71f55e0bf719b73e05709e107eba0a6f.ppt

- Количество слайдов: 20

CRITICAL LEGAL AND REGULATORY ISSUES FOR INVESTMENT MANAGERS AND FUNDS SHARIAH COMPLIANT FUNDS AND SOVEREIGN WEALTH FUNDS Jonathan Lawrence, Moderator Clifford J. Alexander Cary J. Meer 26 January 2009 DC #1288846 Copyright © 2009 by K&L Gates LLP. All rights reserved.

CRITICAL LEGAL AND REGULATORY ISSUES FOR INVESTMENT MANAGERS AND FUNDS SHARIAH COMPLIANT FUNDS AND SOVEREIGN WEALTH FUNDS Jonathan Lawrence, Moderator Clifford J. Alexander Cary J. Meer 26 January 2009 DC #1288846 Copyright © 2009 by K&L Gates LLP. All rights reserved.

Shariah Compliant Funds and Sovereign Wealth Funds § Shariah Compliant Funds § Al Safi Platform § Sovereign Wealth Funds 2

Shariah Compliant Funds and Sovereign Wealth Funds § Shariah Compliant Funds § Al Safi Platform § Sovereign Wealth Funds 2

Shariah Compliant Funds § Divine law as revealed in the Quran and the words and acts of the Prophet Mohammed governing the practical aspects of a Muslim’s life § Shariah Supervisory Board or Committee (3 – 5 scholars) § Investors elect to have fewer rights 3

Shariah Compliant Funds § Divine law as revealed in the Quran and the words and acts of the Prophet Mohammed governing the practical aspects of a Muslim’s life § Shariah Supervisory Board or Committee (3 – 5 scholars) § Investors elect to have fewer rights 3

Shariah Compliant Funds (cont. ) Obligations § Return based on actual fund earnings § Share loss and profit § Avoid uncertainty § Avoid speculation akin to gambling 4

Shariah Compliant Funds (cont. ) Obligations § Return based on actual fund earnings § Share loss and profit § Avoid uncertainty § Avoid speculation akin to gambling 4

Shariah Compliant Funds (cont. ) Prohibitions § Guaranteed fixed rate of return § Earning money solely by passage of time § Dealing with traditional banks on an interest basis or fixed term returns § Alcohol, illegal drugs, gambling, pork, adult entertainment, traditional insurance and reinsurance § Weapons manufacturing and sales § Lack of knowledge or excessive risk 5

Shariah Compliant Funds (cont. ) Prohibitions § Guaranteed fixed rate of return § Earning money solely by passage of time § Dealing with traditional banks on an interest basis or fixed term returns § Alcohol, illegal drugs, gambling, pork, adult entertainment, traditional insurance and reinsurance § Weapons manufacturing and sales § Lack of knowledge or excessive risk 5

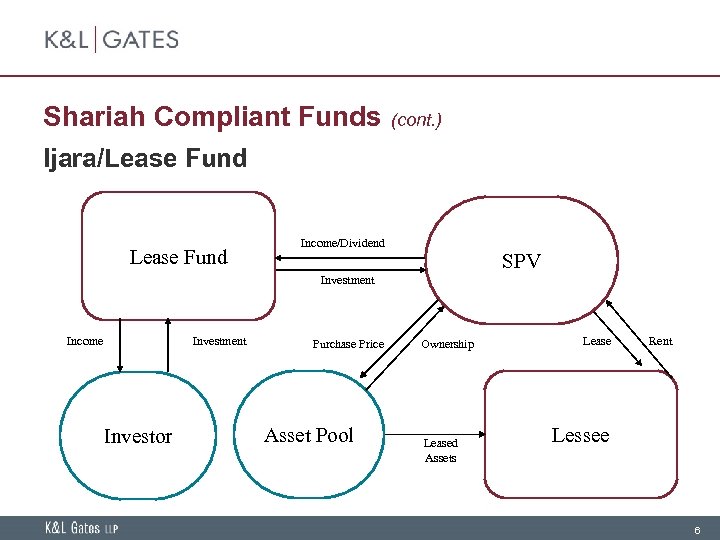

Shariah Compliant Funds (cont. ) Ijara/Lease Fund Income/Dividend SPV Investment Income Investment Investor Purchase Price Asset Pool Ownership Leased Assets Lease Rent Lessee 6

