95b9c6bcfcef1b27999c6c213779c8a8.ppt

- Количество слайдов: 50

De-Mystifying Budget Development Through Understanding OMB A-21 Ann Holmes, University of Maryland Betty Farbman, NYU April 30, 2010

A-21 Purpose o o Principles for determining costs applicable to grants, contracts, and other agreements The principles are designed to provide that the Federal Government bear its fair share of total cost, determined in accordance with generally accepted accounting principles (pg. 5) 2

Direct Costs o Costs that can be identified specifically with a particular sponsored project, an instructional activity, or any other institutional activity; or that can be directly assigned to such activities relatively easily with a high degree of accuracy. (pg. 21) o Examples of Direct Costs: n Salary of Researcher (including benefit costs) n Laboratory Supplies purchased for project n Technician 3

Facilities & Administrative Costs o Cost are those that are incurred for common or joint objectives and therefore cannot be identified readily and specifically with a particular sponsored project… (pg. 22) 4

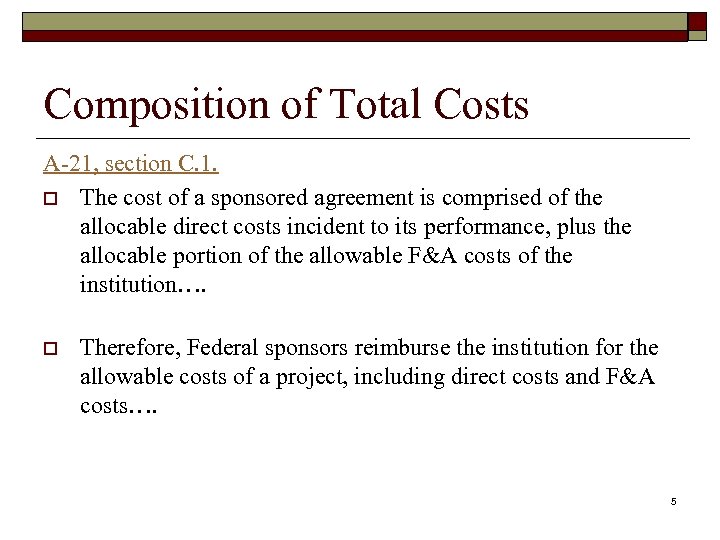

Composition of Total Costs A-21, section C. 1. o The cost of a sponsored agreement is comprised of the allocable direct costs incident to its performance, plus the allocable portion of the allowable F&A costs of the institution…. o Therefore, Federal sponsors reimburse the institution for the allowable costs of a project, including direct costs and F&A costs…. 5

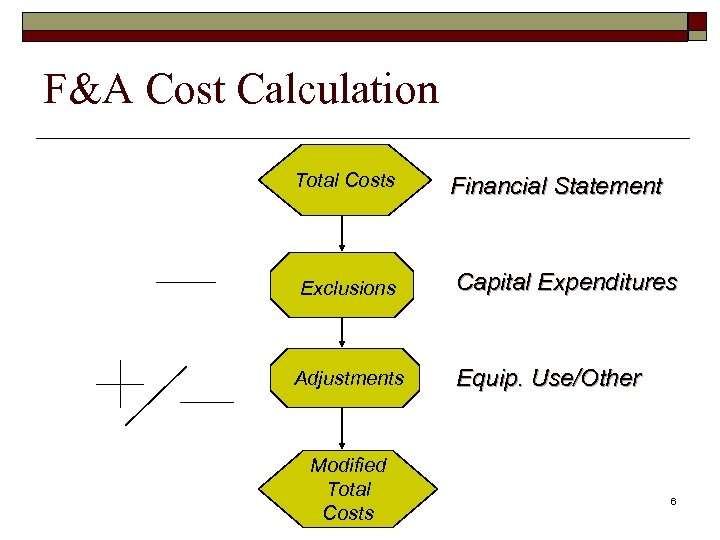

F&A Cost Calculation Total Costs Financial Statement Exclusions Capital Expenditures Adjustments Equip. Use/Other Modified Total Costs 6

