2666ce73526fb6e7889c182aa822fc9b.ppt

- Количество слайдов: 64

David Lynn, Morrison & Foerster LLP Tymour Okasha, Bank of America Merrill Lynch Anna Pinedo, Morrison & Foerster LLP March 8, 2012 © 2012 Morrison & Foerster LLP | All Rights Reserved | mofo. com IFLR Webcast: Private Offering Reform

David Lynn, Morrison & Foerster LLP Tymour Okasha, Bank of America Merrill Lynch Anna Pinedo, Morrison & Foerster LLP March 8, 2012 © 2012 Morrison & Foerster LLP | All Rights Reserved | mofo. com IFLR Webcast: Private Offering Reform

Agenda Overview of concerns raised relating to capital formation Changes to the IPO market IPO Task Force Report Legislation Staying private and the Section 12(g) threshold Private placement related developments Accredited investor definition Bad actor proposal FINRA Regulation A General solicitation Crowdfunding This is Mo. Fo. 2

Agenda Overview of concerns raised relating to capital formation Changes to the IPO market IPO Task Force Report Legislation Staying private and the Section 12(g) threshold Private placement related developments Accredited investor definition Bad actor proposal FINRA Regulation A General solicitation Crowdfunding This is Mo. Fo. 2

Overview This is Mo. Fo. 3

Overview This is Mo. Fo. 3

Post Dodd-Frank Developments There has been heightened focus placed on easing the regulatory burden for smaller or emerging companies Commentators have noted that there have been a variety of changes that have occurred over the last decade or so that have had a chilling effect on capital raising efforts by smaller or emerging companies, including: SOX Market structure issues Changes affecting research analysts Litigation affecting IPO companies Regulatory burdens relative to capital This is Mo. Fo. 4

Post Dodd-Frank Developments There has been heightened focus placed on easing the regulatory burden for smaller or emerging companies Commentators have noted that there have been a variety of changes that have occurred over the last decade or so that have had a chilling effect on capital raising efforts by smaller or emerging companies, including: SOX Market structure issues Changes affecting research analysts Litigation affecting IPO companies Regulatory burdens relative to capital This is Mo. Fo. 4

Decline of the IPO Market in the U. S. Chairman Issa’s March 2011 Letter to Chairman Schapiro cites statistics regarding the number of IPOs in the United States and posits that the dearth of IPOs may be tied to Complexity of SEC regulations SOX and DFA Litigation Overly restrictive rules regarding offering communications This is Mo. Fo. 5

Decline of the IPO Market in the U. S. Chairman Issa’s March 2011 Letter to Chairman Schapiro cites statistics regarding the number of IPOs in the United States and posits that the dearth of IPOs may be tied to Complexity of SEC regulations SOX and DFA Litigation Overly restrictive rules regarding offering communications This is Mo. Fo. 5

IPO Market Review 6

IPO Market Review 6

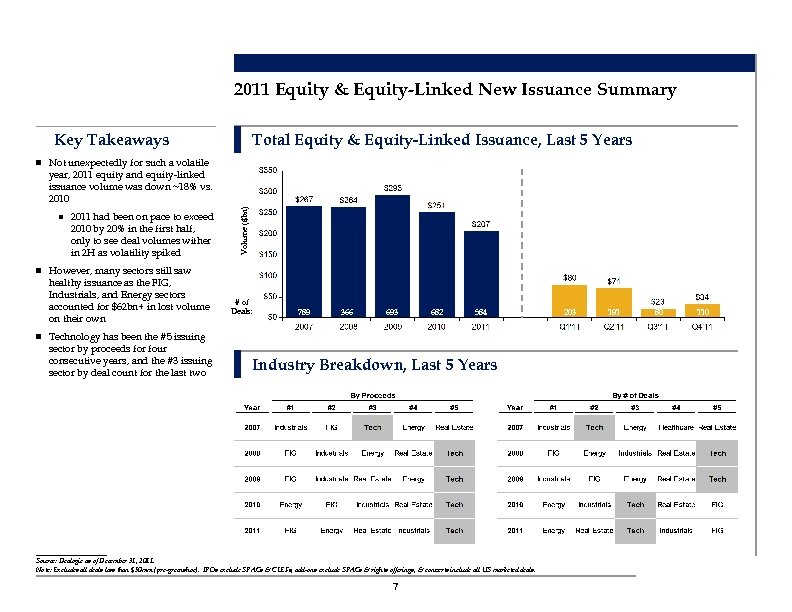

2011 Equity & Equity-Linked New Issuance Summary Key Takeaways Total Equity & Equity-Linked Issuance, Last 5 Years n Not unexpectedly for such a volatile n 2011 had been on pace to exceed 2010 by 20% in the first half, only to see deal volumes wither in 2 H as volatility spiked Volume ($bn) year, 2011 equity and equity-linked issuance volume was down ~18% vs. 2010 n However, many sectors still saw healthy issuance as the FIG, Industrials, and Energy sectors accounted for $62 bn+ in lost volume on their own # of Deals: 789 366 693 682 584 n Technology has been the #5 issuing sector by proceeds for four consecutive years, and the #3 issuing sector by deal count for the last two Industry Breakdown, Last 5 Years __________ Source: Dealogic as of December 31, 2011. Note: Excludes all deals less than $50 mm (pre-greenshoe). IPOs exclude SPACs & CLEFs, add-ons exclude SPACs & rights offerings, & converts include all US marketed deals. 7 203 191 80 110

2011 Equity & Equity-Linked New Issuance Summary Key Takeaways Total Equity & Equity-Linked Issuance, Last 5 Years n Not unexpectedly for such a volatile n 2011 had been on pace to exceed 2010 by 20% in the first half, only to see deal volumes wither in 2 H as volatility spiked Volume ($bn) year, 2011 equity and equity-linked issuance volume was down ~18% vs. 2010 n However, many sectors still saw healthy issuance as the FIG, Industrials, and Energy sectors accounted for $62 bn+ in lost volume on their own # of Deals: 789 366 693 682 584 n Technology has been the #5 issuing sector by proceeds for four consecutive years, and the #3 issuing sector by deal count for the last two Industry Breakdown, Last 5 Years __________ Source: Dealogic as of December 31, 2011. Note: Excludes all deals less than $50 mm (pre-greenshoe). IPOs exclude SPACs & CLEFs, add-ons exclude SPACs & rights offerings, & converts include all US marketed deals. 7 203 191 80 110

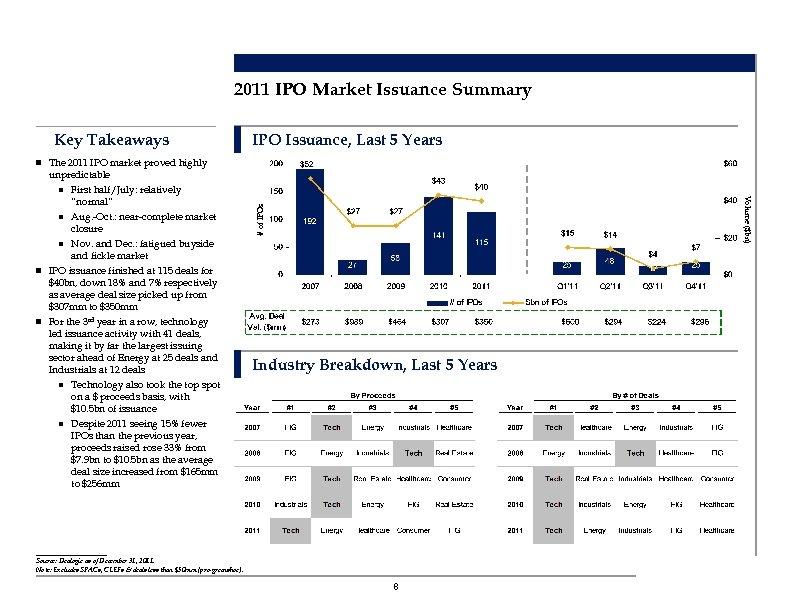

2011 IPO Market Issuance Summary Key Takeaways IPO Issuance, Last 5 Years n The 2011 IPO market proved highly unpredictable First half/July: relatively “normal” n Aug. -Oct. : near-complete market closure n Nov. and Dec. : fatigued buyside and fickle market n IPO issuance finished at 115 deals for $40 bn, down 18% and 7% respectively as average deal size picked up from $307 mm to $350 mm n For the 3 rd year in a row, technology led issuance activity with 41 deals, making it by far the largest issuing sector ahead of Energy at 25 deals and Industrials at 12 deals n Technology also took the top spot on a $ proceeds basis, with $10. 5 bn of issuance n Despite 2011 seeing 15% fewer IPOs than the previous year, proceeds raised rose 33% from $7. 9 bn to $10. 5 bn as the average deal size increased from $165 mm to $256 mm n # of IPOs Volume ($bn) Industry Breakdown, Last 5 Years __________ Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 8

2011 IPO Market Issuance Summary Key Takeaways IPO Issuance, Last 5 Years n The 2011 IPO market proved highly unpredictable First half/July: relatively “normal” n Aug. -Oct. : near-complete market closure n Nov. and Dec. : fatigued buyside and fickle market n IPO issuance finished at 115 deals for $40 bn, down 18% and 7% respectively as average deal size picked up from $307 mm to $350 mm n For the 3 rd year in a row, technology led issuance activity with 41 deals, making it by far the largest issuing sector ahead of Energy at 25 deals and Industrials at 12 deals n Technology also took the top spot on a $ proceeds basis, with $10. 5 bn of issuance n Despite 2011 seeing 15% fewer IPOs than the previous year, proceeds raised rose 33% from $7. 9 bn to $10. 5 bn as the average deal size increased from $165 mm to $256 mm n # of IPOs Volume ($bn) Industry Breakdown, Last 5 Years __________ Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 8

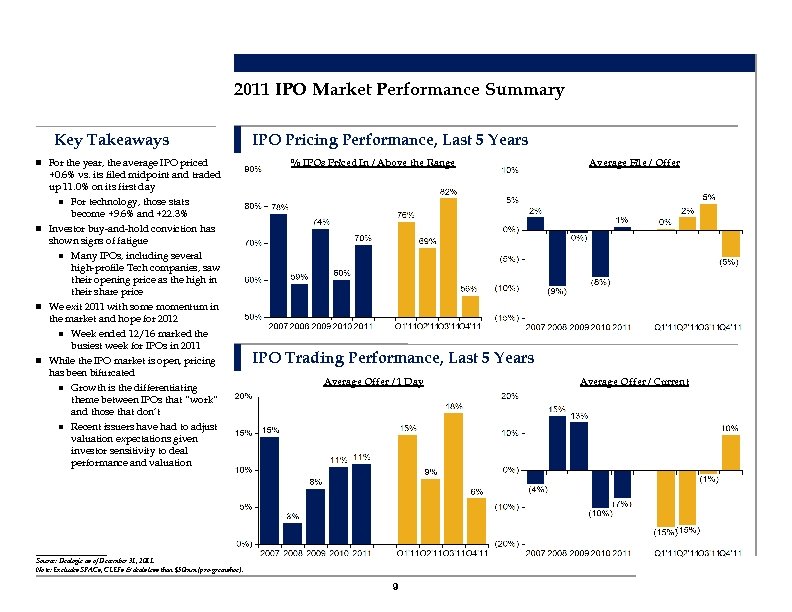

2011 IPO Market Performance Summary Key Takeaways n For the year, the average IPO priced +0. 6% vs. its filed midpoint and traded up 11. 0% on its first day n For technology, those stats become +9. 6% and +22. 3% n Investor buy-and-hold conviction has shown signs of fatigue n Many IPOs, including several high-profile Tech companies, saw their opening price as the high in their share price n We exit 2011 with some momentum in the market and hope for 2012 n Week ended 12/16 marked the busiest week for IPOs in 2011 n While the IPO market is open, pricing has been bifurcated n Growth is the differentiating theme between IPOs that “work” and those that don’t n Recent issuers have had to adjust valuation expectations given investor sensitivity to deal performance and valuation IPO Pricing Performance, Last 5 Years % IPOs Priced In / Above the Range Average File / Offer IPO Trading Performance, Last 5 Years Average Offer / 1 Day __________ Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 9 Average Offer / Current

