864a96e81aaba0bde38e8c08ef84f47e.ppt

- Количество слайдов: 28

CTC 475 Review n n n Bonds Not straightforward because bonds can be bought and/or sold between the date of issuance and the date of maturity P=Vr(P/Ai, n)+F(P/Fi, n) Find P n Find F n Find I n Cash flow frequency, i and n must match n

CTC 475 Comparing Alternatives

Objectives n n n Know the steps for comparing alternatives Know how to determine the possible set of alternatives Know how to develop cash flows using the same planning horizon

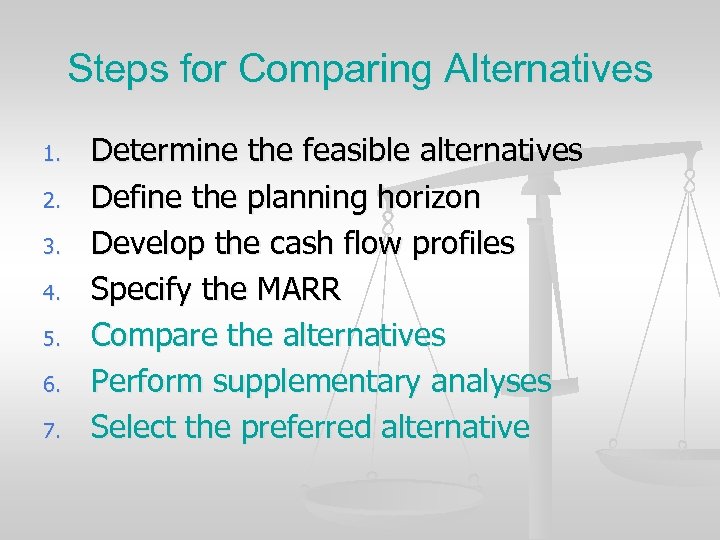

Steps for Comparing Alternatives 1. 2. 3. 4. 5. 6. 7. Determine the feasible alternatives Define the planning horizon Develop the cash flow profiles Specify the MARR Compare the alternatives Perform supplementary analyses Select the preferred alternative

Determine Feasible Alternatives n n Alternatives can consist of various investment proposals Proposals can be: Mutually exclusive n Independent n Contingent upon another proposal n

Mutual Exclusive n At most one project out of the group can be chosen: If I have proposals A, B, and C------- only A or B or C can be chosen (not a combination)

Independent n n n All, none or any combination may be selected Total number of alternatives = 2 m where m is the number of proposals If there are 4 proposals, the total number of options is 24 = 16 alternatives

Contingent n The choice of a project is conditional on the choice of another project If A is contingent on B then A can’t be implemented unless B is also implemented

Example of Defining Alternatives and Developing Cash Flow Profiles Steps 1 and 3 (planning horizon is the same)

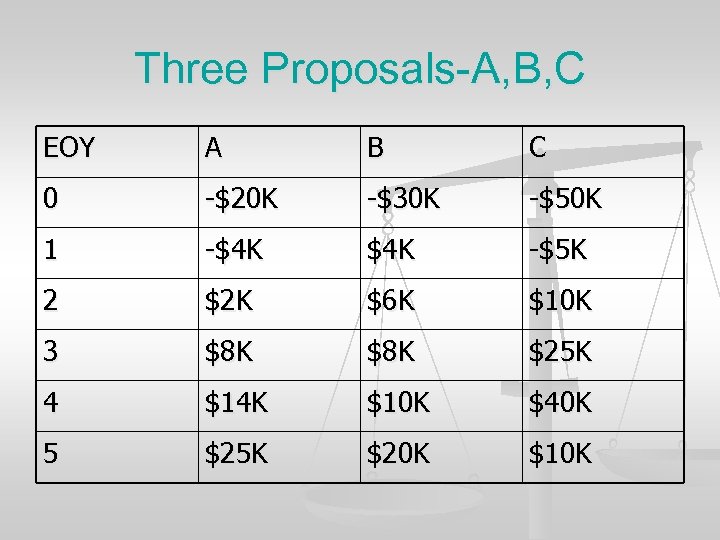

Three Proposals-A, B, C EOY A B C 0 -$20 K -$30 K -$50 K 1 -$4 K -$5 K 2 $2 K $6 K $10 K 3 $8 K $25 K 4 $14 K $10 K $40 K 5 $25 K $20 K $10 K