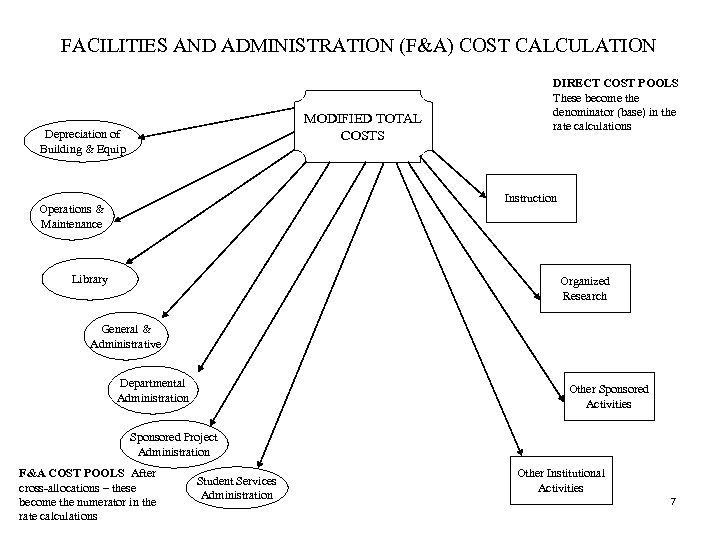

FACILITIES AND ADMINISTRATION (F&A) COST CALCULATION MODIFIED TOTAL COSTS Depreciation of Building & Equip DIRECT COST POOLS These become the denominator (base) in the rate calculations Instruction Operations & Maintenance Library Organized Research General & Administrative Departmental Administration Other Sponsored Activities Sponsored Project Administration F&A COST POOLS After cross-allocations – these become the numerator in the rate calculations Student Services Administration Other Institutional Activities 7

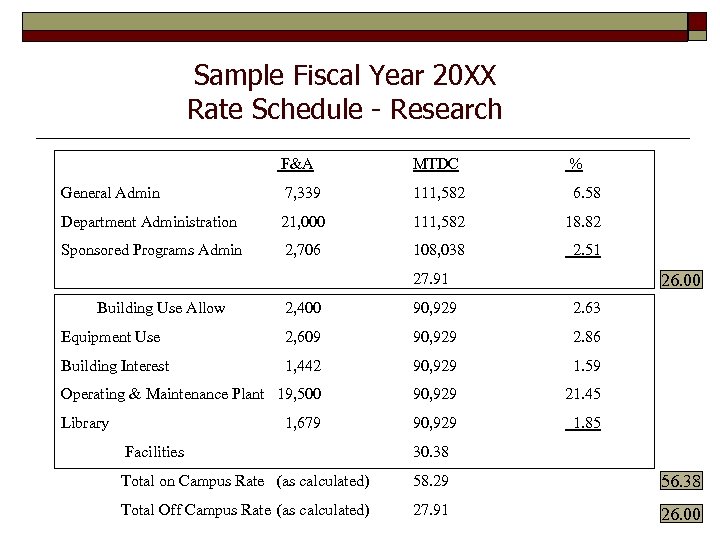

Sample Fiscal Year 20 XX Rate Schedule - Research F&A MTDC % General Admin 7, 339 111, 582 6. 58 Department Administration 21, 000 111, 582 18. 82 Sponsored Programs Admin 2, 706 108, 038 2. 51 26. 00 27. 91 Building Use Allow 2, 400 90, 929 2. 63 Equipment Use 2, 609 90, 929 2. 86 Building Interest 1, 442 90, 929 1. 59 Operating & Maintenance Plant 19, 500 90, 929 21. 45 Library 90, 929 1. 85 1, 679 Facilities 30. 38 Total on Campus Rate (as calculated) 58. 29 56. 38 Total Off Campus Rate (as calculated) 27. 91 26. 00

