84de7c3ae360adf5866e49bb54833577.ppt

- Количество слайдов: 85

Current Events • http: //www. usnews. com/opinion/economicintelligence/2015/03/18/the-federal-reserve -should-lay-out-clear-monetary-policy-rules

Current Events • http: //www. usnews. com/opinion/economicintelligence/2015/03/18/the-federal-reserve -should-lay-out-clear-monetary-policy-rules

International Trade 2

International Trade 2

Why people trade Without trade what things would you have to go without? Everything you don’t produce yourself! (Clothes, car, cell phone, bananas, heath care, etc) Every country specializes in the production of goods and services and trades it to others for things they cannot produce themselves. Limiting trade reduces people’s choices and makes them worse off. The Point: More access to trade means more choices and a higher standard of living. 3

Why people trade Without trade what things would you have to go without? Everything you don’t produce yourself! (Clothes, car, cell phone, bananas, heath care, etc) Every country specializes in the production of goods and services and trades it to others for things they cannot produce themselves. Limiting trade reduces people’s choices and makes them worse off. The Point: More access to trade means more choices and a higher standard of living. 3

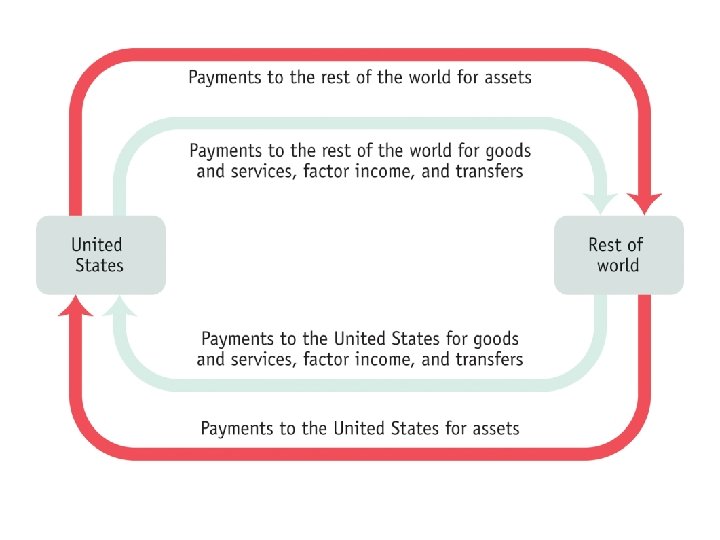

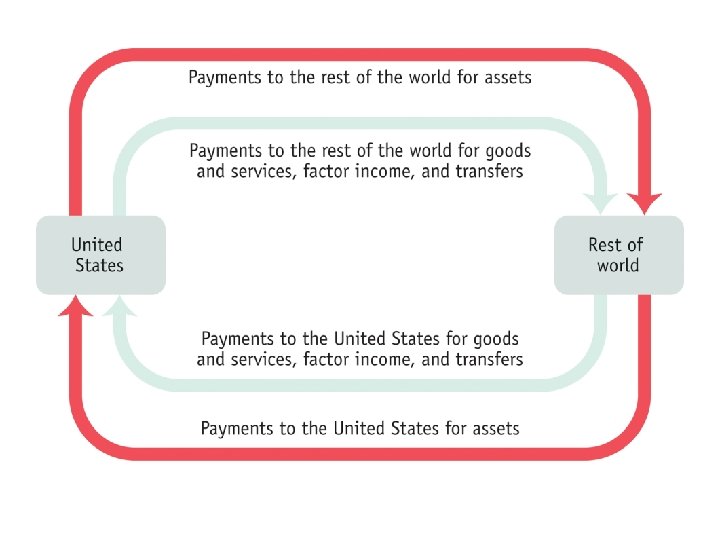

Capital Flows and the Balance of Payments: Keeping track of international transactions by using: • Balance of Payments Accounts • Modeling the Financial Account • Underlying Determinants of International Capital Flows • Two-way Capital Flows

Capital Flows and the Balance of Payments: Keeping track of international transactions by using: • Balance of Payments Accounts • Modeling the Financial Account • Underlying Determinants of International Capital Flows • Two-way Capital Flows

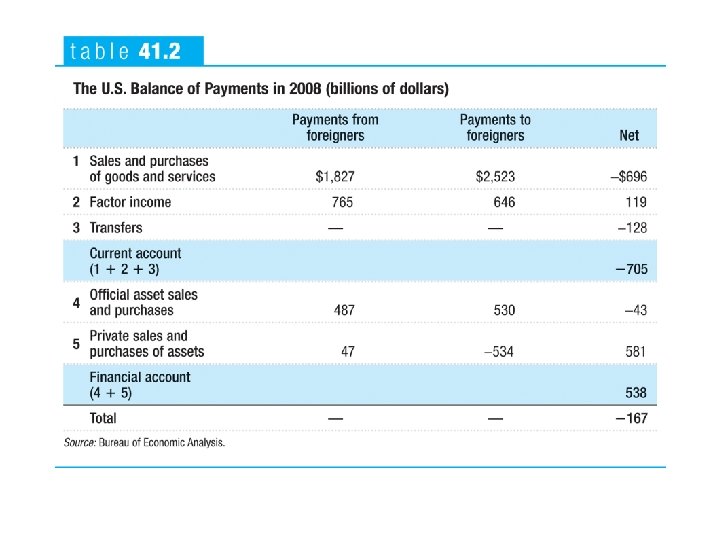

Economists keep track of international transactions using the balance of payments accounts

Economists keep track of international transactions using the balance of payments accounts

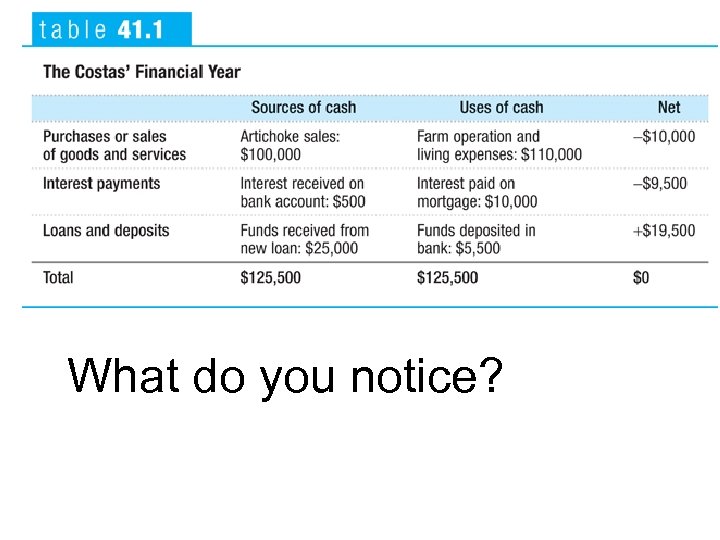

What do you notice?

What do you notice?

The sum of cash coming in from all sources and the sum of cash used are equal, by definition: every dollar has a source, and every dollar received gets used somewhere

The sum of cash coming in from all sources and the sum of cash used are equal, by definition: every dollar has a source, and every dollar received gets used somewhere

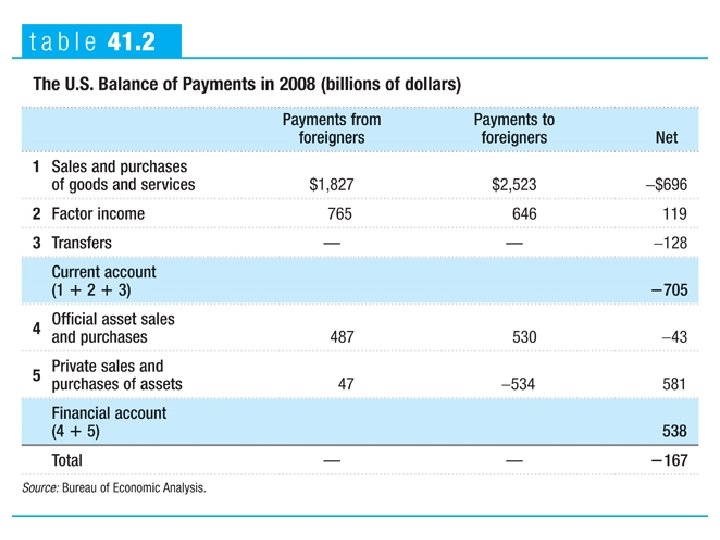

Note: the balance of payments accounts distinguishes between transactions that don’t create liabilities and those that do

Note: the balance of payments accounts distinguishes between transactions that don’t create liabilities and those that do

