b822191eb08cf6014448e8a5301cef86.ppt

- Количество слайдов: 18

Dara Khosrowshahi EVP & CFO, IAC Piper Jaffray Technology Conference May 20, 2004

Dara Khosrowshahi EVP & CFO, IAC Piper Jaffray Technology Conference May 20, 2004

$60 Billion in Demand Goods = $2 B Tickets = $5 B Local Transactions = $7 B Travel = $10 B Personals = $0. 2 B Mortgages = $36 B IAC 2 Prepared 5/20/04 - Read important disclaimer(s) 40 MM customers 180 MM transactions 140 K suppliers Customer data includes duplication.

$60 Billion in Demand Goods = $2 B Tickets = $5 B Local Transactions = $7 B Travel = $10 B Personals = $0. 2 B Mortgages = $36 B IAC 2 Prepared 5/20/04 - Read important disclaimer(s) 40 MM customers 180 MM transactions 140 K suppliers Customer data includes duplication.

Beneficial Relationships IAC aggregates SUPPLIERS Custome r Acquis Multiple Distribut ition Chan n els Market S egmenta Marketin g tion Strength Yield Ma nageme nt 3 Prepared 5/20/04 - Read important disclaimer(s) CONSUMERS Depth World Leading Consumer Brands Technology & Innovation Scale & Infrastructure Merchandising Expertise Multi-Vertical Capital duct oice / Pro Ch e of Use e / Eas onvenienc C es Great Valu vance cal Rele ation / Lo Inform ness ique sivity / Un Exclu

Beneficial Relationships IAC aggregates SUPPLIERS Custome r Acquis Multiple Distribut ition Chan n els Market S egmenta Marketin g tion Strength Yield Ma nageme nt 3 Prepared 5/20/04 - Read important disclaimer(s) CONSUMERS Depth World Leading Consumer Brands Technology & Innovation Scale & Infrastructure Merchandising Expertise Multi-Vertical Capital duct oice / Pro Ch e of Use e / Eas onvenienc C es Great Valu vance cal Rele ation / Lo Inform ness ique sivity / Un Exclu

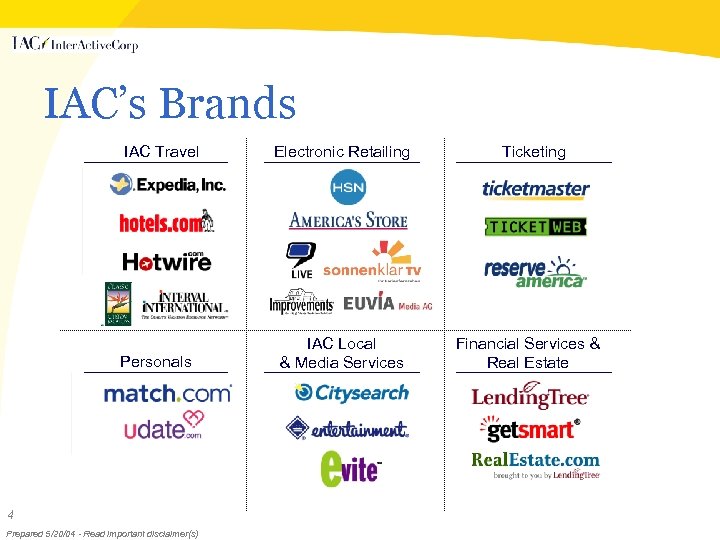

IAC’s Brands IAC Travel Personals 4 Prepared 5/20/04 - Read important disclaimer(s) Electronic Retailing Ticketing IAC Local & Media Services Financial Services & Real Estate

IAC’s Brands IAC Travel Personals 4 Prepared 5/20/04 - Read important disclaimer(s) Electronic Retailing Ticketing IAC Local & Media Services Financial Services & Real Estate

Segment Results LTM $ in millions IAC Travel $1, 813 – Revenue $548 – OIBA 30% – Margin Personals $193 – Revenue $35 – OIBA 18% – Margin 5 Prepared 5/20/04 - Read important disclaimer(s) Electronic Retailing Ticketing $2, 288 – Revenue $202 – OIBA $750 – Revenue $150 – OIBA 9% – Margin 20% – Margin IAC Local & Media Services Financial Services & Real Estate $254 – Revenue $161 – Revenue $19 – OIBA 8% – Margin $21 – OIBA 13% – Margin IAC Travel assumes Hotels. com revenue on a net basis. Financial Services & Real Estate includes Lending. Tree for the full period.