Number of Alternatives 23 = 8 alternatives

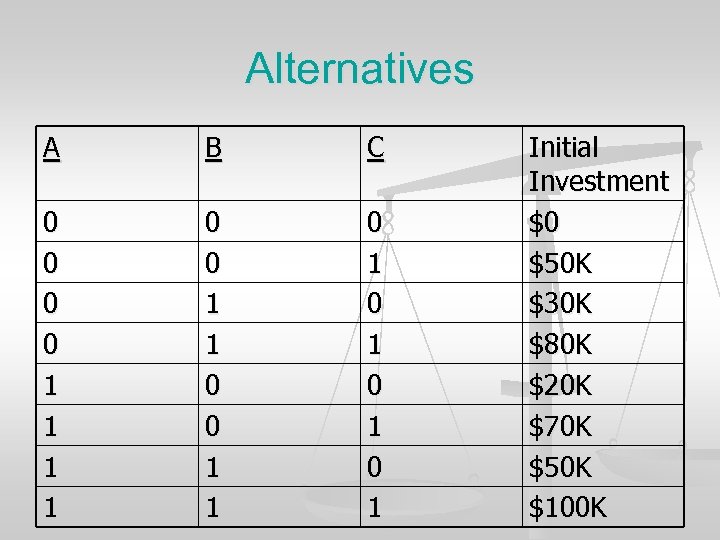

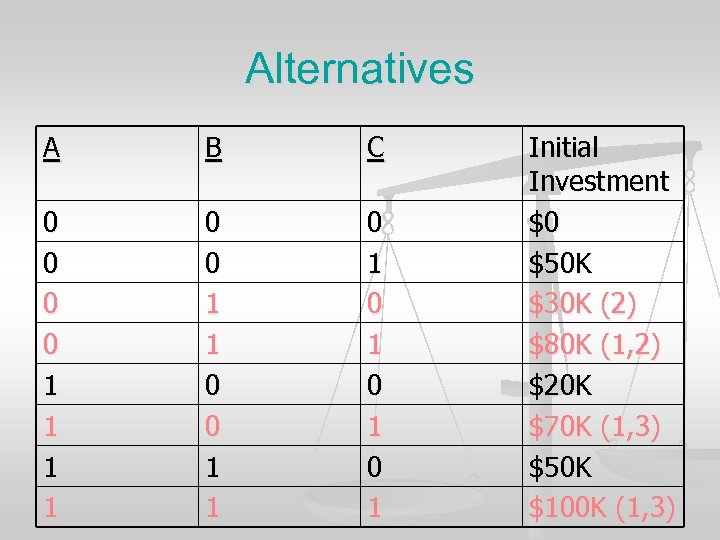

Alternatives A B C 0 0 1 1 0 1 0 1 Initial Investment $0 $50 K $30 K $80 K $20 K $70 K $50 K $100 K

