CTC 475 Review n Dealing with Uncertainty ¨ Breakeven ¨ Sensitivity ¨ Optimistic-Pessimistic

CTC 475 Review n Dealing with Uncertainty ¨ Breakeven ¨ Sensitivity ¨ Optimistic-Pessimistic

CTC 475 Replacement Analysis and Capital Recovery Cost

CTC 475 Replacement Analysis and Capital Recovery Cost

Objective Know how to complete a replacement analysis n Know how to calculate a capital recovery cost n

Objective Know how to complete a replacement analysis n Know how to calculate a capital recovery cost n

Replacement Analysis Use to determine whether an existing asset should be replaced with a new asset

Replacement Analysis Use to determine whether an existing asset should be replaced with a new asset

Definition n Existing Asset is known as the DEFENDER n New Asset is defined as the CHALLENGER

Definition n Existing Asset is known as the DEFENDER n New Asset is defined as the CHALLENGER

Reasons for Replacement n Deterioration ¨ Higher n O&M costs; less reliability than anticipated Requirement change ¨ Consumer n Technology ¨ New n wants more/less/different technology provides new challengers Financing ¨ Better interest rates

Reasons for Replacement n Deterioration ¨ Higher n O&M costs; less reliability than anticipated Requirement change ¨ Consumer n Technology ¨ New n wants more/less/different technology provides new challengers Financing ¨ Better interest rates

Viewpoints n Outsider: Conduct analysis assuming you’re an impartial 3 rd party n Insider (Company): Can be tempting to try and recover past errors

Viewpoints n Outsider: Conduct analysis assuming you’re an impartial 3 rd party n Insider (Company): Can be tempting to try and recover past errors

Don’t recover past losses Market Value < Book Value n Capacity of defender is inadequate n O&M costs of defender is higher than anticipated n Losses have occurred, but shouldn’t be considered for replacement analysis

Don’t recover past losses Market Value < Book Value n Capacity of defender is inadequate n O&M costs of defender is higher than anticipated n Losses have occurred, but shouldn’t be considered for replacement analysis

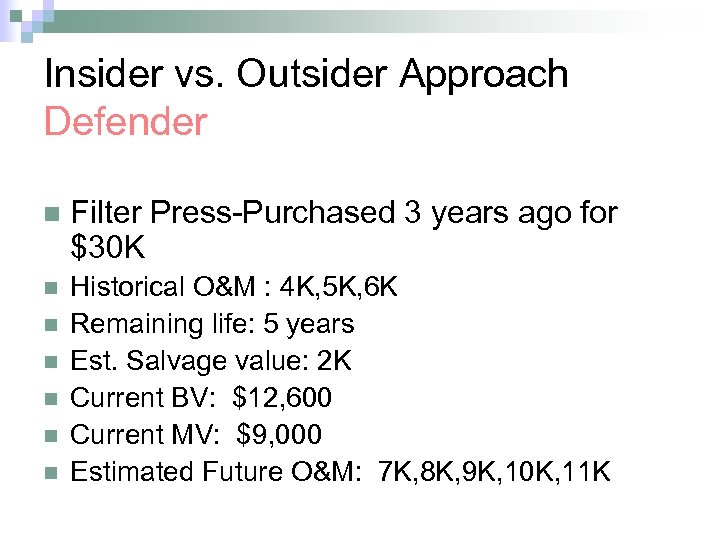

Insider vs. Outsider Approach Defender n Filter Press-Purchased 3 years ago for $30 K n Historical O&M : 4 K, 5 K, 6 K Remaining life: 5 years Est. Salvage value: 2 K Current BV: $12, 600 Current MV: $9, 000 Estimated Future O&M: 7 K, 8 K, 9 K, 10 K, 11 K n n n

Insider vs. Outsider Approach Defender n Filter Press-Purchased 3 years ago for $30 K n Historical O&M : 4 K, 5 K, 6 K Remaining life: 5 years Est. Salvage value: 2 K Current BV: $12, 600 Current MV: $9, 000 Estimated Future O&M: 7 K, 8 K, 9 K, 10 K, 11 K n n n

