69a1f0c27f579cc27e9b6de6ba2aeaa6.ppt

- Количество слайдов: 31

CRT 2010: Views from the Street by Rick Wise, CFA Senior Managing Director Medical Supplies & Devices Leerink Swann LLC For disclosures specific to companies in the Leerink Swann Universe of Coverage, please go to https: //leerink. bluematrix. com/bluematrix/Disclosure 2. CONFIDENTIAL, NOT FOR DISTRIBUTION OUTSIDE OF YOUR FIRM. © 2010 Leerink Swann LLC. All Rights Reserved. This document may not be reproduced or circulated without our written authority. February 2010 For Broker/Dealer Use Only

DISCLOSURES Rick Wise, CFA I have no real or apparent conflicts of interest to report.

Where We Were… February 2010 For Broker/Dealer Use Only

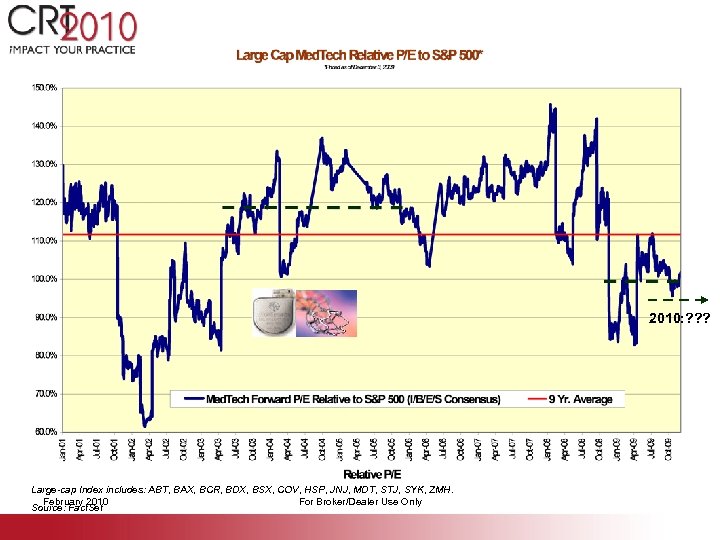

2010: ? ? ? Large-cap Index includes: ABT, BAX, BCR, BDX, BSX, COV, HSP, JNJ, MDT, STJ, SYK, ZMH. February 2010 For Broker/Dealer Use Only Source: Fact. Set

Historical: Large-Cap Med. Tech Relative P/E to S&P 500 • Large-Cap Med. Techs traded at nearly a 20% premium to the S&P 500 during the high-growth period driven by new ICD and DES technology (2003 -2006). • But in 2009, though rebounding from 2008, Large-Cap Med. Tech stocks traded basically in line with the S&P as the industry faced healthcare reform uncertainty and growth headwinds from: – Negative F/X; – A weak economy; – Increasing competition; and, – Lack of major new growth markets. February 2010 For Broker/Dealer Use Only

…And Where We’re Going February 2010 For Broker/Dealer Use Only

Future: Large-Cap Med. Tech Relative P/E to S&P 500 • 2010: Where can Large-Cap Med. Tech stocks trade? • A Better Year Ahead Fundamentally in an Improving Macro Environment… – F/X poised to turn positive and boost sales growth; – Hospital purchasing normalizing; – Upside possible for companies with consumer or elective procedure exposure as employment rebounds; and, – More about portfolio management and cost reductions instead of major new markets. • … And stocks attractively valued at these levels. – The Large-Cap Med. Tech industry’s superior long-term forecasted growth profile and basically sound fundamentals seeming to warrant a premium multiple to the S&P 500. February 2010 For Broker/Dealer Use Only

