61e8349931d6fa46bcc25b686b7a4ab1.ppt

- Количество слайдов: 20

Current Issues in Tourism Policy Making in Hungary Dr Andrea Nemes Director General Tourism and Catering Department

Current Issues in Tourism Policy Making in Hungary Dr Andrea Nemes Director General Tourism and Catering Department

Current Issues of Tourism Policy in Hungary

Current Issues of Tourism Policy in Hungary

National Tourism Development Concept 2014 -2020 3

National Tourism Development Concept 2014 -2020 3

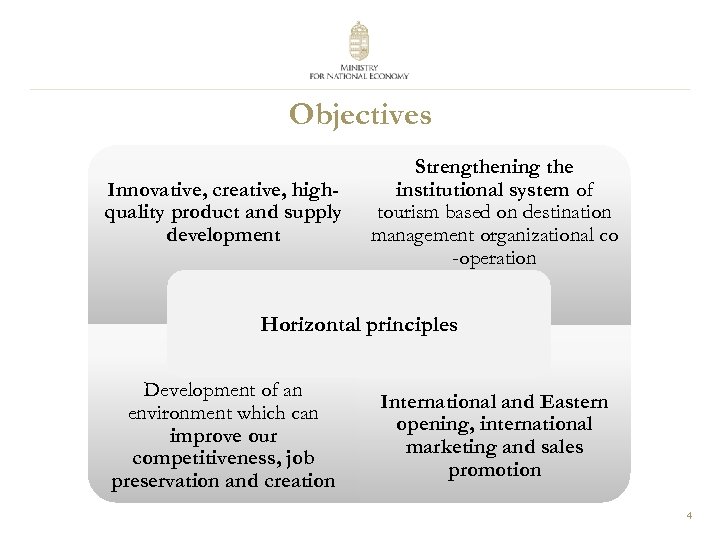

Objectives Innovative, creative, highquality product and supply development Strengthening the institutional system of tourism based on destination management organizational co -operation Horizontal principles Development of an environment which can improve our competitiveness, job preservation and creation International and Eastern opening, international marketing and sales promotion 4

Objectives Innovative, creative, highquality product and supply development Strengthening the institutional system of tourism based on destination management organizational co -operation Horizontal principles Development of an environment which can improve our competitiveness, job preservation and creation International and Eastern opening, international marketing and sales promotion 4

Szechenyi Recreation Card (Sz. RC) – A Means for Encouraging Domestic Tourism 5

Szechenyi Recreation Card (Sz. RC) – A Means for Encouraging Domestic Tourism 5

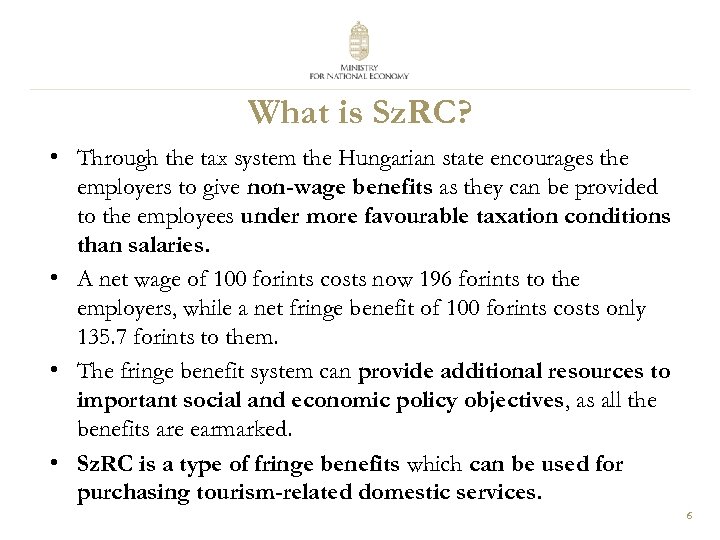

What is Sz. RC? • Through the tax system the Hungarian state encourages the employers to give non-wage benefits as they can be provided to the employees under more favourable taxation conditions than salaries. • A net wage of 100 forints costs now 196 forints to the employers, while a net fringe benefit of 100 forints costs only 135. 7 forints to them. • The fringe benefit system can provide additional resources to important social and economic policy objectives, as all the benefits are earmarked. • Sz. RC is a type of fringe benefits which can be used for purchasing tourism-related domestic services. 6

