9d71f576abf71a253c174a70f4bf2ce1.ppt

- Количество слайдов: 24

DATA DAY Direct Measures of Protection 1

DATA DAY Direct Measures of Protection 1

Market Access n n Beyond obvious negotiations purposes… Information on market access conditions allows exporters to: q q q Evaluate the competitiveness of the product with respect to suppliers from other countries under different tariff schemes Select markets/market segments in which the product has the best prospects Adapt, where necessary, the product to conform to the target market’s import regulations 2

Market Access n n Beyond obvious negotiations purposes… Information on market access conditions allows exporters to: q q q Evaluate the competitiveness of the product with respect to suppliers from other countries under different tariff schemes Select markets/market segments in which the product has the best prospects Adapt, where necessary, the product to conform to the target market’s import regulations 2

n Information on market access conditions allows trade promotion agencies to: q q Evaluate the actual prospects for market access for a given product and destination Compare obstacles to market access in the different markets 3

n Information on market access conditions allows trade promotion agencies to: q q Evaluate the actual prospects for market access for a given product and destination Compare obstacles to market access in the different markets 3

n Information on market access conditions allows trade analysts and policy makers to: q q q Evaluate the cost of foreign and domestic protection Simulate the gains associated with various scenarios of trade liberalisation Compare the benefits of multilateralism versus regionalism 4

n Information on market access conditions allows trade analysts and policy makers to: q q q Evaluate the cost of foreign and domestic protection Simulate the gains associated with various scenarios of trade liberalisation Compare the benefits of multilateralism versus regionalism 4

n Measurement of protection has come to the forefront of the policy debate for three reasons: q q q n Until very recently direct evidence on protection - tariffs - was not reflecting the actual protection. Non-tariff measures play an increasing role as tariffs are progressively phased out. Indirect (econometric) evidence on protection lead to order of magnitudes hardly matching the direct measures: trade costs We focus here on tariffs 5

n Measurement of protection has come to the forefront of the policy debate for three reasons: q q q n Until very recently direct evidence on protection - tariffs - was not reflecting the actual protection. Non-tariff measures play an increasing role as tariffs are progressively phased out. Indirect (econometric) evidence on protection lead to order of magnitudes hardly matching the direct measures: trade costs We focus here on tariffs 5

Issues to be tackled when using tariffs n n n n n Measurement of protection Bound, applied, preferential duties Ad valorem equivalents of specific tariffs Tariff quotas TRQ rents Erosion of preferences Differences among developing economies Modelling liberalisation scenarios at the detailed level Exceptions and sensitive products 6

Issues to be tackled when using tariffs n n n n n Measurement of protection Bound, applied, preferential duties Ad valorem equivalents of specific tariffs Tariff quotas TRQ rents Erosion of preferences Differences among developing economies Modelling liberalisation scenarios at the detailed level Exceptions and sensitive products 6

Different types of tariffs n n n n n Tariff scheme defined at the tariff line level More detailed than the HS 6, differ from one country to another. Series of different instruments grouped under the term 'tariff'. Specific tariff: t. Ad valorem duty: t P = P*(1+ t) = P*+t Compound tariff: ad valorem + specific Mixed duty: conditional choice between ad valorem and specific Technical duty: based on alcohol content, sugar content. . . Tariff quotas 7

Different types of tariffs n n n n n Tariff scheme defined at the tariff line level More detailed than the HS 6, differ from one country to another. Series of different instruments grouped under the term 'tariff'. Specific tariff: t. Ad valorem duty: t P = P*(1+ t) = P*+t Compound tariff: ad valorem + specific Mixed duty: conditional choice between ad valorem and specific Technical duty: based on alcohol content, sugar content. . . Tariff quotas 7

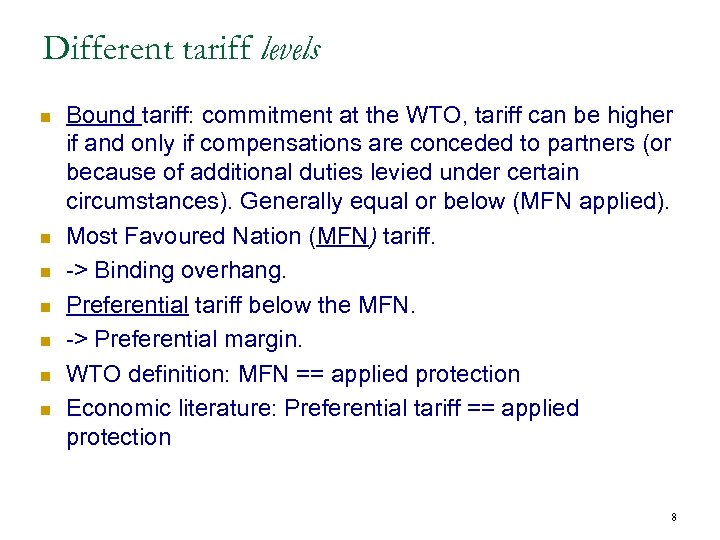

Different tariff levels n n n n Bound tariff: commitment at the WTO, tariff can be higher if and only if compensations are conceded to partners (or because of additional duties levied under certain circumstances). Generally equal or below (MFN applied). Most Favoured Nation (MFN) tariff. -> Binding overhang. Preferential tariff below the MFN. -> Preferential margin. WTO definition: MFN == applied protection Economic literature: Preferential tariff == applied protection 8

Different tariff levels n n n n Bound tariff: commitment at the WTO, tariff can be higher if and only if compensations are conceded to partners (or because of additional duties levied under certain circumstances). Generally equal or below (MFN applied). Most Favoured Nation (MFN) tariff. -> Binding overhang. Preferential tariff below the MFN. -> Preferential margin. WTO definition: MFN == applied protection Economic literature: Preferential tariff == applied protection 8