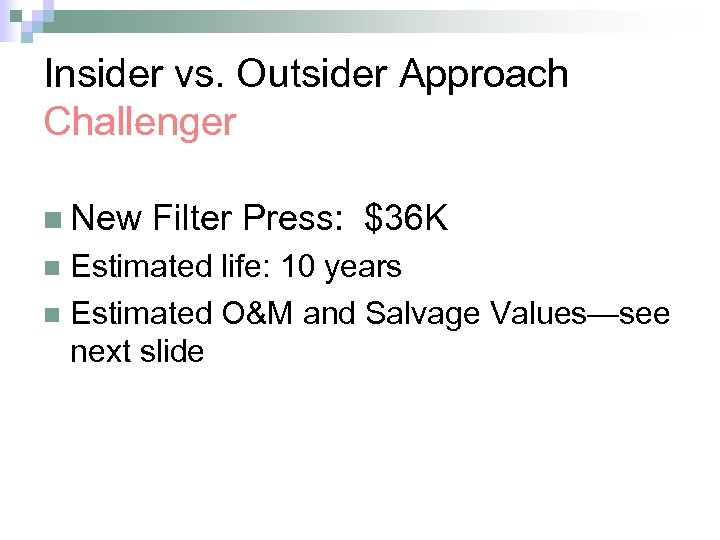

Insider vs. Outsider Approach Challenger n New Filter Press: $36 K Estimated life: 10 years n Estimated O&M and Salvage Values—see next slide n

Insider vs. Outsider Approach Challenger n New Filter Press: $36 K Estimated life: 10 years n Estimated O&M and Salvage Values—see next slide n

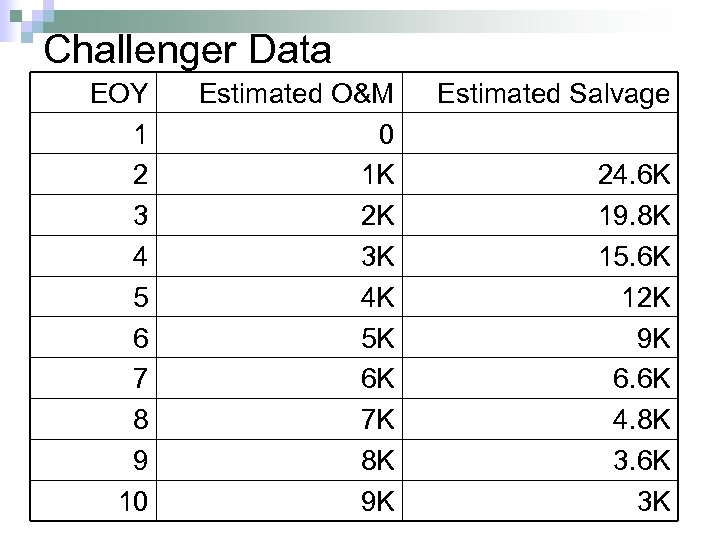

Challenger Data EOY 1 2 3 4 5 6 7 8 9 10 Estimated O&M 0 1 K 2 K 3 K 4 K 5 K 6 K 7 K 8 K 9 K Estimated Salvage 24. 6 K 19. 8 K 15. 6 K 12 K 9 K 6. 6 K 4. 8 K 3. 6 K 3 K

Challenger Data EOY 1 2 3 4 5 6 7 8 9 10 Estimated O&M 0 1 K 2 K 3 K 4 K 5 K 6 K 7 K 8 K 9 K Estimated Salvage 24. 6 K 19. 8 K 15. 6 K 12 K 9 K 6. 6 K 4. 8 K 3. 6 K 3 K

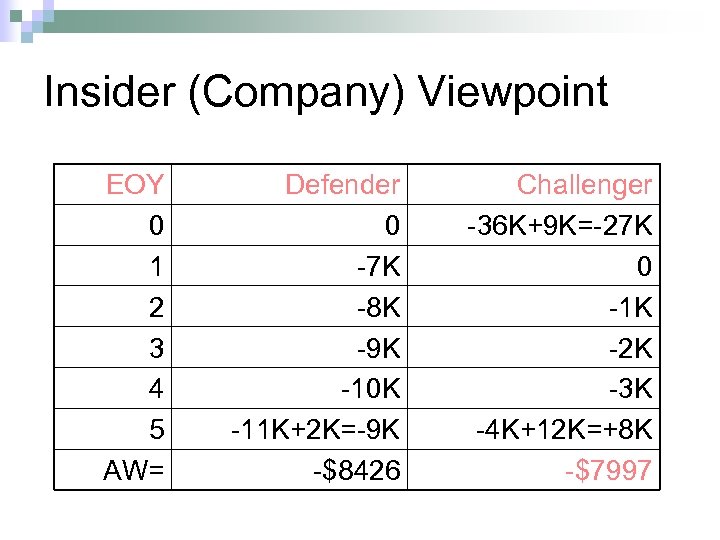

Insider (Company) Viewpoint EOY 0 1 2 3 4 5 AW= Defender 0 -7 K -8 K -9 K -10 K -11 K+2 K=-9 K -$8426 Challenger -36 K+9 K=-27 K 0 -1 K -2 K -3 K -4 K+12 K=+8 K -$7997

