ba126c6fecfd5fbcaeb5f567d7d7009b.ppt

- Количество слайдов: 44

• Critical Illness • Dental • Accident

• Critical Illness • Dental • Accident

CRISIS RECOVERY Critical Illness Policy

CRISIS RECOVERY Critical Illness Policy

Critical Illness Policy Provides immediate cash for your customers when they are diagnosed with a covered medical crisis. They can use the money for: • Treatment not covered by or limited by their existing …. medical insurance. • Non-medical expenses resulting from their condition: …. travel, childcare, and spouse’s time off from work. • Extended convalescence services or for rehabilitation. • Mortgage, auto loans and credit card payments • Or, any way you choose. There are NO restriction on how …. . they spend their money.

Critical Illness Policy Provides immediate cash for your customers when they are diagnosed with a covered medical crisis. They can use the money for: • Treatment not covered by or limited by their existing …. medical insurance. • Non-medical expenses resulting from their condition: …. travel, childcare, and spouse’s time off from work. • Extended convalescence services or for rehabilitation. • Mortgage, auto loans and credit card payments • Or, any way you choose. There are NO restriction on how …. . they spend their money.

Crisis Recovery Provides up to $50, 000 to help cover out-of-pocket medical expenses and the other costs associated with a covered critical illness. Crisis Recovery is designed to ease the financial pressure by providing a lump sum cash benefit paid directly to you upon diagnosis of a covered illness to help you cope with the high cost of recovering from a Medical Crisis. Five benefit level to choose from: . $10, 000 $20, 000 $30, 000 $40, 000 $50, 000 Dependent Chldren's Benefit: $10, 000 per child

Crisis Recovery Provides up to $50, 000 to help cover out-of-pocket medical expenses and the other costs associated with a covered critical illness. Crisis Recovery is designed to ease the financial pressure by providing a lump sum cash benefit paid directly to you upon diagnosis of a covered illness to help you cope with the high cost of recovering from a Medical Crisis. Five benefit level to choose from: . $10, 000 $20, 000 $30, 000 $40, 000 $50, 000 Dependent Chldren's Benefit: $10, 000 per child

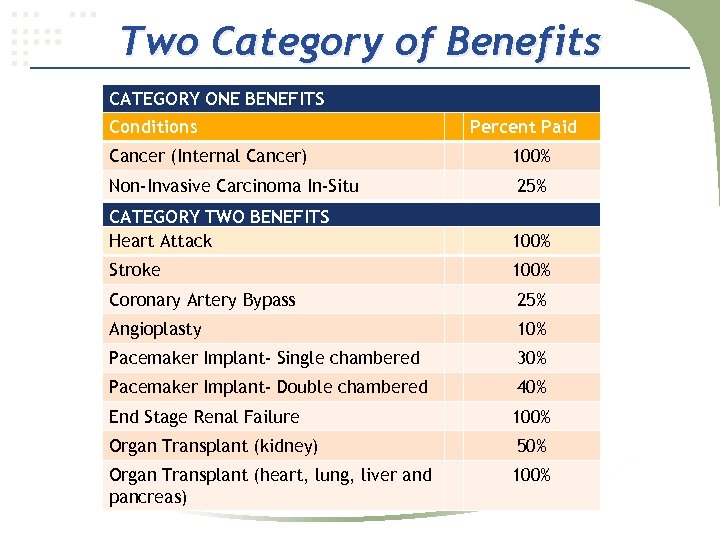

Two Category of Benefits If you collect a benefit for the first diagnosed illness or procedure under this policy in one category of benefits and then have a second diagnosis of a condition or procedure in another category under this policy we will pay the maximum benefit to you again. If a partial benefit is paid (25%) the remainder of the benefit will be payable upon the diagnosis of another covered condition.

Two Category of Benefits If you collect a benefit for the first diagnosed illness or procedure under this policy in one category of benefits and then have a second diagnosis of a condition or procedure in another category under this policy we will pay the maximum benefit to you again. If a partial benefit is paid (25%) the remainder of the benefit will be payable upon the diagnosis of another covered condition.

Two Category of Benefits CATEGORY ONE BENEFITS Conditions Percent Paid Cancer (Internal Cancer) 100% Non-Invasive Carcinoma In-Situ 25% CATEGORY TWO BENEFITS Heart Attack 100% Stroke 100% Coronary Artery Bypass 25% Angioplasty 10% Pacemaker Implant- Single chambered 30% Pacemaker Implant- Double chambered 40% End Stage Renal Failure 100% Organ Transplant (kidney) 50% Organ Transplant (heart, lung, liver and pancreas) 100%

Two Category of Benefits CATEGORY ONE BENEFITS Conditions Percent Paid Cancer (Internal Cancer) 100% Non-Invasive Carcinoma In-Situ 25% CATEGORY TWO BENEFITS Heart Attack 100% Stroke 100% Coronary Artery Bypass 25% Angioplasty 10% Pacemaker Implant- Single chambered 30% Pacemaker Implant- Double chambered 40% End Stage Renal Failure 100% Organ Transplant (kidney) 50% Organ Transplant (heart, lung, liver and pancreas) 100%

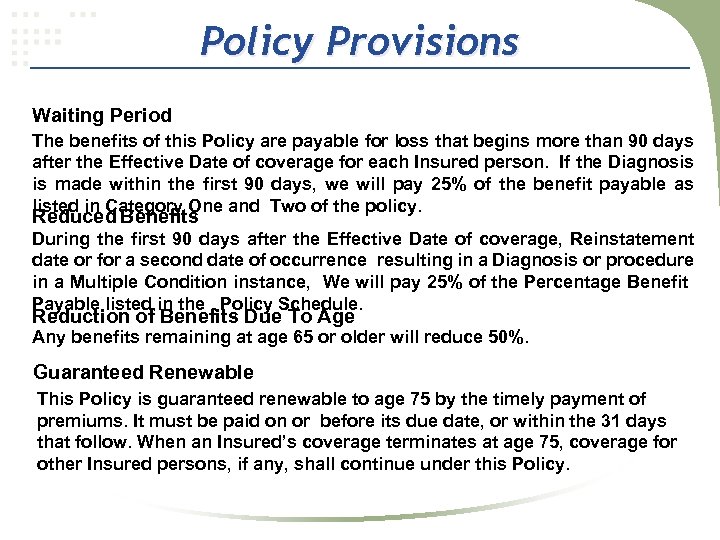

Policy Provisions Waiting Period The benefits of this Policy are payable for loss that begins more than 90 days after the Effective Date of coverage for each Insured person. If the Diagnosis is made within the first 90 days, we will pay 25% of the benefit payable as listed in Category One and Two of the policy. Reduced Benefits During the first 90 days after the Effective Date of coverage, Reinstatement date or for a second date of occurrence resulting in a Diagnosis or procedure in a Multiple Condition instance, We will pay 25% of the Percentage Benefit Payable listed in the Policy Schedule. Reduction of Benefits Due To Age Any benefits remaining at age 65 or older will reduce 50%. Guaranteed Renewable This Policy is guaranteed renewable to age 75 by the timely payment of premiums. It must be paid on or before its due date, or within the 31 days that follow. When an Insured’s coverage terminates at age 75, coverage for other Insured persons, if any, shall continue under this Policy.

Policy Provisions Waiting Period The benefits of this Policy are payable for loss that begins more than 90 days after the Effective Date of coverage for each Insured person. If the Diagnosis is made within the first 90 days, we will pay 25% of the benefit payable as listed in Category One and Two of the policy. Reduced Benefits During the first 90 days after the Effective Date of coverage, Reinstatement date or for a second date of occurrence resulting in a Diagnosis or procedure in a Multiple Condition instance, We will pay 25% of the Percentage Benefit Payable listed in the Policy Schedule. Reduction of Benefits Due To Age Any benefits remaining at age 65 or older will reduce 50%. Guaranteed Renewable This Policy is guaranteed renewable to age 75 by the timely payment of premiums. It must be paid on or before its due date, or within the 31 days that follow. When an Insured’s coverage terminates at age 75, coverage for other Insured persons, if any, shall continue under this Policy.