2011 IPO Market Performance Summary Key Takeaways n For the year, the average IPO priced +0. 6% vs. its filed midpoint and traded up 11. 0% on its first day n For technology, those stats become +9. 6% and +22. 3% n Investor buy-and-hold conviction has shown signs of fatigue n Many IPOs, including several high-profile Tech companies, saw their opening price as the high in their share price n We exit 2011 with some momentum in the market and hope for 2012 n Week ended 12/16 marked the busiest week for IPOs in 2011 n While the IPO market is open, pricing has been bifurcated n Growth is the differentiating theme between IPOs that “work” and those that don’t n Recent issuers have had to adjust valuation expectations given investor sensitivity to deal performance and valuation IPO Pricing Performance, Last 5 Years % IPOs Priced In / Above the Range Average File / Offer IPO Trading Performance, Last 5 Years Average Offer / 1 Day __________ Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 9 Average Offer / Current

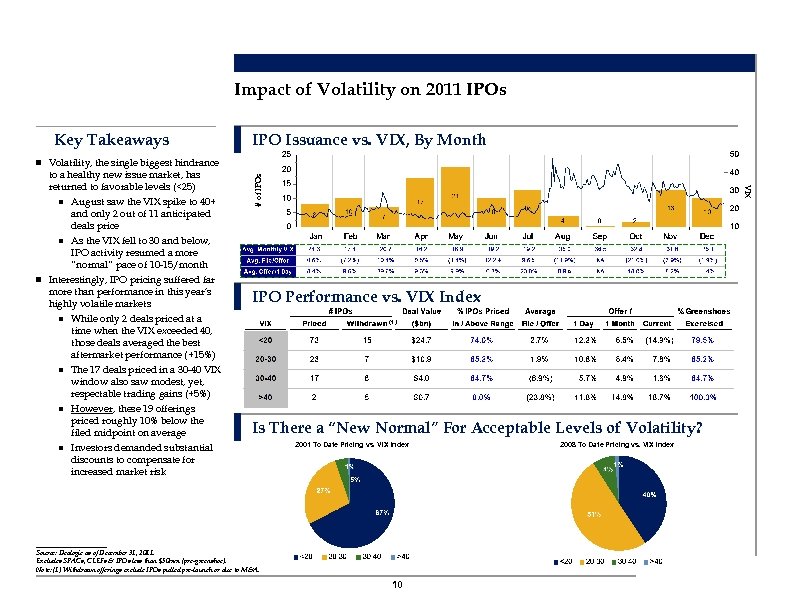

Impact of Volatility on 2011 IPOs Key Takeaways IPO Issuance vs. VIX, By Month VIX to a healthy new issue market, has returned to favorable levels (<25) n August saw the VIX spike to 40+ and only 2 out of 11 anticipated deals price n As the VIX fell to 30 and below, IPO activity resumed a more “normal” pace of 10 -15/month n Interestingly, IPO pricing suffered far more than performance in this year’s highly volatile markets n While only 2 deals priced at a time when the VIX exceeded 40, those deals averaged the best aftermarket performance (+15%) n The 17 deals priced in a 30 -40 VIX window also saw modest, yet, respectable trading gains (+5%) n However, these 19 offerings priced roughly 10% below the filed midpoint on average n Investors demanded substantial discounts to compensate for increased market risk # of IPOs n Volatility, the single biggest hindrance IPO Performance vs. VIX Index (1) Is There a “New Normal” For Acceptable Levels of Volatility? 2001 To Date Pricing vs. VIX Index __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs & IPOs less than $50 mm (pre-greenshoe). Note: (1) Withdrawn offerings exclude IPOs pulled pre-launch or due to M&A. 10 2008 To Date Pricing vs. VIX Index

Impact of Volatility on 2011 IPOs Key Takeaways IPO Issuance vs. VIX, By Month VIX to a healthy new issue market, has returned to favorable levels (<25) n August saw the VIX spike to 40+ and only 2 out of 11 anticipated deals price n As the VIX fell to 30 and below, IPO activity resumed a more “normal” pace of 10 -15/month n Interestingly, IPO pricing suffered far more than performance in this year’s highly volatile markets n While only 2 deals priced at a time when the VIX exceeded 40, those deals averaged the best aftermarket performance (+15%) n The 17 deals priced in a 30 -40 VIX window also saw modest, yet, respectable trading gains (+5%) n However, these 19 offerings priced roughly 10% below the filed midpoint on average n Investors demanded substantial discounts to compensate for increased market risk # of IPOs n Volatility, the single biggest hindrance IPO Performance vs. VIX Index (1) Is There a “New Normal” For Acceptable Levels of Volatility? 2001 To Date Pricing vs. VIX Index __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs & IPOs less than $50 mm (pre-greenshoe). Note: (1) Withdrawn offerings exclude IPOs pulled pre-launch or due to M&A. 10 2008 To Date Pricing vs. VIX Index

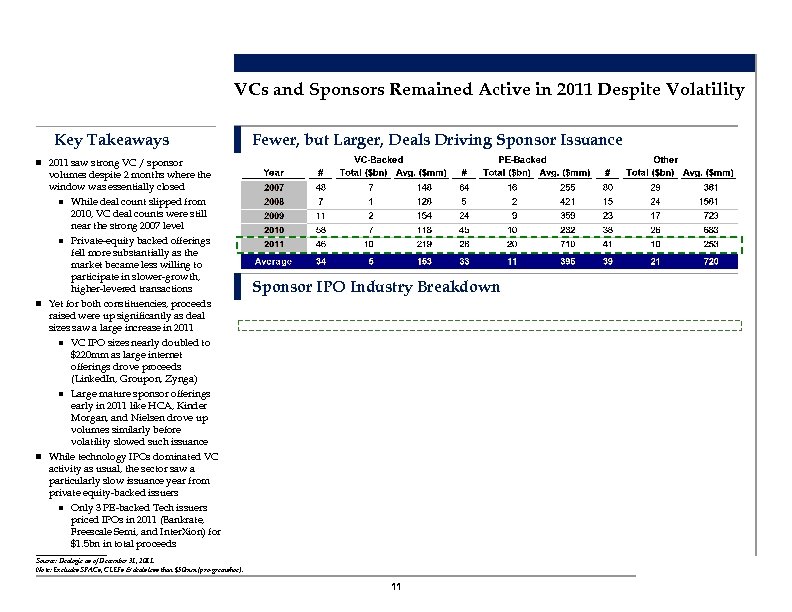

VCs and Sponsors Remained Active in 2011 Despite Volatility Key Takeaways Fewer, but Larger, Deals Driving Sponsor Issuance n 2011 saw strong VC / sponsor volumes despite 2 months where the window was essentially closed n While deal count slipped from 2010, VC deal counts were still near the strong 2007 level n Private-equity backed offerings fell more substantially as the market became less willing to participate in slower-growth, higher-levered transactions n Yet for both constituencies, proceeds raised were up significantly as deal sizes saw a large increase in 2011 n VC IPO sizes nearly doubled to $220 mm as large internet offerings drove proceeds (Linked. In, Groupon, Zynga) n Large mature sponsor offerings early in 2011 like HCA, Kinder Morgan, and Nielsen drove up volumes similarly before volatility slowed such issuance n While technology IPOs dominated VC activity as usual, the sector saw a particularly slow issuance year from private equity-backed issuers n Only 3 PE-backed Tech issuers priced IPOs in 2011 (Bankrate, Freescale Semi, and Inter. Xion) for $1. 5 bn in total proceeds Sponsor IPO Industry Breakdown __________ Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 11

VCs and Sponsors Remained Active in 2011 Despite Volatility Key Takeaways Fewer, but Larger, Deals Driving Sponsor Issuance n 2011 saw strong VC / sponsor volumes despite 2 months where the window was essentially closed n While deal count slipped from 2010, VC deal counts were still near the strong 2007 level n Private-equity backed offerings fell more substantially as the market became less willing to participate in slower-growth, higher-levered transactions n Yet for both constituencies, proceeds raised were up significantly as deal sizes saw a large increase in 2011 n VC IPO sizes nearly doubled to $220 mm as large internet offerings drove proceeds (Linked. In, Groupon, Zynga) n Large mature sponsor offerings early in 2011 like HCA, Kinder Morgan, and Nielsen drove up volumes similarly before volatility slowed such issuance n While technology IPOs dominated VC activity as usual, the sector saw a particularly slow issuance year from private equity-backed issuers n Only 3 PE-backed Tech issuers priced IPOs in 2011 (Bankrate, Freescale Semi, and Inter. Xion) for $1. 5 bn in total proceeds Sponsor IPO Industry Breakdown __________ Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 11

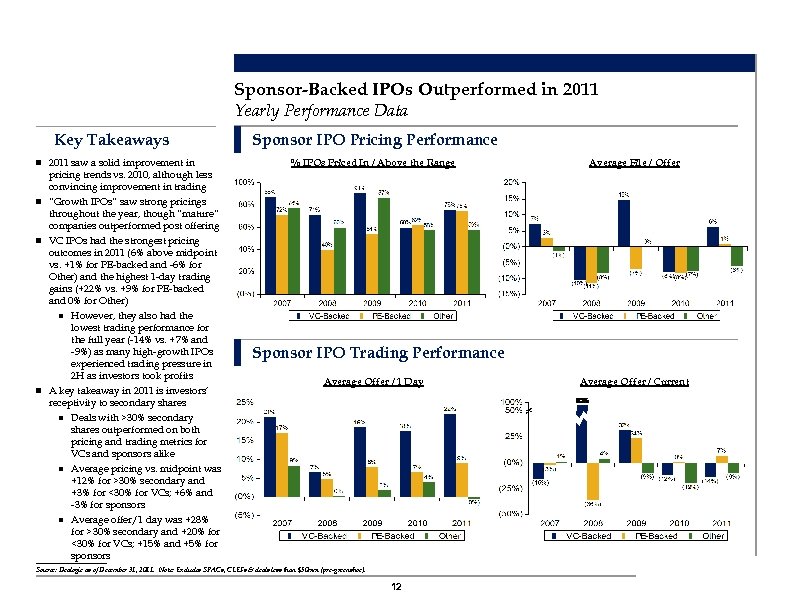

Sponsor-Backed IPOs Outperformed in 2011 Yearly Performance Data Key Takeaways n 2011 saw a solid improvement in pricing trends vs. 2010, although less convincing improvement in trading n “Growth IPOs” saw strong pricings throughout the year, though “mature” companies outperformed post offering n VC IPOs had the strongest pricing outcomes in 2011 (6% above midpoint vs. +1% for PE-backed and -6% for Other) and the highest 1 -day trading gains (+22% vs. +9% for PE-backed and 0% for Other) n However, they also had the lowest trading performance for the full year (-14% vs. +7% and -9%) as many high-growth IPOs experienced trading pressure in 2 H as investors took profits n A key takeaway in 2011 is investors’ receptivity to secondary shares n Deals with >30% secondary shares outperformed on both pricing and trading metrics for VCs and sponsors alike n Average pricing vs. midpoint was +12% for >30% secondary and +3% for <30% for VCs; +6% and -3% for sponsors n Average offer/1 day was +28% for >30% secondary and +20% for <30% for VCs; +15% and +5% for sponsors __________ Sponsor IPO Pricing Performance % IPOs Priced In / Above the Range Average File / Offer Sponsor IPO Trading Performance Average Offer / 1 Day Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 12 Average Offer / Current

