14983cb8b257e363ec2fd660aecaacc1.ppt

- Количество слайдов: 35

CUSTOMER EXPERIENCE MANAGEMENT THE BANK ALFALAH WAY M. Mudassar Aqil November 19, 2009

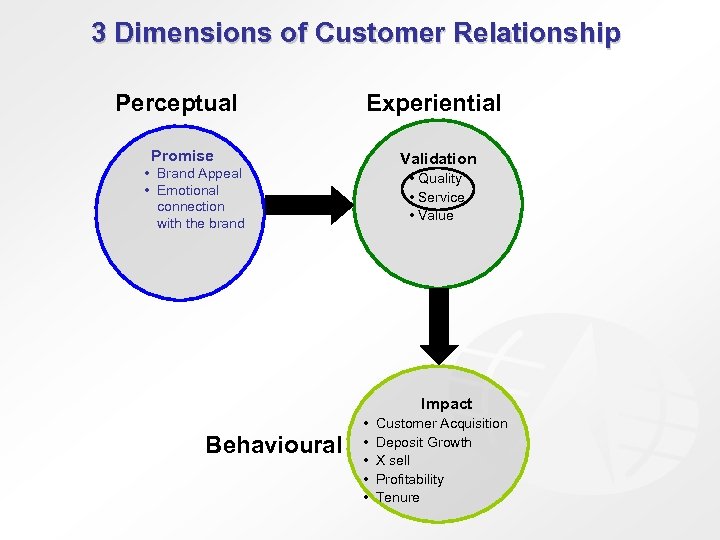

3 Dimensions of Customer Relationship Perceptual Experiential Promise Validation • Brand Appeal • Emotional connection with the brand • Quality • Service • Value Impact Behavioural • • • Customer Acquisition Deposit Growth X sell Profitability Tenure

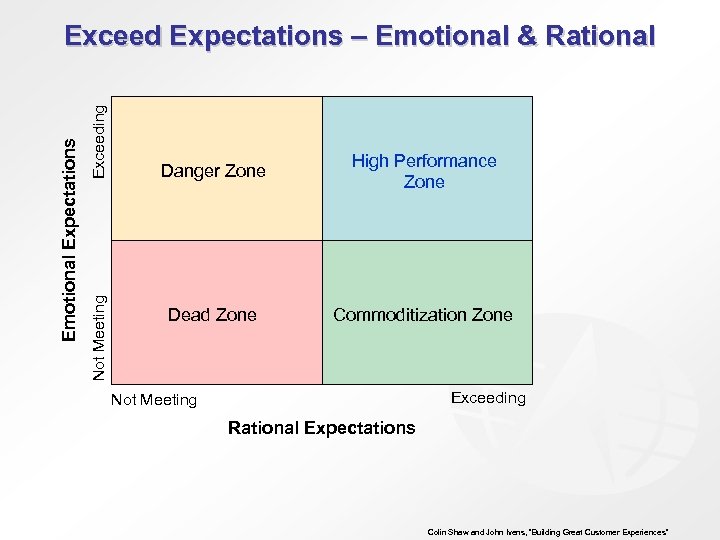

Exceeding Not Meeting Emotional Expectations Exceed Expectations – Emotional & Rational Danger Zone High Performance Zone Dead Zone Commoditization Zone Exceeding Not Meeting Rational Expectations Colin Shaw and John Ivens, “Building Great Customer Experiences”

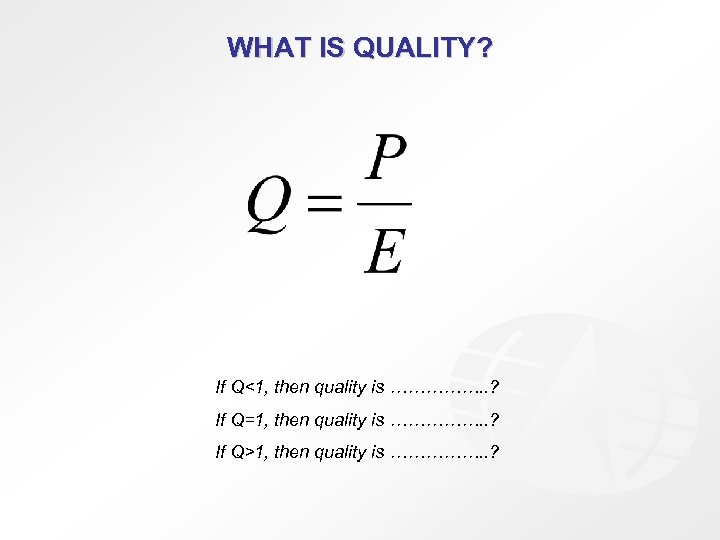

WHAT IS QUALITY? If Q<1, then quality is ……………. . ? If Q=1, then quality is ……………. . ? If Q>1, then quality is ……………. . ?

