f0082cbad3b602a0e60e984b90cc5549.ppt

- Количество слайдов: 36

Dealing With Financial Turmoil: The Fed’s Response David C. Wheelock* Federal Reserve Bank of St. Louis November 6, 2008 *Views expressed are not necessarily official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

Dealing With Financial Turmoil: The Fed’s Response David C. Wheelock* Federal Reserve Bank of St. Louis November 6, 2008 *Views expressed are not necessarily official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

The Housing Slump: Root of the Crisis • • Declining sales and rising vacancy rates Less construction Falling house prices Rising foreclosure rates – Cause mortgage-backed securities to decline in value, resulting in large financial losses and uncertainty about viability of counterparties.

The Housing Slump: Root of the Crisis • • Declining sales and rising vacancy rates Less construction Falling house prices Rising foreclosure rates – Cause mortgage-backed securities to decline in value, resulting in large financial losses and uncertainty about viability of counterparties.

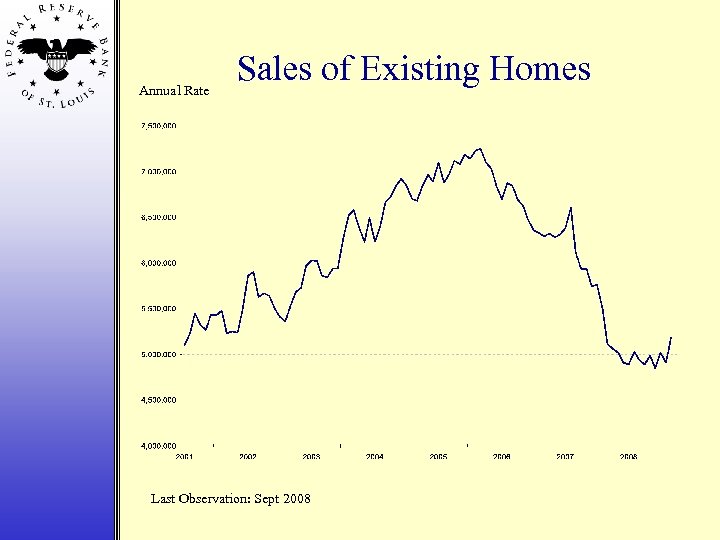

Annual Rate Sales of Existing Homes Last Observation: Sept 2008

Annual Rate Sales of Existing Homes Last Observation: Sept 2008

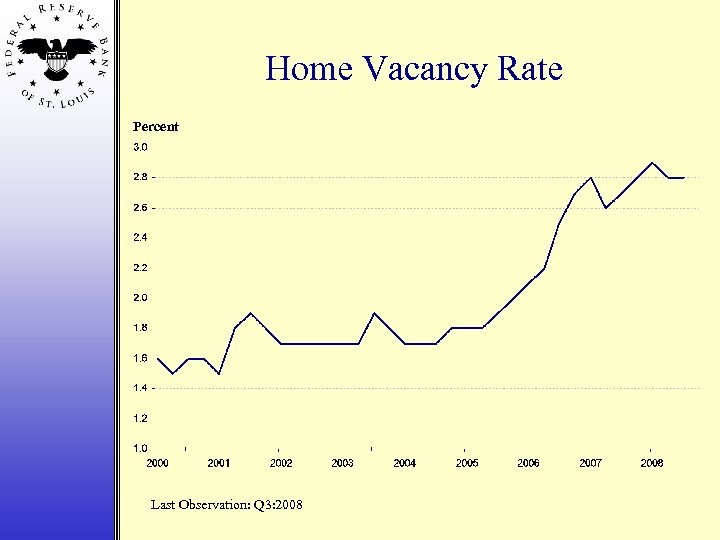

Home Vacancy Rate Percent Last Observation: Q 3: 2008

Home Vacancy Rate Percent Last Observation: Q 3: 2008

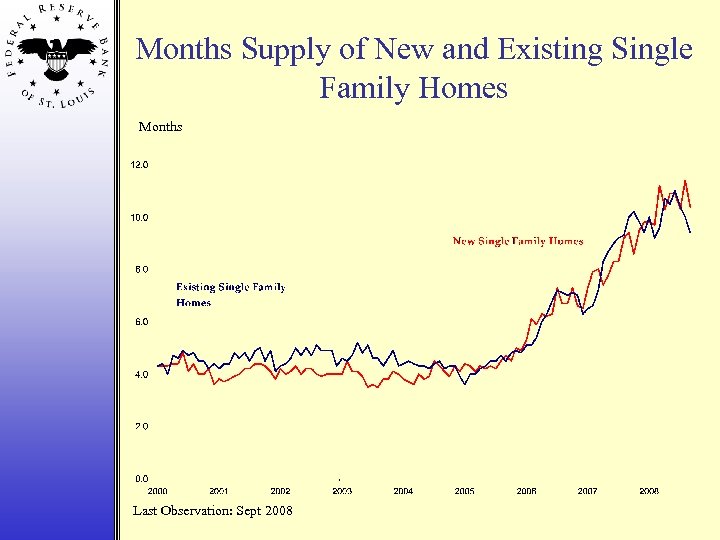

Months Supply of New and Existing Single Family Homes Months Last Observation: Sept 2008

Months Supply of New and Existing Single Family Homes Months Last Observation: Sept 2008