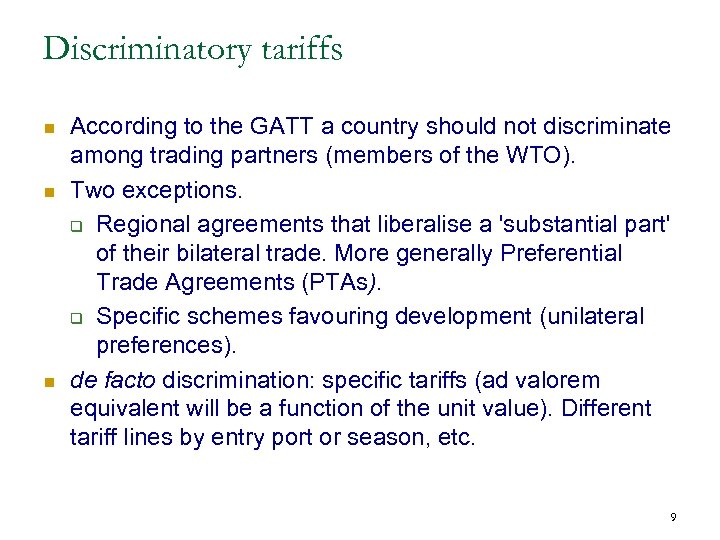

Discriminatory tariffs n n n According to the GATT a country should not discriminate among trading partners (members of the WTO). Two exceptions. q Regional agreements that liberalise a 'substantial part' of their bilateral trade. More generally Preferential Trade Agreements (PTAs). q Specific schemes favouring development (unilateral preferences). de facto discrimination: specific tariffs (ad valorem equivalent will be a function of the unit value). Different tariff lines by entry port or season, etc. 9

Discriminatory tariffs n n n According to the GATT a country should not discriminate among trading partners (members of the WTO). Two exceptions. q Regional agreements that liberalise a 'substantial part' of their bilateral trade. More generally Preferential Trade Agreements (PTAs). q Specific schemes favouring development (unilateral preferences). de facto discrimination: specific tariffs (ad valorem equivalent will be a function of the unit value). Different tariff lines by entry port or season, etc. 9

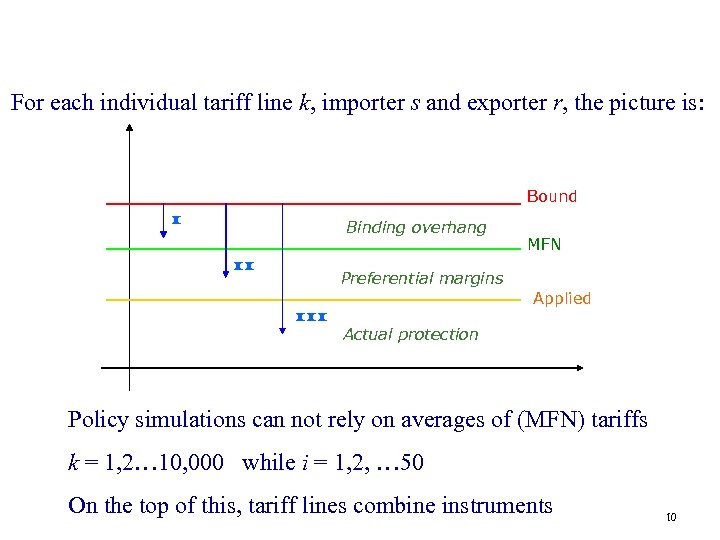

For each individual tariff line k, importer s and exporter r, the picture is: Bound I Binding overhang II MFN Preferential margins Applied III Actual protection Policy simulations can not rely on averages of (MFN) tariffs k = 1, 2… 10, 000 while i = 1, 2, … 50 On the top of this, tariff lines combine instruments 10

For each individual tariff line k, importer s and exporter r, the picture is: Bound I Binding overhang II MFN Preferential margins Applied III Actual protection Policy simulations can not rely on averages of (MFN) tariffs k = 1, 2… 10, 000 while i = 1, 2, … 50 On the top of this, tariff lines combine instruments 10

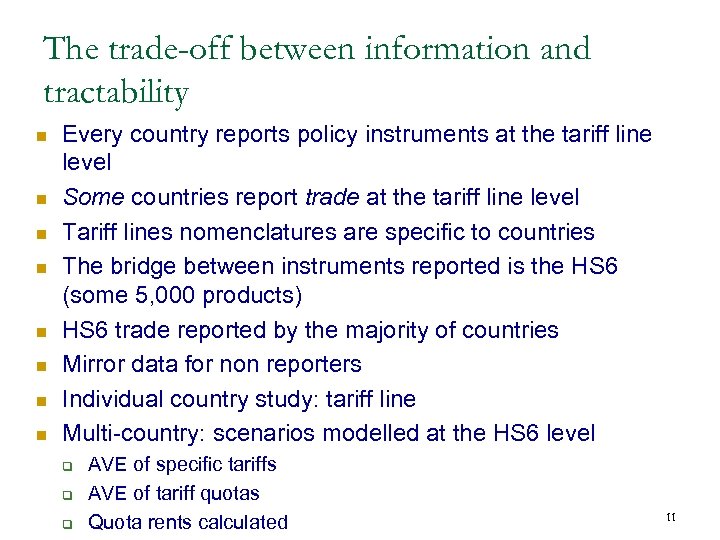

The trade-off between information and tractability n n n n Every country reports policy instruments at the tariff line level Some countries report trade at the tariff line level Tariff lines nomenclatures are specific to countries The bridge between instruments reported is the HS 6 (some 5, 000 products) HS 6 trade reported by the majority of countries Mirror data for non reporters Individual country study: tariff line Multi-country: scenarios modelled at the HS 6 level q q q AVE of specific tariffs AVE of tariff quotas Quota rents calculated 11

The trade-off between information and tractability n n n n Every country reports policy instruments at the tariff line level Some countries report trade at the tariff line level Tariff lines nomenclatures are specific to countries The bridge between instruments reported is the HS 6 (some 5, 000 products) HS 6 trade reported by the majority of countries Mirror data for non reporters Individual country study: tariff line Multi-country: scenarios modelled at the HS 6 level q q q AVE of specific tariffs AVE of tariff quotas Quota rents calculated 11

