3dfd8abc0df7c31ae2323d12d4c560b6.ppt

- Количество слайдов: 61

Currency Analysis with Fundamentals

Currency Analysis with Fundamentals

Fundamental Analysis involves the use of data to assess the strength/weakness of a currency Economic Data Financial Data Demographic Data GDP Employment Prices Interest Rates Asset Prices Population Growth Asset Prices International Data Trade Balance FDI Official Reserve Position

Fundamental Analysis involves the use of data to assess the strength/weakness of a currency Economic Data Financial Data Demographic Data GDP Employment Prices Interest Rates Asset Prices Population Growth Asset Prices International Data Trade Balance FDI Official Reserve Position

Trade Balances n The trade balance approach focuses on a country’s current account. Exports = demand for a country’s currency n Imports = supply of a country’s currency n n Trade deficit (surplus) countries should experience currency depreciations

Trade Balances n The trade balance approach focuses on a country’s current account. Exports = demand for a country’s currency n Imports = supply of a country’s currency n n Trade deficit (surplus) countries should experience currency depreciations

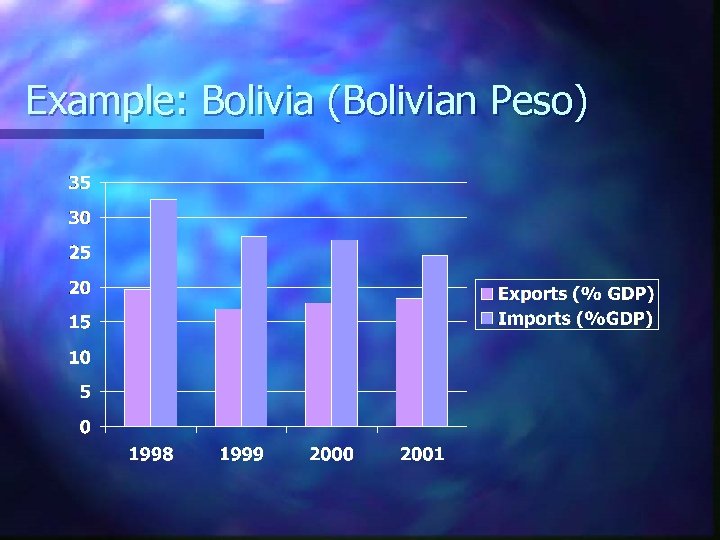

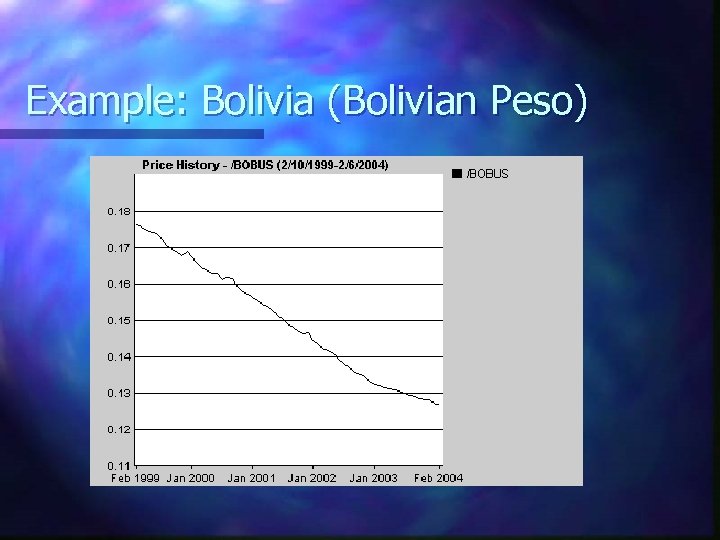

Example: Bolivia (Bolivian Peso)

Example: Bolivia (Bolivian Peso)

Example: Bolivia (Bolivian Peso)

Example: Bolivia (Bolivian Peso)

The J-Curve Recall that currency demand/supply is based on foreign exchange expenditures n If elasticities are low, then rising prices can actually increase expenditures n Elasticities tend to increase over longer time horizons n Necessities (in particular, energy) have lower elasticities than luxuries n

The J-Curve Recall that currency demand/supply is based on foreign exchange expenditures n If elasticities are low, then rising prices can actually increase expenditures n Elasticities tend to increase over longer time horizons n Necessities (in particular, energy) have lower elasticities than luxuries n

Balance of Payments The trade balance approach assumes that currency flows are due to purchases of goods/services alone. n The Capital & Financial Accounts keep track of net inflow of cash due to financial transactions (CA + KFA = 0) n n n Private Capital inflow: Purchases of domestic assets Official Reserve Transactions: Acquisition of official reserve assets (between central banks)

Balance of Payments The trade balance approach assumes that currency flows are due to purchases of goods/services alone. n The Capital & Financial Accounts keep track of net inflow of cash due to financial transactions (CA + KFA = 0) n n n Private Capital inflow: Purchases of domestic assets Official Reserve Transactions: Acquisition of official reserve assets (between central banks)

