2d2a05f86d8cae5fa2244dbfbe24f06f.ppt

- Количество слайдов: 42

DC OPEN DOORS LENDER TRAINING

DC OPEN DOORS LENDER TRAINING

Welcome to DC Open Doors Presentation Summary • Program Overview o o o Program Highlights Loan Products Down Payment Assistance Program Facts Program FAQs • Program Process o o o o Reservation Process Data Transmission Pre-closing Review Reservation Extensions Direct Funding, Closing Post-Closing Process FAQs • Contact Information 2

Welcome to DC Open Doors Presentation Summary • Program Overview o o o Program Highlights Loan Products Down Payment Assistance Program Facts Program FAQs • Program Process o o o o Reservation Process Data Transmission Pre-closing Review Reservation Extensions Direct Funding, Closing Post-Closing Process FAQs • Contact Information 2

Program Highlights • DC Open Doors allows participating lenders to offer affordable mortgages and down payment assistance to eligible homebuyers. • DC Open Doors has Continuous Funding for its mortgages AND down payment assistance! o Interest rates are posted daily at www. dcopendoors. com, Facebook (DC Open Doors) and Twitter (@DCOpen. Doors). • U. S. Bank, National Association is the Master Servicer. • All participating lenders must: o Be approved by both U. S. Bank and DCHFA o Participate in all mandatory trainings • Lenders are encouraged to originate a minimum of $1 Million annually. 3

Program Highlights • DC Open Doors allows participating lenders to offer affordable mortgages and down payment assistance to eligible homebuyers. • DC Open Doors has Continuous Funding for its mortgages AND down payment assistance! o Interest rates are posted daily at www. dcopendoors. com, Facebook (DC Open Doors) and Twitter (@DCOpen. Doors). • U. S. Bank, National Association is the Master Servicer. • All participating lenders must: o Be approved by both U. S. Bank and DCHFA o Participate in all mandatory trainings • Lenders are encouraged to originate a minimum of $1 Million annually. 3

Program Highlights • • • FHA and Conventional Loan Types Open Doors can provide 1 st trust alone or 1 st trust and DPAL Open to First Time and Repeat Homebuyers Open to all D. C. Neighborhoods and Wards Maximum Borrower Income of $132, 360 • No Household income test • • $453, 100 Maximum 1 st Trust Loan Amount More Inclusive Affordable Homeownership! No Sales Price Limitations No Asset Test U. S. Bank Overlays & Investor Guidelines Apply 4

Program Highlights • • • FHA and Conventional Loan Types Open Doors can provide 1 st trust alone or 1 st trust and DPAL Open to First Time and Repeat Homebuyers Open to all D. C. Neighborhoods and Wards Maximum Borrower Income of $132, 360 • No Household income test • • $453, 100 Maximum 1 st Trust Loan Amount More Inclusive Affordable Homeownership! No Sales Price Limitations No Asset Test U. S. Bank Overlays & Investor Guidelines Apply 4

Freddie Mac Super Conforming • Max loan amount of • $679, 650 • No DPA • 3% Down • Charter Minimum MI 5

Freddie Mac Super Conforming • Max loan amount of • $679, 650 • No DPA • 3% Down • Charter Minimum MI 5

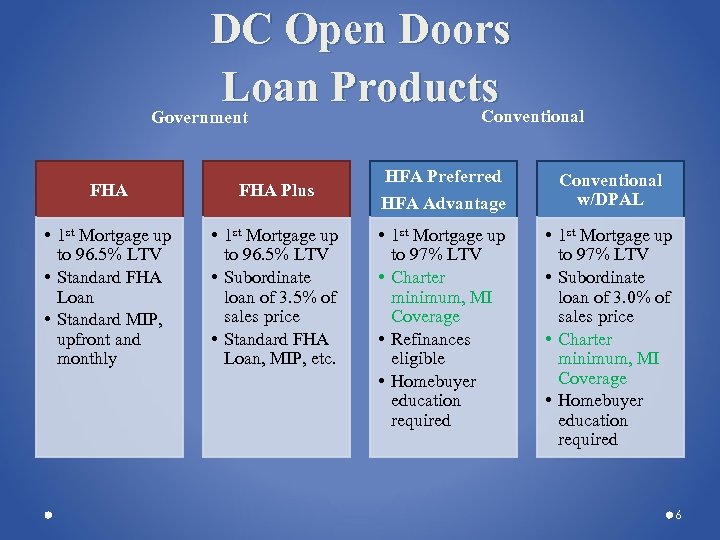

DC Open Doors Loan Products Conventional Government FHA Plus • 1 st Mortgage up to 96. 5% LTV • Standard FHA Loan • Standard MIP, upfront and monthly • 1 st Mortgage up to 96. 5% LTV • Subordinate loan of 3. 5% of sales price • Standard FHA Loan, MIP, etc. HFA Preferred HFA Advantage • 1 st Mortgage up to 97% LTV • Charter minimum, MI Coverage • Refinances eligible • Homebuyer education required Conventional w/DPAL • 1 st Mortgage up to 97% LTV • Subordinate loan of 3. 0% of sales price • Charter minimum, MI Coverage • Homebuyer education required 6

DC Open Doors Loan Products Conventional Government FHA Plus • 1 st Mortgage up to 96. 5% LTV • Standard FHA Loan • Standard MIP, upfront and monthly • 1 st Mortgage up to 96. 5% LTV • Subordinate loan of 3. 5% of sales price • Standard FHA Loan, MIP, etc. HFA Preferred HFA Advantage • 1 st Mortgage up to 97% LTV • Charter minimum, MI Coverage • Refinances eligible • Homebuyer education required Conventional w/DPAL • 1 st Mortgage up to 97% LTV • Subordinate loan of 3. 0% of sales price • Charter minimum, MI Coverage • Homebuyer education required 6

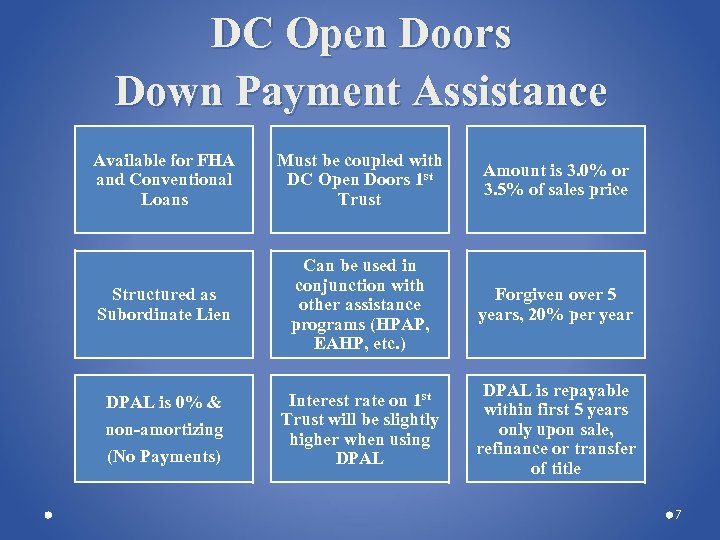

DC Open Doors Down Payment Assistance Available for FHA and Conventional Loans Must be coupled with DC Open Doors 1 st Trust Amount is 3. 0% or 3. 5% of sales price Structured as Subordinate Lien Can be used in conjunction with other assistance programs (HPAP, EAHP, etc. ) Forgiven over 5 years, 20% per year Interest rate on 1 st Trust will be slightly higher when using DPAL is repayable within first 5 years only upon sale, refinance or transfer of title DPAL is 0% & non-amortizing (No Payments) 7

DC Open Doors Down Payment Assistance Available for FHA and Conventional Loans Must be coupled with DC Open Doors 1 st Trust Amount is 3. 0% or 3. 5% of sales price Structured as Subordinate Lien Can be used in conjunction with other assistance programs (HPAP, EAHP, etc. ) Forgiven over 5 years, 20% per year Interest rate on 1 st Trust will be slightly higher when using DPAL is repayable within first 5 years only upon sale, refinance or transfer of title DPAL is 0% & non-amortizing (No Payments) 7

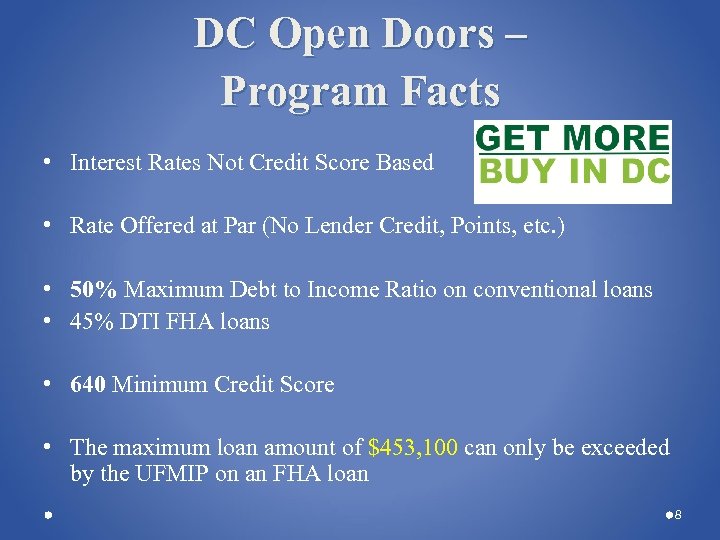

DC Open Doors – Program Facts • Interest Rates Not Credit Score Based • Rate Offered at Par (No Lender Credit, Points, etc. ) • 50% Maximum Debt to Income Ratio on conventional loans • 45% DTI FHA loans • 640 Minimum Credit Score • The maximum loan amount of $453, 100 can only be exceeded by the UFMIP on an FHA loan 8

DC Open Doors – Program Facts • Interest Rates Not Credit Score Based • Rate Offered at Par (No Lender Credit, Points, etc. ) • 50% Maximum Debt to Income Ratio on conventional loans • 45% DTI FHA loans • 640 Minimum Credit Score • The maximum loan amount of $453, 100 can only be exceeded by the UFMIP on an FHA loan 8

