e4739ec710be8e40352309f27795c9df.ppt

- Количество слайдов: 39

DCF MODEL

DCF MODEL

Discount Cash Flow (DCF) Valuation • An important concept in valuing assets – Not just companies • Basis of Fundamental Analysis – Intrinsic value of a company • • • Cash flows Time value of money Opportunity cost Financial statement analysis Change the way you look at things in life?

Discount Cash Flow (DCF) Valuation • An important concept in valuing assets – Not just companies • Basis of Fundamental Analysis – Intrinsic value of a company • • • Cash flows Time value of money Opportunity cost Financial statement analysis Change the way you look at things in life?

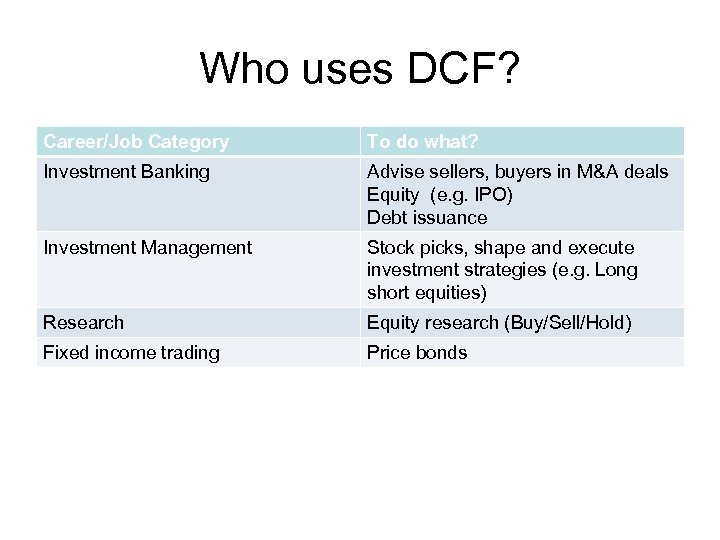

Who uses DCF? Career/Job Category To do what? Investment Banking Advise sellers, buyers in M&A deals Equity (e. g. IPO) Debt issuance Investment Management Stock picks, shape and execute investment strategies (e. g. Long short equities) Research Equity research (Buy/Sell/Hold) Fixed income trading Price bonds

Who uses DCF? Career/Job Category To do what? Investment Banking Advise sellers, buyers in M&A deals Equity (e. g. IPO) Debt issuance Investment Management Stock picks, shape and execute investment strategies (e. g. Long short equities) Research Equity research (Buy/Sell/Hold) Fixed income trading Price bonds

But who does what? • An equity analyst work is to find the real value of a firm, then DCF is the work model! • An portfolio manager job is to invest in the ”best” company, why relative valuation is more important tool!

But who does what? • An equity analyst work is to find the real value of a firm, then DCF is the work model! • An portfolio manager job is to invest in the ”best” company, why relative valuation is more important tool!

Discounted Cash Flow Valuation - DCF • What is it: In discounted cash flow valuation, the value of an asset is the present value of the expected cash flow on the asset. • Philosophical basis: Every asset has an intrinsic value that can be estimated, based upon its characteristics in terms of cash flows, growth and risk. • Information needed: To use DSF valuation, you need – To estimate the life of the asset – To estimate the cash flow during the life of the asset – To estimate the discount rate to apply to these cash flows to get present value • Market inefficiency: Markets are assumed to make mistakes in pricing assets across time, and are assumed to correct themselves over time, as new information comes out about assets.

Discounted Cash Flow Valuation - DCF • What is it: In discounted cash flow valuation, the value of an asset is the present value of the expected cash flow on the asset. • Philosophical basis: Every asset has an intrinsic value that can be estimated, based upon its characteristics in terms of cash flows, growth and risk. • Information needed: To use DSF valuation, you need – To estimate the life of the asset – To estimate the cash flow during the life of the asset – To estimate the discount rate to apply to these cash flows to get present value • Market inefficiency: Markets are assumed to make mistakes in pricing assets across time, and are assumed to correct themselves over time, as new information comes out about assets.

Advantages of DCF valuation • Since DCF valuation, done right, is based upon an asset’s fundamentals, it should be less exposed to market moods and perceptions. • If good investors buy businesses, rather than stocks, discounted cash flow valuation is the right way to think about what you are getting when you buy asset. • DCF valuation forces you to think about the underlying characteristics of the firm, and understand its business. If nothing else, it brings you face to face with the assumptions you are making when you pay a given price for an asset.

Advantages of DCF valuation • Since DCF valuation, done right, is based upon an asset’s fundamentals, it should be less exposed to market moods and perceptions. • If good investors buy businesses, rather than stocks, discounted cash flow valuation is the right way to think about what you are getting when you buy asset. • DCF valuation forces you to think about the underlying characteristics of the firm, and understand its business. If nothing else, it brings you face to face with the assumptions you are making when you pay a given price for an asset.

Disadvantages of DCF valuation • Since it is an attempt to estimate intrinsic value, it requires far more inputs and information than other valuation approaches. • These inputs and information are not only noisy (and difficult to estimate), but can be manipulated by savvy analyst to provide the conclusion he or she wants. • In an intrinsic valuation model, there is no guarantee that anything will emerge as under or over valued. Thus, it is possible in a DCF valuation model, to find every stock in a market to be over valued. This can be a problem for – Equity research analysts, whose job it is to follow sectors and make recommendations on the most under and over valued stocks – Equity portfolio managers, who have to be fully (or close to fully) invested in equities.

Disadvantages of DCF valuation • Since it is an attempt to estimate intrinsic value, it requires far more inputs and information than other valuation approaches. • These inputs and information are not only noisy (and difficult to estimate), but can be manipulated by savvy analyst to provide the conclusion he or she wants. • In an intrinsic valuation model, there is no guarantee that anything will emerge as under or over valued. Thus, it is possible in a DCF valuation model, to find every stock in a market to be over valued. This can be a problem for – Equity research analysts, whose job it is to follow sectors and make recommendations on the most under and over valued stocks – Equity portfolio managers, who have to be fully (or close to fully) invested in equities.

When DCF valuation works best • This approach is designed for use for assets (firms) that derive their value from their capacity to generate cash flows in the future. It does make your job easier, if the company has a history that can be used in estimating future cash flows. It works best for investors who either – have a long time horizon, allowing the market time to correct its valuation mistakes and for price to revert to “true” value or – are capable of providing the catalyst needed to move price to value, as would be the case if you were an activist investor or a potential acquirer of the whole firm.

When DCF valuation works best • This approach is designed for use for assets (firms) that derive their value from their capacity to generate cash flows in the future. It does make your job easier, if the company has a history that can be used in estimating future cash flows. It works best for investors who either – have a long time horizon, allowing the market time to correct its valuation mistakes and for price to revert to “true” value or – are capable of providing the catalyst needed to move price to value, as would be the case if you were an activist investor or a potential acquirer of the whole firm.

