Date here The Scottish difference Mark Thomson 1

Date here The Scottish difference Mark Thomson 1

Only a year ago… Premium Organic Values Eating out 2

Only a year ago… Premium Organic Values Eating out 2

And now… Value Planning ahead Stability Eating in 3

And now… Value Planning ahead Stability Eating in 3

So what has been the overall impact? Price inflation The fixture The consumer 4

So what has been the overall impact? Price inflation The fixture The consumer 4

Dry Pasta Eggs Cooking Oils Butter Flour Bread +45. 0% +33. 0% +26. 0% +23. 0% +19. 7% +17. 7% Average Inflation across 75, 000 items is 9. 1% 5

Dry Pasta Eggs Cooking Oils Butter Flour Bread +45. 0% +33. 0% +26. 0% +23. 0% +19. 7% +17. 7% Average Inflation across 75, 000 items is 9. 1% 5

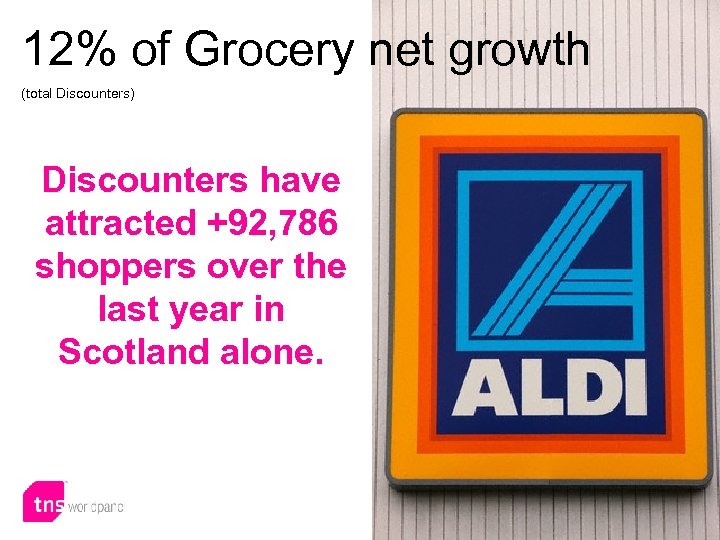

12% of Grocery net growth (total Discounters) Discounters have attracted +92, 786 shoppers over the last year in Scotland alone. 6

12% of Grocery net growth (total Discounters) Discounters have attracted +92, 786 shoppers over the last year in Scotland alone. 6

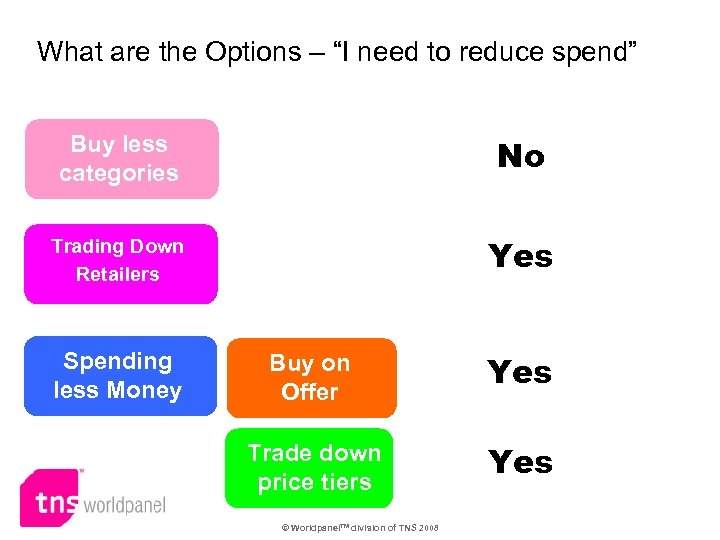

What are the Options – “I need to reduce spend” Buy less categories No Trading Down Retailers Yes Spending less Money Buy on Offer Yes Trade down price tiers Yes © Worldpanel. TM division of TNS 2008

What are the Options – “I need to reduce spend” Buy less categories No Trading Down Retailers Yes Spending less Money Buy on Offer Yes Trade down price tiers Yes © Worldpanel. TM division of TNS 2008