What is Sz. RC? • Through the tax system the Hungarian state encourages the employers to give non-wage benefits as they can be provided to the employees under more favourable taxation conditions than salaries. • A net wage of 100 forints costs now 196 forints to the employers, while a net fringe benefit of 100 forints costs only 135. 7 forints to them. • The fringe benefit system can provide additional resources to important social and economic policy objectives, as all the benefits are earmarked. • Sz. RC is a type of fringe benefits which can be used for purchasing tourism-related domestic services. 6

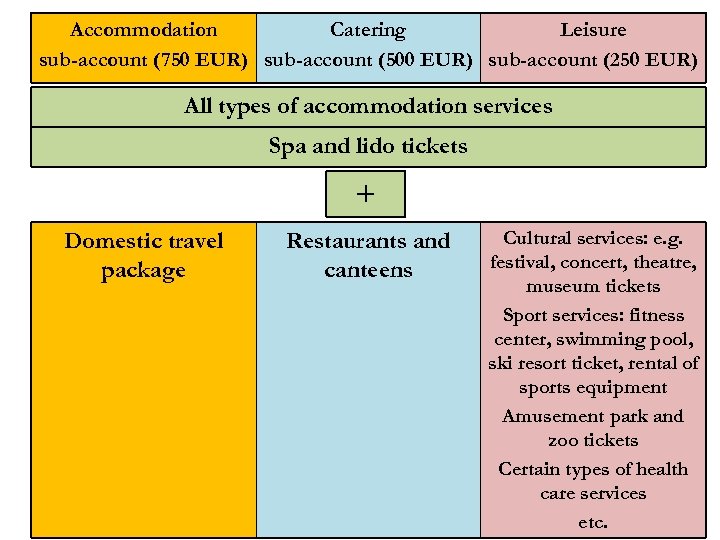

Accommodation Catering Leisure sub-account (750 EUR) sub-account (500 EUR) sub-account (250 EUR) All types of accommodation services Spa and lido tickets + Domestic travel package Restaurants and canteens Cultural services: e. g. festival, concert, theatre, museum tickets Sport services: fitness center, swimming pool, ski resort ticket, rental of sports equipment Amusement park and zoo tickets Certain types of health care services 7 etc.

Accommodation Catering Leisure sub-account (750 EUR) sub-account (500 EUR) sub-account (250 EUR) All types of accommodation services Spa and lido tickets + Domestic travel package Restaurants and canteens Cultural services: e. g. festival, concert, theatre, museum tickets Sport services: fitness center, swimming pool, ski resort ticket, rental of sports equipment Amusement park and zoo tickets Certain types of health care services 7 etc.

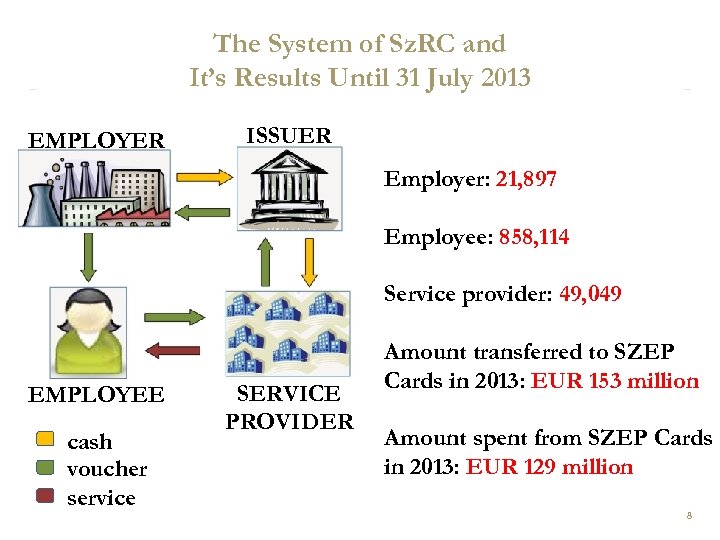

The System of Sz. RC and It’s Results Until 31 July 2013 EMPLOYER ISSUER Employer: 21, 897 Employee: 858, 114 Service provider: 49, 049 EMPLOYEE cash voucher service SERVICE PROVIDER Amount transferred to SZEP Cards in 2013: EUR 153 million Amount spent from SZEP Cards in 2013: EUR 129 million 8

The System of Sz. RC and It’s Results Until 31 July 2013 EMPLOYER ISSUER Employer: 21, 897 Employee: 858, 114 Service provider: 49, 049 EMPLOYEE cash voucher service SERVICE PROVIDER Amount transferred to SZEP Cards in 2013: EUR 153 million Amount spent from SZEP Cards in 2013: EUR 129 million 8