Segment Results LTM $ in millions IAC Travel $1, 813 – Revenue $548 – OIBA 30% – Margin Personals $193 – Revenue $35 – OIBA 18% – Margin 5 Prepared 5/20/04 - Read important disclaimer(s) Electronic Retailing Ticketing $2, 288 – Revenue $202 – OIBA $750 – Revenue $150 – OIBA 9% – Margin 20% – Margin IAC Local & Media Services Financial Services & Real Estate $254 – Revenue $161 – Revenue $19 – OIBA 8% – Margin $21 – OIBA 13% – Margin IAC Travel assumes Hotels. com revenue on a net basis. Financial Services & Real Estate includes Lending. Tree for the full period.

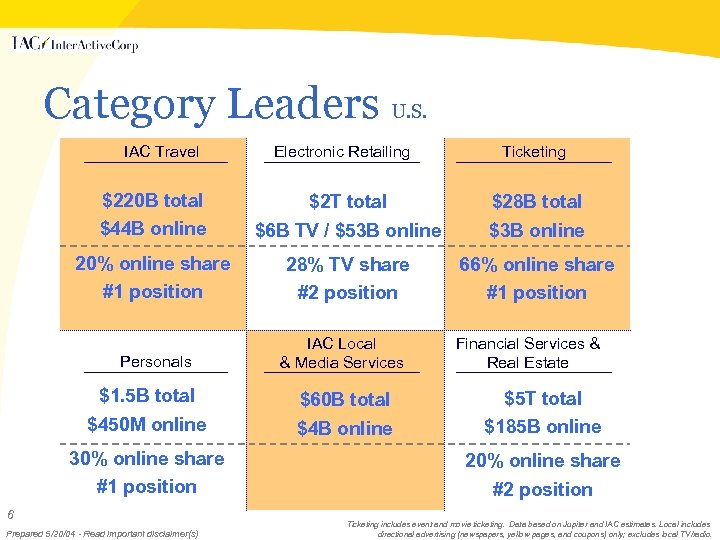

Category Leaders U. S. IAC Travel Electronic Retailing Ticketing $220 B total $2 T total $28 B total $44 B online $6 B TV / $53 B online $3 B online 20% online share #1 position 28% TV share #2 position 66% online share #1 position Personals IAC Local & Media Services Financial Services & Real Estate $1. 5 B total $60 B total $5 T total $450 M online $4 B online $185 B online 30% online share #1 position 6 Prepared 5/20/04 - Read important disclaimer(s) 20% online share #2 position Ticketing includes event and movie ticketing. Data based on Jupiter and IAC estimates. Local includes directional advertising (newspapers, yellow pages, and coupons) only; excludes local TV/radio.

Category Leaders U. S. IAC Travel Electronic Retailing Ticketing $220 B total $2 T total $28 B total $44 B online $6 B TV / $53 B online $3 B online 20% online share #1 position 28% TV share #2 position 66% online share #1 position Personals IAC Local & Media Services Financial Services & Real Estate $1. 5 B total $60 B total $5 T total $450 M online $4 B online $185 B online 30% online share #1 position 6 Prepared 5/20/04 - Read important disclaimer(s) 20% online share #2 position Ticketing includes event and movie ticketing. Data based on Jupiter and IAC estimates. Local includes directional advertising (newspapers, yellow pages, and coupons) only; excludes local TV/radio.