What do Scottish households spend more money on? 1. Fresh Vegetables 2. Fresh Fruit 3. Wine 4. Fresh Milk 5. Spirits 6. Cheese 7. Beer & Lager 8. Chilled Ready Meals 9. Chocolate Confectionery 10. Cooked Meats 11. Bread 12. Fresh Poultry 13. Fresh Beef 14. Breakfast Cereal 15. Morning Goods 1. Wine 2. Spirits 3. Fresh Vegetables 4. Fresh Fruit 5. Fresh Milk 6. Chilled Ready Meals 7. Chocolate Confectionery 8. Beer & Lager 9. Cooked Meats 10. Cheese (X 10) 11. Bread 12. Fresh Beef 13. Fresh Poultry 14. Morning Goods 15. Breakfast Cereal TNS Worldpanel – 52 W/E 10 th August 2008 Ranked on total spend (£) © Worldpanel. TM division of TNS 2008

What do Scottish households spend more money on? 1. Fresh Vegetables 2. Fresh Fruit 3. Wine 4. Fresh Milk 5. Spirits 6. Cheese 7. Beer & Lager 8. Chilled Ready Meals 9. Chocolate Confectionery 10. Cooked Meats 11. Bread 12. Fresh Poultry 13. Fresh Beef 14. Breakfast Cereal 15. Morning Goods 1. Wine 2. Spirits 3. Fresh Vegetables 4. Fresh Fruit 5. Fresh Milk 6. Chilled Ready Meals 7. Chocolate Confectionery 8. Beer & Lager 9. Cooked Meats 10. Cheese (X 10) 11. Bread 12. Fresh Beef 13. Fresh Poultry 14. Morning Goods 15. Breakfast Cereal TNS Worldpanel – 52 W/E 10 th August 2008 Ranked on total spend (£) © Worldpanel. TM division of TNS 2008

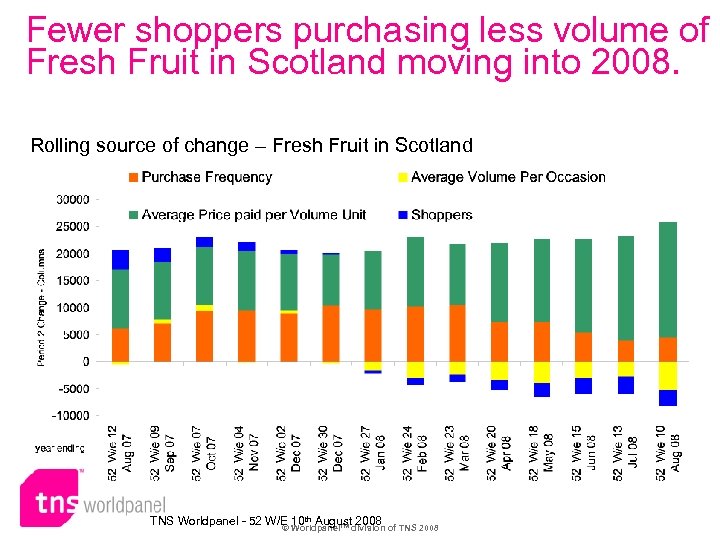

Fewer shoppers purchasing less volume of Fresh Fruit in Scotland moving into 2008. Rolling source of change – Fresh Fruit in Scotland TNS Worldpanel - 52 W/E Worldpanel. TM division of TNS 2008 10 th August 2008 ©

Fewer shoppers purchasing less volume of Fresh Fruit in Scotland moving into 2008. Rolling source of change – Fresh Fruit in Scotland TNS Worldpanel - 52 W/E Worldpanel. TM division of TNS 2008 10 th August 2008 ©

