34aec02a1f4314a5b749c12801dd8aba.ppt

- Количество слайдов: 19

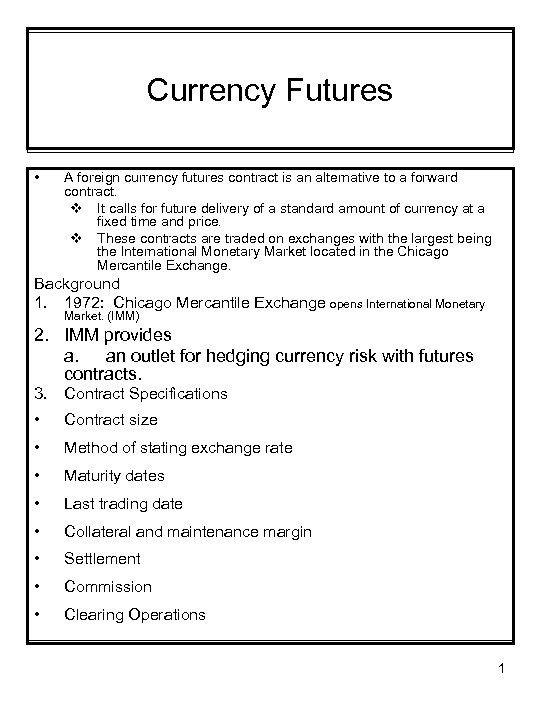

Currency Futures • A foreign currency futures contract is an alternative to a forward contract. v It calls for future delivery of a standard amount of currency at a fixed time and price. v These contracts are traded on exchanges with the largest being the International Monetary Market located in the Chicago Mercantile Exchange. Background 1. 1972: Chicago Mercantile Exchange opens International Monetary Market. (IMM) 2. IMM provides a. an outlet for hedging currency risk with futures contracts. 3. Contract Specifications • Contract size • Method of stating exchange rate • Maturity dates • Last trading date • Collateral and maintenance margin • Settlement • Commission • Clearing Operations 1

Currency Futures • A foreign currency futures contract is an alternative to a forward contract. v It calls for future delivery of a standard amount of currency at a fixed time and price. v These contracts are traded on exchanges with the largest being the International Monetary Market located in the Chicago Mercantile Exchange. Background 1. 1972: Chicago Mercantile Exchange opens International Monetary Market. (IMM) 2. IMM provides a. an outlet for hedging currency risk with futures contracts. 3. Contract Specifications • Contract size • Method of stating exchange rate • Maturity dates • Last trading date • Collateral and maintenance margin • Settlement • Commission • Clearing Operations 1

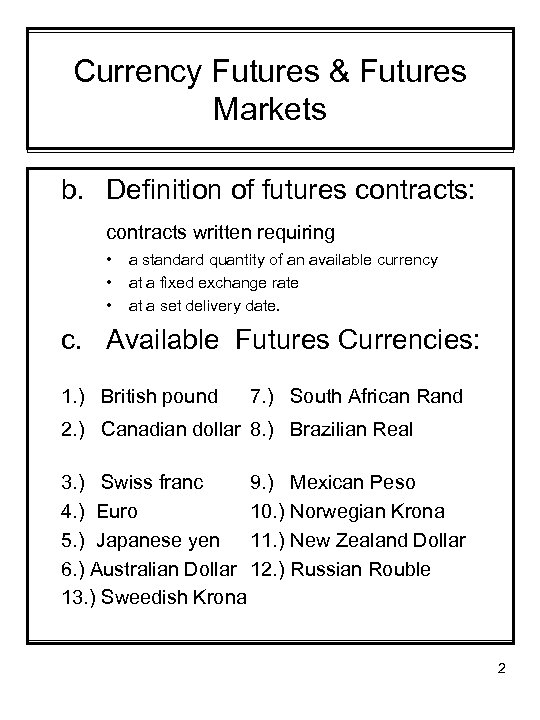

Currency Futures & Futures Markets b. Definition of futures contracts: contracts written requiring • • • a standard quantity of an available currency at a fixed exchange rate at a set delivery date. c. Available Futures Currencies: 1. ) British pound 7. ) South African Rand 2. ) Canadian dollar 8. ) Brazilian Real 3. ) Swiss franc 9. ) Mexican Peso 4. ) Euro 10. ) Norwegian Krona 5. ) Japanese yen 11. ) New Zealand Dollar 6. ) Australian Dollar 12. ) Russian Rouble 13. ) Sweedish Krona 2

Currency Futures & Futures Markets b. Definition of futures contracts: contracts written requiring • • • a standard quantity of an available currency at a fixed exchange rate at a set delivery date. c. Available Futures Currencies: 1. ) British pound 7. ) South African Rand 2. ) Canadian dollar 8. ) Brazilian Real 3. ) Swiss franc 9. ) Mexican Peso 4. ) Euro 10. ) Norwegian Krona 5. ) Japanese yen 11. ) New Zealand Dollar 6. ) Australian Dollar 12. ) Russian Rouble 13. ) Sweedish Krona 2

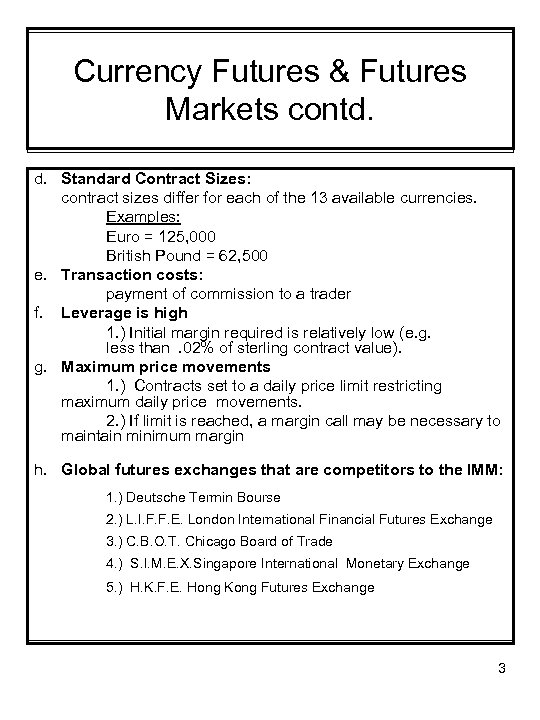

Currency Futures & Futures Markets contd. d. Standard Contract Sizes: contract sizes differ for each of the 13 available currencies. Examples: Euro = 125, 000 British Pound = 62, 500 e. Transaction costs: payment of commission to a trader f. Leverage is high 1. ) Initial margin required is relatively low (e. g. less than. 02% of sterling contract value). g. Maximum price movements 1. ) Contracts set to a daily price limit restricting maximum daily price movements. 2. ) If limit is reached, a margin call may be necessary to maintain minimum margin h. Global futures exchanges that are competitors to the IMM: 1. ) Deutsche Termin Bourse 2. ) L. I. F. F. E. London International Financial Futures Exchange 3. ) C. B. O. T. Chicago Board of Trade 4. ) S. I. M. E. X. Singapore International Monetary Exchange 5. ) H. K. F. E. Hong Kong Futures Exchange 3