Balance of payments on current account (current account) are transactions that do not create liabilities. They include: 1. Balance of payments on goods and services 2. Factor income: investment income( US earnings on investment aboard minus foreign earnings from capital invested in the US) 3. Net international transfer payments: foreign aid sent to other countries and funds that immigrants send to family abroad)

Balance of payments on current account (current account) are transactions that do not create liabilities. They include: 1. Balance of payments on goods and services 2. Factor income: investment income( US earnings on investment aboard minus foreign earnings from capital invested in the US) 3. Net international transfer payments: foreign aid sent to other countries and funds that immigrants send to family abroad)

The Current Account is made up of three parts: 1. Trades in Goods and Services (Net Exports)Difference between a nation’s exports of goods and services and its imports Ex: Toys imported from China, US cars exported to Mexico 2. Investment Income- $ from factors of production including payments made to foreign investors. Ex: Money earned by Japanese car producers in the US 3. Net Transfers- $ flows from the private & public sectors Ex: donations, aids and grants, official assistance

The Current Account is made up of three parts: 1. Trades in Goods and Services (Net Exports)Difference between a nation’s exports of goods and services and its imports Ex: Toys imported from China, US cars exported to Mexico 2. Investment Income- $ from factors of production including payments made to foreign investors. Ex: Money earned by Japanese car producers in the US 3. Net Transfers- $ flows from the private & public sectors Ex: donations, aids and grants, official assistance

Capital or (Financial) Account The Capital Account measures the purchase and sale of financial assets abroad. (Purchases of things that stay in the foreign country). Examples: – US company buys a hotel in Russia – A Korean company sells a factory in Ohio – Australian company owns local Mall

Capital or (Financial) Account The Capital Account measures the purchase and sale of financial assets abroad. (Purchases of things that stay in the foreign country). Examples: – US company buys a hotel in Russia – A Korean company sells a factory in Ohio – Australian company owns local Mall

Balance of payments on goods and services=the difference between the value of exports and the value of imports during a given period Merchandise trade balance (trade balance)= exports-imports; more reliable to look at goods Student alert: If a country uses (loses) foreign currency to complete the transaction it is a debit. If the country earns (gains) foreign currency it is a credit. Debit is negative and credit is positive

Balance of payments on goods and services=the difference between the value of exports and the value of imports during a given period Merchandise trade balance (trade balance)= exports-imports; more reliable to look at goods Student alert: If a country uses (loses) foreign currency to complete the transaction it is a debit. If the country earns (gains) foreign currency it is a credit. Debit is negative and credit is positive

Liability creation comes with the balance of payments on financial account (financial account; capital account) Note: Current acct+ financial acct=0 No, you did not stump me if you look at Table 41 -2. There can be rounding errors! In total, the sources of cash must equal the uses of cash

Liability creation comes with the balance of payments on financial account (financial account; capital account) Note: Current acct+ financial acct=0 No, you did not stump me if you look at Table 41 -2. There can be rounding errors! In total, the sources of cash must equal the uses of cash

Summary: Balance of Payments = accounting record of the inflows and outlfows of a nation with respect to the rest of the world. Transactions that produce an inflow are positive = credit Transactions that produce an outflow are negative = debit

Summary: Balance of Payments = accounting record of the inflows and outlfows of a nation with respect to the rest of the world. Transactions that produce an inflow are positive = credit Transactions that produce an outflow are negative = debit

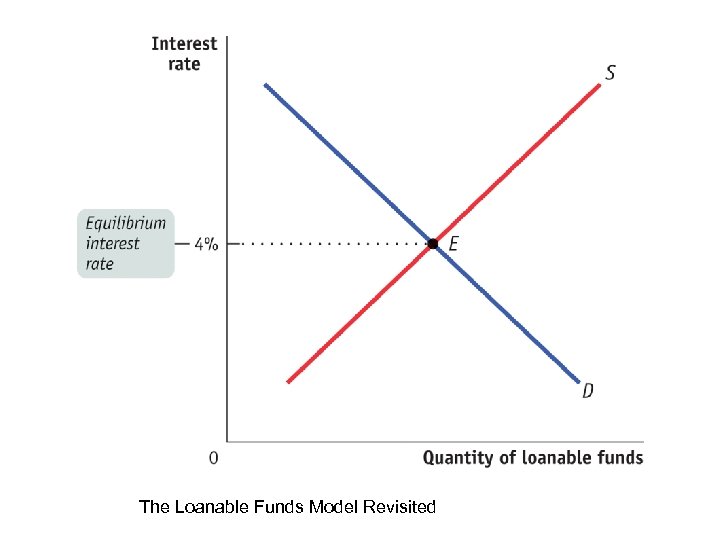

Modeling the Financial Acct Measures capital inflows, foreign savings that are available to finance domestic investment spending LOANABLE FUNDS MODEL! Assumes two things: 1. All flows are in the form of loans (instead of direct foreign investment, real estate, etc) 2. Ignores effects of expected changes in exchange rates (more, later)

Modeling the Financial Acct Measures capital inflows, foreign savings that are available to finance domestic investment spending LOANABLE FUNDS MODEL! Assumes two things: 1. All flows are in the form of loans (instead of direct foreign investment, real estate, etc) 2. Ignores effects of expected changes in exchange rates (more, later)

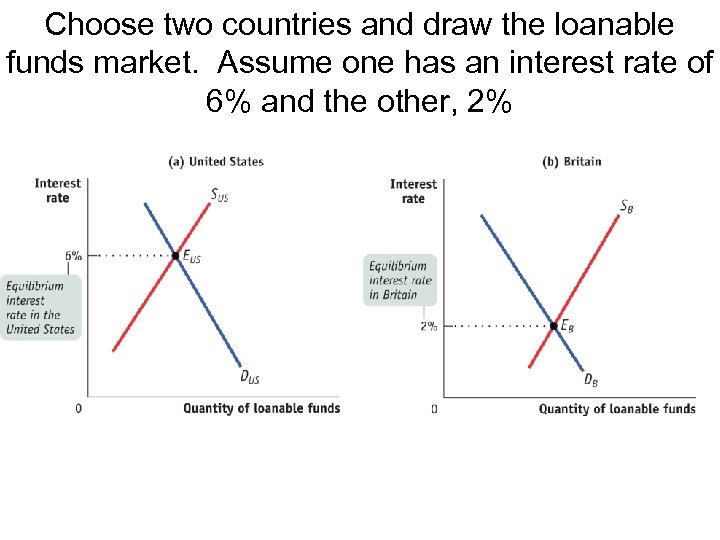

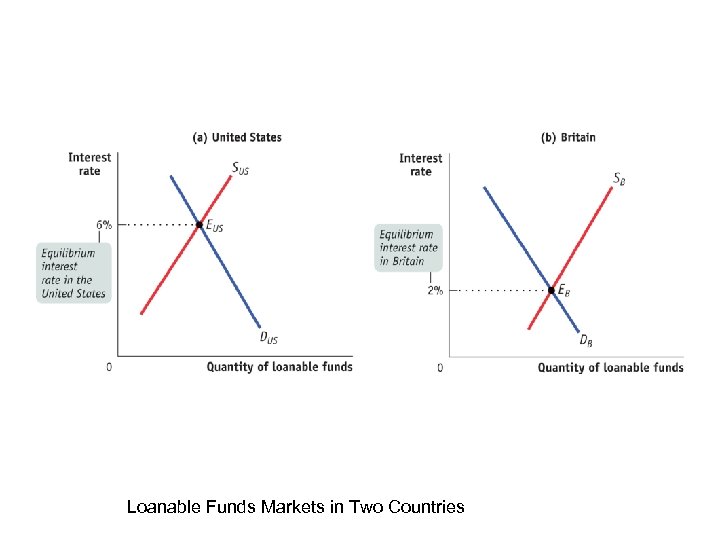

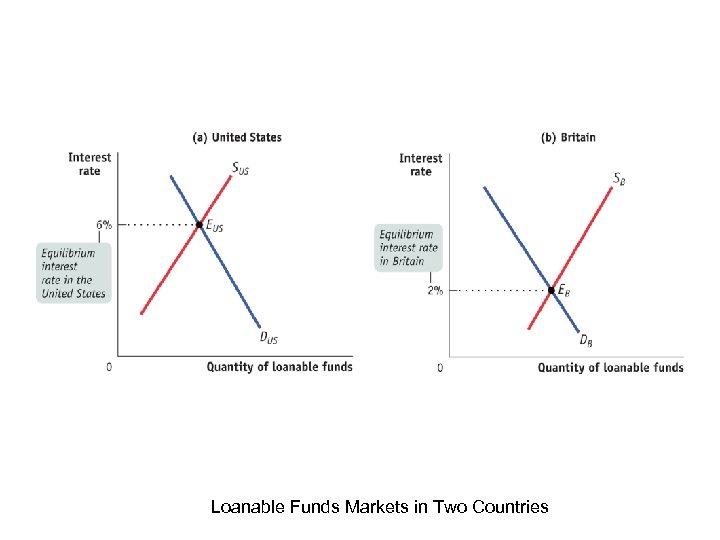

Choose two countries and draw the loanable funds market. Assume one has an interest rate of 6% and the other, 2%

Choose two countries and draw the loanable funds market. Assume one has an interest rate of 6% and the other, 2%

When two nations have differing IR in their domestic LFM, they look where their return on a financial asset is higher = looking for financial assets, not physical One country is exporting dollars, importing financial assets and vice versa.