Merits of the DCF Strengths: • Captures the time value of money and opportunity cost • Scientific • Widely used • Based on cashflow Weaknesses: • Almost always results in overvaluation. Why? • Can we ever predict the future? – “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future. ” Warren Buffett • Based on many assumptions – Which assumptions are the most critical? – 5 years vs. 10 years estimation

Merits of the DCF Strengths: • Captures the time value of money and opportunity cost • Scientific • Widely used • Based on cashflow Weaknesses: • Almost always results in overvaluation. Why? • Can we ever predict the future? – “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future. ” Warren Buffett • Based on many assumptions – Which assumptions are the most critical? – 5 years vs. 10 years estimation

Valuing a company using a DCF model Steps: 1. Understand the business of the company you are valuing 2. Find Inputs: a) Calculate the Discount Rate – b) Build Future (Pro forma) Cash Flow and find the PV of these cash flow – c) Weighted Average Cost of Capital (WACC) Free Cash Flow (FCF) Calculate Terminal Value – EBITDA Multiple 3. Analyze Outputs: a) b) c) Enterprise value (EV) Equity (share price) Perform Sensitivity Analysis – • Range vs. Point Estimate There are many correct answers and many variations on methods and which numbers to use (academics vs. practitioners).

Valuing a company using a DCF model Steps: 1. Understand the business of the company you are valuing 2. Find Inputs: a) Calculate the Discount Rate – b) Build Future (Pro forma) Cash Flow and find the PV of these cash flow – c) Weighted Average Cost of Capital (WACC) Free Cash Flow (FCF) Calculate Terminal Value – EBITDA Multiple 3. Analyze Outputs: a) b) c) Enterprise value (EV) Equity (share price) Perform Sensitivity Analysis – • Range vs. Point Estimate There are many correct answers and many variations on methods and which numbers to use (academics vs. practitioners).

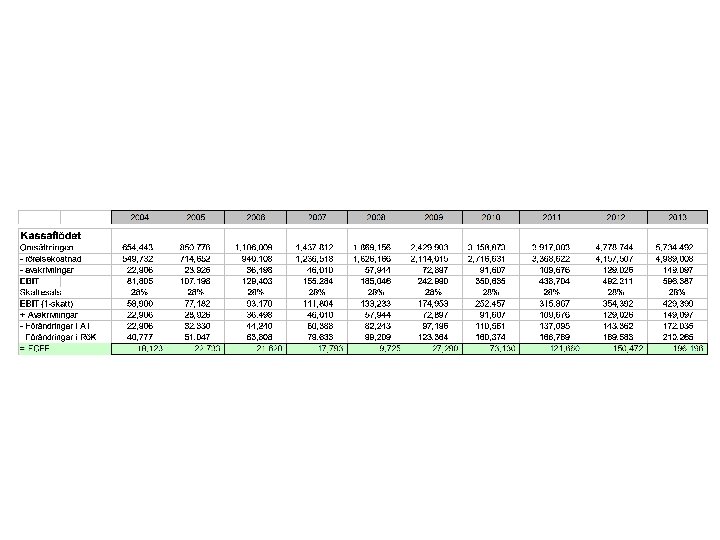

Pro Forma Cash Flow • • • Estimate the future cash flow of a company (horizon is 5 to 10 years) An EBITDA world (Earnings Before Interest, Tax, Depreciation and Amortization), but EBITDA is not cash Need Free Cash Flow (FCF), estimated by – FCF = EBIT * (1 -Tc) + D&A – Change in net working capital – Capital Expenditure (CAPEX) Where to find the stuff? • EBIT • D&A • Net working capital (current asset – current liabilities) • Capex • • Find the PV of FCF (remember C/(1+r)n) How do we estimate future cash flow? – – – • (I/S) (C/S) (B/S) (C/S, B/S) Probably the toughest task in the entire DCF valuation exercise First thing is to get a better understanding of the business and the industry as a whole. Start with the 10 -K Estimate future growth profile from company filings. Is past history a good indication of the future? We want to predict the trends. Leverage analyst reports (ibankers) Talk to management (research analysts) Start with the income statement. In real-life you often have to pro forma (at least parts of) all three financial statements but there are shortcuts

Pro Forma Cash Flow • • • Estimate the future cash flow of a company (horizon is 5 to 10 years) An EBITDA world (Earnings Before Interest, Tax, Depreciation and Amortization), but EBITDA is not cash Need Free Cash Flow (FCF), estimated by – FCF = EBIT * (1 -Tc) + D&A – Change in net working capital – Capital Expenditure (CAPEX) Where to find the stuff? • EBIT • D&A • Net working capital (current asset – current liabilities) • Capex • • Find the PV of FCF (remember C/(1+r)n) How do we estimate future cash flow? – – – • (I/S) (C/S) (B/S) (C/S, B/S) Probably the toughest task in the entire DCF valuation exercise First thing is to get a better understanding of the business and the industry as a whole. Start with the 10 -K Estimate future growth profile from company filings. Is past history a good indication of the future? We want to predict the trends. Leverage analyst reports (ibankers) Talk to management (research analysts) Start with the income statement. In real-life you often have to pro forma (at least parts of) all three financial statements but there are shortcuts

Terminal value • The 5 to 10 year pro forma cash flow attempts to capture foreseeable changes in earnings • The terminal value estimates the company’s value after it has entered “steady state”

Terminal value • The 5 to 10 year pro forma cash flow attempts to capture foreseeable changes in earnings • The terminal value estimates the company’s value after it has entered “steady state”

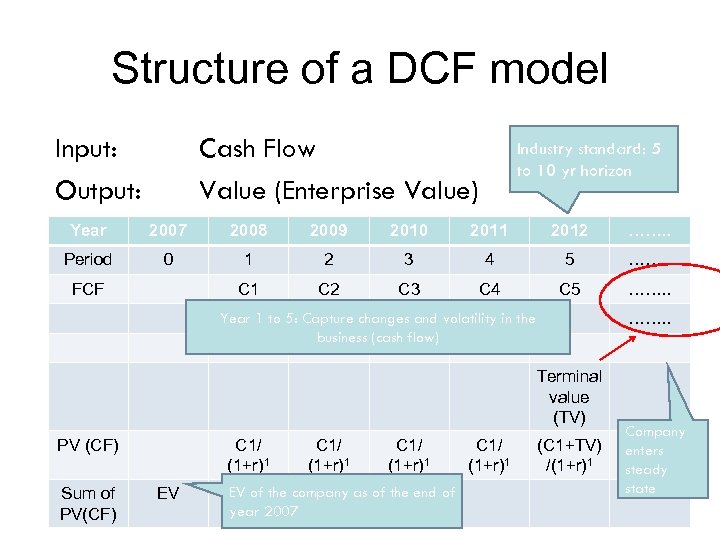

Structure of a DCF model Input: Output: Cash Flow Value (Enterprise Value) Industry standard: 5 to 10 yr horizon Year 2007 2008 2009 2010 2011 2012 ……. . Period 0 1 2 3 4 5 ……. . C 1 C 2 C 3 C 4 C 5 ……. . FCF ……. . Year 1 to 5: Capture changes and volatility in the business (cash flow) Terminal value (TV) PV (CF) Sum of PV(CF) C 1/ (1+r)1 EV of the company as of the end of year 2007 C 1/ (1+r)1 (C 1+TV) /(1+r)1 Company enters steady state

