dcccc125ac1bdd018ebfbcb4a3ce035b.ppt

- Количество слайдов: 21

DATA MINING IN THE FINANCIAL SERVICES INDUSTRY PRESENTATION TO KNOWLEDGE DISCOVERY CENTRE (15 FEBRUARY 2001) Steven Parker Head CRM Consumer Banking Standard Chartered 1

DATA MINING IN THE FINANCIAL SERVICES INDUSTRY PRESENTATION TO KNOWLEDGE DISCOVERY CENTRE (15 FEBRUARY 2001) Steven Parker Head CRM Consumer Banking Standard Chartered 1

STANDARD CHARTERED • World’s leading emerging markets bank - Asia, Sub. Continent, Africa, the Middle East and Latin America • 740+ offices (55 countries); US$90 bn in assets • Key business lines: – Consumer Banking - deposits, mutual funds, mortgages, credit cards, personal loans – Commercial Banking - cash management, trade finance, treasury, custody services • Long-term commitment to Hong Kong e. g. note issuer, #1 consumer credit card etc. 2

STANDARD CHARTERED • World’s leading emerging markets bank - Asia, Sub. Continent, Africa, the Middle East and Latin America • 740+ offices (55 countries); US$90 bn in assets • Key business lines: – Consumer Banking - deposits, mutual funds, mortgages, credit cards, personal loans – Commercial Banking - cash management, trade finance, treasury, custody services • Long-term commitment to Hong Kong e. g. note issuer, #1 consumer credit card etc. 2

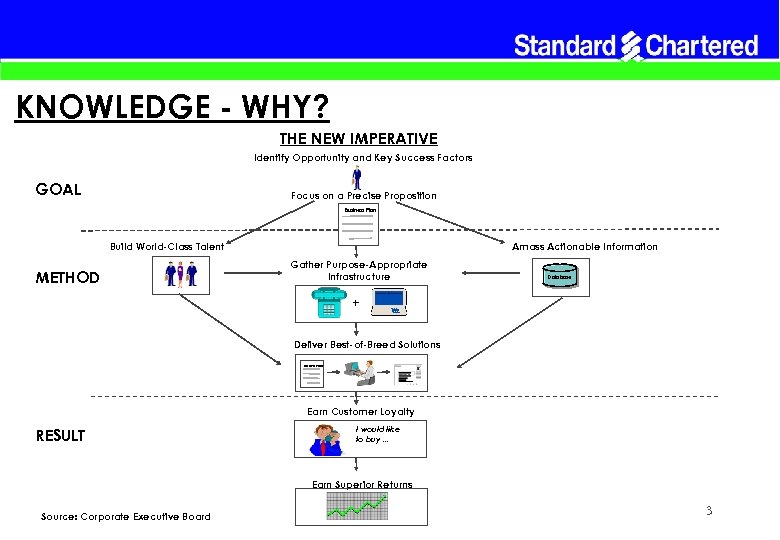

KNOWLEDGE - WHY? THE NEW IMPERATIVE Identify Opportunity and Key Success Factors GOAL Focus on a Precise Proposition Business Plan Build World-Class Talent METHOD Amass Actionable Information Gather Purpose-Appropriate Infrastructure Database + Deliver Best-of-Breed Solutions Business Plan Earn Customer Loyalty RESULT I would like to buy. . . Earn Superior Returns Source: Corporate Executive Board 3

KNOWLEDGE - WHY? THE NEW IMPERATIVE Identify Opportunity and Key Success Factors GOAL Focus on a Precise Proposition Business Plan Build World-Class Talent METHOD Amass Actionable Information Gather Purpose-Appropriate Infrastructure Database + Deliver Best-of-Breed Solutions Business Plan Earn Customer Loyalty RESULT I would like to buy. . . Earn Superior Returns Source: Corporate Executive Board 3

