fc4114e083a0dc9492824ca61ada223e.ppt

- Количество слайдов: 183

CSSPP/DNB INTERNATIONAL SEMINAR JUNE 9 – JUNE 11 2010 Supervision on Pension Funds Experience from Romania and The Netherlands

Supervision on pension funds Introduction to the seminar Adina Dragomir/Leendert van Driel Bucharest, Romania June 9 to June 11, 2010

Supervision on Pension Funds l l Objective of seminar Introduction of participants

Programme Seminar Wednesday, June 9 09. 00 Welcome and Introduction (Adina Dragomir/Leendert van Driel) 09. 15 Review and summary of DNB seminar 2009(David Schelhaas/Leendert van Driel) 10. 15 Morning coffee break 10. 45 Review and summary of DNB seminar 2009 (2) 12. 30 Lunch

Programme Seminar Wednesday, June 9 14. 00 Supervision 15. 30 16. 00 17. 00 18. 30 IOPS Principles of Pension (Rick Hoogendoorn) Break Pension Fund Supervision in Romania End of day programme Dinner

Programme seminar Thursday, June 10 09. 00 Pension Fund Governance: OECD Guidelines (Rick Hoogendoorn/David Schelhaas) 10. 15 Morning coffee break 10. 45 Risk Management (Paulus Dijkstra) 11. 30 First Round of Investment Game (Paulus Dijkstra/David Schelhaas) 12. 30 Lunch

Programme seminar Thursday, June 10 14. 00 pension 14. 45 15. 15 16. 00 17. 00 18. 30 Investigation into investments of funds during credit crisis (Paulus Dijkstra) Afternoon coffee break Supervision in practice (Leendert van Driel/David Schelhaas) Second Round of Investment Game (Paulus Dijkstra/David Schelhaas) End of day programme Dinner

Programme seminar Friday, June 11 09. 00 Council of Europe position in respect of pension rights (Sixto Molina) 10. 00 Morning coffee break 10. 15 Final round of Investment Game (Paulus Dijkstra/David Schelhaas) 11. 30 Seminar evaluation (Leendert van Driel/David Schelhaas) 12. 30 Lunch 14. 00 End of seminar

Review seminar 2009 Summary 1. 2. 3. 4. 5. Pensions in the Netherlands FIRM and FAF Dealing with the crisis in Holland Dealing with the crisis in Europe Financial crisis and the impact on pensions in Europe

Pensions in the Netherlands The Netherlands: 1. Pension system 2. Pension supervision 10 Apeldoorn

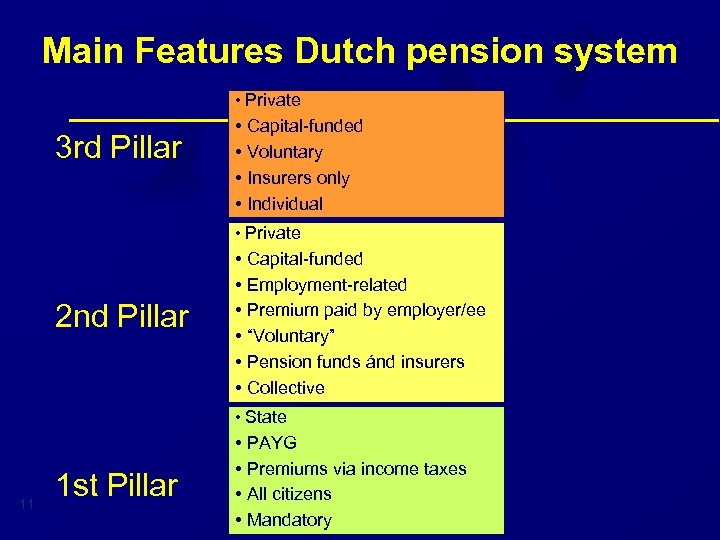

Main Features Dutch pension system • Private 3 rd Pillar • Capital-funded • Voluntary • Insurers only • Individual • Private 2 nd Pillar • Capital-funded • Employment-related • Premium paid by employer/ee • “Voluntary” • Pension funds ánd insurers • Collective • State 11 1 st Pillar • PAYG • Premiums via income taxes • All citizens • Mandatory

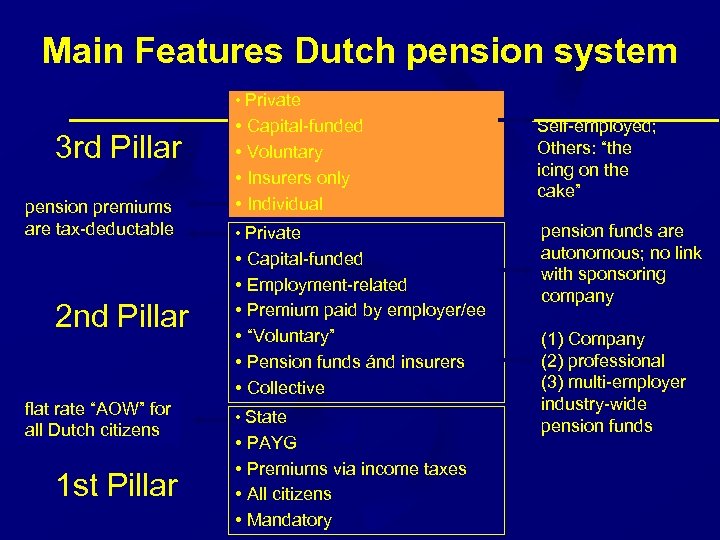

Main Features Dutch pension system • Private 3 rd Pillar pension premiums are tax-deductable 2 nd Pillar flat rate “AOW” for all Dutch citizens 1 st Pillar • Capital-funded • Voluntary • Insurers only • Individual Self-employed; Others: “the icing on the cake” • Private pension funds are autonomous; no link with sponsoring company • Capital-funded • Employment-related • Premium paid by employer/ee • “Voluntary” • Pension funds ánd insurers • Collective • State • PAYG • Premiums via income taxes • All citizens • Mandatory (1) Company (2) professional (3) multi-employer industry-wide pension funds

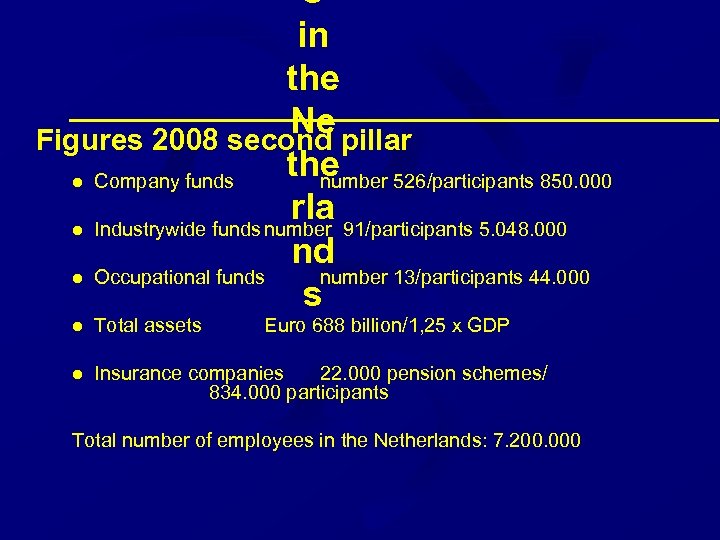

s in the Ne Figures 2008 second pillar the l Company funds number 526/participants 850. 000 rla l Industrywide funds number 91/participants 5. 048. 000 nd l Occupational funds number 13/participants 44. 000 s l Total assets Euro 688 billion/1, 25 x GDP l Insurance companies 22. 000 pension schemes/ 834. 000 participants Total number of employees in the Netherlands: 7. 200. 000

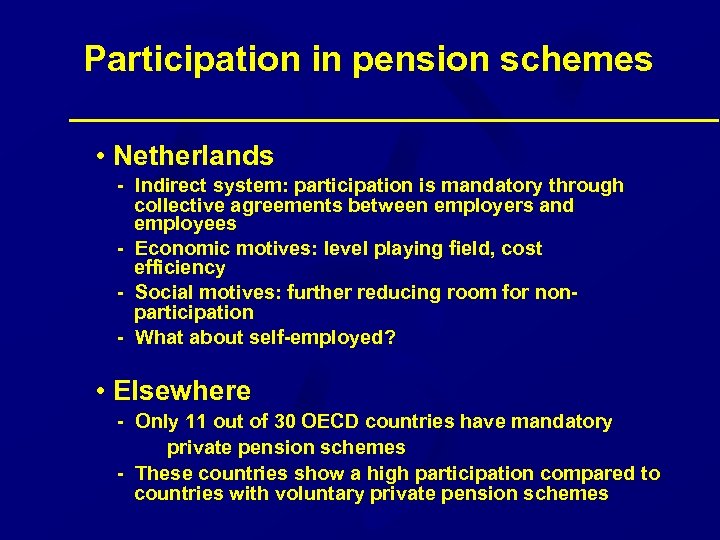

Participation in pension schemes • Netherlands - Indirect system: participation is mandatory through collective agreements between employers and employees - Economic motives: level playing field, cost efficiency - Social motives: further reducing room for non participation - What about self-employed? • Elsewhere - Only 11 out of 30 OECD countries have mandatory private pension schemes - These countries show a high participation compared to countries with voluntary private pension schemes

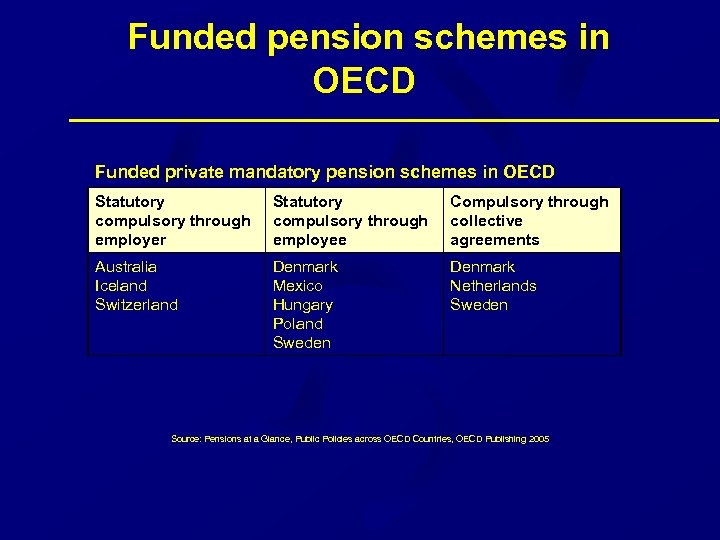

Funded pension schemes in OECD Funded private mandatory pension schemes in OECD Statutory compulsory through employer Statutory compulsory through employee Compulsory through collective agreements Australia Iceland Switzerland Denmark Mexico Hungary Poland Sweden Denmark Netherlands Sweden Source: Pensions at a Glance, Public Policies across OECD Countries, OECD Publishing 2005

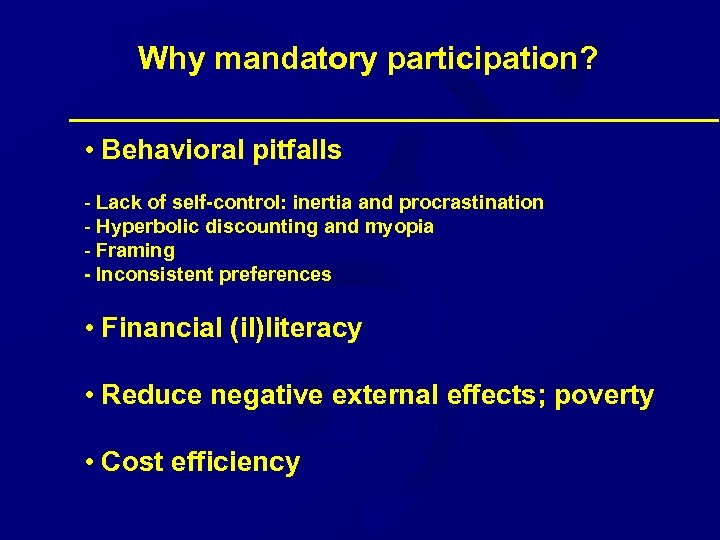

Why mandatory participation? • Behavioral pitfalls - Lack of self-control: inertia and procrastination - Hyperbolic discounting and myopia - Framing - Inconsistent preferences • Financial (il)literacy • Reduce negative external effects; poverty • Cost efficiency

Conclusions • International comparison indicates that compulsion is attended by higher participation • Empirical evidence shows that Dutch pension savers too are prone to behavioral pitfalls • On balance the public seems to be aware of this, given the dominant preference for a mandatory system with high certainty and limited autonomy

Conclusions • Is our current pension system optimal? - Overall, our pension system performs well vis-à-vis that in other industrial countries, but…. - Issue requires a broader analysis from different angles - Broad spectrum from fully mandatory system to full autonomy; introducing more autonomy while at the same time preventing people from making major mistakes could be the way forward - How to improve pensions for the self-employed?

