97f3cfb0082e1d0a128201bf4a7e2bb2.ppt

- Количество слайдов: 40

Customs & Border Modernization, Trade Facilitation and Technology Markus A. Werling, Vice President SAP AG, IBU Public Sector Michael C. Eads, VP Marketing/Board Member Tatis S. A.

Summary of SAP Today SAP AG in 2005 revenues: € 8. 5 billion n More than 32, 000 companies run SAP software n Providing more than 25 industry solutions n 35, 873 SAP employees (Dec, 2005) 12 million users in 120+ countries team with us to… n Integrate their business processes n Extend their competitive capabilities n Get a better return on investment at a lower total cost of ownership Unique partner ecosystem n More than 1, 600 partners n Overall more than 180, 000 SAP partner certificates ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 2

Summary of TATIS Today TATIS SA was founded in Switzerland in 2000 n developed a comprehensive customs management system application suite n The TATIS business strategy is to develop alliances with global technology and business partners Solution of TATIS SA n TATIScms V 1. 01 is a modular customs management system that incorporates methodologies, business applications, tools and best practices: – Designed to address revenue and trade compliance, enforcement and trade facilitation – Risk-centric – Based on intervention by exception – WCO/ WTO aligned (ACV, Kyoto, UCR, SAD) ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 3

e slid title e n th i ure pict a for e mpl sa Customs & Border Modernization TATIS/SAP Solution Offering: Overview & Demo Luxembourg Project Highlights & Lessons Learned to Date Wrap up and Discussion

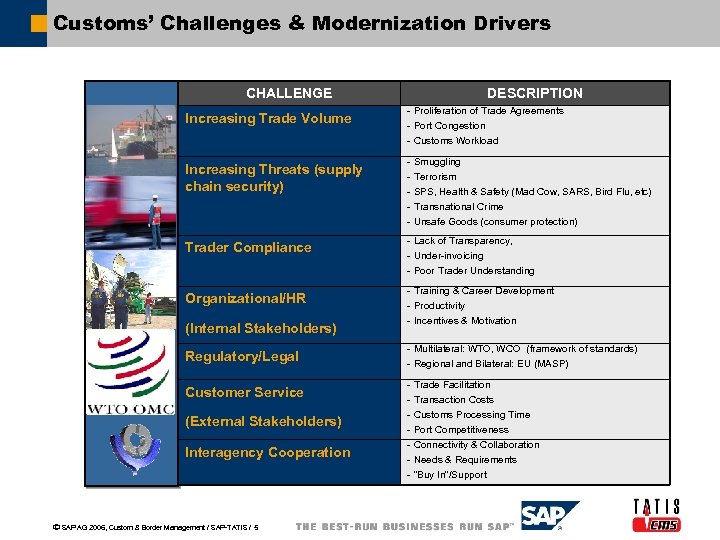

Customs’ Challenges & Modernization Drivers CHALLENGE Increasing Trade Volume Increasing Threats (supply chain security) Trader Compliance Organizational/HR (Internal Stakeholders) Regulatory/Legal Customer Service (External Stakeholders) Interagency Cooperation ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 5 DESCRIPTION - Proliferation of Trade Agreements - Port Congestion - Customs Workload - Smuggling - Terrorism - SPS, Health & Safety (Mad Cow, SARS, Bird Flu, etc) - Transnational Crime - Unsafe Goods (consumer protection) - Lack of Transparency, - Under-invoicing - Poor Trader Understanding - Training & Career Development - Productivity - Incentives & Motivation - Multilateral: WTO, WCO (framework of standards) - Regional and Bilateral: EU (MASP) - Trade Facilitation - Transaction Costs - Customs Processing Time - Port Competitiveness - Connectivity & Collaboration - Needs & Requirements - “Buy In”/Support

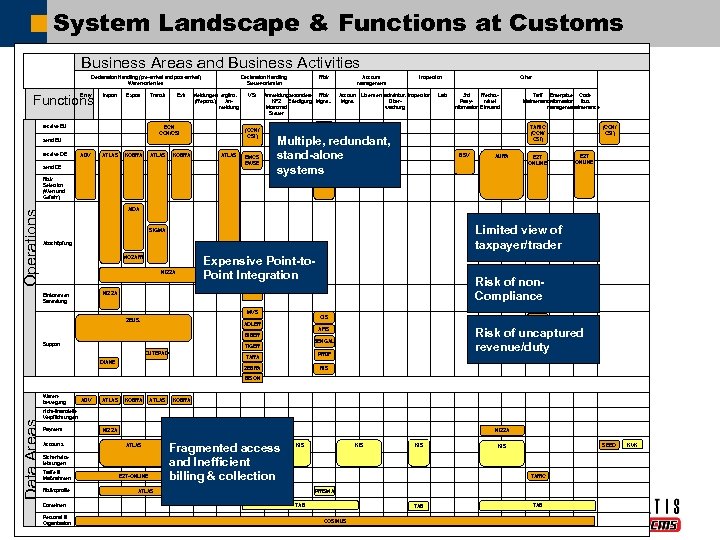

System Landscape & Functions at Customs Business Areas and Business Activities Declaration Handling (pre-arrival and post-arrival) Waren-orientiert Entry Functions Import Export Transit receive EU Exit Declaration Handling Steuer-orientiert Meldungen ergänz. (Reports) Anmeldung ECN CCN/CSI (CCN/ CSI) send EU receive DE AÜV ATLAS KOBRA VSt ATLAS send DE EMCS EWSE Risk Anmeldungbesondere Risk KFZ Erledigung Mgmt. . Motrorrad Steuer Account management Inspection Account Lizenzen administr. Inspection Mgmt. Überwachung Lab Other 3 rd Rechts. Partymittel information Einwand (CCN/ CSI) Tarif Enterprise Code Maintenance information lists management maintenance (CCN/ CSI) TARIC (CCN/ CSI) Multiple, redundant, RAMSES stand-alone systems BSV AURA EZT ONLINE Operations Risk Selection (Wert und Gefahr) AIDA Limited view of taxpayer/trader SIGMA Abschöpfung MOZART NIZZA Expensive Point-to. Point Integration Risk of non. NIZZA Compliance NIZZA Einkommen Sammlung MVS ZEUS. CIS ADLER BIBER Support TARIC EBTI Risk of uncaptured QUOTA revenue/duty AFIS BENGALI TIGER CUTEPAD PRÜF TARA DIANE ZEBRA RIS BISON Data Areas Warenbewegung AÜV ATLAS KOBRA nicht-finanzielle Verpflichtungen Payment Accounts NIZZA ATLAS Sicherheitsleistungen Tarife & Maßnahmen Risikoprofile EZT-ONLINE ATLAS Fragmented access and Inefficient EZTbilling & collection ONLINE ATLAS KIS ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 6 KIS SEED KIS TARIC ATLAS Domeinen Personal & Organisation NIZZA KIS PRISMA TAB COSINUS TAB KVK

