4f0fca6f012607c5cfa48570efaa58de.ppt

- Количество слайдов: 44

De Nederlandsche Bank Financial crisis and Global Developments Michael van Doeveren 3 rd Conference of the Macedonian Financial sector on Payments and Securities settlement Systems Ohrid 28 June 2010 De Nederlandsche Bank Eurosysteem

Knowledge is power! Sir Francis Bacon, Religious Meditations, Of Heresies, 1597 De Nederlandsche Bank Eurosysteem

Agenda Definitions and Roles of Central Banks in Payments Systems l Financial crisis l Global developments l De Nederlandsche Bank Eurosysteem

Agenda l FINANCIAL CRISIS PAYMENTS SYSTEMS Ø CPSS Report on System Interdependencies Ø Liquidity Issues Ø TARGET 2 l De Nederlandsche Bank Eurosysteem

Role of central banks IT´S ALL ABOUT FINANCIAL STABILITY De Nederlandsche Bank Eurosysteem

Mission of the central bank De Nederlandsche Bank Safeguarding the stability of the financial system and the institutions that are part of it, by l Contributing to the monetary policy of the Eurosystem l Supervising the financial soundness and integrity of financial institutions l Promoting the smooth functioning of the payments system De Nederlandsche Bank Eurosysteem

Payment systems policy OBJECTIVES MAIN GOAL l to promote safe and efficient payment and settlement systems Other goals: central bank specific l e. g. crime prevention, effective competition, consumer protection, accessibility De Nederlandsche Bank Eurosysteem

Importance payment systems Payment systems … … facilitate the exchange of goods and services … are necessary to conduct monetary policy … can be transmission channels of ‘disturbances’ (financial crises) De Nederlandsche Bank Eurosysteem

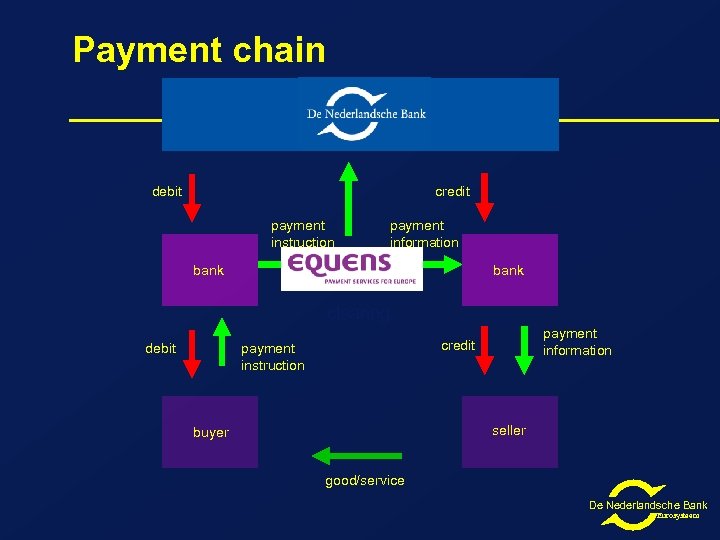

Payment chain debit credit payment instruction payment information bank clearing debit payment information credit payment instruction seller buyer good/service De Nederlandsche Bank Eurosysteem

Retail versus wholesale payments Low value ↔ Large value High volume ↔ Low volume Consumers and businesses ↔ Financial institutions Time less important ↔ Time critical Low systemic risk ↔ High systemic risk De Nederlandsche Bank Eurosysteem