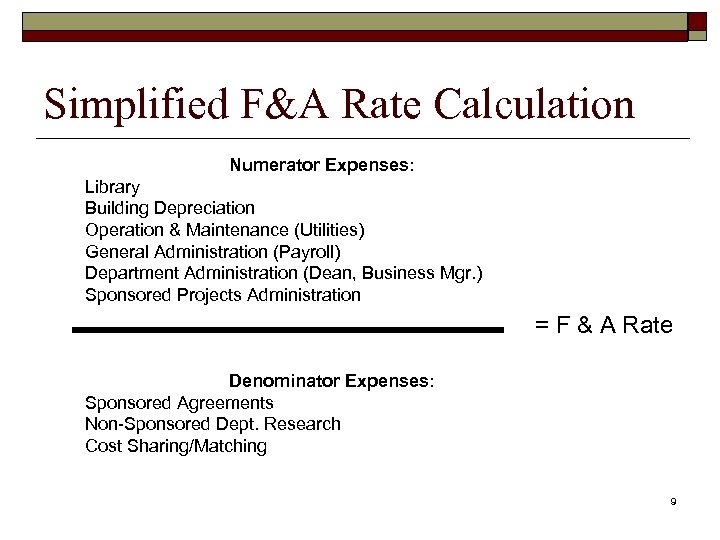

Simplified F&A Rate Calculation Numerator Expenses: Library Building Depreciation Operation & Maintenance (Utilities) General Administration (Payroll) Department Administration (Dean, Business Mgr. ) Sponsored Projects Administration = F & A Rate Denominator Expenses: Sponsored Agreements Non-Sponsored Dept. Research Cost Sharing/Matching 9

Negotiation of F&A rate o Department of Health & Human Services o Cognizant agency is responsible for negotiating and approving rates on behalf of all federal agencies 10

Assessing Whether a Cost is Allowable or Unallowable o A cost may be “expressly” unallowable, i. e. , it is always unallowable as either a direct or indirect. n Unallowable activities: fund raising, alumni relations, lobbying, etc n Unallowable transactions: alcohol, entertainment, fines, etc. o A cost may be allowable but only as an indirect (F&A) cost, not a direct charge, e. g. , proposal preparation o A cost that is allowable as a direct charge should not be included in the F&A rate, e. g. , salary of technician 11

What Does “Allowable” Mean? o An allowable cost must be: n REASONABLE: A prudent business person would have purchased this item and paid this price. n ALLOCABLE: It can be assigned to the activity on some reasonable basis. n CONSISTENTLY TREATED: Like costs must be treated the same in like circumstances, as either direct or F&A costs. (pg. 11) 12

More on Allowable o An “allowable” cost is one that is eligible for reimbursement by the federal government. o Contrast with: n PERMISSIBLE BY INSTITUTION: A cost is permitted by institution, as outlined in its various administrative policies or procedures. n ALLOWABLE BY AGENCY: A cost is permitted by the policies of the sponsoring agency or the terms or an award. o An "unallowable" cost is one that is not eligible for reimbursement by the federal government. 13

Reasonable Costs o o Reflect the action that a prudent person would have taken under the circumstances prevailing at the time the decision to incur the cost was made. Necessary for … the performance of the sponsored agreement; (pg. 12) 14

How Is Allocability Determined? o o o A cost can be allocable as a direct or an indirect cost A cost is allocable as a direct cost if the goods or services provided are assignable in accordance with the relative benefits received…. n It is incurred solely to advance the work under the sponsored agreement n It benefits both the work under the sponsored agreement and other work of the institution in proportions that can be approximated (pg. 12) n If a cost benefits two or more interrelated projects in proportions that cannot be determined the cost may be allocated on any reasonable basis A cost is allocable as an indirect cost if it is necessary for the overall operation of the institution (and conforms with the other principles in A-21) 15

