2436eaca7facd33bd659461fb6405b44.ppt

- Количество слайдов: 12

Critical Evaluation – Bancassurance Synergy or Conflict Mumbai – 4 th July’ 12 Speaker – Ms. Vishakha R M – Director – Sales & Marketing Canara HSBC Oriental Bank of Commerce Life Insurance Co. Ltd. 1

Agenda • Why Bancassurance ? • Customer Perspective on Bancassurance • Leveraging the Synergies with Bancassurance • Our opportunities for regulatory support 2

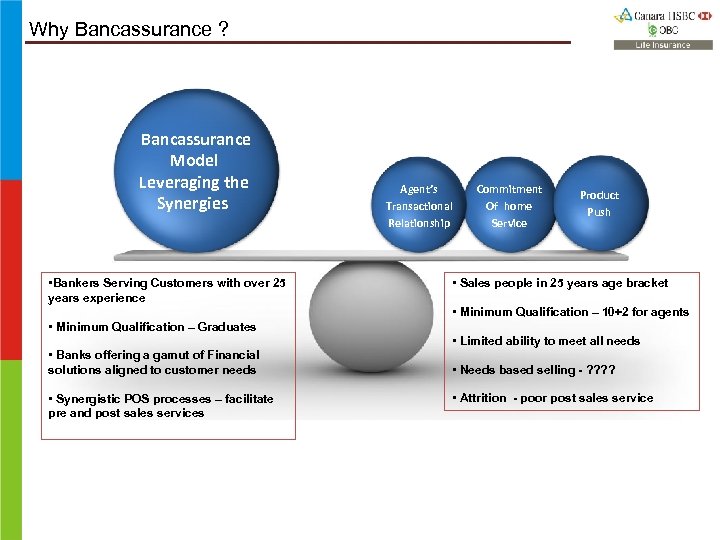

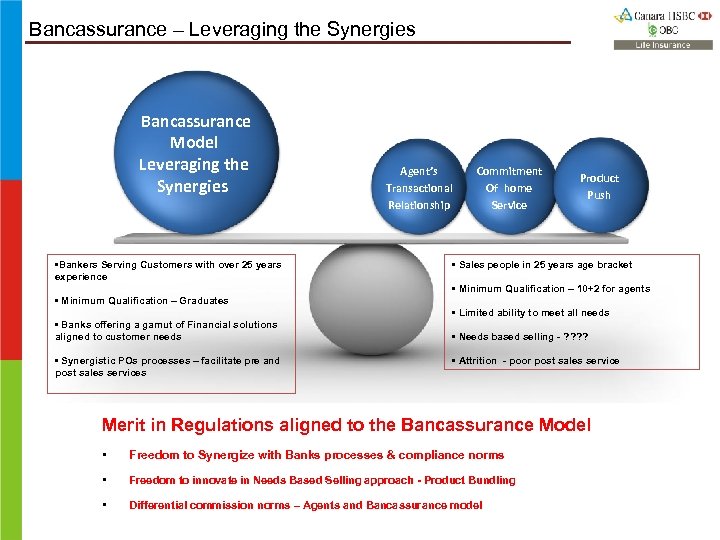

Why Bancassurance ? Bancassurance Model Leveraging the Synergies • Bankers Serving Customers with over 25 years experience Agent’s Transactional Relationship Commitment Of home Service Product Push • Sales people in 25 years age bracket • Minimum Qualification – 10+2 for agents • Minimum Qualification – Graduates • Limited ability to meet all needs • Banks offering a gamut of Financial solutions aligned to customer needs • Synergistic POS processes – facilitate pre and post sales services • Needs based selling - ? ? • Attrition - poor post sales service

