10d34639de1adca0af8a1d325e5997f8.ppt

- Количество слайдов: 22

Cyprotex PLC 2007 Results April 2008 Cyprotex Confidentia

Cyprotex PLC 2007 Results April 2008 Cyprotex Confidentia

Business Overview A unique packaged solution • A specialist provider of technology and information to evaluate and optimise ADME, toxicity and pharmacokinetic properties of potential drug candidates • A portfolio of technologies to identify potential problems at the drug discovery stage and help determine likely outcome of administering compounds • Highly automated in-vitro and in-silico screening, designed to significantly accelerate and simplify the process from “hit-to-lead” in drug discovery • Helps eliminate the potential of costly late-stage development failure or product withdrawal due to unexpected pharmacokinetics and safety problems • Success of Cloe® Integrated Product Offering • Cyprotex is an Ethical investment Cyprotex Confidentia

Business Overview A unique packaged solution • A specialist provider of technology and information to evaluate and optimise ADME, toxicity and pharmacokinetic properties of potential drug candidates • A portfolio of technologies to identify potential problems at the drug discovery stage and help determine likely outcome of administering compounds • Highly automated in-vitro and in-silico screening, designed to significantly accelerate and simplify the process from “hit-to-lead” in drug discovery • Helps eliminate the potential of costly late-stage development failure or product withdrawal due to unexpected pharmacokinetics and safety problems • Success of Cloe® Integrated Product Offering • Cyprotex is an Ethical investment Cyprotex Confidentia

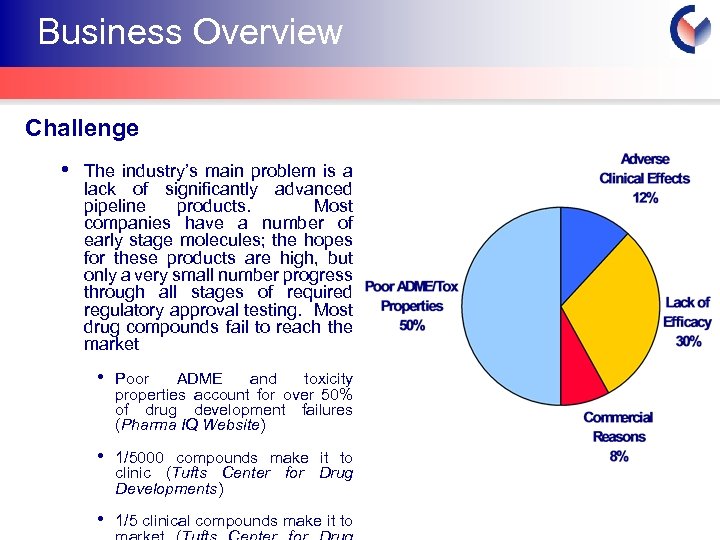

Business Overview Challenge • The industry’s main problem is a lack of significantly advanced pipeline products. Most companies have a number of early stage molecules; the hopes for these products are high, but only a very small number progress through all stages of required regulatory approval testing. Most drug compounds fail to reach the market • Poor ADME and toxicity properties account for over 50% of drug development failures (Pharma IQ Website) • 1/5000 compounds make it to clinic (Tufts Center for Drug Developments) • 1/5 clinical compounds make it to Cyprotex Confidentia

Business Overview Challenge • The industry’s main problem is a lack of significantly advanced pipeline products. Most companies have a number of early stage molecules; the hopes for these products are high, but only a very small number progress through all stages of required regulatory approval testing. Most drug compounds fail to reach the market • Poor ADME and toxicity properties account for over 50% of drug development failures (Pharma IQ Website) • 1/5000 compounds make it to clinic (Tufts Center for Drug Developments) • 1/5 clinical compounds make it to Cyprotex Confidentia

Business Overview • • • Validated Technology – now well over 100 customers worldwide, including half the ‘top ten’ pharmaceutical giants Highly automated environment supported by proprietary technologies Unrivalled scale, reproducibility, turnaround and pricing make Cyprotex the standard-setter for this industry Collaborative agreements provide forward visibility Exceptional operational gearing An Ethical investment Cyprotex Confidentia