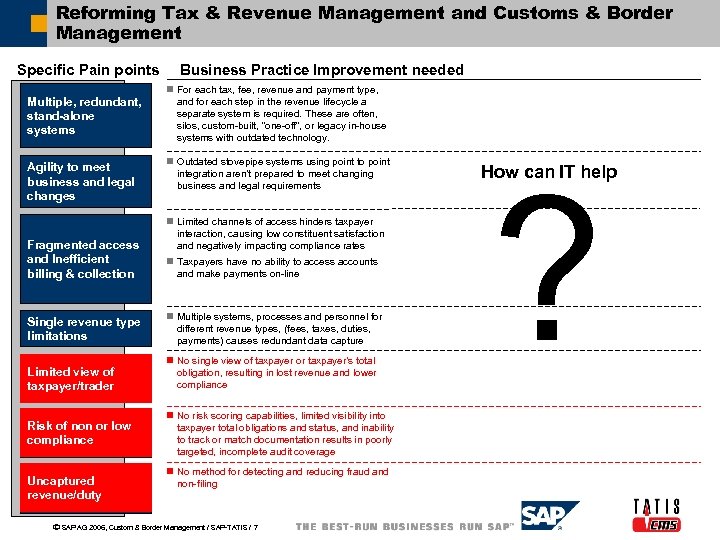

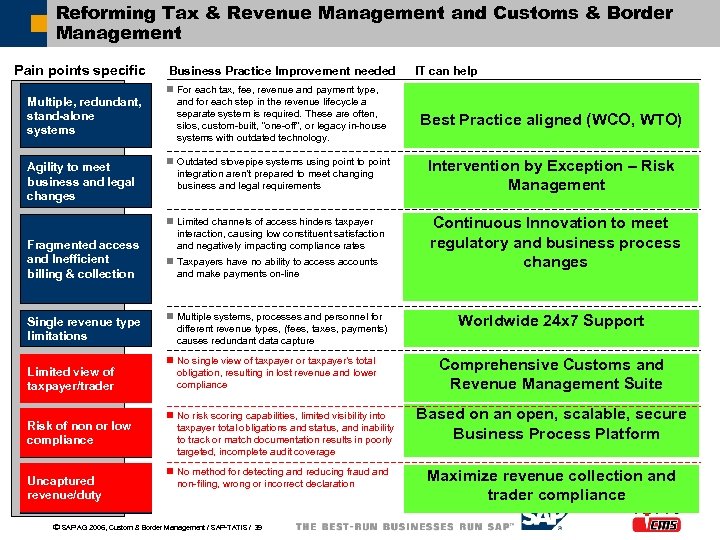

Reforming Tax & Revenue Management and Customs & Border Management Specific Pain points Multiple, redundant, stand-alone systems Agility to meet business and legal changes Fragmented access and Inefficient billing & collection Business Practice Improvement needed n For each tax, fee, revenue and payment type, and for each step in the revenue lifecycle a separate system is required. These are often, silos, custom-built, “one-off”, or legacy in-house systems with outdated technology. n Outdated stovepipe systems using point to point integration aren’t prepared to meet changing business and legal requirements n Limited channels of access hinders taxpayer interaction, causing low constituent satisfaction and negatively impacting compliance rates n Taxpayers have no ability to access accounts and make payments on-line Single revenue type limitations n Multiple systems, processes and personnel for different revenue types, (fees, taxes, duties, payments) causes redundant data capture Limited view of taxpayer/trader n No single view of taxpayer or taxpayer’s total obligation, resulting in lost revenue and lower compliance Risk of non or low Low compliance Uncaptured revenue/duty n No risk scoring capabilities, limited visibility into taxpayer total obligations and status, and inability to track or match documentation results in poorly targeted, incomplete audit coverage n No method for detecting and reducing fraud and non-filing ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 7 ? How can IT help

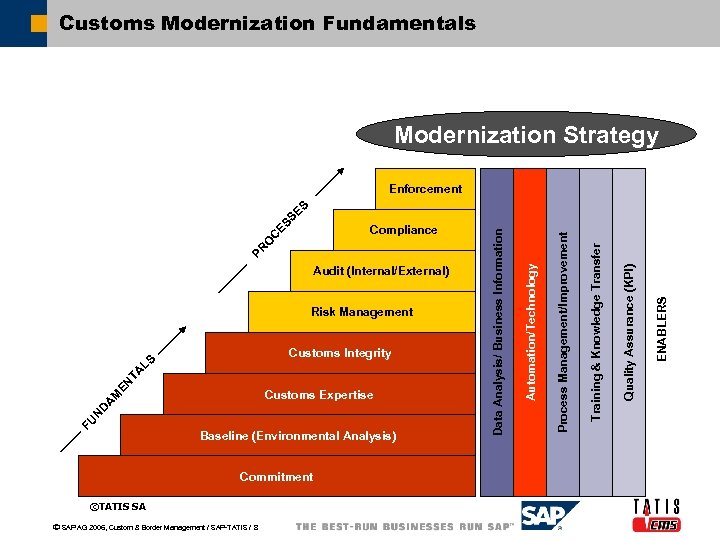

Customs Modernization Fundamentals Modernization Strategy FU N D A M Customs Expertise Baseline (Environmental Analysis) Commitment ©TATIS SA ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 8 ENABLERS Quality Assurance (KPI) EN TA LS Customs Integrity Training & Knowledge Transfer Risk Management Process Management/Improvement Audit (Internal/External) Automation/Technology PR O C Compliance Data Analysis/ Business Information ES SE S Enforcement

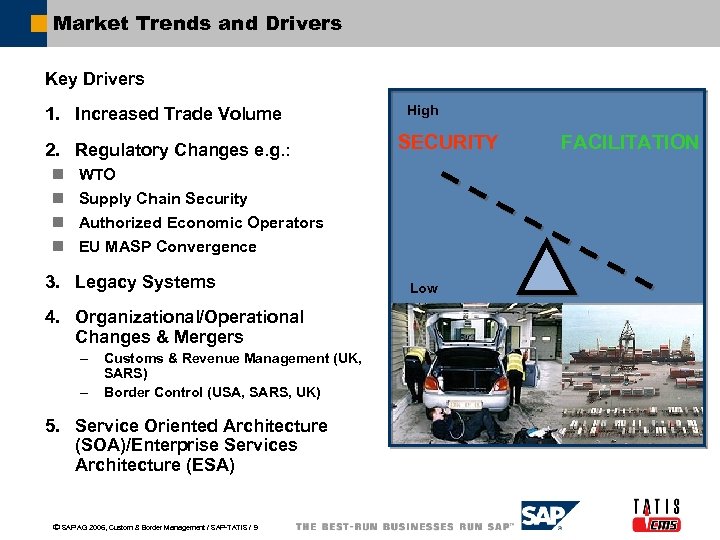

Market Trends and Drivers Key Drivers 1. Increased Trade Volume 2. Regulatory Changes e. g. : n n High SECURITY WTO Supply Chain Security Authorized Economic Operators EU MASP Convergence 3. Legacy Systems 4. Organizational/Operational Changes & Mergers – – Customs & Revenue Management (UK, SARS) Border Control (USA, SARS, UK) 5. Service Oriented Architecture (SOA)/Enterprise Services Architecture (ESA) ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 9 Low FACILITATION