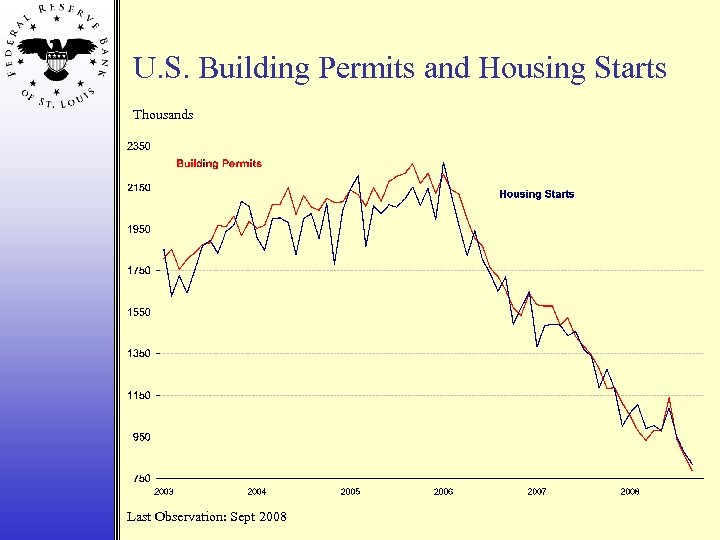

U. S. Building Permits and Housing Starts Thousands Last Observation: Sept 2008

U. S. Building Permits and Housing Starts Thousands Last Observation: Sept 2008

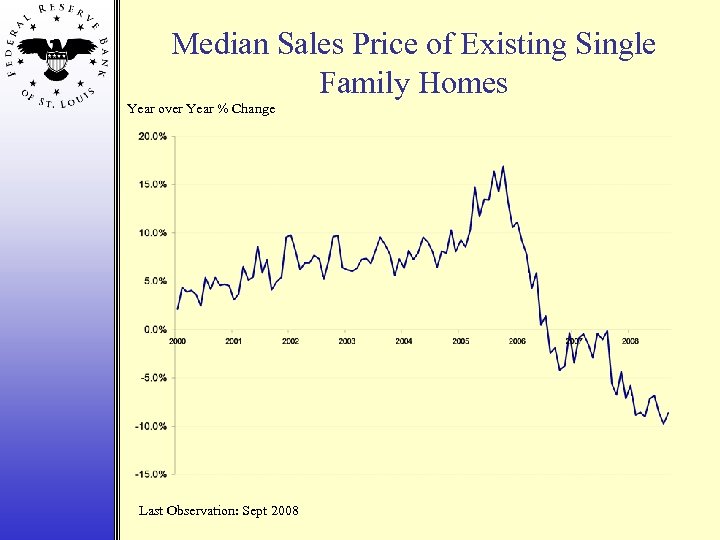

Median Sales Price of Existing Single Family Homes Year over Year % Change Last Observation: Sept 2008

Median Sales Price of Existing Single Family Homes Year over Year % Change Last Observation: Sept 2008

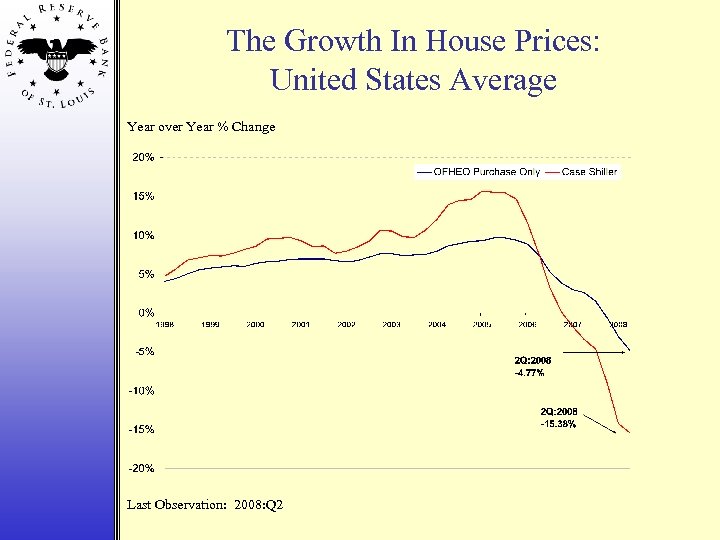

The Growth In House Prices: United States Average Year over Year % Change Last Observation: 2008: Q 2

The Growth In House Prices: United States Average Year over Year % Change Last Observation: 2008: Q 2

