098190656a01946d45bff1eace5a7fe6.ppt

- Количество слайдов: 17

Current Asset Management (Chapter 7) (Chapter 6 – pages 143 – 145) n Working Capital Management n Current Asset Investment Policy n Temporary and Permanent n n n Current Assets Zero Working Capital Cash Management Marketable Securities Accounts Receivable Management Inventory Management

Current Asset Management (Chapter 7) (Chapter 6 – pages 143 – 145) n Working Capital Management n Current Asset Investment Policy n Temporary and Permanent n n n Current Assets Zero Working Capital Cash Management Marketable Securities Accounts Receivable Management Inventory Management

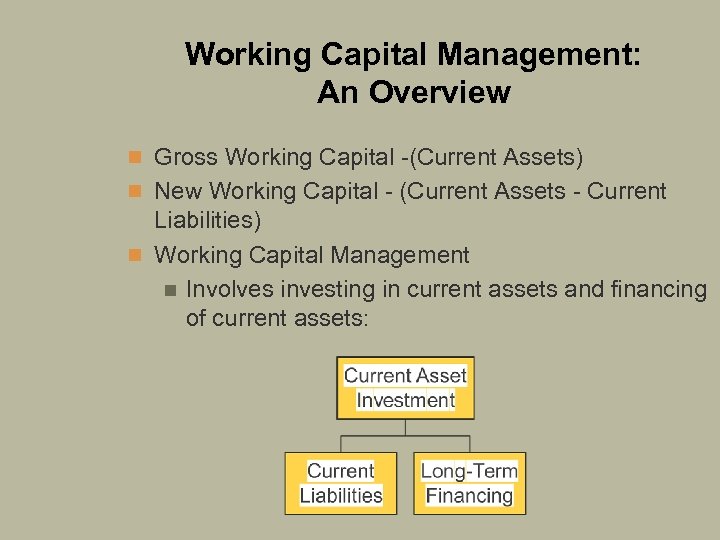

Working Capital Management: An Overview n Gross Working Capital -(Current Assets) n New Working Capital - (Current Assets - Current Liabilities) n Working Capital Management n Involves investing in current assets and financing of current assets:

Working Capital Management: An Overview n Gross Working Capital -(Current Assets) n New Working Capital - (Current Assets - Current Liabilities) n Working Capital Management n Involves investing in current assets and financing of current assets:

Current Asset Investment Policy n Everything else remaining the same, higher levels of current assets mean lower risk and lower expected return n Lower Risk n Greater ability to meet short-run obligations. n Lower Return n Cash and marketable securities typically yield low returns. Furthermore, when current assets are increased, additional financing costs will be incurred thereby lowering returns. n Lower levels of current assets result in opposite effects.

Current Asset Investment Policy n Everything else remaining the same, higher levels of current assets mean lower risk and lower expected return n Lower Risk n Greater ability to meet short-run obligations. n Lower Return n Cash and marketable securities typically yield low returns. Furthermore, when current assets are increased, additional financing costs will be incurred thereby lowering returns. n Lower levels of current assets result in opposite effects.

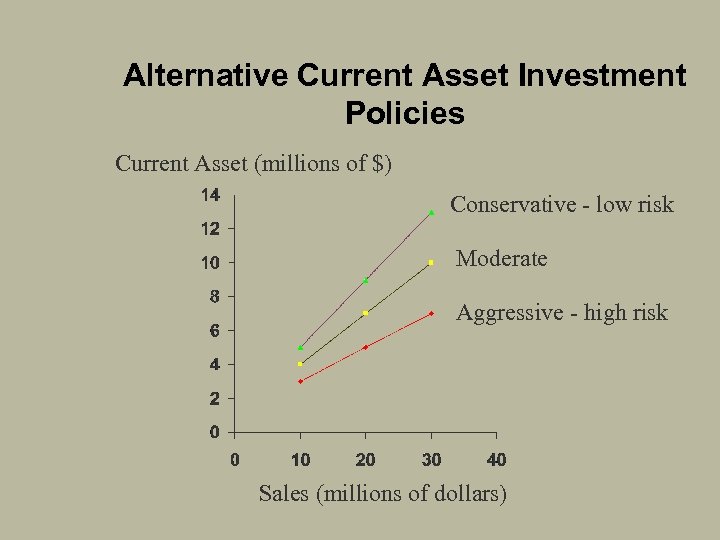

Alternative Current Asset Investment Policies Current Asset (millions of $) Conservative - low risk Moderate Aggressive - high risk Sales (millions of dollars)

Alternative Current Asset Investment Policies Current Asset (millions of $) Conservative - low risk Moderate Aggressive - high risk Sales (millions of dollars)

