Int. trade. Ricardo Law of CA.pptx

- Количество слайдов: 18

D. Ricardo’s theory of “comparative advantages” Student: Julia Pronkina

D. Ricardo’s theory of “comparative advantages” Student: Julia Pronkina

Content Introduction 1. Historical background 2. Principles of theory of comparative advantage: 3. Explanation of theory 4. Gains from trade 5. Price-specie-flow mechanism Conclusion

Content Introduction 1. Historical background 2. Principles of theory of comparative advantage: 3. Explanation of theory 4. Gains from trade 5. Price-specie-flow mechanism Conclusion

Historical background “Principles of Political Economy and Taxation” (1817) Mercantilism (e. g. The Corn Laws in 1815) Adam Smith (The Wealth of Nations in 1776)

Historical background “Principles of Political Economy and Taxation” (1817) Mercantilism (e. g. The Corn Laws in 1815) Adam Smith (The Wealth of Nations in 1776)

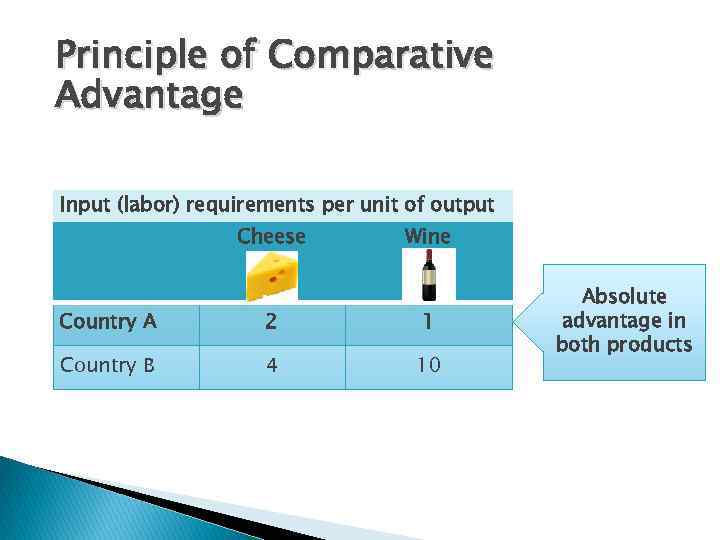

Principle of Comparative Advantage Even if a country had a considerable absolute advantage in the production of both goods, Ricardo would argue that specialization and trade are still mutually beneficial. WHY?

Principle of Comparative Advantage Even if a country had a considerable absolute advantage in the production of both goods, Ricardo would argue that specialization and trade are still mutually beneficial. WHY?

Principle of Comparative Advantage Basic assumptions: Only two nations and two commodities; Free trade; Labor theory of value; Absence of transportation costs; Labor is perfectly mobile within a country but it is perfectly immobile within countries; Constant cost of production; Full employment of labor; Technology remains unchanged.

Principle of Comparative Advantage Basic assumptions: Only two nations and two commodities; Free trade; Labor theory of value; Absence of transportation costs; Labor is perfectly mobile within a country but it is perfectly immobile within countries; Constant cost of production; Full employment of labor; Technology remains unchanged.

Principle of Comparative Advantage Input (labor) requirements per unit of output Cheese Wine Country A 2 1 Country B 4 10 Absolute advantage in both products

Principle of Comparative Advantage Input (labor) requirements per unit of output Cheese Wine Country A 2 1 Country B 4 10 Absolute advantage in both products

Principle of Comparative Advantage Countries should specialize in producing those goods in which they have the lowest opportunity costs or greatest comparative advantage Countries with higher opportunity costs of production should import from a lower opportunity cost country.

Principle of Comparative Advantage Countries should specialize in producing those goods in which they have the lowest opportunity costs or greatest comparative advantage Countries with higher opportunity costs of production should import from a lower opportunity cost country.