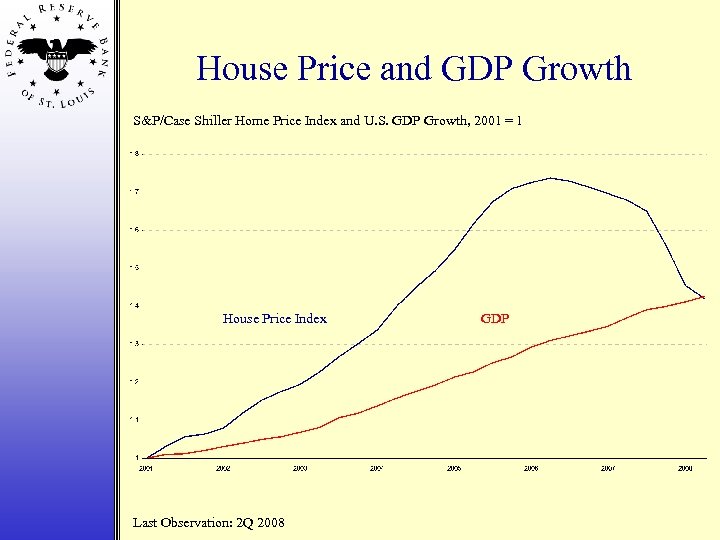

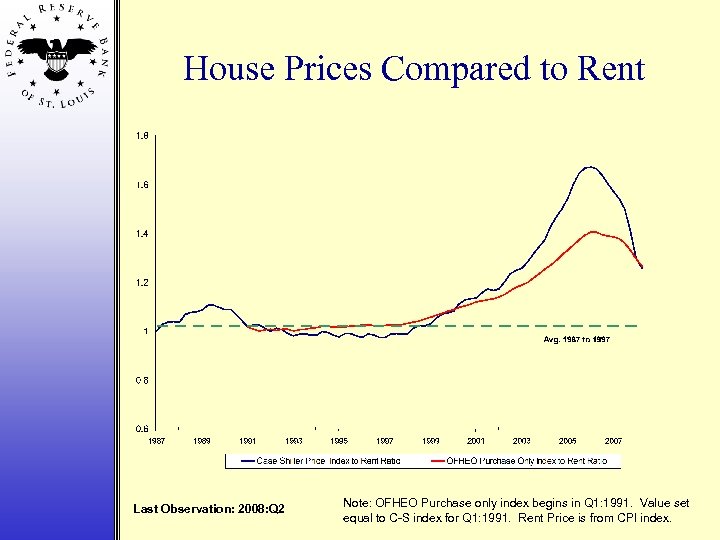

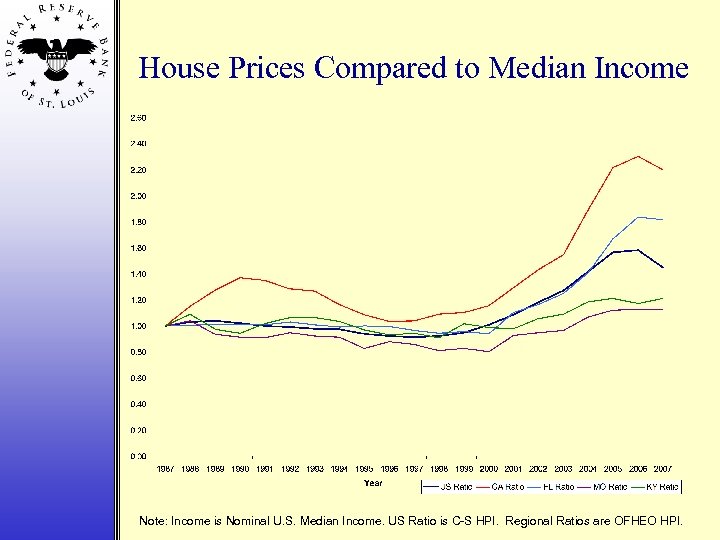

The Housing Boom (Bubble? ) • Many economists discounted the “bubble” notion: – Income growth was high – Interest rates were low • But, house prices rose much faster than GDP, rents, or median household income

The Housing Boom (Bubble? ) • Many economists discounted the “bubble” notion: – Income growth was high – Interest rates were low • But, house prices rose much faster than GDP, rents, or median household income

House Price and GDP Growth S&P/Case Shiller Home Price Index and U. S. GDP Growth, 2001 = 1 House Price Index Last Observation: 2 Q 2008 GDP

House Price and GDP Growth S&P/Case Shiller Home Price Index and U. S. GDP Growth, 2001 = 1 House Price Index Last Observation: 2 Q 2008 GDP

House Prices Compared to Rent Last Observation: 2008: Q 2 Note: OFHEO Purchase only index begins in Q 1: 1991. Value set equal to C-S index for Q 1: 1991. Rent Price is from CPI index.

House Prices Compared to Rent Last Observation: 2008: Q 2 Note: OFHEO Purchase only index begins in Q 1: 1991. Value set equal to C-S index for Q 1: 1991. Rent Price is from CPI index.

House Prices Compared to Median Income Note: Income is Nominal U. S. Median Income. US Ratio is C-S HPI. Regional Ratios are OFHEO HPI.

House Prices Compared to Median Income Note: Income is Nominal U. S. Median Income. US Ratio is C-S HPI. Regional Ratios are OFHEO HPI.