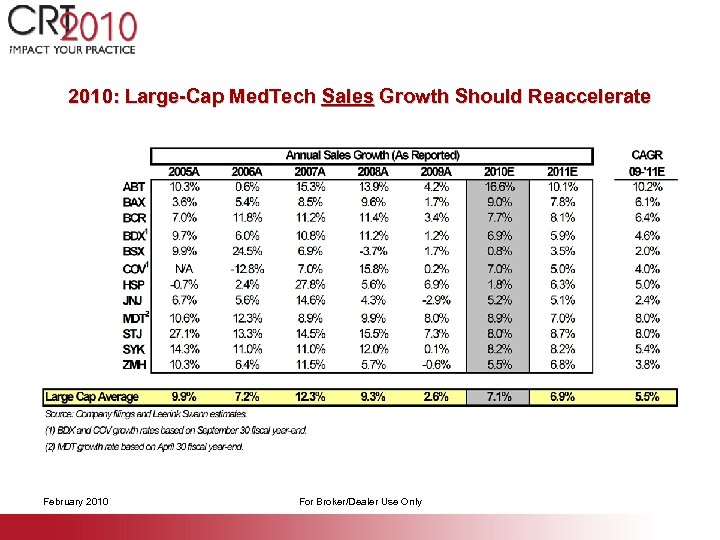

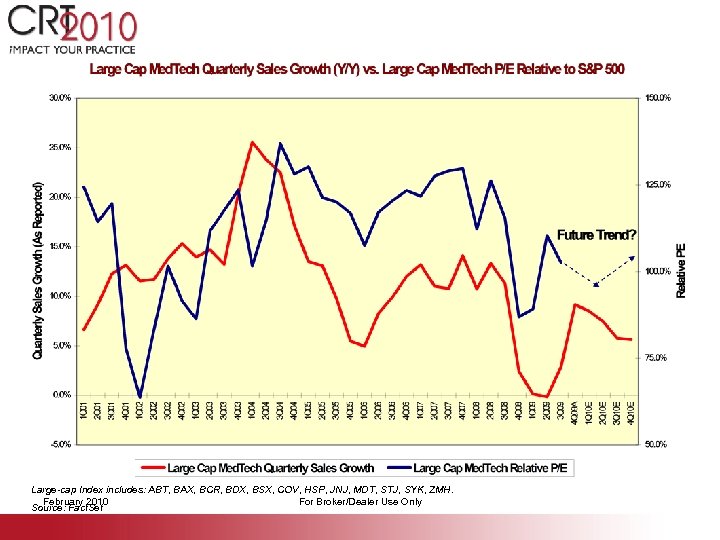

2010: Large-Cap Med. Tech Sales Growth Should Reaccelerate February 2010 For Broker/Dealer Use Only

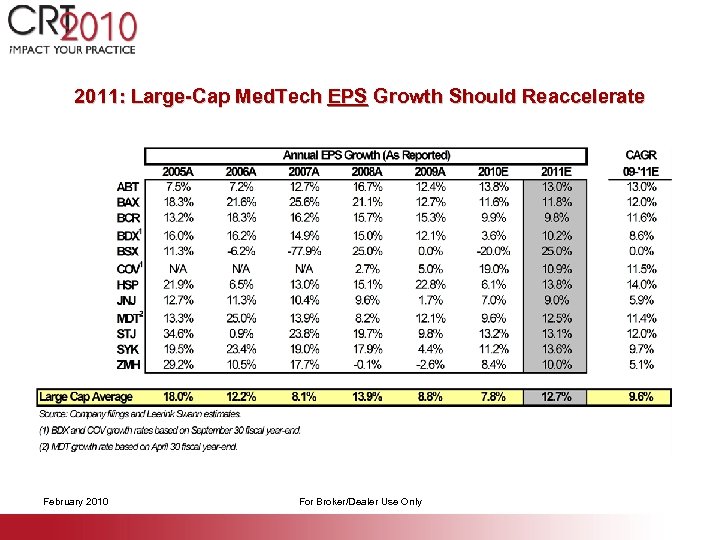

2011: Large-Cap Med. Tech EPS Growth Should Reaccelerate February 2010 For Broker/Dealer Use Only

Large-cap Index includes: ABT, BAX, BCR, BDX, BSX, COV, HSP, JNJ, MDT, STJ, SYK, ZMH. February 2010 For Broker/Dealer Use Only Source: Fact. Set