Tourism Trends in Hungary - Statistics

Tourism Trends in Hungary - Statistics

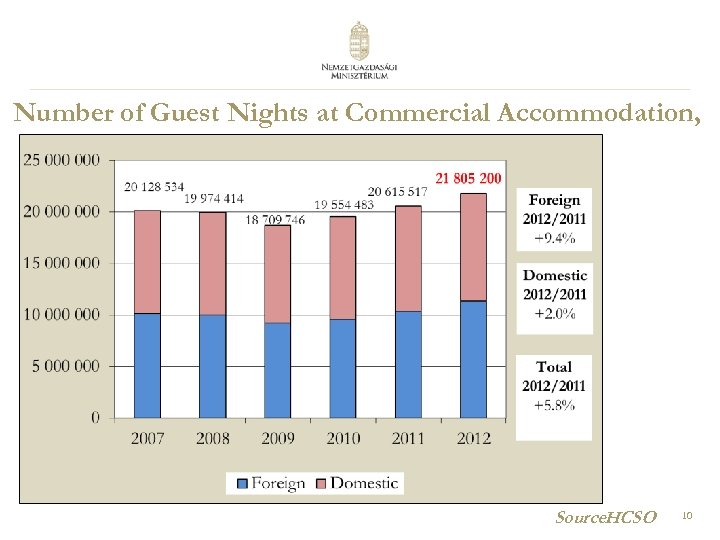

Number of Guest Nights at Commercial Accommodation, 2007 -2012 Source: HCSO 10

Number of Guest Nights at Commercial Accommodation, 2007 -2012 Source: HCSO 10

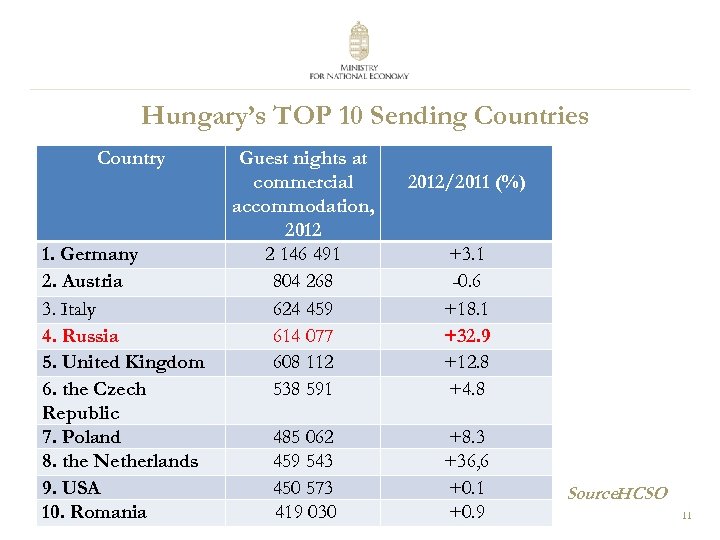

Hungary’s TOP 10 Sending Countries Country 1. Germany 2. Austria 3. Italy 4. Russia 5. United Kingdom 6. the Czech Republic 7. Poland 8. the Netherlands 9. USA 10. Romania Guest nights at commercial accommodation, 2012 2 146 491 804 268 624 459 614 077 608 112 538 591 485 062 459 543 450 573 419 030 2012/2011 (%) +3. 1 -0. 6 +18. 1 +32. 9 +12. 8 +4. 8 +8. 3 +36, 6 +0. 1 +0. 9 Source: HCSO 11

Hungary’s TOP 10 Sending Countries Country 1. Germany 2. Austria 3. Italy 4. Russia 5. United Kingdom 6. the Czech Republic 7. Poland 8. the Netherlands 9. USA 10. Romania Guest nights at commercial accommodation, 2012 2 146 491 804 268 624 459 614 077 608 112 538 591 485 062 459 543 450 573 419 030 2012/2011 (%) +3. 1 -0. 6 +18. 1 +32. 9 +12. 8 +4. 8 +8. 3 +36, 6 +0. 1 +0. 9 Source: HCSO 11