Structure of a DCF model Input: Output: Cash Flow Value (Enterprise Value) Industry standard: 5 to 10 yr horizon Year 2007 2008 2009 2010 2011 2012 ……. . Period 0 1 2 3 4 5 ……. . C 1 C 2 C 3 C 4 C 5 ……. . FCF ……. . Year 1 to 5: Capture changes and volatility in the business (cash flow) Terminal value (TV) PV (CF) Sum of PV(CF) C 1/ (1+r)1 EV of the company as of the end of year 2007 C 1/ (1+r)1 (C 1+TV) /(1+r)1 Company enters steady state

Example: Kraft (NYSE: KFT) • Kraft Foods • Remember, before we jump into Excel: – What does Kraft do? – Market position (market share, revenue, etc)? – Established or emerging industry? – Level of competition? – Growth opportunities? – Quality management? • Excel demonstration

Example: Kraft (NYSE: KFT) • Kraft Foods • Remember, before we jump into Excel: – What does Kraft do? – Market position (market share, revenue, etc)? – Established or emerging industry? – Level of competition? – Growth opportunities? – Quality management? • Excel demonstration

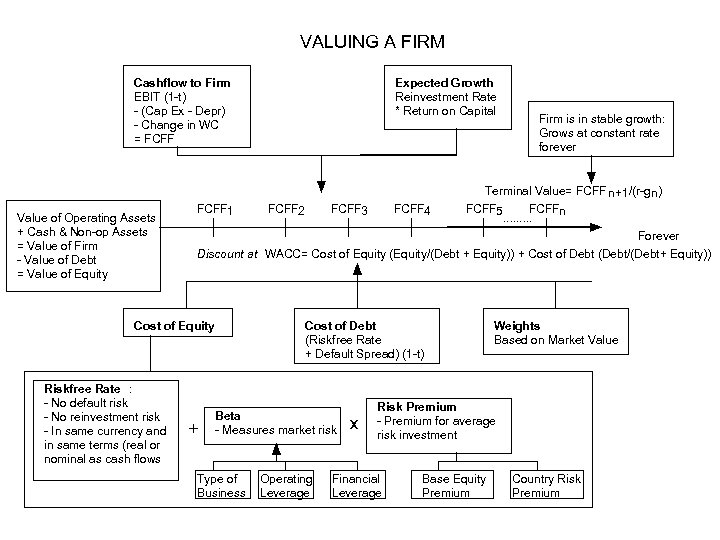

VALUING A FIRM Cashflow to Firm EBIT (1 -t) - (Cap Ex - Depr) - Change in WC = FCFF Value of Operating Assets + Cash & Non-op Assets = Value of Firm - Value of Debt = Value of Equity Firm is in stable growth: Grows at constant rate forever Terminal Value= FCFF n+1 /(r-gn) FCFF 1 FCFF 2 FCFF 3 FCFF 4 FCFF 5 FCFFn. . Forever Discount at WACC= Cost of Equity (Equity/(Debt + Equity)) + Cost of Debt (Debt/(Debt+ Equity)) Cost of Equity Riskfree Rate : - No default risk - No reinvestment risk - In same currency and in same terms (real or nominal as cash flows Expected Growth Reinvestment Rate * Return on Capital + Cost of Debt (Riskfree Rate + Default Spread) (1 -t) Beta - Measures market risk Type of Business Operating Leverage X Weights Based on Market Value Risk Premium - Premium for average risk investment Financial Leverage Base Equity Premium Country Risk Premium

VALUING A FIRM Cashflow to Firm EBIT (1 -t) - (Cap Ex - Depr) - Change in WC = FCFF Value of Operating Assets + Cash & Non-op Assets = Value of Firm - Value of Debt = Value of Equity Firm is in stable growth: Grows at constant rate forever Terminal Value= FCFF n+1 /(r-gn) FCFF 1 FCFF 2 FCFF 3 FCFF 4 FCFF 5 FCFFn. . Forever Discount at WACC= Cost of Equity (Equity/(Debt + Equity)) + Cost of Debt (Debt/(Debt+ Equity)) Cost of Equity Riskfree Rate : - No default risk - No reinvestment risk - In same currency and in same terms (real or nominal as cash flows Expected Growth Reinvestment Rate * Return on Capital + Cost of Debt (Riskfree Rate + Default Spread) (1 -t) Beta - Measures market risk Type of Business Operating Leverage X Weights Based on Market Value Risk Premium - Premium for average risk investment Financial Leverage Base Equity Premium Country Risk Premium

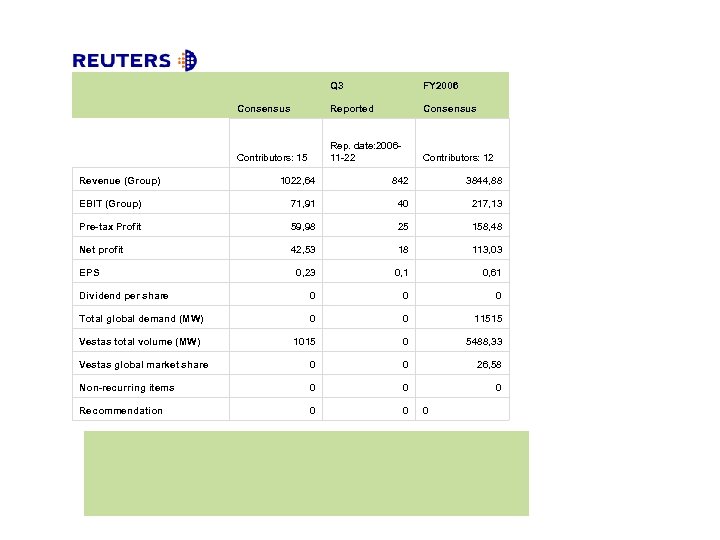

Q 3 FY 2006 Consensus Reported Consensus Contributors: 15 Rep. date: 200611 -22 Contributors: 12 Revenue (Group) 1022, 64 842 3844, 88 EBIT (Group) 71, 91 40 217, 13 Pre-tax Profit 59, 98 25 158, 48 Net profit 42, 53 18 113, 03 0, 23 0, 1 0, 61 Dividend per share 0 0 0 Total global demand (MW) 0 0 11515 1015 0 5488, 33 Vestas global market share 0 0 26, 58 Non-recurring items 0 0 0 Recommendation 0 0 EPS Vestas total volume (MW) 0