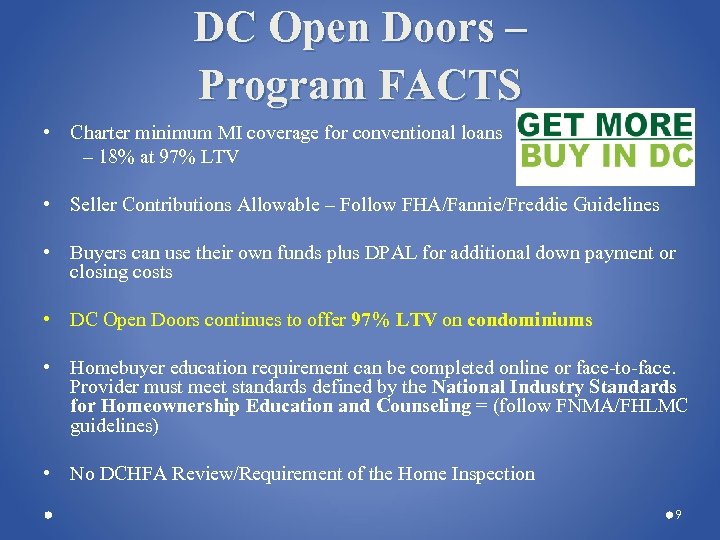

DC Open Doors – Program FACTS • Charter minimum MI coverage for conventional loans – 18% at 97% LTV • Seller Contributions Allowable – Follow FHA/Fannie/Freddie Guidelines • Buyers can use their own funds plus DPAL for additional down payment or closing costs • DC Open Doors continues to offer 97% LTV on condominiums • Homebuyer education requirement can be completed online or face-to-face. Provider must meet standards defined by the National Industry Standards for Homeownership Education and Counseling = (follow FNMA/FHLMC guidelines) • No DCHFA Review/Requirement of the Home Inspection 9

DC Open Doors – Program FACTS • Charter minimum MI coverage for conventional loans – 18% at 97% LTV • Seller Contributions Allowable – Follow FHA/Fannie/Freddie Guidelines • Buyers can use their own funds plus DPAL for additional down payment or closing costs • DC Open Doors continues to offer 97% LTV on condominiums • Homebuyer education requirement can be completed online or face-to-face. Provider must meet standards defined by the National Industry Standards for Homeownership Education and Counseling = (follow FNMA/FHLMC guidelines) • No DCHFA Review/Requirement of the Home Inspection 9

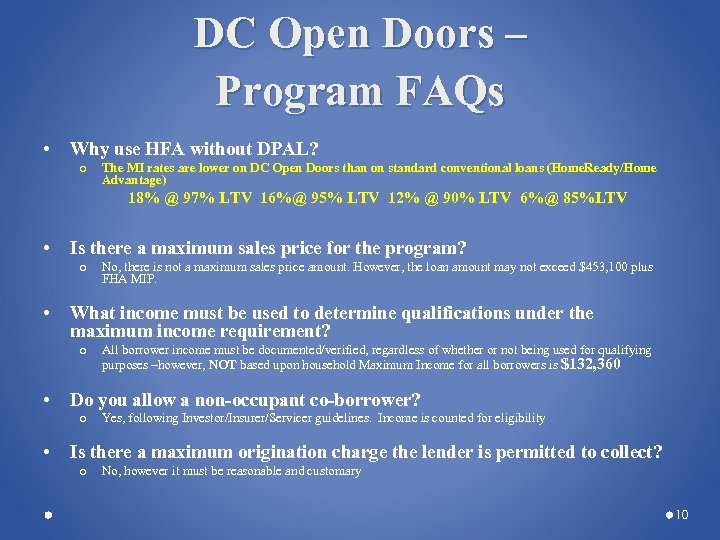

DC Open Doors – Program FAQs • Why use HFA without DPAL? o The MI rates are lower on DC Open Doors than on standard conventional loans (Home. Ready/Home Advantage) 18% @ 97% LTV 16%@ 95% LTV 12% @ 90% LTV 6%@ 85%LTV • Is there a maximum sales price for the program? o • What income must be used to determine qualifications under the maximum income requirement? o • All borrower income must be documented/verified, regardless of whether or not being used for qualifying purposes –however, NOT based upon household Maximum Income for all borrowers is $132, 360 Do you allow a non-occupant co-borrower? o • No, there is not a maximum sales price amount. However, the loan amount may not exceed $453, 100 plus FHA MIP. Yes, following Investor/Insurer/Servicer guidelines. Income is counted for eligibility Is there a maximum origination charge the lender is permitted to collect? o No, however it must be reasonable and customary 10

DC Open Doors – Program FAQs • Why use HFA without DPAL? o The MI rates are lower on DC Open Doors than on standard conventional loans (Home. Ready/Home Advantage) 18% @ 97% LTV 16%@ 95% LTV 12% @ 90% LTV 6%@ 85%LTV • Is there a maximum sales price for the program? o • What income must be used to determine qualifications under the maximum income requirement? o • All borrower income must be documented/verified, regardless of whether or not being used for qualifying purposes –however, NOT based upon household Maximum Income for all borrowers is $132, 360 Do you allow a non-occupant co-borrower? o • No, there is not a maximum sales price amount. However, the loan amount may not exceed $453, 100 plus FHA MIP. Yes, following Investor/Insurer/Servicer guidelines. Income is counted for eligibility Is there a maximum origination charge the lender is permitted to collect? o No, however it must be reasonable and customary 10

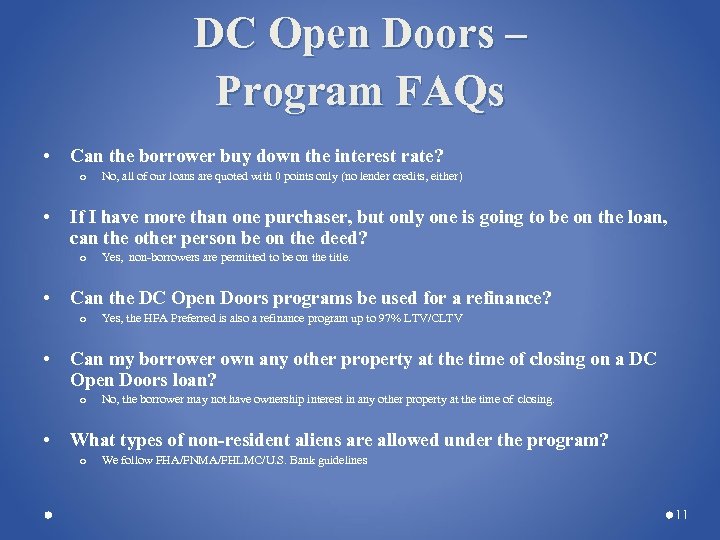

DC Open Doors – Program FAQs • Can the borrower buy down the interest rate? o • If I have more than one purchaser, but only one is going to be on the loan, can the other person be on the deed? o • Yes, the HFA Preferred is also a refinance program up to 97% LTV/CLTV Can my borrower own any other property at the time of closing on a DC Open Doors loan? o • Yes, non-borrowers are permitted to be on the title. Can the DC Open Doors programs be used for a refinance? o • No, all of our loans are quoted with 0 points only (no lender credits, either ) No, the borrower may not have ownership interest in any other property at the time of closing. What types of non-resident aliens are allowed under the program? o We follow FHA/FNMA/FHLMC/U. S. Bank guidelines 11

DC Open Doors – Program FAQs • Can the borrower buy down the interest rate? o • If I have more than one purchaser, but only one is going to be on the loan, can the other person be on the deed? o • Yes, the HFA Preferred is also a refinance program up to 97% LTV/CLTV Can my borrower own any other property at the time of closing on a DC Open Doors loan? o • Yes, non-borrowers are permitted to be on the title. Can the DC Open Doors programs be used for a refinance? o • No, all of our loans are quoted with 0 points only (no lender credits, either ) No, the borrower may not have ownership interest in any other property at the time of closing. What types of non-resident aliens are allowed under the program? o We follow FHA/FNMA/FHLMC/U. S. Bank guidelines 11

DC OPEN DOORS PROGRAM PROCESS

DC OPEN DOORS PROGRAM PROCESS

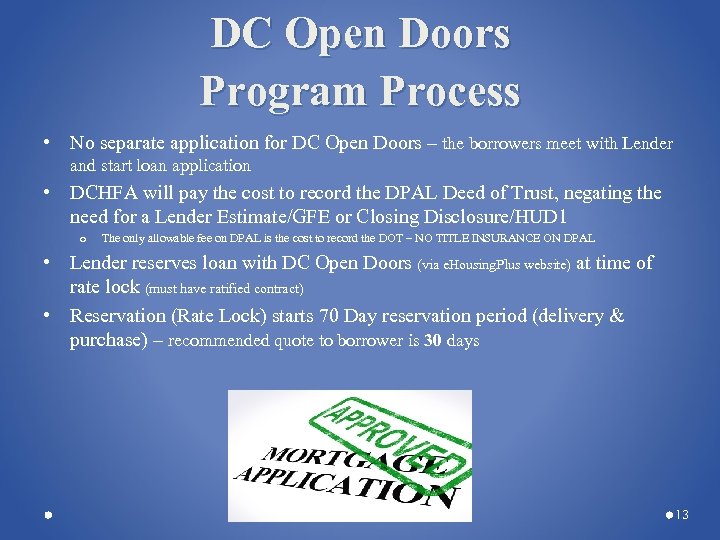

DC Open Doors Program Process • No separate application for DC Open Doors – the borrowers meet with Lender and start loan application • DCHFA will pay the cost to record the DPAL Deed of Trust, negating the need for a Lender Estimate/GFE or Closing Disclosure/HUD 1 o The only allowable fee on DPAL is the cost to record the DOT – NO TITLE INSURANCE ON DPAL • Lender reserves loan with DC Open Doors (via e. Housing. Plus website) at time of rate lock (must have ratified contract) • Reservation (Rate Lock) starts 70 Day reservation period (delivery & purchase) – recommended quote to borrower is 30 days 13

DC Open Doors Program Process • No separate application for DC Open Doors – the borrowers meet with Lender and start loan application • DCHFA will pay the cost to record the DPAL Deed of Trust, negating the need for a Lender Estimate/GFE or Closing Disclosure/HUD 1 o The only allowable fee on DPAL is the cost to record the DOT – NO TITLE INSURANCE ON DPAL • Lender reserves loan with DC Open Doors (via e. Housing. Plus website) at time of rate lock (must have ratified contract) • Reservation (Rate Lock) starts 70 Day reservation period (delivery & purchase) – recommended quote to borrower is 30 days 13

DC Open Doors Program Process • DC Open Doors does pre-closing review for all loans • DC Open Doors coordinates closing with Lender • Post-closing – e. Housing. Plus review & U. S. Bank review • DC Open Doors – always here to answer questions! 14

DC Open Doors Program Process • DC Open Doors does pre-closing review for all loans • DC Open Doors coordinates closing with Lender • Post-closing – e. Housing. Plus review & U. S. Bank review • DC Open Doors – always here to answer questions! 14