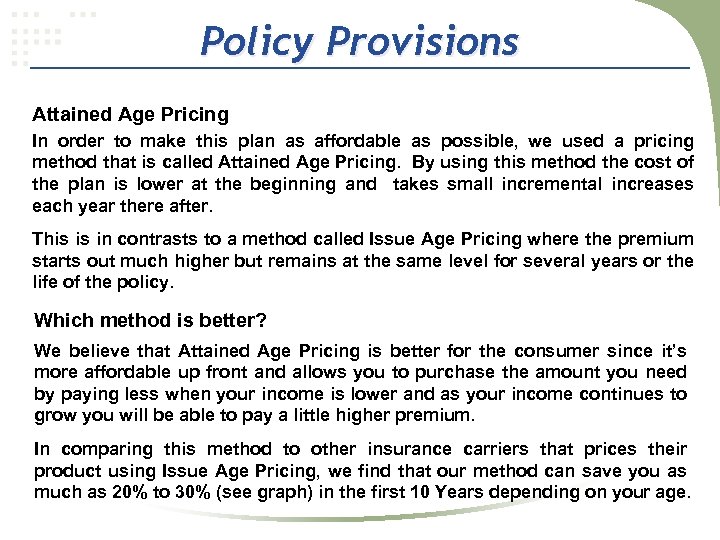

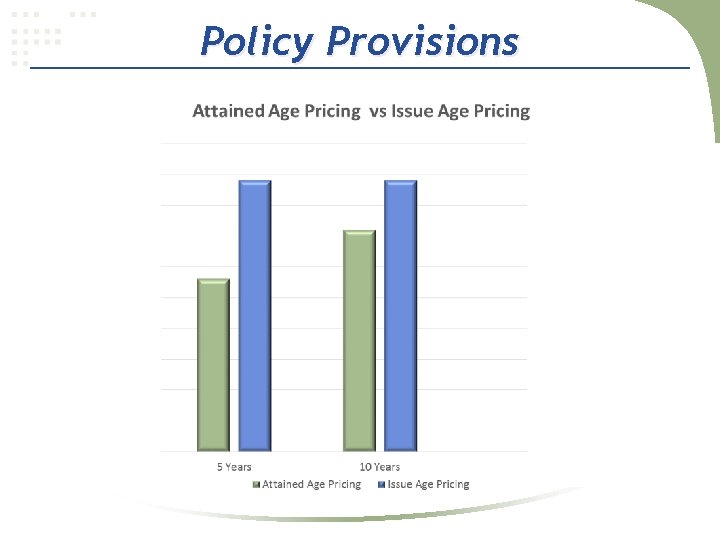

Policy Provisions Attained Age Pricing In order to make this plan as affordable as possible, we used a pricing method that is called Attained Age Pricing. By using this method the cost of the plan is lower at the beginning and takes small incremental increases each year there after. This is in contrasts to a method called Issue Age Pricing where the premium starts out much higher but remains at the same level for several years or the life of the policy. Which method is better? We believe that Attained Age Pricing is better for the consumer since it’s more affordable up front and allows you to purchase the amount you need by paying less when your income is lower and as your income continues to grow you will be able to pay a little higher premium. In comparing this method to other insurance carriers that prices their product using Issue Age Pricing, we find that our method can save you as much as 20% to 30% (see graph) in the first 10 Years depending on your age.

Policy Provisions Attained Age Pricing In order to make this plan as affordable as possible, we used a pricing method that is called Attained Age Pricing. By using this method the cost of the plan is lower at the beginning and takes small incremental increases each year there after. This is in contrasts to a method called Issue Age Pricing where the premium starts out much higher but remains at the same level for several years or the life of the policy. Which method is better? We believe that Attained Age Pricing is better for the consumer since it’s more affordable up front and allows you to purchase the amount you need by paying less when your income is lower and as your income continues to grow you will be able to pay a little higher premium. In comparing this method to other insurance carriers that prices their product using Issue Age Pricing, we find that our method can save you as much as 20% to 30% (see graph) in the first 10 Years depending on your age.

Policy Provisions

Policy Provisions

Policy Provisions Pre-Existing Sickness or Injury Provision The benefits of the policy will not be payable during the first 12 months that coverage is in force with respect to an insured person for a loss caused by a Pre-Existing Sickness or Injury disclosed or not disclosed in the application. This 12 month period is measured from the effective date of coverage for each insured person. A Pre-Existing Sickness or Injury means a Sickness or Injury which is Diagnosed by a legally qualified physician or for which medical advice or treatment was recommended or received from a legally qualified physician within 12 months prior to the effective date of coverage for each insured person.

Policy Provisions Pre-Existing Sickness or Injury Provision The benefits of the policy will not be payable during the first 12 months that coverage is in force with respect to an insured person for a loss caused by a Pre-Existing Sickness or Injury disclosed or not disclosed in the application. This 12 month period is measured from the effective date of coverage for each insured person. A Pre-Existing Sickness or Injury means a Sickness or Injury which is Diagnosed by a legally qualified physician or for which medical advice or treatment was recommended or received from a legally qualified physician within 12 months prior to the effective date of coverage for each insured person.

CRISIS RECOVERY If you knew that you would be diagnosed with cancer in six months, would you buy this insurance? How do you know that you won’t be?

CRISIS RECOVERY If you knew that you would be diagnosed with cancer in six months, would you buy this insurance? How do you know that you won’t be?

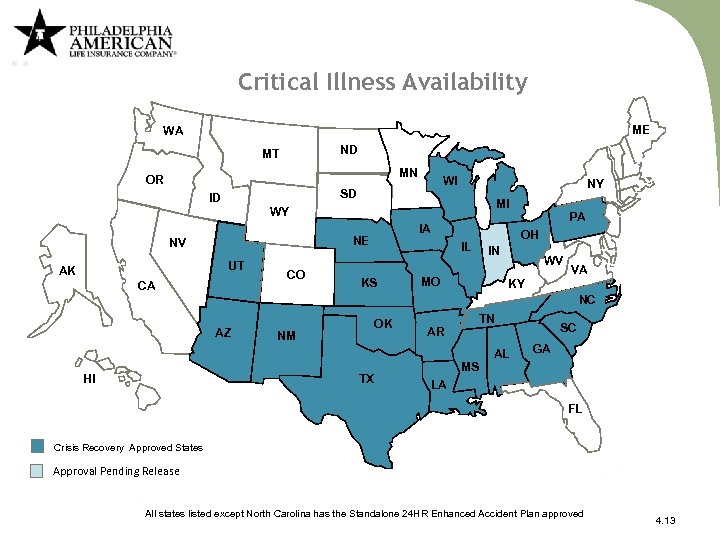

Critical Illness Availability ME WA ND MT MN OR WI SD ID NY MI WY NE NV UT AK IA CA CO IL KS PA OH IN MO WV VA KY NC AZ OK NM TN AR AL HI TX SC GA MS LA FL Crisis Recovery Approved States Approval Pending Release All states listed except North Carolina has the Standalone 24 HR Enhanced Accident Plan approved 4. 13

Critical Illness Availability ME WA ND MT MN OR WI SD ID NY MI WY NE NV UT AK IA CA CO IL KS PA OH IN MO WV VA KY NC AZ OK NM TN AR AL HI TX SC GA MS LA FL Crisis Recovery Approved States Approval Pending Release All states listed except North Carolina has the Standalone 24 HR Enhanced Accident Plan approved 4. 13

Dental Choice. Plus

Dental Choice. Plus

Dental Choice. Plus Introducing a new type of “hybrid” dental insurance policy that combines traditional fully insured benefits with PPO discount pricing.

Dental Choice. Plus Introducing a new type of “hybrid” dental insurance policy that combines traditional fully insured benefits with PPO discount pricing.

Dental Choice. Plus Freedom of Choice • Unlike many PPO plans that will not pay anything if you go outside their network, Dental Choice Plus will pay the non-network provider at the same rate as if they were in network. • Your client will only be responsible for the non-network charges that are in excess of the pre-negotiated network fee schedule.