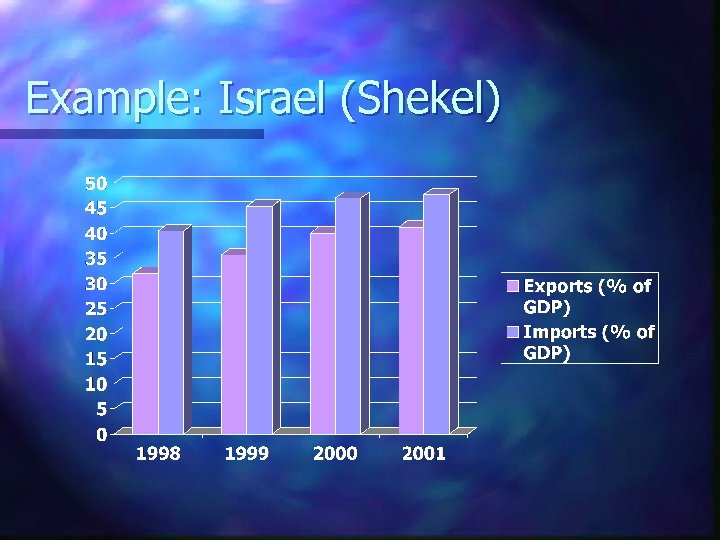

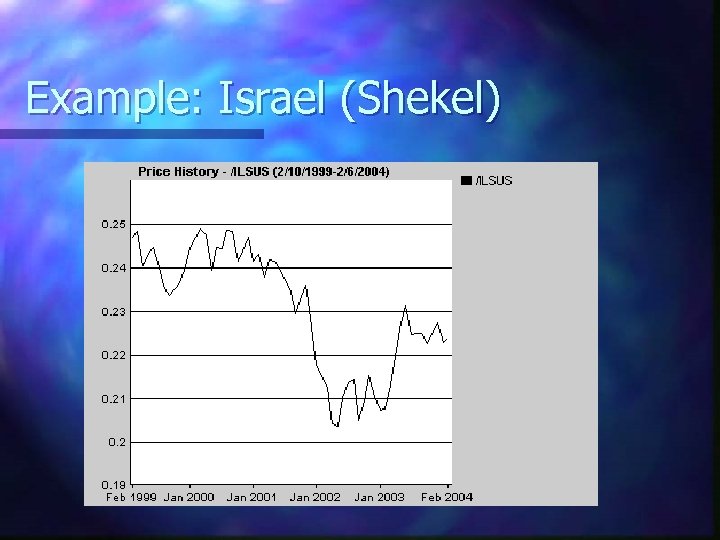

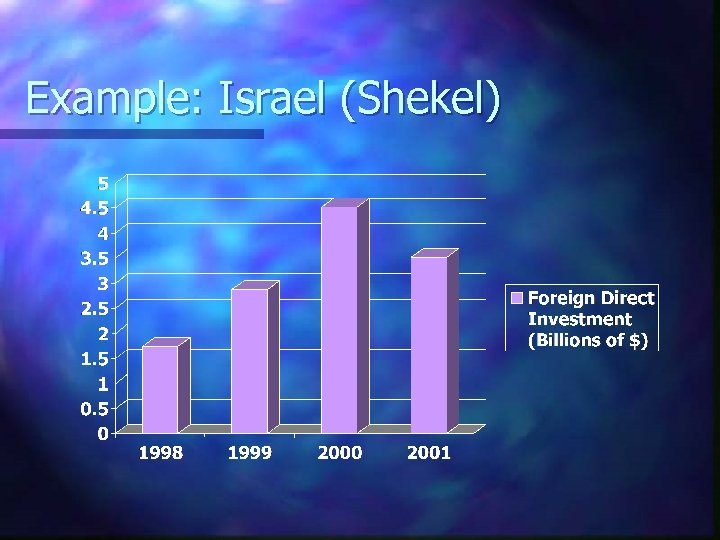

Example: Israel (Shekel)

Example: Israel (Shekel)

Example: Israel (Shekel)

Example: Israel (Shekel)

Example: Israel (Shekel)

Example: Israel (Shekel)

Balance of Payments Approach Adding the Capital account complicates the analysis: n Remember, if a country is financing its trade deficit by selling its assets. These assets are claims to future payments n n n How big is “too big” A country’s ability to repay its debts lies in in its ability to run future trade surpluses (or have a VERY cheap currency)

Balance of Payments Approach Adding the Capital account complicates the analysis: n Remember, if a country is financing its trade deficit by selling its assets. These assets are claims to future payments n n n How big is “too big” A country’s ability to repay its debts lies in in its ability to run future trade surpluses (or have a VERY cheap currency)

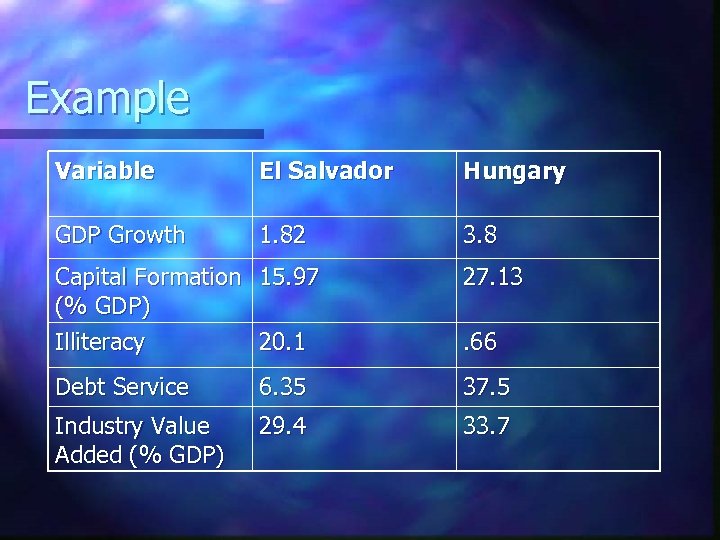

Example Variable El Salvador Hungary GDP Growth 1. 82 3. 8 Capital Formation 15. 97 (% GDP) Illiteracy 20. 1 27. 13 Debt Service 6. 35 37. 5 Industry Value Added (% GDP) 29. 4 33. 7 . 66

Example Variable El Salvador Hungary GDP Growth 1. 82 3. 8 Capital Formation 15. 97 (% GDP) Illiteracy 20. 1 27. 13 Debt Service 6. 35 37. 5 Industry Value Added (% GDP) 29. 4 33. 7 . 66

Monetary Approach (Flexible Prices) n The classical approach assumes that all prices are flexible and that all markets clear. Money markets take the lead n Bond markets play a passive role. n

Monetary Approach (Flexible Prices) n The classical approach assumes that all prices are flexible and that all markets clear. Money markets take the lead n Bond markets play a passive role. n

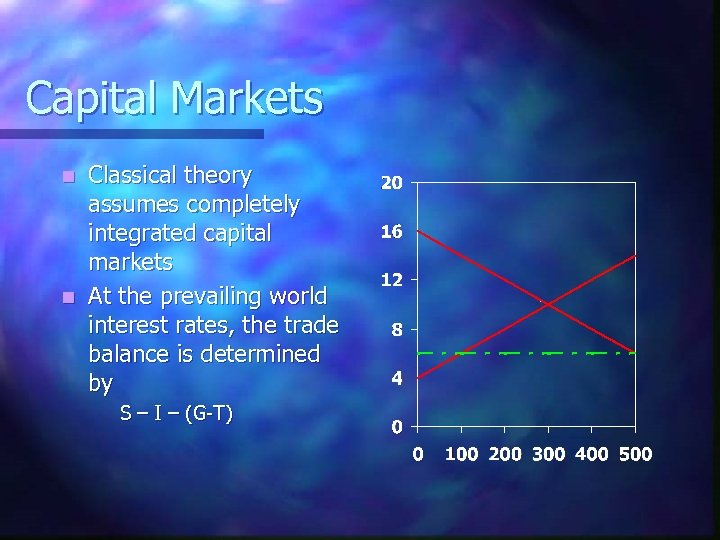

Capital Markets Classical theory assumes completely integrated capital markets n At the prevailing world interest rates, the trade balance is determined by n S – I – (G-T)

Capital Markets Classical theory assumes completely integrated capital markets n At the prevailing world interest rates, the trade balance is determined by n S – I – (G-T)

Monetary Policy & Capital Markets n Money is ”Neutral” in classical theory. Therefore, Federal Reserve policy only influences the price level

Monetary Policy & Capital Markets n Money is ”Neutral” in classical theory. Therefore, Federal Reserve policy only influences the price level

Classical Money Demand n It is assumed that households choose to hold a fraction of their nominal income in the form of cash (or a checking account)

Classical Money Demand n It is assumed that households choose to hold a fraction of their nominal income in the form of cash (or a checking account)

Classical Money Demand n It is assumed that households choose to hold a fraction of their nominal income in the form of cash (or a checking account) Money Demand = k* PY

Classical Money Demand n It is assumed that households choose to hold a fraction of their nominal income in the form of cash (or a checking account) Money Demand = k* PY

Classical Money Demand n It is assumed that households choose to hold a fraction of their nominal income in the form of cash (or a checking account) Money Demand = k* PY For example, suppose that National Income is $8 T. If the average household chooses to hold 10% of their income in the form of cash, what is aggregate money demand?

Classical Money Demand n It is assumed that households choose to hold a fraction of their nominal income in the form of cash (or a checking account) Money Demand = k* PY For example, suppose that National Income is $8 T. If the average household chooses to hold 10% of their income in the form of cash, what is aggregate money demand?