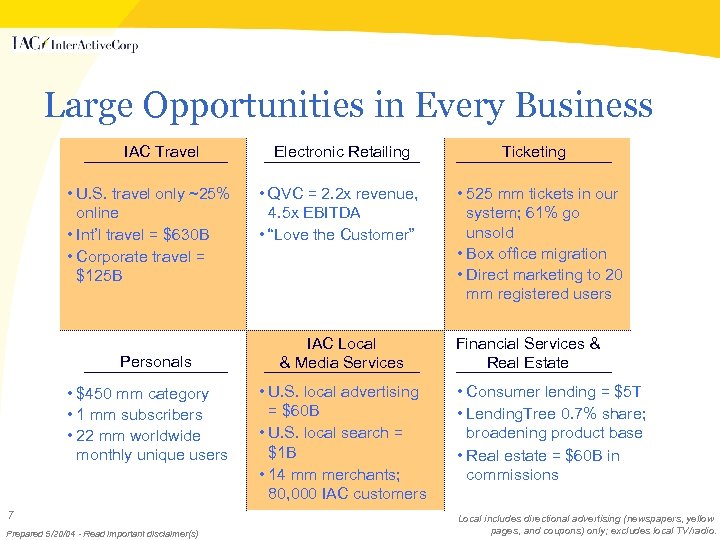

Large Opportunities in Every Business IAC Travel • U. S. travel only ~25% online • Int’l travel = $630 B • Corporate travel = $125 B Personals • $450 mm category • 1 mm subscribers • 22 mm worldwide monthly unique users 7 Prepared 5/20/04 - Read important disclaimer(s) Electronic Retailing • QVC = 2. 2 x revenue, 4. 5 x EBITDA • “Love the Customer” IAC Local & Media Services • U. S. local advertising = $60 B • U. S. local search = $1 B • 14 mm merchants; 80, 000 IAC customers Ticketing • 525 mm tickets in our system; 61% go unsold • Box office migration • Direct marketing to 20 mm registered users Financial Services & Real Estate • Consumer lending = $5 T • Lending. Tree 0. 7% share; broadening product base • Real estate = $60 B in commissions Local includes directional advertising (newspapers, yellow pages, and coupons) only; excludes local TV/radio.

Large Opportunities in Every Business IAC Travel • U. S. travel only ~25% online • Int’l travel = $630 B • Corporate travel = $125 B Personals • $450 mm category • 1 mm subscribers • 22 mm worldwide monthly unique users 7 Prepared 5/20/04 - Read important disclaimer(s) Electronic Retailing • QVC = 2. 2 x revenue, 4. 5 x EBITDA • “Love the Customer” IAC Local & Media Services • U. S. local advertising = $60 B • U. S. local search = $1 B • 14 mm merchants; 80, 000 IAC customers Ticketing • 525 mm tickets in our system; 61% go unsold • Box office migration • Direct marketing to 20 mm registered users Financial Services & Real Estate • Consumer lending = $5 T • Lending. Tree 0. 7% share; broadening product base • Real estate = $60 B in commissions Local includes directional advertising (newspapers, yellow pages, and coupons) only; excludes local TV/radio.

Travel Strategy 8 Prepared 5/20/04 - Read important disclaimer(s)

Travel Strategy 8 Prepared 5/20/04 - Read important disclaimer(s)

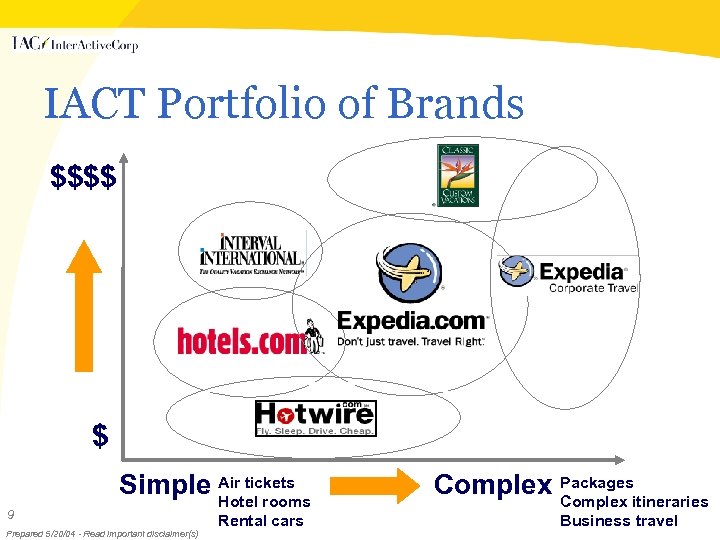

IACT Portfolio of Brands $$$$ $ 9 Simple Air tickets Hotel rooms Prepared 5/20/04 - Read important disclaimer(s) Rental cars Complex Packages Complex itineraries Business travel