Sponsor-Backed IPOs Outperformed in 2011 Yearly Performance Data Key Takeaways n 2011 saw a solid improvement in pricing trends vs. 2010, although less convincing improvement in trading n “Growth IPOs” saw strong pricings throughout the year, though “mature” companies outperformed post offering n VC IPOs had the strongest pricing outcomes in 2011 (6% above midpoint vs. +1% for PE-backed and -6% for Other) and the highest 1 -day trading gains (+22% vs. +9% for PE-backed and 0% for Other) n However, they also had the lowest trading performance for the full year (-14% vs. +7% and -9%) as many high-growth IPOs experienced trading pressure in 2 H as investors took profits n A key takeaway in 2011 is investors’ receptivity to secondary shares n Deals with >30% secondary shares outperformed on both pricing and trading metrics for VCs and sponsors alike n Average pricing vs. midpoint was +12% for >30% secondary and +3% for <30% for VCs; +6% and -3% for sponsors n Average offer/1 day was +28% for >30% secondary and +20% for <30% for VCs; +15% and +5% for sponsors __________ Sponsor IPO Pricing Performance % IPOs Priced In / Above the Range Average File / Offer Sponsor IPO Trading Performance Average Offer / 1 Day Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 12 Average Offer / Current

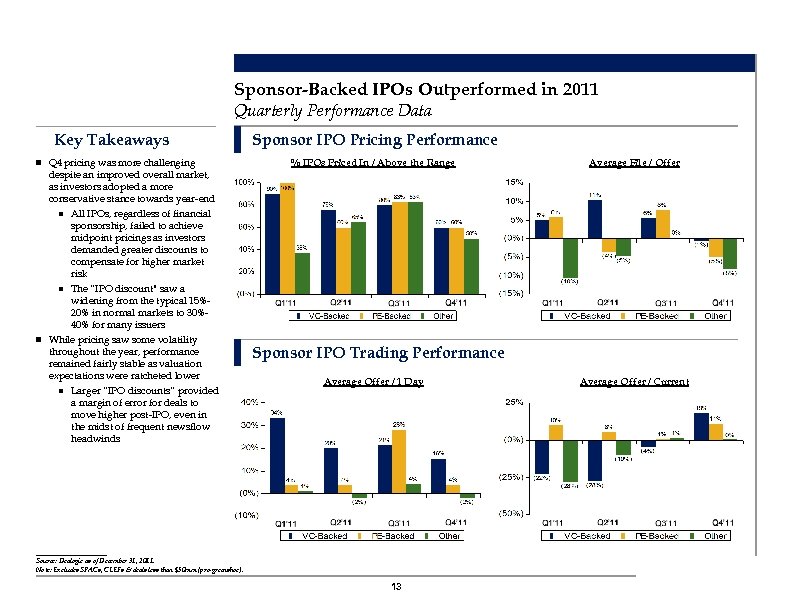

Sponsor-Backed IPOs Outperformed in 2011 Quarterly Performance Data Key Takeaways n Q 4 pricing was more challenging despite an improved overall market, as investors adopted a more conservative stance towards year-end n All IPOs, regardless of financial sponsorship, failed to achieve midpoint pricings as investors demanded greater discounts to compensate for higher market risk n The “IPO discount" saw a widening from the typical 15%20% in normal markets to 30%40% for many issuers n While pricing saw some volatility throughout the year, performance remained fairly stable as valuation expectations were ratcheted lower n Larger “IPO discounts” provided a margin of error for deals to move higher post-IPO, even in the midst of frequent newsflow headwinds Sponsor IPO Pricing Performance % IPOs Priced In / Above the Range Average File / Offer Sponsor IPO Trading Performance Average Offer / 1 Day __________ Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 13 Average Offer / Current

Sponsor-Backed IPOs Outperformed in 2011 Quarterly Performance Data Key Takeaways n Q 4 pricing was more challenging despite an improved overall market, as investors adopted a more conservative stance towards year-end n All IPOs, regardless of financial sponsorship, failed to achieve midpoint pricings as investors demanded greater discounts to compensate for higher market risk n The “IPO discount" saw a widening from the typical 15%20% in normal markets to 30%40% for many issuers n While pricing saw some volatility throughout the year, performance remained fairly stable as valuation expectations were ratcheted lower n Larger “IPO discounts” provided a margin of error for deals to move higher post-IPO, even in the midst of frequent newsflow headwinds Sponsor IPO Pricing Performance % IPOs Priced In / Above the Range Average File / Offer Sponsor IPO Trading Performance Average Offer / 1 Day __________ Source: Dealogic as of December 31, 2011. Note: Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). 13 Average Offer / Current

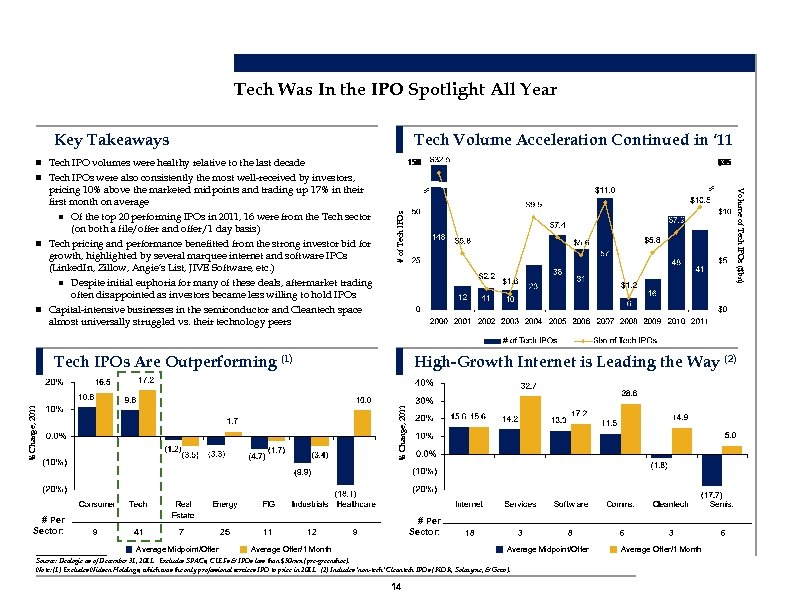

Tech Was In the IPO Spotlight All Year Key Takeaways Tech Volume Acceleration Continued in ‘ 11 n Tech IPO volumes were healthy relative to the last decade n Tech IPOs were also consistently the most well-received by investors, # of Tech IPOs High-Growth Internet is Leading the Way (2) % Change, 2011 Tech IPOs Are Outperforming (1) # Per Sector: Volume of Tech IPOs ($bn) pricing 10% above the marketed midpoints and trading up 17% in their first month on average n Of the top 20 performing IPOs in 2011, 16 were from the Tech sector (on both a file/offer and offer/1 day basis) n Tech pricing and performance benefitted from the strong investor bid for growth, highlighted by several marquee internet and software IPOs (Linked. In, Zillow, Angie’s List, JIVE Software, etc. ) n Despite initial euphoria for many of these deals, aftermarket trading often disappointed as investors became less willing to hold IPOs n Capital-intensive businesses in the semiconductor and Cleantech space almost universally struggled vs. their technology peers 9 41 7 25 11 12 # Per Sector: 9 18 3 8 Average Midpoint/Offer Average Offer/1 Month __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs & IPOs less than $50 mm (pre-greenshoe). Note: (1) Excludes Nielsen Holdings, which was the only professional services IPO to price in 2011. (2) Includes ‘non-tech’ Cleantech IPOs (Ki. OR, Solazyme, & Gevo). 14 6 3 Average Offer/1 Month 6

Tech Was In the IPO Spotlight All Year Key Takeaways Tech Volume Acceleration Continued in ‘ 11 n Tech IPO volumes were healthy relative to the last decade n Tech IPOs were also consistently the most well-received by investors, # of Tech IPOs High-Growth Internet is Leading the Way (2) % Change, 2011 Tech IPOs Are Outperforming (1) # Per Sector: Volume of Tech IPOs ($bn) pricing 10% above the marketed midpoints and trading up 17% in their first month on average n Of the top 20 performing IPOs in 2011, 16 were from the Tech sector (on both a file/offer and offer/1 day basis) n Tech pricing and performance benefitted from the strong investor bid for growth, highlighted by several marquee internet and software IPOs (Linked. In, Zillow, Angie’s List, JIVE Software, etc. ) n Despite initial euphoria for many of these deals, aftermarket trading often disappointed as investors became less willing to hold IPOs n Capital-intensive businesses in the semiconductor and Cleantech space almost universally struggled vs. their technology peers 9 41 7 25 11 12 # Per Sector: 9 18 3 8 Average Midpoint/Offer Average Offer/1 Month __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs & IPOs less than $50 mm (pre-greenshoe). Note: (1) Excludes Nielsen Holdings, which was the only professional services IPO to price in 2011. (2) Includes ‘non-tech’ Cleantech IPOs (Ki. OR, Solazyme, & Gevo). 14 6 3 Average Offer/1 Month 6

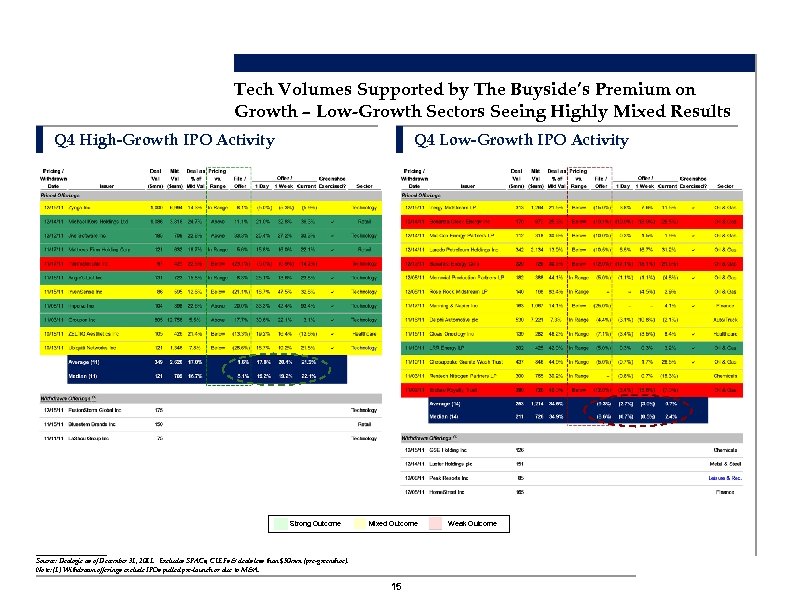

Tech Volumes Supported by The Buyside’s Premium on Growth – Low-Growth Sectors Seeing Highly Mixed Results Q 4 High-Growth IPO Activity Q 4 Low-Growth IPO Activity Strong Outcome Mixed Outcome __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). Note: (1) Withdrawn offerings exclude IPOs pulled pre-launch or due to M&A. 15 Weak Outcome

Tech Volumes Supported by The Buyside’s Premium on Growth – Low-Growth Sectors Seeing Highly Mixed Results Q 4 High-Growth IPO Activity Q 4 Low-Growth IPO Activity Strong Outcome Mixed Outcome __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs & deals less than $50 mm (pre-greenshoe). Note: (1) Withdrawn offerings exclude IPOs pulled pre-launch or due to M&A. 15 Weak Outcome