Business Overview • • • Validated Technology – now well over 100 customers worldwide, including half the ‘top ten’ pharmaceutical giants Highly automated environment supported by proprietary technologies Unrivalled scale, reproducibility, turnaround and pricing make Cyprotex the standard-setter for this industry Collaborative agreements provide forward visibility Exceptional operational gearing An Ethical investment Cyprotex Confidentia

Highlights Year ended 31 st December 2007 • • • Revenues for the year ended 31 December 2007 increased by 3. 7% to £ 3. 63 million against £ 3. 50 million for the comparable period. Gross profits for the year rose marginally to £ 3. 00 million from £ 2. 97 million. Operating losses for the year were cut by 33% to £ 496, 000 from £ 741, 000 in 2006. Non-recurring costs of around £ 80, 000, used in defending the group from the attempted requisition, sapped the group’s cash resources during the first half-year. Despite continued investment, cash-in-hand improved slightly from the low point recorded at the half year to 30 June 2007 of £ 267, 000, to just over £ 300, 000 at the year Cyprotex Confidentia

Highlights Year ended 31 st December 2007 • • • Revenues for the year ended 31 December 2007 increased by 3. 7% to £ 3. 63 million against £ 3. 50 million for the comparable period. Gross profits for the year rose marginally to £ 3. 00 million from £ 2. 97 million. Operating losses for the year were cut by 33% to £ 496, 000 from £ 741, 000 in 2006. Non-recurring costs of around £ 80, 000, used in defending the group from the attempted requisition, sapped the group’s cash resources during the first half-year. Despite continued investment, cash-in-hand improved slightly from the low point recorded at the half year to 30 June 2007 of £ 267, 000, to just over £ 300, 000 at the year Cyprotex Confidentia

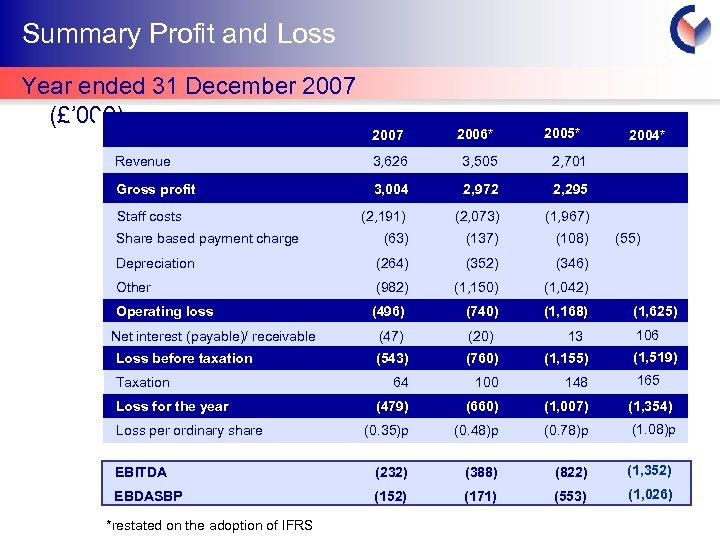

Summary Profit and Loss Year ended 31 December 2007 (£’ 000) 2005* 2007 2006* Revenue 3, 626 3, 505 2, 701 Gross profit 3, 004 2, 972 2, 295 (2, 191) (2, 073) (1, 967) (63) (137) (108) Depreciation (264) (352) (346) Other (982) (1, 150) (1, 042) Operating loss (496) (740) (1, 168) (47) (20) (543) (760) (1, 155) 64 100 148 (479) (660) (1, 007) (1, 354) (0. 35)p (0. 48)p (0. 78)p (1. 08)p EBITDA (232) (388) (822) (1, 352) EBDASBP (152) (171) (553) (1, 026) Staff costs Share based payment charge Net interest (payable)/ receivable Loss before taxation Taxation Loss for the year Loss per ordinary share *restated on the adoption of IFRS 13 2004* (55) - (1, 625) 106 (1, 519) 165 Cyprotex Confidentia