Currency Futures & Futures Markets contd. d. Standard Contract Sizes: contract sizes differ for each of the 13 available currencies. Examples: Euro = 125, 000 British Pound = 62, 500 e. Transaction costs: payment of commission to a trader f. Leverage is high 1. ) Initial margin required is relatively low (e. g. less than. 02% of sterling contract value). g. Maximum price movements 1. ) Contracts set to a daily price limit restricting maximum daily price movements. 2. ) If limit is reached, a margin call may be necessary to maintain minimum margin h. Global futures exchanges that are competitors to the IMM: 1. ) Deutsche Termin Bourse 2. ) L. I. F. F. E. London International Financial Futures Exchange 3. ) C. B. O. T. Chicago Board of Trade 4. ) S. I. M. E. X. Singapore International Monetary Exchange 5. ) H. K. F. E. Hong Kong Futures Exchange 3

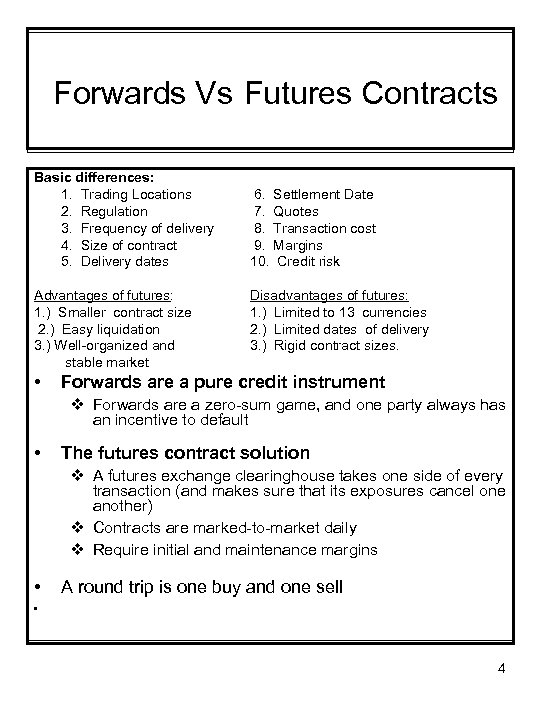

Forwards Vs Futures Contracts Basic differences: 1. Trading Locations 2. Regulation 3. Frequency of delivery 4. Size of contract 5. Delivery dates Advantages of futures: 1. ) Smaller contract size 2. ) Easy liquidation 3. ) Well-organized and stable market • 6. Settlement Date 7. Quotes 8. Transaction cost 9. Margins 10. Credit risk Disadvantages of futures: 1. ) Limited to 13 currencies 2. ) Limited dates of delivery 3. ) Rigid contract sizes. Forwards are a pure credit instrument v Forwards are a zero-sum game, and one party always has an incentive to default • The futures contract solution v A futures exchange clearinghouse takes one side of every transaction (and makes sure that its exposures cancel one another) v Contracts are marked-to-market daily v Require initial and maintenance margins • A round trip is one buy and one sell • 4

Forwards Vs Futures Contracts Basic differences: 1. Trading Locations 2. Regulation 3. Frequency of delivery 4. Size of contract 5. Delivery dates Advantages of futures: 1. ) Smaller contract size 2. ) Easy liquidation 3. ) Well-organized and stable market • 6. Settlement Date 7. Quotes 8. Transaction cost 9. Margins 10. Credit risk Disadvantages of futures: 1. ) Limited to 13 currencies 2. ) Limited dates of delivery 3. ) Rigid contract sizes. Forwards are a pure credit instrument v Forwards are a zero-sum game, and one party always has an incentive to default • The futures contract solution v A futures exchange clearinghouse takes one side of every transaction (and makes sure that its exposures cancel one another) v Contracts are marked-to-market daily v Require initial and maintenance margins • A round trip is one buy and one sell • 4

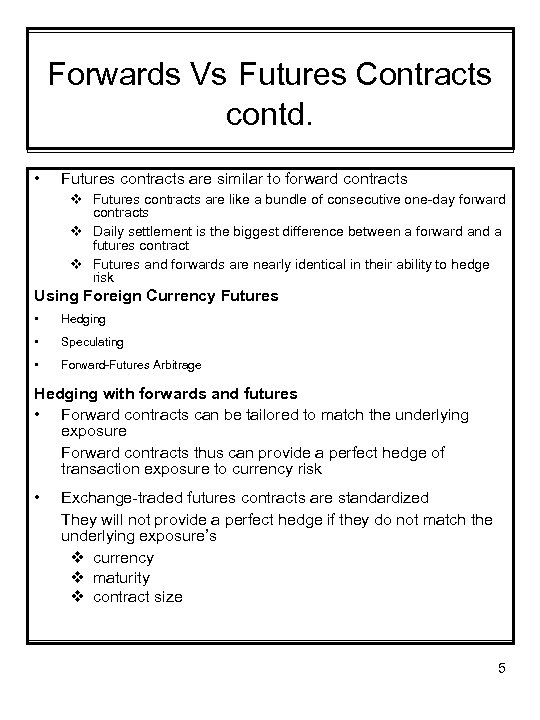

Forwards Vs Futures Contracts contd. • Futures contracts are similar to forward contracts v Futures contracts are like a bundle of consecutive one-day forward contracts v Daily settlement is the biggest difference between a forward and a futures contract v Futures and forwards are nearly identical in their ability to hedge risk Using Foreign Currency Futures • Hedging • Speculating • Forward-Futures Arbitrage Hedging with forwards and futures • Forward contracts can be tailored to match the underlying exposure Forward contracts thus can provide a perfect hedge of transaction exposure to currency risk • Exchange-traded futures contracts are standardized They will not provide a perfect hedge if they do not match the underlying exposure’s v currency v maturity v contract size 5