When two nations have differing IR in their domestic LFM, they look where their return on a financial asset is higher = looking for financial assets, not physical One country is exporting dollars, importing financial assets and vice versa.

Underlying determinants of International Capital Flows A country with rapidly growing economy offers more investment opportunities= usually a higher demand for capital= capital flows from slow fast Also, MPS of indv. And gov’ts can impact loanable funds

Underlying determinants of International Capital Flows A country with rapidly growing economy offers more investment opportunities= usually a higher demand for capital= capital flows from slow fast Also, MPS of indv. And gov’ts can impact loanable funds

Two-way capital flows: countries diversify risk; we invest in other countries and vice versa

Two-way capital flows: countries diversify risk; we invest in other countries and vice versa

How would the following transactions be categorized in the U. S. balance of payments accounts? How will the balance of payments on the current and financial accounts change? • An American college student decides to spend a year studying (and paying tuition) at a university in Australia. • A German telecommunications firm purchases microprocessors from an American firm. • An American bank purchases shares of stock in Japanese firms traded on the Tokyo stock exchange.

How would the following transactions be categorized in the U. S. balance of payments accounts? How will the balance of payments on the current and financial accounts change? • An American college student decides to spend a year studying (and paying tuition) at a university in Australia. • A German telecommunications firm purchases microprocessors from an American firm. • An American bank purchases shares of stock in Japanese firms traded on the Tokyo stock exchange.

Warm Up Do not get a chrome book 1. Think of a place where you would like to travel 2. List five things you would need to travel there

Warm Up Do not get a chrome book 1. Think of a place where you would like to travel 2. List five things you would need to travel there

Summing Up Module 41 • The financial account reflects inflows and outflows of capital and is modeled as equilibrium in the international loanable funds market. • At the same time- the balance of payments on goods & services in the current account is determined by decisions in the international markets for goods and services. So… what ensures that the two accounts really do offset each other?

Summing Up Module 41 • The financial account reflects inflows and outflows of capital and is modeled as equilibrium in the international loanable funds market. • At the same time- the balance of payments on goods & services in the current account is determined by decisions in the international markets for goods and services. So… what ensures that the two accounts really do offset each other?

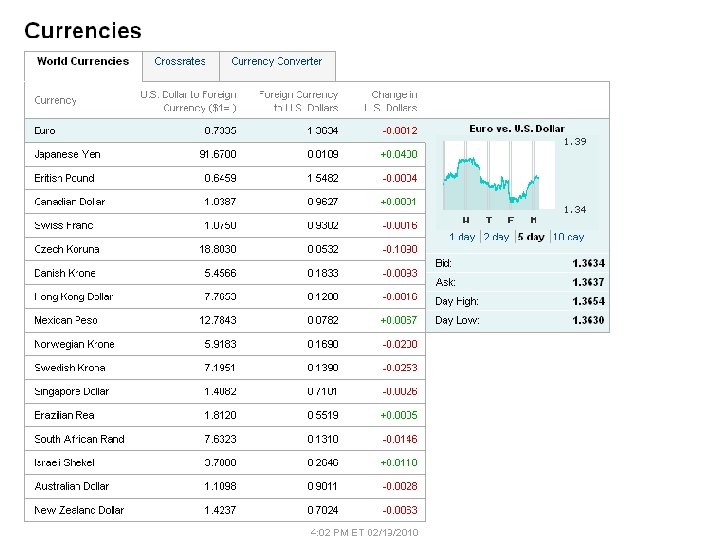

The Exchange rate • International transactions require a market - the Foreign Exchange Market • Currencies are exchanges for one another • This market determines the exchange rate • The prices at which currencies trade is called the exchange rate

The Exchange rate • International transactions require a market - the Foreign Exchange Market • Currencies are exchanges for one another • This market determines the exchange rate • The prices at which currencies trade is called the exchange rate

The Role of the Exchange Rate Use the Lecture Notes. • Understanding Exchange Rates • The Equilibrium Exchange Rate • Inflation and real Exchange Rates • Purchasing Power Parity:

The Role of the Exchange Rate Use the Lecture Notes. • Understanding Exchange Rates • The Equilibrium Exchange Rate • Inflation and real Exchange Rates • Purchasing Power Parity:

Role of ER What ensures that the balance of payments really does balance? recall: financial=mvmt of capital; current= g&s The exchange rate!

Role of ER What ensures that the balance of payments really does balance? recall: financial=mvmt of capital; current= g&s The exchange rate!

Current Events http: //www. bbc. com/news/business-27230632 Take a moment to read the following article. Do you understand what the article is saying?

Current Events http: //www. bbc. com/news/business-27230632 Take a moment to read the following article. Do you understand what the article is saying?

Understanding ER Pretend we just traveled to…. .

Understanding ER Pretend we just traveled to…. .

While walking along we see this:

While walking along we see this:

And they have these:

And they have these:

How do you get one!? Price: 2 Euro

How do you get one!? Price: 2 Euro

How many US dollars will you 2 Euros/. 72 Euros per dollar= need to buy this 2 Euro ~$2. 77 crepe?

How many US dollars will you 2 Euros/. 72 Euros per dollar= need to buy this 2 Euro ~$2. 77 crepe?

What happens if tomorrow, the exchange rate was. 80 Euro to the dollar? $2. 50 What happened to the dollar’s value? It has appreciated in value against the Euro What happens if tomorrow, the exchange rate was. 60 Euro to the dollar? $3. 33 What happened to the dollar’s value? It has depreciated in value against the Euro

What happens if tomorrow, the exchange rate was. 80 Euro to the dollar? $2. 50 What happened to the dollar’s value? It has appreciated in value against the Euro What happens if tomorrow, the exchange rate was. 60 Euro to the dollar? $3. 33 What happened to the dollar’s value? It has depreciated in value against the Euro

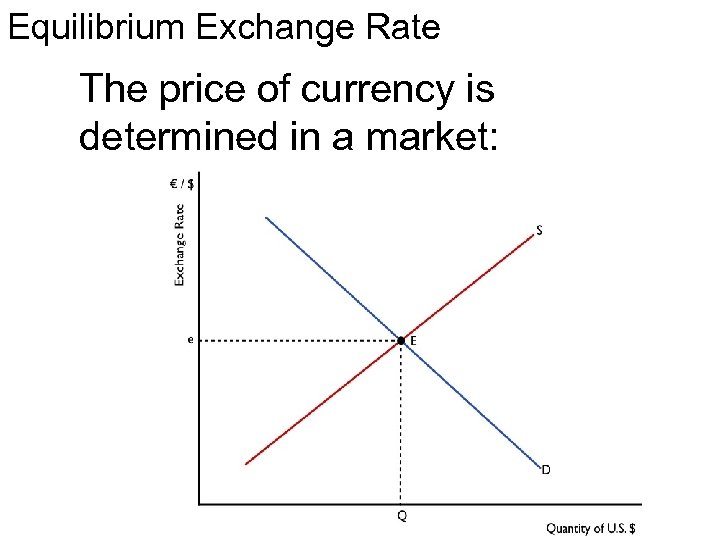

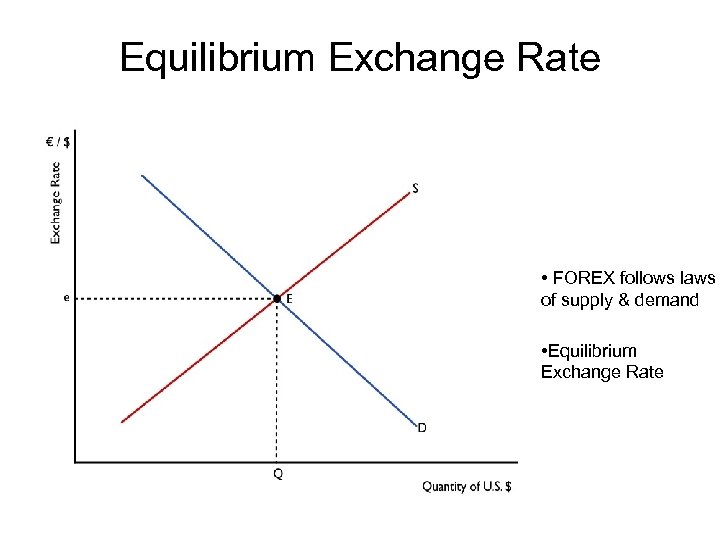

Equilibrium Exchange Rate The price of currency is determined in a market:

Equilibrium Exchange Rate The price of currency is determined in a market:

Why does the demand for dollars slope downward? As the price of a dollar falls (depreciates) it takes fewer Euros to buy one dollar Consumers in Europe find US good to be less expensive US exports rise to Europe and more dollars will be demanded Why does supply of dollars slow upward? As the price of a dollar rises (appreciates) one dollar buys more Euros Consumers in US find European goods less expensive US imports from Europe increase and more dollars will be supplied to pay for those goods.