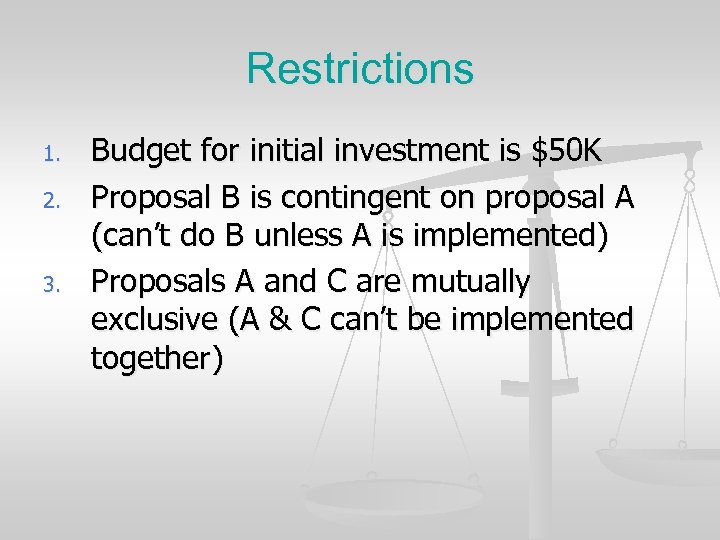

Restrictions 1. 2. 3. Budget for initial investment is $50 K Proposal B is contingent on proposal A (can’t do B unless A is implemented) Proposals A and C are mutually exclusive (A & C can’t be implemented together)

Alternatives A B C 0 0 1 1 0 1 0 1 Initial Investment $0 $50 K $30 K (2) $80 K (1, 2) $20 K $70 K (1, 3) $50 K $100 K (1, 3)

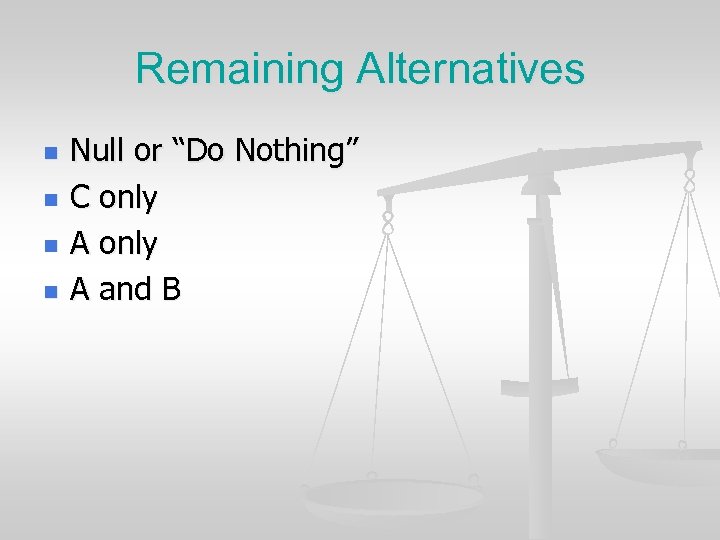

Remaining Alternatives n n Null or “Do Nothing” C only A and B

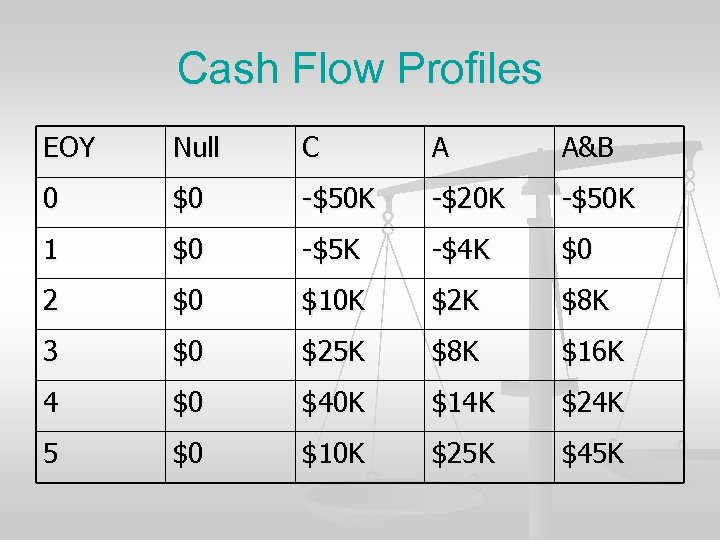

Cash Flow Profiles EOY Null C A A&B 0 $0 -$50 K -$20 K -$50 K 1 $0 -$5 K -$4 K $0 2 $0 $10 K $2 K $8 K 3 $0 $25 K $8 K $16 K 4 $0 $40 K $14 K $24 K 5 $0 $10 K $25 K $45 K