DC Open Doors – Reservation Process • Reservation = Official Program Rate Lock Date • Reservation date starts 70 Day period from lock to U. S. Bank purchase post-closing o Recommended quote of 30 days to borrower to allow sufficient time for post-closing • Reserve Loan Using Online Reservation System (e. Housing. Plus): o Input as much borrower/loan information into the reservation system as possible to reduce Pre-Closing Review processing time o Information must match what is submitted to DCHFA • Purchase Contracts MUST be Fully Ratified Prior to Reserving a Loan with DCHFA 15

DC Open Doors – Reservation Process • Reservation = Official Program Rate Lock Date • Reservation date starts 70 Day period from lock to U. S. Bank purchase post-closing o Recommended quote of 30 days to borrower to allow sufficient time for post-closing • Reserve Loan Using Online Reservation System (e. Housing. Plus): o Input as much borrower/loan information into the reservation system as possible to reduce Pre-Closing Review processing time o Information must match what is submitted to DCHFA • Purchase Contracts MUST be Fully Ratified Prior to Reserving a Loan with DCHFA 15

DC Open Doors Data Transmission • DCHFA uses a secure FTP portal for receiving and sending all data, documents, etc. o FTP portal supports PDF, Word, Excel, etc. ; o Lenders are responsible for transmitting all document submissions via FTP portal; o Documents are uploaded to DCHFA via secure FTP portal, with specific file naming: Last Name, First Name – Submission or Document Title o DCHFA will transmit DPAL closing documents (commitment letters, loan documents, settlement instructions, etc. ) via FTP portal; o DPAL docs are NOT sent to lender via e. Housing. Plus – the FTP is a separate website; o Each Lender will be provided with login credentials FTP link: https: //sftp. dchfa. org 16

DC Open Doors Data Transmission • DCHFA uses a secure FTP portal for receiving and sending all data, documents, etc. o FTP portal supports PDF, Word, Excel, etc. ; o Lenders are responsible for transmitting all document submissions via FTP portal; o Documents are uploaded to DCHFA via secure FTP portal, with specific file naming: Last Name, First Name – Submission or Document Title o DCHFA will transmit DPAL closing documents (commitment letters, loan documents, settlement instructions, etc. ) via FTP portal; o DPAL docs are NOT sent to lender via e. Housing. Plus – the FTP is a separate website; o Each Lender will be provided with login credentials FTP link: https: //sftp. dchfa. org 16

DC Open Doors Data Transmission • Lenders must designate a system administrator to manage access to FTP portal • DCHFA will provide each individual lender with one set of log -in credentials for access. Credentials can be used by multiple parties (processors, underwriters, etc. ) 17

DC Open Doors Data Transmission • Lenders must designate a system administrator to manage access to FTP portal • DCHFA will provide each individual lender with one set of log -in credentials for access. Credentials can be used by multiple parties (processors, underwriters, etc. ) 17

DC Open Doors Pre-closing Review DCHFA reviews all loans for compliance and provides a “Clear to Close” Notice. DCHFA is reviewing for the following: o o o Loan Application Form 1003 for accuracy Maximum Borrower Income of $132, 360 Proof of Income (*see checklist) Ratified Purchase Contract Homebuyer Education (If Applicable) DPAL (If Applicable) • DPA Loan Funding Request form & Wiring Instructions • Need 3 business days to process DPAL funding *Always reference the Review Checklist to ensure your complete. package is 18

DC Open Doors Pre-closing Review DCHFA reviews all loans for compliance and provides a “Clear to Close” Notice. DCHFA is reviewing for the following: o o o Loan Application Form 1003 for accuracy Maximum Borrower Income of $132, 360 Proof of Income (*see checklist) Ratified Purchase Contract Homebuyer Education (If Applicable) DPAL (If Applicable) • DPA Loan Funding Request form & Wiring Instructions • Need 3 business days to process DPAL funding *Always reference the Review Checklist to ensure your complete. package is 18

DC Open Doors Pre-Closing Review • Files reviewed on “first come, first served” basis; • We will receive an email alert when a loan file has been uploaded by a lender. Files will be logged upon receipt; • Files missing documentation will be taken out of the review queue and placed in pending queue until the files are complete; • DCHFA commits to a timely pre-closing review time from receipt of a completed package; • File Approved – DC Open Doors Sends ‘Clear to Close’ Notice 19

DC Open Doors Pre-Closing Review • Files reviewed on “first come, first served” basis; • We will receive an email alert when a loan file has been uploaded by a lender. Files will be logged upon receipt; • Files missing documentation will be taken out of the review queue and placed in pending queue until the files are complete; • DCHFA commits to a timely pre-closing review time from receipt of a completed package; • File Approved – DC Open Doors Sends ‘Clear to Close’ Notice 19

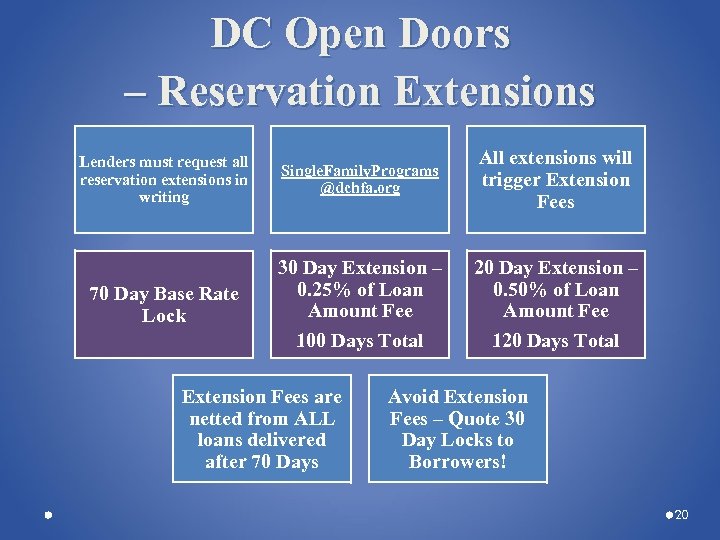

DC Open Doors – Reservation Extensions Lenders must request all reservation extensions in writing Single. Family. Programs @dchfa. org All extensions will trigger Extension Fees 70 Day Base Rate Lock 30 Day Extension – 0. 25% of Loan Amount Fee 100 Days Total 20 Day Extension – 0. 50% of Loan Amount Fee 120 Days Total Extension Fees are netted from ALL loans delivered after 70 Days Avoid Extension Fees – Quote 30 Day Locks to Borrowers! 20

DC Open Doors – Reservation Extensions Lenders must request all reservation extensions in writing Single. Family. Programs @dchfa. org All extensions will trigger Extension Fees 70 Day Base Rate Lock 30 Day Extension – 0. 25% of Loan Amount Fee 100 Days Total 20 Day Extension – 0. 50% of Loan Amount Fee 120 Days Total Extension Fees are netted from ALL loans delivered after 70 Days Avoid Extension Fees – Quote 30 Day Locks to Borrowers! 20

DC Open Doors Direct Funding and Closing – DPAL only • DCHFA prepares DPAL closing documents and uploads to FTP for lender to access • Lender downloads DPAL closing documents and sends to settlement company with 1 st trust docs • DCHFA funds the DPAL directly to settlement company o • 3 BUSINESS DAYS TO PROCESS FUNDING. DCHFA NEEDS SUFFICIENT TIME TO FUND THE DPAL PLEASE ENSURE DCHFA HAS If a first trust loan contains deficiencies, or for any other reason cannot be purchased by U. S. Bank, the lender is responsible for reimbursing DCHFA for the DPAL o DCHFA will send a letter to the lender requesting reimbursement including wiring instructions and timing o Failure to reimburse DCHFA for a DPAL closed with a first trust loan that is not purchased by U. S. Bank could result in lender suspension. 21

DC Open Doors Direct Funding and Closing – DPAL only • DCHFA prepares DPAL closing documents and uploads to FTP for lender to access • Lender downloads DPAL closing documents and sends to settlement company with 1 st trust docs • DCHFA funds the DPAL directly to settlement company o • 3 BUSINESS DAYS TO PROCESS FUNDING. DCHFA NEEDS SUFFICIENT TIME TO FUND THE DPAL PLEASE ENSURE DCHFA HAS If a first trust loan contains deficiencies, or for any other reason cannot be purchased by U. S. Bank, the lender is responsible for reimbursing DCHFA for the DPAL o DCHFA will send a letter to the lender requesting reimbursement including wiring instructions and timing o Failure to reimburse DCHFA for a DPAL closed with a first trust loan that is not purchased by U. S. Bank could result in lender suspension. 21

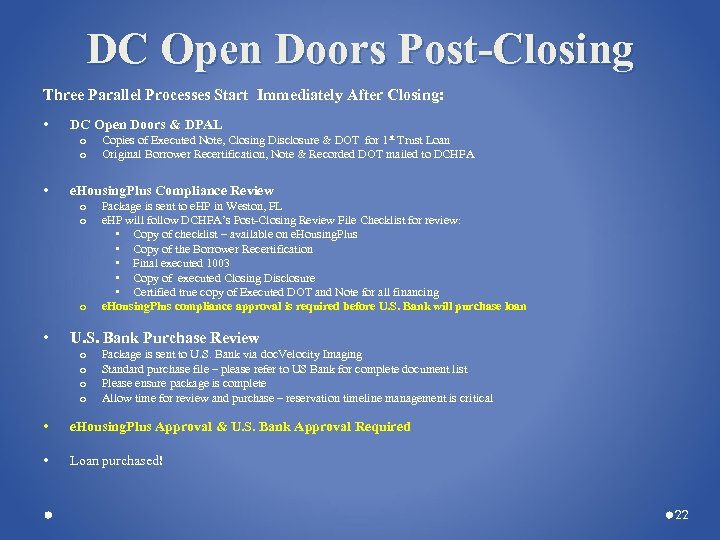

DC Open Doors Post-Closing Three Parallel Processes Start Immediately After Closing: • DC Open Doors & DPAL o o • e. Housing. Plus Compliance Review o o o • Copies of Executed Note, Closing Disclosure & DOT for 1 st Trust Loan Original Borrower Recertification, Note & Recorded DOT mailed to DCHFA Package is sent to e. HP in Weston, FL e. HP will follow DCHFA’s Post-Closing Review File Checklist for review: • Copy of checklist – available on e. Housing. Plus • Copy of the Borrower Recertification • Final executed 1003 • Copy of executed Closing Disclosure • Certified true copy of Executed DOT and Note for all financing e. Housing. Plus compliance approval is required before U. S. Bank will purchase loan U. S. Bank Purchase Review o o Package is sent to U. S. Bank via doc. Velocity Imaging Standard purchase file – please refer to US Bank for complete document list Please ensure package is complete Allow time for review and purchase – reservation timeline management is critical • e. Housing. Plus Approval & U. S. Bank Approval Required • Loan purchased! 22