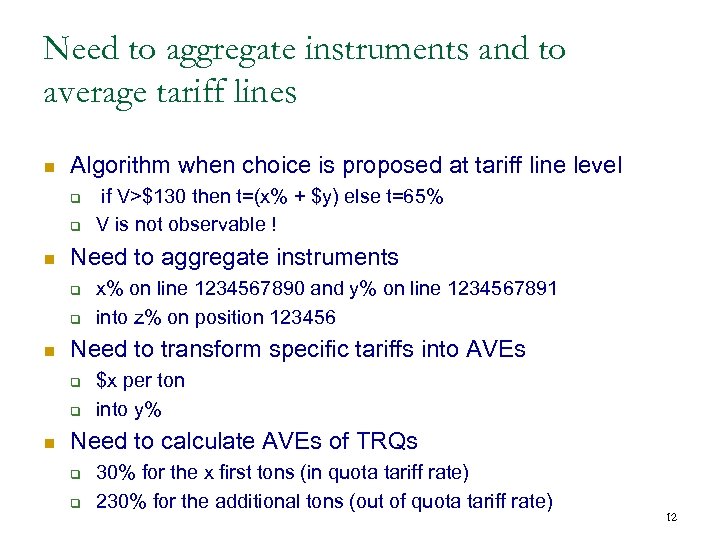

Need to aggregate instruments and to average tariff lines n Algorithm when choice is proposed at tariff line level q q n Need to aggregate instruments q q n x% on line 1234567890 and y% on line 1234567891 into z% on position 123456 Need to transform specific tariffs into AVEs q q n if V>$130 then t=(x% + $y) else t=65% V is not observable ! $x per ton into y% Need to calculate AVEs of TRQs q q 30% for the x first tons (in quota tariff rate) 230% for the additional tons (out of quota tariff rate) 12

Need to aggregate instruments and to average tariff lines n Algorithm when choice is proposed at tariff line level q q n Need to aggregate instruments q q n x% on line 1234567890 and y% on line 1234567891 into z% on position 123456 Need to transform specific tariffs into AVEs q q n if V>$130 then t=(x% + $y) else t=65% V is not observable ! $x per ton into y% Need to calculate AVEs of TRQs q q 30% for the x first tons (in quota tariff rate) 230% for the additional tons (out of quota tariff rate) 12

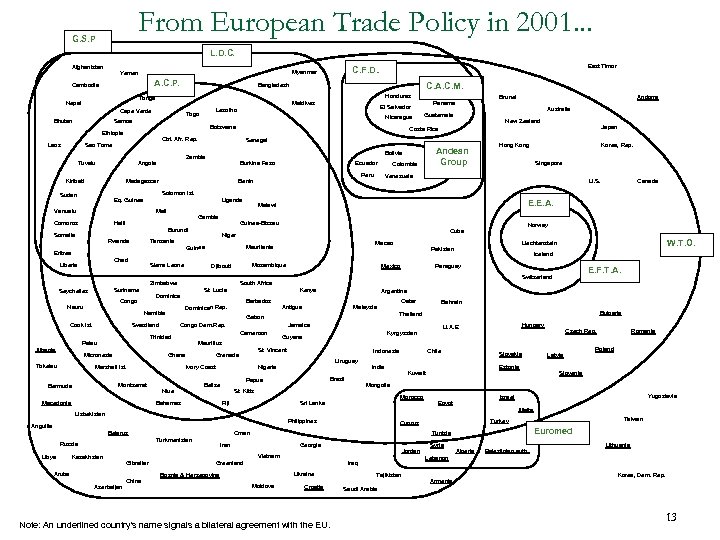

From European Trade Policy in 2001. . . G. S. P L. D. C. Afghanistan A. C. P. Cambodia Honduras Cape Verde Bhutan Tuvalu Haiti Somalia Nauru Cook Isl. Micronesia Bermuda Mozambique Mauritius Macedonia Ivory Coast Niue Libya Brazil Kazakhstan Aruba Azerbaijan Gibraltar China Chile India Slovakia Estonia Kuwait Morocco Moldova Jordan Croatia Note: An underlined country's name signals a bilateral agreement with the EU. Slovenia Yugoslavia Taiwan Turkey Euromed Syria Algeria Palestinian auth. Lithuania Lebanon Iraq Ukraine Bosnia & Herzegovina Poland Malta Cyprus Georgia Vietnam Latvia Romania Israel Egypt Tunisia Iran Czech Rep. Mongolia Sri Lanka Greenland Hungary U. A. E Indonesia Uruguay Oman Turkmenistan Bulgaria Kyrgyzstan Guyana Philippines Belarus Bahrain Thailand St. Kitts Uzbekistan Russia Qatar Malaysia Nigeria Fiji E. F. T. A. Argentina Antigua Papua Belize Bahamas Anguilla Kenya St. Vincent Grenada Iceland Paraguay Jamaica Cameroon W. T. O. Liechtenstein Switzerland South Africa Barbados Canada Norway Pakistan Mexico Gabon Marshall Isl. Montserrat Macao Congo Dem. Rep. Ghana U. S. E. E. A. Mauritania St. Lucia Trinidad Singapore Cuba Dominican Rep. Swaziland Palau Colombia Korea, Rep. Venezuela Guinea-Bissau Dominica Namibia Japan Hong Kong Malawi Djibouti Zimbabwe Congo Peru Niger Guinea Sierra Leone Suriname Seychelles Gambia Tanzania Chad Liberia Uganda Burundi Rwanda Eritrea Ecuador Benin Mali Comoros Tokelau Burkina Faso Solomon Isl. Eq. Guinea Vanuatu New Zealand Andean Group Bolivia Madagascar Sudan Guatemala Senegal Zambia Angola Andorra Australia Costa Rica Ctrl. Afr. Rep. Sao Tome Albania Nicaragua Brunei Panama El Salvador Botswana Ethiopia Kiribati Maldives Lesotho Togo Samoa Laos C. A. C. M. Bangladesh Tonga Nepal East Timor C. F. D. . Myanmar Yemen Tajikistan Armenia Korea, Dem. Rep. Saudi Arabia 13