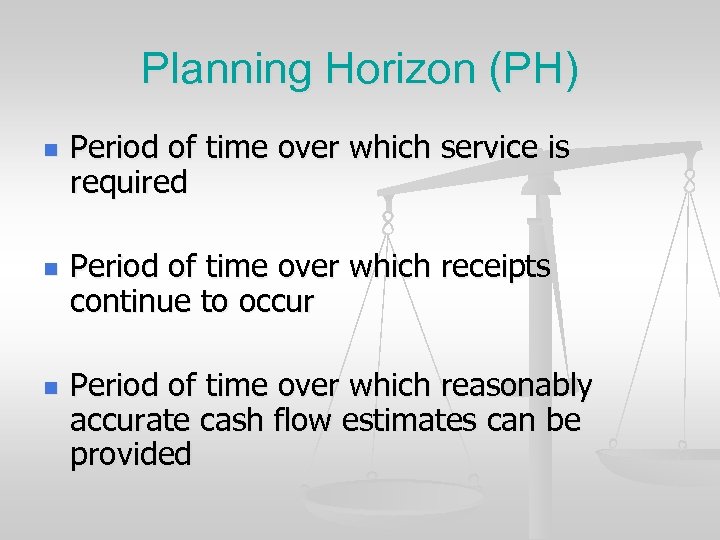

Planning Horizon (PH) n n n Period of time over which service is required Period of time over which receipts continue to occur Period of time over which reasonably accurate cash flow estimates can be provided

Planning horizon, working life of equipment and depreciable life are not necessarily the same

When comparing Alternatives----The Planning Horizon must be the same

Methods: n n Least common multiple (LCM) Shortest life Longest life Some determined life

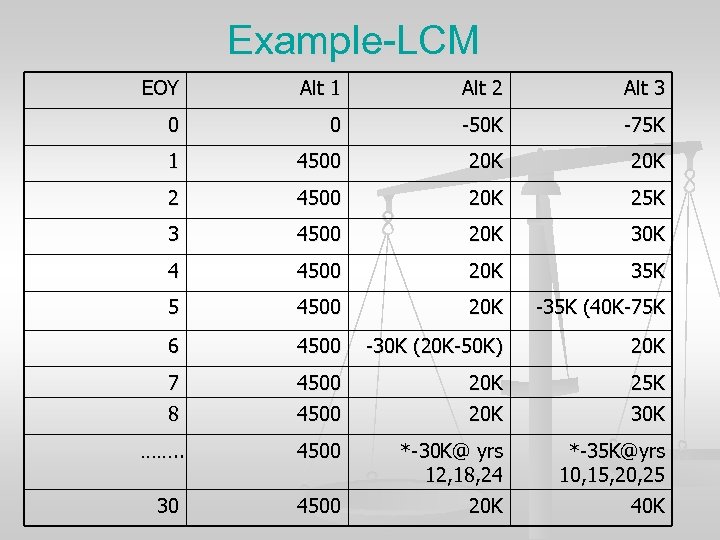

Example n Alternatives A, B & C have 3, 6, and 5 -year lives Least common multiple = 30 years n Shortest life = 3 years n Longest life = 6 years n Standard planning horizon could be 5 years (or 4 years or some other number) n