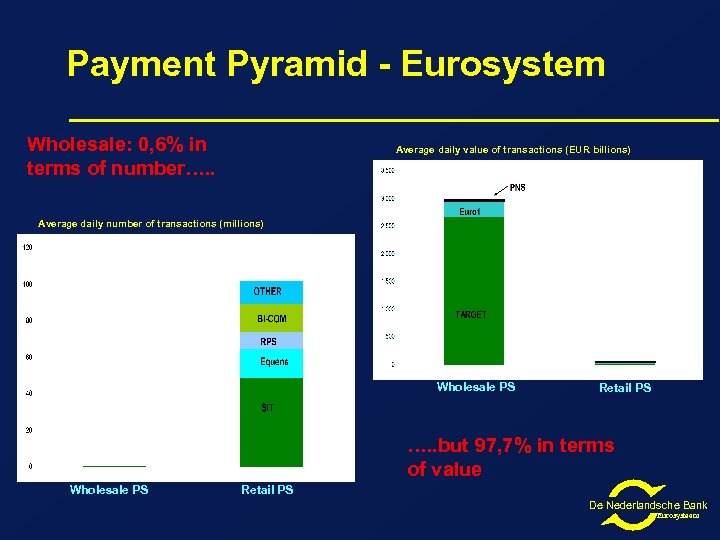

Payment Pyramid - Eurosystem Wholesale: 0, 6% in terms of number…. . Average daily value of transactions (EUR billions) Average daily number of transactions (millions) Wholesale PS Retail PS …. . but 97, 7% in terms of value Wholesale PS Retail PS De Nederlandsche Bank Eurosysteem

How to Achieve Policy Objectives? l OPERATIONS l OVERSIGHT l CATALYST De Nederlandsche Bank Eurosysteem

Operational role central bank Issuance and distribution of cash l Operator large value transfer system l Settlement services retail transactions l Cash settlement securities transactions l Clearing services retail payments l Operator securities settlement system l Other securities related services l Public sector payments l De Nederlandsche Bank Eurosysteem

Oversight l ‘a central bank activity focused on the safety and efficiency of payment and securities settlement systems, in particular to reduce systemic risk’. De Nederlandsche Bank Eurosysteem

Catalyst Case for intervention, but not necessarily regulation or operations ‘Third way’ - ‘guide’ the market, by promoting initiatives and co-operation l between stakeholders l between other public authorities, e. g. - Government Competition authorities De Nederlandsche Bank Eurosysteem

De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS key words: EXCESSIVE OPTIMISM EXCESSIVE RISK APPETITE ASPECTS ● Relative Stability (the great moderation, Bernanke) ● Search for Yield ● Easing Criteria for Credit (subprime, alt-a etc) ● Innovations (originate-to-distribute model, monoliners etc) De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS SOURCES ● US Housing Market GLOBAL CONTAGION OF markets and financial institutions Unprecedented: scale and scope of contagion De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS Crisis comes in waves De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS 15 september 2008 Lehman Brothers † Trigger of severe loss of confidence, wave of contagion De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS First, liquidity problems but also solvency problems De Nederlandsche Bank Eurosysteem

De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS What´s Next? Credit crunch Ø Ø Ø Ø Stock Markets Banking Sector Insurance sector House prices Pension funds World recession Protection De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS MANAGEMENT l l l Provision Liquidity Nationalizations Savings Guarantee Capital Injections & Debt Guarantees Interest rates ↓ In order to UNDERPIN CONFIDENCE De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS Other Crises l Great Depression (1929 -1930) l Savings and Loan Crisis (US, 1984) l Japan (1984) l Sweden (1991) De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS Differences with Great Depression Many (regional) banks had no access to Fed money l No Savings Guarantee System l National Protectionism l Tight monetary policy l De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS 2009 -2010: NEXT WAVE of Crisis: RECESSION Issues: l Credit Crunch: dilemma for banks l Avoid beggar-thy-neighbour policy l How to restore confidence? Ø Crisis is worldwide Ø Establishment of ´bad banks´? De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS – FUTURE Recommendations of Financial Stability Forum Improve Risk Management Enlarge Transparency Further Cooperation between Public Authorities Reform supervision Improve Crisis Management De Nederlandsche Bank Eurosysteem

RISK MANAGEMENT USED TO BE SMART De Nederlandsche Bank Eurosysteem

Crisis: Payments Systems Angle STYLIZED FACT: Scale and Scope of Contagion We live in global village De Nederlandsche Bank Eurosysteem