But Questions Remain • Healthcare Reform Uncertainty Still an Overhang • 510(k) Approval Process is Lengthening • Timing of an Economic Rebound Still Unknown • Major Large Markets Stable, But Growth Still Slow (ICDs, DES) February 2010 For Broker/Dealer Use Only

Healthcare Reform Debate Still Uncertain… …And the Face of Healthcare Reform Has Changed February 2010 For Broker/Dealer Use Only

New MA Senator Scott Brown February 2010 For Broker/Dealer Use Only

Healthcare Reform: Still an Overhang • Pending Healthcare Reform uncertainty was an overhang on Med. Tech stocks in 2 H 09, depressing valuations. • The proposed $20 B over ten years ($2 B per year) industry tax would have cost most large companies’ ~2%-4% in earnings. • But the impact would have been much larger on smaller manufacturers. • Now following the MA election, most investors assume reform will not occur or will be significantly scaled down. • Still, some of the “side effects” of this recession and spotlight on the HC system could be here to stay. . . : – – • Intensified focus on cost; Tougher pricing environment for premium technologies; Increased demands for evidence/clinical studies; and, Comparative effectiveness. …Contributing to a tougher environment for companies. February 2010 For Broker/Dealer Use Only

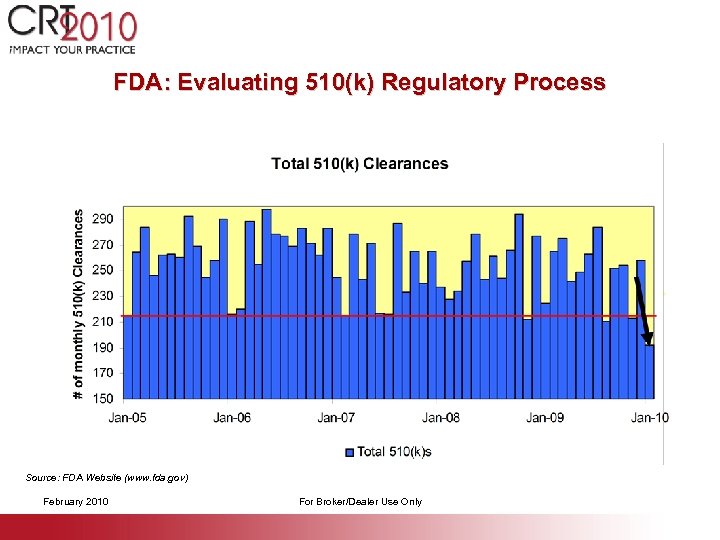

FDA: Evaluating 510(k) Regulatory Process • Changes to 510(k) process could be a headwind to long-term earnings growth. • New administrative, regulatory, or legislative changes at FDA could lead to fewer 510(k) and/or a more resource intensive approval process. • These changes could potentially: – – February 2010 Negatively impact the flow of new products on which Med. Tech companies rely to generate positive mix opportunities; and, Increase the cost of bringing new products to market. For Broker/Dealer Use Only

FDA: Evaluating 510(k) Regulatory Process Source: FDA Website (www. fda. gov) February 2010 For Broker/Dealer Use Only