Contents The Netherlands: 1. Pension system 2. Pension supervision Apeldoorn

Regulation • Regulation - 1 st pillar: Old Age Act (“AOW”) - 2 nd Pillar: Pensions Act (“PW”) • Regulator - Ministry of Social Affairs: pensions - Ministry of Finance: all other financial markets segments • Supervisor - DNB: De Nederlandsche Bank - AFM: Autoriteit Financiële Markten

Supervision • In 2004 the Twin Peaks model was introduced - prudential supervision of financial institutions by DNB - supervisor for market conduct (“AFM”) • Cooperation between two ‘Peaks’ is essential - potential for overlap/white spots - covenant between DNB and AFM • Experiences - more effective supervision - better grip on financial stability risks - substantial cost savings 21

Supervisory approach • Supervisory principles: – – Principle-based / Prudent person in investments Risk-oriented Integrity Transparent / ICT facilitated • Executive powers: – – – Quarterly and annual statements Contractual agreements Investment plan / strategy Actuarial and business memorandum Fit and proper test board & management On-site inspections • Sanctions and redress: – – Imposing a binding direction Fines and penalties Appointing interim managers / administrator Replacing the Board In practice: • Open discussions • Principle-based • Discretionary powers • Sanctioning only if dialogue fails • Focus on prudential supervision (funding and solvency)

Review seminar 2009 Summary 1. Pensions in the Netherlands 2. FIRM and FAF 3. 4. 5. Dealing with the crisis in Holland Dealing with the crisis in Europe Financial crisis and the impact on pensions in Europe

Pension right € 1000, - when retired Pension fund

Risk based supervision • Quantitative: Pension fund as a ´money factory´ • Qualitative: Pension fund as a company EUR 200 billion!

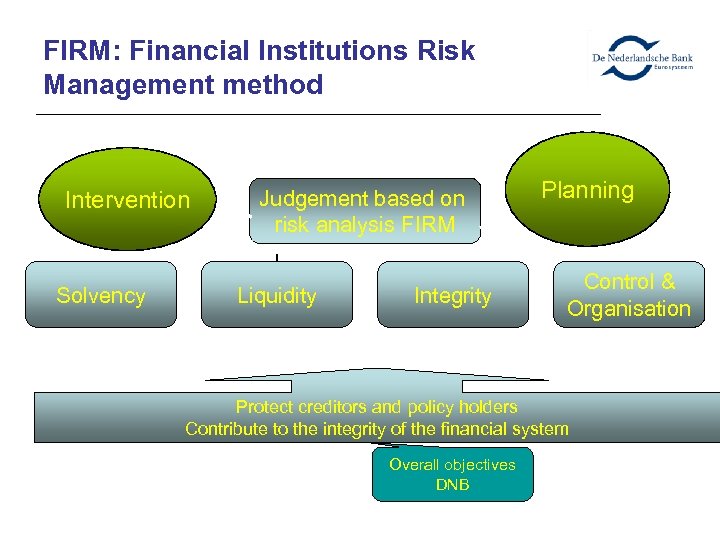

FIRM: Financial Institutions Risk Management method Intervention Solvency Judgement based on risk analysis FIRM Liquidity Integrity Planning Control & Organisation Protect creditors and policy holders Contribute to the integrity of the financial system Overall objectives DNB

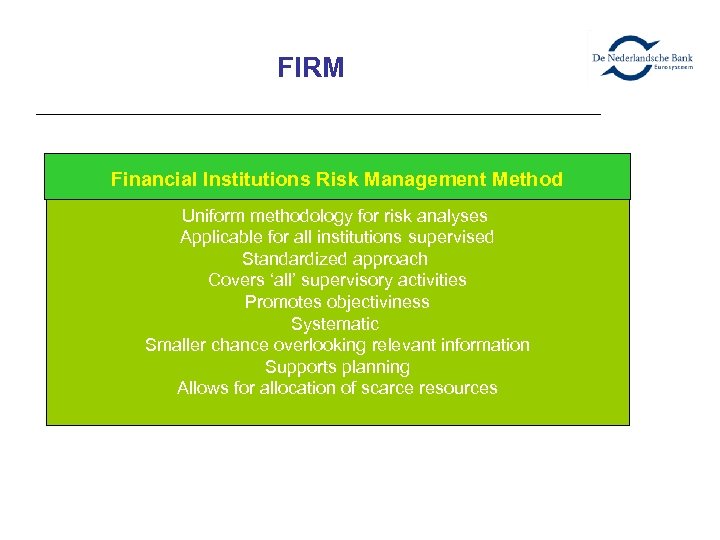

FIRM Financial Institutions Risk Management Method Uniform methodology for risk analyses Applicable for all institutions supervised Standardized approach Covers ‘all’ supervisory activities Promotes objectiviness Systematic Smaller chance overlooking relevant information Supports planning Allows for allocation of scarce resources

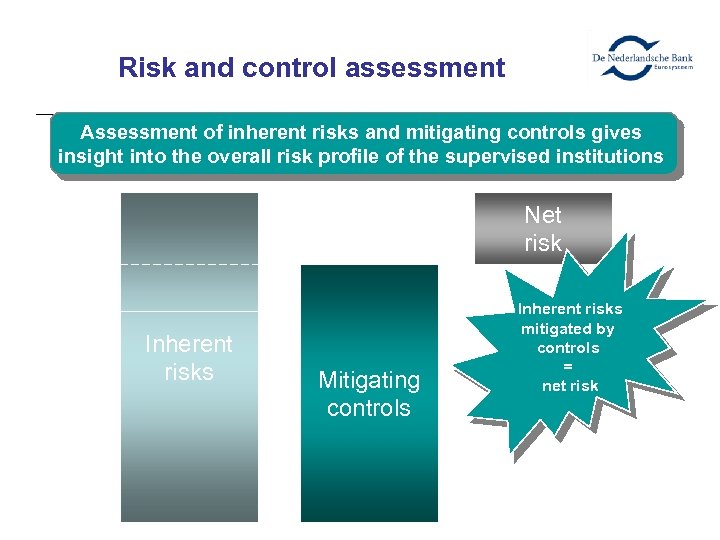

Risk and control assessment Assessment of inherent risks and mitigating controls gives insight into the overall risk profile of the supervised institutions Net risk Inherent risks Mitigating controls Inherent risks mitigated by controls = net risk

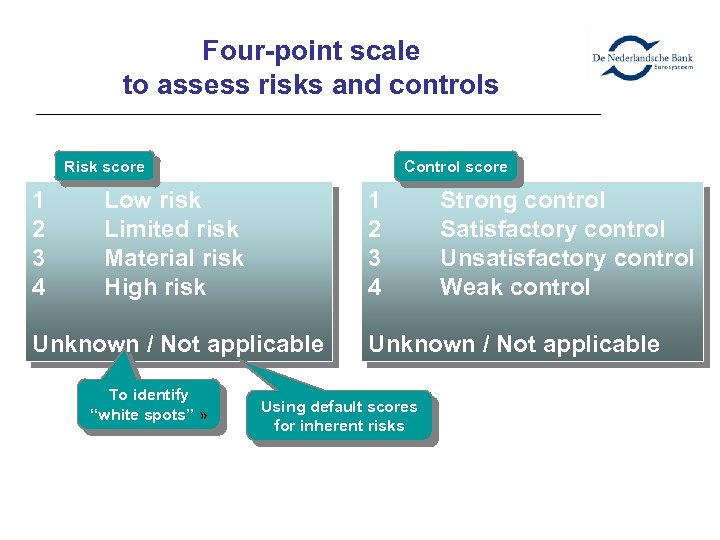

Four-point scale to assess risks and controls Risk score 1 2 3 4 Control score Low risk Limited risk Material risk High risk 1 2 3 4 Unknown / Not applicable To identify “white spots” » Strong control Satisfactory control Unsatisfactory control Weak control Unknown / Not applicable Using default scores for inherent risks

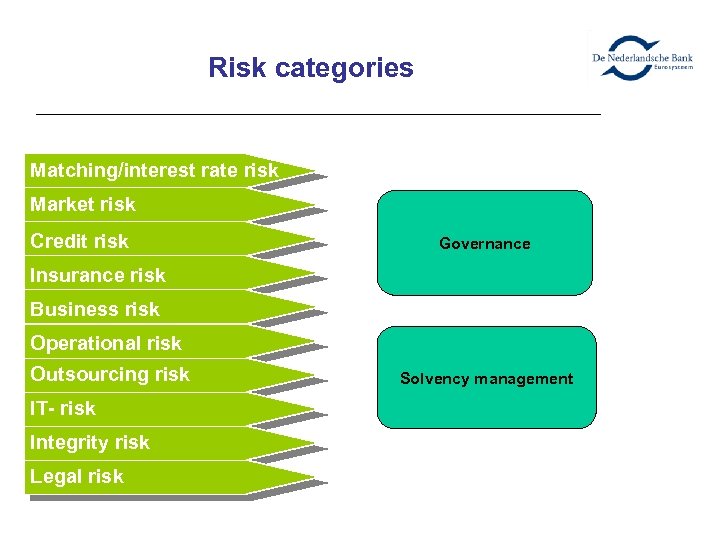

Risk categories Matching/interest rate risk Market risk Credit risk Governance Insurance risk Business risk Operational risk Outsourcing risk IT- risk Integrity risk Legal risk Solvency management

Risk based supervision Outsourcing risk Legal risk Marketrisk Insurance risk Integrity risk

Risks, some examples • ´Qualitative´: • Bad management (governance) • Lehman as transition manager (legal) • Real estate fraud (integrity) • `Madoff´ (outsourcing) • IT systems failing (IT) • Investments in weapons or child labor (integrity) • Employee taking money from the fund (integrity)

Risks, some examples Quantitative: • Underfunding (solvency management) • Great losses due to risky investments or credit crunch (market or credit) • Raise in obligations due to declining interest rates (matching) • People live ´too long´ (insurance)

Quantitative risks: Financial Assessment Framework (FAF) • FAF is part of new Pension Law (2 nd Pillar) • FAF objectives: Insight in the financial position of a pension fund Market value valuation of investments and liabilities Risk based approach Risk sensitive capital requirements Structured early intervention Analysis of availability and power of policy instruments in the long run

Financial Assessment Framework • Market valuation • Full funding requirement • Cost-effective premium • Strict rules for premium rebates or contribution holidays • Risk based solvency requirements & recovery plans • Prudent person approach • No investment restrictions • Except for investments in the sponsoring company

Financial Assessment Framework Three questions Does the pension fund have sufficient: • 1. Assets to cover the liabilities? • • • 2. Surplus to cover risks? • • Actual value (market-consistent) Market rates, no fixed discount rate Risk horizon of 1 year confidence level 97, 5%, ‘once in 40 years’ Test available solvency to required level in solvency test 3. Flexible policy instruments to deal with long term risks? • • Continuitiy analysis Investment, premium and indexation policy

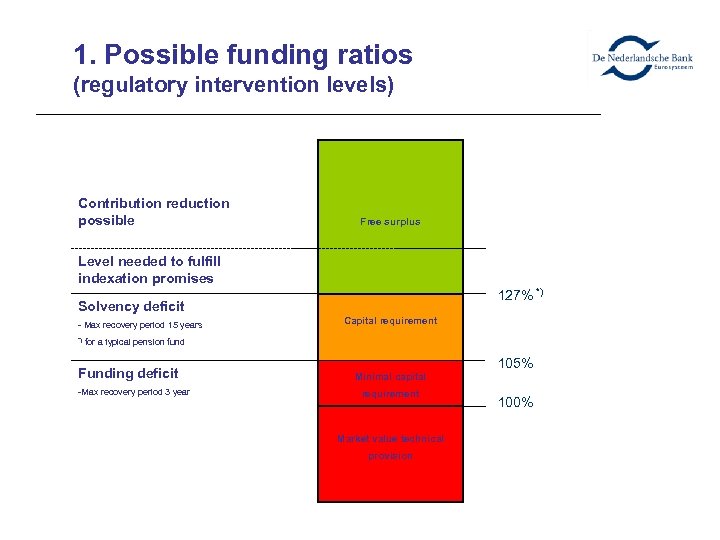

1. Possible funding ratios (regulatory intervention levels) Contribution reduction possible Free surplus Level needed to fulfill indexation promises 127% *) Solvency deficit - Max recovery period 15 years Capital requirement *) for a typical pension fund Funding deficit -Max recovery period 3 year 105% Minimal capital requirement Market value technical provision 100%