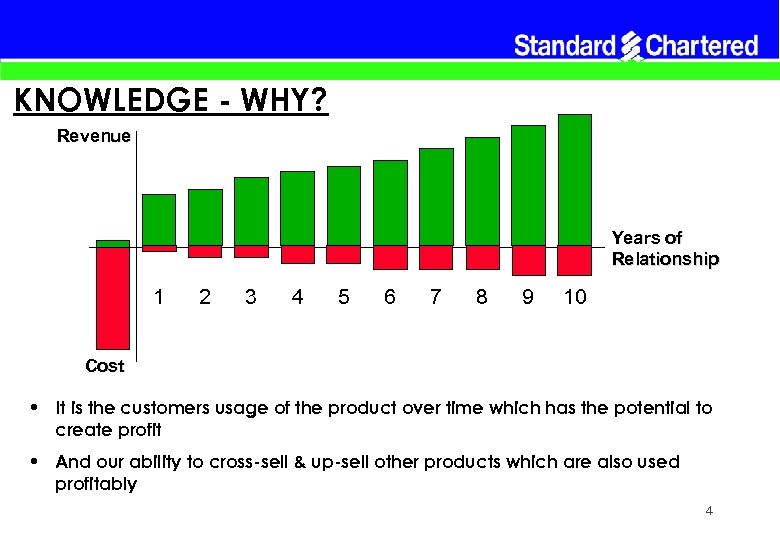

KNOWLEDGE - WHY? Revenue Years of Relationship 1 2 3 4 5 6 7 8 9 10 Cost • It is the customers usage of the product over time which has the potential to create profit • And our ability to cross-sell & up-sell other products which are also used profitably 4

KNOWLEDGE - WHY? Revenue Years of Relationship 1 2 3 4 5 6 7 8 9 10 Cost • It is the customers usage of the product over time which has the potential to create profit • And our ability to cross-sell & up-sell other products which are also used profitably 4

KNOWLEDGE - HOW? Retention Customer Relationship Management New Customer Management Acquisition Re-pricing 0 Acquisition Model 6 -12 Customer Segmentation time (months) Retention Model 5

KNOWLEDGE - HOW? Retention Customer Relationship Management New Customer Management Acquisition Re-pricing 0 Acquisition Model 6 -12 Customer Segmentation time (months) Retention Model 5

KNOWLEDGE - HOW? KNOWLEDGE OF CUSTOMERS • Customer Retention + • Cross-sell/Utilisation + • Service Needs • Pricing Optimisation + • Demographics • Customer De-marketing + • Product Re-design + • Purchase Behaviour • Product Usage • Relationship • Price Sensitivity etc. TAILORED PROGRAMMES AND COMMUNICATION TAILORED CUSTOMER SERVICE • Channel Management + ______________ = HIGHER PROFIT 6

KNOWLEDGE - HOW? KNOWLEDGE OF CUSTOMERS • Customer Retention + • Cross-sell/Utilisation + • Service Needs • Pricing Optimisation + • Demographics • Customer De-marketing + • Product Re-design + • Purchase Behaviour • Product Usage • Relationship • Price Sensitivity etc. TAILORED PROGRAMMES AND COMMUNICATION TAILORED CUSTOMER SERVICE • Channel Management + ______________ = HIGHER PROFIT 6

KNOWLEDGE - HOW? Learning Test & Learn Cycle – Definitive Results Proprietary Knowledge = Competitive Advantage Today - some learning based on assumptions about “what worked” Time 7

KNOWLEDGE - HOW? Learning Test & Learn Cycle – Definitive Results Proprietary Knowledge = Competitive Advantage Today - some learning based on assumptions about “what worked” Time 7

DATA MINING INTO PRACTICE Data Warehouse Customer Profitability/ Segmentation Campaign Management Contact Management 8

DATA MINING INTO PRACTICE Data Warehouse Customer Profitability/ Segmentation Campaign Management Contact Management 8