Forwards Vs Futures Contracts contd. • Futures contracts are similar to forward contracts v Futures contracts are like a bundle of consecutive one-day forward contracts v Daily settlement is the biggest difference between a forward and a futures contract v Futures and forwards are nearly identical in their ability to hedge risk Using Foreign Currency Futures • Hedging • Speculating • Forward-Futures Arbitrage Hedging with forwards and futures • Forward contracts can be tailored to match the underlying exposure Forward contracts thus can provide a perfect hedge of transaction exposure to currency risk • Exchange-traded futures contracts are standardized They will not provide a perfect hedge if they do not match the underlying exposure’s v currency v maturity v contract size 5

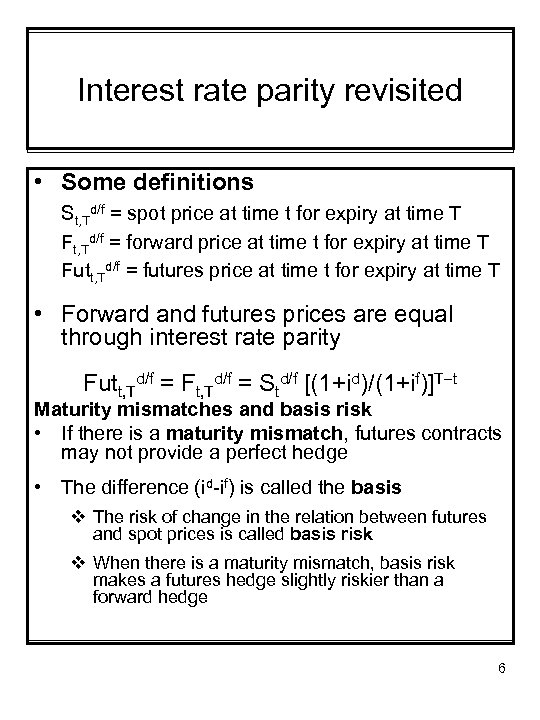

Interest rate parity revisited • Some definitions St, Td/f = spot price at time t for expiry at time T Ft, Td/f = forward price at time t for expiry at time T Futt, Td/f = futures price at time t for expiry at time T • Forward and futures prices are equal through interest rate parity Futt, Td/f = Ft, Td/f = Std/f [(1+id)/(1+if)]T-t Maturity mismatches and basis risk • If there is a maturity mismatch, futures contracts may not provide a perfect hedge • The difference (id-if) is called the basis v The risk of change in the relation between futures and spot prices is called basis risk v When there is a maturity mismatch, basis risk makes a futures hedge slightly riskier than a forward hedge 6

Interest rate parity revisited • Some definitions St, Td/f = spot price at time t for expiry at time T Ft, Td/f = forward price at time t for expiry at time T Futt, Td/f = futures price at time t for expiry at time T • Forward and futures prices are equal through interest rate parity Futt, Td/f = Ft, Td/f = Std/f [(1+id)/(1+if)]T-t Maturity mismatches and basis risk • If there is a maturity mismatch, futures contracts may not provide a perfect hedge • The difference (id-if) is called the basis v The risk of change in the relation between futures and spot prices is called basis risk v When there is a maturity mismatch, basis risk makes a futures hedge slightly riskier than a forward hedge 6

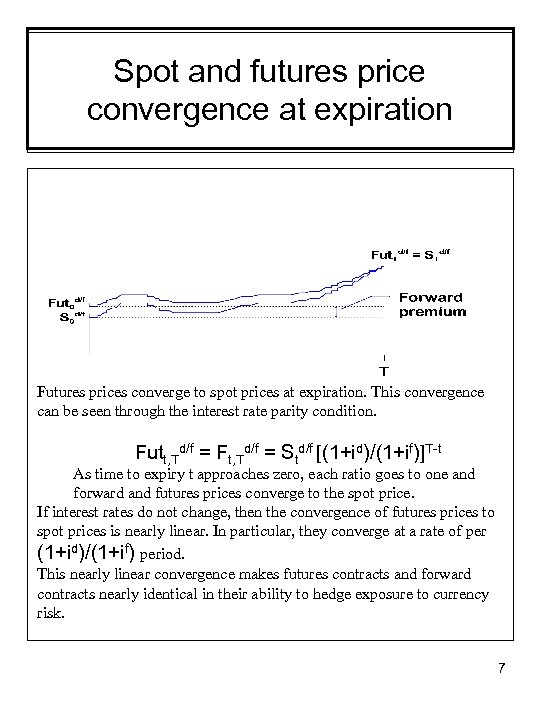

Spot and futures price convergence at expiration Futures prices converge to spot prices at expiration. This convergence can be seen through the interest rate parity condition. Futt, Td/f = Ft, Td/f = Std/f [(1+id)/(1+if)]T-t As time to expiry t approaches zero, each ratio goes to one and forward and futures prices converge to the spot price. If interest rates do not change, then the convergence of futures prices to spot prices is nearly linear. In particular, they converge at a rate of per (1+id)/(1+if) period. This nearly linear convergence makes futures contracts and forward contracts nearly identical in their ability to hedge exposure to currency risk. 7

Spot and futures price convergence at expiration Futures prices converge to spot prices at expiration. This convergence can be seen through the interest rate parity condition. Futt, Td/f = Ft, Td/f = Std/f [(1+id)/(1+if)]T-t As time to expiry t approaches zero, each ratio goes to one and forward and futures prices converge to the spot price. If interest rates do not change, then the convergence of futures prices to spot prices is nearly linear. In particular, they converge at a rate of per (1+id)/(1+if) period. This nearly linear convergence makes futures contracts and forward contracts nearly identical in their ability to hedge exposure to currency risk. 7

