of whole u Expires at age 65 (usually) n Whole life -- death benefit plus savings u Builds cash value u Does not expire u Low but fixed rate u Use for estate tax purposes

Provide for Others--Life Insurance n Term life -- pure death benefit u No savings component u About 1/10 th the cost of whole u Expires at age 65 (usually) n Whole life -- death benefit plus savings u Builds cash value u Does not expire u Low but fixed rate u Use for estate tax purposes

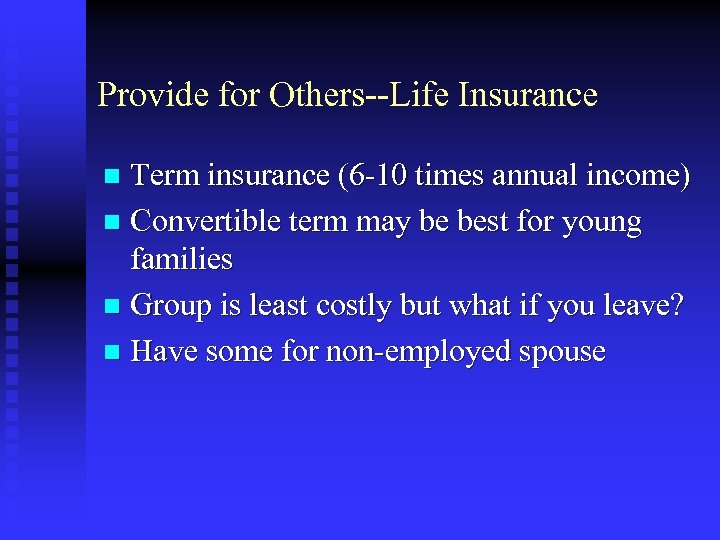

Provide for Others--Life Insurance Term insurance (6 -10 times annual income) n Convertible term may be best for young families n Group is least costly but what if you leave? n Have some for non-employed spouse n

Provide for Others--Life Insurance Term insurance (6 -10 times annual income) n Convertible term may be best for young families n Group is least costly but what if you leave? n Have some for non-employed spouse n

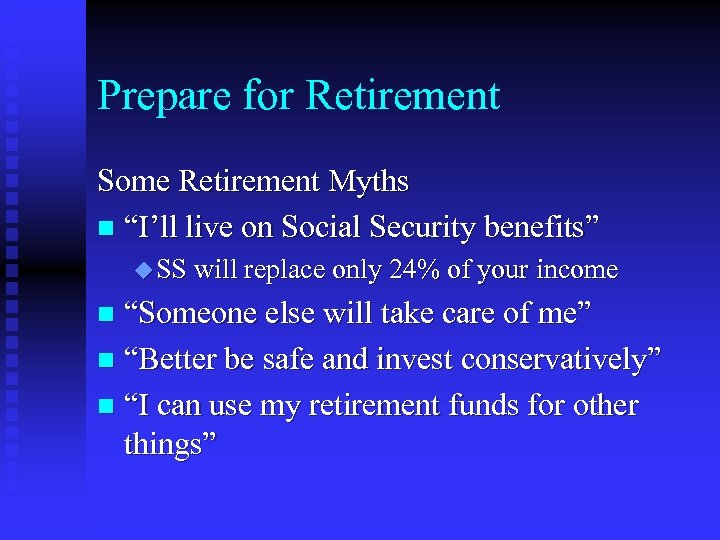

Prepare for Retirement Some Retirement Myths n “I’ll live on Social Security benefits” u SS will replace only 24% of your income “Someone else will take care of me” n “Better be safe and invest conservatively” n “I can use my retirement funds for other things” n

Prepare for Retirement Some Retirement Myths n “I’ll live on Social Security benefits” u SS will replace only 24% of your income “Someone else will take care of me” n “Better be safe and invest conservatively” n “I can use my retirement funds for other things” n

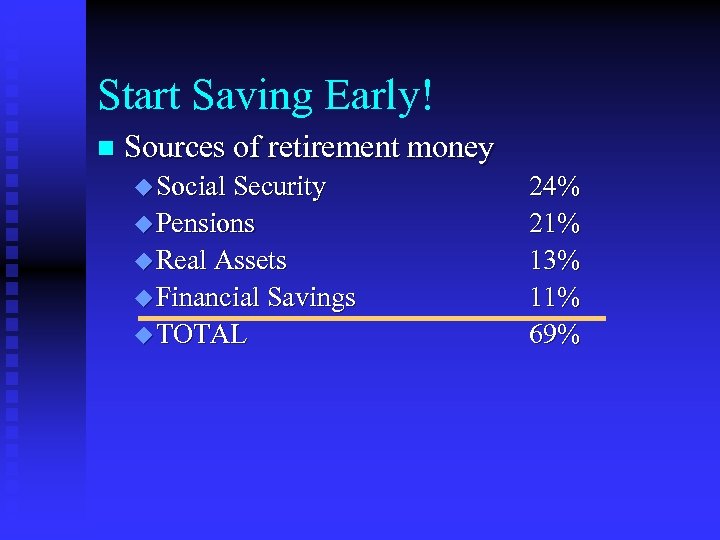

Start Saving Early! n Sources of retirement money u Social Security u Pensions u Real Assets u Financial Savings u TOTAL 24% 21% 13% 11% 69%