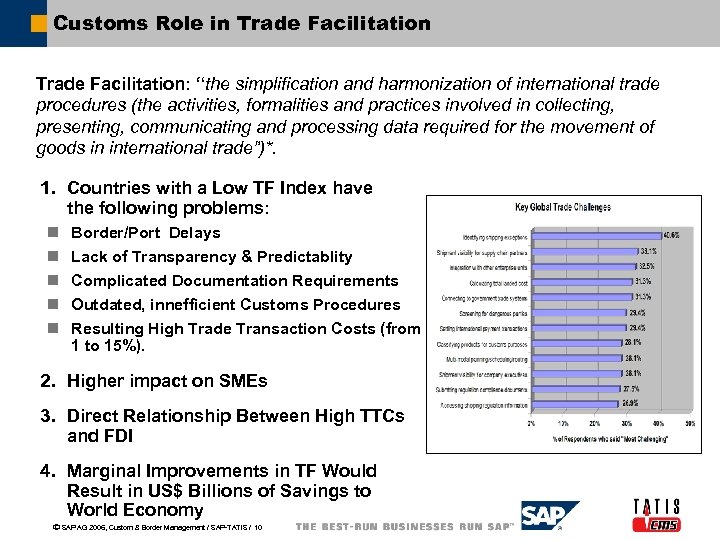

Customs Role in Trade Facilitation: “the simplification and harmonization of international trade procedures (the activities, formalities and practices involved in collecting, presenting, communicating and processing data required for the movement of goods in international trade”)*. 1. Countries with a Low TF Index have the following problems: n n n Border/Port Delays Lack of Transparency & Predictablity Complicated Documentation Requirements Outdated, innefficient Customs Procedures Resulting High Trade Transaction Costs (from 1 to 15%). 2. Higher impact on SMEs 3. Direct Relationship Between High TTCs and FDI 4. Marginal Improvements in TF Would Result in US$ Billions of Savings to World Economy ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 10

e slid title e n th i ure pict a for e mpl sa Customs & Border Modernization TATIS/SAP Solution Offering: Overview & Demo Luxembourg Project Highlights & Lessons Learned to Date Wrap up and Discussion

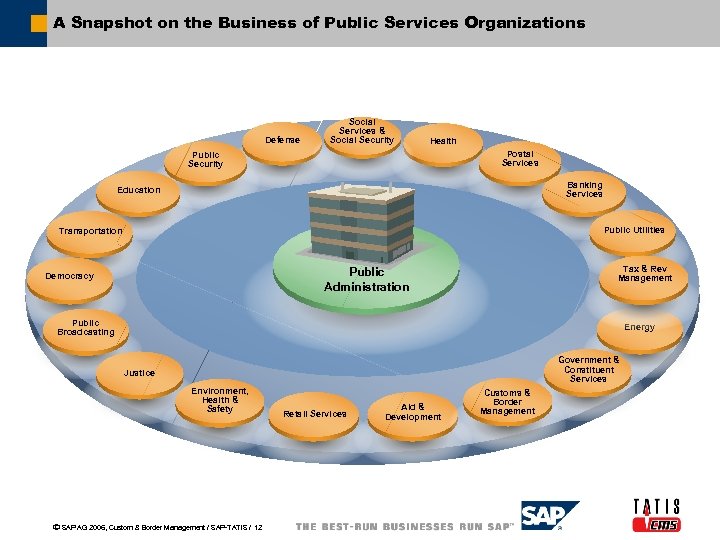

A Snapshot on the Business of Public Services Organizations Defense Social Services & Social Security Health Postal Services Public Security Banking Services Education Public Utilities Transportation Tax & Rev Management Public Administration Democracy Public Broadcasting Energy Government & Constituent Services Justice Environment, Health & Safety ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 12 Retail Services Aid & Development Customs & Border Management

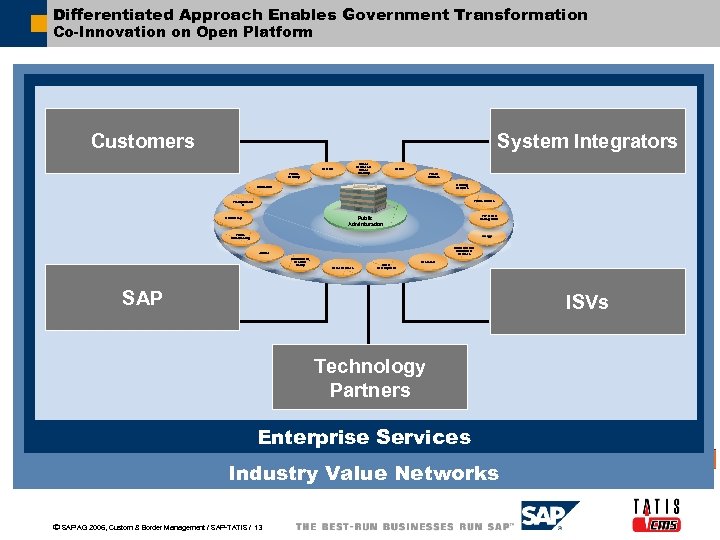

Differentiated Approach Enables Government Transformation Co-Innovation on Open Platform Customers System Integrators Social Services & Social Security Defense Public Security Health Postal Services Banking Services Education Public Utilities Transportatio n Tax & Rev Management Public Administration Democracy Public Broadcasting Energy Government & Constituent Services Justice Environment, Health & Safety Retail Services Aid & Development Research SAP ISVs Technology Partners Enterprise Services Industry Value Networks ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 13

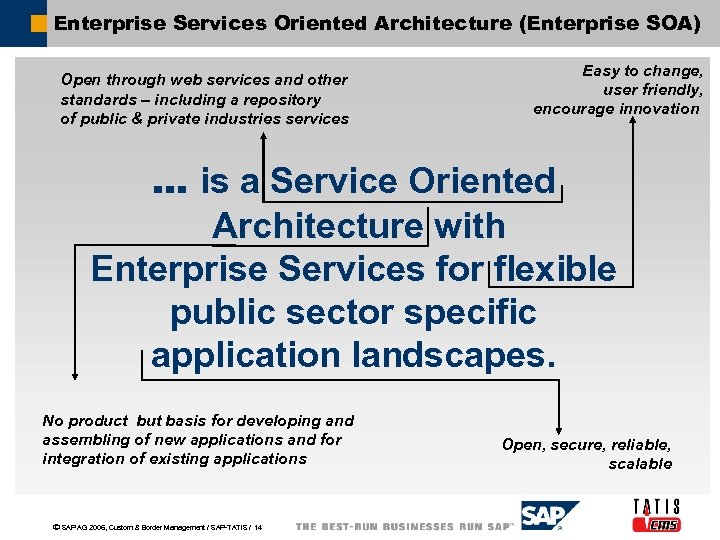

Enterprise Services Oriented Architecture (Enterprise SOA) Open through web services and other standards – including a repository of public & private industries services Easy to change, user friendly, encourage innovation … is a Service Oriented Architecture with Enterprise Services for flexible public sector specific application landscapes. No product but basis for developing and assembling of new applications and for integration of existing applications ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 14 Open, secure, reliable, scalable