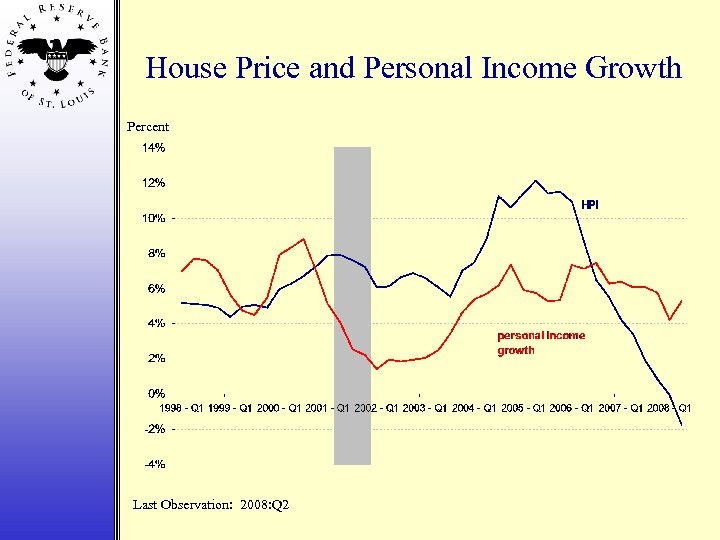

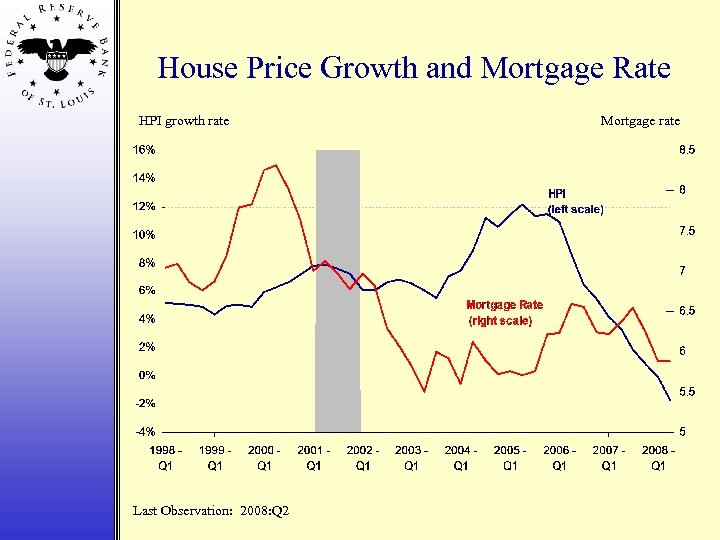

What Caused the Boom? House prices had been rising since the mid-1990 s, but accelerated in 2002 -03, coinciding with: – Low interest rates – Rising household incomes – Mortgage market innovations (“originate to distribute” – subprime loans and securitization)

What Caused the Boom? House prices had been rising since the mid-1990 s, but accelerated in 2002 -03, coinciding with: – Low interest rates – Rising household incomes – Mortgage market innovations (“originate to distribute” – subprime loans and securitization)

House Price and Personal Income Growth Percent Last Observation: 2008: Q 2

House Price and Personal Income Growth Percent Last Observation: 2008: Q 2

House Price Growth and Mortgage Rate HPI growth rate Last Observation: 2008: Q 2 Mortgage rate

House Price Growth and Mortgage Rate HPI growth rate Last Observation: 2008: Q 2 Mortgage rate

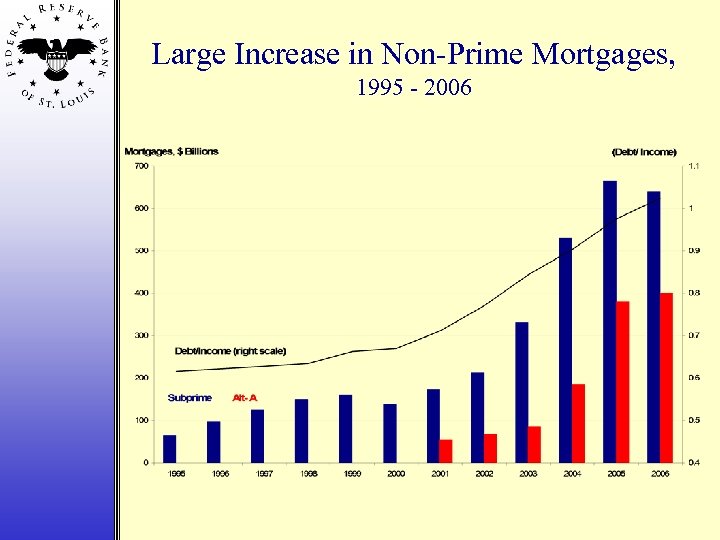

Large Increase in Non-Prime Mortgages, 1995 - 2006

Large Increase in Non-Prime Mortgages, 1995 - 2006

What Ended the Boom? House price appreciation began to fall in the second half of 2005, coinciding with: – Slowing of U. S. personal income growth – Rise in mortgage rates – Hurricane’s Katrina and Rita

What Ended the Boom? House price appreciation began to fall in the second half of 2005, coinciding with: – Slowing of U. S. personal income growth – Rise in mortgage rates – Hurricane’s Katrina and Rita