From European Trade Policy in 2001. . . G. S. P L. D. C. Afghanistan A. C. P. Cambodia Honduras Cape Verde Bhutan Tuvalu Haiti Somalia Nauru Cook Isl. Micronesia Bermuda Mozambique Mauritius Macedonia Ivory Coast Niue Libya Brazil Kazakhstan Aruba Azerbaijan Gibraltar China Chile India Slovakia Estonia Kuwait Morocco Moldova Jordan Croatia Note: An underlined country's name signals a bilateral agreement with the EU. Slovenia Yugoslavia Taiwan Turkey Euromed Syria Algeria Palestinian auth. Lithuania Lebanon Iraq Ukraine Bosnia & Herzegovina Poland Malta Cyprus Georgia Vietnam Latvia Romania Israel Egypt Tunisia Iran Czech Rep. Mongolia Sri Lanka Greenland Hungary U. A. E Indonesia Uruguay Oman Turkmenistan Bulgaria Kyrgyzstan Guyana Philippines Belarus Bahrain Thailand St. Kitts Uzbekistan Russia Qatar Malaysia Nigeria Fiji E. F. T. A. Argentina Antigua Papua Belize Bahamas Anguilla Kenya St. Vincent Grenada Iceland Paraguay Jamaica Cameroon W. T. O. Liechtenstein Switzerland South Africa Barbados Canada Norway Pakistan Mexico Gabon Marshall Isl. Montserrat Macao Congo Dem. Rep. Ghana U. S. E. E. A. Mauritania St. Lucia Trinidad Singapore Cuba Dominican Rep. Swaziland Palau Colombia Korea, Rep. Venezuela Guinea-Bissau Dominica Namibia Japan Hong Kong Malawi Djibouti Zimbabwe Congo Peru Niger Guinea Sierra Leone Suriname Seychelles Gambia Tanzania Chad Liberia Uganda Burundi Rwanda Eritrea Ecuador Benin Mali Comoros Tokelau Burkina Faso Solomon Isl. Eq. Guinea Vanuatu New Zealand Andean Group Bolivia Madagascar Sudan Guatemala Senegal Zambia Angola Andorra Australia Costa Rica Ctrl. Afr. Rep. Sao Tome Albania Nicaragua Brunei Panama El Salvador Botswana Ethiopia Kiribati Maldives Lesotho Togo Samoa Laos C. A. C. M. Bangladesh Tonga Nepal East Timor C. F. D. . Myanmar Yemen Tajikistan Armenia Korea, Dem. Rep. Saudi Arabia 13

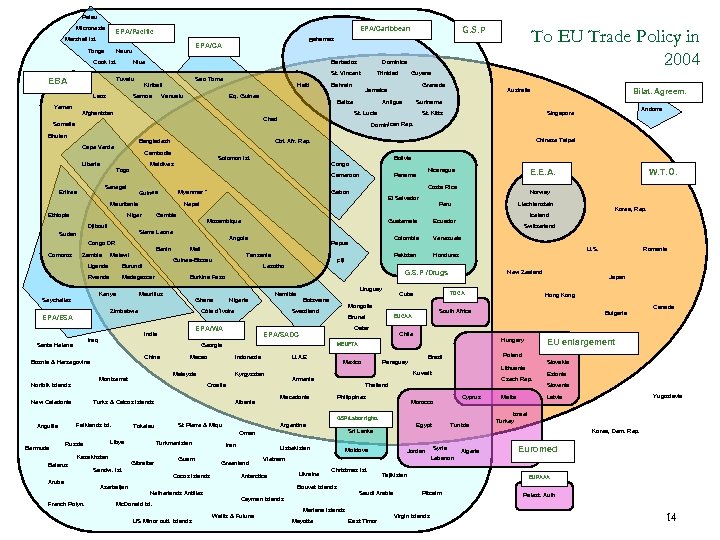

Palau Micronesia Tonga Niue Tuvalu EBA Laos Barbados Samoa Haiti Vanuatu Bangladesh Cape Verde Guinea Djibouti Congo DR Zambia Benin Malawi Burundi Rwanda Madagascar Kenya Mali Ghana Santa Helena China Honduras U. S. New Zealand TDCA Cuba Qatar Chile Indonesia U. A. E Kyrgyzstan Mexico Albania Paraguay Philippines Anguilla Bermuda Tokelau Libya Russia Kazakhstan Belarus Aruba French Polyn. Sandw. Isl. Argentina Cyprus Morocco Guam Cocos Islands Netherlands Antilles Mc. Donald Isl. US Minor outl. Islands Iran Uzbekistan Greenland Moldova Jordan Tunisia Syria Algeria Malta Estonia Slovenia Yugoslavia Latvia Israel Turkey Korea, Dem. Rep. Euromed Lebanon Vietnam Antarctica Ukraine Christmas Isl. Bouvet Islands Cayman Islands Wallis & Futuna Egypt Sri Lanka Oman Turkmenistan Gibraltar Azerbaijan St Pierre & Miqu Slovakia Czech Rep. GSP/Labor rights Falklands Isl. Canada EU enlargement Lithuania Thailand Macedonia Bulgaria Poland Brazil Kuwait Armenia Croatia Hong Kong Hungary MEUFTA Romania Japan South Africa EUCAA Brunei EPA/SADC Macao Turks & Caicos Islands Switzerland Venezuela Mongolia Swaziland EPA/WA Malaysia Montserrat New Caledonia Botswana Georgia Bosnia & Herzegovina Norfolk Islands Uruguay Korea, Rep. Iceland Ecuador G. S. P /Drugs Namibia Nigeria Côte d’Ivoire India Iraq Lesotho Liechtenstein Pakistan Fiji W. T. O. Norway Peru Colombia Papua Tanzania E. E. A. Costa Rica El Salvador Burkina Faso Mauritius Nicaragua Panama Guatemala Angola Zimbabwe EPA/ESA Bolivia Congo Mozambique Guinea-Bissau Uganda Seychelles Chinese Taipei Gabon Sierra Leone Andorra Singapore Dominican Rep. Myanmar * Gambia Bilat. Agreem. Australia Suriname St. Kitts Nepal Niger Sudan Comoros Antigua Cameroon Mauritania Ethiopia Grenada Jamaica St. Lucia Solomon Isl. Maldives Senegal Eritrea Guyana Ctrl. Afr. Rep. Cambodia Togo Trinidad Belize Chad Somalia Liberia Bahrain Eq. Guinea Afghanistan Bhutan To EU Trade Policy in 2004 Dominica St. Vincent Sao Tome Kiribati G. S. P Bahamas EPA/CA Nauru Cook Isl. Yemen EPA/Caribbean EPA/Pacific Marshall Isl. Saudi Arabia Mariana Islands Mayotte Tajikistan East Timor EUPAAA Pitcairn Virgin Islands Palest. Auth 14