DC Open Doors Post-Closing Three Parallel Processes Start Immediately After Closing: • DC Open Doors & DPAL o o • e. Housing. Plus Compliance Review o o o • Copies of Executed Note, Closing Disclosure & DOT for 1 st Trust Loan Original Borrower Recertification, Note & Recorded DOT mailed to DCHFA Package is sent to e. HP in Weston, FL e. HP will follow DCHFA’s Post-Closing Review File Checklist for review: • Copy of checklist – available on e. Housing. Plus • Copy of the Borrower Recertification • Final executed 1003 • Copy of executed Closing Disclosure • Certified true copy of Executed DOT and Note for all financing e. Housing. Plus compliance approval is required before U. S. Bank will purchase loan U. S. Bank Purchase Review o o Package is sent to U. S. Bank via doc. Velocity Imaging Standard purchase file – please refer to US Bank for complete document list Please ensure package is complete Allow time for review and purchase – reservation timeline management is critical • e. Housing. Plus Approval & U. S. Bank Approval Required • Loan purchased! 22

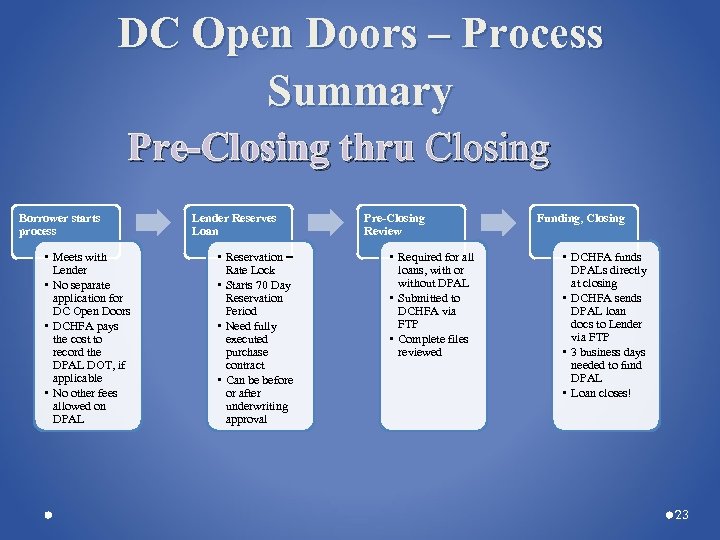

DC Open Doors – Process Summary Pre-Closing thru Closing Borrower starts process • Meets with Lender • No separate application for DC Open Doors • DCHFA pays the cost to record the DPAL DOT, if applicable • No other fees allowed on DPAL Lender Reserves Loan • Reservation = Rate Lock • Starts 70 Day Reservation Period • Need fully executed purchase contract • Can be before or after underwriting approval Pre-Closing Review • Required for all loans, with or without DPAL • Submitted to DCHFA via FTP • Complete files reviewed Funding, Closing • DCHFA funds DPALs directly at closing • DCHFA sends DPAL loan docs to Lender via FTP • 3 business days needed to fund DPAL • Loan closes! 23

DC Open Doors – Process Summary Pre-Closing thru Closing Borrower starts process • Meets with Lender • No separate application for DC Open Doors • DCHFA pays the cost to record the DPAL DOT, if applicable • No other fees allowed on DPAL Lender Reserves Loan • Reservation = Rate Lock • Starts 70 Day Reservation Period • Need fully executed purchase contract • Can be before or after underwriting approval Pre-Closing Review • Required for all loans, with or without DPAL • Submitted to DCHFA via FTP • Complete files reviewed Funding, Closing • DCHFA funds DPALs directly at closing • DCHFA sends DPAL loan docs to Lender via FTP • 3 business days needed to fund DPAL • Loan closes! 23

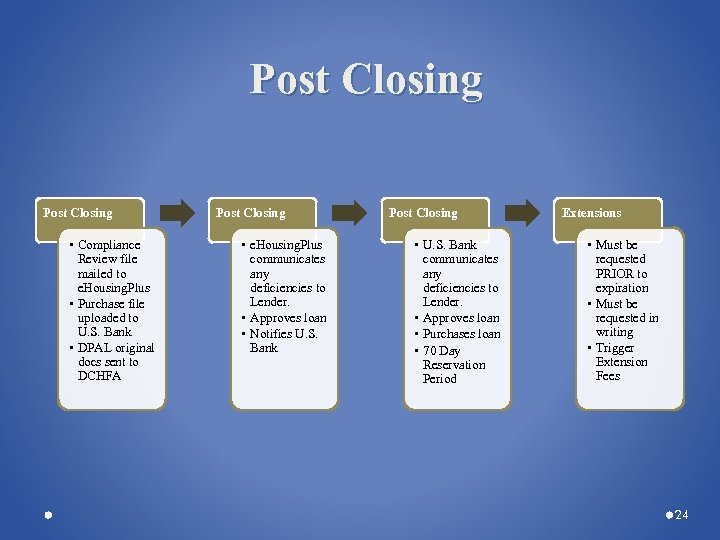

Post Closing • Compliance Review file mailed to e. Housing. Plus • Purchase file uploaded to U. S. Bank • DPAL original docs sent to DCHFA Post Closing • e. Housing. Plus communicates any deficiencies to Lender. • Approves loan • Notifies U. S. Bank Post Closing • U. S. Bank communicates any deficiencies to Lender. • Approves loan • Purchases loan • 70 Day Reservation Period Extensions • Must be requested PRIOR to expiration • Must be requested in writing • Trigger Extension Fees 24

Post Closing • Compliance Review file mailed to e. Housing. Plus • Purchase file uploaded to U. S. Bank • DPAL original docs sent to DCHFA Post Closing • e. Housing. Plus communicates any deficiencies to Lender. • Approves loan • Notifies U. S. Bank Post Closing • U. S. Bank communicates any deficiencies to Lender. • Approves loan • Purchases loan • 70 Day Reservation Period Extensions • Must be requested PRIOR to expiration • Must be requested in writing • Trigger Extension Fees 24

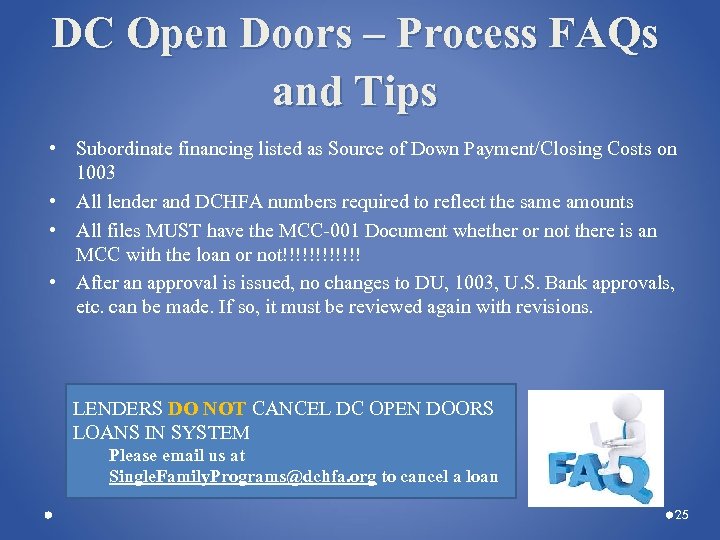

DC Open Doors – Process FAQs and Tips • Subordinate financing listed as Source of Down Payment/Closing Costs on 1003 • All lender and DCHFA numbers required to reflect the same amounts • All files MUST have the MCC-001 Document whether or not there is an MCC with the loan or not!!!!!! • After an approval is issued, no changes to DU, 1003, U. S. Bank approvals, etc. can be made. If so, it must be reviewed again with revisions. LENDERS DO NOT CANCEL DC OPEN DOORS LOANS IN SYSTEM Please email us at Single. Family. Programs@dchfa. org to cancel a loan 25

DC Open Doors – Process FAQs and Tips • Subordinate financing listed as Source of Down Payment/Closing Costs on 1003 • All lender and DCHFA numbers required to reflect the same amounts • All files MUST have the MCC-001 Document whether or not there is an MCC with the loan or not!!!!!! • After an approval is issued, no changes to DU, 1003, U. S. Bank approvals, etc. can be made. If so, it must be reviewed again with revisions. LENDERS DO NOT CANCEL DC OPEN DOORS LOANS IN SYSTEM Please email us at Single. Family. Programs@dchfa. org to cancel a loan 25

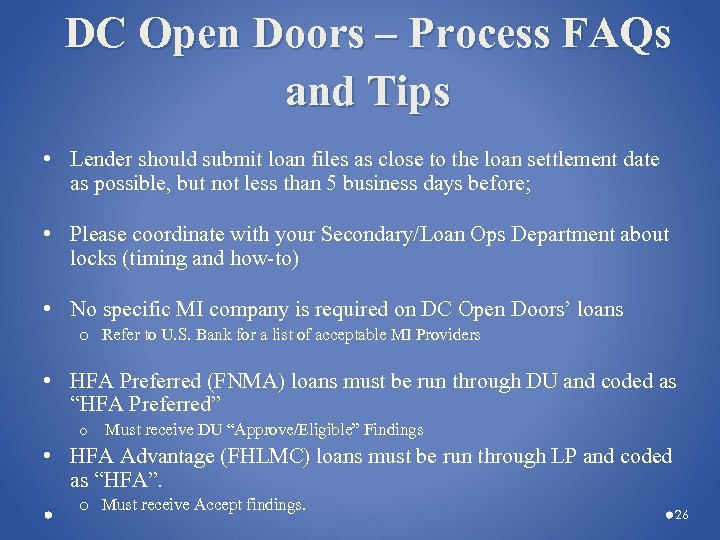

DC Open Doors – Process FAQs and Tips • Lender should submit loan files as close to the loan settlement date as possible, but not less than 5 business days before; • Please coordinate with your Secondary/Loan Ops Department about locks (timing and how-to) • No specific MI company is required on DC Open Doors’ loans o Refer to U. S. Bank for a list of acceptable MI Providers • HFA Preferred (FNMA) loans must be run through DU and coded as “HFA Preferred” o Must receive DU “Approve/Eligible” Findings • HFA Advantage (FHLMC) loans must be run through LP and coded as “HFA”. o Must receive Accept findings. 26