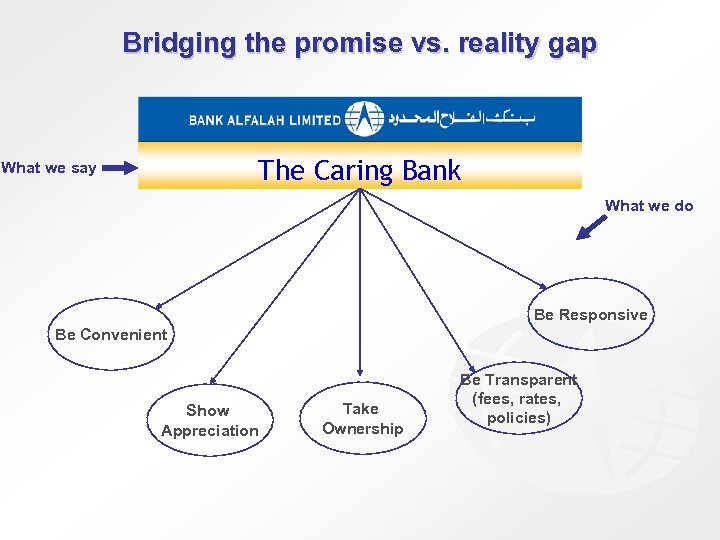

Bridging the promise vs. reality gap The Caring Bank What we say What we do Be Responsive Be Convenient Show Appreciation Take Ownership Be Transparent (fees, rates, policies)

BAL Quality Assurance Mission “To ensure the delivery of a consistent and high quality customer experience through all bank channels and products leading to improved customer satisfaction, loyalty, and profitability. ”

Quality Assurance Journey at Alfalah • QA Established as an independent function at BAL in Mid 2006 • Developed the vision to become the number one bank in Service Quality in Pakistan • Inducted Six Sigma Black Belt to develop the systems approach to Customer Experience Management • Initially focused on Managing Customer Experience at direct customer touch points and defined KPIs

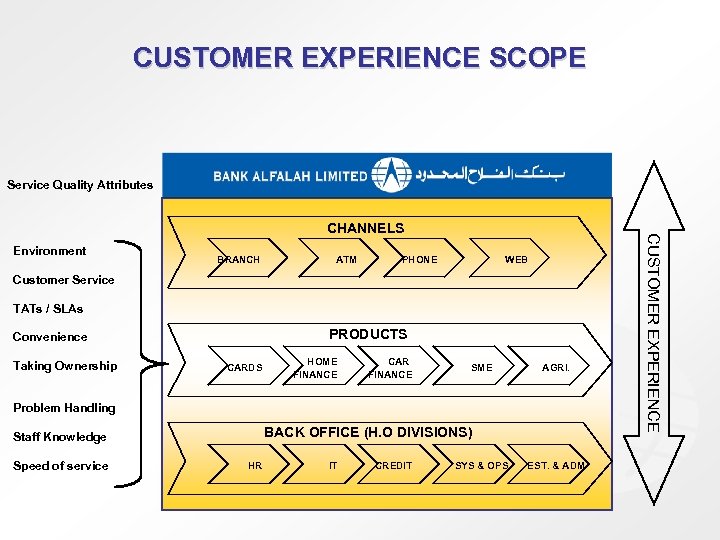

CUSTOMER EXPERIENCE SCOPE Service Quality Attributes Environment BRANCH ATM PHONE WEB Customer Service TATs / SLAs PRODUCTS Convenience Taking Ownership CARDS HOME FINANCE CAR FINANCE SME AGRI. Problem Handling BACK OFFICE (H. O DIVISIONS) Staff Knowledge Speed of service HR IT CREDIT SYS & OPS EST. & ADM CUSTOMER EXPERIENCE CHANNELS