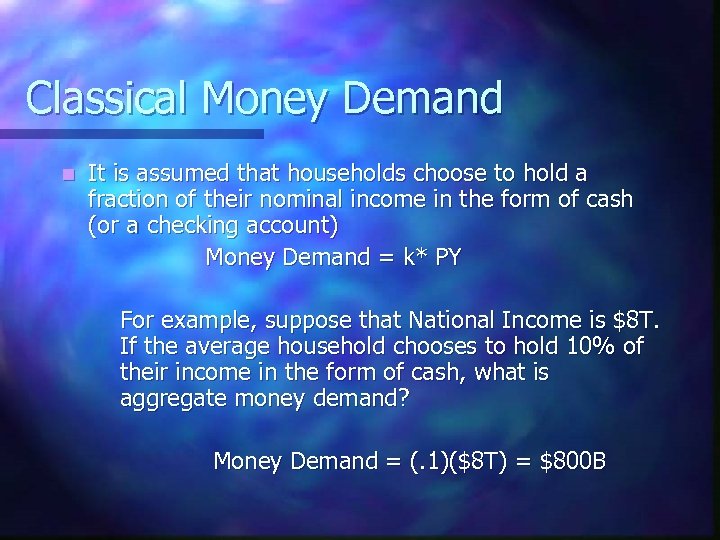

Classical Money Demand n It is assumed that households choose to hold a fraction of their nominal income in the form of cash (or a checking account) Money Demand = k* PY For example, suppose that National Income is $8 T. If the average household chooses to hold 10% of their income in the form of cash, what is aggregate money demand? Money Demand = (. 1)($8 T) = $800 B

Classical Money Demand n It is assumed that households choose to hold a fraction of their nominal income in the form of cash (or a checking account) Money Demand = k* PY For example, suppose that National Income is $8 T. If the average household chooses to hold 10% of their income in the form of cash, what is aggregate money demand? Money Demand = (. 1)($8 T) = $800 B

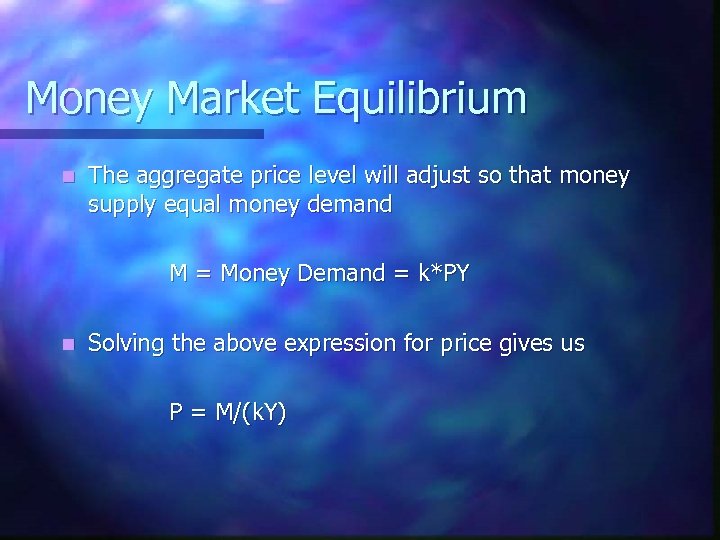

Money Market Equilibrium n The aggregate price level will adjust so that money supply equal money demand

Money Market Equilibrium n The aggregate price level will adjust so that money supply equal money demand

Money Market Equilibrium n The aggregate price level will adjust so that money supply equal money demand M = Money Demand = k*PY

Money Market Equilibrium n The aggregate price level will adjust so that money supply equal money demand M = Money Demand = k*PY

Money Market Equilibrium n The aggregate price level will adjust so that money supply equal money demand M = Money Demand = k*PY n Solving the above expression for price gives us P = M/(k. Y)

Money Market Equilibrium n The aggregate price level will adjust so that money supply equal money demand M = Money Demand = k*PY n Solving the above expression for price gives us P = M/(k. Y)

Money Demand the Quantity Theory of Money n An alternative way of expressing the previous expression is MV = PY Where ‘V’ is the velocity of money (V = 1/k) n This is known as quantity theory of money

Money Demand the Quantity Theory of Money n An alternative way of expressing the previous expression is MV = PY Where ‘V’ is the velocity of money (V = 1/k) n This is known as quantity theory of money

Implications of the Quantity Theory n In the long run, velocity is relatively constant. Therefore, a country’s inflation rate is equal to Inflation = Money Growth – Output Growth

Implications of the Quantity Theory n In the long run, velocity is relatively constant. Therefore, a country’s inflation rate is equal to Inflation = Money Growth – Output Growth

Purchasing Power Parity n Purchasing power parity (PPP) suggests that currencies should have the same purchasing power everywhere. P = e. P* n A more useful form of PPP is %Change in e = Inflation – Inflation* n For example, if the US inflation rate (annual) is 4% while the annual European inflation rate is 2%, the dollar should depreciate by 2% over the year.

Purchasing Power Parity n Purchasing power parity (PPP) suggests that currencies should have the same purchasing power everywhere. P = e. P* n A more useful form of PPP is %Change in e = Inflation – Inflation* n For example, if the US inflation rate (annual) is 4% while the annual European inflation rate is 2%, the dollar should depreciate by 2% over the year.

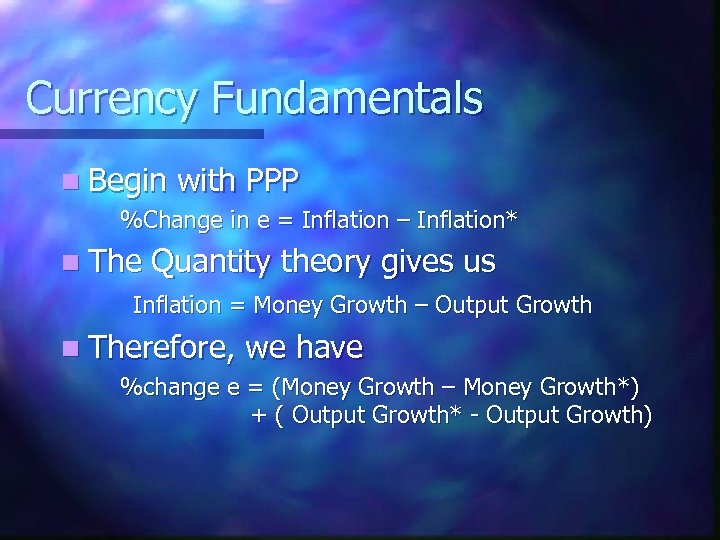

Currency Fundamentals n Begin with PPP %Change in e = Inflation – Inflation*

Currency Fundamentals n Begin with PPP %Change in e = Inflation – Inflation*

Currency Fundamentals n Begin with PPP %Change in e = Inflation – Inflation* n The Quantity theory gives us Inflation = Money Growth – Output Growth

Currency Fundamentals n Begin with PPP %Change in e = Inflation – Inflation* n The Quantity theory gives us Inflation = Money Growth – Output Growth

Currency Fundamentals n Begin with PPP %Change in e = Inflation – Inflation* n The Quantity theory gives us Inflation = Money Growth – Output Growth n Therefore, we have %change e = (Money Growth – Money Growth*) + ( Output Growth* - Output Growth)

Currency Fundamentals n Begin with PPP %Change in e = Inflation – Inflation* n The Quantity theory gives us Inflation = Money Growth – Output Growth n Therefore, we have %change e = (Money Growth – Money Growth*) + ( Output Growth* - Output Growth)