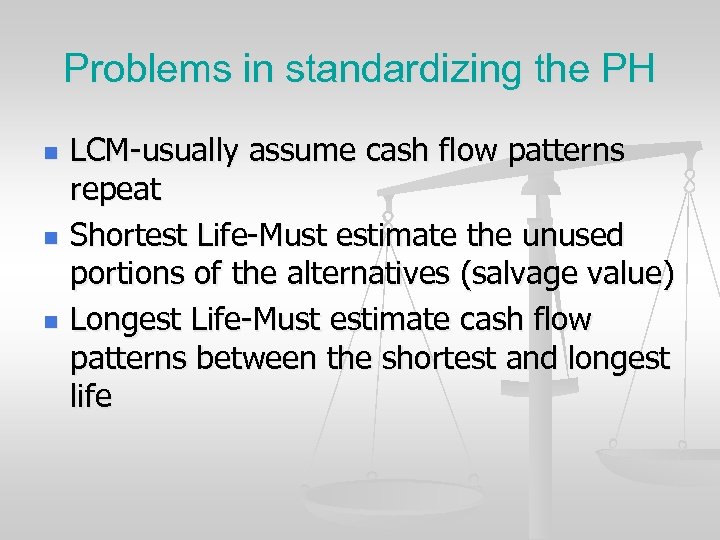

Problems in standardizing the PH n n n LCM-usually assume cash flow patterns repeat Shortest Life-Must estimate the unused portions of the alternatives (salvage value) Longest Life-Must estimate cash flow patterns between the shortest and longest life

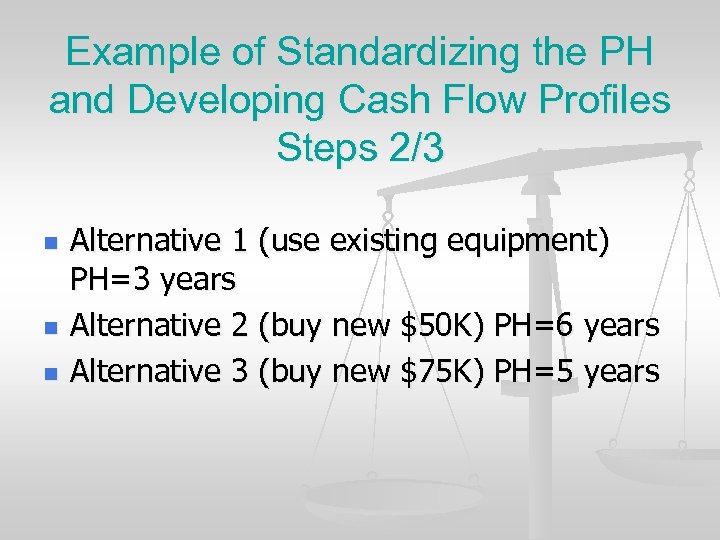

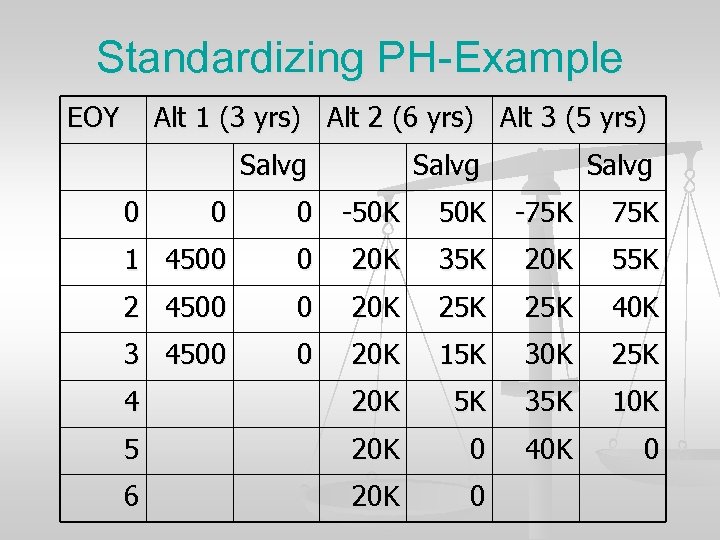

Example of Standardizing the PH and Developing Cash Flow Profiles Steps 2/3 n n n Alternative 1 (use existing equipment) PH=3 years Alternative 2 (buy new $50 K) PH=6 years Alternative 3 (buy new $75 K) PH=5 years

Standardizing PH-Example EOY Alt 1 (3 yrs) Alt 2 (6 yrs) Alt 3 (5 yrs) Salvg 0 0 -50 K -75 K 1 4500 0 20 K 35 K 20 K 55 K 2 4500 0 20 K 25 K 40 K 3 4500 0 20 K 15 K 30 K 25 K 4 20 K 5 K 35 K 10 K 5 20 K 0 40 K 0 6 20 K 0