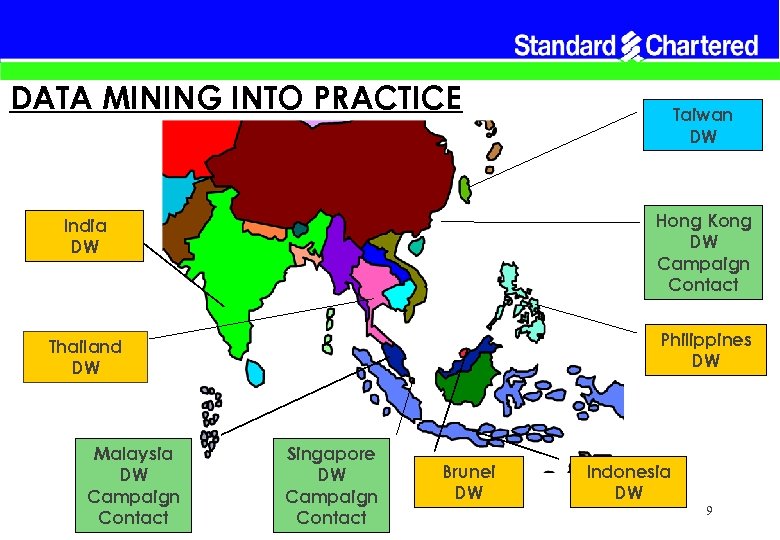

DATA MINING INTO PRACTICE Taiwan DW India DW Hong Kong DW Campaign Contact Thailand DW Philippines DW Malaysia DW Campaign Contact Singapore DW Campaign Contact Brunei DW Indonesia DW 9

DATA MINING INTO PRACTICE Taiwan DW India DW Hong Kong DW Campaign Contact Thailand DW Philippines DW Malaysia DW Campaign Contact Singapore DW Campaign Contact Brunei DW Indonesia DW 9

CHALLENGES • Changing the culture - data-driven, product to customer, volume to value • Shortage of skills - analytical, technical, marketing • Immature market e. g. vendor networks, public data, lists etc. 10

CHALLENGES • Changing the culture - data-driven, product to customer, volume to value • Shortage of skills - analytical, technical, marketing • Immature market e. g. vendor networks, public data, lists etc. 10

SUCCESSES • Building on “early wins” • Learn from developed markets - faster cycle time • No public data = proprietary data even more valuable • Ability to combine emerging markets channels with information capabilities 11

SUCCESSES • Building on “early wins” • Learn from developed markets - faster cycle time • No public data = proprietary data even more valuable • Ability to combine emerging markets channels with information capabilities 11

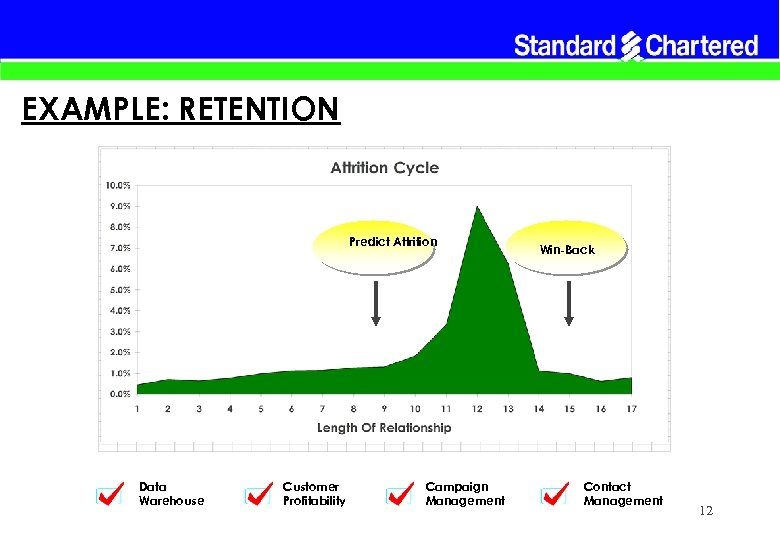

EXAMPLE: RETENTION Predict Attrition Data Warehouse Customer Profitability Campaign Management Win-Back Contact Management 12

EXAMPLE: RETENTION Predict Attrition Data Warehouse Customer Profitability Campaign Management Win-Back Contact Management 12

EXAMPLE: RETENTION No Pre-Attrition No Yes Post Attrition Yes No Retained Yes Attrition Gating Yes High Profit Post Attrition No High Profit No Low Potential Attritors Low Potential 13

EXAMPLE: RETENTION No Pre-Attrition No Yes Post Attrition Yes No Retained Yes Attrition Gating Yes High Profit Post Attrition No High Profit No Low Potential Attritors Low Potential 13