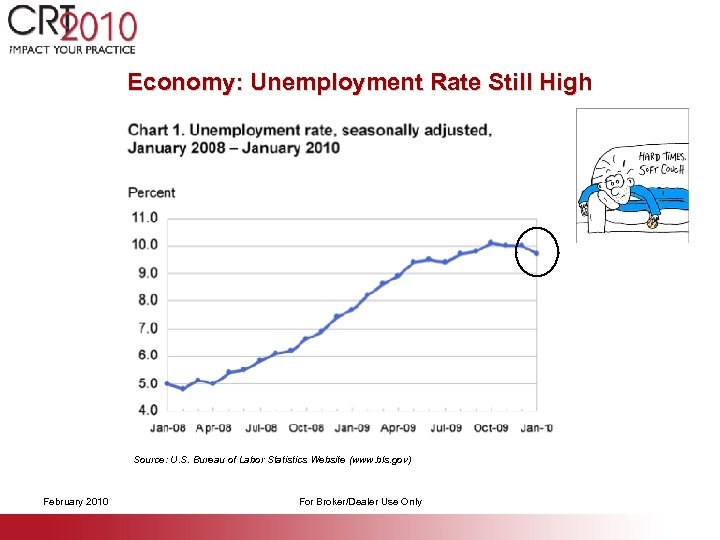

Economy: Unemployment Rate Still High Source: U. S. Bureau of Labor Statistics Website (www. bls. gov) February 2010 For Broker/Dealer Use Only

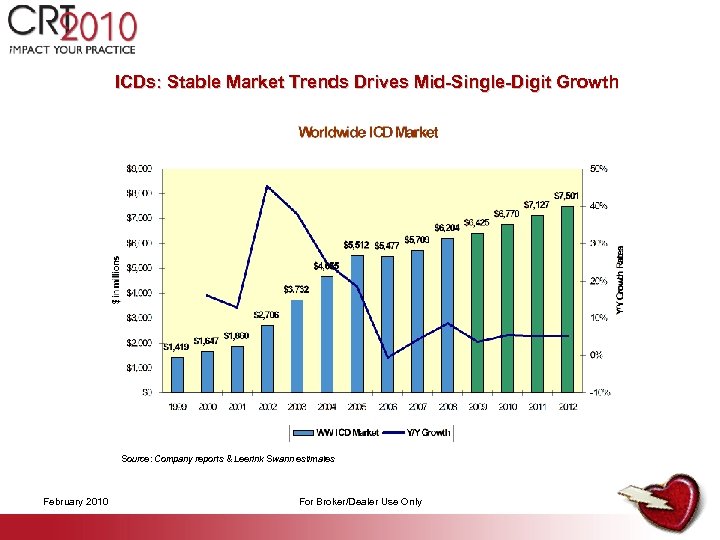

ICDs: Stable Market Trends Drives Mid-Single-Digit Growth • The ICD market has been plagued by recalls and slowing referral patterns since mid-2005. • But recent company reports have indicated that ICD market trends seem basically stable… • …And recent data releases actually bode well for ICD market growth. – – MADIT-CRT: Possibly positive mix shift to premium-priced CRT-Ds; and, MADIT-II: Long-term benefit of ICDs could drive referrals. • In 2009, F/X pressured market growth and Leerink Swann projects the WW ICD market grew ~4% y/y---down from ~9% in 2008 which was helped with easier y/y comparables. • In 2010 and beyond, we expect the market to get back a sustainable mid-singledigit growth rate helped by: – Stable implant volumes (basically flat new implant growth, mid-to-high single-digit replacement volume growth); – No unusual pricing pressure; and, – A cadence of new product launches. Broker/Dealer Use Only February 2010 For

ICDs: Stable Market Trends Drives Mid-Single-Digit Growth Source: Company reports & Leerink Swann estimates February 2010 For Broker/Dealer Use Only