DC Open Doors – Process FAQs and Tips • Lender should submit loan files as close to the loan settlement date as possible, but not less than 5 business days before; • Please coordinate with your Secondary/Loan Ops Department about locks (timing and how-to) • No specific MI company is required on DC Open Doors’ loans o Refer to U. S. Bank for a list of acceptable MI Providers • HFA Preferred (FNMA) loans must be run through DU and coded as “HFA Preferred” o Must receive DU “Approve/Eligible” Findings • HFA Advantage (FHLMC) loans must be run through LP and coded as “HFA”. o Must receive Accept findings. 26

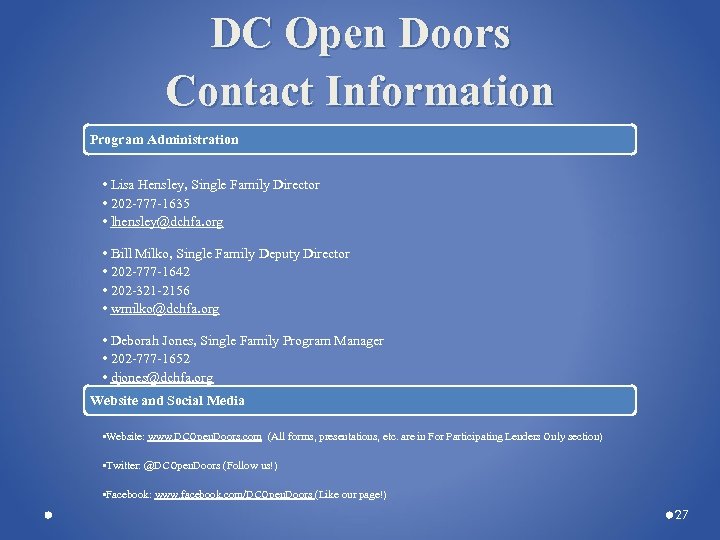

DC Open Doors Contact Information Program Administration • Lisa Hensley, Single Family Director • 202 -777 -1635 • lhensley@dchfa. org • Bill Milko, Single Family Deputy Director • 202 -777 -1642 • 202 -321 -2156 • wmilko@dchfa. org • Deborah Jones, Single Family Program Manager • 202 -777 -1652 • djones@dchfa. org Website and Social Media • Website: www. DCOpen. Doors. com (All forms, presentations, etc. are in For Participating Lenders Only section) • Twitter: @DCOpen. Doors (Follow us!) • Facebook: www. facebook. com/DCOpen. Doors (Like our page!) 27

DC Open Doors Contact Information Program Administration • Lisa Hensley, Single Family Director • 202 -777 -1635 • lhensley@dchfa. org • Bill Milko, Single Family Deputy Director • 202 -777 -1642 • 202 -321 -2156 • wmilko@dchfa. org • Deborah Jones, Single Family Program Manager • 202 -777 -1652 • djones@dchfa. org Website and Social Media • Website: www. DCOpen. Doors. com (All forms, presentations, etc. are in For Participating Lenders Only section) • Twitter: @DCOpen. Doors (Follow us!) • Facebook: www. facebook. com/DCOpen. Doors (Like our page!) 27

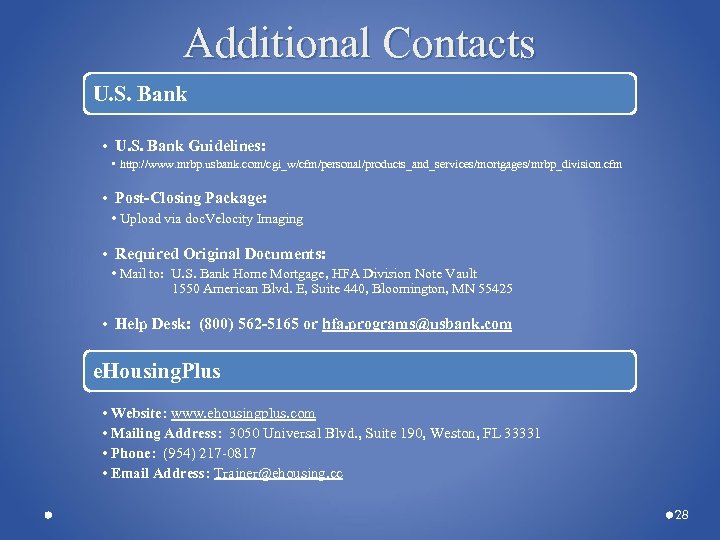

Additional Contacts U. S. Bank • U. S. Bank Guidelines: • http: //www. mrbp. usbank. com/cgi_w/cfm/personal/products_and_services/mortgages/mrbp_division. cfm • Post-Closing Package: • Upload via doc. Velocity Imaging • Required Original Documents: • Mail to: U. S. Bank Home Mortgage, HFA Division Note Vault 1550 American Blvd. E, Suite 440, Bloomington, MN 55425 • Help Desk: (800) 562 -5165 or hfa. programs@usbank. com e. Housing. Plus • Website: www. ehousingplus. com • Mailing Address: 3050 Universal Blvd. , Suite 190, Weston, FL 33331 • Phone: (954) 217 -0817 • Email Address: Trainer@ehousing. cc 28

Additional Contacts U. S. Bank • U. S. Bank Guidelines: • http: //www. mrbp. usbank. com/cgi_w/cfm/personal/products_and_services/mortgages/mrbp_division. cfm • Post-Closing Package: • Upload via doc. Velocity Imaging • Required Original Documents: • Mail to: U. S. Bank Home Mortgage, HFA Division Note Vault 1550 American Blvd. E, Suite 440, Bloomington, MN 55425 • Help Desk: (800) 562 -5165 or hfa. programs@usbank. com e. Housing. Plus • Website: www. ehousingplus. com • Mailing Address: 3050 Universal Blvd. , Suite 190, Weston, FL 33331 • Phone: (954) 217 -0817 • Email Address: Trainer@ehousing. cc 28

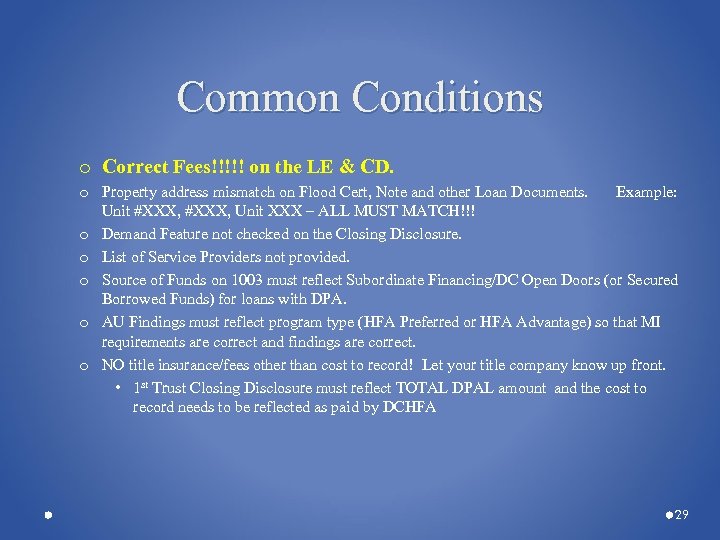

Common Conditions o Correct Fees!!!!! on the LE & CD. o Property address mismatch on Flood Cert, Note and other Loan Documents. Example: Unit #XXX, Unit XXX – ALL MUST MATCH!!! o Demand Feature not checked on the Closing Disclosure. o List of Service Providers not provided. o Source of Funds on 1003 must reflect Subordinate Financing/DC Open Doors (or Secured Borrowed Funds) for loans with DPA. o AU Findings must reflect program type (HFA Preferred or HFA Advantage) so that MI requirements are correct and findings are correct. o NO title insurance/fees other than cost to record! Let your title company know up front. • 1 st Trust Closing Disclosure must reflect TOTAL DPAL amount and the cost to record needs to be reflected as paid by DCHFA 29

Common Conditions o Correct Fees!!!!! on the LE & CD. o Property address mismatch on Flood Cert, Note and other Loan Documents. Example: Unit #XXX, Unit XXX – ALL MUST MATCH!!! o Demand Feature not checked on the Closing Disclosure. o List of Service Providers not provided. o Source of Funds on 1003 must reflect Subordinate Financing/DC Open Doors (or Secured Borrowed Funds) for loans with DPA. o AU Findings must reflect program type (HFA Preferred or HFA Advantage) so that MI requirements are correct and findings are correct. o NO title insurance/fees other than cost to record! Let your title company know up front. • 1 st Trust Closing Disclosure must reflect TOTAL DPAL amount and the cost to record needs to be reflected as paid by DCHFA 29

DC’ S MCC S LETS START WITH THE BASICS Ø The Mortgage Credit Certificate (“MCC”) is NOT a down payment assistance program or a mortgage loan Ø The MCC program provides a federal income tax credit similar to the federal first-time homebuyer tax credit Ø The DC MCC is a federal income tax credit that may 1) Reduce the amount of federal income tax the borrower is required to pay 2) Provide more available income to pay the monthly mortgage payment Ø The Credit Amount for the DC MCC is 20% and there is NO annual cap on the amount!

DC’ S MCC S LETS START WITH THE BASICS Ø The Mortgage Credit Certificate (“MCC”) is NOT a down payment assistance program or a mortgage loan Ø The MCC program provides a federal income tax credit similar to the federal first-time homebuyer tax credit Ø The DC MCC is a federal income tax credit that may 1) Reduce the amount of federal income tax the borrower is required to pay 2) Provide more available income to pay the monthly mortgage payment Ø The Credit Amount for the DC MCC is 20% and there is NO annual cap on the amount!