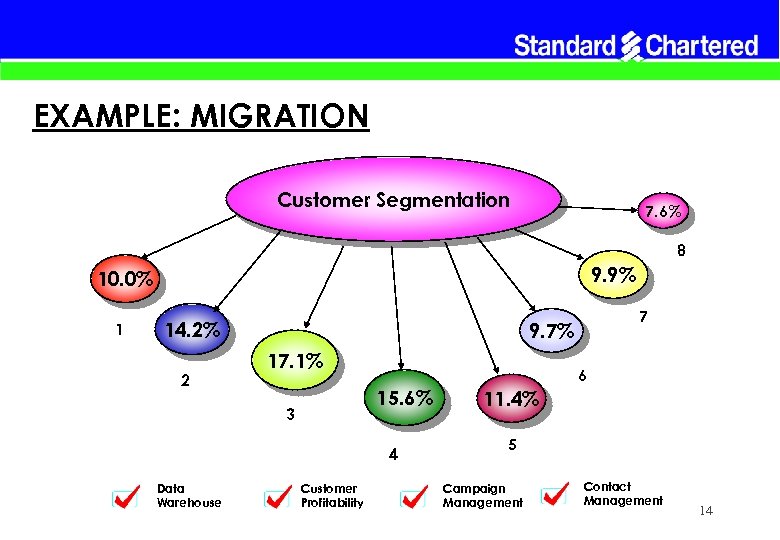

EXAMPLE: MIGRATION Customer Segmentation 7. 6% 8 9. 9% 10. 0% 1 14. 2% 2 9. 7% 17. 1% 6 15. 6% 3 4 Data Warehouse 7 Customer Profitability 11. 4% 5 Campaign Management Contact Management 14

EXAMPLE: MIGRATION Customer Segmentation 7. 6% 8 9. 9% 10. 0% 1 14. 2% 2 9. 7% 17. 1% 6 15. 6% 3 4 Data Warehouse 7 Customer Profitability 11. 4% 5 Campaign Management Contact Management 14

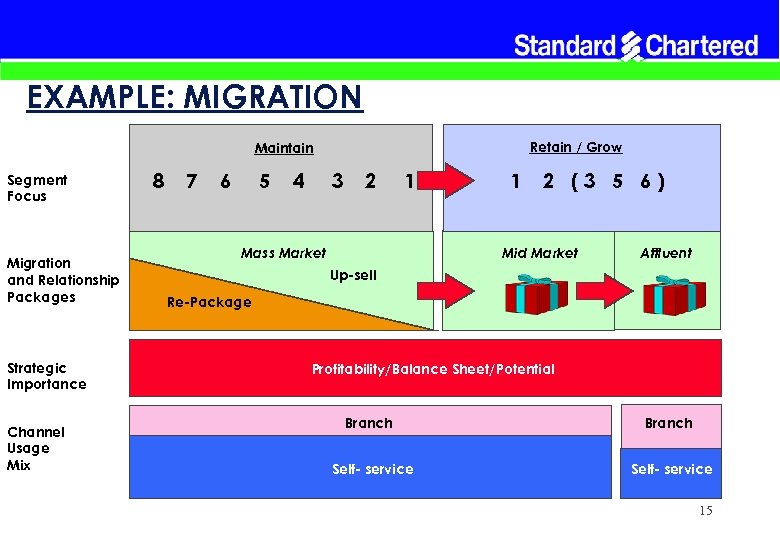

EXAMPLE: MIGRATION Retain / Grow Maintain Segment Focus Migration and Relationship Packages Strategic Importance Channel Usage Mix 8 7 6 5 4 3 2 1 Mass Market 1 2 (3 5 6) Mid Market Affluent Up-sell Re-Package Profitability/Balance Sheet/Potential Branch Self- service 15

EXAMPLE: MIGRATION Retain / Grow Maintain Segment Focus Migration and Relationship Packages Strategic Importance Channel Usage Mix 8 7 6 5 4 3 2 1 Mass Market 1 2 (3 5 6) Mid Market Affluent Up-sell Re-Package Profitability/Balance Sheet/Potential Branch Self- service 15