Consequence of the housing slump…

Consequence of the housing slump…

Financial Distress

Financial Distress

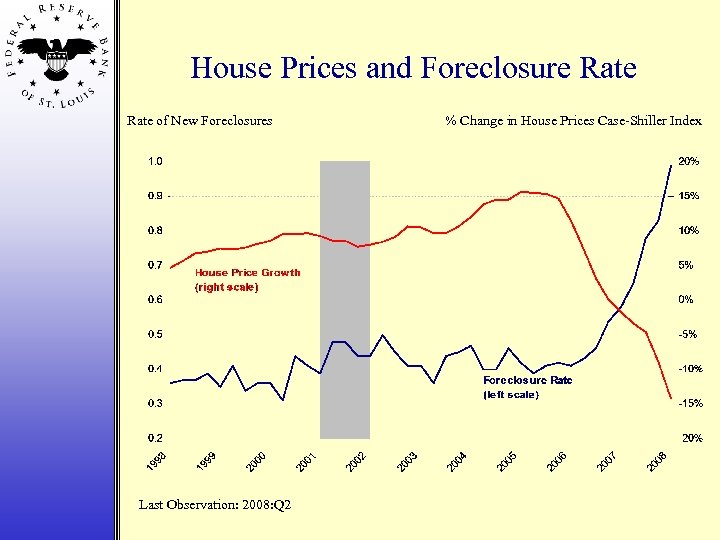

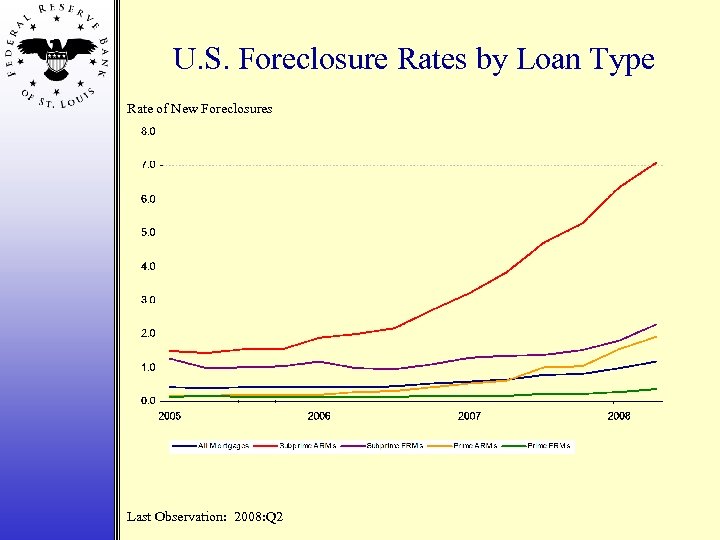

Falling House Prices and Financial Distress • Rise in mortgage defaults and foreclosures – Mainly on subprime, adjustable rate loans • Significant losses on mortgage-backed securities and derivatives (especially privatelabel MBS’s, even highly-rated securities) • Uncertainty about the viability of counterparties caused risk spreads to increase and trading in financial markets to fall sharply.

Falling House Prices and Financial Distress • Rise in mortgage defaults and foreclosures – Mainly on subprime, adjustable rate loans • Significant losses on mortgage-backed securities and derivatives (especially privatelabel MBS’s, even highly-rated securities) • Uncertainty about the viability of counterparties caused risk spreads to increase and trading in financial markets to fall sharply.

House Prices and Foreclosure Rate of New Foreclosures Last Observation: 2008: Q 2 % Change in House Prices Case-Shiller Index

House Prices and Foreclosure Rate of New Foreclosures Last Observation: 2008: Q 2 % Change in House Prices Case-Shiller Index

U. S. Foreclosure Rates by Loan Type Rate of New Foreclosures Last Observation: 2008: Q 2

U. S. Foreclosure Rates by Loan Type Rate of New Foreclosures Last Observation: 2008: Q 2

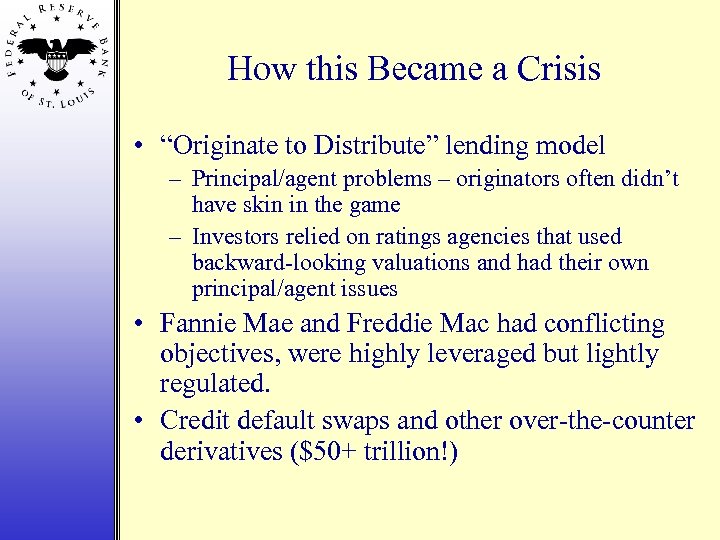

How this Became a Crisis • “Originate to Distribute” lending model – Principal/agent problems – originators often didn’t have skin in the game – Investors relied on ratings agencies that used backward-looking valuations and had their own principal/agent issues • Fannie Mae and Freddie Mac had conflicting objectives, were highly leveraged but lightly regulated. • Credit default swaps and other over-the-counter derivatives ($50+ trillion!)

How this Became a Crisis • “Originate to Distribute” lending model – Principal/agent problems – originators often didn’t have skin in the game – Investors relied on ratings agencies that used backward-looking valuations and had their own principal/agent issues • Fannie Mae and Freddie Mac had conflicting objectives, were highly leveraged but lightly regulated. • Credit default swaps and other over-the-counter derivatives ($50+ trillion!)