Summary Profit and Loss Year ended 31 December 2007 (£’ 000) 2005* 2007 2006* Revenue 3, 626 3, 505 2, 701 Gross profit 3, 004 2, 972 2, 295 (2, 191) (2, 073) (1, 967) (63) (137) (108) Depreciation (264) (352) (346) Other (982) (1, 150) (1, 042) Operating loss (496) (740) (1, 168) (47) (20) (543) (760) (1, 155) 64 100 148 (479) (660) (1, 007) (1, 354) (0. 35)p (0. 48)p (0. 78)p (1. 08)p EBITDA (232) (388) (822) (1, 352) EBDASBP (152) (171) (553) (1, 026) Staff costs Share based payment charge Net interest (payable)/ receivable Loss before taxation Taxation Loss for the year Loss per ordinary share *restated on the adoption of IFRS 13 2004* (55) - (1, 625) 106 (1, 519) 165 Cyprotex Confidentia

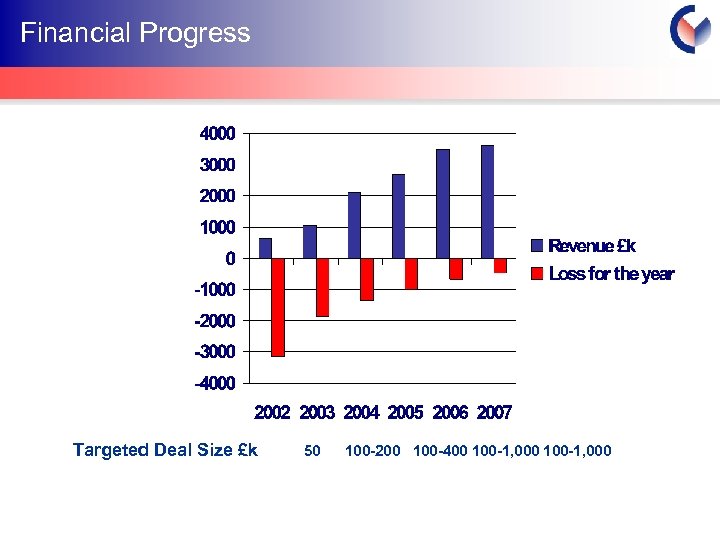

Financial Progress Targeted Deal Size £k 50 100 -200 100 -400 100 -1, 000 Cyprotex Confidentia

Financial Progress Targeted Deal Size £k 50 100 -200 100 -400 100 -1, 000 Cyprotex Confidentia

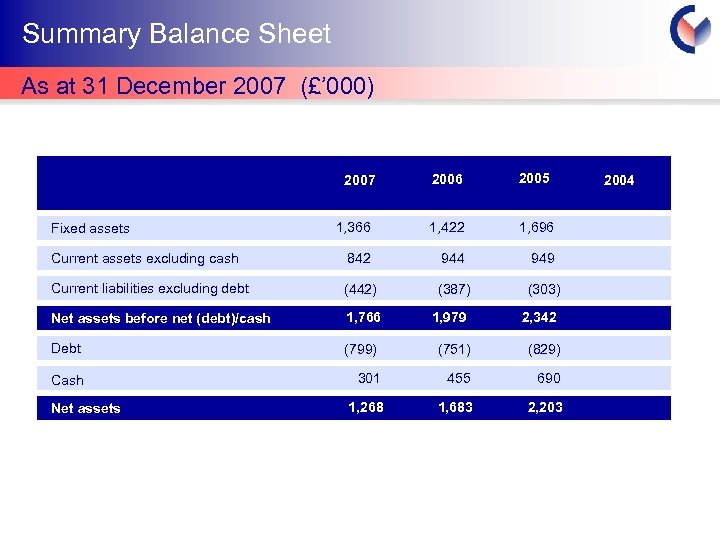

Summary Balance Sheet As at 31 December 2007 (£’ 000) 2006 2005 1, 366 1, 422 1, 696 Current assets excluding cash 842 944 949 Current liabilities excluding debt (442) (387) (303) Net assets before net (debt)/cash 1, 766 1, 979 2, 342 Debt (799) (751) (829) Cash 301 455 690 1, 268 1, 683 2, 203 2007 Fixed assets Net assets 2004 Cyprotex Confidentia

Summary Balance Sheet As at 31 December 2007 (£’ 000) 2006 2005 1, 366 1, 422 1, 696 Current assets excluding cash 842 944 949 Current liabilities excluding debt (442) (387) (303) Net assets before net (debt)/cash 1, 766 1, 979 2, 342 Debt (799) (751) (829) Cash 301 455 690 1, 268 1, 683 2, 203 2007 Fixed assets Net assets 2004 Cyprotex Confidentia