De Nederlandsche Bank Eurosysteem

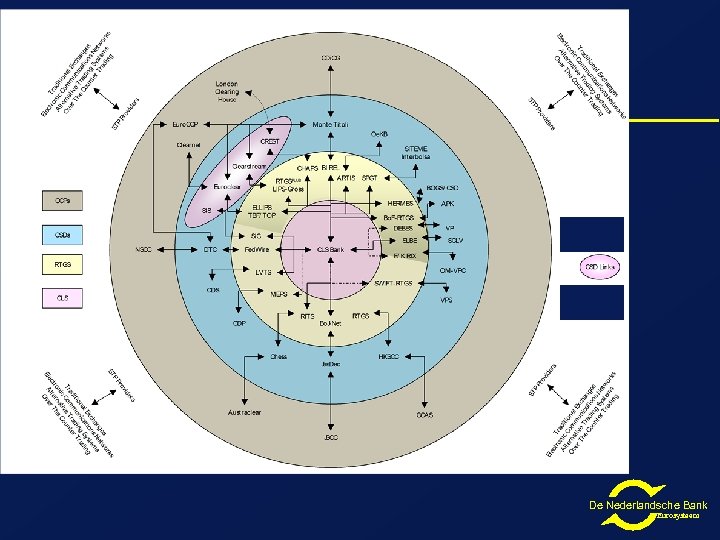

Payments and Securities Infrastructure WEB OF GLOBAL INTERDEPENDENCIES (LVPSs, CCPs, CSDs, Banks) WITH TIGHT DEADLINES (RTGS, DVP, PVP) Key words ● technological developments ● globalization ● consolidation in financial sector De Nederlandsche Bank Eurosysteem

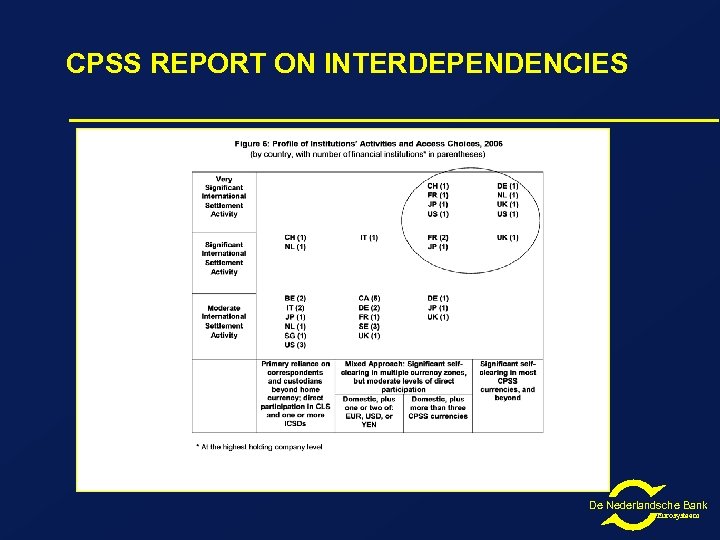

CPSS REPORT ON INTERDEPENDENCIES De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS No Crisis of P&SS Infrastructure BUT it may have an infrastructural impact, e. g. Need for further standardization (operating rules, legal devices etc)? l US: intraday credit policy l UK: highly tiered structure of CHAPS De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS FURTHER ISSUES l Assess BCP arrangements: scope and scale of contagion, cross-border l Cross-border Collateral: ELA facilities Growth and Quality of Collateral l De Nederlandsche Bank Eurosysteem

FINANCIAL CRISIS COOPERATION WITH SUPERVISORS (domestic and cross-border) l l l FX Settlement Risk: use of CLS Correspondent banking: risk management Update Sound Practices on Liquidity Management: intraday liquidity De Nederlandsche Bank Eurosysteem

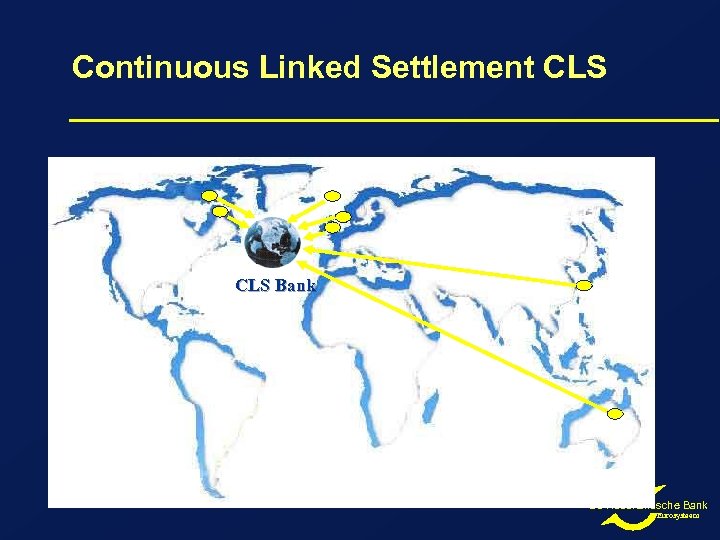

FX Settlement Risk – Continuous Linked Settelement CLS: Continuous Linked Settlement ● FX Risks ● basically a ´guaranteed refund´ scheme, i. e. you will either receive the correct currency or a refund De Nederlandsche Bank Eurosysteem