Let’s hear Customer Perspective 4

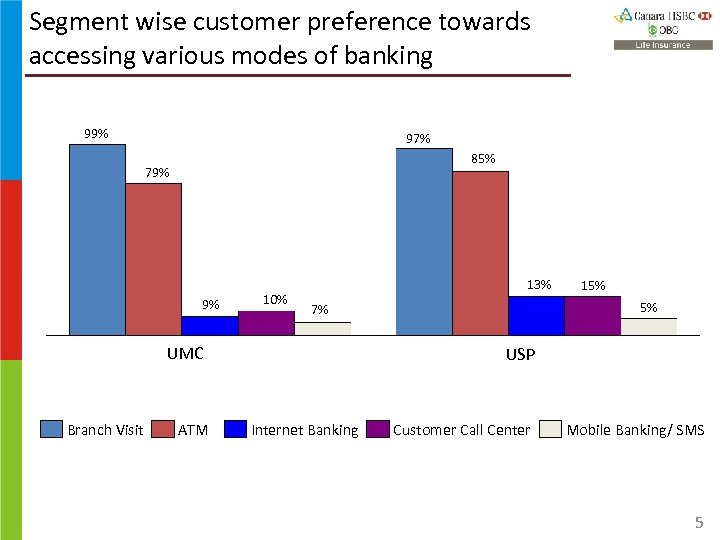

Segment wise customer preference towards accessing various modes of banking 99% 97% 85% 79% 9% 10% 13% Branch Visit ATM 5% 7% UMC 15% USP Internet Banking Customer Call Center Mobile Banking/ SMS 5

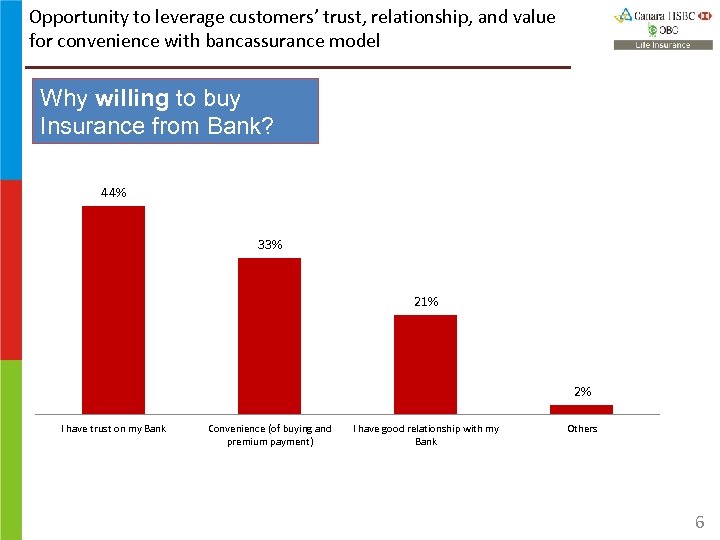

Opportunity to leverage customers’ trust, relationship, and value for convenience with bancassurance model Why willing to buy Insurance from Bank? 44% 30% 35% 28% 32% 33% 38% 33% 34% 39% 21% 2% I have trust on my Bank Convenience (of buying and premium payment) I have good relationship with my Bank Others 6

Key takeaways • Trust the bank staff for advise • Bank customers are interested in insurance from their bank • Expect bank to leverage existing information for meeting Insurance requirements • Most important financial instrument to fulfill needs – combination of Life Insurance and Bank products • Need all services at their home branch 7

Bancassurance – Synergizing for Total Customer Satisfaction What are our opportunities? • Make it simpler • Make it convenient • Create trust • Right product at the right time aligned to customer needs • Regulatory norms aligned to customer expectations and synergies • Drive Customer Advocacy