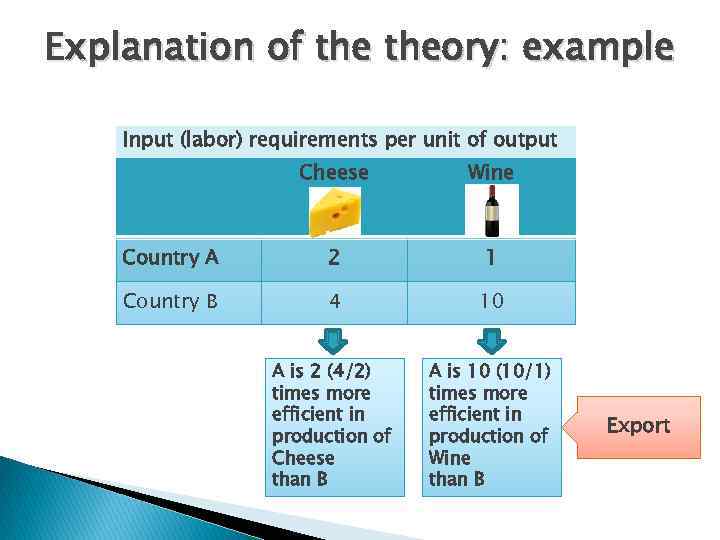

Explanation of theory: example Input (labor) requirements per unit of output Cheese Wine Country A 2 1 Country B 4 10 A is 2 (4/2) times more efficient in production of Cheese than B A is 10 (10/1) times more efficient in production of Wine than B Export

Explanation of theory: example Input (labor) requirements per unit of output Cheese Wine Country A 2 1 Country B 4 10 A is 2 (4/2) times more efficient in production of Cheese than B A is 10 (10/1) times more efficient in production of Wine than B Export

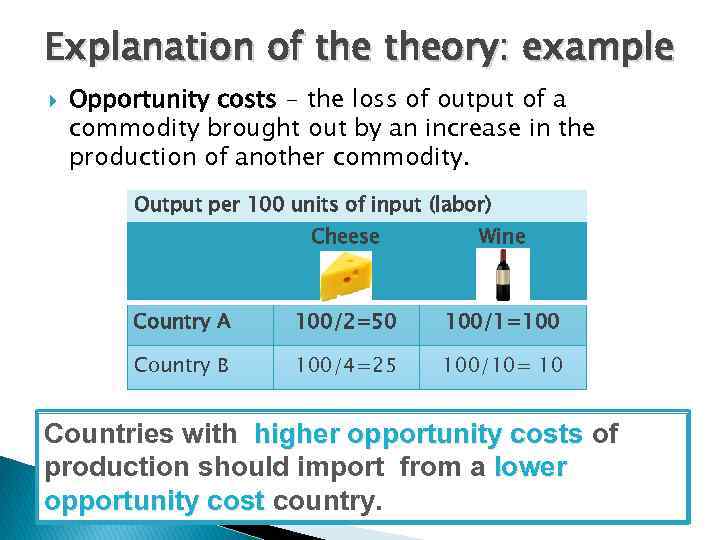

Explanation of theory: example Opportunity costs - the loss of output of a commodity brought out by an increase in the production of another commodity. Output per 100 units of input (labor) Cheese Wine Country A 100/2=50 100/1=100 Country B 100/4=25 100/10= 10 Countries with higher opportunity costs of production should import from a lower opportunity cost country.

Explanation of theory: example Opportunity costs - the loss of output of a commodity brought out by an increase in the production of another commodity. Output per 100 units of input (labor) Cheese Wine Country A 100/2=50 100/1=100 Country B 100/4=25 100/10= 10 Countries with higher opportunity costs of production should import from a lower opportunity cost country.

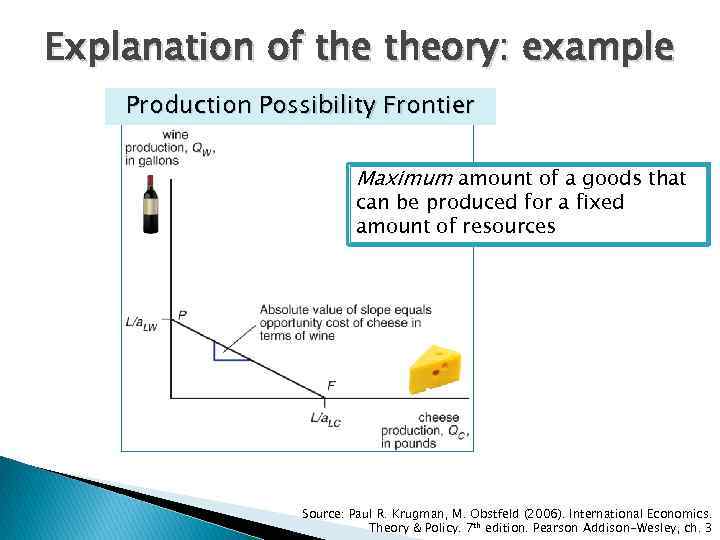

Explanation of theory: example Production Possibility Frontier Maximum amount of a goods that can be produced for a fixed amount of resources Source: Paul R. Krugman, M. Obstfeld (2006). International Economics. Theory & Policy. 7 th edition. Pearson Addison-Wesley, ch. 3