Insider (Company) Viewpoint EOY 0 1 2 3 4 5 AW= Defender 0 -7 K -8 K -9 K -10 K -11 K+2 K=-9 K -$8426 Challenger -36 K+9 K=-27 K 0 -1 K -2 K -3 K -4 K+12 K=+8 K -$7997

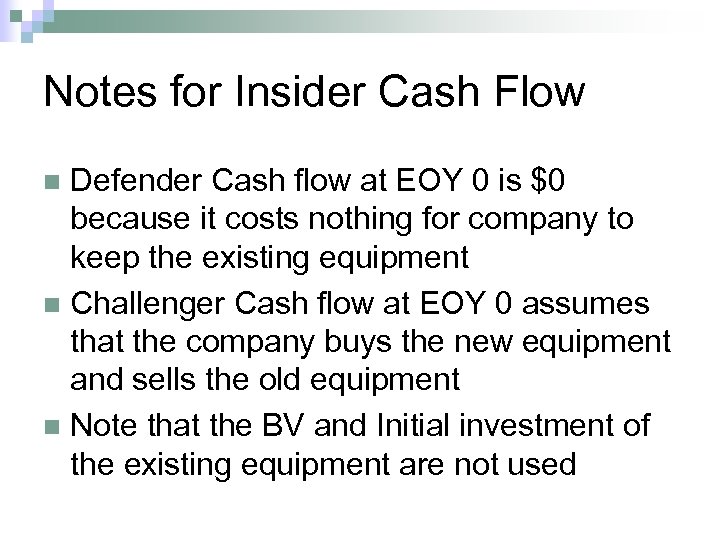

Notes for Insider Cash Flow Defender Cash flow at EOY 0 is $0 because it costs nothing for company to keep the existing equipment n Challenger Cash flow at EOY 0 assumes that the company buys the new equipment and sells the old equipment n Note that the BV and Initial investment of the existing equipment are not used n

Notes for Insider Cash Flow Defender Cash flow at EOY 0 is $0 because it costs nothing for company to keep the existing equipment n Challenger Cash flow at EOY 0 assumes that the company buys the new equipment and sells the old equipment n Note that the BV and Initial investment of the existing equipment are not used n

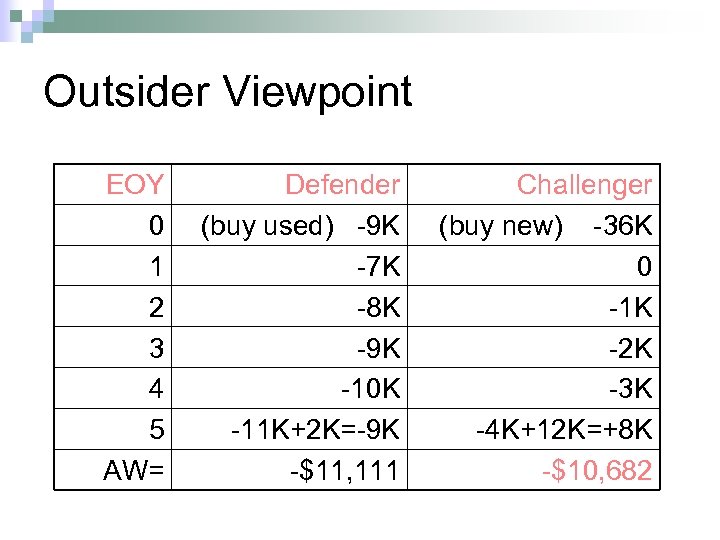

Outsider Viewpoint EOY 0 1 2 3 4 5 AW= Defender (buy used) -9 K -7 K -8 K -9 K -10 K -11 K+2 K=-9 K -$11, 111 Challenger (buy new) -36 K 0 -1 K -2 K -3 K -4 K+12 K=+8 K -$10, 682