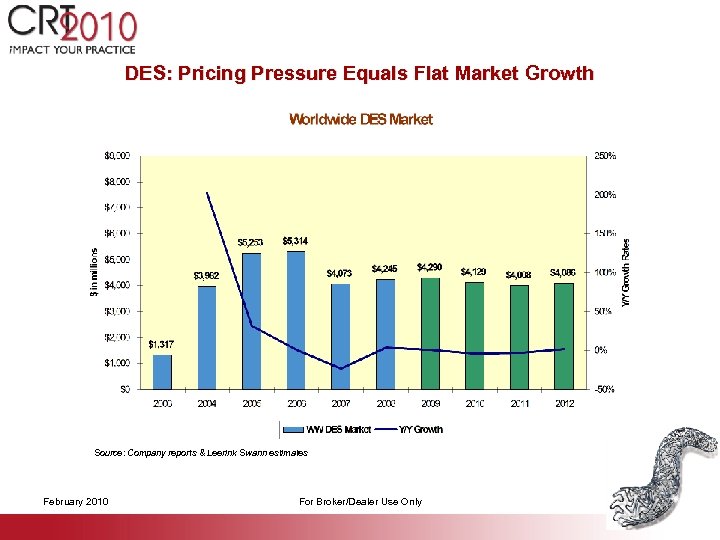

DES: Pricing Pressure Equals Flat Market Growth • In 2006 and 2007, the DES market came under pressure due to long-term safety concerns and COURAGE, driving a 23% WW market decline in 2007… • …But recent company reports indicate that procedure volumes have basically stabilized and U. S. DES penetration has increased to the ~77% range from a low of 62% in 1 Q 07. • Still, price is declining---high-single-digits in 4 Q 09 ---as hospitals strive to cut costs. • And with little new in the way of product innovation over the next 12 -18 months, the WW DES market could be flat-to-down in 2010 relative to ~1% 2009 growth. • Recent/upcoming data releases could drive market share shifts: – – – Sept. 2009: SPIRIT IV 1 yr. data released at TCT demonstrated Xience’s/Promus’ (ABT/BSX) superiority vs. Taxus (BSX); Sept. 2009: COMPARE 1 yr. data released at TCT demonstrated Xience’s/Promus’ superiority to the next-gen Taxus Liberte; and, 2010: 1 yr. Endeavor Resolute data vs. Xience possible at PCR, 4 yr. SPIRIT II and 3 yr. Endeavor V data at ACC, and 2 yr. SPIRIT IV and COMPARE data at TCT. February 2010 For Broker/Dealer Use Only

DES: Pricing Pressure Equals Flat Market Growth Source: Company reports & Leerink Swann estimates February 2010 For Broker/Dealer Use Only

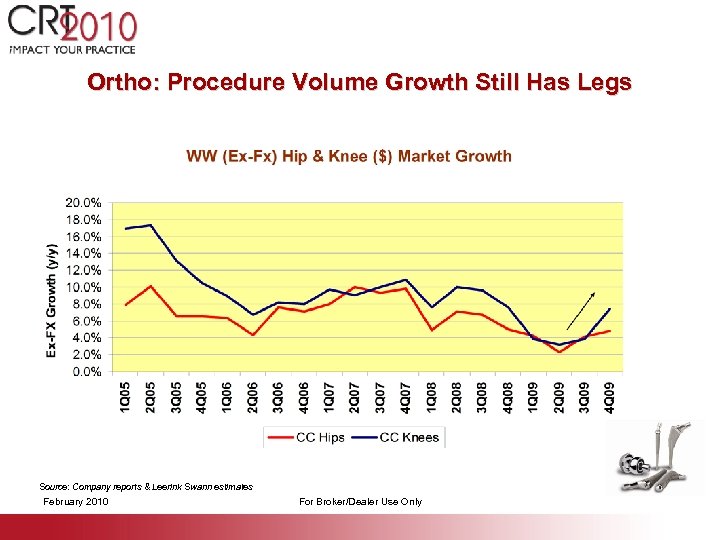

Ortho: Procedure Volume Growth Still Has Legs • Hip/knee growth is returning to more normal levels. • In 2009, procedures were deferred as patients lost insurance coverage or feared losing employment due weak economy. • In 2010, Ortho companies should see a positive revenue impact as volume growth in hip/knee procedures continues to reaccelerate, and postponed procedures get performed. • Accelerating volume growth should offset pricing pressure. February 2010 For Broker/Dealer Use Only

Ortho: Procedure Volume Growth Still Has Legs Source: Company reports & Leerink Swann estimates February 2010 For Broker/Dealer Use Only