Dental Choice. Plus Freedom of Choice • Unlike many PPO plans that will not pay anything if you go outside their network, Dental Choice Plus will pay the non-network provider at the same rate as if they were in network. • Your client will only be responsible for the non-network charges that are in excess of the pre-negotiated network fee schedule.

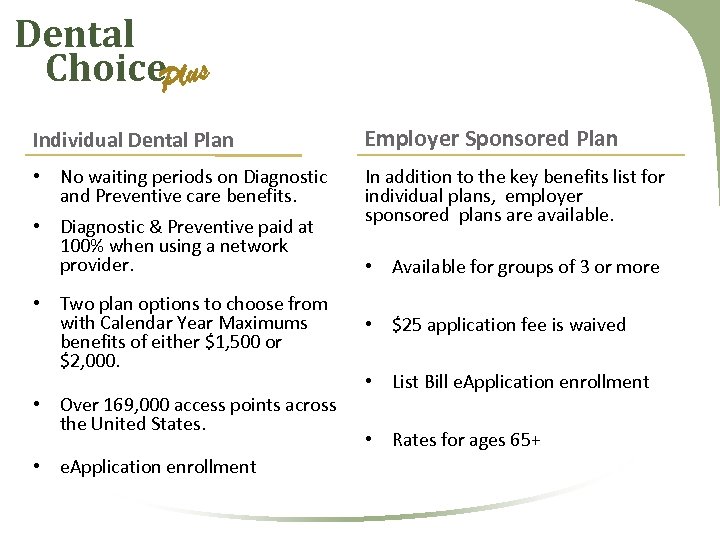

Dental Choice. Plus Individual Dental Plan Employer Sponsored Plan • No waiting periods on Diagnostic and Preventive care benefits. In addition to the key benefits list for individual plans, employer sponsored plans are available. • Diagnostic & Preventive paid at 100% when using a network provider. • Two plan options to choose from with Calendar Year Maximums benefits of either $1, 500 or $2, 000. • Over 169, 000 access points across the United States. • e. Application enrollment • Available for groups of 3 or more • $25 application fee is waived • List Bill e. Application enrollment • Rates for ages 65+

Dental Choice. Plus Individual Dental Plan Employer Sponsored Plan • No waiting periods on Diagnostic and Preventive care benefits. In addition to the key benefits list for individual plans, employer sponsored plans are available. • Diagnostic & Preventive paid at 100% when using a network provider. • Two plan options to choose from with Calendar Year Maximums benefits of either $1, 500 or $2, 000. • Over 169, 000 access points across the United States. • e. Application enrollment • Available for groups of 3 or more • $25 application fee is waived • List Bill e. Application enrollment • Rates for ages 65+

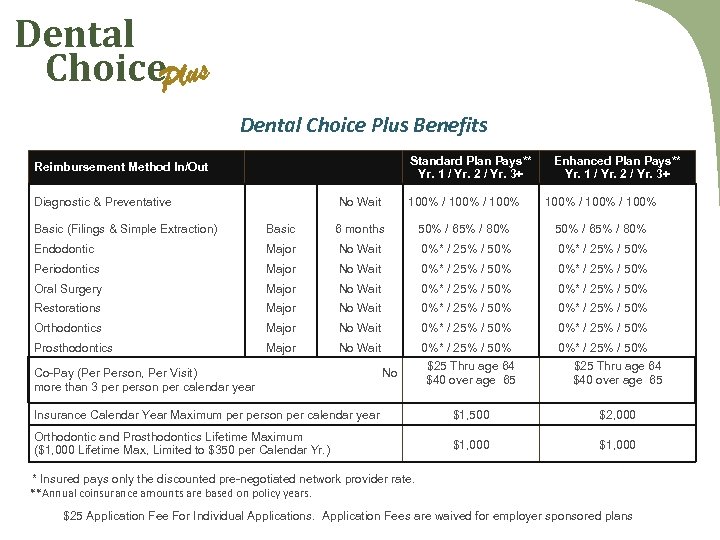

Dental Choice. Plus Dental Choice Plus Benefits Reimbursement Method In/Out Diagnostic & Preventative Standard Plan Pays** Yr. 1 / Yr. 2 / Yr. 3+ Enhanced Plan Pays** Yr. 1 / Yr. 2 / Yr. 3+ No Wait 100% / 100% Basic (Filings & Simple Extraction) Basic 6 months 50% / 65% / 80% Endodontic Major No Wait 0%* / 25% / 50% Periodontics Major No Wait 0%* / 25% / 50% Oral Surgery Major No Wait 0%* / 25% / 50% Restorations Major No Wait 0%* / 25% / 50% Orthodontics Major No Wait 0%* / 25% / 50% Prosthodontics Major No Wait 0%* / 25% / 50% $25 Thru age 64 Co-Pay (Per Person, Per Visit) No $40 over age 65 more than 3 person per calendar year Insurance Calendar Year Maximum person per calendar year $1, 500 $2, 000 Orthodontic and Prosthodontics Lifetime Maximum ($1, 000 Lifetime Max, Limited to $350 per Calendar Yr. ) $1, 000 * Insured pays only the discounted pre-negotiated network provider rate. **Annual coinsurance amounts are based on policy years. $25 Application Fee For Individual Applications. Application Fees are waived for employer sponsored plans

Dental Choice. Plus Dental Choice Plus Benefits Reimbursement Method In/Out Diagnostic & Preventative Standard Plan Pays** Yr. 1 / Yr. 2 / Yr. 3+ Enhanced Plan Pays** Yr. 1 / Yr. 2 / Yr. 3+ No Wait 100% / 100% Basic (Filings & Simple Extraction) Basic 6 months 50% / 65% / 80% Endodontic Major No Wait 0%* / 25% / 50% Periodontics Major No Wait 0%* / 25% / 50% Oral Surgery Major No Wait 0%* / 25% / 50% Restorations Major No Wait 0%* / 25% / 50% Orthodontics Major No Wait 0%* / 25% / 50% Prosthodontics Major No Wait 0%* / 25% / 50% $25 Thru age 64 Co-Pay (Per Person, Per Visit) No $40 over age 65 more than 3 person per calendar year Insurance Calendar Year Maximum person per calendar year $1, 500 $2, 000 Orthodontic and Prosthodontics Lifetime Maximum ($1, 000 Lifetime Max, Limited to $350 per Calendar Yr. ) $1, 000 * Insured pays only the discounted pre-negotiated network provider rate. **Annual coinsurance amounts are based on policy years. $25 Application Fee For Individual Applications. Application Fees are waived for employer sponsored plans

Dental Choice. Plus Good oral hygiene and regular dental care is important throughout your life • Given the suspected link between periodontitis and systemic health problems, prevention is the first step to maintain good long-term health. • Dental Choice Plus is economical because it focuses on benefits you need…not benefits you may never use. • Diagnostic & Preventive Services are paid at 100% with only a $25 co-pay when using a network provider. No waiting periods or deductibles.

Dental Choice. Plus Good oral hygiene and regular dental care is important throughout your life • Given the suspected link between periodontitis and systemic health problems, prevention is the first step to maintain good long-term health. • Dental Choice Plus is economical because it focuses on benefits you need…not benefits you may never use. • Diagnostic & Preventive Services are paid at 100% with only a $25 co-pay when using a network provider. No waiting periods or deductibles.