Explanation of theory: example Production Possibility Frontier Maximum amount of a goods that can be produced for a fixed amount of resources Source: Paul R. Krugman, M. Obstfeld (2006). International Economics. Theory & Policy. 7 th edition. Pearson Addison-Wesley, ch. 3

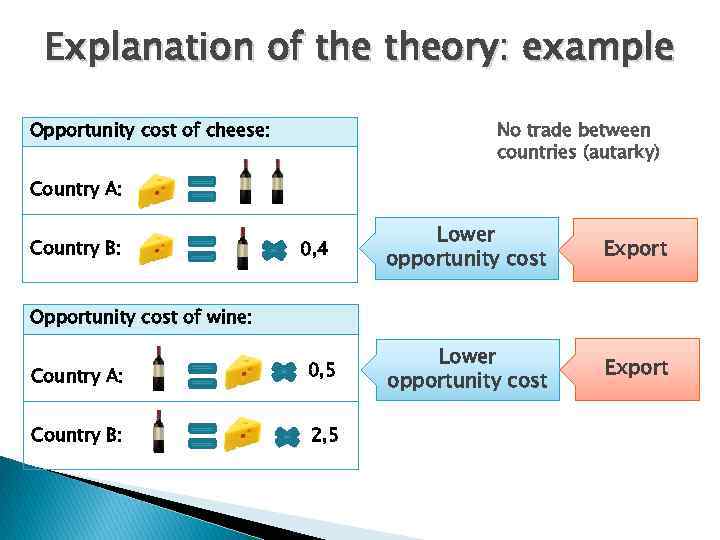

Explanation of theory: example Opportunity cost of cheese: No trade between countries (autarky) Country A: Country B: 0, 4 Lower opportunity cost Export Opportunity cost of wine: Country A: 0, 5 Country B: 2, 5

Explanation of theory: example Opportunity cost of cheese: No trade between countries (autarky) Country A: Country B: 0, 4 Lower opportunity cost Export Opportunity cost of wine: Country A: 0, 5 Country B: 2, 5

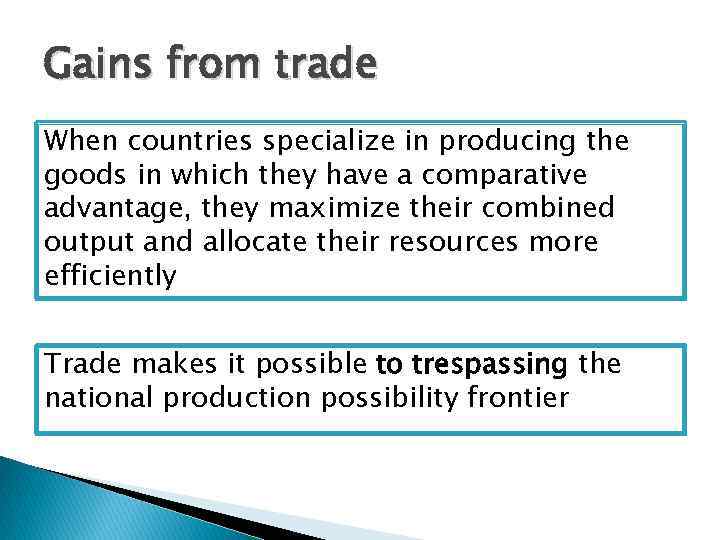

Gains from trade When countries specialize in producing the goods in which they have a comparative advantage, they maximize their combined output and allocate their resources more efficiently Trade makes it possible to trespassing the national production possibility frontier

Gains from trade When countries specialize in producing the goods in which they have a comparative advantage, they maximize their combined output and allocate their resources more efficiently Trade makes it possible to trespassing the national production possibility frontier