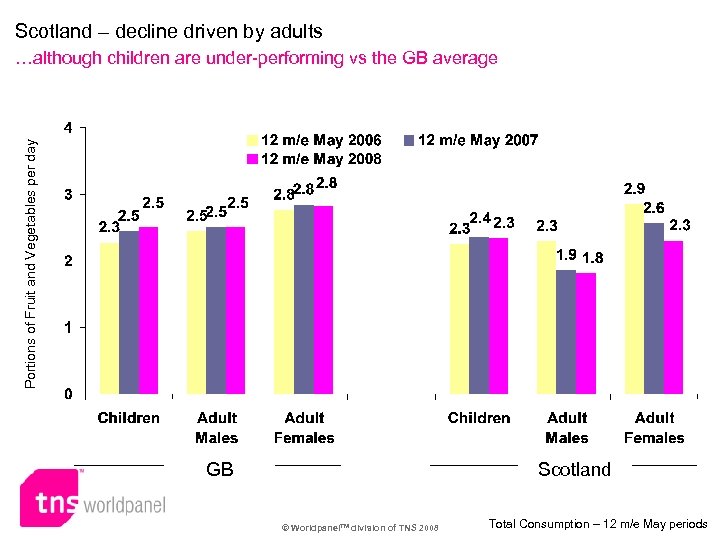

Scotland – decline driven by adults Portions of Fruit and Vegetables per day …although children are under-performing vs the GB average GB Scotland © Worldpanel. TM division of TNS 2008 Total Consumption – 12 m/e May periods

Scotland – decline driven by adults Portions of Fruit and Vegetables per day …although children are under-performing vs the GB average GB Scotland © Worldpanel. TM division of TNS 2008 Total Consumption – 12 m/e May periods

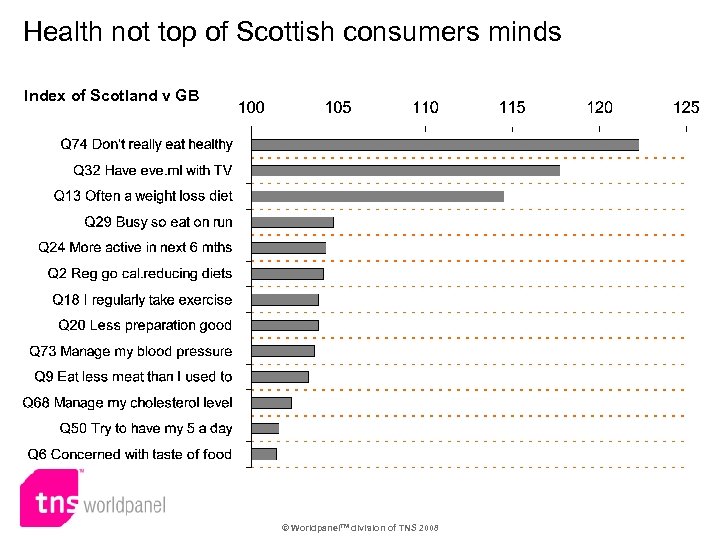

Health not top of Scottish consumers minds Index of Scotland v GB © Worldpanel. TM division of TNS 2008

Health not top of Scottish consumers minds Index of Scotland v GB © Worldpanel. TM division of TNS 2008

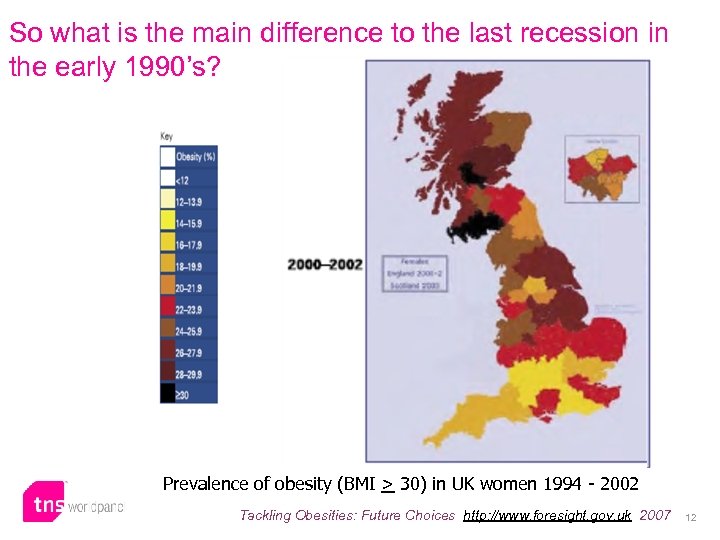

So what is the main difference to the last recession in the early 1990’s? Prevalence of obesity (BMI > 30) in UK women 1994 - 2002 Tackling Obesities: Future Choices http: //www. foresight. gov. uk 2007 12