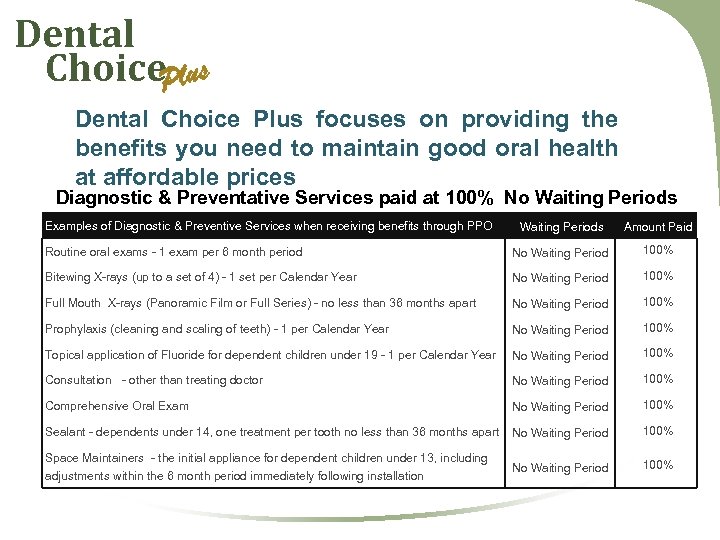

Dental Choice. Plus Dental Choice Plus focuses on providing the benefits you need to maintain good oral health at affordable prices Diagnostic & Preventative Services paid at 100% No Waiting Periods Examples of Diagnostic & Preventive Services when receiving benefits through PPO Waiting Periods Amount Paid Routine oral exams - 1 exam per 6 month period No Waiting Period 100% Bitewing X-rays (up to a set of 4) - 1 set per Calendar Year No Waiting Period 100% Full Mouth X-rays (Panoramic Film or Full Series) - no less than 36 months apart No Waiting Period 100% Prophylaxis (cleaning and scaling of teeth) - 1 per Calendar Year No Waiting Period 100% Topical application of Fluoride for dependent children under 19 - 1 per Calendar Year No Waiting Period 100% Consultation - other than treating doctor No Waiting Period 100% Comprehensive Oral Exam No Waiting Period 100% Sealant - dependents under 14, one treatment per tooth no less than 36 months apart No Waiting Period 100% Space Maintainers - the initial appliance for dependent children under 13, including adjustments within the 6 month period immediately following installation No Waiting Period 100%

Dental Choice. Plus Dental Choice Plus focuses on providing the benefits you need to maintain good oral health at affordable prices Diagnostic & Preventative Services paid at 100% No Waiting Periods Examples of Diagnostic & Preventive Services when receiving benefits through PPO Waiting Periods Amount Paid Routine oral exams - 1 exam per 6 month period No Waiting Period 100% Bitewing X-rays (up to a set of 4) - 1 set per Calendar Year No Waiting Period 100% Full Mouth X-rays (Panoramic Film or Full Series) - no less than 36 months apart No Waiting Period 100% Prophylaxis (cleaning and scaling of teeth) - 1 per Calendar Year No Waiting Period 100% Topical application of Fluoride for dependent children under 19 - 1 per Calendar Year No Waiting Period 100% Consultation - other than treating doctor No Waiting Period 100% Comprehensive Oral Exam No Waiting Period 100% Sealant - dependents under 14, one treatment per tooth no less than 36 months apart No Waiting Period 100% Space Maintainers - the initial appliance for dependent children under 13, including adjustments within the 6 month period immediately following installation No Waiting Period 100%

Care PPO Schedule CI-5 The schedule applies to services provide by a participating General Dentist and is an extensive list of most common procedures. The purpose of this schedule is to establish the maximum fee that a General Dentist will charge for each listed procedure . Fee schedules are determined by the zip code of the participating provider. Participating Specialists do not charge according to this fee schedule but will give a 20% discount.

Care PPO Schedule CI-5 The schedule applies to services provide by a participating General Dentist and is an extensive list of most common procedures. The purpose of this schedule is to establish the maximum fee that a General Dentist will charge for each listed procedure . Fee schedules are determined by the zip code of the participating provider. Participating Specialists do not charge according to this fee schedule but will give a 20% discount.

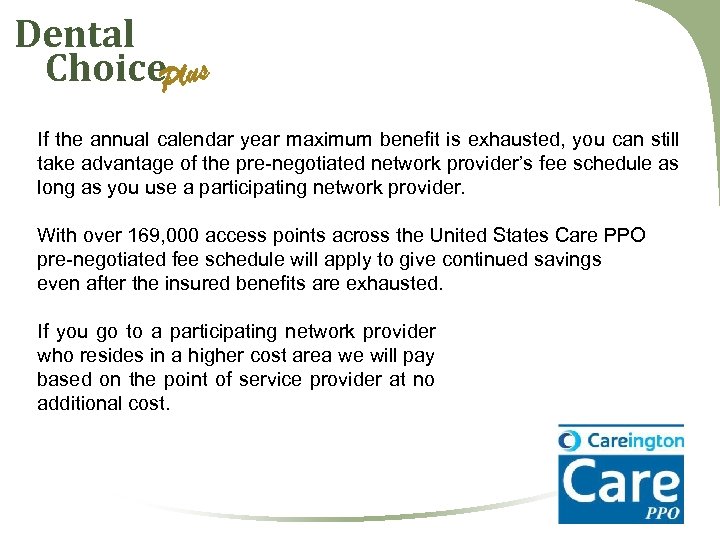

Dental Choice. Plus If the annual calendar year maximum benefit is exhausted, you can still take advantage of the pre-negotiated network provider’s fee schedule as long as you use a participating network provider. With over 169, 000 access points across the United States Care PPO pre-negotiated fee schedule will apply to give continued savings even after the insured benefits are exhausted. If you go to a participating network provider who resides in a higher cost area we will pay based on the point of service provider at no additional cost.

Dental Choice. Plus If the annual calendar year maximum benefit is exhausted, you can still take advantage of the pre-negotiated network provider’s fee schedule as long as you use a participating network provider. With over 169, 000 access points across the United States Care PPO pre-negotiated fee schedule will apply to give continued savings even after the insured benefits are exhausted. If you go to a participating network provider who resides in a higher cost area we will pay based on the point of service provider at no additional cost.

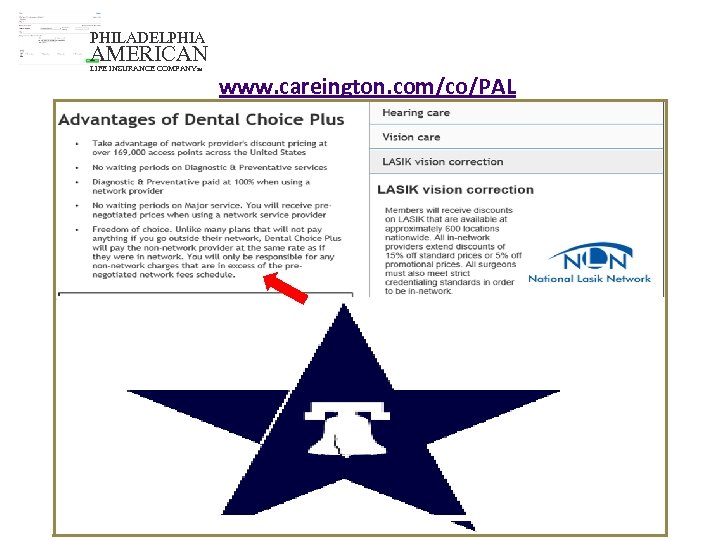

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM www. careington. com/co/PAL

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM www. careington. com/co/PAL