Start Saving Early! n Sources of retirement money u Social Security u Pensions u Real Assets u Financial Savings u TOTAL 24% 21% 13% 11% 69%

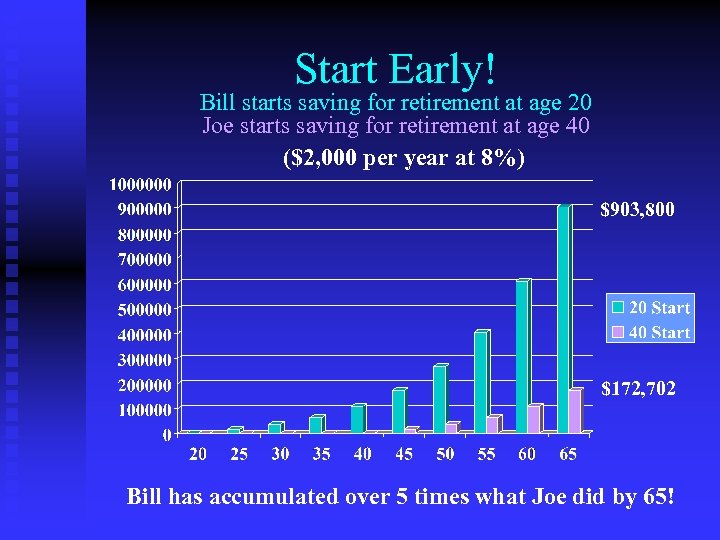

Start Early! Bill starts saving for retirement at age 20 Joe starts saving for retirement at age 40 ($2, 000 per year at 8%) $903, 800 $172, 702 Bill has accumulated over 5 times what Joe did by 65!

Start Early! Bill starts saving for retirement at age 20 Joe starts saving for retirement at age 40 ($2, 000 per year at 8%) $903, 800 $172, 702 Bill has accumulated over 5 times what Joe did by 65!

How Does This Work? Compound interest n Bill started earlier--compound interest has more time to work its miracle n If someone had put $1 in an account back in 1776 at 8% interest how much would the account have in it today? n $30, 685, 000 !!

How Does This Work? Compound interest n Bill started earlier--compound interest has more time to work its miracle n If someone had put $1 in an account back in 1776 at 8% interest how much would the account have in it today? n $30, 685, 000 !!

How Much Will I Need in Retirement? Money Magazine Survey Estimates: 53% Actual: 71% n One third of retirees support children and grandchildren n Health care costs generally higher n Biggest regrets for retirees: n u Didn’t take full advantage of tax deferred investments u Didn’t start earlier to save for retirement

How Much Will I Need in Retirement? Money Magazine Survey Estimates: 53% Actual: 71% n One third of retirees support children and grandchildren n Health care costs generally higher n Biggest regrets for retirees: n u Didn’t take full advantage of tax deferred investments u Didn’t start earlier to save for retirement

Life Cycle Savings (000’s) Save 20% Retirement Save 10% Borrowing To heirs Age

Life Cycle Savings (000’s) Save 20% Retirement Save 10% Borrowing To heirs Age

What Should I Invest In? n Principle: risk-return trade-off u High risk--high return u Low risk--low return n What? u Stocks -- ownership in a company (risky) u Bonds -- loan to a company/government (less risky) u Deposit accounts -- (insured, no risk) n How? u Mutual funds u Tax-advantaged investing

What Should I Invest In? n Principle: risk-return trade-off u High risk--high return u Low risk--low return n What? u Stocks -- ownership in a company (risky) u Bonds -- loan to a company/government (less risky) u Deposit accounts -- (insured, no risk) n How? u Mutual funds u Tax-advantaged investing