Example-LCM EOY Alt 1 Alt 2 Alt 3 0 0 -50 K -75 K 1 4500 20 K 25 K 3 4500 20 K 30 K 4 4500 20 K 35 K 5 4500 20 K -35 K (40 K-75 K 6 4500 -30 K (20 K-50 K) 20 K 7 4500 20 K 25 K 8 4500 20 K 30 K ……. . 4500 *-30 K@ yrs 12, 18, 24 *-35 K@yrs 10, 15, 20, 25 30 4500 20 K 40 K

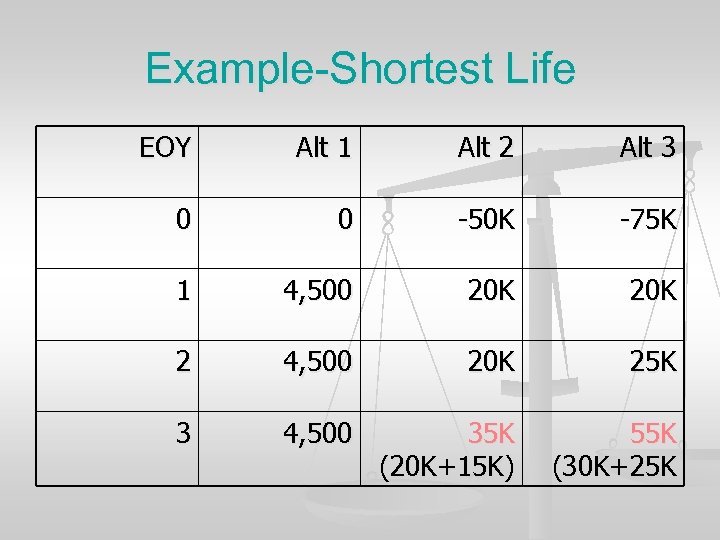

Example-Shortest Life EOY Alt 1 Alt 2 Alt 3 0 0 -50 K -75 K 1 4, 500 20 K 25 K 3 4, 500 35 K (20 K+15 K) 55 K (30 K+25 K

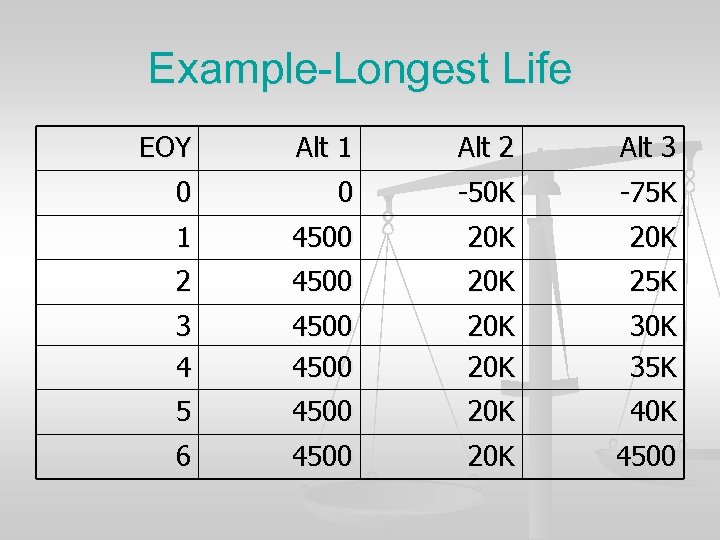

Example-Longest Life EOY Alt 1 Alt 2 Alt 3 0 0 -50 K -75 K 1 4500 20 K 25 K 3 4 4500 20 K 30 K 35 K 5 4500 20 K 40 K 6 4500 20 K 4500

Next lecture n Methods for Comparing Alternatives: n n Ranking (PW, AW, FW) Incremental (all) n Supplementary Analyses n Selling the Alternative

864a96e81aaba0bde38e8c08ef84f47e.ppt