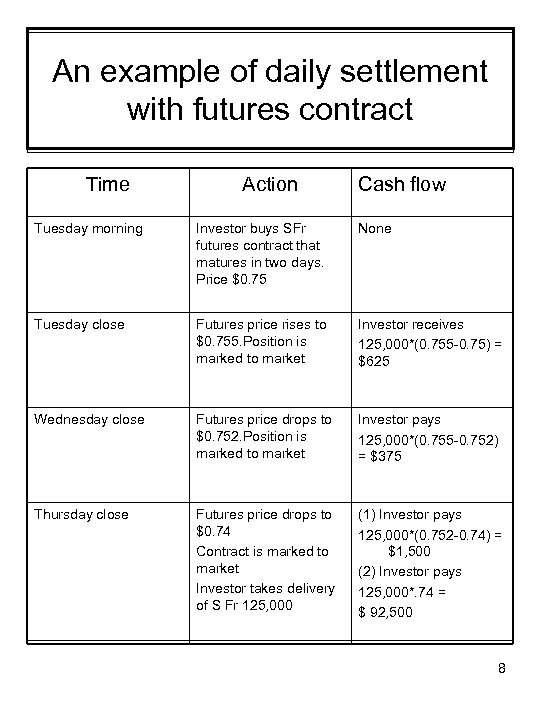

An example of daily settlement with futures contract Time Action Cash flow Tuesday morning Investor buys SFr futures contract that matures in two days. Price $0. 75 None Tuesday close Futures price rises to $0. 755. Position is marked to market Investor receives 125, 000*(0. 755 -0. 75) = $625 Wednesday close Futures price drops to $0. 752. Position is marked to market Investor pays 125, 000*(0. 755 -0. 752) = $375 Thursday close Futures price drops to $0. 74 Contract is marked to market Investor takes delivery of S Fr 125, 000 (1) Investor pays 125, 000*(0. 752 -0. 74) = $1, 500 (2) Investor pays 125, 000*. 74 = $ 92, 500 8

An example of daily settlement with futures contract Time Action Cash flow Tuesday morning Investor buys SFr futures contract that matures in two days. Price $0. 75 None Tuesday close Futures price rises to $0. 755. Position is marked to market Investor receives 125, 000*(0. 755 -0. 75) = $625 Wednesday close Futures price drops to $0. 752. Position is marked to market Investor pays 125, 000*(0. 755 -0. 752) = $375 Thursday close Futures price drops to $0. 74 Contract is marked to market Investor takes delivery of S Fr 125, 000 (1) Investor pays 125, 000*(0. 752 -0. 74) = $1, 500 (2) Investor pays 125, 000*. 74 = $ 92, 500 8

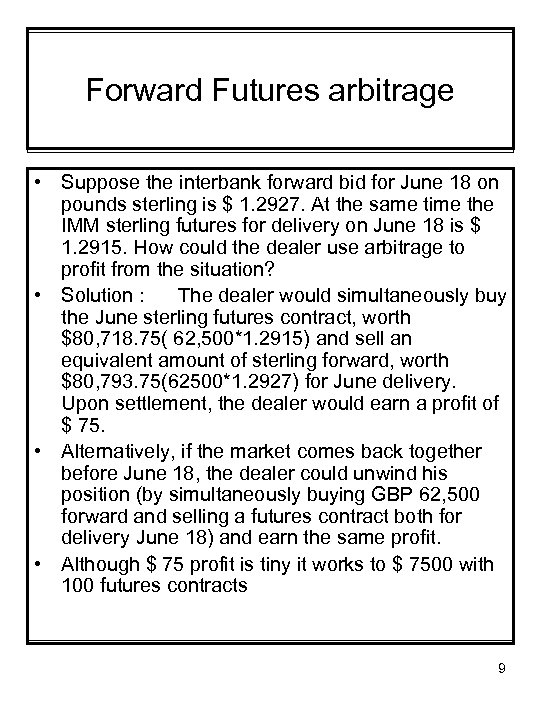

Forward Futures arbitrage • Suppose the interbank forward bid for June 18 on pounds sterling is $ 1. 2927. At the same time the IMM sterling futures for delivery on June 18 is $ 1. 2915. How could the dealer use arbitrage to profit from the situation? • Solution : The dealer would simultaneously buy the June sterling futures contract, worth $80, 718. 75( 62, 500*1. 2915) and sell an equivalent amount of sterling forward, worth $80, 793. 75(62500*1. 2927) for June delivery. Upon settlement, the dealer would earn a profit of $ 75. • Alternatively, if the market comes back together before June 18, the dealer could unwind his position (by simultaneously buying GBP 62, 500 forward and selling a futures contract both for delivery June 18) and earn the same profit. • Although $ 75 profit is tiny it works to $ 7500 with 100 futures contracts 9

Forward Futures arbitrage • Suppose the interbank forward bid for June 18 on pounds sterling is $ 1. 2927. At the same time the IMM sterling futures for delivery on June 18 is $ 1. 2915. How could the dealer use arbitrage to profit from the situation? • Solution : The dealer would simultaneously buy the June sterling futures contract, worth $80, 718. 75( 62, 500*1. 2915) and sell an equivalent amount of sterling forward, worth $80, 793. 75(62500*1. 2927) for June delivery. Upon settlement, the dealer would earn a profit of $ 75. • Alternatively, if the market comes back together before June 18, the dealer could unwind his position (by simultaneously buying GBP 62, 500 forward and selling a futures contract both for delivery June 18) and earn the same profit. • Although $ 75 profit is tiny it works to $ 7500 with 100 futures contracts 9

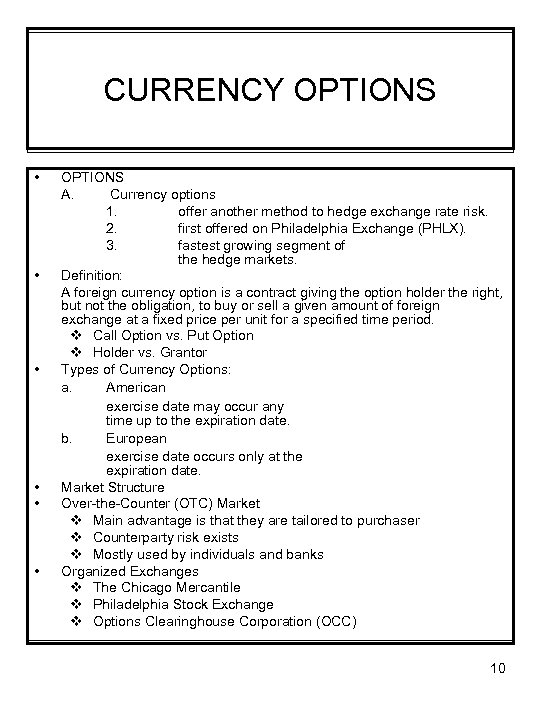

CURRENCY OPTIONS • • • OPTIONS A. Currency options 1. offer another method to hedge exchange rate risk. 2. first offered on Philadelphia Exchange (PHLX). 3. fastest growing segment of the hedge markets. Definition: A foreign currency option is a contract giving the option holder the right, but not the obligation, to buy or sell a given amount of foreign exchange at a fixed price per unit for a specified time period. v Call Option vs. Put Option v Holder vs. Grantor Types of Currency Options: a. American exercise date may occur any time up to the expiration date. b. European exercise date occurs only at the expiration date. Market Structure Over-the-Counter (OTC) Market v Main advantage is that they are tailored to purchaser v Counterparty risk exists v Mostly used by individuals and banks Organized Exchanges v The Chicago Mercantile v Philadelphia Stock Exchange v Options Clearinghouse Corporation (OCC) 10