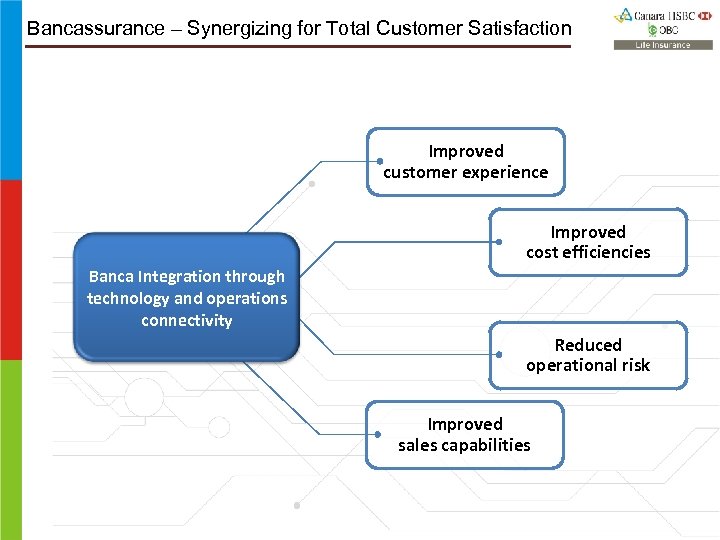

Bancassurance – Synergizing for Total Customer Satisfaction Improved customer experience Improved cost efficiencies Banca Integration through technology and operations connectivity Reduced operational risk Improved sales capabilities

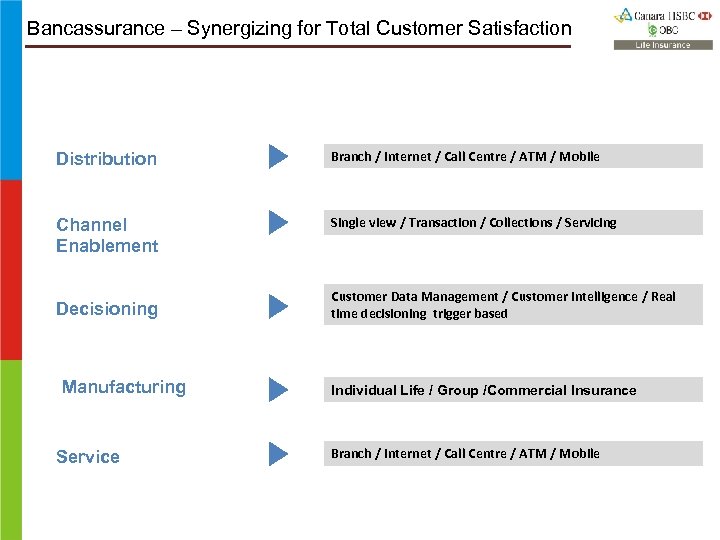

Bancassurance – Synergizing for Total Customer Satisfaction Distribution Branch / Internet / Call Centre / ATM / Mobile Channel Enablement Single view / Transaction / Collections / Servicing Decisioning Manufacturing Service Customer Data Management / Customer Intelligence / Real time decisioning trigger based Individual Life / Group /Commercial Insurance Branch / Internet / Call Centre / ATM / Mobile

Bancassurance – Leveraging the Synergies Bancassurance Model Leveraging the Synergies • Bankers Serving Customers with over 25 years experience Agent’s Transactional Relationship Commitment Of home Service Product Push • Sales people in 25 years age bracket • Minimum Qualification – 10+2 for agents • Minimum Qualification – Graduates • Limited ability to meet all needs • Banks offering a gamut of Financial solutions aligned to customer needs • Synergistic POs processes – facilitate pre and post sales services • Needs based selling - ? ? • Attrition - poor post sales service Merit in Regulations aligned to the Bancassurance Model • Freedom to Synergize with Banks processes & compliance norms • Freedom to innovate in Needs Based Selling approach - Product Bundling • Differential commission norms – Agents and Bancassurance model

![[ ] This is a beginning……. . [ ] This is a beginning……. .](https://present5.com/presentation/2436eaca7facd33bd659461fb6405b44/image-12.jpg)

[ ] This is a beginning……. .

2436eaca7facd33bd659461fb6405b44.ppt