Continuity Analysis Goals from perspective of regulator/supervisor: • Investigate the balance between premium-, indexation- and investment policy • Incorporate a long-term perspective • Identify possible problems at an early stage • Bring forward the moment of intervention • Stimulating risk-awareness • Tribute to more transparency and communication

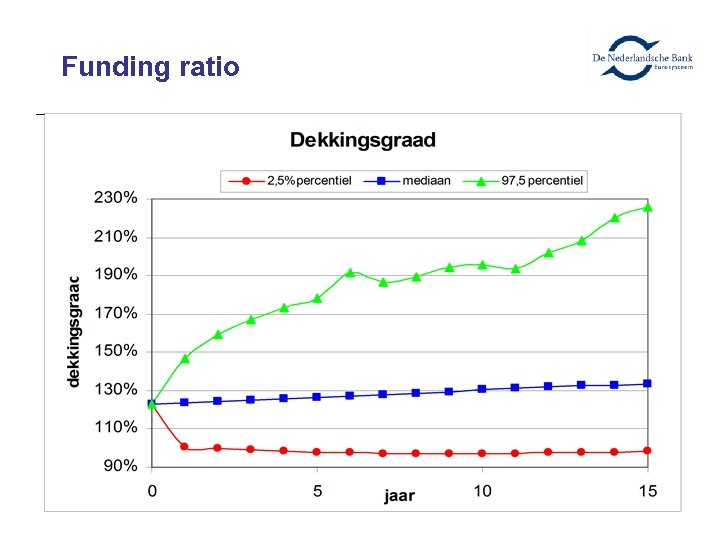

Funding ratio

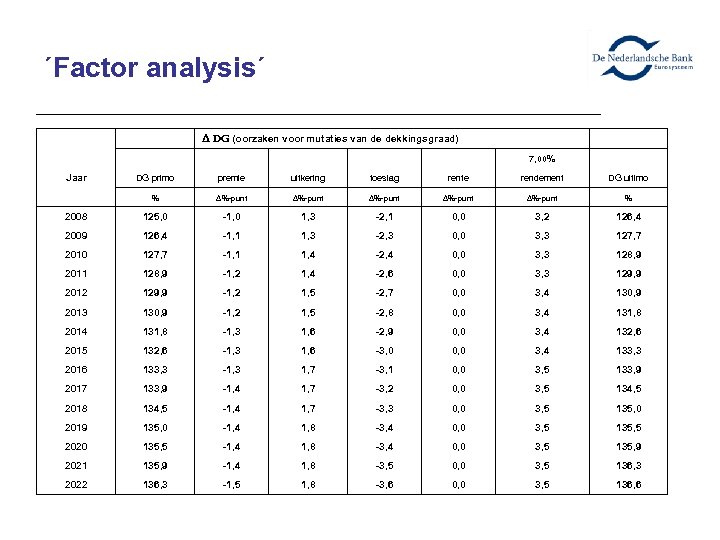

´Factor analysis´ Jaar Δ DG (oorzaken voor mutaties van de dekkingsgraad) 7, 00% DG primo premie uitkering toeslag rente rendement DG ultimo % Δ%-punt Δ%-punt % 2008 125, 0 -1, 0 1, 3 -2, 1 0, 0 3, 2 126, 4 2009 126, 4 -1, 1 1, 3 -2, 3 0, 0 3, 3 127, 7 2010 127, 7 -1, 1 1, 4 -2, 4 0, 0 3, 3 128, 9 2011 128, 9 -1, 2 1, 4 -2, 6 0, 0 3, 3 129, 9 2012 129, 9 -1, 2 1, 5 -2, 7 0, 0 3, 4 130, 9 2013 130, 9 -1, 2 1, 5 -2, 8 0, 0 3, 4 131, 8 2014 131, 8 -1, 3 1, 6 -2, 9 0, 0 3, 4 132, 6 2015 132, 6 -1, 3 1, 6 -3, 0 0, 0 3, 4 133, 3 2016 133, 3 -1, 3 1, 7 -3, 1 0, 0 3, 5 133, 9 2017 133, 9 -1, 4 1, 7 -3, 2 0, 0 3, 5 134, 5 2018 134, 5 -1, 4 1, 7 -3, 3 0, 0 3, 5 135, 0 2019 135, 0 -1, 4 1, 8 -3, 4 0, 0 3, 5 135, 5 2020 135, 5 -1, 4 1, 8 -3, 4 0, 0 3, 5 135, 9 2021 135, 9 -1, 4 1, 8 -3, 5 0, 0 3, 5 136, 3 2022 136, 3 -1, 5 1, 8 -3, 6 0, 0 3, 5 136, 6

Summary • Many risks regarding pension rights, both qualitative and quantitative • Supervision is risk based • FIRM tool for assessment risks and controls • Financial Assessment Framework for assessment and control of quantitative risks

Review seminar 2009 Summary 1. Pensions in the Netherlands 2. FIRM and FAF 3. Dealing with the crisis in Holland 4. Dealing with the crisis in Europe 5. Financial crisis and the impact on pensions in Europe

Agenda • Full funding requirement • Key developments in 2008 • Security mechanisms in the Dutch system • Long term solutions

Why full funding is important • Underfunding has a price • • High and volatile recovery costs: prevention cheaper than cure Uncertainty reduces consumption and increases savings • Funding contributes to confidence in pensions • • Employees will be more confident that their pension will be there when they retire Encourages labour mobility: facilitates transfer of accrued rights • Funding is a hedge for an ageing society • • The ratio of retirees to workers is to double the next 30 years Less opportunity to ‘pass on the bill’

How is funding measured? • Funding ratio = market value assets / market value liabilities • Assets = all assets at free disposal of the pension scheme • Liabilities = all non-discretionairy liabilities (accrued benefit obligations) discounted at the current term structure of interest rates

Possible deficits • Solvency deficit • • • Funding ratio is above 105% but Below the required level (127% for the average pension scheme) Long-term recovery plan (max 15 years) • Funding deficit • • Funding ratio is below 105% Short-term recovery plan (max 3 years)

Key developments in 2008 • The MSCI World total return index decreased by 37% • Solvency test is based upon a 25% decrease • Overall, the interest rate term structure dropped by 140 basis points • • Solvency test is based upon a 100 basis points decrease Intra year swings even bigger

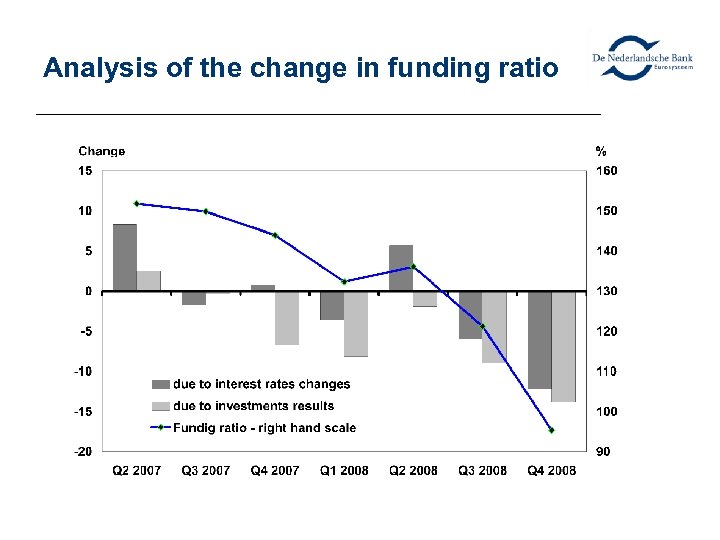

Analysis of the change in funding ratio

How to safeguard pension liabilities in a defined benefit environment • Security mechanisms in the Dutch system • • • Regulatory own funds Increases in the contractual contributions One-off sponsor commitments Adjustments in investment policy Reduction of future indexation • If all security mechanisms are exhausted • Accrued pension rights can be reduced • Note: there is no pension guarantee fund in the Netherlands • Like the PBGC in the US or the PPF in the UK

Supervisory dilemma • Prevent unnecessary reduction of accrued pension benefits and cause social disorder …versus… • Delay emergency measures for too long and let the situation develop from bad to worse

Problems associated with current system Problem #1 • Who provides the nominal pension guarantee, and is there a fair compensation for providing it? With the guarantors’ agreement? Problem #2 • Conditional indexation is an option to reduce the real value of the pension. What if there is no inflation? Problem #3 • If the funded ratio declines towards 105%, either contributions must be raised, or risk and hence higher return prospects must be removed from the balance sheet. Both are particularly unfair to young workers (especially in an aging society)

Long term solutions • Volatility in funding ratios seems to be underestimated • Existing policy instruments have relatively low risk absorption capacity • Is the Dutch pension system in need for higher regulatory own funds?

Reduction of balance sheet volatility can be accomplished by • Investing in matching assets • Consider a pension scheme as a risk management vehicle • Creating alternative liabilities • Consider a pension scheme as an life-cycle saving and investing vehicle • Combination of the above

Matching assets • Pension schemes can lay off risk in the international capital market by funding pensions with corresponding assets • A key purpose of funding is to diversify risks over international markets • Possible issue is the low liquidity in inflation let alone wage-indexed products

Conclusion • In both cases, at a macro level the pension sector can do with lower solvency requirements • In the first solution, matching assets allow for lower regulatory own funds • In second solution, the youth bear the residual risks of the guarantees given provided to the elderly

Review seminar 2009 Summary 1. Pensions in the Netherlands 2. FIRM and FAF 3. Dealing with the crisis in Holland 4. Dealing with the crisis in Europe 5. Financial crisis and the impact on pensions in Europe

Agenda • Effects of the crisis on different systems • Responses to the crisis • Possible effects of the crisis

Effects of the crisis Asset side of the balance sheet • Decreasing value of equities • Increasing value of fixed income products (caused by decreasing market interest rate) Liabilities side of the balance sheet • Increasing liabilities (caused by decreasing market interest rate)

Effects on different systems Pay-as-you-go system • Pensions in payment untouched • Indirect effect through lower purchasing power? Funded system • Lower capital • Lower interest rates when converting capital into annuity

Effects on funded systems Defined Benefit • No change to benefits • Pension in payment continue as planned (for now) • Recovery takes time and/or money (pro-cyclical) • Direct loss of purchasing power for pensioners when indexation is conditional

Effects on funded systems Defined Contribution • Direct effect on new pensioners (lower than expected pension annuities) • • No possibility for recovery No direct effect on active members

Reduction of effects through system choices Defined benefit • Adequate buffers (NL? ) • Quantitative restrictions • • Limitations to foreign investments • • Limitations to equity investments Limitations on securitised products (DE) Technical provisions • • Expected return on investment (UK-funds, IE) • • Fixed discount rate (ES, DE) Corporate bond yield curve (UK-employers) Positive effect of currency risk (UK)

Reduction of effects through system choices Defined contribution • Effects only for people reaching retirement age during crisis • Young DC-systems (RO, SK, etc) • Life-cycling

Dutch response to the crisis Defined benefit • In ‘normal’ market conditions the maximum recovery period is 3 years once the minimum funding level of 105% is breached • Given the exceptional circumstances, the minister of Social Affairs has decided to extend this period to 5 years • The recovery period for a solvency deficit remains at 15 years

Dutch response to the crisis Defined benefit (2) • Recovery plan must contain measures how to get back to the minimum funding level of 105% within 5 years • If all other measures fail, reduction of accrued benefits might be neccessary • Reduction of benefits no earlier than April 1 st, 2012 • Result of discussions over total crisis management package between government and social partners

Dutch response to the crisis Defined contribution • In ‘normal’ market conditions, a life-time annuity must be bought at retirement • Given the exceptional circumstances, the minister of Social Affairs has decided to allow a capital segmentation • This is a temporary measure, for those who retire before 2014

Dutch response to the crisis Defined contribution (2) • Capital segmentation: • Step 1: what would be the life-time annuity under current market conditions? • Step 2: accrual of that benefit for 5 years • Step 3: the rest of the pension capital remains invested and (hopefully) profits from market recovery • If ´satisfied´ with current market circumstances, the remaining pension capital can be used to buy a deferred life-time annuity (following on the temporary annuity).