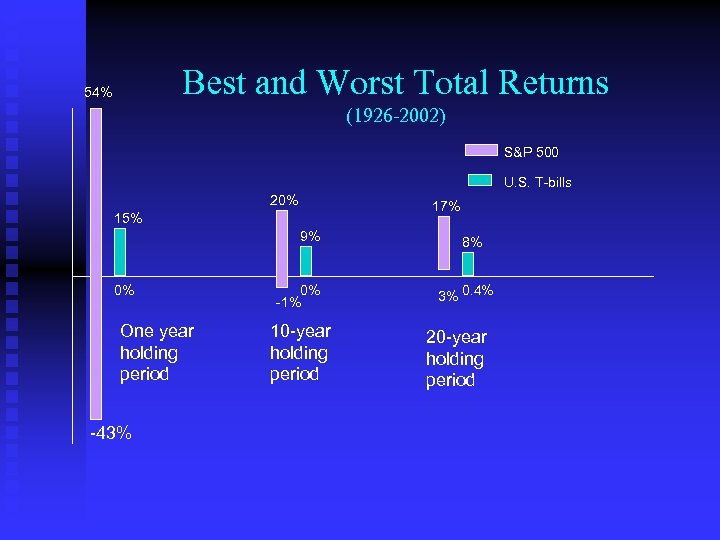

Best and Worst Total Returns 54% (1926 -2002) S&P 500 U. S. T-bills 20% 17% 15% 9% 0% One year holding period -43% 0% -1% 10 -year holding period 8% 3% 0. 4% 20 -year holding period

Best and Worst Total Returns 54% (1926 -2002) S&P 500 U. S. T-bills 20% 17% 15% 9% 0% One year holding period -43% 0% -1% 10 -year holding period 8% 3% 0. 4% 20 -year holding period

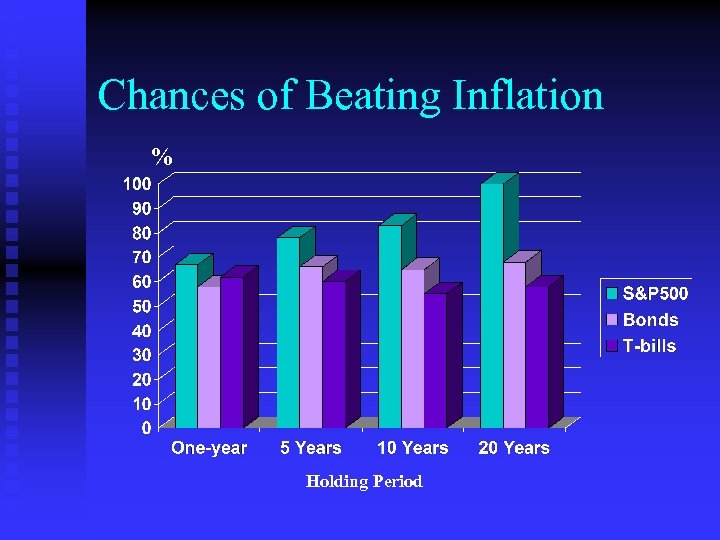

Chances of Beating Inflation % Holding Period

Chances of Beating Inflation % Holding Period

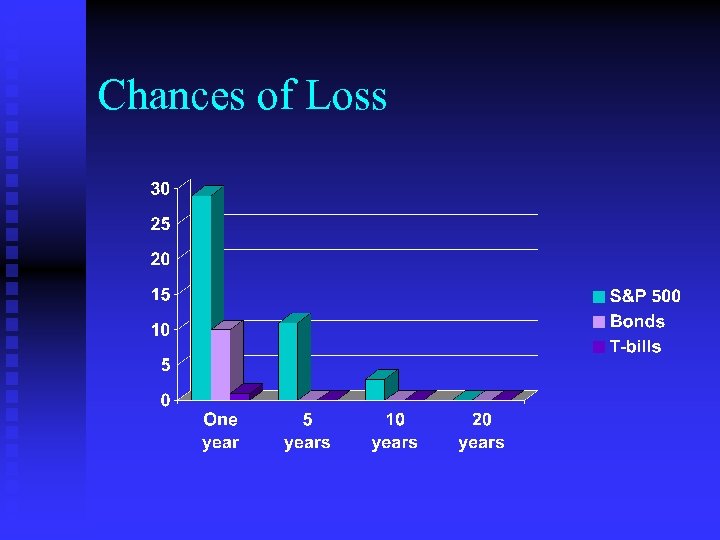

Chances of Loss

Chances of Loss

Corollary 1: n n When investing for a short period (5 years or less), put your money in less risky investments like savings accounts and bonds. When investing for a longer period (10 -20 or more years), put your money in stocks.

Corollary 1: n n When investing for a short period (5 years or less), put your money in less risky investments like savings accounts and bonds. When investing for a longer period (10 -20 or more years), put your money in stocks.