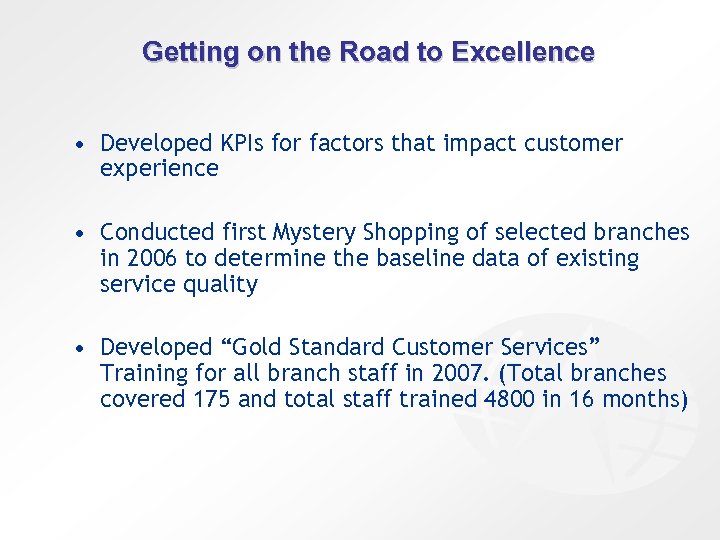

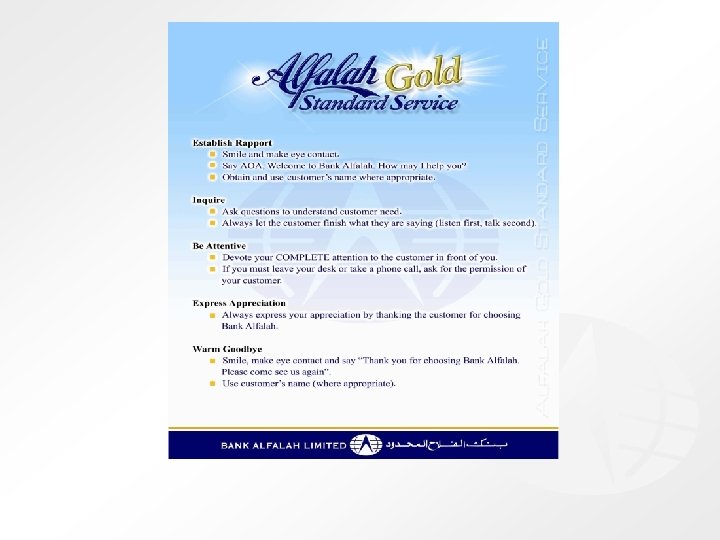

Getting on the Road to Excellence • Developed KPIs for factors that impact customer experience • Conducted first Mystery Shopping of selected branches in 2006 to determine the baseline data of existing service quality • Developed “Gold Standard Customer Services” Training for all branch staff in 2007. (Total branches covered 175 and total staff trained 4800 in 16 months)

Whatever doesn’t get measured doesn’t get managed Step One: Quality / Service Performance Data Collection OR…

Vehicle for Quality Improvement • Approach for quality deployment / improvement on DMAIC concept of SIX SIGMA. • DMAIC stands for: • Define • Measure • Analyze • Improve • Control

Catalysts of Excellence • A 20 member QA team of highly qualified and well trained professional bankers, assess the branches from the customers’ perspective • Each QA officer visits 15 branches in a month and on the average 3600 visits are done in a year by QA team • QA officers also provide on the spot trainings to the branches on products and customer services

Marching on the Road to Excellence • Started measurement process of branch service quality using checklist & system generated data. Service Quality parameters displayed on Scorecard • First year (June 2007) assessments covered 56 branches and in two years the coverage increased to more than 250 branches. • Incorporated customer complaints as a factor of service quality in 2008.

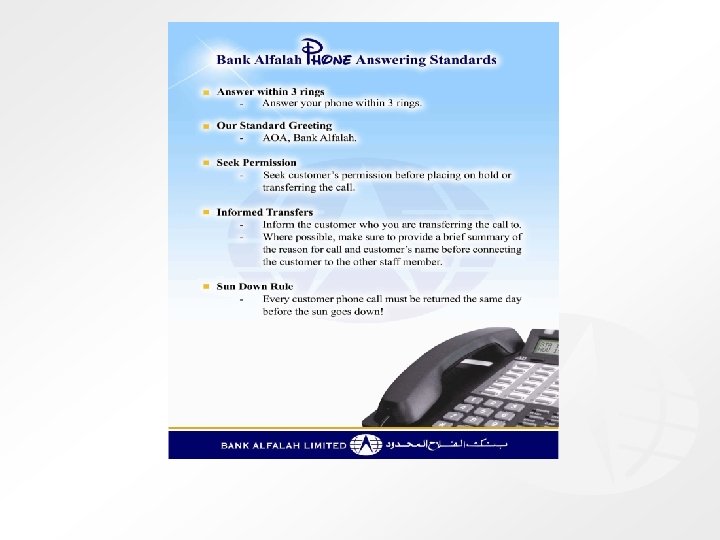

Areas of Quality Score Card • • Branch Environment & Facilities Compliance to Gold Standard Customer Services Turn Around Times for transactions Compliance of Customer Related Regulatory Requirements Phone Response Quality ATM Availability Number of Customer Complaints