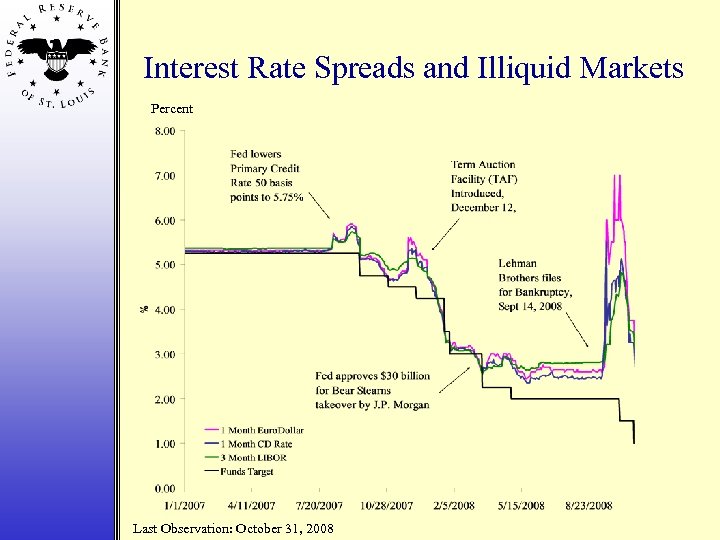

Interest Rate Spreads and Illiquid Markets Percent Last Observation: October 31, 2008

Interest Rate Spreads and Illiquid Markets Percent Last Observation: October 31, 2008

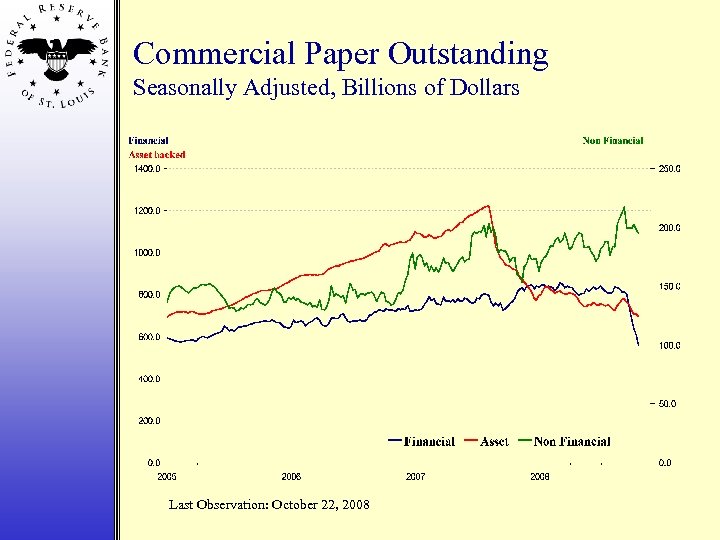

Commercial Paper Outstanding Seasonally Adjusted, Billions of Dollars Last Observation: October 22, 2008

Commercial Paper Outstanding Seasonally Adjusted, Billions of Dollars Last Observation: October 22, 2008

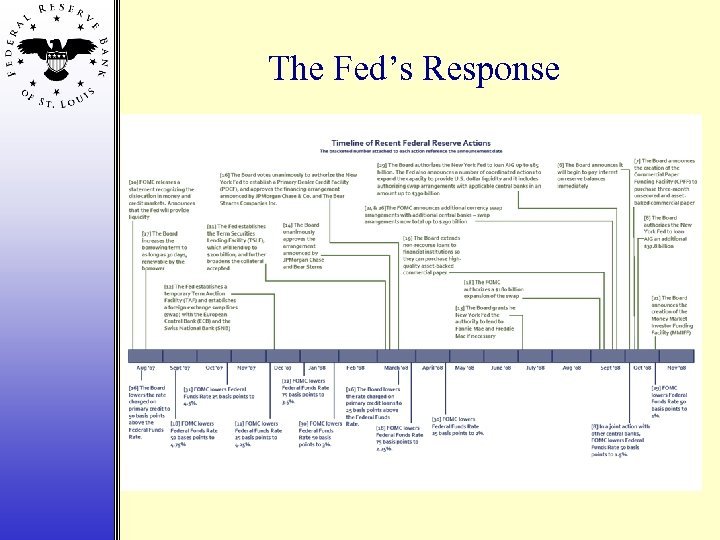

The Fed’s Response

The Fed’s Response

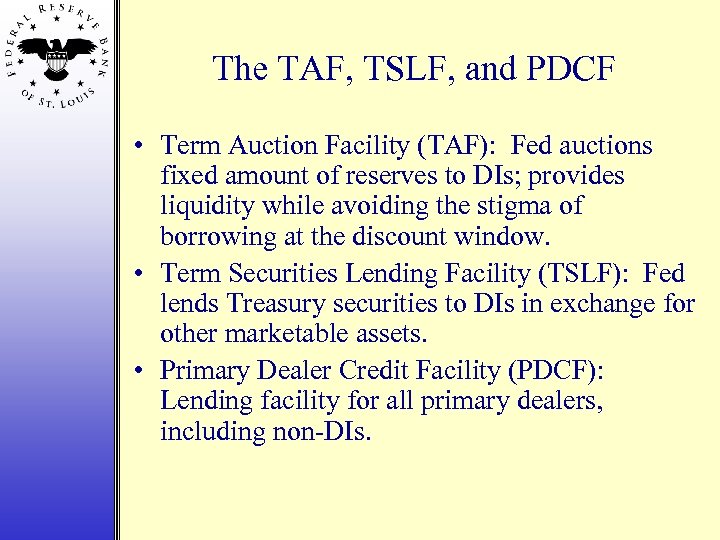

The TAF, TSLF, and PDCF • Term Auction Facility (TAF): Fed auctions fixed amount of reserves to DIs; provides liquidity while avoiding the stigma of borrowing at the discount window. • Term Securities Lending Facility (TSLF): Fed lends Treasury securities to DIs in exchange for other marketable assets. • Primary Dealer Credit Facility (PDCF): Lending facility for all primary dealers, including non-DIs.