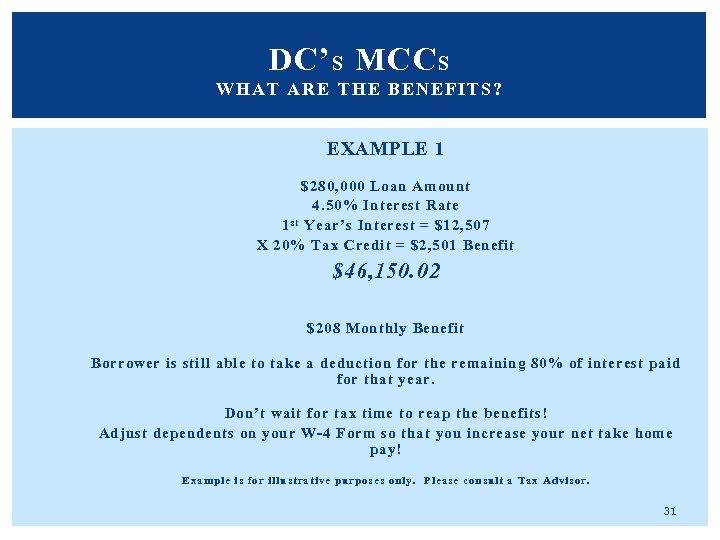

DC’ S MCC S WHAT ARE THE BENEFITS? EXAMPLE 1 $280, 000 Loan Amount 4. 50% Interest Rate 1 s t Year’s Interest = $12, 507 X 20% Tax Credit = $2, 501 Benefit $46, 150. 02 $208 Monthly Benefit Borrower is still able to take a deduction for the remaining 80% of interest paid for that year. Don’t wait for tax time to reap the benefits! Adjust dependents on your W-4 Form so that you increase your net take home pay! Example is for illustrative purposes only. Please consult a Tax Advisor. 31

DC’ S MCC S WHAT ARE THE BENEFITS? EXAMPLE 1 $280, 000 Loan Amount 4. 50% Interest Rate 1 s t Year’s Interest = $12, 507 X 20% Tax Credit = $2, 501 Benefit $46, 150. 02 $208 Monthly Benefit Borrower is still able to take a deduction for the remaining 80% of interest paid for that year. Don’t wait for tax time to reap the benefits! Adjust dependents on your W-4 Form so that you increase your net take home pay! Example is for illustrative purposes only. Please consult a Tax Advisor. 31

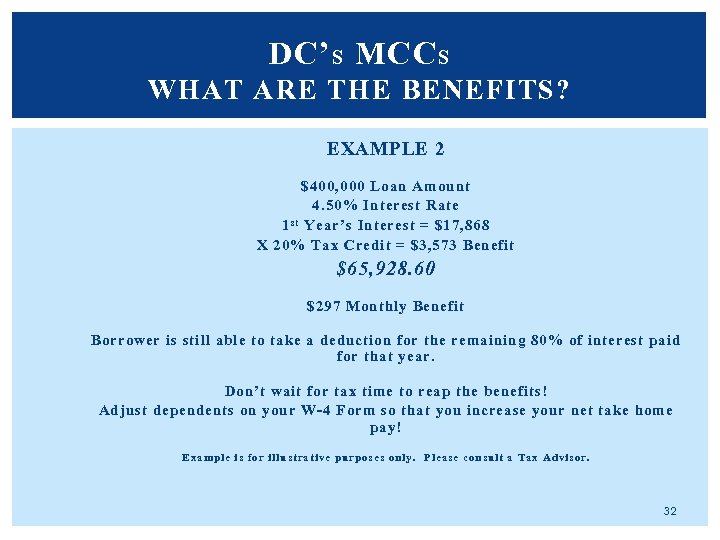

DC’ S MCC S WHAT ARE THE BENEFITS? EXAMPLE 2 $400, 000 Loan Amount 4. 50% Interest Rate 1 s t Year’s Interest = $17, 868 X 20% Tax Credit = $3, 573 Benefit $65, 928. 60 $297 Monthly Benefit Borrower is still able to take a deduction for the remaining 80% of interest paid for that year. Don’t wait for tax time to reap the benefits! Adjust dependents on your W-4 Form so that you increase your net take home pay! Example is for illustrative purposes only. Please consult a Tax Advisor. 32

DC’ S MCC S WHAT ARE THE BENEFITS? EXAMPLE 2 $400, 000 Loan Amount 4. 50% Interest Rate 1 s t Year’s Interest = $17, 868 X 20% Tax Credit = $3, 573 Benefit $65, 928. 60 $297 Monthly Benefit Borrower is still able to take a deduction for the remaining 80% of interest paid for that year. Don’t wait for tax time to reap the benefits! Adjust dependents on your W-4 Form so that you increase your net take home pay! Example is for illustrative purposes only. Please consult a Tax Advisor. 32

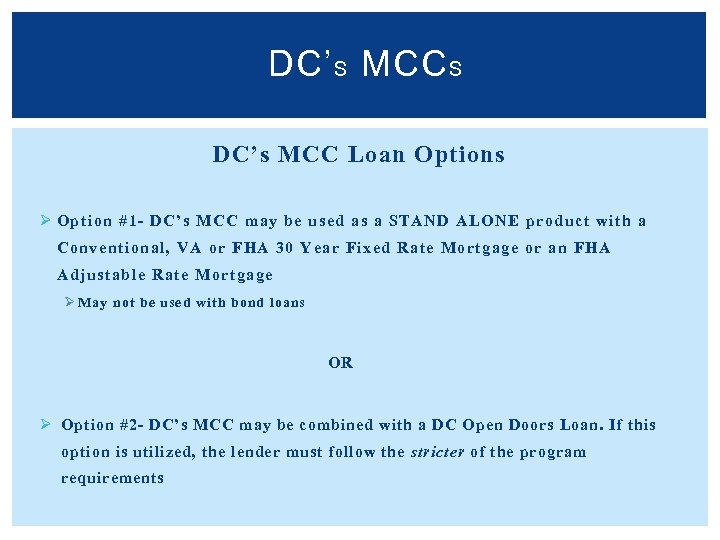

DC’ S MCC S DC’s MCC Loan Options Ø Option #1 - DC’s MCC may be used as a STAND ALONE product with a Conventional, VA or FHA 30 Year Fixed Rate Mortgage or an FHA Adjustable Rate Mortgage Ø May not be used with bond loans OR Ø Option #2 - DC’s MCC may be combined with a DC Open Doors Loan. If this option is utilized, the lender must follow the stricter of the program requirements

DC’ S MCC S DC’s MCC Loan Options Ø Option #1 - DC’s MCC may be used as a STAND ALONE product with a Conventional, VA or FHA 30 Year Fixed Rate Mortgage or an FHA Adjustable Rate Mortgage Ø May not be used with bond loans OR Ø Option #2 - DC’s MCC may be combined with a DC Open Doors Loan. If this option is utilized, the lender must follow the stricter of the program requirements

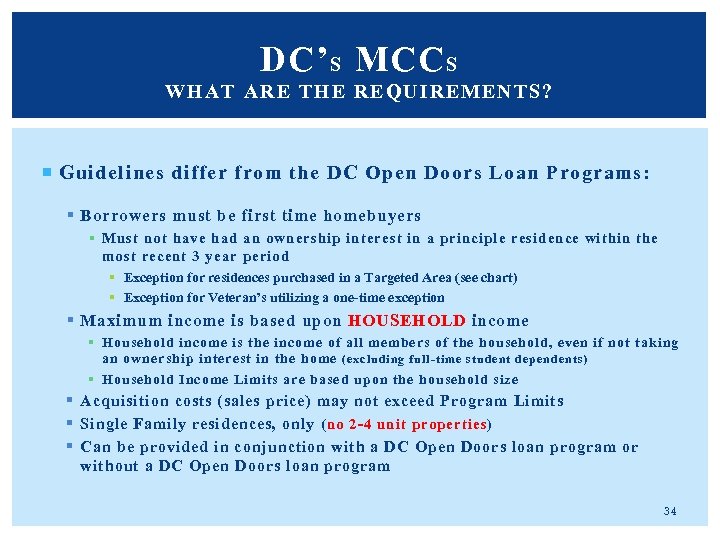

DC’ S MCC S WHAT AR E THE REQUI REMENTS? Guidelines differ from the DC Open Doors Loan Programs: § Borrowers must be first time homebuyers § Must not have had an ownership interest in a principle residence within the most recent 3 year period § Exception for residences purchased in a Targeted Area (see chart) § Exception for Veteran’s utilizing a one-time exception § Maximum income is based upon HOUSEHOLD income § Household income is the income of all members of the household, even if not taking an ownership interest in the home (excluding full-time student dependents) § Household Income Limits are based upon the household size § Acquisition costs (sales price) may not exceed Program Limits § Single Family residences, only (no 2 -4 unit properties) § Can be provided in conjunction with a DC Open Doors loan program or without a DC Open Doors loan program 34

DC’ S MCC S WHAT AR E THE REQUI REMENTS? Guidelines differ from the DC Open Doors Loan Programs: § Borrowers must be first time homebuyers § Must not have had an ownership interest in a principle residence within the most recent 3 year period § Exception for residences purchased in a Targeted Area (see chart) § Exception for Veteran’s utilizing a one-time exception § Maximum income is based upon HOUSEHOLD income § Household income is the income of all members of the household, even if not taking an ownership interest in the home (excluding full-time student dependents) § Household Income Limits are based upon the household size § Acquisition costs (sales price) may not exceed Program Limits § Single Family residences, only (no 2 -4 unit properties) § Can be provided in conjunction with a DC Open Doors loan program or without a DC Open Doors loan program 34

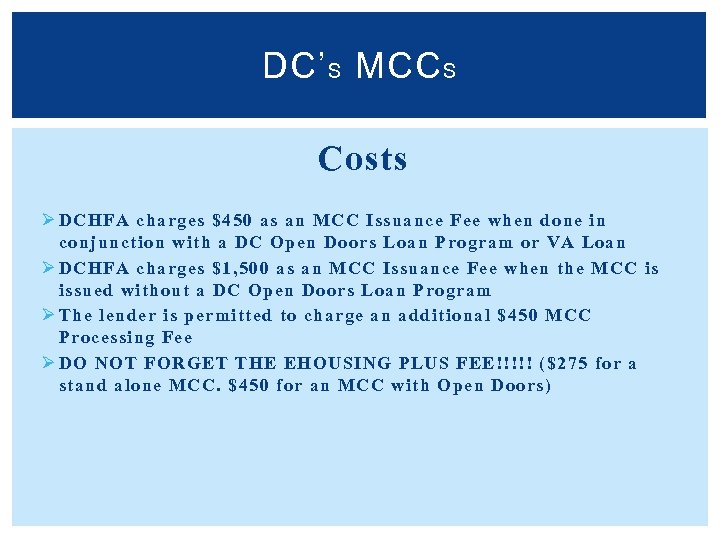

DC’ S MCC S Costs Ø DCHFA charges $450 as an MCC Issuance Fee when done in conjunction with a DC Open Doors Loan Program or VA Loan Ø DCHFA charges $1, 500 as an MCC Issuance Fee when the MCC is issued without a DC Open Doors Loan Program Ø The lender is permitted to charge an additional $450 MCC Processing Fee Ø DO NOT FORGET THE EHOUSING PLUS FEE!!!!! ($275 for a stand alone MCC. $450 for an MCC with Open Doors)