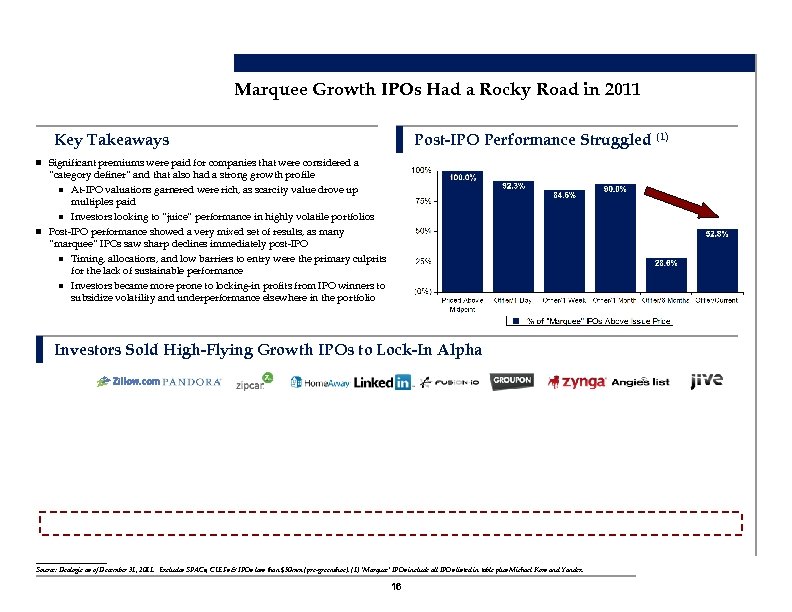

Marquee Growth IPOs Had a Rocky Road in 2011 Key Takeaways Post-IPO Performance Struggled (1) n Significant premiums were paid for companies that were considered a “category definer” and that also had a strong growth profile At-IPO valuations garnered were rich, as scarcity value drove up multiples paid n Investors looking to “juice” performance in highly volatile portfolios n Post-IPO performance showed a very mixed set of results, as many “marquee” IPOs saw sharp declines immediately post-IPO n Timing, allocations, and low barriers to entry were the primary culprits for the lack of sustainable performance n Investors became more prone to locking-in profits from IPO winners to subsidize volatility and underperformance elsewhere in the portfolio n Investors Sold High-Flying Growth IPOs to Lock-In Alpha __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs & IPOs less than $50 mm (pre-greenshoe). (1) ‘Marquee’ IPOs include all IPOs listed in table plus Michael Kors and Yandex. 16

Marquee Growth IPOs Had a Rocky Road in 2011 Key Takeaways Post-IPO Performance Struggled (1) n Significant premiums were paid for companies that were considered a “category definer” and that also had a strong growth profile At-IPO valuations garnered were rich, as scarcity value drove up multiples paid n Investors looking to “juice” performance in highly volatile portfolios n Post-IPO performance showed a very mixed set of results, as many “marquee” IPOs saw sharp declines immediately post-IPO n Timing, allocations, and low barriers to entry were the primary culprits for the lack of sustainable performance n Investors became more prone to locking-in profits from IPO winners to subsidize volatility and underperformance elsewhere in the portfolio n Investors Sold High-Flying Growth IPOs to Lock-In Alpha __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs & IPOs less than $50 mm (pre-greenshoe). (1) ‘Marquee’ IPOs include all IPOs listed in table plus Michael Kors and Yandex. 16

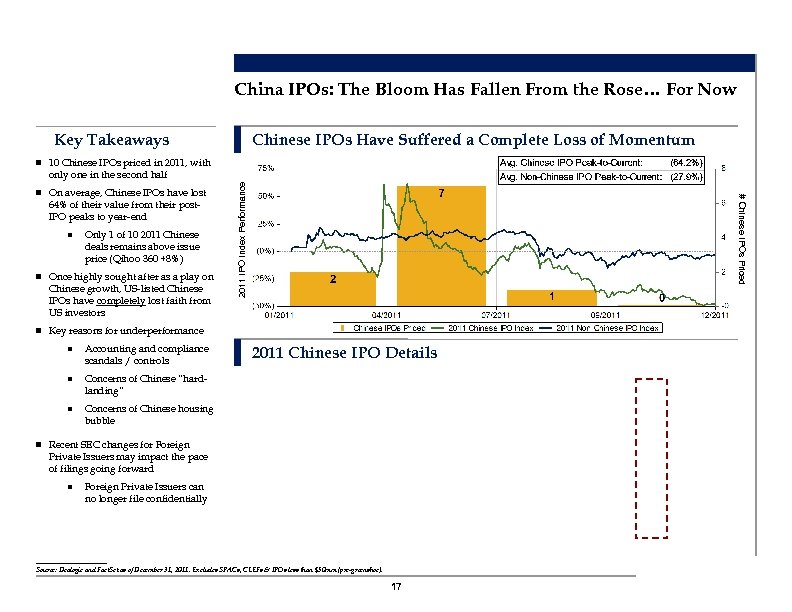

China IPOs: The Bloom Has Fallen From the Rose… For Now Key Takeaways Chinese IPOs Have Suffered a Complete Loss of Momentum n 10 Chinese IPOs priced in 2011, with 64% of their value from their post. IPO peaks to year-end n Only 1 of 10 2011 Chinese deals remains above issue price (Qihoo 360 +8%) n Once highly sought after as a play on Chinese growth, US-listed Chinese IPOs have completely lost faith from US investors # Chinese IPOs Priced n On average, Chinese IPOs have lost 2011 IPO Index Performance only one in the second half n Key reasons for underperformance n Accounting and compliance scandals / controls n Concerns of Chinese “hardlanding” n Concerns of Chinese housing bubble 2011 Chinese IPO Details n Recent SEC changes for Foreign Private Issuers may impact the pace of filings going forward n Foreign Private Issuers can no longer file confidentially __________ Source: Dealogic and Fact. Set as of December 31, 2011. Excludes SPACs, CLEFs & IPOs less than $50 mm (pre-greenshoe). 17

China IPOs: The Bloom Has Fallen From the Rose… For Now Key Takeaways Chinese IPOs Have Suffered a Complete Loss of Momentum n 10 Chinese IPOs priced in 2011, with 64% of their value from their post. IPO peaks to year-end n Only 1 of 10 2011 Chinese deals remains above issue price (Qihoo 360 +8%) n Once highly sought after as a play on Chinese growth, US-listed Chinese IPOs have completely lost faith from US investors # Chinese IPOs Priced n On average, Chinese IPOs have lost 2011 IPO Index Performance only one in the second half n Key reasons for underperformance n Accounting and compliance scandals / controls n Concerns of Chinese “hardlanding” n Concerns of Chinese housing bubble 2011 Chinese IPO Details n Recent SEC changes for Foreign Private Issuers may impact the pace of filings going forward n Foreign Private Issuers can no longer file confidentially __________ Source: Dealogic and Fact. Set as of December 31, 2011. Excludes SPACs, CLEFs & IPOs less than $50 mm (pre-greenshoe). 17

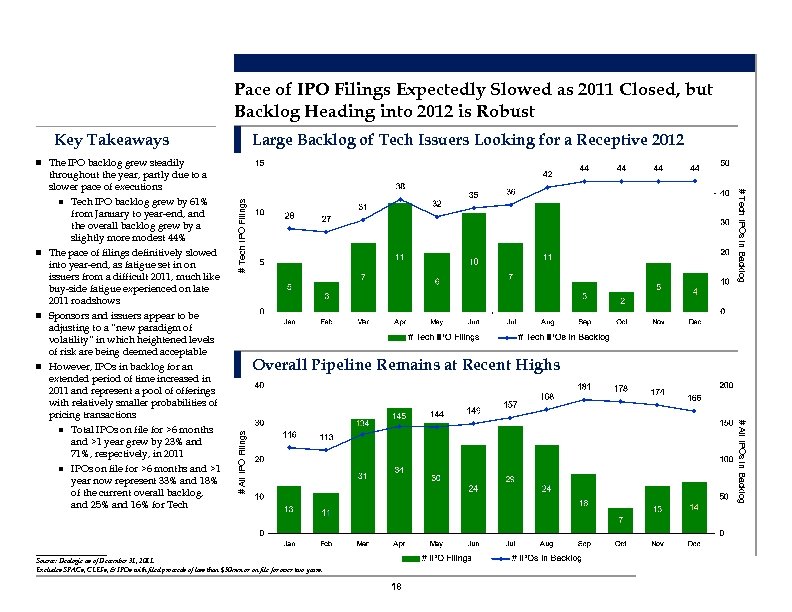

Pace of IPO Filings Expectedly Slowed as 2011 Closed, but Backlog Heading into 2012 is Robust Key Takeaways Large Backlog of Tech Issuers Looking for a Receptive 2012 n The IPO backlog grew steadily # Tech IPO Filings # Tech IPOs in Backlog Overall Pipeline Remains at Recent Highs # All IPO Filings # All IPOs in Backlog throughout the year, partly due to a slower pace of executions n Tech IPO backlog grew by 61% from January to year-end, and the overall backlog grew by a slightly more modest 44% n The pace of filings definitively slowed into year-end, as fatigue set in on issuers from a difficult 2011, much like buy-side fatigue experienced on late 2011 roadshows n Sponsors and issuers appear to be adjusting to a “new paradigm of volatility” in which heightened levels of risk are being deemed acceptable n However, IPOs in backlog for an extended period of time increased in 2011 and represent a pool of offerings with relatively smaller probabilities of pricing transactions n Total IPOs on file for >6 months and >1 year grew by 23% and 71%, respectively, in 2011 n IPOs on file for >6 months and >1 year now represent 33% and 18% of the current overall backlog, and 25% and 16% for Tech __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs, & IPOs with filed proceeds of less than $50 mm or on file for over two years. 18

Pace of IPO Filings Expectedly Slowed as 2011 Closed, but Backlog Heading into 2012 is Robust Key Takeaways Large Backlog of Tech Issuers Looking for a Receptive 2012 n The IPO backlog grew steadily # Tech IPO Filings # Tech IPOs in Backlog Overall Pipeline Remains at Recent Highs # All IPO Filings # All IPOs in Backlog throughout the year, partly due to a slower pace of executions n Tech IPO backlog grew by 61% from January to year-end, and the overall backlog grew by a slightly more modest 44% n The pace of filings definitively slowed into year-end, as fatigue set in on issuers from a difficult 2011, much like buy-side fatigue experienced on late 2011 roadshows n Sponsors and issuers appear to be adjusting to a “new paradigm of volatility” in which heightened levels of risk are being deemed acceptable n However, IPOs in backlog for an extended period of time increased in 2011 and represent a pool of offerings with relatively smaller probabilities of pricing transactions n Total IPOs on file for >6 months and >1 year grew by 23% and 71%, respectively, in 2011 n IPOs on file for >6 months and >1 year now represent 33% and 18% of the current overall backlog, and 25% and 16% for Tech __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs, & IPOs with filed proceeds of less than $50 mm or on file for over two years. 18

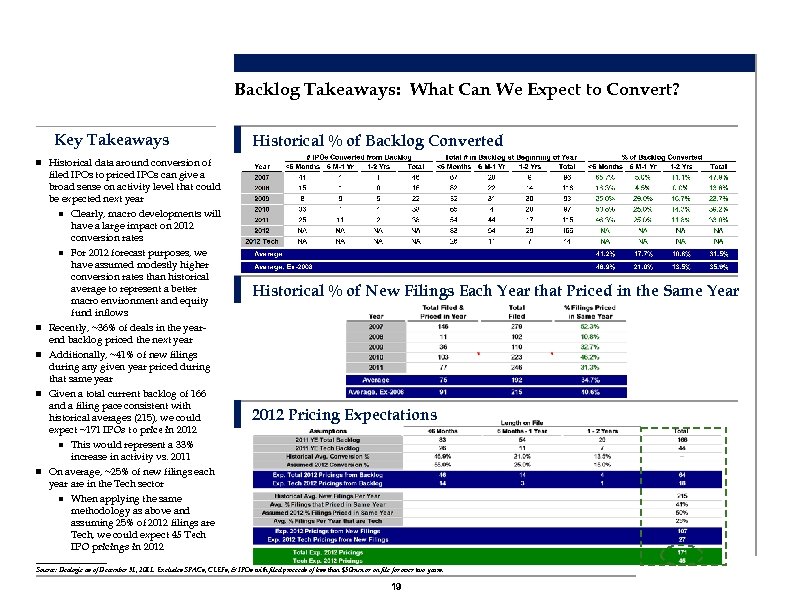

Backlog Takeaways: What Can We Expect to Convert? Key Takeaways Historical % of Backlog Converted n Historical data around conversion of n n filed IPOs to priced IPOs can give a broad sense on activity level that could be expected next year n Clearly, macro developments will have a large impact on 2012 conversion rates n For 2012 forecast purposes, we have assumed modestly higher conversion rates than historical average to represent a better macro environment and equity fund inflows Recently, ~36% of deals in the yearend backlog priced the next year Additionally, ~41% of new filings during any given year priced during that same year Given a total current backlog of 166 and a filing pace consistent with historical averages (215), we could expect ~171 IPOs to price in 2012 n This would represent a 33% increase in activity vs. 2011 On average, ~25% of new filings each year are in the Tech sector n When applying the same methodology as above and assuming 25% of 2012 filings are Tech, we could expect 45 Tech IPO pricings in 2012 Historical % of New Filings Each Year that Priced in the Same Year 2012 Pricing Expectations __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs, & IPOs with filed proceeds of less than $50 mm or on file for over two years. 19