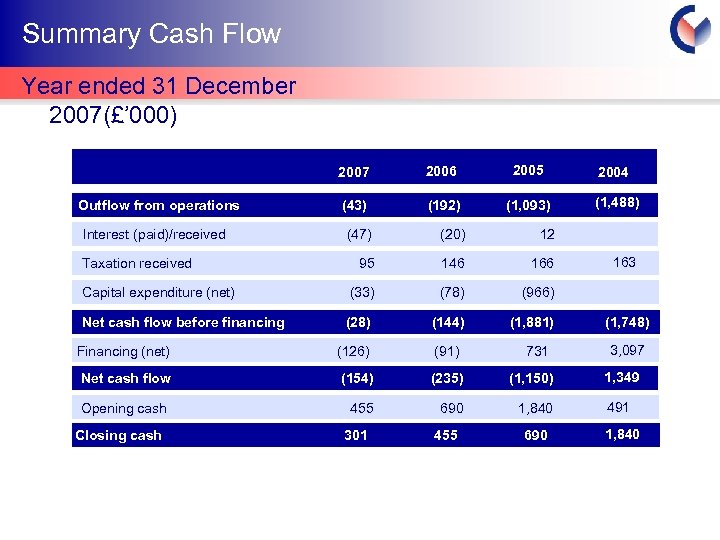

Summary Cash Flow Year ended 31 December 2007(£’ 000) 2007 Outflow from operations Interest (paid)/received 2006 2005 2004 (43) (192) (1, 093) (1, 488) (47) (20) 12 95 146 166 Capital expenditure (net) (33) (78) (966) Net cash flow before financing (28) (144) (1, 881) Taxation received Financing (net) (126) (91) 731 Net cash flow (154) (235) (1, 150) Opening cash 455 690 1, 840 Closing cash 301 455 690 163 (1, 748) 3, 097 1, 349 491 1, 840 Cyprotex Confidentia

Summary Cash Flow Year ended 31 December 2007(£’ 000) 2007 Outflow from operations Interest (paid)/received 2006 2005 2004 (43) (192) (1, 093) (1, 488) (47) (20) 12 95 146 166 Capital expenditure (net) (33) (78) (966) Net cash flow before financing (28) (144) (1, 881) Taxation received Financing (net) (126) (91) 731 Net cash flow (154) (235) (1, 150) Opening cash 455 690 1, 840 Closing cash 301 455 690 163 (1, 748) 3, 097 1, 349 491 1, 840 Cyprotex Confidentia

Customers Cyprotex Confidentia

Customers Cyprotex Confidentia

Market Global Market Opportunities Pharma Majors Biotech/CROs • • • Looking to replace integrated services with trusted external development collaborations Presently account for over 70% of global drug development spending Pressure to outsource comes from • Weak pipelines • Slow development processes • Cost cutting drives • Failure/litigation • Need to accelerate throughput Need to change business model • Safeguarding IP • Focus on core skills • Purchasing new early stage development • • Rely on key R&D outsourcing relationships Presently account for around 30% of global drug development spending Hold over half of development molecules Growth powered by corporate structure • Cash rich • Limited exposure to generics • Self-funding R&D • Partnerships arrangement in later stages Successful R&D achievements • Highly efficient pricing • Rapid turnaround • Independent scrutiny Cyprotex Confidentia

Market Global Market Opportunities Pharma Majors Biotech/CROs • • • Looking to replace integrated services with trusted external development collaborations Presently account for over 70% of global drug development spending Pressure to outsource comes from • Weak pipelines • Slow development processes • Cost cutting drives • Failure/litigation • Need to accelerate throughput Need to change business model • Safeguarding IP • Focus on core skills • Purchasing new early stage development • • Rely on key R&D outsourcing relationships Presently account for around 30% of global drug development spending Hold over half of development molecules Growth powered by corporate structure • Cash rich • Limited exposure to generics • Self-funding R&D • Partnerships arrangement in later stages Successful R&D achievements • Highly efficient pricing • Rapid turnaround • Independent scrutiny Cyprotex Confidentia