Allocation and Documentation o C. 4. d. (1) Cost principles. The recipient institution is responsible for ensuring that costs charged to a sponsored agreement are allowable, allocable, and reasonable under these cost principles. C. 4. d. (2) Internal controls. The institution's financial management system shall ensure that no one person has complete control over all aspects of a financial transaction. (pg. 13) 16

A-21 F. 6. b o o The salaries of administrative and clerical staff should normally be treated as F&A costs. Direct charging of these costs may be appropriate where a major project or activity explicitly budgets for administrative or clerical services and individuals involved can be specifically identified with the project or activity. Items such as office supplies, postage, local telephone costs, and memberships shall normally be treated as F&A costs. (pg. 30) 17

Examples of Major Projects Those which require or involve: 1. 2. 3. 4. 5. 6. Extensive data accumulation, analysis, entry. . . Large amount of travel/meeting arrangements Preparation of manuals, large reports, books. . . Large, complex programs Geographically inaccessible project locations Conditions including human or animal protocols, multiple -investigator coordination See A-21 Exhibit C page 97 18

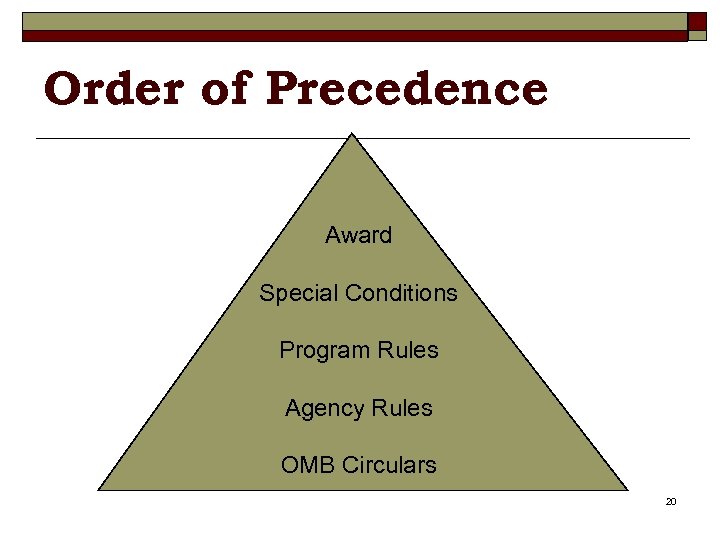

A-21 Section J General Provisions for Selected Items of Costs o In a case of discrepancy between provisions of a sponsored agreement and section J, the agreement should govern. 19

Order of Precedence Award Special Conditions Program Rules Agency Rules OMB Circulars 20 20

A-21 Section J General Provisions for Selected Items of Costs o Cost principles apply whether an item is treated as direct or F&A costs o In a case of discrepancy between provisions of a sponsored agreement and section J, the agreement should govern. (pg. 43) 21

Equipment - What is allowable? A-21 J 18 a o o Equipment means: n “Article of nonexpendable, tangible personal property having a useful life of more than one year and a cost of $5, 000 or more. ” Capital Expenditure means: n Cost of an asset including attachments, accessories, modifications and installation and delivery costs 22

Equipment - What is allowable? A-21 J 18 a o Special Purpose Equipment: n o Equipment used only for research, medical, scientific or other technical activities General Purpose Equipment: n Equipment which use is not limited to research or technical activities (e. g. office equipment, reproduction & printing equipment and automatic data processing equipment) 23

Budget Preparation Rules to Live By: o Read the Request for Proposal (RFP), Request For Quote (RFQ), or program announcement for budget restrictions n n o Limitations on F&A Not to exceed amounts Remember your cost principles and the concepts of reasonable, allowable and allocable 24

Caution on Budgeting “The fact that a cost requested in a budget is awarded, as requested, does not ensure a determination of allowability. The organization is responsible for presenting costs consistently and must not include costs associated with their F&A rate as direct costs. ” NIH Grants Policy Statement 12/03 Subpart A: General -- Part 3 of 7 25