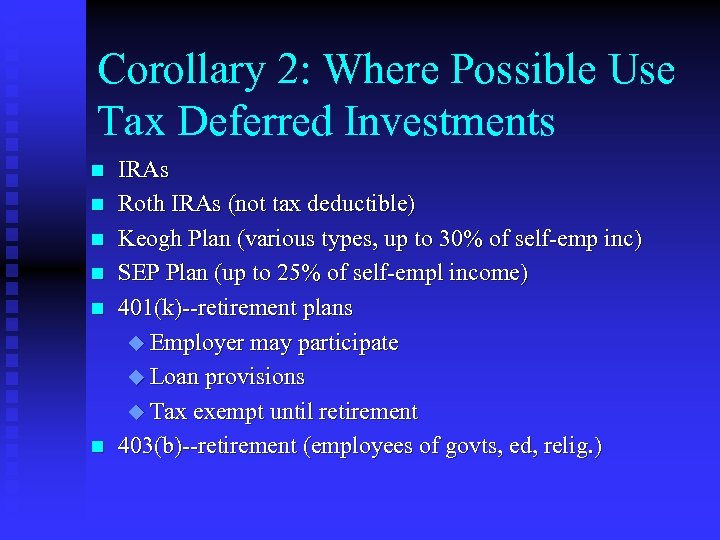

Corollary 2: Where Possible Use Tax Deferred Investments n n n IRAs Roth IRAs (not tax deductible) Keogh Plan (various types, up to 30% of self-emp inc) SEP Plan (up to 25% of self-empl income) 401(k)--retirement plans u Employer may participate u Loan provisions u Tax exempt until retirement 403(b)--retirement (employees of govts, ed, relig. )

Corollary 2: Where Possible Use Tax Deferred Investments n n n IRAs Roth IRAs (not tax deductible) Keogh Plan (various types, up to 30% of self-emp inc) SEP Plan (up to 25% of self-empl income) 401(k)--retirement plans u Employer may participate u Loan provisions u Tax exempt until retirement 403(b)--retirement (employees of govts, ed, relig. )

What’s a Tax-advantaged Investment? Say you make $10, 000 n You put $1, 000 in a 401 k n u Money goes into stock, bonds—wherever you want u You leave it there until you retire n n n You are taxed on $9, 000—not $10, 000 The $1, 000 grows for many years You DO pay taxes when you take out the ($1, 000 + the increase)

What’s a Tax-advantaged Investment? Say you make $10, 000 n You put $1, 000 in a 401 k n u Money goes into stock, bonds—wherever you want u You leave it there until you retire n n n You are taxed on $9, 000—not $10, 000 The $1, 000 grows for many years You DO pay taxes when you take out the ($1, 000 + the increase)

Corollary 3: Diversify! Never put all or even most of your eggs in one basket n Use mutual funds n

Corollary 3: Diversify! Never put all or even most of your eggs in one basket n Use mutual funds n

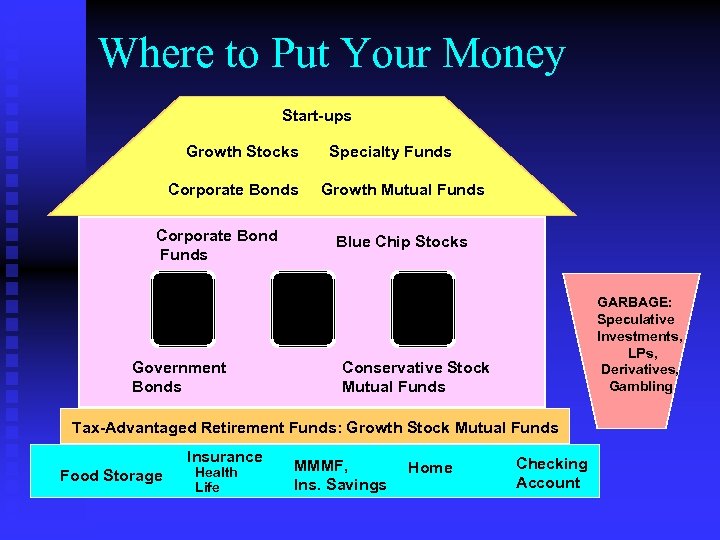

Where to Put Your Money Start-ups Growth Stocks Corporate Bond Funds Government Bonds Specialty Funds Growth Mutual Funds Blue Chip Stocks GARBAGE: Speculative Investments, LPs, Derivatives, Gambling Conservative Stock Mutual Funds Tax-Advantaged Retirement Funds: Growth Stock Mutual Funds Insurance Food Storage Health Life MMMF, Ins. Savings Home Checking Account

Where to Put Your Money Start-ups Growth Stocks Corporate Bond Funds Government Bonds Specialty Funds Growth Mutual Funds Blue Chip Stocks GARBAGE: Speculative Investments, LPs, Derivatives, Gambling Conservative Stock Mutual Funds Tax-Advantaged Retirement Funds: Growth Stock Mutual Funds Insurance Food Storage Health Life MMMF, Ins. Savings Home Checking Account

Stay away from “get rich quick” schemes n n Some investment seminars! $1. 00 per box cereal scam Telephone scams Pyramid schemes u “Make $3 each stuffing envelopes in your own home!”