Backlog Takeaways: What Can We Expect to Convert? Key Takeaways Historical % of Backlog Converted n Historical data around conversion of n n filed IPOs to priced IPOs can give a broad sense on activity level that could be expected next year n Clearly, macro developments will have a large impact on 2012 conversion rates n For 2012 forecast purposes, we have assumed modestly higher conversion rates than historical average to represent a better macro environment and equity fund inflows Recently, ~36% of deals in the yearend backlog priced the next year Additionally, ~41% of new filings during any given year priced during that same year Given a total current backlog of 166 and a filing pace consistent with historical averages (215), we could expect ~171 IPOs to price in 2012 n This would represent a 33% increase in activity vs. 2011 On average, ~25% of new filings each year are in the Tech sector n When applying the same methodology as above and assuming 25% of 2012 filings are Tech, we could expect 45 Tech IPO pricings in 2012 Historical % of New Filings Each Year that Priced in the Same Year 2012 Pricing Expectations __________ Source: Dealogic as of December 31, 2011. Excludes SPACs, CLEFs, & IPOs with filed proceeds of less than $50 mm or on file for over two years. 19

IPO On-Ramp Concept IPO Task Force Report U. S. IPO market severely declined from 2001 -2008, with IPOs by smaller companies showing the steepest decline Decline caused by a series of regulatory and market structure changes that: drive up costs for smaller companies looking to go public; constrain the amount of information available to investors about such companies; and shift the economics of investment banking away from long-term investing in such companies and toward high-frequency trading of large-cap stocks, thus making the IPO process less attractive to, and more difficult for, smaller companies This is Mo. Fo. 20

IPO On-Ramp Concept IPO Task Force Report U. S. IPO market severely declined from 2001 -2008, with IPOs by smaller companies showing the steepest decline Decline caused by a series of regulatory and market structure changes that: drive up costs for smaller companies looking to go public; constrain the amount of information available to investors about such companies; and shift the economics of investment banking away from long-term investing in such companies and toward high-frequency trading of large-cap stocks, thus making the IPO process less attractive to, and more difficult for, smaller companies This is Mo. Fo. 20

IPO On-Ramp Concept (cont’d) Four principal recommendations to the Treasury Department: providing an “on-ramp” (or phasing in of disclosure requirements) for smaller companies that complete IPOs; improving the availability and flow of information for investors before and after an IPO; lowering the capital gains tax rate for investors who purchase shares in an IPO and hold these shares for a minimum of two years; and educating issuers about how to succeed in the new capital markets environment. Task Force stressed that these recommendations purport only to adjust the scale of current regulations, not change the focus on investor protection This is Mo. Fo. 21

IPO On-Ramp Concept (cont’d) Four principal recommendations to the Treasury Department: providing an “on-ramp” (or phasing in of disclosure requirements) for smaller companies that complete IPOs; improving the availability and flow of information for investors before and after an IPO; lowering the capital gains tax rate for investors who purchase shares in an IPO and hold these shares for a minimum of two years; and educating issuers about how to succeed in the new capital markets environment. Task Force stressed that these recommendations purport only to adjust the scale of current regulations, not change the focus on investor protection This is Mo. Fo. 21

IPO On-Ramp Legislation The “Reopening American Capital Markets to Emerging Growth Companies Act of 2011” Amends Section 2(a) of the Securities Act and Section 3(a) of the Exchange Act by creating a new category of issuer called an “emerging growth company” “Emerging growth company” would be defined as an issuer that had total annual gross revenues of less than $1 billion dollars at the end of its most recent completed fiscal year, and following the initial public offering, less than $700 million in publicly traded shares. An issuer that is an emerging growth company as of the first day of that fiscal year shall remain one until the earliest of: the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1 billion or more or $700 million in public float; the last day of the fiscal year of the issuer following the fifth anniversary of the date of first sale of common equity securities of the issuer pursuant to an effective Securities Act registration statement; and the date on which the issuer is considered to be a Large Accelerated Filer as defined by the SEC. This is Mo. Fo. 22

IPO On-Ramp Legislation The “Reopening American Capital Markets to Emerging Growth Companies Act of 2011” Amends Section 2(a) of the Securities Act and Section 3(a) of the Exchange Act by creating a new category of issuer called an “emerging growth company” “Emerging growth company” would be defined as an issuer that had total annual gross revenues of less than $1 billion dollars at the end of its most recent completed fiscal year, and following the initial public offering, less than $700 million in publicly traded shares. An issuer that is an emerging growth company as of the first day of that fiscal year shall remain one until the earliest of: the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1 billion or more or $700 million in public float; the last day of the fiscal year of the issuer following the fifth anniversary of the date of first sale of common equity securities of the issuer pursuant to an effective Securities Act registration statement; and the date on which the issuer is considered to be a Large Accelerated Filer as defined by the SEC. This is Mo. Fo. 22

IPO On-Ramp Legislation Permits filing a registration statement with the SEC on a confidential basis Expands the range of permissible pre-filing communications made to qualified institutional buyers or accredited investors Requires emerging growth companies to provide only two years of audited financial statements to the SEC (rather than three years), and removes the auditor attestation requirement Allows brokers and dealers, even if they were participating in the underwriting process, to publish research reports about emerging growth companies prior to the IPO This is Mo. Fo. 23

IPO On-Ramp Legislation Permits filing a registration statement with the SEC on a confidential basis Expands the range of permissible pre-filing communications made to qualified institutional buyers or accredited investors Requires emerging growth companies to provide only two years of audited financial statements to the SEC (rather than three years), and removes the auditor attestation requirement Allows brokers and dealers, even if they were participating in the underwriting process, to publish research reports about emerging growth companies prior to the IPO This is Mo. Fo. 23

Staying Private This is Mo. Fo. 24

Staying Private This is Mo. Fo. 24

500 -Holder Rule In light of the issues arising in connection with private companies choosing to stay private longer, pressure is being put on the 500 holder rule Currently, there is proposed legislation that would amend the 500 holder rubric This is Mo. Fo. 25

500 -Holder Rule In light of the issues arising in connection with private companies choosing to stay private longer, pressure is being put on the 500 holder rule Currently, there is proposed legislation that would amend the 500 holder rubric This is Mo. Fo. 25

Exchange Act reporting Voluntary listing Initial public offering – capital raise, plus listing Tripping threshold: Total assets exceeding $10 m as of the last day of company’s fiscal year, A class of equity securities held of record by 500 or more persons. Important developments Use of stock-based compensation for employees. SEC has provided some relief. Increased trading of stock of private companies Formation of special purpose vehicles to invest in stock of privately held companies Private companies deferring IPOs This is Mo. Fo. 26

Exchange Act reporting Voluntary listing Initial public offering – capital raise, plus listing Tripping threshold: Total assets exceeding $10 m as of the last day of company’s fiscal year, A class of equity securities held of record by 500 or more persons. Important developments Use of stock-based compensation for employees. SEC has provided some relief. Increased trading of stock of private companies Formation of special purpose vehicles to invest in stock of privately held companies Private companies deferring IPOs This is Mo. Fo. 26

Legislative proposals Increase threshold to 2000 for banks and bank holding companies only Increase threshold to 1000 for all companies Exclude holders who acquired shares through exempt crowdfunding from the count Exclude holders who received their shares pursuant to a compensation plan from the count This is Mo. Fo. 27

Legislative proposals Increase threshold to 2000 for banks and bank holding companies only Increase threshold to 1000 for all companies Exclude holders who acquired shares through exempt crowdfunding from the count Exclude holders who received their shares pursuant to a compensation plan from the count This is Mo. Fo. 27

Private Placements This is Mo. Fo. 28

Private Placements This is Mo. Fo. 28

Regulation D – Rules 501 -508 Regulation D provides a non-exclusive safe harbor The satisfaction of the conditions of the Regulation D safe harbor will ensure that there is no “public offering” Section 4(2) is still available Regulation D contains the following offering exemptions: Rule 504: available for offerings of up to $1 million; Rule 505: available for offerings of up to $5 million to an unlimited number of accredited investors and up to 35 other purchasers; and Rule 506: available for private placement offerings of an unlimited amount of money to an unlimited number of accredited investors and up to 35 other purchasers that are sophisticated This is Mo. Fo. 29

Regulation D – Rules 501 -508 Regulation D provides a non-exclusive safe harbor The satisfaction of the conditions of the Regulation D safe harbor will ensure that there is no “public offering” Section 4(2) is still available Regulation D contains the following offering exemptions: Rule 504: available for offerings of up to $1 million; Rule 505: available for offerings of up to $5 million to an unlimited number of accredited investors and up to 35 other purchasers; and Rule 506: available for private placement offerings of an unlimited amount of money to an unlimited number of accredited investors and up to 35 other purchasers that are sophisticated This is Mo. Fo. 29

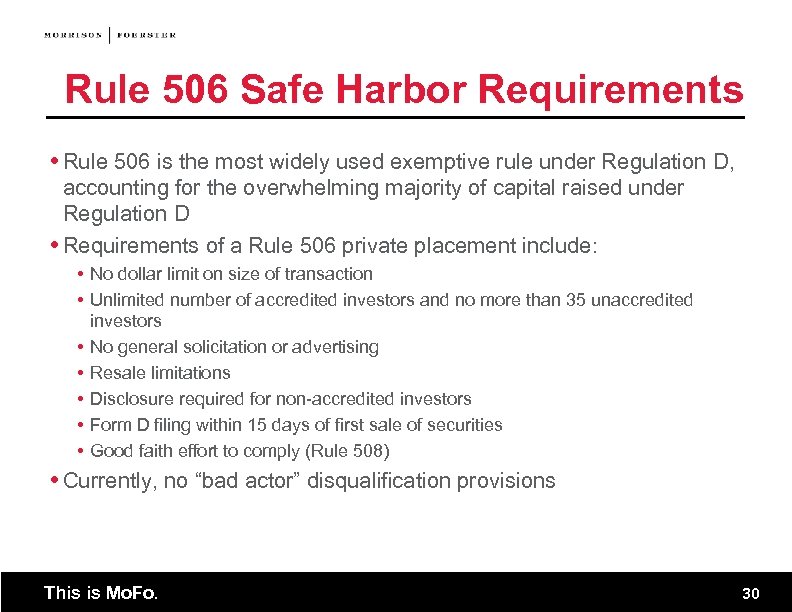

Rule 506 Safe Harbor Requirements Rule 506 is the most widely used exemptive rule under Regulation D, accounting for the overwhelming majority of capital raised under Regulation D Requirements of a Rule 506 private placement include: No dollar limit on size of transaction Unlimited number of accredited investors and no more than 35 unaccredited investors No general solicitation or advertising Resale limitations Disclosure required for non-accredited investors Form D filing within 15 days of first sale of securities Good faith effort to comply (Rule 508) Currently, no “bad actor” disqualification provisions This is Mo. Fo. 30