Budgets Must: o o Reflect the project’s objectives Demonstrate that the project costs are realistic Contain reasonable estimates based on sound business practices Provide answers - not lead to questions 26

Budget Preparation o o Establish a standard template Interview PI for needs analysis Review program guidelines Determine vendor versus subcontractor n o Identify subcontractor point of contact n o Subs may follow different cost principles Determine how F&A will be calculated n o OMB A-133 section 210 TDC, MDTC or S&W The subcontractor may do it differently Plan for writing the budget justification Determine the cost sharing requirement and how it will be calculated 27

Constructing a Proposal Budget: Elements of Direct Costs o o o o Salaries and wages Fringe benefits Equipment Expendable supplies and materials Travel Subcontracts Consultants n n o External Interdepartmental Other 28

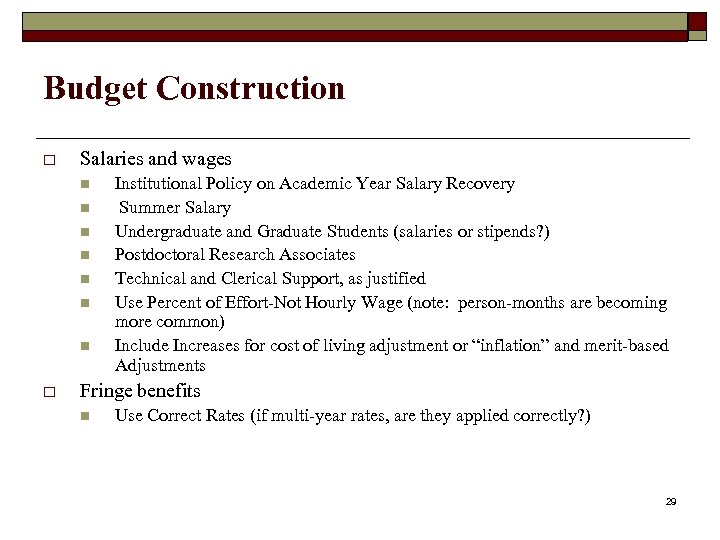

Budget Construction o Salaries and wages n n n n o Institutional Policy on Academic Year Salary Recovery Summer Salary Undergraduate and Graduate Students (salaries or stipends? ) Postdoctoral Research Associates Technical and Clerical Support, as justified Use Percent of Effort-Not Hourly Wage (note: person-months are becoming more common) Include Increases for cost of living adjustment or “inflation” and merit-based Adjustments Fringe benefits n Use Correct Rates (if multi-year rates, are they applied correctly? ) 29

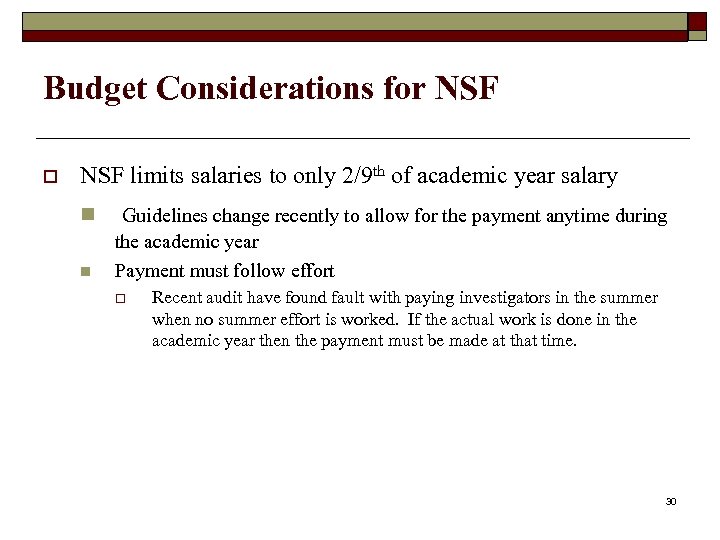

Budget Considerations for NSF o NSF limits salaries to only 2/9 th of academic year salary n n Guidelines change recently to allow for the payment anytime during the academic year Payment must follow effort o Recent audit have found fault with paying investigators in the summer when no summer effort is worked. If the actual work is done in the academic year then the payment must be made at that time. 30