Russian Tourists in Hungary - Statistics

Russian Tourists in Hungary - Statistics

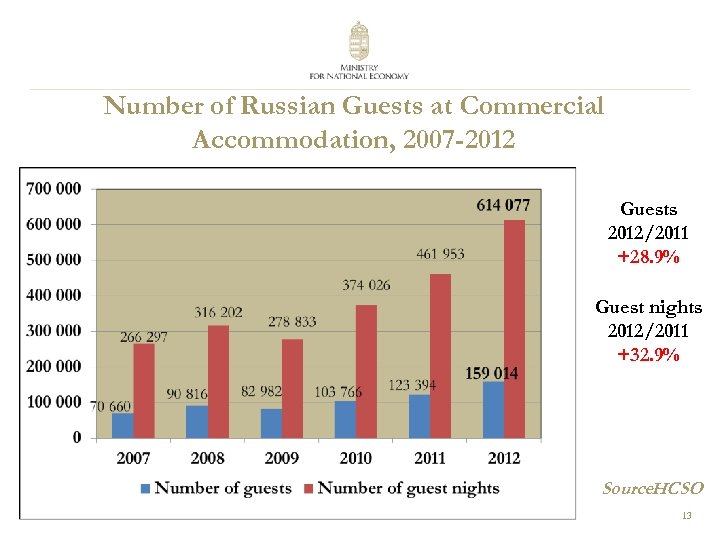

Number of Russian Guests at Commercial Accommodation, 2007 -2012 Guests 2012/2011 +28. 9% Guest nights 2012/2011 +32. 9% Source: HCSO 13

Number of Russian Guests at Commercial Accommodation, 2007 -2012 Guests 2012/2011 +28. 9% Guest nights 2012/2011 +32. 9% Source: HCSO 13

Russian Tourists in Hungarian Spa Hotels • According to the number of guest nights Russia is the 2 nd most important source market • In 2012 Ø 26 517 guests → +85% to 2011 Ø 201 344 guest nights → +80% to 2011 • Average length of stay: 7. 6 nights Source: HCSO 14

Russian Tourists in Hungarian Spa Hotels • According to the number of guest nights Russia is the 2 nd most important source market • In 2012 Ø 26 517 guests → +85% to 2011 Ø 201 344 guest nights → +80% to 2011 • Average length of stay: 7. 6 nights Source: HCSO 14

Russian Tourists at Commercial Accommodation, January-July 2013 Number of Guests Jan-Jun 2013/Jan. Jul 2012 (%) Number of Guest Nights Jan-Jun 2013/Jan. Jul 2012 (%) Commercial Accommodation 103 576 +19. 4 417 351 +21. 8 From which: Hotels 100 549 +19. 7 405 854 +22. 6 ~1/3 of Russian guest nights realized in spa hotels, where the average length of stay was 9 nights, while the number of guests was 14 625 and the number of guest nights was 132 149 Source: HCSO 15

Russian Tourists at Commercial Accommodation, January-July 2013 Number of Guests Jan-Jun 2013/Jan. Jul 2012 (%) Number of Guest Nights Jan-Jun 2013/Jan. Jul 2012 (%) Commercial Accommodation 103 576 +19. 4 417 351 +21. 8 From which: Hotels 100 549 +19. 7 405 854 +22. 6 ~1/3 of Russian guest nights realized in spa hotels, where the average length of stay was 9 nights, while the number of guests was 14 625 and the number of guest nights was 132 149 Source: HCSO 15

Tourism Policy Priorities on the Russian Market

Tourism Policy Priorities on the Russian Market

Direct flights between Hungary and Russia • Scheduled flights on the route Budapest-St. Petersburg and between Hévíz and Moscow are expected to be launched in the near future 17

Direct flights between Hungary and Russia • Scheduled flights on the route Budapest-St. Petersburg and between Hévíz and Moscow are expected to be launched in the near future 17

Visas • Our objectives are – assist in simpler and faster procedures for the reception and consideration of visa applications – outsourcing of visa applications to attract more tourists and to facilitate the access for visas 18

Visas • Our objectives are – assist in simpler and faster procedures for the reception and consideration of visa applications – outsourcing of visa applications to attract more tourists and to facilitate the access for visas 18

Medical Treatment, Rehabilitation • Exploring opportunities for co-operation • Our aim is to assist Hungarian spa resorts, spas and tour operators in meeting the increasing demand of the Russian market 19

Medical Treatment, Rehabilitation • Exploring opportunities for co-operation • Our aim is to assist Hungarian spa resorts, spas and tour operators in meeting the increasing demand of the Russian market 19

y om ent m on Ec epart l na tio ing D a u r N ater v. h fo C go try and mes m. s ng ini ism Ne l M ur s@ a rea ener eme To And G a. n r Dr ecto ndre r Di ail: a Em Thank you for your attention! 20

y om ent m on Ec epart l na tio ing D a u r N ater v. h fo C go try and mes m. s ng ini ism Ne l M ur s@ a rea ener eme To And G a. n r Dr ecto ndre r Di ail: a Em Thank you for your attention! 20