Palau Micronesia Tonga Niue Tuvalu EBA Laos Barbados Samoa Haiti Vanuatu Bangladesh Cape Verde Guinea Djibouti Congo DR Zambia Benin Malawi Burundi Rwanda Madagascar Kenya Mali Ghana Santa Helena China Honduras U. S. New Zealand TDCA Cuba Qatar Chile Indonesia U. A. E Kyrgyzstan Mexico Albania Paraguay Philippines Anguilla Bermuda Tokelau Libya Russia Kazakhstan Belarus Aruba French Polyn. Sandw. Isl. Argentina Cyprus Morocco Guam Cocos Islands Netherlands Antilles Mc. Donald Isl. US Minor outl. Islands Iran Uzbekistan Greenland Moldova Jordan Tunisia Syria Algeria Malta Estonia Slovenia Yugoslavia Latvia Israel Turkey Korea, Dem. Rep. Euromed Lebanon Vietnam Antarctica Ukraine Christmas Isl. Bouvet Islands Cayman Islands Wallis & Futuna Egypt Sri Lanka Oman Turkmenistan Gibraltar Azerbaijan St Pierre & Miqu Slovakia Czech Rep. GSP/Labor rights Falklands Isl. Canada EU enlargement Lithuania Thailand Macedonia Bulgaria Poland Brazil Kuwait Armenia Croatia Hong Kong Hungary MEUFTA Romania Japan South Africa EUCAA Brunei EPA/SADC Macao Turks & Caicos Islands Switzerland Venezuela Mongolia Swaziland EPA/WA Malaysia Montserrat New Caledonia Botswana Georgia Bosnia & Herzegovina Norfolk Islands Uruguay Korea, Rep. Iceland Ecuador G. S. P /Drugs Namibia Nigeria Côte d’Ivoire India Iraq Lesotho Liechtenstein Pakistan Fiji W. T. O. Norway Peru Colombia Papua Tanzania E. E. A. Costa Rica El Salvador Burkina Faso Mauritius Nicaragua Panama Guatemala Angola Zimbabwe EPA/ESA Bolivia Congo Mozambique Guinea-Bissau Uganda Seychelles Chinese Taipei Gabon Sierra Leone Andorra Singapore Dominican Rep. Myanmar * Gambia Bilat. Agreem. Australia Suriname St. Kitts Nepal Niger Sudan Comoros Antigua Cameroon Mauritania Ethiopia Grenada Jamaica St. Lucia Solomon Isl. Maldives Senegal Eritrea Guyana Ctrl. Afr. Rep. Cambodia Togo Trinidad Belize Chad Somalia Liberia Bahrain Eq. Guinea Afghanistan Bhutan To EU Trade Policy in 2004 Dominica St. Vincent Sao Tome Kiribati G. S. P Bahamas EPA/CA Nauru Cook Isl. Yemen EPA/Caribbean EPA/Pacific Marshall Isl. Saudi Arabia Mariana Islands Mayotte Tajikistan East Timor EUPAAA Pitcairn Virgin Islands Palest. Auth 14