DC’ S MCC S Costs Ø DCHFA charges $450 as an MCC Issuance Fee when done in conjunction with a DC Open Doors Loan Program or VA Loan Ø DCHFA charges $1, 500 as an MCC Issuance Fee when the MCC is issued without a DC Open Doors Loan Program Ø The lender is permitted to charge an additional $450 MCC Processing Fee Ø DO NOT FORGET THE EHOUSING PLUS FEE!!!!! ($275 for a stand alone MCC. $450 for an MCC with Open Doors)

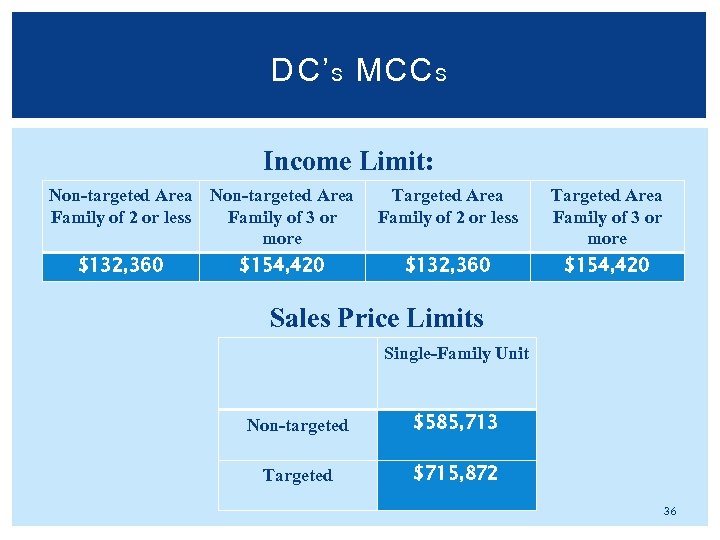

DC’ S MCC S Income Limit: Non-targeted Area Family of 2 or less Family of 3 or more $132, 360 $154, 420 Targeted Area Family of 2 or less $132, 360 Targeted Area Family of 3 or more $154, 420 Sales Price Limits Single-Family Unit Non-targeted $585, 713 Targeted $715, 872 36

DC’ S MCC S Income Limit: Non-targeted Area Family of 2 or less Family of 3 or more $132, 360 $154, 420 Targeted Area Family of 2 or less $132, 360 Targeted Area Family of 3 or more $154, 420 Sales Price Limits Single-Family Unit Non-targeted $585, 713 Targeted $715, 872 36

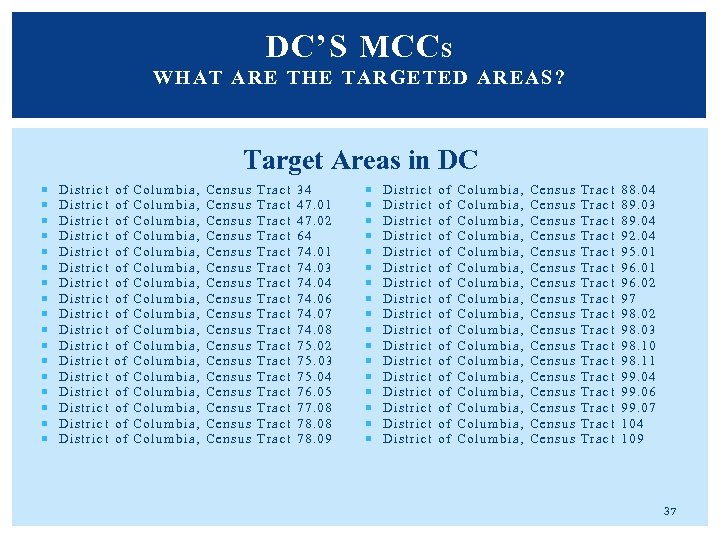

DC’S MCC S WHAT ARE T HE TARGETED AREAS? Target Areas in DC District District District District District of of of of of Columbia, Columbia, Columbia, Columbia, Columbia, Census Census Census Census Census Tract Tract Tract Tract Tract 34 47. 01 47. 02 64 74. 01 74. 03 74. 04 74. 06 74. 07 74. 08 75. 02 75. 03 75. 04 76. 05 77. 08 78. 09 District District District District District of of of of of Columbia, Columbia, Columbia, Columbia, Columbia, Census Census Census Census Census Tract Tract Tract Tract Tract 88. 04 89. 03 89. 04 92. 04 95. 01 96. 02 97 98. 02 98. 03 98. 10 98. 11 99. 04 99. 06 99. 07 104 109 37

DC’S MCC S WHAT ARE T HE TARGETED AREAS? Target Areas in DC District District District District District of of of of of Columbia, Columbia, Columbia, Columbia, Columbia, Census Census Census Census Census Tract Tract Tract Tract Tract 34 47. 01 47. 02 64 74. 01 74. 03 74. 04 74. 06 74. 07 74. 08 75. 02 75. 03 75. 04 76. 05 77. 08 78. 09 District District District District District of of of of of Columbia, Columbia, Columbia, Columbia, Columbia, Census Census Census Census Census Tract Tract Tract Tract Tract 88. 04 89. 03 89. 04 92. 04 95. 01 96. 02 97 98. 02 98. 03 98. 10 98. 11 99. 04 99. 06 99. 07 104 109 37

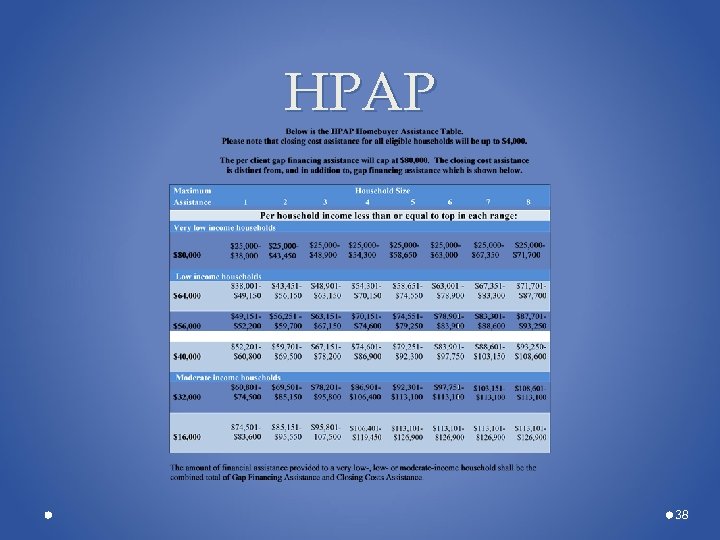

HPAP 38

HPAP 38

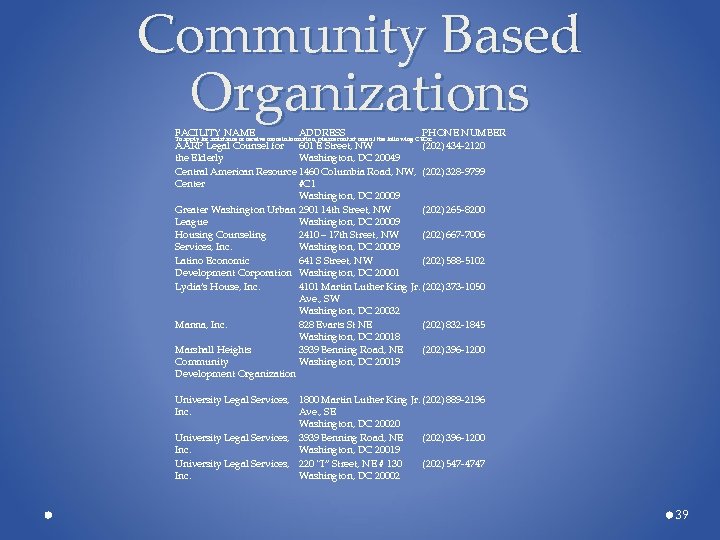

Community Based Organizations FACILITY NAME ADDRESS PHONE NUMBER AARP Legal Counsel for 601 E Street, NW (202) 434 -2120 the Elderly Washington, DC 20049 Central American Resource 1460 Columbia Road, NW, (202) 328 -9799 Center #C 1 Washington, DC 20009 Greater Washington Urban 2901 14 th Street, NW (202) 265 -8200 League Washington, DC 20009 Housing Counseling 2410 – 17 th Street, NW (202) 667 -7006 Services, Inc. Washington, DC 20009 Latino Economic 641 S Street, NW (202) 588 -5102 Development Corporation Washington, DC 20001 Lydia’s House, Inc. 4101 Martin Luther King Jr. (202) 373 -1050 Ave. , SW Washington, DC 20032 Manna, Inc. 828 Evarts St NE (202) 832 -1845 Washington, DC 20018 Marshall Heights 3939 Benning Road, NE (202) 396 -1200 Community Washington, DC 20019 Development Organization To apply for assistance or receive more information, please contact one of the following CBOs: University Legal Services, 1800 Martin Luther King Jr. (202) 889 -2196 Inc. Ave. , SE Washington, DC 20020 University Legal Services, 3939 Benning Road, NE (202) 396 -1200 Inc. Washington, DC 20019 University Legal Services, 220 “I” Street, NE # 130 (202) 547 -4747 Inc. Washington, DC 20002 39

Community Based Organizations FACILITY NAME ADDRESS PHONE NUMBER AARP Legal Counsel for 601 E Street, NW (202) 434 -2120 the Elderly Washington, DC 20049 Central American Resource 1460 Columbia Road, NW, (202) 328 -9799 Center #C 1 Washington, DC 20009 Greater Washington Urban 2901 14 th Street, NW (202) 265 -8200 League Washington, DC 20009 Housing Counseling 2410 – 17 th Street, NW (202) 667 -7006 Services, Inc. Washington, DC 20009 Latino Economic 641 S Street, NW (202) 588 -5102 Development Corporation Washington, DC 20001 Lydia’s House, Inc. 4101 Martin Luther King Jr. (202) 373 -1050 Ave. , SW Washington, DC 20032 Manna, Inc. 828 Evarts St NE (202) 832 -1845 Washington, DC 20018 Marshall Heights 3939 Benning Road, NE (202) 396 -1200 Community Washington, DC 20019 Development Organization To apply for assistance or receive more information, please contact one of the following CBOs: University Legal Services, 1800 Martin Luther King Jr. (202) 889 -2196 Inc. Ave. , SE Washington, DC 20020 University Legal Services, 3939 Benning Road, NE (202) 396 -1200 Inc. Washington, DC 20019 University Legal Services, 220 “I” Street, NE # 130 (202) 547 -4747 Inc. Washington, DC 20002 39