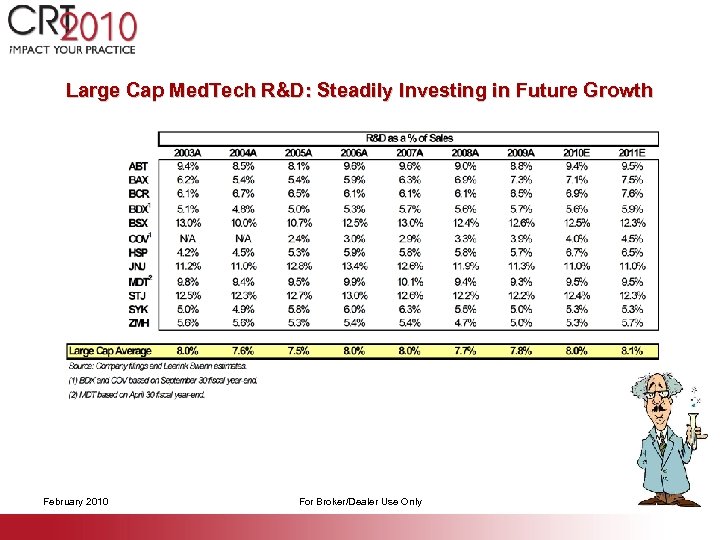

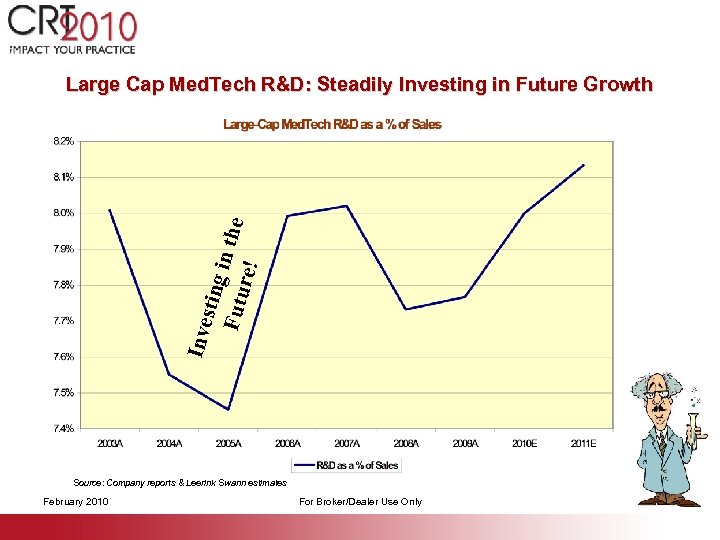

Large Cap Med. Tech R&D: Steadily Investing in Future Growth February 2010 For Broker/Dealer Use Only

Inve sting Futu in the re! Large Cap Med. Tech R&D: Steadily Investing in Future Growth Source: Company reports & Leerink Swann estimates February 2010 For Broker/Dealer Use Only

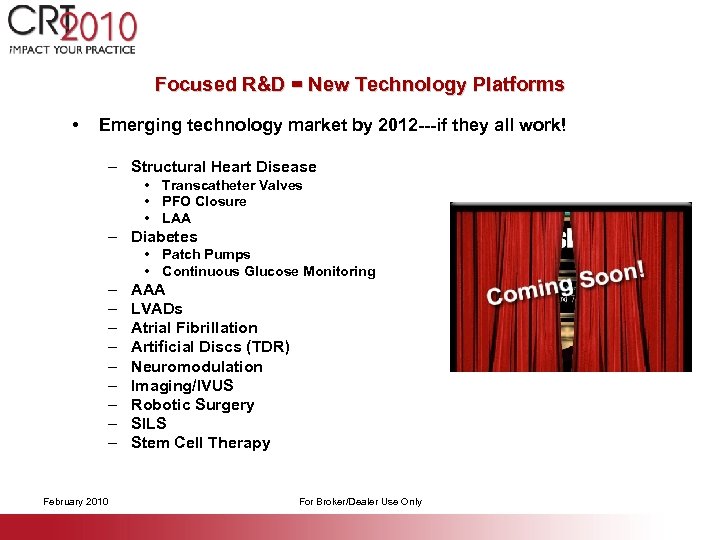

Focused R&D = New Technology Platforms • Emerging technology market by 2012 ---if they all work! – Structural Heart Disease • Transcatheter Valves • PFO Closure • LAA – Diabetes • Patch Pumps • Continuous Glucose Monitoring – – – – – February 2010 AAA LVADs Atrial Fibrillation Artificial Discs (TDR) Neuromodulation Imaging/IVUS Robotic Surgery SILS Stem Cell Therapy For Broker/Dealer Use Only