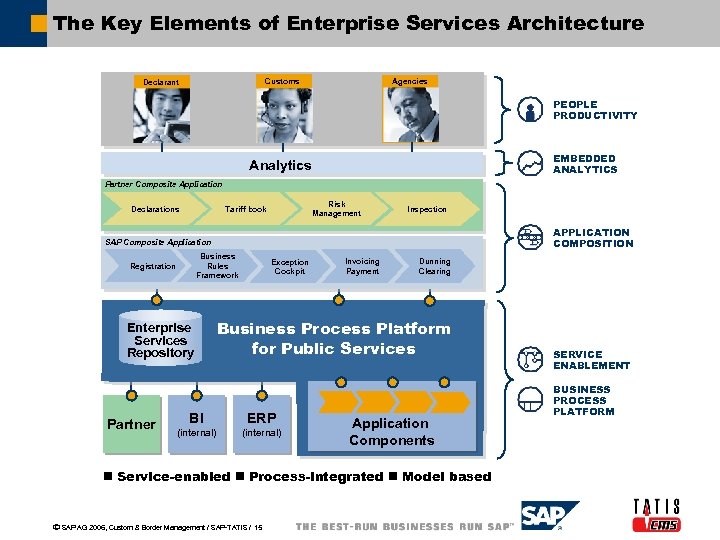

The Key Elements of Enterprise Services Architecture Agencies Customs Declarant PEOPLE PRODUCTIVITY EMBEDDED ANALYTICS Analytics Partner Composite Application Declarations Risk Management Tariff book Inspection APPLICATION COMPOSITION SAP Composite Application Business Rules Framework Registration Enterprise Services Repository Partner Exception Cockpit Invoicing Payment Dunning Clearing Business Process Platform for Public Services BI ERP (internal) Application Components n Service-enabled n Process-integrated n Model based ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 15 SERVICE ENABLEMENT BUSINESS PROCESS PLATFORM

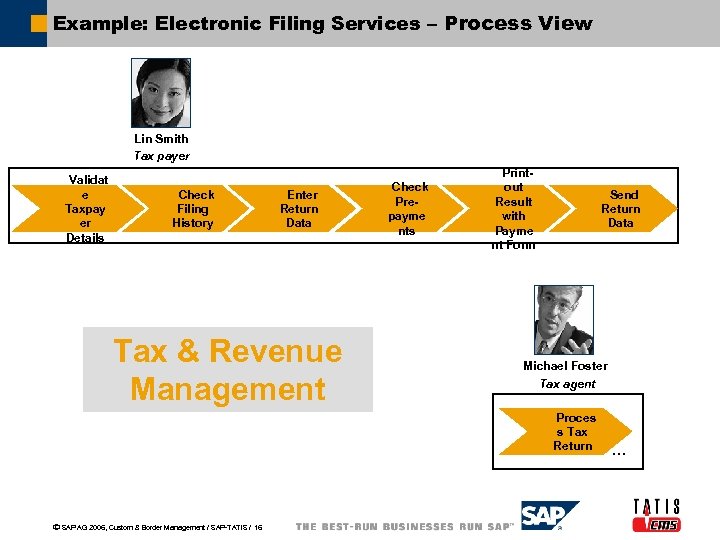

Example: Electronic Filing Services – Process View Lin Smith Tax payer Validat e Taxpay er Details Check Filing History Enter Return Data Tax & Revenue Management Check Prepayme nts Printout Result with Payme nt Form Send Return Data Michael Foster Tax agent Proces s Tax Return ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 16 …

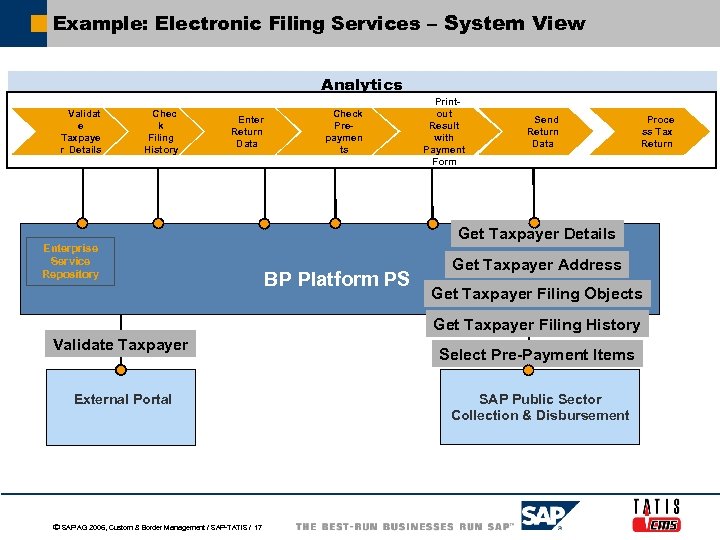

Example: Electronic Filing Services – System View Analytics Validat e Taxpaye r Details Chec k Filing History Enter Return Data Enterprise Service Repository Check Prepaymen ts Printout Result with Payment Form Send Return Data Proce ss Tax Return Get Taxpayer Details BP Platform PS Get Taxpayer Address Get Taxpayer Filing Objects Get Taxpayer Filing History Validate Taxpayer External Portal ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 17 Select Pre-Payment Items SAP Public Sector Collection & Disbursement

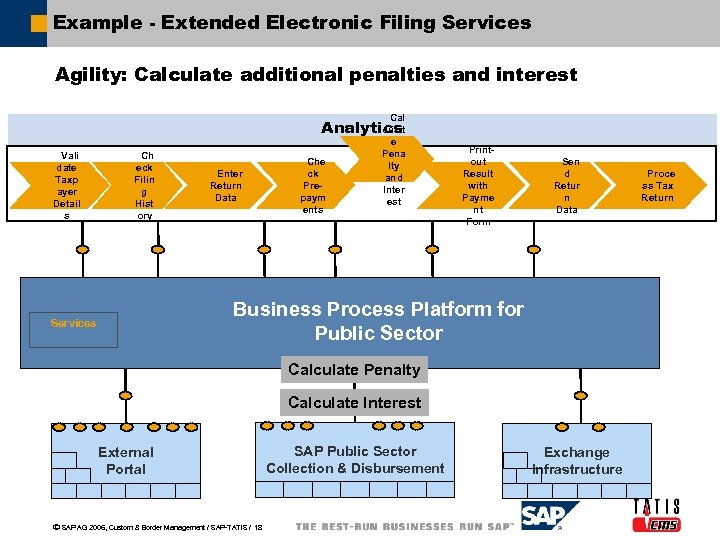

Example - Extended Electronic Filing Services Agility: Calculate additional penalties and interest Cal Analytics culat Vali date Taxp ayer Detail s Ch eck Filin g Hist ory Enter Return Data Che ck Prepaym ents e Pena lty and Inter est Printout Result with Payme nt Form Sen d Retur n Data Business Process Platform for Public Sector Services Calculate Penalty Calculate Interest External Portal ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 18 SAP Public Sector Collection & Disbursement Exchange Infrastructure Proce ss Tax Return