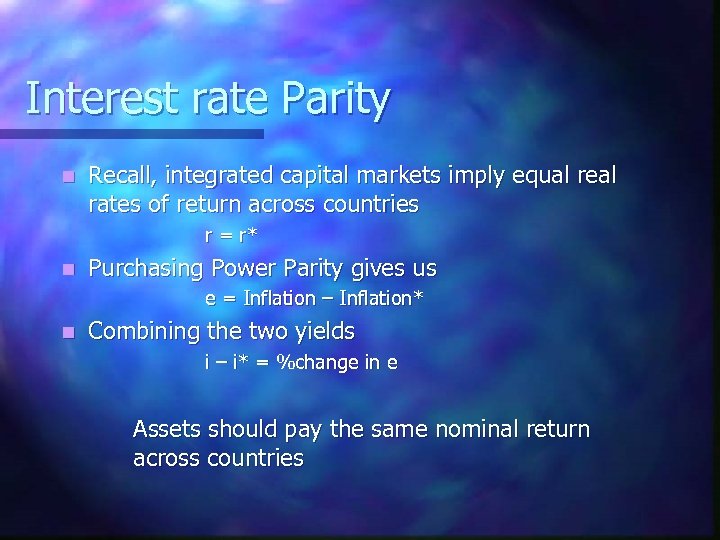

Interest rate Parity n Recall, integrated capital markets imply equal real rates of return across countries r = r*

Interest rate Parity n Recall, integrated capital markets imply equal real rates of return across countries r = r*

Interest rate Parity n Recall, integrated capital markets imply equal real rates of return across countries r = r* n Purchasing Power Parity gives us e = Inflation – Inflation*

Interest rate Parity n Recall, integrated capital markets imply equal real rates of return across countries r = r* n Purchasing Power Parity gives us e = Inflation – Inflation*

Interest rate Parity n Recall, integrated capital markets imply equal real rates of return across countries r = r* n Purchasing Power Parity gives us e = Inflation – Inflation* n Combining the two yields i – i* = %change in e Assets should pay the same nominal return across countries

Interest rate Parity n Recall, integrated capital markets imply equal real rates of return across countries r = r* n Purchasing Power Parity gives us e = Inflation – Inflation* n Combining the two yields i – i* = %change in e Assets should pay the same nominal return across countries

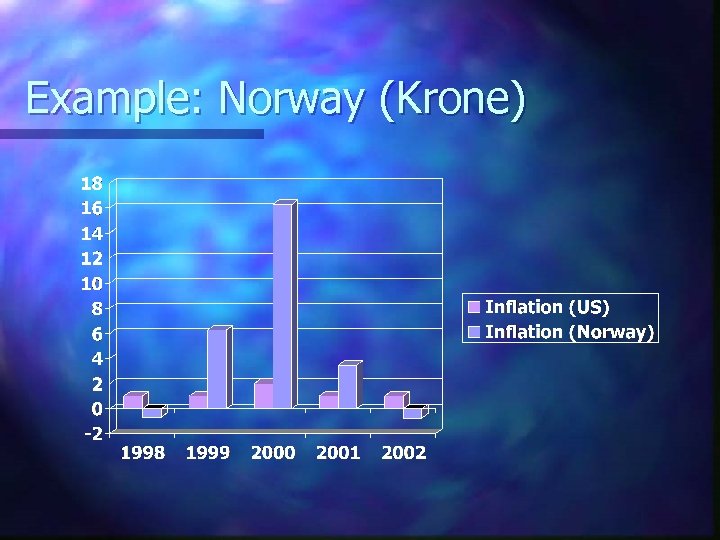

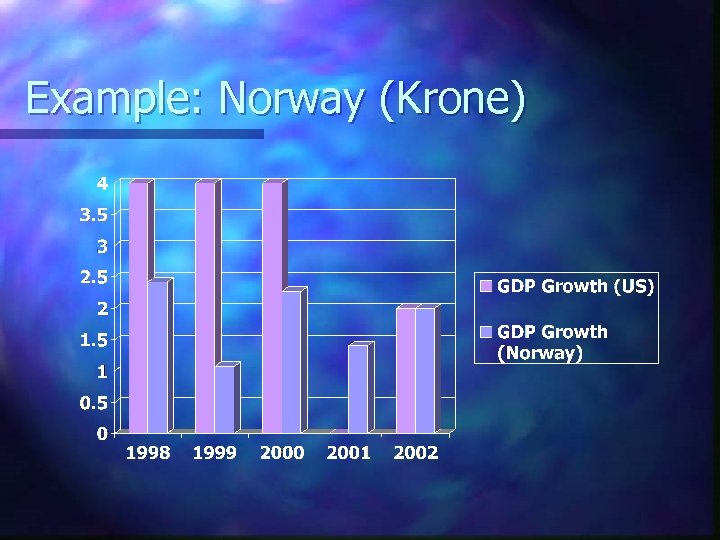

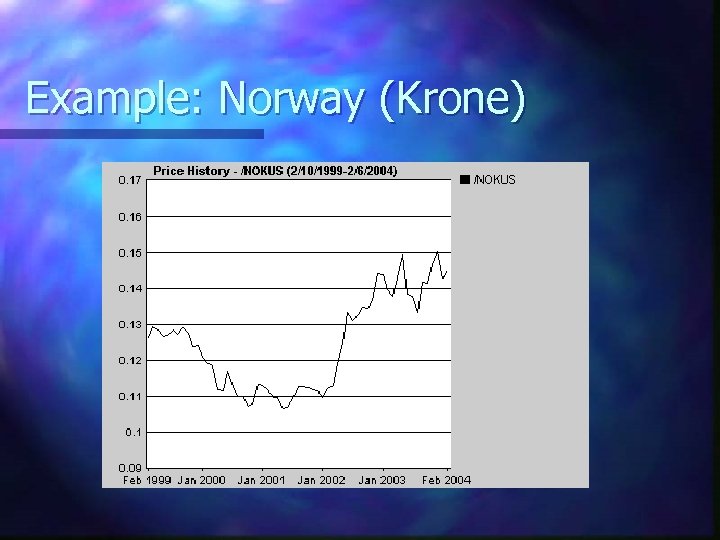

Example: Norway (Krone)

Example: Norway (Krone)

Example: Norway (Krone)

Example: Norway (Krone)

Example: Norway (Krone)

Example: Norway (Krone)

The Importance of Relative Prices n The fundamentals do quite well in explaining general trends, but are not so good at shorter term fluctuations

The Importance of Relative Prices n The fundamentals do quite well in explaining general trends, but are not so good at shorter term fluctuations