Stay away from “get rich quick” schemes n n Some investment seminars! $1. 00 per box cereal scam Telephone scams Pyramid schemes u “Make $3 each stuffing envelopes in your own home!”

How to Recognize Them n Is promised return unusually high? u Remember the risk-return trade-off Is product significantly above or below reasonable market price? n Does sale require pressure tactics? n Does seller emphasize BYU or Church connections? n Is most of the product purchased by end users or by other distributors? n

How to Recognize Them n Is promised return unusually high? u Remember the risk-return trade-off Is product significantly above or below reasonable market price? n Does sale require pressure tactics? n Does seller emphasize BYU or Church connections? n Is most of the product purchased by end users or by other distributors? n

Read a Good Personal Finance Book n n n Tyson, Personal Finance for Dummies, 3 rd Edition Engel and Hecht, How to Buy Stocks, 8 th Edition Lynch and Rothchild, Learn to Earn Jane Bryant Quinn, Making the Most of Your Money Stanley and Danko, The Millionaire Next Door

Read a Good Personal Finance Book n n n Tyson, Personal Finance for Dummies, 3 rd Edition Engel and Hecht, How to Buy Stocks, 8 th Edition Lynch and Rothchild, Learn to Earn Jane Bryant Quinn, Making the Most of Your Money Stanley and Danko, The Millionaire Next Door

Learn about Your Own Finances n n n Organize and know how to read your financial documents (insurance, retirement, bank and investment statements) Create financial reports for your family (assets and liabilities) Know your monthly cash inflows and outflows Use the Web for financial information Develop a plan

Learn about Your Own Finances n n n Organize and know how to read your financial documents (insurance, retirement, bank and investment statements) Create financial reports for your family (assets and liabilities) Know your monthly cash inflows and outflows Use the Web for financial information Develop a plan

Excel Mone y Man Internet Qu ic ken Y aho ager Computerize your Finances !Fi o nce na Tur bo. T ax Personal Branch

Excel Mone y Man Internet Qu ic ken Y aho ager Computerize your Finances !Fi o nce na Tur bo. T ax Personal Branch

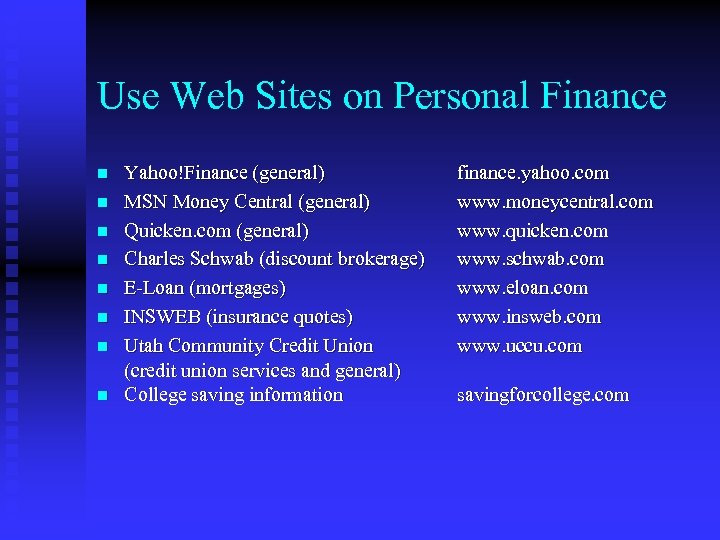

Use Web Sites on Personal Finance n n n n Yahoo!Finance (general) MSN Money Central (general) Quicken. com (general) Charles Schwab (discount brokerage) E-Loan (mortgages) INSWEB (insurance quotes) Utah Community Credit Union (credit union services and general) College saving information finance. yahoo. com www. moneycentral. com www. quicken. com www. schwab. com www. eloan. com www. insweb. com www. uccu. com savingforcollege. com

Use Web Sites on Personal Finance n n n n Yahoo!Finance (general) MSN Money Central (general) Quicken. com (general) Charles Schwab (discount brokerage) E-Loan (mortgages) INSWEB (insurance quotes) Utah Community Credit Union (credit union services and general) College saving information finance. yahoo. com www. moneycentral. com www. quicken. com www. schwab. com www. eloan. com www. insweb. com www. uccu. com savingforcollege. com

Conclusions Be very careful about debt: avoid it where possible n Wise financial management empowers you to serve more capably: family, community, church n Spend the time to acquire a basic understanding of personal finance n Surely we will be held accountable for how we manage our resources n

Conclusions Be very careful about debt: avoid it where possible n Wise financial management empowers you to serve more capably: family, community, church n Spend the time to acquire a basic understanding of personal finance n Surely we will be held accountable for how we manage our resources n