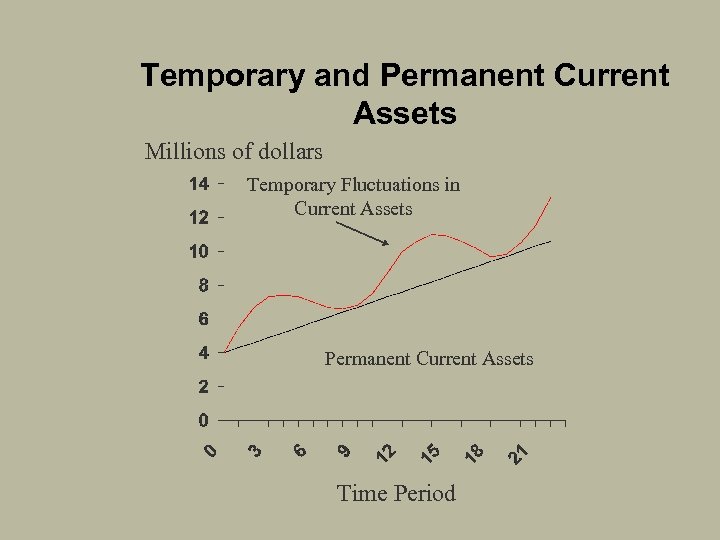

Temporary vs. Permanent Investment in Current Assets n Temporary Investment - Commonly, firms experience short-run fluctuations in current assets. For example, retail department stores will have high levels of inventory around Thanksgiving. In January, the inventory should be low. n Permanent Investment - Firms always have some minimum level of investment in current assets (i. e. , a permanent investment). As a firm grows over time, the level of permanent current assets also grows (e. g. , a supermarket chain with 70 stores will have more permanent inventory than a chain with 4 stores).

Temporary vs. Permanent Investment in Current Assets n Temporary Investment - Commonly, firms experience short-run fluctuations in current assets. For example, retail department stores will have high levels of inventory around Thanksgiving. In January, the inventory should be low. n Permanent Investment - Firms always have some minimum level of investment in current assets (i. e. , a permanent investment). As a firm grows over time, the level of permanent current assets also grows (e. g. , a supermarket chain with 70 stores will have more permanent inventory than a chain with 4 stores).

Temporary and Permanent Current Assets Millions of dollars Temporary Fluctuations in Current Assets Permanent Current Assets Time Period

Temporary and Permanent Current Assets Millions of dollars Temporary Fluctuations in Current Assets Permanent Current Assets Time Period

Cash Management: An Overview n Beginning Cash Balance + Cash Inflows - - - Speed Up - Cash Outflows - - - Slow Down = Ending Cash Balance - Desired Cash Balance = Surplus or Shortage n If Surplus: Pay off short-term debt or buy marketable securities n If Shortage: Short-term borrowing or sell marketable securities

Cash Management: An Overview n Beginning Cash Balance + Cash Inflows - - - Speed Up - Cash Outflows - - - Slow Down = Ending Cash Balance - Desired Cash Balance = Surplus or Shortage n If Surplus: Pay off short-term debt or buy marketable securities n If Shortage: Short-term borrowing or sell marketable securities

Desired Cash Balance: n Precautionary Demand - Satisfy possible, but n n as yet indefinite cash needs. Speculative Demand - Build up current cash balances in anticipation of future business costs being lower. Risk Preferences Compensating Balances Transactions Demand - Cash needs arising in the ordinary course of doing business.

Desired Cash Balance: n Precautionary Demand - Satisfy possible, but n n as yet indefinite cash needs. Speculative Demand - Build up current cash balances in anticipation of future business costs being lower. Risk Preferences Compensating Balances Transactions Demand - Cash needs arising in the ordinary course of doing business.

Float n Much of cash management is oriented towards managing the float. n Mail Float n Time lapse from the moment a customer mails a remittance check until the firm begins to process it. n Processing Float n Time required for the firm to process remittance checks before they can be deposited in the bank.

Float n Much of cash management is oriented towards managing the float. n Mail Float n Time lapse from the moment a customer mails a remittance check until the firm begins to process it. n Processing Float n Time required for the firm to process remittance checks before they can be deposited in the bank.

Float (Continued) n Transit Float n Time necessary for a deposited check to clear through the commercial banking system and become usable funds to the company. n Disbursing Float n Funds available in the firm’s bank account until its payment check has cleared through the system.

Float (Continued) n Transit Float n Time necessary for a deposited check to clear through the commercial banking system and become usable funds to the company. n Disbursing Float n Funds available in the firm’s bank account until its payment check has cleared through the system.

Electronic Funds Transfer n Substantially reduces float n Some Examples: n Automated teller machines n Direct deposit of payroll checks n Paying the supermarket and others with bank cards.