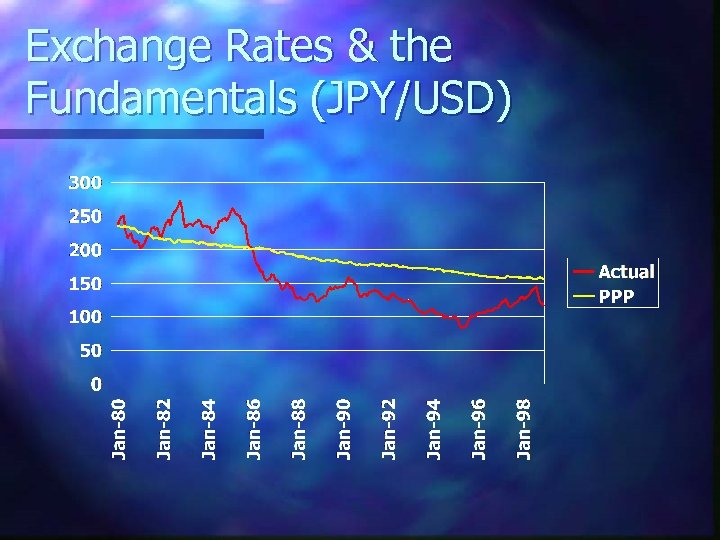

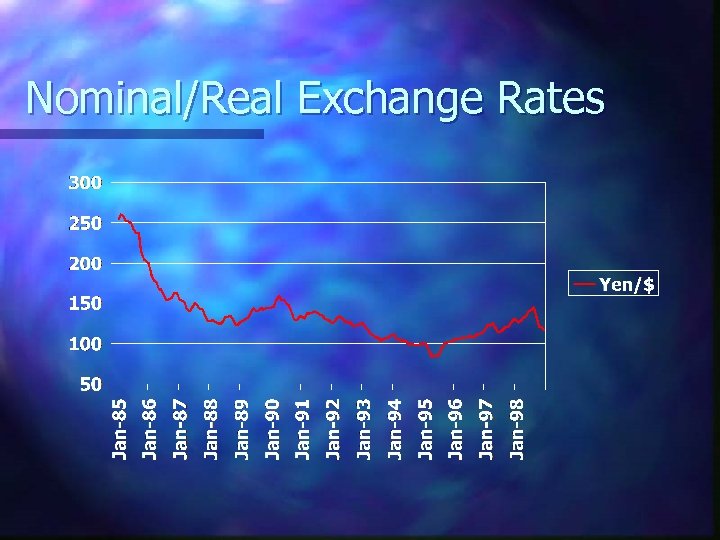

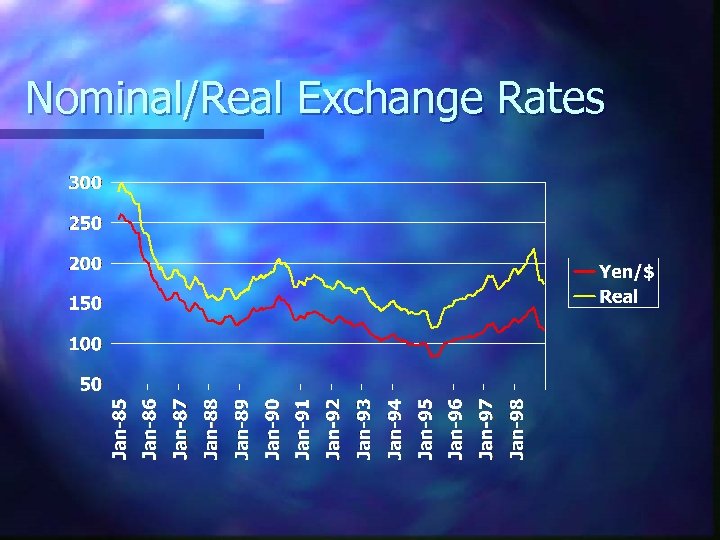

Exchange Rates & the Fundamentals (JPY/USD)

Exchange Rates & the Fundamentals (JPY/USD)

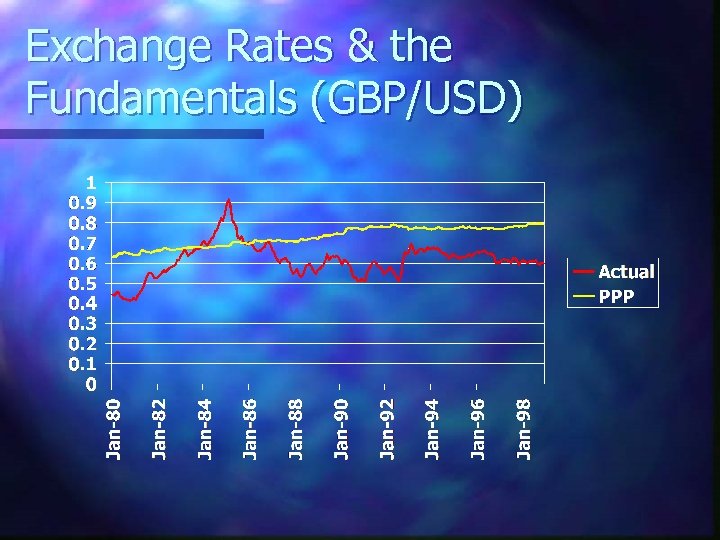

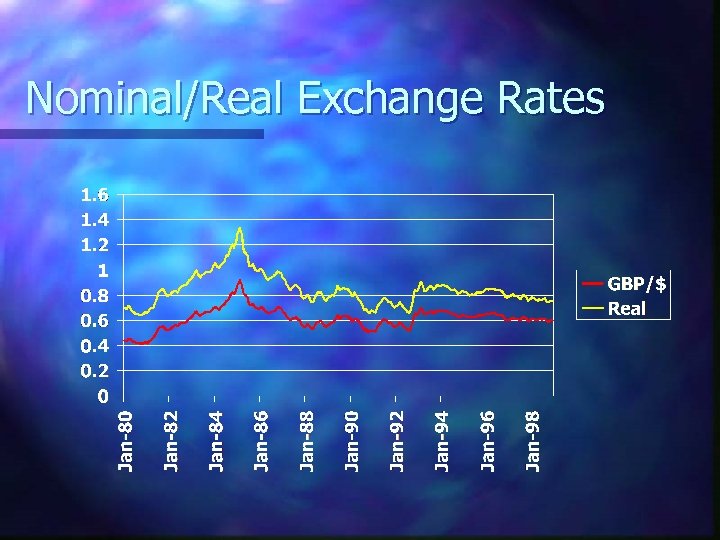

Exchange Rates & the Fundamentals (GBP/USD)

Exchange Rates & the Fundamentals (GBP/USD)

The Importance of Relative Prices The fundamentals do quite well in explaining general trends, but are not so good at shorter term fluctuations n While impediments to trade (tariffs, transportation costs can be blamed for the failure of PPP) – movement in the real exchange rate n

The Importance of Relative Prices The fundamentals do quite well in explaining general trends, but are not so good at shorter term fluctuations n While impediments to trade (tariffs, transportation costs can be blamed for the failure of PPP) – movement in the real exchange rate n

Nominal/Real Exchange Rates

Nominal/Real Exchange Rates

Nominal/Real Exchange Rates

Nominal/Real Exchange Rates

Nominal/Real Exchange Rates

Nominal/Real Exchange Rates

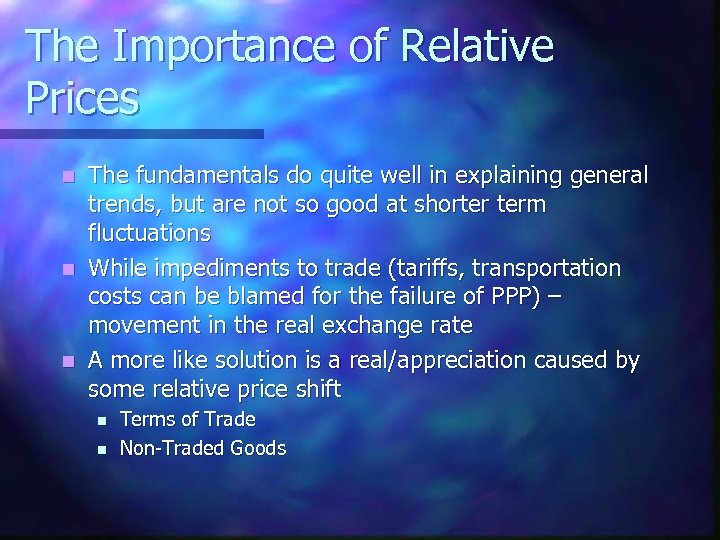

The Importance of Relative Prices n n n The fundamentals do quite well in explaining general trends, but are not so good at shorter term fluctuations While impediments to trade (tariffs, transportation costs can be blamed for the failure of PPP) – movement in the real exchange rate A more like solution is a real/appreciation caused by some relative price shift n n Terms of Trade Non-Traded Goods