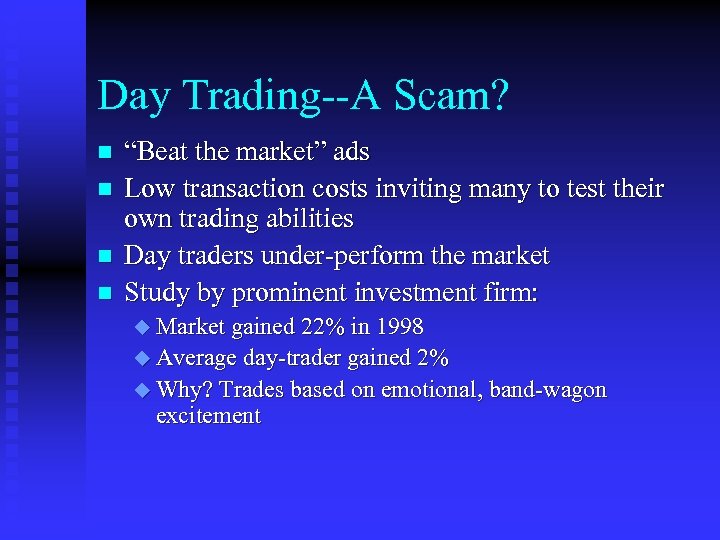

Day Trading--A Scam? n n “Beat the market” ads Low transaction costs inviting many to test their own trading abilities Day traders under-perform the market Study by prominent investment firm: u Market gained 22% in 1998 u Average day-trader gained 2% u Why? Trades based on emotional, band-wagon excitement

Day Trading--A Scam? n n “Beat the market” ads Low transaction costs inviting many to test their own trading abilities Day traders under-perform the market Study by prominent investment firm: u Market gained 22% in 1998 u Average day-trader gained 2% u Why? Trades based on emotional, band-wagon excitement

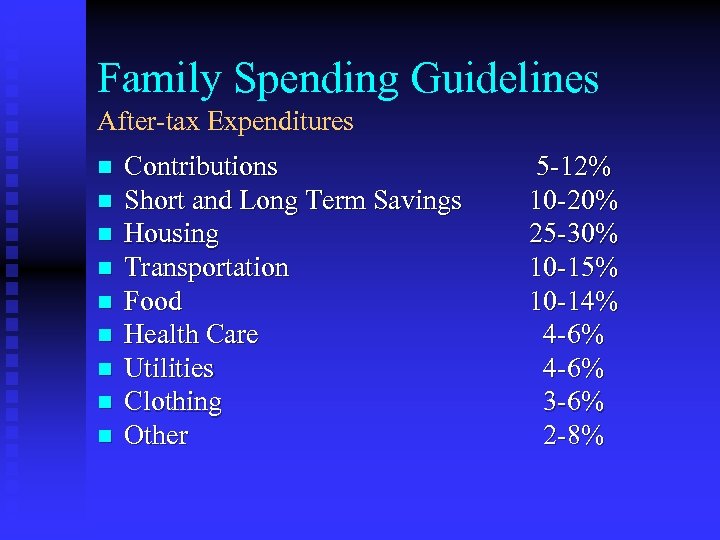

Family Spending Guidelines After-tax Expenditures n n n n n Contributions Short and Long Term Savings Housing Transportation Food Health Care Utilities Clothing Other 5 -12% 10 -20% 25 -30% 10 -15% 10 -14% 4 -6% 3 -6% 2 -8%

Family Spending Guidelines After-tax Expenditures n n n n n Contributions Short and Long Term Savings Housing Transportation Food Health Care Utilities Clothing Other 5 -12% 10 -20% 25 -30% 10 -15% 10 -14% 4 -6% 3 -6% 2 -8%

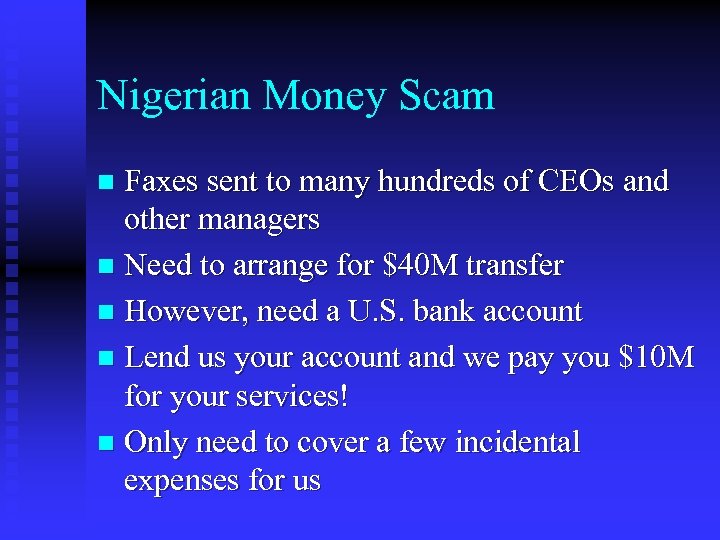

Nigerian Money Scam Faxes sent to many hundreds of CEOs and other managers n Need to arrange for $40 M transfer n However, need a U. S. bank account n Lend us your account and we pay you $10 M for your services! n Only need to cover a few incidental expenses for us n