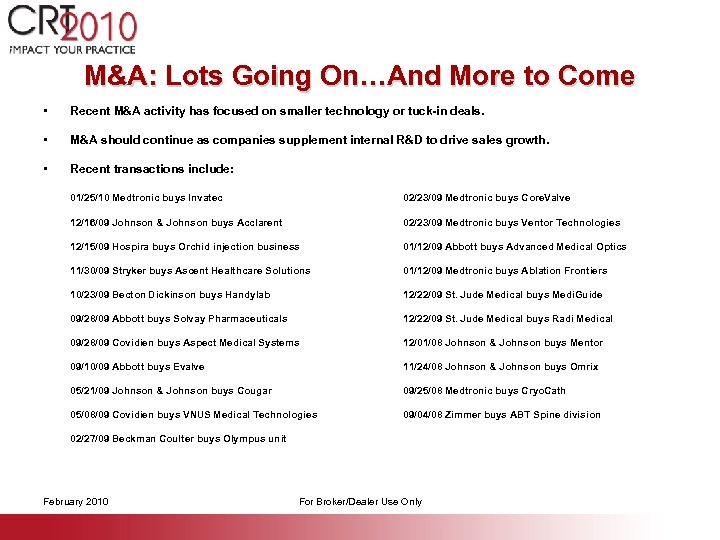

M&A: Lots Going On…And More to Come • Recent M&A activity has focused on smaller technology or tuck-in deals. • M&A should continue as companies supplement internal R&D to drive sales growth. • Recent transactions include: 01/25/10 Medtronic buys Invatec 02/23/09 Medtronic buys Core. Valve 12/16/09 Johnson & Johnson buys Acclarent 02/23/09 Medtronic buys Ventor Technologies 12/15/09 Hospira buys Orchid injection business 01/12/09 Abbott buys Advanced Medical Optics 11/30/09 Stryker buys Ascent Healthcare Solutions 01/12/09 Medtronic buys Ablation Frontiers 10/23/09 Becton Dickinson buys Handylab 12/22/09 St. Jude Medical buys Medi. Guide 09/28/09 Abbott buys Solvay Pharmaceuticals 09/28/09 Covidien buys Aspect Medical Systems 12/22/09 St. Jude Medical buys Radi Medical 09/10/09 Abbott buys Evalve 11/24/08 Johnson & Johnson buys Omrix 05/21/09 Johnson & Johnson buys Cougar 09/25/08 Medtronic buys Cryo. Cath 05/08/09 Covidien buys VNUS Medical Technologies 09/04/08 Zimmer buys ABT Spine division 12/01/08 Johnson & Johnson buys Mentor 02/27/09 Beckman Coulter buys Olympus unit February 2010 For Broker/Dealer Use Only

2010 Outlook: Promising but Uncertain • A Better Year Ahead Fundamentally in an Improving Macro Environment and Attractive Valuations. BUT… • Healthcare Reform Uncertainty Still an Overhang • 510(k) Approval Process is Lengthening • Timing of an Economic Rebound Still Unknown • Major Large Markets Stable, But Growth Still Slow (ICDs, DES) February 2010 For Broker/Dealer Use Only