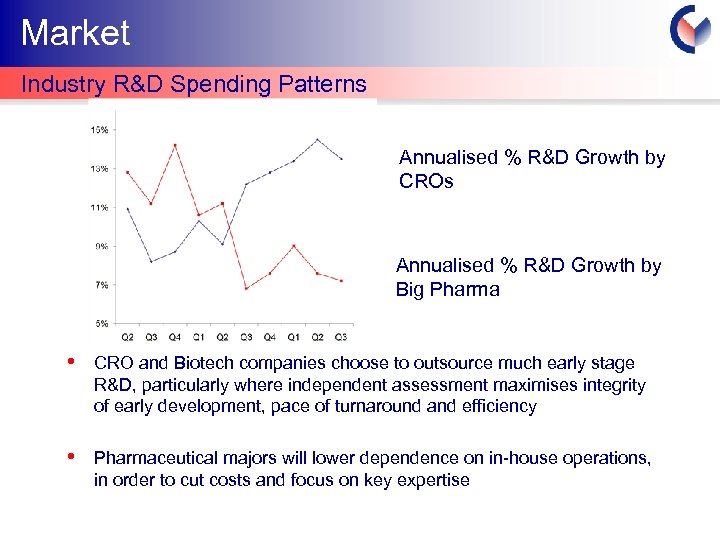

Market Industry R&D Spending Patterns Annualised % R&D Growth by CROs Annualised % R&D Growth by Big Pharma 2003 2004 2005 • CRO and Biotech companies choose to outsource much early stage R&D, particularly where independent assessment maximises integrity of early development, pace of turnaround and efficiency • Pharmaceutical majors will lower dependence on in-house operations, in order to cut costs and focus on key expertise Cyprotex Confidentia

Market Industry R&D Spending Patterns Annualised % R&D Growth by CROs Annualised % R&D Growth by Big Pharma 2003 2004 2005 • CRO and Biotech companies choose to outsource much early stage R&D, particularly where independent assessment maximises integrity of early development, pace of turnaround and efficiency • Pharmaceutical majors will lower dependence on in-house operations, in order to cut costs and focus on key expertise Cyprotex Confidentia

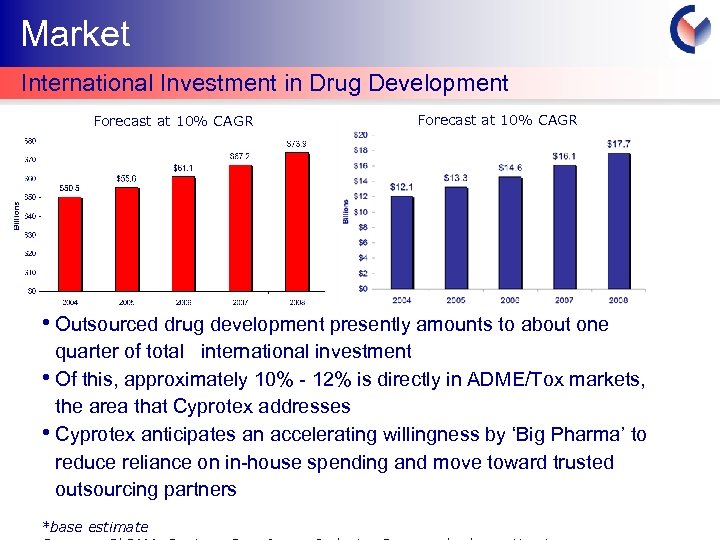

Market International Investment in Drug Development Forecast at 10% CAGR • Outsourced drug development presently amounts to about one quarter of total international investment • Of this, approximately 10% - 12% is directly in ADME/Tox markets, the area that Cyprotex addresses • Cyprotex anticipates an accelerating willingness by ‘Big Pharma’ to reduce reliance on in-house spending and move toward trusted outsourcing partners *base estimate Cyprotex Confidentia

Market International Investment in Drug Development Forecast at 10% CAGR • Outsourced drug development presently amounts to about one quarter of total international investment • Of this, approximately 10% - 12% is directly in ADME/Tox markets, the area that Cyprotex addresses • Cyprotex anticipates an accelerating willingness by ‘Big Pharma’ to reduce reliance on in-house spending and move toward trusted outsourcing partners *base estimate Cyprotex Confidentia