The Importance of Relative Prices n n n The fundamentals do quite well in explaining general trends, but are not so good at shorter term fluctuations While impediments to trade (tariffs, transportation costs can be blamed for the failure of PPP) – movement in the real exchange rate A more like solution is a real/appreciation caused by some relative price shift n n Terms of Trade Non-Traded Goods

Non Traded Goods n Suppose that two countries have identical price indices P =. 5(Goods) +. 5(Services)

Non Traded Goods n Suppose that two countries have identical price indices P =. 5(Goods) +. 5(Services)

Non Traded Goods n Suppose that two countries have identical price indices P =. 5(Goods) +. 5(Services) n Suppose the domestic price of services increases

Non Traded Goods n Suppose that two countries have identical price indices P =. 5(Goods) +. 5(Services) n Suppose the domestic price of services increases

Non Traded Goods n Suppose that two countries have identical price indices P =. 5(Goods) +. 5(Services) n Suppose the domestic price of services increases n The domestic price level rises by 10% n No change in the nominal exchange rate is required n A real appreciation of 10% occurs

Non Traded Goods n Suppose that two countries have identical price indices P =. 5(Goods) +. 5(Services) n Suppose the domestic price of services increases n The domestic price level rises by 10% n No change in the nominal exchange rate is required n A real appreciation of 10% occurs

Non Traded Goods n In the previous example, a 20% rise in the price of a non-traded good created a 10% real appreciation n No change in nominal exchange rate n 10% rise in domestic price level

Non Traded Goods n In the previous example, a 20% rise in the price of a non-traded good created a 10% real appreciation n No change in nominal exchange rate n 10% rise in domestic price level

Non Traded Goods In the previous example, a 20% rise in the price of a non-traded good created a 10% real appreciation n No change in nominal exchange rate n 10% rise in domestic price level n This real appreciation could happen a number of different ways. For example n 5% nominal appreciation n 5% domestic price level increase n

Non Traded Goods In the previous example, a 20% rise in the price of a non-traded good created a 10% real appreciation n No change in nominal exchange rate n 10% rise in domestic price level n This real appreciation could happen a number of different ways. For example n 5% nominal appreciation n 5% domestic price level increase n

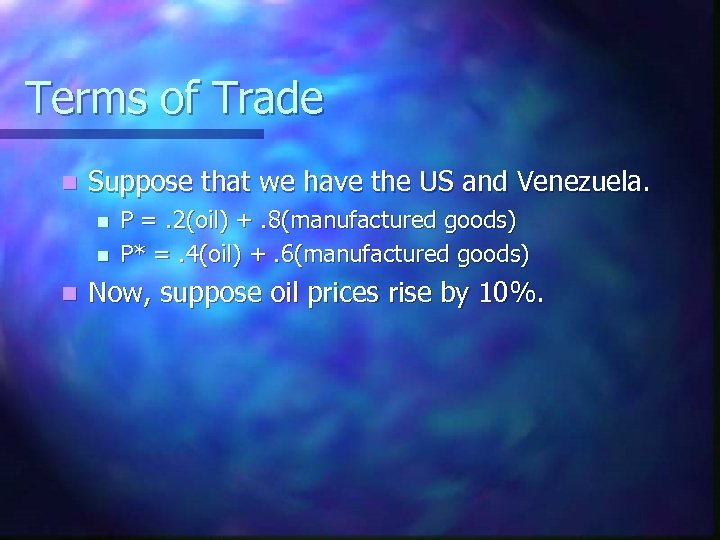

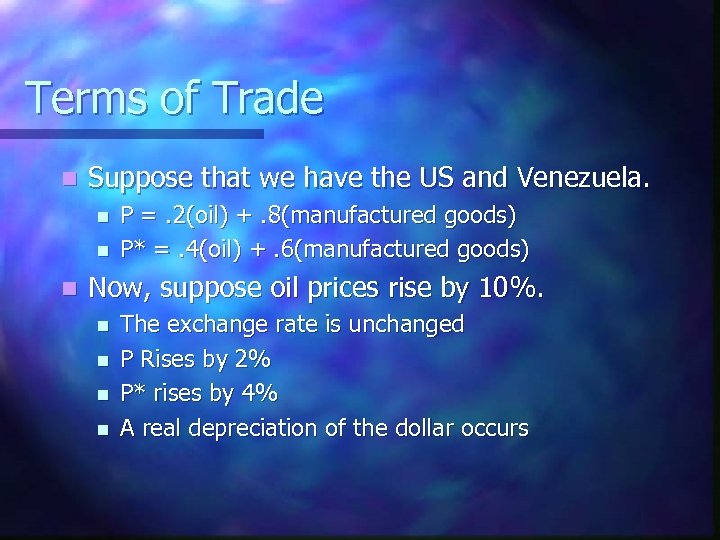

Terms of Trade n Suppose that we have the US and Venezuela. n n n P =. 2(oil) +. 8(manufactured goods) P* =. 4(oil) +. 6(manufactured goods) Now, suppose oil prices rise by 10%.

Terms of Trade n Suppose that we have the US and Venezuela. n n n P =. 2(oil) +. 8(manufactured goods) P* =. 4(oil) +. 6(manufactured goods) Now, suppose oil prices rise by 10%.

Terms of Trade n Suppose that we have the US and Venezuela. n n n P =. 2(oil) +. 8(manufactured goods) P* =. 4(oil) +. 6(manufactured goods) Now, suppose oil prices rise by 10%. n n The exchange rate is unchanged P Rises by 2% P* rises by 4% A real depreciation of the dollar occurs

Terms of Trade n Suppose that we have the US and Venezuela. n n n P =. 2(oil) +. 8(manufactured goods) P* =. 4(oil) +. 6(manufactured goods) Now, suppose oil prices rise by 10%. n n The exchange rate is unchanged P Rises by 2% P* rises by 4% A real depreciation of the dollar occurs

Terms of Trade n The n n n previous example gave us: The exchange rate is unchanged P Rises by 2% P* rises by 4% A 2% real depreciation of the dollar occurs However, any combination that adds up to a 2% real depreciation is possible. For example n A 2% nominal depreciation with no price changes.

Terms of Trade n The n n n previous example gave us: The exchange rate is unchanged P Rises by 2% P* rises by 4% A 2% real depreciation of the dollar occurs However, any combination that adds up to a 2% real depreciation is possible. For example n A 2% nominal depreciation with no price changes.

Terms of Trade n It is generally assumed that a country’s exports will make up a larger share of its price index than imports. n Therefore, in the previous example, the US is an importer of oil, and an exporter of manufactured goods.

Terms of Trade n It is generally assumed that a country’s exports will make up a larger share of its price index than imports. n Therefore, in the previous example, the US is an importer of oil, and an exporter of manufactured goods.