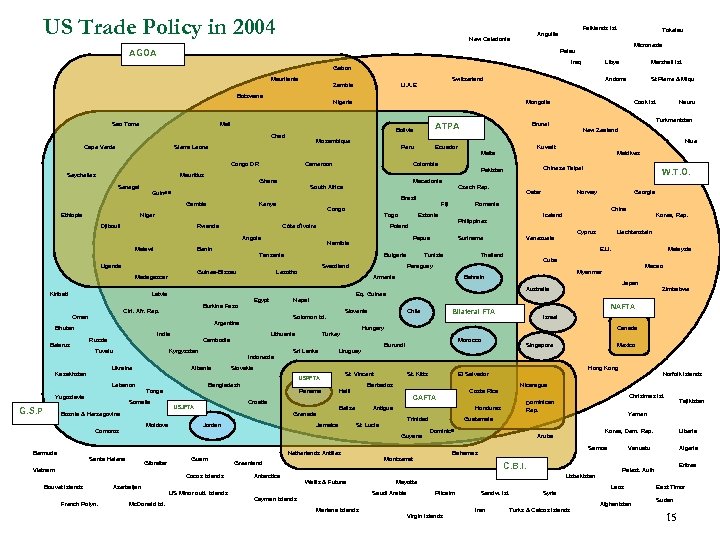

US Trade Policy in 2004 Falklands Isl. Anguilla New Caledonia Iraq Mauritania Zambia Botswana Sao Tome Nigeria Chad Mozambique Congo DR Mauritius Gambia Kenya Congo Rwanda Côte d’Ivoire Benin Uganda Kiribati India Russia Tuvalu Kyrgyzstan Ukraine Kazakhstan Indonesia Albania Yugoslavia Tonga Somalia Panama Croatia USJFTA Bosnia & Herzegovina Grenada Moldova Comoros Bermuda Jordan Gibraltar Vietnam Guam Cocos Islands Bouvet Islands French Polyn. Azerbaijan Mc. Donald Isl. US Minor outl. Islands Liechtenstein E. U. Thailand Macao Myanmar Japan Burundi St. Kitts NAFTA Wallis & Futuna Cayman Islands Mariana Islands Norfolk Islands Nicaragua Costa Rica Trinidad Christmas Isl. Dominican Rep. Korea, Dem. Rep. Aruba Samoa Bahamas C. B. I. Uzbekistan Mayotte Pitcairn Virgin Islands Sandw. Isl. Iran Tajikistan Yemen Guatemala Dominica Montserrat Saudi Arabia Mexico Hong Kong Honduras St. Lucia Greenland Singapore El Salvador Antigua Netherlands Antilles Zimbabwe Israel Morocco CAFTA Belize Malaysia Cuba Bilateral FTA Barbados Haiti Korea, Rep. Canada St. Vincent Jamaica Antarctica Cyprus Australia Guyana Santa Helena China Bahrain Chile Uruguay Slovakia Georgia Hungary Turkey Sri Lanka Bangladesh Tunisia Paraguay Slovenia USPFTA Lebanon G. S. P Lithuania Cambodia Norway Venezuela Eq. Guinea Solomon Isl. W. T. O. Iceland Suriname Armenia Nepal Argentina Bhutan Belarus Egypt Burkina Faso Ctrl. Afr. Rep. Swaziland Lesotho Latvia Oman Bulgaria Qatar Philippines Papua Tanzania Guinea-Bissau Madagascar Estonia Namibia Niue Maldives Romania Fiji Poland Angola Malawi Togo Turkmenistan Chinese Taipei Czech Rep. Nauru New Zealand Kuwait Malta Pakistan Macedonia Brazil Niger Djibouti Ecuador Colombia South Africa Guinea St Pierre & Miqu Cook Isl. Brunei ATPA Peru Cameroon Ghana Marshall Isl. Mongolia Bolivia Sierra Leone Seychelles Switzerland U. A. E Mali Cape Verde Libya Andorra Gabon Ethiopia Micronesia Palau AGOA Senegal Tokelau Syria Turks & Caicos Islands Liberia Vanuatu Algeria Eritrea Palest. Auth Laos Afghanistan East Timor Sudan 15

US Trade Policy in 2004 Falklands Isl. Anguilla New Caledonia Iraq Mauritania Zambia Botswana Sao Tome Nigeria Chad Mozambique Congo DR Mauritius Gambia Kenya Congo Rwanda Côte d’Ivoire Benin Uganda Kiribati India Russia Tuvalu Kyrgyzstan Ukraine Kazakhstan Indonesia Albania Yugoslavia Tonga Somalia Panama Croatia USJFTA Bosnia & Herzegovina Grenada Moldova Comoros Bermuda Jordan Gibraltar Vietnam Guam Cocos Islands Bouvet Islands French Polyn. Azerbaijan Mc. Donald Isl. US Minor outl. Islands Liechtenstein E. U. Thailand Macao Myanmar Japan Burundi St. Kitts NAFTA Wallis & Futuna Cayman Islands Mariana Islands Norfolk Islands Nicaragua Costa Rica Trinidad Christmas Isl. Dominican Rep. Korea, Dem. Rep. Aruba Samoa Bahamas C. B. I. Uzbekistan Mayotte Pitcairn Virgin Islands Sandw. Isl. Iran Tajikistan Yemen Guatemala Dominica Montserrat Saudi Arabia Mexico Hong Kong Honduras St. Lucia Greenland Singapore El Salvador Antigua Netherlands Antilles Zimbabwe Israel Morocco CAFTA Belize Malaysia Cuba Bilateral FTA Barbados Haiti Korea, Rep. Canada St. Vincent Jamaica Antarctica Cyprus Australia Guyana Santa Helena China Bahrain Chile Uruguay Slovakia Georgia Hungary Turkey Sri Lanka Bangladesh Tunisia Paraguay Slovenia USPFTA Lebanon G. S. P Lithuania Cambodia Norway Venezuela Eq. Guinea Solomon Isl. W. T. O. Iceland Suriname Armenia Nepal Argentina Bhutan Belarus Egypt Burkina Faso Ctrl. Afr. Rep. Swaziland Lesotho Latvia Oman Bulgaria Qatar Philippines Papua Tanzania Guinea-Bissau Madagascar Estonia Namibia Niue Maldives Romania Fiji Poland Angola Malawi Togo Turkmenistan Chinese Taipei Czech Rep. Nauru New Zealand Kuwait Malta Pakistan Macedonia Brazil Niger Djibouti Ecuador Colombia South Africa Guinea St Pierre & Miqu Cook Isl. Brunei ATPA Peru Cameroon Ghana Marshall Isl. Mongolia Bolivia Sierra Leone Seychelles Switzerland U. A. E Mali Cape Verde Libya Andorra Gabon Ethiopia Micronesia Palau AGOA Senegal Tokelau Syria Turks & Caicos Islands Liberia Vanuatu Algeria Eritrea Palest. Auth Laos Afghanistan East Timor Sudan 15