CURRENCY OPTIONS • • • OPTIONS A. Currency options 1. offer another method to hedge exchange rate risk. 2. first offered on Philadelphia Exchange (PHLX). 3. fastest growing segment of the hedge markets. Definition: A foreign currency option is a contract giving the option holder the right, but not the obligation, to buy or sell a given amount of foreign exchange at a fixed price per unit for a specified time period. v Call Option vs. Put Option v Holder vs. Grantor Types of Currency Options: a. American exercise date may occur any time up to the expiration date. b. European exercise date occurs only at the expiration date. Market Structure Over-the-Counter (OTC) Market v Main advantage is that they are tailored to purchaser v Counterparty risk exists v Mostly used by individuals and banks Organized Exchanges v The Chicago Mercantile v Philadelphia Stock Exchange v Options Clearinghouse Corporation (OCC) 10

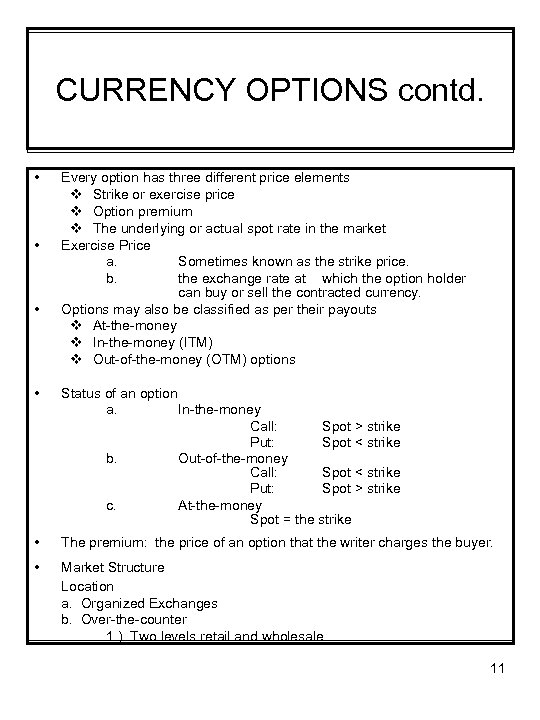

CURRENCY OPTIONS contd. • • • Every option has three different price elements v Strike or exercise price v Option premium v The underlying or actual spot rate in the market Exercise Price a. Sometimes known as the strike price. b. the exchange rate at which the option holder can buy or sell the contracted currency. Options may also be classified as per their payouts v At-the-money v In-the-money (ITM) v Out-of-the-money (OTM) options • Status of an option a. In-the-money Call: Spot > strike Put: Spot < strike b. Out-of-the-money Call: Spot < strike Put: Spot > strike c. At-the-money Spot = the strike • The premium: the price of an option that the writer charges the buyer. • Market Structure Location a. Organized Exchanges b. Over-the-counter 1. ) Two levels retail and wholesale 11

CURRENCY OPTIONS contd. • • • Every option has three different price elements v Strike or exercise price v Option premium v The underlying or actual spot rate in the market Exercise Price a. Sometimes known as the strike price. b. the exchange rate at which the option holder can buy or sell the contracted currency. Options may also be classified as per their payouts v At-the-money v In-the-money (ITM) v Out-of-the-money (OTM) options • Status of an option a. In-the-money Call: Spot > strike Put: Spot < strike b. Out-of-the-money Call: Spot < strike Put: Spot > strike c. At-the-money Spot = the strike • The premium: the price of an option that the writer charges the buyer. • Market Structure Location a. Organized Exchanges b. Over-the-counter 1. ) Two levels retail and wholesale 11

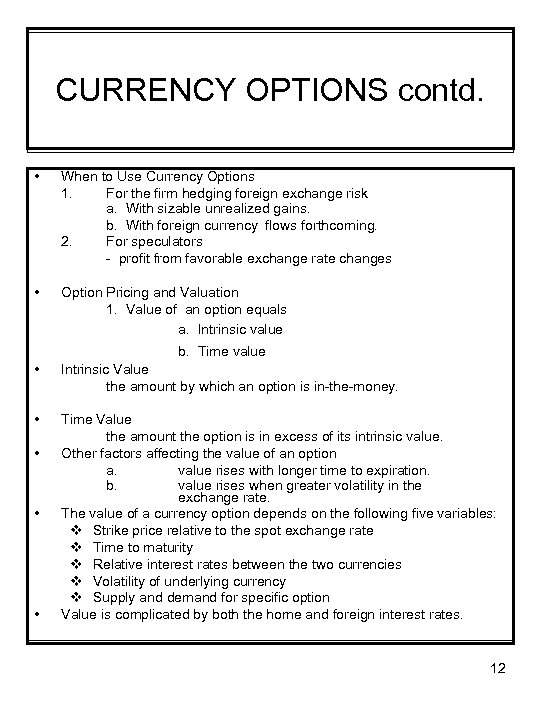

CURRENCY OPTIONS contd. • When to Use Currency Options 1. For the firm hedging foreign exchange risk a. With sizable unrealized gains. b. With foreign currency flows forthcoming. 2. For speculators - profit from favorable exchange rate changes • Option Pricing and Valuation 1. Value of an option equals a. Intrinsic value b. Time value • Intrinsic Value the amount by which an option is in-the-money. • Time Value the amount the option is in excess of its intrinsic value. Other factors affecting the value of an option a. value rises with longer time to expiration. b. value rises when greater volatility in the exchange rate. The value of a currency option depends on the following five variables: v Strike price relative to the spot exchange rate v Time to maturity v Relative interest rates between the two currencies v Volatility of underlying currency v Supply and demand for specific option Value is complicated by both the home and foreign interest rates. • • • 12