IACT Portfolio of Brands $$$$ $ 9 Simple Air tickets Hotel rooms Prepared 5/20/04 - Read important disclaimer(s) Rental cars Complex Packages Complex itineraries Business travel

IACT Portfolio vs. Competitors 10 Prepared 5/20/04 - Read important disclaimer(s)

IACT Portfolio vs. Competitors 10 Prepared 5/20/04 - Read important disclaimer(s)

IACT: Outpacing the Market $ in millions Expedia Travelocity Orbitz Hotels. com Priceline Trip Network 11 Prepared 5/20/04 - Read important disclaimer(s)

IACT: Outpacing the Market $ in millions Expedia Travelocity Orbitz Hotels. com Priceline Trip Network 11 Prepared 5/20/04 - Read important disclaimer(s)

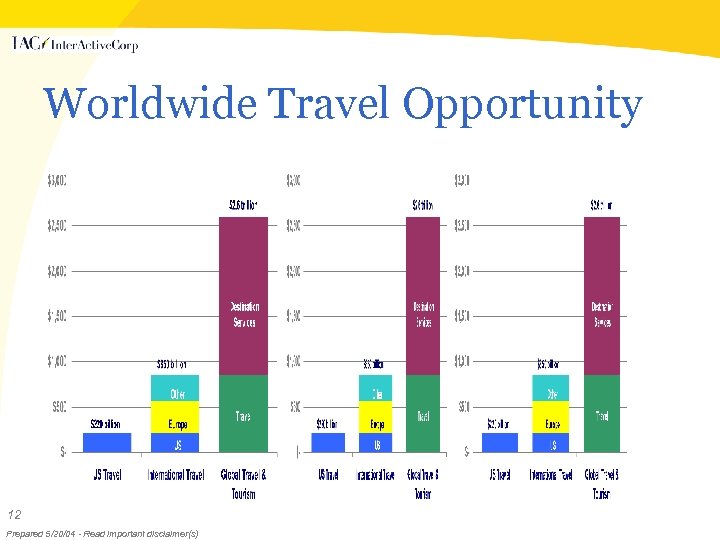

Worldwide Travel Opportunity 12 Prepared 5/20/04 - Read important disclaimer(s)

Worldwide Travel Opportunity 12 Prepared 5/20/04 - Read important disclaimer(s)

Long Term Goals 5 -Year OIBA Goal = $3, 000 $ in millions 2003 OIBA = $860 Travel $524 Goods $144 25% to 35% $2, 000 $223 Ticketing Goal CAGR Financial & Realty Personals x Local Services $1 $31 $26 20% to 25% $550 15% to 20% 80% to 25% 90% to 3 0% 45% to 5 0% $280 $130 $100 13 Prepared 5/20/04 - Read important disclaimer(s) $150 2003 and 2008 total OIBA is after corporate and other expenses

Long Term Goals 5 -Year OIBA Goal = $3, 000 $ in millions 2003 OIBA = $860 Travel $524 Goods $144 25% to 35% $2, 000 $223 Ticketing Goal CAGR Financial & Realty Personals x Local Services $1 $31 $26 20% to 25% $550 15% to 20% 80% to 25% 90% to 3 0% 45% to 5 0% $280 $130 $100 13 Prepared 5/20/04 - Read important disclaimer(s) $150 2003 and 2008 total OIBA is after corporate and other expenses

IAC’s Competitive Advantage § 43 leading brands § Strong balance sheet § Ability to invest aggressively in new growth areas § Shared learning and natural relationships across Businesses § Diversity & reduced volatility 14 Prepared 5/20/04 - Read important disclaimer(s)

IAC’s Competitive Advantage § 43 leading brands § Strong balance sheet § Ability to invest aggressively in new growth areas § Shared learning and natural relationships across Businesses § Diversity & reduced volatility 14 Prepared 5/20/04 - Read important disclaimer(s)

Harnessing the power of interactivity to make people’s lives easier, everywhere and everyday.

Harnessing the power of interactivity to make people’s lives easier, everywhere and everyday.