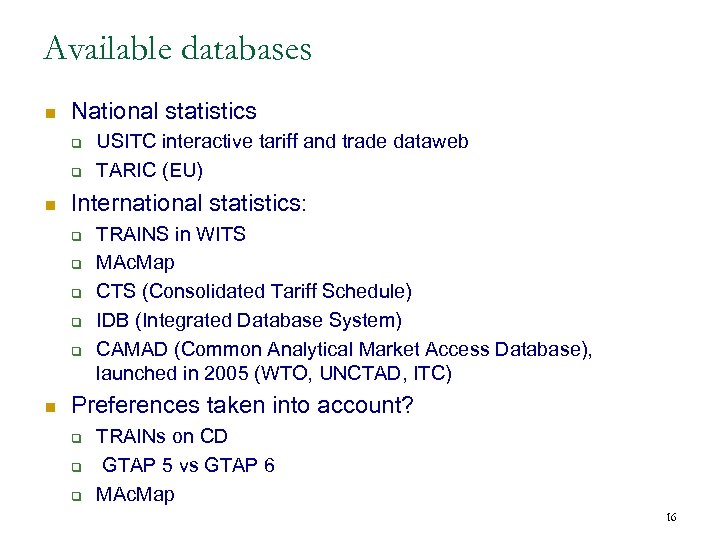

Available databases n National statistics q q n International statistics: q q q n USITC interactive tariff and trade dataweb TARIC (EU) TRAINS in WITS MAc. Map CTS (Consolidated Tariff Schedule) IDB (Integrated Database System) CAMAD (Common Analytical Market Access Database), launched in 2005 (WTO, UNCTAD, ITC) Preferences taken into account? q q q TRAINs on CD GTAP 5 vs GTAP 6 MAc. Map 16

Available databases n National statistics q q n International statistics: q q q n USITC interactive tariff and trade dataweb TARIC (EU) TRAINS in WITS MAc. Map CTS (Consolidated Tariff Schedule) IDB (Integrated Database System) CAMAD (Common Analytical Market Access Database), launched in 2005 (WTO, UNCTAD, ITC) Preferences taken into account? q q q TRAINs on CD GTAP 5 vs GTAP 6 MAc. Map 16

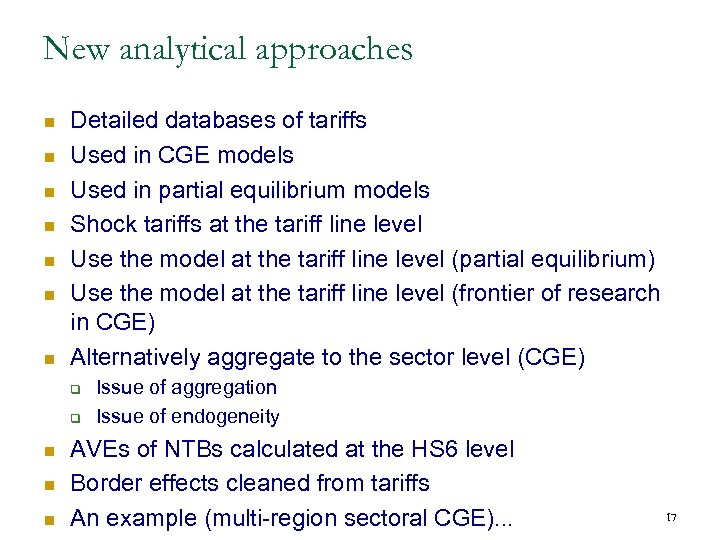

New analytical approaches n n n n Detailed databases of tariffs Used in CGE models Used in partial equilibrium models Shock tariffs at the tariff line level Use the model at the tariff line level (partial equilibrium) Use the model at the tariff line level (frontier of research in CGE) Alternatively aggregate to the sector level (CGE) q q n n n Issue of aggregation Issue of endogeneity AVEs of NTBs calculated at the HS 6 level Border effects cleaned from tariffs An example (multi-region sectoral CGE). . . 17

New analytical approaches n n n n Detailed databases of tariffs Used in CGE models Used in partial equilibrium models Shock tariffs at the tariff line level Use the model at the tariff line level (partial equilibrium) Use the model at the tariff line level (frontier of research in CGE) Alternatively aggregate to the sector level (CGE) q q n n n Issue of aggregation Issue of endogeneity AVEs of NTBs calculated at the HS 6 level Border effects cleaned from tariffs An example (multi-region sectoral CGE). . . 17

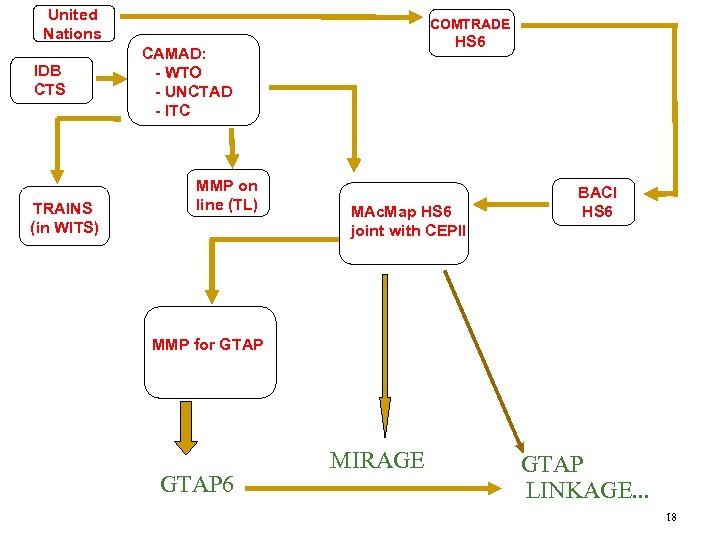

United Nations IDB CTS TRAINS (in WITS) COMTRADE HS 6 CAMAD: - WTO - UNCTAD - ITC MMP on line (TL) MAc. Map HS 6 joint with CEPII BACI HS 6 MMP for GTAP 6 MIRAGE GTAP LINKAGE. . . 18

United Nations IDB CTS TRAINS (in WITS) COMTRADE HS 6 CAMAD: - WTO - UNCTAD - ITC MMP on line (TL) MAc. Map HS 6 joint with CEPII BACI HS 6 MMP for GTAP 6 MIRAGE GTAP LINKAGE. . . 18