Shariah Compliant Funds (cont. ) Ijara/Lease Fund Income/Dividend SPV Investment Income Investment Investor Purchase Price Asset Pool Ownership Leased Assets Lease Rent Lessee 6

Shariah Compliant Funds (cont. ) Islamic Equity Funds § Stock selection § Industry screen § Financial screen § Non-compliant stocks: temporary, short-term or permanent? § Disclosure concerns 7

Shariah Compliant Funds (cont. ) Islamic Equity Funds § Stock selection § Industry screen § Financial screen § Non-compliant stocks: temporary, short-term or permanent? § Disclosure concerns 7

Al Safi Platform § May 2008 Cayman Islands mutual fund § Shariah compliant alternative investments § Multi-class unit trust with multiple sub-trusts § Specific investment objective and strict segregation between sub-trusts 8

Al Safi Platform § May 2008 Cayman Islands mutual fund § Shariah compliant alternative investments § Multi-class unit trust with multiple sub-trusts § Specific investment objective and strict segregation between sub-trusts 8

Al Safi Platform (cont. ) § Shariah Adviser (Shariah Capital): advises on each sub-trust’s compliance with Shariah investment guidelines and provides reports § Shariah Supervisory Board: supervises the Trust and each sub-trust’s business, activities and investments 9

Al Safi Platform (cont. ) § Shariah Adviser (Shariah Capital): advises on each sub-trust’s compliance with Shariah investment guidelines and provides reports § Shariah Supervisory Board: supervises the Trust and each sub-trust’s business, activities and investments 9

Al Safi Platform (cont. ) § Shariah compliant “short sale” of securities § “Arboon”: down payment; a non-refundable deposit equal to a percentage of securities’ fair market value § Closing date for payment of unpaid portion with right of acceleration 10

Al Safi Platform (cont. ) § Shariah compliant “short sale” of securities § “Arboon”: down payment; a non-refundable deposit equal to a percentage of securities’ fair market value § Closing date for payment of unpaid portion with right of acceleration 10

Al Safi Platform (cont. ) § Barclays Capital: prime broker and structured product distributor § Dubai Multi Commodities Centre Authority (DMCC) seeded $50 m each to: § Tocqueville Asset Management: Gold § Lucas Capital Management: Energy/Oil and Gas § Zweig-Di. Menna Intl Managers: Natural Resources § Black Rock: Global Resources and Mining 11

Al Safi Platform (cont. ) § Barclays Capital: prime broker and structured product distributor § Dubai Multi Commodities Centre Authority (DMCC) seeded $50 m each to: § Tocqueville Asset Management: Gold § Lucas Capital Management: Energy/Oil and Gas § Zweig-Di. Menna Intl Managers: Natural Resources § Black Rock: Global Resources and Mining 11

Sovereign Wealth Funds § Special purpose investment funds owned by the central government and created for macroeconomic purposes § SWFs hold, manage, or administer assets to achieve financial objectives, and employ a set of investment strategies, which include investing in foreign financial assets 12

Sovereign Wealth Funds § Special purpose investment funds owned by the central government and created for macroeconomic purposes § SWFs hold, manage, or administer assets to achieve financial objectives, and employ a set of investment strategies, which include investing in foreign financial assets 12

Sovereign Wealth Funds (cont. ) SWFs are commonly established out of: § balance of payments surpluses; § official foreign currency operations; § proceeds of privatisations; § fiscal surpluses; and/or § receipts resulting from commodity exports 13

Sovereign Wealth Funds (cont. ) SWFs are commonly established out of: § balance of payments surpluses; § official foreign currency operations; § proceeds of privatisations; § fiscal surpluses; and/or § receipts resulting from commodity exports 13