Nigerian Money Scam Faxes sent to many hundreds of CEOs and other managers n Need to arrange for $40 M transfer n However, need a U. S. bank account n Lend us your account and we pay you $10 M for your services! n Only need to cover a few incidental expenses for us n

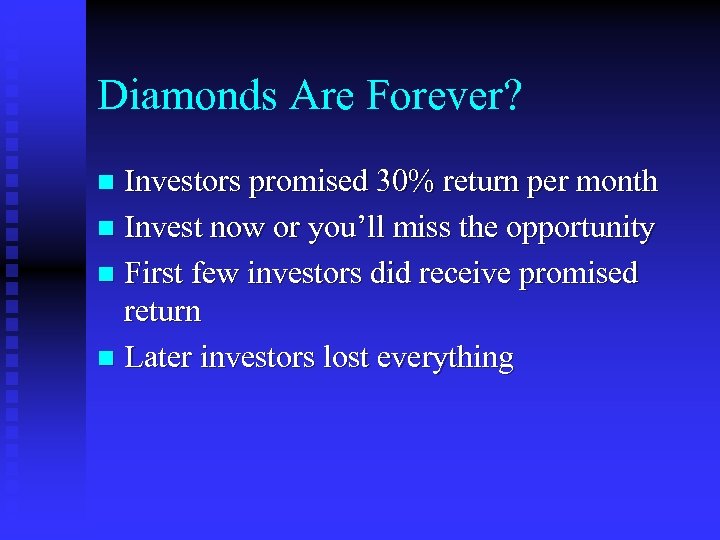

Diamonds Are Forever? Investors promised 30% return per month n Invest now or you’ll miss the opportunity n First few investors did receive promised return n Later investors lost everything n

Diamonds Are Forever? Investors promised 30% return per month n Invest now or you’ll miss the opportunity n First few investors did receive promised return n Later investors lost everything n

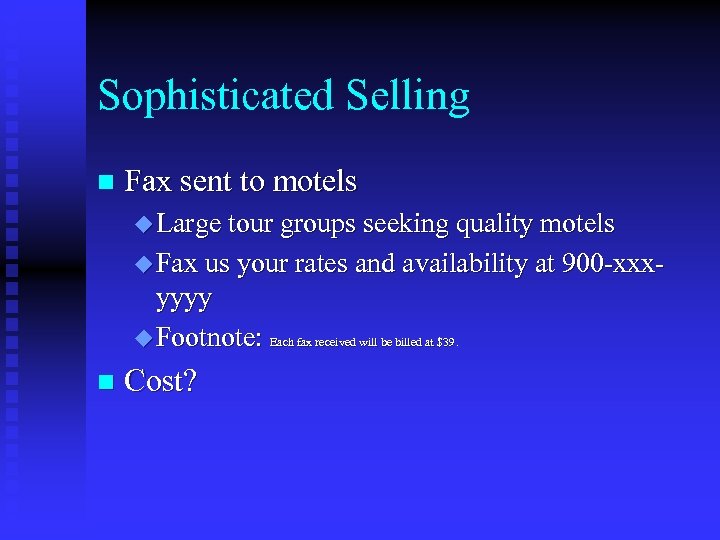

Sophisticated Selling n Fax sent to motels u Large tour groups seeking quality motels u Fax us your rates and availability at 900 -xxx- yyyy u Footnote: Each fax received will be billed at $39 n Cost? .

Sophisticated Selling n Fax sent to motels u Large tour groups seeking quality motels u Fax us your rates and availability at 900 -xxx- yyyy u Footnote: Each fax received will be billed at $39 n Cost? .

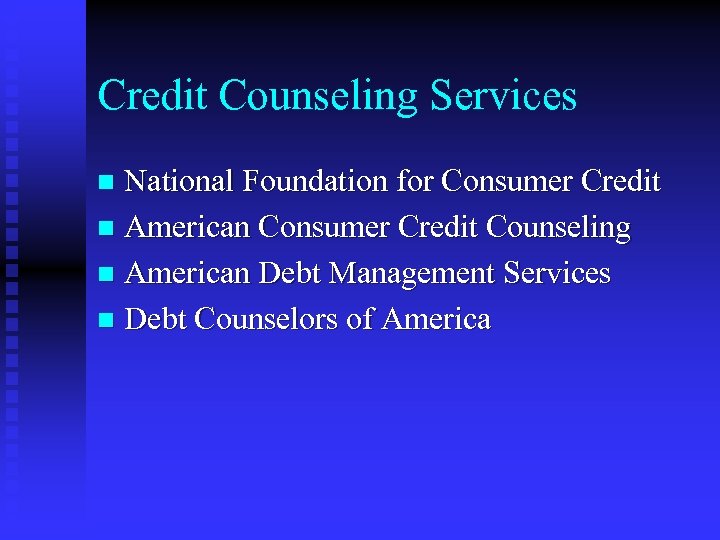

Credit Counseling Services National Foundation for Consumer Credit n American Consumer Credit Counseling n American Debt Management Services n Debt Counselors of America n