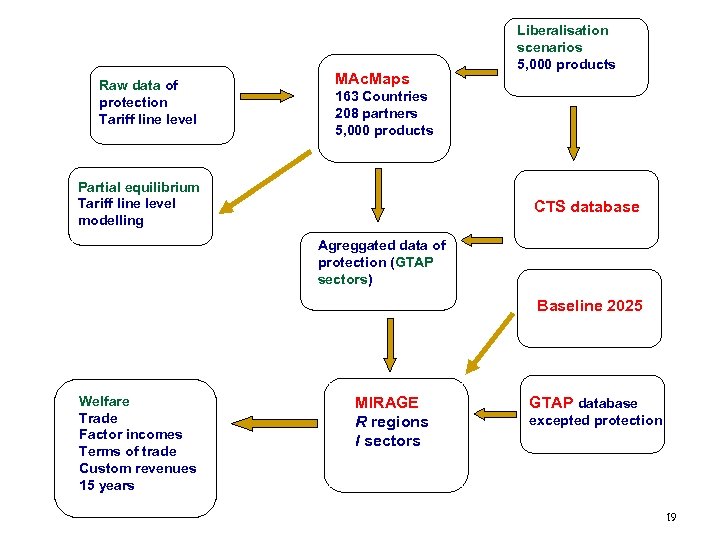

Raw data of protection Tariff line level MAc. Maps Liberalisation scenarios 5, 000 products 163 Countries 208 partners 5, 000 products Partial equilibrium Tariff line level modelling CTS database Agreggated data of protection (GTAP sectors) Baseline 2025 Welfare Trade Factor incomes Terms of trade Custom revenues 15 years MIRAGE R regions I sectors GTAP database excepted protection 19

Raw data of protection Tariff line level MAc. Maps Liberalisation scenarios 5, 000 products 163 Countries 208 partners 5, 000 products Partial equilibrium Tariff line level modelling CTS database Agreggated data of protection (GTAP sectors) Baseline 2025 Welfare Trade Factor incomes Terms of trade Custom revenues 15 years MIRAGE R regions I sectors GTAP database excepted protection 19

Objectives and scope of MAc. Map n n Fully harmonised & exhaustive picture of world wide protection Actual impact of tariff reduction. q q n Bound >= MFN (applied) >= applied (preferential) New Applied rate = Min [New Bound rate, Current protection] Exhaustive coverage q q q all reporting countries (importers) all partners all products at the most disaggregated level 20

Objectives and scope of MAc. Map n n Fully harmonised & exhaustive picture of world wide protection Actual impact of tariff reduction. q q n Bound >= MFN (applied) >= applied (preferential) New Applied rate = Min [New Bound rate, Current protection] Exhaustive coverage q q q all reporting countries (importers) all partners all products at the most disaggregated level 20

MAc. Map Methodology : The Reference Group n Clustering on countries (real GDP per capita, trade openness) q 5 reference groups n Group of exporters : Computation of unit values, ERGUV. n Group of importers : weights for the MAc. Map methodology of aggregation (limits the endogeneity problem). 21

MAc. Map Methodology : The Reference Group n Clustering on countries (real GDP per capita, trade openness) q 5 reference groups n Group of exporters : Computation of unit values, ERGUV. n Group of importers : weights for the MAc. Map methodology of aggregation (limits the endogeneity problem). 21

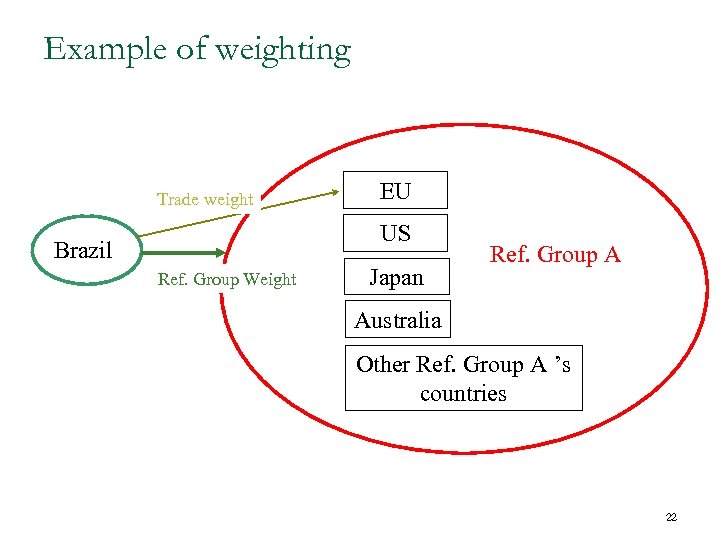

Example of weighting Trade weight EU US Brazil Ref. Group Weight Japan Ref. Group A Australia Other Ref. Group A ’s countries 22

Example of weighting Trade weight EU US Brazil Ref. Group Weight Japan Ref. Group A Australia Other Ref. Group A ’s countries 22

Conclusion n n n The direct approaches conclude to limited protection for most countries and sectors Hardly fits the evidence provided by comparing trade to benchmark Hardly fits the perception of exporters There must be some “hidden protection” and/or NTBs not taken into account in EAVs Success of the “indirect” approaches There are two indirect approaches: q q Deviation from expected trade patterns Deviations from the LOP 23

Conclusion n n n The direct approaches conclude to limited protection for most countries and sectors Hardly fits the evidence provided by comparing trade to benchmark Hardly fits the perception of exporters There must be some “hidden protection” and/or NTBs not taken into account in EAVs Success of the “indirect” approaches There are two indirect approaches: q q Deviation from expected trade patterns Deviations from the LOP 23

n n Actual deviations are due to trade costs Trade costs include all costs incurred in getting a good to a final user other than the marginal cost of producing the good itself: q q q q Transportation costs (both freight costs and time costs) Policy barriers (tariffs and non-tariff barriers) Additional taxes Information costs Contract enforcement costs Costs associated with the use of different currencies Legal and regulatory costs Local distribution costs (wholesale and retail). 24

n n Actual deviations are due to trade costs Trade costs include all costs incurred in getting a good to a final user other than the marginal cost of producing the good itself: q q q q Transportation costs (both freight costs and time costs) Policy barriers (tariffs and non-tariff barriers) Additional taxes Information costs Contract enforcement costs Costs associated with the use of different currencies Legal and regulatory costs Local distribution costs (wholesale and retail). 24