Rule 506 Safe Harbor Requirements Rule 506 is the most widely used exemptive rule under Regulation D, accounting for the overwhelming majority of capital raised under Regulation D Requirements of a Rule 506 private placement include: No dollar limit on size of transaction Unlimited number of accredited investors and no more than 35 unaccredited investors No general solicitation or advertising Resale limitations Disclosure required for non-accredited investors Form D filing within 15 days of first sale of securities Good faith effort to comply (Rule 508) Currently, no “bad actor” disqualification provisions This is Mo. Fo. 30

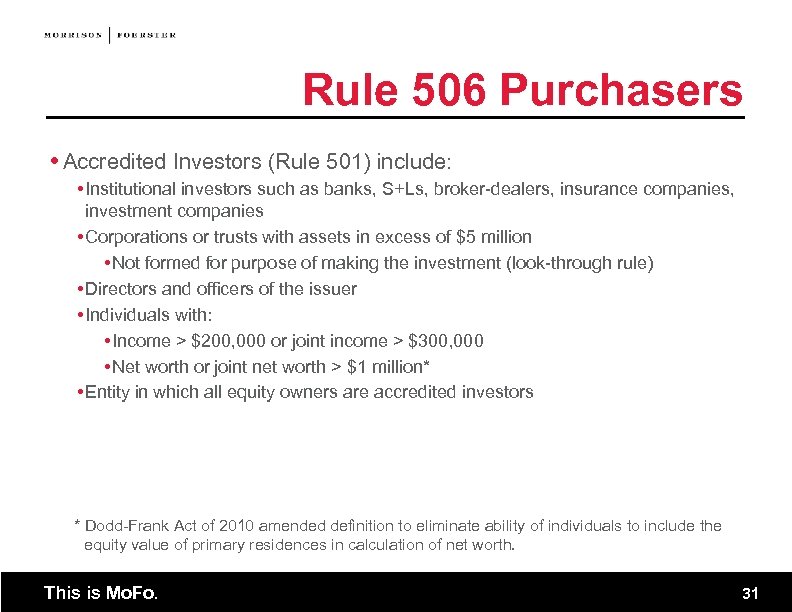

Rule 506 Purchasers Accredited Investors (Rule 501) include: Institutional investors such as banks, S+Ls, broker-dealers, insurance companies, investment companies Corporations or trusts with assets in excess of $5 million Not formed for purpose of making the investment (look-through rule) Directors and officers of the issuer Individuals with: Income > $200, 000 or joint income > $300, 000 Net worth or joint net worth > $1 million* Entity in which all equity owners are accredited investors * Dodd-Frank Act of 2010 amended definition to eliminate ability of individuals to include the equity value of primary residences in calculation of net worth. This is Mo. Fo. 31

Rule 506 Purchasers Accredited Investors (Rule 501) include: Institutional investors such as banks, S+Ls, broker-dealers, insurance companies, investment companies Corporations or trusts with assets in excess of $5 million Not formed for purpose of making the investment (look-through rule) Directors and officers of the issuer Individuals with: Income > $200, 000 or joint income > $300, 000 Net worth or joint net worth > $1 million* Entity in which all equity owners are accredited investors * Dodd-Frank Act of 2010 amended definition to eliminate ability of individuals to include the equity value of primary residences in calculation of net worth. This is Mo. Fo. 31

“Accredited Investor” Reviews The Dodd-Frank Act provides that, upon enactment and for four years following enactment, the net worth threshold for accredited investor status will be $1 million, excluding the equity value (if any) of the investor’s primary residence One year after enactment, the SEC is authorized to review the definition of the term “accredited investor” (as it is applied to natural persons) and to adopt rules that adjust the definition, except for modifying the net worth threshold Four years after enactment, and every four years thereafter, the SEC must review the “accredited investor” definition as applied to natural persons, including adjusting the threshold (although it may not be lowered below $1 million) This is Mo. Fo. 32

“Accredited Investor” Reviews The Dodd-Frank Act provides that, upon enactment and for four years following enactment, the net worth threshold for accredited investor status will be $1 million, excluding the equity value (if any) of the investor’s primary residence One year after enactment, the SEC is authorized to review the definition of the term “accredited investor” (as it is applied to natural persons) and to adopt rules that adjust the definition, except for modifying the net worth threshold Four years after enactment, and every four years thereafter, the SEC must review the “accredited investor” definition as applied to natural persons, including adjusting the threshold (although it may not be lowered below $1 million) This is Mo. Fo. 32

New Accredited Investor Definition The SEC has adopted amendments to the accredited investor standards to reflect the requirements of the Dodd-Frank Act As amended, Rules 215(e) and 501(a)(5) define as an accredited investor: “Any natural person whose individual net worth, or joint net worth with that person’s spouse, at the time of purchase, exceeds $1, 000, excluding the value of the primary residence of such natural person, calculated by subtracting from the estimated fair market value of the property the amount of debt secured by the property, up to the estimated fair market value of the property. ” The SEC added the phrase “calculated by subtracting from the estimated fair market value of the property the amount of debt secured by the property, up to the estimated fair market value of the property” The SEC stated that the purpose of adding this phrase is to clarify that net worth is calculated by excluding only the investor’s net equity in the primary residence This is Mo. Fo. 33

New Accredited Investor Definition The SEC has adopted amendments to the accredited investor standards to reflect the requirements of the Dodd-Frank Act As amended, Rules 215(e) and 501(a)(5) define as an accredited investor: “Any natural person whose individual net worth, or joint net worth with that person’s spouse, at the time of purchase, exceeds $1, 000, excluding the value of the primary residence of such natural person, calculated by subtracting from the estimated fair market value of the property the amount of debt secured by the property, up to the estimated fair market value of the property. ” The SEC added the phrase “calculated by subtracting from the estimated fair market value of the property the amount of debt secured by the property, up to the estimated fair market value of the property” The SEC stated that the purpose of adding this phrase is to clarify that net worth is calculated by excluding only the investor’s net equity in the primary residence This is Mo. Fo. 33

Bad Actors This is Mo. Fo. 34

Bad Actors This is Mo. Fo. 34

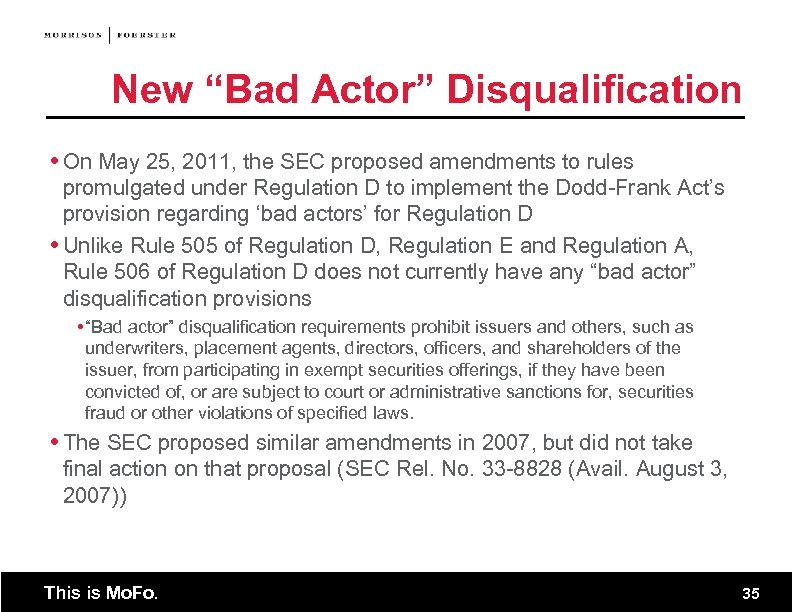

New “Bad Actor” Disqualification On May 25, 2011, the SEC proposed amendments to rules promulgated under Regulation D to implement the Dodd-Frank Act’s provision regarding ‘bad actors’ for Regulation D Unlike Rule 505 of Regulation D, Regulation E and Regulation A, Rule 506 of Regulation D does not currently have any “bad actor” disqualification provisions “Bad actor” disqualification requirements prohibit issuers and others, such as underwriters, placement agents, directors, officers, and shareholders of the issuer, from participating in exempt securities offerings, if they have been convicted of, or are subject to court or administrative sanctions for, securities fraud or other violations of specified laws. The SEC proposed similar amendments in 2007, but did not take final action on that proposal (SEC Rel. No. 33 -8828 (Avail. August 3, 2007)) This is Mo. Fo. 35

New “Bad Actor” Disqualification On May 25, 2011, the SEC proposed amendments to rules promulgated under Regulation D to implement the Dodd-Frank Act’s provision regarding ‘bad actors’ for Regulation D Unlike Rule 505 of Regulation D, Regulation E and Regulation A, Rule 506 of Regulation D does not currently have any “bad actor” disqualification provisions “Bad actor” disqualification requirements prohibit issuers and others, such as underwriters, placement agents, directors, officers, and shareholders of the issuer, from participating in exempt securities offerings, if they have been convicted of, or are subject to court or administrative sanctions for, securities fraud or other violations of specified laws. The SEC proposed similar amendments in 2007, but did not take final action on that proposal (SEC Rel. No. 33 -8828 (Avail. August 3, 2007)) This is Mo. Fo. 35

Section 926 of Dodd-Frank Requires the SEC to adopt rules that would make the exemption available under Rule 506 unavailable for any securities offering in which certain “felons” or other “bad actors” are involved Requires the new rules to be substantially similar to the bad actor disqualification provisions of another limited offering exemptive rule, Rule 262, the bad actor disqualification provisions specified in Regulation A This is Mo. Fo. 36

Section 926 of Dodd-Frank Requires the SEC to adopt rules that would make the exemption available under Rule 506 unavailable for any securities offering in which certain “felons” or other “bad actors” are involved Requires the new rules to be substantially similar to the bad actor disqualification provisions of another limited offering exemptive rule, Rule 262, the bad actor disqualification provisions specified in Regulation A This is Mo. Fo. 36

Covered Persons Proposed amendments would add a new Section 506(c) to Regulation D. Comment period ended on July 14, 2011 Technically, the rule must be adopted by July 21, 2011 (still not adopted) The new section would encompass disqualification provisions that are currently codified in Rule 262 of Regulation A and in section 926(1) of the Dodd-Frank Act This is Mo. Fo. 37

Covered Persons Proposed amendments would add a new Section 506(c) to Regulation D. Comment period ended on July 14, 2011 Technically, the rule must be adopted by July 21, 2011 (still not adopted) The new section would encompass disqualification provisions that are currently codified in Rule 262 of Regulation A and in section 926(1) of the Dodd-Frank Act This is Mo. Fo. 37

Covered Persons (cont’d) The disqualification provisions in proposed Rule 506(c) generally correspond to the persons currently covered under Rule 262 and would thus apply to the following “covered persons”: the issuer and any predecessor of the issuer or affiliated issuer, any director, or any officer; any director, officer, general partner, or managing member of the issuer; any beneficial owner of 10 percent or more of any class of the issuer’s equity securities; any promoter connected with the issuer in any capacity at the time of the sale; any person that has been or will be paid, directly or indirectly, remuneration for solicitation of purchasers in a securities offering; or any director, officer, general partner, or managing member of any compensated solicitor This is Mo. Fo. 38

Covered Persons (cont’d) The disqualification provisions in proposed Rule 506(c) generally correspond to the persons currently covered under Rule 262 and would thus apply to the following “covered persons”: the issuer and any predecessor of the issuer or affiliated issuer, any director, or any officer; any director, officer, general partner, or managing member of the issuer; any beneficial owner of 10 percent or more of any class of the issuer’s equity securities; any promoter connected with the issuer in any capacity at the time of the sale; any person that has been or will be paid, directly or indirectly, remuneration for solicitation of purchasers in a securities offering; or any director, officer, general partner, or managing member of any compensated solicitor This is Mo. Fo. 38