Q 3 FY 2006 Consensus Reported Consensus Contributors: 15 Rep. date: 200611 -22 Contributors: 12 Revenue (Group) 1022, 64 842 3844, 88 EBIT (Group) 71, 91 40 217, 13 Pre-tax Profit 59, 98 25 158, 48 Net profit 42, 53 18 113, 03 0, 23 0, 1 0, 61 Dividend per share 0 0 0 Total global demand (MW) 0 0 11515 1015 0 5488, 33 Vestas global market share 0 0 26, 58 Non-recurring items 0 0 0 Recommendation 0 0 EPS Vestas total volume (MW) 0

Industry Implications • Everyone in the industry knows how to do a DCF • Every bank, every analyst uses , uses similar assumptions, studies the same theories in school, but bankers and analysts come up with extremely different values and recommendations (Buy/Sell/Hold) for the same company • Interesting trends • The industry always comes back to two questions: – What percentage of a banker/analyst’s performance is due to luck vs. skills – Is past performance a good indicator of future performance?

Industry Implications • Everyone in the industry knows how to do a DCF • Every bank, every analyst uses , uses similar assumptions, studies the same theories in school, but bankers and analysts come up with extremely different values and recommendations (Buy/Sell/Hold) for the same company • Interesting trends • The industry always comes back to two questions: – What percentage of a banker/analyst’s performance is due to luck vs. skills – Is past performance a good indicator of future performance?

So is it all just a crapshoot? • Experience leads to better valuation • Valuation is an art, not a science – The key is to develop your own framework and style • Understanding of the business is the key • Wall Street often gets it wrong?

So is it all just a crapshoot? • Experience leads to better valuation • Valuation is an art, not a science – The key is to develop your own framework and style • Understanding of the business is the key • Wall Street often gets it wrong?

Discounted Cash Flow Valuation • DCF is the cornerstone of valuations and is the "analytically most correct" way – In reality: several "fudge-factors" and disagreement between practitioners • Robust in valuing anything that gives cash-flow in the future given assumptions – Bonds, derivatives, companies, etc. • Valuation of future cash that the investor will get from holding the firm. At the end of the day: "Cash is King" "Cash is fact – profit is an opinion" "Earnings do not pay the bills" • Used when significant information is available on company and its prospects • Also used to select between internal projects and to price the impact of various scenarios e. g. during negotiations

Discounted Cash Flow Valuation • DCF is the cornerstone of valuations and is the "analytically most correct" way – In reality: several "fudge-factors" and disagreement between practitioners • Robust in valuing anything that gives cash-flow in the future given assumptions – Bonds, derivatives, companies, etc. • Valuation of future cash that the investor will get from holding the firm. At the end of the day: "Cash is King" "Cash is fact – profit is an opinion" "Earnings do not pay the bills" • Used when significant information is available on company and its prospects • Also used to select between internal projects and to price the impact of various scenarios e. g. during negotiations

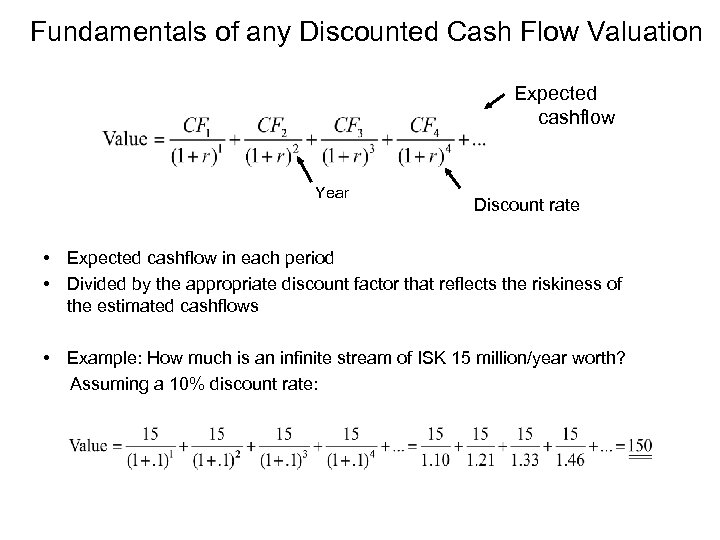

Fundamentals of any Discounted Cash Flow Valuation Expected cashflow Year Discount rate • Expected cashflow in each period • Divided by the appropriate discount factor that reflects the riskiness of the estimated cashflows • Example: How much is an infinite stream of ISK 15 million/year worth? Assuming a 10% discount rate:

Fundamentals of any Discounted Cash Flow Valuation Expected cashflow Year Discount rate • Expected cashflow in each period • Divided by the appropriate discount factor that reflects the riskiness of the estimated cashflows • Example: How much is an infinite stream of ISK 15 million/year worth? Assuming a 10% discount rate:

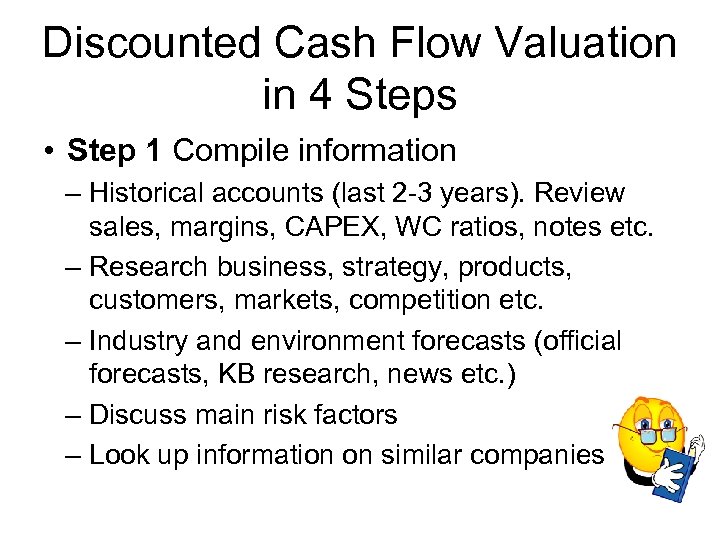

Discounted Cash Flow Valuation in 4 Steps • Step 1 Compile information – Historical accounts (last 2 -3 years). Review sales, margins, CAPEX, WC ratios, notes etc. – Research business, strategy, products, customers, markets, competition etc. – Industry and environment forecasts (official forecasts, KB research, news etc. ) – Discuss main risk factors – Look up information on similar companies

Discounted Cash Flow Valuation in 4 Steps • Step 1 Compile information – Historical accounts (last 2 -3 years). Review sales, margins, CAPEX, WC ratios, notes etc. – Research business, strategy, products, customers, markets, competition etc. – Industry and environment forecasts (official forecasts, KB research, news etc. ) – Discuss main risk factors – Look up information on similar companies