Possible effects? Short-term effects • Reduction of benefits • Investing in liquid assets (with government guarantee) Long-term effects • Lower pensions promise, even with steady premiums • Shift from DB to DC? • Doubts on adequacy of DC-schemes • • Closure of voluntary schemes (IT) Return of mandatory schemes to the public system (SK)

Review seminar 2009 Summary 1. Pensions in the Netherlands 2. FIRM and FAF 3. Dealing with the crisis in Holland 4. Dealing with the crisis in Europe 5. Financial crisis and the impact on pensions in Europe

Agenda • • Pension savings in the European Union Consequences of the financial crisis Are private pension savings a thing of the past? The importance of pension plan design: lessons from the Dutch experience? • Concluding remarks: policy recommendations • Questions/discussion 70

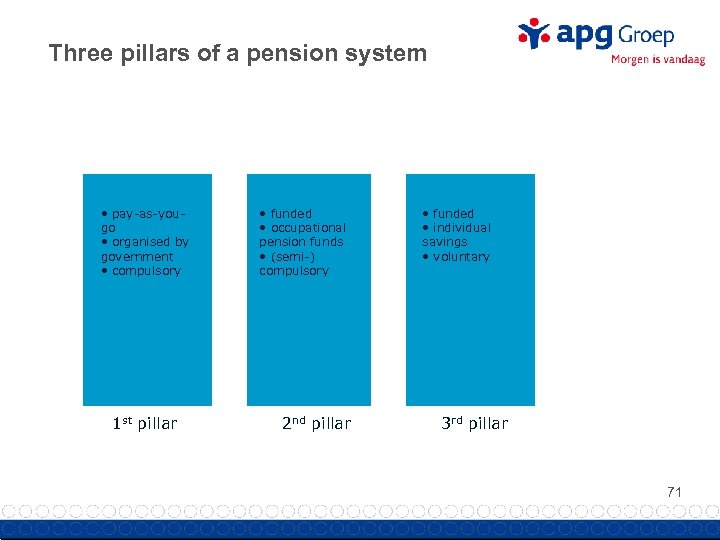

Three pillars of a pension system • pay-as-yougo • organised by government • compulsory 1 st pillar • funded • occupational pension funds • (semi-) compulsory 2 nd pillar • funded • individual savings • voluntary 3 rd pillar 71

First versus second/third pillar First pillar Second pillar • Financed by taxes/public • Financed by private funds savings • Demographics have strong • Demographics have little impact • Inflation has strong • Financial markets have little impact • Financial markets have strong impact • Fiscal policy has little impact 72

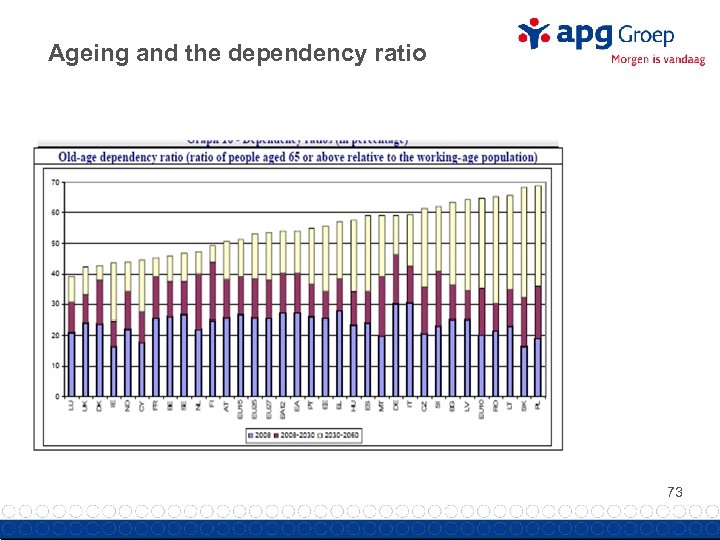

Ageing and the dependency ratio 73

Collective versus individual Collective scheme • Low cost • No conversion risk • Little choice • Professional management Individual scheme • High cost • Conversion risk • Adaptable to individual preferences • Behavorial finance arguments 74

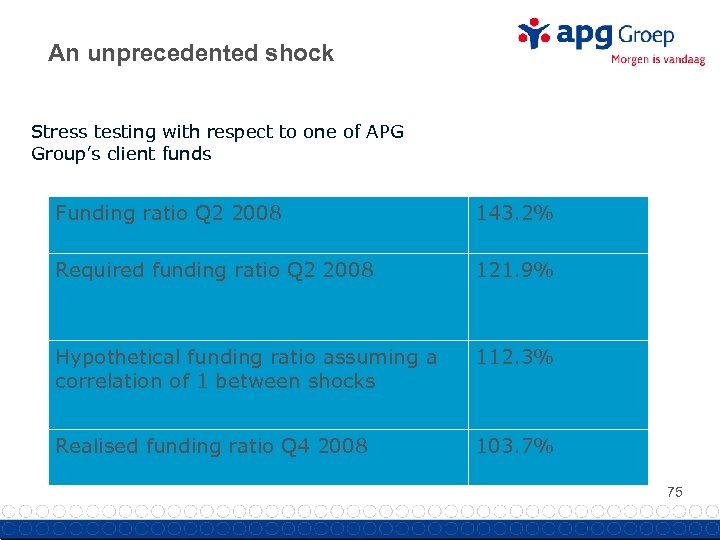

An unprecedented shock Stress testing with respect to one of APG Group’s client funds Funding ratio Q 2 2008 143. 2% Required funding ratio Q 2 2008 121. 9% Hypothetical funding ratio assuming a correlation of 1 between shocks 112. 3% Realised funding ratio Q 4 2008 103. 7% 75

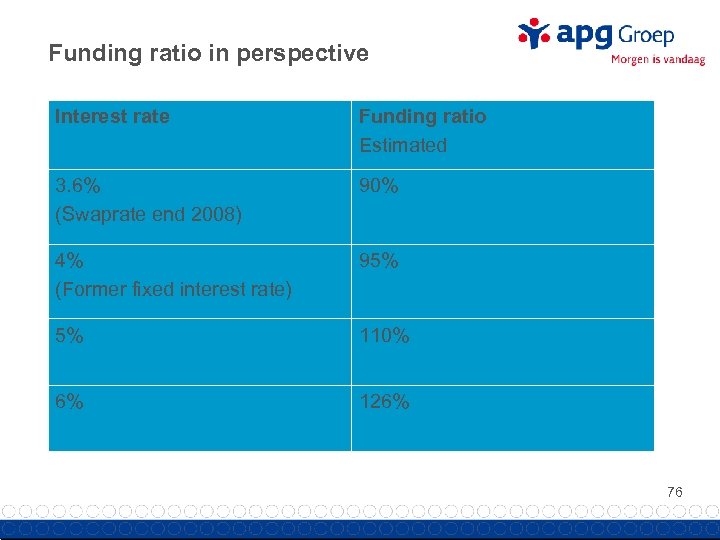

Funding ratio in perspective Interest rate Funding ratio Estimated 3. 6% (Swaprate end 2008) 90% 4% (Former fixed interest rate) 95% 5% 110% 6% 126% 76

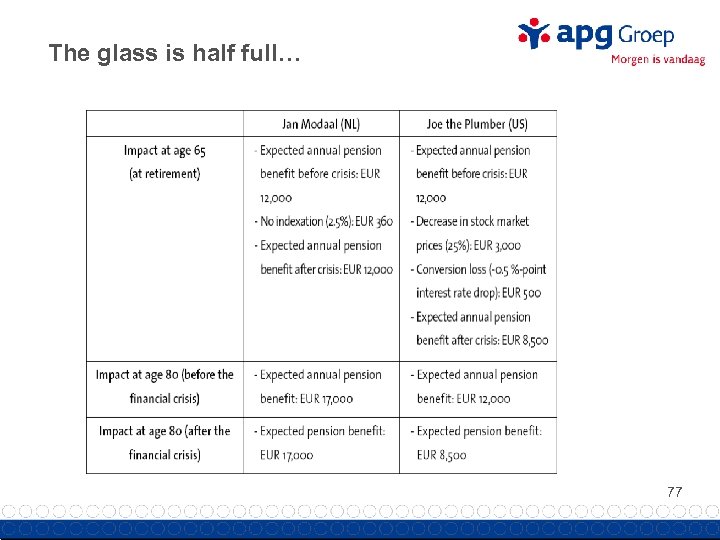

The glass is half full… 77

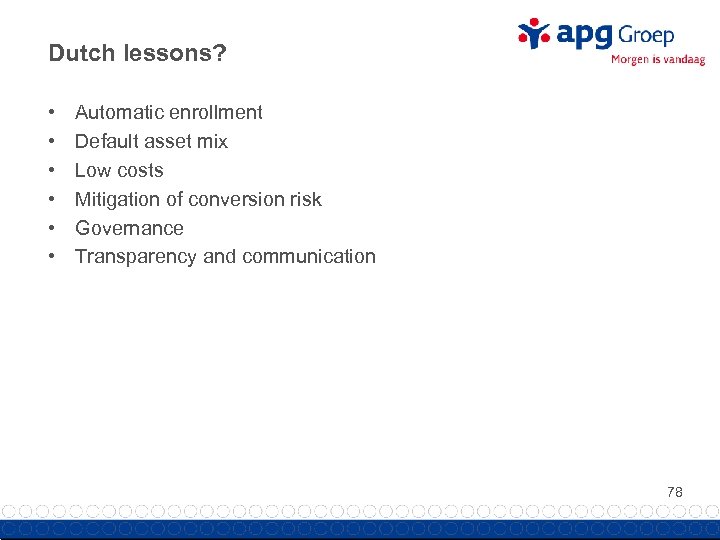

Dutch lessons? • • • Automatic enrollment Default asset mix Low costs Mitigation of conversion risk Governance Transparency and communication 78

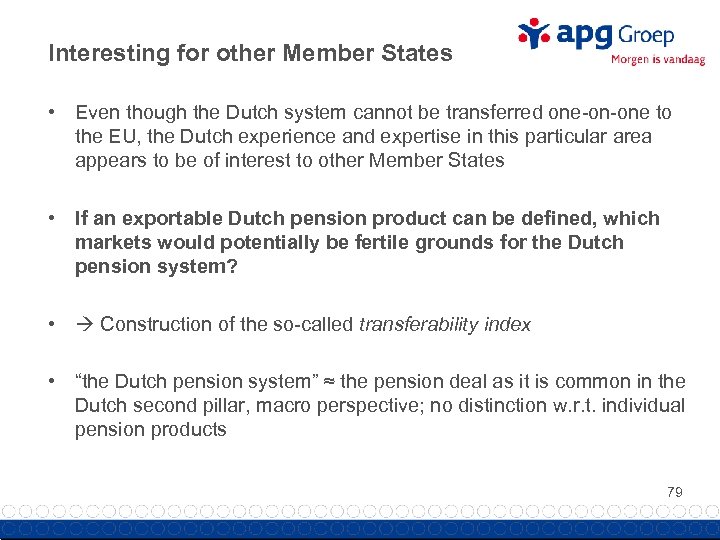

Interesting for other Member States • Even though the Dutch system cannot be transferred one-on-one to the EU, the Dutch experience and expertise in this particular area appears to be of interest to other Member States • If an exportable Dutch pension product can be defined, which markets would potentially be fertile grounds for the Dutch pension system? • Construction of the so-called transferability index • “the Dutch pension system” ≈ the pension deal as it is common in the Dutch second pillar, macro perspective; no distinction w. r. t. individual pension products 79

Two important factors • Need for reforms Member States that have to move from PAYG to funded schemes are potentially interesting export markets • Characteristics Those countries that bear most similarities with the foundations of the Dutch pension system should be the ones most susceptible for it 80

Analysis of the results • Belgium, Finland France, Germany, Ireland, Spain and the United Kingdom show highest transferability opportunities • For Estonia, Hungary, Poland Slovakia transferability is lowest • Transferability for several countries could change in upcoming years • When considering the exportability of Dutch pension asset management as such, all countries in quadrant I, II and IV should be considered • For Member States with the largest need for reform (quadrants I and IV), two options for future development exist 81

Concluding remarks Policy recommendations • Need for private pensions savings in the EU has increased: – Higher estimates costs of ageing – Worse budgetary positions • Appropriate policy incentives – Automatic enrollment • Importance of pension plan design – Avoid pitfalls of traditional DC – Lessons to be learned from the Dutch? 82