CURRENCY OPTIONS contd. • When to Use Currency Options 1. For the firm hedging foreign exchange risk a. With sizable unrealized gains. b. With foreign currency flows forthcoming. 2. For speculators - profit from favorable exchange rate changes • Option Pricing and Valuation 1. Value of an option equals a. Intrinsic value b. Time value • Intrinsic Value the amount by which an option is in-the-money. • Time Value the amount the option is in excess of its intrinsic value. Other factors affecting the value of an option a. value rises with longer time to expiration. b. value rises when greater volatility in the exchange rate. The value of a currency option depends on the following five variables: v Strike price relative to the spot exchange rate v Time to maturity v Relative interest rates between the two currencies v Volatility of underlying currency v Supply and demand for specific option Value is complicated by both the home and foreign interest rates. • • • 12

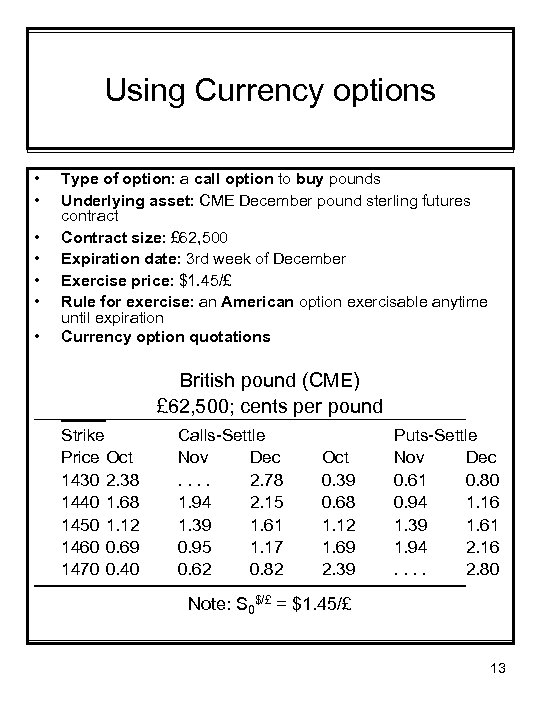

Using Currency options • • Type of option: a call option to buy pounds Underlying asset: CME December pound sterling futures contract Contract size: £ 62, 500 Expiration date: 3 rd week of December Exercise price: $1. 45/£ Rule for exercise: an American option exercisable anytime until expiration Currency option quotations British pound (CME) £ 62, 500; cents per pound Strike Price Oct 1430 2. 38 1440 1. 68 1450 1. 12 1460 0. 69 1470 0. 40 Calls-Settle Nov Dec. . 2. 78 1. 94 2. 15 1. 39 1. 61 0. 95 1. 17 0. 62 0. 82 Oct 0. 39 0. 68 1. 12 1. 69 2. 39 Puts-Settle Nov Dec 0. 61 0. 80 0. 94 1. 16 1. 39 1. 61 1. 94 2. 16. . 2. 80 Note: S 0$/£ = $1. 45/£ 13

Using Currency options • • Type of option: a call option to buy pounds Underlying asset: CME December pound sterling futures contract Contract size: £ 62, 500 Expiration date: 3 rd week of December Exercise price: $1. 45/£ Rule for exercise: an American option exercisable anytime until expiration Currency option quotations British pound (CME) £ 62, 500; cents per pound Strike Price Oct 1430 2. 38 1440 1. 68 1450 1. 12 1460 0. 69 1470 0. 40 Calls-Settle Nov Dec. . 2. 78 1. 94 2. 15 1. 39 1. 61 0. 95 1. 17 0. 62 0. 82 Oct 0. 39 0. 68 1. 12 1. 69 2. 39 Puts-Settle Nov Dec 0. 61 0. 80 0. 94 1. 16 1. 39 1. 61 1. 94 2. 16. . 2. 80 Note: S 0$/£ = $1. 45/£ 13

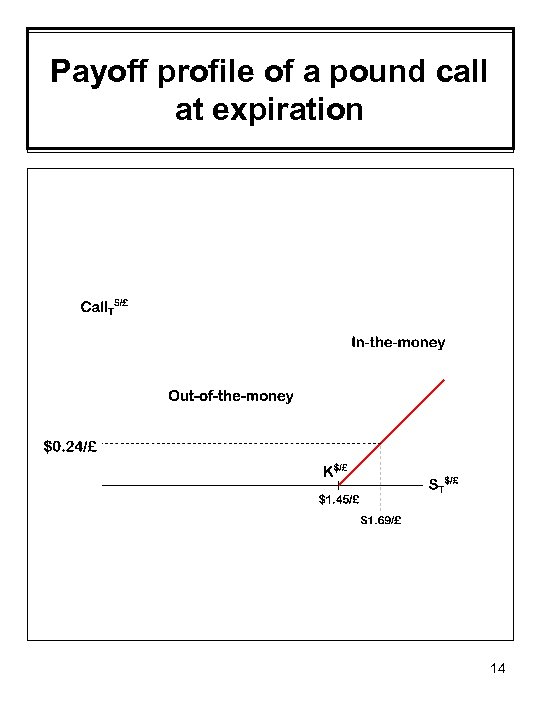

Payoff profile of a pound call at expiration 14

Payoff profile of a pound call at expiration 14

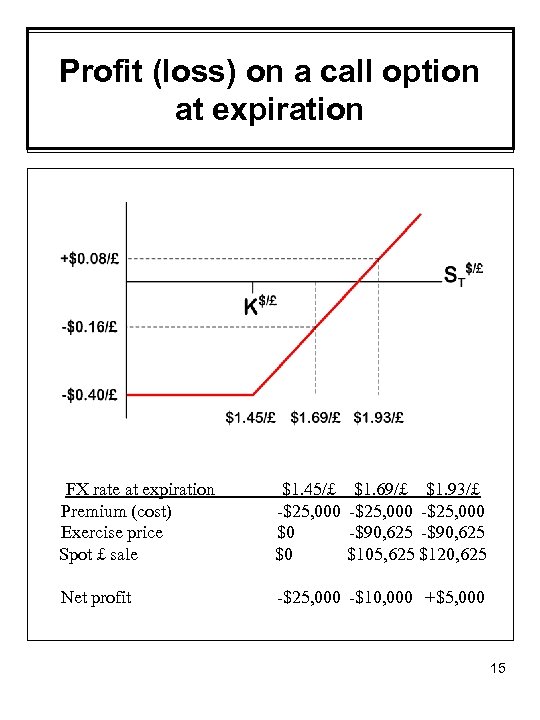

Profit (loss) on a call option at expiration FX rate at expiration Premium (cost) Exercise price Spot £ sale $1. 45/£ -$25, 000 $0 $0 $1. 69/£ $1. 93/£ -$25, 000 -$90, 625 $105, 625 $120, 625 Net profit -$25, 000 -$10, 000 +$5, 000 15