Disqualifying Events The proposed rule includes seven categories of disqualifying events: Criminal convictions; Court injunctions and restraining orders; Final orders of certain state regulators (such as securities, banking, and insurance) and federal regulators; Commission disciplinary orders relating to brokers, dealers, municipal securities dealers, investment advisers, and investment companies and their associated persons; Suspension or expulsion from membership in, or suspension or barring from association with a member of, a securities self-regulatory organization (“SRO”); Commission stop orders and orders suspending a Regulation A exemption; and U. S. Postal Service false representation orders This is Mo. Fo. 39

Disqualifying Events The proposed rule includes seven categories of disqualifying events: Criminal convictions; Court injunctions and restraining orders; Final orders of certain state regulators (such as securities, banking, and insurance) and federal regulators; Commission disciplinary orders relating to brokers, dealers, municipal securities dealers, investment advisers, and investment companies and their associated persons; Suspension or expulsion from membership in, or suspension or barring from association with a member of, a securities self-regulatory organization (“SRO”); Commission stop orders and orders suspending a Regulation A exemption; and U. S. Postal Service false representation orders This is Mo. Fo. 39

Disqualifying Events (cont’d) Section 926(2)(B) of the Dodd-Frank Act provides for disqualification if any covered person “has been convicted of any felony or misdemeanor in connection with the purchase or sale of any security or involving the making of any false filing with the Commission” Also includes a five-year look-back period for criminal convictions of issuers and a ten-year look-back period for other covered persons SEC is seeking comments on: whether a longer look-back period is appropriate whether the inquiry should focus on the beneficial ownership structure of an entity at the time of the disqualifying event, on the application of the rule to the date of the relevant sale, on the scope of the application whether corresponding convictions in foreign courts should trigger disqualification This is Mo. Fo. 40

Disqualifying Events (cont’d) Section 926(2)(B) of the Dodd-Frank Act provides for disqualification if any covered person “has been convicted of any felony or misdemeanor in connection with the purchase or sale of any security or involving the making of any false filing with the Commission” Also includes a five-year look-back period for criminal convictions of issuers and a ten-year look-back period for other covered persons SEC is seeking comments on: whether a longer look-back period is appropriate whether the inquiry should focus on the beneficial ownership structure of an entity at the time of the disqualifying event, on the application of the rule to the date of the relevant sale, on the scope of the application whether corresponding convictions in foreign courts should trigger disqualification This is Mo. Fo. 40

Measuring dates For purposes of ascertaining compliance, the measuring period begins on the date on which the issuer seeks the exemption The SEC measures the bad act from the date of a final order and not from the date of the bad act This is Mo. Fo. 41

Measuring dates For purposes of ascertaining compliance, the measuring period begins on the date on which the issuer seeks the exemption The SEC measures the bad act from the date of a final order and not from the date of the bad act This is Mo. Fo. 41

Reasonable Care Exception Proposed Rule 506 incorporates a reasonable care exception that would apply if an issuer can establish that it did not know and, in the exercise of reasonable care, could not have known that a disqualification existed because of the presence or participation of a covered person. The reasonable care exception would help preserve the intended benefits of Rule 506 and avoid creating an undue burden on capitalraising activities, while giving effect to the legislative intent to screen out felons and bad actors. [1] Issuer would need to conduct a factual inquiry. [1] Regulation D already has a provision, Rule 508, under which “insignificant deviations” from the terms, conditions, and requirements of Regulation D will not result in the loss of the exemption if the person relying on the exemption can show that: (i) the failure to comply did not pertain to a term, condition or requirement directly intended to protect that individual or entity; (ii) the failure to comply was insignificant with respect to the offering as a whole; and (iii) a good faith and reasonable attempt was made to comply. The Commission does not believe that Rule 508 would cover circumstances in which an offering was disqualified under proposed Rule 506(c). This is Mo. Fo. 42

Reasonable Care Exception Proposed Rule 506 incorporates a reasonable care exception that would apply if an issuer can establish that it did not know and, in the exercise of reasonable care, could not have known that a disqualification existed because of the presence or participation of a covered person. The reasonable care exception would help preserve the intended benefits of Rule 506 and avoid creating an undue burden on capitalraising activities, while giving effect to the legislative intent to screen out felons and bad actors. [1] Issuer would need to conduct a factual inquiry. [1] Regulation D already has a provision, Rule 508, under which “insignificant deviations” from the terms, conditions, and requirements of Regulation D will not result in the loss of the exemption if the person relying on the exemption can show that: (i) the failure to comply did not pertain to a term, condition or requirement directly intended to protect that individual or entity; (ii) the failure to comply was insignificant with respect to the offering as a whole; and (iii) a good faith and reasonable attempt was made to comply. The Commission does not believe that Rule 508 would cover circumstances in which an offering was disqualified under proposed Rule 506(c). This is Mo. Fo. 42

Satisfying reasonable case burden Issuers will be required to implement new procedures in connection with any Rule 506 offering this may be especially burdensome for private funds that regularly conduct private offerings in reliance on Rule 506 Issuers may consider: adding additional questions to D&O questionnaires, requiring placement agents to complete a questionnaire or provide a representation require other participants (that may be covered persons) to complete questionnaires or provide representations This is Mo. Fo. 43

Satisfying reasonable case burden Issuers will be required to implement new procedures in connection with any Rule 506 offering this may be especially burdensome for private funds that regularly conduct private offerings in reliance on Rule 506 Issuers may consider: adding additional questions to D&O questionnaires, requiring placement agents to complete a questionnaire or provide a representation require other participants (that may be covered persons) to complete questionnaires or provide representations This is Mo. Fo. 43

Waivers Currently, issuers may seek waivers of disqualification under Regulation A if the issuer shows good cause. Proposed Rule 506(c)(2)(i) carries over the current waiver provisions of Regulation A. Waivers under the new rule will be issued by the Commission. This is Mo. Fo. 44

Waivers Currently, issuers may seek waivers of disqualification under Regulation A if the issuer shows good cause. Proposed Rule 506(c)(2)(i) carries over the current waiver provisions of Regulation A. Waivers under the new rule will be issued by the Commission. This is Mo. Fo. 44

Blue Sky Considerations Securities that are sold pursuant to Rule 506 are considered “covered securities” for purposes of Section 18(b)(4)(D) of the Securities Act this means that securities sold in reliance on Rule 506 are exempt from state securities review An issuer that relies on Section 4(2) will need to consider state securities requirements This is Mo. Fo. 45

Blue Sky Considerations Securities that are sold pursuant to Rule 506 are considered “covered securities” for purposes of Section 18(b)(4)(D) of the Securities Act this means that securities sold in reliance on Rule 506 are exempt from state securities review An issuer that relies on Section 4(2) will need to consider state securities requirements This is Mo. Fo. 45

FINRA Developments This is Mo. Fo. 46

FINRA Developments This is Mo. Fo. 46

FINRA Notice 10 -22 FINRA issued Regulatory Notice 10 -22 in April 2010 reminding brokerdealers of their diligence obligations in connection with Reg D offerings FINRA has stated that it will focus on abuses in the private placement market The Notice emphasizes a broker-dealer’s obligation to conduct diligence on the issuer, management, the issuer’s business and prospects, the representations and warranties made by the issuer, and the intended uses of proceeds Scope of investigation depends upon recommendation, role of broker in transaction, knowledge of issuer and size/stability of issuer; should be tailored and BD must follow up on red flags. BDs must also conduct suitability analysis for investors Following the issuance of Notice 10 -22, FINRA has been quite active on the enforcement side taking actions against member firms in connection with private placements (including private placements involving non-traded REITs) This is Mo. Fo. 47

FINRA Notice 10 -22 FINRA issued Regulatory Notice 10 -22 in April 2010 reminding brokerdealers of their diligence obligations in connection with Reg D offerings FINRA has stated that it will focus on abuses in the private placement market The Notice emphasizes a broker-dealer’s obligation to conduct diligence on the issuer, management, the issuer’s business and prospects, the representations and warranties made by the issuer, and the intended uses of proceeds Scope of investigation depends upon recommendation, role of broker in transaction, knowledge of issuer and size/stability of issuer; should be tailored and BD must follow up on red flags. BDs must also conduct suitability analysis for investors Following the issuance of Notice 10 -22, FINRA has been quite active on the enforcement side taking actions against member firms in connection with private placements (including private placements involving non-traded REITs) This is Mo. Fo. 47

FINRA 5123 FINRA has proposed Rule 5123, which will apply to private placements Proposed new rule would affect all private placements where a FINRA member firm offers or sells the security or participates in the preparation of any offering or disclosure document This is Mo. Fo. 48

FINRA 5123 FINRA has proposed Rule 5123, which will apply to private placements Proposed new rule would affect all private placements where a FINRA member firm offers or sells the security or participates in the preparation of any offering or disclosure document This is Mo. Fo. 48

Rule 5123 Disclosure: any term sheet or PPM to be provided to investors prior to sale must describe: use of proceeds; amount and type of offering expenses; compensation to funders, members, etc. Notice Filings with FINRA: within 15 days after date of first sale. A designated member can file on behalf of all members in the private placement. If no disclosure document is used, a participating member must still make a notice filing identifying all participating members and stating that no disclosure document was used. Limited exemptions: exemptions for non-convertible debt or preferred; 3(a)(3) exempt securities; 144 A/Reg S offerings; or offerings solely to QPs/QIBs or “institutional accredited investors” Confidentiality provisions similar to those included in Rule 5122. This is Mo. Fo. 49

Rule 5123 Disclosure: any term sheet or PPM to be provided to investors prior to sale must describe: use of proceeds; amount and type of offering expenses; compensation to funders, members, etc. Notice Filings with FINRA: within 15 days after date of first sale. A designated member can file on behalf of all members in the private placement. If no disclosure document is used, a participating member must still make a notice filing identifying all participating members and stating that no disclosure document was used. Limited exemptions: exemptions for non-convertible debt or preferred; 3(a)(3) exempt securities; 144 A/Reg S offerings; or offerings solely to QPs/QIBs or “institutional accredited investors” Confidentiality provisions similar to those included in Rule 5122. This is Mo. Fo. 49

General Solicitation This is Mo. Fo. 50

General Solicitation This is Mo. Fo. 50

No General Solicitation or Advertising Prohibition applies to issuer and its agents Rule 502(c): No general solicitation or advertising No seminar with attendees invited by general solicitation or advertising. Importance of preexisting substantive relationship with offerees. Importance of process safeguards. The significance of being “in registration. ” Black Box and Squadron, Elenoff No-Action letters (QIBs and a limited number of institutional accredited investors) and C&DIs Rule 135 c: Safe harbor for limited issuer announcement of exempt offering. Allows for name of issuer, title amount and basic terms of securities, timing and purpose of offering. Cannot name placement agents. This is Mo. Fo. 51

No General Solicitation or Advertising Prohibition applies to issuer and its agents Rule 502(c): No general solicitation or advertising No seminar with attendees invited by general solicitation or advertising. Importance of preexisting substantive relationship with offerees. Importance of process safeguards. The significance of being “in registration. ” Black Box and Squadron, Elenoff No-Action letters (QIBs and a limited number of institutional accredited investors) and C&DIs Rule 135 c: Safe harbor for limited issuer announcement of exempt offering. Allows for name of issuer, title amount and basic terms of securities, timing and purpose of offering. Cannot name placement agents. This is Mo. Fo. 51

SEC Review of General Solicitation Ban In a letter dated April 6, 2011, * SEC Chairman Schapiro advised an SEC staff review of whether the general solicitation ban should be revisited in light of the current technologies and capital raising trends The SEC Chairman re-stated the justification for the ban: “The ban was designed to ensure that those who would benefit from the safeguards of registration are not solicited in connection with a private offering. ” “I recognize that some continue to identify the general solicitation ban as a significant impediment to capital raising for small businesses. I also understand that some believe that the ban may be unnecessary because those who do not purchase the offered security would not be harmed by the solicitation that occurs. At the same time, the general solicitation ban is supported by others on the grounds that it helps prevent securities fraud by making it more difficult for fraudsters to attract investors or unscrupulous issuers to condition the market. ” * The letter was in response to a letter dated March 22, 2011, from Chairman Issa of the House Committee on Oversight and Government Reform. This is Mo. Fo. 52