Gains from trade Once trade allowed between the two countries: Country B: Country A: Per unit gain In Cheese prod. In Wine prod. Country A -1 +2 Country B +2, 5 -1 World +1, 5 +1

Gains from trade Once trade allowed between the two countries: Country B: Country A: Per unit gain In Cheese prod. In Wine prod. Country A -1 +2 Country B +2, 5 -1 World +1, 5 +1

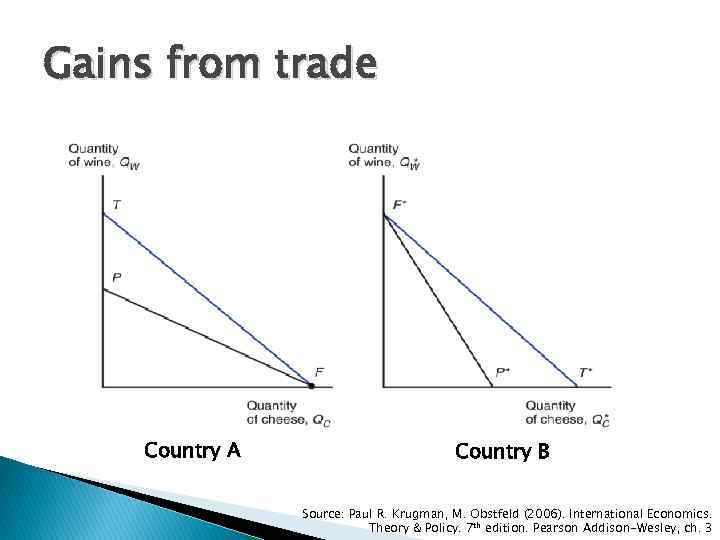

Gains from trade Country A Country B Source: Paul R. Krugman, M. Obstfeld (2006). International Economics. Theory & Policy. 7 th edition. Pearson Addison-Wesley, ch. 3

Gains from trade Country A Country B Source: Paul R. Krugman, M. Obstfeld (2006). International Economics. Theory & Policy. 7 th edition. Pearson Addison-Wesley, ch. 3

Price-specie-flow mechanism Imagine: Prices for both commodities are cheaper in Country A Country B Gold Trade surplus Commodities become more expensive Trade deficit Commodities become cheaper

Price-specie-flow mechanism Imagine: Prices for both commodities are cheaper in Country A Country B Gold Trade surplus Commodities become more expensive Trade deficit Commodities become cheaper

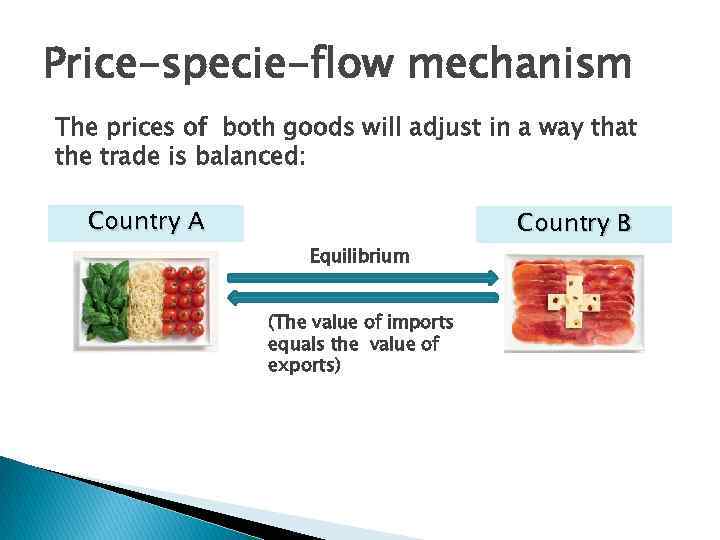

Price-specie-flow mechanism The prices of both goods will adjust in a way that the trade is balanced: Country A Country B Equilibrium (The value of imports equals the value of exports)

Price-specie-flow mechanism The prices of both goods will adjust in a way that the trade is balanced: Country A Country B Equilibrium (The value of imports equals the value of exports)

Each nations seeks to maximise its own advantage, it brings about the best possible outcome because labour is distributed most effectively and most economically

Each nations seeks to maximise its own advantage, it brings about the best possible outcome because labour is distributed most effectively and most economically