Questions February 2010 For Broker/Dealer Use Only

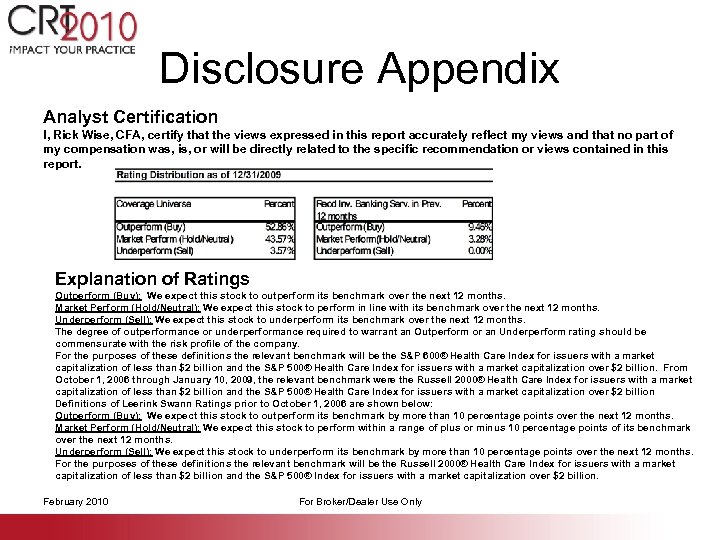

Disclosure Appendix Analyst Certification I, Rick Wise, CFA, certify that the views expressed in this report accurately reflect my views and that no part of my compensation was, is, or will be directly related to the specific recommendation or views contained in this report. Explanation of Ratings Outperform (Buy): We expect this stock to outperform its benchmark over the next 12 months. Market Perform (Hold/Neutral): We expect this stock to perform in line with its benchmark over the next 12 months. Underperform (Sell): We expect this stock to underperform its benchmark over the next 12 months. The degree of outperformance or underperformance required to warrant an Outperform or an Underperform rating should be commensurate with the risk profile of the company. For the purposes of these definitions the relevant benchmark will be the S&P 600® Health Care Index for issuers with a market capitalization of less than $2 billion and the S&P 500® Health Care Index for issuers with a market capitalization over $2 billion. From October 1, 2006 through January 10, 2009, the relevant benchmark were the Russell 2000® Health Care Index for issuers with a market capitalization of less than $2 billion and the S&P 500® Health Care Index for issuers with a market capitalization over $2 billion Definitions of Leerink Swann Ratings prior to October 1, 2006 are shown below: Outperform (Buy): We expect this stock to outperform its benchmark by more than 10 percentage points over the next 12 months. Market Perform (Hold/Neutral): We expect this stock to perform within a range of plus or minus 10 percentage points of its benchmark over the next 12 months. Underperform (Sell): We expect this stock to underperform its benchmark by more than 10 percentage points over the next 12 months. For the purposes of these definitions the relevant benchmark will be the Russell 2000® Health Care Index for issuers with a market capitalization of less than $2 billion and the S&P 500® Index for issuers with a market capitalization over $2 billion. February 2010 For Broker/Dealer Use Only

Disclosure Appendix Important Disclosures This information (including, but not limited to, prices, quotes and statistics) has been obtained from sources that we believe reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All information is subject to change without notice. This is provided for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy any product to which this information relates. The past performance of securities does not guarantee or predict future performance. Transaction strategies described herein may not be suitable for all investors. Additional information is available upon request by contacting the Publishing Department at One Federal Street, 37 th Floor, Boston, MA 02110. Leerink Swann Strategic Advisors, a division of Leerink Swann LLC, provides strategic advisory services to clients in the biomedical space. Any consultant referenced in this note was paid by MEDACorp, which provides a specialized network of experts accessed by Leerink Swann and its clients, and it provides information used by our analysts in preparing research. Like all Firm employees, analysts receive compensation that is impacted by, among other factors, overall firm profitability, which includes revenues from, among other business units, the Private Client Division, Institutional Equities, and Investment Banking. Analysts, however, are not compensated for a specific investment banking services transaction. For price charts, statements of valuation and risk, as well as the disclosures specific to covered companies, client should refer to https: //leerink. bluematrix. com/bluematrix/Disclosure 2 or send a request to Leerink Swann LLC Publishing Department, One Federal Street, 37 th Floor, Boston, MA 02110. February 2010 For Broker/Dealer Use Only

69a1f0c27f579cc27e9b6de6ba2aeaa6.ppt