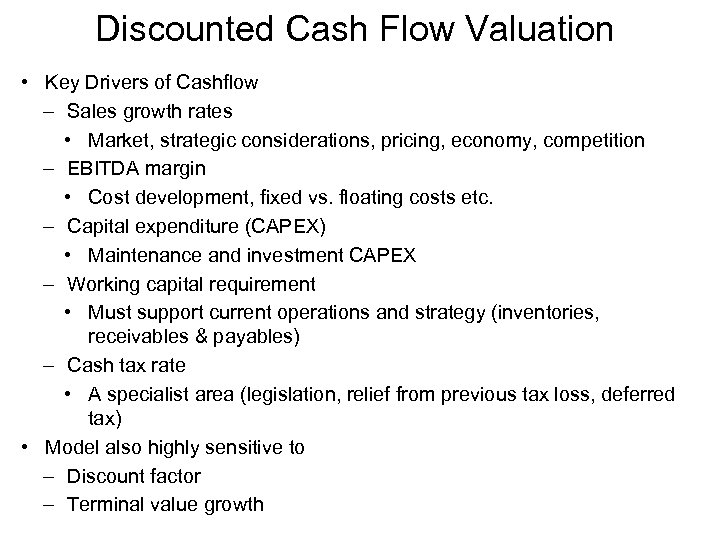

Discounted Cash Flow Valuation • Key Drivers of Cashflow – Sales growth rates • Market, strategic considerations, pricing, economy, competition – EBITDA margin • Cost development, fixed vs. floating costs etc. – Capital expenditure (CAPEX) • Maintenance and investment CAPEX – Working capital requirement • Must support current operations and strategy (inventories, receivables & payables) – Cash tax rate • A specialist area (legislation, relief from previous tax loss, deferred tax) • Model also highly sensitive to – Discount factor – Terminal value growth

Discounted Cash Flow Valuation • Key Drivers of Cashflow – Sales growth rates • Market, strategic considerations, pricing, economy, competition – EBITDA margin • Cost development, fixed vs. floating costs etc. – Capital expenditure (CAPEX) • Maintenance and investment CAPEX – Working capital requirement • Must support current operations and strategy (inventories, receivables & payables) – Cash tax rate • A specialist area (legislation, relief from previous tax loss, deferred tax) • Model also highly sensitive to – Discount factor – Terminal value growth

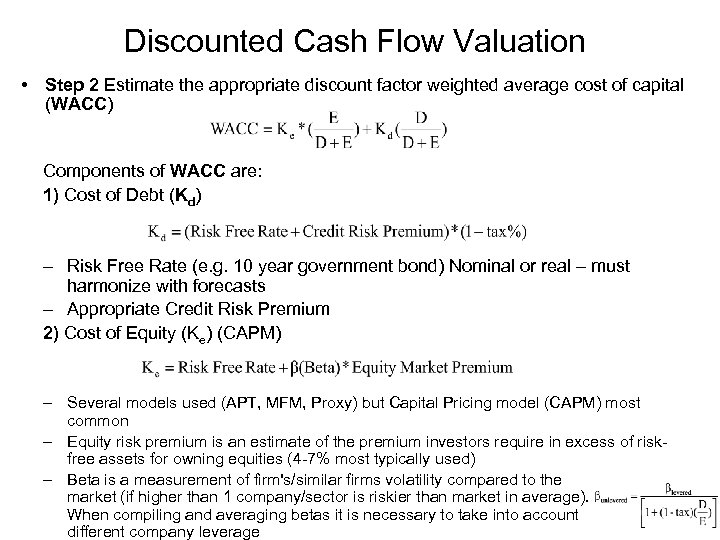

Discounted Cash Flow Valuation • Step 2 Estimate the appropriate discount factor weighted average cost of capital (WACC) Components of WACC are: 1) Cost of Debt (Kd) – Risk Free Rate (e. g. 10 year government bond) Nominal or real – must harmonize with forecasts – Appropriate Credit Risk Premium 2) Cost of Equity (Ke) (CAPM) – Several models used (APT, MFM, Proxy) but Capital Pricing model (CAPM) most common – Equity risk premium is an estimate of the premium investors require in excess of riskfree assets for owning equities (4 -7% most typically used) – Beta is a measurement of firm's/similar firms volatility compared to the market (if higher than 1 company/sector is riskier than market in average). When compiling and averaging betas it is necessary to take into account different company leverage

Discounted Cash Flow Valuation • Step 2 Estimate the appropriate discount factor weighted average cost of capital (WACC) Components of WACC are: 1) Cost of Debt (Kd) – Risk Free Rate (e. g. 10 year government bond) Nominal or real – must harmonize with forecasts – Appropriate Credit Risk Premium 2) Cost of Equity (Ke) (CAPM) – Several models used (APT, MFM, Proxy) but Capital Pricing model (CAPM) most common – Equity risk premium is an estimate of the premium investors require in excess of riskfree assets for owning equities (4 -7% most typically used) – Beta is a measurement of firm's/similar firms volatility compared to the market (if higher than 1 company/sector is riskier than market in average). When compiling and averaging betas it is necessary to take into account different company leverage

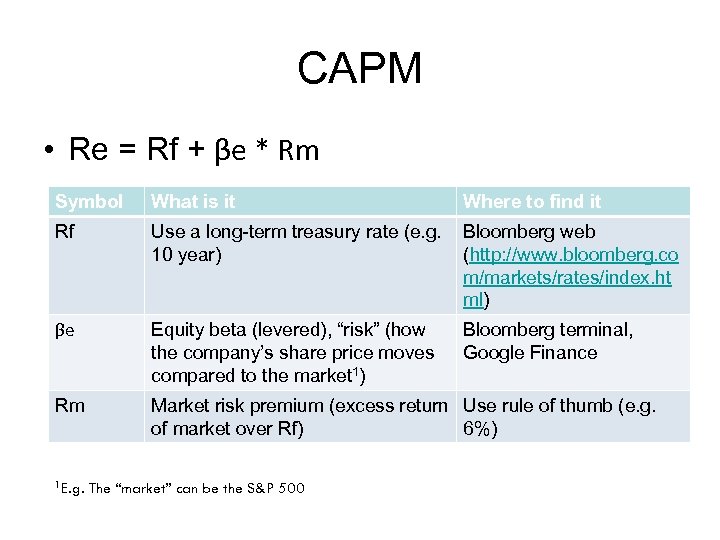

CAPM • Re = Rf + βe * Rm Symbol What is it Where to find it Rf Use a long-term treasury rate (e. g. 10 year) Bloomberg web (http: //www. bloomberg. co m/markets/rates/index. ht ml) βe Equity beta (levered), “risk” (how the company’s share price moves compared to the market 1) Bloomberg terminal, Google Finance Rm Market risk premium (excess return Use rule of thumb (e. g. of market over Rf) 6%) 1 E. g. The “market” can be the S&P 500