SEC Review of General Solicitation Ban In a letter dated April 6, 2011, * SEC Chairman Schapiro advised an SEC staff review of whether the general solicitation ban should be revisited in light of the current technologies and capital raising trends The SEC Chairman re-stated the justification for the ban: “The ban was designed to ensure that those who would benefit from the safeguards of registration are not solicited in connection with a private offering. ” “I recognize that some continue to identify the general solicitation ban as a significant impediment to capital raising for small businesses. I also understand that some believe that the ban may be unnecessary because those who do not purchase the offered security would not be harmed by the solicitation that occurs. At the same time, the general solicitation ban is supported by others on the grounds that it helps prevent securities fraud by making it more difficult for fraudsters to attract investors or unscrupulous issuers to condition the market. ” * The letter was in response to a letter dated March 22, 2011, from Chairman Issa of the House Committee on Oversight and Government Reform. This is Mo. Fo. 52

General solicitation Over the years, there have been many proposals to address the prohibition against general solicitation; it is likely that the SEC will consider those The SEC has said that it is considering a concept release on the issue Legislative proposal pending that would amend Rule 506 to remove the prohibition against general solicitation provided all of the purchasers are accredited investors This is Mo. Fo. 53

General solicitation Over the years, there have been many proposals to address the prohibition against general solicitation; it is likely that the SEC will consider those The SEC has said that it is considering a concept release on the issue Legislative proposal pending that would amend Rule 506 to remove the prohibition against general solicitation provided all of the purchasers are accredited investors This is Mo. Fo. 53

Regulation A This is Mo. Fo. 54

Regulation A This is Mo. Fo. 54

Regulation A – Rules 251 -263 Conditional Small Issues Exemption The Small Company Capital Formation Act (introduced on March 14, 2011) will increase the offering threshold under Regulation A from $5 million to $50 million Currently, Regulation A allows for an offering of up to $5 M of securities of an issuer including up to $1. 5 M of securities offered by selling security holders in any 12 -month period Requires filing of a Form 1 -A Offering Statement and delivery of Offering Circular to investors Amendment (May 3, 2011) provides for a corresponding state “Blue Sky” exemption for Regulation A offerings offered by means other than through a broker dealer Many observers have been welcoming this change This is Mo. Fo. 55

Regulation A – Rules 251 -263 Conditional Small Issues Exemption The Small Company Capital Formation Act (introduced on March 14, 2011) will increase the offering threshold under Regulation A from $5 million to $50 million Currently, Regulation A allows for an offering of up to $5 M of securities of an issuer including up to $1. 5 M of securities offered by selling security holders in any 12 -month period Requires filing of a Form 1 -A Offering Statement and delivery of Offering Circular to investors Amendment (May 3, 2011) provides for a corresponding state “Blue Sky” exemption for Regulation A offerings offered by means other than through a broker dealer Many observers have been welcoming this change This is Mo. Fo. 55

Reg A Basics Eligible issuers - principal place of business in the United States or Canada, and not subject to Section 13 or Section 15 reporting before the offering and not disqualified Primary offerings or secondary offerings (subject to certain limitations) Bad actor disqualification Offering threshold – currently $5 m per 12 -month period, or $1. 5 m for selling stockholder (not aggregated with other exempt offerings) Integration safe harbors – not integrated with subsequent Reg S offerings or 701 offerings or completed exempt offerings (Section 4(2) or Reg D). Other than the safe harbor, one would consider the same five-factor test. This is Mo. Fo. 56

Reg A Basics Eligible issuers - principal place of business in the United States or Canada, and not subject to Section 13 or Section 15 reporting before the offering and not disqualified Primary offerings or secondary offerings (subject to certain limitations) Bad actor disqualification Offering threshold – currently $5 m per 12 -month period, or $1. 5 m for selling stockholder (not aggregated with other exempt offerings) Integration safe harbors – not integrated with subsequent Reg S offerings or 701 offerings or completed exempt offerings (Section 4(2) or Reg D). Other than the safe harbor, one would consider the same five-factor test. This is Mo. Fo. 56

Reg A Basics (cont’d) Offering statement requirement, which includes financial statements Offering communications – under Reg A, an issuer may “test the waters” Nature of the securities – the securities sold in reliance on Reg A are not “restricted securities” Blue sky Liability This is Mo. Fo. 57

Reg A Basics (cont’d) Offering statement requirement, which includes financial statements Offering communications – under Reg A, an issuer may “test the waters” Nature of the securities – the securities sold in reliance on Reg A are not “restricted securities” Blue sky Liability This is Mo. Fo. 57

Crowdfunding This is Mo. Fo. 58

Crowdfunding This is Mo. Fo. 58

Crowdfunding permits entrepreneur to pool money from individuals who have a common interest and are wiling to contribute to a venture Crowdfunding may or may not involve the sale of securities To the extent the effort involves the sale of securities then the offering must be registered or must rely on an exemption A recent enforcement action highlighted this issue The SEC has committed to looking at crowdfunding more closely Pending legislation would amend Section 4 of the Securities Act to create a limited exemption for crowdfunding This is Mo. Fo. 59

Crowdfunding permits entrepreneur to pool money from individuals who have a common interest and are wiling to contribute to a venture Crowdfunding may or may not involve the sale of securities To the extent the effort involves the sale of securities then the offering must be registered or must rely on an exemption A recent enforcement action highlighted this issue The SEC has committed to looking at crowdfunding more closely Pending legislation would amend Section 4 of the Securities Act to create a limited exemption for crowdfunding This is Mo. Fo. 59

Summary of Pending Legislation This is Mo. Fo. 60

Summary of Pending Legislation This is Mo. Fo. 60

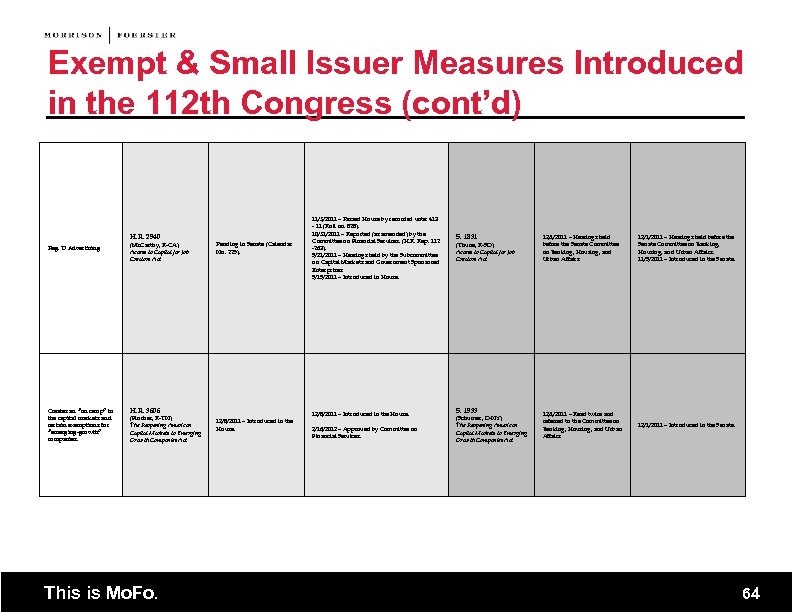

Exempt & Small Issuer Measures Introduced in the 112 th Congress On February 28, 2012, the House Republican Leadership announced plans to incorporate the provisions of H. R. 1070, H. R. 2167, H. R. 2930, H. R. 2940 and H. R. 4088 into an amended version of H. R. 3606, which is renamed the “Jump-Start Our Business Start-Ups Act” or “JOBS Act. ” The JOBS Act is scheduled for debate the week of March 5, 2012. If, as anticipated, the House passes the amended version of H. R. 3606, the House measures listed in the following tables will be replaced by that legislation. This is Mo. Fo. 61

Exempt & Small Issuer Measures Introduced in the 112 th Congress On February 28, 2012, the House Republican Leadership announced plans to incorporate the provisions of H. R. 1070, H. R. 2167, H. R. 2930, H. R. 2940 and H. R. 4088 into an amended version of H. R. 3606, which is renamed the “Jump-Start Our Business Start-Ups Act” or “JOBS Act. ” The JOBS Act is scheduled for debate the week of March 5, 2012. If, as anticipated, the House passes the amended version of H. R. 3606, the House measures listed in the following tables will be replaced by that legislation. This is Mo. Fo. 61

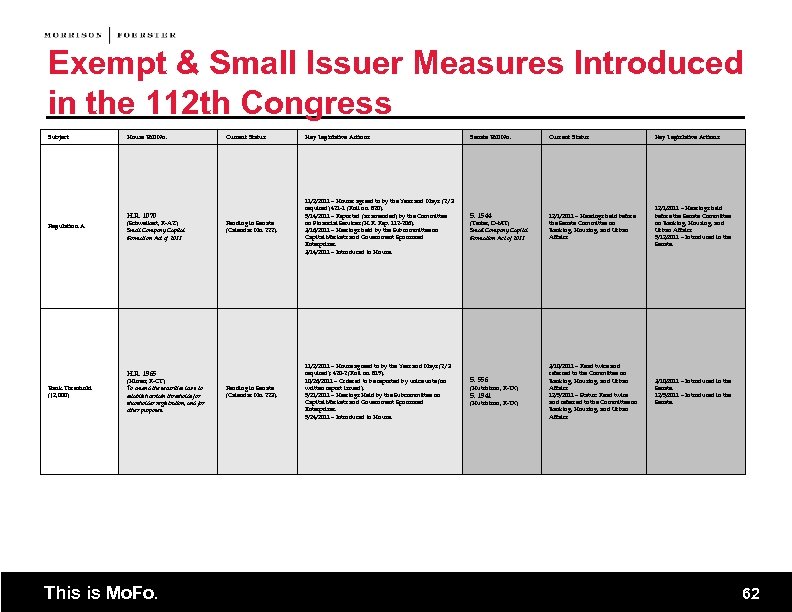

Exempt & Small Issuer Measures Introduced in the 112 th Congress Subject House Bill No. H. R. 1070 Regulation A (Schweikert, R-AZ) Small Company Capital Formation Act of 2011 Current Status Key Legislative Actions Pending in Senate (Calendar No. 222). 11/2/2011 – House: agreed to by the Yeas and Nays: (2/3 required) 421 -1 (Roll no. 820). 9/14/2011 – Reported (as amended) by the Committee on Financial Services (H. R. Rep. 112 -206). 3/16/2011 – Hearings held by the Subcommittee on Capital Markets and Government Sponsored Enterprises. 3/14/2011 – Introduced in House. Pending in Senate (Calendar No. 223). 11/2/2011 – House agreed to by the Yeas and Nays (2/3 required): 420 -2 (Roll no. 819). 10/26/2011 – Ordered to be reported by voice vote (no written report issued). 9/21/2011 – Hearings Held by the Subcommittee on Capital Markets and Government Sponsored Enterprises. 5/24/2011 – Introduced in House. H. R. 1965 Bank Threshold (↑ 2, 000) (Himes, R-CT) To amend the securities laws to establish certain thresholds for shareholder registration, and for other purposes. This is Mo. Fo. Senate Bill No. Current Status Key Legislative Actions S. 1544 12/1/2011 – Hearings held before the Senate Committee on Banking, Housing, and Urban Affairs. 9/12/2011 – Introduced in the Senate. 3/10/2011 – Read twice and referred to the Committee on Banking, Housing, and Urban Affairs 12/5/2011 – Status: Read twice and referred to the Committee on Banking, Housing, and Urban Affairs 3/10/2011 – Introduced in the Senate. 12/5/2011 – Introduced in the Senate. (Tester, D-MT) Small Company Capital Formation Act of 2011 S. 556 (Hutchison, R-TX) S. 1941 (Hutchison, R-TX) 62