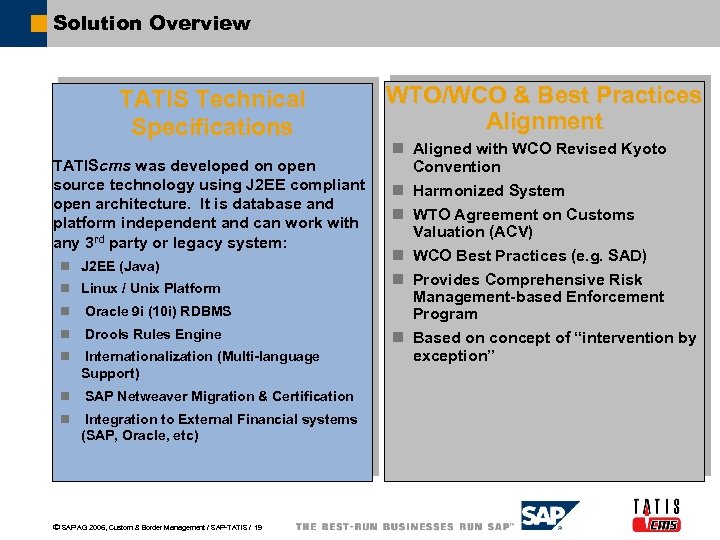

Solution Overview TATIS Technical Specifications TATIScms was developed on open source technology using J 2 EE compliant open architecture. It is database and platform independent and can work with any 3 rd party or legacy system: n J 2 EE (Java) n Linux / Unix Platform n Oracle 9 i (10 i) RDBMS n Drools Rules Engine n Internationalization (Multi-language Support) n SAP Netweaver Migration & Certification n Integration to External Financial systems (SAP, Oracle, etc) ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 19 WTO/WCO & Best Practices Alignment n Aligned with WCO Revised Kyoto Convention n Harmonized System n WTO Agreement on Customs Valuation (ACV) n WCO Best Practices (e. g. SAD) n Provides Comprehensive Risk Management-based Enforcement Program n Based on concept of “intervention by exception”

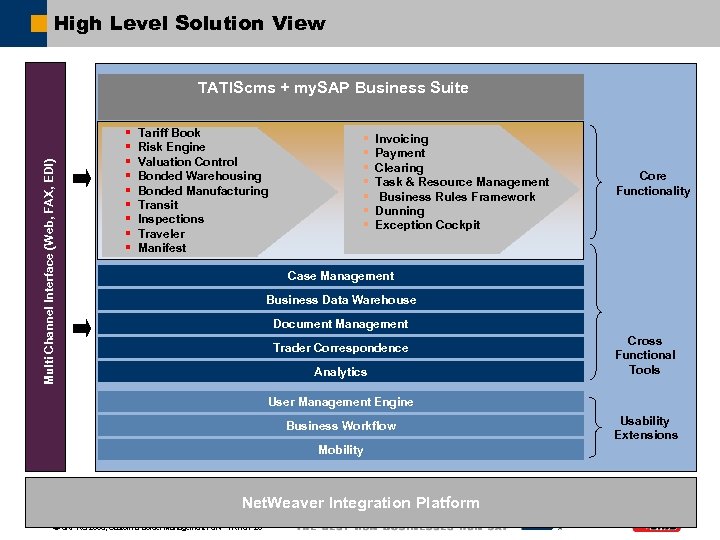

High Level Solution View Multi Channel Interface (Web, FAX, EDI) TATIScms + my. SAP Business Suite § § § § § Tariff Book Risk Engine Valuation Control Bonded Warehousing Bonded Manufacturing Transit Inspections Traveler Manifest § § § § Invoicing Payment Clearing Task & Resource Management Business Rules Framework Dunning Exception Cockpit Core Functionality Case Management Business Data Warehouse Document Management Trader Correspondence Analytics Cross Functional Tools User Management Engine Business Workflow Mobility Net. Weaver Integration Platform ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 20 Usability Extensions

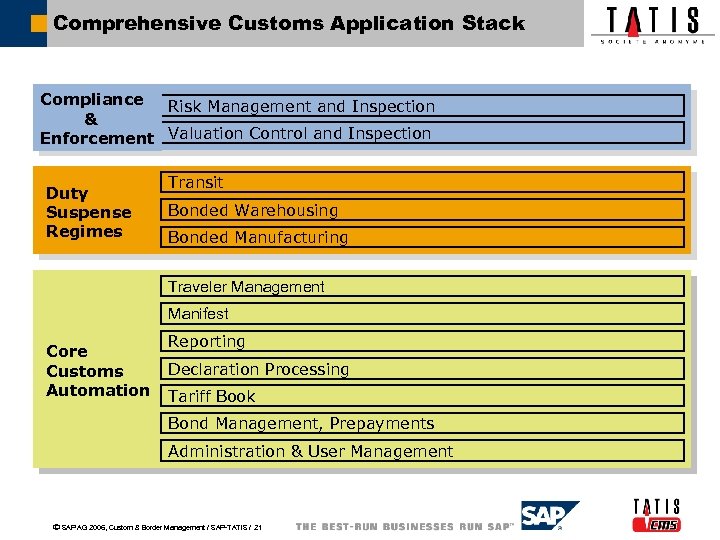

Comprehensive Customs Application Stack Compliance Risk Management and Inspection & Enforcement Valuation Control and Inspection Duty Suspense Regimes Transit Bonded Warehousing Bonded Manufacturing Traveler Management Manifest Core Customs Automation Reporting Declaration Processing Tariff Book Bond Management, Prepayments Administration & User Management ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 21

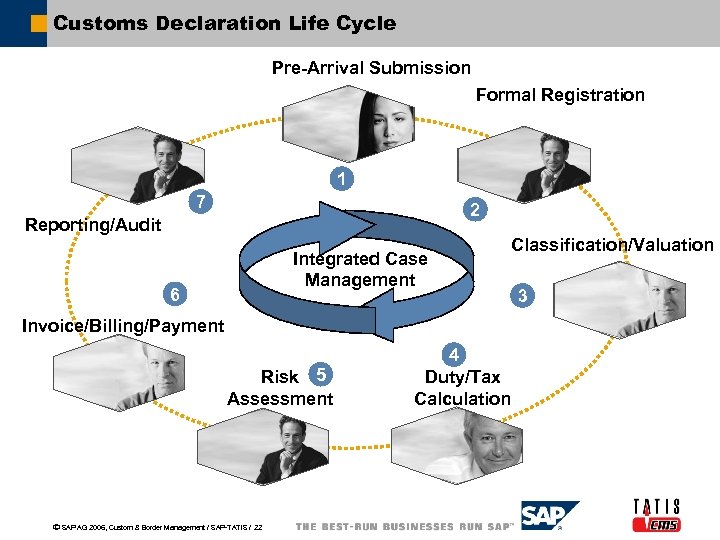

Customs Declaration Life Cycle Pre-Arrival Submission Formal Registration 1 7 2 Reporting/Audit Integrated Case Management 6 Invoice/Billing/Payment Risk 5 Assessment ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 22 4 Duty/Tax Calculation Classification/Valuation 3

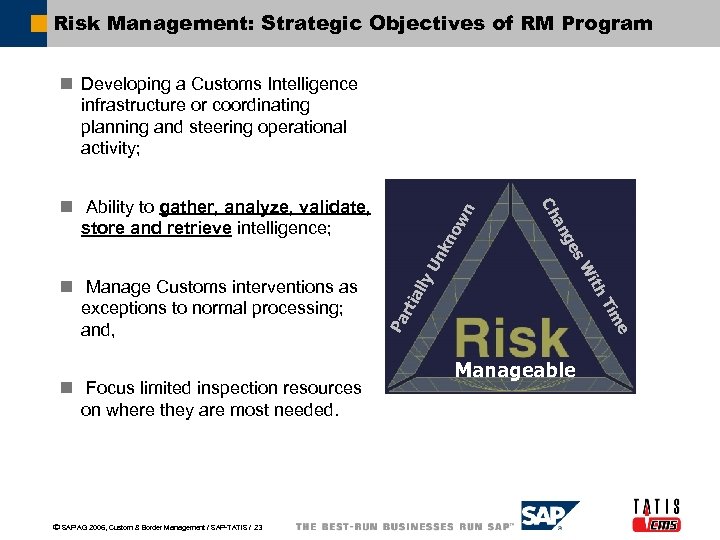

Risk Management: Strategic Objectives of RM Program n Developing a Customs Intelligence infrastructure or coordinating planning and steering operational activity; y. U nk no wn e Pa Tim rti all ith s. W ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 23 ge n Focus limited inspection resources on where they are most needed. an n Manage Customs interventions as exceptions to normal processing; and, Ch n Ability to gather, analyze, validate, store and retrieve intelligence; Manageable