Terms of Trade n The Terms of Trade is defined as the relative price of exports in terms of imports n In the previous example, the Terms of Trade for the US worsened causing a real depreciation of the $.

Terms of Trade n The Terms of Trade is defined as the relative price of exports in terms of imports n In the previous example, the Terms of Trade for the US worsened causing a real depreciation of the $.

Oil Prices Year 1972 1973 1974 1978 1979 1980 1985 1986 Price ($/Brl. ) $10. 65 $11. 58 $18. 76 $18. 66 $24. 19 $37. 85 $32. 69 $16. 61

Oil Prices Year 1972 1973 1974 1978 1979 1980 1985 1986 Price ($/Brl. ) $10. 65 $11. 58 $18. 76 $18. 66 $24. 19 $37. 85 $32. 69 $16. 61

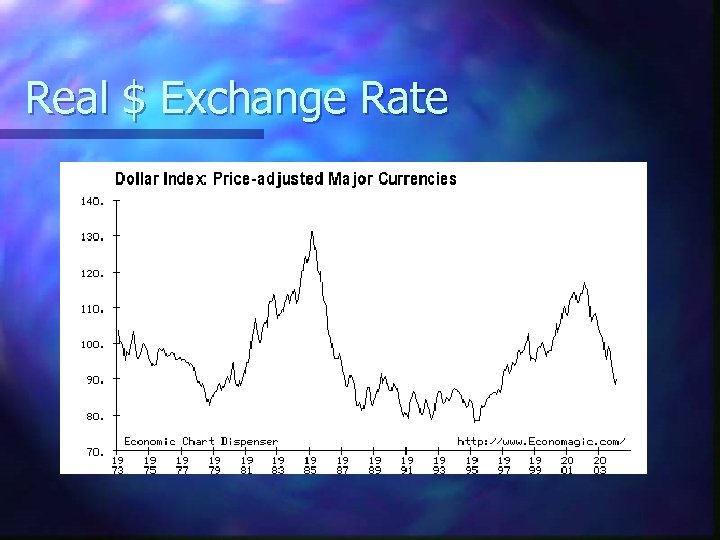

Real $ Exchange Rate

Real $ Exchange Rate

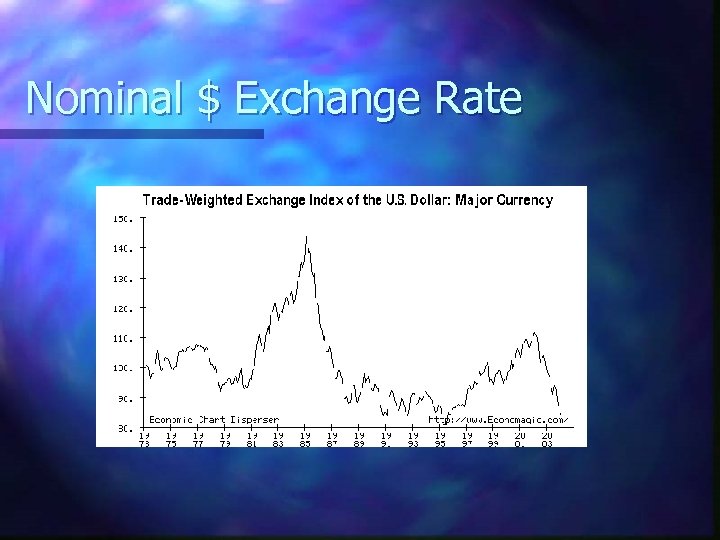

Nominal $ Exchange Rate

Nominal $ Exchange Rate

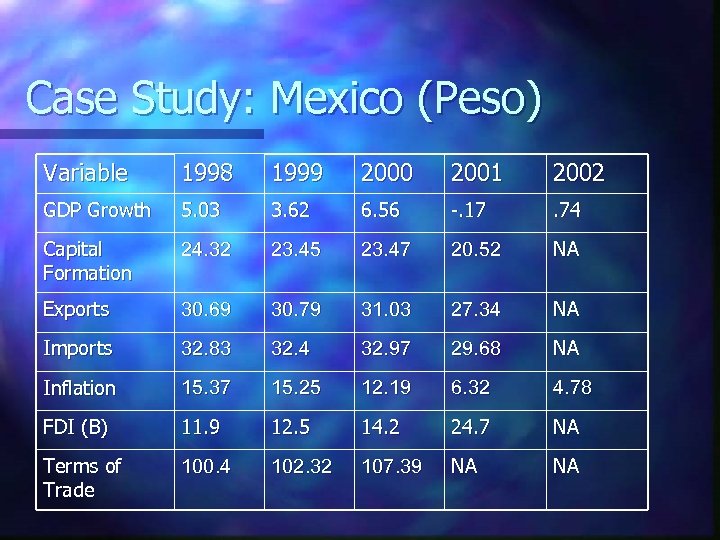

Case Study: Mexico (Peso) Variable 1998 1999 2000 2001 2002 GDP Growth 5. 03 3. 62 6. 56 -. 17 . 74 Capital Formation 24. 32 23. 45 23. 47 20. 52 NA Exports 30. 69 30. 79 31. 03 27. 34 NA Imports 32. 83 32. 4 32. 97 29. 68 NA Inflation 15. 37 15. 25 12. 19 6. 32 4. 78 FDI (B) 11. 9 12. 5 14. 2 24. 7 NA Terms of Trade 100. 4 102. 32 107. 39 NA NA

Case Study: Mexico (Peso) Variable 1998 1999 2000 2001 2002 GDP Growth 5. 03 3. 62 6. 56 -. 17 . 74 Capital Formation 24. 32 23. 45 23. 47 20. 52 NA Exports 30. 69 30. 79 31. 03 27. 34 NA Imports 32. 83 32. 4 32. 97 29. 68 NA Inflation 15. 37 15. 25 12. 19 6. 32 4. 78 FDI (B) 11. 9 12. 5 14. 2 24. 7 NA Terms of Trade 100. 4 102. 32 107. 39 NA NA

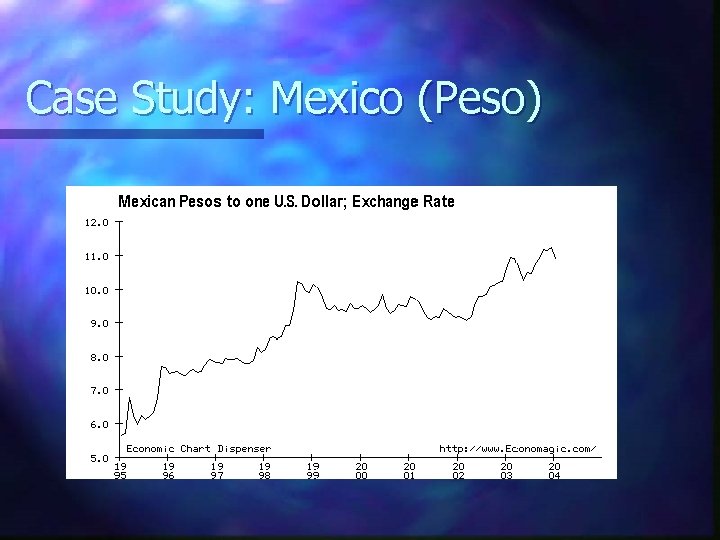

Case Study: Mexico (Peso)

Case Study: Mexico (Peso)