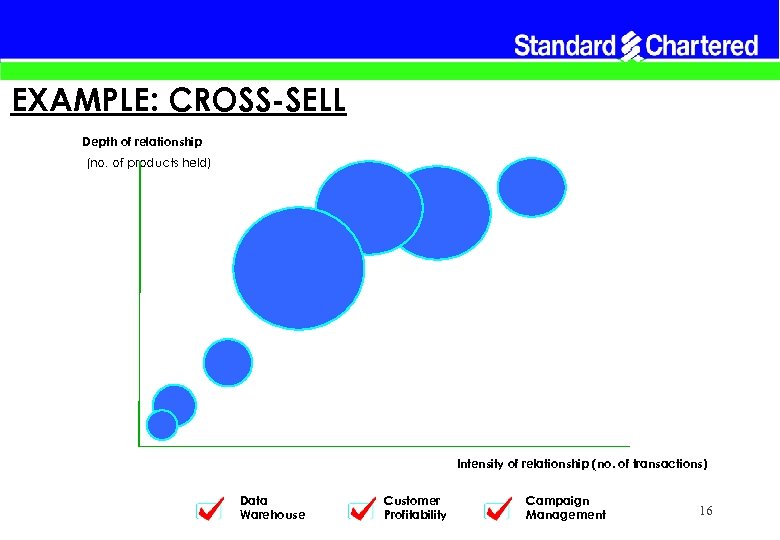

EXAMPLE: CROSS-SELL Depth of relationship (no. of products held) Intensity of relationship (no. of transactions) Data Warehouse Customer Profitability Campaign Management 16

EXAMPLE: CROSS-SELL Depth of relationship (no. of products held) Intensity of relationship (no. of transactions) Data Warehouse Customer Profitability Campaign Management 16

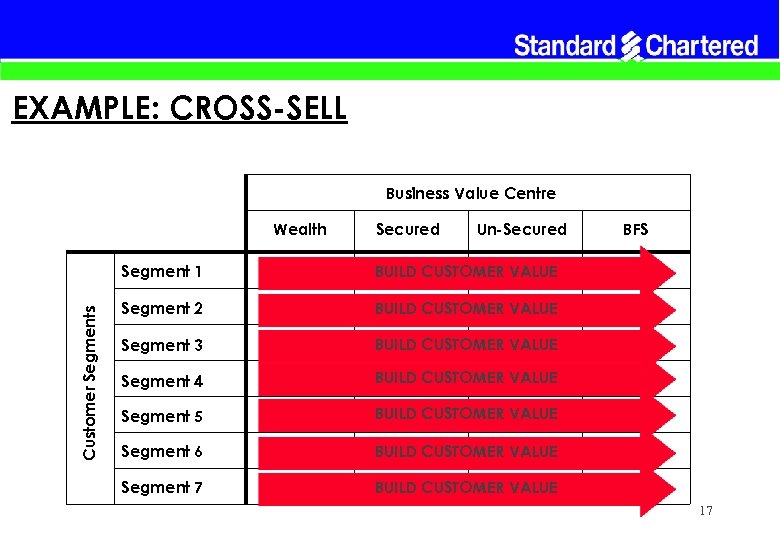

EXAMPLE: CROSS-SELL Business Value Centre Wealth Secured Un-Secured Customer Segments Segment 1 BUILD CUSTOMER VALUE Segment 2 BUILD CUSTOMER VALUE Segment 3 BUILD CUSTOMER VALUE Segment 4 BUILD CUSTOMER VALUE Segment 5 BUILD CUSTOMER VALUE Segment 6 BUILD CUSTOMER VALUE Segment 7 BFS BUILD CUSTOMER VALUE 17

EXAMPLE: CROSS-SELL Business Value Centre Wealth Secured Un-Secured Customer Segments Segment 1 BUILD CUSTOMER VALUE Segment 2 BUILD CUSTOMER VALUE Segment 3 BUILD CUSTOMER VALUE Segment 4 BUILD CUSTOMER VALUE Segment 5 BUILD CUSTOMER VALUE Segment 6 BUILD CUSTOMER VALUE Segment 7 BFS BUILD CUSTOMER VALUE 17