Why does the demand for dollars slope downward? As the price of a dollar falls (depreciates) it takes fewer Euros to buy one dollar Consumers in Europe find US good to be less expensive US exports rise to Europe and more dollars will be demanded Why does supply of dollars slow upward? As the price of a dollar rises (appreciates) one dollar buys more Euros Consumers in US find European goods less expensive US imports from Europe increase and more dollars will be supplied to pay for those goods.

Summary: An increase in capital flows into the US leads to a stronger dollar, which then creates a decrease in US net exports (and vice versa)A decrease in capital inflows into the US leads to a weaker dollar, which then creates an increase in US net exports an inc. in US balance of pymts on the financial acct is exactly offset by a dec. in the US balance of pymts in the current acct

Summary: An increase in capital flows into the US leads to a stronger dollar, which then creates a decrease in US net exports (and vice versa)A decrease in capital inflows into the US leads to a weaker dollar, which then creates an increase in US net exports an inc. in US balance of pymts on the financial acct is exactly offset by a dec. in the US balance of pymts in the current acct

Inflation and Real Exchange Rate Price of imported goods depends on ER foreign currencies and the aggregate price level in those nations Therefore, we calculate the real exchange rate: ER adjusted for international differences in aggregate price levels

Inflation and Real Exchange Rate Price of imported goods depends on ER foreign currencies and the aggregate price level in those nations Therefore, we calculate the real exchange rate: ER adjusted for international differences in aggregate price levels

Example: The real exchange rate between 2 currencies Base year: Where 12. 5 pesos=1 dollar PUS, Pmex=price index Real exchange rate= 12. 5 x (100/100)= 12. 5 pesos per dollar Next year, Mexico had a 10% aggregate inflation: RER=12. 5 x (100/110)= 11. 4 pesos per dollar

Example: The real exchange rate between 2 currencies Base year: Where 12. 5 pesos=1 dollar PUS, Pmex=price index Real exchange rate= 12. 5 x (100/100)= 12. 5 pesos per dollar Next year, Mexico had a 10% aggregate inflation: RER=12. 5 x (100/110)= 11. 4 pesos per dollar

Shifters in currencies • • Tastes Price Level Income Interest Rates

Shifters in currencies • • Tastes Price Level Income Interest Rates

Summary • When a currency becomes more valuable in terms of other currencies- it appreciates • When a currency becomes less valuable in terms with other currencies- it depreciates.

Summary • When a currency becomes more valuable in terms of other currencies- it appreciates • When a currency becomes less valuable in terms with other currencies- it depreciates.

Purchasing Power Parity Between two countries’ currencies is the nominal ER at which a basket of goods and services would cost the same amount in each country Ex: basket = $100 in US, costs 1, 000 pesos in Mexico PPP= 10 pesos per US dollar At that exchange rate 1, 000 pesos = $100 so the market basket cost the same amount in both countries.

Purchasing Power Parity Between two countries’ currencies is the nominal ER at which a basket of goods and services would cost the same amount in each country Ex: basket = $100 in US, costs 1, 000 pesos in Mexico PPP= 10 pesos per US dollar At that exchange rate 1, 000 pesos = $100 so the market basket cost the same amount in both countries.

Closed vs. Open Economies A closed economy focuses only on the domestic price. An open economy trades for the lowest world price. Export Goods & Services are now 16% of Americas GDP. US Exports have doubled as a percent of GDP since 1975. 43

Closed vs. Open Economies A closed economy focuses only on the domestic price. An open economy trades for the lowest world price. Export Goods & Services are now 16% of Americas GDP. US Exports have doubled as a percent of GDP since 1975. 43

Two-way Capital Flows • Capital moves in both directions • Differences in individual investor's incentives • Financial specialization • Countries can be both creditors and debtors simultaneously

Two-way Capital Flows • Capital moves in both directions • Differences in individual investor's incentives • Financial specialization • Countries can be both creditors and debtors simultaneously

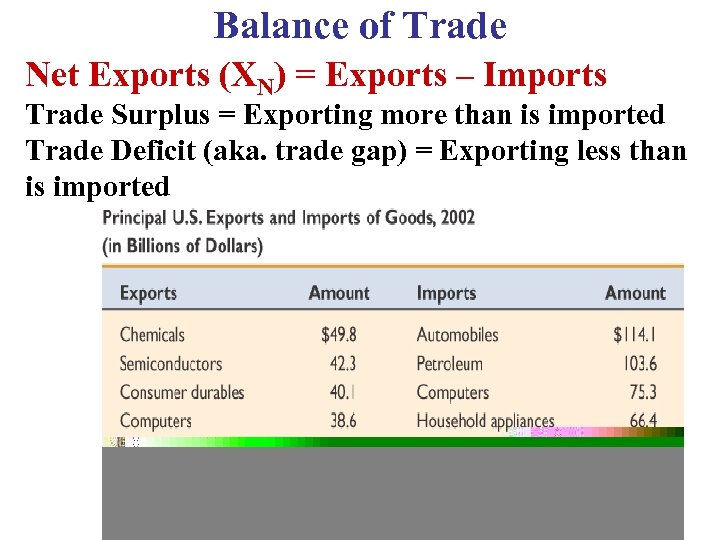

Balance of Trade Net Exports (XN) = Exports – Imports Trade Surplus = Exporting more than is imported Trade Deficit (aka. trade gap) = Exporting less than is imported

Balance of Trade Net Exports (XN) = Exports – Imports Trade Surplus = Exporting more than is imported Trade Deficit (aka. trade gap) = Exporting less than is imported

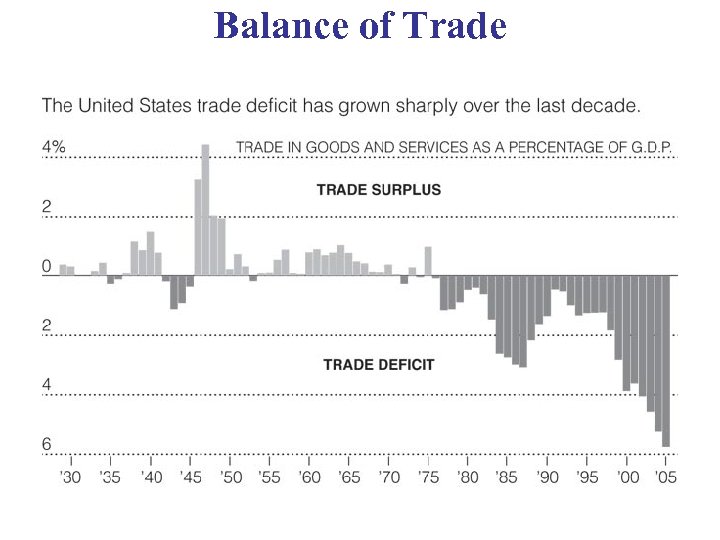

Balance of Trade

Balance of Trade

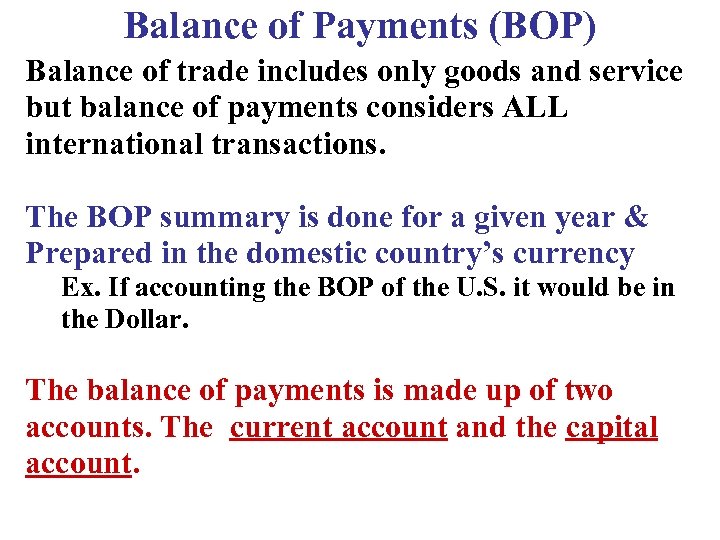

Balance of Payments (BOP) Balance of trade includes only goods and service but balance of payments considers ALL international transactions. The BOP summary is done for a given year & Prepared in the domestic country’s currency Ex. If accounting the BOP of the U. S. it would be in the Dollar. The balance of payments is made up of two accounts. The current account and the capital account.