CAPM • Re = Rf + βe * Rm Symbol What is it Where to find it Rf Use a long-term treasury rate (e. g. 10 year) Bloomberg web (http: //www. bloomberg. co m/markets/rates/index. ht ml) βe Equity beta (levered), “risk” (how the company’s share price moves compared to the market 1) Bloomberg terminal, Google Finance Rm Market risk premium (excess return Use rule of thumb (e. g. of market over Rf) 6%) 1 E. g. The “market” can be the S&P 500

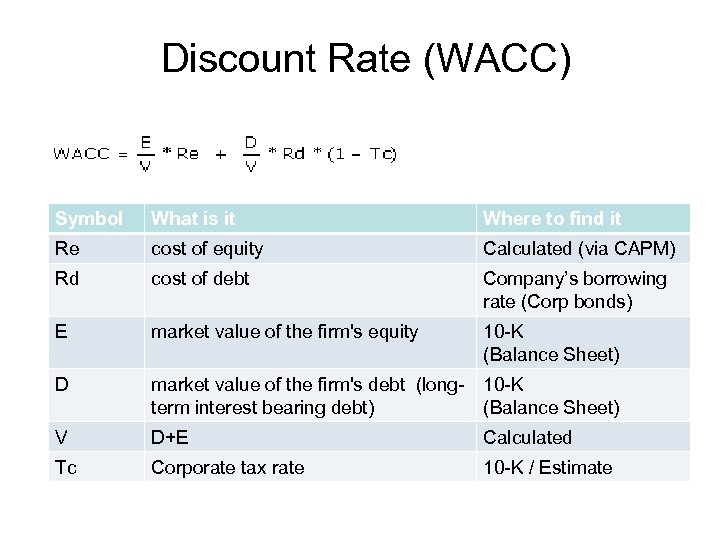

Discount Rate (WACC) Symbol What is it Where to find it Re cost of equity Calculated (via CAPM) Rd cost of debt Company’s borrowing rate (Corp bonds) E market value of the firm's equity 10 -K (Balance Sheet) D market value of the firm's debt (long- 10 -K term interest bearing debt) (Balance Sheet) V D+E Calculated Tc Corporate tax rate 10 -K / Estimate

Discount Rate (WACC) Symbol What is it Where to find it Re cost of equity Calculated (via CAPM) Rd cost of debt Company’s borrowing rate (Corp bonds) E market value of the firm's equity 10 -K (Balance Sheet) D market value of the firm's debt (long- 10 -K term interest bearing debt) (Balance Sheet) V D+E Calculated Tc Corporate tax rate 10 -K / Estimate

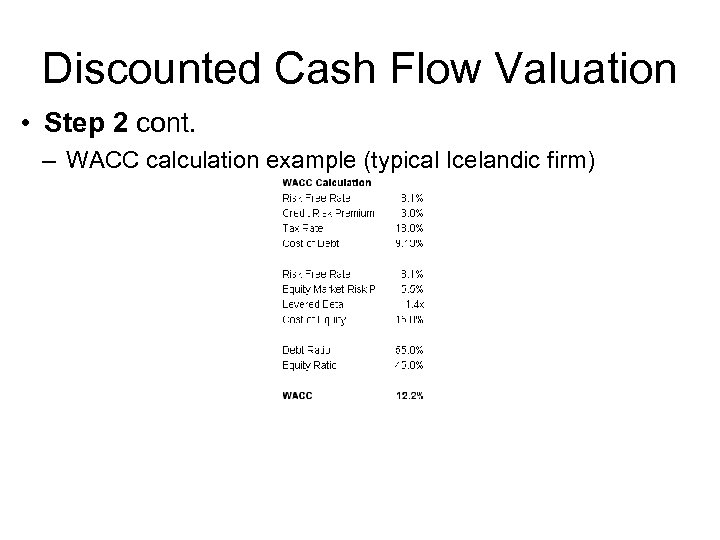

Discounted Cash Flow Valuation • Step 2 cont. – WACC calculation example (typical Icelandic firm)

Discounted Cash Flow Valuation • Step 2 cont. – WACC calculation example (typical Icelandic firm)

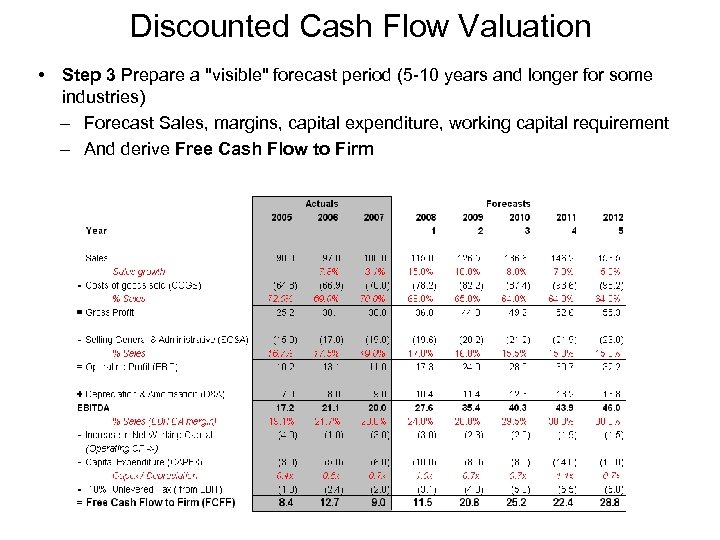

Discounted Cash Flow Valuation • Step 3 Prepare a "visible" forecast period (5 -10 years and longer for some industries) – Forecast Sales, margins, capital expenditure, working capital requirement – And derive Free Cash Flow to Firm

Discounted Cash Flow Valuation • Step 3 Prepare a "visible" forecast period (5 -10 years and longer for some industries) – Forecast Sales, margins, capital expenditure, working capital requirement – And derive Free Cash Flow to Firm