Credit Counseling Services National Foundation for Consumer Credit n American Consumer Credit Counseling n American Debt Management Services n Debt Counselors of America n

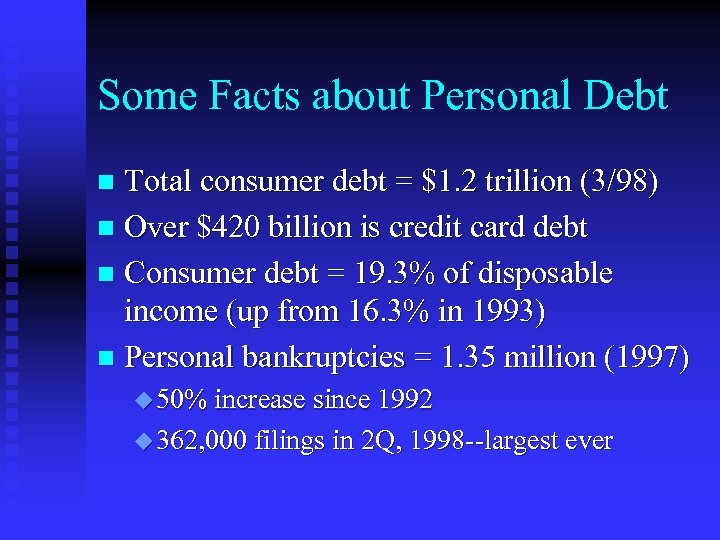

Some Facts about Personal Debt Total consumer debt = $1. 2 trillion (3/98) n Over $420 billion is credit card debt n Consumer debt = 19. 3% of disposable income (up from 16. 3% in 1993) n Personal bankruptcies = 1. 35 million (1997) n u 50% increase since 1992 u 362, 000 filings in 2 Q, 1998 --largest ever

Some Facts about Personal Debt Total consumer debt = $1. 2 trillion (3/98) n Over $420 billion is credit card debt n Consumer debt = 19. 3% of disposable income (up from 16. 3% in 1993) n Personal bankruptcies = 1. 35 million (1997) n u 50% increase since 1992 u 362, 000 filings in 2 Q, 1998 --largest ever

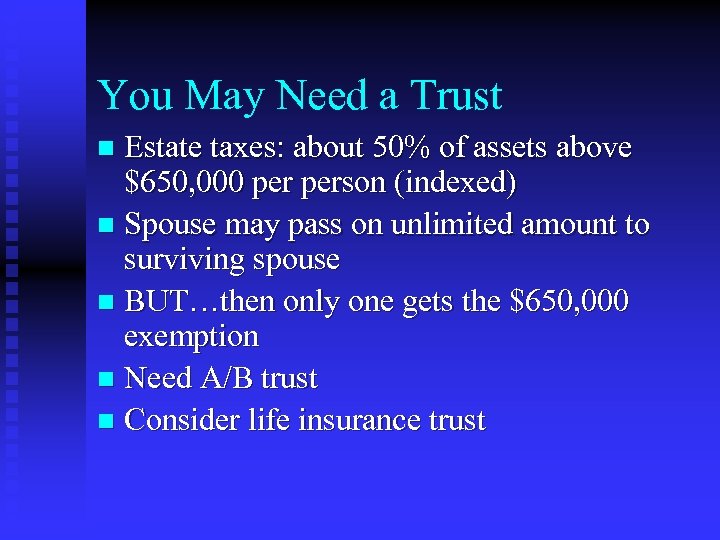

You May Need a Trust Estate taxes: about 50% of assets above $650, 000 person (indexed) n Spouse may pass on unlimited amount to surviving spouse n BUT…then only one gets the $650, 000 exemption n Need A/B trust n Consider life insurance trust n

You May Need a Trust Estate taxes: about 50% of assets above $650, 000 person (indexed) n Spouse may pass on unlimited amount to surviving spouse n BUT…then only one gets the $650, 000 exemption n Need A/B trust n Consider life insurance trust n

Risk and Scams There is risk in everything we do n What is a scam? n How does a scam differ from a legitimate investment? n How can we avoid unnecessary risk? n

Risk and Scams There is risk in everything we do n What is a scam? n How does a scam differ from a legitimate investment? n How can we avoid unnecessary risk? n