02b5794c735bb63a3b50261722609de1.ppt

- Количество слайдов: 21

CUSTOMS PLANNING FOR A RECESSION John M. Peterson NEVILLE PETERSON LLP New York Washington D. C. Superior Brokerage Services Inc. Eagan, Minnesota November 6, 2008

CUSTOMS PLANNING FOR A RECESSION John M. Peterson NEVILLE PETERSON LLP New York Washington D. C. Superior Brokerage Services Inc. Eagan, Minnesota November 6, 2008

Customs and Supply Chain Planning in a Recession How Bad is It? – Retailers struggling – Smaller orders, placed later – Continuous pricepoint pressure – Weak dollar makes imports more expensive – Credit spending down

Customs and Supply Chain Planning in a Recession How Bad is It? – Retailers struggling – Smaller orders, placed later – Continuous pricepoint pressure – Weak dollar makes imports more expensive – Credit spending down

What does CBP Do in a Recession? “We’re not going anywhere” Increased emphasis on commercial enforcement; Legal mandates to enforce – 10+2, Consumer Product Safety Improvement Act, Lacey Act Amendments More audits; More intellectual property enforcement

What does CBP Do in a Recession? “We’re not going anywhere” Increased emphasis on commercial enforcement; Legal mandates to enforce – 10+2, Consumer Product Safety Improvement Act, Lacey Act Amendments More audits; More intellectual property enforcement

Can You Squeeze Savings Out of Your Supply Chain? Review Customs compliance procedures Interaction With Corporate Internal Audit Interaction with Sarbanes-Oxley programs Don’t depend on the “Merchandise Fairy” “Sorry, the Merchandise Fairy is strictly retail. ”

Can You Squeeze Savings Out of Your Supply Chain? Review Customs compliance procedures Interaction With Corporate Internal Audit Interaction with Sarbanes-Oxley programs Don’t depend on the “Merchandise Fairy” “Sorry, the Merchandise Fairy is strictly retail. ”

Toolbox Item # 1: Documented Procedures and Policies Company should have documented policies for Customs matters; Companies without such policies cannot be scored “highly compliant” Interactive intranet resources should be considered “The right tools for the right job”

Toolbox Item # 1: Documented Procedures and Policies Company should have documented policies for Customs matters; Companies without such policies cannot be scored “highly compliant” Interactive intranet resources should be considered “The right tools for the right job”

Toolbox Item #2: Recordkeeping Program “You’re keeping the records; that’s a start. Now, it would help to organize them” Tariff Act requires import records be retained at least 5 years; “(a)(1)(A)” list items must be kept 5 years under pain of penalty; Customs will approve electronic recordkeeping formats Agree with brokers on document ownership and rights

Toolbox Item #2: Recordkeeping Program “You’re keeping the records; that’s a start. Now, it would help to organize them” Tariff Act requires import records be retained at least 5 years; “(a)(1)(A)” list items must be kept 5 years under pain of penalty; Customs will approve electronic recordkeeping formats Agree with brokers on document ownership and rights

Toolbox Item #3 – Tariff Classification Program Review your products’ classification; Question old rulings; Examine way you design products; Examine way you ship products; Composite good – See GRI 3(B)

Toolbox Item #3 – Tariff Classification Program Review your products’ classification; Question old rulings; Examine way you design products; Examine way you ship products; Composite good – See GRI 3(B)

Toolbox Item #3 – Classification Program Exercise Equipment – or Toy? Suppose you reduce a product’s duty rate from 5% to 1%; That’s a 4% reduction in landed cost; Falls right to the bottom line; or Reduces your price point, drives sales No engineering cost, no compromise of product quality

Toolbox Item #3 – Classification Program Exercise Equipment – or Toy? Suppose you reduce a product’s duty rate from 5% to 1%; That’s a 4% reduction in landed cost; Falls right to the bottom line; or Reduces your price point, drives sales No engineering cost, no compromise of product quality

Toolbox Item # 3 – Classification Program Best of its kind --Now, what is it, exactly? Monitoring classification issues Customs rulings; CIT decisions; Decisions of foreign courts and agencies (e. g. , European BTIs); World Customs Organization decisions and HS changes

Toolbox Item # 3 – Classification Program Best of its kind --Now, what is it, exactly? Monitoring classification issues Customs rulings; CIT decisions; Decisions of foreign courts and agencies (e. g. , European BTIs); World Customs Organization decisions and HS changes

Toolbox Item #4 – Put Your Customs Value on a Diet Customs valuation – follow the money! Is there “fat” in your Customs values? Are you “bundling” non-dutiable items into the price paid for your goods? Can you restructure transactions to save on duties?