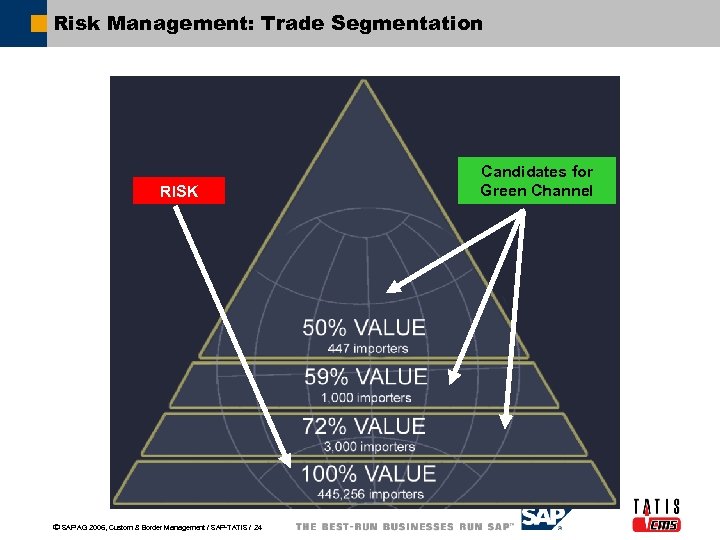

Risk Management: Trade Segmentation RISK ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 24 Candidates for Green Channel

Risk Management Program Overview Building the Foundation Workload Analysis Drives Key Policy Decisions Related to Risk: n Identify Primary Focus Industries n Establish Trade Priority Issues n Focus on Largest Importers n Develop Account Management Strategy n Strengthen Partnerships with Compliant Traders and Service Providers n Initiate Legislative Program Reforms if Necessary ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 25

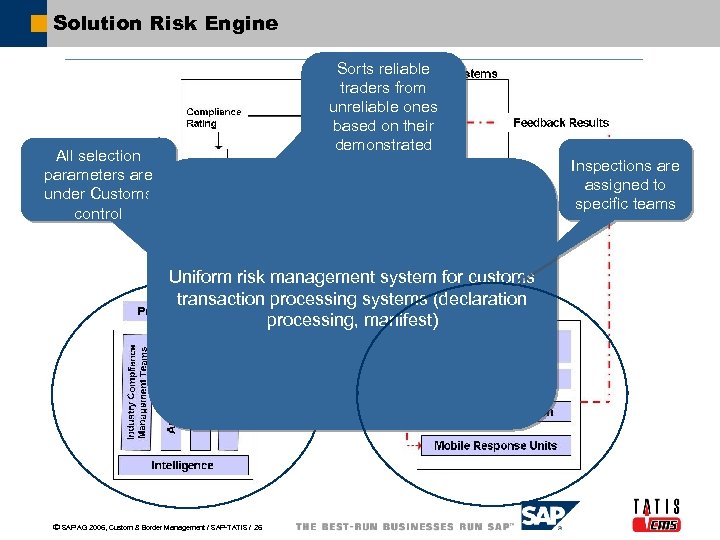

Solution Risk Engine Sorts reliable traders from unreliable ones based on their demonstrated compliance over time All selection parameters are under Customs control Uniform risk management system for customs transaction processing systems (declaration processing, manifest) ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 26 Inspections are assigned to specific teams

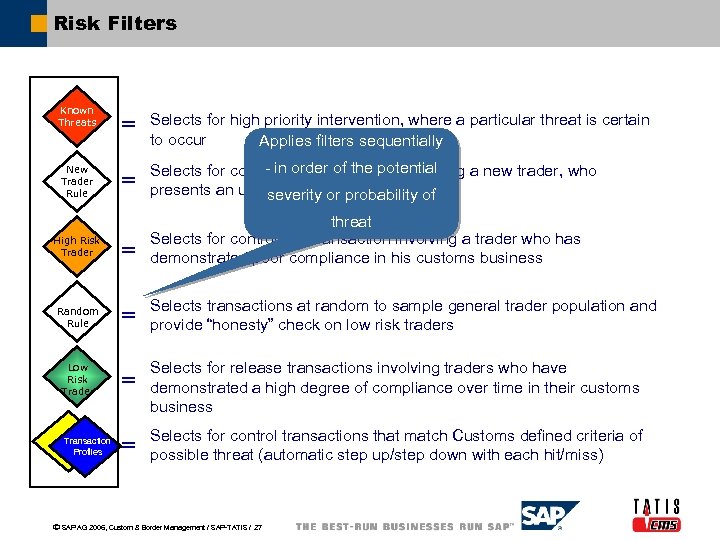

Risk Filters Known Threats New Trader Rule = Selects for high priority intervention, where a particular threat is certain to occur Applies filters sequentially = - in order of the potential Selects for control any transactions involving a new trader, who presents an unknown threatprobability of severity or High Risk Trader = threat Selects for control any transaction involving a trader who has demonstrated poor compliance in his customs business Random Rule = Selects transactions at random to sample general trader population and provide “honesty” check on low risk traders = Selects for release transactions involving traders who have demonstrated a high degree of compliance over time in their customs business = Selects for control transactions that match Customs defined criteria of possible threat (automatic step up/step down with each hit/miss) Low Risk Trader Transaction Profiles ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 27

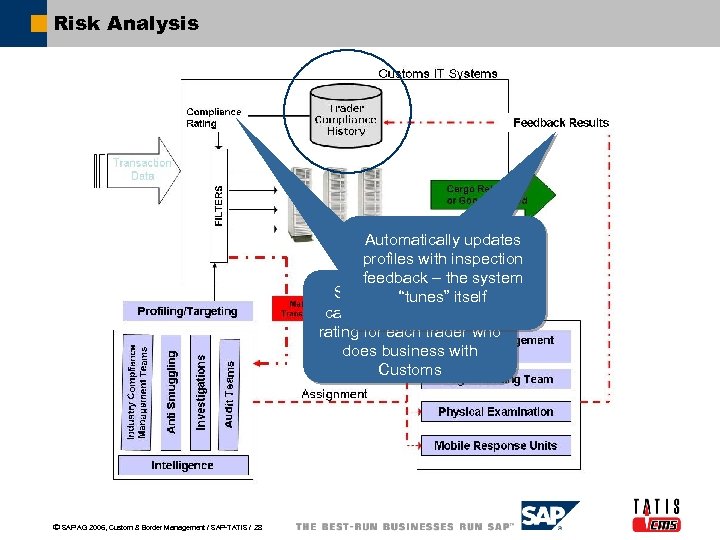

Risk Analysis Automatically updates profiles with inspection feedback – the system System automatically “tunes” itself calculates a compliance rating for each trader who does business with Customs ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 28