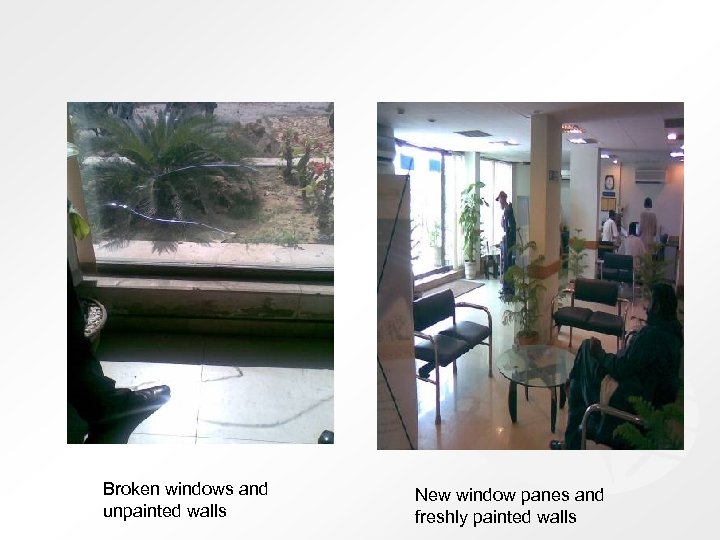

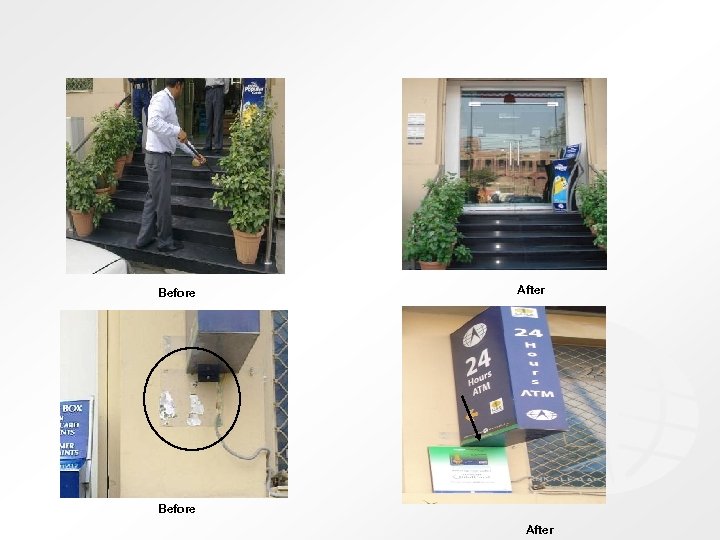

Some examples of branch environment improvement

Before QA Intervention After QA Intervention

Before QA After QA

Broken windows and unpainted walls New window panes and freshly painted walls

Before After

Before After

Before After

Store Room Before After

Store room properly organized and clean.

Listening to the Voice of the Customer • Customer Complaint Management Unit actively listens to the voice of about 4000 customers on the average every month. • Customers can send their suggestion or grievance through corporate website, complaint/suggestion box, direct letters and/or through regulatory bodies • All complaints are acknowledged within one working day and Average Turn Around time for complaint redressal is 3 days

Reward & Recognition Programs • Certificate of Appreciation is awarded to the branch which has shown remarkable improvement in service quality in a quarter • Certificate of Excellence to branches scoring “Excellent” rating for consecutive three months • Revolving Service Quality Champion trophy to the best branch of the entire bank network • One month salary as a bonus to entire branch staff

Fruits of Efforts • Most well maintained facilities in the banking industry. • Highest ATM uptime in the industry as acknowledged by SBP • Highest brand awareness • Our research showed us to be almost tied at #2 spot in terms of customer satisfaction vs. competitor banks in 2007. We aim to be #1 in 2010.