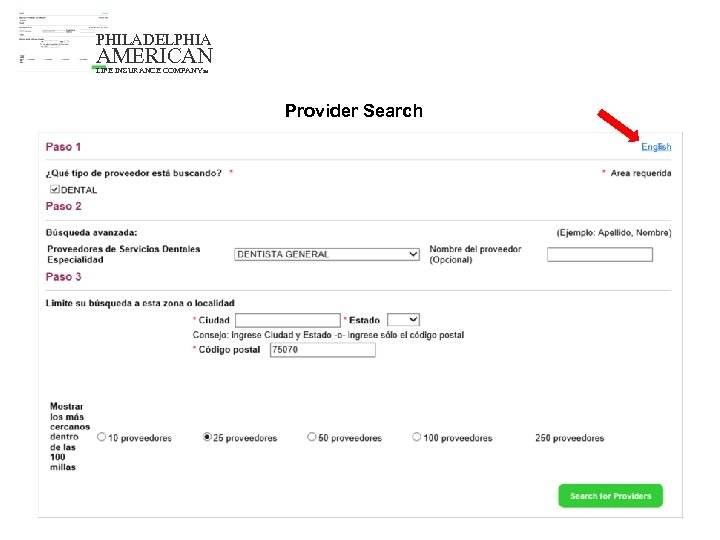

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM Provider Search

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM Provider Search

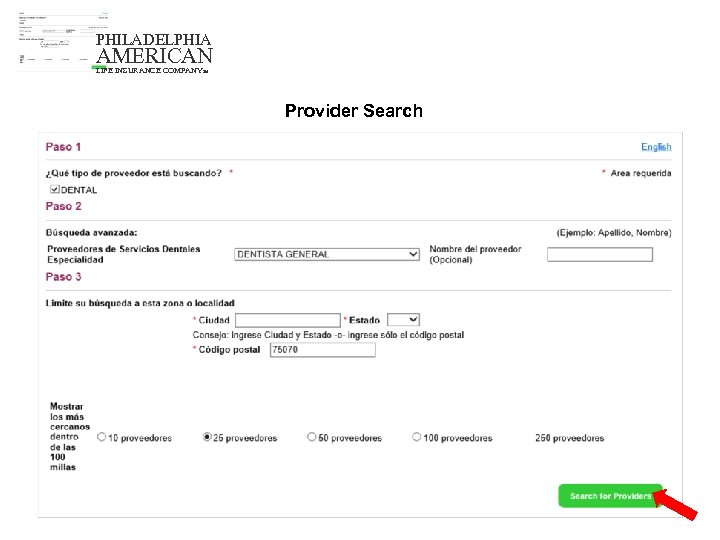

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM Provider Search

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM Provider Search

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM Provider Search

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM Provider Search

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM Step 4 Provider Search Results For 75070

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM Step 4 Provider Search Results For 75070

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM www. careington. com/co/PAL Administered by: Careington International Corporation 7400 Gaylord Parkway Frisco, TX 75034 Toll Free Service Line 855 -332 -1271

PHILADELPHIA AMERICAN LIFE INSURANCE COMPANYSM www. careington. com/co/PAL Administered by: Careington International Corporation 7400 Gaylord Parkway Frisco, TX 75034 Toll Free Service Line 855 -332 -1271

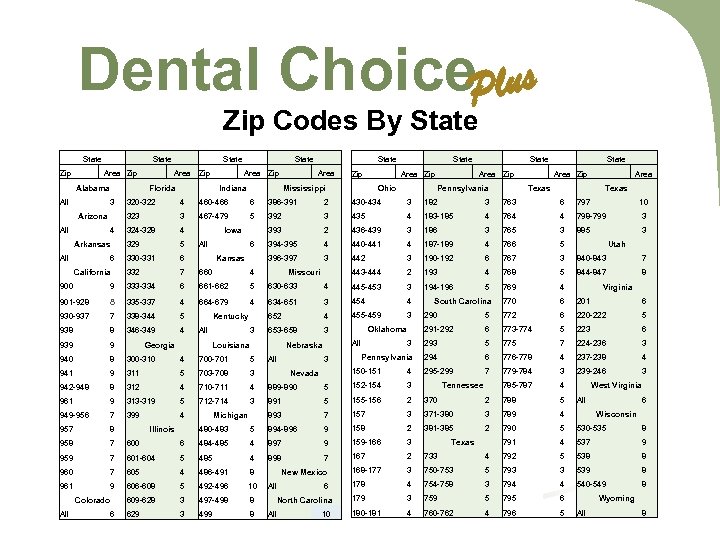

Dental Choice. Plus Zip Codes By State Zip State Area Zip Alabama All 3 4 6 California 900 Zip State Area Zip Area Indiana Area Zip Ohio State Area Zip Pennsylvania State Area Zip Texas Area Texas 9 4 460 -466 6 386 -391 2 430 -434 3 182 3 763 3 467 -479 5 392 3 435 4 183 -185 4 764 324 -328 4 393 2 436 -439 3 186 3 765 3 329 5 394 -395 4 440 -441 4 187 -189 4 766 5 330 -331 6 396 -397 3 442 3 190 -192 6 767 3 840 -843 7 332 7 660 4 443 -444 2 193 4 768 5 844 -847 8 333 -334 6 661 -662 5 4 445 -453 3 194 -196 5 769 4 634 -651 3 454 4 South Carolina 770 6 201 6 652 4 455 -459 8 335 -337 4 930 -937 7 338 -344 Iowa All 6 Kansas 5 346 -349 4 664 -679 4 Kentucky 938 8 939 9 940 8 300 -310 4 700 -701 5 941 9 311 5 703 -708 942 -948 8 312 4 710 -711 4 Georgia All 3 Missouri 630 -633 3 9 313 -319 5 949 -956 7 399 4 957 8 958 7 712 -714 3 Michigan All Virginia 5 772 6 220 -222 5 6 773 -774 5 223 6 3 293 5 775 7 224 -236 3 Pennsylvania 294 6 776 -778 4 237 -238 4 295 -299 7 779 -784 3 239 -246 3 150 -151 4 5 152 -154 3 785 -787 4 891 5 155 -156 2 370 2 788 5 893 7 157 3 371 -380 3 789 4 2 381 -385 2 790 5 530 -535 8 Nevada 889 -890 Tennessee West Virginia All 6 Wisconsin 6 9 484 -485 4 897 9 159 -166 3 791 4 537 9 7 167 2 733 4 792 5 538 8 168 -177 3 750 -753 5 793 3 539 8 178 4 754 -758 3 794 4 540 -549 8 179 3 759 5 795 6 180 -181 4 760 -762 4 796 5 5 485 4 960 7 605 4 486 -491 8 606 -608 5 492 -496 10 609 -628 3 497 -498 8 629 3 Utah 894 -896 601 -604 6 885 5 7 Colorado 3 158 959 9 10 291 -292 All 3 797 290 Oklahoma 3 Nebraska 3 6 October 1, 2013 4 798 -799 480 -483 Illinois 600 653 -658 Louisiana 961 All Zip Mississippi State 320 -322 901 -928 961 State 323 Arkansas All Area Florida Arizona All State 3 499 8 898 New Mexico All 6 North Carolina All 10 Texas Wyoming All 8

Dental Choice. Plus Zip Codes By State Zip State Area Zip Alabama All 3 4 6 California 900 Zip State Area Zip Area Indiana Area Zip Ohio State Area Zip Pennsylvania State Area Zip Texas Area Texas 9 4 460 -466 6 386 -391 2 430 -434 3 182 3 763 3 467 -479 5 392 3 435 4 183 -185 4 764 324 -328 4 393 2 436 -439 3 186 3 765 3 329 5 394 -395 4 440 -441 4 187 -189 4 766 5 330 -331 6 396 -397 3 442 3 190 -192 6 767 3 840 -843 7 332 7 660 4 443 -444 2 193 4 768 5 844 -847 8 333 -334 6 661 -662 5 4 445 -453 3 194 -196 5 769 4 634 -651 3 454 4 South Carolina 770 6 201 6 652 4 455 -459 8 335 -337 4 930 -937 7 338 -344 Iowa All 6 Kansas 5 346 -349 4 664 -679 4 Kentucky 938 8 939 9 940 8 300 -310 4 700 -701 5 941 9 311 5 703 -708 942 -948 8 312 4 710 -711 4 Georgia All 3 Missouri 630 -633 3 9 313 -319 5 949 -956 7 399 4 957 8 958 7 712 -714 3 Michigan All Virginia 5 772 6 220 -222 5 6 773 -774 5 223 6 3 293 5 775 7 224 -236 3 Pennsylvania 294 6 776 -778 4 237 -238 4 295 -299 7 779 -784 3 239 -246 3 150 -151 4 5 152 -154 3 785 -787 4 891 5 155 -156 2 370 2 788 5 893 7 157 3 371 -380 3 789 4 2 381 -385 2 790 5 530 -535 8 Nevada 889 -890 Tennessee West Virginia All 6 Wisconsin 6 9 484 -485 4 897 9 159 -166 3 791 4 537 9 7 167 2 733 4 792 5 538 8 168 -177 3 750 -753 5 793 3 539 8 178 4 754 -758 3 794 4 540 -549 8 179 3 759 5 795 6 180 -181 4 760 -762 4 796 5 5 485 4 960 7 605 4 486 -491 8 606 -608 5 492 -496 10 609 -628 3 497 -498 8 629 3 Utah 894 -896 601 -604 6 885 5 7 Colorado 3 158 959 9 10 291 -292 All 3 797 290 Oklahoma 3 Nebraska 3 6 October 1, 2013 4 798 -799 480 -483 Illinois 600 653 -658 Louisiana 961 All Zip Mississippi State 320 -322 901 -928 961 State 323 Arkansas All Area Florida Arizona All State 3 499 8 898 New Mexico All 6 North Carolina All 10 Texas Wyoming All 8