Electronic Funds Transfer n Substantially reduces float n Some Examples: n Automated teller machines n Direct deposit of payroll checks n Paying the supermarket and others with bank cards.

Lock-Box System n Customers mail remittance checks to P. O. Box. n Local bank processes and deposits checks directly into the company’s account. n Reduces mail and processing float. n Also reduces transit float if lock-box is located near Federal Reserve Bank or branches.

Lock-Box System n Customers mail remittance checks to P. O. Box. n Local bank processes and deposits checks directly into the company’s account. n Reduces mail and processing float. n Also reduces transit float if lock-box is located near Federal Reserve Bank or branches.

Marketable Securities n The marketable securities portfolio is typically used for temporary investments of excess cash, or as a substitute for cash (i. e. , near cash). Therefore, securities in the portfolio are generally safe, shortterm, and highly liquid. n Treasury Bills n Short-term obligations of the federal government with maturities of 91 days to a year. They are traded on a discount basis in bearer form. Not taxable at state and local levels, but taxable at the federal level. n Commercial Paper n Unsecured promissory notes issued by large corporations in amounts of $25, 000 or more (No active secondary market).

Marketable Securities n The marketable securities portfolio is typically used for temporary investments of excess cash, or as a substitute for cash (i. e. , near cash). Therefore, securities in the portfolio are generally safe, shortterm, and highly liquid. n Treasury Bills n Short-term obligations of the federal government with maturities of 91 days to a year. They are traded on a discount basis in bearer form. Not taxable at state and local levels, but taxable at the federal level. n Commercial Paper n Unsecured promissory notes issued by large corporations in amounts of $25, 000 or more (No active secondary market).

Marketable Securities Continued n Negotiable Certificates of Deposit (CDs) Offered by financial institutions (e. g. , banks, S&Ls). Those big business is interested in have $100, 000 minimums. n Banker’s Acceptance: Generally arise out of foreign trade. n Importer (buyer) issues a promise to pay a certain amount to the exporter (seller). n A bank accepts the promise, and commits itself to pay the amount when due. n Exporter (seller) can now sell this acceptance in the marketplace at a discount (a price that is less than the promised amount). n

Marketable Securities Continued n Negotiable Certificates of Deposit (CDs) Offered by financial institutions (e. g. , banks, S&Ls). Those big business is interested in have $100, 000 minimums. n Banker’s Acceptance: Generally arise out of foreign trade. n Importer (buyer) issues a promise to pay a certain amount to the exporter (seller). n A bank accepts the promise, and commits itself to pay the amount when due. n Exporter (seller) can now sell this acceptance in the marketplace at a discount (a price that is less than the promised amount). n

Accounts Receivable Management n Major Decisions Credit Standards n Credit Terms n Collection Policy n Credit Standards: Will they pay as agreed? n Credit Scoring n Credit Reports n Past Experience n Financial Analysis n Debt Ratios, Liquidity Ratios, Profit Ratios n

Accounts Receivable Management n Major Decisions Credit Standards n Credit Terms n Collection Policy n Credit Standards: Will they pay as agreed? n Credit Scoring n Credit Reports n Past Experience n Financial Analysis n Debt Ratios, Liquidity Ratios, Profit Ratios n

Accounts Receivable Management (Continued) n Credit Terms Example: 2/10, net 30 n Collection Policy n Standard Operating Procedures n Be professional, firm, and do not bluff. n Vary procedures with slow payers. n Evaluating Collection Efforts n Average Collection Period, Bad Debt to Sales Ratio, Aging Accounts Receivable, Receivables to Assets Ratio, Credit Sales to Receivables Ratio. n

Accounts Receivable Management (Continued) n Credit Terms Example: 2/10, net 30 n Collection Policy n Standard Operating Procedures n Be professional, firm, and do not bluff. n Vary procedures with slow payers. n Evaluating Collection Efforts n Average Collection Period, Bad Debt to Sales Ratio, Aging Accounts Receivable, Receivables to Assets Ratio, Credit Sales to Receivables Ratio. n

Inventory Management (Covered in Detail in Production Management) n Basic Costs Associated With Inventory Carrying Costs n storage, insurance, cost of capital used n Ordering Costs n placing orders, shipping and handling n Costs of Running Short n lost sales, reduced customer goodwill n Objective n Minimize total costs associated with managing inventory. n

Inventory Management (Covered in Detail in Production Management) n Basic Costs Associated With Inventory Carrying Costs n storage, insurance, cost of capital used n Ordering Costs n placing orders, shipping and handling n Costs of Running Short n lost sales, reduced customer goodwill n Objective n Minimize total costs associated with managing inventory. n