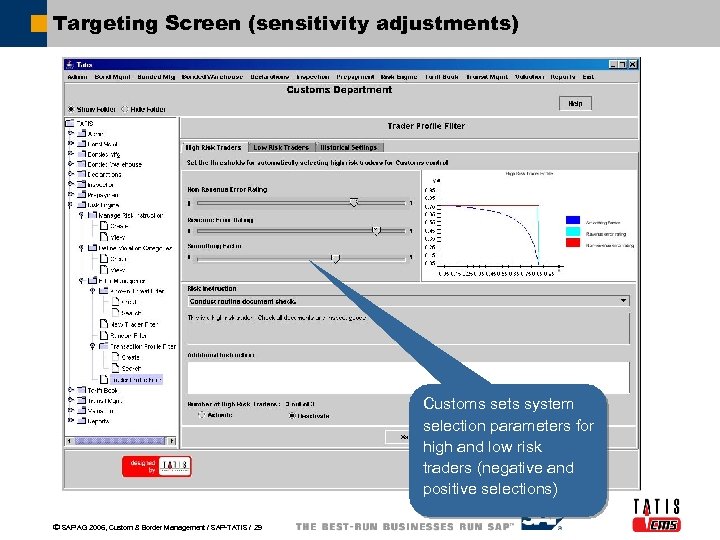

Targeting Screen (sensitivity adjustments) Customs sets system selection parameters for high and low risk traders (negative and positive selections) ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 29

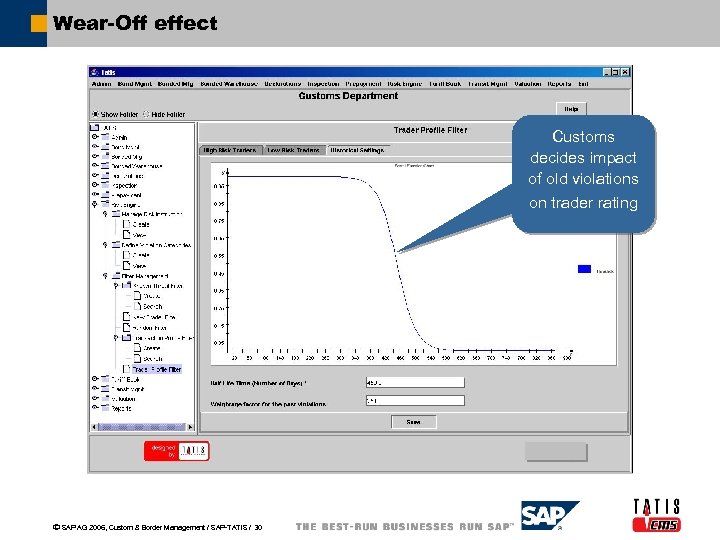

Wear-Off effect Customs decides impact of old violations on trader rating ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 30

Valuation Control: Objectives n Prevent tax loss from under-valuation, false invoicing and Customs fraud in general n Collect price data of “identical or similar” goods needed for Customs valuation purposes (i. e. , valuation under methods 2 or 3, audit support, validation of related party prices, etc. ) n Identify operations or traders that may require audit or investigation n Prevent evasion of hard currency controls through overvaluation n Ensure accuracy of external trade statistics ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 31

Valuation Control: Design Features n Allows Customs to obtain product data from importers at the level of detail required to make valid price comparisons n Allows Customs to target imports that present high risk of undervaluation (“reasons to doubt”), and deliver a control message to Customs valuation examiner n Allows the Customs examiner to analyze declared prices against historic data, and adjust for different trade levels, currency fluctuation, mode of transport, and other WTO-allowed factors n Automatically builds an in-country, price database, accessible by Customs managers, of good and bad prices for analysis, creation of risk profiles, planning, etc. ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 32

e slid title e n th i ure pict a for e mpl sa Customs & Border Modernization TATIS/SAP Solution Offering: Overview & Demo Luxembourg Project Highlights & Lessons Learned to Date Wrap up and Discussion

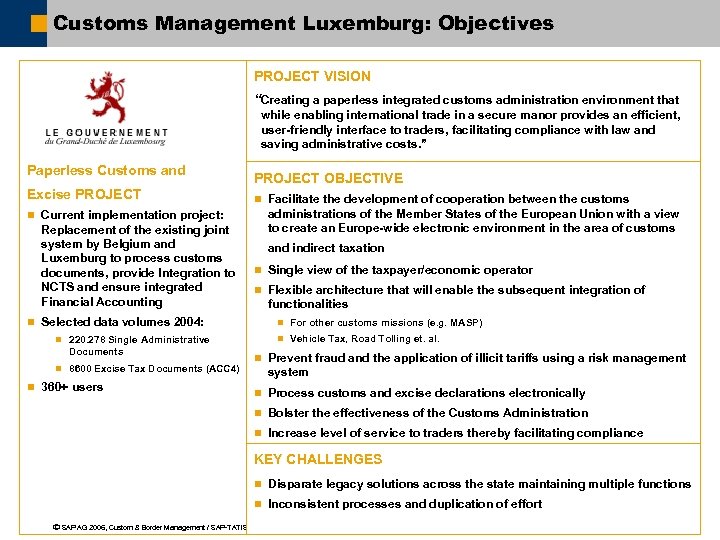

Customs Management Luxemburg: Objectives PROJECT VISION “Creating a paperless integrated customs administration environment that while enabling international trade in a secure manor provides an efficient, user-friendly interface to traders, facilitating compliance with law and saving administrative costs. ” Paperless Customs and Excise PROJECT OBJECTIVE n Facilitate the development of cooperation between the customs administrations of the Member States of the European Union with a view to create an Europe-wide electronic environment in the area of customs n Current implementation project: Replacement of the existing joint system by Belgium and Luxemburg to process customs documents, provide Integration to NCTS and ensure integrated Financial Accounting and indirect taxation n Single view of the taxpayer/economic operator n Flexible architecture that will enable the subsequent integration of functionalities n Selected data volumes 2004: n For other customs missions (e. g. MASP) n Vehicle Tax, Road Tolling et. al. n 220. 278 Single Administrative Documents n 8600 Excise Tax Documents (ACC 4) n 360+ users n Prevent fraud and the application of illicit tariffs using a risk management system n Process customs and excise declarations electronically n Bolster the effectiveness of the Customs Administration n Increase level of service to traders thereby facilitating compliance KEY CHALLENGES n Disparate legacy solutions across the state maintaining multiple functions n Inconsistent processes and duplication of effort ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 34