Toolbox Item #4 – Put Your Customs Value on a Diet Customs valuation – follow the money! Is there “fat” in your Customs values? Are you “bundling” non-dutiable items into the price paid for your goods? Can you restructure transactions to save on duties?

Toolbox Item #4 – Put Your Customs Values on a Diet tips: Unbundle buying commissions, nondutiable royalties, etc. from price; Examine use of “first sale” valuation rule; Turn middlemen into buying agents Use “American Goods Returned”, 9802. 00. 80, other programs

Toolbox Item #4 – Put Your Customs Values on a Diet tips: Unbundle buying commissions, nondutiable royalties, etc. from price; Examine use of “first sale” valuation rule; Turn middlemen into buying agents Use “American Goods Returned”, 9802. 00. 80, other programs

Toolbox Item # 5 (A, B, C, etc. ); Special Trade Programs Which special trade programs does your company use? Which programs should you use? A separate compliance module should be established for each such program Another load of NAFTA goods arriving – assuming you can prove it!

Toolbox Item # 5 (A, B, C, etc. ); Special Trade Programs Which special trade programs does your company use? Which programs should you use? A separate compliance module should be established for each such program Another load of NAFTA goods arriving – assuming you can prove it!

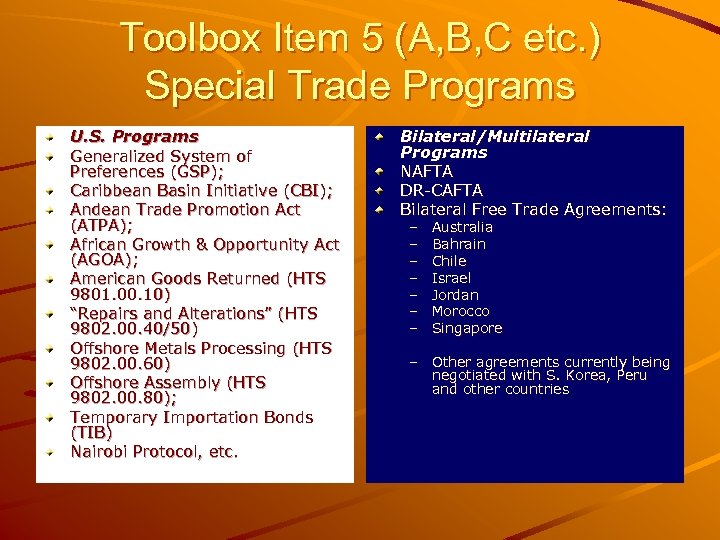

Toolbox Item 5 (A, B, C etc. ) Special Trade Programs U. S. Programs Generalized System of Preferences (GSP); Caribbean Basin Initiative (CBI); Andean Trade Promotion Act (ATPA); African Growth & Opportunity Act (AGOA); American Goods Returned (HTS 9801. 00. 10) “Repairs and Alterations” (HTS 9802. 00. 40/50) Offshore Metals Processing (HTS 9802. 00. 60) Offshore Assembly (HTS 9802. 00. 80); Temporary Importation Bonds (TIB) Nairobi Protocol, etc. Bilateral/Multilateral Programs NAFTA DR-CAFTA Bilateral Free Trade Agreements: – – – – Australia Bahrain Chile Israel Jordan Morocco Singapore – Other agreements currently being negotiated with S. Korea, Peru and other countries

Toolbox Item 5 (A, B, C etc. ) Special Trade Programs U. S. Programs Generalized System of Preferences (GSP); Caribbean Basin Initiative (CBI); Andean Trade Promotion Act (ATPA); African Growth & Opportunity Act (AGOA); American Goods Returned (HTS 9801. 00. 10) “Repairs and Alterations” (HTS 9802. 00. 40/50) Offshore Metals Processing (HTS 9802. 00. 60) Offshore Assembly (HTS 9802. 00. 80); Temporary Importation Bonds (TIB) Nairobi Protocol, etc. Bilateral/Multilateral Programs NAFTA DR-CAFTA Bilateral Free Trade Agreements: – – – – Australia Bahrain Chile Israel Jordan Morocco Singapore – Other agreements currently being negotiated with S. Korea, Peru and other countries