Balance of Payments (BOP) Balance of trade includes only goods and service but balance of payments considers ALL international transactions. The BOP summary is done for a given year & Prepared in the domestic country’s currency Ex. If accounting the BOP of the U. S. it would be in the Dollar. The balance of payments is made up of two accounts. The current account and the capital account.

Which countries have the highest account surpluses and account deficits?

Which countries have the highest account surpluses and account deficits?

The Loanable Funds Model Revisited

The Loanable Funds Model Revisited

Loanable Funds Markets in Two Countries

Loanable Funds Markets in Two Countries

Loanable Funds Markets in Two Countries

Loanable Funds Markets in Two Countries

Current or Capital Account? Identify if examples are counted in the current or capital account and determine if it is a credit or debit for the US. 1. Bill, an American, invests $20 million in a ski resort in Canada 2. A Korean company sells vests to the US Military 3. A US company, Boeing, sells twenty 747 s to France 4. A Chinese company buys a shopping mall in San Diego 5. An illegal immigrant sends a portion of his earning to his family 6. An German investor buys $50, 000 US Treasury Bonds 7. Italian tourists spend 5 million in the US while American tourists spend 8 million in Italy.

Current or Capital Account? Identify if examples are counted in the current or capital account and determine if it is a credit or debit for the US. 1. Bill, an American, invests $20 million in a ski resort in Canada 2. A Korean company sells vests to the US Military 3. A US company, Boeing, sells twenty 747 s to France 4. A Chinese company buys a shopping mall in San Diego 5. An illegal immigrant sends a portion of his earning to his family 6. An German investor buys $50, 000 US Treasury Bonds 7. Italian tourists spend 5 million in the US while American tourists spend 8 million in Italy.

Current or Capital Account Answers 1. Capital Account (financial asset), Debit 2. Current Account (trade of goods/services), Debit 3. Current Account (trade of goods/services), Credit 4. Capital Account (financial asset), Credit 5. Current Account (net transfer), Debit 6. Capital Account (financial asset), Credit 7. Current Account (net transfer), Debit

Current or Capital Account Answers 1. Capital Account (financial asset), Debit 2. Current Account (trade of goods/services), Debit 3. Current Account (trade of goods/services), Credit 4. Capital Account (financial asset), Credit 5. Current Account (net transfer), Debit 6. Capital Account (financial asset), Credit 7. Current Account (net transfer), Debit

Practice Questions & Answers 1. U. S. income increases relative to other countries. Does the BOP move toward a deficit or a surplus? - U. S. citizens have more disposable income - Americans import more - Net exports (Xn) decrease The current account balance decreases and moves toward a deficit. 2. If the U. S. dollar depreciates relative to other countries does the BOP move to a deficit or a surplus? - US exports are desirable - America exports more - Net exports (Xn) increase The current account balance decreases and moves toward a surplus.

Practice Questions & Answers 1. U. S. income increases relative to other countries. Does the BOP move toward a deficit or a surplus? - U. S. citizens have more disposable income - Americans import more - Net exports (Xn) decrease The current account balance decreases and moves toward a deficit. 2. If the U. S. dollar depreciates relative to other countries does the BOP move to a deficit or a surplus? - US exports are desirable - America exports more - Net exports (Xn) increase The current account balance decreases and moves toward a surplus.

Review problems

Review problems

Foreign Exchange (aka. FOREX) Module 42 Exchange Rate = Relative Price of Currencies

Foreign Exchange (aka. FOREX) Module 42 Exchange Rate = Relative Price of Currencies

Exports and Imports 1. US sells cars to Mexico 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U. S. For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exporter).

Exports and Imports 1. US sells cars to Mexico 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U. S. For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (exporter).

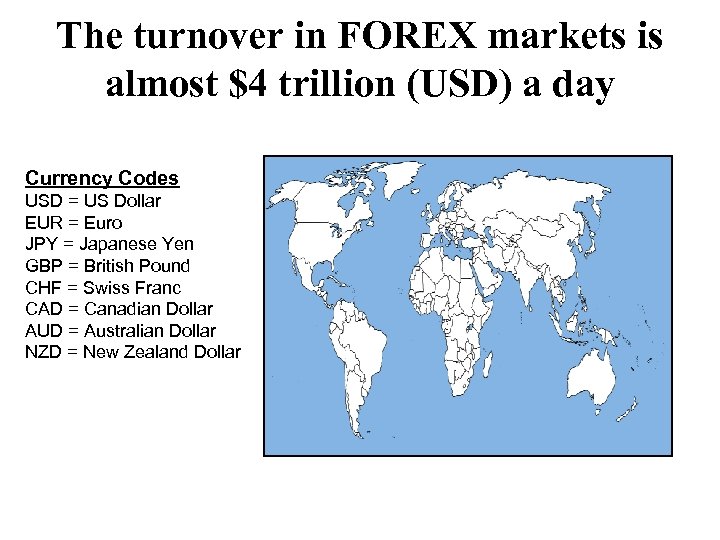

The turnover in FOREX markets is almost $4 trillion (USD) a day Currency Codes USD = US Dollar EUR = Euro JPY = Japanese Yen GBP = British Pound CHF = Swiss Franc CAD = Canadian Dollar AUD = Australian Dollar NZD = New Zealand Dollar

The turnover in FOREX markets is almost $4 trillion (USD) a day Currency Codes USD = US Dollar EUR = Euro JPY = Japanese Yen GBP = British Pound CHF = Swiss Franc CAD = Canadian Dollar AUD = Australian Dollar NZD = New Zealand Dollar

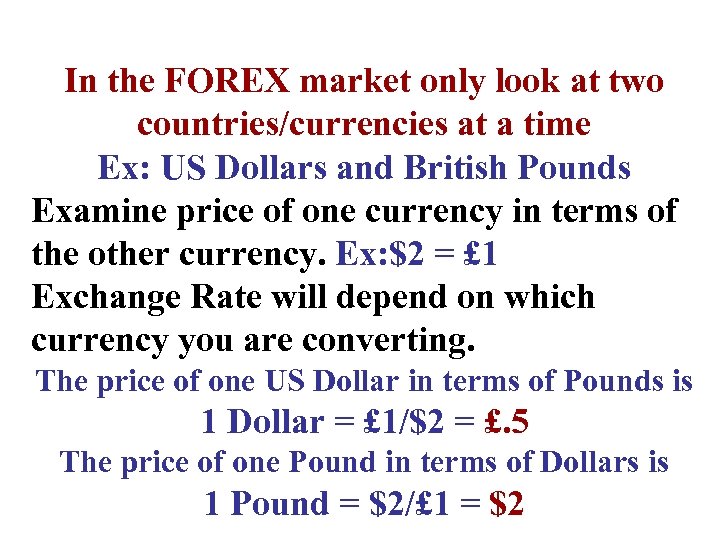

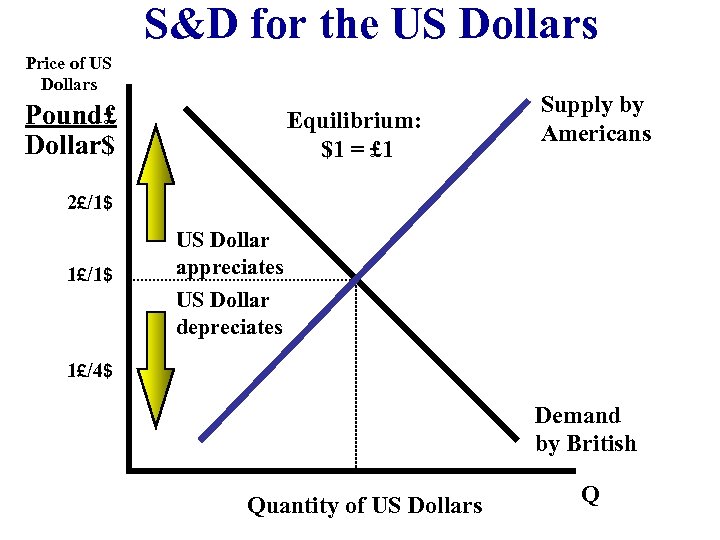

In the FOREX market only look at two countries/currencies at a time Ex: US Dollars and British Pounds Examine price of one currency in terms of the other currency. Ex: $2 = £ 1 Exchange Rate will depend on which currency you are converting. The price of one US Dollar in terms of Pounds is 1 Dollar = £ 1/$2 = £. 5 The price of one Pound in terms of Dollars is 1 Pound = $2/£ 1 = $2