So what is the main difference to the last recession in the early 1990’s? Prevalence of obesity (BMI > 30) in UK women 1994 - 2002 Tackling Obesities: Future Choices http: //www. foresight. gov. uk 2007 12

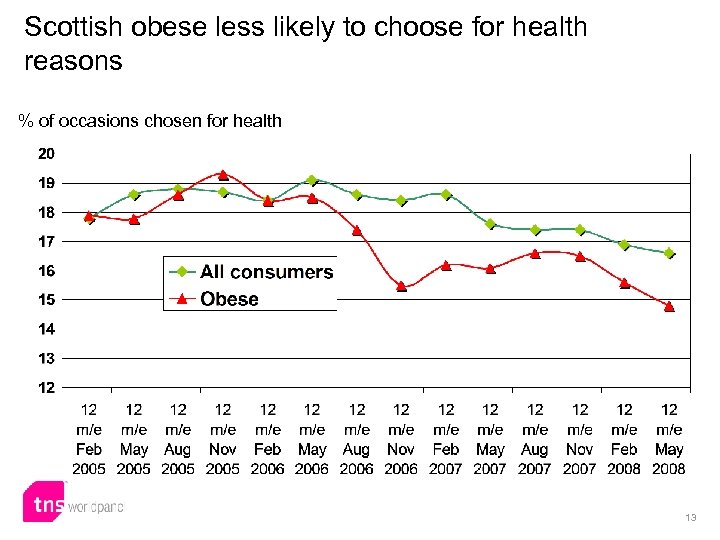

Scottish obese less likely to choose for health reasons % of occasions chosen for health 13

Scottish obese less likely to choose for health reasons % of occasions chosen for health 13

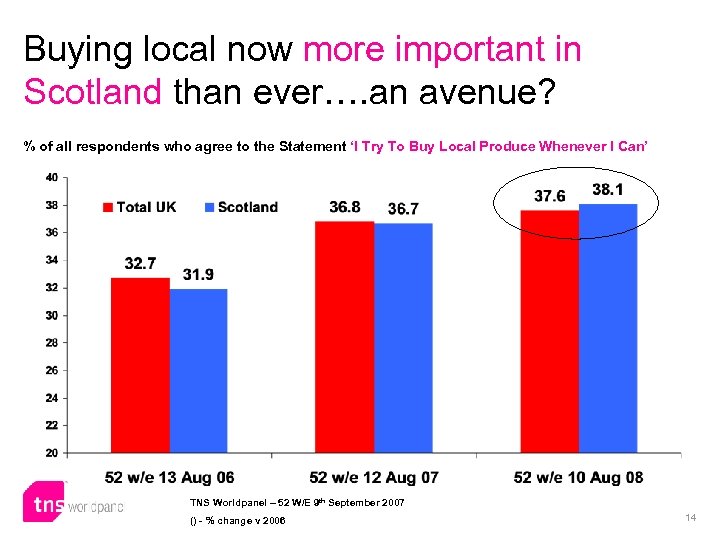

Buying local now more important in Scotland than ever…. an avenue? % of all respondents who agree to the Statement ‘I Try To Buy Local Produce Whenever I Can’ (X 10) TNS Worldpanel – 52 W/E 9 th September 2007 () - % change v 2006 14

Buying local now more important in Scotland than ever…. an avenue? % of all respondents who agree to the Statement ‘I Try To Buy Local Produce Whenever I Can’ (X 10) TNS Worldpanel – 52 W/E 9 th September 2007 () - % change v 2006 14

Trading down within markets Little steps are more achievable Moderation Kids and families are more open to change Emotions have more connection Icons can work © Worldpanel. TM division of TNS 2008

Trading down within markets Little steps are more achievable Moderation Kids and families are more open to change Emotions have more connection Icons can work © Worldpanel. TM division of TNS 2008