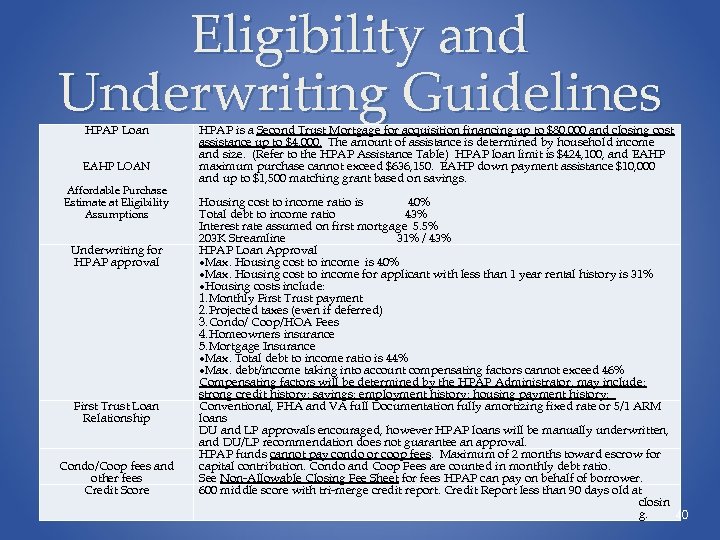

Eligibility and Underwriting Guidelines HPAP Loan HPAP is a Second Trust Mortgage for acquisition financing up to $80, 000 and closing cost assistance up to $4, 000. The amount of assistance is determined by household income and size. (Refer to the HPAP Assistance Table) HPAP loan limit is $424, 100, and EAHP maximum purchase cannot exceed $636, 150. EAHP down payment assistance $10, 000 and up to $1, 500 matching grant based on savings. Housing cost to income ratio is 40% Total debt to income ratio 43% Interest rate assumed on first mortgage 5. 5% 203 K Streamline 31% / 43% Underwriting for HPAP Loan Approval HPAP approval Max. Housing cost to income is 40% Max. Housing cost to income for applicant with less than 1 year rental history is 31% Housing costs include: 1. Monthly First Trust payment 2. Projected taxes (even if deferred) 3. Condo/ Coop/HOA Fees 4. Homeowners insurance 5. Mortgage Insurance Max. Total debt to income ratio is 44% Max. debt/income taking into account compensating factors cannot exceed 46% Compensating factors will be determined by the HPAP Administrator, may include: strong credit history; savings; employment history; housing payment history; First Trust Loan Conventional, FHA and VA full Documentation fully amortizing fixed rate or 5/1 ARM Relationship loans DU and LP approvals encouraged, however HPAP loans will be manually underwritten, and DU/LP recommendation does not guarantee an approval. HPAP funds cannot pay condo or coop fees. Maximum of 2 months toward escrow for Condo/Coop fees and capital contribution. Condo and Coop Fees are counted in monthly debt ratio. other fees See Non-Allowable Closing Fee Sheet for fees HPAP can pay on behalf of borrower. Credit Score 600 middle score with tri-merge credit report. Credit Report less than 90 days old at closin g. 40 EAHP LOAN Affordable Purchase Estimate at Eligibility Assumptions

Eligibility and Underwriting Guidelines HPAP Loan HPAP is a Second Trust Mortgage for acquisition financing up to $80, 000 and closing cost assistance up to $4, 000. The amount of assistance is determined by household income and size. (Refer to the HPAP Assistance Table) HPAP loan limit is $424, 100, and EAHP maximum purchase cannot exceed $636, 150. EAHP down payment assistance $10, 000 and up to $1, 500 matching grant based on savings. Housing cost to income ratio is 40% Total debt to income ratio 43% Interest rate assumed on first mortgage 5. 5% 203 K Streamline 31% / 43% Underwriting for HPAP Loan Approval HPAP approval Max. Housing cost to income is 40% Max. Housing cost to income for applicant with less than 1 year rental history is 31% Housing costs include: 1. Monthly First Trust payment 2. Projected taxes (even if deferred) 3. Condo/ Coop/HOA Fees 4. Homeowners insurance 5. Mortgage Insurance Max. Total debt to income ratio is 44% Max. debt/income taking into account compensating factors cannot exceed 46% Compensating factors will be determined by the HPAP Administrator, may include: strong credit history; savings; employment history; housing payment history; First Trust Loan Conventional, FHA and VA full Documentation fully amortizing fixed rate or 5/1 ARM Relationship loans DU and LP approvals encouraged, however HPAP loans will be manually underwritten, and DU/LP recommendation does not guarantee an approval. HPAP funds cannot pay condo or coop fees. Maximum of 2 months toward escrow for Condo/Coop fees and capital contribution. Condo and Coop Fees are counted in monthly debt ratio. other fees See Non-Allowable Closing Fee Sheet for fees HPAP can pay on behalf of borrower. Credit Score 600 middle score with tri-merge credit report. Credit Report less than 90 days old at closin g. 40 EAHP LOAN Affordable Purchase Estimate at Eligibility Assumptions

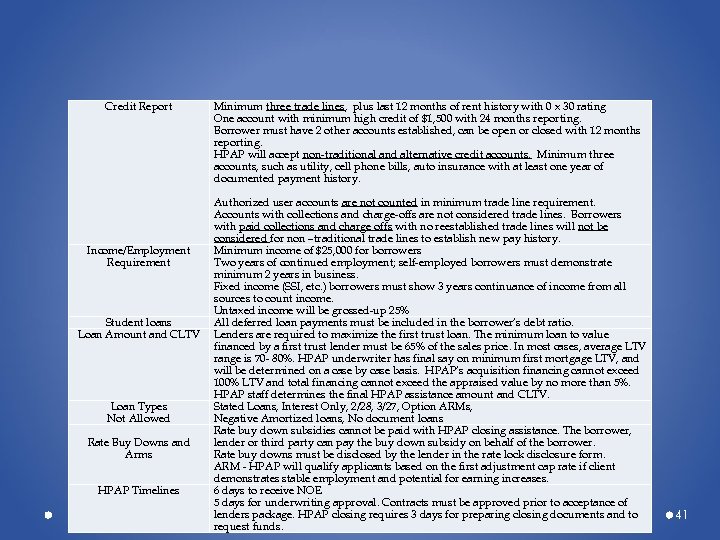

Credit Report Income/Employment Requirement Student loans Loan Amount and CLTV Loan Types Not Allowed Rate Buy Downs and Arms HPAP Timelines Minimum three trade lines, plus last 12 months of rent history with 0 x 30 rating One account with minimum high credit of $1, 500 with 24 months reporting. Borrower must have 2 other accounts established, can be open or closed with 12 months reporting. HPAP will accept non-traditional and alternative credit accounts. Minimum three accounts, such as utility, cell phone bills, auto insurance with at least one year of documented payment history. Authorized user accounts are not counted in minimum trade line requirement. Accounts with collections and charge-offs are not considered trade lines. Borrowers with paid collections and charge offs with no reestablished trade lines will not be considered for non –traditional trade lines to establish new pay history. Minimum income of $25, 000 for borrowers Two years of continued employment; self-employed borrowers must demonstrate minimum 2 years in business. Fixed income (SSI, etc. ) borrowers must show 3 years continuance of income from all sources to count income. Untaxed income will be grossed-up 25% All deferred loan payments must be included in the borrower’s debt ratio. Lenders are required to maximize the first trust loan. The minimum loan to value financed by a first trust lender must be 65% of the sales price. In most cases, average LTV range is 70 - 80%. HPAP underwriter has final say on minimum first mortgage LTV, and will be determined on a case by case basis. HPAP’s acquisition financing cannot exceed 100% LTV and total financing cannot exceed the appraised value by no more than 5%. HPAP staff determines the final HPAP assistance amount and CLTV. Stated Loans, Interest Only, 2/28, 3/27, Option ARMs, Negative Amortized loans, No document loans Rate buy down subsidies cannot be paid with HPAP closing assistance. The borrower, lender or third party can pay the buy down subsidy on behalf of the borrower. Rate buy downs must be disclosed by the lender in the rate lock disclosure form. ARM - HPAP will qualify applicants based on the first adjustment cap rate if client demonstrates stable employment and potential for earning increases. 6 days to receive NOE 5 days for underwriting approval. Contracts must be approved prior to acceptance of lenders package. HPAP closing requires 3 days for preparing closing documents and to request funds. 41

Credit Report Income/Employment Requirement Student loans Loan Amount and CLTV Loan Types Not Allowed Rate Buy Downs and Arms HPAP Timelines Minimum three trade lines, plus last 12 months of rent history with 0 x 30 rating One account with minimum high credit of $1, 500 with 24 months reporting. Borrower must have 2 other accounts established, can be open or closed with 12 months reporting. HPAP will accept non-traditional and alternative credit accounts. Minimum three accounts, such as utility, cell phone bills, auto insurance with at least one year of documented payment history. Authorized user accounts are not counted in minimum trade line requirement. Accounts with collections and charge-offs are not considered trade lines. Borrowers with paid collections and charge offs with no reestablished trade lines will not be considered for non –traditional trade lines to establish new pay history. Minimum income of $25, 000 for borrowers Two years of continued employment; self-employed borrowers must demonstrate minimum 2 years in business. Fixed income (SSI, etc. ) borrowers must show 3 years continuance of income from all sources to count income. Untaxed income will be grossed-up 25% All deferred loan payments must be included in the borrower’s debt ratio. Lenders are required to maximize the first trust loan. The minimum loan to value financed by a first trust lender must be 65% of the sales price. In most cases, average LTV range is 70 - 80%. HPAP underwriter has final say on minimum first mortgage LTV, and will be determined on a case by case basis. HPAP’s acquisition financing cannot exceed 100% LTV and total financing cannot exceed the appraised value by no more than 5%. HPAP staff determines the final HPAP assistance amount and CLTV. Stated Loans, Interest Only, 2/28, 3/27, Option ARMs, Negative Amortized loans, No document loans Rate buy down subsidies cannot be paid with HPAP closing assistance. The borrower, lender or third party can pay the buy down subsidy on behalf of the borrower. Rate buy downs must be disclosed by the lender in the rate lock disclosure form. ARM - HPAP will qualify applicants based on the first adjustment cap rate if client demonstrates stable employment and potential for earning increases. 6 days to receive NOE 5 days for underwriting approval. Contracts must be approved prior to acceptance of lenders package. HPAP closing requires 3 days for preparing closing documents and to request funds. 41

QUESTIONS? 42

QUESTIONS? 42