The TAF, TSLF, and PDCF • Term Auction Facility (TAF): Fed auctions fixed amount of reserves to DIs; provides liquidity while avoiding the stigma of borrowing at the discount window. • Term Securities Lending Facility (TSLF): Fed lends Treasury securities to DIs in exchange for other marketable assets. • Primary Dealer Credit Facility (PDCF): Lending facility for all primary dealers, including non-DIs.

Bailouts and Non-Bailouts • Bear Stearns (March ’ 08): Fed lent $30 billion to facilitate JPMorgan’s acquisition of Bear. Concern about systemic risk. • Fannie/Freddie (Sept. ’ 08): Treasury places in conservatorship, replaces CEOs. • Lehman (Sept. ’ 08): Allowed to fail. • AIG (Sept. ’ 08): Fed lends up to $85 billion (increased later to $120); CEO replaced. Systemic risk – huge amount of credit default swaps outstanding.

Bailouts and Non-Bailouts • Bear Stearns (March ’ 08): Fed lent $30 billion to facilitate JPMorgan’s acquisition of Bear. Concern about systemic risk. • Fannie/Freddie (Sept. ’ 08): Treasury places in conservatorship, replaces CEOs. • Lehman (Sept. ’ 08): Allowed to fail. • AIG (Sept. ’ 08): Fed lends up to $85 billion (increased later to $120); CEO replaced. Systemic risk – huge amount of credit default swaps outstanding.

The $700 Billion TARP Troubled Asset Relief Program • Capital Purchase Program – Treasury will purchase preferred stock in a qualifying financial firm. $125 billion in nine largest banks $125 billion in other banks that apply and qualify • Other program(s) may include purchases of MBSs and loans, insurance of troubled assets, and assistance to borrowers.

The $700 Billion TARP Troubled Asset Relief Program • Capital Purchase Program – Treasury will purchase preferred stock in a qualifying financial firm. $125 billion in nine largest banks $125 billion in other banks that apply and qualify • Other program(s) may include purchases of MBSs and loans, insurance of troubled assets, and assistance to borrowers.

Commercial Paper, Money Market Funds • Commercial Paper Funding Facility (CPFF): Fed will purchase highly-rated unsecured and asset-backed commercial paper. • Money Market Mutual Fund Liquidity Facility (AMLF): Fed loans to banks to purchase assetbacked paper from MMMFs. • Money Market Investor Funding Facility (MMIFF): Sets up special vehicles to buy money market instruments. Fed committed up to $540 billion.

Commercial Paper, Money Market Funds • Commercial Paper Funding Facility (CPFF): Fed will purchase highly-rated unsecured and asset-backed commercial paper. • Money Market Mutual Fund Liquidity Facility (AMLF): Fed loans to banks to purchase assetbacked paper from MMMFs. • Money Market Investor Funding Facility (MMIFF): Sets up special vehicles to buy money market instruments. Fed committed up to $540 billion.

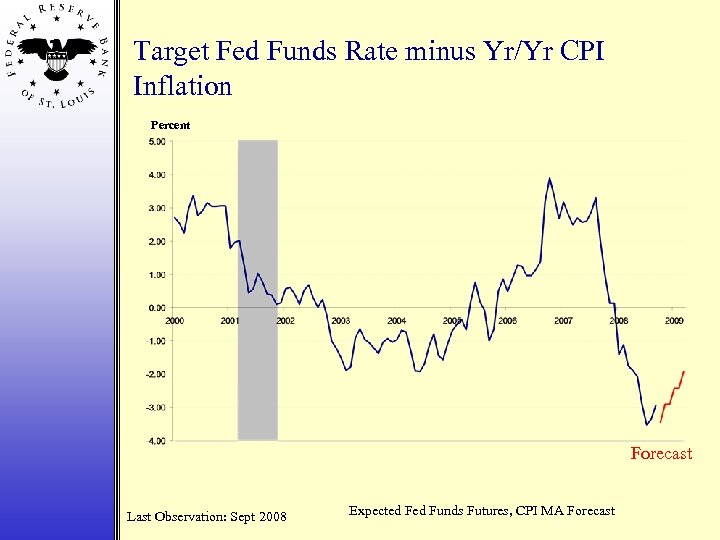

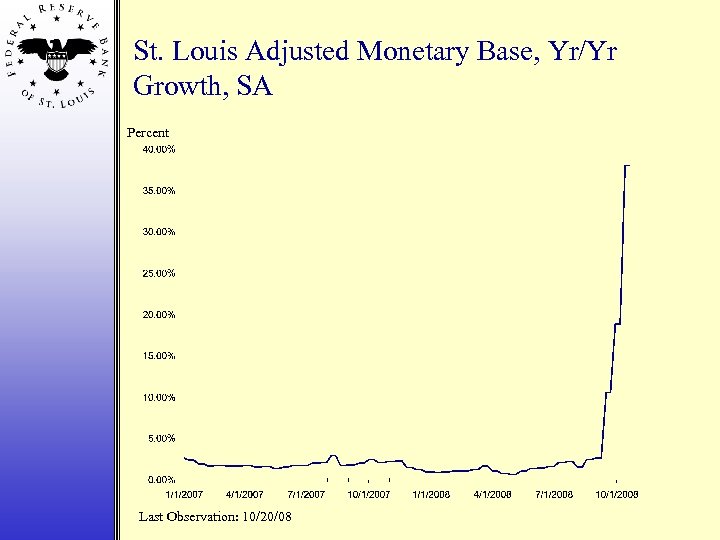

Old Fashioned Monetary Policy • The FOMC has sharply cut the fed funds rate target – negative real rate throughout 2008. • Monetary base growth – up sharply since September (“quantitative easing”).