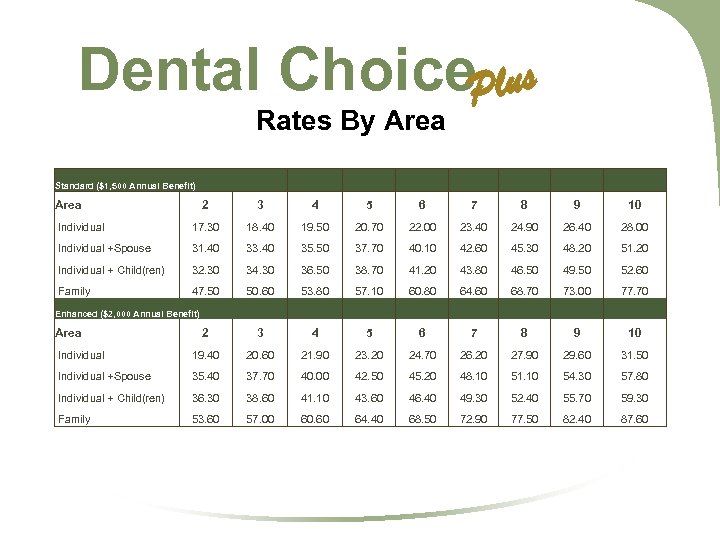

Dental Choice. Plus Rates By Area Standard ($1, 500 Annual Benefit) Area 2 3 4 5 6 7 8 9 10 Individual 17. 30 18. 40 19. 50 20. 70 22. 00 23. 40 24. 90 26. 40 28. 00 Individual +Spouse 31. 40 33. 40 35. 50 37. 70 40. 10 42. 60 45. 30 48. 20 51. 20 Individual + Child(ren) 32. 30 34. 30 36. 50 38. 70 41. 20 43. 80 46. 50 49. 50 52. 60 Family 47. 50 50. 60 53. 80 57. 10 60. 80 64. 60 68. 70 73. 00 77. 70 Enhanced ($2, 000 Annual Benefit) Area October 1, 2013 2 3 4 5 6 7 8 9 10 Individual 19. 40 20. 60 21. 90 23. 20 24. 70 26. 20 27. 90 29. 60 31. 50 Individual +Spouse 35. 40 37. 70 40. 00 42. 50 45. 20 48. 10 51. 10 54. 30 57. 80 Individual + Child(ren) 36. 30 38. 60 41. 10 43. 60 46. 40 49. 30 52. 40 55. 70 59. 30 Family 53. 60 57. 00 60. 60 64. 40 68. 50 72. 90 77. 50 82. 40 87. 60

Dental Choice. Plus Rates By Area Standard ($1, 500 Annual Benefit) Area 2 3 4 5 6 7 8 9 10 Individual 17. 30 18. 40 19. 50 20. 70 22. 00 23. 40 24. 90 26. 40 28. 00 Individual +Spouse 31. 40 33. 40 35. 50 37. 70 40. 10 42. 60 45. 30 48. 20 51. 20 Individual + Child(ren) 32. 30 34. 30 36. 50 38. 70 41. 20 43. 80 46. 50 49. 50 52. 60 Family 47. 50 50. 60 53. 80 57. 10 60. 80 64. 60 68. 70 73. 00 77. 70 Enhanced ($2, 000 Annual Benefit) Area October 1, 2013 2 3 4 5 6 7 8 9 10 Individual 19. 40 20. 60 21. 90 23. 20 24. 70 26. 20 27. 90 29. 60 31. 50 Individual +Spouse 35. 40 37. 70 40. 00 42. 50 45. 20 48. 10 51. 10 54. 30 57. 80 Individual + Child(ren) 36. 30 38. 60 41. 10 43. 60 46. 40 49. 30 52. 40 55. 70 59. 30 Family 53. 60 57. 00 60. 60 64. 40 68. 50 72. 90 77. 50 82. 40 87. 60

Dental Choice. Plus Finally, a dental policy that covers the services you want at a price you can afford.

Dental Choice. Plus Finally, a dental policy that covers the services you want at a price you can afford.

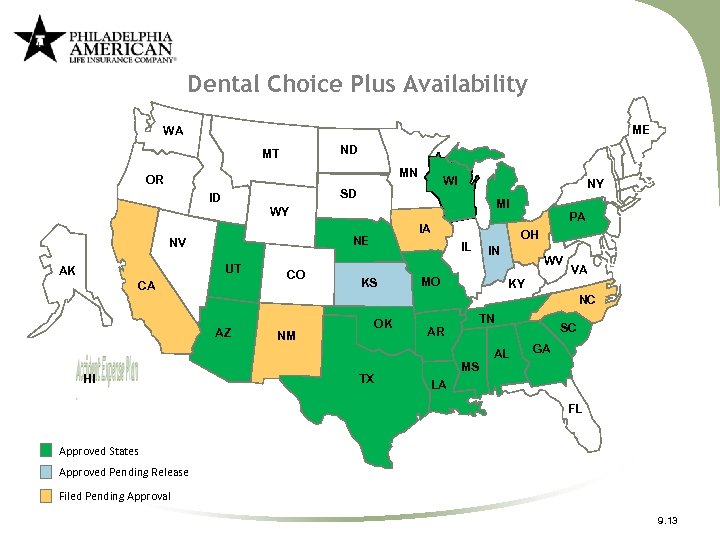

Dental Choice Plus Availability ME WA ND MT MN OR WI SD ID NY MI WY NE NV UT AK IA CA CO IL KS PA OH IN MO WV VA KY NC AZ OK NM TN AR AL HI TX SC GA MS LA FL Approved States Approved Pending Release Filed Pending Approval 9. 13

Dental Choice Plus Availability ME WA ND MT MN OR WI SD ID NY MI WY NE NV UT AK IA CA CO IL KS PA OH IN MO WV VA KY NC AZ OK NM TN AR AL HI TX SC GA MS LA FL Approved States Approved Pending Release Filed Pending Approval 9. 13

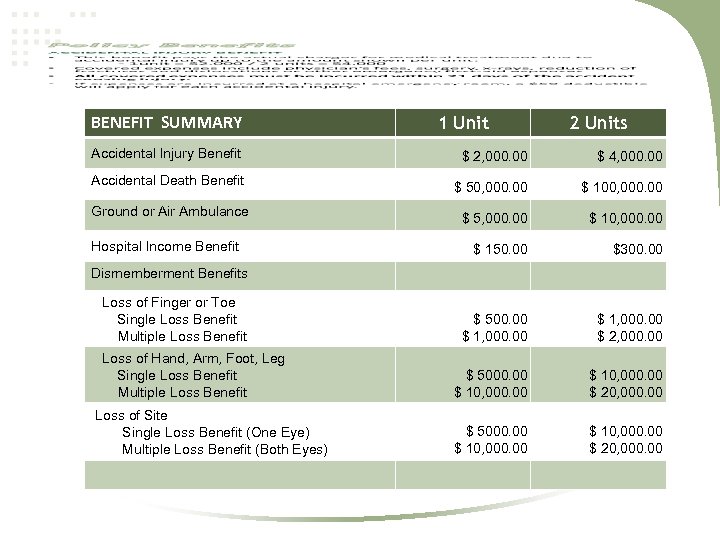

BENEFIT SUMMARY 1 Unit 2 Units Accidental Injury Benefit $ 2, 000. 00 $ 4, 000. 00 Accidental Death Benefit $ 50, 000. 00 $ 100, 000. 00 Ground or Air Ambulance $ 5, 000. 00 $ 10, 000. 00 $ 150. 00 $300. 00 $ 500. 00 $ 1, 000. 00 $ 2, 000. 00 $ 5000. 00 $ 10, 000. 00 $ 20, 000. 00 Hospital Income Benefit Dismemberment Benefits Loss of Finger or Toe Single Loss Benefit Multiple Loss Benefit Loss of Hand, Arm, Foot, Leg Single Loss Benefit Multiple Loss Benefit Loss of Site Single Loss Benefit (One Eye) Multiple Loss Benefit (Both Eyes)