Toolbox Item #6 – Special Duties and Quotas/TRQs Defensive Tools: Antidumping or Countervailing Duties – do they affect your imports? Are you aware of scope issues? Are you aware of how duties are imposed? Do you obligate vendors to cooperate with AD/CVD investigations? Do you have an “escape clause” in your contract? DANGER: Could lead to a “Brush” with Antidumping Duties

Toolbox Item #6 – Special Duties and Quotas/TRQs Defensive Tools: Antidumping or Countervailing Duties – do they affect your imports? Are you aware of scope issues? Are you aware of how duties are imposed? Do you obligate vendors to cooperate with AD/CVD investigations? Do you have an “escape clause” in your contract? DANGER: Could lead to a “Brush” with Antidumping Duties

Toolbox Item #6 – Special Duties and Quotas/TRQs Lucky Charms – Magically Expensive, Duty-Wise Quotas/TRQs: Do you import any products subject to absolute quotas (e. g. , textiles or apparel)? Do you import goods subject to TRQ (mostly agricultural)? Are you certain of classification? Are you certain you have proper documents?

Toolbox Item #6 – Special Duties and Quotas/TRQs Lucky Charms – Magically Expensive, Duty-Wise Quotas/TRQs: Do you import any products subject to absolute quotas (e. g. , textiles or apparel)? Do you import goods subject to TRQ (mostly agricultural)? Are you certain of classification? Are you certain you have proper documents?

Toolbox Item # 7: Duty Drawback and FTZs Do you have drawback -eligible export activity? Is it manufacturing or unused merchandise drawback? MPFs, HMTs now eligible for unused merchandise drawback; 3 years from date of export to claim Drawback can turn you around A bit – but can be worth it

Toolbox Item # 7: Duty Drawback and FTZs Do you have drawback -eligible export activity? Is it manufacturing or unused merchandise drawback? MPFs, HMTs now eligible for unused merchandise drawback; 3 years from date of export to claim Drawback can turn you around A bit – but can be worth it

Toolbox Item # 8: FTZs, Bonded Warehouses Allow deferral of duty payments; Avoidance of duty payments for exported goods; “Inverted tariff” benefits for manufactured goods; Merchandise processing fee savings

Toolbox Item # 8: FTZs, Bonded Warehouses Allow deferral of duty payments; Avoidance of duty payments for exported goods; “Inverted tariff” benefits for manufactured goods; Merchandise processing fee savings

Toolbox Item #9: Protect Your Intellectual Property Counterfeits, knockoffs and gray market goods increase in recessions; You can record your trademark with Customs for import protection from infringing goods; Customs will seize, forefeit and destroy counterfeits – and penalize the importers

Toolbox Item #9: Protect Your Intellectual Property Counterfeits, knockoffs and gray market goods increase in recessions; You can record your trademark with Customs for import protection from infringing goods; Customs will seize, forefeit and destroy counterfeits – and penalize the importers

Toolbox Item #8 – Protecting Intellectual Property Funny hat. Serious business. Section 337 of the Tariff Act – the nuclear weapon of International Trade Following ITC investigation, Customs will exclude goods which infringe patents and other IP rights.

Toolbox Item #8 – Protecting Intellectual Property Funny hat. Serious business. Section 337 of the Tariff Act – the nuclear weapon of International Trade Following ITC investigation, Customs will exclude goods which infringe patents and other IP rights.

Toolbox Item 9: Exports Weak US dollar makes US goods attractive overseas; Most foreign countries use Customs laws similar to those in US; You can leverage your US knowledge base overseas

Toolbox Item 9: Exports Weak US dollar makes US goods attractive overseas; Most foreign countries use Customs laws similar to those in US; You can leverage your US knowledge base overseas

Recessions Stink: Use the Time Well Examine all aspects of the supply chain critically; Look for savings in Customs duties; Protect your Intellectual Property; Look to the past for savings, while planning for the future. Chill – it’ll get better

Recessions Stink: Use the Time Well Examine all aspects of the supply chain critically; Look for savings in Customs duties; Protect your Intellectual Property; Look to the past for savings, while planning for the future. Chill – it’ll get better