Profit (loss) on a call option at expiration FX rate at expiration Premium (cost) Exercise price Spot £ sale $1. 45/£ -$25, 000 $0 $0 $1. 69/£ $1. 93/£ -$25, 000 -$90, 625 $105, 625 $120, 625 Net profit -$25, 000 -$10, 000 +$5, 000 15

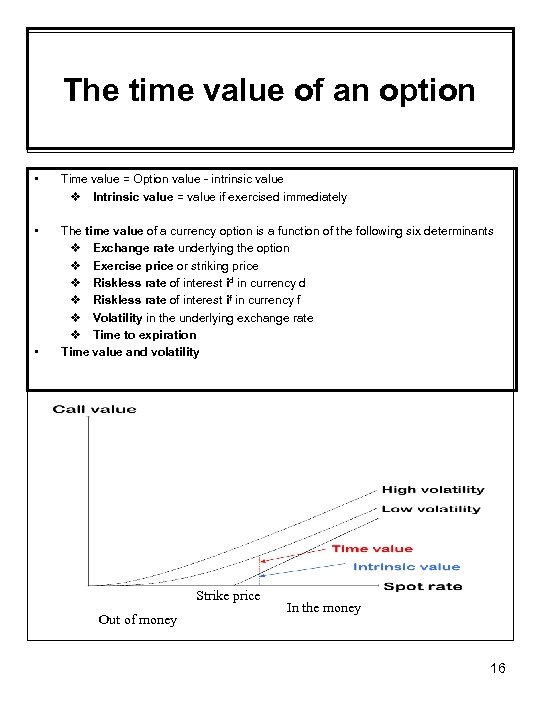

The time value of an option • Time value = Option value - intrinsic value v Intrinsic value = value if exercised immediately • The time value of a currency option is a function of the following six determinants v Exchange rate underlying the option v Exercise price or striking price v Riskless rate of interest id in currency d v Riskless rate of interest if in currency f v Volatility in the underlying exchange rate v Time to expiration Time value and volatility • Strike price Out of money In the money 16

The time value of an option • Time value = Option value - intrinsic value v Intrinsic value = value if exercised immediately • The time value of a currency option is a function of the following six determinants v Exchange rate underlying the option v Exercise price or striking price v Riskless rate of interest id in currency d v Riskless rate of interest if in currency f v Volatility in the underlying exchange rate v Time to expiration Time value and volatility • Strike price Out of money In the money 16

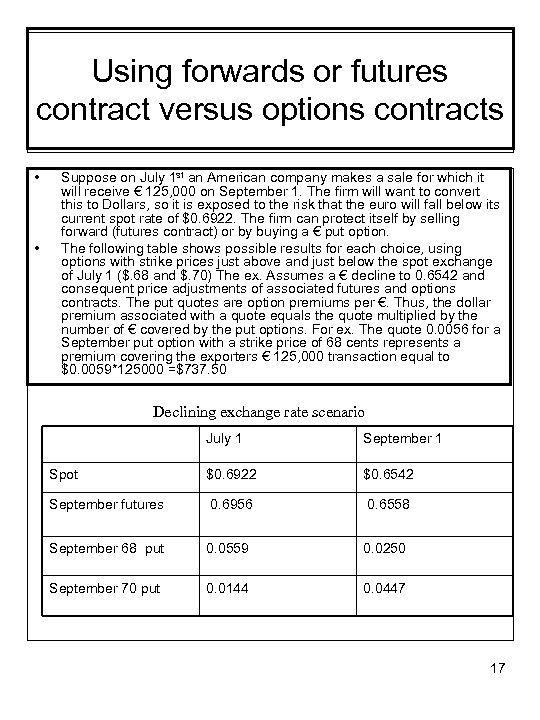

Using forwards or futures contract versus options contracts • • Suppose on July 1 st an American company makes a sale for which it will receive € 125, 000 on September 1. The firm will want to convert this to Dollars, so it is exposed to the risk that the euro will fall below its current spot rate of $0. 6922. The firm can protect itself by selling forward (futures contract) or by buying a € put option. The following table shows possible results for each choice, using options with strike prices just above and just below the spot exchange of July 1 ($. 68 and $. 70) The ex. Assumes a € decline to 0. 6542 and consequent price adjustments of associated futures and options contracts. The put quotes are option premiums per €. Thus, the dollar premium associated with a quote equals the quote multiplied by the number of € covered by the put options. For ex. The quote 0. 0056 for a September put option with a strike price of 68 cents represents a premium covering the exporters € 125, 000 transaction equal to $0. 0059*125000 =$737. 50 Declining exchange rate scenario July 1 September 1 Spot $0. 6922 $0. 6542 September futures 0. 6956 0. 6558 September 68 put 0. 0559 0. 0250 September 70 put 0. 0144 0. 0447 17

Using forwards or futures contract versus options contracts • • Suppose on July 1 st an American company makes a sale for which it will receive € 125, 000 on September 1. The firm will want to convert this to Dollars, so it is exposed to the risk that the euro will fall below its current spot rate of $0. 6922. The firm can protect itself by selling forward (futures contract) or by buying a € put option. The following table shows possible results for each choice, using options with strike prices just above and just below the spot exchange of July 1 ($. 68 and $. 70) The ex. Assumes a € decline to 0. 6542 and consequent price adjustments of associated futures and options contracts. The put quotes are option premiums per €. Thus, the dollar premium associated with a quote equals the quote multiplied by the number of € covered by the put options. For ex. The quote 0. 0056 for a September put option with a strike price of 68 cents represents a premium covering the exporters € 125, 000 transaction equal to $0. 0059*125000 =$737. 50 Declining exchange rate scenario July 1 September 1 Spot $0. 6922 $0. 6542 September futures 0. 6956 0. 6558 September 68 put 0. 0559 0. 0250 September 70 put 0. 0144 0. 0447 17