IOPS PRINCIPLES OF PRIVATE PENSION SUPERVISION Rick Hoogendoorn Seminar ‘Supervision on pension funds, experience from Romania and the Netherlands’ June 9 -11, 2010

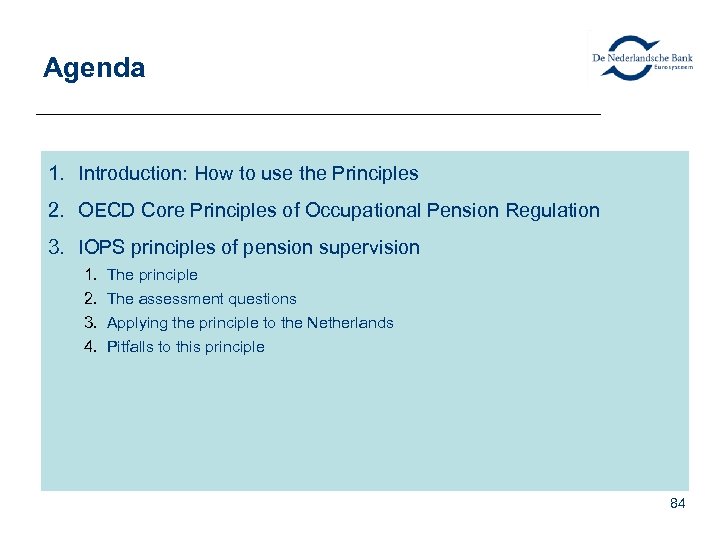

Agenda 1. Introduction: How to use the Principles 2. OECD Core Principles of Occupational Pension Regulation 3. IOPS principles of pension supervision 1. 2. 3. 4. The principle The assessment questions Applying the principle to the Netherlands Pitfalls to this principle 84

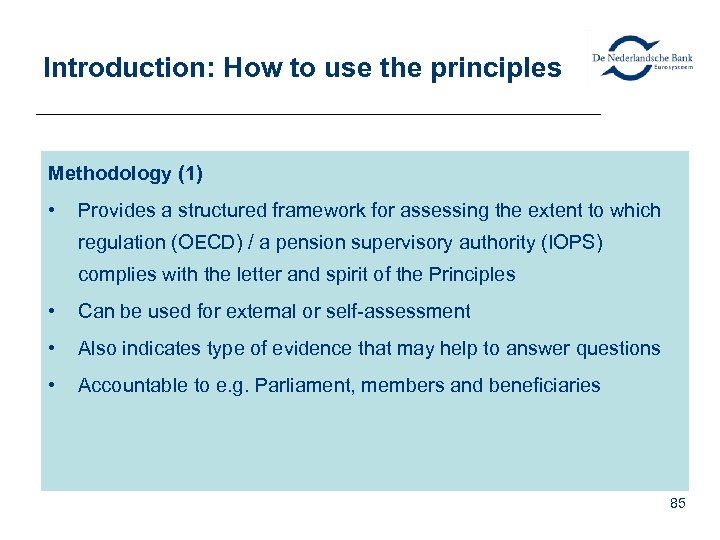

Introduction: How to use the principles Methodology (1) • Provides a structured framework for assessing the extent to which regulation (OECD) / a pension supervisory authority (IOPS) complies with the letter and spirit of the Principles • Can be used for external or self-assessment • Also indicates type of evidence that may help to answer questions • Accountable to e. g. Parliament, members and beneficiaries 85

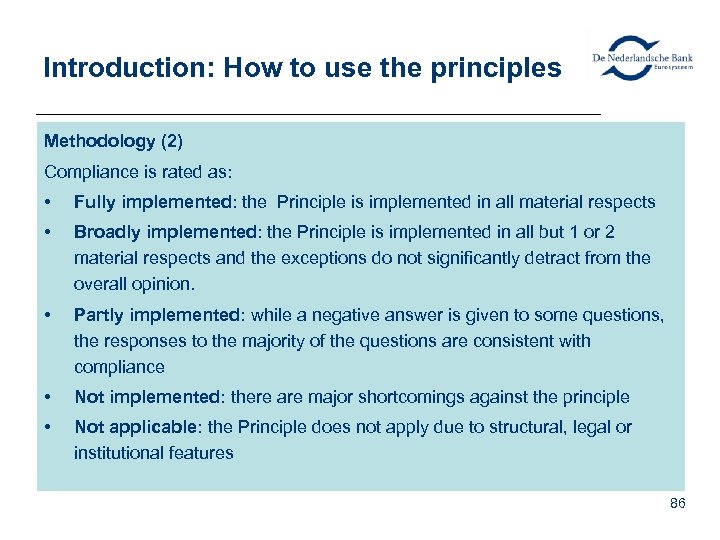

Introduction: How to use the principles Methodology (2) Compliance is rated as: • Fully implemented: the Principle is implemented in all material respects • Broadly implemented: the Principle is implemented in all but 1 or 2 material respects and the exceptions do not significantly detract from the overall opinion. • Partly implemented: while a negative answer is given to some questions, the responses to the majority of the questions are consistent with compliance • Not implemented: there are major shortcomings against the principle • Not applicable: the Principle does not apply due to structural, legal or institutional features 86

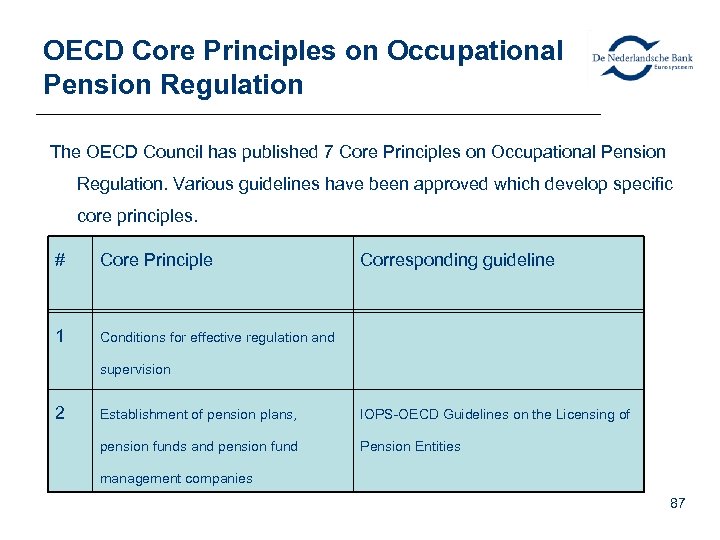

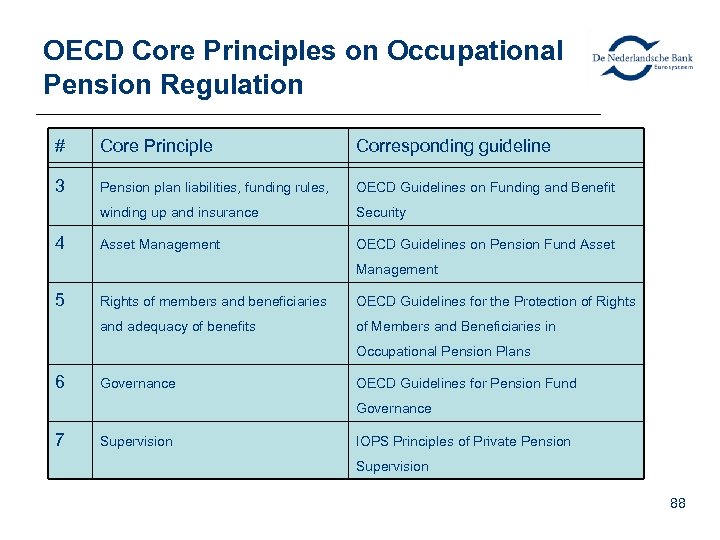

OECD Core Principles on Occupational Pension Regulation The OECD Council has published 7 Core Principles on Occupational Pension Regulation. Various guidelines have been approved which develop specific core principles. # Core Principle 1 Corresponding guideline Conditions for effective regulation and supervision 2 Establishment of pension plans, IOPS-OECD Guidelines on the Licensing of pension funds and pension fund Pension Entities management companies 87

OECD Core Principles on Occupational Pension Regulation # Core Principle Corresponding guideline 3 Pension plan liabilities, funding rules, OECD Guidelines on Funding and Benefit winding up and insurance Security Asset Management OECD Guidelines on Pension Fund Asset 4 Management 5 Rights of members and beneficiaries OECD Guidelines for the Protection of Rights and adequacy of benefits of Members and Beneficiaries in Occupational Pension Plans 6 Governance OECD Guidelines for Pension Fund Governance 7 Supervision IOPS Principles of Private Pension Supervision 88

IOPS Principles of Pension Supervision The International Organisation of Pension Supervisors (IOPS) was formed in 2004 as a world-wide forum for dialogue and the exchange of information as well as the standard setting organisation promoting good practices in pension fund supervision. IOPS currently has around 60 members and observers representing approximately 50 countries and territories worldwide 89

IOPS Principles of Pension Supervision The aims and purposes of IOPS are: • Serving as the standard-setting body on pension supervisory matters and regulating issues related to pension supervision • Promoting international co-operation on pension supervision • Providing a worldwide forum for policy dialogue and exchange of information on pension supervision • Participating in the work of relevant international bodies in the area of pensions More information about IOPS can be found on: www. iopsweb. org 90

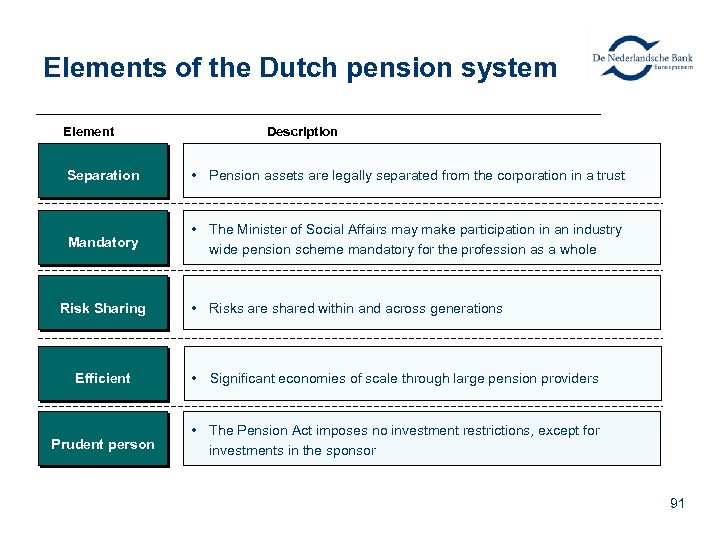

Elements of the Dutch pension system Element Description Separation • Pension assets are legally separated from the corporation in a trust Mandatory • The Minister of Social Affairs may make participation in an industry wide pension scheme mandatory for the profession as a whole Risk Sharing • Risks are shared within and across generations Efficient • Significant economies of scale through large pension providers Prudent person • The Pension Act imposes no investment restrictions, except for investments in the sponsor 91

IOPS Principles of Pension Supervision Principle 1 National laws should assign clear and explicit objectives to pension supervisory authorities • Strategic objectives should be clear and public • Responsibilities of the pensions supervisor should give a clear mandate and assign specific duties 92

Principle 1: Clear and Explicit Objectives Assessment questions • Is there legislation providing for a pension supervisor? • Does the legislation set out objectives? • Are the objectives public and binding? • Does the legislation explicitly set out responsibilities and duties of the pension supervisor? • Does the supervisor explicitly set out its responsibilities and duties? 93

Principle 1: Clear and Explicit Objectives Assessing the Dutch supervisory system Principle 1 is fully implemented in the Netherlands. The supervisory objectives are clear and the supervisor has set out how it deals with these objectives. Rules are in the Pension Act and DNB has published a strategic ‘Vision on supervision’ for 2010 2014. This document states the objectives, responsibilities and duties of DNB. 94

Principle 1: Clear and Explicit Objectives Pitfalls

IOPS Principles of Pension Supervision Principle 2 Pension supervisory authorities should have operational independence • Autonomy in day-to-day operations and decision making • Funding to ensure independence • Appointment procedures transparent • Judicial review of supervisory actions 96

Principle 2: Operational Independence Assessment questions • Is the supervisory authority established as a body with operational independence? • What type of restrictions exist on the ability of the government to make directions to the supervisory authority? • Is there transparency in the process for appointing senior positions ? • Is there transparency in the process for terminating senior positions? • Are senior officers replaced when there is a change of government? • If funded by levies on supervised entities is there freedom from interference by these entities? 97