In the FOREX market only look at two countries/currencies at a time Ex: US Dollars and British Pounds Examine price of one currency in terms of the other currency. Ex: $2 = £ 1 Exchange Rate will depend on which currency you are converting. The price of one US Dollar in terms of Pounds is 1 Dollar = £ 1/$2 = £. 5 The price of one Pound in terms of Dollars is 1 Pound = $2/£ 1 = $2

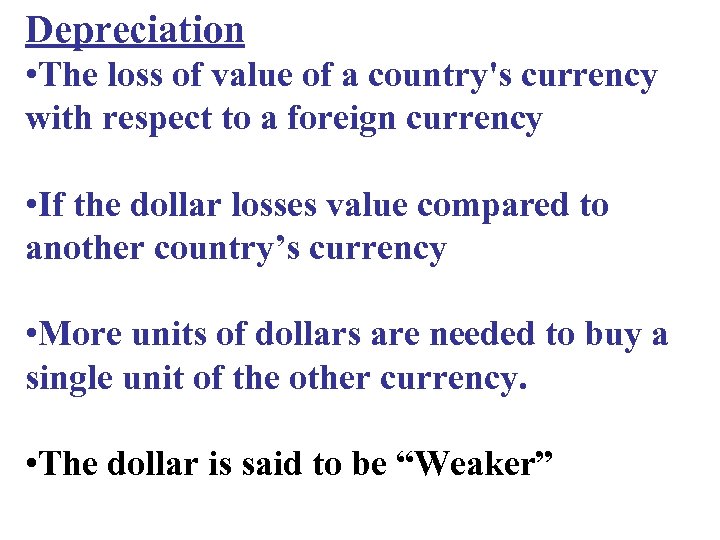

Depreciation • The loss of value of a country's currency with respect to a foreign currency • If the dollar losses value compared to another country’s currency • More units of dollars are needed to buy a single unit of the other currency. • The dollar is said to be “Weaker”

Depreciation • The loss of value of a country's currency with respect to a foreign currency • If the dollar losses value compared to another country’s currency • More units of dollars are needed to buy a single unit of the other currency. • The dollar is said to be “Weaker”

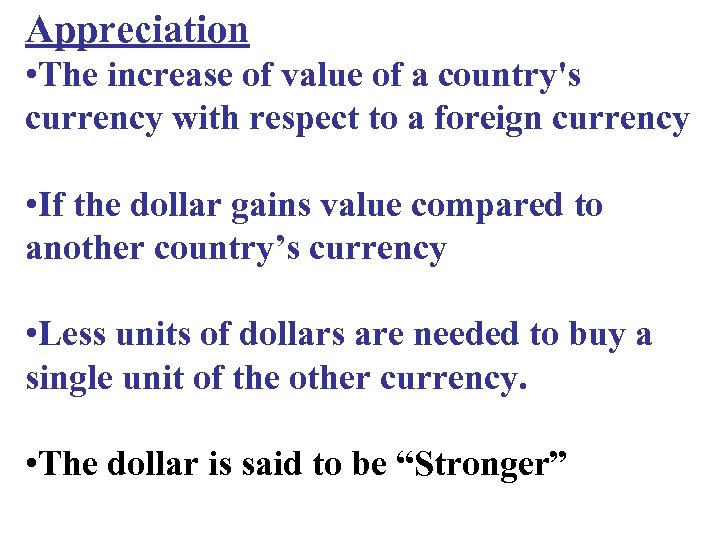

Appreciation • The increase of value of a country's currency with respect to a foreign currency • If the dollar gains value compared to another country’s currency • Less units of dollars are needed to buy a single unit of the other currency. • The dollar is said to be “Stronger”

Appreciation • The increase of value of a country's currency with respect to a foreign currency • If the dollar gains value compared to another country’s currency • Less units of dollars are needed to buy a single unit of the other currency. • The dollar is said to be “Stronger”

FOREX is based upon Supply and Demand Imagine a huge table with all the different currencies from every country This is the Foreign Exchange Market! If you demand one currency, you must supply your currency. Ex: If Canadians want Russian Rubles. The demand for Rubles in the FOREX market will increase and the supply of Canadian Dollars will increase.

FOREX is based upon Supply and Demand Imagine a huge table with all the different currencies from every country This is the Foreign Exchange Market! If you demand one currency, you must supply your currency. Ex: If Canadians want Russian Rubles. The demand for Rubles in the FOREX market will increase and the supply of Canadian Dollars will increase.

Equilibrium Exchange Rate • FOREX follows laws of supply & demand • Equilibrium Exchange Rate

Equilibrium Exchange Rate • FOREX follows laws of supply & demand • Equilibrium Exchange Rate

S&D for the US Dollars Price of US Dollars Pound£ Dollar$ Equilibrium: $1 = £ 1 Supply by Americans 2£/1$ 1£/1$ US Dollar appreciates US Dollar depreciates 1£/4$ Demand by British Quantity of US Dollars Q

S&D for the US Dollars Price of US Dollars Pound£ Dollar$ Equilibrium: $1 = £ 1 Supply by Americans 2£/1$ 1£/1$ US Dollar appreciates US Dollar depreciates 1£/4$ Demand by British Quantity of US Dollars Q

Inflation and Real Exchange Rates • Real Exchange Rates Are Adjusted for Inflation • Nominal Exchange Rates • Real Exchange Rate and the Current Account

Inflation and Real Exchange Rates • Real Exchange Rates Are Adjusted for Inflation • Nominal Exchange Rates • Real Exchange Rate and the Current Account

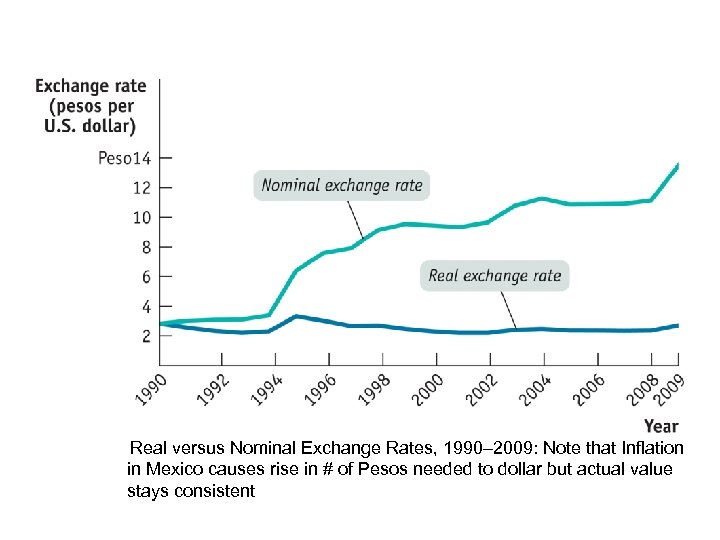

Real versus Nominal Exchange Rates, 1990– 2009: Note that Inflation in Mexico causes rise in # of Pesos needed to dollar but actual value stays consistent

Real versus Nominal Exchange Rates, 1990– 2009: Note that Inflation in Mexico causes rise in # of Pesos needed to dollar but actual value stays consistent

Purchasing Power Parity • Purchasing Power Parity (PPP) is nominal exchange rate between 2 countries for a given basket of goods and services. • Big Mac Index (single item cost nation to nation) • Nominal Exchange Rates and PPP • If a basket of goods cost $1 k in Mexico but only $100 in U. S. then the exchange rate would be 10 pesos to the dollar.

Purchasing Power Parity • Purchasing Power Parity (PPP) is nominal exchange rate between 2 countries for a given basket of goods and services. • Big Mac Index (single item cost nation to nation) • Nominal Exchange Rates and PPP • If a basket of goods cost $1 k in Mexico but only $100 in U. S. then the exchange rate would be 10 pesos to the dollar.