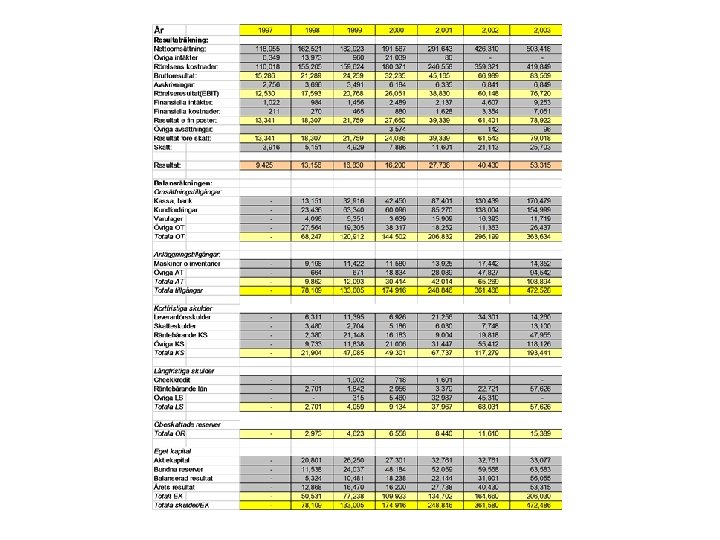

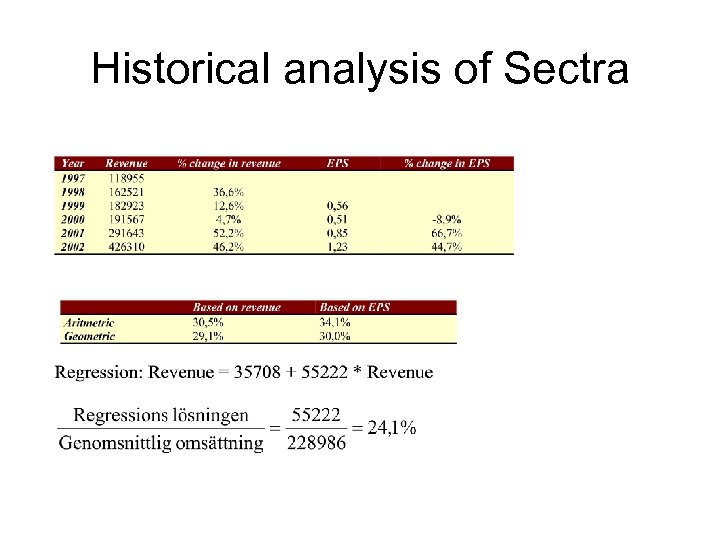

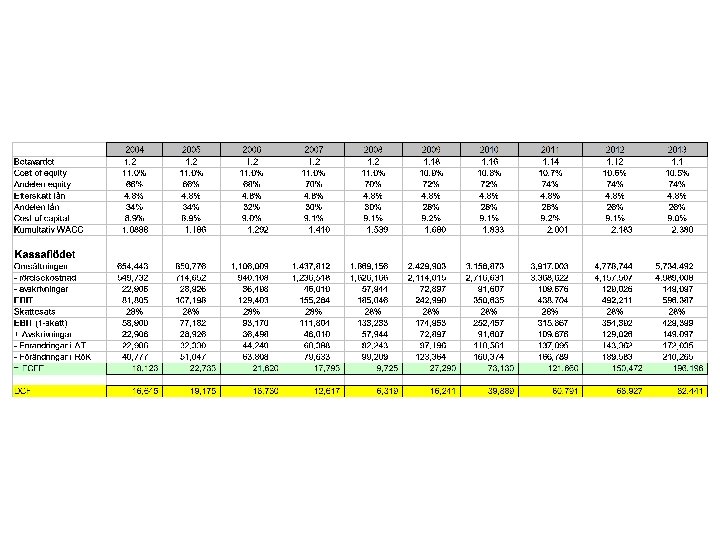

Historical analysis of Sectra

Historical analysis of Sectra

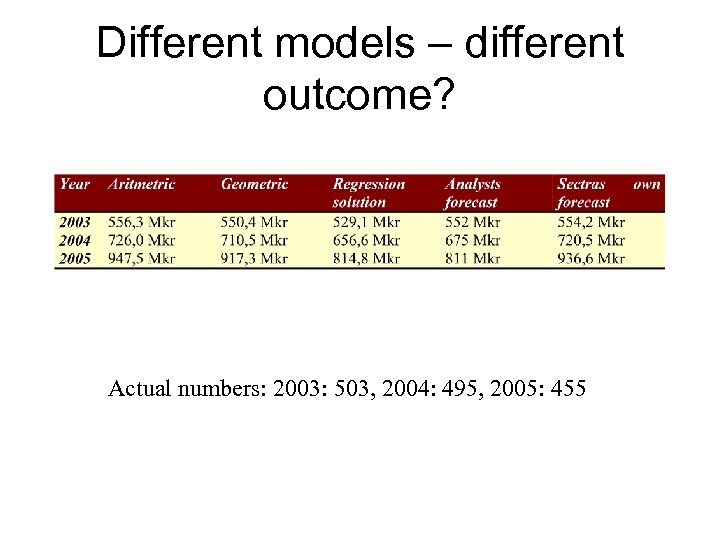

Different models – different outcome? Actual numbers: 2003: 503, 2004: 495, 2005: 455

Different models – different outcome? Actual numbers: 2003: 503, 2004: 495, 2005: 455

Analysts mainly focus on • Information from companies, press release, meetings etc. • Macro information important for the company – airliner/oil • Information from other companies in the same industry Nokia/Ericsson • Other sector specific analysts – Gartner Group

Analysts mainly focus on • Information from companies, press release, meetings etc. • Macro information important for the company – airliner/oil • Information from other companies in the same industry Nokia/Ericsson • Other sector specific analysts – Gartner Group

Do equity analysts forecast well? • Old studies show they no more than – bad! But we can see a shift about 1995 – why? • Resent research in Sweden show that newspaper/magazines: Affärsvärlden, Veckan Affärer and Aktiespararna all are over optimistic. • In the period 1987 to 2002 analysts are 11 % over optimistic in there p/s forecast but with changing spread due to volatility.

Do equity analysts forecast well? • Old studies show they no more than – bad! But we can see a shift about 1995 – why? • Resent research in Sweden show that newspaper/magazines: Affärsvärlden, Veckan Affärer and Aktiespararna all are over optimistic. • In the period 1987 to 2002 analysts are 11 % over optimistic in there p/s forecast but with changing spread due to volatility.

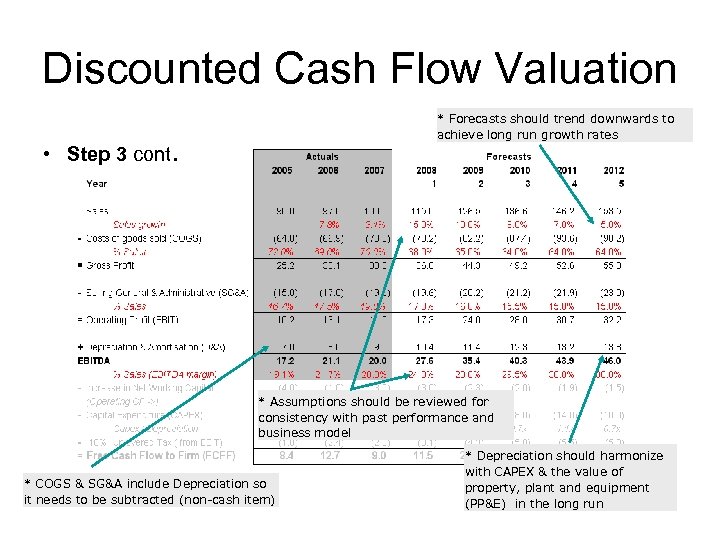

Discounted Cash Flow Valuation * Forecasts should trend downwards to achieve long run growth rates • Step 3 cont. * Assumptions should be reviewed for consistency with past performance and business model * COGS & SG&A include Depreciation so it needs to be subtracted (non-cash item) * Depreciation should harmonize with CAPEX & the value of property, plant and equipment (PP&E) in the long run