Principle 2: Operational Independence Assessing the Dutch supervisory system Principle 2 is broadly implemented in the Netherlands. DNB operates under full operational independence. A flaw in this respect might be the fact that DNB can be held liable in civil court actions. 98

Principle 2: Operational Independence Pitfalls 99

IOPS Principles of Pension Supervision Principle 3 Pension supervisory authorities require adequate financial, human and other resources • Able to conduct functions efficiently and independently • Funding to ensure independence 100

Principle 3: Adequate Resources Assessment questions • Is the budgetary timeframe long enough (e. g. 3 years) to provide stability in planning and recruitment? • Is the budget sufficient to enable the supervisory agency to meet its responsibility? (very subjective) • Does the agency have freedom in hiring with regard to staff numbers and salary? • Are senior staff appropriately qualified? 101

Principle 3: Adequate Resources Assessing the Dutch supervisory system Principle 3 is fully implemented in the Netherlands. DNB is able to (and has achieved to) hire adequate, experienced and expert staff. DNB is granted access to sufficient resources to enable it to properly perform its duties. Even so, the credit crisis proved that external shocks can seriously put pressure on the organization and its capacity. 102

Principle 3: Adequate Resources Pitfalls 103

IOPS Principles of Pension Supervision Principle 4 Pension supervisory authorities should be endowed with the necessary investigative and enforcement powers to fulfill their functions and achieve their objectives • Powers appropriate to the system being supervised • Powers appropriate to the manner of supervision e. g. appropriate investigatory and enforcement powers 104

Principle 4: Adequate Powers Assessment questions • Are the supervisor’s powers clearly established by its governing legislation? • Can the supervisor gain access to the information it needs? • Is there a licensing or registration process that enables the supervisory agency to obtain relevant information and to reject/amend/revoke the license/registration in the case of serious non-compliance ? • Can the supervisor enforce legislation relating to funding/capital adequacy, fitness and propriety? • Have there been difficulties in using available powers? 105

Principle 4: Adequate Powers Assessing the Dutch supervisory system Principle 4 is broadly implemented in the Netherlands. DNB has adequate powers to deal with pension funds breaching their legal obligations. DNB can also obtain any information it deems necessary, from any party at no cost. The only flaw with respect to this Principle is the limited direct access of DNB regarding third parties performing outsourced pension fund functions. 106

Principle 4: Adequate Powers Pitfalls 107

IOPS Principles of Pension Supervision Principle 5 Pension supervision should seek to mitigate the greatest potential risks to the pension system • Objectives of supervision should be risk-based • Allocate supervisory resources to highest risk areas • Pro-active approach to avoid problems before they occur 108

Principle 5: Risk Orientation Assessment questions • Are the supervisory authority’s objectives risk based rather than focusing on compliance? • Are resources of the authority allocated to the highest risk areas? • Do the supervisors consider both the probability and likely impact of potential risks? • Does the supervisor assess risks for each entity under supervision (for example by a risk scoring model) 109

Principle 5: Risk Orientation Assessing the Dutch supervisory system Principle 5 is fully implemented in the Netherlands. DNB uses a risk assessment approach for its supervision of pension funds. Both the risks and the risk control mechanisms are scored in the risk scoring model FIRM. Priorities in supervision d allocation of resources are based on aggregate and individual scoring in the FIRM system. 110

Principle 5: Risk Orientation Pitfalls 111

IOPS Principles of Pension Supervision Principle 6 Pension supervisory authorities should ensure that investigatory and enforcement requirements are proportional to the risks being mitigated and that their actions are consistent • Important to have the appropriate range of legal powers and tools • Similar cases dealt in similar manner 112

Principle 6: Proportionality and Consistency Assessment questions • Can the supervisory authority vary its activities according to the risks being addressed? • Does the supervisory have procedures for helping the choice of a proportionate response, such as an enforcement pyramid? • Does the supervisory allow entities appropriate flexibilty in deciding how to comply with legislation? • Are there processes in place to ensure consistency between actions where circumstances are similar? 113

Principle 6: Proportionality and Consistency Assessing the Dutch supervisory system Principle 6 is fully implemented in the Netherlands. DNB has attention for the proportionality and consistency of its actions towards pension funds. Proportionality is ensured through the use of the FIRM system and consistency through welldeveloped documentation systems. 114

Principle 6: Proportionality and Consistency Pitfalls 115

IOPS Principles of Pension Supervision Principle 7 Pension supervisory authorities should consult with the bodies they are overseeing and cooperate with other supervisory authorities • Industry consultation assists to get ‘buy-in’ • Information exchange with co-regulators at home and under crossborder arrangements promotes efficiency and supports preventive measures 116

Principle 7: Consultation and Cooperation Assessment questions • Does the supervisory authority consult with the pensions industry when determining strategic supervisory approaches? • Is the supervisory authority empowered to exchange information with equivalent oversees authority, subject to appropriate requirements? 117

Principle 7: Consultation and Cooperation Assessing the Dutch supervisory system Principle 7 is fully implemented in the Netherlands. DNB is open towards pension funds, pension fund associations, social partners and other supervisory authorities, within the limitations of its confidentiality requirements. This includes consultations with the pension sector when DNB is considering new regulation and regular meetings with these parties to discuss developments in the pension sector. 118

IOPS Principles of Pension Supervision Principle 8 Pension supervisory authorities should treat confidential information appropriately • Only release if permitted by law • If in doubt, check first • Principle extends ‘down the line’ 119

Principle 8: Confidentiality Assessment questions • Does the supervisory authority have a confidentiality policy which sets out the authority’s procedures to prevent inappropriately disclosure of non public information? • Are there mechanisms to prevent disclosure of confidential information by staff, including after they have left the supervisory authority? 120

Principle 8: Confidentiality Assessing the Dutch supervisory system Principle 8 is fully implemented in the Netherlands. The Pension Act sets high confidentiality standards, complemented with processes and rules to ensure that information on individual funds is not shared if the confidentiality of that information is not protected with the envisaged recipient. 121

Principle 8: Confidentiality Pitfalls 122

IOPS Principles of Pension Supervision Principle 9 Pension supervisory authorities should conduct their operations in a transparent manner • Adopts clear, transparent and consistent processes • Regularly reports on policy and performance • Subject to external review • Publishes industry information 123

Principle 9: Transparency Assessment questions • Does the supervisory authority publish its rules and procedures? • Is the supervisory authority subject to appropriate audit and reporting requirements (that do not compromise its independence)? • Does the supervisory authority publish an Annual Report explaining how it has (or has not) met its objectives? • Does the supervisory authority explain to individual supervised entities why it has taken particular actions? 124

Principle 9: Transparency Assessing the Dutch supervisory system Principle 9 is fully implemented in the Netherlands. DNB is transparent with regard to its supervisory processes. An example of this transparency is Open Book Supervision (on DNB’s website www. dnb. nl ), an information system that discloses regulations, policy rules, supervisory processes and Q&A’s. 125

IOPS Principles of Pension Supervision Principle 10 The supervisory authority should adhere to its own governance code and should be accountable • Controls, checks and balances • Code of conduct • Decisions are reviewable • Accountable to e. g. Parliament, members and beneficiaries 126

Principle 10: Governance Assessment questions • Does the supervisory authority have appropriate codified procedures for internal governance, and is compliance with these monitored and enforced? • Is there a code of conduct for all staff regarding gifts, hospitality etc and declaring conflicts of interest? • Is there independent review within the agency of decisions which have significant implications for the supervised entity? • Is there an appeals process against decisions? • Does the supervisory agency measure its performance against objectives and provide external stakeholders with the results? 127

Principle 10: Governance Assessing the Dutch supervisory system Principle 10 is fully implemented in the Netherlands. DNB has established clear governance codes and due processes to be held accountable for its conduct and activity. 128

Principle 10: Governance Pitfalls 129

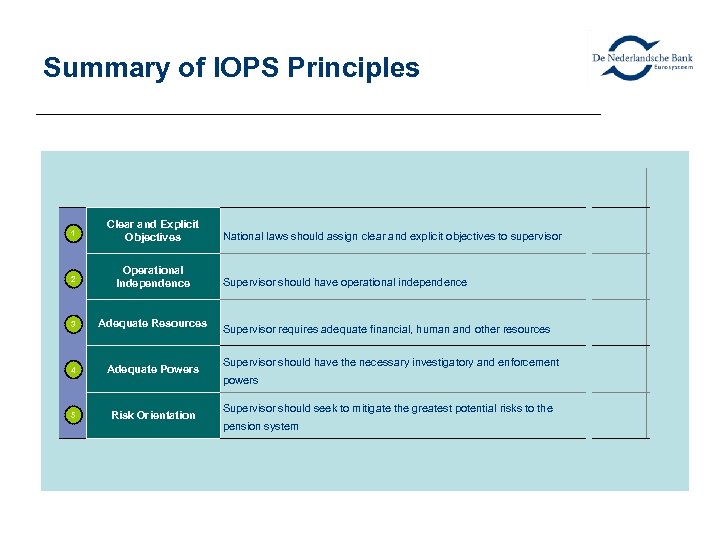

Summary of IOPS Principles 1 Clear and Explicit Objectives 2 Operational Independence 3 Adequate Resources 4 Adequate Powers 5 Risk Orientation National laws should assign clear and explicit objectives to supervisor Supervisor should have operational independence Supervisor requires adequate financial, human and other resources Supervisor should have the necessary investigatory and enforcement powers Supervisor should seek to mitigate the greatest potential risks to the pension system

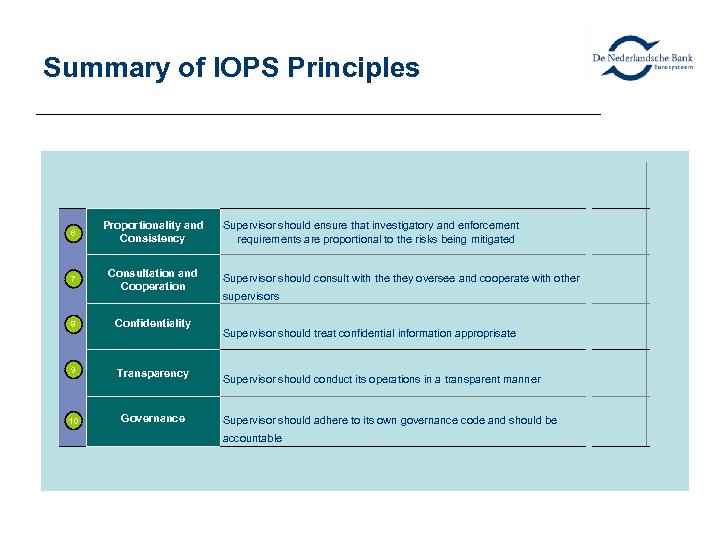

Summary of IOPS Principles 6 Proportionality and Consistency 7 Consultation and Cooperation 8 Confidentiality 9 Transparency 10 Governance Supervisor should ensure that investigatory and enforcement requirements are proportional to the risks being mitigated Supervisor should consult with they oversee and cooperate with other supervisors Supervisor should treat confidential information approprisate Supervisor should conduct its operations in a transparent manner Supervisor should adhere to its own governance code and should be accountable

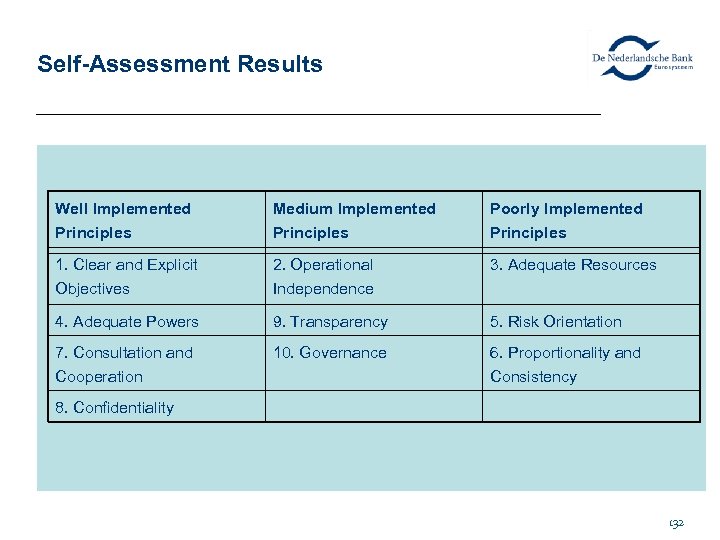

Self-Assessment Results Well Implemented Principles Medium Implemented Principles Poorly Implemented Principles 1. Clear and Explicit Objectives 2. Operational Independence 3. Adequate Resources 4. Adequate Powers 9. Transparency 5. Risk Orientation 7. Consultation and Cooperation 10. Governance 6. Proportionality and Consistency 8. Confidentiality 132