BENEFIT SUMMARY 1 Unit 2 Units Accidental Injury Benefit $ 2, 000. 00 $ 4, 000. 00 Accidental Death Benefit $ 50, 000. 00 $ 100, 000. 00 Ground or Air Ambulance $ 5, 000. 00 $ 10, 000. 00 $ 150. 00 $300. 00 $ 500. 00 $ 1, 000. 00 $ 2, 000. 00 $ 5000. 00 $ 10, 000. 00 $ 20, 000. 00 Hospital Income Benefit Dismemberment Benefits Loss of Finger or Toe Single Loss Benefit Multiple Loss Benefit Loss of Hand, Arm, Foot, Leg Single Loss Benefit Multiple Loss Benefit Loss of Site Single Loss Benefit (One Eye) Multiple Loss Benefit (Both Eyes)

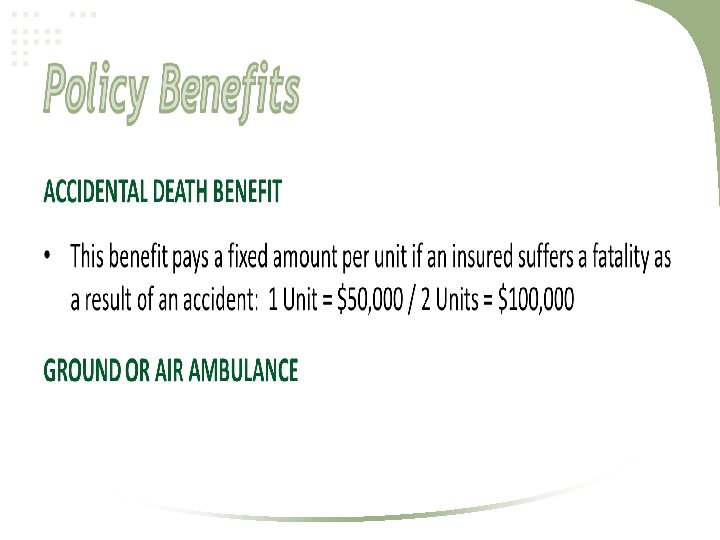

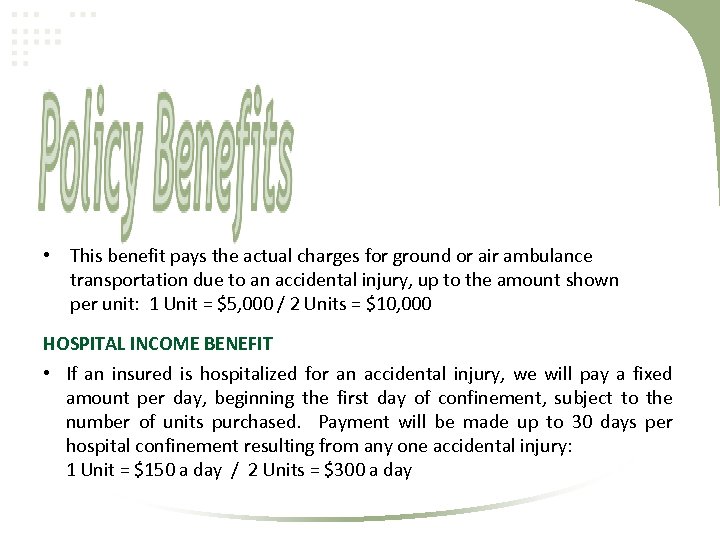

• This benefit pays the actual charges for ground or air ambulance transportation due to an accidental injury, up to the amount shown per unit: 1 Unit = $5, 000 / 2 Units = $10, 000 HOSPITAL INCOME BENEFIT • If an insured is hospitalized for an accidental injury, we will pay a fixed amount per day, beginning the first day of confinement, subject to the number of units purchased. Payment will be made up to 30 days per hospital confinement resulting from any one accidental injury: 1 Unit = $150 a day / 2 Units = $300 a day

• This benefit pays the actual charges for ground or air ambulance transportation due to an accidental injury, up to the amount shown per unit: 1 Unit = $5, 000 / 2 Units = $10, 000 HOSPITAL INCOME BENEFIT • If an insured is hospitalized for an accidental injury, we will pay a fixed amount per day, beginning the first day of confinement, subject to the number of units purchased. Payment will be made up to 30 days per hospital confinement resulting from any one accidental injury: 1 Unit = $150 a day / 2 Units = $300 a day

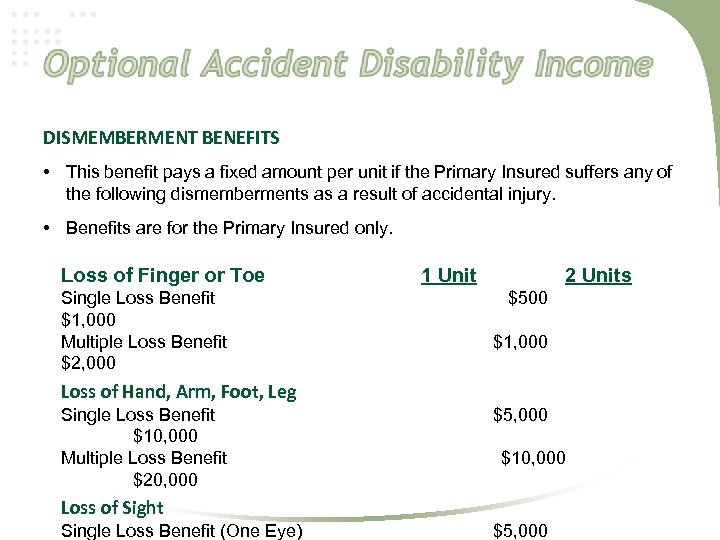

DISMEMBERMENT BENEFITS • This benefit pays a fixed amount per unit if the Primary Insured suffers any of the following dismemberments as a result of accidental injury. • Benefits are for the Primary Insured only. Loss of Finger or Toe Single Loss Benefit $1, 000 Multiple Loss Benefit $2, 000 1 Unit 2 Units $500 $1, 000 Loss of Hand, Arm, Foot, Leg Single Loss Benefit $10, 000 Multiple Loss Benefit $20, 000 $5, 000 $10, 000 Loss of Sight Single Loss Benefit (One Eye) $5, 000

DISMEMBERMENT BENEFITS • This benefit pays a fixed amount per unit if the Primary Insured suffers any of the following dismemberments as a result of accidental injury. • Benefits are for the Primary Insured only. Loss of Finger or Toe Single Loss Benefit $1, 000 Multiple Loss Benefit $2, 000 1 Unit 2 Units $500 $1, 000 Loss of Hand, Arm, Foot, Leg Single Loss Benefit $10, 000 Multiple Loss Benefit $20, 000 $5, 000 $10, 000 Loss of Sight Single Loss Benefit (One Eye) $5, 000

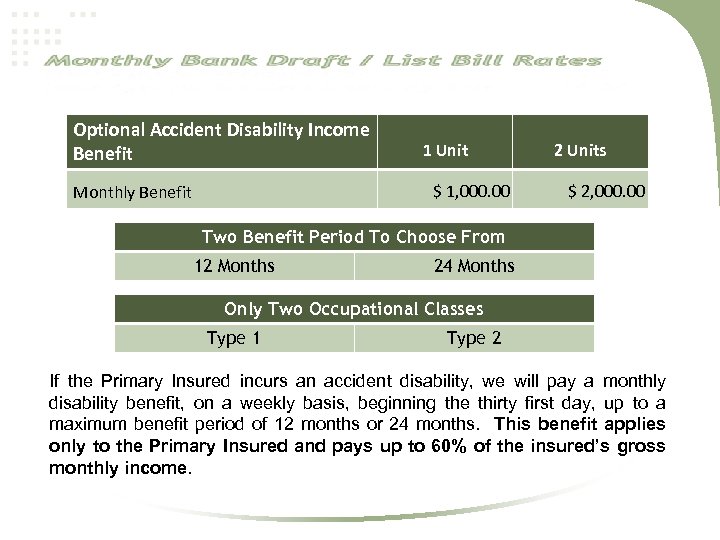

Optional Accident Disability Income Benefit 1 Unit $ 1, 000. 00 Monthly Benefit 2 Units $ 2, 000. 00 Two Benefit Period To Choose From 12 Months 24 Months Only Two Occupational Classes Type 1 Type 2 If the Primary Insured incurs an accident disability, we will pay a monthly disability benefit, on a weekly basis, beginning the thirty first day, up to a maximum benefit period of 12 months or 24 months. This benefit applies only to the Primary Insured and pays up to 60% of the insured’s gross monthly income.