Discounted Cash Flow Valuation * Forecasts should trend downwards to achieve long run growth rates • Step 3 cont. * Assumptions should be reviewed for consistency with past performance and business model * COGS & SG&A include Depreciation so it needs to be subtracted (non-cash item) * Depreciation should harmonize with CAPEX & the value of property, plant and equipment (PP&E) in the long run

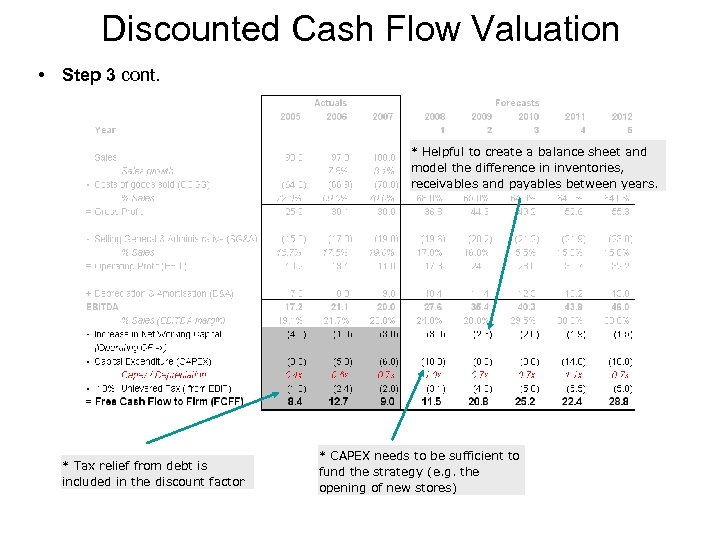

Discounted Cash Flow Valuation • Step 3 cont. * Helpful to create a balance sheet and model the difference in inventories, receivables and payables between years. * Tax relief from debt is included in the discount factor * CAPEX needs to be sufficient to fund the strategy (e. g. the opening of new stores)

Discounted Cash Flow Valuation • Step 3 cont. * Helpful to create a balance sheet and model the difference in inventories, receivables and payables between years. * Tax relief from debt is included in the discount factor * CAPEX needs to be sufficient to fund the strategy (e. g. the opening of new stores)

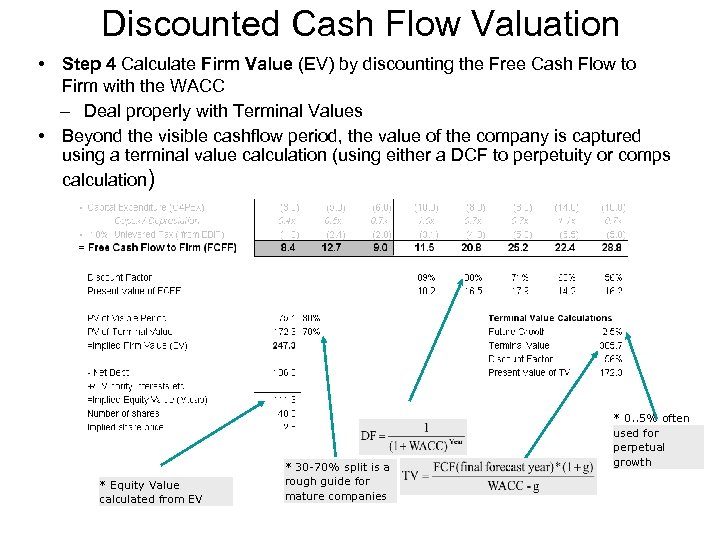

Discounted Cash Flow Valuation • Step 4 Calculate Firm Value (EV) by discounting the Free Cash Flow to Firm with the WACC – Deal properly with Terminal Values • Beyond the visible cashflow period, the value of the company is captured using a terminal value calculation (using either a DCF to perpetuity or comps calculation) * Equity Value calculated from EV * 30 -70% split is a rough guide for mature companies * 0. . 5% often used for perpetual growth

Discounted Cash Flow Valuation • Step 4 Calculate Firm Value (EV) by discounting the Free Cash Flow to Firm with the WACC – Deal properly with Terminal Values • Beyond the visible cashflow period, the value of the company is captured using a terminal value calculation (using either a DCF to perpetuity or comps calculation) * Equity Value calculated from EV * 30 -70% split is a rough guide for mature companies * 0. . 5% often used for perpetual growth

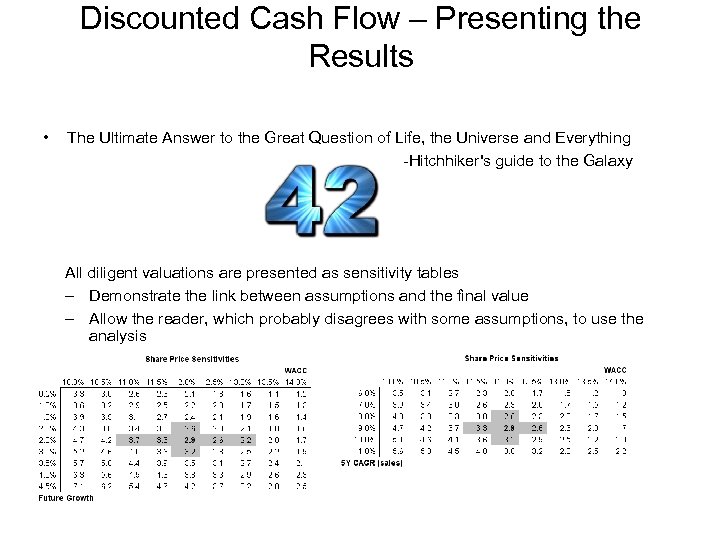

Discounted Cash Flow – Presenting the Results • The Ultimate Answer to the Great Question of Life, the Universe and Everything -Hitchhiker's guide to the Galaxy All diligent valuations are presented as sensitivity tables – Demonstrate the link between assumptions and the final value – Allow the reader, which probably disagrees with some assumptions, to use the analysis

Discounted Cash Flow – Presenting the Results • The Ultimate Answer to the Great Question of Life, the Universe and Everything -Hitchhiker's guide to the Galaxy All diligent valuations are presented as sensitivity tables – Demonstrate the link between assumptions and the final value – Allow the reader, which probably disagrees with some assumptions, to use the analysis