END 133

PENSION FUND GOVERNANCE: OECD GUIDELINES David Schelhaas + Rick Hoogendoorn Seminar ‘Supervision on pension funds, experience from Romania and the Netherlands’ June 9 -11, 2010

Agenda 1. OECD Core Principles of Occupational Pension Regulation 2. OECD Guidelines on Pension Fund Governance 3. Governance in Practice 135

OECD Guidelines for Pension Fund Governance structure 4 8 guidelines about the structure of pension fund governance Governance mechanisms 4 3 guidelines about mechanisms that should enable boards to govern pension funds 136

OECD Guidelines for Pension Fund Governance structure 1 • Identification of responsibilities: there should be clear identification and separation of operational and oversight responsibilities 2 • Governing body: every pension fund should have a governing body vested with the power to administer the pension fund. 3 • Accountability: the governing body should be accountable to the pension plan members and beneficiaries, its supervisory board and the competent authorities. 4 • Suitability: membership in the governing board should be subject to minimum suitability standards in order to ensure a high level of integrity, competence, experience and professionalism in the governance of the pension fund 137

OECD Guidelines for Pension Fund Governance structure 5 • Delegation and expert advice: the governing body may rely on the support of subcommittees and may delegate functions to internal staff or external providers 6 • Auditor: an independent auditor should be appointed by the appropriate body to carry out a periodic audit consistent with the needs of the arrangement. 7 • Actuary: an actuary should be appointed by the appropriate body for all defined benefit plans financed via pension funds. 8 • Custodian: custody of the pension fund assets may be carried out by the pension entity, the financial institution that manages the pension fund or by the independent custodian. 138

OECD Guidelines for Pension Fund Governance mechanisms 9 • Risk-based internal controls: there should appropriate controls in place to ensure that all persons and entities with responsibilities act in accordance with objectives. 10 • Reporting: reporting channels between all persons and entities involved in the governance should established. 11 • Disclosure: the governing body should disclose relevant information to all parties involved. 139

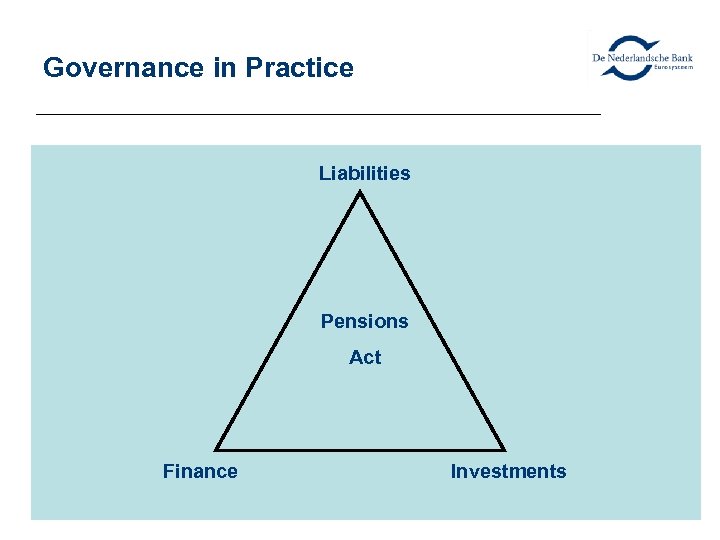

Governance in Practice Liabilities Pensions Act Finance Investments

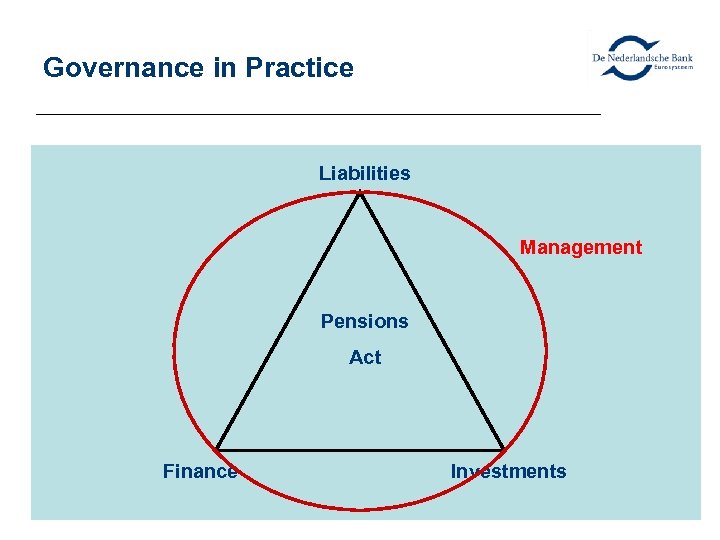

Governance in Practice Liabilities Management Pensions Act Finance Investments

Supervisory strategy 2010 - 2014 • Supra institutional benchmarking thematic investigations • Conduct and culture

Supervisory themes 2010 • Pension Fund Governance • Follow up investment investigations • Financial structure • Outsourcing • Quality of provided data • Evaluation of recovery plans

Pension Fund Governance • Decision making process • Transparency • Consistency • Balanced representation of interests

Pension fund governance Decision making processes • Selection process of advisors • Financial agreement • Self assessment process of the board • Internal supervision

END 146

Risk management for investments Paulus Dijkstra Reinsurance and Asset & Liability Management department June 10 2010

Agenda • Supervision and risk management • Levels of risk management • A simple case • Sources of complexity • Example

Supervision and risk management • Risk management central part of governance • Prime focus of supervision: Assessing quality and independence of risk management function • Risk management not only technical: – Tone at the top – countervailing power on all levels

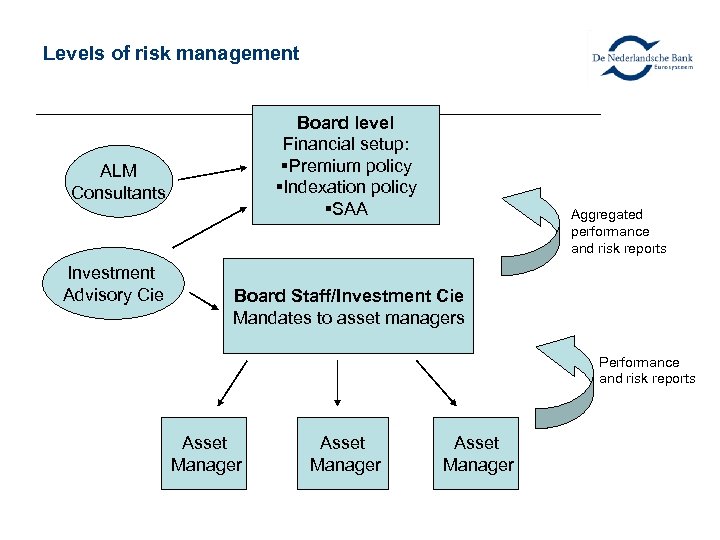

Levels of risk management Board level Financial setup: Premium policy Indexation policy SAA ALM Consultants Investment Advisory Cie Aggregated performance and risk reports Board Staff/Investment Cie Mandates to asset managers Performance and risk reports Asset Manager

Supervision and risk management • Our pension fund law is principle-based: • • Boards should behave as prudent person Business environment should be controlled and integer • In practice: Balance between complexity of investments and robustness of risk control No one size fits all!

A simple case • Investment mandate in liquid asset class with: • Clearly defined market index as benchmark: Communicates strategic risk-return preferences Broadly defines desired portfolio composition Yardstick for measuring market and active performance • Limited degrees of freedom for active positions • No ‘out of benchmark’ positions • No (non-linear) derivatives (including embedded options) • Limits on concentration risks • Effective limits on active risk exposures (e. g. duration bands, tracking error) • Risk management: ex post checking of compliance with guidelines and restrictions

Signs of complexity • • • Broadly defined investment universe, more room for ‘new ideas’ Significant use of derivatives (especially option-like) Higher risk asset classes Illiquid asset classes Alternative asset classes Asset classes that involve underlying cash investments (e. g. commodities) • • Risk management much more proactive: Continuous monitoring of actual portfolio composition Identification of type and form of risk exposures Frequent assessment of adequacy of risk measures and methodologies Challenging of choices made by asset managers

Alternative asset classes • Issues that complicate risk management: • Lack of suitable benchmarks to – Guide composition of actual portfolio – Distinguish between market performance and active performance • Lack of transparency of portfolio and risk composition • Fee schedules encourage high risk taking • Higher levels of leverage • Illiquidity hides true risk profile (smoothing)

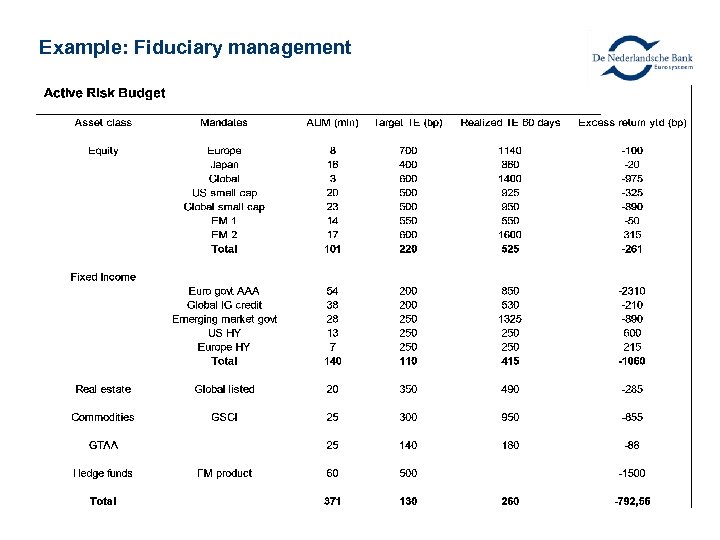

Example: Fiduciary management • Common division of roles and responsibilities: • Board determines strategic asset allocation • FM responsible for implementation of SAA – Goal: • FM outperforms strategic benchmarks. . . • … within a preset budget for active management risk • Remuneration: • FM gets base fee plus performance related fee

Example: Fiduciary management • Services outsourced to FM: • Selection of active managers • Risk control of active management risks • Potential conflicts of interest: • Investment mandates managed by FM • Performance related fees and risk management responsibilities

Example: Fiduciary management

De Nederlandsche Bank Investigation into investments of pension funds Paulus Dijkstra Reinsurance and Asset & Liability Management department June 10 2010

Investigation into investments • Presented findings are based on: Sectorwide analysis of quarterly and yearly standard reporting and recovery plans. Experiences of regular supervision (among which a quick scan on active management). In-depth investigations into investments of 10 pension funds

Overall picture Total loss of reserves of pension sector in 2008 was: € 219 bln, roughly for 60% caused by decreasing asset values and for 40% due to increasing value of liability Losses attributable to severity of crisis, strategic exposures of pension funds and additional losses in implementation of these strategies Loss due to implementation around € 20 bln Risks of investments generally underestimated Boards not always in control Risk management function generally not robust enough

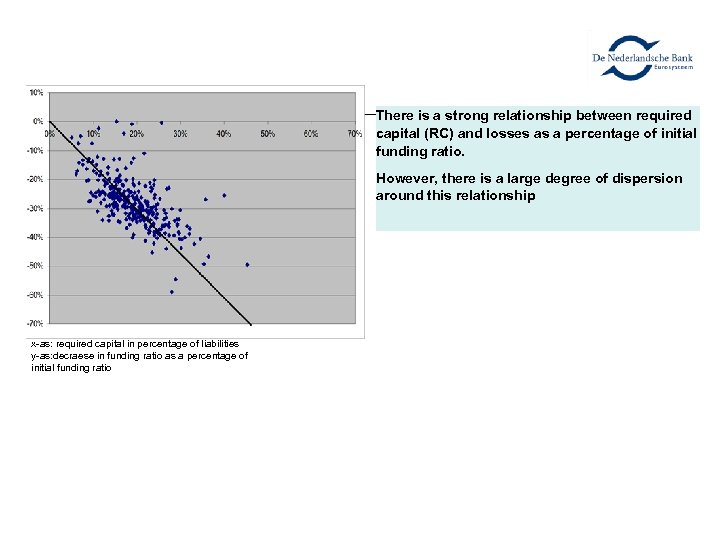

Strategic investment policy There is a strong relationship between required capital (RC) and losses as a percentage of initial funding ratio. However, there is a large degree of dispersion around this relationship x-as: required capital in percentage of liabilities y-as: decraese in funding ratio as a percentage of initial funding ratio