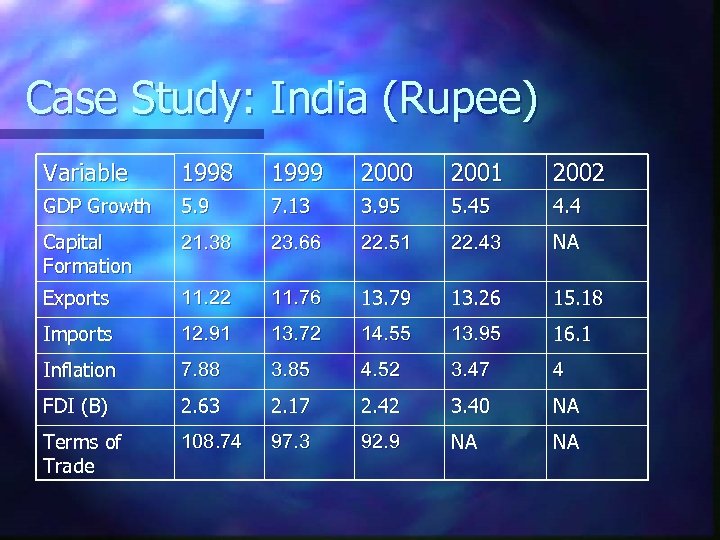

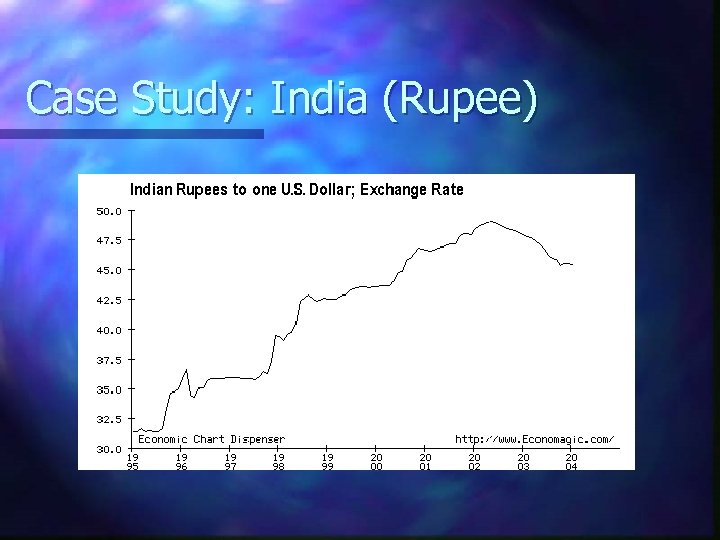

Case Study: India (Rupee) Variable 1998 1999 2000 2001 2002 GDP Growth 5. 9 7. 13 3. 95 5. 45 4. 4 Capital Formation 21. 38 23. 66 22. 51 22. 43 NA Exports 11. 22 11. 76 13. 79 13. 26 15. 18 Imports 12. 91 13. 72 14. 55 13. 95 16. 1 Inflation 7. 88 3. 85 4. 52 3. 47 4 FDI (B) 2. 63 2. 17 2. 42 3. 40 NA Terms of Trade 108. 74 97. 3 92. 9 NA NA

Case Study: India (Rupee) Variable 1998 1999 2000 2001 2002 GDP Growth 5. 9 7. 13 3. 95 5. 45 4. 4 Capital Formation 21. 38 23. 66 22. 51 22. 43 NA Exports 11. 22 11. 76 13. 79 13. 26 15. 18 Imports 12. 91 13. 72 14. 55 13. 95 16. 1 Inflation 7. 88 3. 85 4. 52 3. 47 4 FDI (B) 2. 63 2. 17 2. 42 3. 40 NA Terms of Trade 108. 74 97. 3 92. 9 NA NA

Case Study: India (Rupee)

Case Study: India (Rupee)

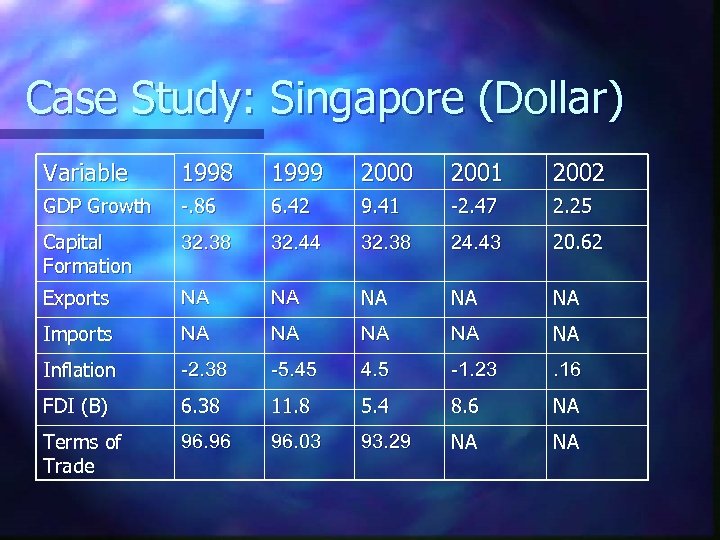

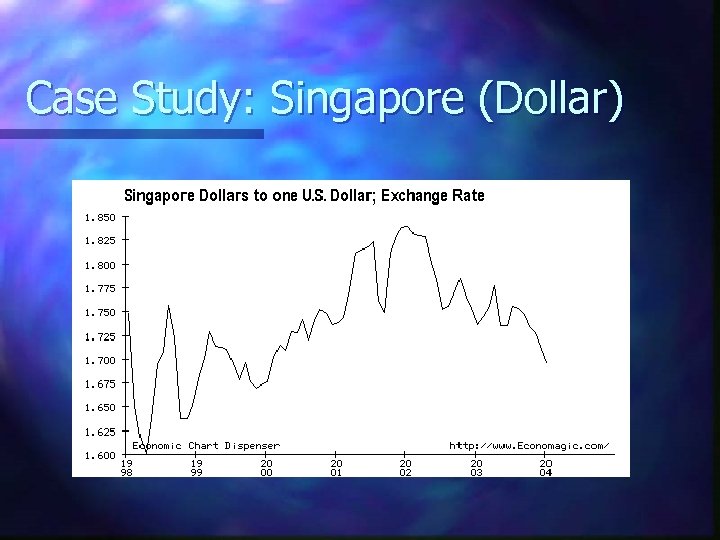

Case Study: Singapore (Dollar) Variable 1998 1999 2000 2001 2002 GDP Growth -. 86 6. 42 9. 41 -2. 47 2. 25 Capital Formation 32. 38 32. 44 32. 38 24. 43 20. 62 Exports NA NA NA Imports NA NA NA Inflation -2. 38 -5. 45 4. 5 -1. 23 . 16 FDI (B) 6. 38 11. 8 5. 4 8. 6 NA Terms of Trade 96. 96 96. 03 93. 29 NA NA

Case Study: Singapore (Dollar) Variable 1998 1999 2000 2001 2002 GDP Growth -. 86 6. 42 9. 41 -2. 47 2. 25 Capital Formation 32. 38 32. 44 32. 38 24. 43 20. 62 Exports NA NA NA Imports NA NA NA Inflation -2. 38 -5. 45 4. 5 -1. 23 . 16 FDI (B) 6. 38 11. 8 5. 4 8. 6 NA Terms of Trade 96. 96 96. 03 93. 29 NA NA

Case Study: Singapore (Dollar)

Case Study: Singapore (Dollar)