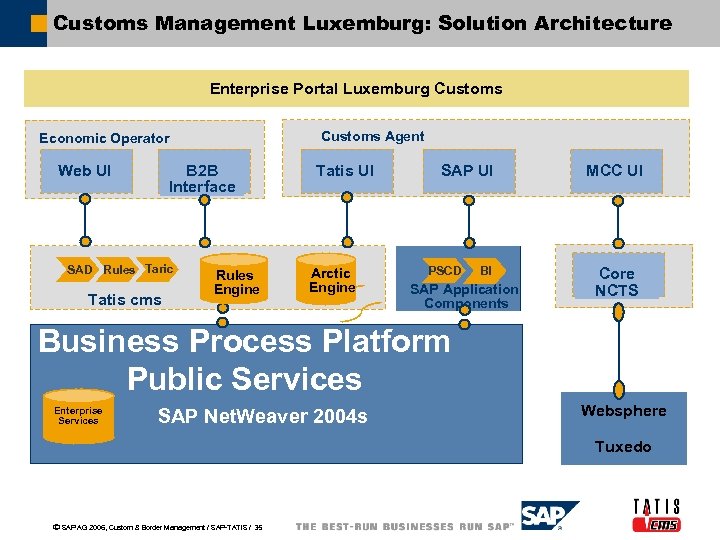

Customs Management Luxemburg: Solution Architecture Enterprise Portal Luxemburg Customs Agent Economic Operator B 2 B Interface Web UI SAD Rules Taric Tatis cms Rules Engine Tatis UI Arctic Engine SAP UI PSCD BI SAP Application Components MCC UI Core NCTS Business Process Platform Public Services Enterprise Services SAP Net. Weaver 2004 s Websphere Tuxedo ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 35

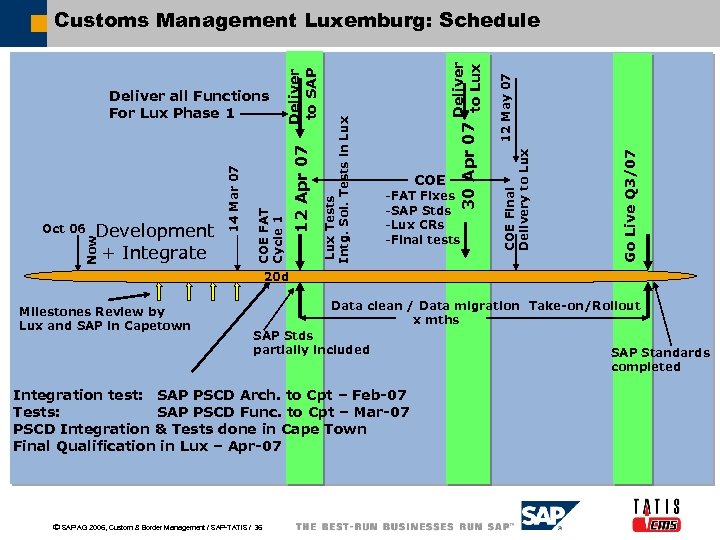

Go Live Q 3/07 -FAT Fixes -SAP Stds -Lux CRs -Final tests 12 May 07 COE Final Delivery to Lux Deliver COE 30 Apr 07 to Lux Tests Intg. Sol. Tests in Lux 12 Apr 07 COE FAT Cycle 1 Development + Integrate Now Oct 06 14 Mar 07 Deliver all Functions For Lux Phase 1 Deliver to SAP Customs Management Luxemburg: Schedule 20 d Milestones Review by Lux and SAP in Capetown Data clean / Data migration Take-on/Rollout x mths SAP Stds partially included Integration test: SAP PSCD Arch. to Cpt – Feb-07 Tests: SAP PSCD Func. to Cpt – Mar-07 PSCD Integration & Tests done in Cape Town Final Qualification in Lux – Apr-07 ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 36 SAP Standards completed

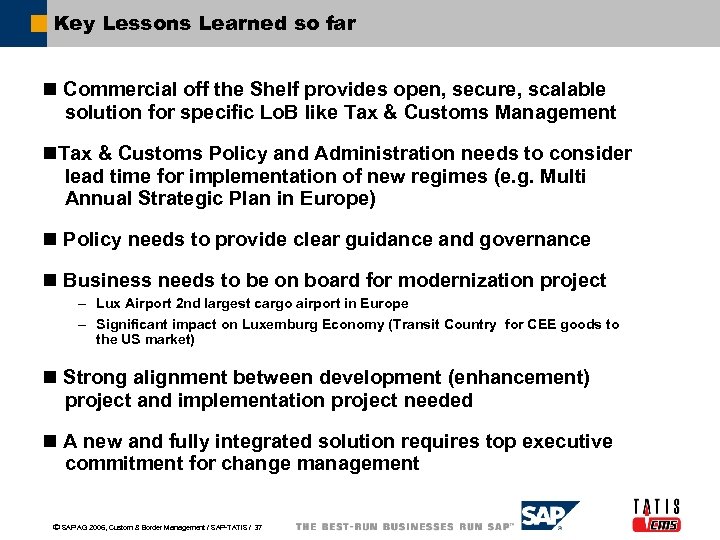

Key Lessons Learned so far n Commercial off the Shelf provides open, secure, scalable solution for specific Lo. B like Tax & Customs Management n. Tax & Customs Policy and Administration needs to consider lead time for implementation of new regimes (e. g. Multi Annual Strategic Plan in Europe) n Policy needs to provide clear guidance and governance n Business needs to be on board for modernization project – Lux Airport 2 nd largest cargo airport in Europe – Significant impact on Luxemburg Economy (Transit Country for CEE goods to the US market) n Strong alignment between development (enhancement) project and implementation project needed n A new and fully integrated solution requires top executive commitment for change management ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 37

e slid title e n th i ure pict a for e mpl sa Customs & Border Modernization TATIS/SAP Solution Offering: Overview & Demo Luxembourg Project Highlights & Lessons Learned to Date Wrap up and Discussion

Reforming Tax & Revenue Management and Customs & Border Management Pain points specific Multiple, redundant, stand-alone systems Agility to meet business and legal changes Fragmented access and Inefficient billing & collection Business Practice Improvement needed n For each tax, fee, revenue and payment type, and for each step in the revenue lifecycle a separate system is required. These are often, silos, custom-built, “one-off”, or legacy in-house systems with outdated technology. Intervention by Exception – Risk Management n Limited channels of access hinders taxpayer interaction, causing low constituent satisfaction and negatively impacting compliance rates Continuous Innovation to meet regulatory and business process changes n Taxpayers have no ability to access accounts and make payments on-line n Multiple systems, processes and personnel for different revenue types, (fees, taxes, payments) causes redundant data capture Limited view of taxpayer/trader n No single view of taxpayer or taxpayer’s total obligation, resulting in lost revenue and lower compliance Uncaptured revenue/duty Best Practice aligned (WCO, WTO) n Outdated stovepipe systems using point to point integration aren’t prepared to meet changing business and legal requirements Single revenue type limitations Risk of non or low Low compliance IT can help Worldwide 24 x 7 Support Comprehensive Customs and Revenue Management Suite n No risk scoring capabilities, limited visibility into taxpayer total obligations and status, and inability to track or match documentation results in poorly targeted, incomplete audit coverage Based on an open, scalable, secure Business Process Platform n No method for detecting and reducing fraud and non-filing, wrong or incorrect declaration Maximize revenue collection and trader compliance ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 39

Further Information è Internet www. sap. com/industries/publicsector/ SAP Service Marketplace: www. service. sap. com www. tatis. com è Contacts Gonda Marcusse, gonda. marcusse@sap. com, SAP AG Michael Eads, michael. eads@tatis. com , TATIS ã SAP AG 2006, Custom & Border Management / SAP-TATIS / 40

97f3cfb0082e1d0a128201bf4a7e2bb2.ppt