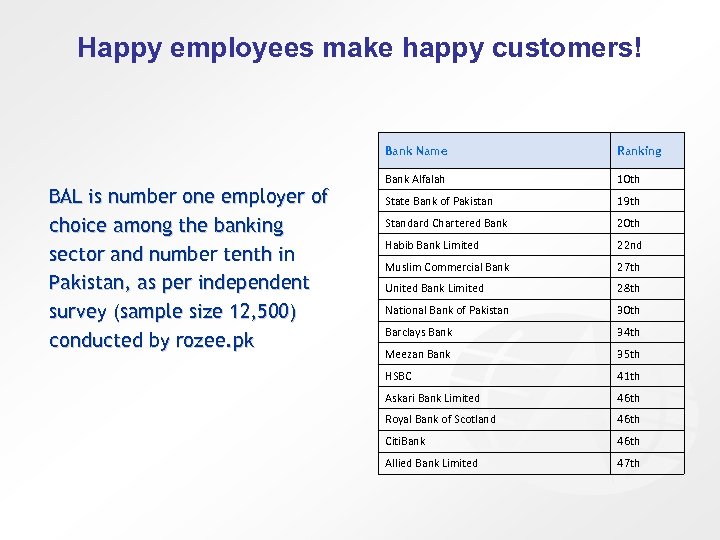

Happy employees make happy customers! Bank Name BAL is number one employer of choice among the banking sector and number tenth in Pakistan, as per independent survey (sample size 12, 500) conducted by rozee. pk Ranking Bank Alfalah 10 th State Bank of Pakistan 19 th Standard Chartered Bank 20 th Habib Bank Limited 22 nd Muslim Commercial Bank 27 th United Bank Limited 28 th National Bank of Pakistan 30 th Barclays Bank 34 th Meezan Bank 35 th HSBC 41 th Askari Bank Limited 46 th Royal Bank of Scotland 46 th Citi. Bank 46 th Allied Bank Limited 47 th

What do Customers Say about us?

The Way Forward v Superior service v Customer convenience v Becoming simple to do business with

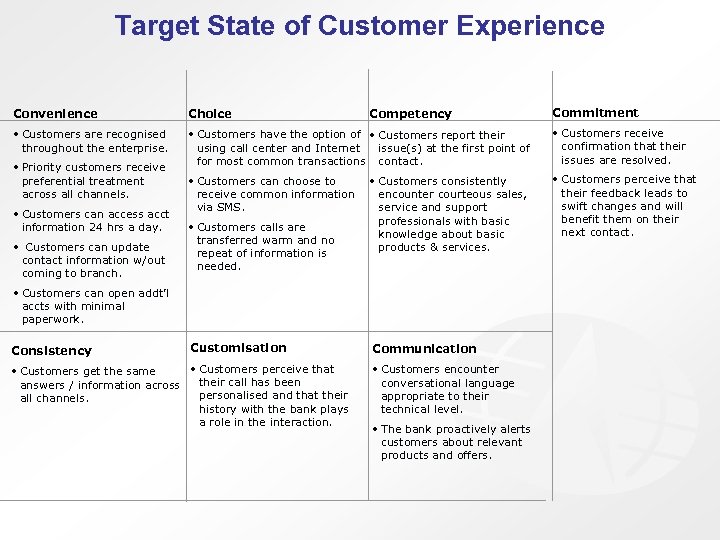

Target State of Customer Experience Commitment Convenience Choice • Customers are recognised throughout the enterprise. • Customers have the option of • Customers report their using call center and Internet issue(s) at the first point of for most common transactions contact. • Customers receive confirmation that their issues are resolved. • Customers can choose to receive common information via SMS. • Customers perceive that their feedback leads to swift changes and will benefit them on their next contact. • Priority customers receive preferential treatment across all channels. • Customers can access acct information 24 hrs a day. • Customers can update contact information w/out coming to branch. • Customers calls are transferred warm and no repeat of information is needed. Competency • Customers consistently encounter courteous sales, service and support professionals with basic knowledge about basic products & services. • Customers can open addt’l accts with minimal paperwork. Consistency Customisation • Customers perceive that • Customers get the same their call has been answers / information across personalised and that their all channels. history with the bank plays a role in the interaction. Communication • Customers encounter conversational language appropriate to their technical level. • The bank proactively alerts customers about relevant products and offers.

Thank You Questions? mmudassar@bankalfalah. com

14983cb8b257e363ec2fd660aecaacc1.ppt