Sovereign Wealth Funds (cont. ) Key Elements § Ownership § Investments § Purposes and Objectives 14

Sovereign Wealth Funds (cont. ) Key Elements § Ownership § Investments § Purposes and Objectives 14

Sovereign Wealth Funds (cont. ) Estimated Worth § SWFs: $3. 3 trillion § Hedge funds: $1. 9 trillion § Private equity firms: $1. 16 trillion 15

Sovereign Wealth Funds (cont. ) Estimated Worth § SWFs: $3. 3 trillion § Hedge funds: $1. 9 trillion § Private equity firms: $1. 16 trillion 15

Sovereign Wealth Funds (cont. ) UK Regulation of SWFs § One of the least restrictive regulatory regimes § November 2007: Walker Guidelines for Disclosure and Transparency in Private Equity? § Qatar Investment Authority vehicle Delta Two Limited in bid for Sainsbury’s 16

Sovereign Wealth Funds (cont. ) UK Regulation of SWFs § One of the least restrictive regulatory regimes § November 2007: Walker Guidelines for Disclosure and Transparency in Private Equity? § Qatar Investment Authority vehicle Delta Two Limited in bid for Sainsbury’s 16

Sovereign Wealth Funds (cont. ) US Regulation of SWFs § US Office of Foreign Assets Control § 2007 Foreign Investment and National Security Act (FINSA) § Review by Committee on Foreign Investment in the United States (CFIUS) § March 2008: US Treasury Principles for SWF Investment with Abu Dhabi and Singapore § April 2008: Withdrawal of proposed California ban on pension funds investing in PE firms backed by SWFs 17

Sovereign Wealth Funds (cont. ) US Regulation of SWFs § US Office of Foreign Assets Control § 2007 Foreign Investment and National Security Act (FINSA) § Review by Committee on Foreign Investment in the United States (CFIUS) § March 2008: US Treasury Principles for SWF Investment with Abu Dhabi and Singapore § April 2008: Withdrawal of proposed California ban on pension funds investing in PE firms backed by SWFs 17

Sovereign Wealth Funds (cont. ) International Regulation of SWFs § June 2008: OECD Declaration on SWFs and Recipient Country Policies § July 2008: European Parliament resolution § October 2008: IMF International Working Group of SWFs Generally Accepted Principles and Practices (GAPP) – the “Santiago Principles” 18

Sovereign Wealth Funds (cont. ) International Regulation of SWFs § June 2008: OECD Declaration on SWFs and Recipient Country Policies § July 2008: European Parliament resolution § October 2008: IMF International Working Group of SWFs Generally Accepted Principles and Practices (GAPP) – the “Santiago Principles” 18

Sovereign Wealth Funds (cont. ) Issues for Contracting with SWFs § Authority to invest § Willingness to make representations and warranties § Willingness to waive sovereign immunity § Consent to jurisdiction in foreign courts § Regime change 19

Sovereign Wealth Funds (cont. ) Issues for Contracting with SWFs § Authority to invest § Willingness to make representations and warranties § Willingness to waive sovereign immunity § Consent to jurisdiction in foreign courts § Regime change 19

CRITICAL LEGAL AND REGULATORY ISSUES FOR INVESTMENT MANAGERS AND FUNDS SHARIAH COMPLIANT FUNDS AND SOVEREIGN WEALTH FUNDS Jonathan Lawrence, Moderator Clifford J. Alexander Cary J. Meer 26 January 2009 DC #1288846 Copyright © 2009 by K&L Gates LLP. All rights reserved.

CRITICAL LEGAL AND REGULATORY ISSUES FOR INVESTMENT MANAGERS AND FUNDS SHARIAH COMPLIANT FUNDS AND SOVEREIGN WEALTH FUNDS Jonathan Lawrence, Moderator Clifford J. Alexander Cary J. Meer 26 January 2009 DC #1288846 Copyright © 2009 by K&L Gates LLP. All rights reserved.