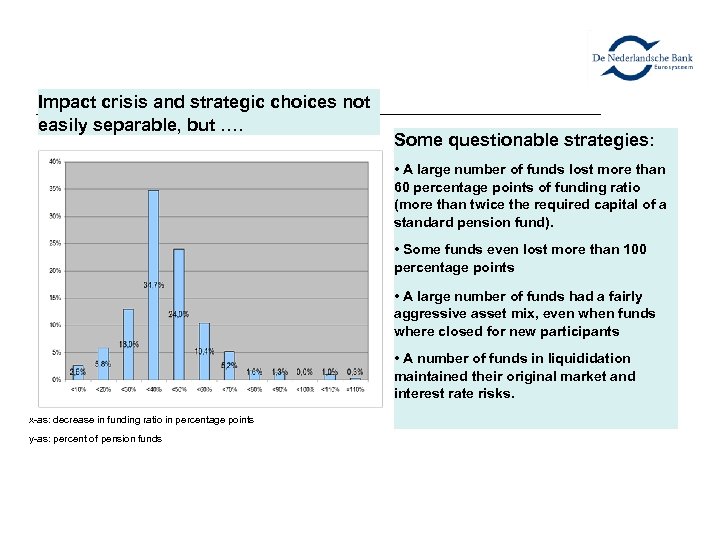

Decrease in funding ratios Impact crisis and strategic choices not easily separable, but …. Some questionable strategies: • A large number of funds lost more than 60 percentage points of funding ratio (more than twice the required capital of a standard pension fund). • Some funds even lost more than 100 percentage points • A large number of funds had a fairly aggressive asset mix, even when funds where closed for new participants • A number of funds in liquididation maintained their original market and interest rate risks. x-as: decrease in funding ratio in percentage points y-as: percent of pension funds

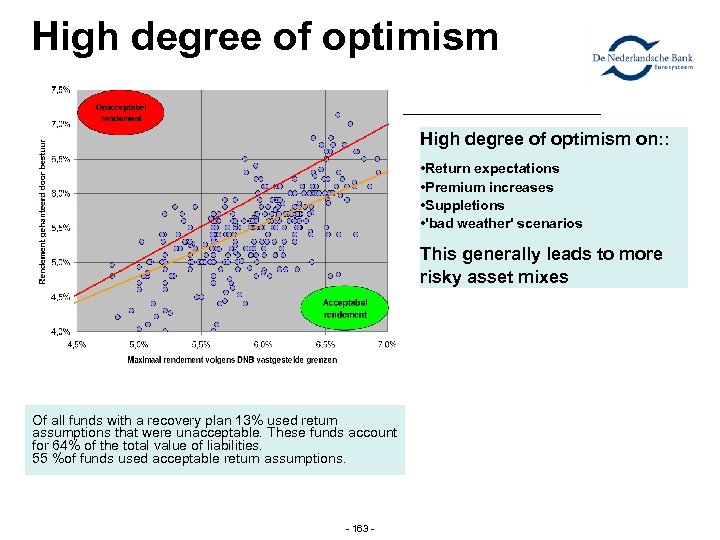

High degree of optimism on: : • Return expectations • Premium increases • Suppletions • 'bad weather' scenarios This generally leads to more risky asset mixes Of all funds with a recovery plan 13% used return assumptions that were unacceptable. These funds account for 64% of the total value of liabilities. 55 %of funds used acceptable return assumptions. - 163 -

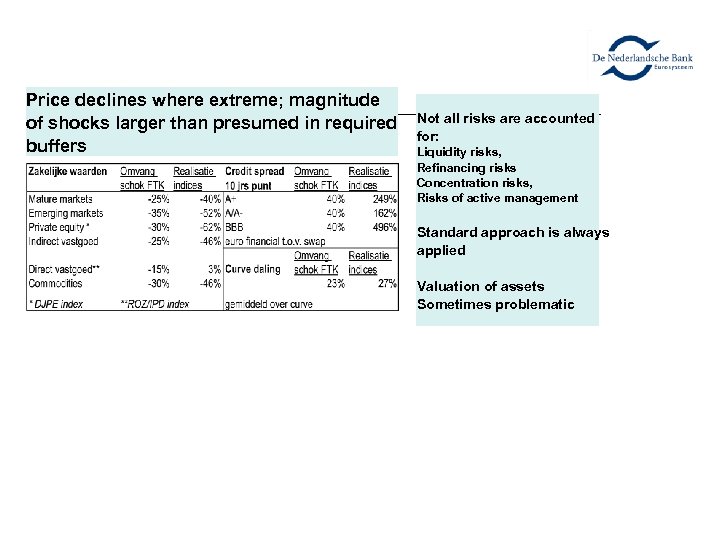

Price declines where extreme; magnitude Buffers and valuations of shocks larger than presumed in required buffers Not all risks are accounted for: Liquidity risks, Refinancing risks Concentration risks, Risks of active management Standard approach is always applied Valuation of assets Sometimes problematic

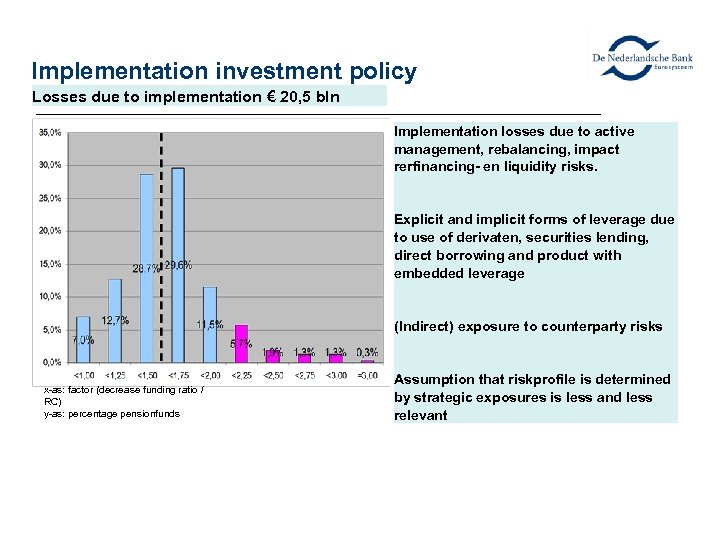

Implementation investment policy Losses due to implementation € 20, 5 bln Implementation losses due to active management, rebalancing, impact rerfinancing- en liquidity risks. Explicit and implicit forms of leverage due to use of derivaten, securities lending, direct borrowing and product with embedded leverage (Indirect) exposure to counterparty risks x-as: factor (decrease funding ratio / RC) y-as: percentage pensionfunds Assumption that riskprofile is determined by strategic exposures is less and less relevant

Governance • CONTROL Strong tendency towards active investment risks and innovative investments. Board is vulnerable for creative ideas. Loss of direct control in cases of outsourcing not compensated by additional control measures. Information provisioninsufficientto enable adequate steering of risk profile. Countervailing powers are not organised to arrive at balanced decision making. RISK MANAGEMENT Magnitude of Investment risks is generally underestimated. Role and importance of adequate risk control underestimated. Risk identification and analysis underdeveloped. Independence adequate weight of risk control function in the organisation not adequately safeguarded.

Supervision in practice David Schelhaas/Leendert van Driel Bucharest, Romania June 10, 2010

Supervision in practice Life cycle of a pension fund Stages in the life cycle of a pension fund • • • Setting up of a pension fund Legal requirements and documents Regular meeting with board Inspection of a fund Winding up of a fund

Supervision in practice Setting up of a pension fund • • Legal requirement: • Within 3 months submission of articles of association • Within 3 months submission of regulations of the fund Submission of Actuarial and Technical Business Memorandum (abtn) Abtn should outline: • Accrual and funding of pension benefits • Composition and valuation of fund´s assets and liabilities • Management and internal control • Assets and liability matching • Buffer capital Submission of funding agreement between employer and fund

Supervision in practice Regular supervision is based on risk analysis. • • • Following sources of information are used: • Articles of association and funding agreement • Actuarial and Technical Business Memorandum • Periodic returns and annual accounts • Quarterly reports • Reports requested on ad hoc basis Main objective is determination of present and future solvency of the fund Assessment of annual returns is partly automated. Information is read into a database and the system indicates when assessment is needed

Supervision in practice Regular supervision Main objective of consultation To determine and ensure that pension funds are: • Financially sound • Well organised and controlled • Meet legal requirement

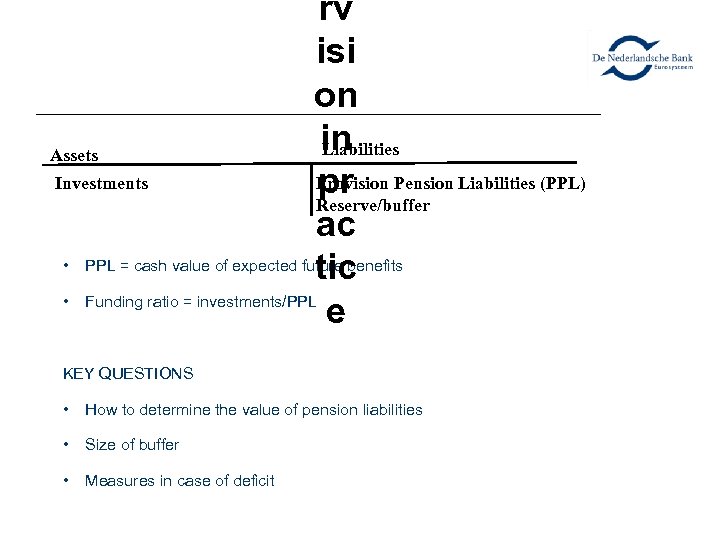

rv isi on in Liabilities Assets Investments Provision Pension Liabilities (PPL) pr Reserve/buffer ac • PPL = cash value of expected future benefits tic • Funding ratio = investments/PPL e KEY QUESTIONS • How to determine the value of pension liabilities • Size of buffer • Measures in case of deficit

Supervision in practice The frequency of consultation depends on factors as the size and risk profile of the fund Risk profile depends in general on • Insured plan vs. own risk • Self administered vs. outsourced

Supervision in practice Consultation is done through: • Periodical meetings (once every 1, 5 years) • Special investigation In general consultation is done by a supervisor and a business analist. If deemed necessary, they are supported by a supervisor specialist.

Supervision in practice Periodical meetings A periodical meeting : • Takes one to two days • Is on location

Supervision in practice Periodical meetings – continued In preparing a meeting, the following steps are taken: 1. Set a meeting date. 2. Request meeting notes of board meetings and participant meetings over the last 2 years. 3. Business analist scans the available information at DNB, (i. e. meeting notes, fund profile, FIRM, plan rules, articles of association, actuarial and technical business memorandum, funding agreement, annual report, management letters of auditor and actuary, annual DNB statements, quarterly investment reports, etc. )

Supervision in practice Periodical meetings – continued 4. Business analyst drafts a report of preliminary findings including an update of the fund profile. 5. Report and fund profile are discussed with supervisor. 6. An agenda is set and sent to the fund.

Supervision in practice • Periodical meetings – continued During a meeting DNB will need to have access to all local documents, procedures, etc. Consultation can be with board of directors, management of the fund, auditor, actuary administrator, investment manager, etc.

Supervision in practice Periodical meetings – continued The actual meeting day(s) • Start with a short mutual introduction including focussing on any actual developments of the fund. • Based on preparation perform a (quick) scan of available local documents and procedures. • Based on agenda (and new findings)have a meeting with the board, administrator, actuary, auditor, etc. • Set concluding remarks and follow-up activities.

Supervision in practice Periodical meetings – continued. After the meeting: • Findings, concluding remarks and follow-up activities arre confirmed in writing by DNB (TRIM) • Follow-up activities are placed on the agenda (TOETSY) • FIRM and fund profile are updated

Supervision in practice TOOLS • Toetsy - Workflow management • TRIM - Digital archives • FIRM - Risk analysis

Supervision in practice Group transfer of benefits • This can for example happen when a part of a company is sold • The fund that is transferring must inform DNB about: • • • Number of participants to be transferred Size of the benefits to be transferred Institution where benefits will be transferred to Financial consequenses for the fund Intended transferral date

Supervision in practice Winding up of a fund Board of the pension fund decides about termination of the fund. Following information must be submitted to DNB: • Minutes of meeting where decision has been taken • Liquidation report of accountant • Information about spending of possible surplus • Method of information of parties involved • Agreement with new pension executive

fc4114e083a0dc9492824ca61ada223e.ppt