Strategy Strategic Development Services & Software Model – fast track profitability • • • Drive sales of existing services Enormous scope to build turnover of business over next 3 years The worldwide ADME/Tox/screening market in 2005 was worth in excess of $1 bn. This is expected to grow to beyond $2 bn by end-2008. As the industry standard-setter, in terms of service, product, turnaround, reproducibility etc, Cyprotex expects to benefit from a general move toward outsourcing such services by big pharma and the increasing proliferation of biotech development companies Continued revenue growth driven by Cloe® services Pathway to revenue generating business with growing portfolio of clients Cyprotex Confidentia

Strategy Strategic Development Services & Software Model – fast track profitability • • • Drive sales of existing services Enormous scope to build turnover of business over next 3 years The worldwide ADME/Tox/screening market in 2005 was worth in excess of $1 bn. This is expected to grow to beyond $2 bn by end-2008. As the industry standard-setter, in terms of service, product, turnaround, reproducibility etc, Cyprotex expects to benefit from a general move toward outsourcing such services by big pharma and the increasing proliferation of biotech development companies Continued revenue growth driven by Cloe® services Pathway to revenue generating business with growing portfolio of clients Cyprotex Confidentia

High Operational Gearing • • • Major investment phase now complete Significant cash balance remains Very low cost of consumables Break-even at just over 40% of present operational capacity and existing site capable of further significant expansion Significant carried forward tax losses Enlargement of sales force “Increased activity will now drop largely to the bottom line” Cyprotex Confidentia

High Operational Gearing • • • Major investment phase now complete Significant cash balance remains Very low cost of consumables Break-even at just over 40% of present operational capacity and existing site capable of further significant expansion Significant carried forward tax losses Enlargement of sales force “Increased activity will now drop largely to the bottom line” Cyprotex Confidentia

Outlook Key Objectives 2008 • • • Target a positive outcome for 2008 Significantly outpace sector growth as recognised standard-setter industry-wide Broaden Cyprotex’s range of products, services and technologies, both organically and through acquisition Add further downstream value and visibility through integrated drug discovery collaborations Build rapidly upon contribution from the US Expand foothold in Japanese market Cyprotex Confidentia

Outlook Key Objectives 2008 • • • Target a positive outcome for 2008 Significantly outpace sector growth as recognised standard-setter industry-wide Broaden Cyprotex’s range of products, services and technologies, both organically and through acquisition Add further downstream value and visibility through integrated drug discovery collaborations Build rapidly upon contribution from the US Expand foothold in Japanese market Cyprotex Confidentia

Summary • • • Unique, validated and standard-setting industrialscale laboratory testing (Cloe® Screen) supported and integrated predictive software to offer “virtual human” screening Enormous global market opportunity Major investment phase now complete. Strict management has ensured the Group remains cash rich Very highly operationally geared An Ethical investment Cyprotex Confidentia

Summary • • • Unique, validated and standard-setting industrialscale laboratory testing (Cloe® Screen) supported and integrated predictive software to offer “virtual human” screening Enormous global market opportunity Major investment phase now complete. Strict management has ensured the Group remains cash rich Very highly operationally geared An Ethical investment Cyprotex Confidentia

Appendices Cyprotex Confidentia

Appendices Cyprotex Confidentia

Cloe® Integrated Product Offering • • • Industrial Scale testing • A predictive software product now bundled with Cloe® Screen, to offer “virtual human” synthesis Unit cost 1/10 th of competition Complete outsourcing solution, new applications • Annual subscriptions £ 100, 000 to £ 500, 000 p. a. • Target market all drug discovery scientists • Software that predicts pharmacokinetics from chemical structure • Enables pre-screening of compounds that do not yet exist, so only the most promising proceed to development • Complementary to other Cloe® technologies Cyprotex Confidentia

Cloe® Integrated Product Offering • • • Industrial Scale testing • A predictive software product now bundled with Cloe® Screen, to offer “virtual human” synthesis Unit cost 1/10 th of competition Complete outsourcing solution, new applications • Annual subscriptions £ 100, 000 to £ 500, 000 p. a. • Target market all drug discovery scientists • Software that predicts pharmacokinetics from chemical structure • Enables pre-screening of compounds that do not yet exist, so only the most promising proceed to development • Complementary to other Cloe® technologies Cyprotex Confidentia