Outsider Viewpoint EOY 0 1 2 3 4 5 AW= Defender (buy used) -9 K -7 K -8 K -9 K -10 K -11 K+2 K=-9 K -$11, 111 Challenger (buy new) -36 K 0 -1 K -2 K -3 K -4 K+12 K=+8 K -$10, 682

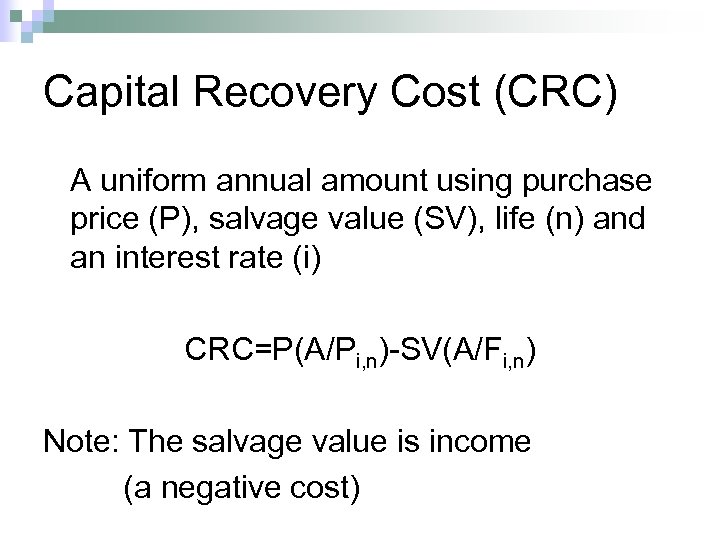

Capital Recovery Cost (CRC) A uniform annual amount using purchase price (P), salvage value (SV), life (n) and an interest rate (i) CRC=P(A/Pi, n)-SV(A/Fi, n) Note: The salvage value is income (a negative cost)

Capital Recovery Cost (CRC) A uniform annual amount using purchase price (P), salvage value (SV), life (n) and an interest rate (i) CRC=P(A/Pi, n)-SV(A/Fi, n) Note: The salvage value is income (a negative cost)

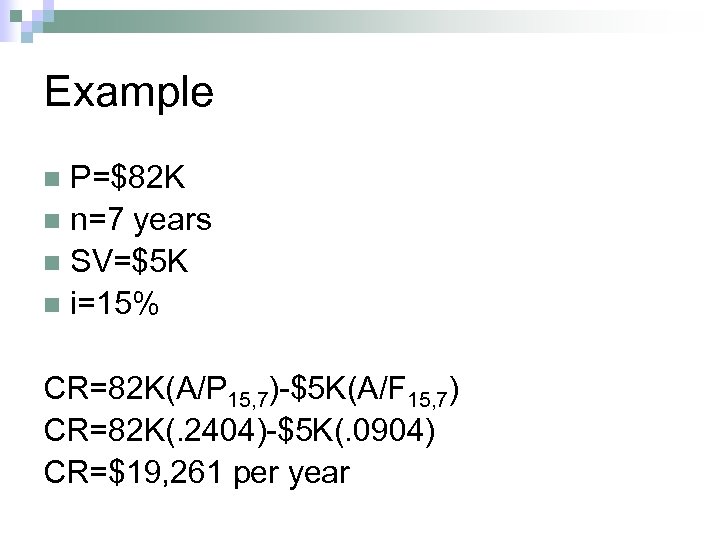

Example P=$82 K n n=7 years n SV=$5 K n i=15% n CR=82 K(A/P 15, 7)-$5 K(A/F 15, 7) CR=82 K(. 2404)-$5 K(. 0904) CR=$19, 261 per year

Example P=$82 K n n=7 years n SV=$5 K n i=15% n CR=82 K(A/P 15, 7)-$5 K(A/F 15, 7) CR=82 K(. 2404)-$5 K(. 0904) CR=$19, 261 per year

Other Formulas for CRC CR=(P-SV)(A/Fi, n)+Pi n CR=(P-SV)(A/Pi, n)+SV*i n These alternate formulas can be derived from math equations; however---first equation is easier to remember

Other Formulas for CRC CR=(P-SV)(A/Fi, n)+Pi n CR=(P-SV)(A/Pi, n)+SV*i n These alternate formulas can be derived from math equations; however---first equation is easier to remember

Next lecture n Review n Case Study n Presentations

Next lecture n Review n Case Study n Presentations