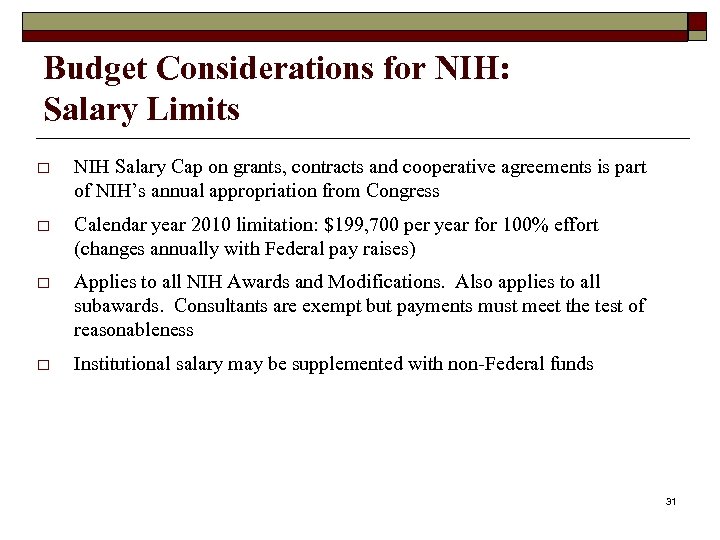

Budget Considerations for NIH: Salary Limits o NIH Salary Cap on grants, contracts and cooperative agreements is part of NIH’s annual appropriation from Congress o Calendar year 2010 limitation: $199, 700 per year for 100% effort (changes annually with Federal pay raises) o Applies to all NIH Awards and Modifications. Also applies to all subawards. Consultants are exempt but payments must meet the test of reasonableness o Institutional salary may be supplemented with non-Federal funds 31

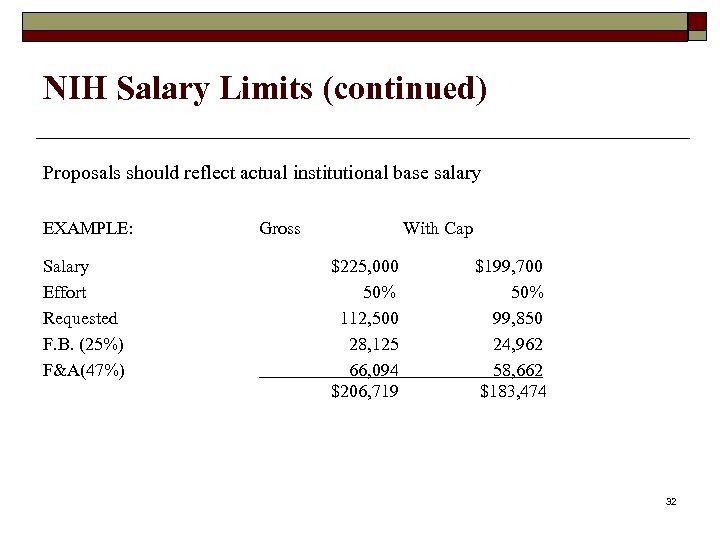

NIH Salary Limits (continued) Proposals should reflect actual institutional base salary EXAMPLE: Salary Effort Requested F. B. (25%) F&A(47%) Gross With Cap $225, 000 50% 112, 500 28, 125 66, 094 $206, 719 $199, 700 50% 99, 850 24, 962 58, 662 $183, 474 32

Budget Construction o Equipment n n Defined as having a useful life of more than one year and acquisition cost of $3, 000 or more (NYU’s institutional level) Beware of potential differences between equipment definitions (sponsor / institution / subcontractor) 33