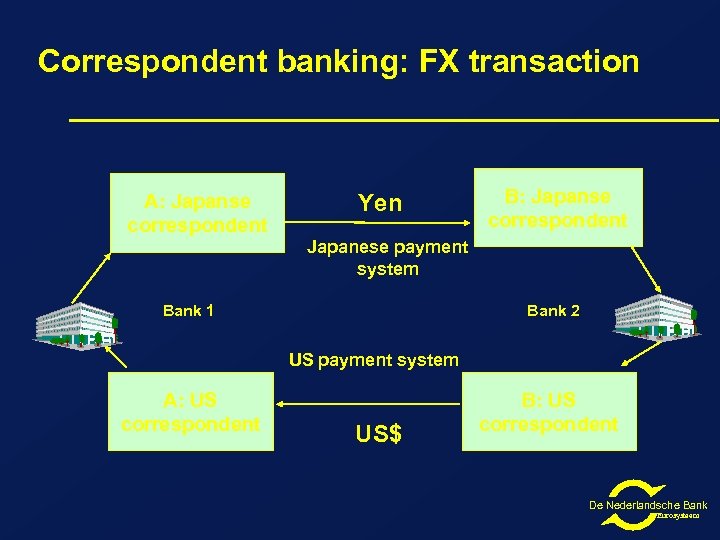

Correspondent banking: FX transaction A: Japanse correspondent Yen B: Japanse correspondent Japanese payment system Bank 1 Bank 2 US payment system A: US correspondent US$ B: US correspondent De Nederlandsche Bank Eurosysteem

Continuous Linked Settlement CLS Bank De Nederlandsche Bank Eurosysteem

FX transaction, via CLS Bank A A: Settlement member CLS BANK A: Settlement member Yen B: Settlement member Bank B B: Settlement member US $ De Nederlandsche Bank Eurosysteem

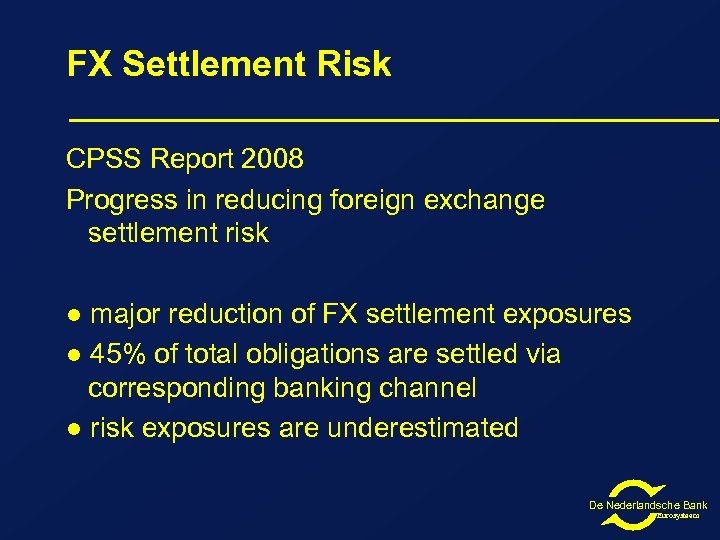

FX Settlement Risk CPSS Report 2008 Progress in reducing foreign exchange settlement risk ● major reduction of FX settlement exposures ● 45% of total obligations are settled via corresponding banking channel ● risk exposures are underestimated De Nederlandsche Bank Eurosysteem