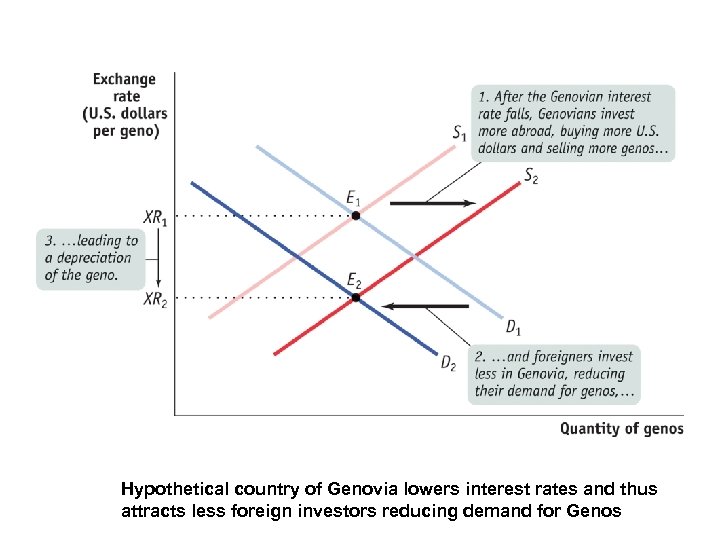

Hypothetical country of Genovia lowers interest rates and thus attracts less foreign investors reducing demand for Genos

Hypothetical country of Genovia lowers interest rates and thus attracts less foreign investors reducing demand for Genos

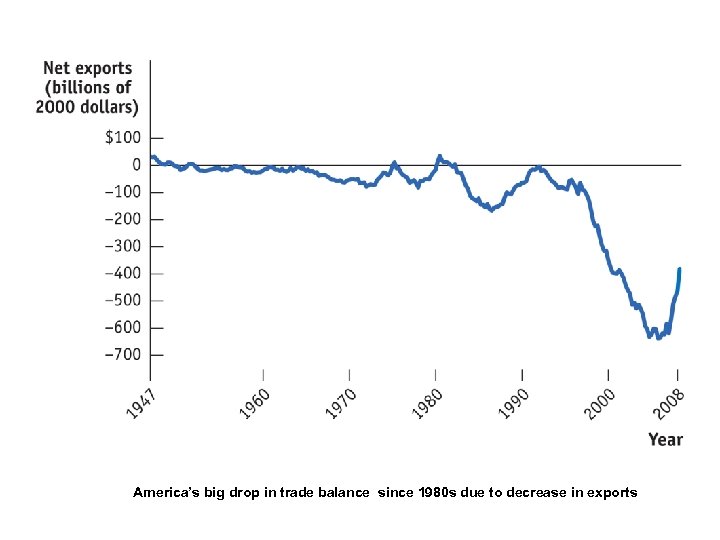

America’s big drop in trade balance since 1980 s due to decrease in exports

America’s big drop in trade balance since 1980 s due to decrease in exports

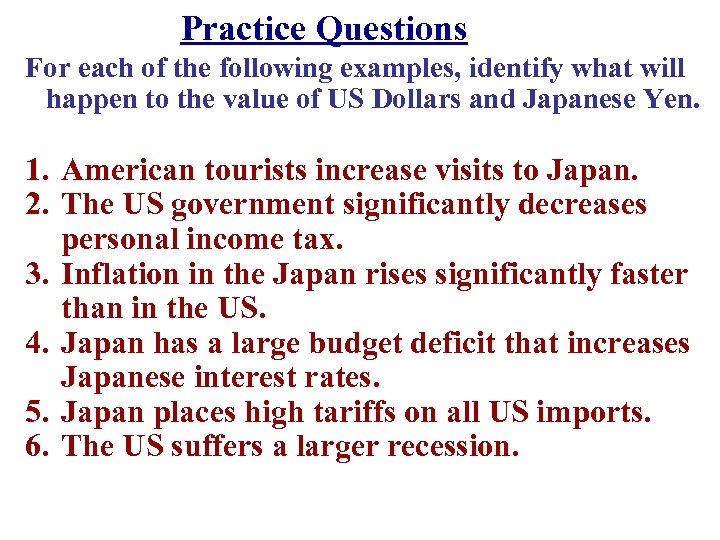

Practice Questions For each of the following examples, identify what will happen to the value of US Dollars and Japanese Yen. 1. American tourists increase visits to Japan. 2. The US government significantly decreases personal income tax. 3. Inflation in the Japan rises significantly faster than in the US. 4. Japan has a large budget deficit that increases Japanese interest rates. 5. Japan places high tariffs on all US imports. 6. The US suffers a larger recession.

Practice Questions For each of the following examples, identify what will happen to the value of US Dollars and Japanese Yen. 1. American tourists increase visits to Japan. 2. The US government significantly decreases personal income tax. 3. Inflation in the Japan rises significantly faster than in the US. 4. Japan has a large budget deficit that increases Japanese interest rates. 5. Japan places high tariffs on all US imports. 6. The US suffers a larger recession.

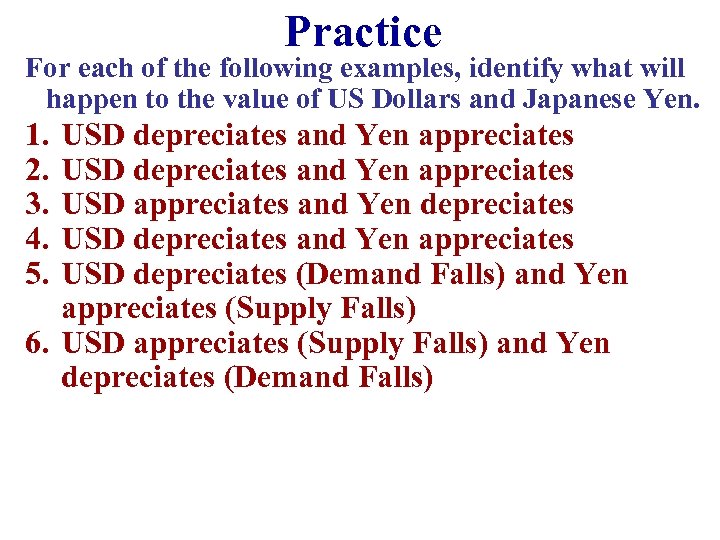

Practice For each of the following examples, identify what will happen to the value of US Dollars and Japanese Yen. 1. 2. 3. 4. 5. USD depreciates and Yen appreciates USD appreciates and Yen depreciates USD depreciates and Yen appreciates USD depreciates (Demand Falls) and Yen appreciates (Supply Falls) 6. USD appreciates (Supply Falls) and Yen depreciates (Demand Falls)

Practice For each of the following examples, identify what will happen to the value of US Dollars and Japanese Yen. 1. 2. 3. 4. 5. USD depreciates and Yen appreciates USD appreciates and Yen depreciates USD depreciates and Yen appreciates USD depreciates (Demand Falls) and Yen appreciates (Supply Falls) 6. USD appreciates (Supply Falls) and Yen depreciates (Demand Falls)

Module 43 Exchange Rate Policy • Governments have more power to influence nominal exchange rates than other prices • Exchange rates are important to countries where exports and imports are a large fraction of GDP

Module 43 Exchange Rate Policy • Governments have more power to influence nominal exchange rates than other prices • Exchange rates are important to countries where exports and imports are a large fraction of GDP

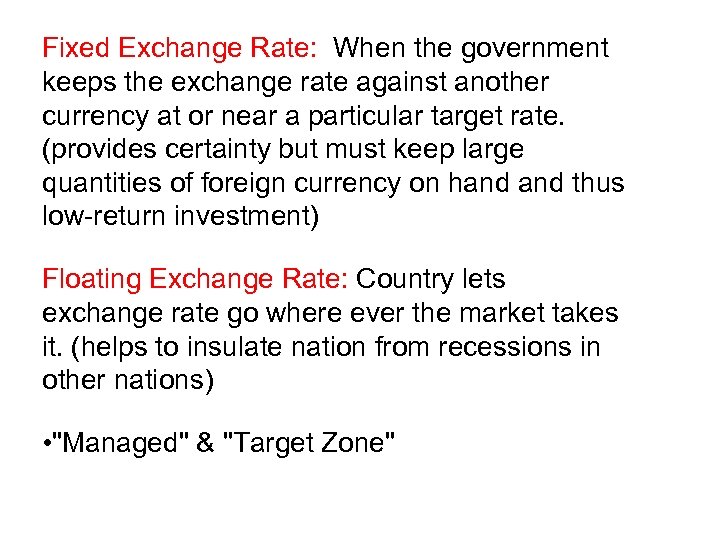

Fixed Exchange Rate: When the government keeps the exchange rate against another currency at or near a particular target rate. (provides certainty but must keep large quantities of foreign currency on hand thus low-return investment) Floating Exchange Rate: Country lets exchange rate go where ever the market takes it. (helps to insulate nation from recessions in other nations) • "Managed" & "Target Zone"

Fixed Exchange Rate: When the government keeps the exchange rate against another currency at or near a particular target rate. (provides certainty but must keep large quantities of foreign currency on hand thus low-return investment) Floating Exchange Rate: Country lets exchange rate go where ever the market takes it. (helps to insulate nation from recessions in other nations) • "Managed" & "Target Zone"