Optional Accident Disability Income Benefit 1 Unit $ 1, 000. 00 Monthly Benefit 2 Units $ 2, 000. 00 Two Benefit Period To Choose From 12 Months 24 Months Only Two Occupational Classes Type 1 Type 2 If the Primary Insured incurs an accident disability, we will pay a monthly disability benefit, on a weekly basis, beginning the thirty first day, up to a maximum benefit period of 12 months or 24 months. This benefit applies only to the Primary Insured and pays up to 60% of the insured’s gross monthly income.

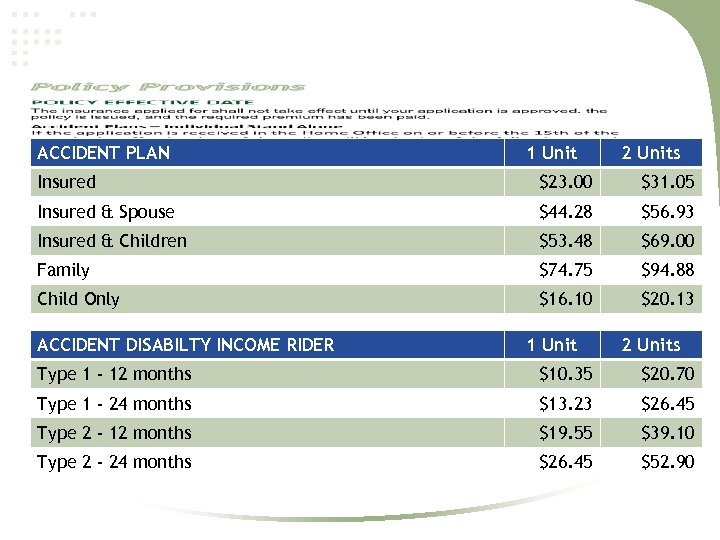

ACCIDENT PLAN 1 Unit 2 Units Insured $23. 00 $31. 05 Insured & Spouse $44. 28 $56. 93 Insured & Children $53. 48 $69. 00 Family $74. 75 $94. 88 Child Only $16. 10 $20. 13 ACCIDENT DISABILTY INCOME RIDER 1 Unit 2 Units Type 1 - 12 months $10. 35 $20. 70 Type 1 - 24 months $13. 23 $26. 45 Type 2 - 12 months $19. 55 $39. 10 Type 2 - 24 months $26. 45 $52. 90

ACCIDENT PLAN 1 Unit 2 Units Insured $23. 00 $31. 05 Insured & Spouse $44. 28 $56. 93 Insured & Children $53. 48 $69. 00 Family $74. 75 $94. 88 Child Only $16. 10 $20. 13 ACCIDENT DISABILTY INCOME RIDER 1 Unit 2 Units Type 1 - 12 months $10. 35 $20. 70 Type 1 - 24 months $13. 23 $26. 45 Type 2 - 12 months $19. 55 $39. 10 Type 2 - 24 months $26. 45 $52. 90

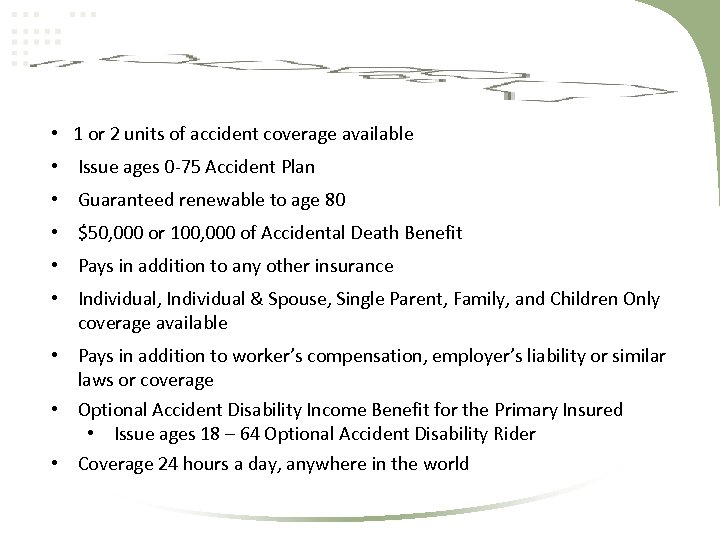

• 1 or 2 units of accident coverage available • Issue ages 0 -75 Accident Plan • Guaranteed renewable to age 80 • $50, 000 or 100, 000 of Accidental Death Benefit • Pays in addition to any other insurance • Individual, Individual & Spouse, Single Parent, Family, and Children Only coverage available • Pays in addition to worker’s compensation, employer’s liability or similar laws or coverage • Optional Accident Disability Income Benefit for the Primary Insured • Issue ages 18 – 64 Optional Accident Disability Rider • Coverage 24 hours a day, anywhere in the world

• 1 or 2 units of accident coverage available • Issue ages 0 -75 Accident Plan • Guaranteed renewable to age 80 • $50, 000 or 100, 000 of Accidental Death Benefit • Pays in addition to any other insurance • Individual, Individual & Spouse, Single Parent, Family, and Children Only coverage available • Pays in addition to worker’s compensation, employer’s liability or similar laws or coverage • Optional Accident Disability Income Benefit for the Primary Insured • Issue ages 18 – 64 Optional Accident Disability Rider • Coverage 24 hours a day, anywhere in the world

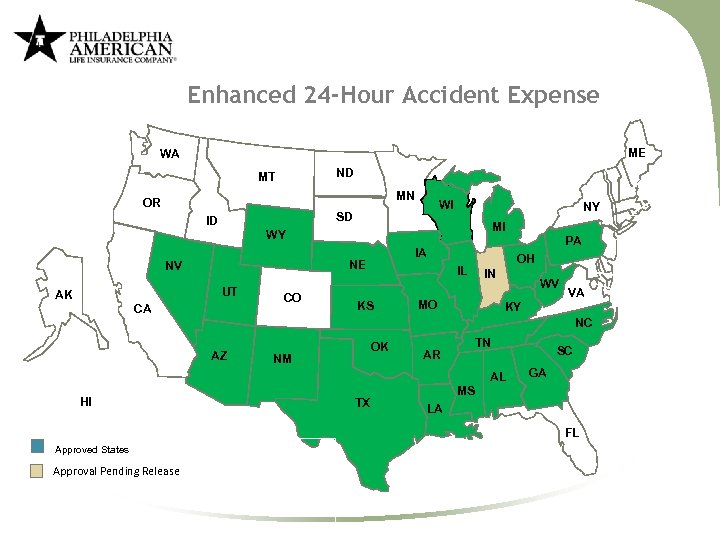

Enhanced 24 -Hour Accident Expense ME WA ND MT MN OR WI SD ID NY MI WY NE NV UT AK IA CA CO IL KS PA OH IN MO WV VA KY NC AZ OK NM TN AR AL HI TX SC GA MS LA FL Approved States Approval Pending Release

Enhanced 24 -Hour Accident Expense ME WA ND MT MN OR WI SD ID NY MI WY NE NV UT AK IA CA CO IL KS PA OH IN MO WV VA KY NC AZ OK NM TN AR AL HI TX SC GA MS LA FL Approved States Approval Pending Release