Materials, Supplies & Expendable Equipment o o Need to be identified and justified Includes such things as: n n chemicals/glassware small electronic components software animals and animal rations 34

Travel o Relationship must exist between the funded project and professional meeting n o Consult with colleagues, conduct research, or disseminate knowledge at professional meetings May include: n Air/rail, lodging, per diem, taxi, rental car, gas, parking, tolls etc. 35

Travel o Adhere to institutional policy and agency guidelines o Distinguish between domestic and foreign travel n o Fly America Act requires the use of U. S. air carriers if using federal funds (even if it costs more!!) If foreign travel is sponsored by the Federal government, use Federal international per diem rates 36

Subcontract or Vendor? o Subcontractor n Performance measured against whether the objectives of the federal program are met n Has responsibility for programmatic decision making n Has responsibility for adherence to applicable federal program compliance requirements 37

Subcontract or Vendor? o Vendor n Provides the goods and services within normal business operations n Provides similar goods or services to many different purchasers n Operates in a competitive environment n Provides goods or services that are ancillary to the project n Not subject to compliance requirements 38

Budgeting of Subawards o A subaward is a contractual document that conveys a portion of a project’s scope of work to another organization. The other organization’s budget should be included as part of the proposal package. 39

Subawards at the Proposal Stage o Make sure you obtain a good budget and scope of work, countersigned by the subrecipient’s authorized organizational representative o Get a copy of the subrecipient’s negotiated F&A rate agreement o Review the budget for allowable and reasonable costs n Remember you are responsible for the actions of the subcontractor 40

Consultant Costs o Paid to experts outside of the institution o Rates must be reasonable and justifiable n Documentation to justify the rates may be required by sponsor or institutional purchasing department 41

Employee or Consultant? o IRS Regulations dictate how to classify workers. o Caution: Hiring workers improperly as consultants can be viewed by the IRS as a means of avoiding payment of: n Employer match for FICA n Federal unemployment tax 42

Employee or Consultant? o Employees are generally subject to business instructions including: n n n When and where to work What tools for equipment to use Who to hire to assist with the work Where to purchase supplies What work must be performed by specific individuals What order or sequence to follow. o See IRS Publication 15 -A 43

Publications o Include n n Manuscript illustration Cost of reprints Page charges Technical reports 44

Copying & Duplication o Generally considered F&A costs o Allowable only for unusual costs n large survey instrument n tests and questionnaires n workshop procedures 45

Budget Construction o Other direct costs n n n n n o Communications Publications Animal Care Costs Human Subject Costs Shop Charges Maintenance / Service Contracts Computer Costs Graphic Arts / Photographic Services Rental / Lease of Facilities Construction / Renovation / Remodeling Costs Include Inflationary Adjustments 46

Budgeting for Unusual Expenses o Cell phones o Visa costs o First class travel o Hosting expenses for visitors 47

What Is Excluded from F&A for MTDC Base o Equipment (greater than $5, 000) o Capital Expenditures o Charges for Patient Care o Portion of each subgrant/subcontract in excess of $25 K o Rental agreements (for facilities) o Renovations o Stipends o Tuition 48

Budget Justification § The budget is the financial representation of the statement of work (SOW). § The justification should clearly explain what costs will be paid by the sponsor and how the expense was calculated. § Compare the SOW to the budget and make sure all costs are accounted for. (i. e. if the SOW mentions travel, make sure there are travel expenses in the budget) § Check the budget to make sure there are no expenses that can’t be explained in by the SOW. (i. e. the budget mentions equipment but the equipment is not explained in the SOW). 49

Budget Final Review § Make sure the math is right! § Double check the F&A calculation to ensure that only the correct items were included. § Review all subcontractor budgets for accuracy and compliance with the regulations. (Think F 6. b!) § Review the budget justification for clarity. 50

95b9c6bcfcef1b27999c6c213779c8a8.ppt