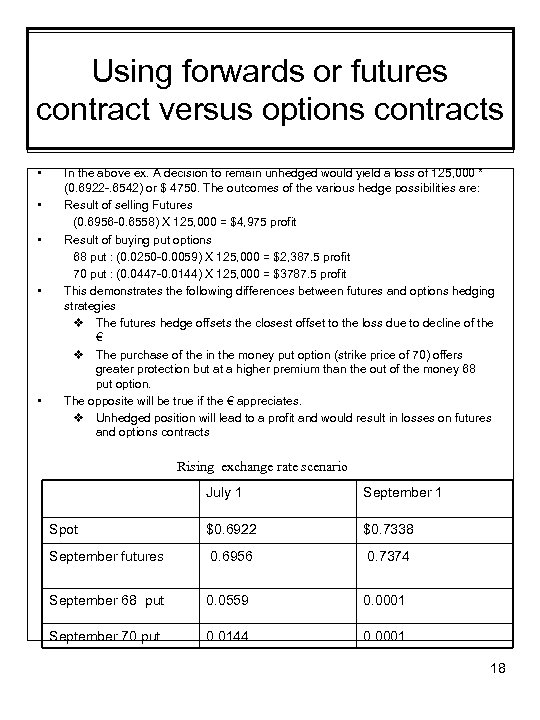

Using forwards or futures contract versus options contracts • • • In the above ex. A decision to remain unhedged would yield a loss of 125, 000 * (0. 6922 -. 6542) or $ 4750. The outcomes of the various hedge possibilities are: Result of selling Futures (0. 6956 -0. 6558) X 125, 000 = $4, 975 profit Result of buying put options 68 put : (0. 0250 -0. 0059) X 125, 000 = $2, 387. 5 profit 70 put : (0. 0447 -0. 0144) X 125, 000 = $3787. 5 profit This demonstrates the following differences between futures and options hedging strategies v The futures hedge offsets the closest offset to the loss due to decline of the € v The purchase of the in the money put option (strike price of 70) offers greater protection but at a higher premium than the out of the money 68 put option. The opposite will be true if the € appreciates. v Unhedged position will lead to a profit and would result in losses on futures and options contracts Rising exchange rate scenario July 1 September 1 Spot $0. 6922 $0. 7338 September futures 0. 6956 0. 7374 September 68 put 0. 0559 0. 0001 September 70 put 0. 0144 0. 0001 18

Using forwards or futures contract versus options contracts • • • In the above ex. A decision to remain unhedged would yield a loss of 125, 000 * (0. 6922 -. 6542) or $ 4750. The outcomes of the various hedge possibilities are: Result of selling Futures (0. 6956 -0. 6558) X 125, 000 = $4, 975 profit Result of buying put options 68 put : (0. 0250 -0. 0059) X 125, 000 = $2, 387. 5 profit 70 put : (0. 0447 -0. 0144) X 125, 000 = $3787. 5 profit This demonstrates the following differences between futures and options hedging strategies v The futures hedge offsets the closest offset to the loss due to decline of the € v The purchase of the in the money put option (strike price of 70) offers greater protection but at a higher premium than the out of the money 68 put option. The opposite will be true if the € appreciates. v Unhedged position will lead to a profit and would result in losses on futures and options contracts Rising exchange rate scenario July 1 September 1 Spot $0. 6922 $0. 7338 September futures 0. 6956 0. 7374 September 68 put 0. 0559 0. 0001 September 70 put 0. 0144 0. 0001 18

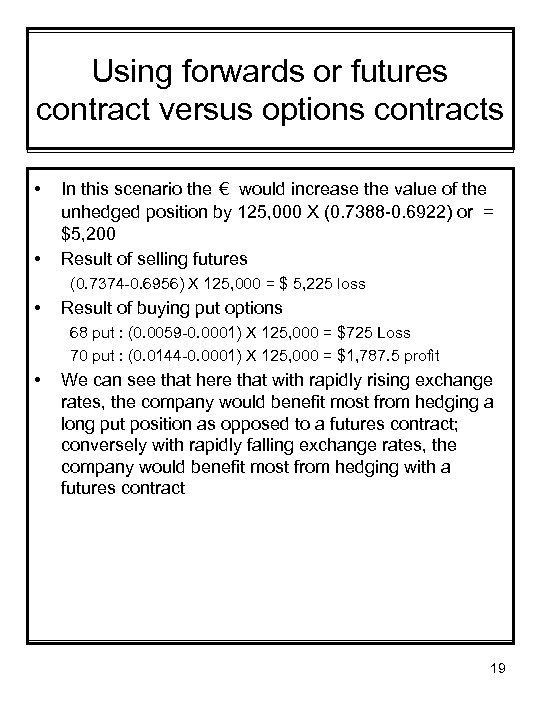

Using forwards or futures contract versus options contracts • • In this scenario the € would increase the value of the unhedged position by 125, 000 X (0. 7388 -0. 6922) or = $5, 200 Result of selling futures (0. 7374 -0. 6956) X 125, 000 = $ 5, 225 loss • Result of buying put options 68 put : (0. 0059 -0. 0001) X 125, 000 = $725 Loss 70 put : (0. 0144 -0. 0001) X 125, 000 = $1, 787. 5 profit • We can see that here that with rapidly rising exchange rates, the company would benefit most from hedging a long put position as opposed to a futures contract; conversely with rapidly falling exchange rates, the company would benefit most from hedging with a futures contract 19

Using forwards or futures contract versus options contracts • • In this scenario the € would increase the value of the unhedged position by 125, 000 X (0. 7388 -0. 6922) or = $5, 200 Result of selling futures (0. 7374 -0. 6956) X 125, 000 = $ 5, 225 loss • Result of buying put options 68 put : (0. 0059 -0. 0001) X 125, 000 = $725 Loss 70 put : (0. 0144 -0. 0001) X 125, 000 = $1, 787. 5 profit • We can see that here that with rapidly rising exchange rates, the company would benefit most from hedging a long put position as opposed to a futures contract; conversely with rapidly falling exchange rates, the company would benefit most from hedging with a futures contract 19