Important Safe Harbor Statement Under The Private Securities Litigation Reform Act Of 1995 This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, particularly statements anticipating future growth in revenues and operating income before amortization. Words such as “believes, ” “could, ” “expects, ” “anticipates, ” “estimates, ” “intends, ” “plans, ” “projects, ” “seeks, ” or similar expressions used in connection with any discussion of future operating or financial performance identify forward-looking statements. These forward-looking statements are necessarily estimates reflecting the best judgment of IAC’s senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These risks and uncertainties are described in IAC’s filings with the U. S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10 -K for the fiscal year ended 2003, especially in the Risk Factors and the Management’s Discussion and Analysis sections, its Quarterly Reports on Form 10 -Q and its Current Reports on Form 8 -K. Other unknown or unpredictable factors also could have material adverse effects on IAC’s future results, performance or achievements. In light of these risks and uncertainties, the forward-looking events discussed in this presentation may not occur. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date of this presentation. IAC is not under any obligation and does not intend to make publicly available any update or other revisions to any of the forward-looking statements contained in this presentation to reflect circumstances existing after the date of this presentation or to reflect the occurrence of future events even if experience or future events make it clear that any expected results expressed or implied by those forward-looking statements will not be realized. 16 Prepared 5/20/04 - Read important disclaimer(s)

Important Safe Harbor Statement Under The Private Securities Litigation Reform Act Of 1995 This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, particularly statements anticipating future growth in revenues and operating income before amortization. Words such as “believes, ” “could, ” “expects, ” “anticipates, ” “estimates, ” “intends, ” “plans, ” “projects, ” “seeks, ” or similar expressions used in connection with any discussion of future operating or financial performance identify forward-looking statements. These forward-looking statements are necessarily estimates reflecting the best judgment of IAC’s senior management and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. These risks and uncertainties are described in IAC’s filings with the U. S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10 -K for the fiscal year ended 2003, especially in the Risk Factors and the Management’s Discussion and Analysis sections, its Quarterly Reports on Form 10 -Q and its Current Reports on Form 8 -K. Other unknown or unpredictable factors also could have material adverse effects on IAC’s future results, performance or achievements. In light of these risks and uncertainties, the forward-looking events discussed in this presentation may not occur. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date of this presentation. IAC is not under any obligation and does not intend to make publicly available any update or other revisions to any of the forward-looking statements contained in this presentation to reflect circumstances existing after the date of this presentation or to reflect the occurrence of future events even if experience or future events make it clear that any expected results expressed or implied by those forward-looking statements will not be realized. 16 Prepared 5/20/04 - Read important disclaimer(s)

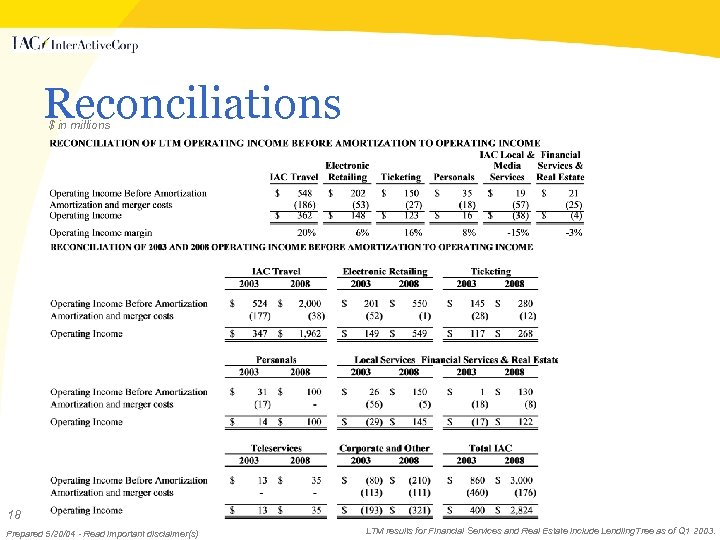

Reconciliations $ in millions 18 Prepared 5/20/04 - Read important disclaimer(s) LTM results for Financial Services and Real Estate include Lendiing. Tree as of Q 1 2003.

Reconciliations $ in millions 18 Prepared 5/20/04 - Read important disclaimer(s) LTM results for Financial Services and Real Estate include Lendiing. Tree as of Q 1 2003.