An Ethical Investment • • • Cyprotex’s in-silico technology is designed to create a “virtual human”. Drugs can be screened within this “virtual human” to test for pharmacokinetics. The evolution of this process will allow drug development to bypass in vivo testing Part of ECVAM (the European Consortium for Validation of Alternative Methods) – designed to demonstrate that in vivo toxicity can be predicted using a combination of in vitro ADME data and cytotoxicity Declared policy on corporate governance and stakeholder management Strict environmental and pollution controls. Cyprotex “engages” with its environment Cyprotex is an Equal Opportunities Employer Cyprotex Confidentia

An Ethical Investment • • • Cyprotex’s in-silico technology is designed to create a “virtual human”. Drugs can be screened within this “virtual human” to test for pharmacokinetics. The evolution of this process will allow drug development to bypass in vivo testing Part of ECVAM (the European Consortium for Validation of Alternative Methods) – designed to demonstrate that in vivo toxicity can be predicted using a combination of in vitro ADME data and cytotoxicity Declared policy on corporate governance and stakeholder management Strict environmental and pollution controls. Cyprotex “engages” with its environment Cyprotex is an Equal Opportunities Employer Cyprotex Confidentia

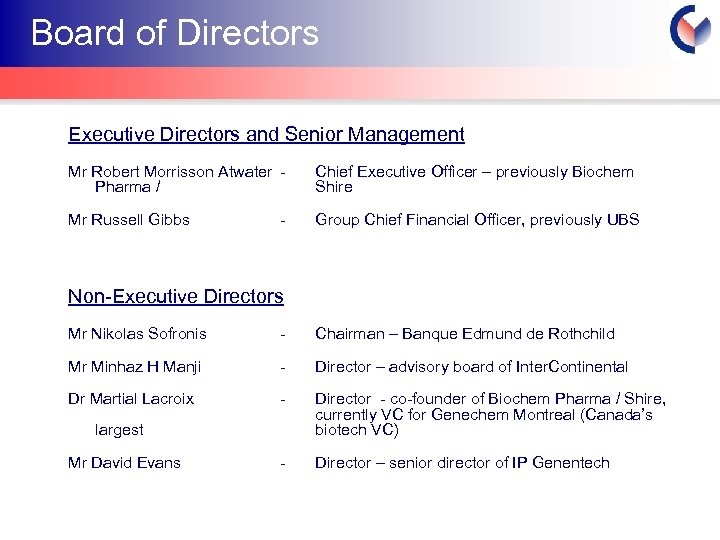

Board of Directors Executive Directors and Senior Management Mr Robert Morrisson Atwater Pharma / Chief Executive Officer – previously Biochem Shire Mr Russell Gibbs Group Chief Financial Officer, previously UBS - Non-Executive Directors Mr Nikolas Sofronis - Chairman – Banque Edmund de Rothchild Mr Minhaz H Manji - Director – advisory board of Inter. Continental Dr Martial Lacroix - Director - co-founder of Biochem Pharma / Shire, currently VC for Genechem Montreal (Canada’s biotech VC) - Director – senior director of IP Genentech largest Mr David Evans Cyprotex Confidentia

Board of Directors Executive Directors and Senior Management Mr Robert Morrisson Atwater Pharma / Chief Executive Officer – previously Biochem Shire Mr Russell Gibbs Group Chief Financial Officer, previously UBS - Non-Executive Directors Mr Nikolas Sofronis - Chairman – Banque Edmund de Rothchild Mr Minhaz H Manji - Director – advisory board of Inter. Continental Dr Martial Lacroix - Director - co-founder of Biochem Pharma / Shire, currently VC for Genechem Montreal (Canada’s biotech VC) - Director – senior director of IP Genentech largest Mr David Evans Cyprotex Confidentia

Cyprotex 15 Beech Lane Macclesfield Cheshire SK 10 2 DR UK info@cyprotex. com www. cyprotex. com Cyprotex Confidentia

Cyprotex 15 Beech Lane Macclesfield Cheshire SK 10 2 DR UK info@cyprotex. com www. cyprotex. com Cyprotex Confidentia