Old Fashioned Monetary Policy • The FOMC has sharply cut the fed funds rate target – negative real rate throughout 2008. • Monetary base growth – up sharply since September (“quantitative easing”).

Target Fed Funds Rate minus Yr/Yr CPI Inflation Percent Forecast Last Observation: Sept 2008 Expected Funds Futures, CPI MA Forecast

Target Fed Funds Rate minus Yr/Yr CPI Inflation Percent Forecast Last Observation: Sept 2008 Expected Funds Futures, CPI MA Forecast

St. Louis Adjusted Monetary Base, Yr/Yr Growth, SA Percent Last Observation: 10/20/08

St. Louis Adjusted Monetary Base, Yr/Yr Growth, SA Percent Last Observation: 10/20/08

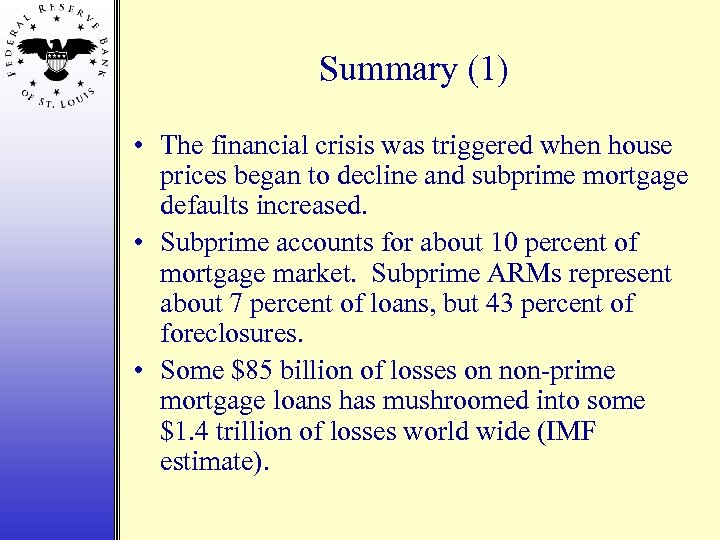

Summary (1) • The financial crisis was triggered when house prices began to decline and subprime mortgage defaults increased. • Subprime accounts for about 10 percent of mortgage market. Subprime ARMs represent about 7 percent of loans, but 43 percent of foreclosures. • Some $85 billion of losses on non-prime mortgage loans has mushroomed into some $1. 4 trillion of losses world wide (IMF estimate).

Summary (1) • The financial crisis was triggered when house prices began to decline and subprime mortgage defaults increased. • Subprime accounts for about 10 percent of mortgage market. Subprime ARMs represent about 7 percent of loans, but 43 percent of foreclosures. • Some $85 billion of losses on non-prime mortgage loans has mushroomed into some $1. 4 trillion of losses world wide (IMF estimate).

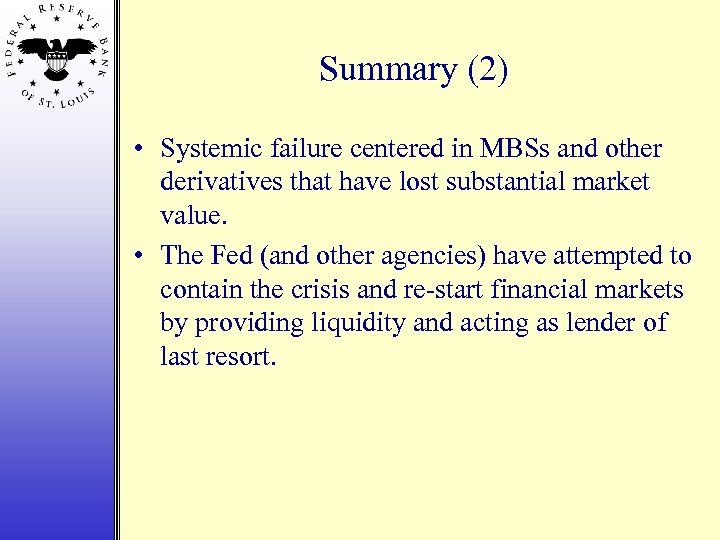

Summary (2) • Systemic failure centered in MBSs and other derivatives that have lost substantial market value. • The Fed (and other agencies) have attempted to contain the crisis and re-start financial markets by providing liquidity and acting as lender of last resort.

Summary (2) • Systemic failure centered in MBSs and other derivatives that have lost substantial market value. • The Fed (and other agencies) have attempted to contain the crisis and re-start financial markets by providing liquidity and acting as lender of last resort.

Questions?

Questions?