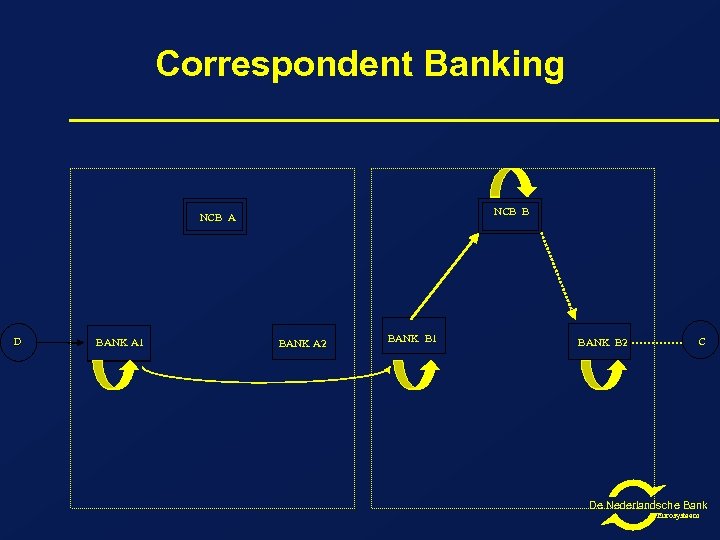

Correspondent Banking NCB B NCB A D BANK A 1 BANK A 2 BANK B 1 BANK B 2 C De Nederlandsche Bank Eurosysteem

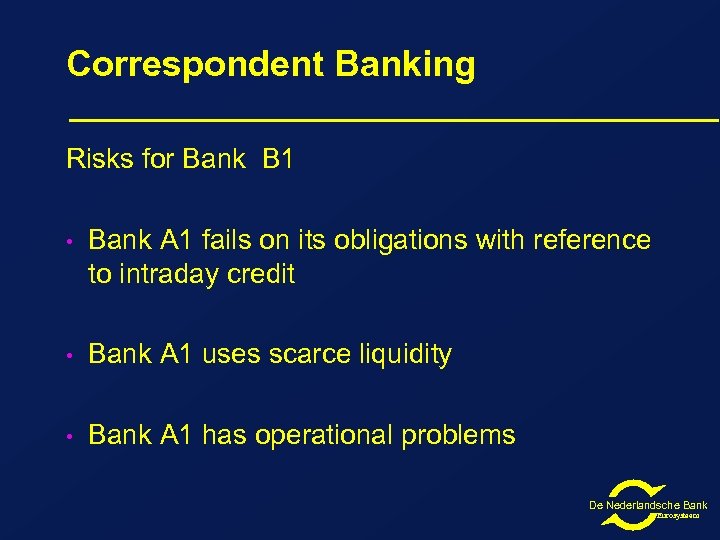

Correspondent Banking Risks for Bank B 1 • Bank A 1 fails on its obligations with reference to intraday credit • Bank A 1 uses scarce liquidity • Bank A 1 has operational problems De Nederlandsche Bank Eurosysteem

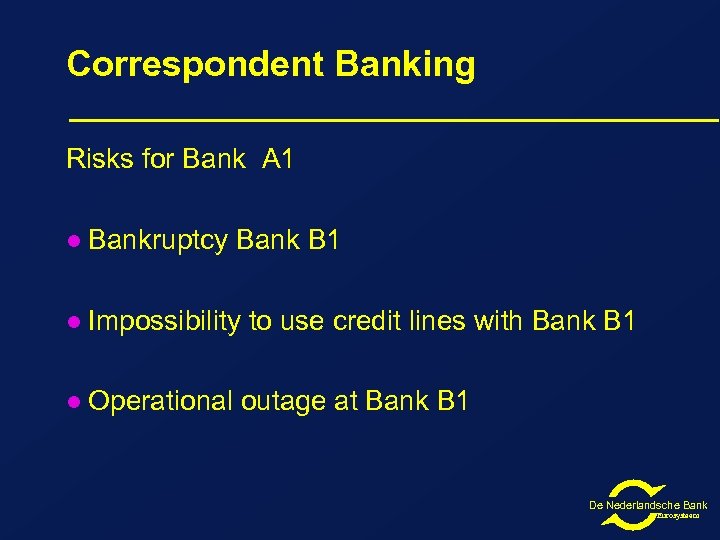

Correspondent Banking Risks for Bank A 1 l Bankruptcy Bank B 1 l Impossibility to use credit lines with Bank B 1 l Operational outage at Bank B 1 De Nederlandsche Bank Eurosysteem

4f0fca6f012607c5cfa48570efaa58de.ppt