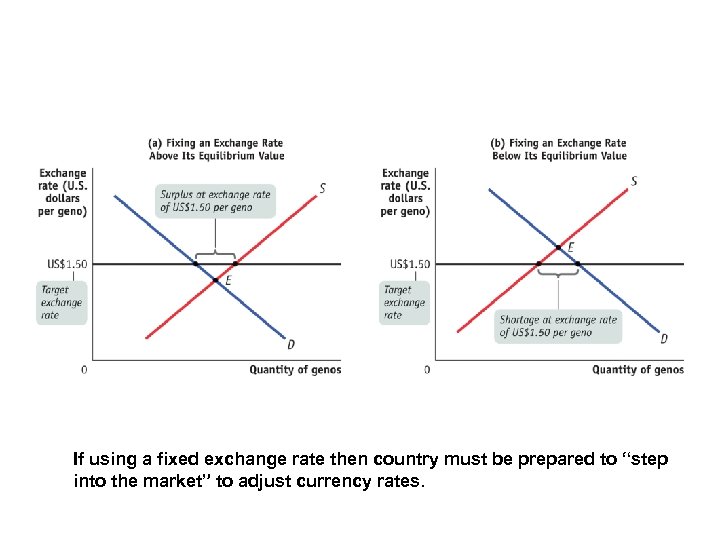

If using a fixed exchange rate then country must be prepared to “step into the market” to adjust currency rates.

If using a fixed exchange rate then country must be prepared to “step into the market” to adjust currency rates.

Module 44: Exchange Rates and Policy • Devaluation: A reduction in the value of a nation’s currency • Revaluation: An increase in a nation’s currency value General Rule: Recessions lead to a fall in imports and an expansion leads to a rise in imports

Module 44: Exchange Rates and Policy • Devaluation: A reduction in the value of a nation’s currency • Revaluation: An increase in a nation’s currency value General Rule: Recessions lead to a fall in imports and an expansion leads to a rise in imports

What is Protectionism? • Practice of limiting trade to protect domestic industries. • Tariffs; tax on imports • Quotas: Cap on the # of goods allowed into a country • Tariffs provide governments with revenues and quotas do NOT.

What is Protectionism? • Practice of limiting trade to protect domestic industries. • Tariffs; tax on imports • Quotas: Cap on the # of goods allowed into a country • Tariffs provide governments with revenues and quotas do NOT.

• https: //www. youtube. com/watch? v=Gr. Ld 7 Dn. BZQ

• https: //www. youtube. com/watch? v=Gr. Ld 7 Dn. BZQ

Review with Mr. Clifford • https: //www. youtube. com/watch? v=u. CZ 58 OJjr. FU

Review with Mr. Clifford • https: //www. youtube. com/watch? v=u. CZ 58 OJjr. FU

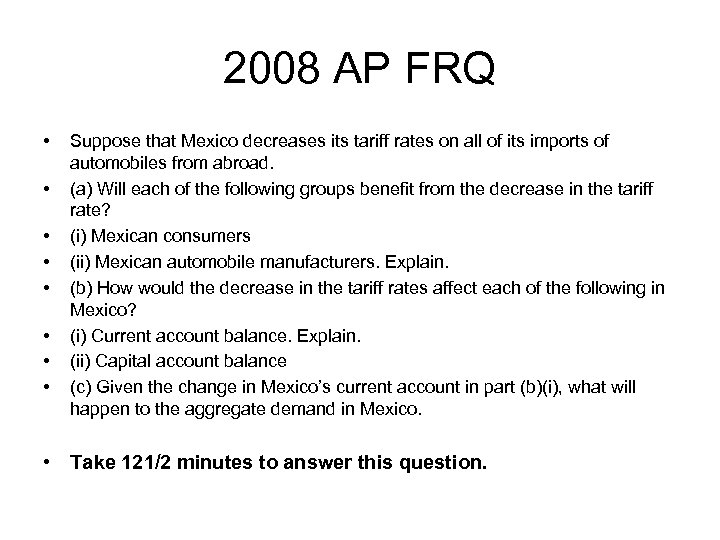

2008 AP FRQ • • Suppose that Mexico decreases its tariff rates on all of its imports of automobiles from abroad. (a) Will each of the following groups benefit from the decrease in the tariff rate? (i) Mexican consumers (ii) Mexican automobile manufacturers. Explain. (b) How would the decrease in the tariff rates affect each of the following in Mexico? (i) Current account balance. Explain. (ii) Capital account balance (c) Given the change in Mexico’s current account in part (b)(i), what will happen to the aggregate demand in Mexico. • Take 121/2 minutes to answer this question.

2008 AP FRQ • • Suppose that Mexico decreases its tariff rates on all of its imports of automobiles from abroad. (a) Will each of the following groups benefit from the decrease in the tariff rate? (i) Mexican consumers (ii) Mexican automobile manufacturers. Explain. (b) How would the decrease in the tariff rates affect each of the following in Mexico? (i) Current account balance. Explain. (ii) Capital account balance (c) Given the change in Mexico’s current account in part (b)(i), what will happen to the aggregate demand in Mexico. • Take 121/2 minutes to answer this question.

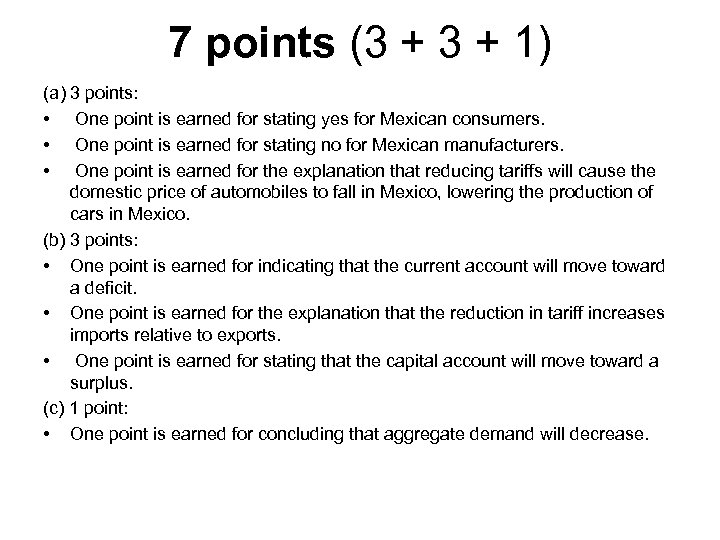

7 points (3 + 1) (a) 3 points: • One point is earned for stating yes for Mexican consumers. • One point is earned for stating no for Mexican manufacturers. • One point is earned for the explanation that reducing tariffs will cause the domestic price of automobiles to fall in Mexico, lowering the production of cars in Mexico. (b) 3 points: • One point is earned for indicating that the current account will move toward a deficit. • One point is earned for the explanation that the reduction in tariff increases imports relative to exports. • One point is earned for stating that the capital account will move toward a surplus. (c) 1 point: • One point is earned for concluding that aggregate demand will decrease.

7 points (3 + 1) (a) 3 points: • One point is earned for stating yes for Mexican consumers. • One point is earned for stating no for Mexican manufacturers. • One point is earned for the explanation that reducing tariffs will cause the domestic price of automobiles to fall in Mexico, lowering the production of cars in Mexico. (b) 3 points: • One point is earned for indicating that the current account will move toward a deficit. • One point is earned for the explanation that the reduction in tariff increases imports relative to exports. • One point is earned for stating that the capital account will move toward a surplus. (c) 1 point: • One point is earned for concluding that aggregate demand will decrease.

Stossel • https: //www. youtube. com/watch? v=x. T 0 Mq a. Wbwjo • How does Stossel see the Road to Serfdom?

Stossel • https: //www. youtube. com/watch? v=x. T 0 Mq a. Wbwjo • How does Stossel see the Road to Serfdom?

Graphs you need to know: 1. Production Possibilities Curve 2. Aggregate Demand, Aggregate Supply 3. Money Market 4. Loanable Funds Market 5. Foreign Exchange Market 6. The Phillips Curve 7. Circular Flow http: //www. slideshare. net/Mr. Red/graphs 2 -know-for-the-ap-econexam#13989467975441&hide. Spinner

Graphs you need to know: 1. Production Possibilities Curve 2. Aggregate Demand, Aggregate Supply 3. Money Market 4. Loanable Funds Market 5. Foreign Exchange Market 6. The Phillips Curve 7. Circular Flow http: //www. slideshare. net/Mr. Red/graphs 2 -know-for-the-ap-econexam#13989467975441&hide. Spinner