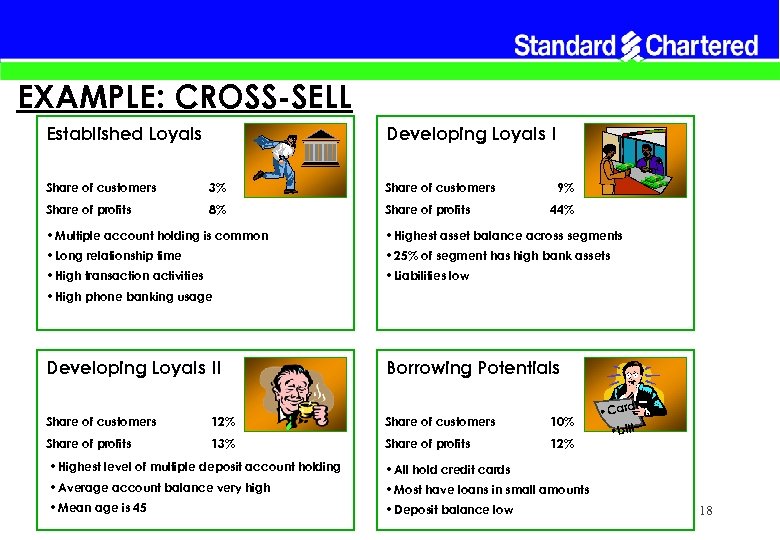

EXAMPLE: CROSS-SELL Established Loyals Developing Loyals I Share of customers 3% Share of customers Share of profits 8% Share of profits 9% 44% • Multiple account holding is common • Highest asset balance across segments • Long relationship time • 25% of segment has high bank assets • High transaction activities • Liabilities low • High phone banking usage Developing Loyals II Borrowing Potentials Share of customers 12% Share of customers 10% Share of profits 13% Share of profits 12% • Highest level of multiple deposit account holding • All hold credit cards • Average account balance very high • Most have loans in small amounts • Mean age is 45 • Deposit balance low • Card • bill 18

EXAMPLE: CROSS-SELL Established Loyals Developing Loyals I Share of customers 3% Share of customers Share of profits 8% Share of profits 9% 44% • Multiple account holding is common • Highest asset balance across segments • Long relationship time • 25% of segment has high bank assets • High transaction activities • Liabilities low • High phone banking usage Developing Loyals II Borrowing Potentials Share of customers 12% Share of customers 10% Share of profits 13% Share of profits 12% • Highest level of multiple deposit account holding • All hold credit cards • Average account balance very high • Most have loans in small amounts • Mean age is 45 • Deposit balance low • Card • bill 18

EXAMPLE: CROSS-SELL New Savers Share of customers Share of profits 12% 3% • Dominated by single deposit account holders • Short relationship time • Open accounts in response to promotions Low Value Savers Share of customers Share of profits Low Activity Savers 10% 0% Share of customers Share of profits • z 15% 2% • Single deposit account holders – mainly saving accounts • Mostly customers with one deposit account • Longest relationship time with SCB • Highest proportion of static balance • Mean age is 50 • Over-represented by females • Dormant customers over-represented 19 • z

EXAMPLE: CROSS-SELL New Savers Share of customers Share of profits 12% 3% • Dominated by single deposit account holders • Short relationship time • Open accounts in response to promotions Low Value Savers Share of customers Share of profits Low Activity Savers 10% 0% Share of customers Share of profits • z 15% 2% • Single deposit account holders – mainly saving accounts • Mostly customers with one deposit account • Longest relationship time with SCB • Highest proportion of static balance • Mean age is 50 • Over-represented by females • Dormant customers over-represented 19 • z

TARGET BENEFIT - QUICK WINS RETENTION High MIGRATION Medium/high CROSS-SELL Medium/low 20

TARGET BENEFIT - QUICK WINS RETENTION High MIGRATION Medium/high CROSS-SELL Medium/low 20

FACING THE CHALLENGES • Building competencies • Integrating value concepts into all points of customer contact • Re-engineering processes in marketing, sales and service • Continuing technology investment 21

FACING THE CHALLENGES • Building competencies • Integrating value concepts into all points of customer contact • Re-engineering processes in marketing, sales and service • Continuing technology investment 21